Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - RiskMetrics Group Inc | a2196648zex-21_1.htm |

| EX-32.1 - EXHIBIT 32.1 - RiskMetrics Group Inc | a2196648zex-32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - RiskMetrics Group Inc | a2196648zex-31_2.htm |

| EX-23.1 - EXHIBIT 23.1 - RiskMetrics Group Inc | a2196648zex-23_1.htm |

| EX-32.2 - EXHIBIT 32.2 - RiskMetrics Group Inc | a2196648zex-32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - RiskMetrics Group Inc | a2196648zex-31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2009

Commission file number: 001-33928

RiskMetrics Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

20-8175809 (IRS Employer Identification No.) |

|

One Chase Manhattan Plaza, 44th Floor New York, New York (Address of principal executive offices) |

10005 (Zip Code) |

(212) 981-7475

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of Each Exchange on which Registered | |

|---|---|---|

| Common Stock $.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer, accelerated filer" in Rule 12b-2 of the Exchange Act. (check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the registrant's voting stock held by non-affiliates of the registrant, computed by reference to the closing sales price as quoted on June 30, 2009 was approximately $464,096,729.

The number of shares outstanding of each of the registrant's classes of common stock, as of February 18, 2010 was:

| Class | Outstanding | |

|---|---|---|

| Common stock $.01 par value | 63,265,668 |

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Items 10, 11, 12, 13 and 14 of this Annual Report on Form 10-K is incorporated by reference from our definitive Proxy Statement for our 2010 Annual Meeting of Stockholders which will be filed not later than 120 days after the close of our year ended December 31, 2009.

Index to Form 10-K

Table of Contents

1

Unless the context otherwise indicates or requires, as used in this Annual Report on Form 10-K, references to "we," "us," "our" or the "company" refer to RiskMetrics Group, Inc and its subsidiaries. References to "RiskMetrics" refer only to our subsidiary, RiskMetrics Solutions, Inc. and its subsidiaries, references to "ISS" refer only to our subsidiary Institutional Shareholder Services Inc. and its subsidiaries.

In this annual report on Form 10-K, all dollar amounts are expressed in thousands, unless indicated otherwise. References to our "clients" include each business unit, division or wholly-owned subsidiary of a parent company which has entered into a separate customer contract with us.

THIS ANNUAL REPORT ON FORM 10-K CONTAINS FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER FEDERAL SECURITIES LAWS. THESE FORWARD LOOKING STATEMENTS ARE BASED ON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, AND MAY NOT OCCUR. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS. SEE ALSO "ITEM 1A. RISK FACTORS." EXCEPT AS REQUIRED BY LAW, WE UNDERTAKE NO OBLIGATION TO UPDATE OR RELEASE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

Our Company

RiskMetrics Group is a leading provider of risk management and corporate governance products and services to participants in the global financial markets. We enable clients to better understand and manage the risks associated with their financial holdings, to provide greater transparency to their internal and external constituencies, to satisfy regulatory and reporting requirements and to make more informed investment decisions. Our offerings address multiple asset classes, markets and geographies and are sold to a diverse client base including asset managers, hedge funds, pension funds, banks, insurance companies, financial advisors and corporations. As of December 31, 2009, we had approximately 3,500 clients located in 53 countries. Among our clients are 70 of the 100 largest investment managers, 43 of the 50 largest mutual fund companies and 42 of the 50 largest hedge funds, in each case measured by assets under management.

Our company consists of two industry leading businesses: RiskMetrics and ISS (Institutional Shareholder Services). Together, these businesses offer what we believe is the most comprehensive suite of risk management and corporate governance products and services available in our industry, covering the market, credit, portfolio, governance, accounting, legal and environmental risks associated with our clients' financial holdings.

RiskMetrics. The RiskMetrics segment is a leading global provider, as measured by revenues, of multi-asset, position-based risk and wealth management products and services. We provide our clients, which approximated 530 as of December 31, 2009, with comprehensive, interactive products and services that allow them to measure and quantify portfolio risk across security types, geographies and markets. Our flagship RiskManager mark-to-market risk system integrates consistently modeled market data with our widely adopted analytical models and robust processing capabilities to address our clients' risk reporting requirements. Our clients generally license RiskManager as a secure, interactive web-based application service or as a fully outsourced risk reporting service. In similar fashion, we provide clients with solutions based on credit-event risk (through our CreditManager application) as well as solutions for financial advisors at private banks (through our WealthBench application). The breadth, performance and scalability of our hosted systems are the result of over a decade of investment in research and development, which we believe provides us with a significant competitive advantage.

2

ISS. ISS is a leading provider, as measured by revenues, of corporate governance and specialized financial research and analysis services to institutional investors and corporations around the world. Through ISS, which we acquired on January 11, 2007, we provide our clients, which approximated 2,970 as of December 31, 2009, with a fully-outsourced proxy research, voting and vote reporting service to assist them with their proxy voting responsibilities. Through our web-based delivery platform, clients can access our in-depth research reports and proxy voting recommendations. We offer both global security coverage and a comprehensive proxy voting solution, from policy creation to comprehensive research, vote recommendations, reliable vote execution, post-vote disclosure and reporting and analytical tools. Our Financial Research and Analysis products also provide our clients with research reports and analytical tools covering many investment criteria that have become increasingly important to investors, including companies' environmental, social and governance ("ES&G") attributes and accounting and compensation practices. In 2009, ISS acquired Innovest Strategic Advisors ("Innovest") and KLD Research and Analytics, Inc. ("KLD") to further enhance our ES&G product offering.

We sell our products and services primarily on an annual subscription basis and generally receive upfront subscription payments from our clients. As of December 31, 2009, our annualized contract value ("ACV") was approximately $282.5 million. For the year ended December 31, 2009, we generated approximately 92.7% of our revenues from annual subscriptions to our products and services. Our historical renewal rate has ranged from the mid 80 to low 90 percent range. Our renewal rate for 2009 was 82.6% and is lower than historical levels due to the recent adverse financial environment which resulted in hedge fund liquidations, price pressure and declines in demand for discretionary financial research products. Our products and services are generally priced based on a client's access to our applications and services, including volume of data, research, voting and reports purchased. Our experience has been that, over time, our clients have often added users and purchased additional products and services from us, which has led to increases in our revenues per client. Refer to "Selected Consolidated Financial Data" for a further discussion regarding annualized contract value, recurring revenue and renewal rate.

We serve our global client base through a network of 20 offices in 12 countries. For the year ended December 31, 2009, approximately 41% of our revenues were generated from clients outside the Americas.

Company History and Acquisitions

At RiskMetrics Group, we help clients understand and manage a broad spectrum of risk across their financial portfolios. Originally founded upon a methodology to measure market risk in a portfolio, our business today is built upon a more global, multi-dimensional view that is unique in the market place. RiskMetrics Group offers investors and other financial market participants multiple views into the risk profile of a company, security or portfolio of financial assets, and the expertise to better understand them. We believe that effective risk mitigation and management hinges on the ability to fully understand it.

The RiskMetrics methodology was developed within JPMorgan in 1992 and was published publicly in 1994. In 1998, RiskMetrics was spun off and became an independent company providing risk management products and services.

On January 11, 2007, recognizing that our clients' view of risk needed to broaden beyond market and credit risk, we acquired ISS in order to increase the scale and scope of our product and service offerings. ISS was founded in 1985 with the goal of promoting good corporate governance practices in the private sector. It was the pioneer in the development of policy-based proxy voting recommendations and today is a leader in corporate governance with the broadest research coverage in the market.

On August 1, 2007, we completed the acquisition of the Center for Financial Research and Analysis ("CFRA"). CFRA was founded in 1994 and provides forensic accounting risk research, legal

3

and regulatory risk assessment, due diligence and educational products and services. Our acquisition of CFRA further increased the range of specialized financial research and analysis products and services that we are able to offer to our clients.

In January 2008, we completed our initial public offering of 14,000,000 shares of our common stock, which included 4,035,816 shares sold by selling stockholders. We did not receive any proceeds from the sale of the shares by the selling stockholders. In addition, we granted the underwriters an option to purchase a maximum of 2,100,000 additional shares of common stock from us to cover over-allotments, which was exercised in full in January 2008. Our net proceeds from the offering, including the exercise of the underwriters' allotment, were $193.9 million, after deducting underwriting discounts, commissions and offering expenses.

On October 3, 2008 we acquired all of the outstanding stock of Applied4 Technology Ltd. ("Applied4") for approximately $1.8 million in cash. Additional purchase price consideration of between approximately $1.6 million and $1.9 million may be paid for the acquisition of Applied4 if certain earning targets are achieved through 2011. Such earning targets and additional consideration have not been achieved as of December 31, 2009. The purpose of this acquisition was to broaden the performance attribution analytical tools we can offer our clients.

In 2008, we recorded a non-cash impairment charge for goodwill and intangible asset totaling $160.1 million as a result of the Company' annual goodwill and indefinite-lived intangible asset impairment review. The impairment charge included a $154.2 million write-down to ISS goodwill primarily as a result of the negative equity market conditions which caused a material decline in industry market multiples in the second half of 2008. In addition, the impairment charge also included a $5.9 million writedown to an ISS product tradename as a result of an integration plan for the tradename which reduced its expected life.

On March 2, 2009 we acquired all of the outstanding stock of Innovest for approximately $14.8 million in cash and on October 30, 2009 we acquired all of the outstanding stock of KLD for approximately $9.9 million in cash. Innovest and KLD are leading providers of sustainability research for the institutional investment community. The purpose of these acquisitions was to enhance the product offerings and services, including sustainability, research, data, compliance and index products, we offer our customers in the ES&G sectors.

Our Growth Strategy

We intend to continue to develop and sell products and services that enable investors to make more informed investment decisions, monitor and comply with exposure and risk limits, provide greater transparency to both internal audiences and external constituencies and meet regulatory and reporting requirements. Most of our clients are in the financial services industry. In 2008 and continuing into 2009, stock market volatility and lack of available credit led to the closure or consolidation of a number of our clients. These recent events impacted our financial results, including a decline in our historical renewal rate and new sales growth. We expect over the next year our new sales growth and renewal rate to improve as market conditions improve.

The major components of our growth strategy are as follows:

1) Increase Sales to Existing Clients.

We plan to broaden our relationships with our clients in the following ways:

- •

- Provide additional data, research and analytical products and services. We continue to expand RiskMetrics' coverage of asset classes and its library of analytical models in response to our clients' needs. This expansion has allowed us to sell more data, applications and services to our clients. Similarly, as ISS increases its global research coverage and develops new issue-specific

4

- •

- Offer more products and services. Our clients increasingly

rely on us for more fully-outsourced risk management services. A significant percentage of our new sales to existing clients have involved fully-outsourced offerings. We expect this trend to continue

and have invested in the scalable technology and data infrastructure necessary to support our outsourced products and services. In the year ended December 31, 2009, approximately half of our

new subscription ACV resulted from sales to existing customers. Further, our average contract value has significantly increased over the last five years.

- •

- Leverage our sales force. As of December 31, 2009, we had a global sales force of approximately 69 employees in 12 offices worldwide. We believe that our sales force will allow us to sell our expanded set of products and services to our worldwide client base. In particular, we expect to sell more products and services to our existing clients as we work with more business groups or units within their organizations as a result of our expanded suite of risk, governance and research products and services.

research products and services, we expect to continue to increase our product subscriptions through volume-based expansion of proxy research and voting services and by providing additional financial research and analytical products and services.

2) Expand our Client Base.

We plan to continue to pursue the following initiatives to further expand our client base:

- •

- Sell our portfolio risk reporting products and services to new

clients. Despite the growth of our RiskMetrics business, the market for outsourced risk reporting is relatively new and many financial

institutions continue to rely on in-house risk management products and services. We believe that, over time, many of these institutions will choose to integrate our fully-outsourced risk

reporting management and analysis systems to reduce costs and improve functionality.

- •

- Sell our Governance Services and Financial Research and Analysis offerings to new

clients. We believe that additional opportunities exist with respect to institutional investors who currently conduct proxy research and

vote their proxies in-house. Additionally, we believe there is an opportunity to increase our penetration among front office portfolio managers, whom we have not traditionally targeted, by

selling them our financial research and analysis products and services.

- •

- Expand our significant global presence. We believe that the international market for corporate governance products and services is growing, and that we will be able to capitalize on increased demand by leveraging our globally-recognized RiskMetrics Group brand, international presence and sales force.

For the year ended December 31, 2009, we added over $41 million in new ACV, of which approximately half was from new clients, a 42% decline from 2008 due to the recent economic down turn which resulted in customer consolidations, lack of credit and budget constraints of our customers.

3) Enhance and Extend our Products and Services.

We plan to continue to augment our suite of risk management and corporate governance products and services in the following ways:

- •

- Enhance our product capabilities. RiskMetrics has broadened its coverage of asset classes, enhanced its analytical models and launched major upgrades of its entire risk services product suite. Additionally, ISS has broadened its research coverage and introduced new governance and research products. We intend to continue to develop new products that enable our clients to

5

- •

- Extend our service offerings. We have continuously

upgraded the features, functionality and scalability of our infrastructure in order to offer our clients additional fully-outsourced risk reporting and electronic proxy voting services. We believe

that this continued investment will allow us to continue to improve our outsourcing capabilities. In January 2010, we launched ProxyExchange which is our new proxy voting platform that will provide

additional functionality and services to proxy voting clients.

- •

- Selectively pursue acquisitions. We intend to continue to selectively pursue acquisition opportunities to complement our product and service offerings.. In 2008, we supplemented our internal product and service development efforts with our acquisition of Applied4. As a result, we began to build a multi-asset class performance attribution system with the purpose of increasing the strategic value of our existing product platform to our clients. In 2009, we acquired Innovest and KLD to enhance the product offerings and services to offer our ES&G customers.

measure and manage many elements of risk by broadening the scope of our product and service offerings.

4) Continue to Develop our Distinct Corporate Culture.

Our ability to develop new products and services has been, and will continue to be, crucial to keeping pace with evolving financial markets. Consequently, we believe that our success will continue to depend on the strength of our intellectual capital, and that our employees and distinct corporate culture provide us with significant competitive advantages. We work hard to retain our employees by ensuring that they have a challenging, rewarding and fun work environment. We also encourage our employees to follow their instincts and develop new ideas, which have resulted in many of our most important analytical and technological developments. At the same time, we strive to engender a team spirit and sense of common purpose that we believe enables us to attract and retain talented employees.

Our talented employees share a unique sense of purpose. With little corporate hierarchy and few formal titles, we value substance over form and question every assumption. Every employee is an owner, as we see ownership as a key to providing the highest level of service to our clients, as well as attracting, developing and retaining the talent we seek in today's highly competitive labor market. This work environment and ownership create a culture of respect, empowerment, and shared purpose that is aggressively managed to ensure our long-term success.

Business Segments, Products and Services

We divide our business operations into two segments: RiskMetrics and ISS. The table below shows revenue by business segment for each of the past three years:

| |

For the years ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Revenue by Segment

|

2009 | 2008 | 2007 | ||||||||

RiskMetrics |

$ | 158,691 | $ | 154,626 | $ | 121,126 | |||||

Revenue Growth |

2.6 | % | 27.7 | % | |||||||

ISS(1)(2) |

$ | 144,670 | $ | 141,767 | $ | 119,175 | |||||

Revenue Growth |

2.0 | % | 19.0 | % | |||||||

- (1)

- ISS revenue in 2007 does not include $3.3 million in revenue generated by ISS from January 1, 2007 through January 11, 2007. In addition, ISS revenue in 2007 was impacted by the acquisition of CFRA on August 1, 2007.

6

- (2)

- ISS revenue growth in 2009 was impacted by the acquisitions of Innovest on March 2, 2009, and KLD on October 30, 2009.

Business segment revenue, segment income from operations and assets attributable to foreign and domestic operations are set forth in Note 18 of the Notes to the Consolidated Financial Statements, included herein.

RiskMetrics Segment

Overview

RiskMetrics is a leading provider of multi-asset, position-based risk and wealth management products and services to global asset managers, hedge funds, banks, insurance companies, pension funds and wealth managers. We provide our clients with access to customizable applications, interactive analytics and risk reports based on comprehensive and consistently-modeled market data that are fully-integrated with their holdings. We believe that our comprehensive approach to analyzing multi-asset portfolios and our ability to fully integrate with our clients' holdings enable us to provide products and services which are an integral and essential part of our clients' portfolio risk management systems. These products and services provide timely and actionable insights into the market and credit risks of clients' portfolios.

These products and services allow our clients to:

- •

- measure their trading, credit and counterparty risk;

- •

- monitor and comply with internal or external exposure and risk limits;

- •

- deploy and optimize their use of capital;

- •

- communicate risk in a transparent fashion to regulators, investors, clients and creditors;

- •

- meet regulatory requirements, address suitability criteria and implement best practices; and

- •

- create investment planning proposals for high net worth individuals.

All of our RiskMetrics products and services include integrated access to our extensive set of market-related data. Embedded within our RiskMetrics offerings are over 750,000 market data time series spanning global interest rates, foreign exchange rates, equity prices, implied volatilities, credit spreads, commodity prices and inflation rates. These data are systematically quality-controlled by our dedicated teams of analysts who examine the data for outliers, missing data points and other anomalies. These data are then transformed into a form suitable for use in risk management systems. We also collect and process international benchmark data for thousands of equity, fixed-income and commodity indices. These data are used by asset managers and pension plans who track standard or customized benchmarks as well as by clients to measure their risk and exposure relative to an index.

The pricing model for our RiskMetrics products and services is primarily subscription-based, typically for a period of one year. Depending upon the solution offering, our RiskMetrics products and services are available through a variety of delivery options, including hosted web-based applications, fully-outsourced managed services, local installation and on a component-by-component basis.

In order to further enhance our RiskMetrics product set we are currently working on new and enhanced product offerings which include, a multi-asset class performance attribution system, credit scoring models for non-financial Corporate entities and enhanced counter party risk models.

7

Our comprehensive suite of products and services covers a broad range of asset classes including equities, bonds, commodities, foreign exchange, futures, options, derivatives, structured products, interest-rate products and credit products and is designed to provide our clients with a transparent assessment of the risk in their portfolios in the following three areas: Market Risk, Credit Risk and Wealth Management.

Market Risk

Increasingly complex instruments, expanding asset classes, complex trading strategies and significant data requirements have created a complicated risk assessment task. Our approach is to combine all the analytics, technologies and data required into one comprehensive offering, accessible through a common portal. We provide our clients with comprehensive, interactive products and services that allow them to measure and quantify portfolio risk across security types, geographies and markets.

During 2009, our Market Risk offerings accounted for approximately 87% of RiskMetrics' revenue. Our Market Risk products and services consist of RiskManager and its related services, HedgePlatform and DataMetrics. Although we sometimes sell our data on a standalone basis, our data are usually embedded in our products and services.

RiskManager

RiskManager, our flagship market risk system, provides clients with a comprehensive solution for measuring risk in their portfolios and for running sensitivity and stress test analyses. Underlying RiskManager is a service-oriented architecture which is flexible, scalable and extensible. Because we host our products and deliver our services from a scalable common technology and data infrastructure, all of our clients benefit from advances in our RiskManager market risk system.

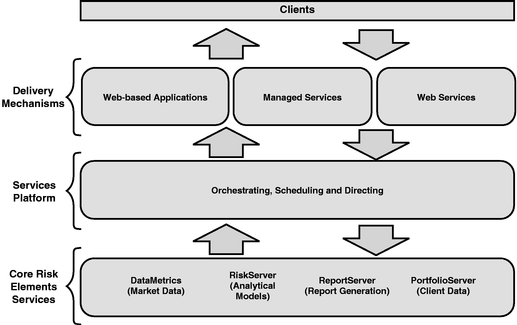

RiskManager incorporates three primary components: delivery mechanisms, a services platform and the core risk elements, as shown in the following diagram:

Delivery Mechanisms—Our delivery mechanisms enable our clients to access risk analyses and reports in one of three methods: as an interactive web-based application operated in a self-directed fashion, as a fully-outsourced or managed service offering in which RiskMetrics utilizes the system on behalf of the client, or as a web service in which a client's systems access our core risk elements by

8

connecting directly to our systems. Each of these methods involves varying degrees of interaction with the key components of our system. When accessed as a web-based application, clients have complete control over when and how often they upload positions and holdings into the system application. Clients can create their own ad hoc analysis, build dynamic "what-if" scenarios, design custom reports for immediate use, run intra-day pre-trade tests and schedule their own overnight data processing and report generation. As a fully-outsourced or managed service, we configure the services platform to create a customized risk reporting service for our clients. In doing so we take on the additional responsibility of uploading the client's positions and holdings from the client's internal systems, fund administrator, broker or custodian, schedule and direct the running of all risk analyses, and produce risk reports our clients use for their internal and external requirements.

Web service clients bypass our other delivery mechanisms and instead have their own systems connect directly to our core risk elements. Clients typically use our web services to seamlessly embed the functionality available in RiskManager directly into their own systems and interfaces.

Services Platform—Our proprietary platform is at the core of our scalable services-oriented architecture and allows us to manage many processes simultaneously. The platform orchestrates the flow of information between us and our clients as well as directs the internal operations of our risk elements. Our platform allows us to simultaneously process millions of positions for hundreds of clients per day. The platform is monitored 24 hours a day, seven days a week by a group of dedicated operations engineers to ensure peak performance of the entire system.

HedgePlatform

HedgePlatform is a reporting service allowing clients that invest in hedge funds, including funds of funds, pension funds and endowments, to measure, evaluate and monitor the risk of their hedge fund investments across multiple hedge fund strategies. We collect position-level information from hedge funds on a monthly basis and provide our clients with a risk report for each individual hedge fund in which they invest as well as an aggregate risk report for their overall portfolio of hedge funds. Our clients who use RiskManager to measure the risk of their own holdings can further integrate the positions collected via our HedgePlatform service to allow computation of risk across their entire portfolio but retains the proprietary nature of the underlying hedge fund holdings. HedgePlatform reports include statistics such as exposure (long, short, net and gross), sensitivities, scenario analysis, stress tests and VAR analysis.

DataMetrics

DataMetrics is a data service that allows clients to access the market data embedded in RiskManager for use in their own proprietary or other third-party systems. In addition to direct access to market data time series, DataMetrics can provide clients with customized data processing services.

Credit Risk

Our credit risk products and services allow our clients to consolidate multiple types of credit exposures across an institution. Our CreditManager product is a portfolio credit risk management system used primarily by banks to calculate economic capital, facilitate risk-based pricing, credit scores and measure risk concentrations. The application is designed to consolidate and compare risks and opportunities across multiple credit exposures including bonds, credit derivatives and traditional lending.

Wealth Management

WealthBench. WealthBench is an investment planning platform for private banks, financial advisors, brokerages and trust companies. WealthBench delivers fully-informed, tailored investment

9

planning proposals for high net worth individuals reflecting their needs, goals and risk tolerances while remaining consistent with firm-driven investment and risk-based policies. WealthBench incorporates robust analytics, market-consistent inputs and transparent methodologies.

ISS Segment

Overview

ISS is a leading provider of corporate governance and financial research and analysis services to institutional investors and corporations around the world. We facilitate the voting of proxies by institutional investors and provide in-depth research and analysis to help inform their voting decisions and assess issuer-specific risk. ISS' products and services consist of: Governance Services to institutional investors and Financial Research and Analysis services to institutional investors, corporations and professional service firms. The pricing model for ISS' products and services is primarily subscription-based and varies depending on the product or service purchased.

We provide proxy services to institutional investors globally. We are the largest proxy advisory firm that offers a fully-integrated, end-to-end proxy voting service, including policy creation, comprehensive research, vote recommendations, reliable vote execution and reporting and analytical tools. Although some of our Proxy Research and Voting clients purchase our proxy research on a stand-alone basis, the vast majority purchase a comprehensive research and voting product. In 2009, we issued proxy research and vote recommendations for more than 37,000 shareholder meetings across 108 countries and voted, on behalf of our clients, 7.6 million ballots representing over 1.3 trillion shares. We believe these amounts are substantially more than any of our competitors. During 2009, Governance Services accounted for approximately 64% of ISS revenues.

We also offer Financial Research and Analysis products and services designed to assess the overall financial health of companies by analyzing the investment implications of companies' accounting policies, legal and regulatory exposure, environmental, social and governance practices, mergers and acquisitions initiatives and compensation plans. Our product and service offerings are provided primarily to portfolio managers for investment analysis, to corporations to monitor compliance with corporate governance practices and to professional services organizations to support due diligence efforts. These offerings are either bundled with other services or sold on an individual basis and allow investors to add specialized, qualitative analysis to more traditional research used in the investment decision-making process. During 2009, Financial Research and Analysis accounted for approximately 36% of ISS revenues.

Governance Services

We categorize our Governance Services products and services into three distinct categories: Proxy Research and Voting, Global Proxy Distribution Services and Securities Class Action Services.

Proxy Research and Voting

Through our ProxyExchage platform, we provide our clients with vote recommendations, comprehensive analyses and online voting capabilities that enable users to make informed decisions about how to vote on all items with respect to each shareholder meeting agenda that we cover, execute their votes and monitor and track their votes for reporting purposes. Our Proxy Research and Voting staff currently operates out of numerous offices around the world, providing a global network of local expertise.

10

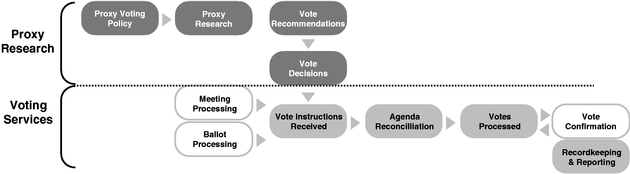

The following diagram illustrates our Proxy Research and Voting services and how they integrate into the flow of the proxy process:

Proxy Research. We provide research coverage on over 6,400 U.S.-based companies and approximately 20,000 non-U.S. companies. Our standard global coverage includes Morgan Stanley EAFE stocks, FTSE All-Share and TSE 300 listings, selected Goldman Sachs/FTA securities; the first section of the Tokyo Stock Exchange, selected sponsored ADRs from a broad range of countries as well as securities in emerging markets. The size, breadth and experience of the research team allows ISS to maximize an in-depth understanding of local business practices, proxy voting requirements, language and culture across most developed corporate governance markets globally.

ISS' policy board works to ensure that ISS' voting policies are developed and applied within a framework of corporate governance best practices. ISS actively works with institutional clients and industry professionals around the world to gather input on its proxy voting policies. Each year, through an annual policy survey of our institutional clients and other forums, institutional investors are invited to share their ideas on corporate governance issues including board structure, executive compensation, mergers and acquisitions and corporate accountability to ensure that our standard voting policies are aligned with the views of our institutional clients.

Our Proxy Research and Voting recommendations are based on the application of ISS' voting policies to the particular voting items on an issuer's agenda. Our research and recommendations are produced based on benchmark, specialized and custom policies.

ISS develops separate benchmark policies for U.S. securities and non-U.S. securities. ISS' non-U.S. benchmark policies are adjusted to address in-country concerns. ISS' benchmark policies serve as an industry standard and best practice guide to corporate governance. In addition to our benchmark policies, we recognize that the philosophies and policies used to make proxy voting decisions range widely among different types of investors. Understanding the diverse needs of our clients, we are able to create policies that meet their requirements through a number of specialized policies such as SRI policies based on environmentally and socially responsible guidelines and our Taft-Hartley policy which is based on AFL-CIO guidelines. For many institutional investors with highly specialized or unique needs for proxy research and policy, we also offer custom proxy advisory services in which we work with our clients to develop and refine governance policy guidelines that match their particular views and are unique to them.

Proxy Voting. Our Proxy Voting services include notifying clients of upcoming shareholder meetings, receiving proxy ballots from third-party proxy distributors, generating consolidated proxy ballots and instructions across our clients' portfolios, executing and tabulating our clients' votes in accordance with their instructions, maintaining voting records and providing comprehensive vote reporting.

Our vote reporting lets our clients stay informed and empowered with accurate and timely information, including full vote audit trails and intra-day updates of all fund, meeting and agenda

11

information. In addition to daily audits and detailed vote reconciliation, we conduct automated end-of-day production checks to ensure all votes are executed accurately.

Our account representatives and voting operations professionals worldwide provide expert guidance and dedicated support to make sure all clients' votes are cast in accordance with their established proxy guidelines. In addition, we have a Straight Through Processing, or STP, arrangement with Broadridge Financial Solutions with respect to U.S. and global ballots. This STP arrangement allows for ballots to be received and proxy votes to be made electronically minimizing the manual aspects of the proxy voting process and limiting the risk of error inherent in manual processes. This STP arrangement and other arrangements with third party ballot distributors and custodians have allowed our number of ballots processed to increase from 2.0 million in 2000 to 7.0 million in 2009.

Vote Disclosure is a cost-effective proxy voting solution to help U.S. investment companies comply with the SEC disclosure rules and give shareholders easy access to institutional voting records. For users of this service, we collect, report and record the information required by the SEC in the Form N-PX and provide users with reports and a personalized easily navigable web site for public vote and proxy policy disclosure.

Global Proxy Distribution Services ("GPD")

Our GPD service offers a complete global proxy distribution solution to custodian banks for non-U.S. securities through a single independent platform. GPD provides for the efficient distribution and voting of proxies giving clients the ability to review and download detailed meeting information and individualized account information. GPD also provides online access to customized record-keeping and reporting across all custodians and sub-custodians.

Securities Class Action Services ("SCAS")

We deliver a complete class action monitoring and claims filing service to institutional investors who have potential recovery rights in class action lawsuits. We provide a comprehensive securities litigation database, including up-to-date case information and detailed historical class action data, and provide fully-outsourced notification, tracking and claims filing services to our institutional clients. Our arrangements with claims administrators and law firms around the world enable us to advise on new developments in global markets and streamline the filing process.

SCAS offers more detailed portfolio specific views of cases and settlements with an online report library that allows clients to keep track of the complete securities class action lifecycle from when a case is first identified until payment is disbursed. Securities class action data provided to our clients include class periods, settlement dates, status reports, award amounts, claim deadline dates, claims administrator details and pertinent related data.

Financial Research and Analysis

We provide specialized financial research and analysis products and services to asset managers, hedge funds, corporations and professional services firms across many dimensions of risk, governance, accounting, environmental, social and legal issues.

Our Financial Research and Analysis offerings fall into four general categories: CFRA Forensic Accounting Research, (ES&G), M&A Edge and Compensation Advisory Services.

CFRA Forensic Accounting Research

Through a rigorous and proprietary research process, our global team of analysts assesses the reported financial results of over 10,000 companies worldwide. We focus on providing our clients with timely and actionable risk analysis reports regarding earnings and cash flow quality and sustainability,

12

legal and regulatory risk and overall business health. Our clients rely on our continuous analysis and objective perspective.

CFRA's largest product is Accounting Lens, a leading forensic accounting risk research report offering for investors, providing early warning signals for companies showing signs of operational or financial distress. The reports consist of in-depth company research, educational and industry research, access to our proprietary earnings quality database and research analyst contact. In addition, CFRA's Legal Edge product is focused on identifying and analyzing hidden legal and regulatory risks. CFRA also provides customized research services for client-defined projects.

Environmental, Social and Governance Services

Our ES&G Research and Analytics products and services include screening and modeling tools that allow institutional investors to apply socially responsible guidelines to portfolios, understand the implications of restrictions on portfolios, and examine company-specific profiles. Our services also help clients manage portfolio risk by incorporating an in-depth set of quantitative and qualitative ES&G information, including a range of screening, research and Index solutions, into their investment decision making processes.

Our ES&G Analytics provides sector-based research reports on thousands of companies and numerous environmental issues. These reports are designed to summarize key issues and to facilitate discussions on social and environmental policies between institutional investor clients and global companies. Relative scoring data for each company enable investors to compare performance and capabilities across industry sectors to assess a company's progress towards best practices. In 2009, we acquired Innovest and KLD in order to expand our ES&G product offering.

M&A Edge

Our M&A Edge service provides an independent, in-depth analysis that focuses specifically on proposed merger and acquisition deals and proxy contests to inform institutional investors. This offering complements our traditional proxy research by providing the same foundational analysis and vote recommendation, but also delivers ongoing deal notes that keep users abreast of key events as the deal or contest evolves. Coverage continues as issues develop, from the date of announcement through the shareholder vote. The analysis covers key aspects of a transaction, including strategic rationale, corporate governance and shareholder rights issues.

Compensation and Corporate Advisory Services

We provide a set of turnkey products and services that enable compensation professionals and board committee members to optimize compensation plan design by modeling, analyzing and benchmarking executive compensation. Our Compensation and Corporate Advisory Services provide access to experienced and dedicated compensation plan analysts and support to our clients in modeling the cost of equity compensation plans and determining optimal compensation plan design. Alternatively, we provide a web-based compensation modeling tool, Compass, that measures the cost of equity-based incentive plans using a binomial option pricing model.

Our Clients

We have a global footprint, which allows us to support our highly-diversified client base across numerous geographies with in-depth analysis based on local knowledge. No client represented more than 1.2% of ACV and our top 20 clients represented less than 14% of ACV. Our client base is geographically diverse as well, with 41% of our revenues during the year ended December 31, 2009 generated from clients located outside of the Americas.

13

As of December 31, 2009, our ACV by client type was distributed approximately as follows: 57% asset management; 18% alternative investment managers (including hedge funds and fund of funds); 18% commercial and investment banking and trading (including prime brokers); and 7% corporate, professional services and other. As of December 31, 2009 our clients in the Americas, EMEA and Asia, comprised approximately 58%, 35% and 7% of RiskMetrics' ACV, respectively.

RiskMetrics

Approximately 530 clients worldwide rely on us for their portfolio risk management needs. Our RiskMetrics clients include leading asset managers, hedge funds, pension funds, commercial and investment banks, central banks, insurance companies, private banks and regulators. The following table summarizes RiskMetrics revenue on a percentage basis by geographic region, based on the country in which the customer is located:

| |

For the years ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

RiskMetrics Revenue by Region

|

2009 | 2008 | 2007 | ||||||||

Americas |

44.5 | % | 45.6 | % | 46.7 | % | |||||

EMEA (Europe, Middle East and Africa) |

48.5 | % | 47.3 | % | 45.0 | % | |||||

Asia |

7.0 | % | 7.1 | % | 8.3 | % | |||||

Total |

100.0 | % | 100.0 | % | 100.0 | % | |||||

ISS

Approximately 2,970 organizations worldwide rely on ISS for their corporate governance, proxy voting and financial research and analysis needs. Clients of our financial research and analysis services generally include institutional investors, hedge funds, insurance underwriters and diversified financial institutions. We also provide our Financial Research and Analysis products and services to corporations and regulatory bodies worldwide. The following table summarizes ISS revenue on a percentage basis by geographic region, based on the country in which the customer is located:

| |

For the years ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

ISS Revenue by Region

|

2009 | 2008 | 2007 | ||||||||

Americas |

75.8 | % | 78.0 | % | 77.6 | % | |||||

EMEA (Europe, Middle East and Africa) |

19.8 | % | 17.6 | % | 17.4 | % | |||||

Asia |

4.4 | % | 4.4 | % | 5.0 | % | |||||

Total |

100.0 | % | 100.0 | % | 100.0 | % | |||||

Our ISS business serves both institutional and corporate clients and we recognize that there is a potential for conflict of interest with respect to the provision of products and services to corporate issuers and the products and services we provide to our institutional investor clients. We have instituted multiple safeguards to mitigate any real or perceived conflicts of interests. We have formed a subsidiary that provides governance services to corporations. This subsidiary, ISS Corporate Services, Inc., has distinct resources and a firewall that prevents the flow of information from ISS Corporate Services to ISS. Every ISS Corporate Services contract indicates that the purchase of corporate services will not result in preferential treatment from ISS and does not influence ISS' proxy recommendations or other research coverage. Recommendations and research coverage are based solely on the application of ISS' published policies and by an issuer's actual governance policies and practices.

14

Our Industry and Market Opportunity

Industry

The recent adverse impact on the global financial markets which included illiquidity, market volatility, widening credit spreads, changes in interest rates, currency exchange fluctuations and new legal and compliance requirements, has had a negative impact on a number of our clients and has resulted in a decline on renewal rates and new sales growth. However, we believe there may be opportunities for the Company in the area of risk management in the event there is additional risk regulation. In general, regulation has been a key driver to our business growth in the past. In the event that the recent financial crisis results in further regulation, we believe that such regulation could be a driver for growth in our business by increasing the demand for our existing products and services.

As a result of increasing complexity of investment strategies, governments and regulatory authorities and investors are increasing the requirements on financial services firms and investment firms to track and report risk as part of their daily operations. To satisfy their risk management needs, firms across the financial services industry have significantly increased their expenditures on portfolio risk management technologies. Financial services firms have traditionally developed these products and services through in-house information technology, or IT, and research and development staffs. However, the increasing scale and specialization needed to support multi-asset class portfolios and complex securities and strategies have, in many cases, caused these firms to turn to more comprehensive products and services from dedicated providers who can furnish more effective solutions than internal development teams. In addition, an increasing number of firms are utilizing risk management solutions from external vendors in order to provide the third party independent risk reports often demanded by their clients.

Government regulation is also driving significant changes in governance practices. In the United States, proxy voting is both a legal requirement and a non-discretionary event for many institutional investors. Through its oversight of ERISA, the U.S. Department of Labor requires that pension funds treat their proxy, or right to vote, as an asset which must be exercised. At the same time, the SEC requires mutual funds to disclose to their customers how they voted the proxies of the securities they hold. In the United States, corporate governance-related regulation aimed at issuers, such as the Sarbanes-Oxley Act, further strengthens the focus among investors on governance and related issues. While the United States remains at the forefront of regulation-mandated corporate governance practices, the rest of the world is increasingly adopting more stringent corporate governance requirements.

The visibility of corporate governance and recognition of the risks associated with poor governance practices have increased significantly during the past several years. Corporate governance has shifted from a compliance function to a business imperative. Whether driven by high-profile corporate scandals or increasing shareholder activism, both investors and issuers are far more cognizant of the consequences of governance practices on their businesses or portfolio returns. Public companies that ignore best practices increasingly risk shareholder dissent and reputation risk. As institutional equity ownership grows, the power of institutional investors to effect change in their portfolio companies has grown in tandem. Along with the focus on corporate governance, investors are increasingly focusing on environmental and social issues in making investment and proxy voting decisions. This has increased the need for in-depth proxy research as a tool for investors engaging in socially responsible investing.

Market Opportunity

Our target market is a cross-section of global financial services firms that includes asset managers, hedge funds, commercial and investment banks, pension funds and insurance companies. We also target other market participants, such as third-party advisors, corporations, underwriters and central banks.

15

We believe that a number of key market trends are driving the growth of our business and increasing the value we can offer to our expanding client universe:

Growing Global Financial Markets and Investment Portfolio Complexity. The variety, complexity and geographic diversity of financial assets held by investors have expanded significantly, resulting in multi-asset class, multi-national portfolios often including derivatives and other structured products.

Increasing Demand for Transparency. RiskMetrics believes that the viability of the global financial community is founded upon transparency and trust. Investors increasingly need to document their risk profile on a regular basis for both internal audiences, such as risk committees, as well as external constituencies, such as limited partners and regulators. In order to satisfy these demands, comprehensive risk management has become an essential requirement. Furthermore, institutional investors have increasingly used their proxy voting power as a tool to motivate companies to demonstrate better accountability and transparency. We believe that as investors continue to demand greater transparency with respect to multiple dimensions of financial risk, demand for our comprehensive suite of risk management services will continue to grow.

Increasing Regulatory Requirements. Regulatory bodies around the world continue to drive change and create opportunities in the markets we serve. Portfolio risk reporting and measurement regulations, such as UCITS III, U.S. Department of Labor proxy voting requirements and corporate governance related regulations, including the Sarbanes-Oxley Act, have increased regulatory compliance requirements and have further emphasized the need for comprehensive risk management tools. We believe the increased focus on regulatory requirements around the world will drive further demand for our products and services.

Increasing Focus on Corporate Governance. During the past several years, there has been significant growth in the visibility of corporate governance and recognition of the risks associated with poor governance practices. Whether driven by high-profile corporate scandals or increasing shareholder activism, both investors and issuers are far more cognizant of the consequences of governance practices on their businesses or portfolio returns. Furthermore, investors are increasingly focusing on companies' environmental and social attributes when making investment and proxy voting decisions. We believe that these trends are driving the need for in-depth specialized research as a tool for investors engaging in socially responsible investing.

Increasing Demand for Outsourced Products and Services. Many financial services firms are increasingly utilizing outsourced solutions that enable them to focus on their core competencies and provide greater capabilities and are more cost effective than their in-house systems. As third-party alternatives have improved in quality, reliability, efficiency and scalability, even the largest firms are recognizing the value of outsourcing. In particular, an increasing number of firms are utilizing risk measurement and management solutions from external vendors. These vendors provide independent risk reporting products and services which are often requested by the financial services firms' clients. As a provider of market leading, fully-outsourced risk and governance services, we believe that we will continue to be able to capitalize on this trend.

Competition

The competitive landscape for multi-asset class risk management and corporate governance and financial research and analysis products and services is characterized by a limited number of external third-party competitors. ISS competes with firms such as Broadridge Financial Solutions (which provides proxy voting services), Glass, Lewis & Co. (which provides research, voting recommendation and voting execution services) and Proxy Governance, Inc. (which provides research, voting recommendation and voting execution services). In addition, RiskMetrics competes with firms such as JP Morgan's Measurisk, BlackRock Inc.'s BlackRock Solutions unit, DST Systems Inc., Fimalac S.A.'s

16

Algorithmics unit, Moody Corporation's KMV unit, MSCI Barra and SunGard Data Systems Inc. We also face competition from internal development at financial institutions and corporations. We compete in these markets primarily on the basis of brand recognition, market coverage, methodology and breadth of service offering.

Research and Development and Operations

Research and Development

RiskMetrics

The RiskMetrics research and development team is responsible for our risk research, data and analytics engineering, infrastructure and application development, testing, implementation and deployment. The team's years of collaborative innovation and research with our clients, which include many of the world's leading financial institutions, has resulted in an institutional knowledge which we believe would require substantial time and investment to replicate. We seek to maintain this competitive advantage through significant ongoing investment in research and development.

ISS

ISS has invested in systems, processes and controls to handle an increase in transactions processed. We have a technology infrastructure and a proven track record in automating and scaling operationally complex and time critical tasks. Our ISS development team has created integrated processing systems which have been developed in a scalable architecture linked to a centralized data warehouse. The ISS operations and research and development team also supports the recently launched ProxyExchange proxy voting platform that will provide additional functionality and services to our proxy voting clients. Our operations and research and development team are currently working on the implementation of the new proxy voting platform in order to prepare for the peak of the 2010 proxy season.

Research and development expenses amounted to $43,456, $41,593 and $31,142 for the years ended December 31, 2009, 2008 and 2007, respectively.

Operations

We maintain RiskMetrics' US operations teams in New York, Boston, Maryland, Oklahoma, and international operations in London, Singapore and Manila. Our operations group manages the internal technical infrastructure of RiskMetrics (including data centers, networks and telecommunications) and the daily operational elements of our hosted applications which run all analytics, data and client processes. Daily functions include processing our market data time series, securities reference data and benchmarks from our global data providers, loading and processing millions of client positions and monitoring and ensuring peak performance. Our primary operations are hosted at two redundant data centers in Watertown, Massachusetts and Asburn, Virginia, connected together via a secure network.

Many of ISS' clients outsource proxy voting and vote reporting to ISS. We have had success in meeting client requirements while also increasing our transactional volume through increased automation and by leveraging our operations center in Manila, Philippines. This operations center reduces the operational cost per transaction and has been a key component of our success.

Sales, Marketing and Client Support

We sell our products and services primarily through direct interaction with our clients. As of December 31, 2009, we had a sales force of approximately 69 employees in 12 offices around the world. Sales employees are compensated on a salary and commission basis.

17

Our account management staff is composed of approximately 128 employees in 13 offices worldwide. Account managers are assigned to our clients based on geographic location and client type. Our account management team works closely with our clients to optimize our clients' use of our products and services, and we believe that our account management team's product knowledge and local presence differentiates us from our competition.

Our marketing and communications team supports all of our business units with the aim of helping us increase sales, generate qualified sales leads, enhance our brand, increase our visibility, improve the client experience and educate the financial community about risk and governance. Key areas of focus include communications and industry outreach and event management. The team also proactively manages our relationship with the media, which frequently seeks our opinion on industry issues, particularly in the area of corporate governance.

Government Regulation

ISS is a registered investment advisor and must comply with the requirements of the Investment Advisers Act of 1940 and related SEC regulations. Such requirements relate to, among other things, disclosure obligations, recordkeeping and reporting requirements, marketing restrictions and general anti-fraud prohibitions.

Employees

Our employee base is comprised of talented people from diverse backgrounds. Some of our employees have extensive experience at prominent financial institutions and Fortune 500 companies. As of December 31, 2009, we had approximately 1,140 full-time employees in 12 countries. During the proxy season (March to July), ISS typically retains approximately more than 200 temporary employees. We believe that we maintain good working relationships with our employees. None of our employees are subject to a collective bargaining agreement.

Website Access to our Periodic SEC Reports

Our corporate headquarters are located at One Chase Manhattan Plaza, New York, New York 10005, and our telephone number is (212) 981-7145. We maintain an Investor Relations website on the Internet at www.riskmetrics.com. We make available free of charge, on or through this website, our annual, quarterly and current reports and any amendments to those reports as soon as reasonably practicable following the time they are electronically filed with or furnished to the SEC. To access these, just click on the "SEC Filings" link found on our Investor Relations homepage.

Information contained on our website is not incorporated by reference into this Annual Report on Form 10-K or any other document filed with the SEC.

The Company is exposed to the risk factors described below. You should carefully consider the following risk factors, as well as the other information in this Annual Report on Form 10-K, before deciding whether to invest in our common stock. If any of the events highlighted in the following risks actually occurs, our business, results of operations or financial condition would likely suffer. In such an event, the trading price of our common stock could decline and you could lose all or part of your investment.

18

Risks Relating to our Business

Our revenues and earnings depend substantially upon conditions in the financial services industry, and a significant or prolonged downturn in the financial services industry could decrease demand for our products and services.

Recently, general worldwide economic conditions have experienced deterioration due to credit conditions resulting from the recent financial crisis affecting the banking system and financial markets and other factors including slower economic growth, concerns about valuations and decreased consumer confidence. These conditions make it extremely difficult for our customers and us to accurately forecast and plan future business activities. We cannot predict the timing or duration of any economic slowdown or subsequent economic recovery. If the economy or markets in which we operate do not continue at their present levels or continue to deteriorate, we may record charges related to restructuring costs and further impairments to goodwill and long-lived assets, and our business, financial condition and results of operations will likely be materially and adversely affected.

Our revenues are principally derived from the provision of risk management and corporate governance products and services to the financial services industry. The vast majority of our business involves the sale of products and services to clients in the financial services industry including asset managers, banks, insurance companies, hedge funds, pension funds as well as professional organizations that serve the financial services industry. The global financial markets have been particularly adversely impacted by the market environment of the past two years that includes illiquidity, market volatility, widening credit spreads, changes in interest rates, currency exchange fluctuations and new legal and compliance requirements. These market conditions and the reduced business activity have had a negative impact on a number of our clients and could negatively impact our future revenues due to the potential for declining sales and renewal rates.

Similarly, we are exposed to other market trends in the financial services industry. Consolidation in the financial services industry could reduce our existing client base and the number of potential clients. This may negatively impact our ability to generate future growth and may reduce demand for our products and services, which could have a material adverse effect on our business, financial condition or results of operations.

Our investments in recorded goodwill and other intangible assets as a result of prior acquisitions, including goodwill and other intangible assets resulting from our ISS acquisitions could be impaired as a result of future business conditions, requiring us to record substantial write-downs that would reduce our operating income.

We have goodwill and intangible assets of $461.6 million recorded on our balance sheet as of December 31, 2009. During 2008 we recorded a $160.1 million impairment charge to goodwill and intangible assets primarily as a result of the negative equity market conditions which caused a material decline in industry market multiples in 2008 and a reduction in the useful life of an ISS tradename. We evaluate the recoverability of recorded goodwill amounts and intangible assets annually, or when evidence of potential impairment exists. The annual impairment test is based on several factors requiring judgment. Changes in fair market valuations and our operating performance or business conditions, in general, could result in additional future impairments of goodwill which could be material to our results of operations. In addition, if we are not successful in achieving anticipated operating efficiencies associated with acquisitions, our goodwill and intangible assets may become impaired.

19

We have incurred significant indebtedness which could affect our ability to finance our operations, pursue desirable business opportunities or successfully run our businesses in the future.

As of December 31, 2009 we have outstanding indebtedness of $288.4 million. The 2009 interest cost to service our debt was approximately $19.6 million. In addition, we are required to make quarterly principal payments of $0.7 million and re-pay the entire amount outstanding in December 2013. This indebtedness has created substantial demands upon our available cash to pay interest and future debt principal requirements. Our leverage and debt service obligations could have important consequences to you, including the following:

- •

- The terms of the indebtedness obligations that we have incurred contain numerous restrictive covenants which, among other

things, restrict our ability to pay dividends on or make other distributions or repurchase our capital stock or make other restricted payments, incur additional indebtedness or issue preferred stock,

make investments, enter into transactions with affiliates and sell assets or merge with or into other companies or otherwise dispose of all or substantially all of our assets. In addition, we are

required to satisfy and maintain specified financial ratios and tests. If we do not comply with these obligations, we may cause an event of default which, if not cured or waived, could require us to

repay the indebtedness immediately.

- •

- We may be vulnerable in the event of downturns and adverse changes in our businesses, in our industries, or in the economy

generally, due to our debt service.

- •

- We may have difficulty obtaining additional financing, if necessary, at favorable interest rates or at all, to meet our

requirements for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes.

- •

- We are required to dedicate a substantial portion of our current cash flow to the payment of interest on our indebtedness, and future cash flow to principal indebtedness, which will reduce the amount of funds available for operations, capital expenditures and future acquisitions.

We require highly trained and skilled management and other key employees to maintain and expand our analytical models, proxy voting recommendations and other important aspects of our product and service offerings.

Our strategic direction and growth, as well as the development, maintenance and support of our products and services, are dependent upon the knowledge, experience and ability of our highly skilled, educated and trained employees. The members of our research and development and operations groups have, in many cases, advanced degrees and backgrounds in quantitative disciplines, including physics, engineering and economics, and use their experience and expertise to design product and service enhancements. In addition, the members of ISS' policy board use their experience and expertise in corporate governance and policy formation to ensure that ISS' voting policies are developed and applied within a framework of corporate governance best practices. Other ISS employees have extensive experience in the process and mechanics of voting proxies. The success of our business depends to a significant extent upon the continued service of our executive officers and other key management, research, sales and marketing, information technology and other technical personnel. In particular, Ethan Berman, our chief executive officer and a key participant in the formulation of our growth strategy to date, has been instrumental to our success. The loss of Mr. Berman could have a serious negative effect on the future development of our business, particularly if we are not able to implement an effective succession plan.

We believe that success in our business will continue to be based upon our intellectual capital. Consequently, we must hire and retain employees with the technical expertise and industry knowledge necessary to continue to develop our services and effectively manage our growing sales and marketing organization to ensure the growth of our operations. Despite the current market conditions, the market

20

for highly skilled employees remains very competitive and we compete for talent with some of the largest financial institutions and corporations in the world.

If we are unable to retain and recruit a sufficient number of these employees at all levels, our ability to maintain and grow our business could be negatively impacted.

We face competition that may cause price reductions or loss of market share.

We are subject to competitive conditions in all aspects of our business. We are one of the largest providers of outsourced multi-asset class market risk management and the largest provider of outsourced proxy research and voting services. The competitive landscape for multi-asset class risk management and corporate governance and financial research and analysis products and services is characterized by a limited number of competitors. ISS competes with firms such as Broadridge Financial Solutions (which provides proxy voting services), Glass, Lewis & Co. (which provides research, voting recommendation and voting execution services) and Proxy Governance, Inc. (which provides research, voting recommendation and voting execution services). ISS also competes with local niche proxy voting and research providers in certain international markets. In addition, RiskMetrics competes with firms such as JP Morgan's Measurisk, BlackRock Inc.'s BlackRock Solutions unit, DST Systems Inc, Fimalac S.A.'s Algorithmics unit, Moody Corporation's KMV unit, MSCI Barra and SunGard Data Systems Inc. We also face competition from:

- •

- the in-house operations of the businesses we seek as clients;

- •

- other general and specialized proxy reporting and business information services providers; and

- •

- other information and professional service providers.

Intense competition could harm us by causing, among other things, price reductions, reduced margins and loss of market share. We could further be required to reduce the fees we charge clients as a result of competitive pressure, which could result in lower revenues and profitability.

Our ability to compete, succeed and generate profits depends, in part, on our ability to obtain data from third-party vendors on commercially reasonable terms.

We currently obtain data for use in our products and services from a number of third-party vendors. Termination of one or more of our significant data agreements or exclusion from, or restricted use of a data provider's information could decrease the available information for us to use and offer our clients and may have a material adverse effect on our business, financial condition or results of operations. In addition, ISS relies on our data feed agreement with Broadridge Financial Solutions which allows for many ballots to be received and proxy votes to be made electronically, minimizing the manual aspects of the proxy voting process and limiting the risk of error inherent in manual processes. If our data feed agreement with Broadridge was terminated, we would have to incur significant expenses in order to input our clients' voting instructions directly into Broadridge's proprietary electronic voting systems and our business and results of operations would be materially adversely affected. Since we also compete with Broadridge in some markets with respect to providing certain aspects of proxy voting services, Broadridge may have an incentive not to renew our data feed agreement when its initial term expires or to offer renewal terms which we may deem unreasonable.

Some of our competitors could enter into exclusive contracts with our data suppliers. If our competitors enter into such exclusive contracts, we may be precluded from receiving certain data from these suppliers or restricted in our use of such data, which would give our competitors an advantage. Such exclusive contracts would hinder our ability to provide our clients with the data they prefer, which could lead to a decrease in our client base and could have a material adverse effect on our business, financial condition or results of operations.

21

In addition, some data suppliers may seek to increase licensing fees for providing their content to us. If we are unable to renegotiate acceptable licensing arrangements with these data suppliers or find alternative sources of equivalent content, we may be required to reduce our profit margins or experience a reduction in our market share.

Any perceived conflicts of interest resulting from providing products and services to institutional investors in addition to proxy voting recommendations, or providing products and services to corporations which are the subject of our proxy recommendations or other analytical products and services could harm our reputation and business.