Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009 Commission file number 0-1402

LINCOLN ELECTRIC HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Ohio | 34-1860551 | |||||||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |||||||

| 22801 St. Clair Avenue, Cleveland, Ohio | 44117 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(216) 481-8100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common Shares, without par value | The NASDAQ Stock Market LLC | |||||||

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the common shares held by non-affiliates as of June 30, 2009 was $1,438,957,655 (affiliates, for this purpose, have been deemed to be Directors and Executive Officers of the Company and certain significant shareholders).

The number of shares outstanding of the registrant’s common shares as of December 31, 2009 was 42,637,247.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference certain information from the registrant’s definitive proxy statement to be filed on or about March 19, 2010 with respect to the registrant’s 2010 Annual Meeting of Shareholders.

PART I

| ITEM 1. | BUSINESS |

General

As used in this report, the term “Company,” except as otherwise indicated by the context, means Lincoln Electric Holdings, Inc., its wholly-owned and majority-owned subsidiaries for which it has a controlling interest. The Lincoln Electric Company began operations in 1895 and was incorporated under the laws of the State of Ohio in 1906. During 1998, The Lincoln Electric Company reorganized into a holding company structure, and Lincoln Electric Holdings, Inc. became the publicly-held parent of Lincoln Electric subsidiaries worldwide, including The Lincoln Electric Company.

The Company is a broad-line manufacturer and reseller of welding and cutting products. Welding products include arc welding power sources, wire feeding systems, robotic welding packages, fume extraction equipment, consumable electrodes and fluxes. The Company’s welding product offering also includes regulators and torches used in oxy-fuel welding and cutting. In addition, the Company has a leading global position in the brazing and soldering alloys market.

The arc welding power sources and wire feeding systems manufactured by the Company range in technology from basic units used for light manufacturing and maintenance to highly sophisticated robotic applications for high production welding and fabrication. Three primary types of arc welding electrodes are produced: (1) coated manual or stick electrodes, (2) solid electrodes produced in coil, reel or drum forms for continuous feeding in mechanized welding, and (3) cored electrodes produced in coil form for continuous feeding in mechanized welding.

The Company has wholly-owned subsidiaries or joint venture manufacturing facilities located in the United States, Australia, Brazil, Canada, Colombia, France, Germany, India, Indonesia, Italy, Mexico, the Netherlands, People’s Republic of China, Poland, Portugal, Turkey, United Kingdom and Venezuela. Nearly all of the above facilities are ISO 9001 certified.

During the fourth quarter of 2009, the Company realigned its business units into five operating segments to enhance the utilization of the Company’s worldwide resources and global sourcing initiatives. The operating segments consist of North America Welding, Europe Welding, Asia Pacific Welding, South America Welding and The Harris Products Group. The North America Welding segment includes welding operations in the United States, Canada and Mexico. The other three welding segments include welding operations in Europe, Asia Pacific and South America, respectively. The fifth segment, The Harris Products Group, includes the Company’s global cutting, soldering and brazing businesses as well as the retail business in the United States. See Note 3 to the Company’s Consolidated Financial Statements for segment and geographic area information.

Customers

The Company’s products are sold in both domestic and international markets. In North America, products are sold principally through industrial distributors, retailers and also directly to users of welding products. Outside of North America, the Company has an international sales organization comprised of Company employees and agents who sell products from the Company’s various manufacturing sites to distributors and product users.

The Company’s major end-user markets include:

| • | general metal fabrication, |

| • | power generation and process industry, |

| • | structural steel construction (buildings and bridges), |

| • | heavy equipment fabrication (farming, mining and rail), |

| • | shipbuilding, |

| • | automotive, |

2

| • | pipe mills and pipelines, and |

| • | offshore oil and gas exploration and extraction. |

The Company is not dependent on a single customer or a few customers. The loss of any one customer would not have a material adverse effect on its business. The Company’s business is not seasonal.

Competition

Conditions in the arc welding and cutting industry are highly competitive. The Company believes it is the world’s largest manufacturer of consumables and equipment with relatively few major broad-line competitors worldwide, but numerous smaller competitors in specific geographic markets. The Company continues to pursue strategies to heighten its competitiveness in domestic and international markets, which includes positioning low cost manufacturing facilities in most geographical markets. Competition in the arc welding and cutting industry is on the basis of brand preference, product quality, price, performance, warranty, delivery, service and technical support. The Company believes its performance against these factors has contributed to the Company’s position as the leader in the industry.

Most of the Company’s products may be classified as standard commercial articles and are manufactured for stock. The Company believes it has a competitive advantage in the marketplace because of its highly trained technical sales force and the support of its welding research and development staff, which allow it to assist the consumers of its products in optimizing their welding applications. The Company utilizes this technical expertise to present its Guaranteed Cost Reduction Program to end users through which the Company guarantees that the user will achieve cost savings in its manufacturing process when it utilizes the Company’s products. This allows the Company to introduce its products to new users and to establish and maintain close relationships with its consumers. This close relationship between the technical sales force and the direct consumers, together with its supportive relationship with its distributors, who are particularly interested in handling the broad range of the Company’s products, is an important element of the Company’s market success and a valuable asset of the Company.

Raw Materials

The principal raw materials essential to the Company’s business are various chemicals, electronics, steel, engines, brass, copper and aluminum alloys, all of which are normally available for purchase in the open market.

Patents and Trademarks

The Company holds many valuable patents, primarily in arc welding, and has increased the application process as research and development has progressed in both the United States and major international jurisdictions. The Company believes its trademarks are an important asset and aggressively pursues brand management.

Environmental Regulations

The Company’s facilities are subject to environmental regulations. To date, compliance with these environmental regulations has not had a material adverse effect on the Company’s earnings. The Company is ISO 14001 certified at all significant manufacturing facilities in North America and Europe and is working to gain certification at its remaining facilities worldwide. In addition, the Company is ISO 9001 certified at nearly all facilities worldwide.

International Operations

The Company conducts a significant amount of its business and has a number of operating facilities in countries outside the United States. As a result, the Company is subject to business risks inherent to non- U.S. activities, including political uncertainty, import and export limitations, exchange controls and currency fluctuations.

3

Research and Development

Research activities, which the Company believes provide a competitive advantage, relate to the development of new products and the improvement of existing products. Research activities are Company-sponsored. Refer to Note 1 to the consolidated financial statements with respect to total costs of research and development.

Employees

The number of persons employed by the Company worldwide at December 31, 2009 was 8,950. See Item 10 of Part III for information regarding the Company’s executive officers, which is incorporated herein by reference.

Website Access

The Company’s website, www.lincolnelectric.com, is used as a channel for routine distribution of important information, including news releases and financial information. The Company posts its filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC, including annual, quarterly, and current reports on Forms 10-K, 10-Q, and 8-K; proxy statements; and any amendments to those reports or statements. The Company also posts its Code of Corporate Conduct and Ethics on its website. All such postings and filings are available on the Company’s website free of charge. In addition, this website allows investors and other interested persons to sign up to automatically receive e-mail alerts when news releases and financial information is posted on the website. The SEC also maintains a web site, www.sec.gov, that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The content on any website referred to in this Annual Report on Form 10-K is not incorporated by reference into this Annual Report unless expressly noted.

| ITEM 1A. | RISK FACTORS |

From time to time, information we provide, statements by our employees or information included in our filings with the SEC may contain forward-looking statements that are not historical facts. Those statements are “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, and our future performance, operating results, financial position and liquidity, are subject to a variety of factors that could materially affect results, including those described below. Any forward-looking statements made in this report or otherwise speak only as of the date of the statement, and, except as required by law, we undertake no obligation to update those statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

In the ordinary course of our business, we face various strategic, operating, compliance and financial risks. These risks could have an impact on our business, financial condition, operating results and cash flows. Many of our most significant risks are set forth below and elsewhere in this Annual Report on Form 10-K. We can mitigate these risks and their impact on the Company only to a limited extent.

Our Enterprise Risk Management (“ERM”) process seeks to identify and address significant risks. Our ERM process is a company-wide initiative that is designed with the intent of prioritizing risks and giving risks appropriate consideration. We use the integrated risk framework of the Committee of Sponsoring Organizations to assess, manage and monitor risks.

Management has identified and prioritized critical risks based on the severity and likelihood of each risk and assigned an executive to address each major identified risk area and lead action plans to monitor and mitigate risks, where possible. Our Board of Directors provides oversight of the ERM process and systematically reviews identified critical risks. The Audit Committee also reviews major financial risk exposures and the steps management has taken to monitor and seek to control them.

4

Our goal is to proactively manage risks in a structured approach and in conjunction with strategic planning, with the intent to preserve and enhance shareholder value. However, these and other risks and uncertainties could cause our results to vary materially from recent results or from our anticipated future results.

The risks and uncertainties described below and all of the other information in this Annual Report on Form 10-K should be carefully considered. These risks and uncertainties are not the only ones we face. Additional risks and uncertainties of which we are currently unaware or that we currently believe to be immaterial may also adversely affect our business.

General economic and market conditions may adversely affect the Company’s financial condition, results of operations and access to capital markets.

The Company’s operating results are sensitive to changes in general economic conditions. Recessionary economic cycles, higher interest rates, inflation, higher tax rates and other changes in tax laws or other economic factors could adversely affect demand for the Company’s products. The industrial downturn recently experienced affecting the U.S. and global economies could continue to negatively impact investment activity within key geographic and market segments served by the Company. In addition, any further deterioration in the condition of financial markets may limit the Company’s access to capital markets. There can be no assurances that government responses to disruptions in the financial and broader industrial markets will restore market confidence.

Availability of and volatility in energy costs or raw material prices may adversely affect our performance.

In the normal course of business, we are exposed to market risks related to the availability of and price fluctuations in the purchase of energy and commodities used in the manufacture of our products (primarily steel, brass, copper and aluminum alloys, electricity and natural gas). The availability and prices for raw materials are subject to volatility and are influenced by worldwide economic conditions, speculative action, world supply and demand balances, inventory levels, availability of substitute materials, currency exchange rates, our competitors’ production costs, anticipated or perceived shortages and other factors. The price of the type of steel used to manufacture our products has experienced periods of significant price volatility and has been subject to periodic shortages due to global economic factors. We have also experienced substantial volatility in prices for other raw materials, including metals, chemicals and energy costs. Our operating margins will be dependent on our ability to manage the impact of volatility in supply and related costs.

We are a co-defendant in litigation alleging manganese induced illness and litigation alleging asbestos induced illness. Liabilities relating to such litigation could reduce our profitability and impair our financial condition.

At December 31, 2009, we were a co-defendant in cases alleging manganese induced illness involving claims by approximately 3,333 plaintiffs and a co-defendant in cases alleging asbestos induced illness involving claims by approximately 17,191 plaintiffs. In each instance, we are one of a large number of defendants. In the manganese cases, the claimants allege that exposure to manganese contained in welding consumables caused the plaintiffs to develop adverse neurological conditions, including a condition known as manganism. In the asbestos cases, the claimants allege that exposure to asbestos contained in welding consumables caused the plaintiffs to develop adverse pulmonary diseases, including mesothelioma and other lung cancers.

Since January 1, 1995, we have been a co-defendant in manganese cases that have been resolved as follows: 13,471 of those claims were dismissed, 20 were tried to defense verdicts in favor of us and five were tried to plaintiff verdicts (four of which are being or will be appealed). In addition, 13 claims were resolved by agreement for immaterial amounts and one was decided in favor of us following a motion for summary judgment. Since January 1, 1995, we have been a co-defendant in asbestos cases that have been resolved as follows: 38,465 of those claims were dismissed, 12 were tried to defense verdicts, four were tried to plaintiff verdicts, one was resolved by agreement for an immaterial amount and 563 were decided in favor of us following summary judgment motions.

5

Defense costs remain significant. The long-term impact of the manganese and asbestos loss contingencies, in each case in the aggregate, on operating results, operating cash flows and access to capital markets is difficult to assess, particularly since claims are in many different stages of development and we benefit significantly from cost-sharing with co-defendants and insurance carriers. While we intend to contest these lawsuits vigorously, and believe we have applicable insurance relating to these claims, there are several risks and uncertainties that may affect our liability for personal claims relating to exposure to manganese and asbestos, including the future impact of changing cost sharing arrangements or a change in our overall trial experience.

Manganese is an essential element of steel and cannot be eliminated from welding consumables. Asbestos use in welding consumables in the U.S. ceased in 1981.

We may incur material losses and costs as a result of product liability claims that may be brought against us.

Our products are used in a variety of applications, including infrastructure projects such as oil and gas pipelines and platforms, buildings, bridges and power generation facilities, the manufacture of transportation and heavy equipment and machinery, and various other construction projects. We face risk of exposure to product liability claims in the event that accidents or failures on these projects result, or are alleged to result, in bodily injury or property damage. Further, our welding products are designed for use in specific applications, and if a product is used inappropriately, personal injury or property damage may result. For example, in the period between 1994 and 2000, we were a defendant or co-defendant in 21 lawsuits filed by building owners or insurers in Los Angeles County, California. The plaintiffs in those cases alleged that certain buildings affected by the 1994 Northridge earthquake sustained property damage in part because a particular electrode used in the construction of those buildings was unsuitable for that use. In the Northridge cases, one case was tried to a defense verdict in favor of us, 12 were voluntarily dismissed, seven were settled and we received summary judgment in our favor in another.

The occurrence of defects in or failures of our products, or the misuse of our products in specific applications, could cause termination of customer contracts, increased costs and losses to us, our customers and other end users. We cannot be assured that we will not experience any material product liability losses in the future or that we will not incur significant costs to defend those claims. Further, we cannot be assured that our product liability insurance coverage will be adequate for any liabilities that we may ultimately incur or that it will continue to be available on terms acceptable to us.

The cyclicality and maturity of the arc welding and cutting industry in developed markets may adversely affect our performance.

The arc welding and cutting industry is generally a mature industry in developed markets such as North America and Western Europe and is very cyclical in nature. The growth of the arc welding and cutting industry in developed markets has been and continues to be constrained by factors such as the increased cost of steel. Overall demand for arc welding and cutting products is largely determined by the level of capital spending in manufacturing and other industrial sectors, and the welding industry has historically experienced contraction during periods of slowing industrial activity. If economic, business and industry conditions deteriorate, capital spending in those sectors may be substantially decreased, which could reduce demand for our products, our revenues and our results of operations.

We may not be able to complete our acquisition strategy or successfully integrate acquired businesses.

Part of our business strategy is to pursue targeted business acquisition opportunities, including foreign investment opportunities. For example, the Company has completed and continues to pursue acquisitions or joint ventures in the People’s Republic of China in order to strategically position resources to increase our presence in this growing market. We cannot be certain that we will be successful in pursuing potential acquisition candidates or that the consequences of any acquisition would be beneficial to us. Future acquisitions may involve the expenditure of significant funds and management time. Depending on the nature, size and timing of future

6

acquisitions, we may be required to raise additional financing, which may not be available to us on acceptable terms. Our current operational cash flow is sufficient to fund our current acquisition plans, but a significant acquisition could require access to the capital markets. Further, we may not be able to successfully integrate any acquired business with our existing businesses or recognize the expected benefits from any completed acquisition.

If we cannot continue to develop, manufacture and market products that meet customer demands, our revenues and gross margins may suffer.

Our continued success depends, in part, on our ability to continue to meet our customers’ needs for welding products through the introduction of innovative new products and the enhancement of existing product design and performance characteristics. We must remain committed to product research and development and customer service in order to remain competitive. Accordingly, we may spend a proportionately greater amount on research and development than some of our competitors. We cannot be assured that new products or product improvements, once developed, will meet with customer acceptance and contribute positively to our operating results, or that we will be able to continue our product development efforts at a pace to sustain future growth. Further, we may lose customers to our competitors if they demonstrate product design, development or manufacturing capabilities superior to ours.

The competitive pressures we face could harm our revenue, gross margins and prospects.

We operate in a highly competitive global environment and compete in each of our businesses with other broad-line manufacturers and numerous smaller competitors specializing in particular products. We compete primarily on the basis of brand, product quality, price, performance, warranty, delivery, service and technical support. We have initiated significant rationalization activities to align our business to current market conditions. Rationalization activities could fail to deliver the desired competitive cost structure and could result in disruptions in customer service. If our products, services, support and cost structure do not enable us to compete successfully based on any of the criteria listed above, our operations, results and prospects could suffer.

Further, in the past decade, the United States arc welding industry has been subject to increased levels of foreign competition as low cost imports have become more readily available. Our competitive position could also be harmed if new or emerging competitors become more active in the arc welding business. For example, while steel manufacturers traditionally have not been significant competitors in the domestic arc welding industry, some foreign integrated steel producers manufacture selected consumable arc welding products. Our sales and results of operations, as well as our plans to expand in some foreign countries, could be harmed by this practice.

We conduct our sales and distribution operations on a worldwide basis and are subject to the risks associated with doing business outside the United States.

Our long-term strategy is to continue to increase our share in growing international markets, particularly Asia (with emphasis in China and India), Latin America, Eastern Europe and other developing markets. There are a number of risks in doing business abroad, which may impede our ability to achieve our strategic objectives relating to our foreign operations. Many developing countries, like Venezuela, have a significant degree of political and economic uncertainty that may impede our ability to implement and achieve our foreign growth objectives. Conducting business internationally also subjects us to corporate governance and management challenges in consideration of the numerous U.S. and foreign laws and regulations, including regulations relating to import-export control, technology transfer restrictions, repatriation of earnings, exchange controls, anti-boycott provisions and anti-bribery laws (such as the Foreign Corrupt Practices Act and the Organization for Economic Cooperation and Development Convention). Failure by the Company or its sales representatives or agents to comply with these laws and regulations could result in administrative, civil or criminal liabilities, all or any of which could negatively impact our business and reputation.

Moreover, social unrest, the absence of trained labor pools and the uncertainties associated with entering into joint ventures or similar arrangements in foreign countries have slowed our business expansion into some

7

developing economies. Our presence in emerging markets has been facilitated in part through joint venture agreements with local organizations. While this strategy has allowed us to gain a footprint in emerging markets while leveraging the experience of local organizations, it also presents corporate governance and management challenges.

Our foreign operations also subject us to the risks of international terrorism and hostilities and to foreign currency risks, including exchange rate fluctuations and limits on the repatriation of funds.

The share of sales and profits we derive from our international operations and exports from the United States is significant and growing. This trend increases our exposure to the performance of many developing economies in addition to the developed economies outside of the United States.

Our operations depend on maintaining a skilled workforce, and any interruption in our workforce could negatively impact our results of operations and financial condition.

We are dependent on our highly trained technical sales force and the support of our welding research and development staff. Any interruption of our workforce, including interruptions due to unionization efforts, changes in labor relations or shortages of appropriately skilled individuals for our research, production and sales forces could impact our results of operations and financial condition.

Our revenues and results of operations may suffer if we cannot continue to enforce the intellectual property rights on which our business depends or if third parties assert that we violate their intellectual property rights.

We rely upon patent, trademark, copyright and trade secret laws in the United States and similar laws in foreign countries, as well as agreements with our employees, customers, suppliers and other third parties, to establish and maintain our intellectual property rights. However, any of our intellectual property rights could be challenged, invalidated or circumvented, or our intellectual property rights may not be sufficient to provide a competitive advantage. Further, the laws and their application in certain foreign countries do not protect our proprietary rights to the same extent as U.S. laws. Accordingly, in certain countries, we may be unable to protect our proprietary rights against unauthorized third-party copying or use, which could impact our competitive position.

Further, third parties may claim that we or our customers are infringing upon their intellectual property rights. Even if we believe that those claims are without merit, defending those claims and contesting the validity of patents can be time-consuming and costly. Claims of intellectual property infringement also might require us to redesign affected products, enter into costly settlement or license agreements or pay costly damage awards, or face a temporary or permanent injunction prohibiting us from manufacturing, marketing or selling certain of our products.

Our global operations are subject to increasingly complex environmental regulatory requirements.

We are subject to increasingly complex environmental regulations affecting international manufacturers, including those related to air and water emissions, waste management and climate change.

There is a growing political and scientific belief that emissions of greenhouse gases (“GHG”) alter the composition of the global atmosphere in ways that are affecting the global climate. Various stakeholders, including legislators and regulators, shareholders and non-governmental organizations, as well as companies in many business sectors, are considering ways to reduce GHG emissions. There is growing consensus that some form of U.S. regulation will be forthcoming at the federal level with respect to GHG emissions. Such regulation could result in regulatory or product standard requirements for the Company’s global businesses but because any impact is dependent on the design of the mandate or standard, the Company is unable to predict its significance at this time.

Furthermore, the potential physical impacts of theorized climate change on the Company’s customers, and therefore on the Company’s operations, are speculative and highly uncertain, and would be particular to the circumstances developing in various geographical regions. These may include changes in weather patterns

8

(including drought and rainfall levels), water availability, storm patterns and intensities, and temperature levels. These potential physical effects may adversely impact the cost, production, sales and financial performance of the Company’s operations.

It is our policy to apply strict standards for environmental protection to sites inside and outside the United States, even when we are not subject to local government regulations. We may incur substantial costs, including cleanup costs, fines and civil or criminal sanctions, liabilities resulting from third-party property damage or personal injury claims, or our products could be enjoined from entering certain jurisdictions, if we were to violate or become liable under environmental laws or if our products become non-compliant with environmental laws.

We also face increasing complexity in our products design and procurement operations as we adjust to new and future requirements relating to the design, production and labeling of our products that are sold in the European Union. The ultimate costs under environmental laws and the timing of these costs are difficult to predict, and liability under some environmental laws relating to contaminated sites can be imposed retroactively and on a joint and several basis.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

The Company’s corporate headquarters and principal United States manufacturing facilities are located in the Cleveland, Ohio area. Total Cleveland area property consists of 233 acres, of which present manufacturing facilities comprise an area of approximately 2,940,000 square feet.

The Company has 38 manufacturing facilities, including operations and joint ventures in 18 countries, the locations (grouped by operating segment) of which are as follows:

| North American Welding: |

||

| United States |

Cleveland, Ohio; Oceanside, California. | |

| Canada |

Toronto; Mississauga. | |

| Mexico |

Mexico City; Torreon. | |

| Europe Welding: |

||

| France |

Grand-Quevilly. | |

| Germany |

Essen. | |

| Italy |

Genoa; Corsalone. | |

| Netherlands |

Nijmegen. | |

| Poland |

Bielawa; Swietochlowice; Dzierzoniow. | |

| Portugal |

Lisbon. | |

| Turkey |

Istanbul. | |

| United Kingdom |

Sheffield; Chertsey. | |

| Asia Pacific Welding: |

||

| Australia |

Sydney. | |

| India |

Chennai. | |

| Indonesia |

Cikarang. | |

| People’s Republic of China |

Shanghai; Jining; Jinzhou; Nanjing; Zhengzhou. | |

| South America Welding: |

||

| Brazil |

Sao Paulo. | |

| Colombia |

Bogota. | |

| Venezuela |

Maracay. | |

| The Harris Products Group: |

||

| United States |

Mason, Ohio; Gainesville, Georgia; Santa Fe Springs, California. | |

| Brazil |

Guarulhos. | |

| Mexico |

Tijuana. | |

| Poland |

Dzierzoniow. | |

9

All properties relating to the Company’s Cleveland, Ohio headquarters and manufacturing facilities are owned by the Company. Most of the Company’s foreign subsidiaries own manufacturing facilities in the country where they are located. The Company believes that its existing properties are in good condition and are suitable for the conduct of its business. At December 31, 2009, $2.2 million of indebtedness under capital leases was secured by property with a book value of $4.7 million.

In addition, the Company maintains operating leases for its distribution centers and many sales offices throughout the world. See Note 11 to the Company’s Consolidated Financial Statements with respect to lease commitments.

| ITEM 3. | LEGAL PROCEEDINGS |

The Company is subject, from time to time, to a variety of civil and administrative proceedings arising out of its normal operations, including, without limitation, product liability claims and health, safety and environmental claims. Among such proceedings are the cases described below.

At December 31, 2009, the Company was a co-defendant in cases alleging asbestos induced illness involving claims by approximately 17,191 plaintiffs, which is a net decrease of 255 claims from those previously reported. In each instance, the Company is one of a large number of defendants. The asbestos claimants seek compensatory and punitive damages, in most cases for unspecified sums. Since January 1, 1995, the Company has been a co-defendant in other similar cases that have been resolved as follows: 38,465 of those claims were dismissed, 12 were tried to defense verdicts, four were tried to plaintiff verdicts, one was resolved by agreement for an immaterial amount and 563 were decided in favor of the Company following summary judgment motions.

At December 31, 2009, the Company was a co-defendant in cases alleging manganese induced illness involving claims by approximately 3,333 plaintiffs, which is a net decrease of 11 claims from those previously reported. In each instance, the Company is one of a large number of defendants. The claimants in cases alleging manganese induced illness seek compensatory and punitive damages, in most cases for unspecified sums. The claimants allege that exposure to manganese contained in welding consumables caused the plaintiffs to develop adverse neurological conditions, including a condition known as manganism. At December 31, 2009, cases involving 2,048 claimants were filed in or transferred to federal court where the Judicial Panel on MultiDistrict Litigation has consolidated these cases for pretrial proceedings in the Northern District of Ohio. Since January 1, 1995, the Company has been a co-defendant in similar cases that have been resolved as follows: 13,471 of those claims were dismissed, 20 were tried to defense verdicts in favor of the Company and five were tried to plaintiff verdicts (four of which are being or will be appealed). In addition, 13 claims were resolved by agreement for immaterial amounts and one claim was decided in favor of the Company following a summary judgment motion.

On December 13, 2006, the Company filed a complaint in U.S. District Court (Northern District of Ohio) against Illinois Tool Works, Inc. seeking a declaratory judgment that eight patents owned by the defendant relating to certain inverter power sources have not and are not being infringed and that the subject patents are invalid. Illinois Tool Works filed a motion to dismiss this action, which the Court denied on June 21, 2007. On September 7, 2007, the Court stayed the litigation, referencing pending reexaminations before the U.S. Patent and Trademark Office. On June 17, 2008, the Company filed a motion to amend its pleadings in the foregoing matter to include several additional counts, including specific allegations of fraud on the U.S. Patent and Trademark Office with respect to portable professional welding machines and resulting monopoly power in that market.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the quarter ended December 31, 2009.

10

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

| (In thousands of dollars, except per share data) |

The Company’s common shares are traded on The NASDAQ Stock Market under the symbol “LECO.” The number of record holders of common shares at December 31, 2009 was 1,758.

The total amount of dividends paid in 2009 was $45,801. For 2009, dividends were paid quarterly on January 15, April 15, July 15 and October 15.

Quarterly high and low stock prices and dividends declared for the last two years were:

| 2009 | 2008 | |||||||||||||||||

| Stock Price | Dividends Declared |

Stock Price | Dividends Declared | |||||||||||||||

| High | Low | High | Low | |||||||||||||||

| First quarter |

$ | 56.22 | $ | 26.32 | $ | 0.27 | $ | 71.48 | $ | 53.32 | $ | 0.25 | ||||||

| Second quarter |

45.96 | 30.88 | 0.27 | 86.97 | 64.07 | 0.25 | ||||||||||||

| Third quarter |

52.81 | 32.97 | 0.27 | 86.47 | 59.78 | 0.25 | ||||||||||||

| Fourth quarter |

56.71 | 42.90 | 0.28 | 65.11 | 34.27 | 0.27 | ||||||||||||

Source: The NASDAQ Stock Market

Issuer purchases of equity securities for 2009 were:

| Period |

Total Number of Shares Repurchased (1) |

Average Price Paid Per Share |

Total Number of Shares Repurchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs (2) | |||||

| February 1-28, 2009 |

8,407 | $ | 40.85 | 8,407 | 3,784,610 | ||||

| (1) | The above acquisition consists of the surrender of 8,407 shares of the Company’s common shares to satisfy minimum income tax withholding requirements related to the vesting of 30,550 restricted shares granted pursuant to the Company’s 1998 Stock Plan. |

| (2) | The Company’s Board of Directors authorized share repurchase programs for up to 15 million shares of the Company’s common stock. Total shares purchased through the share repurchase programs were 11,215,390 shares at a cost of $274,531 for a weighted average cost of $24.48 per share through December 31, 2009. |

11

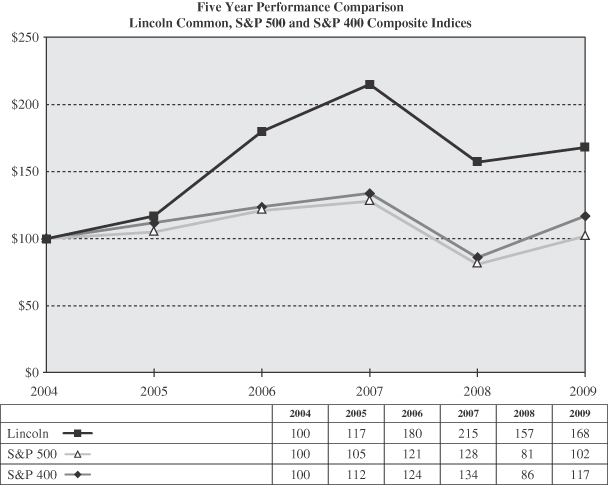

The following line graph compares the yearly percentage change in the cumulative total shareholder return on Lincoln Electric Holdings, Inc. (“Lincoln”) common shares against the cumulative total return of the S&P Composite 500 Stock Index (“S&P 500”) and the S&P 400 MidCap Index (“S&P 400”) for the five-year calendar period commencing January 1, 2005 and ending December 31, 2009. This graph assumes that $100 was invested on December 31, 2004 in each of Lincoln common, the S&P 500 and the S&P 400. A peer-group index for the welding industry, in general, was not readily available because the industry is comprised of a large number of privately held competitors and competitors that are relatively small entities of large publicly traded companies.

| ITEM 6. | SELECTED FINANCIAL DATA |

| (In thousands of dollars, except per share data) |

| Year Ended December 31, | |||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| Net sales |

$ | 1,729,285 | $ | 2,479,131 | $ | 2,280,784 | $ | 1,971,915 | $ | 1,601,190 | |||||

| Net income |

48,576 | 212,286 | 202,736 | 175,008 | 122,306 | ||||||||||

| Basic earnings per share |

$ | 1.15 | $ | 4.98 | $ | 4.73 | $ | 4.11 | $ | 2.93 | |||||

| Diluted earnings per share |

1.14 | 4.93 | 4.67 | 4.07 | 2.90 | ||||||||||

| Cash dividends declared |

1.09 | 1.02 | 0.91 | 0.79 | 0.73 | ||||||||||

| Total assets |

$ | 1,705,292 | $ | 1,718,805 | $ | 1,645,296 | $ | 1,394,579 | $ | 1,161,161 | |||||

| Long-term debt |

87,850 | 91,537 | 117,329 | 113,965 | 157,853 | ||||||||||

12

Results for 2009 include rationalization and asset impairment charges of $29,897 ($23,789 after-tax). The Company’s rationalization activities to align the business to current market conditions resulted in charges of $29,018 ($23,193 after-tax) and impairment charges of $879 ($596 after-tax) were recognized for certain indefinite-lived intangible assets. Results also include a loss of $7,943 ($7,943 after-tax) associated with the acquisition of a business in China and the related disposal of an interest in Taiwan, a pension settlement gain of $1,543 ($1,543 after-tax) and a gain on the sale of a property by the Company’s joint venture in Turkey of $5,667 ($5,667 after-tax).

Results for 2008 include a charge of $2,447 ($1,698 after-tax) relating to the Company’s rationalization programs that began in the fourth quarter of 2008 designed to align the business to current market conditions. Results for 2008 also include $16,924 ($16,615 after-tax) in asset impairment charges including $13,194 of goodwill and $2,388 of long-lived assets related to two businesses in China (with no tax benefit) as well as an impairment charge of $1,342 ($1,033 after-tax) for intangible assets in North America and Europe.

Results for 2007 include a net gain of $188 ($107 after-tax) relating to the Company’s rationalization programs.

Results for 2006 include a charge of $3,478 ($3,478 after-tax) relating to the Company’s rationalization programs and a gain of $9,006 ($7,204 after-tax) on the sale of a facility in Ireland.

Results for 2005 include a charge of $1,761 ($1,303 after-tax) relating to the Company’s rationalization programs, a one-time state income tax benefit of $1,807 (net of federal benefit) relating to changes in Ohio tax laws, a favorable adjustment of $8,711 related to the resolution of prior years’ tax liabilities, a net favorable tax benefit of $1,146 associated with the repatriation of foreign earnings and a gain of $1,418 ($876 after-tax) on the settlement of legal disputes.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| (In thousands of dollars, except share and per share data) |

The following discussions of financial condition and results of operations should be read together with “Selected Financial Data,” the Company’s Consolidated Financial Statements and other financial information included elsewhere in this report. This report contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those indicated in the forward-looking statements. See Risk Factors in Item 1A for more information regarding forward-looking statements.

General

The Company is the world’s largest designer and manufacturer of arc welding and cutting products, manufacturing a broad line of arc welding equipment, consumable welding products and other welding and cutting products.

The Company is one of only a few worldwide broad-line manufacturers of both arc welding equipment and consumable products. Welding products include arc welding power sources, wire feeding systems, robotic welding packages, fume extraction equipment, consumable electrodes and fluxes. The Company’s welding product offering also includes regulators and torches used in oxy-fuel welding and cutting. In addition, the Company has a leading global position in the brazing and soldering alloys market.

The Company invests in the research and development of arc welding equipment and consumable products in order to continue its market leading product offering. The Company continues to invest in technologies that improve the quality and productivity of welding products. In addition, the Company continues to actively increase its patent application process in order to secure its technology advantage in the United States and other major international jurisdictions. The Company believes its significant investment in research and development and its highly trained technical sales force provide a competitive advantage in the marketplace.

The Company’s products are sold in both domestic and international markets. In North America, products are sold principally through industrial distributors, retailers and also directly to users of welding products. Outside of North America, the Company has an international sales organization comprised of Company employees and agents who sell products from the Company’s various manufacturing sites to distributors and product users.

13

The Company’s major end user markets include:

| • | general metal fabrication, |

| • | power generation and process industry, |

| • | structural steel construction (buildings and bridges), |

| • | heavy equipment fabrication (farming, mining and rail), |

| • | shipbuilding, |

| • | automotive, |

| • | pipe mills and pipelines, and |

| • | offshore oil and gas exploration and extraction. |

The Company has, through wholly-owned subsidiaries or joint ventures, manufacturing facilities located in the United States, Australia, Brazil, Canada, Colombia, France, Germany, India, Indonesia, Italy, Mexico, the Netherlands, People’s Republic of China, Poland, Portugal, Turkey, United Kingdom and Venezuela.

During the fourth quarter of 2009, the Company realigned its business units into five operating segments to enhance the utilization of the Company’s worldwide resources and global sourcing initiatives. The operating segments consist of North America Welding, Europe Welding, Asia Pacific Welding, South America Welding and The Harris Products Group. The North America Welding segment includes welding operations in the United States, Canada and Mexico. The other three welding segments include welding operations in Europe, Asia Pacific and South America, respectively. The fifth segment, The Harris Products Group, includes the Company’s global cutting, soldering and brazing businesses as well as the retail business in the United States. The segment information of prior periods has been recast to conform to the current segment presentation.

The principal raw materials essential to the Company’s business are various chemicals, electronics, steel, engines, brass, copper and aluminum alloys, all of which are normally available for purchase in the open market.

The Company’s facilities are subject to environmental regulations. To date, compliance with these environmental regulations has not had a material adverse effect on the Company’s earnings. The Company is ISO 9001 certified at nearly all facilities worldwide. In addition, the Company is ISO 14001 certified at all significant manufacturing facilities in North America and Europe and is working to gain certification at its remaining facilities worldwide.

Key Indicators

Key economic measures relevant to the Company include industrial production trends, steel consumption, purchasing manager indices, capacity utilization within durable goods manufacturers and consumer confidence indicators. Key industries which provide a relative indication of demand drivers to the Company include steel, farm machinery and equipment, construction and transportation, fabricated metals, electrical equipment, ship and boat building, defense, truck manufacturing, energy and railroad equipment. Although these measures provide key information on trends relevant to the Company, the Company does not have available a more direct correlation of leading indicators which can provide a forward-looking view of demand levels in the markets which ultimately use the Company’s welding products.

Key operating measures utilized by the operating units to manage the Company include orders, sales, inventory and fill-rates, all of which provide key indicators of business trends. These measures are reported on various cycles including daily, weekly and monthly depending on the needs established by operating management.

Key financial measures utilized by the Company’s executive management and operating units in order to evaluate the results of its business and in understanding key variables impacting the current and future results of the Company include: sales; gross profit; selling, general and administrative expenses; earnings before interest and taxes; earnings before interest, taxes and bonus; net income; operating cash flows; and capital expenditures, including applicable ratios such as return on invested capital and average operating working capital to sales. These measures are reviewed at monthly, quarterly and annual intervals and compared with historical periods, as well as objectives established by the Board of Directors of the Company.

14

Results of Operations

The following table shows the Company’s results of operations:

| Year Ended December 31, | |||||||||||||||||||||

| 2009 | 2008 | 2007 | |||||||||||||||||||

| Amount | % of Sales | Amount | % of Sales | Amount | % of Sales | ||||||||||||||||

| Net sales |

$ | 1,729,285 | 100.0 | % | $ | 2,479,131 | 100.0 | % | $ | 2,280,784 | 100.0 | % | |||||||||

| Cost of goods sold |

1,273,017 | 73.6 | % | 1,758,980 | 71.0 | % | 1,633,218 | 71.6 | % | ||||||||||||

| Gross profit |

456,268 | 26.4 | % | 720,151 | 29.0 | % | 647,566 | 28.4 | % | ||||||||||||

| Selling, general & administrative expenses |

333,395 | 19.3 | % | 405,376 | 16.4 | % | 370,122 | 16.2 | % | ||||||||||||

| Rationalization and asset impairment charges (gain) |

29,897 | 1.7 | % | 19,371 | 0.8 | % | (188 | ) | (0.0 | )% | |||||||||||

| Operating income |

92,976 | 5.4 | % | 295,404 | 11.9 | % | 277,632 | 12.2 | % | ||||||||||||

| Interest income |

3,462 | 0.2 | % | 8,845 | 0.4 | % | 8,294 | 0.4 | % | ||||||||||||

| Equity (loss) earnings in affiliates |

(5,025 | ) | (0.3 | )% | 6,034 | 0.2 | % | 9,838 | 0.4 | % | |||||||||||

| Other income |

3,589 | 0.2 | % | 1,681 | 0.1 | % | 2,823 | 0.1 | % | ||||||||||||

| Interest expense |

(8,521 | ) | (0.5 | )% | (12,155 | ) | (0.5 | )% | (11,430 | ) | (0.5 | )% | |||||||||

| Income before income taxes |

86,481 | 5.0 | % | 299,809 | 12.1 | % | 287,157 | 12.6 | % | ||||||||||||

| Income taxes |

37,905 | 2.2 | % | 87,523 | 3.5 | % | 84,421 | 3.7 | % | ||||||||||||

| Net income |

$ | 48,576 | 2.8 | % | $ | 212,286 | 8.6 | % | $ | 202,736 | 8.9 | % | |||||||||

2009 Compared to 2008

Net Sales: Net sales for 2009 decreased 30.2% to $1,729,285 from $2,479,131 in 2008. The decrease in Net sales reflects a $738,535 (29.8%) decrease due to volume, a $13,130 (0.5%) decrease due to price, a $73,450 (3.0%) increase from acquisitions and a $71,631 (2.9%) unfavorable impact as a result of changes in foreign currency exchange rates.

Net sales for the North America Welding segment decreased 34.7% to $858,180 in 2009 compared with $1,313,881 in 2008. This decrease reflects a decrease of $456,826 (34.8%) due to volume, a $15,912 (1.2%) increase due to price and a $14,787 (1.1%) decrease as a result of changes in foreign currency exchange rates.

Net sales for the Europe Welding segment decreased 35.7% to $346,383 in 2009 compared with $538,570 in 2008. This decrease reflects a decrease of $130,235 (24.2%) due to volume, a $22,510 (4.2%) decrease due to price, a $5,242 (1.0%) increase from acquisitions and a $44,684 (8.3%) unfavorable impact as a result of changes in foreign currency exchange rates.

Net sales for the Asia Pacific Welding segment decreased 9.7% to $208,280 in 2009 compared with $230,661 in 2008. This decrease reflects a decrease of $68,447 (29.7%) due to volume, a $5,471 (2.4%) decrease due to price, a $54,638, (23.7%) increase from acquisitions and a $3,101 (1.3%) unfavorable impact as a result of changes in foreign currency exchange rates.

Net sales for the South America Welding segment decreased 14.6% to $99,171 in 2009 compared with $116,061 in 2008. This decrease reflects a decrease of $23,831 (20.5%) due to volume, a $13,117 (11.3%) increase due to price and a $6,176 (5.3%) unfavorable impact as a result of changes in foreign currency exchange rates.

15

Net sales for The Harris Products Group segment decreased 22.4% to $217,271 in 2009 compared with $279,958 in 2008. This decrease reflects a decrease of $59,196 (21.1%) due to volume, a $14,178 (5.1%) decrease due to price, a $13,570, (4.8%) increase from acquisitions and a $2,883 (1.0%) unfavorable impact as a result of changes in foreign currency exchange rates.

Gross Profit: Gross profit decreased 36.6% to $456,268 during 2009 compared with $720,151 in 2008. As a percentage of Net sales, Gross profit decreased to 26.4% in 2009 from 29.0% in 2008. This decrease was primarily a result of lower volumes, the liquidation of higher cost inventories and higher retirement costs in the U.S. of $15,466 offset by lower product liability costs of $5,412 primarily due to a gain on an insurance settlement. Foreign currency exchange rates had a $12,653 unfavorable translation impact in 2009. The LIFO reserve decreased by $28,467 as a result of decreases in commodity prices in 2009, primarily steel, and a reduction in inventory levels. The reduction in inventory levels resulted in a decrease to the LIFO reserve of $14,254.

Selling, General & Administrative (“SG&A”) Expenses: SG&A expenses decreased $71,981 (17.8%) during 2009 compared with 2008. The decrease was primarily due to lower bonus expense of $56,292, lower selling, administrative and research and development expenses of $11,574, the favorable translation impact of foreign currency exchange rates of $12,785 and incremental foreign currency transaction gains of $9,172 partially offset by higher retirement costs in the U.S. of $12,120 and incremental SG&A from acquisitions of $6,118. The Company realized a gain of $1,543 on the settlement of a pension obligation during 2009 that was recorded as a reduction to SG&A expenses.

Rationalization and Asset Impairment Charges (Gain): In 2009, the Company recorded $29,897 ($23,789 after-tax) in charges related to rationalization activities to align the business to current market conditions and asset impairments. These charges include $27,142 primarily related to employee severance costs, $2,061 in long-lived asset impairment charges and a gain of $185 recognized in connection with the partial settlement of a pension plan. Rationalization activities during the year affected 1,063 employees and included the closure of two manufacturing facilities. Impairment charges on certain indefinite-lived intangible assets of $879 were also included under this caption.

Interest Income: Interest income decreased to $3,462 in 2009 from $8,845 in 2008. The decrease was due to lower interest rates on Cash and cash equivalents in 2009 when compared with 2008.

Equity (Loss) Earnings in Affiliates: Equity loss in affiliates was $5,025 in 2009 compared with earnings of $6,034 in 2008. The equity loss in 2009 includes a loss of $7,943 associated with the acquisition of Jinzhou Jin Tai Welding and Metal Co, Ltd. (“Jin Tai”) and the related disposal of an interest in Kuang Tai Metal Industrial Co., Ltd. (“Kuang Tai”), the Company’s Taiwanese joint venture, and income of $5,667 as the Company’s share of a gain realized on the sale of a property by the Company’s joint venture in Turkey. Excluding these items, equity earnings decreased primarily as a result of losses at the Company’s joint venture in Taiwan prior to the acquisition of Jin Tai. See the “Acquisitions” section of Item 7 for additional information related to the acquisition of Jin Tai.

Interest Expense: Interest expense decreased to $8,521 in 2009 from $12,155 in 2008 primarily as a result of a lower average debt balance from the payment of $30,000 on the Senior Unsecured Note that matured in March 2009 and the impact of the amortization of gains on the terminated interest rate swaps.

Income Taxes: The Company recorded $37,905 of tax expense on pre-tax income of $86,481, resulting in an effective tax rate of 43.8% for 2009. The effective tax rate exceeds the Company’s statutory rate due to losses at certain non-U.S. entities, including the loss associated with the acquisition of Jin Tai and related disposal of Kuang Tai of $7,943, with no tax benefit, partially offset by a benefit for the utilization of foreign tax credits.

Net Income: Net income for 2009 was $48,576 compared with $212,286 in the prior year. Diluted earnings per share for 2009 were $1.14 compared with earnings of $4.93 per share in 2008. Foreign currency exchange rate movements had a favorable translation effect of $612 and $2,508 on net income for 2009 and 2008, respectively.

16

Non-GAAP Financial Measures: The Company reviews Operating income, Net income and Diluted earnings per share (“EPS”) excluding special items, non-GAAP financial measures, in assessing and evaluating the Company’s underlying operating performance. The following tables present reconciliations of Operating income, Net income and Diluted EPS as reported to Operating income, Net income and Diluted EPS excluding special items.

| Year Ended December 31, | |||||||

| 2009 | 2008 | ||||||

| Operating income as reported |

$ | 92,976 | $ | 295,404 | |||

| Special items: |

|||||||

| Rationalization charges |

29,018 | 2,447 | |||||

| Impairment charges |

879 | 16,924 | |||||

| Pension settlement gain |

(1,543 | ) | — | ||||

| Adjusted Operating income excluding special items |

$ | 121,330 | $ | 314,775 | |||

| Year Ended December 31, | |||||||

| 2009 | 2008 | ||||||

| Net income as reported |

$ | 48,576 | $ | 212,286 | |||

| Special items (after-tax): |

|||||||

| Rationalization charges |

23,193 | 1,698 | |||||

| Impairment charges |

596 | 16,615 | |||||

| Pension settlement gain |

(1,543 | ) | — | ||||

| Loss associated with the acquisition of Jin Tai |

7,943 | — | |||||

| Gain on sale of property |

(5,667 | ) | — | ||||

| Adjusted Net income excluding special items |

$ | 73,098 | $ | 230,599 | |||

| Diluted EPS |

$ | 1.14 | $ | 4.93 | |||

| Special items |

0.57 | 0.43 | |||||

| Adjusted Diluted EPS excluding special items |

$ | 1.71 | $ | 5.36 | |||

2008 Compared to 2007

Net Sales: Net sales for 2008 increased 8.7% to $2,479,131 from $2,280,784 in 2007. The increase in Net sales reflects an $88,436 (3.9%) decrease due to volume, a $176,045 (7.7%) increase due to price, a $67,538 (3.0%) increase from acquisitions and a $43,200 (1.9%) favorable impact as a result of changes in foreign currency exchange rates.

Net sales for the North America Welding segment increased 5.2% to $1,313,881 in 2008 compared with $1,248,382 in 2007. This increase reflects a decrease of $57,607 (4.6%) due to volume, a $113,883 (9.1%) increase due to price and a $9,425 (0.8%) increase from acquisitions.

Net sales for the Europe Welding segment increased 13.5% to $538,570 in 2008 compared with $474,388 in 2007. This increase reflects a decrease of $1,592 (0.3%) due to volume, a $6,458 (1.4%) increase due to price, a $29,827 (6.3%) increase from acquisitions and a $29,489 (6.2%) favorable impact as a result of changes in foreign currency exchange rates.

17

Net sales for the Asia Pacific Welding segment increased 29.5% to $230,661 in 2008 compared with $178,120 in 2007. This increase reflects a $21,752 (12.2%) increase due to price, a $23,159 (13.0%) increase from acquisitions and a $7,699 (4.3%) favorable impact as a result of changes in foreign currency exchange rates.

Net sales for the South America Welding segment increased 14.4% to $116,061 in 2008 compared with $101,426 in 2007. This increase reflects a decrease of $10,444 (10.3%) due to volume, a $20,883 (20.6%) increase due to price and a $4,196 (4.1%) favorable impact as a result of changes in foreign currency exchange rates.

Net sales for The Harris Products Group segment increased 0.5% to $279,958 in 2008 compared with $278,468 in 2007. This increase reflects a decrease of $18,724 (6.7%) due to volume, a $13,069 (4.7%) increase due to price, a $5,127 (1.8%) increase from acquisitions and a $2,018 (0.7%) favorable impact as a result of changes in foreign currency exchange rates.

Gross Profit: Gross profit increased 11.2% to $720,151 during 2008 compared with $647,566 in 2007. As a percentage of Net sales, Gross profit increased to 29.0% in 2008 from 28.4% in 2007. This increase was primarily a result of favorable pricing leverage and improved operational effectiveness partially offset by volume decreases and the continuing shift in sales mix to traditionally lower margin geographies and businesses. Foreign currency exchange rates had a $10,621 favorable impact in 2008.

Selling, General & Administrative Expenses: SG&A expenses increased $35,254 (9.5%) in 2008 compared with 2007. The increase was primarily due to higher selling expenses of $10,543 resulting from increased sales activity, incremental selling, general and administrative expenses from acquisitions totaling $9,222, higher bonus expense of $5,706 and higher foreign currency transaction losses of $4,381. Foreign currency exchange rates had a $5,587 unfavorable impact.

Rationalization and Asset Impairment Charges (Gain): In 2008, the Company recorded $19,371 in rationalization and asset impairment charges. This total included $2,447 ($1,698 after-tax) in rationalization charges related to workforce reductions that affected 67 employees in The Harris Products Group segment and 65 employees in the Europe Welding segment. The actions were taken to align the business to current market conditions. Asset impairment charges of $16,924 ($16,615 after-tax) included $15,582 (with no tax benefit) to write off goodwill and write down long-lived assets related to two businesses in China and $1,342 ($1,033 after-tax) to write down intangible assets in North America and Europe.

In 2007, the Company recorded a net gain of $188 ($107 after-tax) to rationalization charges due to a gain of $816 ($735 after-tax) related to the termination of the Harris Ireland Pension Plan offsetting other charges related to severance costs covering 66 employees at the Company’s facility in Ireland.

Interest Income: Interest income increased to $8,845 in 2008 from $8,294 in 2007. The increase was a result of higher cash balances partially offset by lower interest rate investments in 2008 when compared with 2007.

Equity Earnings in Affiliates: Equity earnings in affiliates decreased to $6,034 in 2008 from $9,838 in 2007 as a result of lower earnings at the Company’s joint venture investments in Turkey and Taiwan.

Interest Expense: Interest expense increased to $12,155 in 2008 from $11,430 in 2007 as a result of a lower level of amortization of the gain associated with previously terminated interest rate swap agreements and higher debt levels.

Income Taxes: Income taxes for 2008 were $87,523 on income before income taxes of $299,809, an effective rate of 29.2%, compared with income taxes of $84,421 on income before income taxes of $287,157, or an effective rate of 29.4% for 2007. The decrease in the effective tax rate for 2008 from 2007 was a result of additional utilization of foreign tax credits from the repatriation of higher-taxed earnings partially offset by non-deductible asset impairment charges in China. The effective rate for 2008 and 2007 was lower than the Company’s statutory rate primarily because of the utilization of foreign tax credits, lower taxes on non-U.S. earnings and the utilization of foreign tax loss carryforwards, for which valuation allowances had been previously provided.

18

Net Income: Net income for 2008 was $212,286 compared with $202,736 in the prior year. Diluted EPS for 2008 was $4.93 compared with $4.67 per share in 2007. Foreign currency exchange rate movements had a $2,508 and a $3,419 favorable effect on net income for 2008 and 2007, respectively.

Non-GAAP Financial Measures: The Company reviews Operating income, Net income and Diluted EPS excluding special items, non-GAAP financial measures, in assessing and evaluating the Company’s underlying operating performance. The following tables present reconciliations of Operating income, Net income and Diluted EPS as reported to Operating income, Net income and Diluted EPS excluding special items.

| Year Ended December 31, | |||||||

| 2008 | 2007 | ||||||

| Operating income as reported |

$ | 295,404 | $ | 277,632 | |||

| Special items: |

|||||||

| Rationalization charges (gain) |

2,447 | (188 | ) | ||||

| Impairment charges |

16,924 | — | |||||

| Adjusted Operating income excluding special items |

$ | 314,775 | $ | 277,444 | |||

| Year Ended December 31, | |||||||

| 2008 | 2007 | ||||||

| Net income as reported |

$ | 212,286 | $ | 202,736 | |||

| Special items (after-tax): |

|||||||

| Rationalization charges (gain) |

1,698 | (107 | ) | ||||

| Impairment charges |

16,615 | — | |||||

| Adjusted Net income excluding special items |

$ | 230,599 | $ | 202,629 | |||

| Diluted EPS |

$ | 4.93 | $ | 4.67 | |||

| Special items |

0.43 | — | |||||

| Adjusted Diluted EPS excluding special items |

$ | 5.36 | $ | 4.67 | |||

Liquidity and Capital Resources

The Company’s cash flow from operations, while cyclical, has been reliable and strong. Operational cash flow is a key driver of liquidity, providing cash and access to capital markets. In assessing liquidity, the Company reviews working capital measurements to define areas for improvement. Management anticipates the Company will be able to satisfy cash requirements for its ongoing businesses for the foreseeable future primarily with cash generated by operations, existing cash balances and, if necessary, borrowings under its existing credit facilities.

19

The following table reflects changes in key cash flow measures:

| Year Ended December 31, | $ Change | |||||||||||||||||||

| 2009 | 2008 | 2007 | 2009 vs. 2008 | 2008 vs. 2007 | ||||||||||||||||

| Cash provided by operating activities: |

$ | 250,350 | $ | 257,449 | $ | 249,832 | $ | (7,099 | ) | $ | 7,617 | |||||||||

| Cash used by investing activities: |

(63,581 | ) | (115,800 | ) | (79,705 | ) | 52,219 | (36,095 | ) | |||||||||||

| Capital expenditures |

(38,201 | ) | (72,426 | ) | (61,633 | ) | 34,225 | (10,793 | ) | |||||||||||

| Acquisition of businesses, net of cash acquired |

(25,449 | ) | (44,036 | ) | (18,773 | ) | 18,587 | (25,263 | ) | |||||||||||

| Cash used by financing activities: |

(89,072 | ) | (67,741 | ) | (77,586 | ) | (21,331 | ) | 9,845 | |||||||||||

| (Payments) proceeds on short-term borrowings, net |

(12,954 | ) | 6,104 | 2,826 | (19,058 | ) | 3,278 | |||||||||||||

| (Payments) proceeds on long-term borrowings, net |

(30,874 | ) | 319 | (40,142 | ) | (31,193 | ) | 40,461 | ||||||||||||

| Proceeds from exercise of stock options |

705 | 7,201 | 8,644 | (6,496 | ) | (1,443 | ) | |||||||||||||

| Tax benefit from exercise of stock options |

195 | 3,728 | 4,289 | (3,533 | ) | (561 | ) | |||||||||||||

| Purchase of shares for treasury |

(343 | ) | (42,337 | ) | (15,459 | ) | 41,994 | (26,878 | ) | |||||||||||

| Cash dividends paid to shareholders |

(45,801 | ) | (42,756 | ) | (37,744 | ) | (3,045 | ) | (5,012 | ) | ||||||||||

| Increase in Cash and cash equivalents |

103,804 | 66,950 | 97,170 | 36,854 | (30,220 | ) | ||||||||||||||

Cash and cash equivalents increased 36.5%, or $103,804, to $388,136 as of December 31, 2009, from $284,332 as of December 31, 2008. This compares with an increase of 30.8%, or $66,950, in Cash and cash equivalents during 2008.

Cash provided by operating activities for 2009 decreased $7,099 from 2008. The decrease was primarily due to lower net income that was largely offset by reductions in accounts receivable and inventory as the Company adjusted working capital levels commensurate with lower demand. Net operating working capital to net sales was 23.2% at December 31, 2009 compared with 24.8% at December 31, 2008. Days sales in inventory decreased to 100.8 days at December 31, 2009 from 115.8 days at December 31, 2008. Accounts receivable days increased to 56.9 days at December 31, 2009 from 55.0 days at December 31, 2008. Average days in accounts payable decreased to 30.0 days at December 31, 2009 from 32.1 days at December 31, 2008.

Cash used by investing activities decreased by $52,219 for 2009 compared with 2008. Cash used in the acquisition of businesses in 2009 decreased $18,587 from 2008. Capital expenditures during 2009 were $38,201, a $34,225 decrease from 2008. The Company anticipates capital expenditures in 2010 in the range of $40,000 — $50,000. Anticipated capital expenditures reflect plans to improve operational effectiveness and the Company’s continuing international expansion. Management critically evaluates all proposed capital expenditures and requires each project to increase efficiency, reduce costs, promote business growth or to improve the overall safety and environmental conditions of the Company’s facilities.

Cash used by financing activities for 2009 increased $21,331 from 2008. The increase was primarily due to the $30,000 repayment of the Company’s Series B Senior Unsecured Note upon maturity during the first quarter of 2009, a reduction in short-term borrowings of $12,954 in the current period versus an increase of $6,104 in the comparable period of 2008 and a decrease in proceeds from the exercise of stock options and related tax benefits of $10,029 partially offset by lower purchases of shares for treasury of $41,994.

The Company’s debt levels decreased from $142,230 at December 31, 2008, to $123,717 at December 31, 2009. Debt to total capitalization decreased to 10.2% at December 31, 2009 from 12.3% at December 31, 2008.

A total of $45,801 in dividends was paid during 2009. In January 2010, the Company paid a quarterly cash dividend of $0.28 cents per share, or $11,885 to shareholders of record on December 31, 2009.

20

Subsequent Events

The Company has investments in Venezuela which currently require the approval of a government agency to convert local currency to U.S. dollars at official government rates. Government approval for currency conversion to satisfy U.S. dollar liabilities to foreign suppliers, including payables to Lincoln affiliates, has lagged payment due dates from time to time in the past, resulting in higher cash balances and higher past due U.S. dollar payables within our Venezuelan subsidiary. If the Company had settled its Venezuelan subsidiary’s U.S. dollar liabilities using unofficial parallel currency exchange mechanisms as of December 31, 2009, it would have resulted in a currency exchange gain of approximately $437.

Cumulative inflation in Venezuela over the preceding three year period reached 100% during the fourth quarter of 2009. As a result, the Company changed the functional currency of its Venezuelan subsidiary to the U.S. dollar as of January 1, 2010. During January 2010, the Venezuelan government announced the devaluation of the official exchange rate used for most foreign currency transactions common to the Company’s Venezuelan subsidiary from 2.15 to 4.30 Bolivars to the U.S. dollar.

The Company’s Venezuelan subsidiary’s net Bolivar denominated monetary liability position is expected to result in a gain of approximately $2,500 during the first quarter of 2010. The Company also expects that its Venezuelan subsidiary’s results of operations will decrease significantly in 2010 due to the new exchange rate. The impact of selling inventories carried at the previous exchange rate is expected to decrease gross profit by approximately $5,000.

Rationalization and Asset Impairments

The Company recorded rationalization and asset impairment charges of $29,897 for the year ended December 31, 2009. These charges include $27,142 primarily related to employee severance costs, $2,061 in long-lived asset impairment charges, $879 in indefinite-lived intangible asset impairment charges and a gain of $185 recognized in connection with the partial settlement of a pension plan.

In the fourth quarter of 2009, the Company determined that the carrying value of certain long-lived assets exceeded fair value at operations affected by rationalization activities initiated in the second and third quarters of 2009. As a result, asset impairment charges totaling $2,061 were recognized in “Rationalization and asset impairment charges (gain).” Of the total asset impairment charges, $253 were recognized in the Europe Welding segment, $1,515 in the Asia Pacific Welding segment and $293 in The Harris Products Group segment. Fair values of impaired long-lived assets were determined primarily by third party appraisal.

During the third quarter of 2009, the Company initiated various rationalization actions including the closure of a manufacturing facility in Europe and the consolidation of certain manufacturing operations in the Europe Welding and Asia Pacific Welding segments. These actions impacted 80 employees in the Europe Welding segment, 175 employees in the Asia Pacific Welding segment and nine employees in the South America Welding segment. These actions are expected to cost approximately $12,000, of which the Company recorded rationalization charges of $8,333 for the year ended December 31, 2009. At December 31, 2009, a liability related to these actions of $3,912 was recorded in “Other current liabilities.” Costs related to these actions relate primarily to employee severance actions that are expected to be substantially completed and paid over the next year.