Attached files

| file | filename |

|---|---|

| EX-99 - EXHIBIT 99-1 SLIDE PRESENTATION - CPG INTERNATIONAL INC. | exhibit_99-1.pdf |

| 8-K - FORM8-KPRESENTATION - CPG INTERNATIONAL INC. | form8-k_2010.htm |

2010 Wells Fargo Securities

Housing and Building Products Conference

February 24th 2010

Scottsdale, AZ

Exhibit 99.1

Safe Harbor Statement and Use of Non-GAAP and Pro Forma Information

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements made in

this presentation that relate to future events or the

Company’s expectations, guidance, projections, estimates, intentions, goals, targets and strategies

are forward looking statements. You are cautioned that all forward-looking statements are based upon current expectations and estimates and

the

Company assumes no obligation to update this information. Because actual results may differ materially from those expressed or implied by the

forward-looking statements, the Company cautions you not to place undue reliance on these statements. For

a detailed discussion of the important

factors that affect the Company and that could cause actual results to differ from those expressed or implied by the Company’s forward-looking

statements, please see “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and “Risk Factors” in the Company’s

current and future Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

ADJUSTED EBITDA STATEMENT

We refer to the term “Adjusted EBITDA” in various places throughout this presentation. Adjusted EBITDA, or earnings (adjusted as described below)

before interest, taxes, depreciation and

amortization calculated on a pro forma basis as provided herein, is a material component of the significant

covenants contained in our credit agreements and the indenture governing the notes and accordingly, is important to the Company’s liquidity

and ability

to borrow under its debt instruments. Adjusted EBITDA is calculated similarly under both the credit agreements and the indenture by adding

consolidated net income, income taxes, interest expense, depreciation and amortization

and other non-cash expenses, income or loss attributable to

discontinued operations and amounts payable pursuant to the management agreement with AEA Investors. In addition, consolidated net income is

adjusted to exclude certain items, including

non-recurring charges with respect to the closing of the acquisition of Compos-A-Tron Manufacturing, (the

“Composatron Acquisition”), the closing of the acquisition of Procell Decking Systems (the “Procell Acquisition”) and the related

financing transactions,

as well as certain other nonrecurring or unusual charges. Please see the Company’s December 31, 2008 10-K, which contains a detailed description of

our covenants and a thorough description of our use of Adjusted

EBITDA, and the use of Adjusted EBITDA in connection with certain calculations under

the covenants, under our credit agreements and indenture.

While the determination of appropriate adjustments in the calculation of Adjusted EBITDA is subject to interpretation under our debt agreements,

management believes the adjustments are in accordance with the

covenants in our credit agreements and indenture, as discussed above. Adjusted

EBITDA should not be considered in isolation or construed as an alternative to our net income or other measures as determined in accordance with

GAAP. In

addition, other companies in our industry or across different industries may calculate Adjusted EBITDA differently than we do, limiting its

usefulness as a comparative measure. In future SEC filings, we may be required to change our presentation

of Adjusted EBITDA in order to comply

with the SEC’s rules regarding the use of non-GAAP financial measures. In addition, you are cautioned not to place undue reliance on Adjusted

EBITDA. For a reconciliation of Adjusted EBITDA

to net income, please see the Appendix to this presentation.

CPG Overview

CPG International Overview

Founded in 1983

Headquarters in Scranton, PA

TTM Revenue: $267mm

TTM PF Adjusted EBITDA: $61mm

EBITDA margin: 23%

Net Debt/EBITDA of 4.3x (12/09)

$65 million credit facility

$25 million term loan

$128 million Senior FRN

$150 million Senior Notes

Acquired by AEA Investors in 2005

Investment Thesis

CPG Overview

Excellent Financial

Performance

Market Leading

Brands

Products with Superior

Value Proposition

Large and Growing

Distribution Network

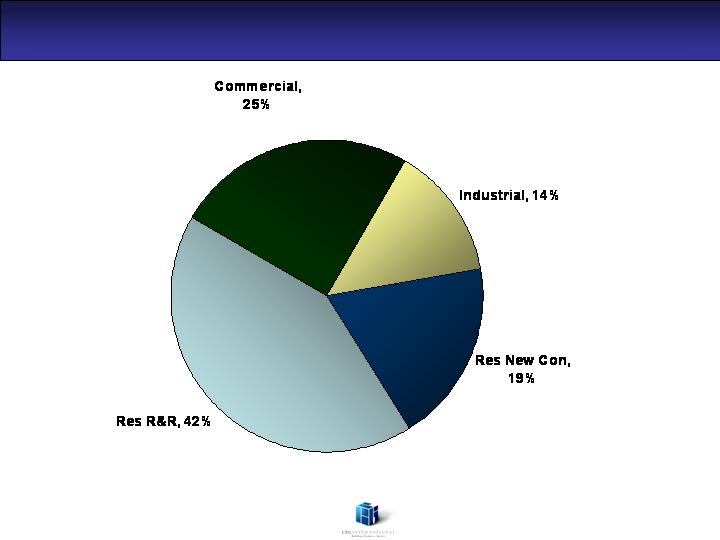

Diversified End Markets

Large Addressable

Markets Early in

Conversion Cycle

Favorable Long-term

Demographics

Leading Innovation

and Manufacturing

Excellence

Leading Brands of High Performance Building Products

$66mm rev 2009

Leading brand in bathroom

partition & locker systems

Conversion opportunity &

product extensions

$164mm revenue 2009

Leading brand in exterior residential building

product materials

Significant conversion opportunity, market growth

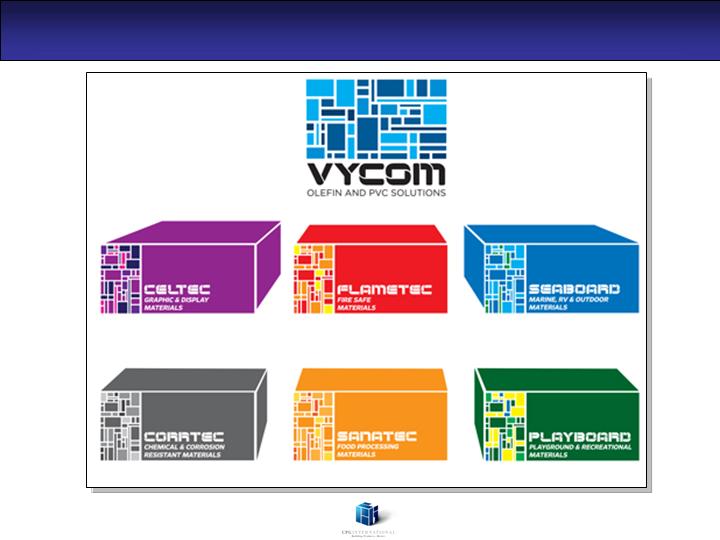

$37mm rev 2009

Leading provider of PVC

& olefin sheet solutions

Rebranding, channel

expansion

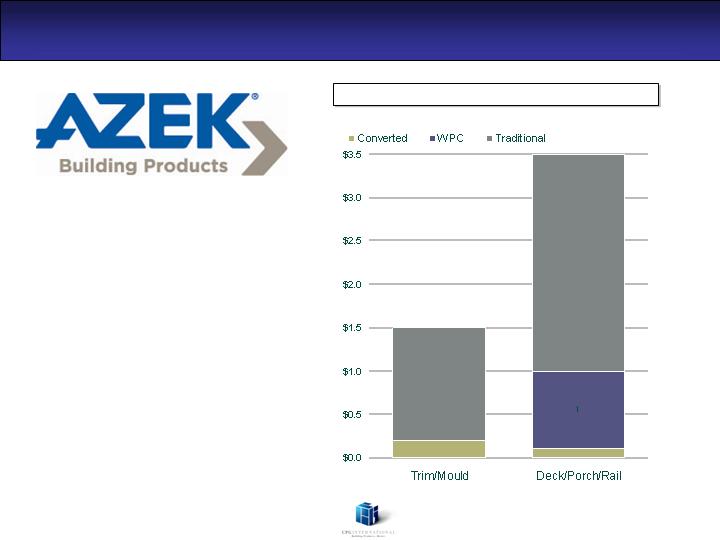

CPG Serving Large Markets in Early Stages of Conversion

CPG Overview

($ in billions)

______________________________________________________________________________________________________________

Source: Management estimates

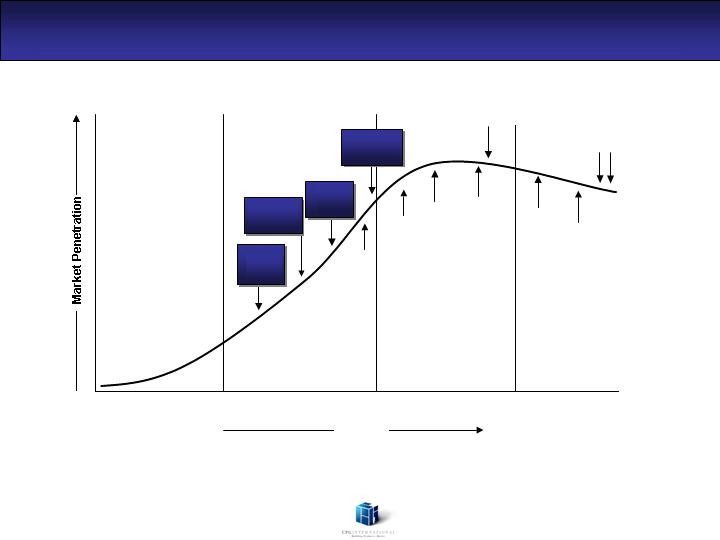

Conversion Opportunity for Trim/Deck/Rail

Conversion to Synthetic Materials

Introduction

Growth

Maturity

Decline

Fiber Cement

Siding

Vinyl

Windows

Timeline

OSB

Wood

Windows

Plywood

AZEK

Trim

Lumber

Vinyl

Siding

AZEK

Deck

CPG Overview

Composite

Decking

Laminated

Shingles

Plastic

Partitions

Plastic

Lockers

______________________________________________________________________________________________________________

Source: Management estimates

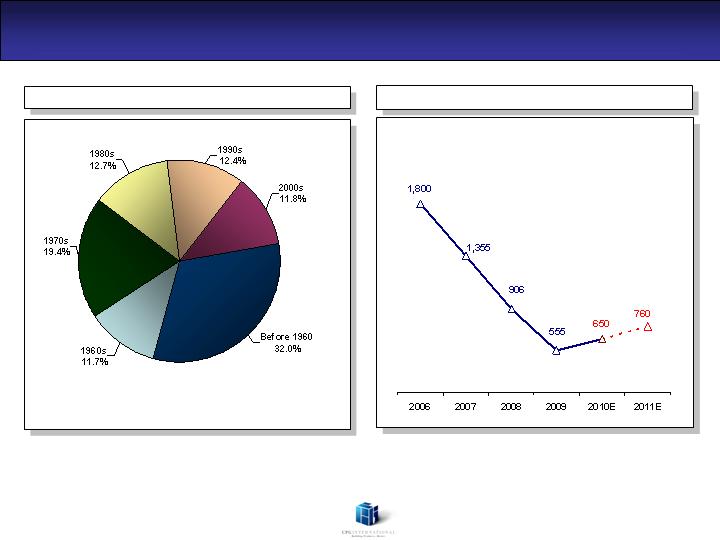

Long Term Investment in Housing

Year of Construction of Housing Stock

The Median age of existing housing stock in 2008 was over 30 years

______________________________________________________________________________________________________________

Source: The Freedonia Group, Inc. U.S Census, Monthly Outlook, September 09 - Wells Fargo U.S Economic Forecast

SAAR Total Housing Starts Outlook

Starts in 000’s

CPG Overview

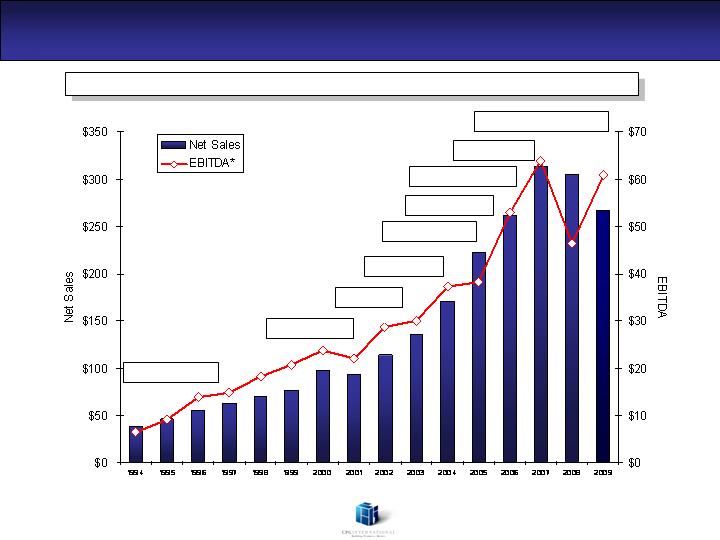

A Long History of Growth and Profitability

CPG Overview

($ in millions)

* Adjusted EBITDA per credit agreement

AZEK Launched

Santana Acquired

Comtec Launched

Procell Acquired

Mouldings Launched

AZEK Canada

AZEK West

Retail Channel

Net Sales and EBITDA*

Composatron Acquisition**

E

Performance in a Difficult Market

Capital Expenditures

Net Debt/EBITDA

($ in millions)

$6

TTM Rev & EBITDA

($ in millions)

Adjusted Working Capital *

($ in millions)

Excludes Cash, Deferred Income Tax, Line of Credit and Accrued Interest

CPG Overview

_____________________

(1) Represents Adjusted EBITDA as defined by our credit agreement.

Appendix

Net Income to Adjusted EBITDA Reconciliation(1)

Year Ended

Year

Ended

(Dollars in thousands)

December 31,

December 31

,

200

8

200

9

Net

loss

$

(48,354

)

$

(

10,306

)

Interest expense, net

34,905

3

1

,3

47

Income tax

benefit

(7,095

)

(11

1

)

Depreciat

ion and amortization

21,491

21,6

04

EBITDA

947

42,534

Impairment of goodwill and other intangibles

40,000

1

4,408

SFAS 141 inventory adjustment

1,505

—

Relocation and hiring costs

802

474

Composatron non

-

recurring charges

60

6

—

Management fee

and expenses

1,855

1,7

40

Severance costs

171

412

Settlement charges

26

—

Non

-

cash compensation charge

118

97

Disposal

of fixed assets

—

52

5

Lease termination fees

—

657

Registration expenses

rela

ted to Notes

309

26

Adjusted EBITDA

$

46,339

$

60,8

7

3