Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWFIELD EXPLORATION CO /DE/ | nfx8k-02162010.htm |

| EX-99.2 - EARNINGS PRESS RELEASE - NEWFIELD EXPLORATION CO /DE/ | nfx8k-02162010ex992.htm |

| EX-99.1 - RESERVES PRESS RELEASE - NEWFIELD EXPLORATION CO /DE/ | nfx8k-02162010ex991.htm |

Exhibit

99.3

@NFX is

periodically published to keep shareholders aware of current operating

activities at Newfield. It may include estimates of expected production volumes,

costs and expenses, recent changes to hedging positions and commodity

pricing.

February

16, 2010

This

edition of @NFX includes:

|

·

|

2009

HIGHLIGHTS & 2010 PLANS2009 FOURTH QUARTER DRILLING ACTIVITY BY

AREA

|

|

·

|

OPERATIONAL

SUMMARIES BY FOCUS AREA

|

|

·

|

UPDATED

TABLES DETAILING COMPLETE HEDGE

POSITIONS

|

Fourth Quarter 2009 Drilling

Activity*

|

NFX

Operated

|

Non-Operated

|

Gross

Wells

|

Dry

Holes

|

|||||||||||||

|

Mid-Continent

|

30 | 5 | 35 | 0 | ||||||||||||

|

Rocky

Mount.

|

54 | 7 | 61 | 0 | ||||||||||||

|

Onshore

GC

|

2 | 1 | 3 | 0 | ||||||||||||

|

Gulf

of Mexico

|

1 | 1 | 2 | 1 | ||||||||||||

|

International

|

3 | 1 | 4 | 0 | ||||||||||||

|

Total:

|

90 | 15 | 105 | 1 | ||||||||||||

*Represents

a 99% success rate

2009

total gross wells: 422; dry wells: 7

2009

HIGHLIGHTS

|

·

|

Full

year 2009 production was 257 Bcfe, an increase of 9% over 2008 production

volumes. Production was in the top half of our original 2009 guidance

(250-260 Bcfe), despite curtailment of 3 Bcfe in 3Q09 related to low

natural gas prices.

|

|

·

|

Our

proved reserves increased 23% in 2009 and at year-end were 3.6 Tcfe. The

Company replaced approximately 250% of its 2009 production with the

addition of new reserves (excluding the impact of the new SEC rules).

Proved reserves in Newfield’s two largest divisions – the Mid-Continent

and Rocky Mountains – increased 34% and represent more than 80% of the

Company’s total proved reserves. Approximately 53% of the Company’s proved

reserves were proved developed and 72% were natural gas. The Company’s

proved reserve life index is approximately 14 years, reflecting continued

growth in longer-lived resource plays. A detailed news release on our

proved reserves for 2009 was released on February 16,

2010.

|

|

·

|

We

allocated our capital more effectively in 2009. We lived within our cash

flow from operations in 2009, while reducing our debt by approximately

$200 million. Some 2009 projects were deferred into future periods and we

added new projects to our original budget totaling approximately $100

million. Capital investments for 2009 totaled $1.4

billion.

|

|

·

|

In

recent months, we added more than 500,000 net acres in long-lived,

domestic resource plays. New ventures include: acquisition of Maverick

Basin assets from TXCO Resources, Inc (>300,000 acres), Marcellus Shale

entry through an exploration agreement with Hess Corp (approximately

35,000 acres), and a joint venture on Blackfeet Tribal acreage in northern

Montana’s Southern Alberta Basin (approximately 156,000

acres).

|

1

2010

CAPITAL INVESTMENT PLANS AND PRODUCTION GUIDANCE

Newfield’s

2010 capital budget is $1.6 billion (including approximately $124 million in

capitalized interest and overhead). This budget approximates the Company’s

estimate of 2010 cash flow from operations and includes approximately $100

million for planned investments on the acreage recently acquired in the Maverick

Basin of Texas. The budget excludes the recent $215 million purchase price for

the acquisition of assets from TXCO Resources, Inc.

Our

production for 2010 is expected to be 278 – 288 Bcfe, an increase of 8 – 12%

over 2009. In 2010, we will invest approximately 70% of our budget, or

approximately $1 billion, in domestic resource plays. More than one-third of the

budget will be directed to oil plays. The following pie chart details our

expected 2010 production by area.

Newfield

has ample liquidity and, following our recent issuance of $700 million of 6 7/8%

Senior Subordinated Notes, we have no outstanding borrowings under our $1.25

billion credit facility. Approximately 70% of our expected 2010 gas production

is hedged at a weighted average minimum price of approximately $6.60 per MMbtu.

Approximately 65% of our expected 2010 domestic oil production is hedged at a

weighted average minimum price of approximately $108.00 per barrel. Complete

hedging details are found at the end of this edition of @NFX.

2

RECENT

ACTIVITTY BY AREA AND 2010 PLANS

ONSHORE

TEXAS

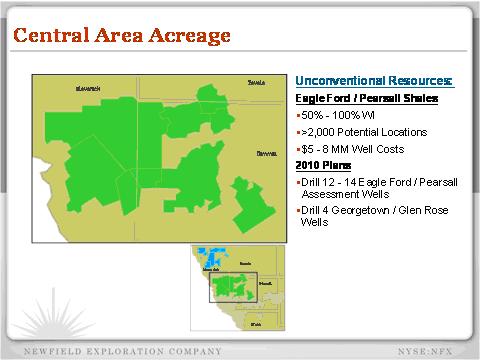

For 2010,

the primary focus of our activity will be on the acreage that we recently

acquired in the Maverick Basin from TXCO Resources. This transaction closed on

February 11, 2010. In 2010, we expect to invest approximately $100 million in

the asset, with drilling programs beginning in the second quarter.

This

transaction marked our entry into the Maverick Basin of Texas. We now have

300,000 net acres located primarily in Maverick and Dimmit Counties, Texas.

Current production from the assets totals about 1,300 BOEPD. There are multiple

geologic horizons on the acreage, with prospects ranging from dry gas to

oil. The following cross section details the prospective formations

throughout our acreage.

Our 2010

plans are aggressive. We will begin work immediately and expect to be running at

least three operated rigs here by summer. Our efforts will be primarily focused

on three plays – the Eagle Ford, Pearsall Shales and the Georgetown

formation.

3

MID-CONTINENT

Our net

production from the Mid-Continent grew 18% in 2009. The growth is being driven

by the Granite Wash and Woodford Shale plays. Gross production from the

Mid-Continent is currently more than 500 MMcfe/d, or approximately 320 MMcfe/d

net. Approximately 40% of our 2010 budget will be allocated to our activities in

the Mid-Continent.

The

Granite Wash

In

today’s fourth quarter and full year 2009 earnings and operating release, we

announced results from six additional completions in our horizontal Granite Wash

play. In total, we have results from 13 Granite Wash horizontal completions.

Average initial production rates for our first 12 wells was 20 MMcfe/d. Our

13th

well, the Britt 8-6H, commenced production this week and the rate continues to

rise following fracture stimulation. We have six additional horizontal Granite

Wash wells that are in various stages of completion at this time. The following

chart shows our results to date.

4

Since

2002, we have drilled approximately 150 vertical wells in our Granite Wash play

(primarily Stiles/Britt Ranch fields, Wheeler County, Texas). We know from this

drilling that there are multiple productive horizons within the four primary

geologic targets – Marmaton, Red Fork, Cherokee and Atoka. In the table above,

the wells with high condensate yields were located in the Marmaton, the

shallowest of the four targets. Of our recent wells (6) were completed in the

Atoka, a known dry-gas producer. We plan to drill horizontal wells in 4-6

additional horizons in 2010.

We

continue to optimize our drilling and completion practices in the Granite Wash.

Lateral lengths in our most recent wells are 4,300’ - 4,700’ and our “best in

class” drill and complete costs to date is approximately $7.3 million. Our drill

and case cost per lateral foot is down approximately 20% when comparing our

first seven wells with our most recent wells.

We are

running a four rig program today and expect that this level of activity will

allow us to drill about 20 horizontal wells in 2010. Although extensive work is

underway to determine our overall development plan, we estimate that there are

about 250 remaining horizontal locations in our Granite Wash play. We have more

than 40,000 net acres in this play.

The

Woodford Shale

Our

production in the Woodford continues to grow. Gross operated production is

approximately 329 MMcfe/d, or approximately 191 MMcfe/d net. Our 2009 volumes in

the Woodford grew 25% and we expect that our production will increase more than

25% during 2010. Today, we have 166,500 net acres in the play and substantially

all of the acreage is held by production.

In 2010,

we expect to run 6-8 operated rigs in our Woodford Shale area. Although this is

fewer operated rigs than we have run in previous years, our efficiency gains are

allowing us to drill and complete more lateral feet per year, per rig. The

following chart depicts these efficiency gains.

5

We expect

to drill approximately 50 horizontal wells in our Woodford play in 2010. Our

average lateral length is expected to be approximately 6,000’. We define wells

with lateral lengths in excess of 5,000’ as “Super Extended Laterals,” or SXLs.

About one-third of our 2010 wells in the Woodford are expected to be SXLs. Our

efficiencies have been improved through lengthened laterals and operational

gains. Our average lateral length in 2009 was approximately 5,000’, compared to

an average of approximately 4,000’ in 2008 and less than 2,500’ in

2006-07.

To date,

the Company has drilled 11 SXLs with an average lateral length of nearly 9,000’.

As previously reported, the first five SXL wells had average initial production

rates of approximately 10 MMcfe/d gross. The remainder of the SXLs (6) are in

various stages of completion.

Today, we

have more than 300 horizontal wells producing in the Woodford Shale. Since

October 2009, we have completed and turned a total of 34 Woodford wells to sales

(SXLs, standard completions and multi-well pads). The average initial

gross production rate for all wells is 6 MMcfe/d.

Since the

beginning of 2009, our drill and complete costs in the Woodford have decreased

about 20%.

ROCKY

MOUNTAINS

Our net

production from the Rocky Mountains grew 10% in 2009 and is expected to grow by

a comparable amount in 2010. Nearly 25% of our 2010 budget will be allocated to

our activities in the Rocky Mountains. Our primary areas of focus will be the

Uinta, Williston and Southern Alberta Basins.

Monument

Butte

Our

largest oil asset is Monument Butte, located in the Uinta Basin of northeast

Utah. The Monument Butte field covers approximately 180,000 net acres (includes

63,000 Ute Tribal acres). Our production from this field is currently 17,000

BOPD (gross). In 2010, we expect to run a 5-rig program and to drill about 275

wells. Our Monument Butte production is expected to increase 15% in

2010.

Recent

drilling results on our Ute Tribal acreage have exceeded our expectations. To

date, we have drilled 75 wells on this acreage, located north and adjacent to

Monument Butte. We have two rigs active on this acreage today. Recent wells have

“stepped out” as far as 10 miles from core development drilling areas and

initial production rates have ranged from 100 – 1,500 BOPD. Our interest on the

Ute Tribal acreage is approximately 70%. The following map shows our acreage in

the Monument Butte area.

6

There are

more than 1,300 producing wells in the Monument Butte field, of which

approximately 900 have been drilled since we acquired the field in 2004. The

average initial gross production rate for a typical Monument Butte well has

ranged from 65 – 80 BOPD.

Williston /

Southern Alberta Basins

Over the

last several years, we have assembled a large acreage position in the Williston

and Southern Alberta Basins. Newfield has approximately 150,000 net acres in

prospective development areas, located primarily on the Nesson Anticline and

west of the Nesson. In addition, Newfield owns interest in approximately 54,000

net acres in the Elm Coulee field. In addition, we have 221,000 net acres in the

Southern Alberta Basin of northern Montana. Our activity levels in these regions

are increasing and we expect that our Williston production will grow by about

40% in 2010. We have more than 80 development locations, located primarily along

the Nesson Anticline. Our current net production is approximately 3,000

BOEPD.

Due to

strong oil prices, we recently increased our operated rig count in the Williston

to three rigs. Two of the rigs will be dedicated to our development areas,

located along the Nesson Anticline. The third rig will be used to continue to

assess our acreage west of the Nesson. We have drilled 14 successful oil wells

in the North Dakota portion of the Williston Basin since entering the region in

late 2007. The following chart details our results to date:

7

In late

2009, we signed an agreement with the Blackfeet Nation, adding 156,000 net acres

in the Southern Alberta Basin. This was additive to our existing acreage and we

now own interests in 221,000 net acres in Glacier County, Montana. The area is

geologically similar to the Williston Basin. Our prospective oil targets

include: the Bakken, Three Forks and Lodgepole. We expect to begin assessment

drilling in the region in April 2010 and, depending on success, plan to drill as

many as 10 operated wells during 2010.

MARCELLUS

SHALE / APPALACHIAN BASIN

In late

2009, we entered the Marcellus Shale through a joint exploration agreement with

Hess. To date, we have leased interests in approximately 35,000 net acres,

primarily in Susquehanna and Wayne Counties, Pennsylvania. We operate the

venture with a 50 percent working interest.

We

recently filed permits to drill up to 10 vertical assessment wells in Wayne

County in 2010. Our first well is expected to spud this summer.

GULF

OF MEXICO

Approximately

15% of our 2010 budget will be allocated to our activities in the deepwater Gulf

of Mexico. Our GOM production is expected to increase more than 60% in 2010. We

have five active deepwater developments that we expect to add significant

production growth in 2010 -12. In addition to these developments, we anticipate

participating in 2-3 deepwater exploration wells in 2010.

GOM

Deepwater Developments

|

·

|

Fastball: Fastball

(Viosca Knoll 1003) commenced production in late 2009. This field is

currently producing 41 MMcf/d and 3,000 BOPD gross. We operate with a 66%

working interest.

|

|

·

|

Sargent: We

are currently developing Sargent (Garden Banks 339), which was a 2008

discovery with a single well tie back to existing infrastructure. We have

a 25% interest in this non-operated development and expect first

production in April 2010.

|

|

·

|

Gladden: In

December 2009, we gained an additional 10% interest in our Gladden

development through a trade for our remaining interest in the Anduin West

development (Mississippi Canyon 754). Gladden (Mississippi Canyon 800) is

expected to commence production in late 2010. We operate with a 57.5%

working interest.

|

8

|

·

|

Dalmatian:

The Dalmatian development (DeSoto Canyon 48) is underway with first

production expected in 2011. Newfield has a 37.5% non-operated interest in

this development. Additional exploration opportunities exist around

Dalmatian.

|

|

·

|

Pyrenees: In

mid-2009, we announced a significant operated discovery at Pyrenees

(Garden Banks 293). Development of the field is underway with first

production expected in late 2011. Additional drilling prospects remain on

an 11-block area around Pyrenees. We operate the development with a 40%

working interest.

|

2010

GOM Deepwater Exploration

Our 2010

planned exploration wells in the deepwater GOM are shown below:

Saluki

prospect: Our operated Saluki prospect (Garden Banks 425) will spud in late

February 2010. We have recently taken additional partners in the well and will

have a 50% working interest (35% cost interest). The prospect is located in

close proximity to our Pyrenees development.

Axe:

Located in close proximity to our outside-operated Dalmatian development, Axe

(DeSoto Canyon 4) is expected to spud in March 2010. We will have a 23%

non-operated interest in Axe.

We expect

to drill 1-2 additional deepwater prospects in 2010, including Lyell (Green

Canyon 551) where we have a 25% substantially-carried interest.

INTERNATIONAL

Our

international activities in 2010 will comprise about 15% of our planned capital

budget. Our activities are focused solely on our offshore Malaysia and China

assets (Bohai Bay and Pearl River Mouth Basin). Our production from our

international division was up 40% in 2009. It is expected to decline in 2010,

but will grow significantly in 2011 and 2012 due to new field

developments.

Malaysia

Total

liftings from Malaysia in 2009 totaled 5.3 MMBbls, or 14,500 BOPD (net). Our

production benefitted from new developments East Belumut and Chermingat, located

on PM 323.

East Belumut and

Chermingat – In late 2009, we accelerated planned development drilling in

our East Belumut field, offshore Malaysia. We are now drilling our sixth of

seven planned development wells from an existing platform. The program is

expected to add approximately 1 MMBbls of incremental oil production in 2010 due

to its accelerated timing. Our interest in PM 323, which we operate, is

approximately 60%.

9

Phase

II drilling operations on Newfield’s East Belumut platform

Horizontal drilling is not only

applied in U.S. resource plays… in fact, we have been increasing our

lateral lengths overseas, as well. Our development wells in the East Belumut

field are all horizontal wells and recent completions are nearly

6,000’.

China

Our Bohai

Bay production is approximately 2,500 BOPD net. We have a 12% non-operated

interest in a unit where more than 20 planned development wells are expected to

be drilled during 2010.

In the

Pearl River Mouth Basin, our recent Jade exploration test was unsuccessful. The

dry hole was drilled to test a fault separated structure approximately 10 miles

northeast of our Pearl discovery. The well was drilled for approximately $10

million and material exploration opportunities remain in the area.

Our

operated Pearl development is underway with first production expected in late

2012. We recently completed the first phase of the regulatory approval process,

which we anticipate be concluded by the end of 2010.

We have two additional exploration

wells planned offshore China in 2010.

10

FIRST

QUARTER 2010 ESTIMATES

|

1Q10

Estimates

|

||||||||||||

|

Domestic

|

Int’l

|

Total

|

||||||||||

|

Production/Liftings

|

||||||||||||

|

Natural

gas – Bcf

|

45.6 – 50.4 | – | 45.6 – 50.4 | |||||||||

|

Oil

and condensate – MMBbls

|

1.6 – 1.7 | 1.3 – 1.4 | 2.9 – 3.1 | |||||||||

|

Total

Bcfe

|

54.9 – 60.7 | 7.7 – 8.5 | 62.6 – 69.2 | |||||||||

|

Average

Realized Prices

|

||||||||||||

|

Natural

gas – $/Mcf

|

Note

1

|

|||||||||||

|

Oil

and condensate – $/Bbl

|

Note

2

|

Note

3

|

||||||||||

|

Mcf

equivalent – $/Mcfe

|

||||||||||||

|

Operating

Expenses:

|

||||||||||||

|

Lease

operating

|

||||||||||||

|

Recurring

($MM)

|

$ | 54.9 - $60.7 | $ | 14.2 - $15.7 | $ | 69.1 - $76.4 | ||||||

|

per/Mcfe

|

$ | 1.01 - $1.03 | $ | 1.82 - $1.86 | $ | 1.11 - $1.13 | ||||||

|

Major

(workover, repairs, etc.) ($MM)

|

$ | 9.1 - $10.1 | $ | 0.4 - $0.5 | $ | 9.5 - $10.5 | ||||||

|

per/Mcfe

|

$ | 0.16 - $0.17 | $ | 0.04 - $0.05 | $ | 0.15 - $0.16 | ||||||

|

Production and other taxes

($MM)Note

4

|

$ | 17.1 - $18.9 | $ | 11.7 - $12.9 | $ | 28.8 - $31.8 | ||||||

|

per/Mcfe

|

$ | 0.31 - $0.32 | $ | 1.50 - $1.53 | $ | 0.46 - $0.47 | ||||||

|

General and administrative

(G&A), net ($MM)

|

$ | 34.2 - $37.8 | $ | 1.1 - $1.2 | $ | 35.3 - $39.0 | ||||||

|

per/Mcfe

|

$ | 0.63 - $0.64 | $ | 0.14 - $0.15 | $ | 0.57 - $0.58 | ||||||

|

Capitalized

internal costs ($MM)

|

$ | (19.4 - $21.5 | ) | |||||||||

|

per/Mcfe

|

$ | (0.31 - $0.32 | ) | |||||||||

|

Interest

expense ($MM)

|

$ | 39.0 - $43.1 | ||||||||||

|

per/Mcfe

|

$ | 0.62 - $0.64 | ||||||||||

|

Capitalized

interest ($MM)

|

$ | (11.5 - $12.7 | ) | |||||||||

|

per/Mcfe

|

$ | (0.18 - $0.19 | ) | |||||||||

|

Tax

rate (%)Note

5

|

35% - 37 | % | ||||||||||

|

Income

taxes (%)

|

||||||||||||

|

Current

|

14% - 16 | % | ||||||||||

|

Deferred

|

84% - 86 | % | ||||||||||

|

Note

1: The price that we receive for natural gas production from the Gulf of

Mexico and onshore Gulf Coast, after basis differentials, transportation

and handling charges, typically averages $0.25 - $0.50 per MMBtu less than

the Henry Hub Index. Realized natural gas prices for our

Mid-Continent properties, after basis differentials, transportation and

handling charges, typically average 85-90% of the Henry Hub

Index.

Note

2: The price we receive for our Gulf Coast oil production typically

averages about 90-95% of the NYMEX West Texas Intermediate (WTI) price.

The price we receive for our oil production in the Rocky Mountains is

currently averaging about $12-$14 per barrel below the WTI price. Oil

production from our Mid-Continent properties typically averages 80-85% of

the WTI price.

Note

3: Oil sales from our operations in Malaysia typically sell at a slight

discount to Tapis, or about 90-95% of WTI. Oil sales from our operations

in China typically sell at $4-$6 per barrel less than the WTI

price.

Note

4: Guidance for production taxes determined using $70/Bbl oil and

$5.50/MMBtu gas.

Note

5: Tax rate applied to earnings excluding unrealized gains or losses

on commodity derivatives.

|

||||||||||||

11

NATURAL GAS HEDGE

POSITIONS

Please

see the tables below for our complete hedging positions.

The

following hedge positions for the first quarter of 2010 and beyond are as of

February 15, 2010:

First Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

31,800

MMMBtus

|

$ | 6.79 | — | — | — | — | ||||||||||||||

|

5,700

MMMBtus

|

— | — | $ | 8.50 — $10.44 | $ | 8.50 | $ | 10.00 — $11.00 | ||||||||||||

Second Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

34,850

MMMBtus

|

$ | 6.41 | — | — | — | — | ||||||||||||||

Third Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

35,200

MMMBtus

|

$ | 6.41 | — | — | — | — | ||||||||||||||

Fourth Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

28,320

MMMBtus

|

$ | 6.49 | — | — | — | — | ||||||||||||||

First Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

18,900

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

|

9,900

MMMBtus*

|

— | — | $ | 6.00 — $7.91 | $ | 6.00 | $ | 7.75 — $8.03 | ||||||||||||

Second Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

19,110

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

|

10,010

MMMBtus*

|

— | — | $ | 6.00 — $7.91 | $ | 6.00 | $ | 7.75 — $8.03 | ||||||||||||

Third Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

19,320

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

|

10,120

MMMBtus*

|

— | — | $ | 6.00 — $7.91 | $ | 6.00 | $ | 7.75 — $8.03 | ||||||||||||

Fourth Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

6,510

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

|

8,290

MMMBtus*

|

— | — | $ | 6.00 — $7.94 | $ | 6.00 | $ | 7.75 — $8.03 | ||||||||||||

*These 3-way collar contracts

are standard natural gas collar contracts with respect to the periods, volumes

and prices stated above. The contracts have floor and ceiling prices per MMMBtu

as per the table above until the price drops below a weighted average price of

$4.50 per MMMBtu. Below $4.50 per MMMBtu, these contracts effectively result in

realized prices that are on average $1.50 per MMMBtu higher than the cash price

that otherwise would have been realized.

12

The

following table details the expected impact to pre-tax income from the

settlement of our derivative contracts, outlined above, at various NYMEX gas

prices.

|

Gas

Prices

|

||||||||||||||||||||||||

| $ | 4.00 | $ | 5.00 | $ | 6.00 | $ | 7.00 | $ | 8.00 | $ | 9.00 | |||||||||||||

|

2010

|

||||||||||||||||||||||||

|

1st

Quarter

|

$ | 114 | $ | 77 | $ | 40 | $ | 2 | $ | (35 | ) | $ | (70 | ) | ||||||||||

|

2nd

Quarter

|

$ | 84 | $ | 49 | $ | 14 | $ | (21 | ) | $ | (56 | ) | $ | (91 | ) | |||||||||

|

3rd

Quarter

|

$ | 85 | $ | 49 | $ | 14 | $ | (21 | ) | $ | (56 | ) | $ | (91 | ) | |||||||||

|

4th

Quarter

|

$ | 70 | $ | 43 | $ | 14 | $ | (14 | ) | $ | (43 | ) | $ | (71 | ) | |||||||||

|

Total

2010

|

$ | 353 | $ | 218 | $ | 82 | $ | (54 | ) | $ | (190 | ) | $ | (323 | ) | |||||||||

|

2011

|

||||||||||||||||||||||||

|

1st

Quarter

|

$ | 63 | $ | 39 | $ | 10 | $ | (8 | ) | $ | (28 | ) | $ | (57 | ) | |||||||||

|

2nd

Quarter

|

$ | 64 | $ | 40 | $ | 10 | $ | (9 | ) | $ | (29 | ) | $ | (58 | ) | |||||||||

|

3rd

Quarter

|

$ | 64 | $ | 40 | $ | 11 | $ | (9 | ) | $ | (29 | ) | $ | (58 | ) | |||||||||

|

4th

Quarter

|

$ | 29 | $ | 18 | $ | 4 | $ | (3 | ) | $ | (10 | ) | $ | (25 | ) | |||||||||

|

Total

2011

|

$ | 220 | $ | 137 | $ | 35 | $ | (29 | ) | $ | (96 | ) | $ | (198 | ) | |||||||||

In the Rocky Mountains, we

hedged basis associated with approximately 15 Bcf of our natural gas production

from January 2010 through December 2012 to lock in the differential at a

weighted average of $0.95 per MMBtu less than the Henry Hub Index. In

total, this hedge and the 8,000 MMBtu per day we have sold on a fixed physical

basis for the same period results in an average basis hedge of $0.95 per

MMBtu.

In the Mid-Continent, we

hedged basis associated with approximately 12 Bcf of our anticipated

Stiles/Britt Ranch natural gas production from January 2010 through August

2011. In total, this hedge and the 30,000 MMBtu per day we have sold

on a fixed physical basis for the same period results in an average basis hedge

of $0.52 per MMBtu. We have also hedged basis associated with

approximately 23 Bcf of our natural gas production from this area for the period

September 2011 through December 2012 at an average of $0.55 per

MMBtu.

Approximately 12% of our

natural gas production correlates to Houston Ship Channel, 13% to Columbia Gulf,

13% to Texas Gas Zone 1, 9% to Southern Natural Gas, 9% to Tenn 100, 5% to

CenterPoint/East, 22% to Panhandle Eastern Pipeline, 6% to Waha, 6% to Colorado

Interstate, and 5% to others.

CRUDE

OIL HEDGE POSITIONS

The

following hedge positions for the first quarter of 2010 and beyond are as of

February 15, 2010:

First Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000 Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

810,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

360,000

Bbls*

|

— | — | $ | 67.50 — $106.28 | $ | 60.00 — $75.00 | $ | 100.00 —$112.10 | ||||||||||||

Second Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000 Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

819,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

364,000

Bbls*

|

— | — | $ | 67.50 — $106.28 | $ | 60.00 — $75.00 | $ | 100.00 —$112.10 | ||||||||||||

13

Third Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000 Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

828,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

368,000

Bbls*

|

— | — | $ | 67.50 — $106.28 | $ | 60.00 — $75.00 | $ | 100.00 —$112.10 | ||||||||||||

Fourth Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000 Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

828,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

368,000

Bbls*

|

— | — | $ | 67.50 — $106.28 | $ | 60.00 — $75.00 | $ | 100.00 —$112.10 | ||||||||||||

First Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

360,000

Bbls*

|

— | — | $ | 77.50 — $119.94 | $ | 75.00 — $80.00 | $ | 118.50—$121.50 | ||||||||||||

Second Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

364,000

Bbls*

|

— | — | $ | 77.50 — $119.94 | $ | 75.00 — $80.00 | $ | 118.50—$121.50 | ||||||||||||

Third Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

368,000

Bbls*

|

— | — | $ | 77.50 — $119.94 | $ | 75.00 — $80.00 | $ | 118.50—$121.50 | ||||||||||||

Fourth Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

368,000

Bbls*

|

— | — | $ | 77.50 — $119.94 | $ | 75.00 — $80.00 | $ | 118.50—$121.50 | ||||||||||||

*These

3-way collar contracts are standard crude oil collar contracts with respect to

the periods, volumes and prices stated above. The contracts have floor and

ceiling prices per Bbl as per the table above until the price drops below a

weighted average price of $58.75 per Bbl. Below $58.75 per Bbl, these contracts

effectively result in realized prices that are on average $13.75 per Bbl higher

than the cash price that otherwise would have been realized.

The following table details the

expected impact to pre-tax income from the settlement of our derivative

contracts, outlined above, at various NYMEX oil prices, net of premiums paid for

these contracts (in millions).

|

Oil

Prices

|

||||||||||||||||||||||||||||

| $ | 40.00 | $ | 50.00 | $ | 60.00 | $ | 70.00 | $ | 80.00 | $ | 90.00 | $ | 100.00 | |||||||||||||||

|

2010

|

||||||||||||||||||||||||||||

|

1st

Quarter

|

$ | 73 | $ | 64 | $ | 53 | $ | 43 | $ | 33 | $ | 23 | $ | 14 | ||||||||||||||

|

2nd

Quarter

|

$ | 74 | $ | 65 | $ | 54 | $ | 43 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

3rd

Quarter

|

$ | 74 | $ | 65 | $ | 54 | $ | 43 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

4th

Quarter

|

$ | 75 | $ | 65 | $ | 54 | $ | 43 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

Total

2010

|

$ | 296 | $ | 259 | $ | 215 | $ | 172 | $ | 132 | $ | 95 | $ | 59 | ||||||||||||||

|

2011

|

||||||||||||||||||||||||||||

|

1st

Quarter

|

$ | 5 | $ | 5 | $ | 5 | $ | 2 | $ | - | $ | - | $ | - | ||||||||||||||

|

2nd

Quarter

|

$ | 5 | $ | 5 | $ | 5 | $ | 3 | $ | - | $ | - | $ | - | ||||||||||||||

|

3rd

Quarter

|

$ | 6 | $ | 6 | $ | 6 | $ | 3 | $ | - | $ | - | $ | - | ||||||||||||||

|

4th

Quarter

|

$ | 6 | $ | 6 | $ | 6 | $ | 3 | $ | - | $ | - | $ | - | ||||||||||||||

|

Total

2011

|

$ | 22 | $ | 22 | $ | 22 | $ | 11 | $ | - | $ | - | $ | - | ||||||||||||||

14

We

provide information regarding our outstanding hedging positions in our annual

and quarterly reports filed with the SEC and in our electronic publication --

@NFX. This publication can be found on Newfield’s web page at

http://www.newfield.com. Through the web page, you may elect to receive @NFX

through e-mail distribution.

Newfield

Exploration Company is an independent crude oil and natural gas exploration and

production company. The Company relies on a proven growth strategy of growing

reserves through the drilling of a balanced risk/reward portfolio and select

acquisitions. Newfield's domestic areas of operation include the U.S. onshore

Gulf Coast, the Anadarko and Arkoma Basins of the Mid-Continent, the Rocky

Mountains and the Gulf of Mexico. The Company has international operations in

Malaysia and China.

**This

publication contains forward-looking information. All information other than

historical facts included in this publication, such as information regarding

estimated or anticipated first quarter 2010 results, estimated capital

expenditures, cash flow, production and cost reductions, drilling and

development plans and the timing of activities, is forward-looking information.

Although Newfield believes that these expectations are reasonable, this

information is based upon assumptions and anticipated results that are subject

to numerous uncertainties and risks. Actual results may vary significantly from

those anticipated due to many factors, including drilling results, oil and gas

prices, industry conditions, the prices of goods and services, the availability

of drilling rigs and other support services, the availability of refining

capacity for the crude oil Newfield produces from its Monument Butte field in

Utah, the availability and cost of capital resources, labor conditions and

severe weather conditions (such as hurricanes). In addition, the drilling of oil

and gas wells and the production of hydrocarbons are subject to governmental

regulations and operating risks.

15