Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

Commission File Number 001-10109

BECKMAN COULTER, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 95-104-0600 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 250 S. Kraemer Boulevard, Brea, California |

92821 | |

| (Address of principal executive offices) | (Zip Code) | |

(714) 993-5321

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.10 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

Aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2009: $3,642,689,456

69,867,500 shares of the registrant’s Common Stock, $0.10 par value were outstanding as of February 5, 2010

DOCUMENTS INCORPORATED BY REFERENCE

Certain information contained in the Proxy Statement for the Annual Meeting of Stockholders of the registrant to be held on April 22, 2010 is incorporated by reference into Part III hereof.

Table of Contents

| Page number | ||||

| Part I | ||||

| Item 1. |

3 | |||

| Item 1A. |

16 | |||

| Item 1B. |

20 | |||

| Item 2. |

20 | |||

| Item 3. |

21 | |||

| Item 4. |

21 | |||

| Part II | ||||

| Item 5. |

22 | |||

| Item 6. |

24 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

25 | ||

| Item 7A. |

45 | |||

| Item 8. |

47 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

96 | ||

| Item 9A. |

96 | |||

| Item 9B. |

96 | |||

| Part III | ||||

| Item 10. |

98 | |||

| Item 11. |

98 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

98 | ||

| Item 13. |

Certain Relationships and Related Transactions and Director Independence |

98 | ||

| Item 14. |

98 | |||

| Part IV | ||||

| Item 15. |

98 |

| 2 | BEC 2009 FORM 10-K |

Table of Contents

This Annual Report on Form 10-K (“Form 10-K”) contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Many of the forward-looking statements are located in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section below. You can identify the forward-looking statements by words such as “may,” “will,” “might,” “expect,” “believe,” “anticipate,” “could,” “would,” “estimate,” “continue,” “pursue,” “plans,” “should,” “likely,” “might,” or the negative thereof or comparable terminology. The forward-looking statements may include information regarding our expectations, goals or intentions regarding the future. Forward-looking statements reflect our current views with respect to future events and involve certain risks and uncertainties. Our actual results may differ materially from those expressed or implied in our forward-looking statements. Factors that could cause results to differ include those discussed in the section below entitled “Risk Factors” under Part I, Item 1A of this Form 10-K. All forward-looking statements in this Form 10-K are made as of the date of this filing and we assume no obligation to update any forward-looking statement, except as required by law.

| Item 1. | Business. |

Company Profile

From complex DNA sequencing in pioneering research laboratories and high-volume laboratory testing in hospitals to simple single-use diagnostic screening kits used in physicians’ offices, Beckman Coulter is the world’s largest company devoted solely to biomedical testing. We estimate this market had about $40.8 billion in worldwide sales in 2009. Tracing our origins to 1935, we are a leading manufacturer and marketer of biomedical testing instrument systems, tests and supplies that simplify, automate and innovate complex laboratory processes. Our inspiration is to improve patient health and reduce the cost of care with products that fall into two basic categories:

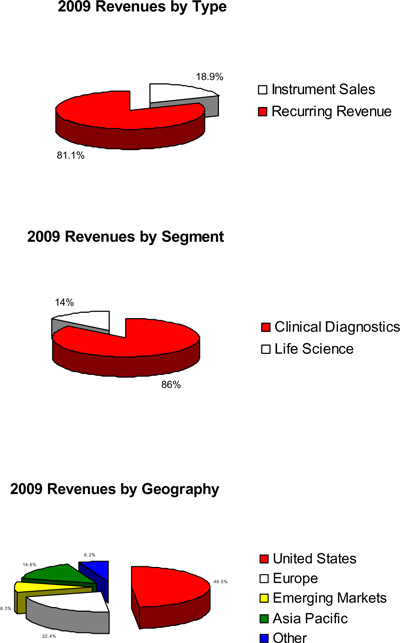

| • | Clinical Diagnostics, which represent over 85% of our total revenues, produce information physicians use to diagnose disease, make treatment decisions and monitor patients in hospitals and other critical care settings around the world. We estimate that 65% of health care decisions are based on critical diagnostic information produced by laboratory-based testing. Our clinical diagnostic customers include hospitals, physician’s offices and reference laboratories. Central laboratories of mid- to large-size hospitals represent our most significant customer group. |

| • | Life Science research instruments and tools, which generate less than 15% of total revenues, are used by scientists to study complex biological problems including the causes of disease, identifying new therapies and testing new drugs. Our Life Science customers include pharmaceutical and biotechnology companies, universities, medical schools and research institutions. |

Our revenue is about evenly distributed inside and outside of the United States. In 2009, about 81% of our total revenue was generated from recurring revenue consisting of consumable supplies (including reagent test kits), service and operating-type lease payments.

Incorporated in Delaware in 1988, we have approximately 11,800 employees in 136 facilities on six continents, all dedicated to improving patient health and reducing the cost of care in more than 160 countries in which our products are sold.

| BEC 2009 FORM 10-K | 3 |

Table of Contents

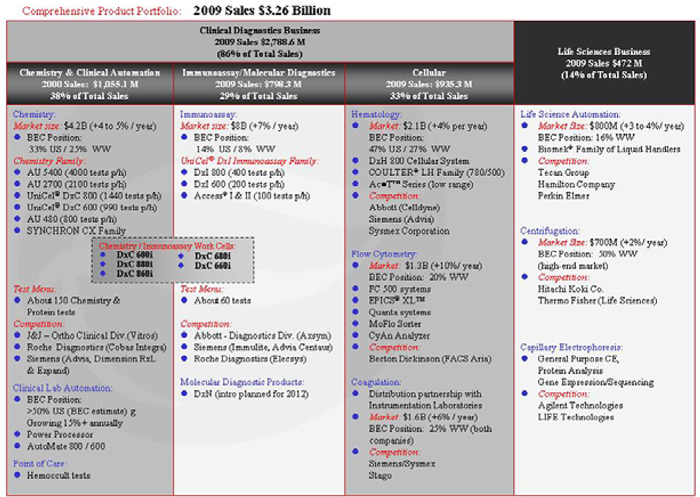

| • | This Comprehensive Product Portfolio chart is a representative listing of our products and our competitors’ products. Not all products are included in the chart. |

| • | Market estimates and share amounts are approximate and are based on external surveys and internal estimates. For additional information regarding our business segments and geographic information see Note 18 “Business Segment Information” of the Notes to Consolidated Financial Statements in Item 8 of this Form 10-K. |

Company History

Beckman and Coulter combine two of the best known brand names in laboratories. We adopted our current name in April 1998, changing from Beckman Instruments, Inc. to Beckman Coulter, Inc. (the “Company”), to reflect the October 1997 acquisition of Coulter Corporation.

Beckman Instruments, Inc., founded by Dr. Arnold O. Beckman in 1935, entered the laboratory market with the world’s first pH meter, an electronic instrument used to measure pH (acidity or alkalinity). The company became a publicly traded corporation in 1952. In 1968, Beckman Instruments, Inc. expanded its laboratory instrument focus to include healthcare applications in clinical diagnostics. We were acquired by SmithKline Corporation to form SmithKline Beckman Corporation in 1982, operating as a subsidiary of SmithKline Beckman until 1989, when we once again became a publicly owned company.

Coulter Corporation was founded by Wallace and Joseph Coulter in 1958 as a private company, remaining under the control of the Coulter family until acquired by Beckman Instruments, Inc. in 1997. Coulter invented the “Coulter Principle” in 1948 to automatically count and characterize particles and reduced it to practice for the medical field in an instrument used to determine the distribution of red and white cells in blood. This proved to be the foundation of automated hematology.

Company Strengths

We believe the Beckman and Coulter names have become two of the most valuable brand names in biomedical testing for a number of reasons:

| • | Our installed base of more than 200,000 systems operating in laboratories in more than 160 countries |

| • | Our breadth of product offering and “building block” designs provide laboratories with broad-based testing capability that is highly configurable and flexible |

| • | Our world class menu of more than 600 clinical diagnostics tests, capable of meeting nearly 100% of hospital-based routine laboratory testing needs |

| 4 | BEC 2009 FORM 10-K |

Table of Contents

| • | Our development capabilities across chemical, biological, hardware and software disciplines enable a prolific flow of new systems to meet customer requirements for simplifying, automating and innovating laboratory testing |

| • | Our first mover approach has enabled us to be the first to provide islands of automation, the first to develop an integrated centrifuge and the first with refrigerated post-analytical storage. With the leading market share in the United States, we are the recognized leader in total laboratory automation. |

Major trends support increased worldwide demand for our products including an aging population, the explosion in biological understanding, growth of outreach testing and the ever-present focus on increased efficiency and lower costs.

Strategic Initiatives

Our core strategy is to simplify, automate and innovate biomedical testing processes. Our strategic initiatives for 2010 continue our focus on growth, quality and operating excellence:

| • | We are integrating our recent acquisition of the diagnostics systems portion of Olympus Corporation’s business or Olympus. In 2009 we completed the Olympus acquisition to extend our Clinical Diagnostics chemistry and automation product offering and enhance our geographic reach and scale. We expect to substantially complete the Olympus integration by mid-2010 and to realize additional synergies as the integration progresses. |

| • | We are working to expand our test menu, particularly in our immunoassay and molecular diagnostics products and believe our focus on certain disease states will enable us to deliver enhanced testing capability to our customers, which will ultimately improve patient health and reduce the cost of care. |

| • | We are building on our industry-leading ability to help customers simplify, automate and innovate their processes. Our unparalleled knowledge of customers’ laboratory processes supports our expansion of automation and work cells, growing our installed base of instruments. |

| • | From a geographic perspective, we are increasing resources in developing markets, including China, which we believe will improve our opportunities for long-term growth. |

| • | We intend to continue to reduce product, service and operating costs by streamlining our supply chain operations and expanding our use of “Lean Six Sigma” tools to other business processes throughout the company. |

| • | We have announced that we plan to design and build an automated, fully integrated molecular diagnostic sample to result system to enable moderately complex testing in clinical diagnostic laboratories. Product development costs for the project are anticipated to be about $30 million per year at least through 2012, excluding any test menu licensing fees. |

As part of our strategic initiatives, we expect to incur charges as we integrate Olympus, realign our manufacturing and distribution footprint and implement initiatives to improve productivity and reduce operating costs in the future.

Customers and Markets

We provide the critical laboratory tools that enable our customers to:

| • | Conduct basic research into the fundamental processes of human biology |

| • | Develop vaccines and drugs to treat disease |

| • | Conduct clinical trials and related research activities |

| • | Perform tests ranging from simple patient blood analysis to complex diagnostics |

Our customers are the hospitals, laboratories, research centers and physician’s offices that are continuously searching for processes and systems to help them perform these types of tests faster, more efficiently and at a lower cost. To meet these needs, we seek to leverage our investment in research and development (“R&D”) and to use our core competencies in systems integration, applications, distribution and service to create systems that meet customer requirements.

Since mid-2005, most of our instruments have been provided to customers under cash sales or operating type lease or OTL arrangements, rather than the sales-type lease or STL arrangements that we previously utilized. We provide OTLs under bundled lease arrangements, in which our customers pay a monthly amount for the instruments, supplies, test kits and service. Our lease arrangements primarily take the form of what are known as “reagent rentals” where an instrument is placed at a customer location and the customer commits to purchase a minimum volume of reagents annually. We also enter into “metered” contracts with customers where the instrument is placed at a customer location with a stock of reagents and the customer is billed monthly based on actual reagent usage.

| BEC 2009 FORM 10-K | 5 |

Table of Contents

As indicated in the above Comprehensive Product Portfolio chart, Beckman Coulter targets two principal markets: Clinical Diagnostics and Life Science.

Clinical Diagnostics

Our Clinical Diagnostics business includes:

| • | Beckman Coulter 2009 Revenues — $2,788.6 million |

| • | Estimated World Market — $41 billion |

| • | Top Five Competitors’ Share — over 60% |

| • | Estimated Long Term Market Growth Rate — 4 to 5% in constant currency |

| • | Typical Customers — hospitals, clinics, physicians’ offices and reference laboratories |

| • | Beckman Coulter Products — UniCel DxC and AU Chemistry Family, UniCel DxI Immunoassay Family, Hematology and Flow Cytometry Family, Hemostasis Products and Test Panels |

| • | Principal Competitors — Abbott Laboratories (Diagnostics Division), Johnson & Johnson (Ortho Clinical Diagnostics), Roche Diagnostics, Siemens Medical Diagnostics Solutions, Becton Dickinson and Company (BD Bioscience Immunocytometry Systems) and Sysmex Corporation |

Clinical diagnostics products are used to evaluate and analyze samples made up of body fluids, cells and other substances from patients or “in vitro” diagnostic or IVD testing. More than 20 billion tests are conducted each year worldwide, with over 82% of the tests routine tests. The information generated is used to diagnose disease, monitor and guide treatment and therapy, assist in managing chronic disease and assess patient status during hospital admission and discharge. This type of diagnostic testing is increasingly valued as an effective method of reducing health care costs through accurate, early detection of health disorders and enhanced management of treatment, potentially reducing the length of expensive hospital stays and improving patient outcomes. Due to their important role in the diagnosis and treatment of patients, these tests are an integral part of the overall care of patients. In general, clinical diagnostic testing influences over 60% of critical health care decisions, while representing less than 3% of overall health care costs.

The major fields that comprise the clinical diagnostics testing industry are clinical chemistry, immunoassay, microbiology, hematology and cellular, with molecular diagnostics a new and expanding part of the clinical diagnostics testing market. We have significant market positions in the three largest fields: clinical chemistry (33% United States; 25% worldwide), immunoassay (14% United States; 8% worldwide) and hematology (47% United States; 27% worldwide).

Today’s clinical laboratories face unique and significant challenges. Newer diagnostic tests demand greater and greater sensitivity and can be complex and time consuming to perform. At the same time, the laboratory must consistently and rapidly provide high quality results, often 24 hours per day, in a regulated environment that is faced with a shortage of skilled labor. We are the leading provider of progressive automation solutions to help laboratories reduce testing turnaround time, reduce the staff required, enhance the quality of testing and reduce overall health care costs.

Life Science

Our Life Science business includes:

| • | Beckman Coulter 2009 Revenues — $472 million |

| • | Estimated World Market — $36 billion |

| • | Estimated Long Term Market Growth Rate — 3 to 4% in constant currency |

| • | Typical Customers — Research laboratories in universities and medical schools, research institutes, government laboratories, and biotechnology and pharmaceutical companies |

| • | Beckman Coulter Products — Centrifuges, automated liquid handling systems and capillary electrophoresis systems |

| • | Principal Competitors — Agilent Technologies (Chemical Analysis Group), LIFE (ABI), Hamilton, Perkin Elmer Inc., Tecan Group, Ltd., Hitachi Koki Co., Ltd. and Thermo Fisher (Life Science). |

Life science research is the study of the characteristics, behavior and structure of living organisms and their component systems. The life science testing market is evolving rapidly as a result of advances in genomics, proteomics and cell based testing. With the rough map of the human genome complete, the work that will more directly affect patient care has begun, as researchers start to incorporate this information into specific studies to improve therapeutic efficacy. Our life science testing products play a role in helping researchers understand disease by simplifying and automating key testing processes.

| 6 | BEC 2009 FORM 10-K |

Table of Contents

Growth in the life science testing market is driven by funding for government and academic research, pharmaceutical R&D spending and biotechnology investment. Universities and medical research laboratories represent about half of the life science testing market. These customers perform basic medical research to further understand the basis of disease and clinical research, where human samples are used to characterize disease states. Biotechnology firms and pharmaceutical companies represent the other half of the life science testing market. They rely on our instrument systems to speed the long and detailed drug discovery process. Also, once new therapeutics and vaccines emerge from the research phase, they move into clinical trials to evaluate their effectiveness, where our products are used to monitor clinical trials.

Business Segments

We operate our business on the basis of two reportable segments: Clinical Diagnostics and Life Science. Segment revenue and profit information is presented in Note 18 “Business Segment Information” of the Notes to Consolidated Financial Statements in Item 8 of this Form 10-K. Within our Clinical Diagnostics segment, we have identified three product areas, each focused on a core product strategy: chemistry and clinical automation, immunoassay and molecular diagnostics and cellular analysis. The majority of Olympus revenue is classified as part of our Clinical Diagnostics business segment.

Approximately 81% of our revenue and 93% of our gross profit are derived from recurring revenue, comprised of consumable supplies (including reagent test kits), services and operating-type lease payments for our leased instruments. The remaining balance of our revenue is derived from “instrument sales.” Our products and services include:

| • | Instruments, which typically have a five to seven year life in their initial placement on an operating-type lease. |

| • | Supplies such as sample containers, adapters and pipette tips and other items used during test procedures |

| • | Test kits, which include chemistries consisting of reagents that react with samples to produce measurable, objective results, as well as calibrators and quality control materials |

| • | Services provided by scientists and technical specialists in each product line and major scientific discipline served by our products. These individuals provide the level of after-sales service and technical support critical to customer satisfaction, including immediate technical support by telephone, delivery of parts and servicing instruments on site |

| • | Data management tools that consolidate patient test information from multiple instruments in the lab enhancing the laboratory information system and delivering laboratory management information from a single workstation |

Consumable supplies (including reagent test kits), service and operating-type lease payments generate significant ongoing revenue, which continues throughout the life of an instrument. We also sell instruments under normal credit terms.

Product Areas

Clinical Diagnostics

Chemistry and Clinical Automation. Routine chemistry systems use electrochemical detection and chemical reactions with patient samples to detect and quantify substances of diagnostic interest (referred to as “analytes”) in blood, urine and other body fluids. Commonly performed tests include glucose, cholesterol, triglycerides, electrolytes, proteins and enzymes. We offer tests for more than 100 individual analytes, which account for the vast majority of hospital-based clinical chemistry testing. To save time and reduce the opportunity for errors, systems identify patient samples through barcodes. Automated clinical chemistry systems are designed to be highly reliable and available on short notice, 24 hours a day. We offer systems and workflow solutions for a broad range of customers from small hospitals to the largest reference laboratories.

We acquired the diagnostics systems business from Olympus Corporation on August 3, 2009 through a cash payment of approximately $800 million. The Olympus acquisition expands our reach in the high-throughput and low-volume segments of the clinical diagnostics industry. The Olympus products include a broad offering of reliable chemistry systems, complemented by robust and efficient pre-analytical automation systems. Customers should benefit from the expanded range of products, particularly those large hospital and university laboratories where higher throughput systems are preferred.

Chemistry Systems. Our primary autochemistry clinical chemistry systems are:

| • | AU5400, our maximum throughput analyzer with the capacity to hold up to 96 different reagents on board |

| • | AU2700, designed for high to very high volume labs with the capacity to hold up to 96 different reagents on board |

| BEC 2009 FORM 10-K | 7 |

Table of Contents

| • | UniCel DxC 800, designed for high volume laboratories with the capacity to hold up to 70 different reagents on board |

| • | UniCel DxC 600, designed for labs with moderate volume with the capacity to hold up to 65 different reagents on board |

| • | AU680, designed for labs with moderate volume with the capacity to hold up to 63 different reagents on board |

| • | AU480, designed for small to medium sized laboratories with the capacity to hold about 60 different reagents on board |

Both the UniCel DxC 600 and 800 systems are capable of performing closed tube sampling, which allows the operator to use the tubes that samples are collected in to perform assays. This capability eliminates the tedious and time consuming de-capping and recapping steps while reducing operator exposure to biohazards and repetitive motion injuries. These systems also offer minimal maintenance, fast start up and superior STAT testing capability. The AU5400, AU2700 and AU480 systems, acquired in the Olympus transaction are amongst the highest throughput and most reliable analyzers on the market today.

Clinical Lab Automation. In recent years, automation has become an increasingly important element in the efficient operation of clinical laboratories as a result of a worsening shortage of skilled laboratory personnel and an increasing focus on cost savings. We address these needs through our Power Processor, AutoMate 600/800 and AutoMate 1200/2500 systems. Our Power Processor and AutoMate systems allow the laboratory to automate a number of pre-analytical steps, including sample log-in and sorting through bar code technology, centrifugation, aliquoting and cap removal. These systems also sort the prepared samples into discrete racks for further processing on our clinical chemistry, immunoassay and hematology systems. The post-analytical capability includes resorting for additional testing on other platforms or to a storage position. The Power Processor can be integrated with modules, track systems and analyzers to create comprehensive laboratory automation that handles virtually all of the laboratory’s preanalytical and post analytical processes. The Automate 1200/2500 systems that we acquired from Olympus automate the pre- and post-analytical sample handling steps in very to ultra-high volume laboratories. Our strength in total lab automation should be complemented by Olympus’ worldwide leadership position in pre-analytical automation.

Point of Care Testing. Point of care testing products are used in physicians’ office laboratories, clinics, hospitals and other medical settings. These products include a range of rapid diagnostic test kits and hematology instruments that give physicians immediate information to help them manage patients. The Hemoccult and Hemoccult SENSA tests are the industry standard in fecal occult blood testing and are used as aids in screening for gastrointestinal disease and colorectal cancer.

Immunohematology. Our immunohematology products were acquired in the Olympus acquisition. The products include the PK 7200 and PK 7300 fully automated analyzers, blood grouping reagents and CMV and Syphilis screening assays. These products are sold to blood donor testing centers worldwide. The PK 7300 analyzer includes features that enable customers to comply with donor testing regulations around the globe. The PK systems are the highest throughput and among the most reliable products in the donor testing market. More than 90% of donor blood units collected worldwide are tested on a PK system.

Immunoassay and Molecular Diagnostics. Immunoassay systems also detect and quantify chemical substances of diagnostic interest in blood, urine or other body fluids. These systems, however, use antibodies as the central components in their analytical reactions and have the ability to detect and quantify very low analyte concentrations. Commonly performed tests assess thyroid function, screen and monitor for cancer and cardiac risk and provide important information in fertility and reproductive testing. Other tests are used to monitor critical factors associated with anemia, blood viruses and infectious disease.

We offer over 60 immunoassay test kits. Our most significant products are the Access family of immunoassay systems. The Access family includes:

| • | Access Classic and Access 2, targeted to lower volume immunoassay testing environments |

| • | UniCel DxI 600 Access Immunoassay System, introduced in 2007. The UniCel DxI 600 system is used primarily in mid-volume laboratories, making it possible for mid-sized hospitals to perform lower-volume assays in-house, reducing outsourcing costs and improving laboratory efficiency. |

| 8 | BEC 2009 FORM 10-K |

Table of Contents

| • | UniCel DxI 800 Access Immunoassay System, the highest throughput immunoassay system available in the industry today, is used primarily in large hospital and reference laboratories. We believe these laboratories make up approximately 40% of the immunodiagnostic testing market worldwide. |

In addition, we offer a comprehensive menu of more than 60 assays, targeted to a broad range of disease states, from cancer (PSA, fPSA)) to reproductive testing (Inhibin A). Most of the systems use identical reagents, which can facilitate improved work flow and flexibility and can simplify inventory management for the laboratory.

Molecular Diagnostics Products. Molecular diagnostics is an emerging and promising field that includes testing for infectious diseases, genetic diseases and disorders, human cancers and pharmacogenics. As knowledge of the genome and its functioning continues to expand, new applications are being developed and, in some cases, are being used today as diagnostic tools as well as in genetic disease susceptibility testing. We are developing a sample-to-result system for molecular diagnostics, the UniCel DxN, which we believe will meet the needs of routine, moderately complex clinical laboratories for an automated, fully integrated molecular diagnostics test system. We expect to commercialize the UniCel DxN in the next few years.

In 2008, we licensed certain rights to testing for the hepatitis C virus (HCV) from Siemens Healthcare Diagnostics. Under the agreement, Beckman Coulter can develop, manufacture and sell a quantitative viral load HCV blood test for use on our DxN system under development. HCV viral load testing is essential for managing patients affected by the hepatitis C virus and is used to monitor therapy for the duration of the infection. An estimated 170 million people are chronically infected with the hepatitis virus and an additional three to four million people are newly infected each year- making HCV viral load testing one of the most commonly ordered infectious disease tests in molecular diagnostics.

Our wholly owned subsidiary, Beckman Coulter Genomics, Inc., is a leading provider of nucleic acid purification products in the biomedical research market. Its patented Solid Phase Reversible Immobilization (SPRI) technology provides state-of-the-art results for the isolation and purification of RNA and DNA. This technology is integrated with our automated liquid handling systems to provide customers with an automated solution for nucleic acid purification. We are incorporating the SPRI technology into other product lines to further expand the overall use of this technology. Recently, we launched the SPRI-TE Nucleic Acid Extractor for simple, automated purification of DNA and RNA.

Chemistry/Immunoassay Work Cells. Work cells, the integration of chemistry and immunoassay, is one of the fastest growing areas in the clinical diagnostics laboratory. We believe we offer some of the most capable work cells in the industry, from the mid-volume UniCel DxC 600i to the high-volume DxC 880i. At the end of 2008 three additional work cells were launched: UniCel DxC 860i, DxC 680i and the DxC 660i.

Beckman Coulter work cells offer our entire menu of more than 150 chemistry and immunoassay tests from a single point of sample entry. And they all feature our exclusive closed-tube sampling, which helps improve efficiency and reduce the potential for errors. Importantly, the entire fielded base of UniCel DxC 600 and 800 chemistry systems can be upgraded to work cells.

Cellular Analysis

Hematology. Our blood cell systems use principles of physics, optics, electronics and chemistry to separate cells of diagnostic interest and then quantify and characterize them. These systems allow clinicians to study formed elements in blood, such as red and white blood cells and platelets. The most common diagnostic test is a “CBC” or complete blood count, which provides information on from eight to 23 different blood cell parameters. Our hematology product line is structured to address the differing requirements of high, medium and low volume laboratories and includes:

| • | COULTER LH 750, 755, 780, and 1500 series of hematology systems. These systems offer features such as five-part white blood cell differential analysis, enumeration of nucleated red blood cells, random-access capability and automated slide making and staining from a single aspiration of blood. The LH 780 system offers enhanced quality control features that improve productivity and add additional parameters to support anemia studies. The LH 1500 series of hematology automation systems are designed to link multiple analyzers, to automate the pre-analytical process and to eliminate a number of post-analytical steps. |

| • | COULTER DxH 800, cleared by the FDA in late 2008, provides a differentiated modular and scalable system for cellular testing. The system’s algorithms and optics are expected to deliver enhanced value by reducing the number of manual reviews by pathologists using a microscope, when a sample is flagged as abnormal. The overall system design also allows for future integration of full flow cytometry capability, which should better meet customers’ cellular analysis needs, allowing for menu expansion within the hematology laboratory. |

| BEC 2009 FORM 10-K | 9 |

Table of Contents

| • | COULTER LH 500 Hematology Analyzer and other moderate volume hematology systems. These systems offer the technology features of larger systems in a compact bench top system. |

| • | COULTER Ac•T family of hematology systems and other low-volume hematology systems. The Ac•T series hematology analyzers are small, compact and relatively simple to use, making them well suited for low volume office labs and smaller laboratories. They also are suitable for use with pediatric specimens that are typically of small volume, as these systems require comparatively small sample volumes for analysis. |

Flow Cytometry. Flow cytometry is used in numerous applications in basic research, clinical research, drug discovery and clinical diagnostics testing. Flow cytometers rapidly identify, categorize and characterize multiple types of cells in suspension. Flow cytometers allow analysis of cell types including specific cell characteristics such as phenotype or functionally, thereby allowing researchers to analyze specific cell populations. This analysis can be performed beyond blood to include bone marrow, tumors and other cellular samples. Our line of flow cytometry systems includes:

| • | Gallios research analyzer, which is our new high performance analyzer used for a broad range of research applications |

| • | Navios clinical analyzer used in applications such as HIV monitoring and a variety of clinical research applications, such as leukemia and lymphoma testing |

| • | CyAn ADP analyzer, predominantly used in research, is known for its speed and is finding increased utility where speed of analysis can be a key requirement, such as high content and high throughput screening for drug discovery |

| • | MoFlo XDP cell sorter is a high performance, high speed cell sorter used to identify and individually select and sort cells of interest for further analysis, often at a functional or genetic level |

| • | Cytomics FC 500 series of flow cytometry systems and COULTER EPICS XL and XL-MCL flow cytometer series, which also are used in the clinical laboratory, predominantly for HIV monitoring and additionally in the case of the FC500 for CD34 enumeration |

Coagulation. Coagulation systems rely on clotting, chromogenic and immunologic technologies to provide the detailed information that the clinician requires to diagnose bleeding and clotting disorders and to monitor anticoagulant therapy. We offer a range of hemostasis systems and reagents as the North American distributor of the Instrumentation Laboratory ACL line of hemostasis systems and its Instrumentation Laboratory and Hemoliance brands of reagents. We believe these products give a laboratory access to the broadest automated hemostasis menu in the industry, from routine screening tests such as the activated partial thromboplastin time and prothrombin time to a wide range of esoteric tests.

Life Science

Life Science Automation. Our products are used in many parts of the drug discovery and development process as well as automated sample preparation for genomic and cellular analysis. Important applications for these automation products include sample preparation for high throughput genomic analysis such as genotyping. The analysis of massive amounts of genetic information requires automation of sample preparation to meet timing requirements. Our automation systems are used in the process of handling live cells in a high throughput mode as biologic drugs are a critical part of the drug development pipeline. Other drug development applications that require samples to be processed in an automated or high-throughput mode include target identification, secondary screening and pre-clinical testing.

Centrifugation. Centrifuges separate liquid samples based on the density of the components. Centrifugal samples are spun at up to 150,000 revolutions per minute to create forces that exceed 1,000,000 times that of gravity. These forces result in the nondestructive separation of proteins, DNA, viruses and other cellular components while retaining their biological activity. Our centrifuges are routinely used in cellular, genomic and proteomic research as well as in vaccine development and production because they enable very efficient sample separation processes.

Capillary Electrophoresis. This microscale technology provides the separation, quantitation and characterization of charged/polar molecules like ions, drugs, metabolites, proteins, glycoproteins and nucleic acids in a fast and efficient way, reducing analysis cost, sample consumption and time to answer. We have developed this core separation technology into analytical solutions for industrial, academic, medical and government laboratories. Our CE based solutions include:

| • | PA 800 Plus, Pharmaceutical Analysis Systems for characterization and quality control of therapeutic biologics using automated SDS-gel for purity analysis, isoelectric focusing for heterogeneity and identity determination and glycan analysis for in depth characterization |

| • | GeXP Genetic Analysis Systems that focus on gene expression, SNP detection, STR analysis and sequencing for pathogen identification, stem cell, cancer and industrial applications |

| 10 | BEC 2009 FORM 10-K |

Table of Contents

| • | P/ACE Series Platform focusing on ion, drug and metabolite analysis in industrial, forensic and medical research |

Competition

To compete effectively in our markets, a company must invest in R&D and establish the technical infrastructure needed to develop complex systems, integrating engineering, chemical, biological and computer sciences. In addition, an extensive distribution infrastructure with highly qualified personnel to perform sales, service, customer training and technical product support is needed in the market segment. Also, in some cases, authorization to market Clinical Diagnostics products must be obtained from regulatory authorities in the United States and other countries. We consider our reputation for service responsiveness and our sales and service network within our market segments to be important competitive assets.

Nevertheless, we encounter significant competition from many domestic and international manufacturers, with many of these companies participating in one or more parts of each of our market segments. Some of these competitors are divisions or subsidiaries of corporations with substantial resources. In addition, we compete with several companies that offer reagents, consumables and service for laboratory instruments that are manufactured by us and others.

Research and Development

We must continue to introduce new instrument and reagent technologies and remain at the forefront in helping customers advance medical science, improve patient outcomes and reduce healthcare costs to continue to grow, gain market share and remain competitive. To remain competitive our strategy is to acquire and defend intellectual property and invest in R&D. Otherwise, our current products could become technologically obsolete over time.

Our new products originate from four sources:

| • | Internal R&D programs |

| • | External collaborative efforts with individuals in academic institutions and technology companies |

| • | Devices or techniques generated in customers’ laboratories |

| • | Business and technology acquisitions |

Development programs focus on production of new generations of existing product lines as well as new product categories not currently offered. Areas of pursuit include innovative approaches to cell characterization, immunochemistry, molecular biology, advanced electrophoresis technologies and automated sample processing and information technologies. Our R&D teams are skilled in a variety of scientific, engineering and computer science disciplines, in addition to a broad range of biological and chemical sciences. Our R&D expenditures were $266.4 million in 2009 and $280.1 million in 2008. Our expenditures vary due primarily to charges incurred in certain periods to acquire licenses for products in development that have no alternative future use.

Sales and Service

We have sales in more than 160 countries. Most of our products are distributed by our own marketing, service and sales organizations in major markets. We also employ independent distributors to serve those markets that are more efficiently reached through such channels. Our sales representatives are technically educated and trained in the operation and application of our products. The sales force is supported by a staff of scientists and technical specialists in each product line and in each major scientific discipline served by our products. These individuals enable us to provide the level of immediate after-sales service and technical support that is critical to customer satisfaction. This includes capabilities to provide immediate technical support by phone and to deliver parts or have a service engineer on site within hours. To have such capabilities on a global basis requires a major investment in personnel, facilities and other resources. Our large installed base of instruments makes the required service and support infrastructure financially viable.

Patents and Trademarks

Patents and other proprietary rights are essential to our business. We rely on trademarks, copyrights, trade secrets, know-how and confidentiality agreements to develop, maintain and strengthen our competitive position. We own a number of patents and trademarks throughout the world and have also entered into license arrangements relating to various third-party patents and technologies.

Products manufactured by us are sold primarily under our own trademarks and trade names. Our primary trademark and trade name is “Beckman Coulter” alone or in association with our logo. We vigorously protect our primary trademark, which is used on or in association with our worldwide product offerings. We believe that the name “Beckman Coulter” is recognized throughout the worldwide scientific and diagnostic community as a premier source of biomedical instrumentation and products. We also own and use secondary trademarks with various products for product differentiation purposes. “Coulter” is used as a secondary mark and source identifier with some of our products.

| BEC 2009 FORM 10-K | 11 |

Table of Contents

We protect our products and technology through patents on a worldwide basis, balancing the cost of such protection against obtaining the greatest value. We currently maintain a worldwide patent portfolio of approximately 3,500 active patents and pending applications for patents, which includes approximately 693 active U.S. patents, 213 applications for U.S. patents, 1,357 active foreign patents and 1,237 applications for foreign patents. Our entire portfolio of patents and applications is distributed between our Clinical Diagnostics and Life Science products and the chemistries and kits used with them.

We also protect certain unpatented confidential and proprietary information important to our business as trade secrets. We maintain certain details about our processes, products and technology as trade secrets and generally require employees, consultants, parties to collaboration agreements and other business partners to enter into confidentiality agreements.

We recognize the need to promote the enforcement of our patents and trademarks and continue to take commercially reasonable steps to enforce our patents and trademarks around the world against potential infringers. We operate in an industry susceptible to significant patent litigation. At any given time, we generally are involved as both a plaintiff and defendant in a number of patent infringement and other intellectual-property related actions. Such litigation can result in significant royalty or other payments or result in injunctions that can prevent the sale of products.

Government Regulations

Our products and operations are subject to a number of federal, state, local and foreign laws and regulations. Virtually all of our Clinical Diagnostics products and some of our Life Science products are classified as “medical devices” under the United States Food, Drug and Cosmetic Act (the “FDCA”). The FDCA requires these products, when sold in the United States, to be safe and effective for their intended use and to comply with regulations administered by the United States Food & Drug Administration (“FDA”). These regulatory requirements include:

| • | Establishment Registration. We must register with the FDA each facility where regulated products are developed or manufactured. These facilities are periodically inspected by the FDA. |

| • | Marketing Authorization. We must obtain FDA authorization to begin marketing a regulated, non-exempted product in the United States. For most of our products, this authorization is obtained by submitting a pre-market notification, which simply provides data on the performance of the product to allow the FDA to determine substantial equivalence to a product already in commercial distribution in the United States. A small number of products must go through a formal pre-market approval process which includes the performance of clinical studies and may include review of the product by a formal scientific review panel. |

| • | Quality Systems. We are required to establish a quality system that includes procedures for ensuring regulated products are developed, manufactured and distributed in accordance with specified standards. We also must establish procedures for investigating and responding to customer complaints regarding the performance of regulated products. |

| • | Labeling. The labeling for the products must contain specified information. In some cases, the FDA must review and approve the labeling and any quality assurance protocols specified in the labeling. |

| • | Imports and Exports. The FDCA establishes requirements for importing and exporting products into and from the United States. In general, any limitations on importing and exporting products apply only to products that have not received marketing authorization. |

| • | Post-market Reporting. After regulated products have been distributed to customers, we must investigate and report to the FDA certain events involving the products. We also must notify the FDA when we conduct recalls or certain types of field corrective actions involving our products. |

The FDCA authorizes the FDA to bring legal action to enforce the act and to address violations. Legal remedies available to the FDA for violations of the act include criminal prosecution, seizure of violative products, injunctions against the distribution of the products and assessment of civil penalties. The FDA normally provides companies with an opportunity to correct alleged violations before taking legal action.

| 12 | BEC 2009 FORM 10-K |

Table of Contents

The European Union also has adopted requirements that affect our products. These requirements include establishing standards that address creating a certified quality system as well as a number of directives that address specific product areas. The most significant of these directives is the In Vitro Diagnostic Medical Device Directive (“IVDD”), which includes:

| • | Essential Requirements. The IVDD specifies “essential requirements” that all medical devices must meet. The requirements are similar to those adopted by the FDA relating to quality systems and product labeling. |

| • | Conformity Assessment. Unlike United States regulations, which require virtually all devices to undergo some level of premarket review by the FDA, the IVDD allows manufacturers to bring many devices to market using a process in which the manufacturer certifies that the device conforms to the essential requirements for that device. A small number of products must go through a more formal pre-market review process. |

| • | Vigilance. The IVDD also specifies requirements for post market reporting similar to those adopted by the FDA. |

Our major manufacturing operations and development centers and many of our international sales and service subsidiaries have been certified as complying with the European Union’s quality system requirements. We also have programs in place that address the various aspects of the IVDD.

A number of other countries, including Australia, Brazil, Canada, China and Japan, have adopted or are in the process of adopting standards for medical devices sold in those countries. Many of these standards are loosely patterned after those adopted by the European Union, but with elements unique to each country. We routinely monitor these developments and address compliance with the various country requirements as new standards are adopted.

United States and foreign regulations governing reimbursement for diagnostic laboratory testing services may directly or indirectly affect our products’ design and potential market. In many cases, the acceptance of new technologies in the marketplace is directly related to the availability of reimbursement. Health care reform efforts in the United States and other countries also may further alter the methods and financial aspects of doing business in the health care field. We closely follow these developments, so we may position ourselves to respond to them.

Environmental

We are subject to federal, state and local environmental laws and regulations both in the United States and other countries. Although we continue to make expenditures to comply with environmental laws and regulations, we do not anticipate that these expenditures will have a material impact on our operations or financial position. We believe our operations comply in all material respects with applicable federal, state and local environmental laws and regulations.

Although few of our products are directly regulated by environmental laws, they may be impacted by environmental laws that have broad general scope. For example, a growing number of jurisdictions have adopted laws banning the use of certain chemicals and materials in electronic components as well as requiring those components to be recycled rather than discarded. Similarly, a number of customers are located in areas that either ban outright or limit the use of products that contain chemicals, such as mercury, lead and other heavy metals, cyanides and certain organic compounds. In some cases, manufacturers of chemicals that we use as raw materials have withdrawn those materials from the market due to perceived environmental issues. We have adopted a number of programs to address these various requirements and, in a few cases, have been required to redesign products to address them.

We began conducting environmental studies at our Fullerton site in 2008 in connection with our previously announced Orange County consolidation project and closure of our Fullerton, California site. The data generated by these studies suggests that soils under and around several of the buildings contain chemicals previously used in operations at the facility. Some of these chemicals also have been found in groundwater underlying the site. Studies to determine the source and extent of these chemicals are underway. We notified the California State Department of Toxic Substances Control of the presence of these chemicals at the site and expect the agency to oversee determination of any remediation requirements. We recorded a liability of $19.0 million representing our best estimate of the future expenditures for investigation and remediation at the site. The ultimate costs incurred could range from $10.0 million to $30.0 million. Our estimates are based upon the results of our investigation to date and comparison to our prior experience with environmental remediation at another site. Additional activities not contemplated at this time could be required and that the actual costs could differ materially from the amount we have recorded as a liability or our estimated range. Through December 31, 2009 we have spent $1.4 million.

We also remain subject to costs of remediating sites where we formerly conducted operations or where we disposed of wastes. For most of these sites, we are one of a large number of parties required to contribute toward remediation of the site. To address these contingent environmental costs we establish accruals when the costs are probable and can be reasonably estimated. We believe that, based on current information and regulatory requirements, the accruals established for environmental expenditures are adequate. Based on current knowledge, to the extent that additional costs may be incurred that exceed the accruals, the amounts are not expected to have a material adverse effect on our operations, financial condition or liquidity, although no assurance can be given in this regard.

| BEC 2009 FORM 10-K | 13 |

Table of Contents

Executive Officers of the Registrant

Following are our executive officers as of February 9, 2010:

Scott Garrett, 60, Chairman of the Board, President and Chief Executive Officer

Mr. Garrett serves as Beckman Coulter’s Chairman of the Board, President, Chief Executive Officer. He was named Chairman of the Board in April 2008, Chief Executive Officer effective February 2005 and served as President and Chief Operating Officer since December 2003. He joined Beckman Coulter in 2002 as President, Clinical Diagnostics. Prior to joining Beckman Coulter, he served as chief executive officer of Garrett Capital Advisors, L.L.C., a private equity firm focused on medical device companies, and as chief executive officer for Kendro Laboratory Products, L.P., a life science company. Mr. Garrett also spent over 20 years of his career with Baxter International/American Hospital Supply Corporation and a Baxter spin-off company. He began his career with Baxter in product development. Through a series of promotions Mr. Garrett became Group Vice President of Baxter and President of the Diagnostics subsidiary. Baxter’s Diagnostics subsidiary subsequently became Dade International and then Dade Behring, Inc., where Mr. Garrett served as Chairman and Chief Executive Officer. Mr. Garrett has been a director of Beckman Coulter since January 2005.

Scott Atkin, 46, Executive Vice President, Chemistry, Discovery and Instrument Systems Development

Mr. Atkin was named Executive Vice President, Chemistry, Discovery and Instrument Systems Development in January 2010. Prior to this, he was Group Vice President, Chemistry, Discovery and Automation Business Group and Instrument Systems Development Center, effective January 2007. Mr. Atkin joined Beckman Coulter in 1996 as a Director with product development and business leadership responsibilities. Previously, Mr. Atkin was President, Chief Executive Officer and a principal founder of SAGIAN, Inc., a company involved with data acquisition and laboratory robotics, which Beckman Coulter acquired in 1996.

Carolyn D. Beaver, 52, Corporate Vice President, Controller and Chief Accounting Officer

Ms. Beaver was named Corporate Vice President and Controller of Beckman Coulter, Inc. effective August 2005 and was named Chief Accounting Officer effective October 2005. She served as interim Chief Financial Officer from July 2006 through October 2006. Ms. Beaver is a director of Commerce National Bank, Newport Beach, California, chair of its audit committee and a member of its asset/liability committee. She is a member of the finance committee of Hoag Memorial Hospital Presbyterian, Newport Beach, California. Ms. Beaver was an audit partner with KPMG LLP from 1987 through April 2002 and is a certified public accountant.

Cynthia Collins, 51, Group Vice President, Cellular Analysis

Ms. Collins was named Group Vice President, Cellular Analysis effective May 2007. Ms. Collins joined Beckman Coulter from Sequoia Pharmaceuticals, Inc., where she most recently served as Chief Executive Officer. Prior to joining Sequoia Pharmaceuticals, Ms. Collins served as President of Clinical Micro Sensors, Inc., a wholly owned subsidiary of Motorola where she directed the development and commercialization of molecular diagnostic microarray products. Before Motorola, she spent over 17 years at Baxter Healthcare in a variety of executive roles, including President of Global Oncology and Vice President of Strategy and Portfolio Management of BioScience, in addition to six years with Abbott Laboratories in a series of operational assignments. Ms. Collins also serves on the Corporate Strategic Advisory Council with the University of Miami, Miller School of Medicine.

| 14 | BEC 2009 FORM 10-K |

Table of Contents

Richard S. Creager, Ph.D., 57, Group Vice President, Immunoassay and Molecular Diagnostics

Dr. Creager was named Group Vice President, Immunoassay and Molecular Diagnostics in December 2009 after serving as Group Vice President, High Sensitivity Testing since September 2008. Prior to this, he held a variety of management positions with the Company: Corporate Vice President, Immunoassay Business Center from September 2007 to 2008; Vice President, Immunoassay Product and Business Development from 2003 to 2007; Vice President and Director Chemistry Reagent Development Clinical Diagnostics Division from 2002 to 2003; Director Immunoassay Research and Development and Chaska Site Manager from 1998 to 2002; and Director Immunoassay Research and Development and Manufacturing Operations from 1997 to 1998.

Paul Glyer, 53, Senior Vice President, Strategy, Business Development and Communications

Mr. Glyer was named Senior Vice President, Strategy, Business Development and Communications in February 2006. He previously served as Vice President Corporate Development since July 2005 and Vice President and Treasurer since February 2003. Prior positions were Vice President-Director, Financial Planning since November 1999 and Vice President-Director, Finance for Diagnostics Development and Corporate Manufacturing since February 1999 and Assistant Treasurer and then Treasurer from 1989 to 1999. Mr. Glyer joined Beckman Coulter, Inc. in 1989.

J. Robert Hurley, 60, Senior Vice President, Human Resources and Chairman, Beckman Coulter, Japan

Mr. Hurley was named Senior Vice President, Human Resources effective July 2005 and Chairman, Beckman Coulter, Japan in August 2009. He joined Beckman Coulter in May 2005 as Vice President, Human Resources. Before Beckman Coulter, Mr. Hurley was a Corporate Vice President at Baxter International Inc.

Robert W. Kleinert, 58, Executive Vice President, Worldwide Commercial Operations

Mr. Kleinert was named Executive Vice President, Worldwide Commercial Operations in January 2007. He served as Executive Vice President, North America Commercial Operations since May 2006. He joined Beckman Coulter in 2003 as Vice President, Clinical Diagnostics Commercial Operations, Americas. Prior to Beckman Coulter, Mr. Kleinert served as President and Chief Executive Officer of Lifestream International, Inc.

Pamela A. Miller, 55, Senior Vice President, Supply Chain Management

Ms. Miller was named Senior Vice President, Supply Chain Management of Beckman Coulter, Inc., effective June 2006. From 1997 to 2006, she held the following management positions with the Company: Vice President, Immunoassay Supply Chain Management from 2004 to 2006; Director Worldwide Reagent Production from 2003 to 2004; and Director Immunoassay Manufacturing from 1997 to 2003. Ms. Miller currently sits on the Board of Directors for the Orange County Chapter of the American Red Cross.

Clair K. O’Donovan, Ph.D., 53, Senior Vice President, Quality and Regulatory Affairs

Dr. O’Donovan was named Senior Vice President, Quality and Regulatory in October 2009. Prior to this, she held a variety of management positions with the Company as Vice President, Supply Chain for Chemistry Systems from 2006 to 2009; Director of Reagent Manufacturing for Carlsbad, California and Galway, Ireland from 2004 to 2006; Director of Worldwide Technical Operations from 2003 to 2004; Director of Reagent Manufacturing for Miami, Florida from 2001 to 2003; and Plant Manager Galway Ireland from 1997 to 2001.

Arnold A. Pinkston, 51, Senior Vice President, General Counsel and Secretary

Mr. Pinkston was named Senior Vice President and General Counsel effective November 2005 and Secretary effective December 2005. Prior to joining Beckman Coulter, Mr. Pinkston was Deputy General Counsel of Eli Lilly and Company, responsible for the legal affairs of Lilly USA, Eli Lilly and Company’s global pharmaceutical products component and its global marketing and sales organization. Mr. Pinkston served as the General Counsel for PCS Health Systems, a pharmacy benefit management company from 1994 to 1999. Prior to this, Mr. Pinkston held senior positions in the Law Department of McKesson Corporation.

Charles P. Slacik, 55, Senior Vice President and Chief Financial Officer

Mr. Slacik joined Beckman Coulter as Senior Vice President and Chief Financial Officer in October 2006. Before joining Beckman Coulter, Mr. Slacik was Executive Vice President and Chief Financial Officer of the specialty pharmaceutical company Watson Pharmaceuticals, Inc. since 2003. Prior to that, he was Senior Vice President and Chief Financial Officer at C.R. Bard, which develops and manufactures vascular, urology, oncology and surgical specialty products. Before C.R. Bard, he was with Wyeth (formerly American Home Products) in a variety of increasingly responsible positions in finance, information technology, and general management for several of the company’s divisions.

| BEC 2009 FORM 10-K | 15 |

Table of Contents

Employee Relations

As of December 31, 2009, we and our subsidiaries had approximately 11,800 employees worldwide. We believe relations with our employees are good.

Financial Information About Geographic Areas

Geographic data information is presented in Note 18 “Business Segment Information” of the Notes to Consolidated Financial Statements in Item 8 of this Form 10-K.

Available Information

We file reports and other information with the SEC, including Forms 8-K, 10-K, 10-Q, and 11-K, Form S-8, and proxy statements. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NW, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy, and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is “http://www.sec.gov.”

Our website includes a link to a website where copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act may be obtained free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The website also includes copies of our code of ethics for officers, employees, and directors, including our chief executive officer and senior finance officers, our corporate governance guidelines, and the charters for our audit and finance, organization and compensation, and nominating and corporate governance committees. These materials may be obtained by accessing the website at “http://www.beckmancoulter.com,” selecting “Investor Relations,” and then “Corporate Governance.” Paper copies of these documents may be obtained free of charge by writing to us at Beckman Coulter, Inc., Office of Investor Relations, 250 S. Kraemer Boulevard, Brea, California 92821.

We face significant competition, and our failure to compete effectively could adversely affect our sales and results of operations.

We face significant competition from many domestic and international manufacturers, with many of these companies participating in one or more parts of each of our markets. Some of these competitors are divisions or subsidiaries of corporations with substantial resources. We also compete with several companies that offer reagents, supplies and service for laboratory instruments that are manufactured by us or others. Our sales and results of operations may be adversely affected by loss of market share through aggressive competition, the rate at which new products are introduced by us and our competitors and the extent to which new products displace existing technologies and competitive pricing especially in areas where currency has an effect.

We are subject to various federal, state, local and foreign regulations, and compliance with these laws or any new laws or regulations, including potential health care reform, could cause us to incur substantial costs and adversely affect our business and results of operations.

Our products and operations are subject to a number of federal, state, local and foreign laws and regulations. A determination that our products or operations are not in compliance with these laws and regulations could subject us to civil and criminal penalties, prevent us from manufacturing or selling certain of our products and cause us to incur substantial costs in order to be in compliance. To varying degrees, compliance with these laws and regulations may:

| • | Take a significant amount of time |

| • | Require the expenditure of substantial resources |

| • | Involve extensive clinical and pre-clinical testing |

| • | Involve modifications, repairs or replacements of our products |

| • | Result in limitations on the proposed uses of our products |

| 16 | BEC 2009 FORM 10-K |

Table of Contents

In addition, changes to existing laws or regulations, including the effect of potential health care reforms, also could prevent us from manufacturing or selling our products, reduce funding for government and academic research and cause us to incur substantial compliance costs.

Our compliance costs include addressing our ongoing responsibilities under FDA regulations that apply to our products both before and after they are approved for distribution. If the FDA were to conclude that any of our products are ineffective or pose an unreasonable health risk, or that we are not in compliance with applicable regulations, the FDA could:

| • | Ban the product |

| • | Seize adulterated or misbranded products |

| • | Order a recall, repair or replacement of such product or a refund to the purchaser of the product |

| • | Require us to notify health professionals and others that the products present unreasonable risks of substantial harm to the public health |

| • | Impose operating restrictions |

| • | Enjoin and restrain certain violations of applicable law pertaining to the products |

| • | Assess civil penalties against our company, officers or employees |

| • | Recommend criminal prosecution to the Department of Justice |

An adverse regulatory action could restrict us from effectively marketing and selling our products.

Foreign governmental regulations have become more common and stringent. We may become subject to more rigorous regulation by foreign governmental authorities in the future. Penalties for noncompliance with foreign regulation could be severe, including revocation or suspension of the ability to sell products in that country and criminal sanctions.

As a result of the factors discussed above, domestic or foreign health care or tax laws and regulations may have a material adverse effect on our business.

Current healthcare reform changes, if adopted, may have a material adverse effect on our operating results.

The U.S. Administration has announced healthcare reform to be one of its priorities. Members of Congress have proposed major healthcare reform measures that, if adopted, could have a material impact on our business. There are pending proposals in both the House and Senate, each intended to institute substantial changes to the way health care is financed by both governmental and private insurers. Pending provisions, if adopted, could include imposition of a significant non-deductible fee on the medical device industry. If the proposals are passed by Congress, President Obama can either sign the legislation into law or veto it.

We must continue to market and improve existing products and develop new products that meet customer needs and expectations or our business and results of operations will be adversely impacted.

Our ability to continue to grow depends on our success in continuing to market and improve our existing products and develop new products that meet customer needs and expectations. Improving existing products and developing new products requires us to successfully integrate hardware, software and chemistry components. Consequently, the expected introductions of new products may be impacted by factors such as complexity and uncertainty in the development of new high-technology products and availability of qualified engineers, programmers and other key personnel. The viability of supply partners also may impact new product introductions for products we distribute. In addition, our ability to introduce new products and to continue marketing existing products may be affected by patents and other intellectual property rights of others, our ability to protect our intellectual property from others, the acquisition and integration of other companies and intellectual property and our ability to obtain regulatory approvals, including delays in obtaining any government marketing authorizations necessary to market the products, particularly with respect to Clinical Diagnostics products. Factors affecting the introduction of molecular diagnostic products include the inability to develop clinical diagnostic tests based on new technologies, a determination that the tests do not provide sufficient precision and accuracy, identification of additional necessary intellectual property rights, failure to establish the clinical utility of these tests during clinical studies and delays resulting from the timing and scope of regulatory agency reviews.

| BEC 2009 FORM 10-K | 17 |

Table of Contents

Our business could be adversely affected if we do not prevail in present or future third party intellectual property litigation adverse to our products or if our patents or other intellectual property rights are challenged, invalidated, circumvented or expire.

We cannot assure you that our products will be free of intellectual property rights of others or that a court will not find such products to infringe third party rights. Patent disputes are frequent, costly and may preclude or delay product commercialization. We may have to pay significant licensing fees to obtain access to third party intellectual property rights to make and sell current products or to introduce new products and cannot guarantee that such licenses will be available on terms acceptable to us, or at all. We also cannot assure you that our issued patents will include claims sufficiently broad to prevent competitors from developing competing products or that pending patent applications will result in issued patents. Obtaining and maintaining patents is an iterative process with patent offices worldwide. Our patents may not protect us against competitors with similar products or technologies, because competing products or technologies may not infringe our patents. The enforcement of our issued patents requires the filing and prosecution of legal actions in countries around the world, and we cannot assure you that we will prevail in such actions.

We rely on certain suppliers and manufacturers for raw materials and other products, and fluctuations in the availability and price of such products and services may interfere with our ability to meet our customers’ needs.

Difficulty in obtaining raw materials and components for our products, especially in the rapidly evolving electronic components market, could affect our ability to achieve anticipated production levels. For some of our products we are dependent on a small number of suppliers of finished products and of critical raw materials and components and our ability to obtain, enter into and maintain contracts with these suppliers. We cannot assure you that we will be able to obtain, enter into or maintain all such contracts in the future. On occasion, we have been forced to redesign portions of products when a supplier of critical raw materials or components terminated its contract or no longer made the materials or components available. If we are unable to achieve anticipated production levels and meet our customers needs, our operating results could be adversely affected. In addition, our results of operations may be significantly impacted by unanticipated increases in the costs of labor, raw materials, freight, utilities and other items needed to develop, manufacture and maintain our products and operate our business. Suppliers also may deliver components or materials that do not meet specifications preventing us from manufacturing products that meet our design specifications or customer requirements.

Consolidation of our customer base and the formation of group purchasing organizations could adversely affect our sales and results of operations.

Consolidation among health care providers and the formation of buying groups has put pressure on pricing and sales of our products, and in some instances, required payment of fees to group purchasing organizations. Our success in these areas depends partly on our ability to enter into contracts with integrated health networks and group purchasing organizations. If we are unable to enter into contracts with these group purchasing organizations and integrated health networks on terms acceptable to us, our sales and results of operations may be adversely affected. Even if we are able to enter into these contracts, they may be on terms that negatively affect our current or future profitability.

Reductions in government funding to our customers could negatively impact our sales and results of operations.

Many of our customers rely on government funding and on prompt and full reimbursement by Medicare and equivalent programs outside of the United States. In addition, our sales are affected by factors such as:

| • | Level of government funding for clinical testing, biomedical research, bioterrorism, forensics, and food safety |

| • | Pharmaceutical company spending policies |

| • | Access to capital by biotechnology start ups |

A reduction in the amount or types of government funding or reimbursement that affect our customers, as well as the unavailability of capital to our Clinical Diagnostics and biomedical research customers, could have a negative impact on our sales. Global economic uncertainty can result in lower levels of government funding or reimbursement.

Our international operations expose us to foreign currency exchange fluctuations.