Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

|

For

the fiscal year ended December 31, 2009

|

|

Commission

file number 001-09913

|

KINETIC

CONCEPTS, INC.

(Exact

name of registrant as specified in its charter)

|

Texas

|

74-1891727

|

|

|

(State

of Incorporation)

|

(I.R.S.

Employer Identification No.)

|

|

|

8023

Vantage Drive

San

Antonio,

Texas

|

78230

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (210) 524-9000

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each

class

|

Name of each exchange

on which registered

|

|

|

Common

stock, par value $0.001

|

New

York Stock Exchange

|

Securities

registered pursuant to section 12(g) of the Act: NONE

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes X No ____

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes ____ No X

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes X No ____

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes ____ No ____

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

|

X

|

Accelerated

filer

|

||

|

Non-accelerated

filer

|

(Do

not check if a smaller reporting company)

|

Smaller

reporting company

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes ____ No X

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates as of June 30, 2009 was $1,234,957,983 based upon the closing

sales price for the registrant's common stock on the New York Stock

Exchange.

As of

February 19, 2010, there were 71,332,359 shares of the registrant's common stock

outstanding.

Documents

Incorporated by Reference: Certain information called for by Part III

of this Form 10-K is incorporated by reference to the definitive Proxy Statement

for the 2009 Annual Meeting of Shareholders, which will be filed not later than

120 days after the close of the Company's fiscal year.

KINETIC

CONCEPTS, INC.

|

Page

No.

|

|||

|

4

|

|||

|

30

|

|||

|

41

|

|||

|

42

|

|||

|

43

|

|||

|

45

|

|||

|

46

|

|||

|

49

|

|||

|

51

|

|||

|

74

|

|||

|

76

|

|||

|

121

|

|||

|

121

|

|||

|

124

|

|||

|

124

|

|||

|

124

|

|||

|

125

|

|||

|

125

|

|||

|

125

|

|||

|

126

|

|||

|

130

|

|||

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, which are covered by the "safe harbor" created

by those sections. The forward-looking statements are based on our current

expectations and projections about future events. Discussions containing

forward-looking statements may be found in "Management's Discussion and Analysis

of Financial Condition and Results of Operations," "Risk Factors," and elsewhere

in this report. In some cases, you can identify forward-looking statements by

terminology such as "may," "will," "should," "could," "predicts," "projects,"

"potential," "continue," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates," or the negative of those terms and other variations of

them or by comparable terminology.

These

forward-looking statements are only predictions, not historical facts, and

involve certain risks and uncertainties, as well as

assumptions. Actual results, levels of activity, performance,

achievements and events could differ materially from those stated, anticipated

or implied by such forward-looking statements. The factors that could

contribute to such differences include those discussed under the caption "Risk

Factors." You should consider each of the risk factors and uncertainties under

the caption "Risk Factors" in this Annual Report on Form 10-K among other

things, in evaluating our prospects and future financial performance. The

occurrence of the events described in the risk factors could harm our business,

results of operations and financial condition. These forward-looking statements

are made as of the date of this report. We disclaim any obligation to

update or alter these forward-looking statements, whether as a result of new

information, future events or otherwise.

TRADEMARKS

3M™

Tegaderm™ is a licensed trademark of 3M Company; Spirit Select™ is a

licensed trademark of Carroll Hospital Group, Inc.; and GraftJacket® is a

licensed mark of Wright Medical Technology Inc. All other trademarks appearing

in this report are proprietary to KCI Licensing, Inc., its affiliates and/or

licensors. The absence of a trademark or service mark or logo from this

report does not constitute a waiver of trademark or other intellectual property

rights of KCI Licensing, Inc., its affiliates and/or licensors.

INTRODUCTION

General

Kinetic

Concepts, Inc., or KCI®, is a

leading global medical technology company devoted to the discovery, development,

manufacture and marketing of innovative, high-technology therapies and products

that have been designed to leverage the body’s ability to heal, thus improving

clinical outcomes while helping to reduce the overall cost of patient

care. We have an infrastructure designed to meet the specific needs

of medical professionals and patients across all healthcare settings, including

acute care hospitals, extended care organizations and patients’ homes, both in

the United States and abroad. Our primary business units serve the

advanced wound care, regenerative medicine and therapeutic support system

markets.

|

·

|

Our

Active Healing Solutions™ business, or AHS, is focused on the development

and commercialization of advanced wound care therapies based on our

Negative Pressure Technology Platform, or NPTP, which employs negative

pressure to elicit a bioresponse in a variety of wound types to promote

wound healing through unique mechanisms of action and to speed recovery

times while reducing the overall cost of treating patients with complex

wounds. NPTP comprises three primary product categories:

Negative Pressure Wound Therapy, or NPWT, Negative Pressure Surgical

Management, or NPSM, and Negative Pressure Regenerative Medicine, or

NPRM. NPWT, through our V.A.C.®

Therapy portfolio, currently represents the primary source of revenue for

the AHS business. We continue to develop and commercialize new products

and therapies in NPSM and NPRM to diversify our NPTP revenue

streams.

|

|

·

|

Our

Regenerative Medicine business is primarily comprised of the operations of

our wholly-owned subsidiary, LifeCell Corporation, or

LifeCell™. LifeCell is focused on the development and

commercialization of regenerative and reconstructive acellular tissue

matrices for use in reconstructive, orthopedic, and urogynecologic

surgical procedures to repair soft tissue defects, as well as for

reconstructive and cosmetic procedures. Existing products include

our human-based AlloDerm®

Regenerative Tissue Matrix and porcine-based Strattice™ Tissue Matrix in

various configurations designed to meet the needs of patients and

caregivers. The majority of our Regenerative Medicine revenue is

generated from the clinical applications of challenging hernia repair and

post-mastectomy breast reconstruction. We continue our efforts

to penetrate markets with our other current products while developing and

commercializing additional tissue matrix products and applications to

expand into new markets and

geographies.

|

|

·

|

Our

Therapeutic Support Systems business, or TSS, is focused on

commercializing specialized therapeutic support systems, including

hospital beds, mattress replacement systems and overlays. Our

TSS business is comprised of three primary surface categories: critical

care, wound care and bariatric. Our critical care products,

often used in the intensive care unit, or ICU, are designed to address

pulmonary complications associated with immobility; our wound care

surfaces are used to reduce or treat skin breakdown; and our bariatric

surfaces assist caregivers in the safe and dignified handling of patients

of size. We also have products designed to reduce the incidence

and severity of patient falls in the hospital

setting.

|

KCI was

founded in 1976 and is incorporated in Texas. Our principal executive

offices are located at 8023 Vantage Drive, San Antonio, Texas

78230. Our telephone number is (210) 524-9000.

Corporate

Strategy

KCI is

committed to consistently generating superior clinical outcomes for patients and

caregivers using our products and therapies. Our differentiated

products, competencies and know-how continue to drive trust and recognition of

superior performance among our customers, which we believe translates into

strong stakeholder value. We intend to execute on our strategic

vision of sustaining leadership positions in each of our AHS, Regenerative

Medicine and TSS businesses by delivering unparalleled outcomes with compelling

economic value for our customers and focusing on innovation, globalization and

diversification. We are also focused on organizational readiness and

are making a concerted effort to enhance our management systems and business

processes through a corporate global business transformation initiative to

enable us to effectively and efficiently carry out our strategic

vision.

Innovation. We

continue to focus on our core technologies as platforms for growth through the

development of new products and clinical data. In our AHS business,

we plan to leverage our highly successful NPWT franchise, now with its third

generation V.A.C. Therapy System, into a more expansive NPTP portfolio based on

the successful development and commercialization of next generation NPWT systems

and dressings as well as new NPSM and NPRM products to diversify our AHS revenue

in the future. We are currently developing our fourth generation NPWT

portfolio of products including our V.A.C.Ulta™ and

V.A.C.Via™ Therapy Systems, for which we anticipate market launch during

2010. In 2009, we launched our first NPSM product, ABThera™ Open

Abdomen Negative Pressure Therapy System, which is used primarily for management

of the open abdomen, and we plan to launch a second product, Prevena™ Therapy

System, for the management of higher-risk surgical incisions, in

2010. In the future, our goal is to commercialize advanced NPRM

therapies for the treatment of chronic wounds and hard tissue

defects. In our Regenerative Medicine business, we are currently

launching products for use in new clinical applications such as stoma

reinforcement and mastopexy and are continuing development of additional

applications for lumpectomy and inguinal hernia. At the same time, we

are investing in advanced technologies in tissue engineering,

genetically-modified animals, and new tissue types to address unmet clinical

needs and to improve outcomes through regenerative medicine. In our

TSS business, we are investing in the development and commercialization of

enhanced products designed to meet the needs of ICU patients and to reduce or

prevent “never” events such as hospital-acquired pressure ulcers, nosocomial

infections and injurious falls. Over the long term, we will continue

to make significant investments in innovation to strengthen our competitive

position in the markets we serve.

Globalization. We

continue our efforts to increase penetration in existing geographic markets

while we expand availability of our product offerings in new

countries. Currently, the majority of our revenue from each of our

business units is generated in North America, while we have notable operations

in Europe, the Middle East and Africa, or EMEA, and the Asia Pacific, or APAC,

regions. The goal of our globalization efforts is to increase the

share of our revenue generated outside the United States over time while growing

our business overall. In our AHS business, we are now entering the

large and unpenetrated Japan market with our core NPWT product, the V.A.C.

Therapy System and related disposables. In 2009, we received approval

to begin market development activities in Japan, where we have submitted

applications to relevant reimbursement bodies for coverage determination of our

V.A.C. Therapy products. We expect to receive such coverage determination in the

first quarter of 2010, followed by commercial launch shortly

thereafter. In other countries, we have identified several

opportunities for our NPWT products that may be best served initially by

distributors. We are working aggressively to construct appropriate

networks to launch NPWT products in other countries including Brazil, Russia,

India and China. We have also recently expanded our NPWT dressing

portfolio with the Simplace™ Dressing and GranuFoam™ Bridge products, which are

now widely available in the countries where we operate. In early

2009, LifeCell launched Strattice Tissue Matrix in the United Kingdom and

Germany, and we are currently expanding further in other European

markets. In the future, we plan to commercialize our tissue matrix

products globally. Our TSS business currently operates primarily in

the United States and Europe, and we are evaluating opportunities for further

geographic expansion.

Diversification. Beyond

expanding our product offerings and revenue streams through innovation and

globalization, we plan to seek additional opportunities to diversify our

business through continued technology licensing and strategic

acquisitions. We intend to build on the leadership positions held by

our AHS, Regenerative Medicine and TSS businesses through the evaluation and

investment in adjacent or enabling technologies and synergistic growth

opportunities, supplementing our continued organic innovation

efforts. Our strong balance sheet and liquidity position should

enable us to take advantage of growth opportunities as they arise.

Organizational

Readiness. In an effort to implement our long-term strategy,

our management team is focused on organizational readiness, with a goal of

improved operations and management systems which transform us into a more agile,

progressive and global enterprise. We are currently undertaking a

global business transformation initiative designed to improve efficiencies in

our systems and operations through standardization and automation which

translate into reduced costs and more effective decision-making. As a

result of ongoing improvements to our manufacturing operations through improved

sourcing and automation, as well as global consolidation of certain shared

services, we look forward to substantial and permanent cost reductions exiting

2011. We are also making significant progress in the rationalization

of our service center and distribution infrastructure for our AHS and TSS

businesses, yielding additional cost savings. As we improve our

management systems and operations over time, we will continue to look for new

opportunities to augment our business processes and make infrastructure

enhancements to improve our efficiency and agility as a company.

Competitive

Strengths

We

believe we have the following competitive strengths:

Innovation and

commercialization. We have a successful track record spanning

over 30 years in commercializing novel technologies that change the clinical

practice of medicine by addressing the critical unmet needs of clinicians,

restoring the well-being of their patients and helping to reduce the overall

cost of patient care. We leverage our scientific depth, clinical

know-how and market experience, and we manage an active research and development

program in all three of our businesses in support of our development and

commercialization efforts. We seek to provide novel,

clinically-efficacious solutions and treatment alternatives that increase

patient compliance, enhance clinician performance and ease-of-use and ultimately

improve healthcare outcomes.

Product differentiation and superior

clinical efficacy. We differentiate our portfolio of products

by providing effective therapies, supported by a clinically-focused and

highly-trained sales and service organization, which combine to produce

clinically-proven, superior outcomes. The superior clinical efficacy

of our products is supported by an extensive collection of published clinical

studies, peer-reviewed journal articles and textbook citations, which aid

adoption by clinicians. We successfully distinguish our NPWT products from

competitive offerings through unique marketing claims that have been cleared by

the U.S. Food and Drug Administration, or FDA. These unique claims

mirror our novel mechanisms of actions with respect to the creation of an

environment that promotes wound healing through the reduction of edema and

promotion of granulation tissue formation and perfusion, ultimately preparing

the wound bed for closure. In addition, our V.A.C. Therapy Systems

are specifically cleared for use in all care settings, including in the home,

with the exception of the V.A.C. Instill system. In Regenerative

Medicine, we differentiate our products through clinically-proven performance

demonstrating tissue acceptance, cell recruitment and incorporation,

revascularization and angiogenesis and finally tissue remodeling and

regeneration. Our proprietary tissue processes minimize the potential

for specific rejection of transplanted tissue matrices, and our products offer

improved ease-of-use while reducing the risk of complications, including

adhesions to the implant. The benefits of using our tissue matrix

products over the use of autografts and other processed and synthetic products

include reduced susceptibility to infection, resorption, encapsulation, movement

away from the transplanted area, and erosion through the skin along with reduced

patient discomfort compared to autograft procedures. In our TSS

business, we have successfully differentiated our critical care products with

clinical data showing the benefits of our Kinetic Therapy™ surfaces in the

reduction of ventilator acquired pneumonia. We have also developed

and commercialized our RotoProne™ product, the only ICU therapeutic surface to

provide 360 degrees of rotation, essential automated proning therapy for

patients with acute respiratory distress syndrome, or ARDS, and other severe

pulmonary conditions. Through our commitment to innovation and

diversification, we are well positioned to continue differentiating our products

through demonstrated superior clinical efficacy.

Broad reach and customer

relationships. Our worldwide sales organization, consisting of

approximately 2,000 team members, has fostered strong relationships with our

prescribers, caregivers and payers over the past three decades by providing a

high degree of clinical support and consultation along with our extensive

education and training programs. Because our products address the

critical needs of patients who seek treatment in numerous locations where care

is provided, we have built a broad and diverse reach across all healthcare

settings and among a wide variety of clinicians and specialized

surgeons. We have key relationships with an extensive list of acute

care hospitals worldwide and long-term care facilities, skilled nursing

facilities, home healthcare agencies and wound care clinics in the United

States. Additionally, our LifeCell sales representatives interact

with plastic surgeons, general surgeons, head and neck surgeons, burn surgeons

and trauma/acute care surgeons regarding the use and potential benefits of our

tissue matrix products. As we continue to innovate in our product portfolio and

diversify our business, we plan to leverage our customer relationships to

advance the commercialization of essential therapies to patients and caregivers

worldwide.

Reimbursement

expertise. During the commercialization process for each of

our therapies and products, we dedicate substantial resources to seeking and

obtaining reimbursement from third-party payers in each of the countries where

we operate. This process requires demonstration of clinical efficacy,

determination of economic value and obtaining appropriate pricing for each

offering, which is critical to the commercial success of our

products. We have also developed a core competency in

post-commercialization reimbursement systems, which enables us to efficiently

manage our collections and accounts receivable with third-party

payers. We leverage a comprehensive set of skills and systems through

our Advantage Center operation to manage billing and collections activities in

support of our reimbursement efforts. Our focus on reimbursement provides us

with an advantage both in product development and in the responsible management

of our working capital.

Extensive service center

network. With a network of 111 domestic and 53 international

service centers, we are able to rapidly deliver, manage and service our products

at major hospitals in the United States, Canada, Australia, Singapore, South

Africa, and most major European countries. Our network gives us the ability to

deliver our products to any major Level I U.S. trauma center rapidly. This

extensive network and capability is critical to securing contracts with national

group purchasing organizations, or GPOs, and allows us to directly and

efficiently serve the homecare market. Our network also provides a platform for

the introduction of additional products in one or more care

settings.

Corporate

Organization

We are

principally engaged in the rental and sale of our products throughout the United

States and in 20 primary countries internationally. We are

headquartered in San Antonio, Texas, and our international corporate office is

located in Amstelveen, the Netherlands. We have research and

development facilities in the United States and the United Kingdom, and we

maintain manufacturing and engineering operations in the United States, the

United Kingdom, Ireland and Belgium. Our operations are run by our

three separate business units: AHS, Regenerative Medicine and

TSS. AHS and TSS are headquartered in San Antonio, and Regenerative

Medicine, primarily our LifeCell subsidiary, is located in Branchburg, New

Jersey.

During

the first quarter of 2009, we changed our operating unit reporting structure to

correspond with our current management structure, including the reclassification

of prior-period amounts to conform to this current reporting

structure. Under our current management structure, we manage our

business by each of our three business units. All three of our business units

are supported by shared services, which include Finance, Legal, Human Resources,

and Information Technology.

INFORMATION

RELATED TO BUSINESS UNITS

Introduction

and Revenue Summary

We have

three reportable operating segments which correspond to our business units: AHS,

Regenerative Medicine, and TSS. We have two primary geographic

regions: North America, which is comprised principally of the United States and

includes Canada and Puerto Rico; and EMEA/APAC, which is comprised principally

of Europe and includes the Middle East, Africa and the Asia Pacific

region.

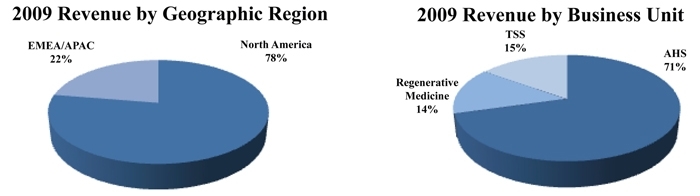

For the

year ended December 31, 2009, we generated revenue of

$1.99 billion. Approximately 70.6% of our 2009 revenue was from

our AHS business unit, while our Regenerative Medicine and TSS business units

accounted for 14.3% and 15.1%, respectively. Revenue from our North

America operations accounted for 77.6% of our fiscal 2009 revenue, while our

EMEA/APAC operations represented approximately 22.4% of total

revenue.

For

financial reporting purposes, our performance by reportable segment and

financial performance attributable to significant geographic areas is included

in Note 17 to our accompanying consolidated financial statements.

ACTIVE

HEALING SOLUTIONS

|

Description

of Business

|

Our

Active Healing Solutions business, or AHS, offers advanced wound healing and

tissue repair systems that are targeted to meet the needs of specific care

settings and wound or patient requirements and that incorporate our proprietary

Negative Pressure Technology Platform, or NPTP. NPTP comprises three

primary product categories, Negative Pressure Wound Therapy, or NPWT, Negative

Pressure Surgical Management, or NPSM, and Negative Pressure Regenerative

Medicine, or NPRM. NPWT currently represents the primary source of

revenue for the AHS business. We continue to develop and

commercialize new products and therapies in NPSM and NPRM to diversify our NPTP

revenue in the future.

Our NPWT

franchise is built upon our proprietary V.A.C. Therapy technology, which

promotes wound healing by delivering negative pressure (a vacuum) at the wound

site which is distributed to the wound bed through a patented disposable

dressing. This distributed negative pressure helps draw wound edges

together, removes infectious materials and actively promotes granulation at the

cellular level. Since its introduction, our V.A.C. Therapy technology

has changed the way wounds are treated and managed. With more published clinical

evidence than any competitive offering, V.A.C. Therapy has been selected by

prescribers as the treatment of choice for approximately 3,000,000 patients

worldwide. As part of our corporate strategy and to better address

customer and patient needs, we are in the process of expanding from our suite of

NPWT products to a broad, differentiated NPWT therapeutic

portfolio. We are currently planning the commercial launch of two new

NPWT products during 2010, the V.A.C.Ulta and V.A.C.Via Therapy

Systems. V.A.C.Ulta combines our existing V.A.C. Therapy technology

with instillation techniques in one device, intended to augment and accelerate

the wound healing process while targeting ease of use. V.A.C.Via is a disposable

device designed with the clinical benefits of V.A.C. Therapy in an embodiment

that is easier to procure, store and use, which we believe will enhance

utilization and patient compliance. Our new NPWT products, which are

supported by new intellectual property, are in pre-commercialization stages and

remain subject to regulatory approval in the U.S. and

internationally.

We are

also making significant investments in the development and commercialization of

new AHS products in NPSM and NPRM over the next several years. In 2009, we

launched our first NPSM product, the ABThera Open Abdomen Negative Pressure

Therapy System, which is used primarily for management of the open abdomen, and

we plan to launch the Prevena Therapy System in 2010 for the management of

higher-risk surgical site incisions. In the future, our goal is to develop

and commercialize new and next generation products in NPWT and NPSM, as well as

advanced NPRM therapies for the treatment of chronic wounds and hard tissue

defects.

Our AHS

business offers an exclusive combination of technology, support and proven

results that delivers 360 degrees of healing. In addition to the innovative

therapy systems and dressings and the most evidence-based outcomes in the NPWT

field, AHS also offers an unmatched integrated service and delivery model, which

includes support through the care continuum provided by on-call clinical experts

that offer clinical assistance and education across all care

settings.

|

Products

and Clinical Applications

|

Our AHS

products are designed to deliver highly-effective therapies in multiple clinical

applications with the needs of physicians, nurses, and patients in mind for both

the acute care and post-acute care settings. The table below provides

a summary view of our NPTP products, including those that are already

commercially available as well as those currently under

development. Unless otherwise noted, all of our AHS products are

approved for use in the United States, Canada, and the European

Union.

|

NPTP

(Negative Pressure Technology Platform)

|

||||||||

|

NPWT

(Negative Pressure Wound Therapy

|

NPSM

(Negative Pressure Surgical Management)

|

|||||||

|

Care

Setting

|

Acute

|

Post

-Acute

|

Acute

(Operating Room)

|

|||||

|

Products

|

InfoV.A.C.®

V.A.C.

ATS®

V.A.C.

Instill®

V.A.C.Ulta™†

|

ActiV.A.C.

®

V.A.C

Freedom®

(1)

V.A.C.Via™†

|

ABThera™

|

Prevena™ (2)

|

||||

|

Clinical

Application

|

Used

primarily for creating an environment that promotes wound healing by

preparing the wound bed for closure, reducing edema, promoting granulation

tissue formation and perfusion, and by removing exudate and infectious

material

|

Used

primarily for management of the open abdomen, as a temporary bridging of

abdominal wall openings where primary closure is not possible and/or

repeat abdominal entries are necessary

|

Used

primarily to manage surgical incisions by maintaining a closed environment

to protect the incision site from external infectious sources, removing

exudates, approximating incision edges and reducing edema

|

|||||

|

|

||||||||

|

† Product

currently in pre-commercialization phase; not currently approved for use

with patients

|

||||||||

|

(1)

Certified for Joint Airworthiness by the U.S. Military

|

||||||||

|

(2)

CE Marked, approved for use only in the European Union and Canada as of

January 29, 2010

|

||||||||

NPWT

Products

Each of

the V.A.C. Therapy Systems in our NPWT portfolio consists of a therapy unit and

four types of disposables: our proprietary dressings, an occlusive drape, a

unique tubing system connecting the dressing to the therapy unit and a

specialized canister. Our V.A.C. Therapy dressings are specially

designed to address the unique physical characteristics of different wound

types, such as large open wounds, surgical incisions, and diabetic foot ulcers,

among others. The V.A.C. Therapy unit consists of a pump that

generates controlled negative pressure and sophisticated internal software that

controls and monitors the application of the therapy. The therapy can

be programmed for individualized use based on prescriber preferences and

requirements. The occlusive drape covers the dressing and secures the

foam, thereby allowing negative pressure to be maintained at the wound

site. The tubing system is both a means of delivering negative

pressure therapy to a wound site as well as a proprietary feedback mechanism to

measure and monitor therapy levels. The canister collects the fluids, or

exudates, helps reduce odors through the use of special filters and provides for

safe disposal of medical waste. Additionally, all of our V.A.C.

Therapy units include safety alarms that respond in real time to signal users of

any tubing blockage, dressing leakage or other condition which may interfere

with appropriate therapy delivery. The systems have a number of

on-screen user-assist features such as treatment guidelines.

The

superior clinical efficacy of our V.A.C. Therapy wound healing and tissue repair

systems is proven and supported by an extensive collection of published clinical

studies. In addition, independent consensus conferences have issued guidelines

for the use of NPWT for diabetic foot wounds, pressure ulcers, complex chest

wounds, hospital-treated wounds and open abdominal wounds. The table

below provides a summary description of each of our NPWT therapy systems and

specialized dressings.

NPWT

Products

|

NPWT

Product

|

Introduction

Year

|

Description

|

||

|

V.A.C.Ulta™

Therapy

System

|

Planned

in 2010

|

V.A.C.Ulta

is designed to incorporate all of the functionality of InfoV.A.C. and

V.A.C. Instill into a single therapy system thereby enhancing efficiency

and ease of use. The therapeutic highlight is V.A.C. VeraFlo™ Therapy,

which enhances V.A.C. Therapy with the controlled delivery and removal of

topical solutions in the wound bed. V.A.C. VeraFlo Therapy expands the

current NPWT market opportunity.

|

||

|

V.A.C.Via™

Therapy

System

|

Planned

in 2010

|

V.A.C.Via

is designed as a single use, disposable NPWT device. V.A.C.Via provides

all of the clinical benefits of V.A.C. Therapy for less-complex wounds

having minimal to moderate levels of exudate. The portable, sleek design

of V.A.C.Via enhances patient mobility and provides discretion, which

enables improved patient therapy compliance.

|

||

|

V.A.C.

® GranuFoam™ Bridge Dressing

|

2009

|

The

V.A.C. GranuFoam Bridge Dressing is specifically designed to allow the

SensaT.R.A.C.™ Pad to be placed away from the wound site. This

makes the V.A.C. GranuFoam Bridge Dressing an ideal dressing for diabetic

foot wounds requiring NPWT and off-loading therapy. Because

V.A.C. GranuFoam Bridge Dressing can be used with all existing V.A.C.

Therapy Systems, and in combination with standard-of-care off-loading

boots or devices, the V.A.C. GranuFoam Bridge Dressing improves patient

mobility and allows patients to resume daily living

activities. The V.A.C. GranuFoam Bridge Dressing, when used

with an off-loading boot and V.A.C. Therapy, facilitates patient

transition from acute facilities to non-acute care settings.

|

||

|

V.A.C.

® Simplace™ Dressing

|

2008

|

The

V.A.C. Simplace Dressing features a newly designed GranuFoam Dressing and

a 3M™ Tegaderm™ Dressing designed exclusively for use with our proprietary

V.A.C. Therapy Systems. The unique features of the V.A.C.

Simplace Dressing kit are designed to simplify and quicken the V.A.C.

Therapy dressing application process, which results in improved adaptation

of the technology with less training required. The new spiral shaped

GranuFoam Dressing is pre-scored, which reduces the need to cut the foam

and facilitates easier placement in the wound site. The 3M

Tegaderm Dressing conforms to the body and flexes with the skin to help

ensure the existence of an optimal wound-healing environment.

|

||

|

InfoV.A.C.

®

Therapy

System

|

2007

|

InfoV.A.C.

provides a digital wound imaging feature that allows caregivers to monitor

and document wound healing progress. Digital images can be

reviewed on-screen or transferred electronically to help document patient

progress, which enables convenient sharing of wound information among

caregivers and payers who require evidence of wound

healing. Advancements also include SensaT.R.A.C. Technology and

Seal Check™ Leak Detector, which simplify the application, monitoring and

documentation of wound therapy.

|

||

|

ActiV.A.C.®

Therapy

System

|

2007

|

ActiV.A.C.

addresses the demand for a simpler, lighter, and lower profile design that

enhances patient comfort and mobility. ActiV.A.C. features newly-developed

technology that automatically documents the patient's therapy history and

treatment times. Reports can be reviewed on-screen or

downloaded to a computer and are electronically stored in the

system. ActiV.A.C., which can be battery operated, incorporates

SensaT.R.A.C. Technology and Seal Check Leak Detector, which simplify the

application, monitoring and documentation of wound therapy.

|

||

|

V.A.C.

GranuFoam Silver®

Dressing

|

2005

|

The

V.A.C. GranuFoam Silver Dressing combines the proven benefits of NPWT with

the antimicrobial attributes of silver. The V.A.C. GranuFoam

Silver Dressing is the only silver dressing that allows the GranuFoam

Silver Dressing pores to directly contact the wound, thereby eliminating

the need for additional silver dressing layers that may inhibit negative

pressure and granulation. Micro-bonded metallic silver is

uniformly distributed throughout the dressing, providing continuous

delivery of silver even after dressing sizing. A single

application of V.A.C. GranuFoam Silver Dressing eliminates the need for

adjunct silver dressings. The dressing offers a protective

barrier to reduce certain infection-producing bacteria, yeast and fungi

and may help reduce infections in the wound.

|

||

|

V.A.C.

Instill®

Therapy

System

|

2003

|

V.A.C.

Instill has all the capabilities and features of the V.A.C. ATS®

(described below), while also providing the ability to instill topical

wound treatment solutions and suspensions into the wound

bed.

|

||

|

V.A.C.

ATS®

Therapy

System

|

2002

|

V.A.C.

ATS incorporates our proprietary T.R.A.C. technology, which enables the

system to monitor pressure at the wound site and automatically adjust

system operation to maintain the desired therapy protocol. With

the introduction of the InfoV.A.C. to the acute care market, V.A.C. ATS is

being transitioned solely into the long-term care market segment and will

be the initial therapy system commercialized in Japan.

|

||

|

V.A.C.

Freedom®

Therapy

System

|

2002

|

V.A.C.

Freedom was designed to meet the requirements for a lightweight product

suitable for ambulatory patients. V.A.C. Freedom also utilizes

T.R.A.C. technology and T.R.A.C. dressings. With the

introduction of ActiV.A.C. to the post-acute market, V.A.C. Freedom is

being transitioned primarily into the long-term care market. In

addition, V.A.C. Freedom has achieved Joint Airworthiness Certification

status by the U.S. Military, following an extensive evaluation process

testing the device’s safety for use on military aeromedical evacuation

aircraft. The certification program is a shared U.S. Air

Force-Army initiative and applies to specific U.S. Air Force aircraft and

U.S. Army helicopters. The certification enables military

caregivers to continue providing effective and uninterrupted treatment for

injured military personnel that are being transported long distances from

theatre hospitals to continental U.S. hospitals.

|

NPSM

Products

The NPSM product portfolio consists of

products designed specifically for use in the surgical suite. These products

leverage the NPTP to address unique challenges that surgeons encounter during

and after surgical procedures. Each NPSM product offering includes a

therapy unit, specific dressing, tubing set, drape, and canister. The

levels of negative pressure for each therapy unit are pre-determined based on

the surgical procedures it is designed to address. Relevant alarms and alerts

are also built into the unit and are based on the specific surgical

procedure. The dressings offered are designed to suit the needs of

the surgeon during the surgical procedure. A tubing set connects the

dressing to the therapy unit. A canister is also available to collect exudate.

The canister size varies to accommodate levels of exudate observed for each type

of surgical procedure, ranging from 45 mL for the management of

surgically-closed incisions to 1000 mL for the management of the open

abdomen. The table below provides a summary description of each of

our NPSM therapy systems.

NPSM

Products

|

NPSM

Product

|

Introduction

Year

|

Description

|

||

|

Prevena™

Incision Management System

|

2010

|

Prevena

is designed for the management of surgical incisions. Prevena

provides a closed environment to protect the incision site from external

infectious sources, removes exudates, approximates incision edges, and

reduces edema, all of which assist with the management of surgical

incisions. Prevena is fully disposable and includes a

battery-powered, pre-programmed therapy unit delivering negative pressure,

a peel and place dressing and a carrying case. Prevena is

currently approved for use only in the European Union and Canada as of

January 29, 2010. Prevena is currently pending FDA approval in

the U.S.

|

||

|

ABThera™

Open

Abdomen Negative

Pressure

Therapy

System

|

2009

|

ABThera

is designed specifically for the management of patients with an open

abdomen. The system includes a dedicated therapy unit

delivering negative pressure, which is designed to be easy to use and is

made available in the operating room. ABThera Therapy is a

unique temporary abdominal closure technique, which helps

achieve primary fascial closure, manage exudate, protect the

abdominal contents and allow for rapid application.

|

|

Customers

|

In U.S.

acute care and long-term care facilities, we bill our customers directly for the

rental and sale of our products. We contract with healthcare

facilities individually or through GPOs that represent large numbers of

hospitals and long-term care facilities. In the U.S. homecare

setting, we provide products and services to patients in the home and bill

third-party payers, such as Medicare and private insurance,

directly. For 2009, 2008 and 2007, U.S. Medicare placements accounted

for 15.2%, 17.0%, and 19.1% of total AHS revenue, respectively. None

of our individual customers or third party payers accounted for 10% or more of

total AHS revenues for 2009, 2008 or 2007. Outside of the U.S., most

of our AHS revenue is generated in the acute care setting on a direct billing

basis. Sales and rentals of our AHS products accounted for

approximately 70.6% of our total revenue in 2009. By geographic

region, North America and EMEA/APAC represented 75.8% and 24.2%, respectively,

of total 2009 AHS revenue.

Reimbursement

We have

extensive contractual relationships and reimbursement coverage for our AHS

products in the United States. We have contracts with nearly all

major acute care hospital organizations and most major extended care

organizations, either directly or through GPOs. As of December 31,

2009, our AHS business had contracts with private and governmental payer

organizations covering over 200 million member lives in the United

States. We are paid directly by hospitals and extended care

organizations, who seek reimbursement for surgical procedures from both private

and public payers. A substantial portion of AHS product placements,

particularly placements in the home, are subject to reimbursement coverage from

various public and private third-party payers, including government-funded

programs, such as the Medicare and Medicaid programs in the United States, and

other publicly-funded health plans in foreign jurisdictions. As a

result, the demand and payment for our products are dependent, in part, on the

reimbursement policies of these payers.

In the

U.S. homecare market, our NPWT products are subject to Medicare Part B

reimbursement and many U.S. insurers have adopted coverage criteria similar to

Medicare standards. From time to time, the U.S. Medicare

administrative agency, The Centers for Medicare and Medicaid Services, or CMS,

publishes reimbursement policies and rates that affect reimbursement for our

Medicare placements in the home. The continued assignment of

reimbursement codes by CMS to competing products increases the likelihood of the

NPWT product category being included in future rounds of the Medicare

competitive bidding program.

We are

continuing our efforts to obtain expanded reimbursement for our NPWT products

and related disposables in foreign jurisdictions. These efforts have

resulted in varying levels of reimbursement from private and public payers in

Germany, Austria, the Netherlands, Switzerland, Canada, South Africa, Australia

and the United Kingdom, mainly in the acute care setting. Generally,

our NPWT products are covered and reimbursed in the inpatient hospital setting

and to some extent, depending on the country, in post-acute or community-based

care settings. However, in certain countries important to AHS’s

growth, such as Germany, the United Kingdom, France and Spain, post-acute care

coverage and reimbursement are largely provided on a case-by-case basis, and

multiple efforts are underway with certain countries to secure consistent

coverage and reimbursement policies in community-based outpatient care

settings. In targeted countries, we are utilizing accepted “coverage

with evidence” mechanisms in close cooperation with local clinicians and

clinical centers, government health ministry officials, and in some cases,

private payers to obtain the necessary evidence to support adequate coverage and

reimbursement.

In the

APAC region, we are undertaking major coverage and reimbursement efforts for our

NPWT products. In Japan, following our receipt of approval to begin

market development activities in 2009, we submitted reimbursement applications

for coverage of our V.A.C. Therapy Systems. The successful results

from our V.A.C. Therapy clinical trials, which we have reported, have been

submitted with our reimbursement dossiers. We expect to receive

reimbursement approval in Japan in the first quarter of 2010 followed by

commercial launch shortly thereafter. In Australia, where acute care

reimbursement for the V.A.C. Therapy System has been approved for many years, we

are seeking reimbursement approval for V.A.C. Therapy in the post acute or

community-based settings. In this regard, negotiations are underway

with the Australian health ministry, as well as that country’s largest private

payers. Other APAC countries that are important to AHS’s growth are China,

India, South Korea, Taiwan and Singapore, where we intend to dedicate

substantial efforts to obtain reimbursement in the future.

In

Germany, we now receive reimbursement for our NPWT products in the acute care

setting. We continue to seek expanded homecare reimbursement as part

of our growth plans in Germany although there have been delays in this approval

process. We are working with the German government and several German

insurance agencies to design clinical trials and possibly a registry for the

purposes of assessing payment and coverage for V.A.C. Therapy in the

home. Initial patient enrollment is expected in the latter half of

2010 with all studies concluding in the 2012 time frame. Assessment

of results and any coverage decisions will follow the conclusion of the

studies.

Overall,

the prospects of achieving broader global coverage and reimbursement for our

NPWT products in both acute and post-acute settings are dependent upon the

controls applied by governments and private payers with regard to rising

healthcare costs balanced by the significant and growing evidence that our NPWT

products have demonstrated the ability to prepare wounds for closure while

reducing the overall costs associated with treatment. We believe that our plans

to achieve positive coverage and reimbursement decisions for NPWT products

outside the United States are supported by the growing need for clinical and

economic evidence and are prioritizing these efforts country by

country.

To ensure

compliance with Medicare and other regulations to which we are subject, regional

carriers often conduct audits and request patient records and other documents to

support claims we submit for payment of services rendered to

customers. From time to time, we receive inquiries from various

government agencies requesting customer records and other

documents. It has been our policy to cooperate with all such requests

for information. We also are subject to routine pre-payment and post-payment

audits of reimbursement claims submitted to Medicare. These audits

typically involve a review, by Medicare or its designated contractors and

representatives, of documentation supporting the medical necessity of the

therapy provided by us and could ultimately result in denial, recoupment or

refund demands for claims submitted for Medicare reimbursement. In

addition, Medicare or its contractors could place us on extended pre-payment

review, which could slow our collections process for submitted

claims. Initial audit findings of this type are subject to

administrative remedies and appeals processes. Going forward, it is likely that

we will be subject to periodic inspections, assessments and audits of our

billing and collections practices.

|

Competition

|

Historically,

our AHS therapies and systems have competed primarily with traditional wound

care dressings, other advanced wound dressings (hydrogels, hydrocolloids,

alginates), skin substitutes, products containing growth factors and other

medical devices used for wound care. Many of these methods can be

used to compete with our NPWT products or as adjunctive therapies which may

complement our products. In recent years, as a result of the success

of our V.A.C. Therapy System, a number of companies have announced or introduced

products similar to, or designed to mimic the product component of, our NPWT

solution, and others may do so in the future.

We

believe that the principal competitive factors within our markets are clinical

outcomes, cost of care and support and service, especially across care settings.

Furthermore, we believe that a national presence with full distribution

capabilities is important to serve large, national and regional healthcare GPOs

and care systems. We believe our AHS business is well-positioned to

compete effectively in advanced wound care markets based on our broad reach and

relationships, the clinical efficacy and superior outcomes of our products,

which is supported by a large body of evidence, and our differentiated global

infrastructure, service and support. Multiple studies have

demonstrated that our V.A.C. Therapy System, including its unique foam dressing,

provides a clinical advantage for treatment of wounds, including limb salvage in

patients with diabetic foot ulcers.

Our AHS

business primarily competes with Convatec, Huntleigh Healthcare/Getinge, Smith

& Nephew, and Talley, in addition to several smaller companies that have

introduced medical devices designed to compete with our products.

|

Sales

and Marketing

|

We

currently market our AHS products in the acute, extended and home care

settings. We operate one of the largest sales organizations in the

world dedicated to wound healing with negative pressure, which is comprised of

approximately 1,550 employees. In each foreign market where we have a

presence, we sell our products through our direct sales force or through local

distributors with local expertise. Our U.S. dedicated AHS sales

organization consists of approximately 900 individuals dedicated to the

sale and placement of AHS products and is organized by care

setting. Our international sales organization includes approximately

350 employees in 20 foreign countries, and we also have over 300 individuals in

our sales organization that support both our AHS and TSS business

units. In addition, our Regenerative Medicine and AHS sales

organizations are beginning to capitalize on synergistic opportunities involving

commercialization of products used in surgical procedures, such as those

involving the open abdomen. Because physicians and nurses are

critical to the adoption and use of advanced medical systems, a major element of

our marketing focus is to educate and train these medical practitioners in the

application of our therapies, including the specific knowledge necessary to

drive optimal clinical outcomes, restore patient well-being and reduce the cost

of patient care. Our AHS sales organization includes over 500

clinical consultants, all of whom are healthcare professionals, whose principal

responsibilities are to make product rounds, consult on complex cases and assist

organizations and home health agencies in developing their patient-care

protocols and educate facility staff on the use of our

therapies. Additionally, these team members consult with our

customers regarding the often demanding and complex paperwork required by

Medicare and private insurance companies. In fulfilling the paperwork

requirements, these specialists enhance the overall productivity of our sales

force.

|

Seasonality

|

Historically,

we have experienced a seasonal slowing of AHS unit growth beginning in the

fourth quarter and continuing into the first quarter, which we believe has been

caused by year-end clinical treatment patterns, such as the postponement of

elective surgeries and increased discharges of individuals from the acute care

setting. Although we do not know if our historical experience will

prove to be indicative of future periods, similar slow-downs may occur in

subsequent periods.

Operations

and Manufacturing

Our

U.S. operations have a national 24-hour, seven days-a-week customer service

communications system, which allows us to quickly and efficiently respond to our

customers’ needs. Additionally, we have approximately 1,000 employees

located in San Antonio at our Advantage Center operation who perform functions

associated with customer service and sales administration. We

maintain a secure and encrypted website, KCI Express®,

allowing customers across all care settings to transact business with us

directly and efficiently on the web. This website, www.kciexpress.com,

provides AHS customers self-service applications designed to meet the specific

needs in their care setting. In the U.S., we distribute our AHS

products through a network of 111 service centers and three strategically

located distribution centers. Our U.S. network gives us the ability

to deliver our products to any major Level I domestic trauma center

rapidly. Our international operations distribute our products through

a network of 53 service centers. These international service centers

are strategically located within the regions and countries where we market our

products and provide services similar to those provided in the U.S. market, but

vary by country to ensure we meet the unique needs of our international

customers. In addition, we manage a V.A.C. Therapy van fleet which

has enhanced our efficiency and ability to better serve customers by providing

increased mobility and accelerated turnaround of products.

In

addition to delivery, pick-up and technical support services, our service

organization cleans, disinfects and reconditions products between

rentals. To ensure availability when products are needed, the service

organization manages our rental fleet of approximately 95,000 V.A.C.

Therapy units, deploying units to meet individual service center demand patterns

while maintaining high levels of rental asset utilization. Services

are provided by approximately 1,000 employees in the U.S. and 600 employees

internationally.

Our

manufacturing processes for AHS products involve producing final assemblies in

accordance with a master production plan. Assembly of our products is

accomplished using metal parts, plastics, electronics and other materials

and component parts that are primarily purchased from outside

suppliers. Component parts and materials are obtained from industrial

distributors, original equipment manufacturers and contract

manufacturers. The majority of parts and materials are readily

available in the open market (steel, aluminum, plastics, fabric, etc.) for which

price volatility is reasonably low. Our manufacturing processes and

quality systems are intended to comply with appropriate FDA and International

Organization for Standardization, or ISO, requirements.

Our

manufacturing plant in Athlone, Ireland currently manufactures our V.A.C.

Therapy units for our global markets. Our Ireland plant also

manufactures certain disposable supplies, on a high-volume automation line,

which have historically been supplied by Avail Medical Products, Inc., a

subsidiary of Flextronics International Ltd. We plan to continue

leveraging our existing infrastructure and manufacturing capabilities within our

Athlone plant and expand internal production in the future. In 2007,

we entered into a supply agreement with Avail, which has a term of five years

through November 2012 and may be renewed by agreement of both

parties. Under this agreement, we have title to the raw materials

used to manufacture our disposable supplies and retain title of all disposables

inventory throughout the manufacturing process. The terms of the

supply agreement provide that key indicators be provided to us that would alert

us to any inability of Avail to perform under the

agreement. Approximately 22.6%, 24.1% and 24.1% of our total revenue

for the years ended December 31, 2009, 2008 and 2007, respectively, was

generated from the sale of NPWT disposables.

REGENERATIVE

MEDICINE

|

Description

of Business

|

Our

Regenerative Medicine business unit, operated by our wholly-owned subsidiary

LifeCell Corporation, or LifeCell, develops, processes and markets novel

biological soft tissue repair products made from human or animal sources that

have been uniquely designed to harness the body’s natural healing processes to

promote remodeling and regeneration of lost or damaged tissue while restoring

function and well-being. Soft tissue, such as skin, heart valves,

blood vessels and nerve connective tissue, contains a complex, three-dimensional

structure consisting of multiple forms of collagen, elastin, proteoglycans,

other proteins and blood vessels making up the tissue matrix. As part

of the body’s natural regenerative process, cells within a tissue continuously

degrade and, in the process, replace the tissue matrix. However, in

the event that a large portion of the body’s existing tissue matrix is destroyed

or lost, such as from trauma or surgery, the body cannot effectively regenerate

the damaged portion, resulting in scar formation. In such situations,

surgeons consider a number of treatment options in the attempt to restore

structure, function and physiology, including the use of implant

materials. Alternatives include autograft transplants from one part

of the patient’s body to another, processed allograft tissue, processed

xenograft tissue and synthetic products.

We

believe the use of autograft tissue is disadvantageous due to the creation of a

separate donor site wound and the associated pain, morbidity and scarring from

this additional wound. We also believe there are disadvantages to

using synthetic materials and certain biologic materials including their

susceptibility to infection, resorption, encapsulation, movement away from the

transplanted area, and erosion through the skin. Some biologic

materials may include bovine collagen, which requires patient sensitivity

testing.

We

believe that our acellular tissue matrix products provide surgeons with benefits

over other implant materials due to our approach to biomaterials processing,

namely to produce advanced tissue matrix products which the body recognizes as

safe and self, thus encouraging acceptance and proper incorporation which in

turn allows progression to healing and restoration. Our tissue matrix

products undergo non-damaging proprietary processing, resulting in intact tissue

matrices that are strong and support tissue regeneration by way of rapid

revascularization and remodeling. Our proprietary tissue processes

remove cells from biologic tissues to minimize the potential for specific

rejection of the transplanted tissue. Our tissue matrix products also

offer ease of use and minimize risk of some complications, including adhesions

to the implant.

|

Products

and Clinical Applications

|

Our

Regenerative Medicine product portfolio includes biological soft tissue repair

products made from human and animal tissue for use in reconstructive, orthopedic

and urogynecologic surgical procedures to repair or reinforce soft tissue

defects or weaknesses.

Allograft-Based

Regenerative Tissue Matrix Products

Our

allograft-based tissue matrices are made from donated human skin tissue

processed with our non-damaging proprietary technique. Our allograft

products support the repair or reinforcement of damaged or weakened tissue by

providing a foundation for regeneration of normal human soft

tissue. Following transplant, our regenerative tissue matrix products

revascularize and repopulate with the patient’s own cells becoming incorporated

into the patient, thus providing a versatile scaffold with multiple surgical

applications. The table below provides a description of our allograft

tissue matrix products, common clinical applications and distribution

channels.

Allograft

Products

|

Product

|

Description

|

Clinical

Applications

|

Distribution

|

|||

|

AlloDerm®

Regenerative Tissue Matrix

|

Human

allograft tissue matrix product

|

Predominately

used in general, plastic and

reconstructive procedures:

· as

an implant for soft tissue reconstruction or tissue deficit

correction

· as

a graft for tissue coverage or closure; and

· as

a sling to provide support to tissue following nerve or muscle

damage

Examples

of application include:

· in

cancer reconstruction procedures, including breast reconstruction

following mastectomy procedures

· in

surgical repair of abdominal wall defects, to repair defects resulting

from trauma, previous surgery, hernia repair, infection, tumor resection

or general failure of the musculofascial tissue

· in

periodontal surgical procedures, to increase the amount of attached gum

tissue supporting the teeth as an alternative to autologous connective

tissue grafts

· for

the treatment of third-degree and deep second-degree burns requiring skin

grafting to replace lost skin

|

Our

direct sales force handles the distribution of AlloDerm RTM for all

applications other than periodontal applications.

BioHorizons

Implant Systems, Inc. is an exclusive distributor in the U.S. and certain

international markets of AlloDerm RTM for use in periodontal

applications.

|

|||

|

Cymetra®

Micronized AlloDerm®

Tissue

|

Micronized

human allograft tissue matrix product

|

Ideally

suited for the correction of soft-tissue defects requiring minimally

invasive techniques

Example

of application includes:

· injection

laryngoplasty

|

Our

direct sales force handles the distribution of Cymetra Micronized AlloDerm

Tissue.

|

|||

|

GRAFTJACKET®

Regenerative Tissue Matrix

|

Human

allograft tissue matrix product

|

Intended

for use in repairing damaged or inadequate integumental tissue in

orthopedic surgical procedures

Examples

of application include:

· for

rotator cuff tendon reinforcement

· by

podiatrists for the treatment of lower extremity wounds (e.g., deep,

chronic diabetic foot ulcers)

|

Wright

Medical Technology Inc. is an exclusive distributor in the U.S. and

certain international markets for GraftJacket RTM.

|

|||

|

GRAFTJACKET®

Xpress Flowable Soft Tissue Scaffold

|

Micronized

human allograft tissue matrix product

|

Intended

for the repair of damaged or inadequate integumental tissue, such as deep

dermal wounds

Example

of application includes:

· for

tunneling diabetic foot ulcers

|

Wright

Medical Technology Inc. is an exclusive distributor in the U.S. and

certain international markets for GraftJacket Xpress.

|

|||

|

AlloCraft®

DBM

|

Human

allograft bone-grafting product that combines demineralized bone and

micronized human tissue matrix to form a putty-like material

|

Intended

for use as a bone void filler in various orthopedic surgical

procedures

Example

of application includes:

· for

spinal infusions

|

Stryker

Corporation is our exclusive distributor for AlloCraft DBM in the United

States.

|

|||

|

Repliform®

Tissue Regeneration Matrix

|

Human

allograft tissue matrix product

|

Intended

for use in repairing damaged or inadequate integumental tissue in

urogynecologic surgical procedures

Examples

of application include:

· as

a bladder sling in the treatment of stress urinary

incontinence

· for

the repair of pelvic floor defects

|

Boston

Scientific Corporation is an exclusive worldwide sales and marketing agent

for Repliform TRM for use in urogynecology.

|

Xenograft-Based

Reconstructive Tissue Matrix Products

Our

xenograft-based tissue matrices are porcine skin tissue processed with our

non-damaging proprietary processing technique that removes cells and

significantly reduces a component believed to play a major role in the

xenogeneic rejection response. Our xenograft tissue matrix products

support the repair of damaged tissue by allowing rapid revascularization and

cell repopulation with a patient’s own cells, providing a versatile scaffold for

optimal remodeling into the patient’s own tissues. The table below provides a

description of our xenograft tissue matrix products, common clinical

applications and distribution channels.

Xenograft

Products

|

Product

|

Description

|

Clinical

Applications

|

Distribution

|

|||

|

Strattice™

Reconstructive Tissue Matrix

|

Porcine

reconstructive tissue matrix product

|

Intended

for use as an implant to reinforce soft tissue where weakness exists and

for the surgical repair of damaged or ruptured soft tissue

membranes

Examples

of application include:

· in

cancer reconstruction procedures, including breast reconstruction

following mastectomy procedures

· in

surgical repair of abdominal wall defects, to repair defects resulting

from trauma, previous surgery, hernia repair, infection, tumor resection

or general failure of the musculofascial tissue

· in

reinforcement and repair of stoma sites at risk of herniation

· in

breast augmentation revisionary procedures

|

Our

direct sales force handles the distribution of Strattice TM for

all applications.

|

|||

|

Conexa™

Reconstructive Tissue Matrix

|

Porcine

reconstructive tissue matrix product

|

Intended

for use in soft tissue reinforcement

Example

of application includes:

· for

reinforcement of rotator cuff, patellar, achilles, biceps, quadriceps, or

other tendons

|

Tornier

is an exclusive distributor for Conexa TM in the United States and certain

international markets.

|

|

Customers

|

Our

Regenerative Medicine sales accounted for approximately 14% of our total revenue

in 2009. By geographic region, North America and EMEA/APAC

represented approximately 99% and 1%, respectively, of total 2009 Regenerative

Medicine revenue. Our tissue matrix products are used primarily by

general, plastic and reconstruction surgeons for challenging abdominal

wall/hernia repair, stoma reinforcement, breast reconstruction post-mastectomy,

mastopexy, head and neck trauma, and certain cosmetic surgical

procedures. Hospitals are the primary purchasers of our tissue matrix

products, and these surgical procedures are handled primarily in the hospital

inpatient care setting.

|

Reimbursement

|

LifeCell

has contractual relationships with hospitals and ambulatory surgical centers, or

ASCs, in the United States. For direct sales of our tissue matrix

products, we are paid directly by hospitals and ASCs, who seek reimbursement for

surgical procedures from both private and public payers. In 2009, we

launched Strattice in our EMEA geographic region, where we have initially

contracted directly with hospitals for the use of Strattice in challenging

hernia repair and breast reconstruction. We are in the process of

seeking reimbursement for Strattice from payers in Germany and the United

Kingdom, and we plan to seek expanded reimbursement in other countries as we

continue our geographic expansion in EMEA.

We have

undertaken significant efforts to inform and educate private insurers about the

clinical efficacy and economic value associated with the use of AlloDerm in the

United States. The majority of national and regional insurers have

adopted coverage policies for the use of AlloDerm in connection with surgical

procedures, making AlloDerm more accessible in the United

States. With the launch of Strattice in the first quarter of 2008, we

initiated efforts to secure insurance coverage. Initial coverage of

Strattice has been favorable.

For the

2010 Healthcare Common Procedure Coding Systems, or HCPCS code set, we submitted

to CMS a Coding Modification Recommendation requesting an appropriate HCPCS code

for Strattice. In November 2009, CMS notified us that a new HCPCS code was

not created for Strattice and since that time we have resubmitted a new request

for a HCPCS code for Strattice. If we are successful in obtaining a code

under this new request, the code would be effective beginning in 2011.

HCPCS product codes are important to facilities for appropriate payment for

Strattice when procedures are performed in a hospital outpatient setting or in

an ASC.

|

Competition

|

Our

Regenerative Medicine products compete with autologous tissue and various

commercially available products made from synthetic materials or biologic

materials of human or animal tissue origin. Our tissue matrix

products compete with synthetic surgical mesh products marketed by such medical

device companies as Covidien, C.R. Bard Inc., Johnson & Johnson, Integra

LifeSciences Holdings Corporation, and W.L. Gore &

Associates. Our tissue matrix products also compete with

animal-derived products marketed by companies such as C.R. Bard Inc.; Cook,

Inc., Covidien, TEI Biosciences Inc., and Synovis Surgical

Innovations. Two tissue processors, Musculoskeletal Transplant