Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of Chicago | d8k.htm |

Exhibit 99.1

February 22, 2010

To Our Members:

The Federal Home Loan Bank of Chicago (Bank) expects to file its 2009 Form 10-K Annual Report with the Securities and Exchange Commission next month; you will be able to access it through our website, www.fhlbc.com, or the SEC’s reporting website, www.sec.gov/edgar. This letter will update you on our progress in remediating the condition of the Bank. Specifically, our goals continue to be:

| • | Return to profitability; |

| • | Stabilize our capital base through a capital stock conversion; |

| • | Grow retained earnings; |

| • | Simplify the business model and operations of the Bank; and, |

| • | Restore an appropriate dividend and full liquidity to our stock. |

In the numerous interactions we have had with our members around Illinois and Wisconsin, it is clear that achieving these outcomes while continuing to provide competitively priced liquidity and term financing is what you expect — and what you deserve — from your Home Loan Bank. This is precisely what we are focused on achieving to enhance the value of your Bank membership.

The results discussed here are preliminary and unaudited. Please refer to the attached Condensed Statements of Income and Statements of Condition. Also, please review the discussion of the market value of the Bank’s equity, level of retained earnings, and return on regulatory capital that follows the summary of financial results. (See “Remediation Dashboard.”)

Summary of Financial Results

Impact of Credit Crisis and Slow Economy on Members and Bank

We began 2009 focused on the potential impact of the credit crisis and slowing economy on our members and on our balance sheet. Through careful monitoring of members’ financial conditions and their collateral positions, as well as coordination with banking regulators, we have successfully managed through 19 member resolutions without credit losses. We continue to work with many members challenged by the current environment, balancing the needs of individual members against the health of the overall member investment in the Bank.

We managed the potential negative impact of a government-supported lower-rate environment by restructuring our balance sheet, lowering our funding costs, improving our net interest income, and helping to position the Bank for consistent net interest income in the future. In addition, the restructuring of the balance sheet, along with a general improvement in credit spreads during the second half of 2009, have led to an improvement in our market value of equity.

1

Although we ended the year in an improved position relative to where we began it, we were still negatively impacted by other-than-temporary impairment (OTTI) charges against income related to our private-label mortgage-backed securities (MBS) portfolio. Without these charges, the Bank would have earned a profit for 2009.

| • | We expect to record a net loss for 2009 of $65 million. While we have transformed our balance sheet composition with positive results on our net interest income, the $437 million OTTI charge on our private-label MBS more than offsets improvements to our earnings from operations. |

| • | Advances outstanding at the year-end were $24.1 billion, 37% lower than the previous year-end level of $38.1 billion, as members’ borrowing needs changed dramatically. Member borrowing needs decreased significantly as the economic slowdown continued, member deposits increased, low-cost government alternatives were available to some, and members decreased their lending activities to shore up balance sheets negatively impacted by credit losses. |

| • | Mortgage Partnership Finance® (MPF®) loans held in portfolio declined $8.3 billion (26%) to $23.8 billion as market response to governmental actions produced low home mortgage rate levels leading to accelerated prepayments and refinancings. |

| • | We submitted an application to our regulator, the Federal Housing Finance Agency (FHFA), to convert our capital stock to a Gramm-Leach-Bliley capital structure and are currently awaiting the results of their review of the proposed plan. |

| • | We awarded $8 million in grants through our competitive Affordable Housing Program and $4 million in assistance through our Downpayment Plus® Program. |

| • | We remain in compliance with all of our regulatory capital requirements. |

Net Interest Income Improves Significantly

Net interest income was $570 million in 2009, an increase of 186% over net interest income of $199 million in 2008. During 2009, we called higher-cost long-term debt and replaced it with lower-cost debt. In addition, we had anticipated that the government’s quantitative easing program would accelerate the run-off of our MPF portfolio as homeowners took advantage of the low mortgage rates and refinanced. With the support and approval of our Board and the FHFA, we embarked on a restructuring of the balance sheet to replace those MPF assets to positively impact net interest income. Specifically, we increased our investment in agency MBS and other investments we believe have lower credit risk to offset lower earnings from the run-off of the MPF portfolio. In general, we have undertaken to increase the net interest income by increasing our investment portfolio, reducing the underlying interest-rate risk profile of the investment portfolio, lowering our funding costs, and simplifying the hedging activities associated with it. We believe the successful implementation of this asset replacement strategy and the results on our financial performance are integral to the Bank’s ability to generate a consistent earnings stream in the future.

2

MBS Portfolio Decline Continues, but Slows

Our investment in private-label MBS had a significant negative impact on financial results in 2009, with net OTTI charges of $437 million. As we reported in the first quarter of 2009, we early adopted new accounting guidance issued by the Financial Accounting Standards Board related to the accounting for impaired investment securities. With this change in the way we account for OTTI, we recorded a one-time adjustment of an increase in retained earnings of $233 million. This methodology involves distinguishing between estimated credit losses (those due to the timing and amount of cash received on the underlying securities) and non-credit losses (primarily the result of current market conditions). The credit loss is recognized in non-interest income; the non-credit loss is deferred in accumulated other comprehensive income (loss). While we may experience additional OTTI charges in the future, the steep decline in the value of the portfolio slowed in the fourth quarter.

Hedging Costs Fluctuate Due to Market Volatility and Balance Sheet Composition

The income/loss from derivative and hedging activities fluctuated quarter-to-quarter during the year as rate volatility in the markets affected the sensitivity of our balance sheet to interest rate movements. For the year, we recognized a loss of derivative and hedging activities of $83 million compared to income of $45 million in 2008. In a very low rate environment, the prepayment risk associated with the MPF portfolio increases, increasing the costs of hedging that portfolio. Ultimately, we expect that our moves to reduce the interest-rate risk of our investments will result in more consistent costs.

Attention to Non-Interest Expense to Achieve Appropriate Scale

Our non-interest expense for the year remained essentially unchanged, increasing $2 million (2%) to $128 million. The costs of our move to new headquarters, including $4 million in lease termination costs and approximately $1 million of actual moving costs, are nonrecurring in nature and will not impact future periods. Further, in future years we anticipate significant savings in lease payments compared to prior years. We are also in the final phase of a major operating system conversion, which we expect will facilitate the streamlining of internal processes and expense savings in 2010 and beyond through operating efficiencies and lower staffing levels. Non-interest expense for 2009 also includes a $3 million contribution to our Affordable Housing Program (typically funded through an assessment against earnings).

Restructured Balance Sheet, Resized Balance Sheet

Advances fell $14.0 billion (37%) from $38.1 billion at year-end 2008 to $24.1 billion at year-end 2009. After a dramatic increase in advances during the credit crunch of 2008, our members’ borrowing needs have decreased as the economy slowed, resulting in lower borrowing demand among their customers. In addition, their customer deposits increased, some members took advantage of the availability of government lending programs, and others paid down debt and reduced their overall lending levels to improve their capital positions after experiencing credit losses. Several members have been acquired by out-of-district financial institutions or have collapsed their charters in our district. As a result, their maturing advances will not be renewed. The level of total assets fell to $88.1 billion, in part a reflection of the lower advances level. We anticipate that the overall size of the Bank will fall as MPF loans continue to pay down and we seek to operate at the scale dictated by the level of our members’ borrowing needs.

3

Total MPF loans held in portfolio were $23.8 billion at year-end 2009, a reduction of $8.3 billion (26 %) from $32.1 billion at the previous year-end. While we expected reductions in the level of MPF loans as a result of our 2008 decision not to acquire new MPF loans for the Bank’s balance sheet, the accelerated pace of the portfolio reduction reflects the low level of mortgage rates throughout the year and accompanying prepayments/refinancings. We increased our allowance for loan loss from $5 million to $14 million consistent with the increase in our nonperforming and impaired MPF Loan amounts.

The MPF Xtra® product continues to grow in popularity among our members, as well as the members of the Federal Home Loan Banks of Boston, Des Moines, and Pittsburgh. Since the inception of the program, 222 PFIs systemwide have funded more than $3.4 billion in loans. We expect to introduce other enhancements in the MPF Xtra product line in the future.

Member Credit Concerns

During 2009, 19 of our member institutions were resolved by the FDIC. At the time of their resolutions, we had a total of $460 million in advances and other credit outstanding to these members. We are pleased to report that the Federal Home Loan Bank model of securing advances with mortgage assets and securities has proven to be sound as we have not experienced any credit losses as a result of the resolutions. Our credit monitoring includes careful analysis of members’ financial conditions in conjunction with enhanced collateral precautions. We have lowered our internally generated risk rating on many of our members this year and substantially increased the number of members listing and delivering collateral. The new collateral system we have used for nearly a year has helped us retrieve more timely data about collateral positions, an important component of our commitment to monitor the overall collateral position of our membership.

Commitment to Community Investment

Despite our operating loss this year, our Board of Directors voted to commit at least $5 million to Affordable Housing Programs in 2010. We all recognize the importance of the competitive grant program and the down payment assistance efforts, especially in this economy. These programs are an integral component of our work to support members and member communities. In future years, we anticipate being able to fund the programs with allocations from earnings.

In Summary

We have submitted a capital stock conversion plan to our regulator and will notify you and proceed with converting our stock as expeditiously as possible upon receipt of regulatory approval. As indicated on numerous occasions, the stabilization of our capital base through conversion of our stock is a fundamental step in remediating the Bank, and we are committed to doing so as soon as we can.

In addition to our focus on serving our members directly through our products and services and on restoring our capital stability, we are also focused on improving the overall effectiveness and efficiency of our operations. The installation of a new member collateral system and substantial progress on the implementation of our core operating platform have provided a framework for reevaluating and restructuring the ways we operate. Our commitment is to improve the value we deliver to you, whether through the improved efficiencies and lower costs of our new space, streamlined processing, or enhanced product offerings.

4

During 2010, we will continue to travel around the district to meet with members in group settings and individually. While we have made progress in addressing the issues of the past, much remains to be done to transition the Bank to an advances bank. As we drive change at the Bank, we are committed to you, our members, to achieve the goals of restoring profitability, paying an appropriate dividend, and restoring full liquidity to our stock while continuing to provide competitive short- and long-term financing to you.

We all look forward to visiting you in your offices, at the member meetings we will schedule in the coming months, or in our excellent new facilities at 200 East Randolph Drive.

As always, we welcome your comments and questions and look forward to working with you and to reporting on our progress during 2010.

Best regards,

Matt Feldman

President and CEO

This letter contains forward-looking statements which are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “anticipates,” “believes,” “expects,” “could,” “plans,” “estimates,” “may,” “should,” “will,” or their negatives or other variations on these terms. We caution that, by their nature, forward-looking statements involve risk or uncertainty, that actual results could differ materially from those expressed or implied in these forward-looking statements, and that actual events could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, instability in the credit and debt markets, economic conditions (including effects on, among other things, mortgage-backed securities), changes in mortgage interest rates and prepayment speeds on mortgage assets, our ability to successfully transition to a new business model and the risk factors set forth in our periodic filings with the Securities and Exchange Commission, which are available on our website at www.fhlbc.com. We assume no obligation to update any forward-looking statements made in this letter. The financial results discussed in this letter are preliminary and unaudited. “Mortgage Partnership Finance,” “MPF,” and “MPF Xtra” are registered trademarks of the Federal Home Loan Bank of Chicago.

5

Condensed Statements of Income

(Dollars in millions)

(Preliminary and Unaudited)

| For the years ended December 31, |

2009 | 2008 | Change | 2008 | 2007 | Change | ||||||||||||||||

| Interest income |

$ | 2,956 | $ | 3,772 | -22 | % | $ | 3,772 | $ | 4,479 | -16 | % | ||||||||||

| Interest expense |

2,376 | 3,570 | -33 | % | 3,570 | 4,217 | -15 | % | ||||||||||||||

| Provision for credit losses |

10 | 3 | 233 | % | 3 | 1 | 200 | % | ||||||||||||||

| Net interest income |

570 | 199 | 186 | % | 199 | 261 | -24 | % | ||||||||||||||

| Non-interest income (loss) |

(507 | ) | (192 | ) | 164 | % | (192 | ) | 3 | N/M | ||||||||||||

| Non-interest expense |

128 | 126 | 2 | % | 126 | 131 | -4 | % | ||||||||||||||

| Assessments |

— | — | — | — | 35 | -100 | % | |||||||||||||||

| Net income (loss) |

$ | (65 | ) | $ | (119 | ) | -45 | % | $ | (119 | ) | $ | 98 | -221 | % | |||||||

| Net interest margin on interest-earning assets |

0.65 | % | 0.22 | % | 0.43 | % | 0.22 | % | 0.30 | % | -0.08 | % | ||||||||||

n/m = not meaningful

Condensed Statements of Condition

(Dollars in millions)

(Preliminary and Unaudited)

| As of December 31, |

2009 | 2008 | ||||||

| Cash and due from banks |

$ | 2,823 | $ | 130 | ||||

| Federal Funds sold and securities purchased under agreement to resell |

2,715 | 1,580 | ||||||

| Investment securities |

34,078 | 19,603 | ||||||

| Advances |

24,148 | 38,140 | ||||||

| MPF Loans held in portfolio, net |

23,838 | 32,087 | ||||||

| Other |

472 | 589 | ||||||

| Total assets |

$ | 88,074 | $ | 92,129 | ||||

| Consolidated obligation discount notes |

$ | 22,139 | $ | 29,466 | ||||

| Consolidated obligation bonds |

58,225 | 55,305 | ||||||

| Subordinated notes |

1,000 | 1,000 | ||||||

| Other |

4,332 | 4,071 | ||||||

| Total liabilities |

85,696 | 89,842 | ||||||

| Capital stock |

2,328 | 2,386 | ||||||

| Retained earnings |

708 | 540 | ||||||

| Accumulated other comprehensive income (loss) |

(658 | ) | (639 | ) | ||||

| Total capital |

2,378 | 2,287 | ||||||

| Total liabilities and capital |

$ | 88,074 | $ | 92,129 | ||||

| Regulatory capital stock plus Designated Amount of subordinated notes |

$ | 3,794 | $ | 3,787 | ||||

6

Remediation Dashboard

In order to provide our members with greater clarity as we work to transition the Bank, we are introducing three charts that we will update each quarter as we discuss our performance. Together, these metrics provide a view of our progress in restructuring our business model and our balance sheet.

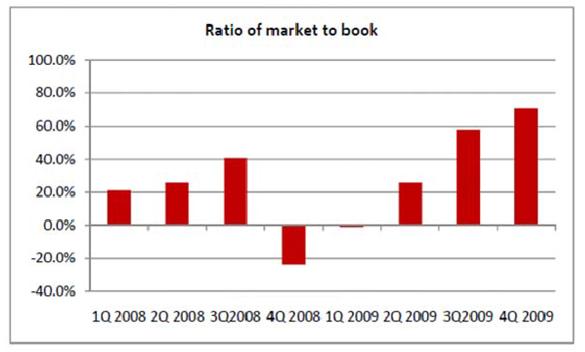

Ratio of Market Value to Book Value

In our dialogue with you over the past two years, we have regularly discussed the impact of the decision to purchase material quantities of MPF assets and the negative effect of our prior hedging and funding practices on net interest income. We have also discussed the ratio of market value of equity to book value of the Bank as our interest-rate-sensitive assets have been impacted by changes in spreads, particularly mortgage spreads. While the Bank’s stock is valued at par and not traded, the market/book ratio does provide insight into the make-up of our balance sheet and the impact of interest rate movements.

Our market value has experienced substantial volatility during the past two years in large part due to changes in mortgage spreads. As indicated previously, during 2009 the market value was also positively impacted by the asset replacement program. It is anticipated that further improvements will occur as mortgages pay down and high-cost debt associated with the acquisition of those mortgages matures or expires. It is important to note that 2009 was a year of extraordinary volatility and a similar improvement in market value during 2010 is unlikely. In fact, it is possible that some deterioration may occur as government programs supporting the mortgage business are withdrawn.

7

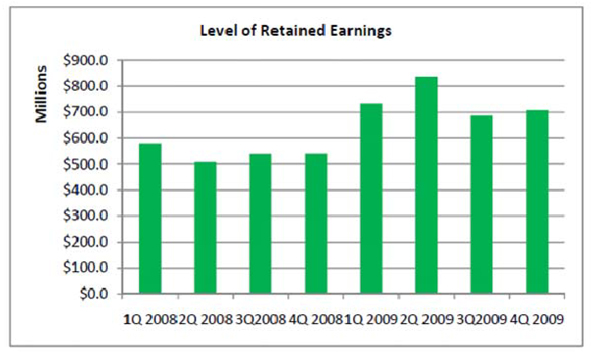

Retained earnings

The Bank is targeting restoring liquidity to our stock through a recovery of market value relative to book value and through the growth of retained earnings. While writedowns in OTTI during 2009 negatively impacted retained earnings, our focus is to grow retained earnings as OTTI writedowns subside and earnings recover.

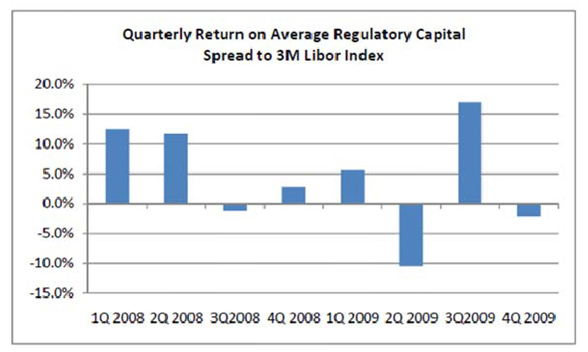

Return on Average Regulatory Capital

We will regularly highlight changes in the spread of our average return on regulatory capital (which excludes the Bank’s subordinated notes) relative to 3 month Libor. As you can see, there continues to be substantial variability in this measure, largely as a result of highly fluctuating hedging costs and continued credit losses due to OTTI.

8