Attached files

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

|

WASHINGTON,

D.C. 20549

|

FORM

10-K

|

|

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE

ACT OF 1934

|

For the

fiscal year ended December 31, 2009

[ ] TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from ________ to _________

Commission

file number 1-11430

MINERALS

TECHNOLOGIES INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

(State

or other jurisdiction of

incorporation

or organization)

|

25-1190717

(I.R.S.

Employer

Identification

Number)

|

|

|

The

Chrysler Building

405

Lexington Avenue

New

York, New York

(Address

of principal executive office)

|

10174-0002

(Zip

Code)

|

(212)

878-1800

(Registrant's

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Name

of each exchange

on

which registered

|

|

Common

Stock, $.10 par value

|

New

York Stock Exchange

|

|

Securities

registered pursuant to Section 12(g) of the

Act:

|

|

None

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes

[X] No [ ]

Indicate

by check mark if Registrant is not required to file reports pursuant to Section

13 or 15(d) of the Act.

Yes

[ ] No [X]

Indicate

by check mark whether the Registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the Registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes

[X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes

[ ] No [ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the Registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. [ ].

Indicate

by check mark whether the Registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer," and "smaller

reporting company" in Rule 12b-2 of the Exchange Act.

|

Large

Accelerated Filer [ ]

|

Accelerated

Filer [X]

|

Non-

accelerated Filer [ ]

|

Smaller

Reporting Company [ ]

|

|

(Do

not check if smaller reporting

company)

|

|||

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule

12b-2 of the Act).

Yes

[ ] No [X]

The

aggregate market value of the voting stock held by non-affiliates of the

Registrant, based upon the closing price at which the stock was sold as of June

30, 2009, was approximately $486 million. Solely for the purposes of

this calculation, shares of common stock held by officers, directors and

beneficial owners of 10% or more of the outstanding common stock have been

excluded in that such persons may be deemed to be affiliates. This

determination of affiliate status is not necessarily a conclusive determination

for other purposes.

As

of February 5, 2010, the Registrant had outstanding 18,758,165 shares of common

stock, all of one class.

DOCUMENTS

INCORPORATED BY REFERENCE

|

Proxy

Statement dated April 5, 2010

|

Part

III

|

||

|

MINERALS

TECHNOLOGIES INC.

2009

FORM 10-K ANNUAL REPORT

|

||

|

Page

|

||

|

PART

I

|

||

|

Item

1.

|

3

|

|

|

Item

1A.

|

8

|

|

|

Item

1B.

|

10

|

|

|

Item

2.

|

10

|

|

|

Item

3.

|

12

|

|

|

Item

4.

|

13

|

|

|

PART

II

|

||

|

Item

5.

|

13

|

|

|

Item

6.

|

17

|

|

|

Item

7.

|

18

|

|

|

Item

7A.

|

34

|

|

|

Item

8.

|

34

|

|

|

Item

9.

|

34

|

|

|

Item

9A.

|

34

|

|

|

Item

9B.

|

34

|

|

|

PART

III

|

||

|

Item

10.

|

35

|

|

|

Item

11.

|

36

|

|

|

Item

12.

|

36

|

|

|

Item

13.

|

36

|

|

|

Item

14.

|

36

|

|

|

PART

IV

|

||

|

Item

15.

|

36

|

|

|

40

|

||

PART

I

Item

1. Business

Minerals

Technologies Inc. (the "Company") is a resource- and technology-based company

that develops, produces and markets worldwide a broad range of specialty

mineral, mineral-based and synthetic mineral products and supporting systems and

services. The Company has two reportable segments: Specialty Minerals

and Refractories. The Specialty Minerals segment produces and sells

the synthetic mineral product precipitated calcium carbonate ("PCC") and

processed mineral product quicklime ("lime"), and mines mineral ores then

processes and sells natural mineral products, primarily limestone and

talc. This segment's products are used principally in the paper,

building materials, paint and coatings, glass, ceramic, polymer, food,

automotive and pharmaceutical industries. The Refractories segment

produces and markets monolithic and shaped refractory materials and specialty

products, services and application and measurement equipment, and calcium metal

and metallurgical wire products. Refractories segment products are primarily

used in high-temperature applications in the steel, non-ferrous metal and glass

industries.

The

Company maintains a research and development focus. The Company's

research and development capability for developing and introducing

technologically advanced new products has enabled the Company to anticipate and

satisfy changing customer requirements, creating market opportunities through

new product development and product application innovations.

Specialty

Minerals Segment

PCC

Products and Markets

The

Company's PCC product line net sales were $534.7 million, $605.7 million and

$602.6 million for the years ended December 31, 2009, 2008 and 2007,

respectively. The Company's sales of PCC have been, and are expected

to continue to be, made primarily to the printing and writing papers segment of

the paper industry. The Company also produces PCC for sale to

companies in the polymer, food and pharmaceutical industries. See Item 7,

"Management's Discussion and Analysis of Financial Condition and Results of

Operations."

PCC

Products - Paper

|

|

In

the paper industry, the Company's PCC is

used:

|

|

·

|

As

a filler in the production of coated and uncoated wood-free printing and

writing papers, such as office papers;

|

|

·

|

As

a filler for coated and uncoated groundwood (wood-containing) paper such

as magazine and catalog papers; and

|

|

·

|

As

a coating pigment for both wood-free and groundwood

papers.

|

The

Company's Paper PCC product line net sales were $484.6 million, $547.2 million

and $542.0 million for the years ended December 31, 2009, 2008 and 2007,

respectively.

Approximately

50% of the Company's sales consist of PCC sold to papermakers from "satellite"

PCC plants. A satellite PCC plant is a PCC manufacturing facility

located near a paper mill, thereby eliminating costs of transporting PCC from

remote production sites to the paper mill. The Company believes the

competitive advantages offered by improved economics and superior optical

characteristics of paper produced with PCC manufactured by the Company's

satellite PCC plants resulted in substantial growth in the number of the

Company's satellite PCC plants since the first such plant was built in

1986. For information with respect to the locations of the Company's

PCC plants as of December 31, 2009, see Item 2, "Properties,"

below.

The

Company currently manufactures several customized PCC product forms using

proprietary processes. Each product form is designed to provide

optimum balance of paper properties including brightness, opacity, bulk,

strength and improved printability. The Company's research and

development and technical service staffs focus on expanding sales from its

existing and potential new satellite PCC plants as well as developing new

technologies for new applications. These technologies include, among

others, acid-tolerant ("AT®") PCC,

which allows PCC to be introduced to the large wood-containing segment of the

printing and writing paper market, and OPACARB® PCC,

a family of products for paper coating.

The

Company owns, staffs, operates and maintains all of its satellite PCC

facilities, and owns or licenses the related technology. Generally,

the Company and its paper mill customers enter into long-term evergreen

agreements, initially ten years in length, pursuant to which the Company

supplies substantially all of the customer's precipitated calcium carbonate

filler requirements. The Company is generally permitted to sell to

third-parties PCC produced at a satellite plant in excess of the host paper

mill's requirement.

The

Company also sells a range of PCC products to paper manufacturers from

production sites not associated with paper mills. These merchant facilities are

located at Adams, Massachusetts; Lifford, England; and Walsum,

Germany.

PCC

Markets - Paper

Uncoated Wood-Free Printing and

Writing Papers – North America. Beginning in the mid-1980's,

as a result of a concentrated research and development effort, the Company's

satellite PCC plants facilitated the conversion of a substantial percentage of

North American uncoated wood-free printing and writing paper producers to

lower-cost alkaline papermaking technology. The Company estimates

that during 2009, more than 90% of North American uncoated wood-free paper was

produced employing alkaline technology. Presently, the Company owns

and operates 19 commercial satellite PCC plants located at paper mills that

produce uncoated wood-free printing and writing papers in North

America.

Uncoated Wood-Free Printing and

Writing Papers – Outside North America. The Company estimates

the amount of uncoated wood-free printing and writing papers produced outside of

North America at facilities that can be served by satellite and merchant PCC

plants is more than twice as large (measured in tons of paper produced) as the

North American uncoated wood-free paper market currently served by the

Company. The Company believes that the superior brightness, opacity

and bulking characteristics offered by its PCC products allow it to compete with

suppliers of ground limestone and other filler products outside of North

America. Presently, the Company owns and operates 20 commercial

satellite PCC plants located at paper mills that produce uncoated wood-free

printing and writing papers outside of North America.

Uncoated Groundwood

Paper. The uncoated groundwood paper market, including

newsprint, represents approximately 30% of worldwide paper

production. Paper mills producing wood-containing paper still

generally employ acid papermaking technology. The conversion to

alkaline technology by these mills has been hampered by the tendency of

wood-containing papers to darken in an alkaline environment. The

Company has developed proprietary application technology for the manufacture of

high-quality groundwood paper in an acidic environment using PCC (AT®

PCC). Furthermore, as groundwood or wood-containing paper mills use

larger quantities of recycled fiber, there is a trend toward the use of neutral

papermaking technology in this segment for which the Company presently supplies

traditional PCC chemistries. The Company now supplies PCC at about 12

groundwood paper mills around the world and licenses its technology to a ground

calcium carbonate producer to help accelerate the conversion from acid to

alkaline papermaking.

Coated Paper. The

Company continues to pursue satellite PCC opportunities in coated paper markets

where our products provide unique performance and/or cost reduction benefits to

papermakers and printers. Our Opacarb product line is designed to create value

to the papermaker and can be used alone or in combination with other coating

pigments. PCC coating products are produced at 10 of the Company's PCC plants

worldwide.

Specialty

PCC Products and Markets

The

Company also produces and sells a full range of dry PCC products on a merchant

basis for non-paper applications. The Company's Specialty PCC product

line net sales were $50.1 million, $58.5 million and $60.6 million for the years

ended December 31, 2009, 2008 and 2007, respectively. The Company sells

surface-treated and untreated grades of PCC to the polymer industry for use in

automotive and construction applications, and to the adhesives and printing inks

industries. The Company's PCC is also used by the food and

pharmaceutical industries as a source of bio-available calcium in tablets and

food applications, as a buffering agent in tablets, and as a mild abrasive in

toothpaste. The Company produces PCC for specialty applications from

production sites at Adams, Massachusetts and Lifford, England.

Processed

Minerals - Products and Markets

The

Company mines and processes natural mineral products, primarily limestone and

talc. The Company also manufactures lime, a limestone-based product.

The Company's net sales of processed mineral products were $93.7 million, $110.7

million and $114.0 million for the years ended December 31, 2009, 2008 and 2007,

respectively. Net sales of talc products were $32.3 million, $35.9 million and

$37.3 million for the years ended December 31, 2009, 2008 and 2007,

respectively. Net sales of ground calcium carbonate ("GCC") products, which are

principally lime and limestone, were $61.4 million, $74.8 million and $76.7

million for the years ended December 31, 2009, 2008 and 2007, respectively. See

Item 7, "Management's Discussion and Analysis of Financial Condition and Results

of Operations."

The

Company mines and processes GCC products at its reserves in the eastern and

western parts of the United States. GCC is used and sold in the construction,

automotive and consumer markets.

Lime

produced at the Company's Adams, Massachusetts, and Lifford, United Kingdom,

facilities is used primarily as a raw material for the manufacture of PCC at

these sites and at some satellite PCC plants, and is sold commercially to

various chemical and other industries.

The

Company mines, beneficiates and processes talc at its Barretts site, located

near Dillon, Montana. Talc is sold worldwide in finely ground form for ceramic

applications and in North America for paint and coatings and polymer

applications. Because of the

exceptional

chemical purity of the Barretts ore, a significant portion of worldwide

automotive catalytic converter ceramic substrates contain the Company's Barretts

talc.

The

Company's natural mineral products are supported by the Company's limestone

reserves located in the western and eastern parts of the United States, and talc

reserves located in Montana. The Company estimates these reserves, at

current usage levels, to be in excess of 30 years at its limestone production

facilities and in excess of 20 years at its talc production

facility.

Refractories

Segment

Refractory

Products and Markets

Refractories

Products

The

Company offers a broad range of monolithic and pre-cast refractory products and

related systems and services. The Company's Refractory segment net

sales were $278.9 million, $395.8 million and $361.1 million for the years ended

December 31, 2009, 2008 and 2007, respectively. See Item 7,

"Management's Discussion and Analysis of Financial Condition and Results of

Operations."

Refractory

product sales are often supported by Company-supplied proprietary application

equipment and on-site technical service support. The Company's

proprietary application equipment is used to apply refractory materials to the

walls of steel-making furnaces and other high temperature vessels to maintain

and extend their useful life. Net sales of refractory products, including those

for non-ferrous applications, were $225.4 million, $320.8 million and $290.5

million for the years ended December 31, 2009, 2008 and 2007. The Company's

proprietary application system, such as its MINSCAN®,

allow for remote-controlled application of the Company's refractory products in

steel-making furnaces, as well as in steel ladles and blast

furnaces. Since the steel-making industry is characterized by intense

price competition, which results in a continuing emphasis on increased

productivity, these application systems and the technologically advanced

refractory materials developed in the Company's research laboratories have been

well accepted by the Company's customers. These products allow steel

makers to improve their performance through, among other things, the application

of monolithic refractories to furnace linings while the furnace is at operating

temperature, thereby eliminating the need for furnace cool-down periods and

steel-production interruption. The result is a lower overall cost for

steel produced by steel makers.

The

Company's experienced technical service staff and advanced application equipment

provide customers assurance that they will achieve their desired productivity

objectives. The Company's technicians are also able to conduct laser

measurement of refractory wear, sometimes in conjunction with robotic

application tools, to improve refractory performance at many customer

locations. The Company believes that these services, together with

its refractory product offerings, provide it with a strategic marketing

advantage.

Over

the past several years the Refractories segment has continued to reformulate its

products and application technology to maintain its competitive advantage in the

market place. Some of the new products the Company has introduced in the past

few years include:

|

·

|

HOTCRETE®:

High durability shotcrete products for applications at high temperatures

in ferrous applications such as steel ladles;

|

|

·

|

FASTFIRE®:

High durability castable and shotcrete products in the non-ferrous and

ferrous industries with the added benefit of rapid dry-out

capabilities;

|

|

·

|

OPTIFORM®:

A system of products and equipment for the rapid continuous casting of

refractories for applications such as steel ladle safety

linings;

|

|

·

|

ENDURATEQ®:

A high durability refractory shape for glass contact applications such as

plungers and orifice rings; and

|

|

·

|

DECTEQ™:

A system for the automatic control of electrical power feeding electrodes

used in electric arc steel making

furnaces.

|

Refractories

Markets

The

principal market for the Company's refractory products is the steel

industry. Management believes that certain trends in the steel

industry will provide growth opportunities for the Company. These

trends include growth and quality improvements in select geographic regions

(e.g., China, Eastern Europe and India) the development of improved

manufacturing processes such as thin-slab casting, the trend in North America to

shift production from integrated mills to electric arc furnaces (mini-mills) and

the ever-increasing need for improved productivity and longer lasting

refractories.

The

Company sells its refractory products in the following markets:

Steel Furnace. The

Company sells gunnable monolithic refractory products and application systems to

users of basic oxygen furnaces and electric furnaces for application on furnace

walls to prolong the life of furnace linings.

Other Iron and

Steel. The Company sells monolithic refractory materials and

pre-cast refractory shapes for iron and steel ladles, vacuum degassers,

continuous casting tundishes, blast furnaces and reheating

furnaces. The Company offers a full line of materials to satisfy most

continuous casting refractory applications. This full line consists

of gunnable materials, refractory shapes and permanent linings.

Industrial Refractory

Systems. The Company sells refractory shapes and linings to

non-steel refractories consuming industries including glass, cement, aluminum

and petrochemicals, power generation and other non-steel industries. The Company

also produces a specialized line of carbon composites and pyrolitic graphite

primarily sold under the PYROID®

trademark, primarily to the aerospace and electronics industries.

Metallurgical

Products and Markets

The

Company produces a number of other technologically advanced products for the

steel industry, including calcium metal, metallurgical wire products and a

number of metal treatment specialty products. Net sales of metallurgical

products were $53.5 million, $75.0 million and $70.6 million for the years ended

December 31, 2009, 2008 and 2007. The Company manufactures calcium metal at its

Canaan, Connecticut, facility and purchases calcium in international

markets. Calcium metal is used in the manufacture of the Company's

PFERROCAL®

solid-core calcium wire, and is also sold for use in the manufacture of

batteries and magnets. The Company sells metallurgical wire products

and associated wire-injection equipment for use in the production of

high-quality steel. These metallurgical wire products are injected

into molten steel to improve castability and reduce

imperfections. The steel produced is used for high-pressure pipeline

and other premium-grade steel applications.

Marketing

and Sales

The

Company relies principally on its worldwide direct sales force to market its

products. The direct sales force is augmented by technical service

teams that are familiar with the industries to which the Company markets its

products, and by several regional distributors. The Company's sales

force works closely with the Company's technical service staff to solve

technical and other issues faced by the Company's customers. The Company's

technical service staff assists paper producers in ongoing evaluations of the

use of PCC for paper coating and filling applications. In the Refractory

segment, the Company's technical service personnel advise on the use of

refractory materials, and, in many cases pursuant to service agreements, apply

the refractory materials to the customers' furnaces and other vessels. Continued

use of skilled technical service teams is an important component of the

Company's business strategy.

The

Company works closely with its customers to ensure that their requirements are

satisfied, and it often trains and supports customer personnel in the use of the

Company's products. The Company oversees domestic marketing and sales activities

from Bethlehem, Pennsylvania, and from regional sales offices in the eastern and

western United States. The Company's international marketing and sales efforts

are directed from regional centers located in Brussels, Belgium; Sao Jose Dos

Campos, Brazil; and Shanghai, China. The Company believes its processed minerals

are at regional locations that satisfy the stringent delivery requirements of

the industries they serve. The Company also believes that its worldwide network

of sales personnel and manufacturing sites facilitates the continued

international expansion.

Raw

Materials

The

Company depends in part on having an adequate supply of raw materials for its

manufacturing operations, particularly lime and carbon dioxide for the PCC

product line, magnesia and alumina for its Refractory operations, and on having

adequate access to ore reserves at its mining operations.

The

Company uses lime in the production of PCC and is a significant purchaser of

lime worldwide. Generally, lime is purchased under long-term supply

contracts from unaffiliated suppliers located in close geographic proximity to

the Company's PCC plants.

The

principal raw materials used in the Company's monolithic refractory products are

refractory-grade magnesia and various forms of aluminasilicates. The

Company also purchases calcium metal, calcium silicide, graphite, calcium

carbide and various alloys for use in the production of metallurgical wire

products and uses lime and aluminum in the production of calcium

metal. The Company purchases a significant portion of its magnesia

requirements from sources in China. The price and availability of

bulk raw materials from China are subject to fluctuations that could affect the

Company's sales to its customers. In addition, the volatility of transportation

costs have also affected the delivered cost of raw materials imported from China

to North America and Europe.

Competition

The

Company is continually engaged in efforts to develop new products and

technologies and refine existing products and technologies in order to remain

competitive and to position itself as a market leader.

With

respect to its PCC products, the Company competes for sales to the paper

industry with other minerals, such as GCC and kaolin, based in large part upon

technological know-how, patents and processes that allow the Company to deliver

PCC that it believes imparts gloss, brightness, opacity and other properties to

paper on an economical basis. The Company is the leading manufacturer

and supplier of PCC to the paper industry.

The

Company competes in sales of its limestone and talc based primarily upon

quality, price, and geographic location.

With

respect to the Company's refractory products, competitive conditions vary by

geographic region. Competition is based upon the performance

characteristics of the product (including strength, consistency and ease of

application), price, and the availability of technical support.

Research

and Development

Many

of the Company's product lines are technologically advanced. Our expertise in

inorganic chemistry, crystallography and structural analysis, fine particle

technology and other aspects of materials science apply to and support all of

our product lines. The Company's business strategy for growth in sales and

profitability depends, to a large extent, on the continued success of its

research and development activities. Among the significant achievements of the

Company's research and development efforts have been: the satellite PCC plant

concept; PCC crystal morphologies for paper coating; AT® PCC

for wood-containing papers; the development of FASTFIRE® and

OPTIFORM®

shotcrete refractory products; LACAM®

laser-based refractory measurement systems; the MINSCAN® and

HOTCRETE®

application systems and EMforce® for

the Processed Minerals and Specialty PCC product lines.

The

Company will continue to develop its filler-fiber composite material, which

could increase filler levels in uncoated freesheet paper to upwards of 30%. This

product remains in development. The Company is in commercialization discussions

with a company in Europe and also conducting large-scale trials in Asia. The

Company will also continue to reformulate its refractory materials to be more

competitive, and will also continue development of unique calcium carbonates for

use in novel biopolymers.

For

the years ended December 31, 2009, 2008 and 2007, the Company spent

approximately $19.9 million, $23.1 million and $26.3 million, respectively, on

research and development. The Company's research and development spending for

2009 was approximately 2.2% of net sales.

The

Company maintains its primary research facilities in Bethlehem and Easton,

Pennsylvania. It also has research and development facilities in

China, Finland, Germany, Ireland, Japan and Turkey. Approximately 93

employees worldwide are engaged in research and development. In

addition, the Company has access to some of the world's most advanced

papermaking and paper coating pilot facilities.

Patents

and Trademarks

The

Company owns or has the right to use approximately 309 patents and approximately

797 trademarks related to its business. The Company believes that its

rights under its existing patents, patent applications and trademarks are of

value to its operations, but no one patent, application or trademark is material

to the conduct of the Company's business as a whole.

Insurance

The

Company maintains liability and property insurance and insurance for business

interruption in the event of damage to its production facilities and certain

other insurance covering risks associated with its business. The

Company believes such insurance is adequate for the operation of its

business. There is no assurance that in the future the Company will

be able to maintain the coverage currently in place or that the premiums will

not increase substantially.

Employees

At

December 31, 2009, the Company employed 2,173 persons, of whom 1,072 were

employed outside of the United States.

Environmental,

Health and Safety Matters

The

Company’s operations are subject to federal, state, local and foreign laws and

regulations relating to the environment and health and

safety. Certain of the Company’s operations involve and have involved

the use and release of substances that have been and are classified as toxic or

hazardous within the meaning of these laws and

regulations. Environmental operating permits are, or may be, required

for certain of the Company’s operations and such permits are subject to

modification, renewal and revocation. The Company regularly

monitors and reviews its operations, procedures and policies for compliance with

these laws and regulations. The Company believes its operations are

in substantial compliance with these laws and regulations and that there are no

violations that would have a material effect on the Company. Despite

these compliance efforts, some risk of environmental and other damage is

inherent in the Company’s operations, as it is with other companies engaged in

similar businesses, and there can be no assurance that material violations will

not occur in the future. The cost of compliance with these laws and

regulations is not expected to have a material adverse effect on the

Company.

Laws

and regulations are subject to change. See Item 1A, Risk Factors, for

information regarding the possible effects that compliance with new

environmental laws and regulations, including those relating to climate change,

may have on our businesses and operating results.

The

Company obtained indemnification for certain potential health and safety

liabilities under agreements entered into between the Company and Pfizer Inc

("Pfizer") or Quigley Company, Inc., a wholly-owned subsidiary of Pfizer, in

connection with the initial public offering of the Company in

1992. See "Certain Relationships and Related Transactions" in Item

13.

Available

Information

The

Company maintains an internet website located at

http://www.mineralstech.com. Its reports on Forms 10-K, 10-Q and 8-K,

and amendments to those reports, as well as its Proxy Statement and filings

under Section 16 of the Securities Exchange Act of 1934 are available free of

charge through the Investor Relations page of its website, as soon as reasonably

practicable after they are filed with the Securities and Exchange Commission

("SEC"). Investors may access these reports through the Company's

website by navigating to "Investor Relations" and then to "SEC

Filings."

Financial

information concerning our business segments and the geographical areas in which

we operate appears in the Notes to the Consolidated Financial

Statements.

Item

1A. Risk Factors

The

disclosure and analysis set forth in this report contains certain

forward-looking statements, particularly statements relating to future actions,

future performance or results of current and anticipated products, sales

efforts, expenditures, and financial results. From time to time, the

Company also provides forward-looking statements in other publicly-released

materials, both written and oral. Forward-looking statements provide

current expectations and forecasts of future events such as new products,

revenues and financial performance, and are not limited to describing historical

or current facts. They can be identified by the use of words such as

"expects," "plans," "anticipates," and other words and phrases of similar

meaning.

Forward-looking

statements are necessarily based on assumptions, estimates and limited

information available at the time they are made. A broad variety of

risks and uncertainties, both known and unknown, as well as the inaccuracy of

assumptions and estimates, can affect the realization of the expectations or

forecasts in these statements. Consequently, no forward-looking

statement can be guaranteed. Actual future results may vary

materially.

The

Company undertakes no obligation to update any forward-looking

statements. Investors should refer to the Company's subsequent

filings under the Securities Exchange Act of 1934 for further

disclosures.

As

permitted by the Private Securities Litigation Reform Act of 1995, the Company

is providing the following cautionary statements which identify factors that

could cause the Company's actual results to differ materially from historical

and expected results.

|

·

|

Adverse

General Economic, Business, and Industry Conditions

|

|

The

Company’s business and operating results have been and may in the future

be adversely affected by the current US recession and other global

economic conditions, including declining consumer and business confidence,

volatile raw material prices, instability in credit markets, high

unemployment, fluctuating interest rates and exchange rates, and other

challenges that could affect the global economy. The Company’s customers

and potential customers may experience deterioration of their businesses,

cash flow shortages, and difficulty obtaining financing. As a result,

existing or potential customers may reduce or delay their growth and

investments and their plans to purchase products, and may not be able to

fulfill their obligations in a timely fashion. Further, suppliers could

experience similar conditions, which could impact their ability to fulfill

their obligations to the Company. Adversity within capital markets may

impact future return on pension assets, thus resulting in greater future

pension costs that impact the company’s results. Accordingly, a

continued adverse economic climate in the U.S. or abroad could result in

decreases in the Company’s net revenue and

profitability.

|

|

|

·

|

Growth

Rate

|

|

Sales

and income growth of the Company depends upon a number of uncertain

events, including the outcome of the Company's strategies of increasing

its penetration into geographic markets such as Asia and Europe;

increasing its penetration into product markets such as the market for

papercoating pigments and the market for groundwood paper pigments;

increasing sales to existing PCC customers by increasing the amount of PCC

used per ton of paper produced; developing, introducing and selling new

products such as filler-fiber composite materials for the paper industry;

and acquisitions. Difficulties, delays or failure of any of

these strategies could affect the future growth rate of the

Company.

|

|

·

|

Contract

Renewals

|

|

Generally,

the Company's sales of PCC are pursuant to long-term evergreen agreements,

initially ten years in length, with paper mills where the Company operates

satellite PCC plants. The terms of many of these agreements

have been extended, often in connection with an expansion of the satellite

plant. However, failure of a number of the Company's customers

to renew or extend existing agreements on terms as favorable to the

Company as those currently in effect could have a substantial adverse

effect on the Company's results of operations, and could also result in

impairment of the assets associated with the PCC plant.

|

|

|

·

|

Consolidation

in Customer Industries, Principally Paper and Steel

|

|

Several

consolidations in the paper industry have taken place in recent

years. These consolidations could result in partial or total

closure of some paper mills where the Company operates PCC

satellites. Such closures would reduce the Company's sales of

PCC, except to the extent that they resulted in shifting paper production

and associated purchases of PCC to another location served by the Company.

Similarly, consolidations have occurred in the steel

industry. Such consolidations in the two major industries we

serve concentrate purchasing power in the hands of a smaller number of

papermakers and steel manufacturers, enabling them to increase pressure on

suppliers, such as the Company. This increased pressure could

have an adverse effect on the Company's results of operations in the

future.

|

|

|

·

|

Regulation

and Litigation; Environmental Exposures

|

|

The

Company’s operations are subject to international, federal, state and

local governmental environmental, health and safety, tax and other laws

and regulations, and potentially to claims for various legal,

environmental and tax matters. The Company is currently a party

in various litigation matters. While the Company carries

liability insurance, which it believes to be appropriate to its

businesses, and has provided reserves for such matters, which it believes

to be adequate, an unanticipated liability, arising out of such a

litigation matter or a tax or environmental proceeding could have a

material adverse effect on the Company’s financial condition or results of

operations.

In

addition, future events, such as changes to or modifications of

interpretations of existing laws and regulations, or enforcement polices,

or further investigation or evaluation of the potential environmental

impacts of operations or health hazards of certain products, may give rise

to additional compliance and other costs that could have a material

adverse effect on the Company. State, national, and

international governments and agencies have been evaluating

climate-related legislation and regulation that would restrict emissions

of greenhouse gases in areas in which we conduct business, and some such

legislation and regulation have already been enacted or

adopted. Enactment of climate-related legislation or adoption

of regulation that restrict emissions of greenhouse gases in areas in

which we conduct business could have an adverse effect on our operations

or demand for our products. Our manufacturing processes,

particularly the manufacturing process for PCC, use a significant amount

of energy and, should energy prices increase as a result of such

legislation or regulation, we may not be able to pass these increased

costs on to purchasers of our products. We cannot predict if or

when currently proposed or additional laws and regulations regarding

climate change or other environmental or health and safety concerns will

be enacted or adopted.

|

|

|

·

|

New

Products

|

|

The

Company is engaged in a continuous effort to develop new products and

processes in all of its product lines. Difficulties, delays or

failures in the development, testing, production, marketing or sale of

such new products could cause actual results of operations to differ

materially from our expected results.

|

|

|

·

|

Competition;

Protection of Intellectual Property

|

|

The

Company's ability to compete is based in part upon proprietary knowledge,

both patented and unpatented. The Company's ability to achieve

anticipated results depends in part on its ability to defend its

intellectual property against inappropriate disclosure as well as against

infringement. In addition, development by the Company's

competitors of new products or technologies that are more effective or

less expensive than those the Company offers could have a material adverse

effect on the Company's financial condition or results of

operations.

|

|

|

·

|

Risks

of Doing Business Abroad

|

|

As

the Company expands its operations overseas, it faces increased risks of

doing business abroad, including inflation, fluctuation in interest rates

and currency exchange rates, changes in applicable laws and regulatory

requirements, export and import restrictions, tariffs, nationalization,

expropriation, limits on repatriation of funds, civil unrest, terrorism,

unstable governments and legal systems, and other

factors. Adverse developments in any of these areas could cause

actual results to differ materially from historical and expected

results.

|

|

·

|

Availability

and Cost of Raw Materials

|

|

The

Company depends in part on having an adequate supply of raw materials for

its manufacturing operations, particularly lime and carbon dioxide for the

PCC product line, and magnesia and alumina for its Refractory operations

and on having adequate access to ore reserves of appropriate quality at

its mining operations. Unanticipated changes in the costs or

availability of such raw materials, or in the Company's ability to have

access to its ore reserves, could adversely affect the Company's results

of operations.

|

|

|

·

|

Cyclical

Nature of Customers' Businesses

|

|

The

majority of the Company's sales are to customers in industries which have

historically been cyclical paper, steel and construction. The

Company's exposure to variations in its customers' businesses has been

reduced by the diversification of its portfolio of products and services;

and by its geographic expansion. Also, the Company has

structured most of its long-term satellite PCC contracts to provide a

degree of protection against declines in the quantity of product

purchased, since the price per ton of PCC generally rises as the number of

tons purchased declines. In addition, many of the Company's

product lines lower its customers' costs of production or increase their

productivity, which should encourage them to use its products. In

addition, our Processed Minerals and Specialty PCC product lines are

affected by the domestic building and construction markets. The

residential component of this market has experienced a significant

slowdown which could have an adverse impact on future growth. A

sustained economic downturn in one or more of the industries or geographic

regions that the Company serves, or in the worldwide economy, could cause

actual results of operations to differ materially from historical and

expected results.

|

Item

1B. Unresolved Staff

Comments

None.

Item

2. Properties

Set

forth below is the location of, and the main customer served by, each of the

Company's 53 satellite PCC plants as of December 31, 2009. Generally,

the land on which each satellite PCC plant is located is leased at a nominal

amount by the Company from the host paper mill pursuant to a lease, the term of

which generally runs concurrently with the term of the PCC production and sale

agreement between the Company and the host paper mill.

|

Location

|

Principal Customer

|

|

United

States

|

|

|

Alabama,

Courtland

|

International

Paper Company

|

|

Alabama,

Jackson

|

Boise

Inc.

|

|

Alabama,

Selma

|

International

Paper Company

|

|

Arkansas,

Ashdown

|

Domtar

Inc.

|

|

Florida,

Pensacola

|

Georgia-Pacific

Corporation (Koch Industries)

|

|

Kentucky,

Wickliffe

|

NewPage

Corporation

|

|

Louisiana,

Port Hudson

|

Georgia-Pacific

Corporation (Koch Industries)

|

|

Maine,

Jay

|

Verso

Paper Holdings LLC

|

|

Maine,

Madison

|

Madison

Paper Industries

|

|

Maine,

Millinocket 3

|

Katahdin

Paper Company LLC

|

|

Michigan,

Quinnesec

|

Verso

Paper Holdings LLC

|

|

Minnesota,

Cloquet

|

Sappi

Ltd.

|

|

Minnesota,

International Falls

|

Boise

Inc.

|

|

New

York, Ticonderoga

|

International

Paper Company

|

|

North

Carolina, Plymouth2

|

Domtar

Inc.

|

|

Ohio,

Chillicothe

|

P.H.

Glatfelter Co.

|

|

Ohio,

West Carrollton

|

Appleton

Papers Inc.

|

|

South

Carolina, Eastover

|

International

Paper Company

|

|

Virginia,

Franklin2

|

International

Paper Company

|

|

Washington,

Camas

|

Georgia-Pacific

Corporation (Koch Industries)

|

|

Washington,

Longview

|

North

Pacific Paper Corporation

|

|

Washington,

Wallula

|

Boise

Inc.

|

|

Wisconsin,

Kimberly

|

Appleton

Coated

|

|

Wisconsin,

Park Falls

|

Flambeau

River Papers LLC

|

|

Wisconsin,

Wisconsin Rapids

|

New

Page Corporation

|

|

Location

|

Principal Customer

|

|

International

|

|

|

Brazil,

Guaiba

|

Aracruz

Celulose S.A.

|

|

Brazil,

Jacarei

|

Ahlstrom-VCP

Industria de Papeis Especialis Ltda.

|

|

Brazil,

Luiz Antonio

|

International

Paper do Brasil Ltda.

|

|

Brazil,

Mucuri

|

Suzano

Papel e Celulose S. A.

|

|

Brazil,

Suzano

|

Suzano

Papel e Celulose S. A.

|

|

Canada,

St. Jerome, Quebec

|

Cascades

Fine Papers Group Inc.

|

|

Canada,

Windsor, Quebec

|

Domtar

Inc.

|

|

China,

Dagang 1

|

Gold

East Paper (Jiangsu) Company Ltd.

|

|

China,

Zhenjiang 1

|

Gold

East Paper (Jiangsu) Company Ltd.

|

|

China,

Suzhou1

|

Gold

HuaSheng Paper Company Ltd.

|

|

Finland,

Äänekoski

|

M-real

Corporation

|

|

Finland,

Anjalankoski

|

Myllykoski

Paper Oy

|

|

Finland,

Tervakoski

|

Trierenberg

Holding

|

|

France,

Alizay

|

M-real

Corporation

|

|

France,

Docelles

|

UPM

Corporation

|

|

France,

Saillat Sur Vienne

|

International

Paper Company

|

|

Germany,

Schongau

|

UPM

Corporation

|

|

India,

Ballarshah1

|

Ballarpur

Industries Ltd.

|

|

Indonesia,

Perawang1

|

PT

Indah Kiat Pulp and Paper Corporation

|

|

Japan,

Shiraoi1

|

Nippon

Paper Group Inc.

|

|

Malaysia,

Sipitang

|

Ballarpur

Industries Ltd.

|

|

Mexico,

Chihuahua

|

Copamex,

S.A. de C.V.

|

|

Poland,

Kwidzyn

|

International

Paper – Kwidzyn, S.A

|

|

Portugal,

Figueira da Foz1

|

Soporcel

- Sociedade Portuguesa de Papel, S.A.

|

|

Slovakia,

Ruzomberok

|

Mondi

Business Paper SCP

|

|

South

Africa, Merebank1

|

Mondi

Paper Company Ltd.

|

|

Thailand,

Namphong

|

Phoenix

Pulp & Paper Public Co. Ltd.

|

|

Thailand,

Tha Toom1

|

Advance

Agro Public Co. Ltd.

|

1 These

plants are owned through joint ventures.

2 The

Company expects to cease production at these facilities in the second quarter of

2010.

3 This

facility was idle in 2009.

The

Company also owned at December 31, 2009, 8 plants engaged in the mining,

processing and/or production of lime, limestone, precipitated calcium carbonate

and talc, and owned or leased 19 manufacturing facilities worldwide within the

Refractories segment. The Company's corporate headquarters, sales

offices, research laboratories, plants and other facilities are owned by the

Company except as otherwise noted. Set forth below is certain

information relating to the Company's plants and office and research

facilities:

|

Location

|

Facility

|

Product Line

|

|

United

States

|

||

|

Arizona,

Pima County

|

Plant;

Quarry1

|

Limestone

|

|

California,

Lucerne Valley

|

Plant;

Quarry

|

Limestone

|

|

Connecticut,

Canaan

|

Plant;

Quarry

|

Limestone,

Metallurgical Wire/Calcium

|

|

Indiana,

Portage

|

Plant

|

Refractories/Shapes

|

|

Louisiana,

Baton Rouge

|

Plant

|

Monolithic

Refractories

|

|

Massachusetts,

Adams

|

Plant;

Quarry

|

Limestone,

Lime, PCC

|

|

Montana,

Dillon

|

Plant;

Quarry

|

Talc

|

|

New

Jersey, Old Bridge

|

Plant

|

Monolithic

Refractories

|

|

New

York, New York

|

Headquarters2

|

All

Company Products

|

|

Ohio,

Bryan

|

Plant

|

Monolithic

Refractories

|

|

Ohio,

Dover

|

Plant

|

Monolithic

Refractories/Shapes

|

|

Pennsylvania,

Bethlehem

|

Administrative

Office; Research laboratories; Sales Offices

|

PCC,

Lime, Limestone, Talc

|

|

Pennsylvania,

Easton

|

Administrative

Office; Research laboratories; Plant; Sales Offices

|

All

Company Products

|

|

Pennsylvania,

Slippery Rock

|

Plant;

Sales Offices

|

Monolithic

Refractories/Shapes

|

|

Texas,

Bay City

|

Plant

|

Talc

|

|

International

|

||

|

Australia,

Carlingford

|

Sales

Office2

|

Monolithic

Refractories

|

|

Belgium,

Brussels

|

Sales

Office2/Administrative

Office

|

Monolithic

Refractories/PCC

|

|

Location

|

Facility

|

Product Line

|

|

Brazil,

Sao Jose dos Campos

|

Sales

Office2/Administrative

Office

|

PCC/Monolithic

Refractories

|

|

China,

Shanghai

|

Administrative

Office/Sales Office

|

PCC/Monolithic

Refractories

|

|

China,

Suzhou

|

Plant/Sales

Office/Research laboratories

|

Monolithic

Refractories/PCC

|

|

Finland,

Kaarina

|

Research

Laboratory2

|

PCC

|

|

Germany,

Duisburg

|

Plant/Sales

Office/Research laboratories

|

Laser

Scanning Instrumentation/ Probes/Monolithic

Refractories

|

|

Germany,

Walsum

|

Plant

|

PCC

|

|

Holland,

Hengelo

|

Plant/Sales

Office

|

Metallurgical

Wire

|

|

India,

Mumbai

|

Sales

Office

|

Monolithic

Refractories/Metallurgical

Wire

|

|

Ireland,

Cork

|

Plant;

Administrative Office2/

Research

laboratories

|

Monolithic

Refractories

|

|

Italy,

Brescia

|

Sales

Office; Plant

|

Monolithic

Refractories/Shapes

|

|

Japan,

Gamagori

|

Plant/Research

laboratories

|

Monolithic

Refractories/Shapes, Calcium

|

|

Japan,

Tokyo

|

Sales

Office

|

Monolithic

Refractories

|

|

Singapore

|

Sales

Office2

|

PCC

|

|

Spain,

Santander

|

Plant/Sales

Office2

|

Monolithic

Refractories

|

|

South

Africa, Pietermaritzburg

|

Plant/Sales

Office

|

Monolithic

Refractories

|

|

South

Korea, Seoul

|

Sales

Office2

|

Monolithic

Refractories

|

|

South

Korea, Yangsan

|

Plant3

|

Monolithic

Refractories

|

|

Turkey,

Gebzea

|

Plant/Research

Laboratories

|

Monolithic

Refractories/Shapes/ Application Equipment

|

|

Turkey,

Istanbul

|

Administrative

Office/Sales Office

|

Monolithic

Refractories

|

|

Turkey,

Kutahya

|

Plant

|

Monolithic

Refractories/Shapes

|

|

United

Kingdom, Lifford

|

Plant

|

PCC,

Lime

|

|

United

Kingdom, Rotherham

|

Plant/Sales

Office

|

Monolithic

Refractories/Shapes

|

|

1

|

This

plant is leased to another company.

|

|

2

|

Leased

by the Company. The facilities in Cork, Ireland, are operated

pursuant to a 99-year lease, the term of which commenced in

1963. The Company's headquarters in New York, New York, are

held under a lease which expires in 2010. The Company entered

into a new lease agreement for its corporate headquarters in New York, New

York which expires in 2021.

|

|

3

|

This

plant is owned through a joint

venture.

|

The

Company believes that its facilities, which are of varying ages and are of

different construction types, have been satisfactorily maintained, are in good

condition, are suitable for the Company's operations and generally provide

sufficient capacity to meet the Company's production

requirements. Based on past loss experience, the Company believes it

is adequately insured with respect to these assets and for liabilities likely to

arise from its operations.

Item

3. Legal Proceedings

Certain

of the Company's subsidiaries are among numerous defendants in a number of cases

seeking damages for exposure to silica or to asbestos-containing

materials. The Company currently has 305 pending silica cases and 26

pending asbestos cases. To date, 1,160 silica cases and 4 asbestos

cases have been dismissed. One silica case was dismissed in the fourth quarter

of 2009. Most of these claims do not provide adequate information to assess

their merits, the likelihood that the Company will be found liable, or the

magnitude of such liability, if any. Additional claims of this nature

may be made against the Company or its subsidiaries. At this time

management anticipates that the amount of the Company's liability, if any, and

the cost of defending such claims, will not have a material effect on its

financial position or results of operations.

The

Company has not settled any silica or asbestos lawsuits to date. We

are unable to state an amount or range of amounts claimed in any of the lawsuits

because state court pleading practices do not require identifying the amount of

the claimed damage. The aggregate cost to the Company for the legal

defense of these cases since inception was approximately $0.1 million, the

majority of which has been reimbursed by Pfizer Inc pursuant to the terms of

certain agreements entered into in connection with the Company's initial public

offering in 1992. Our experience has been that the Company is not

liable to plaintiffs in any of these lawsuits and the Company does not expect to

pay any settlements or jury verdicts in these lawsuits.

Environmental

Matters

On

April 9, 2003, the Connecticut Department of Environmental Protection ("DEP")

issued an administrative consent order relating to our Canaan, Connecticut,

plant where both our Refractories segment and Specialty Minerals segment have

operations. We agreed to the order, which includes provisions requiring

investigation and remediation of contamination associated with historic use of

polychlorinated biphenyls ("PCBs") at a portion of the site. The following is

the present status of the remediation efforts:

|

•

|

Building

Decontamination. We have completed the investigation of building

contamination and submitted a report characterizing the contamination. We

are awaiting review and approval of this report by the regulators. Based

on the results of this investigation, we believe that the contamination

may be adequately addressed by means of encapsulation through painting of

exposed surfaces, pursuant to the Environmental Protection Agency's

("EPA") regulations and have accrued such liabilities as discussed below.

However, this conclusion remains uncertain pending completion of the

phased remediation decision process required by the

regulations.

|

|

•

|

Groundwater. We

have completed investigations of potential groundwater contamination and

have submitted a report on the investigations finding that there is no PCB

contamination, but some oil contamination of the

groundwater. We expect the regulators to require confirmatory

long term groundwater monitoring at the site.

|

|

•

|

Soil. We have completed

the investigation of soil contamination and submitted a report

characterizing contamination to the regulators. Based on the results of

this investigation, we believe that the contamination may be left in place

and monitored, pursuant to a site-specific risk assessment, which is

underway. However, this conclusion is subject to completion of a phased

remediation decision process required by applicable regulations.

|

We

believe that the most likely form of remediation will be to leave existing

contamination in place, encapsulate it, and monitor the effectiveness of the

encapsulation.

We

estimate that the cost of the likely remediation above would approximate

$400,000, and that amount has been recorded as a liability on our books and

records.

The

Company is evaluating options for upgrading the wastewater treatment facilities

at its Adams, Massachusetts, plant. This work has been undertaken pursuant to an

administrative Consent Order originally issued by the Massachusetts Department

of Environmental Protection on June 18, 2002. This Order was amended on June 1,

2009. The amended order requires the installation of a groundwater

containment system by mid-year 2010. The amendment also includes the

investigation by January 1, 2022 of options for ensuring that the facility’s

wastewater treatment ponds will not result in unpermitted discharge to

groundwater. Additional requirements of the amendment include the

submittal by July 1, 2022 of a plan for closure of a historic lime solids

disposal area. Preliminary engineering reviews completed in 2005 indicate that

the estimated cost of wastewater treatment upgrades to operate this facility

beyond 2024 may be between $6 million and $8 million. The Company estimates that

the remaining remediation costs would approximate $400,000, which has been

accrued as of December 31, 2009.

The

Company and its subsidiaries are not party to any other material pending legal

proceedings, other than routine litigation incidental to their

businesses.

Item

4. Submission of Matters to a Vote of

Security Holders

No

matters were submitted to a vote of security holders during the fourth quarter

of 2009.

PART

II

Item

5. Market for Registrant's Common

Equity, Related Stockholder Matters and Issuer Purchases of

Securities

The

Company's common stock is traded on the New York Stock Exchange under the symbol

"MTX."

Information

on market prices and dividends is set forth below:

|

2009 Quarters

|

First

|

Second

|

Third

|

Fourth

|

|||||||

|

Market

Price Range Per Share of Common Stock

|

|||||||||||

|

High

|

$

|

42.10

|

$

|

42.82

|

$

|

50.87

|

$

|

56.39

|

|||

|

Low

|

26.76

|

31.41

|

35.87

|

45.85

|

|||||||

|

Close

|

32.05

|

36.78

|

47.52

|

54.47

|

|||||||

|

Dividends

paid per common

share

|

$

|

0.05

|

$

|

0.05

|

$

|

0.05

|

$

|

0.05

|

|||

|

2008 Quarters

|

First

|

Second

|

Third

|

Fourth

|

|||||||

|

Market

Price Range Per Share of Common Stock

|

|||||||||||

|

High

|

$

|

64.74

|

$

|

72.42

|

$

|

68.38

|

$

|

59.36

|

|||

|

Low

|

52.29

|

62.80

|

60.73

|

37.89

|

|||||||

|

Close

|

61.72

|

64.65

|

61.62

|

40.90

|

|||||||

|

Dividends

paid per common

share

|

$

|

0.05

|

$

|

0.05

|

$

|

0.05

|

$

|

0.05

|

|||

Equity

Compensation Plan Information

|

Plan

Category

|

Number

of securities to be issued upon exercise of outstanding

options

|

Weighted

average exercise price of outstanding options

|

Number

of securities remaining available for future issuance

|

|||||

|

Equity

compensation plans approved by security holders

|

787,530

|

$

|

52.54

|

1,034,125

|

||||

|

Equity

compensation plans not approved by security holders

|

--

|

--

|

--

|

|||||

|

Total

|

787,530

|

$

|

52.54

|

1,034,125

|

||||

Issuer

Purchases of Equity Securities

|

Period

|

Total

Number of Shares Purchased

|

Average

Price Paid Per Share

|

Total

Number of Shares Purchased as Part of the Publicly Announced

Program

|

Dollar

Value of Shares That May Yet be Purchased Under the

Program

|

|||||

|

September

28 - October 25

|

--

|

$

|

--

|

615,674

|

$

|

37,167,023

|

|||

|

October

26 - November 22

|

--

|

$

|

--

|

615,674

|

$

|

37,167,023

|

|||

|

November

23 - December 31

|

--

|

$

|

--

|

615,674

|

$

|

0

|

|||

|

Total

|

--

|

$

|

--

|

||||||

On

October 26, 2005, the Company's Board of Directors authorized the Company's

management, at its discretion, to repurchase up to $75 million in additional

shares over the next three-year period. As of December 31, 2008, the Company

repurchased 1,307,598 shares under this program at an average price of

approximately $57.36 per share. This program was completed in February

2008.

On

October 24, 2007, the Company's Board of Directors authorized the Company's

management to repurchase, at its discretion, up to $75 million of additional

shares over the next two-year period. As of December 31, 2009, 615,674 shares

have been purchased under this program at an average price of approximately

$61.45 per share. This program has expired as of December 31, 2009,

and $37.2 million of the authorized $75 million were not repurchased by the

Company.

On

February 22, 2010, the Company’s Board of Directors authorized the Company’s

management to repurchase, at its discretion, up to $75 million of additional

shares over the next two-year period.

On

January 27, 2010, the Company's Board of Directors declared a regular quarterly

dividend on its common stock of $0.05 per share. No dividend will be payable

unless declared by the Board and unless funds are legally available for payment

thereof.

On

February 5, 2010, the last reported sales price on the NYSE was $47.46 per

share. As of February 5, 2010, there were approximately 188 holders

of record of the common stock.

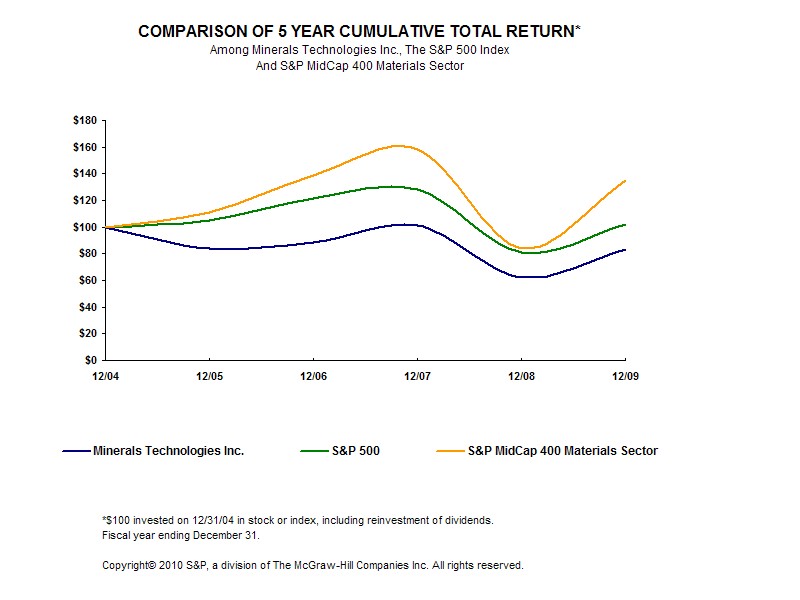

The graph

below matches the cumulative 5-year total return of holders of Minerals

Technologies Inc.'s common stock with the cumulative total returns of the

S&P 500 index and the S&P MidCap 400 Materials Sector index. The graph

assumes that the value of the investment in the company's common stock and in

each of the indexes (including reinvestment of dividends) was $100 on 12/31/2004

and tracks it through 12/31/2009.

|

12/04

|

12/05

|

12/06

|

12/07

|

12/08

|

12/09

|

||

|

Minerals

Technologies Inc.

|

100.00

|

84.07

|

88.76

|

101.39

|

62.13

|

83.15

|

|

|

S&P

500

|

100.00

|

104.91

|

121.48

|

128.16

|

80.74

|

102.11

|

|

|

S&P

MidCap 400 Materials Sector

|

100.00

|

110.68

|

138.49

|

158.15

|

83.98

|

134.88

|

|

The

stock price performance included in this graph is not necessarily indicative of

future stock price performance.

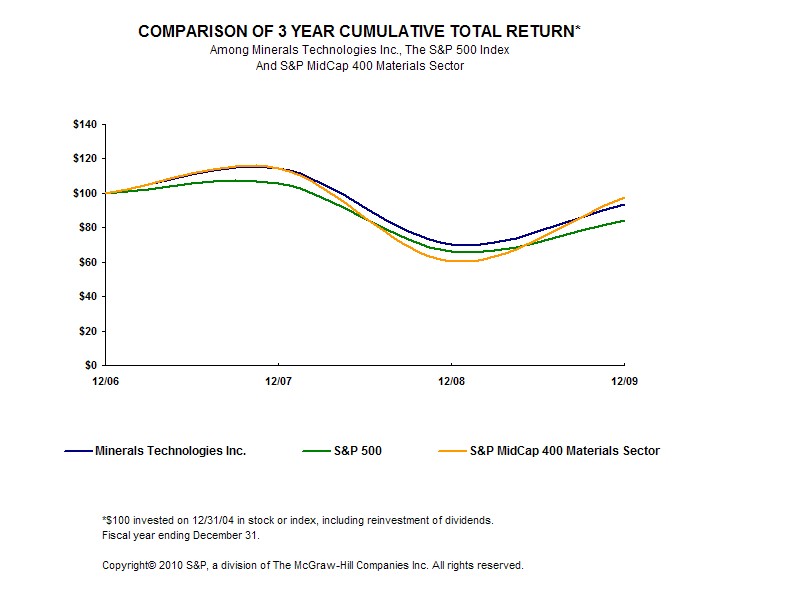

The

following graph compares the cumulative 3-year total return provided

shareholders of Minerals Technologies Inc.’s common stock relative to the

cumulative total returns of the S & P 500 index and the S&P MidCap 400

Materials Sector index. An investment of $100 (with reinvestment of all

dividends) is assumed to have been made in our common stock and in each of the

indices on 12/31/2006 and its relative performance is tracked through

12/31/09.

|

12/06

|

12/07

|

12/08

|

12/09

|

||

|

Minerals

Technologies Inc.

|

100.00

|

114.23

|

70.00

|

93.69

|

|

|

S&P

500

|

100.00

|

105.49

|

66.46

|

84.05

|

|

|

S&P

MidCap 400 Materials Sector

|

100.00

|

114.19

|

60.64

|

97.39

|

|

The

stock price performance included in this graph is not necessarily indicative of

future stock price performance.

It

Item 6. Selected Financial

Data

|

Dollars

in Millions, Except Per Share Data

|

|||||||||||||||

|

Income

Statement Data:

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||

|

Net

sales

|

$

|

907.3

|

$

|

1,112.2

|

$

|

1,077.7

|

$

|

1,023.5

|

$

|

956.8

|

|||||

|

Cost

of goods sold

|

751.5

|

891.7

|

845.1

|

798.7

|

744.0

|

||||||||||

|

Production

margin

|

155.8

|

220.5

|

232.6

|

224.8

|

212.8

|

||||||||||

|

Marketing

and administrative expenses

|

91.1

|

101.8

|

104.6

|

104.6

|

98.1

|

||||||||||

|

Research

and development expenses

|

19.9

|

23.1

|

26.3

|

27.8

|

27.0

|

||||||||||

|

Impairment

of assets

|

39.8

|

0.2

|

94.1

|

--

|

0.3

|

||||||||||

|

Restructuring

and other costs

|

22.0

|

13.4

|

16.0

|

--

|

--

|

||||||||||

|

Income

(loss) from operations

|

(17.0

|

)

|

82.0

|

(8.5

|

)

|

92.4

|

87.4

|

||||||||

|

Non-operating

income (deductions), net

|

(6.1

|

)

|

0.3

|

(3.0

|

)

|

(5.9

|

)

|

(3.9

|

)

|

||||||

|

Income

(loss) from continuing operations before

provision

for taxes on income

|

(23.1

|

)

|

82.3

|

(11.5

|

)

|

86.5

|

83.5

|

||||||||

|

Provision

(benefit) for taxes on income (loss)

|

(5.4

|

)

|

24.1

|

11.3

|

27.0

|

25.1

|

|||||||||

|

Income

(loss) from continuing operations

|

(17.7

|

)

|

58.2

|

(22.8

|

)

|

59.5

|

58.4

|

||||||||

|

Income

(loss) from discontinued operations, net of tax

|

(3.2