Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AIR PRODUCTS & CHEMICALS INC /DE/ | form8-k.htm |

| EX-99.1 - TRANSCRIPT - AIR PRODUCTS & CHEMICALS INC /DE/ | ex99-1.htm |

Barclays

2nd Annual Industrial Select Conference

John E. McGlade, Chairman, President and CEO

February 17, 2010

2nd Annual Industrial Select Conference

John E. McGlade, Chairman, President and CEO

February 17, 2010

Barclays

2nd Annual

industrial Select Conference

2

ADDITIONAL

INFORMATION

• On February

11, 2010, Air Products Distribution, Inc., a wholly owned subsidiary of Air

Products and

Chemicals, Inc. ("Air Products"), commenced a cash tender offer for all the outstanding shares of common

stock of Airgas, Inc. ("Airgas") not already owned by Air Products, subject to the terms and conditions set

forth in the Offer to Purchase dated as of February 11, 2010 (the "Offer to Purchase"). The purchase price

to be paid upon the successful closing of the cash tender offer is $60.00 per share in cash, without interest

and less any required withholding tax, subject to the terms and conditions set forth in the Offer to

Purchase, as amended. The offer is scheduled to expire at midnight, New York City time, on Friday, April 9,

2010, unless further extended in the manner set forth in the Offer to Purchase.

Chemicals, Inc. ("Air Products"), commenced a cash tender offer for all the outstanding shares of common

stock of Airgas, Inc. ("Airgas") not already owned by Air Products, subject to the terms and conditions set

forth in the Offer to Purchase dated as of February 11, 2010 (the "Offer to Purchase"). The purchase price

to be paid upon the successful closing of the cash tender offer is $60.00 per share in cash, without interest

and less any required withholding tax, subject to the terms and conditions set forth in the Offer to

Purchase, as amended. The offer is scheduled to expire at midnight, New York City time, on Friday, April 9,

2010, unless further extended in the manner set forth in the Offer to Purchase.

• This

communication does not constitute an offer to buy or solicitation of an offer to

sell any securities. The

tender offer is being made pursuant to a tender offer statement on Schedule TO (including the Offer to

Purchase, a related letter of transmittal and other offer materials) filed by Air Products with the U.S.

Securities and Exchange Commission) on February 11, 2010. INVESTORS AND SECURITY HOLDERS OF AIRGAS

ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY

BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and

security holders can obtain free copies of these documents and other documents filed with the SEC by Air

Products through the web site maintained by the SEC at http://www.sec.gov. The Offer to Purchase and

related materials may also be obtained for free by contacting the Information Agent for the tender offer,

MacKenzie Partners, Inc., at 212-929-5500 or toll-free at 800-322-2885.

tender offer is being made pursuant to a tender offer statement on Schedule TO (including the Offer to

Purchase, a related letter of transmittal and other offer materials) filed by Air Products with the U.S.

Securities and Exchange Commission) on February 11, 2010. INVESTORS AND SECURITY HOLDERS OF AIRGAS

ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY

BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and

security holders can obtain free copies of these documents and other documents filed with the SEC by Air

Products through the web site maintained by the SEC at http://www.sec.gov. The Offer to Purchase and

related materials may also be obtained for free by contacting the Information Agent for the tender offer,

MacKenzie Partners, Inc., at 212-929-5500 or toll-free at 800-322-2885.

• In

connection with the proposed transaction, Air Products may file a proxy

statement with the SEC. Any

definitive proxy statement will be mailed to stockholders of Airgas. INVESTORS AND SECURITY HOLDERS OF

AIRGAS ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these

documents (if and when available) and other documents filed with the SEC by Air Products through the

web site maintained by the SEC at http://www.sec.gov.

definitive proxy statement will be mailed to stockholders of Airgas. INVESTORS AND SECURITY HOLDERS OF

AIRGAS ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these

documents (if and when available) and other documents filed with the SEC by Air Products through the

web site maintained by the SEC at http://www.sec.gov.

Barclays

2nd Annual

industrial Select Conference

CERTAIN

INFORMATION REGARDING PARTICIPANTS

• [Air

Products] and certain of its respective directors and executive officers

may

be deemed to be participants in the proposed transaction under the rules of the

SEC. Security holders may obtain information regarding the names, affiliations

and interests of [Air Products]’s directors and executive officers in [Air Products]’s

Annual Report on Form 10-K for the year ended September 30, 2009, which was

filed with the SEC on November 25, 2009, and its proxy statement for the 2010

Annual Meeting, which was filed with the SEC on December 10, 2009. These

documents can be obtained free of charge from the sources indicated above.

Additional information regarding the interests of these participants in the proxy

solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will also be included in any proxy statement and other

relevant materials to be filed with the SEC when they become available.

be deemed to be participants in the proposed transaction under the rules of the

SEC. Security holders may obtain information regarding the names, affiliations

and interests of [Air Products]’s directors and executive officers in [Air Products]’s

Annual Report on Form 10-K for the year ended September 30, 2009, which was

filed with the SEC on November 25, 2009, and its proxy statement for the 2010

Annual Meeting, which was filed with the SEC on December 10, 2009. These

documents can be obtained free of charge from the sources indicated above.

Additional information regarding the interests of these participants in the proxy

solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will also be included in any proxy statement and other

relevant materials to be filed with the SEC when they become available.

3

Barclays

2nd Annual

industrial Select Conference

Forward-Looking

Statements

• All

statements included or incorporated by reference in this communication

other

than statements or characterizations of historical fact, are forward-looking

statements. These forward-looking statements are based on our current

expectations, estimates and projections about our business and industry,

management’s beliefs, and certain assumptions made by us, all of which are

subject to change. Forward-looking statements can often be identified by words

such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”,

“estimates”, “may”, “will”, “should”, “would”, “could”, “potential”, “continue”,

“ongoing”, similar expressions, and variations or negatives of these words.

than statements or characterizations of historical fact, are forward-looking

statements. These forward-looking statements are based on our current

expectations, estimates and projections about our business and industry,

management’s beliefs, and certain assumptions made by us, all of which are

subject to change. Forward-looking statements can often be identified by words

such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”,

“estimates”, “may”, “will”, “should”, “would”, “could”, “potential”, “continue”,

“ongoing”, similar expressions, and variations or negatives of these words.

• These

forward-looking statements are not guarantees of future results and are

subject to risks, uncertainties and assumptions that could cause our actual results to

differ materially and adversely from those expressed in any forward-looking

statement. Important risk factors that could contribute to such differences or

otherwise affect our business, results of operations and financial condition include

the possibility that [Air Products] will not pursue a transaction with [Airgas] and the

risk factors discussed in our Annual Report on Form 10-K, subsequent Quarterly

Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings.

The forward-looking statements in this release speak only as of the date of this filing.

We undertake no obligation to revise or update publicly any forward-looking

statement, except as required by law.

subject to risks, uncertainties and assumptions that could cause our actual results to

differ materially and adversely from those expressed in any forward-looking

statement. Important risk factors that could contribute to such differences or

otherwise affect our business, results of operations and financial condition include

the possibility that [Air Products] will not pursue a transaction with [Airgas] and the

risk factors discussed in our Annual Report on Form 10-K, subsequent Quarterly

Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings.

The forward-looking statements in this release speak only as of the date of this filing.

We undertake no obligation to revise or update publicly any forward-looking

statement, except as required by law.

4

Offer to

Acquire Airgas

Barclays

2nd Annual

industrial Select Conference

Airgas

transaction highlights

|

Consideration

|

All-cash

offer for all Airgas shares at $60.00 per share

|

|

Premium

|

Premium

of 38% to Airgas’ closing price on 2/04/10

of $43.53 |

|

Accretion

|

Expected

to be substantially accretive to Air Products cash

EPS in year one |

|

Synergies

|

Substantial

cost synergies yielding $250 million run-rate by the

end of year two |

|

Financing

|

•Air

Products has secured committed financing, is committed

to remaining investment grade and to returning to an A rating •Transaction

costs expected to be approximately $200MM,

expensed as incurred. •Q2

~$0.08 per share impact

•Q3

~$0.10 per share impact

|

|

Regulatory

Approval |

Air

Products has thoroughly considered potential regulatory

issues and is prepared to make appropriate divestitures |

6

Barclays

2nd Annual

industrial Select Conference

Compelling

strategic and industrial logic

Creates

one of the world’s leading integrated industrial gas companies

• Largest

industrial gas company in North America

• Diversified

across geographies and distribution channels with competitive

positions in all three supply modes: Packaged Gases, Liquid Bulk, Tonnage

positions in all three supply modes: Packaged Gases, Liquid Bulk, Tonnage

Combination

of highly complementary skills and strengths enables us to better

serve

the needs of customers

• Air

Products’ leadership in tonnage, strong European and joint venture

packaged gas positions

packaged gas positions

• Airgas’

leadership in U.S. packaged gases

• Air

Products’ Engineering and Technology Skills

Timing

is excellent

• Provides

Air Products a highly efficient re-entry into U.S. packaged gas

market

• Air

Products’ global infrastructure enables more rapid Airgas international

expansion

expansion

Significant

synergies available

• Substantial

cost savings

• Growth

opportunities as economy recovers

• Leverages

Air Products’ supply chain and SAP capabilities

7

Barclays

2nd Annual

industrial Select Conference

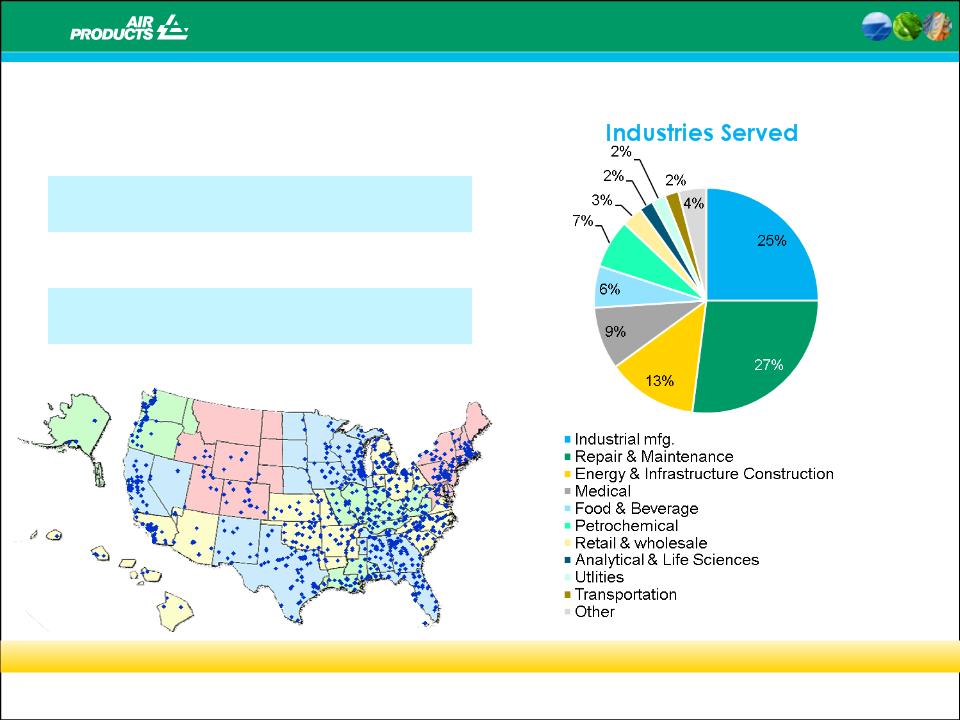

Airgas at a

glance

8

Broad

Coverage - 1,500 Sales Representatives

Source: Based on

Airgas public disclosures

|

Revenue

(FY2009)

|

$4.3B

|

|

Total

CAGR (over last 5 years)

|

19%

|

|

Same

Store Sales Growth

|

7%

|

Barclays

2nd Annual

industrial Select Conference

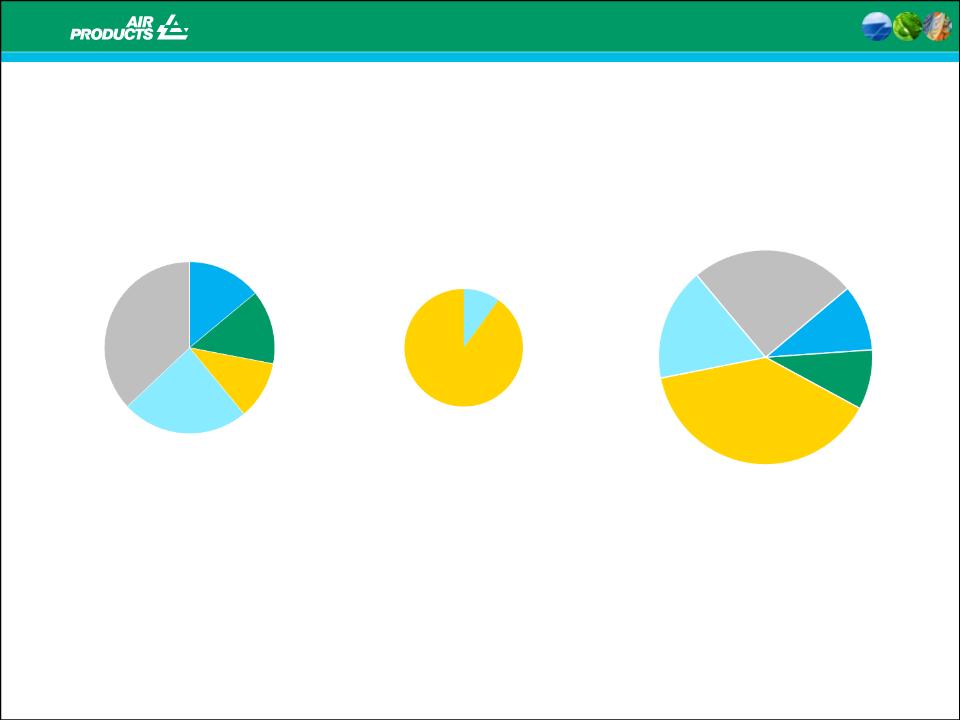

A world

leading integrated industrial gas company

9

Source: Based on

Airgas public disclosures

Packaged

Gas

90%

Gas

90%

Liquid/Bulk

10%

10%

Pro-forma

Air Products

Air Products

Pro-forma

Air Products

Air Products

Airgas

Revenues

Revenues

Airgas

Revenues

Revenues

Air

Products

Revenues

Revenues

Air

Products

Revenues

Revenues

Liquid/Bulk

17%

17%

Onsite

25%

25%

Equipment

& Services

10%

& Services

10%

Onsite/Pipeline

37%

Liquid/Bulk

24%

Equipment

&

Services

Services

14%

Packaged

Gas

Gas

11%

• One of the

largest industrial gas companies in the world

• Largest

industrial gas company in North America

• World-class

competencies across all modes of supply

+

=

Specialty

Materials

14%

Spec

Mat’ls

9%

Mat’ls

9%

Packaged

Gas

39%

Gas

39%

Barclays

2nd Annual

industrial Select Conference

Synergies

Supply

Chain

• Consolidate

filling locations

• Consolidate

specialty gas plant locations

• Move from

local delivery to hub and spoke

• Combine

purchasing requirements

• Utilize

Shared Services for Packaged Gas operations and

Project Management

Project Management

Overheads

• Use Shared

Services for back office operations - Finance, HR,

IT, Purchasing, Invoicing, Credit & Collections and Marketing

IT, Purchasing, Invoicing, Credit & Collections and Marketing

• Rationalize

management

• Rationalize

corporate infrastructure

SAP

enables these synergies

10

Barclays

2nd Annual

industrial Select Conference

Growth

acceleration

• New

Offerings for US Packaged Gases

– Integra ®

cylinders

– 300 BAR

cylinders

• Further

expand Air Products’ offerings into key industries

– Fabrication - Analytical

– Construction - Medical

– Pharmaceuticals - Food

and Beverage

• Utilize Air

Products’ International Structure

Growth

through new offerings, density and international expansion

11

Barclays

2nd Annual

industrial Select Conference

North

America remains a major growth area

GDP

growth

12

Japan

Europe

North

America

Asia

(excl. Japan)

(excl. Japan)

ROW

GDP

growth by location 2009 2013 Growth %

of World 09-'13

CAGR

World 49,115

55,903 6,788 100.0% 3.3%

Europe 16,616 17,907

1,291

19.0% 1.9%

Asia 12,733 15,472

2,739 40.4% 5.0%

Asia

ex. Japan 8,259

10,679

2,420 35.7%

6.6%

Japan 4,474 4,793 319 4.7%

1.7%

North

America 15,023 16,886 1,864

27.5%

3.0%

Rest

of World 4,744 5,637

893 13.2% 4.4%

Source: Global

Insights

Barclays

2nd Annual

industrial Select Conference

Key

measures

13

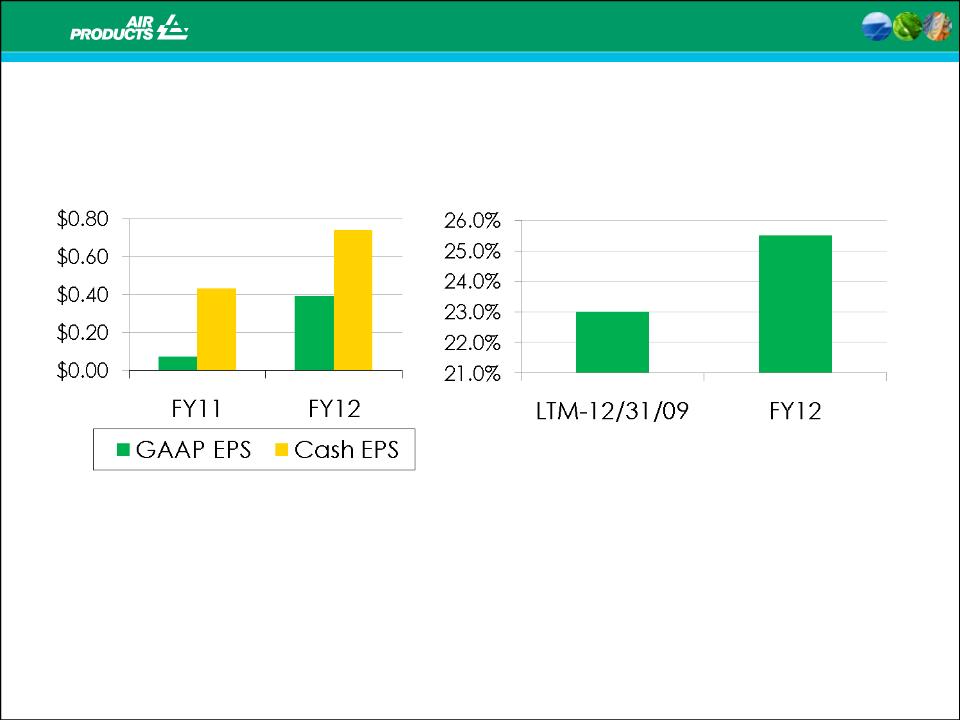

• Transaction

accretive in the

first year

first year

• Solid

shareholder value

• Excludes

transaction and

integration costs

integration costs

• Synergies

enable greater cash

flow generation

flow generation

• Combination

provides for

significant margin benefits

significant margin benefits

Accretion/Dilution

EBITDA

Margin

Barclays

2nd Annual

industrial Select Conference

14

Path

forward . . .

Air

Products

committed to

completing the

transaction

committed to

completing the

transaction

Litigation

• Commenced

litigation in

Delaware

Delaware

Tender

offer

• Offer

commenced Feb 11

• Financing

committed

Regulatory

process

• Prepared to

make

appropriate divestitures

appropriate divestitures

Proxy

contest

• Proceed

with proxy contest

if needed

if needed

Barclays

2nd Annual

industrial Select Conference

Air

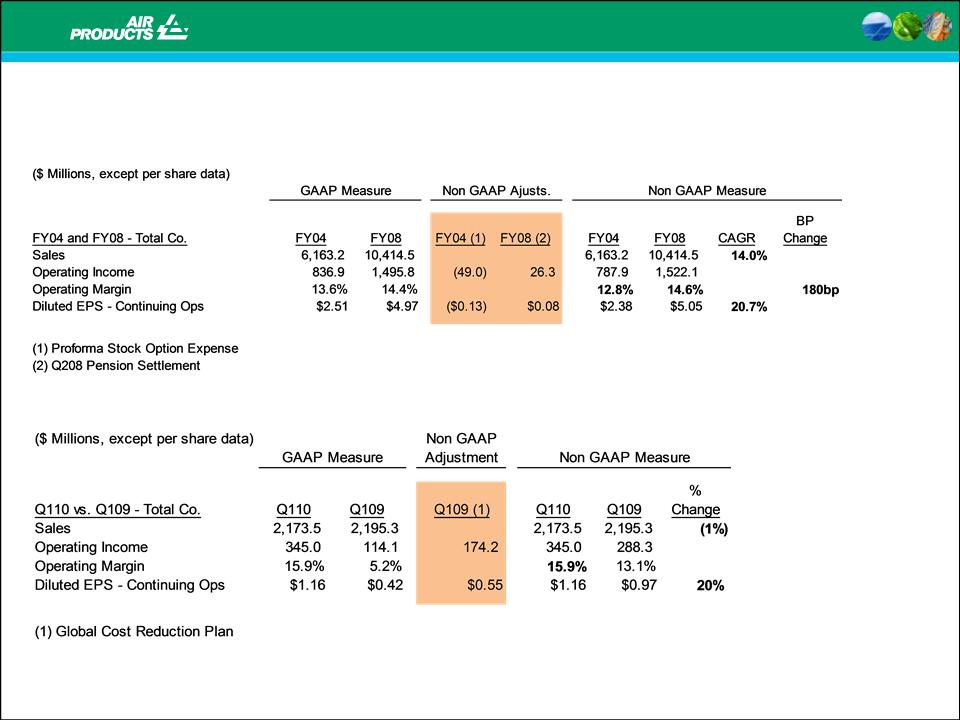

Products Financial Performance

|

|

FY04

|

thru

|

FY08

|

H109

|

H209

|

Q110

|

|

Sales

(

CAGR/ % chg vs PY )

|

|

14%

|

|

(16%)

|

(25%)

|

(1%)

|

|

Operating

Margin *

|

12.8%

|

1.8%

|

14.6%

|

13.2%

|

15.5%

|

15.9%

|

|

EPS

Cont Ops.*

|

|

21%

|

|

(24%)

|

(16%)

|

20%

|

|

ROCE

(4

quarter trailing)*

|

9.6%

|

3.4%

|

13.0%

|

|

|

|

|

ROCE

(instantaneous)

*

|

|

|

|

10.0%

|

11.2%

|

11.7%

|

*

non-GAAP, see appendix for reconciliation

15

Barclays

2nd Annual

industrial Select Conference

We have

Multiple Growth Opportunities

l Hydrogen

for refining

l Oxygen for

gasification

l LNG heat

exchangers

Energy

Environment

Emerging

Markets

l Oxyfuel

l Carbon

capture

l Multiple

Gas Applications

l Electronics

across Asia

l Equity

Affiliate positions

l Expanding

Merchant

positions in Asia

positions in Asia

16

Barclays

2nd Annual

industrial Select Conference

Merchant

Business – At a

glance

• 2009

revenue of $3.6B

• Global

business plus 5 large JVs

• Achieved

18.3% operating margin

in FY’09

in FY’09

• Goals:

– 20%

operating margin by FY’11

– Sustained

annual growth: 10%

Applications

expertise drives growth

17

Barclays

2nd Annual

industrial Select Conference

Cleanfire® HRi™

burner

burner

Efficient

oxygen

plant design

plant design

Merchant

Business

Applications Driven Growth

Applications Driven Growth

A

winning combination!

18

Barclays

2nd Annual

industrial Select Conference

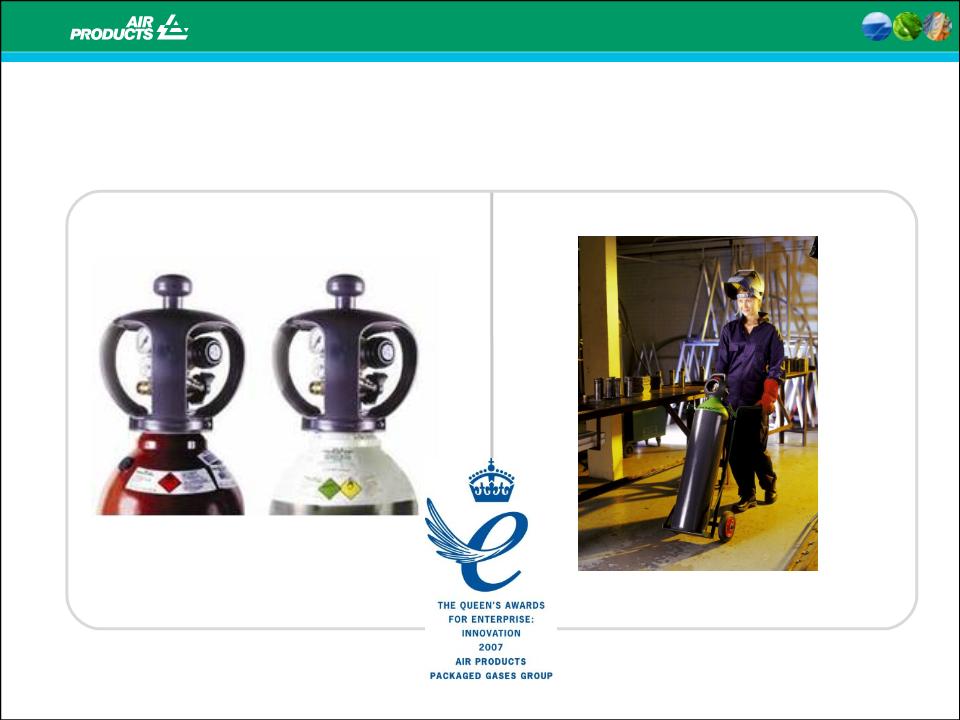

Merchant

Business

Winning New Customers with Industrial Gases

Winning New Customers with Industrial Gases

Integra® Cylinders

19

Barclays

2nd Annual

industrial Select Conference

Tonnage

Gases –

At a glance

• 2009

revenue of

$3.1B

$3.1B

• Leading

supplier of

refinery hydrogen

refinery hydrogen

• Primary end

markets

– Refining

– Chemicals

– Steel

• Expect 10%

H2 and

O2 growth long term

O2 growth long term

Exciting

growth opportunities in all major regions of the world

20

Barclays

2nd Annual

industrial Select Conference

Tonnage

Gases

Hydrogen Fueling Growth for the Future

Hydrogen Fueling Growth for the Future

• Transport

fuels growth

• Heavier,

sour crude slate

• Clean fuels

legislation

• Outsourcing

trend

Conversion

45%

45%

Crude

25%

25%

Clean

Fuels

15%

Fuels

15%

Outsourcing

15%

15%

21

Barclays

2nd Annual

industrial Select Conference

Tonnage

Gases

Leading Global Hydrogen Positions

Leading Global Hydrogen Positions

Southern

California

California

Edmonton,

Canada

Canada

Sarnia,

Canada

Texas

Louisiana

Rotterdam

22

Barclays

2nd Annual

industrial Select Conference

• Steel

– Asian

infrastructure growth

– Mill

modernization

• Gasification

– Power

– Feedstock

independence

– Low BTU

hydrocarbons

• Cleaner

coal

– Power

– CO2

capture

200,000-300,000

tons-per-day new oxygen capacity by 2018

100+ new

plants

23

Barclays

2nd Annual

industrial Select Conference

Projected

2010

• Marathon

Garyville

• XOM Baton

Rouge

• Total Port

Arthur

• XOM

Baytown

• MarkWest

Texas

Projected

2011-2012

• XOM

Rotterdam

• Shell

Rotterdam

• Marathon

Detroit

• Monsanto

Louisiana

Continuous

improvement

improvement

Operating

bonuses

bonuses

Base

take

or pay

or pay

Franchise

positions

positions

Additional

products

products

Superior

returns:

• Ann Joo

Steel Malaysia

• US Steel

Nanticoke, Ont.

• Shadeed

Steel Oman

• Sphinx

Glass Egypt

• Isle of

Grain LNG UK

• Emirates

Glass Abu Dhabi

• Weihe

Energy Gasifier

• Xingtai

Steel

• PetroChina

ASU JV

24

Barclays

2nd Annual

industrial Select Conference

• 2009

revenue of $1.6B

• Significant

opportunities

– Semi

industry recovery

– Thin film

PV

– Eco-friendly

solutions

– Emerging

markets

• Goal of 15%

operating

margins in FY’11

margins in FY’11

Focused

on margin improvement

25

Barclays

2nd Annual

industrial Select Conference

Electronics

Significant Opportunity in Thin-Film PV

Significant Opportunity in Thin-Film PV

• Flat panel

experience = differentiated advantage in thin

film technologies

film technologies

• Comprehensive

offerings and turnkey solutions through

SunSource™ Solutions portfolio

SunSource™ Solutions portfolio

1

GW facility =

$100+MM in annual

revenues

Equip/Services

Bulk

Dopants

Onsites

NF3

Silane

26

Barclays

2nd Annual

industrial Select Conference

Equity

Affiliates

Important Source of Growth

Important Source of Growth

Mexico

Italy

India

South

Africa

Thailand

27

Barclays

2nd Annual

industrial Select Conference

FY’10 Full

Year Outlook Update

● FY’10

overall… expecting a

gradual and modest recovery

gradual and modest recovery

● WW

manufacturing growth

– Globally up

1% to 2%

– US flat to

up modestly

– EU

down

1%

– Asia up

8% to

9%

● Silicon

growth 20% to

25%

● Capex

forecast unchanged

– ~$1.3B to

$1.5B

Comparison

is non-GAAP, see appendix for reconciliation

FY’09

Adjusted Diluted EPS $4.06

– Merchant

loading

– Tonnage new

projects/loading

– E&E

similar to last year

– E&PM

loading, partially offset by

restructuring cost & lower pricing

restructuring cost & lower pricing

– Productivity/restructuring

benefits

– Pension

headwind

– Tax rate

about 25% to 26%

FY’10

EPS $4.75-$4.95

17% - 22%

growth

vs PY

28

Barclays

2nd Annual

industrial Select Conference

RESULTS

• Double-digit

EPS growth

• ROCE 3-5%

above cost of

capital

capital

The Air

Products Opportunity

STABILITY

• Long term

contracts,

consistent and

predictable cash flow

consistent and

predictable cash flow

• Diversified

across

geographies and

distribution channels

geographies and

distribution channels

• Airgas

opportunity

creates competitive

positions in all three

supply modes,

maintains strong

balance sheet

creates competitive

positions in all three

supply modes,

maintains strong

balance sheet

GROWTH

• Solid

backlog and

strong growth

opportunities across all

geographies

strong growth

opportunities across all

geographies

• New

growth

opportunities in energy,

environment and

emerging markets

opportunities in energy,

environment and

emerging markets

• Airgas

provides a highly

efficient re-entry into

U.S. packaged gas

market, broadening our

growth opportunities

efficient re-entry into

U.S. packaged gas

market, broadening our

growth opportunities

Well-positioned

for long-term value creation

29

Thank

you

www.airproducts.com

Barclays

2nd Annual

industrial Select Conference

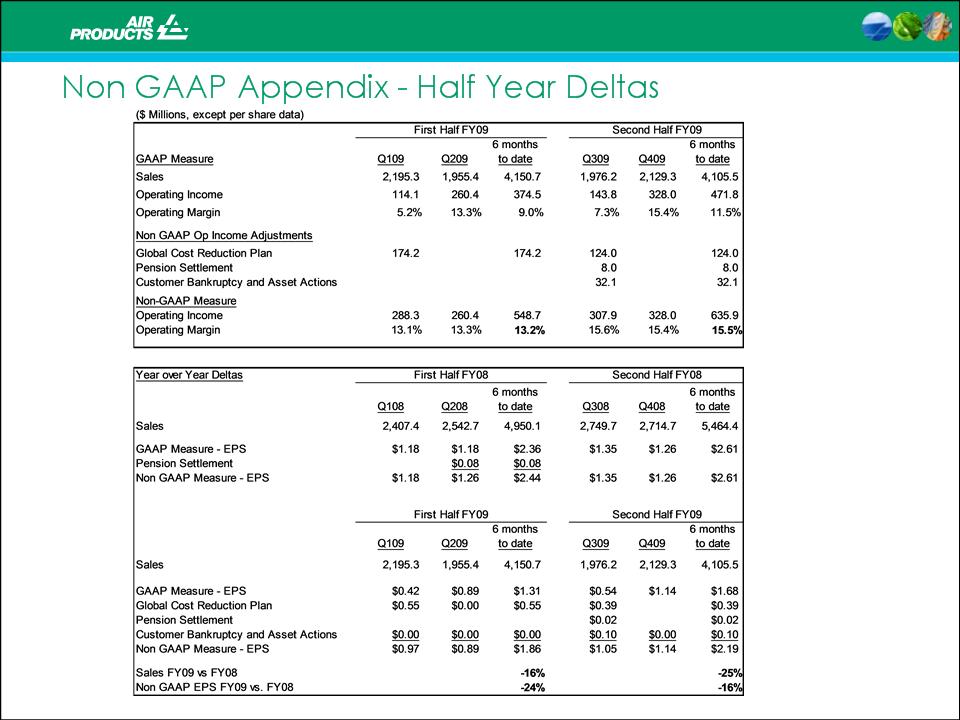

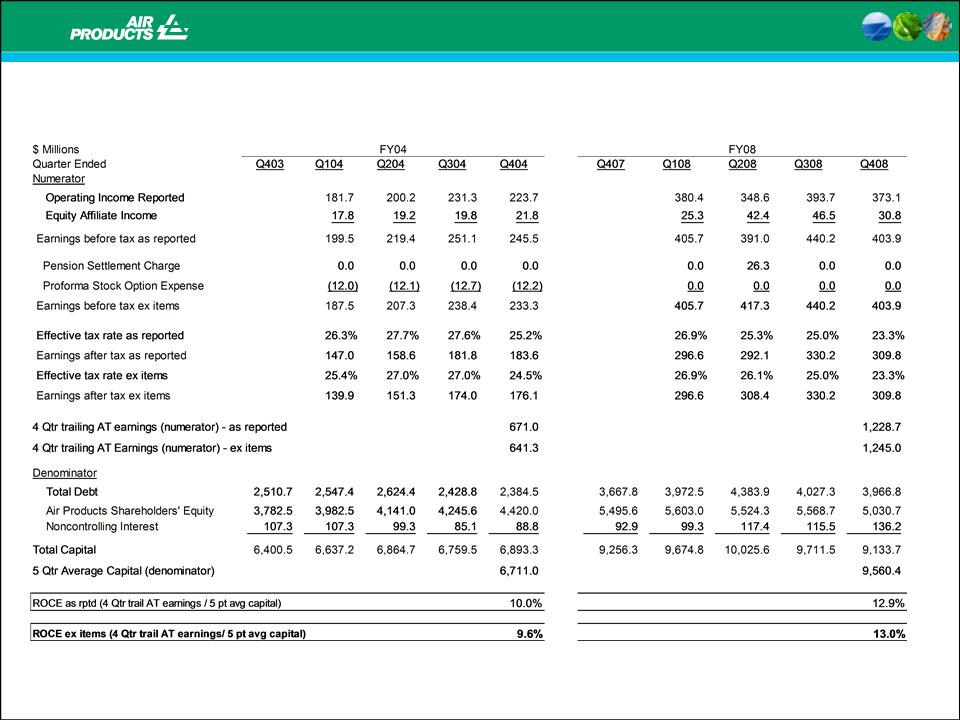

Non GAAP

Appendix - Year over Year Deltas

31

Barclays

2nd Annual

industrial Select Conference

32

Barclays

2nd Annual

industrial Select Conference

Non GAAP

Appendix - ROCE FY04 and FY08

33

Barclays

2nd Annual

industrial Select Conference

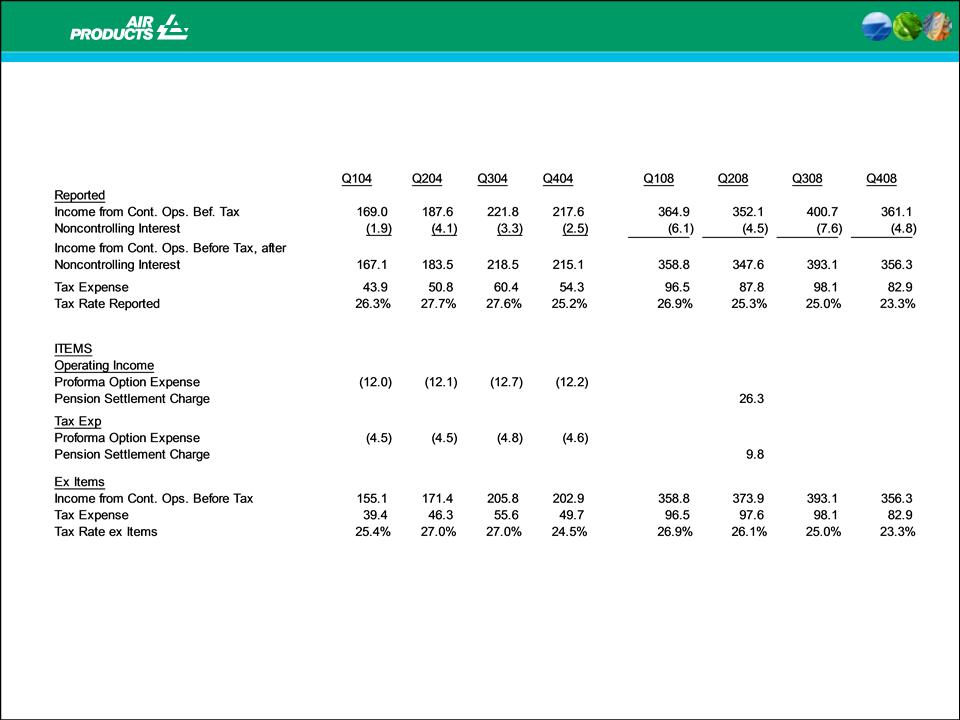

Non GAAP

Appendix - ROCE Tax Rate FY04 and FY08

34

Barclays

2nd Annual

industrial Select Conference

35

Barclays

2nd Annual

industrial Select Conference

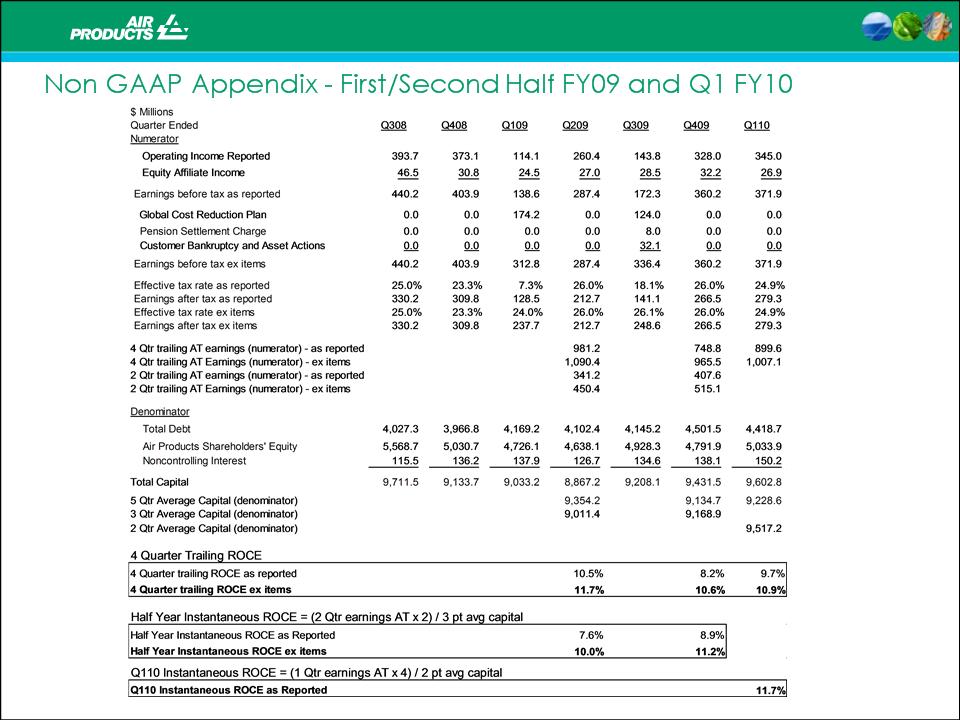

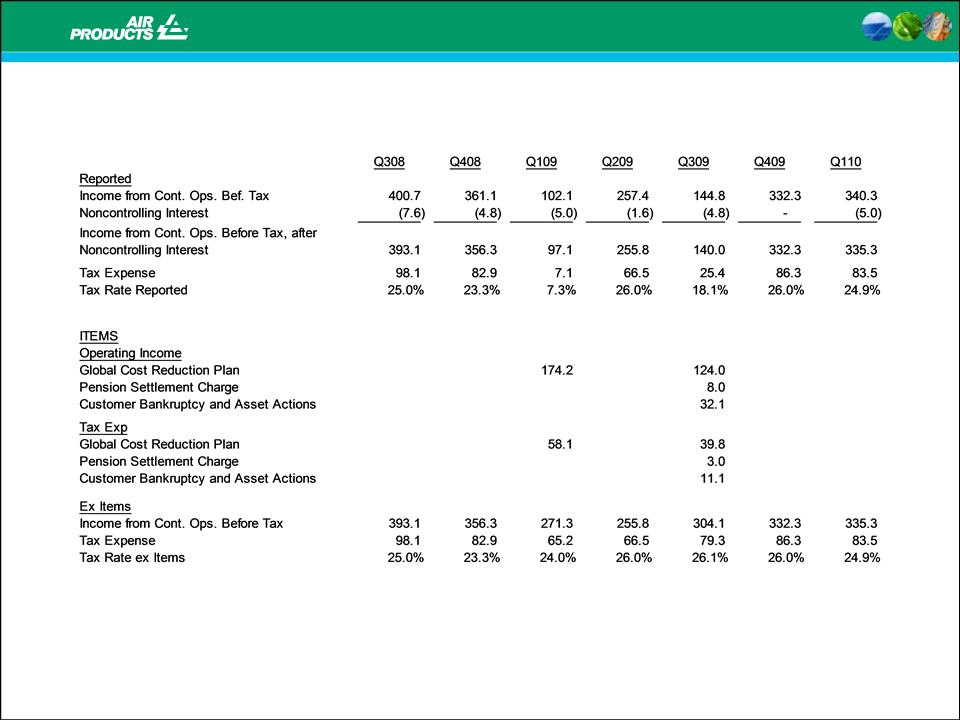

Non GAAP

Appendix - ROCE Tax Rate FY09 and Q1 FY10

36

Barclays

2nd Annual

industrial Select Conference

Non-GAAP

Appendix: FY10

Guidance

($

Millions, except per share data)

FY10

Guidance vs. FY09

Diluted

EPS

Continuing

Ops

FY09

GAAP

$3.00

FY09

Global Cost Reduction Plan

$0.94

FY09

Pension Settlement

$0.02

FY09

Customer Bankruptcy and Asset Actions

$0.10

FY09

Non GAAP

$4.06

FY10

Guidance

$4.75-$4.95

FY09

GAAP

$3.00

%

Change GAAP

58%-65%

FY10

Guidance

$4.75-$4.95

FY09

Non GAAP

$4.06

%

Change Non GAAP

17%-22%

37