Attached files

| file | filename |

|---|---|

| 8-K - NEWMONT Corp /DE/ | v175514_8k.htm |

| EX-99.1 - NEWMONT Corp /DE/ | v175514_ex99-1.htm |

|

Newmont

Mining Corporation

6363

South Fiddlers Green Circle, Suite 800

Greenwood

Village, CO 80111

T 303.863.7414

F 303.837.5837

www.newmont.com

|

|

|

||

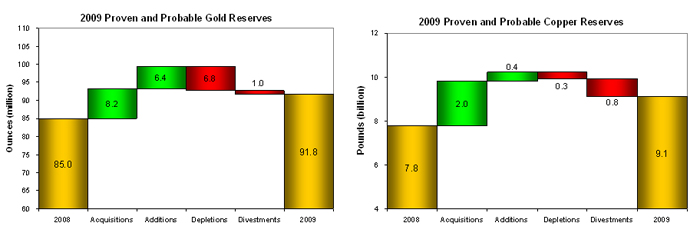

Newmont Reports 8%

Increase in Equity Gold Reserves to 91.8 Million Ounces; Details 2010

Exploration Funding and Opportunities

DENVER, February

25, 2010 – Newmont Mining Corporation (NYSE: NEM) (“Newmont” or “the Company”)

today reported 2009 equity gold reserves of 91.8 million ounces, an 8% increase

over 2008, and equity copper reserves of 9.1 billion pounds, a 17% increase over

2008.

Equity gold

measured and indicated resources (NRM) for 2009 were 1.1 billion tons at an

average grade of 0.020 ounces per ton, up from 0.8 billion tons at a grade of

0.026 ounces per ton for 2008. Equity copper NRM for 2009 were 796 million tons

at an average grade of 0.17%, up from 431 million tons at a grade of 0.13% from

2008.

|

(1)

|

For

detailed information on the Company’s year-end equity proven and probable

reserves and NRM, please refer to the Supplemental Information in this

release.

|

Reserve additions

came from all regions, with notable additions from Gold Quarry in Nevada,

Boddington in Australia, underground operations across Australia and New Zealand

and at Ahafo in Ghana.

“A

combination of strong 2009 exploration results and the Boddington acquisition

resulted in equity gold reserves at our highest level since 2006 and equity gold

NRM at the highest level since 2003.” said Guy Lansdown, Executive Vice

President of Discovery and Development. “These increases, combined

with our generative exploration opportunities, will support future

sustainability in each of our operating regions.”

Exploration,

Advanced Projects, Research & Development

The recent success

of the Company’s exploration program, combined with a demonstrated ability to

advance exploration programs through development and into production, has

established a platform for future growth. To provide increasing value

for shareholders, Newmont plans to continue aggressively advancing its most

prospective near mine and generative exploration development opportunities into

production.

The 2010

exploration budget is between $190 and $220 million, an increase of

approximately 10% from 2009. In addition, funding for Advanced

Project development has increased to between $185 and $210 million, a 40%

increase from 2009. These exploration and advanced project

development programs are designed to generate and develop the projects that will

help drive production in the decades to come.

Approximately 75%

of the exploration budget is focused on programs within Newmont’s existing

operating districts and major land packages, including the prospective gold

belts at Hope Bay in Canada and in Suriname. These exploration

programs are designed to support production, replace reserves, optimize existing

assets, explore and advance copper opportunities and to develop new brown field

projects that leverage existing facilities and infrastructure.

The additional

Advanced Project development programs are coordinated with our exploration

efforts, with exploration delivering new resources that are effectively advanced

through the development pipeline in each of the operating

regions. The Company’s more notable exploration and advanced project

development opportunities include Hope Bay in Canada, the Greater Leeville-Turf

project in Nevada, the Subika underground project in Ghana, expansion drilling

at Boddington in Australia, and multiple programs targeting underground resource

expansions across Australia and New Zealand and sulfide exploration and

development programs in Peru.

Hope

Bay, Canada

At

Hope Bay in Canada, positive 2009 drilling and regional exploration results have

reinforced the positive view of exploration potential across the 80 kilometer

greenstone belt. The Company is advancing development with an underground

focus, to be initiated with a decline at the Doris North deposit. The

Company has deployed an experienced project development team and key contractors

are in place to aggressively advance this underground

opportunity. With near-term development plans and district

exploration for years to come, Hope Bay remains a significant asset within the

Company’s portfolio. The Company expects to spend approximately $60 to $70

million on advanced project development and near mine exploration in 2010 at

Hope Bay, excluding capital.

Greater

Leeville-Turf, Nevada

In

Nevada, the Company has a portfolio of multiple open pit and underground

projects. One of these opportunities is the Greater Leeville-Turf

program, where the Company has a surface exploration program extending well

beyond known mineralization. Early results from both surface and

underground exploration programs suggest significant potential for resource

expansion, with recent surface gold intercepts including CGX-24 with 32 feet at

0.7 ounces per ton and CGX-12 with 151 feet at 0.6 ounces per ton, all

accessible by extensions of current underground infrastructure. The Company

expects to spend approximately $75 to $85 million on advanced project

development and near mine exploration in 2010 in Nevada, excluding

capital.

| Page 2 of 7 |

Subika

Expansion, Ghana

The Subika

Expansion project at our Ahafo operation in Ghana is focused on developing

reserves by expanding the existing open pit and through underground

development. The Company is concurrently advancing exploration and

development with surface drilling to define the exploration potential and

underground drifting and future drilling for resource and project

development. An exploration decline was successfully initiated in

February 2010 and underground development is advancing rapidly. The Company

expects to spend approximately $10 to $15 million on advanced project

development and near mine exploration in 2010 in Ghana, excluding

capital.

Australia

/ New Zealand

As

Boddington ramps-up to full production, the Company continues to step out with

exploration to the north and east, where preliminary results suggest significant

opportunity for higher grade, shallow resource additions. Across

Australia and in New Zealand, the Company is expanding underground resources

with surface and underground exploration and development

programs. One such opportunity is the Gateway project at Jundee,

where drilling continues to identify a new vein system to the south of current

resources with potential exploration drifting scheduled for late 2010 to early

2011. The Company expects to spend approximately $20 to $30 million on advanced

project development and near mine exploration in 2010 in Australia/New Zealand,

excluding capital.

Yanacocha

District, Peru

In

South America, the Company’s exploration focus is on unlocking the sulfide

opportunities within the Yanacocha district and around the Conga

project. Advanced exploration and development of the large

gold-copper sulfide resources underlying current Yanacocha oxide pits is

ongoing. As a result, research and development of metallurgical

process options for potentially minable resources is advancing. In

addition, the Chaquicocha Sur sulfide project has advanced into Stage 2, with a

program focused on an underground mining option to develop this high grade

resource. In addition, while basic engineering and permitting

advances on the Conga project, multiple gold-copper porphyry targets across the

prospective land package are being explored to maximize the value of this world

class project. The Company expects to spend approximately $25 to $30 million on

advanced project development and near mine exploration in 2010 in

Peru.

| Page 3 of 7 |

Supplemental

Information:

|

Equity Proven,

Probable, and Combined Gold Reserves(1)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

December

31, 2009

|

December

31, 2008

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Deposits/Districts

by Reporting Unit

|

Proven

Reserves

|

Probable

Reserves

|

Proven

and Probable Reserves

|

Metallurgical

Recovery

|

Proven

+ Probable Reserves

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Newmont

|

Tonnage

|

Grade

|

Gold

|

Tonnage

|

Grade

|

Gold

|

Tonnage

|

Grade

|

Gold

|

Tonnage

|

Grade

|

Gold

|

||||||||||||||||||||||||||||||||||||||||||||

|

Share

|

(000

tons)

|

(oz/ton)

|

(000

ozs)

|

(000

tons)

|

(oz/ton)

|

(000

ozs)

|

(000

tons)

|

(oz/ton)

|

(000

ozs)

|

(000

tons)

|

(oz/ton)

|

(000

ozs)

|

||||||||||||||||||||||||||||||||||||||||||||

|

NORTH

AMERICA

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Carlin Open Pits, Nevada(2)

|

100 | % | 24,400 | 0.067 | 1,640 | 234,900 | 0.042 | 9,760 | 259,300 | 0.044 | 11,400 | 74 | % | 202,400 | 0.045 | 9,050 | ||||||||||||||||||||||||||||||||||||||||

|

Carlin

Underground, Nevada

|

100 | % | 4,600 | 0.307 | 1,400 | 5,100 | 0.315 | 1,590 | 9,700 | 0.311 | 2,990 | 88 | % | 11,700 | 0.313 | 3,650 | ||||||||||||||||||||||||||||||||||||||||

|

Midas, Nevada(3)

|

100 | % | 400 | 0.480 | 200 | 300 | 0.347 | 100 | 700 | 0.425 | 300 | 95 | % | 900 | 0.436 | 390 | ||||||||||||||||||||||||||||||||||||||||

|

Phoenix,

Nevada

|

100 | % | 0 | 0 | 285,000 | 0.020 | 5,670 | 285,000 | 0.020 | 5,670 | 73 | % | 299,800 | 0.021 | 6,310 | |||||||||||||||||||||||||||||||||||||||||

|

Twin

Creeks, Nevada

|

100 | % | 9,300 | 0.097 | 900 | 40,900 | 0.072 | 2,950 | 50,200 | 0.077 | 3,850 | 80 | % | 51,700 | 0.077 | 3,960 | ||||||||||||||||||||||||||||||||||||||||

|

Turquoise Ridge, Nevada(4)

|

25 | % | 1,100 | 0.480 | 550 | 1,500 | 0.527 | 810 | 2,600 | 0.507 | 1,360 | 92 | % | 2,600 | 0.500 | 1,330 | ||||||||||||||||||||||||||||||||||||||||

|

Nevada In-Process(5)

|

100 | % | 33,800 | 0.021 | 730 | 0 | 0 | 33,800 | 0.021 | 730 | 65 | % | 36,000 | 0.026 | 940 | |||||||||||||||||||||||||||||||||||||||||

|

Nevada Stockpiles(6)

|

100 | % | 27,000 | 0.079 | 2,140 | 2,500 | 0.028 | 70 | 29,500 | 0.075 | 2,210 | 79 | % | 34,200 | 0.072 | 2,460 | ||||||||||||||||||||||||||||||||||||||||

|

Total

Nevada

|

100,600 | 0.075 | 7,560 | 570,200 | 0.037 | 20,950 | 670,800 | 0.042 | 28,510 | 77 | % | 639,300 | 0.044 | 28,090 | ||||||||||||||||||||||||||||||||||||||||||

|

La

Herradura, Mexico

|

44 | % | 46,100 | 0.019 | 900 | 47,100 | 0.019 | 880 | 93,200 | 0.019 | 1,780 | 66 | % | 76,100 | 0.025 | 1,890 | ||||||||||||||||||||||||||||||||||||||||

|

TOTAL

NORTH AMERICA

|

146,700 | 0.058 | 8,460 | 617,300 | 0.035 | 21,830 | 764,000 | 0.040 | 30,290 | 77 | % | 715,400 | 0.044 | 29,980 | ||||||||||||||||||||||||||||||||||||||||||

|

SOUTH

AMERICA

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Conga, Peru(7)

|

51.35 | % | 0 | 0 | 317,200 | 0.019 | 6,080 | 317,200 | 0.019 | 6,080 | 79 | % | 317,200 | 0.019 | 6,080 | |||||||||||||||||||||||||||||||||||||||||

|

Yanacocha Open Pits(8)

|

51.35 | % | 7,800 | 0.035 | 270 | 123,700 | 0.036 | 4,480 | 131,500 | 0.036 | 4,750 | 69 | % | 207,500 | 0.030 | 6,150 | ||||||||||||||||||||||||||||||||||||||||

|

Yanacocha In-Process(5)

|

51.35 | % | 26,400 | 0.025 | 660 | 0 | 0 | 26,400 | 0.025 | 660 | 74 | % | 20,800 | 0.026 | 530 | |||||||||||||||||||||||||||||||||||||||||

|

Total

Yanacocha, Peru

|

34,200 | 0.027 | 930 | 123,700 | 0.036 | 4,480 | 157,900 | 0.034 | 5,410 | 69 | % | 228,300 | 0.029 | 6,680 | ||||||||||||||||||||||||||||||||||||||||||

|

Kori Kollo, Bolivia(9)

|

88 | % | 0 | 0 | 0 | 0 | 0 | 0 | 11,500 | 0.017 | 190 | |||||||||||||||||||||||||||||||||||||||||||||

|

La Zanja, Peru(10)

|

46.94 | % | 0 | 0 | 18,800 | 0.018 | 340 | 18,800 | 0.018 | 340 | 67 | % | 0 | 0 | ||||||||||||||||||||||||||||||||||||||||||

|

TOTAL

SOUTH AMERICA

|

34,200 | 0.027 | 930 | 459,700 | 0.024 | 10,900 | 493,900 | 0.024 | 11,830 | 74 | % | 557,000 | 0.023 | 12,950 | ||||||||||||||||||||||||||||||||||||||||||

|

ASIA

PACIFIC

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Batu Hijau Open Pit(11)

|

52.44 | % | 201,100 | 0.015 | 2,970 | 167,700 | 0.005 | 810 | 368,800 | 0.010 | 3,780 | 76 | % | 348,800 | 0.011 | 3,680 | ||||||||||||||||||||||||||||||||||||||||

|

Batu Hijau Stockpiles(6)(11)

|

52.44 | % | 0 | 0 | 193,800 | 0.004 | 720 | 193,800 | 0.004 | 720 | 70 | % | 131,400 | 0.003 | 410 | |||||||||||||||||||||||||||||||||||||||||

|

Total

Batu Hijau, Indonesia

|

52.44 | % | 201,100 | 0.015 | 2,970 | 361,500 | 0.004 | 1,530 | 562,600 | 0.008 | 4,500 | 75 | % | 480,200 | 0.009 | 4,090 | ||||||||||||||||||||||||||||||||||||||||

|

Boddington, Western Australia(12)

|

100.00 | % | 184,600 | 0.025 | 4,640 | 781,800 | 0.021 | 16,320 | 966,400 | 0.022 | 20,960 | 82 | % | 583,200 | 0.023 | 13,370 | ||||||||||||||||||||||||||||||||||||||||

|

Jundee,

Western Australia

|

100 | % | 4,100 | 0.065 | 260 | 3,300 | 0.273 | 910 | 7,400 | 0.159 | 1,170 | 90 | % | 6,300 | 0.202 | 1,270 | ||||||||||||||||||||||||||||||||||||||||

|

Kalgoorlie

Open Pit and Underground

|

50 | % | 21,200 | 0.061 | 1,280 | 39,600 | 0.062 | 2,470 | 60,800 | 0.062 | 3,750 | 85 | % | 63,700 | 0.062 | 3,970 | ||||||||||||||||||||||||||||||||||||||||

|

Kalgoorlie

Stockpiles(6)

|

50 | % | 14,300 | 0.031 | 440 | 0 | 0 | 14,300 | 0.031 | 440 | 78 | % | 14,400 | 0.031 | 450 | |||||||||||||||||||||||||||||||||||||||||

|

Total

Kalgoorlie, Western Australia

|

50 | % | 35,500 | 0.049 | 1,720 | 39,600 | 0.062 | 2,470 | 75,100 | 0.056 | 4,190 | 84 | % | 78,100 | 0.056 | 4,420 | ||||||||||||||||||||||||||||||||||||||||

|

Tanami,

Northern Territories

|

100 | % | 5,200 | 0.160 | 830 | 7,900 | 0.102 | 810 | 13,100 | 0.125 | 1,640 | 96 | % | 11,500 | 0.129 | 1,480 | ||||||||||||||||||||||||||||||||||||||||

|

Waihi,

New Zealand

|

100 | % | 0 | 0 | 4,000 | 0.101 | 410 | 4,000 | 0.101 | 410 | 90 | % | 2,900 | 0.124 | 360 | |||||||||||||||||||||||||||||||||||||||||

|

TOTAL

ASIA PACIFIC

|

430,500 | 0.024 | 10,420 | 1,198,100 | 0.019 | 22,450 | 1,628,600 | 0.020 | 32,870 | 82 | % | 1,162,200 | 0.022 | 24,990 | ||||||||||||||||||||||||||||||||||||||||||

|

AFRICA

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Ahafo Open Pits(13)

|

100 | % | 0 | 0 | 128,700 | 0.068 | 8,810 | 128,700 | 0.068 | 8,810 | 87 | % | ||||||||||||||||||||||||||||||||||||||||||||

|

Ahafo Stockpiles(6)

|

100 | % | 9,300 | 0.034 | 320 | 0 | 0 | 9,300 | 0.034 | 320 | 87 | % | ||||||||||||||||||||||||||||||||||||||||||||

|

Total

Ahafo, Ghana

|

100 | % | 9,300 | 0.034 | 320 | 128,700 | 0.068 | 8,810 | 138,000 | 0.066 | 9,130 | 87 | % | 125,100 | 0.075 | 9,380 | ||||||||||||||||||||||||||||||||||||||||

|

Akyem, Ghana(14)

|

100 | % | 0 | 0 | 147,200 | 0.052 | 7,660 | 147,200 | 0.052 | 7,660 | 89 | % | 147,200 | 0.052 | 7,660 | |||||||||||||||||||||||||||||||||||||||||

|

TOTAL

AFRICA

|

9,300 | 0.034 | 320 | 275,900 | 0.060 | 16,470 | 285,200 | 0.059 | 16,790 | 88 | % | 272,300 | 0.063 | 17,040 | ||||||||||||||||||||||||||||||||||||||||||

|

TOTAL

NEWMONT WORLDWIDE

|

620,700 | 0.032 | 20,130 | 2,551,000 | 0.028 | 71,650 | 3,171,700 | 0.029 | 91,780 | 80 | % | 2,706,900 | 0.031 | 84,960 | ||||||||||||||||||||||||||||||||||||||||||

|

(1)

|

Reserves

are calculated at a gold price of US$800, A$1000, or NZ$1,200 per ounce

unless otherwise noted. 2008 reserves were calculated at a gold price

of US$725, A$850, or NZ$1,000 per ounce unless

otherwise noted. Tonnage amounts have been rounded to the

nearest 100,000 unless they are less than 50,000, and gold ounces have

been rounded to the nearest 10,000.

|

|

(2)

|

Includes

undeveloped reserves at the Emigrant deposits for combined total

undeveloped reserves of 1.2 million ounces.

|

|

(3)

|

Also

contains reserves of 4.6 million ounces of silver with a metallurgical

recovery of 88%.

|

|

(4)

|

Reserve

estimates provided by Barrick, the operator of the Turquoise Ridge Joint

Venture.

|

|

(5)

|

In-process

material is the material on leach pads at the end of each year from which

gold remains to be recovered. In-process material reserves are

reported separately where tonnage or contained ounces are greater than 5%

of the total site-reported reserves and contained ounces are greater than

100,000.

|

|

(6)

|

Stockpiles

are comprised primarily of material that has been set aside to allow

processing of higher grade material in the mills. Stockpiles

increase or decrease depending on current mine plans. Stockpile

reserves are reported separately where tonnage or contained ounces are

greater than 5% of the total site-reported reserves and contained ounces

are greater than 100,000.

|

|

(7)

|

Deposit

is currently undeveloped.

|

|

(8)

|

Reserves

include the currently undeveloped deposit at Tapado Oeste (formerly called

Corimayo), which contains undeveloped reserves of 1.2 million equity

ounces.

|

|

(9)

|

Newmont

divested its interest in Kori Kollo in July 2009.

|

|

(10)

|

Reserves

estimates were provided by Buenaventura, the operator of the La Zanja

project.

|

|

(11)

|

Percentage

reflects Newmont's economic interest at December 31, 2009. In

November and December 2009 our economic interest increased from 45% to

52.44% as a result of transactions with a noncontrolling partner,

partially offset by divestiture required under the Contract of

Work.

|

|

(12)

|

Newmont

acquired the remaining 33.33% of Boddington from AngloGold in June

2009.

|

|

(13)

|

Includes

undeveloped reserves at Amoma, Yamfo South, Yamfo Central, Techire West,

Subenso South, Subenso North, Yamfo Northeast, and Susuan totaling 3.7

million ounces.

|

|

(14)

|

Deposit

is undeveloped.

|

| Page 4 of 7 |

|

Equity Gold

Mineralized Material Not in Reserves(1)(2)

|

||||||||||||||||||||||||||||||||||||

|

December

31, 2009

|

||||||||||||||||||||||||||||||||||||

|

Deposits/Districts

|

Measured

Material

|

Indicated

Material

|

Measured

+ Indicated Material

|

Inferred

Material

|

||||||||||||||||||||||||||||||||

|

Newmont

|

Tonnage

|

Grade

|

Tonnage

|

Grade

|

Tonnage

|

Grade

|

Tonnage

|

Grade

|

||||||||||||||||||||||||||||

|

Share

|

(000

tons)

|

(oz/ton)

|

(000

tons)

|

(oz/ton)

|

(000

tons)

|

(oz/ton)

|

(000

tons)

|

(oz/ton)

|

||||||||||||||||||||||||||||

|

NORTH

AMERICA

|

||||||||||||||||||||||||||||||||||||

|

Carlin

Trend Open Pit, Nevada

|

100 | % | 2,600 | 0.027 | 26,200 | 0.020 | 28,800 | 0.021 | 10,400 | 0.034 | ||||||||||||||||||||||||||

|

Carlin

Trend Underground, Nevada

|

100 | % | 700 | 0.189 | 110 | 0.153 | 810 | 0.18 | 7,400 | 0.289 | ||||||||||||||||||||||||||

|

Lone

Tree Complex, Nevada

|

100 | % | 0 | 4,200 | 0.022 | 4,200 | 0.022 | 0 | ||||||||||||||||||||||||||||

|

Midas,

Nevada

|

100 | % | 0 | 0.205 | 100 | 0.188 | 100 | 0.193 | 100 | 0.248 | ||||||||||||||||||||||||||

|

Phoenix,

Nevada

|

100 | % | 0 | 0.000 | 158,400 | 0.013 | 158,400 | 0.013 | 35,400 | 0.015 | ||||||||||||||||||||||||||

|

Twin

Creeks, Nevada

|

100 | % | 3,400 | 0.097 | 31,600 | 0.045 | 35,000 | 0.050 | 11,300 | 0.018 | ||||||||||||||||||||||||||

|

Turquoise

Ridge (3),

Nevada

|

25 | % | 300 | 0.412 | 300 | 0.452 | 600 | 0.431 | 1,300 | 0.456 | ||||||||||||||||||||||||||

|

Nevada

Stockpiles

(4), Nevada

|

100 | % | 10,700 | 0.060 | 10,700 | 0.060 | 2,300 | 0.043 | ||||||||||||||||||||||||||||

|

Total

Nevada

|

17,700 | 0.074 | 220,910 | 0.020 | 238,610 | 0.024 | 68,200 | 0.058 | ||||||||||||||||||||||||||||

|

La

Herradura, Mexico

|

44 | % | 6,500 | 0.017 | 7,800 | 0.016 | 14,300 | 0.016 | 20,500 | 0.019 | ||||||||||||||||||||||||||

|

TOTAL

NORTH AMERICA

|

24,200 | 0.058 | 228,710 | 0.019 | 252,910 | 0.023 | 88,700 | 0.049 | ||||||||||||||||||||||||||||

|

SOUTH

AMERICA

|

||||||||||||||||||||||||||||||||||||

|

Conga,

Peru

|

51.35 | % | 0 | 58,000 | 0.013 | 58,000 | 0.013 | 79,000 | 0.011 | |||||||||||||||||||||||||||

|

Yanacocha,

Peru

|

51.35 | % | 1,300 | 0.017 | 157,800 | 0.020 | 159,100 | 0.020 | 25,800 | 0.019 | ||||||||||||||||||||||||||

|

La

Zanja(5),

Peru

|

46.94 | % | 0 | 0 | 0.000 | 0 | 0.000 | 4,000 | 0.016 | |||||||||||||||||||||||||||

|

TOTAL

SOUTH AMERICA

|

1,300 | 0.017 | 215,800 | 0.018 | 217,100 | 0.018 | 108,800 | 0.013 | ||||||||||||||||||||||||||||

|

ASIA

PACIFIC

|

||||||||||||||||||||||||||||||||||||

|

Batu

Hijau (6),

Indonesia

|

52.44 | % | 25,400 | 0.017 | 148,400 | 0.007 | 173,800 | 0.008 | 81,300 | 0.002 | ||||||||||||||||||||||||||

|

Boddington, Western Australia(7)

|

100 | % | 20,600 | 0.010 | 344,200 | 0.015 | 364,800 | 0.014 | 292,900 | 0.016 | ||||||||||||||||||||||||||

|

Jundee,

Western Australia

|

100 | % | 0 | 200 | 0.045 | 200 | 0.045 | 3,800 | 0.068 | |||||||||||||||||||||||||||

|

Kalgoorlie,

Western Australia

|

50 | % | 2,300 | 0.059 | 4,100 | 0.054 | 6,400 | 0.056 | 1,600 | 0.136 | ||||||||||||||||||||||||||

|

Tanami,

Northern Territory

|

100 | % | 300 | 0.099 | 1,100 | 0.082 | 1,400 | 0.086 | 8,100 | 0.152 | ||||||||||||||||||||||||||

|

Waihi,

New Zealand

|

100 | % | 0 | 1,200 | 0.206 | 1,200 | 0.206 | 300 | 0.146 | |||||||||||||||||||||||||||

|

TOTAL

ASIA PACIFIC

|

48,600 | 0.016 | 499,200 | 0.013 | 547,800 | 0.013 | 388,000 | 0.017 | ||||||||||||||||||||||||||||

|

AFRICA

|

||||||||||||||||||||||||||||||||||||

|

Ahafo,

Ghana

|

100 | % | 0 | 97,800 | 0.050 | 97,800 | 0.050 | 26,200 | 0.104 | |||||||||||||||||||||||||||

|

Akyem,

Ghana

|

100 | % | 0 | 11,600 | 0.048 | 11,600 | 0.048 | 4,600 | 0.047 | |||||||||||||||||||||||||||

|

TOTAL

AFRICA

|

0 | 109,400 | 0.050 | 109,400 | 0.050 | 30,800 | 0.095 | |||||||||||||||||||||||||||||

|

TOTAL

NEWMONT WORLDWIDE

|

74,100 | 0.030 | 1,053,110 | 0.019 | 1,127,210 | 0.020 | 616,300 | 0.025 | ||||||||||||||||||||||||||||

|

(1)

|

Mineralized

material is reported exclusive of reserves.

|

|

(2)

|

Mineralized

Material calculated at a gold price of US$950, A$1,200, or NZ$1,400 per

ounce unless otherwise noted. 2008 Mineralized material was

calculated at a gold price of US$850, A$1,000, or NZ$1,175 per ounce.

Tonnage amounts have been rounded to the nearest

100,000.

|

|

(3)

|

Mineralized

material estimates were provided by Barrick, the operator of the Turquoise

Ridge Joint Venture.

|

|

(4)

|

Stockpiles

are comprised primarily of material that has been set aside to allow

processing of higher grade material in the mills. Stockpiles

increase or decrease depending on current mine plans.

|

|

(5)

|

Mineralized

material estimates were provided by Buenaventura, the operator of the La

Zanja Project.

|

|

(6)

|

Percentage

reflects Newmont's economic interest at December 31, 2009. In

November and December 2009 our economic interest increased from 45% to

52.44% as a result of transactions with a noncontrolling partner,

partially offset by divestiture required under the Contract of

Work.

|

|

(7)

|

Newmont

acquired the remaining 33.33% of Boddington from AngloGold in June

2009.

|

| Page 5 of 7 |

|

Equity Copper Reserves(1)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

December

31, 2009

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

December

31, 2008

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Proven

Reserves

|

Probable

Reserves

|

Proven

+ Probable Reserves

|

Proven

+ Probable Reserve

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Deposits/Districts

|

Newmont

|

Tonnage

|

Grade

|

Copper

|

Tonnage

|

Grade

|

Copper

|

Tonnage

|

Grade

|

Copper

|

Metallurgical

|

Tonnage

|

Grade

|

Copper

|

||||||||||||||||||||||||||||||||||||||||||

|

share

|

(000

tons)

|

(Cu%)

|

(million

pounds)

|

(000

tons)

|

(Cu%)

|

(million

pounds)

|

(000

tons)

|

(Cu%)

|

(million

pounds)

|

Recovery

|

(000

tons)

|

(Cu%)

|

(million

pounds)

|

|||||||||||||||||||||||||||||||||||||||||||

|

NORTH

AMERICA

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Phoenix,

Nevada

|

100 | % | 0 | 0 | 287,500 | 0.16 | % | 900 | 287,500 | 0.16 | % | 900 | 61 | % | 302,000 | 0.15 | % | 890 | ||||||||||||||||||||||||||||||||||||||

|

TOTAL

NORTH AMERICA

|

0 | 0 | 287,500 | 0.16 | % | 900 | 287,500 | 0.16 | % | 900 | 61 | % | 302,000 | 0.15 | % | 890 | ||||||||||||||||||||||||||||||||||||||||

| SOUTH AMERICA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Conga, Peru(2)

|

51.35 | % | 0 | 0 | 317,200 | 0.26 | % | 1,660 | 317,200 | 0.26 | % | 1,660 | 85 | % | 317,200 | 0.26 | % | 1,660 | ||||||||||||||||||||||||||||||||||||||

| TOTAL SOUTH AMERICA | 0 | 0 | 317,200 | 0.26 | % | 1,660 | 317,200 | 0.26 | % | 1,660 | 85 | % | 317,200 | 0.26 | % | 1,660 | ||||||||||||||||||||||||||||||||||||||||

|

ASIA

PACIFIC

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Batu Hijau(3)

|

52.44 | % | 201,100 | 0.51 | % | 2,070 | 167,700 | 0.32 | % | 1,060 | 368,800 | 0.42 | % | 3,130 | 77 | % | 348,800 | 0.44 | % | 3,060 | ||||||||||||||||||||||||||||||||||||

|

Batu Hijau,

Stockpiles(3)(4)

|

52.44 | % | 0 | 0 | 193,800 | 0.36 | % | 1,390 | 193,800 | 0.36 | % | 1,390 | 66 | % | 131,400 | 0.34 | % | 890 | ||||||||||||||||||||||||||||||||||||||

|

Batu

Hijau, Indonesia

|

52.44 | % | 201,100 | 0.51 | % | 2,070 | 361,500 | 0.34 | % | 2,450 | 562,600 | 0.40 | % | 4,520 | 74 | % | 480,200 | 0.41 | % | 3,950 | ||||||||||||||||||||||||||||||||||||

|

Boddington, Western

Australia (5)

|

100.00 | % | 184,600 | 0.11 | % | 400 | 781,800 | 0.10 | % | 1,640 | 966,400 | 0.11 | % | 2,040 | 84 | % | 583,200 | 0.11 | % | 1,280 | ||||||||||||||||||||||||||||||||||||

|

TOTAL

ASIA PACIFIC

|

385,700 | 0.32 | % | 2,470 | 1,143,300 | 0.18 | % | 4,090 | 1,529,000 | 0.21 | % | 6,560 | 77 | % | 1,063,400 | 0.25 | % | 5,230 | ||||||||||||||||||||||||||||||||||||||

|

TOTAL

NEWMONT WORLDWIDE

|

385,700 | 0.32 | % | 2,470 | 1,748,000 | 0.19 | % | 6,650 | 2,133,700 | 0.21 | % | 9,120 | 77 | % | 1,682,600 | 0.23 | % | 7,780 | ||||||||||||||||||||||||||||||||||||||

|

(1)

|

Reserves

are calculated at US$2.00 or A$2.40 per pound copper price unless

otherwise noted. 2008 reserves were also calculated at US$2.00

or A$2.40 per pound copper price unless otherwise

noted. Tonnage amounts have been rounded to the nearest 100,000

and pounds have been rounded to the nearest 10 million.

|

|

(2)

|

Deposit

is undeveloped.

|

|

(3)

|

Percentage

reflects Newmont's economic interest at December 31, 2009. In

November and December 2009 our economic interest increased from 45% to

52.44% as a result of transactions with a noncontrolling partner,

partially offset by divestiture required under the Contract of

Work.

|

|

(4)

|

Stockpiles

are comprised primarily of material that has been set aside to allow

processing of higher grade material. Stockpiles increase or

decrease depending on current mine plans. Stockpiles are

reported separately where tonnage or contained metal are greater than 5%

of the total site reported reserves.

|

|

(5)

|

Newmont

acquired the remaining 33.33% of Boddington from AngloGold in June

2009.

|

|

Equity Copper

Mineralized Material Not in Reserves(1)(2)

|

||||||||||||||||||||||||||||||||||||

|

December

31, 2009

|

||||||||||||||||||||||||||||||||||||

|

Deposits/Districts

|

Measured

Material

|

Indicated

Material

|

Measured

+ Indicated Material

|

Inferred

Material

|

||||||||||||||||||||||||||||||||

|

Newmont

|

Tonnage

|

Grade

|

Tonnage

|

Grade

|

Tonnage

|

Grade

|

Tonnage

|

Grade

|

||||||||||||||||||||||||||||

|

Share

|

(000

tons)

|

(Cu%)

|

(000

tons)

|

(Cu%)

|

(000

tons)

|

(Cu%)

|

(000

tons)

|

(Cu%)

|

||||||||||||||||||||||||||||

|

NORTH

AMERICA

|

||||||||||||||||||||||||||||||||||||

|

Phoenix,

Nevada

|

100 | % | 0 | 0.00 | % | 199,687 | 0.18 | % | 199,687 | 0.18 | % | 91,815 | 0.23 | % | ||||||||||||||||||||||

|

TOTAL

NORTH AMERICA

|

199,687 | 0.18 | % | 199,687 | 0.18 | % | 91,815 | 0.23 | % | |||||||||||||||||||||||||||

|

SOUTH

AMERICA

|

||||||||||||||||||||||||||||||||||||

|

Conga,

Peru

|

51.35 | % | 0 | 0.00 | % | 58,000 | 0.18 | % | 58,000 | 0.18 | % | 79,000 | 0.17 | % | ||||||||||||||||||||||

|

TOTAL

SOUTH AMERICA

|

58,000 | 0.18 | % | 58,000 | 0.18 | % | 79,000 | 0.17 | % | |||||||||||||||||||||||||||

|

ASIA

PACIFIC

|

||||||||||||||||||||||||||||||||||||

|

Batu Hijau, Indonesia (3)

|

52.44 | % | 25,400 | 0.42 | % | 148,400 | 0.31 | % | 173,800 | 0.32 | % | 81,300 | 0.22 | % | ||||||||||||||||||||||

|

Boddington, Western Australia (4)

|

100.00 | % | 20,600 | 0.08 | % | 344,200 | 0.10 | % | 364,800 | 0.09 | % | 292,900 | 0.10 | % | ||||||||||||||||||||||

|

TOTAL

ASIA PACIFIC

|

46,000 | 0.27 | % | 492,600 | 0.16 | % | 538,600 | 0.17 | % | 374,200 | 0.13 | % | ||||||||||||||||||||||||

|

TOTAL

NEWMONT WORLDWIDE

|

46,000 | 0.27 | % | 750,287 | 0.17 | % | 796,287 | 0.17 | % | 545,015 | 0.15 | % | ||||||||||||||||||||||||

|

(1)

|

Mineralized

material is reported exclusive of reserves.

|

|

(2)

|

Mineralized

material calculated at a copper price of US$2.50 or A$3.00 per pound

unless otherwise noted. 2008 mineralized material was also

calculated at a copper price of US$2.50 or A$3.00 per

pound. Tonnage amounts have been rounded to the nearest

100,000.

|

|

(3)

|

Percentage

reflects Newmont's economic interest at December 31, 2009. In

November and December 2009 our economic interest increased from 45% to

52.44% as a result of transactions with a noncontrolling partner,

partially offset by divestiture required under the Contract of

Work.

|

|

(4)

|

Newmont

acquired the remaining 33.33% of Boddington from AngloGold in June

2009.

|

| Page 6 of 7 |

To

view more detailed financial disclosure, including regional mine statistics,

Results of Consolidated Operations, Liquidity and Capital Resources,

Management’s Discussion & Analysis, relevant Risk Factors, and a complete

outline of the 2009 Operating and Financial guidance by region, please see the

Company’s Annual Report on Form 10-K, filed with the Securities and Exchange

Commission on February 25, 2010, available at www.newmont.com.

The Company’s

fourth quarter and year-end earnings conference call and web cast presentation

will be held on Thursday, February 25, 2010 beginning at 10:00 a.m. Eastern Time

(8:00 a.m. Mountain Time). To participate:

|

Dial-In

Number

|

800.779.3178

|

|

Intl

Dial-In Number

|

415.228.4957

|

|

Leader

|

John

Seaberg

|

|

Passcode

|

Newmont

|

|

Replay

Number

|

866.451.8896

|

|

Intl

Replay Number

|

203.369.1202

|

|

Replay

Passcode

|

2010

|

The conference call

also will be simultaneously carried on our web site at www.newmont.com under

Investor Relations/Presentations and will be archived there for a limited

time.

|

Investor

Contacts

|

||||

|

John

Seaberg

|

303.837.5743

|

john.seaberg@newmont.com

|

||

|

Media

Contacts

|

||||

|

Omar

Jabara

|

303.837.5114

|

omar.jabara@newmont.com

|

Cautionary

Statement:

This news release contains

“forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended, which are intended to be covered by the safe harbor created by such

sections and other applicable laws. Such forward-looking statements

include, without limitation: (i) estimates of future mineral production and

sales; (ii) estimates of future costs applicable to sales, other expenses and

taxes, for specific operations and on a consolidated basis; (iii) estimates of

future capital expenditures, construction, production or closure activities;

(iv) statements regarding future exploration expenditures, results and reserves;

(v) statements regarding fluctuations in capital and currency markets; (vi)

statements regarding potential cost savings, productivity, operating

performance, and cost structure; (vii) expectations regarding the ramp-up, mine

life, production and costs applicable to sales and exploration potential of

Boddington and the Company’s other projects; and (viii) expectations regarding

the impacts of operating, technical or geotechnical issues in connection with

the Company’s projects or operations. Where the Company expresses or

implies an expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to have a

reasonable basis. However, forward-looking statements are subject to

risks, uncertainties and other factors, which could cause actual results to

differ materially from future results expressed, projected or implied by such

forward-looking statements. Such risks include, but are not limited to,

gold and other metals price volatility, currency fluctuations, increased

production costs and variances in ore grade or recovery rates from those assumed

in mining plans, political and operational risks in the countries in which we

operate, and governmental regulation and judicial outcomes. For a more

detailed discussion of such risks and other factors, see the Company’s 2009

Annual Report on Form 10-K, filed on February 25, 2010, with the Securities and

Exchange Commission, as well as the Company’s other SEC filings. The

Company does not undertake any obligation to release publicly revisions to any

“forward-looking statement,” to reflect events or circumstances after the date

of this news release, or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws.

| Page 7 of 7 |