Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit21.htm |

| EX-23 - EXHIBIT 23 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit23.htm |

| EX-31.2 - EXHIBIT 31.2 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit31_2.htm |

| EX-32.1 - EXHIBIT 32.1 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit32_1.htm |

| EX-31.1 - EXHIBIT 31.1 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit31_1.htm |

| EX-32.2 - EXHIBIT 32.2 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit32_2.htm |

| EX-10.12 - EXHIBIT 10.12 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit10_12.htm |

| EX-10.21 - EXHIBIT 10.21 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit10_21.htm |

| EX-10.24 - EXHIBIT 10.24 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit10_24.htm |

| EX-10.23 - EXHIBIT 10.23 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit10_23.htm |

| EX-10.22 - EXHIBIT 10.22 TO ATC 2009 FORM 10-K - ATC Technology CORP | exhibit10_22.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

__________________

FORM 10-K

(Mark

One)

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the fiscal year ended December 31, 2009

OR

|

o

|

TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

Commission

file number 0-21803

__________________

ATC

Technology Corporation

(Exact

name of registrant as specified in its charter)

|

DELAWARE

|

95-4486486

|

|

(State

or other jurisdiction of

incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

1400

Opus Place, Suite 600, Downers Grove, IL

|

60515

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant's

telephone number, including area code: (630) 271-8100

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

Name

of Each Exchange on Which Listed

|

|

|

Common

Stock, $.01 par value

|

Nasdaq

Global Select Market

|

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files). Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to

this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer,” “accelerated

filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

Large

accelerated filer o Accelerated

filer x Non-accelerated

filer o Smaller

reporting company o

(Do not

check if a smaller reporting company)

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange

Act). Yes o No x

The

aggregate market value of the voting stock held by non-affiliates of the

registrant (based on the closing price of such stock, as reported by the Nasdaq

National Market, on June 30, 2009) was $282 million. The Company does not have

any non-voting stock outstanding.

The

Registrant had 20,055,373 shares of Common Stock outstanding as of February 16,

2010.

DOCUMENTS

INCORPORATED BY REFERENCE:

Portions

of the registrant’s proxy statement in connection with its annual meeting of

shareholders to be held in 2010, are incorporated by reference in Items 10, 11,

12, 13 and 14 of Part III of this Form 10-K.

ANNUAL

REPORT ON FORM 10-K

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

|

Page

|

||

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report contains forward-looking statements (as such term is defined in

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934) and information relating to us that are based

on the current beliefs of our management as well as assumptions made by and

information currently available to management, including statements related to

the markets for our products and services, general trends in our operations or

financial results, plans, expectations, estimates and beliefs. In

addition, when used in this Annual Report, the words "may," "could," "should,"

"anticipate," "believe," "estimate," "expect," "intend," "plan," "predict" and

similar expressions and their variants, as they relate to us or our management,

may identify forward-looking statements. These statements reflect our

judgment as of the date of this Annual Report with respect to future events, the

outcome of which is subject to risks, which may have a significant impact on our

business, operating results or financial condition. Readers are

cautioned that these forward-looking statements are inherently

uncertain. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results or

outcomes may vary materially from those described herein. We

undertake no obligation to update forward-looking statements. The

risks identified in Item 1A. “Risk Factors,” among others, may impact

forward-looking statements contained in this Annual Report.

PART

I

Overview

ATC

Technology Corporation, through its subsidiaries, provides outsourced supply

chain logistics services and engineering solutions to the consumer electronics

industries and light-, medium- and heavy-duty vehicle

aftermarket. Through our Logistics business, we offer value-added

supply chain services primarily to the wireless, high-end consumer electronics,

broadband and cable, and light vehicle automotive electronics markets. These

services include fulfillment, returns management, reverse logistics, packaging,

test and repair, and other related services. Through our Drivetrain

business, we provide customized remanufacturing services focused on complex

light-, medium- and heavy-duty vehicle drivetrain products, consisting

principally of automatic transmissions and to a lesser extent engines, that are

primarily sold through the service, repair and parts organizations of our

customers. We generally provide services under contractual

relationships with customers that distribute high-value, complex

products.

We

believe our service offerings are differentiated from those of our competitors

by the degree of customization we provide coupled with our focus on quality and

the consistency of our performance. We have developed business

processes, technical capabilities and information technology systems that allow

us to design flexible and scaleable solutions that help our customers reduce

their costs, improve their supply chain efficiency and enhance their

profitability. We manage, monitor and communicate detailed

information about our processes and our customers’ shipments, returns, products

and inventory on a real-time basis. This information is readily

accessible to our customers, easy-to-use, and customized to fit their needs. We

also use this information to analyze and improve the performance of our

businesses and to help us achieve our exacting quality and service

benchmarks.

ATC

Technology Corporation was incorporated in Delaware in 1994 and became a

publicly traded company in 1996. Prior to June 2008, we were known as

Aftermarket Technology Corp.

Our

Logistics Business

Our

Logistics business provides a number of value-added services that generate

operational efficiencies for our customers through the outsourcing of certain

supply chain functions. Specifically, our Logistics business provides

value-added warehousing, packaging and distribution, reverse logistics, turnkey

order fulfillment, electronic equipment testing, refurbishment and repair, and

transportation management services. Except for component parts to

support our repair services and certain product accessories and packaging

materials to support our packaging services, we generally do not take ownership

of inventory. As a result, our working capital needs are relatively

less than other logistics service providers who take ownership of

inventory. Our principal customers are in the wireless carrier,

wireless original equipment manufacturer (OEM), consumer electronics and

automotive industries and include AT&T and TomTom. Our Logistics

business segment sales accounted for 71.2%, 66.6%, 55.5%, 52.9% and 36.5% of our

2009, 2008, 2007, 2006 and 2005 net sales, respectively.

We

determine our logistics processes in close consultation with our

customers. Our information technology systems allow rapid integration

with our customers’ systems and, in conjunction with our customized processes,

help us to meet demanding logistics and repair requirements. By

improving our customers’ inventory turns and speed of repair and refurbishments,

as well as enabling our customers to realize value from returned products, we

believe we help our customers increase their profitability, reduce their capital

investments and enhance their opportunities for growth. We customize

our products and services to meet the specific individual needs of customers

instead of offering one standard suite of products and services.

Our

Logistics customers market and distribute complex and serialized consumer

electronics such as wireless devices, navigation devices, broadband and cable

devices, and light vehicle audio systems and instrument clusters. As

part of our service offering, we provide bulk and direct fulfillment of wireless

devices and certain broadband and cable devices for AT&T and its

partners. We deliver products both to AT&T retail locations and

directly to individuals and provide inventory tracking and management, process

warranty-service exchanges and perform test and repair

services. Growth in our Logistics business has been the result of

growth in our customers’ business as well as through the addition of new

services for those customers. For example, we now provide forward

fulfillment, packaging, returns management, test and repair services and

transportation management services for AT&T and

TomTom. Additionally, we provide various subsets of our full suite of

logistics service offerings for our other customers. We generally

provide our services to each customer pursuant to a contract with detailed

statements of work. These contracts typically may be terminated by

the customer on 180 days notice or less. The statements of work for

forward and reverse logistics services and test and repair programs with

AT&T run through 2010.

Our Drivetrain

Business

Our

Drivetrain business remanufactures drivetrain products, which we distribute

primarily to original equipment service organizations and their outlets (i.e., the service and repair

organizations of automotive OEMs) as well as to certain distributors in the

independent aftermarket. Our Drivetrain products consist principally

of remanufactured automatic transmissions and remanufactured engines and also

include remanufactured torque converters and valve bodies. Our

principal Drivetrain customers are Ford, Chrysler and Allison. Honda

was a significant Drivetrain customer prior to the end of our automatic

transmission remanufacturing program with them, which was substantially

completed by the end of 2009. Drivetrain business net sales accounted

for 28.8%, 33.4%, 44.5%, 47.1% and 63.5% of our 2009, 2008, 2007, 2006 and 2005

net sales, respectively.

During

the later part of 2008, our Drivetrain customers and the supporting supply base

experienced unprecedented distress due to the significant adverse changes in the

North American vehicle industry caused by the economic slowdown. In

conjunction with these adverse changes, we took actions to restructure our North

American Drivetrain operations, including the 2009 closure and consolidation of

operations at our Springfield, Missouri facility into our Drivetrain facility in

Oklahoma City, Oklahoma. In connection with this restructuring, we

recorded pre-tax charges of $9.7 million during the fourth quarter of 2008 and

$5.1 million during 2009.

These

events also caused us to reassess the carrying value of goodwill of our North

American Drivetrain business, and as a result we recorded an impairment charge

of $79.1 million during the fourth quarter of 2008. During 2009, we

received notice of the impending loss of our automatic transmission

remanufacturing program with Honda, as a result of which we recorded an

additional goodwill impairment charge of $37.0 million during the second quarter

of 2009.

See Item

7. “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and Item 8. “Consolidated Financial Statements and Supplementary

Data –Note 2, Note 5 and Note 19.”

Remanufactured

products are used in the repair of vehicles by dealers and other service outlets

during both the warranty and post-warranty periods following the sale of a

vehicle. Remanufacturing is a process through which used components

known as “cores” are returned to a central facility where they are disassembled

and the parts are inspected, cleaned, refurbished and tested. We then

combine the reusable parts with new parts to create remanufactured components

that are of comparable quality to new components. We remanufacture

some of the most complex components of a vehicle, such as the transmission and

engine. Generally, our customers and their designated suppliers

provide parts and cores to us and the customer retains title to the

core. However, our medium- and heavy-duty remanufacturing program

with Allison requires us to purchase the cores from them. In cases

where we do not take ownership of the cores, our working capital requirements

are reduced. We believe remanufactured products are generally lower

in cost than new replacement components and frequently facilitate a faster, more

reliable repair when compared to components that are rebuilt at service

outlets. In addition, remanufactured components efficiently reuse

existing parts and are less damaging to the environment.

We

generally sell our products to each customer pursuant to a supply arrangement

that typically may be terminated by the customer on 90 days notice or

less. Our contracts for transmission remanufacturing with Ford and

Chrysler expired at the end of 2009 and 2008, respectively, and are on a

month-to-month basis while we negotiate renewals. Our contract with

Allison runs through 2012.

Our

facilities that remanufacture transmissions for OEMs have QS-9000 or ISO-9000

certification, a complete quality management system developed for manufacturers

who subscribe to the ISO-9002 quality standards. The system is designed to

help suppliers, such as us, develop a quality system that emphasizes defect

prevention and continuous improvement in manufacturing processes.

Industry

Background

Logistics

Industry

Logistics

can generally be defined as the management and transportation of materials and

inventory throughout the supply chain as well as the provision of value-added

services such as assembly, packaging, programming, testing and repair. The

logistics industry has expanded rapidly over the last 15 years due to

dramatic improvements in technology, increased demand in customer service

requirements, and the significant value proposition provided to companies by

third-party logistics (3PL) providers. As more companies focus on

core competencies, many companies have decided to outsource the management of

all or part of their supply chain as a means to reduce costs, increase asset and

labor flexibility, and improve customer service. As a result, 3PL

providers have become extensively involved in the full range of customer supply

chain functions. The operational efficiencies of a 3PL provider enable

companies to reduce investments in facilities, information technology, inventory

and personnel. Third-party services include turnkey supply chain services,

such as order fulfillment, product labeling and packaging, inventory and

warehouse management, product return, refurbishment and repair, electronics

equipment testing, reverse logistics and the physical movement of

goods.

We

compete in the value-added warehousing market, a subset of the 3PL market, which

we believe is fragmented with no dominant industry player and growing

rapidly. According to Armstrong & Associates, Inc.’s 2009 North

American 3PL Market Overview report, this market size was estimated to be $29.4

billion of gross revenues in 2008.

Automotive

Aftermarket

Demand

for replacement or repair of drivetrain products is a function of numerous

factors, such as the number of vehicles in operation, the average age of

vehicles and the average number of miles driven per vehicle. Within

this overall market, factors that influence demand for our remanufactured

products, when compared to repair services, include product complexity, OEM

warranty policies governing repair-versus-replace decisions made by their

dealers, and the length of warranty periods. We supply our products

to the automotive aftermarket, which consists of parts and services for vehicles

after their original purchase.

Remanufacturing

Process

In our

remanufacturing process, we generally obtain used transmission and engine cores

from our customers or their designated suppliers. We then sort the cores

by vehicle make and model and either place them into immediate production or

store them until needed. In the remanufacturing process, we evaluate the

cores, disassemble them into their component parts, and inspect, clean,

refurbish and test the components that can be incorporated into the

remanufactured product. We replace components that we determine to be not

reusable or repairable with other remanufactured or new components. We

conduct inspection and testing at various stages of the remanufacturing process,

and we test each finished assembly on equipment designed to simulate performance

under operating conditions. After testing, we generally package completed

products for immediate delivery.

Our

Competitive Strengths

We

believe we offer products and solutions that improve our customers’ profits and

operations as a result of our competitive strengths, which include the

following:

Customized

Service Offering

We are

recognized by our customers for our high level of service and our flexibility in

providing product and service solutions. This approach involves our

team of specialists who work with the customer to understand the specific

deliverables required by that customer, understand communication points within

the supply chain, design solutions, establish operational and business metrics,

eliminate waste, and improve efficiencies. We offer a broad array of

products and services to our logistics customers, which enables us to work with

the customer to customize our products and services to meet the specific

individual needs of the customer instead of offering one standard suite of

products and services. We believe our “One-Size-Fits-One” approach

helps us attract and retain customers. For instance, for AT&T,

our supply chain management services include product and warranty returns, order

entry processing, testing and repair, warehousing, picking, kitting, customized

packaging, transportation management, and shipping and delivery of wireless

and/or broadband devices. Our integrated logistics services also include

inventory management and private labeling.

High

Quality Through Engineering and Technical Know-How

Our

remanufactured products are of consistently high quality due to the precision

manufacturing techniques, technical upgrades, and rigorous inspection and

testing procedures employed in our remanufacturing processes. We

partner with our customers to design processes that help ensure that our

remanufacturing of complex products such as automatic transmissions, valve

bodies, torque converters, engines and automotive electronics replicates OEM

quality and test procedures. Our remanufacturing process is completed by

testing products using state-of-the-art equipment such as sophisticated test

stands that enable us to replicate OEM test procedures. We are

committed to upholding the quality of our customers’ products and hold QS-9000

Certification, ISO-9000 Certification and Ford’s Q1 Certification. We

monitor our procedures and processes, which allows us to identify and to quickly

correct situations that could impact our product quality. We have a

team of engineers dedicated to enhancing and adding new products, sharing

innovative solutions and reducing our customers’ expenses.

Information

Technology Capabilities

We use

information technology to help meet customers’ needs in product security and

confidentiality, product qualification and identification, inventory management,

and interactive electronic communication. We also provide customers

with solutions for their supply chain management, reverse logistics, product

tracking, and product history needs, while maintaining service and quality

levels. Our use of information technology allows us to provide

flexible, accurate, customized logistics solutions to help meet customer

requirements while providing full visibility across the supply

chain. Our solutions can reduce customer-required investment in

information technology, and can improve the efficiency of our customers’

inventory and supply chains by providing enhanced traceability and visibility of

inventory, resulting in market-leading performance metrics and improved customer

profitability. In addition, our information technology systems allow

for rapid integration with our customers’ systems, enhancing the quality of our

services.

Strong,

Experienced Management Team

Our

executive and operations management team has extensive

experience. Our President and Chief Executive Officer, Todd Peters,

has over 20 years of financial, acquisition and integration, and automotive

operations experience. Our Chairman of the Board, Edward Stewart, has

served on the Company’s Board of Directors for five years and has 37 years of

operations experience in the manufacturing and financial services

industries. Our Vice President and Chief Financial Officer, John

Pinkerton, has over 30 years of financial and strategic planning leadership

experience. The President of our Logistics business, Antony Francis,

has nearly 40 years of financial and logistics operations experience, and the

head of our Drivetrain business, Michael Lepore, has over 30 years of operations

experience in the automotive industry.

Our

Growth Strategies

Our

strategy is to be a valued partner that provides logistics, return and repair

services, and remanufacturing for customers that distribute high-value, complex

products in various markets. We will grow by leveraging our strong

customer relationships while we develop new customers and products.

Growth

Within Our Logistics Business

We

believe we are well positioned to capitalize on growth in the 3PL services

market, particularly with existing and new customers in the consumer

electronics, broadband and cable, and vehicle industries, by offering

customized, reliable and cost effective solutions for customers with complex

logistics requirements involving high-value products. In 2009, we

were awarded new logistics business that we expect to generate $79 million of

annualized revenue.

We intend

to increase penetration of our existing Logistics business customer base by

broadening our offering of Logistics products and services and by marketing our

core competencies as solutions to meet our customers’ needs. Under our

“One-Size-Fits-One” philosophy, we will continue to leverage our broad range of

services to target new customers that provide serialized products across a

variety of industries and provide them with customized products and services to

meet their specific needs instead of offering one standard suite of products and

services. We also intend to leverage our core competencies in

logistics and electronics refurbishment by working with our existing and new

customers to identify products and services where we can add value in

satisfaction of our customers’ specific needs. We intend to further

expand our penetration of the market for logistics services and electronics

repair through the addition of other wireless carriers, wireless OEMs, and

broadband and cable providers to our customer base and through penetration of

and into other vertical markets, including electronics and

computers. We have also identified and targeted several new market

segments including additional classes of consumer electronics.

Growth

Within Our Drivetrain Business

Our

business and product development teams are working to identify new products and

processes that enable us to compete for additional business with our customers

by helping them to increase their penetration of the drivetrain repair market

and/or reduce their total warranty costs. For example, we are working

with certain of our customers to (i) develop and implement products and

strategies designed to enable them to penetrate, or increase their penetration

of, the post-warranty replacement market for automotive transmissions and (ii)

introduce or expand the use of remanufactured transmissions as a transmission

repair alternative in warranty applications.

Additional

Corporate Initiatives

Leverage Operating Efficiency and

Productivity Gains. We regularly evaluate our operating

efficiency and productivity in order to increase our profitability and cash

flows. Over the last several years, we have completed numerous lean

manufacturing, Six Sigma and continuous improvement projects that have resulted

in significant cost savings and increased capacity utilization. Our

“Lean and Continuous Improvement” program has helped us achieve margin

improvements and further enhancement of quality. We believe there are

additional opportunities to further improve our cost base and increase

earnings.

Selectively Pursue

Acquisitions. From time to time we evaluate potential

acquisitions of complementary businesses that we believe will broaden our

product offerings, diversify our customer base or provide us access to new

markets. We have established criteria by which we evaluate potential

acquisitions, which we use to identify and pursue only those that we believe

will enhance long-term stockholder value. We have made various

acquisitions in the past and, to the extent suitable acquisition candidates,

acquisition terms and financing are available, we may pursue acquisitions in the

future.

Competition

In our

Logistics business, we primarily compete in a fragmented market as a niche

participant offering a specialized value-added service requiring stringent

service requirements. Based on our performance levels, we believe we are

well positioned to compete in this market. However, some of our

competitors in this segment such as Caterpillar Logistics and UPS Logistics are

larger and have greater financial and other resources.

In our

Drivetrain business, we primarily compete in the market for remanufactured

transmissions sold to the automotive aftermarket through the OEM dealer

networks. This market, narrowly defined, is one in which the majority of

industry supply comes from a limited number of participants. Competition

is based primarily on product quality, service, delivery, technical support and

price.

Employees

As of

December 31, 2009, we had an aggregate workforce of approximately 3,300

individuals, including full-time employees and temporary workers. We

believe our employee and labor relations are good. We have not experienced

any work stoppages to date and currently none of our employees is represented by

a labor union.

Environmental

We are

subject to various evolving federal, state, local and foreign environmental laws

and regulations governing, among other things, emissions to air, discharge to

waters and the generation, handling, storage, transportation, treatment and

disposal of a variety of hazardous and non-hazardous substances and

wastes. These laws and regulations provide for substantial fines and

criminal sanctions for violations and impose liability for the costs of cleaning

up, and damages resulting from, past spills, disposals or other releases of

hazardous substances.

In

connection with the acquisition of our subsidiaries, some of which have been

subsequently divested or relocated, we conducted certain investigations of these

companies’ facilities and their compliance with applicable environmental

laws. The investigations, which included Phase I assessments by

independent consultants of all manufacturing and various distribution

facilities, found that a number of these facilities have had or may have had

releases of hazardous materials that may require remediation and also may be

subject to potential liabilities for contamination from off-site disposal of

substances or wastes. These assessments also found that reporting and

other regulatory requirements, including waste management procedures, were not

or may not have been satisfied. Although there can be no assurance,

we believe that, based in part on the investigations conducted, in part on

certain remediation completed prior to or since the acquisitions, and in part on

the indemnification provisions of the agreements entered into in connection with

our acquisitions, we will not incur any material liabilities relating to these

matters.

In

connection with the October 2000 sale of our former Distribution Group

business, we agreed to indemnify the buyer against environmental liability at

Distribution Group facilities that had been closed prior to the Distribution

Group sale, including former facilities in Azusa, California, Mexicali, Mexico

and Dayton, Ohio. We also agreed to indemnify the buyer against any

other environmental liability of the Distribution Group relating to periods

prior to the closing of the Distribution Group sale. Our

indemnification obligations to the buyer are subject to an $850,000 deductible

($100,000 in the case of the closed facilities) and a $12.0 million cap

(except with respect to the closed facilities).

Segment

Reporting

We have

two reportable segments: the Logistics segment and the Drivetrain

segment. See Item 7. “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and Item 8. “Consolidated

Financial Statements and Supplementary Data – Note 18.”

Available Information

Our

internet website is www.goATC.com. We

make available free of charge on our website our annual reports on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K and any other

filings we make with the Securities and Exchange Commission as soon as

reasonably practicable. This information may also be obtained by

calling the Securities and Exchange Commission at 1-800-SEC-0330. The

Securities and Exchange Commission also maintains an internet website at www.sec.gov that

contains reports and other information regarding issuers like us that file

electronically with the Commission. We will provide a copy of any of the

foregoing documents to stockholders without charge upon written request to us at

1400 Opus Place, Suite 600, Downers Grove, Illinois 60515, attention:

Corporate Secretary. The contents of our website are not part of this

Annual Report.

We

believe that the following are the material risks currently facing our

business. Additional risks we are not presently aware of, or that we

currently believe are immaterial, may also impair our business

operations. Any of these risks could have a material adverse effect

on our financial condition, results of operations or stock

price. Readers should also refer to the other information included in

this Annual Report, including our consolidated financial statements and related

notes thereto.

We

rely on a few major customers for a significant majority of our business and the

loss of any of those customers, or significant changes in prices or other terms

with any of our major customers, could reduce our net income and operating

results.

A few

customers account for a significant majority of our net sales each

year. In 2009, we had three customers that individually accounted for

10% or more of our net sales: AT&T (48%), TomTom (11%) and Ford

(10%). If we lose any of these customers, or if any of them reduces

or cancels a significant order or program, our net sales and operating results

could decrease significantly.

Most of

our contracts or arrangements with our customers have a term of three years or

less and are terminable by the customer subject to a notice period that ranges

from 30 days or less to 180 days. In addition, we periodically

renegotiate prices and other terms with our customers, and have historically

experienced price reductions in connection with contract

renewals. Furthermore, the current economic climate may lead our

customers to more aggressively pursue cost reduction initiatives, which could

adversely affect the prices we charge for our products and

services. Because of the periodic expiration of our customer

contracts, the short termination periods of those contracts and periodic price

negotiations, we cannot give any assurances of continued business with any of

our customers or the stability of prices for our products and services and,

therefore, our revenue streams.

Our

contract with AT&T expires at the end of 2010 and no assurance can be given

that we will be successful in negotiating a new contract.

From time

to time one or more of our customers could experience severe financial

difficulty, which could lead to such customers no longer utilizing our products

and services, resulting in a potentially material decline in our

revenue. Furthermore, the bankruptcy of any such customer could

adversely affect our ability to collect the related accounts

receivable.

Loss of a

significant customer could also result in us incurring asset impairment charges

and restructuring costs associated with the loss of the customer.

During

2009 we received notice of the impending loss of our automatic transmission

remanufacturing program with Honda, which accounted for 7% and 10% of our net

sales in 2009 and 2008, respectively. The program was substantially

completed by the end of 2009. In connection with the loss of this

business, our Drivetrain segment recorded a goodwill impairment charge of $37

million during the second quarter of 2009.

Our

Logistics business is dependent on the strength of AT&T.

AT&T,

which accounted for 68% of our Logistics segment net sales for 2009, operates in

a highly competitive technology market. The number of wireless

devices sold by AT&T, whether to new subscribers or as replacements to

existing subscribers, is dependent on its ability to keep pace with

technological advancements and to provide service programs and prices that are

attractive to current and potential customers. Our net sales to

AT&T are substantially related to the number of wireless devices sold by

AT&T. Consequently, any material decrease in wireless devices

sold by AT&T would have a material adverse effect on our operating

results.

Our

Drivetrain business is dependent on our business with Ford.

Ford

accounted for 35% of our Drivetrain segment net sales for

2009. Consequently, any material decrease in our business with Ford

will materially and adversely affect Drivetrain net sales. Our

contract with Ford has expired and is currently on a month-to-month basis while

we negotiate a new contract. No assurance can be given that we will

be successful in negotiating a new contract.

Current

economic conditions could impact the market for our customers’ products, which

would in turn adversely affect our results of operations.

Current

economic conditions could cause consumers to reduce their purchases of

discretionary items that are sold by our customers, such as cellular devices and

GPS units, which would in turn reduce the demand for our Logistics

services. These conditions also could lead to automobile owners

deferring the repair of their out-of-warranty vehicles, which would reduce the

demand for our Drivetrain products. Such a reduction in demand could

have a material adverse effect on our results of operations.

Our

financial results are affected by our customers' policies, which are outside our

control.

Our

financial results are also affected by the policies of our

customers. Changes to our key customers’ policies that could

materially affect our business include:

|

|

•

|

our

customers’ product return policies becoming more

restrictive;

|

|

|

•

|

reductions

in the amount of inventory our customers elect to

retain;

|

|

|

•

|

guidelines

that affect dealer decisions to rebuild transmissions at the dealer rather

than install remanufactured

transmissions;

|

|

|

•

|

a

decision not to use remanufactured units for warranty

replacements;

|

|

|

•

|

shortened

warranty periods that could reduce the demand for our products;

and

|

|

|

•

|

pricing

strategies.

|

Substantial

competition could reduce our market share and significantly harm our financial

performance.

Our

industry segments are highly competitive. We may not be successful in

competing against other companies, some of which are larger than us and have

greater financial and other resources available to them than we

do. Increased competition could require us to reduce prices or take

other actions that may have a material adverse effect on our operating

results.

Shortages

of component parts or cores could adversely affect our business.

The test

and repair portion of our Logistics business relies on component parts supplied

by various third parties, and our Drivetrain business relies on component parts

and used transmissions and engines (known as cores) supplied by our customers or

various third parties. From time to time we could experience

shortages of any of these components or cores due to demand, material shortages

or the economic condition of the supplier. Any shortage of parts or

cores would prevent us from completing orders on a timely basis, which could

have a material adverse effect on our business.

Our

Drivetrain financial results are affected by transmission failures, which are

outside our control.

Financial

results in our Drivetrain segment are affected by transmission failures, and a

drop in the number of failures could adversely affect sales or profitability or

lead to variability of operating results. Generally, if transmissions

last longer, there will be less demand for our remanufactured

transmissions. Transmission failures could drop due to a number of

factors outside our control, including:

|

|

•

|

transmission

designs that result in greater

reliability;

|

|

|

•

|

consumers

driving fewer miles per year due to high gasoline

prices;

|

|

|

|

|

•

|

consumers

delaying repairs; and

|

|

|

•

|

mild

weather.

|

We

may incur material liabilities under various federal, state, local and foreign

environmental laws.

We are

subject to various evolving federal, state, local and foreign environmental laws

and regulations governing, among other things, emissions to air, discharge to

waters and the generation, handling, storage, transportation, treatment and

disposal of a variety of hazardous and non-hazardous substances and

wastes. These laws and regulations provide for substantial fines and

criminal sanctions for violations and impose liability for the costs of cleaning

up, and the damages resulting from, past spills, disposals or other releases of

hazardous substances. We have periodically conducted environmental

investigations, some of which have revealed various environmental matters and

conditions that could expose us to liability or which have required us to

undertake compliance-related improvements or remedial activities. Any

liability we may have under environmental laws could materially affect our

business.

Our

stock price is volatile, and investors may not be able to recover their

investment if our stock price declines.

The

trading price of our common stock has been volatile and can be expected to be

affected by factors such as:

|

|

•

|

quarterly

variations in our results of operations, which may be impacted by, among

other things, price renegotiations with, business outlook changes of, or

loss of, our customers;

|

|

|

•

|

quarterly

variations in the results of operations or stock prices of comparable

companies;

|

|

|

•

|

announcements

of new products or services offered by us or our

competitors;

|

|

|

•

|

changes

in earnings estimates or buy/sell recommendations by financial

analysts;

|

|

|

•

|

the

stock price performance of our customers;

and

|

|

|

•

|

general

market conditions or market conditions specific to particular

industries.

|

Our

future operating results may fluctuate significantly.

We may

experience significant variations in our future quarterly results of

operations. These fluctuations may result from many factors,

including the condition of our industry in general and shifts in demand and

pricing for our products. Our operating results are also highly

dependent on our level of gross profit as a percentage of net

sales. Our gross profit percentage fluctuates due to numerous

factors, some of which may be outside of our control. These factors

include:

|

|

•

|

pricing

strategies;

|

|

|

•

|

changes

to our customers’ product return or warranty

policies;

|

|

|

•

|

changes

in product costs from vendors;

|

|

|

•

|

the

risk of some of the items in our inventory becoming

obsolete;

|

|

|

•

|

the

availability and quality of component parts and

cores;

|

|

|

•

|

the

relative mix of products and services sold during the period;

and

|

|

|

•

|

general

market and competitive conditions.

|

Results

of operations in any period, therefore, should not be considered indicative of

the results to be expected for any future period.

Our

success depends on our ability to retain our senior management and to attract

and retain key personnel.

Our

success depends to a significant extent on the efforts and abilities of our

senior management team. We have various programs in place to

motivate, reward and retain our management team, including bonus and stock

incentive plans. However, the loss of one or more of these persons

could have a material adverse effect on our business. Our success and

plans for future growth will also depend on our ability to hire, train and

retain skilled workers in all areas of our business.

We

cannot predict the impact of unionization efforts on our business.

From time

to time, labor unions have indicated their interest in organizing a portion of

our workforce. Given that some of our customers are in the highly

unionized automotive industry, our business is likely to continue to attract the

attention of union organizers. While these efforts have not been

successful to date except in the case of our former Mahwah, New Jersey facility

(which we closed in 2003), we cannot give any assurance that we will not

experience additional union activity in the future. Any union

organization activity, if successful, could result in increased labor costs and,

even if unsuccessful, could result in a temporary disruption of our production

capabilities and a distraction to our management.

We

may be subject to risks associated with future acquisitions.

An

element of our long-term growth strategy is the acquisition and integration of

complementary businesses in order to broaden product and service offerings,

capture market share and improve profitability. We will not be able

to acquire other businesses if we cannot identify suitable acquisition

opportunities, obtain financing on acceptable terms or reach mutually agreeable

terms with acquisition candidates. The negotiation of potential

acquisitions as well as the integration of an acquired business could require us

to incur significant costs and cause diversion of our management's time and

resources. Future acquisitions by us could result in:

|

|

•

|

dilutive

issuances of equity securities;

|

|

|

•

|

reductions

in our operating results;

|

|

|

•

|

incurrence

of debt and contingent liabilities;

|

|

|

•

|

future

impairment of goodwill and other intangibles;

and

|

|

|

•

|

other

acquisition-related expenses.

|

Some or

all of these items could have a material adverse effect on our

business. The businesses we may acquire in the future might not

achieve sales and profitability that justify our investment. In

addition, to the extent that consolidation becomes more prevalent in our

industry, the prices for suitable acquisition candidates may increase to

unacceptable levels and limit our growth.

We may

encounter difficulties in integrating any businesses we acquire with our

operations. The success of these transactions depends on our ability

to:

|

|

•

|

retain

key management members and technical personnel of acquired

companies;

|

|

|

•

|

successfully

merge corporate cultures and operational and financial systems;

and

|

|

|

•

|

realize

cost reduction and sales synergies.

|

Furthermore,

we may not realize the benefits we anticipated when we entered into these

transactions. In addition, after we have completed an acquisition,

our management must be able to assume significantly greater responsibilities,

and this in turn may cause them to divert their attention from our existing

operations. Any of the foregoing could have a material adverse effect

on our business and results of operations.

Our

level of indebtedness and the terms of our indebtedness could adversely affect

our business and liquidity position.

As of

February 16, 2010, we had no debt outstanding. However, our

indebtedness could increase substantially from time to time in the future for

various reasons, including fluctuations in operating results, capital

expenditures and possible acquisitions. Our consolidated indebtedness

level could materially affect our business because:

|

|

•

|

a

portion of our cash flow from operations must be dedicated to interest

payments on our indebtedness and is not available for other purposes,

which amount would increase if prevailing interest rates

rise;

|

|

|

•

|

it

may materially impair our ability to obtain financing in the

future;

|

|

|

•

|

it

may reduce our flexibility to respond to changing business and economic

conditions or take advantage of business opportunities that may

arise;

|

|

|

•

|

of

a prolonged recession and/or unforeseen regulatory changes;

and

|

|

|

•

|

our

ability to pay dividends is

limited.

|

In

addition, our credit facility requires us to meet specified financial ratios and

limits our ability to enter into various transactions. If we default

on any of our indebtedness, or if we are unable to replace our credit facility

when it expires in March 2011 or are otherwise unable to obtain necessary

liquidity, our business could be adversely affected.

Our

certificate of incorporation contains provisions that may hinder or prevent a

change in control of our company.

Provisions

of our certificate of incorporation could make it more difficult for a third

party to obtain control of us, even if such a change in control might benefit

our stockholders. Our Board of Directors can issue preferred stock

without stockholder approval. The rights of common stockholders could

be adversely affected by the rights of holders of preferred stock that we issue

in the future. These provisions could discourage a third party from

trying to obtain control of us. Such provisions may also impede a

transaction in which our stockholders could receive a premium over then-current

market prices and our stockholders' ability to approve transactions that they

consider in their best interests.

None.

We

conduct our business from the following facilities:

|

Location

|

Approx.

Sq.

Feet

|

Lease

Expiration

Date

|

Products

Produced/Services Provided

|

|||

|

Oklahoma

City, OK

|

100,000

|

2019

|

transmissions,

transfer cases and assorted components(1)

|

|||

|

Oklahoma

City, OK(2)

|

200,000

|

owned

|

transmissions

and assorted components(1)

|

|||

|

Oklahoma

City, OK

|

94,000

|

2010

|

returned

material reclamation and disposition, core management(3)(4)

|

|||

|

Carrollton

(Dallas), TX

|

39,000

|

2010

|

radios,

telematics and instrument and display clusters(3)

|

|||

|

Ft.

Worth, TX

|

414,000

|

2013

|

wireless

device and accessory distribution, electronics packaging and related

services(3)

|

|||

|

Ft.

Worth, TX

|

375,000

|

2013

|

wireless

device and electronics test and repair, returns processing, accessory

packaging(3)

|

|||

|

Ft.

Worth, TX

|

181,000

|

2012

|

wireless

device and accessory packaging, distribution and related services(3)

|

|||

|

Grantham,

England

|

120,000

|

owned

|

engines

and related components(1)

|

___________

|

(1)

|

This

facility is used by the Drivetrain

segment.

|

|

(2)

|

This

property is subject to a mortgage securing our bank credit

facility.

|

|

(3)

|

This

facility is used by the Logistics

segment.

|

|

(4)

|

This

facility will be closed in 2010 and a portion of its operations will be

consolidated into another facility.

|

We also

lease assorted warehouses and space for our corporate offices and computer

services center. We believe that our current facilities are adequate

for the current level of our activities. In the event we were to require

additional facilities, we believe that we could procure acceptable

facilities.

From time

to time, we have been, and currently are, involved in various legal

proceedings. Management believes that all of our litigation is

routine in nature and incidental to the conduct of our business, and that none

of our litigation, if determined adversely to us, would have a material adverse

effect, individually or in the aggregate, on us.

No

matters were submitted to a vote of our stockholders during the quarter ended

December 31, 2009.

PART

II

Market

Information and Holders

Our

common stock is traded on the Nasdaq Global Select Market under the symbol

"ATAC". As of February 16, 2010, there were 123 record holders of our

common stock. The following table sets forth for the periods

indicated the range of high and low sale prices of the common stock as reported

by Nasdaq:

|

High

|

Low

|

||||

|

2009

|

|||||

|

First quarter

|

$ | 15.75 | $ | 8.57 | |

|

Second quarter

|

20.00 | 10.60 | |||

|

Third quarter

|

23.00 | 13.55 | |||

|

Fourth quarter

|

24.79 | 18.82 | |||

|

2008

|

|||||

|

First quarter

|

$ | 27.97 | $ | 18.27 | |

|

Second quarter

|

26.78 | 19.57 | |||

|

Third quarter

|

27.05 | 21.80 | |||

|

Fourth quarter

|

24.20 | 12.02 | |||

On

February 16, 2010, the last sale price of our common stock, as reported by

Nasdaq, was $23.21 per share.

Stock

Repurchases

During

the three months ended December 31, 2009, certain employees delivered to us

2,807 shares of our outstanding common stock in payment of $66,064 of minimum

withholding tax obligations arising from the vesting of restricted stock

previously awarded under our stock incentive plans. Per the stock

incentive plans, the shares delivered to us were valued at $23.54 per share, the

average closing price of our common stock on the vesting dates of the restricted

stock.

Following

is a summary of treasury stock acquisitions during the three months ended

December 31, 2009:

|

Period

|

Total

number

of Shares Purchased

|

Average

Price

Paid

per Share

|

Total

Number of Shares Purchased as Part of Publicly Announced Plans or

Programs

|

Maximum

Number (or Approximate Dollar

Value)

of Shares that May Yet Be Purchased Under

the

Plan(1)

|

|||||

|

October

1-31, 2009

|

− | $ | − | − | − | ||||

|

November

1-30, 2009

|

− | $ | − | − | − | ||||

|

December

1-31, 2009

|

2,807 | $ | 23.54 | 2,807 | − | ||||

___________

|

(1)

|

Excludes

amounts that could be used to repurchase shares acquired under our stock

incentive plans to satisfy withholding tax obligations

of employees and non-employee directors upon the vesting of restricted stock. |

Dividends

We have

never paid cash dividends on our common stock. Because we currently

intend to retain any earnings to provide funds for the operation and expansion

of our business and for the servicing and repayment of indebtedness, we do not

intend to pay cash dividends on the common stock in the foreseeable

future. Furthermore, as a holding company with no independent

operations, the ability of ATC Technology Corporation to pay cash dividends is

dependent upon the receipt of dividends or other payments from our

subsidiaries. The agreement for our bank credit facility contains

certain covenants that, among other things, restrict our ability to pay

dividends. See Item 7. "Management's Discussion and Analysis of

Financial Condition and Results of Operations – Liquidity and Capital

Resources." Any determination to pay cash dividends on the common

stock in the future will be at the sole discretion of our Board of

Directors.

Performance

Graph

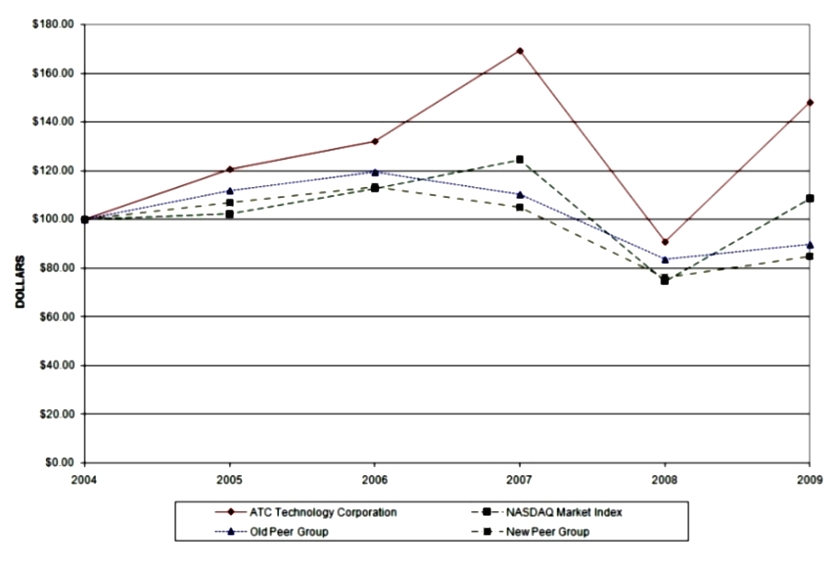

The

following graph shows the total return to our stockholders compared to two peer

groups and the Nasdaq Market Index over the period from January 1, 2005 to

December 31, 2009. Each line on the graph assumes that $100 was

invested in our common stock and the respective indices at the closing price on

January 1, 2005. The graph then presents the value of these

investments, assuming reinvestment of dividends, through the close of trading on

December 31, 2009.

|

1/1/05

|

12/31/05

|

12/31/06

|

12/30/07

|

12/29/08

|

12/31/09

|

||||||

|

ATC

Technology Corporation

|

100.00 | 120.75 | 132.17 | 169.32 | 90.87 | 148.14 | |||||

|

Old

Peer Group

|

100.00 | 111.83 | 119.32 | 110.24 | 83.57 | 89.67 | |||||

|

New

Peer Group

|

100.00 | 106.82 | 113.38 | 104.95 | 76.19 | 84.81 | |||||

|

NASDAQ

Market Index

|

100.00 | 102.20 | 112.68 | 124.57 | 74.71 | 108.56 |

The old

peer group consists of Brightpoint, Inc. and UTI Worldwide Inc. (publicly-traded

companies engaged in third-party logistics businesses) and Genuine Parts Co. and

Standard Motor Products (publicly-traded companies engaged primarily in

businesses in the automotive aftermarket). The new peer group

consists of the same four companies as the old peer group plus ModusLink Global

Solutions, Inc. and TESSCO Technologies Inc. (publicly-traded companies engaged

in third-party logistics businesses). By increasing the number of

logistics companies in the peer group from two to four while maintaining the

number of automotive companies at two, the new peer group more closely matches

the relative size of our two business segments. Management believes

that the new peer group most closely represents the peer group for our

business.

The

cumulative total return shown on the stock performance graph indicates

historical results only and is not necessarily indicative of future

results.

ITEM 6. SELECTED

FINANCIAL DATA

The

selected financial data presented below with respect to the statements of

operations data for the years ended December 31, 2009, 2008 and 2007 and

the balance sheet data as of December 31, 2009 and 2008 are derived from

our Consolidated Financial Statements that have been audited by Ernst &

Young LLP, independent registered public accounting firm, and are included

elsewhere herein, and are qualified by reference to such financial statements

and notes related thereto. The selected financial data with respect

to the statements of operations data for the years ended December 31, 2006 and

2005 and the balance sheet data as of December 31, 2007, 2006 and 2005, are

derived from our Consolidated Financial Statements that have been audited by

Ernst & Young LLP, independent registered public accounting firm, but

are not included herein. The data provided should be read in

conjunction with the Consolidated Financial Statements and related notes,

Management’s Discussion and Analysis of Financial Condition and Results of

Operations, and other financial information included in this Annual

Report.

|

Year

Ended December 31,

|

|||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

(In

thousands, except per share data)

|

|||||||||||||||||||

|

Statements

of Operations Data:

|

|||||||||||||||||||

|

Net

sales

|

$ | 485,017 | $ | 530,560 | $ | 529,171 | $ | 497,891 | $ | 419,618 | |||||||||

|

Cost

of sales

|

367,283 | 408,347 | 389,768 | 392,445 | 315,507 | ||||||||||||||

|

Exit,

disposal, certain severance and other charges

(credits)(1)

|

(572 | ) | 7,614 | 1,962 | − | − | |||||||||||||

|

Gross

profit

|

118,306 | 114,599 | 137,441 | 105,446 | 104,111 | ||||||||||||||

|

Selling,

general and administrative expense

|

49,080 | 56,965 | 61,001 | 48,936 | 47,755 | ||||||||||||||

|

Amortization

of intangible assets

|

50 | 149 | 243 | 190 | 125 | ||||||||||||||

|

Impairment

of goodwill(2)

|

36,991 | 79,146 | − | 14,592 | − | ||||||||||||||

|

Exit,

disposal, certain severance and other charges(1)

|

5,710 | 3,396 | 1,411 | 1,938 | 523 | ||||||||||||||

|

Operating

income (loss)

|

26,475 | (25,057 | ) | 74,786 | 39,790 | 55,708 | |||||||||||||

|

Interest

income

|

195 | 624 | 1,141 | 605 | 2,026 | ||||||||||||||

|

Interest

expense

|

(1,135 | ) | (696 | ) | (969 | ) | (4,297 | ) | (7,696 | ) | |||||||||

|

Other

income, net

|

27 | 17 | 116 | 262 | 542 | ||||||||||||||

|

Write-off

of debt issuance costs

|

− | − | − | (1,691 | ) | − | |||||||||||||

|

Income

tax (expense) benefit

|

(13,855 | ) | 2,423 | (27,952 | ) | (13,011 | ) | (16,827 | ) | ||||||||||

|

Income

(loss) from continuing operations

|

$ | 11,707 | $ | (22,689 | ) | $ | 47,122 | $ | 21,658 | $ | 33,753 | ||||||||

|

Income

(loss) from continuing operations per diluted

share(3)

|

$ | 0.59 | $ | (1.09 | ) | $ | 2.11 | $ | 0.98 | $ | 1.56 | ||||||||

|

Shares

used in computation of income (loss) from continuing

operations per

diluted share(3)

|

19,764 | 20,878 | 22,067 | 21,870 | 21,531 | ||||||||||||||

|

Other

Data:

|

|||||||||||||||||||

|

Capital

expenditures

|

$ | 8,638 | $ | 11,332 | $ | 19,374 | $ | 10,636 | $ | 17,241 | |||||||||

|

As

of December 31,

|

||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||

|

(In

thousands)

|

||||||||||||||

|

Balance

Sheet Data:

|

||||||||||||||

|

Cash

and cash equivalents

|

$ | 73,803 | $ | 17,188 | $ | 40,149 | $ | 7,835 | $ | 45,472 | ||||

|

Working

capital, continuing operations

|

162,744 | 109,887 | 115,259 | 89,353 | 109,143 | |||||||||

|

Property,

plant and equipment, net

|

46,939 | 52,728 | 56,462 | 51,767 | 54,108 | |||||||||

|

Total

assets

|

292,065 | 282,342 | 389,374 | 345,677 | 407,780 | |||||||||

|

Current

and long-term debt outstanding

|

– | – | – | 17,800 | 90,779 | |||||||||

|

Long-term

liabilities, less current portion

|

4,857 | 17,249 | 35,389 | 46,194 | 107,077 | |||||||||

|

Total

stockholders' equity

|

223,926 | 204,702 | 280,513 | 232,330 | 221,230 | |||||||||

_______________

|

(1)

|

See

Item 8. “Consolidated Financial Statements and Supplementary Data – Note

19” for a description of exit, disposal, certain severance and other

charges.

|

|

(2)

|

See

Item 8. “Consolidated Financial Statements and Supplementary Data – Note 2

and Note 5” for a description of goodwill impairment

charges.

|

|

(3)

|

During

2009, we adopted the two-class method of calculating earnings per share

which requires us to allocate a portion of our income to participating

securities and retrospectively apply these provisions to all periods

presented. As a result, our previously reported income from continuing

operations per diluted share decreased by $0.02 and $0.01 for the years

ended December 31, 2007 and 2006, respectively. See Item 8.

“Consolidated Financial Statements and Supplementary Data – Note 2 and

Note 12” for a description of the computation of earnings per

share.

|

ITEM 7.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The

following discussion should be read in conjunction with our consolidated

financial statements and notes thereto included elsewhere in this Annual

Report. See Item 8. “Consolidated Financial Statements and

Supplementary Data.”

Readers

are cautioned that the following discussion contains certain forward-looking

statements and should be read in conjunction with the “Special Note Regarding

Forward-Looking Statements” appearing at the beginning of this Annual

Report.

Our

Business

Our

Logistics segment, which generated 71.2% of our revenues in 2009, is a leader in

providing comprehensive forward logistics, reverse logistics, test and repair,

packaging, warehousing and distribution, and transportation management services

for high-tech industries including wireless, broadband and cable, personal

navigation devices, automotive electronics and other consumer

electronics.

Through

our service offerings, we provide our customers with solutions engineered to

deliver quality, efficiency and cost savings. We utilize our

extensive expertise in supply chain logistics and full-suite service offerings

to provide a closed-loop solution for our customers that decreases their time,

cost and capital requirements, and provides them flexibility by converting fixed

cost to variable cost. Our forward logistics processes encompass

direct-to-consumer and bulk fulfillment of both new and refurbished products,

coupled with warehouse and inventory management, labeling, kitting, pick-pack,

break-bulk, cross-dock and light assembly services. Our reverse

logistics processes include direct consumer and retailer returns management,

advance exchange, test and repair, and asset recovery and disposition.

Additional value-added services include testing and sorting, quality inspection,

transportation management and our recently added foreign trade zone (FTZ)

capabilities.

The

critical success factors that impact our Logistics business include our ability

to (i) increase penetration and add new services with existing customers, (ii)

expand our customer base, (iii) convert pipeline opportunities into new business

wins, (iv) provide superior quality, service and delivery, and (v) continuously

improve efficiency and reduce cost.

Our

Logistics business has grown from annual sales of $153 million in 2005 to $345

million in 2009, a compound annual growth rate of 22.5%. This growth

has been driven by the increased demand for our customers’ products and the

related advancements in electronic technologies, the addition of new services

with existing customers, and an expansion of our customer base.

Our

Drivetrain segment, which generated 28.8% of our revenues in 2009, provides

remanufacturing services predominately to the service and repair organization of

automotive OEMs. As with our Logistics business, through our service

offerings we provide our customers with solutions engineered to deliver quality,

efficiency and cost savings. Our Drivetrain customers utilize

remanufactured drivetrain components as a lower cost alternative to new products

in both warranty and post-warranty applications. As a result of

general improvements in the quality of new transmissions and engines, coupled

with declines in the population of in-warranty vehicles, our Drivetrain business

has experienced significant declines as sales have decreased from $266 million

in 2005 to $140 million in 2009. Furthermore, in the second quarter

of 2009, based upon a declining need for remanufactured transmissions as a

result of the improved quality relating to their newest generation of

transmissions, Honda, one of our largest Drivetrain customers, informed us of

their intention to in-source this function and terminate their automatic

transmission remanufacturing program with us, triggering a $37.0 million ($26.0

million net of tax) impairment charge to write down the remaining goodwill in

the Drivetrain business. As of December 31, 2009, this program with

Honda was substantially completed.

Our

Performance

2009 Consolidated

Summary. Overall, our 2009 results reflect solid execution in

a difficult economic environment. We successfully implemented our

restructuring initiatives in Drivetrain, we achieved cost reductions in

Logistics, we won and launched a meaningful program with a new customer in

Logistics, and we successfully focused on working capital management by driving

inventories down, which contributed to our strong liquidity. Our

consolidated sales were $485.0 million for the year ended December 31, 2009,

down 8.6% from 2008. Income from continuing operations for 2009

increased to $11.7 million from a loss of $22.7 million in 2008. Our

results for 2009 included charges of (i) $26.0 million (net of tax) for the

impairment of our Drivetrain segment’s goodwill, (ii) $3.2 million (net of tax)

for exit, disposal, certain severance and other charges primarily related to the

restructuring of our Drivetrain business, and (iii) $1.8 million for a valuation

allowance against certain deferred income taxes related to our Drivetrain

subsidiary located in the United Kingdom. The loss from 2008

reflected Drivetrain segment charges of $56.8 million (net of tax) for the

impairment of goodwill and $6.1 million (net of tax) related to our Drivetrain

restructuring efforts. Income from continuing operations per diluted

share was $0.59 for 2009 as compared to a loss from continuing operations of

$1.09 per share for 2008.

Logistics Segment Summary.

For the year ended December 31, 2009, net sales from our Logistics

business decreased $8.1 million, or 2.3%, to $345.3 million in 2009 from $353.4

million in 2008. The decrease in sales was primarily due to a

decrease in sales to TomTom in 2009 as compared to 2008 related to reductions in

their in-channel inventories, and revenue in 2008 from two programs that were

discontinued prior to 2009, partially offset by increased sales from new

programs, including a test and repair program with a leading handset OEM that

could become a 10% customer in 2010. Segment profit for Logistics

increased $7.8 million, or 13.9%, to $64.0 million in 2009 from $56.2 million in

2008. Benefits from our on-going lean and continuous improvement

program and other cost reduction initiatives, the contribution from new program

wins, and a favorable mix in services, all contributed to an increase in our

profitability in 2009 as compared to 2008.

Drivetrain Segment Summary.

Our Drivetrain segment experienced a challenging year as we

(i) completed restructuring activities, which included the closure and

consolidation of our Springfield, Missouri remanufacturing operations into our

Drivetrain operations located in Oklahoma City, Oklahoma, and (ii) wound down

our automatic transmission remanufacturing program with Honda, previously a

major customer in our Drivetrain segment. Drivetrain sales decreased

$37.4 million, or 21.1%, to $139.7 million for 2009 from

$177.1 million for 2008. The decrease was primarily due to (a)

reduced demand for Honda remanufactured transmissions largely related to lower

failure rates of their new transmissions, coupled with the wind-down of this

program, and (b) reduced demand for remanufactured drivetrain products across

our entire customer base due to (1) reductions in the size of in-warranty

vehicle fleets due to declining new car sales, (2) general improvements in

quality of new OEM transmissions, and (3) macroeconomic factors believed to have

resulted in a reduction in the number of miles driven and the deferral of

repairs. Our Drivetrain segment recorded an operating loss of $37.0