Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33778

NEUTRAL TANDEM, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 31-1786871 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| One South Wacker Suite 200 Chicago, Illinois |

60606 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code (312) 384-8000

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value Per Share |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit. Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

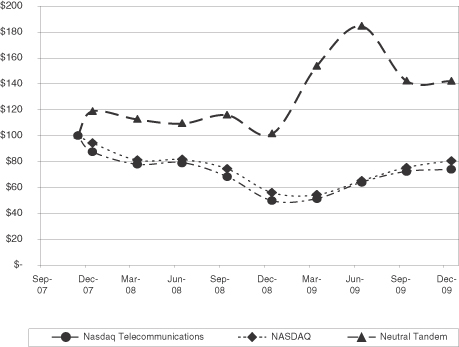

The aggregate market value of the registrant’s common stock, $0.001 par value per share, held by non-affiliates of the registrant on June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, was $930,349,545 (based on the closing sales price of the registrant’s common stock on that date). Shares of the registrant’s common stock held by each officer, director and each other person known to the registrant who beneficially owns more than 5% or more of the registrant’s outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 14, 2010, the registrant had 33,632,701 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Neutral Tandem, Inc. definitive Proxy Statement for its 2009 Annual Meeting of Stockholders to be filed with the Commission pursuant to Regulation 14A not later than 120 days after December 31, 2009 are incorporated by reference in Part III of this Form 10-K.

Table of Contents

NEUTRAL TANDEM, INC.

FORM 10-K

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Our Company

We provide tandem interconnection services principally to competitive carriers, including wireless, wireline, cable and broadband telephony companies. Competitive carriers use tandem switches to interconnect and exchange local and long distance traffic between their networks without the need to establish direct switch-to-switch connections. Prior to the introduction of our service, the primary method for competitive carriers to exchange traffic indirectly was through the tandem switches of the incumbent local exchange carriers, or ILECs. The tandem switching services offered by ILECs consist of transit services, which are provided in connection with local calls, and access services, which are provided in connection with long distance calls. Under certain interpretations of the Telecommunications Act of 1996 and implementing regulations, ILECs are required to provide tandem transit services to competitive carriers. ILECs generally set per minute rates and other charges for tandem transit services according to rate schedules approved by state public utility commissions, although the methodology used to review these rate schedules varies from state to state. ILECs are also required to offer access services to competing telecommunications carriers under the Telecommunications Act of 1996 and implementing regulations. ILECs generally set per minute rates and other charges for access services according to mandated rate schedules set by the Federal Communications Commission, or FCC, for interstate calls and by state public utility commissions for intrastate calls. Our solution enables competitive carriers to exchange traffic between their networks without using an ILEC tandem for both local and long distance calls.

The proliferation of competitive carriers over the past decade and their capture of an increasing share of subscribers shifted a greater amount of intercarrier traffic to ILEC tandem switches and amplified the complexity of carrier interconnections. This resulted in additional traffic loading of ILEC tandems, lower service quality and substantial costs incurred by competitive carriers for interconnection. A loss of ILEC market share to competitive carriers has escalated competitive tensions and resulted in an increased demand for tandem switching.

We founded our company to solve these interconnection problems and better facilitate the exchange of traffic among competitive carriers and non-carriers. By utilizing our managed tandem service, our customers benefit from a simplified interconnection network solution that reduces costs, increases network reliability, decreases competitive tension and adds network diversity and redundancy.

According to the Local Exchange Routing Guide, an industry standard guide maintained by Telcordia that is used by carriers, there are approximately 1.49 billion telephone numbers assigned to carriers in North America. Our services are principally targeted to address the estimated 799 million, or 54% of the total 1.49 billion, telephone numbers assigned primarily to competitive carriers; that is, all carriers that are not ILECs.

We have signed agreements with major competitive carriers and non-carriers and operated in 137 markets as of December 31, 2009. During the fourth quarter of 2009, our network carried 23.8 billion minutes of traffic. As of December 31, 2009, our network was capable of connecting calls to an estimated 480 million telephone numbers assigned to carriers. Telephone numbers assigned to a carrier may not necessarily be assigned to, and in use by, an end user.

Our business originally connected only local traffic among carriers within a single metropolitan market. In 2006, we installed a national IP backbone network connecting our major local markets. As a result, our service offerings now include the capability of switching and carrying long distance traffic between markets and among different types of customers.

We were incorporated in Delaware on April 19, 2001. Since commencing service in February 2004, we have grown rapidly and operated in 137 markets as of December 31, 2009. For the year ended December 31, 2009, we increased revenue to $168.9 million, an increase of 39.7% compared to $120.9 million for the year ended

1

Table of Contents

December 31, 2008. Our income from operations for the year ended December 31, 2009 was $64.0 million compared to $35.4 million for the year ended December 31, 2008. Net income for the year ended December 31, 2009 was approximately $41.3 million compared to net income of $24.0 million for the year ended December 31, 2008.

In recent years, new services and technologies have emerged as competitive alternatives to ILEC services for consumer and enterprise telephony. The increasingly diverse market now includes wireless, wireline and cable and broadband telephony companies. As these competitive carriers have expanded their customer base, the amount of traffic exchanged between them has also increased and is expected to grow in the future. For example:

| • | CTIA reported that total wireless minutes of use exceeded 1.1 trillion in the first half of 2009 and, as of June 2009, the industry survey recorded more than 276 million wireless users which represents a year-over-year increase of nearly 14 million subscribers (CTIA, 2009, CTIA’s Semi-Annual Wireless Industry Survey). |

| • | AT&T, Verizon, Qwest and Embarq, the four largest ILECs in the U.S., reported total access line losses of approximately 11.3 million in 2009, representing a decrease of approximately 9.4%. |

| • | Market Size. The continuing shift of telecommunications traffic away from conventional ILEC phone lines to the wireless segment provides opportunities for us to continue to expand our business. ILEC access lines declined by approximately 11.3 million during the 12 months ending September 30, 2009. Between June 2008 and June 2009, wireless subscribers grew by 14 million (CTIA, Mid-Year 2009 Wireless Industry Survey). Our tandem network was designed to serve the interconnection needs of wireless, cable, VoIP and IXC segments of the communications market, and since the initiation of our service in 2004, we feel we have built strong relationships with a majority of the leading carriers in these segments, which we believe provides opportunities for us to grow with our customers. |

Prior to the introduction of our services, competitive carriers generally had two alternatives for exchanging traffic between their networks. The two alternatives were interconnecting to the ILEC tandems or directly connecting individual switches, commonly referred to as “direct connects.” Given the cost and complexity of establishing direct connects, competitive carriers often elected to utilize the ILEC tandem as the method of exchanging traffic. The ILECs typically required competitive carriers to interconnect to multiple ILEC tandems with each tandem serving a restricted geographic area. In addition, as the competitive telecommunications market grew, the process of establishing interconnections at multiple ILEC tandems became increasingly difficult to manage and maintain, causing delays and inhibiting competitive carrier growth, and the purchase of ILEC tandem services became an increasingly significant component of a competitive carrier’s costs.

Growth in intercarrier traffic switched through ILEC tandems created switch capacity shortages known in the industry as ILEC “tandem exhaust,” where overloaded ILEC tandems became a bottleneck for competitive carriers. This increased call blocking and gave rise to service quality issues for competitive carriers. With the introduction of our services, we believe we became the first carrier to provide alternative tandem services capable of alleviating the ILEC tandem exhaust problem.

2

Table of Contents

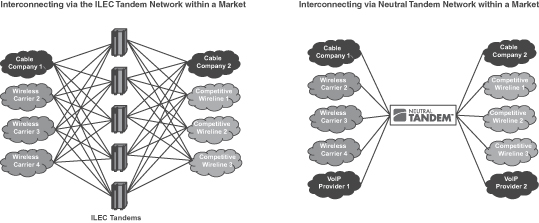

The following diagrams illustrate interconnecting via the ILEC tandem networks and an example of interconnecting via our managed tandem network.

Following the introduction of our services, as discussed in further detail in “—Competition” below, we also began to face competition from other competitive carriers, including Level 3, Hypercube and Peerless Network. Over the past year, competition has intensified causing us to lose some traffic as well as reduce certain rates we charge our customers in various markets, including with respect to our major customers. For a further discussion see “Risk Factors—We face competition from the traditional ILECs and increasing competition from certain other providers such as Level 3 Communications, Peerless Network and Hypercube and expect to compete with new entrants to the tandem services market” in Item 1A below.

The second alternative for exchanging traffic, prior to our commencement of operations, was by directly connecting competitive carrier switches to each other. Implementing direct switch-to-switch network connections between all competitive switches in a market can be challenging. For example, in order to completely bypass the ILEC tandem network, a market with 100 competitive switches would require 9,900 direct one-way switch-to-switch connections. The capital and operating expense requirements, complexity and management challenges of establishing and maintaining direct connections generally makes them economical only for higher traffic switch combinations. However, where sufficient traffic between switches does exist, carriers often do establish direct connections. See “Risk Factors—The market for our services is competitive and increased adoption of IP switching technologies could increase the competition we face from direct connections” in Item 1A below. We believe that our customers are currently frequently directly connecting their networks, even for lower traffic switch pair combinations, for various reasons, including in order to avoid paying a transit fee. For a further discussion see “Risk Factors—The market for our services is competitive and increased adoption of IP switching technologies could increase the competition we face from direct connections” in item 1A below.

Competitive carriers are also interested in ways to reduce the risk of network failure. Recommendations of the Independent Panel Reviewing the Impact of Hurricane Katrina on Communications Networks, which was a report prepared for the FCC in June 2006, noted the need for tandem diversity. The report highlighted that the impact of an ILEC tandem failure due to the failure of routing paths into tandems in New Orleans in August 2005 led to the inability of local carriers to exchange and complete calls and the inability of long distance calls to enter or leave areas served by the tandem.

Our solutions potentially help minimize these network failures and interconnection problems by offering physically diverse tandem switching facilities and transmission paths that increase network reliability. We also simplify the ordering, provisioning and capacity management requirements of our customers, and seek to leverage our extensive interconnection network and proprietary technology to capitalize on the growth of intercarrier traffic.

3

Table of Contents

Our Services

Our services allow competitive carriers to exchange local and long distance traffic between their networks without using an ILEC tandem or establishing direct connections. Each competitive carrier that connects to our network generally gains access to all other competitive carriers’ switches connected to our network. Once connected to our network, carriers can route their traffic to other destinations (telephone numbers) that are addressable by our network. We charge on a per-minute basis for traffic switched by our network.

As a core component of our service offering, we actively manage network capacity between our tandem switches and customers’ switches, which results in improved network quality and reduced call blocking. By monitoring traffic levels and projecting anticipated growth in traffic, we are generally able to provide on a timely basis additional circuits between customer switches and our network to meet increased demand. This feature saves competitive carriers substantial time and effort in managing their interconnection network, improves their customers’ experience, reduces trouble tickets and allows them to focus more on their core business.

We use proprietary software tools (one of which is patent-pending) to manage and track routing combinations associated with hundreds of millions of telephone numbers. Our services include ongoing customer notification of new routing options that become available as we add new customers to our network or enter new markets. We also provide our customers with invoices, management reports and call detail records in paper and electronic formats along with monthly savings summary reports.

Our managed tandem network includes technologically advanced IP switching platforms manufactured by Sonus Networks, Inc. linked together by an IP backbone. Our network is capable of automatically switching IP-originated or conventional Time Division Multiplexing, or TDM, traffic to terminating carriers using either protocol. We support IP-to-IP, IP-to-TDM, TDM-to-IP and TDM-to-TDM traffic with appropriate protocol conversion and gateway functionality. We also support both conventional Signaling System #7 and Session Initiation Protocol call routing. Session Initiation Protocol is an application-layer control (signaling) protocol for creating, modifying and terminating realtime IP communications sessions with one or more participants. These sessions include Internet telephone calls, multimedia distribution and multimedia conferences. Signaling System #7 is a set of telephony signaling protocols which is used to set up the majority of the world’s Public Switched Telephone Network calls.

In addition, patent-pending proprietary software tools help us to manage the complicated routing scenarios required to terminate traffic to hundreds of millions of telephone numbers and support our network. The software allows us to quickly identify new routing opportunities between carriers and to help optimize our customers’ interconnection costs, which leads to improved customer service. We believe the adaptability and flexibility of our technology enables us to provide a robust service offering to interconnect a wide range of traffic types and to adapt our service offerings more efficiently than the ILECs, which predominantly employ legacy Class 4 TDM-only circuit switching technology for tandem switching.

Our network, as of December 31, 2009, connects 1,804 unique competitive carrier switches (a 26% increase over December 31, 2008), creating up to 3.2 million unique switch-to-switch routes serving an estimated 480 million telephone numbers assigned to these carriers. Telephone numbers assigned to a carrier may not necessarily be assigned to, and in use by, an end user. In the quarter ended December 31, 2009, our network carried approximately 8 billion minutes of traffic per month.

4

Table of Contents

Our Strategy

Our strategy is focused on expanding our business by increasing the share of telecommunications traffic that our network can serve. Expanding our share of telecommunications traffic increases the value of our network to our customers and enables us to capture a larger share of total telecommunications revenue. Key elements of our expansion strategy include:

| • | Broaden our geographic presence. Our managed tandem services, as of December 31, 2009, are currently available in 137 markets, serving an estimated 480 million telephone numbers assigned to competitive carriers out of a potential addressable market of 695 million telephone numbers assigned to competitive carriers in these 137 markets. Telephone numbers assigned to a carrier may not necessarily be assigned to, and in use by, an end user. As we now provide our services in most of the United States, in order to expand our business we are now seeking to offer international services (such as exchanging traffic that originates outside of the United States and terminates in the United States to the telephone numbers that we serve). |

| • | Expand our customer base. As our network expands, our market opportunity will include additional competitive carriers (particularly regional wireless carriers and cable companies) and non-carriers that we do not currently serve. Many of these potential customers, although not large providers, are among the fastest growing carriers in their service areas. |

| • | Increase the types of traffic we exchange. Our business originally connected only local traffic among carriers within a single metropolitan market. In 2006, we installed a national IP backbone network connecting our major local markets. As a result, our service offerings now include the capability of switching and carrying traffic between multiple markets and among different types of customers. With one point of access, our customers are able to increase the number of minutes that are switched by our network. In order to expand our business we may also seek to further develop our service offerings by increasing the types of voice traffic we exchange over our network and to offer other services, such as ethernet exchange services. |

Our Customers

We principally serve carriers, which represented approximately 96.5% of our revenues for our 2009 fiscal year, with non-carriers accounting for the remaining 3.5%. As of December 31, 2009, we have 99 carriers originating traffic and 116 carriers connected to our network. Our contracts with our top five customers represented approximately 63.9% of our total revenue through December 31, 2009. Our two largest customers, Sprint Nextel and AT&T, accounted for 23% and 14%, respectively, of our total revenues for the year ended December 31, 2009. Our contracts with customers do not contain volume commitments, are not exclusive, and could be terminated or modified in ways that are not favorable to us. However, while we have lost customers’ traffic in specific routes, since initiating service we have not had any significant customer cease using our services completely. We generate revenue for our managed tandem services by charging tandem transit and access fees on a minute of use basis. For the year ended December 31, 2009, wireless and cable companies account for approximately 64.5% of our revenue.

Since certain of our carrier customers interconnect with us in all of their markets where we have a presence, we have the ability to increase our revenues by entering new markets. In addition, we expect to broaden our customer base by targeting competitive carriers that are not current customers or that operate in markets that we do not yet serve. Of our 99 originating carriers, 92 of them currently use our services to deliver traffic in more than one market.

5

Table of Contents

Our Markets

| Akron, OH | Charlotte, NC | Greenville, SC | Nashville, TN | Salt Lake City, UT | ||||

| Albany, NY | Chattanooga, TN | Hartford, CT | New Mexico | San Antonio, TX | ||||

| Albany, GA | Chicago, IL | Houston, TX | New Orleans, LA | San Diego, CA | ||||

| Altoona, PA | Cincinnati, OH | Huntsville, AL | New York, NY | San Francisco, CA | ||||

| Amarillo, TX | Cleveland, OH | Indianapolis, IN | Oklahoma City, OK | San Luis Obispo, CA | ||||

| Asheville, NC | Colorado Springs, CO | Jackson, MS | Omaha, NE | Savannah, GA | ||||

| Atlanta, GA | Columbia, SC | Jacksonville, FL | Orlando, FL | Scranton, PA | ||||

| Atlantic City, NJ | Columbus, OH | Kansas City, MO | Palm Springs, CA | Seattle, WA | ||||

| Auburn, IN | Corpus Christi, TX | Knoxville, TN | Pensacola, FL | Shreveport, LA | ||||

| Augusta, GA | Dallas, TX | Lafayette, LA | Peoria, IL | South Bend, IN | ||||

| Austin, TX | Davenport, IA | Lansing, MI | Philadelphia, PA | Spokane, WA | ||||

| Bakersfield, CA | Dayton, OH | Las Vegas, NV | Phoenix, AZ | Springfield, IL | ||||

| Baltimore, MD | Daytona Beach, FL | Little Rock, AR | Pine Bluff, AR | St. Cloud, MN | ||||

| Baton Rouge, LA | Delaware Valley, PA | Los Angeles, CA | Pittsburgh, PA | St. Louis, MO | ||||

| Binghamton, NY | Denver, CO | Louisville, KY | Portland, ME | Sterling, IL | ||||

| Birmingham, AL | Des Moines, IA | Macon, GA | Portland, OR | Stockton, CA | ||||

| Bloomington, IL | Detroit, MI | Madison, WI | Poughkeepsie, NY | Syracuse, NY | ||||

| Bloomington, IN | El Paso, TX | Manchester, NH | Puerto Rico | Tallahassee, FL | ||||

| Boise, ID | Erie, PA | Mansfield, OH | Raleigh, NC | Tampa, FL | ||||

| Boston, MA | Eugene, OR | Matton, IL | Reno, NV | Toledo, OH | ||||

| Briston, TN | Evansville, IN | Memphis, TN | Rhode Island | Tulsa, OK | ||||

| Brownsville, TX | Fort Myers, FL | Miami, FL | Richmond, VA | Tucson, AZ | ||||

| Buffalo, NY | Fresno, CA | Milwaukee, WI | Richmond, IN | Waco, TX | ||||

| Capital, PA | Gainesville, FL | Minneapolis, MN | Rochester, NY | Washington DC | ||||

| Cedar Rapids, IA | Grand Rapids, MI | Mobile, AL | Rockford, IL | Wichita, KS | ||||

| Champaign, IL | Green Bay, WI | Montgomery, AL | Rocky Mount, NC | Wilmington, NC | ||||

| Charleston, SC | Greensboro, NC | Newark, NJ | Sacramento, CA | Winchester, KY | ||||

| Saginaw, MI | Youngstown, OH |

Our expected market expansion plan in the United States during the 12-month period following December 31, 2009 is more limited than it has been historically, as we now cover many of the major and mid-size markets in the United States. We are currently considering whether to expand internationally. International services may include exchanging traffic that originates outside of the United States and terminates in the United States to the telephone numbers that we serve.

Sales and Marketing

Our sales and marketing organization divides accounts by wireless, cable, wireline and non-carriers and seeks to develop solutions for our customers. Dividing customers in this way allows us to develop industry knowledge about each carrier and a more value-added sales force. Our sales team works closely with our customers to identify and address their needs. We seek to expand the use of our service offerings by our current customers through account managers who are dedicated to specific customer accounts. The sales team conducts weekly meetings to discuss customer activity, competitive activity and losses, best practices and industry trends. In addition to a base salary, the compensation package for the members of our sales team includes incentive arrangements, including quarterly target incentives based on our performance and the individual’s performance, tiered payment structures and negative incentives. The members of our sales organization have an average of over 22 years of sales experience and in-depth knowledge of the telecommunications industry.

Our marketing team works closely with the sales team to deliver comprehensive services, develop a clear and consistent corporate image and offer a full range of product offerings. Our marketing efforts are designed to

6

Table of Contents

drive awareness of our service offerings. Our marketing activities include direct sales programs, targeted public relations and participation in industry trade shows. We are also engaged in an ongoing effort to maintain relationships with key communications industry analysts.

Our Customer Support

Our ordering and provisioning groups form the core of our customer support team. Each group works closely with the different vendor and customer organizations responsible for establishing service. We assign an implementation manager to each account that is responsible for the end-to-end delivery of our services. These managers make daily contact with their customer and help coordinate our local operations teams during implementation. This process helps to improve customer satisfaction, increase customer implementation and promote our revenue realization.

Our network operations center monitors and supports our tandem network 24 hours a day, 365 days a year. The network operations center is responsible for troubleshooting any potential network problems.

Competition

Our primary competitors today are the traditional ILECs (primarily AT&T, Verizon and Qwest), other competitive carriers that provide tandem or similar services (primarily Level 3, Hypercube and Peerless Network), and direct connections between carriers.

The tandem switching services offered by ILECs consist of transit services, which are provided in connection with local calls, and access services, which are provided in connection with long distance calls. ILECs generally set per minute rates and other charges for tandem transit services according to rate schedules approved by state public utility commissions, although the methodology used to review these rate schedules varies from state to state. ILECs generally set per minute rates and other charges for access services according to mandated rate schedules set by the Federal Communications Commission, or FCC, for interstate calls and by state public utility commissions for intrastate calls. Our solution enables competitive carriers to exchange traffic between their networks without using an ILEC tandem for both local and long distance calls.

Over the past year, we have faced increasing direct competition from other competitive carriers, including Level 3, Hypercube and, most specifically, Peerless Network. As more specifically described below under “Item 3. Legal Proceedings,” we commenced a patent infringement action against Peerless Network and Peerless Network asserted several counterclaims against us generally alleging that (i) our patent is invalid and unenforceable under a variety of theories, (ii) assertion of the patent amounts to patent misuse and violates certain monopolization laws, and (iii) certain conduct surrounding the litigation gave rise to a tortious interference claim.

We also face indirect competition from carriers that directly connect their switches. When there is a significant amount of traffic between two switches, carriers have an economic incentive to establish direct connections to remove intermediate switching. We believe that our customers are currently frequently directly connecting their networks, even for lower traffic switch pair combinations, for various reasons, including in order to avoid paying a transit fee. As our customers grow, the amount of traffic exchanged between them grows, thus leading to the risk that they will increase the number of direct connections between their switches and remove traffic from our tandems. The risk of direct connections will increase as more carriers move to an IP-based interface, because direct connecting between two IP-based carriers is less complex, thus enabling more direct connections. See “Risk Factors—The market for our services is competitive and increased adoption of IP switching technologies could increase the competition we face from direct connections” in Item 1A below.

We are unable to provide accurate market share information, since no regulatory body or industry association requires carriers to identify amounts of traffic to other carrier types. Traffic in most instances is reported on aggregate levels.

7

Table of Contents

The ILECs that provide tandem switching services, as well as many competitive providers, including Level 3, have significantly more employees and greater financial, technical, marketing and other resources than we have. Our ability to compete successfully with them and other competing carriers depends on numerous factors, both inside and outside our control, including:

| • | tandem switching rates charged by third-party competitors; |

| • | our competitors’ ability to offer bundled service offerings, such as transit services and inexpensive long distance services; |

| • | our responsiveness to customer needs; |

| • | our ability to support existing and new industry standards and protocols; |

| • | our ability to raise capital; |

| • | our ability to retain and attract key employees; |

| • | interpretations of or changes to regulatory law; |

| • | our ability to continue development of technical innovations; and |

| • | the quality, reliability, security and price-competitiveness of our services. |

Regulation

Overview

Our communications services business is subject to varying degrees of federal and state regulation. We operate as a common carrier and therefore are subject to the jurisdiction of both federal and state regulatory agencies, which have the authority to review our prices, terms and conditions of service. We operate as a facilities-based carrier in most states and have received all necessary state and FCC authorizations to do so. The regulatory agencies exercise control over our prices and services to varying degrees, and also impose various obligations such as reporting, payment of fees and compliance with consumer protection and public safety requirements.

By operating as a common carrier, we benefit from certain legal rights established by federal and state legislation, especially the federal Telecommunications Act of 1996, which gives us and other competitive entrants the right to interconnect to the networks of incumbent telephone companies and access to their networks. We have used these rights to gain interconnection with the incumbent telephone companies and to purchase selected services at wholesale prices that complement our ability to terminate traffic. We have also used these rights to request interconnection with competitive carriers for the termination of transit traffic to carriers when such carriers decide for whatever reason not to utilize our transit service. While our experience has been that competitive carriers usually accommodate such requests, and indeed frequently become users of our transit service as well, we have participated in federal and state regulatory proceedings against other carriers involving our right to establish or maintain existing direct connections between us. As previously disclosed, we subsequently resolved these proceedings amicably.

The FCC and state regulators are considering a variety of issues that may result in changes in the regulatory environment in which we operate our business. Most importantly, many state and federal proceedings have considered issues related to the ILECs’ pricing of services that compete with our service. To the extent that the regulatory commissions maintain or impose pricing restrictions on the transit or access rates charged by the ILEC, then the price we compete with is likely to be lower than it would be in an unregulated market. In addition, the FCC is conducting a proceeding to consider reform of its intercarrier compensation rules. This proceeding may affect the pricing and regulation of ILEC tandem services against which we compete. To the extent that any state or the FCC mandates reductions in the rates the ILECs’ charge for tandem services, including transit or access rates, it could have a material and adverse effect on our business, financial condition, operating results or growth opportunities. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

8

Table of Contents

Although the nature and effects of governmental regulation are not predictable with certainty, we believe that the FCC is unlikely to enact rules that extinguish our basic right or ability to compete in telecommunications markets. However, even though many possible regulatory developments might not directly affect our operations, to the extent that they limit our customers’ ability to compete effectively against the ILEC or limit or reduce the rates at which an ILEC may provide the same services we provide, we are indirectly impacted. The following sections describe in more detail the regulatory developments described above and other regulatory matters that may affect our business.

Regulatory Framework

The Telecommunications Act of 1996

The Telecommunications Act of 1996, which substantially revised the Communications Act of 1934, established the regulatory framework for the introduction of competition for local communications services throughout the United States by new competitive entrants such as us. Before the passage of the Telecommunications Act, states typically granted an exclusive franchise in each local service area to a single dominant carrier, often a former subsidiary of AT&T known as a Regional Bell Operating Company, or RBOC, which owned the entire local exchange network and operated as a virtual monopoly in the provision of most local exchange services in most locations in the United States. The RBOCs now consist of Verizon, Qwest Communications and AT&T. These three carriers are also referred to as ILECs, along with many other smaller incumbent local exchange carriers that were not former subsidiaries of AT&T.

Among other things, the Telecommunications Act preempts state and local governments from prohibiting any entity from providing communications service, which has the effect of eliminating prohibitions on entry that existed in almost half of the states at the time the Telecommunications Act was enacted. Nonetheless, the Telecommunications Act preserved state and local jurisdiction over many aspects of local telephone service and, as a result, we are subject to varying degrees of federal, state and local regulation.

We believe that the Telecommunications Act provided the opportunity to accelerate the development of competition at the local level by, among other things, requiring the incumbent carriers to cooperate with competitors’ entry into the local exchange market. To that end, incumbent local exchange carriers are required to allow interconnection of their network with competitive networks. Incumbent local exchange carriers are further required by the Telecommunications Act to provide access to certain elements of their network to competitive local exchange carriers. These rules have helped the development of competitive telecommunications carriers, many of which have become our customers.

We have developed our business, including our decision to operate in most instances as a common carrier, and designed and constructed our networks to take advantage of the features of the Telecommunications Act. There have been numerous attempts to revise or eliminate the basic framework for competition in the local exchange services market through a combination of federal legislation, adoption of new rules by the FCC, and challenges to existing and proposed regulations by the incumbent carriers. We anticipate that Congress will consider a range of proposals to modify the Telecommunications Act over the next few years, including some proposals that could restrict or eliminate our access to elements of the incumbent local exchange carriers’ network. Although we consider it unlikely, based on statements of both telecommunications analysts and Congressional leaders, that Congress would reverse the fundamental policy of encouraging competition in communications markets, we cannot predict whether future legislation may adversely affect our business in any way.

Federal Regulation

The FCC regulates interstate and international communications services of common carriers, including access to local communications networks for the origination and termination of these services. We typically

9

Table of Contents

provide our services on a common carrier basis and the FCC has jurisdiction over our tandem access services to the extent they are used as part of the origination or termination of interstate or international calls. Under certain interpretations of the Telecommunications Act, the FCC may also have the authority to regulate our provision of local transit services and intrastate access services, including setting the methodology by which state regulators determine local or intrastate pricing. To date, the FCC has not determined whether to accept this interpretation of the Telecommunications Act with respect to local transit services, although some states have proceeded as if local transit services are subject to that law. For a further discussion of the states’ rights to determine the pricing of our services under the Telecommunications Act, see “Regulatory Framework-State Regulation” below.

The FCC imposes extensive economic regulations on incumbent local exchange carriers due to their ability to exercise market power. The FCC imposes less regulation on common carriers without market power including, to date, competitive local exchange carriers. Unlike incumbent carriers, we are not currently subject to price cap or rate of return regulation, but we are subject to the general federal requirement that our charges for interstate and international services must be just, reasonable and non-discriminatory. The rates we can charge for interstate access services are limited by FCC rules, and may not exceed the rates charged by the incumbent carrier for comparable services. Apart from this limitation, the FCC currently has no rules concerning our rates for tandem transit services. We are also required to file periodic reports, to pay regulatory fees based on our interstate revenues, and to comply with FCC regulations concerning the content and format of our bills, the process for changing a customer’s subscribed carrier, and other consumer protection matters. Because we do not directly serve consumers, many of these regulations have no practical effect on our business. The FCC has authority to impose monetary forfeitures and to condition or revoke a carrier’s operating authority for violations of its requirements. Our operating costs are increased by the need to assure compliance with regulatory obligations.

We are also affected indirectly by FCC regulations that alter the competitive landscape for customers or potential customers of our services. As discussed above, the Telecommunications Act requires the incumbent local exchange carriers to provide competitors access to elements of their local network on an unbundled basis, known as UNEs. Several FCC decisions in 2003 through 2005 significantly altered the terms on which competitive carriers can obtain access to these network elements. Among other things, these decisions eliminated the obligation of incumbent carriers to offer a network element “platform” known as UNE-P that allowed competitors to offer services without any facilities of their own. It also limited the availability of some high- capacity loop and transport network elements that are typically used by competitors who do have some of their own facilities.

These changes in the FCC rules have had several effects on the competitive telecommunications carriers who are our prospective customers. First, the elimination of UNE-P has reduced the market share of resellers and led some former resellers to convert to facilities-based service. This development is positive for us because resellers generally are not potential users of our transit services. Second, the restrictions on the availability of loop and transport UNEs may have contributed to accelerated consolidation among competitive carriers, which may have a negative impact on us because our business model is based on the existence of many independent carriers who need to exchange traffic with each other. It is difficult to predict the overall effect of these countervailing trends on our future business opportunities.

Future FCC rulings may further affect the market for our services. For example, the FCC has been asked in several cases to forbear from requiring incumbent carriers to continue offering loop and transport UNEs in particular markets. The FCC has granted such petitions in portions of two metropolitan areas (Omaha, Nebraska, and Anchorage, Alaska), and denied them in several others (Boston, Providence, New York, Pittsburgh, Philadelphia, and Virginia Beach-Norfolk, Seattle, Minneapolis-St. Paul, Denver, and Phoenix). The petitions that the FCC denied were recently remanded by a federal court of appeals, and are being reconsidered by the FCC. If the FCC approves additional forbearance petitions, or is required to do so by the court, it could force some competitive carriers to reduce or eliminate their operations in affected metropolitan areas, which may negatively affect our business opportunities. The FCC is also considering a number of other proposals that may

10

Table of Contents

affect competitive carriers’ access to UNEs as well as the prices for such access. We cannot predict the results of future regulatory or court rulings, or any changes in the availability of UNEs as the result of future legislative changes.

Intercarrier Compensation

In 2001, the FCC initiated a proceeding to address rules that require one carrier to make payment to another carrier for access to the other’s network, or intercarrier compensation. In its notice of proposed rulemaking, the FCC sought comment on some possible advantages of moving from the current rules to a bill and keep structure for all traffic types in which carriers would recover costs primarily from their own customers, not from other carriers. On November 5, 2008, the FCC issued for public comment two alternative proposed orders that address intercarrier compensation reform. The respective orders did not include express provisions governing transit traffic. Each proposed order did, however, request public comment on whether the proposed rules governing intercarrier compensation would, if enacted, necessitate any changes to the rules that govern transit traffic. To date, the FCC has taken no action on these proposed rules. More recently, on November 13, 2009, the FCC issued a public notice that included a request for comments on the role intercarrier compensation plays in the national broadband plan. If the FCC does make any changes to intercarrier compensation, whether as part of the intercarrier compensation docket or otherwise, such changes could affect our business. For example, the FCC could change the pricing of transit traffic, including lowering the rate, freezing the rate or establishing uniform rates, any of which could have a material adverse effect on our business, financial condition and operating results; or it could clarify that transit rates are intended to be unregulated, which could improve our opportunities in some markets where the current pricing is regulated at a very low level, which discourages competition. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

Additionally, we recently began providing access services, which is part of the origination and termination of long distance calls, using our tandem switches. The FCC generally regulates interstate access services and the states regulate intrastate access services. The FCC, as part of the intercarrier compensation draft orders discussed above, proposed to significantly reduce both interstate and intrastate terminating access charges over a ten-year transition period. As part of the same draft orders, the FCC also proposed to eliminate entirely certain originating interstate and intrastate access charges. If the FCC or any state does lower or eliminate any access charges, whether independent of or as part of the intercarrier compensation docket described above, such change could have a material and adverse effect on our business, financial condition, operating results or growth opportunities. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

We generally have no revenue exposure associated with reciprocal compensation for local traffic because our customers are primarily carrier customers, who are responsible for any compensation. However, the FCC draft orders discussed above, if adopted, would make us and other tandem service providers liable for the intercarrier compensation charges imposed by the terminating carrier in certain instances, which we would then have an opportunity to recover from the carrier who delivered the traffic to us. Even if we do have a legal right to recover these charges, we would bear risk if this occurs, including but not limited to disputes over the amount due and credit risk. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

We cannot predict either the timing or the result of this FCC rulemaking.

Regulatory Treatment of VoIP

In February 2004, the FCC initiated a proceeding to address the appropriate regulatory framework for VoIP providers. Currently, the status of VoIP providers is not clear, although a report issued by the FCC in 1998 suggests that some forms of VoIP may constitute “telecommunications services” that are subject to regulation as common carriers under federal law. The 1998 report also suggested, however, that this regulatory treatment would not apply until after the FCC determined which specific services were subject to regulation. This FCC

11

Table of Contents

proceeding may determine what, if any, regulation is appropriate for VoIP providers and whether the traffic carried by these providers will be subject to access charges. The principal focus of this rulemaking is on whether VoIP providers should be subject to some or all of the regulatory obligations of common carriers. The draft orders related to the intercarrier compensation reform described above each appear to provide that VoIP providers will be required to pay access charges, but only after the completion of a lengthy transition period. It is unclear whether or when any final rules on this matter will be issued.

In recent years, the FCC has imposed on VoIP providers most of the same requirements that would apply if they were regulated as common carriers, other than the payment of access charges. These include duties to provide access to 911 emergency services, to permit duly authorized law enforcement officials to monitor communications, to contribute to the cost of the FCC’s universal service program, to pay certain regulatory fees, and to comply with the same customer privacy rules as telecommunications carriers. These obligations are likely to increase the cost of providing VoIP service and slow the growth of VoIP providers. Because VoIP providers are users of our services, this trend may negatively affect demand for our services.

State Regulation

State agencies exercise jurisdiction over intrastate telecommunications services, including local telephone service and in-state toll calls. To date, we are authorized to provide intrastate local telephone and long-distance telephone services in forty-seven states, Puerto Rico and the District of Columbia. As a condition to providing intrastate telecommunications services as a common carrier, we are required, among other things, to:

| • | file and maintain intrastate tariffs or price lists in most states describing the rates, terms and conditions of our services; |

| • | comply with state regulatory reporting, tax and fee obligations, including contributions to intrastate universal service funds; and |

| • | comply with, and to submit to, state regulatory jurisdiction over consumer protection policies (including regulations governing customer privacy, changing of service providers and content of customer bills), complaints, transfers of control and certain financing transactions. |

Generally, state regulatory authorities can condition, modify, cancel, terminate or revoke certificates of authority to operate in a state for failure to comply with state laws or the rules, regulations and policies of the state regulatory authority. Fines and other penalties may also be imposed for such violations.

In addition, states have authority under the Telecommunications Act to approve or (in limited circumstances) reject agreements for the interconnection of telecommunications carriers’ facilities with those of the incumbent local exchange carrier, to arbitrate disputes arising in negotiations for interconnection and to interpret and enforce interconnection agreements. In exercising this authority, the states determine the rates, terms and conditions under which we can obtain collocation in ILEC central offices and interconnection trunks for termination of local traffic to ILEC customers, under the FCC rules. The states may re-examine these rates, terms and conditions from time to time.

Some state regulatory authorities assert jurisdiction over the provision of tandem transit services in connection with local calls, particularly the ILECs’ provision of the service. Various state regulatory authorities have initiated proceedings to examine the regulatory status of tandem transit services. Some states have taken the position that tandem transit service is an element of the “transport and termination of traffic” services that incumbent ILECs are required to provide at rates based on incremental cost analysis under the Telecommunications Act, while other states have ruled that the Telecommunications Act does not apply to these services. For example, a declaratory action was commenced in 2008 with the Connecticut Department of Public Utility Control (the “DPUC”) pursuant to which a competitive carrier requested that the DPUC order the ILEC to reduce its transit rate to a cost based rate similar to a rate offered by that ILEC in a different state or to a rate justified in a separate cost proceeding. The DPUC recently ordered the ILEC to implement an interim rate that is

12

Table of Contents

based on its costs for transit plus a 35% mark-up. Although the ILEC has filed an appeal of that order to the appropriate federal court, we have in some cases lowered the rate we charge our customers as a result of the DPUC’s ruling. Additionally, in December 2008, the Public Service Commission of Nebraska determined that the ILEC must provide tandem transit service under the Telecommunications Act and that the Nebraska PSC did not err in using TELRIC, an incremental cost based methodology, to determine the applicable rate. Similarly, the Public Service Commission of Georgia and the Public Utilities Commission of Ohio each have open rulemaking proceedings addressing, among other items, applying incremental cost based pricing for local tandem transit services. While we cannot predict whether or how such pricing rules may finally be adopted or implemented, the rulemaking in Ohio allows for waivers of pricing rules based on the existence of competition. We would pursue this waiver if necessary. If, as a result of any state proceeding, an ILEC is required to reduce or limit the rate it charges for transit service, we would likely be forced to reduce our rate, which could have a material and adverse affect on our business, financial condition and operating results. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

To date, the FCC has not resolved this dispute over interpretation of the Telecommunications Act, resulting in disparate pricing of these services among the states. Many states also have asserted that they have jurisdiction over interconnections between competitive carriers. Our success in securing interconnections with competitive carriers may be affected by the degree of jurisdiction states exert over such interconnections. See “Item 3. Legal Proceedings.” If a state takes the position that it does not have jurisdiction over such interconnection or over the regulation of competitive local transit services generally, we may be unable to assert successfully a legal right to terminate transit traffic to a carrier that refuses to accept terminating traffic from us on reasonable or any terms. Such an inability may have a material adverse effect on our business, financial condition and operating results. See “Risk Factors—Carriers may refuse to directly interconnect with us and consequently, we would be unable to terminate our customers’ traffic to them” in Item 1A below.

Additionally, we recently began providing access services, which is part of the origination and termination of long distance calls, using our tandem switches. Under the Telecommunications Act, state governments currently exercise jurisdiction over intrastate access services. Some states have imposed limits on the access charges that competitive carriers may impose, and some are currently considering whether to mandate any decrease in existing intrastate access charges. Also, as noted above, the FCC has asked for comments on the issue of intercarrier compensation. As a result of any proceeding on intercarrier compensation or otherwise, the FCC could require states to reduce their intrastate access charges. If any state does lower or eliminate intrastate access charges for any reason, such change could have a material and adverse effect on our business, financial condition, operating results or growth opportunities. See “Risk Factors—Regulatory developments could negatively impact our business” in Item 1A below.

Intellectual Property

Our success is dependent in part upon our proprietary technology. We rely principally upon trade secret and copyright law to protect our technology, including our software, network design, and subject matter expertise. We enter into confidentiality or license agreements with our employees, distributors, customers and potential customers and limit access to and distribution of our software, documentation and other proprietary information. We believe, however, that because of the rapid pace of technological change in the communications industry, the legal protections for our services are less significant factors in our success than the knowledge, ability and experience of our employees and the timeliness and quality of our services.

We have been granted one patent and have two additional patents pending with the U.S. Patent and Trademark Office. The granted patent addresses our core business, the operation of a managed tandem network. One of the pending patents addresses a series of traffic routing designs developed by us to assist our customers in reducing their internal network operating costs. The second pending patent covers a set of proprietary operating systems and software developed by us to manage our network. There can be no assurance regarding how, whether or when these additional patents may be granted.

13

Table of Contents

In June 2006, we commenced an action generally alleging that Peerless Network is infringing on the granted patent. Peerless Network has asserted several counterclaims against us, generally alleging that (i) our patent is invalid and unenforceable under a variety of theories, (ii) that assertion of the patent amounts to patent misuse and violates certain monopolization laws, and (iii) certain conduct surrounding the litigation gave rise to a tortious interference claim. See “Item 3. Legal Proceedings.”

OTHER MATTERS

Employees

At December 31, 2009, we had 147 full-time employees, including 123 in Operations, 7 in Sales and Marketing and 17 in General and Administrative functions. The number of employees increased by 7.3%, up from 137 on December 31, 2008. We expect to further increase our headcount in 2010 as we continue to expand both existing and new markets. Of our employees, 95 were located at our corporate office in Chicago, Illinois. The remaining 52 employees are located throughout the country at our switch locations. No labor union represents our employees. We have not experienced any work stoppages and consider our relations with our employees to be good.

Information Available on the Internet

Our internet address is www.neutraltandem.com. The information contained on or connected to our web site is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this or any other report filed with the Securities and Exchange Commission (SEC). Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to those reports, are available free of charge through our web site as soon as reasonably practicable after we file them with, or furnish them to, the SEC. These reports may also be obtained at the SEC’s public reference room at 100 F Street, N.E., Washington, DC 20549. The SEC also maintains a web site at www.sec.gov that contains reports, proxy statements and other information regarding SEC registrants, including Neutral Tandem.

Corporate Information

Neutral Tandem’s principal executive offices are located at One South Wacker, Suite 200, Chicago, Illinois, 60606. We have switch sites located in Arizona, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, New York, Massachusetts, Michigan, Minnesota, Missouri, New Jersey, Nevada, Ohio, Oregon, Pennsylvania, Puerto Rico, Texas, Utah, Virginia, Washington and Wisconsin.

EXECUTIVE OFFICERS AND DIRECTORS

The names, ages and positions of our executive officers and directors, as of December 31, 2009, are set forth below:

| Name |

Age | Position(s) | ||

| Rian J. Wren |

53 | President, Chief Executive Officer and Director | ||

| Robert Junkroski |

45 | Chief Financial Officer and Executive Vice President | ||

| Surendra Saboo |

50 | Chief Operating Officer and Executive Vice President | ||

| Richard Monto |

45 | General Counsel, Secretary and Senior Vice President, External Affairs | ||

| David Lopez |

45 | Senior Vice President of Sales | ||

| James P. Hynes |

62 | Director, Chairman | ||

| Dixon R. Doll |

67 | Director | ||

| Peter J. Barris |

58 | Director | ||

| G. Edward Evans |

48 | Director | ||

| Robert C. Hawk |

70 | Director | ||

| Lawrence M. Ingeneri |

51 | Director |

14

Table of Contents

Rian J. Wren. Mr. Wren joined us in February 2006 and has served as our President, Chief Executive Officer and Director since that time. Prior to joining us, Mr. Wren was Senior Vice President and General Manager of Telephony for Comcast Cable from November 1999 to August 2005. Mr. Wren joined Comcast in 1999 and was named CEO of Broadnet, Comcast’s international wireless company located in Brussels, Belgium in 2000. After returning to the United States, he served as the Senior Vice President and General Manager of Telephony for Comcast Cable Division. Prior to joining Comcast, Mr. Wren held several senior management positions at AT&T from 1978 to 1999, including President of the Southwest Region, and worked in the Consumer, Business, Network Services, and Network Systems Manufacturing divisions for more than 20 years. Mr. Wren holds a B.S. degree in Electrical Engineering from the New Jersey Institute of Technology and an M.S. in Management from Stanford University, which he attended as a Sloan Fellow.

Robert Junkroski. Mr. Junkroski has been with the Company since it commenced services, and has served as our Chief Financial Officer and Executive Vice President since that time. Prior to joining us, Mr. Junkroski held the position of Vice President of Finance with Focal Communications Corporation, or Focal (now part of Level 3 Communications Inc.), from 1999 to 2002. Mr. Junkroski previously served as Focal’s Treasurer and Controller from 1997 to 2001. Focal filed for bankruptcy protection in December 2002. Before joining Focal, Mr. Junkroski was Controller for Brambles Equipment Services, Inc. and Focus Leasing Corporation. Mr. Junkroski holds a B.B.A. degree in Accounting and Economics from University of Dubuque and an M.B.A. concentrating in Finance and Accounting from Roosevelt University, and is a Certified Public Accountant in Illinois.

Surendra Saboo. Dr. Saboo joined us in May 2006 as our Chief Operating Officer and Executive Vice President. Prior to joining us, Dr. Saboo was the Vice President of Product Development and Operations for Voice Services at Comcast Corporation from January 2002 to March 2006. From June 2000 to December 2001, Dr. Saboo served as Executive Vice President and Chief Operating Officer of Broadnet Europe, SPRL, a pan-European subsidiary of Comcast Corporation. Prior to joining Comcast Corporation, Dr. Saboo was the Chairman, Chief Executive Officer and founder of Teledigm, an e-CRM software product company in Dallas, Texas. Prior to starting Teledigm, Dr. Saboo spent 14 years at AT&T in a variety of operating areas including research and development, engineering, product management, strategy, systems development and operations. Dr. Saboo began his career with AT&T in 1986 as a Member of Technical Staff at Bell Laboratories in Holmdel, NJ. Dr. Saboo holds a B.S.M.E. degree from Birla Institute of Technology, India as well as M.S. and Ph.D. degrees in Operations Research from Ohio State University.

Richard Monto. Mr. Monto joined us in 2007, and has served as our General Counsel and Corporate Secretary since February 2009. Mr. Monto has 15 years of diversified telecommunications experience. From 2001 to 2005, Mr. Monto held senior positions, including Chief Legal Officer, with Universal Access Global Holdings Inc. From 1995 and 2000, Mr. Monto held various legal positions with MCI Telecommunications. Prior to MCI, Mr. Monto practiced for several years at private law firms, including the law firm of Sonnenschein, Nath and Rosenthal. Mr. Monto holds a B.A. degree from the University of Michigan in Russian and Eastern European Studies and a J.D. from the Boston University School of Law.

David Lopez. Mr. Lopez joined us in 2003 and has served as our Senior Vice President of Sales since that time. As Senior Vice President of Sales, Mr. Lopez oversees the management and growth of all Neutral Tandem carrier accounts. Mr. Lopez brings a wealth of sales management experience to Neutral Tandem and has more than 20 years experience in the telecommunications industry. He has been with Neutral Tandem since its inception and has secured agreements with nearly every national wireless carrier and several dozen other competitive landline and cable providers. For nearly 20 years, Mr. Lopez has provided account management responsibilities at Centel, Sprint, and Focal Communications Corporation. In his most recent position, Mr. Lopez provided sales management for Focal’s largest and most successful market from 1997 to 2003. During his tenures at Centel and Sprint from 1992 to 1997, Mr. Lopez held national account positions with responsibility for local service, Centrex, and PBX equipment to Fortune 500 companies. Lopez holds a B.S. in Marketing from Illinois State University.

15

Table of Contents

James P. Hynes. Mr. Hynes co-founded Neutral Tandem in 2001, and served as Chief Executive Officer until February 2006, after which he became Executive Chairman. In December 2006 Mr. Hynes stepped down as Executive Chairman and assumed the title of Chairman of the Board, a position he holds today. Active in the industry for 30 years, Mr. Hynes personally directed the establishment of COLT Telecommunications in Europe as their first CEO in 1992. As Chairman of the Board, he led COLT’s initial public offering in 1996. Mr. Hynes established MetroRED Telecom in South America and Mexico, as well as KVH Telecom in Tokyo. Concurrent with taking on these operating roles, he was Group Managing Director at Fidelity Capital for 10 years. His career has included senior positions with Chase Manhattan, Continental Corporation, Bache & Co. and New York Telephone. Mr. Hynes is Chairman of the Board of Trustees of Iona College and is also on the North American Board of the SMURFIT Graduate School of Business, University College Dublin in Ireland.

Dixon R. Doll. Dr. Doll has served as a Director of Neutral Tandem since 2003. Dr. Doll is the co-founder and a general partner of DCM, an early stage technology venture capital firm that manages $1.6 billion from offices in Menlo Park, California, Beijing, China and Tokyo, Japan. In the mid-1980’s, Dixon Doll co-founded the venture capital industry’s first fund focused exclusively on telecommunications opportunities. At DCM, he has led the firm’s investments in About.com (Acquired by The New York Times Co.), @Motion (Acquired by Openwave), Clearwire (Nasdaq: CLWR), Foundry Networks (Nasdaq: FDRY), Internap (Nasdaq: INAP), Ipivot (Acquired by Intel) and Neutral Tandem (Nasdaq: TNDM) among others. In April 2005, he was elected to the Board of Directors of the National Venture Capital Association (NVCA) in Washington, D.C. Dr. Doll served as the NVCA Chairman for its 2008/2009 fiscal year. Additionally, he also serves on the Stanford Institute for Economic Policy Research Advisory Board and the Hoover Institution Board of Overseers at Stanford. He is also the Chairman of the San Francisco Asian Art Museum Board. Dr. Doll received his B.S.E.E. degree (cum laude) from Kansas State University as well as M.S. and Ph.D. degrees in Electrical Engineering from the University of Michigan, where he was a National Science Foundation scholar.

Peter J. Barris. Mr. Barris has served as a Director since 2003. Mr. Barris is currently the Managing General Partner of New Enterprise Associates (“NEA”) where he specializes in information technology investing. Mr. Barris has been with NEA since 1992, and he serves as either an executive officer or general partner of various NEA entities. From 1988 to 1990, Mr. Barris was President and Chief Operating Officer at LEGENT Corporation. Mr. Barris held various management positions at UCCEL Corporation from 1985 to 1988. Prior to that, Mr. Barris also held various management positions between 1977 and 1985 at the General Electric Company, including Vice President and General Manager at GE Information Services, Inc. Mr. Barris serves or has served as a member of the Boards of Directors of InnerWorkings, Inc., where he also serves as a member of the audit, compensation and nominating and corporate governance committees, Vonage Holdings Corp., where he also serves as a member of the compensation and nominating and corporate governance committees, Protostar, Boingo Wireless and Hillcrest, as well as several other private companies in the NEA portfolio. Mr. Barris is a member of the Board of Trustees of Northwestern University and the Board of Overseers of Tuck School at Dartmouth College.

G. Edward Evans. Mr. Evans has served as a Director since November 2008. Mr. Evans is currently the Chairman of the Board and Chief Executive Officer of Stelera Wireless, a leader in deploying broadband services to rural markets throughout the United States. Previously, Mr. Evans served as the Chairman of the Board and Chief Executive Officer of Syniverse Holdings, Inc. Mr. Evans was elected Syniverse’s Chairman in February 2005 after having served as a director since February 2002. Mr. Evans served as the Chief Executive Officer of Syniverse from February 2002 until January 2006, at which time he stepped down from the position. Mr. Evans remained Chairman of the Board until January 2007. From January 1997 to January 2002, Mr. Evans held various executive positions with Dobson Communications Corporation, first as President of its cellular subsidiaries and then as President and Chief Operating Officer of the organization. Today, Mr. Evans serves on the boards of Solix, CTIA—The Wireless Association, Carolina West Wireless, and the Network Reliability and Interoperability Commission, an advisory committee to the FCC.

16

Table of Contents

Robert C. Hawk. Mr. Hawk has served as a Director since January 2004. Mr. Hawk has served as President of Hawk Communications since 1996 and is a Venture Partner of DCM. Prior to this, Mr. Hawk served as President and Chief Executive Officer of US West Multimedia Communications, Inc. From 1986 until 1995, Mr. Hawk was President of the Carrier Division of US West Communications, Inc. Prior to holding that position, Mr. Hawk was Vice President, Marketing and Strategic Planning for CXC Corporation, and Director of Advanced Systems Development for American Bell. From 1997 to 2002, Mr. Hawk served as a Special Limited Partner of Crosspoint Venture Partners. During that time he served on the boards of directors or advisory boards of fifteen companies that went public. Mr. Hawk previously served as a Director of Covad Communications and Centillium Communications and is currently a director of several private high technology companies.

Lawrence M. Ingeneri. Mr. Ingeneri has served as a Director since October 2006. Mr. Ingeneri is currently the Chief Financial Officer and a member of the Board of Directors of mindSHIFT Technologies, Inc., an IT managed services provider which he joined in October 2003. Prior to that time, Mr. Ingeneri was employed by COLT Telecom Group plc, or COLT, a European telecommunications services company from July 1996 to December 2002. Mr. Ingeneri was the Chief Financial Officer of COLT from July 1996 to June 2002 and a member of the Board of Directors of COLT from June 2001 to June 2002.

17

Table of Contents

| ITEM 1A. | RISK FACTORS |

Risk Factors

Investing in our common stock involves a high degree of risk, and you should carefully consider the risks and uncertainties described below in addition to the other information included or incorporated by reference in this Annual Report on Form 10-K. If any of the following risks actually occurs, our business, financial condition or results of operations would likely suffer, possibly materially. In that case, the trading price of our common stock could decline.

Risk Factors Related To Our Business

We face competition from the traditional ILECs and increasing competition from certain other providers such as Level 3 Communications, Peerless Network and Hypercube and expect to compete with new entrants to the tandem services market.

We face competition from the traditional ILECs, certain other providers such as Level 3 Communications, Peerless Network and Hypercube, and expect to compete with new entrants to the tandem services market. Please see “Item 3. Legal Proceedings,” for a description of a legal proceeding between us and Peerless Network. Competition has recently intensified, especially with Peerless Network, causing us to lose some traffic as well as reduce certain rates we charge our customers in various markets, including with respect to our major customers in our largest markets. We expect competition to intensify in the future, including as a result of the adoption of IP-based switching by telecommunications carriers, which is likely to increase competition from direct connections. See “The market for our services is competitive and increased adoption of IP switching technologies could increase the competition we face from direct connections” below. Certain of our current and potential competitors have significantly more employees and greater financial, technical, marketing, research and development, intellectual property development and protection and other resources than us. Also, some of our current and potential competitors have greater name recognition that they can use to their advantage. Our competitors have charged rates that are below the rates we charge, at times substantially, and may continue to do so in the future. In addition, our competitors could bundle other services with their transit or access services to compete with us or be able to respond more quickly to new or emerging technologies and changes in customer requirements than we can. Furthermore, changes in switching technology have lowered the cost of entry into our business which could promote additional competition. Existing or increased competition as described above could result in fewer customer orders, reduced revenues, reduced gross margins and loss of market share, any of which could have a material and adverse effect on our business, prospects, financial condition and operating results.

Regulatory developments could negatively impact our business.

The communications services industry is extensively regulated by the federal and state governments. While the pricing of our services is generally not heavily regulated by the Federal Communications Commission, or FCC, or state utility agencies, these agencies have greater regulatory authority over the pricing of incumbent local exchange carriers’, or ILECs’, tandem transit and access services, which generally sets the benchmark for the prices of the competitive services that we offer. To the extent that ILEC transit or access rates are reduced or capped, it could have an adverse impact on us, as we would likely be forced to reduce our rates in order to compete with the ILEC or other competitors.

Local Tandem Transit Service

Some state regulatory authorities assert jurisdiction over the provision of local tandem transit services, particularly the ILECs’ provision of the service. Various states have initiated proceedings to examine the regulatory status of transit services. Some states have taken the position that transit service is an element of the

18

Table of Contents

“transport and termination of traffic” services that incumbent ILECs are required to provide at rates based on incremental costs under the Telecommunications Act, while other states have ruled that the Telecommunications Act does not apply to these services. For example:

| • | A declaratory action was commenced in 2008 with the Connecticut Department of Public Utility Control (the “DPUC”) pursuant to which a competitive carrier requested that the DPUC order the ILEC to reduce its transit rate to a cost-based rate similar to a rate offered by that ILEC in a different state or to a rate justified in a separate cost proceeding. The DPUC recently ordered the ILEC to implement an interim rate for wireless carriers that is based on the ILEC’s costs for transit plus a 35% mark-up. The ILEC has appealed this ruling to the appropriate federal court. We have filed an amicus brief supporting the ILEC’s position. Although we believe the ILEC may prevail in its appeal, we have lowered the rate we charge certain of our wireless customers, in some cases substantially, as a result of the DPUC’s ruling. Moreover, any final ruling in this proceeding by the DPUC could also apply to wireline and cable customers and/or result in the ILEC being forced to charge an even lower rate. |