Attached files

| file | filename |

|---|---|

| EX-24 - POWER OF ATTORNEY - HKN, Inc. | ex24.htm |

| EX-21 - SUBSIDIARIES - HKN, Inc. | ex21.htm |

| EX-23.1 - CONSENT OF IRPAF - HKN, Inc. | ex23-1.htm |

| EX-32.1 - SECTION 906 CERTIFICATION - CEO - HKN, Inc. | ex32-1.htm |

| EX-23.2 - CONSENT OF ENGINEERS & GEOLOGISTS - HKN, Inc. | ex23-2.htm |

| EX-99.1 - COLLARINI RESERVE REPORT SUMMARY - HKN, Inc. | ex99-1.htm |

| EX-99.2 - CREST RESERVE REPORT SUMMARY - HKN, Inc. | ex99-2.htm |

| EX-31.1 - CEO CERTIFICATION - HKN, Inc. | ex31-1.htm |

| EX-31.2 - CFO CERTIFICATION - HKN, Inc. | ex31-2.htm |

| EX-23.3 - CONSENT OF ENGINEERS & GEOLOGISTS - HKN, Inc. | ex23-3.htm |

| EX-32.2 - SECTION 906 CERTIFICATION - CFO - HKN, Inc. | ex32-2.htm |

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM

10-K

x ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2009

o TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

___________ to ___________

Commission

file number 1-10262

HKN,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

95-2841597

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

No.)

|

|

180

State Street, Suite 200

|

76092

|

|

Southlake,

Texas

|

(Zip

Code)

|

|

(Address

of principal executive offices)

|

Registrant’s

telephone number, including area code (817)424-2424

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class:

|

Name

of each exchange on which registered:

|

|

Common

Stock, Par Value $0.01 Per Share

|

NYSE

AMEX

|

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities

Act. ¨ Yes þ No

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. þ Yes ¨ No.

Indicate

by checkmark whether the registrant has submitted electronically and posted on

its corporate Website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such

files). ¨ Yes þ No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to

this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definition of “accelerated filer and large accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large

accelerated filer ¨ Accelerated

filer ¨ Non-accelerated

filer ¨

Smaller reporting company þ

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). ¨

Yes þ No

The

aggregate market value of the voting Common Stock, par value $0.01 per share,

held by non affiliates of the Registrant as of June 30, 2009 was approximately

$25 million. For purposes of the determination of the above stated amount only,

all directors, executive officers and 5% or more stockholders of the Registrant

are presumed to be affiliates.

The

number of shares of Common Stock, par value $0.01 per share, outstanding as of

February 1, 2010 was 9,553,847.

DOCUMENTS

INCORPORATED BY REFERENCE

Specified portions of the registrant’s

definitive Proxy Statement for the 2010 Annual Meeting of Shareholders, to be

filed pursuant to Regulation 14A with the Securities and Exchange Commission not

later than 120 days after the end of this fiscal year covered by this report,

are incorporated by reference in Part III of this report.

2

TABLE OF CONTENTS

| Page | ||

| PART I. | ||

|

ITEM 1.

|

Business

|

4

|

|

|

||

|

ITEM 1A.

|

Risk

Factors

|

10

|

|

ITEM 1B.

|

Unresolved

Staff Comments

|

18

|

|

ITEM 2.

|

Properties

|

18

|

|

ITEM 3.

|

Legal

Proceedings

|

18

|

|

ITEM 4.

|

Submission

of Matters to a Vote of Security Holders

|

18

|

|

PART

II.

|

||

|

ITEM 5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

19

|

|

ITEM 6.

|

Selected

Financial Data

|

21

|

|

ITEM 7.

|

Management’s

Discussion and Analysis of Financial Condition and Results

of Operations

|

22 |

|

ITEM 7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

42 |

|

ITEM 8.

|

Financial

Statements and Supplementary Data

|

42

|

|

ITEM 9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

76

|

|

ITEM 9A.

|

Controls

and Procedures

|

76

|

|

PART

III.

|

||

|

ITEM

10.

|

Directors

and Executive Officers and Corporate Governance

|

79

|

|

ITEM

11.

|

Executive

Compensation

|

79

|

|

ITEM

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

79

|

|

ITEM

13.

|

Certain

Relationships and Related Transactions and Director

Independence

|

79

|

|

ITEM

14.

|

Principal

Accounting Fees and Services

|

79

|

|

PART

IV.

|

||

|

|

||

|

ITEM

15.

|

Exhibits

and Financial Statement Schedules

|

80

|

3

The

following discussion is intended to assist you in understanding our business and

the results of our operations. It should be read in conjunction with

the Consolidated Financial Statements and the related notes that appear

elsewhere in this report. Certain statements made in our discussion

may be forward looking. Forward-looking statements involve risks and

uncertainties and a number of factors could cause actual results or outcomes to

differ materially from our expectations. Unless the context requires

otherwise, when we refer to “we,” “us” and “our,” we are describing HKN, Inc.

and its consolidated subsidiaries on a consolidated basis.

PART

I

ITEM

1. BUSINESS

Overview

Our business strategy is focused on

enhancing value for our stockholders through the development of a well-balanced

portfolio of energy-based assets. Currently, the majority of the

value of our assets is derived from our ownership in Gulf Coast oil and gas

properties and in our coalbed methane prospects in Indiana and

Ohio. We consider these assets to be strategic for us, and our

objective in 2010 is to build the value of these properties by:

|

·

|

Monitoring

and reducing operating costs

|

|

·

|

Reducing

operational, environmental, financial and third-party dependency

risks

|

|

·

|

Pursuing

possibilities for “expanding our footprint” in these

areas

|

|

·

|

Performing

economic upgrades and improvements

|

We are also seeking to identify further

investment opportunities in undervalued energy-based assets or companies which

could provide future value for our shareholders.

We were

incorporated in 1973 in the State of California and reincorporated in 1979 in

the State of Delaware. Our corporate offices are located at 180 State Street,

Suite 200, Southlake, Texas 76092. Our telephone number is (817) 424-2424, and

our web site is accessed at www.hkninc.com. We make available, free of charge,

on our website, our Code of Business Conduct and Ethics, Code of Ethics for

Senior Financial Officers, Audit Committee Charter and Nominating and Corporate

Governance Committee Charter as well as our annual report on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments

to those reports as soon as is reasonably practical after such materials are

electronically filed with, or furnished to, the Securities and Exchange

Commission (SEC).

Oil

and Gas Development and Production Operations

During

the three years ended December 31, 2009, we drilled or participated in the

drilling of 22 oil and gas wells in North America, completing 20 of the wells

drilled. During 2009, we participated in the completion of 2 development wells.

As of December 31, 2009, we operate or own a non-operating working interest in

69 oil wells, 65 gas wells and 12 injection wells in the Gulf Coast area of the

United States. All of our proved oil and gas reserves are concentrated in the

Gulf Coast region of Louisiana and Texas.

Prospect Acreage - In

addition to the producing property interests discussed above, we own, through

certain wholly-owned subsidiaries, interests in a variety of domestic prospect

acreage in the Creole, East Lake Verret and Lapeyrouse fields of Cameron,

Assumption and Terrebonne Parishes, respectively, in Louisiana.

See Note

14 – “Other Information” in the Notes to Consolidated Financial Statements

contained in Part II, Item 8 of this Annual Report on Form 10-K for financial

information about our oil and gas interests.

4

Oil

and Gas Customers

During

2009, one domestic customer, Shell, purchased approximately 61% of our

consolidated oil and gas sales. During 2008, three domestic customers, Shell,

Louis Dreyfus and Sequent, purchased approximately 56% of our consolidated oil

and gas sales. During 2007, three domestic customers, Shell, Chevron and Noble,

purchased approximately 60% of our consolidated oil and gas sales.

Oil

and Natural Gas Marketing

Generally, but not always, the demand

for natural gas decreases during the summer months and increases during the

winter months. Seasonal anomalies such as mild winters or hot summers

sometimes lessen this fluctuation. The spot market for oil and gas is

subject to volatility as supply and demand factors fluctuate. We may

periodically enter into financial hedging arrangements with a portion of our oil

and gas production. In December 2009, we purchased a crude oil

commodity floor contract at a premium of $30 thousand. These

activities are intended to support targeted price levels and to manage our

exposure to price fluctuations. See “Item 7A. Quantitative and

Qualitative Disclosures About Market Risk.”

Oil

and Gas Properties and Locations

Production and Revenues – See

also Note 16 – “Oil and Gas Disclosures” in the Notes to Consolidated Financial

Statements contained in Part II, Item 8 of this Annual Report on Form 10-K for

certain information about our proved oil and gas reserves. A summary

of our ownership in our most significant producing properties at December 31,

2009 is as follows:

|

Average

Working

Interest

|

Average

Revenue

Interest

|

||

|

Lake

Raccourci

|

40%

|

27%

|

|

|

Lapeyrouse

|

12%

|

7%

|

|

|

Raymondville

|

22%

|

16%

|

|

|

Main

Pass Block 35

|

91%

|

72%

|

|

|

Creole

|

15%

|

11%

|

5

The

following table shows, for the periods indicated, operating information

attributable to our oil and gas interests:

|

2009

|

2008

|

2007

|

||||||||||

|

Production:

|

||||||||||||

|

Natural

Gas (Mcf)

|

388,000 | 703,000 | 986,000 | |||||||||

|

Oil

(Bbls)

|

148,000 | 149,000 | 172,000 | |||||||||

|

Revenues:

|

||||||||||||

|

Natural

Gas

|

$ | 1,542,000 | $ | 6,913,000 | $ | 7,881,000 | ||||||

|

Oil

|

8,643,000 | 15,293,000 | 12,538,000 | |||||||||

|

Total

|

$ | 10,185,000 | $ | 22,206,000 | $ | 20,419,000 | ||||||

|

Unit

Prices:

|

||||||||||||

|

Natural

Gas (per Mcf)

|

$ | 3.97 | $ | 9.83 | $ | 7.99 | ||||||

|

Oil

(per Bbl)

|

$ | 58.48 | $ | 102.35 | $ | 72.95 | ||||||

|

Production

costs per

equivalent

Mcfe

|

$ | 6.73 | $ | 6.75 | $ | 4.29 | ||||||

|

Amortization

per

equivalent

Mcfe

|

$ | 2.30 | $ | 2.87 | $ | 2.72 | ||||||

Acreage and Wells -- At

December 31, 2009, we owned interests in the following oil and gas wells

and acreage.

| Gross Wells | Net Wells | Developed Acreage | Undeveloped Acreage | |||||||||||||||||||||||||||||

|

State

|

Oil

|

Gas

|

Oil

|

Gas

|

Gross

|

Net

|

Gross

|

Net

|

||||||||||||||||||||||||

|

Texas

|

- | 31 | - | 4.53 | 1,573 | 304 | 2,811 | 237 | ||||||||||||||||||||||||

|

Louisiana

|

69 | 34 | 44.38 | 3.93 | 7,293 | 2,204 | 7,453 | 2,157 | ||||||||||||||||||||||||

|

Other

|

- | 12 | - | 6.44 | - | - | 1,862 | 1,210 | ||||||||||||||||||||||||

|

Total

|

69 | 77 | 44.38 | 14.90 | 8,866 | 2,508 | 12,126 | 3,604 | ||||||||||||||||||||||||

Drilling Activity - A well is

considered “drilled” when it is completed. A productive well is completed when

permanent equipment is installed for the production of oil or gas. A

dry hole is completed when it has been plugged as required and its abandonment

is reported to the appropriate government agency. The following tables summarize

certain information concerning our drilling activity:

| Number of Gross Wells Drilled | ||||||||||||||||||||||||

| Exploratory | Developmental | Total | ||||||||||||||||||||||

|

Productive

|

Drilled

|

Productive

|

Drilled

|

Productive

|

Drilled

|

|||||||||||||||||||

|

2007

|

2 | 3 | 2 | 2 | 4 | 5 | ||||||||||||||||||

|

2008

|

2 | 2 | 1 | 2 | 3 | 4 | ||||||||||||||||||

|

2009

|

0 | 0 | 2 | 2 | 2 | 2 | ||||||||||||||||||

|

Total

|

4 | 5 | 5 | 6 | 9 | 11 | ||||||||||||||||||

6

| Number of Net Wells Drilled | ||||||||||||||||||||||||

| Exploratory | Developmental | Total | ||||||||||||||||||||||

|

Productive

|

Drilled

|

Productive

|

Drilled

|

Productive

|

Drilled

|

|||||||||||||||||||

|

2007

|

0.33 | 0.44 | 0.30 | 0.30 | 0.63 | 0.74 | ||||||||||||||||||

|

2008

|

0.35 | 0.35 | 0.02 | 0.04 | 0.37 | 0.39 | ||||||||||||||||||

|

2009

|

0.00 | 0.00 | 0.30 | 0.30 | 0.30 | 0.30 | ||||||||||||||||||

|

Total

|

0.68 | 0.79 | 0.62 | 0.64 | 1.30 | 1.43 | ||||||||||||||||||

Reserve Information - Our domestic reserve

estimates at December 31, 2009, 2008 and 2007 have been prepared by Collarini

Associates and Crest Engineering Services, Inc., both of which are independent,

registered members of a professional engineering society in the state of Texas.

We internally tested these reports to ensure the inputs and assumptions used are

reasonable, as well as reviewed the qualifications of both Collarini and Crest.

Proved oil and gas reserves are defined as the estimated quantities of crude

oil, natural gas, and natural gas liquids which geological and engineering data

demonstrate with reasonable certainty to be recoverable in future years from

known reservoirs under existing economic and operating

conditions. Reservoirs are considered proved if economic

productibility is supported by either actual production or conclusive formation

tests. The area of a reservoir considered proved includes that portion

delineated by drilling and defined by gas-oil and/or oil-water contacts, if any,

and the immediately adjoining portions not yet drilled, but which can be

reasonably judged as economically productive on the basis of available

geological and engineering data. In the absence of information on fluid

contacts, the lowest known structural occurrence of hydrocarbons controls the

lower proved limit of the reservoir. Reserves which can be produced economically

through application of improved recovery techniques are included in the “proved”

classification when successful testing by a pilot project or the operation of an

installed program in the reservoir, provides support for the engineering

analysis on which the project or program was based.

The

reliability of reserve information is considerably affected by several factors.

Reserve information is imprecise due to the inherent uncertainties in, and the

limited nature of, the data based upon which the estimating of reserve

information is predicated. Moreover, the methods and data used in estimating

reserve information are often necessarily indirect or analogical in character

rather than direct or deductive. Furthermore, estimating reserve information by

applying generally accepted petroleum engineering and evaluation principles

involves numerous judgments based upon the engineer’s educational background,

professional training and professional experience. The extent and

significance of the judgments to be made are, in themselves, sufficient to

render reserve information inherently imprecise.

7

|

(Unaudited)

|

||||||||

|

Total

(1)

|

||||||||

|

Oil

(Barrels)

|

Gas (Mcf)

|

|||||||

|

(in

thousands)

|

||||||||

|

Proved

reserves:

|

||||||||

|

As

of December 31, 2006

|

1,856 | 7,005 | ||||||

|

Extensions

and discoveries

|

220 | 311 | ||||||

|

Revisions

|

486 | (1,135 | ) | |||||

|

Production

|

(172 | ) | (986 | ) | ||||

|

Purchases

of reserves in place

|

- | - | ||||||

|

Sales

of reserves in place

|

(21 | ) | (175 | ) | ||||

|

As of December 31, 2007

(2)

|

2,369 | 5,020 | ||||||

|

Extensions

and discoveries

|

371 | 601 | ||||||

|

Revisions

|

(1,132 | ) | (703 | ) | ||||

|

Production

|

(149 | ) | (703 | ) | ||||

|

Purchases

of reserves in place

|

- | - | ||||||

|

Sales

of reserves in place

|

- | - | ||||||

|

As of December 31, 2008

(2)

|

1,459 | 4,215 | ||||||

|

Extensions

and discoveries

|

221 | 203 | ||||||

|

Revisions

|

82 | (1,016 | ) | |||||

|

Production

|

(148 | ) | (388 | ) | ||||

|

Purchases

of reserves in place

|

1 | 61 | ||||||

|

Sales

of reserves in place

|

- | - | ||||||

|

As of December 31, 2009

(2)

|

1,615 | 3,075 | ||||||

|

Proved

developed reserves at:

|

||||||||

|

December

31, 2007 (3)

|

1,880 | 4,619 | ||||||

|

December

31, 2008 (3)

|

925 | 1,013 | ||||||

|

December

31, 2009 (3)

|

1,425 | 2,890 | ||||||

|

(1)

|

All

reserves were held within the United States for the years ended December

31, 2009, 2008 and 2007.

|

|

(2)

|

Not

included are our proportional interests of 236,750 barrels and 272,000

Mcf, 237,330 barrels and 240,300 Mcf and 225,750 barrels and 262,750 Mcf

of proved reserves from our equity investment in Spitfire at December 31,

2007, 2008 and 2009 respectively. Spitfire’s reserve report

information is as of March 31, 2007, 2008 and 2009 (their fiscal

year-end). Their reserve report is not compiled in accordance with the SEC

guidelines.

|

|

(3)

|

Not

included are our proportional interests of 201,000 barrels and 228,750 Mcf

, 190,350 barrels and 156,060 Mcf and 163,750 barrels and 220,250 Mcf of

proved developed reserves from our equity investment in Spitfire at

December 31, 2007, 2008 and 2009, respectively. Spitfire’s

reserve report information is as of March 31, 2007, 2008 and 2009 (their

fiscal year-end). Their reserve report is not compiled in

accordance with the SEC guidelines.

|

8

At

December 31, 2009, we had two fields, Main Pass and Creole Field, that contained

15% or more of our total proved reserves. The following table shows the

production for these fields for the year ended December 31:

|

2009

|

2008

|

2007

|

||||||||||||||||||||||

|

Field:

|

Oil

(Bbls)

|

Gas

(Mcf)

|

Oil

(Bbls)

|

Gas

(Mcf)

|

Oil

(Bbls)

|

Gas

(Mcf)

|

||||||||||||||||||

|

Main

Pass

|

104,965 | - | 100,508 | - | 119,815 | - | ||||||||||||||||||

|

Creole

Field

|

23,720 | 66,342 | 17,610 | 22,831 | 6,848 | 6,958 | ||||||||||||||||||

Coalbed

Methane Prospects – Indiana and Ohio

At

December 31, 2009, we currently hold two coalbed methane exploration and

development agreements in Indiana and Ohio. These prospects each provide for an

area of mutual interest of approximately 400,000 acres. The agreements provide

for a phased delineation, pilot and development program with corresponding

staged expenditures. Third party consultants with a long track record in

successful coalbed methane development provide expert advice for these

projects. Currently, we are in the dewatering phase in which the

pilot wells are produced to maximize fluid (water) production in order to lower

reservoir pressure so that desorption of gas can occur in the pilot test wells

on the Indiana Posey Contract area. We continue to evaluate their

progress. With the decline in oil and gas commodity prices, resource

plays, such as coalbed methane prospects, can become uneconomical in low price

environments particularly since all well, facility and flowline costs as well

as operating costs during the dewatering/desorption process must be

incurred before revenues can generated. Our discretionary capital

expenditures, including costs related to our coalbed methane prospects, may be

curtailed at our discretion in the future. Such expenditure curtailments could

result in us losing certain prospect acreage or reducing our interest in future

development projects.

International

Energy Investment – Global Energy Development PLC

At

December 31, 2009 and 2008, we held an investment in Global Energy Development

PLC (“Global”) through our ownership of approximately 34% of Global’s ordinary

shares. We account for our ownership of Global shares as a cost method

investment. Global is a petroleum exploration and production company focused on

Latin America. Global’s shares are traded on the AIM, a market operated by the

London Stock Exchange. See Note 3 – “Other Investments” in the Notes

to Consolidated Financial Statements contained in Part II, Item 8 of this Annual

Report on Form 10-K for further information. Additional information regarding

Global’s operations may be found on their website, www.globalenergydevelopmentplc.com.

Canadian

Energy Investment – Spitfire Energy, Ltd.

At

December 31, 2009 and 2008, we held an investment in Spitfire Energy, Ltd.

(“Spitfire”) through the ownership of approximately 25% and 27%, respectively,

of Spitfire’s currently outstanding common shares. Spitfire is an independent

public company (TSX-V; SEL) engaged in the exploration, development and

production of crude oil, natural gas and natural gas liquids in Western

Canada. At December 31, 2009, we owned 9.9 million common shares of

Spitfire and 1.3 million warrants to acquire common shares of Spitfire. As a

result of our ownership of Spitfire’s outstanding common shares, we are deemed

to have the ability to exert significant influence over Spitfire’s operating and

financial policies. Accordingly, we reflect our investment in Spitfire as an

equity method investment. During 2009, we sold approximately 1.2

million shares of Spitfire in the market for total proceeds of $212 thousand.

Additional information regarding Spitfire’s operations may be found on their

website, www.spitfireenergy.com.

9

Investment

in BriteWater International, LLC (formerly UniPureEnergy)

In

June 2009, we acquired a 19.5% interest in a private company,

BriteWater International, LLC (“BWI”), formerly known as UniPureEnergy

Acquisition, LLC (“UniPure Energy”), which holds patents to the emulsion

breaking “OHSOL” technology. This environmentally-clean process can

be used to purify oilfield emulsions by breaking and separating the emulsions

into oil, water and solids. This technology has been successfully tested using a

mobile OHSOL unit in a demonstration in Prudhoe Bay, Alaska, which demonstrated

the effectiveness of the OHSOL emulsion breaking technology to recover valuable

hydrocarbons and reduce wastes. BWI is currently pursuing opportunities to

commercialize the OHSOL technology by performing emulsion testing of the OHSOL

plant equipment both internationally and domestically.

Discontinued

Operations – Canergy Management Company and Canergy Growth Fund

In 2008, we created the Canergy Growth

Fund to invest in the Canadian junior oil and gas market. As a result

of the dramatic decline in the U.S. and foreign stock markets, and in order to

avoid future additional significant losses, Canergy Growth Fund divested of all

of its common stock holdings in Canadian junior oil and gas companies during

2008. With the continued economic volatility in 2009, we did not participate in

any additional investments during 2009. In the fourth quarter 2009,

we chose to dissolve the Canergy Growth Fund and Canergy Management Company. The

results of operations have been reclassified to discontinued operations in our

Consolidated Financial Statements. See Note 13 – “Discontinued Operations” in

the Notes to Consolidated Financial Statements contained in Part III, Item 8 of

this Annual Report on Form 10-K for further information.

Energy-Based

Trading Investments

In 2008, due to the dramatic volatility

in the U.S. and international stock markets, we terminated all our common stock

and common stock derivative contracts used for trading purposes. We had

previously maintained an investment portfolio of investments in energy industry

and foreign currency securities traded on domestic securities

exchanges. We did not participate in the trading of energy-based

investments in 2009. Therefore, we had no total potential obligations or

exposure associated with such instruments as of December 31,

2009. See “Note 3 – Other Investments” in the Notes to Consolidated

Financial Statements contained in Part II, Item 8 of this Annual Report on Form

10-K for financial information regarding our trading activities.

Employees

At

December 31, 2009, we had 16 employees. We have experienced no work

stoppages or strikes as a result of labor disputes and consider relations with

our employees to be satisfactory. We maintain group medical, dental, surgical

and hospital insurance plans for our employees.

ITEM

1A. RISK FACTORS

We wish to caution you that there are

risks and uncertainties that could cause our actual results to be materially

different from those indicated by forward-looking statements that we make from

time to time in filings with the SEC, news releases, reports, proxy statements,

registration statements and other written communications, as well as oral

forward-looking statements made from time to time by our representatives. These

risks and uncertainties include, but are not limited to, the risks described

below. Because of the following factors, as well as other variables affecting

our operating results, past financial performance may not be a reliable

indicator of future performance, and historical trends should not be used to

anticipate results or trends in future periods. We do not assume any obligation

to update forward-looking statements.

10

Risks

associated with our crude oil and natural gas operations:

Oil

and gas price fluctuations in the market may adversely affect the results of our

operations.

Our

profitability, cash flows and the carrying value of our oil and natural gas

properties are highly dependent upon the market prices of oil and natural gas.

Substantially all of our sales of oil and natural gas are made in the spot

market, or pursuant to contracts based on spot market prices, and not pursuant

to long-term, fixed-price contracts. Accordingly, the prices received

for our oil and natural gas production are dependent upon numerous factors

beyond our control. These factors include the level of consumer product demand,

governmental regulations and taxes, the price and availability of alternative

fuels, the level of foreign imports of oil and natural gas and the overall

economic environment. Historically, the oil and natural gas markets

have proven cyclical and volatile as a result of factors that are beyond our

control. Any additional declines in oil and natural gas prices or any

other unfavorable market conditions could have a material adverse effect on our

financial condition and on the carrying value of our proved

reserves. During 2009, commodity pricing for both crude oil and

natural gas has continued to average below pricing from the respective prior

year period. During 2009, based on NYMEX pricing, the price for a barrel (bbl)

of oil ranged from a high of $81.37 to a low of $33.98 and the price for a Mmbtu

of gas ranged from a high of $6.10 to a low of $1.92.

Our future success depends on our

ability to find, develop and produce oil and gas

reserves.

As is generally the case, our producing

properties in the Gulf of Mexico and the onshore Gulf Coast often have high

initial production rates which are followed by steep declines. To maintain

production levels, we must locate and develop or acquire new oil and gas

reserves to replace those depleted by production. Without successful exploration

or acquisition activities, our reserves, production and revenues will decline

rapidly. We may be unable to find, develop or produce additional reserves at an

acceptable cost. In addition, substantial capital is required to replace and

grow reserves. If lower oil and gas prices or operating constraints or

production difficulties result in our cash flow from operations being less than

expected, we may be unable to expend the capital necessary to locate and develop

or acquire new oil and gas reserves.

Actual quantities of recoverable oil

and gas reserves and future cash flows from those reserves most likely will vary

from our estimates.

Estimating accumulations of oil and gas

is complex. The process relies on interpretations of available geological,

geophysical, engineering and production data. The extent, quality and

reliability of this data can vary. The process also requires certain economic

assumptions, some of which are mandated by the SEC, such as oil and gas prices,

drilling and operating expenses, capital expenditures, taxes and availability of

funds. The accuracy of a reserve estimate is a function of:

|

•

|

the

quality and quantity of available data;

|

|

•

|

the

interpretation of that data;

|

|

•

|

the

accuracy of various mandated economic

assumptions; and

|

|

•

|

the

judgment of the persons preparing the

estimate.

|

The

proved reserve information set forth in this report is based on estimates we

prepared in accordance with the definition of proved reserves prepared in

accordance with Financial Accounting Standards Board’s Accounting Standards

Codification 932, Extractive

Activities- Oil and Gas (“ASC 932”), which was adopted for the

disclosures for the year December 31, 2009.

Estimates

prepared by others might differ materially from our estimates. Actual quantities

of recoverable oil and gas reserves, future production, oil and gas prices,

revenues, taxes, development expenditures and operating expenses most likely

will vary from our estimates. Any significant variance could materially affect

the quantities and net present value of our reserves. In addition, we may adjust

estimates of proved reserves to reflect production history, results of

exploration and development and prevailing oil and gas prices. Our reserves also

may be susceptible to drainage by operators on adjacent properties.

11

You

should not assume that the present value of future net cash flows is the current

market value of our estimated proved oil and gas reserves. In accordance with

new reserve disclosure requirements, we calculate the estimated discounted

future net cash flows from proved reserves using twelve (12) month average

prices and costs. Actual future prices and costs may be materially higher or

lower than the prices and costs we used.

Our

operations require significant expenditures of capital that may not be

recovered.

We

require significant expenditures of capital in order to locate and develop

producing properties and to drill exploratory and exploitation

wells. In conducting exploration, exploitation and development

activities from a particular well, the presence of unanticipated pressure or

irregularities in formations, miscalculations or accidents may cause our

exploration, exploitation, development and production activities to be

unsuccessful, potentially resulting in abandonment of the well. This

could result in a total loss of our investment. In addition, the cost

and timing of drilling, completing and operating wells is difficult to

predict.

We

are dependent on other operators who influence our productivity.

We have

limited influence over the nature and timing of exploration and development on

oil and natural gas properties we do not operate, including limited control over

the maintenance of both safety and environmental standards. In 2009,

approximately 46% of our production and 37% of our reserves were from our

non-operated properties. The operators of those properties may:

|

·

|

refuse

to initiate exploration or development

projects,

|

|

·

|

initiate

exploration or development projects on a slower schedule than we prefer;

or

|

|

·

|

drill

more wells or build more facilities on a project than we can adequately

fund, which may limit our participation in those projects or limit our

percentage of the revenues from those

projects.

|

The

occurrence of any of the foregoing events could have a material adverse effect

on our anticipated exploration and development activities.

Our

working interest owners may face cash flow and liquidity concerns.

If oil

and natural gas prices decline, many of our working interest owners could

experience liquidity and cash flow problems. These problems may lead

to their attempting to delay the pace of drilling or project development in

order to conserve cash. Any such delay could be detrimental to our

projects. Some working interest owners may be unwilling or unable to

pay their share of the project costs as they become due. A working

interest owner may declare bankruptcy and refuse or be unable to pay its share

of the project costs, and we would be obligated to pay that working interest

owner’s share of the project costs.

12

The

oil and gas we produce may not be readily marketable at the time of

production.

Crude

oil, natural gas, condensate and other oil and gas products are generally sold

to other oil and gas companies, government agencies and other

industries. The availability of ready markets for oil and gas that we

might discover and the prices obtained for such oil and gas depend on many

factors beyond our control, including:

|

·

|

the

extent of local production and imports of oil and

gas,

|

|

·

|

the

proximity and capacity of pipelines and other transportation

facilities,

|

|

·

|

fluctuating

demand for oil and gas,

|

|

·

|

the

marketing of competitive fuels, and

|

|

·

|

the

effects of governmental regulation of oil and gas production and

sales.

|

Natural

gas associated with oil production is often not marketable due to demand or

transportation limitations and is often flared at the producing well

site. Pipeline facilities do not exist in certain areas of

exploration and, therefore, any actual sales of discovered oil and gas might be

delayed for extended periods until such facilities are constructed.

We

may encounter operating hazards that may result in substantial

losses.

We are

subject to operating hazards normally associated with the exploration and

production of oil and gas, including hurricanes, blowouts, explosions, oil

spills, cratering, pollution, earthquakes, labor disruptions and

fires. The occurrence of any such operating hazards could result in

substantial losses to us due to injury or loss of life and damage to or

destruction of oil and gas wells, formations, production facilities or other

properties. We maintain insurance coverage limiting financial loss

resulting from certain of these operating hazards. We do not maintain

full insurance coverage for all matters that may adversely affect our

operations, including war, terrorism, nuclear reactions, government fines,

treatment of waste, blowout expenses, wind damage and business

interruptions. Losses and liabilities arising from uninsured or

underinsured events could reduce our revenues or increase our costs. There can

be no assurance that any insurance will be adequate to cover losses or

liabilities associated with operational hazards. We cannot predict

the continued availability of insurance, or its availability at premium levels

that justify its purchase.

Oil

and gas wells particularly in certain regions of the United States could be

hindered by hurricanes, earthquakes and other weather-related operating

risks.

Our

operations in the Texas and Louisiana Gulf Coast area are subject to risks from

hurricanes and other natural disasters. Damage caused by wind, hurricanes,

earthquakes or other operating hazards could result in substantial losses to us.

In the past, our oil and gas operations have been affected by tropical storms

and hurricanes on occasion resulting in additional costs and reduced oil and gas

volumes during those periods.

We

face strong competition from larger oil and gas companies, which could result in

adverse effects on our business.

The

exploration and production business is highly competitive. Many of

our competitors have substantially larger financial resources, staffs and

facilities. Our competitors in the United States include numerous

major oil and gas exploration and production companies. Our

investments in Spitfire and Global may be affected as a result of the

competition faced in Canada, Colombia, Peru and Panama.

13

Our

operations are subject to various litigation that could have an adverse effect

on our business.

From time

to time we are a defendant in various litigation matters. The nature of our

operations expose us to further possible litigation claims in the future. There

is risk that any matter in litigation could be adversely decided against us

regardless of our belief, opinion and position, which could have a material

adverse effect on our financial condition and results of operations. Litigation

is highly costly and the costs associated with defending litigation could also

have a material adverse effect on our financial condition.

Compliance

with, or breach of, environmental laws can be costly and could limit our

operations.

Our

operations are subject to numerous and frequently changing laws and regulations

governing the discharge of materials into the environment or otherwise relating

to environmental protection. We own or lease, and have in the past

owned or leased, properties that have been used for the exploration and

production of oil and gas and these properties and the wastes disposed on these

properties may be subject to the Comprehensive Environmental Response,

Compensation and Liability Act, the Oil Pollution Act of 1990, the Resource

Conservation and Recovery Act, the Federal Water Pollution Control Act and

analogous state laws. Under such laws, we could be required to remove

or remediate previously released wastes or property

contamination. Laws and regulations protecting the environment have

generally become more stringent and may, in some cases, impose “strict

liability” for environmental damage. Strict liability means that we

may be held liable for damage without regard to whether we were negligent or

otherwise at fault. Environmental laws and regulations may expose us

to liability for the conduct of or conditions caused by others or for acts that

were in compliance with all applicable laws at the time they were

performed. Failure to comply with these laws and regulations may

result in the imposition of administrative, civil and criminal

penalties.

Although

we believe that our operations are in substantial compliance with existing

requirements of governmental bodies, our ability to conduct continued operations

is subject to satisfying applicable regulatory and permitting controls. Our

current permits and authorizations and ability to get future permits and

authorizations may be susceptible on a going forward basis, to increased

scrutiny, greater complexity resulting in increased costs, or delays in

receiving appropriate authorizations.

We

may be affected by global climate change or by legal, regulatory, or market

responses to such change.

The

growing political and scientific sentiment is that increased concentrations of

carbon dioxide and other greenhouse gases in the atmosphere are influencing

global weather patterns. Changing weather patterns, along with the increased

frequency or duration of extreme weather conditions, could impact the

availability or increase the cost to produce our products. Additionally, the

sale of our products can be impacted by weather conditions.

Concern

over climate change, including global warming, has led to legislative and

regulatory initiatives directed at limiting the greenhouse gas (“GHG”)

emissions. For example, proposals that would impose mandatory requirements on

GHG emissions continue to be considered by policy makers in the territories we

operate. Laws enacted that directly or indirectly affect our oil and gas

production could impact our business and financial results.

Risk

factors associated with our financial condition:

We

have a history of losses and may suffer losses in the future.

We

reported a net loss of approximately $3.3 million and $27 million for the years

ended December 31, 2009 and 2008, respectively. We have reported net losses in

three of the last five fiscal years. Our ability to generate net

income is strongly affected by, among other factors, the market price of crude

oil and natural gas. During 2008, we recorded a write-down of the

carrying value of our oil and gas properties of approximately $19.9 million

which was primarily due to the significant decline in the market price of crude

oil and natural gas at December 31, 2008. We had no such write-down in 2009;

however, we may report losses in the future. Consequently, future

losses may adversely affect our business, prospects, financial condition,

results of operations and cash flows.

14

If

estimated discounted future net cash flows continue to decrease, we may be

required to take additional write-downs.

We

periodically review the carrying value of our oil and gas properties under

applicable full-cost accounting rules. These rules require a write-down of the

carrying value of oil and gas properties if the carrying value exceeds the

applicable estimated discounted future net cash flows from proved oil and gas

reserves. Given the volatility of oil and gas prices, it is reasonably possible

that the estimated discounted future net cash flows could change in the near

term. If oil and gas prices decline in the future, even if only for a short

period of time, it is possible that write-downs of oil and gas properties could

occur. Whether we will be required to take such a charge will depend on the

average prices for oil and gas during the period and the effect of reserve

additions or revisions, property sales and capital expenditures during such

quarter.

Our

financial condition may suffer if estimates of our oil and gas reserve

information are adjusted, and fluctuations in oil and gas prices and other

factors affect our oil and gas reserves.

Our oil

and gas reserve information is based upon criteria prepared in accordance with

Financial Accounting Standards Board’s Accounting Standards Codification 932,

Extractive Activities- Oil and

Gas (“ASC 932”) and the Securities and Exchange Commission’s Final Rule,

Modernization of the Oil and

Gas Reporting Requirements, and reflects only estimates of the

accumulation of oil and gas and the economic recoverability of those

volumes. Our future production, revenues and expenditures with

respect to such oil and gas reserves could be different from estimates, and any

material differences may negatively affect our business, financial condition and

results of operations.

Petroleum

engineering is a subjective process of estimating underground accumulations of

oil and gas that cannot be measured in an exact manner. Estimates of

economically recoverable oil and gas reserves and of future net cash flows

necessarily depend upon a number of variable factors and

assumptions.

Because

all reserve estimates are to some degree subjective, each of the following items

may prove to differ materially from that assumed in estimating

reserves:

|

·

|

the

quantities of oil and gas that are ultimately

recovered,

|

|

·

|

the

production and operating costs

incurred,

|

|

·

|

the

amount and timing of future development expenditures,

and

|

|

·

|

future

oil and gas sales prices.

|

Furthermore,

different reserve engineers may make different estimates of reserves and cash

flow based on the same available data.

The estimated discounted future net

cash flows described in this Annual Report for the year ended December 31, 2009

should not be considered as the current market value of the estimated oil and

gas reserves attributable to our properties from proved

reserves. Such estimates are prepared in compliance with the ASC 932,

Oil

and Gas Reserve Estimation and Disclosures and the Securities and Exchange

Commission’s Final Rule, Modernization of

the Oil and Gas Reporting Requirements, and, as such, are based on average

prices and costs as of the date of the estimate, while future prices and costs

may be materially higher or lower. The Standard requires that we

report our oil and natural gas reserves using a 12-month average price,

calculated as the unweighted arithmetic average of the first-day-of-the-month

price for each month within the 12-month period prior to the end of the

reporting period, unless prices are defined by contractual arrangements,

excluding escalations based upon future conditions. Using lower values in

forecasting reserves will result in a shorter life being given to producing oil

and natural gas properties because such properties, as their production levels

are estimated to decline, will reach an uneconomic limit, with lower prices, at

an earlier date. There can be no assurance that a decrease in oil and

gas prices or other differences in our estimates of its reserve will not

adversely affect our financial condition and results of

operations.

15

If

the market value of our investments in Global and Spitfire continue to decrease,

the value of our common stock could be negatively impacted.

At

December 31, 2009, we held investments in both Global and Spitfire through our

ownership of approximately 34% and 25%, respectively, of their outstanding

ordinary shares. Both investments represent a substantial part of our

balance sheet at December 31, 2009. The market value of Global’s

common shares increased while the value of Spitfire’s common shares decreased

slightly during 2009, as compared to the prior year period, but there can be no

assurance that their common stock will continue to improve in the future. A

potential decrease in the value of their common stock could adversely affect our

financial statements and the value of our common stock.

We

may suffer losses on our investments from exchange rate

fluctuations.

We

account for our investments in Global and Spitfire using the U.S. dollar as the

functional currency. The shares of common stock associated with our

investments in Global and Spitfire are denominated in British sterling pounds

and Canadian dollars, respectively. We could suffer losses in our

investments if the value of the British sterling pound and the Canadian dollar

were to drop relative to the value of the U.S. dollar. Any

substantial currency fluctuations could create a material adverse effect on the

value of our investments.

One

of our shareholders owns a significant amount of our common stock and exercises

significant control over us.

As of

December 31, 2009, Lyford Investments Enterprises Ltd. (“Lyford”) beneficially

owned approximately 33% of the combined voting power of our outstanding common

stock. Lyford is in a position to significantly influence decisions with respect

to:

|

·

|

our

direction and policies, including the election and removal of

directors,

|

|

·

|

mergers

or other business combinations,

|

|

·

|

the

acquisition or disposition of our

assets,

|

|

·

|

future

issuances of our common stock or other

securities,

|

|

·

|

our

incurrence of debt, and

|

|

·

|

the

payment of dividends, if any, on our common stock, and amendments to our

certificate of incorporation and

bylaws.

|

Lyford’s

concentration of ownership may also have the effect of delaying, deferring or

preventing a future change of control.

16

Risks

associated with market conditions:

Our

stock price is volatile and the value of any investment in our common stock may

fluctuate.

Our stock

price has been and is highly volatile, and we believe this volatility is due to,

among other things:

|

·

|

commodity

prices of oil and natural gas,

|

|

·

|

the

volatility of the market in

general,

|

|

·

|

the

results of our drilling,

|

|

·

|

current

expectations of our future financial

performance.

|

For

example, our common stock price has fluctuated from a high of $13.10 per share

to a low of $1.40 per share over the three years ended December 31,

2009. This volatility may affect the market value of our common stock

in the future. See Part II, Item 5: Market for Registrant’s Common

Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

Future

sales of our common stock may affect the market price of our common

stock.

There are

currently several registration statements with respect to our common stock that

are effective, pursuant to which certain of our stockholders may sell shares of

common stock. Any such sale of stock may also decrease the market

price of our common stock.

Any

conversions of our Series G1 Preferred or Series G2 Preferred Stock involving a

large issuance of shares of our common stock could result in a dilution of

stockholders’ ownership percentage of our common stock and may result in a

decrease in the market value of our common stock. In addition, we may

elect to issue a significant number of additional shares of common stock for

financing or other purposes, which could result in a decrease in the market

price of our common stock.

We

have issued shares of preferred stock with greater rights than our common stock

and may issue additional shares of preferred stock in the future.

We are

permitted under our charter to issue up to 1.0 million shares of preferred

stock. We can issue shares of our preferred stock in one or more

series and can set the terms of the preferred stock without seeking any further

approval from our common

stockholders. Any preferred stock that we issue may rank ahead of our

common stock in terms of dividend priority or liquidation premiums and may have

greater voting rights than our common stock. At December 31, 2009, we

had outstanding 1,000 shares of Series G1 Preferred and 1,000 shares of Series

G2 Preferred. These shares of preferred stock have rights senior to our common

stock with respect to dividends and liquidation.

We

may issue additional shares of common stock which may dilute the value of our

common stock and adversely affect the market price of our common

stock.

Pursuant

to the terms of our investment in BWI and the related Agreement, HKN and the

other BWI unitholders granted to one another put and call options with respect

to 3,050 units of BWI in exchange for issuance of 725 thousand restricted shares

of our common stock. These options are exercisable only if certain

conditions are satisfied prior to June 2012.

17

A large

issuance of shares of common stock could decrease the ownership percentage of

current outstanding stockholders and could result in a decrease in the market

price of our common stock. In addition, we may elect to issue

additional shares of common stock for financing or other purposes, which could

result in a decrease in the market price of our common stock.

ITEM

1B. UNRESOLVED STAFF COMMENTS

None.

ITEM

2. PROPERTIES

See

Item 1. “Business” for discussion of oil and gas properties and

locations.

We have

an office in Southlake, Texas. We have a lease for approximately 4,062 square

feet in Southlake, Texas, which runs through April 30, 2011. We

sublease approximately 1,866 square feet of office space in Katy, Texas to a

third-party. This lease runs through July 31, 2011. The average

annual cost of our leases is approximately $190 thousand. See “Liquidity and

Capital Resources – Obligations and Commitments – Consolidated Contractual

Obligations” contained in Part II, Item 7, Management’s Discussion and Analysis

of Financial Condition and Results of Operations.

ITEM

3. LEGAL PROCEEDINGS

IRS Examination - On August

6, 2008, we received a Revenue Agent’s Report in which the Internal Revenue

Service (“IRS”) proposed an adjustment to our federal tax liability for the

calendar year 2005. The proposed adjustment relates to the

calculation of the adjusted current earnings (“ACE”) component of the

alternative minimum tax and asserts that the Company should have recognized a

gain for ACE purposes on the sale of the Global PLC stock in 2005. In

its proposed adjustment, the IRS alleges that the Company owes approximately

$3.6 million in tax for the year ended December 31, 2005. Penalties and interest

calculated through December 31, 2009 in the amount of $2.1 million could also be

assessed. In response to the proposed adjustment and corresponding tax

assessment, the Company filed a written protest and request for conference on

September 5, 2008 to address the proposed adjustment with the Appeals division

of the IRS. In October 2008, we received an acknowledgement of

receipt of our written protest and request for conference from the IRS Appeals

Office. In April 2009, we filed our supplement to the written protest

filed with the IRS. Based on correspondence received to date, the IRS

Appeals Office is still considering the matter.

We have

recorded an income tax contingency, including interest and penalties, as of

December 31, 2009, of $225 thousand in our consolidated financial statements

based, in part, on a preliminary indication of a probability-weighted fair value

assessment of the Global stock. We intend to vigorously defend the proposed

adjustment and strongly believe that the Company has meritorious

defenses.

ITEM

4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There were no matters submitted to a

vote of security holders during the fourth quarter of 2009.

18

PART

II

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

Price

Range of Common Stock

Beginning

March 1991 until June 2007, our common stock was listed on the American Stock

Exchange and traded under the symbol HEC. In June 2007, the trading symbol of

our common stock was changed to the symbol HKN. The American Stock Exchange was

acquired by NYSE Euronext during 2008 and renamed NYSE Amex. Our common stock is

currently traded on this exchange under the symbol HKN. At December

31, 2009, there were 891 holders of record of our common stock.

The

following table sets forth, for the periods indicated, the reported high and low

closing sales prices of our common stock on the American Stock Exchange

Composite Tape.

|

Prices

|

|||||||||||

|

High

|

Low

|

||||||||||

| 2008-- |

First

Quarter

|

$ | 9.02 | $ | 7.61 | ||||||

|

Second

Quarter

|

13.10 | 8.38 | |||||||||

|

Third

Quarter

|

11.55 | 7.85 | |||||||||

|

Fourth

Quarter

|

8.35 | 2.39 | |||||||||

| 2009-- |

First

Quarter

|

$ | 3.19 | $ | 1.48 | ||||||

|

Second

Quarter

|

2.75 | 1.40 | |||||||||

|

Third

Quarter

|

3.09 | 2.15 | |||||||||

|

Fourth

Quarter

|

3.90 | 2.91 | |||||||||

Dividends

We have not paid any cash dividends on

common stock since our organization, and we do not contemplate that any cash

dividends will be paid on shares of our common stock in the foreseeable future.

Dividends may not be paid to holders of common stock prior to all dividend

obligations related to our Series G1 Preferred Stock and Series G2 Preferred

Stock being satisfied.

For discussion of dividends paid to

holders of our preferred stock and the terms of our preferred stock outstanding,

see Part II, Item 8, Notes to Consolidated Financial Statements, “Note 11 –

Stockholders’ Equity.”

Equity

Compensation Plans

We have no equity compensation plans.

There are no shares currently authorized for issuance related to equity

compensation.

Performance

of the Common Stock

The following performance graph shall

not be deemed incorporated by reference by any general statement incorporating

by reference in the Annual Report on Form 10-K into any filing under the

Securities Act of 1933 or the Securities Exchange Act of 1934, except to the

extent that we specifically incorporate this information by reference, and shall

not otherwise be deemed filed under such Acts.

19

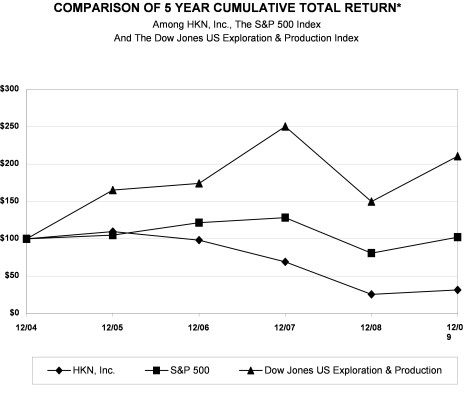

The graph below compares the cumulative

total stockholder return on the Common Stock for the last five fiscal years with

the cumulative total return on the S&P 500 Index and the Dow Jones

Exploration and Production Index over the same period (assuming the investment

of $100 in the Common Stock, the S&P 500 Index and the Dow Jones Secondary

Oils Stock Index on December 31, 2004 and reinvestment of all

dividends).

Comparison

of Cumulative Total Return

Assumes

Initial Investment of $100 on December 31, 2004

Information

on Share Repurchases

The following table provides

information about purchases by us pursuant to our previously announced share

repurchase program during the three months ended December 31, 2009, of our

Common Stock:

|

Total

Number

|

Total

Number

of

Shares

Purchased

as

part

of Publicly

|

Maximum

Number

of Shares

that

May Yet Be

Purchased

Under

|

||||||||||||||

|

of

Shares

|

Average

Price

|

Announced

|

the

Plans or

|

|||||||||||||

|

Period

|

Purchased

|

Paid

per Share

|

Program

|

Programs

|

||||||||||||

|

October

1, 2009 through October 31, 2009

|

- | $ | - | 664,924 | 572,356 | |||||||||||

|

November

1, 2009 through November 30, 2009

|

42,752 | $ | 4.00 | 707,676 | 529,604 | |||||||||||

|

December

1, 2009 through December 31, 2009

|

18 | $ | 3.68 | 707,694 | 529,586 | |||||||||||

|

Total

|

42,770 | $ | 4.00 | 707,694 | 529,586 | |||||||||||

20

|

ITEM

6. SELECTED FINANCIAL

DATA

|

The

information set forth below is not necessarily indicative of results of future

operations, and should be read in conjunction with Item 7, “Management’s

Discussion and Analysis of Financial Condition and Results of Operations”: and

the consolidated financial statements and related notes thereto included in Item

8 of this Form 10-K to fully understand factors that may affect the

comparability of the information presented below.

|

December

31,

|

||||||||||||||||||||

|

2009 (4)

|

2008

|

2007

|

2006 (3)

|

2005

|

||||||||||||||||

|

(in

thousands, except for share amounts)

|

||||||||||||||||||||

|

Operating

Data:

|

||||||||||||||||||||

|

Revenues

and other

|

$ | 12,368 | $ | 20,263 | $ | 24,298 | $ | 30,273 | $ | 40,062 | ||||||||||

|

Net

income/(loss) before cumulative effect of change in

|

||||||||||||||||||||

|

accounting

principle

|

$ | (3,345 | ) | $ | (25,905 | ) | $ | 3,229 | $ | 13 | $ | 42,655 | ||||||||

|

Net

income/(loss)

|

$ | (3,345 | ) | $ | (26,954 | ) | $ | 3,229 | $ | (855 | ) | $ | 42,655 | |||||||

|

Net

income/(loss) attributed to common stock

|

$ | (3,469 | ) | $ | (27,108 | ) | $ | 2,965 | $ | (2,244 | ) | $ | 42,068 | |||||||

|

Basic income/(loss) per common

share: (1)

|

||||||||||||||||||||

|

Net

income/(loss) before cumulative effect of change in

|

||||||||||||||||||||

|

accounting

principle

|

$ | (0.37 | ) | $ | (2.83 | ) | $ | 0.30 | $ | (0.14 | ) | $ | 4.30 | |||||||

|

Net

income/(loss)

|

$ | (0.37 | ) | $ | (2.83 | ) | $ | 0.30 | $ | (0.23 | ) | $ | 4.30 | |||||||

|

Diluted income/(loss) per common

share: (1)

|

||||||||||||||||||||

|

Net

income/(loss) before cumulative effect of change in

|

||||||||||||||||||||

|

accounting

principle

|

$ | (0.37 | ) | $ | (2.83 | ) | $ | 0.30 | $ | (0.14 | ) | $ | 3.95 | |||||||

|

Net

income/(loss)

|

$ | (0.37 | ) | $ | (2.83 | ) | $ | 0.30 | $ | (0.23 | ) | $ | 3.95 | |||||||

|

Balance Sheet

Data:

|

||||||||||||||||||||

|

Current

assets

|

$ | 9,432 | $ | 19,479 | $ | 30,015 | $ | 41,589 | $ | 62,662 | ||||||||||

|

Current

liabilities

|

3,443 | 3,377 | 5,482 | 12,627 | 19,045 | |||||||||||||||

|

Working

capital

|

$ | 5,989 | $ | 16,102 | $ | 24,533 | $ | 28,962 | $ | 43,617 | ||||||||||

|

Total

assets

|

$ | 68,215 | $ | 68,773 | $ | 110,465 | $ | 125,035 | $ | 156,163 | ||||||||||

|

Long-term

obligations:

|

||||||||||||||||||||

|

Share

based compensation liability

|

$ | - | $ | - | $ | - | $ | - | $ | 10,687 | ||||||||||

|

Global

senior convertible notes

|

- | - | - | - | 12,500 | |||||||||||||||

|

Accrued

preferred stock dividends

|

- | - | 10 | - | - | |||||||||||||||

|

Asset

retirement obligation

|

6,193 | 5,472 | 5,187 | 7,407 | 6,301 | |||||||||||||||

|

Deferred

income taxes

|

748 | 20 | 20 | - | - | |||||||||||||||

| - | - | - | - | - | ||||||||||||||||

|

Total

|

$ | 6,941 | $ | 5,492 | $ | 5,217 | $ | 7,407 | $ | 29,488 | ||||||||||

|

Stockholders'

equity

|

$ | 57,831 | $ | 59,904 | $ | 99,766 | $ | 105,001 | $ | 90,267 | ||||||||||

|

Series G1 preferred stock

outstanding (2)

|

1,000 | 1,600 | 1,600 | 1,600 | 1,600 | |||||||||||||||

|

Series G2 preferred stock

outstanding (2)

|

1,000 | 1,000 | 1,000 | 1,000 | 1,000 | |||||||||||||||

|

Series M preferred stock

outstanding (2)

|

- | 44,000 | 44,000 | 44,000 | 50,000 | |||||||||||||||

|

Weighted average common shares

outstanding (1)

|

9,269,565 | 9,587,952 | 9,799,332 | 9,952,742 | 9,793,296 | |||||||||||||||

|

(1)

|

Per

share amounts and weighted average common shares outstanding calculations

reflect the impact of a one-for-22.4 reverse stock split which was

effective June 2007.

|

|

(2)

|

See

"Notes to Consolidated Financial Statements, Note 11 - Stockholders'

Equity contained in Part II, Item 8, for further discussion of our

preferred stock.

|

|

(3)

|

During

2006, we deconsolidated Global from our Financial

Statements.

|

|

(4)

|

During

2009, we deconsolidated the Canergy Management Company and Canergy Growth

Fund from our financial Statements. See "Notes to Consolidated Financial

Statements, Note 13 – Discontinued Operations" contained in Part II, Item

8, for further discussion.

|

21

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS.

The

following discussion is intended to assist you in understanding our business and

the results of our operations. It should be read in conjunction with

the Consolidated Financial Statements and the related notes that appear

elsewhere in this report. Certain statements made in our discussion

may be forward looking. Forward-looking statements involve risks and

uncertainties and a number of factors could cause actual results or outcomes to

differ materially from our expectations. See “Cautionary Statements”

at the beginning of this report on Form 10-K for additional discussion of some

of these risks and uncertainties. Unless the context requires

otherwise, when we refer to “we,” “us” and “our,” we are describing HKN, Inc.

and its consolidated subsidiaries on a consolidated basis.

BUSINESS

OVERVIEW

Our business strategy is focused on

enhancing value for our stockholders through the development of a well-balanced

portfolio of energy-based assets. Currently, the majority of the

value of our assets is derived from our ownership in Gulf Coast oil and gas

properties and in our coalbed methane prospects in Indiana and

Ohio. We consider these assets to be strategic for us, and our

objective in 2010 is to build the value of these properties by:

|

·

|

Monitoring

and reducing operating costs

|

|

·

|

Reducing

operational, environmental, financial and third-party dependency

risks

|

|

·

|

Pursuing

possibilities for “expanding our footprint” in these

areas

|

|

·

|

Performing

economic upgrades and improvements

|

2009

Recap and 2010 Outlook

During 2009, commodity pricing for both

crude oil and natural gas averaged well below pricing from the respective prior

year period. In 2009, industry-wide drilling costs did not reduce in

comparison to the dramatic drop in commodity prices. In order to

allow our operations to continue to generate cash flow from operating

activities, we focused on reducing our costs by cutting our operating expenses

by 20% and our general and administrative costs by 39% over prior

year. However, oil and gas commodity prices during the year averaged

approximately 43% and 60% lower, respectively, than 2008. In 2010,

our objective is to continue to maintain and/or improve our working capital and

to increase our operating margin as compared to prior year. We

believe in the long-term fundamentals of our industry.

In 2009, we used our discretionary

cash to simplify our capital structure by redeeming the remaining 44

thousand shares of our Series M Preferred Stock and six hundred shares of our G1

Preferred Stock for a total of approximately $4.4 million. The Series

M Preferred had an 8% cash coupon rate which was scheduled to increase to 10% in

October 2009. As of December 31, 2009, our Series M Preferred is no

longer outstanding. In accordance with our share buyback program, in 2009, we

also repurchased 708 thousand of our common shares in the market (approximately

7% of our outstanding shares) at a total cost of approximately $1.9

million.

During 2009, we enhanced the value of

our Main Pass 35 field, located offshore Louisiana in the Gulf of Mexico, by

performing various process and structural upgrades and improvements to the

facility and its equipment. We believe our Main Pass 35 asset

has unique characteristics such as low-decline oil production, behind-pipe

development potential as well as third-party oil, gas and water processing and

handling services for neighboring fields in the area. We consider our

Main Pass 35 field a strategic asset for us in 2010.

22

During 2009, we acquired an interest in

a private company, BriteWater International, LLC (“BWI”), formerly known as

UniPureEnergy Acquisition, LLC, which holds patents to the emulsion breaking

“OHSOL” technology. This environmentally-clean process can be used to

purify oilfield emulsions by breaking and separating the emulsions into oil,

water and solids. This technology has been successfully tested using

a mobile OHSOL unit in a demonstration in Prudhoe Bay, Alaska, which

demonstrated the effectiveness of the OHSOL emulsion breaking technology to

recover valuable hydrocarbons and reduce wastes. We are currently

pursuing opportunities to commercialize the OHSOL technology by performing

emulsion testing of the OHSOL plant equipment both internationally and