Attached files

| file | filename |

|---|---|

| EX-10.32 - EX-10.32 - Global Geophysical Services Inc | a2196144zex-10_32.htm |

| EX-23.1 - EX-23.1 - Global Geophysical Services Inc | a2196144zex-23_1.htm |

| EX-4.1 - EX-4.1 - Global Geophysical Services Inc | a2196144zex-4_1.htm |

| EX-10.31 - EX-10.31 - Global Geophysical Services Inc | a2196144zex-10_31.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on February 17, 2010.

Registration No. 333-162540

UNITED STATES

Securities and Exchange Commission

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GLOBAL GEOPHYSICAL SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

1382 (Primary Standard Industrial Classification Code Number) |

05-0574281 (I.R.S. Employer Identification Number) |

13927 South Gessner Road

Missouri City, TX 77489

(713) 972-9200

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Richard A. Degner

Chairman of the Board, President and Chief Executive Officer

13927 South Gessner Road

Missouri City, TX 77489

(713) 972-9200

(Name and address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

| Bryce D. Linsenmayer John W. Menke Haynes and Boone, LLP 1221 McKinney Street, Suite 2100 Houston, Texas 77010 (713) 547-2000 (713) 236-5540 (fax) |

J. Michael Chambers Latham & Watkins LLP 717 Texas Avenue, Suite 1600 Houston, Texas 77002 (713) 546-5400 (713) 546-5401 (fax) |

|

Approximate date of commencement of proposed sale to the public:

As soon as practical after the effective date of this Registration Statement.

If any of the securities being registered on this form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY , 2010

Shares

Common Stock

We are selling shares of our common stock and the selling stockholders, who include our Chief Executive Officer, are selling shares of our common stock. Prior to this offering, there has been no public market for our common stock. The initial public offering price of the common stock is expected to be between $ and $ per share. We have been approved to list our common stock on the NYSE under the symbol "GGS."

The underwriters have an option to purchase from us up to additional shares to cover over-allotments of shares.

Investing in our common stock involves risks. See "Risk Factors" on page 10.

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Global Geophysical Services, Inc. (before expenses) |

Proceeds to Selling Stockholders |

||||

|---|---|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | $ | ||||

Total |

$ | $ | $ | $ |

Delivery of the shares of common stock will be made on or about , 2010.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | Barclays Capital |

Tudor, Pickering, Holt & Co.

| Raymond James | Simmons & Company International |

The date of this prospectus is , 2010.

You should rely only on the information contained in this prospectus. Neither we nor the selling stockholders have authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

As used in this prospectus, unless the context otherwise indicates, references to "Global," the "company," "we," "our," "ours" and "us" refer to Global Geophysical Services, Inc. and its subsidiaries collectively.

Until , 2010 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as underwriter and with respect to unsold allotments or subscriptions.

i

This summary highlights selected information described in more detail later in this prospectus, but does not contain all of the information you should consider in making an investment decision. You should also read this entire prospectus, including the risks of investing in our common stock discussed in the section entitled "Risk Factors" and the financial statements and related notes appearing elsewhere in this prospectus before investing in our common stock.

Our Company

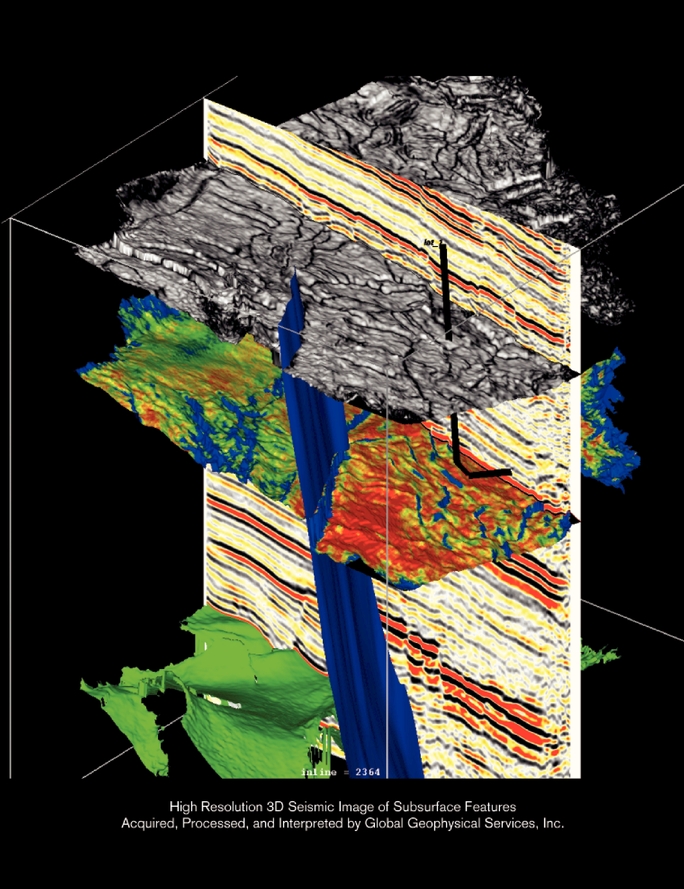

We provide an integrated suite of seismic data solutions to the global oil and gas industry, including our high resolution RG-3D Reservoir Grade™ ("RG3D") seismic solutions. Our seismic data solutions consist primarily of seismic data acquisition, processing and interpretation services. Through these services, we deliver data that enable the creation of high resolution images of the earth's subsurface and reveal complex structural and stratigraphic details. These images are used primarily by oil and gas companies to identify geologic structures favorable to the accumulation of hydrocarbons, to reduce risk associated with oil and gas exploration, to design horizontal drilling programs, to optimize well completion techniques and to monitor changes in hydrocarbon reservoirs. We integrate seismic survey design, data acquisition, processing and interpretation to deliver enhanced services to our clients. In addition, we own and market a growing seismic data library and license this data to clients on a non-exclusive basis.

Our seismic solutions are used by many of the world's largest and most technically advanced oil and gas exploration and production companies, including national oil companies ("NOCs") such as Oil and Natural Gas Corporation Limited ("ONGC") and Petróleos Mexicanos ("Pemex"), major integrated oil and gas companies ("IOCs") such as BP p.l.c. ("BP"), ConocoPhillips Company ("ConocoPhillips") and Exxon Mobil Corporation ("ExxonMobil"), and independent oil and gas exploration and production companies such as Anadarko Petroleum Corporation ("Anadarko"), Apache Corporation, Chesapeake Energy Corporation ("Chesapeake") and Southwestern Energy Company ("Southwestern Energy").

We provide seismic data acquisition for land, transition zone and shallow marine areas, including challenging environments such as marsh, forest, jungle, arctic, mountain and desert. Our management team has significant operational experience in most of the major U.S. shale plays, including the Haynesville, Barnett, Fayetteville, Eagle Ford and Woodford, where we believe our high resolution RG3D seismic solutions are particularly well-suited.

Our operations management team has extensive industry experience, having served in senior leadership roles with Petroleum Geo-Services ASA ("PGS"), Compagnie Générale de Géophysique—Veritas ("CGGVeritas"), Western Geophysical and its successor, WesternGeco, a business unit of Schlumberger Limited. Our Chief Executive Officer, Richard Degner, was President of PGS Onshore Inc., a division of PGS, and has over 25 years of seismic data industry experience. Our operations management team has operated in over 60 countries, and has developed long-term client relationships around the world.

We currently own, or operate under long-term leases, approximately 151,500 recording channels. Our recording channels and systems operate on a common technology platform which provides operational scalability and efficiency. This operational scalability and efficiency enables us to execute on large and technologically complex projects. For example, we recently completed a project for ExxonMobil that we believe to be the largest and one of the most technologically complex land seismic data acquisition projects undertaken to date involving the deployment of over 100,000 recording channels.

1

Our Industry

Seismic technology is the primary tool used to locate oil and gas reserves and facilitates the development of complex reservoirs. Seismic data is acquired by introducing acoustic energy into the earth through controlled energy sources, such as dynamite or vibration equipment. The sound waves generated by these energy sources are reflected back to the surface and collected by seismic sensors referred to as "geophones" or "hydrophones." One or more strategically positioned seismic sensors are connected to a recording channel which transmits the data to a central recording location. A typical project, which in our industry is referred to as a "shoot" or "seismic shoot", involves the use of thousands, and sometimes tens of thousands, of channels recording simultaneously over the survey area.

Seismic data is recorded to produce either two-dimensional ("2D") or three-dimensional ("3D") images of the earth. In a project involving 2D seismic data acquisition, recording channels are laid out in a straight line. For projects to acquire 3D seismic data, channels are arranged in a grid covering an area.

Once acquired, seismic data is processed using complex and often proprietary algorithms to transform the raw data into images of the subsurface. These images are used primarily by oil and gas companies to identify geologic structures favorable to the accumulation of hydrocarbons, to reduce risk associated with oil and gas exploration, to design horizontal drilling programs, to optimize well completion techniques and to monitor changes in hydrocarbon reservoirs.

Our business and the overall demand for seismic data services depend on the worldwide levels of capital expenditures for oil and gas exploration, development and production activities. We believe the following industry trends should benefit our business and provide the basis for our long-term growth:

Demand for new energy resources combined with increasing difficulty of locating and producing new oil reserves

According to the International Energy Agency, worldwide oil demand is expected to grow by approximately 24% from 2008 to 2030. To meet growing world demand and to offset steep decline rates from existing proved oil resources, significant quantities of new oil reserves must be discovered. Accordingly, exploration and production companies are increasingly required to access reservoirs that are typically smaller, deeper or have other complex characteristics. In addition, existing fields which have previously been shot with older technologies are being re-shot with newer, high resolution seismic technology in connection with efforts to increase their production, identify previously bypassed reserves, and locate new prospective drilling locations.

Increased industry focus on unconventional plays, including natural gas shales in North America and internationally

Technical advances in horizontal drilling and new well completion techniques have greatly enhanced the ability of oil and gas companies to produce natural gas from unconventional resource plays such as natural gas shales. As a result, domestic shale gas resources have become a significant contributor to recent increases in U.S. natural gas production and reserves. In particular, seismic data is useful in designing and optimizing horizontal drilling programs to avoid unfavorable geologic features that may increase drilling costs. Using the experience derived from the development of domestic shales, exploration and production companies have also begun to focus on shale gas resources on a global scale. Because many of these resources are located in areas that have not experienced significant historical oil and gas production, large amounts of new seismic data will be required as companies delineate the extent of shales and evaluate drilling inventories and leasing opportunities. High resolution 3D seismic data, such as that obtained through our RG3D seismic solutions, is also commonly used to formulate and implement completion techniques in shale gas reservoirs.

2

Significant advances in seismic data technologies

We believe that recent advances in seismic data equipment, technologies and processing capabilities, such as those that enable our high resolution RG3D seismic solutions, have improved not only the efficiency of seismic data acquisition but also the usefulness of the data provided. We believe that demand for our services will increase as clients become familiar with the benefits of more advanced seismic technologies, including higher density 3D and multi-component seismic data which uses multiple geophones or accelerometers to record all components of reflected acoustic energy. While seismic data historically has been used solely as an exploration tool, higher resolution seismic images are now used in applications such as designing horizontal drilling programs, formulating well completion techniques and for time-lapse reservoir monitoring, which is commonly referred to as four-dimensional seismic data.

Many large and well capitalized oil and gas companies have maintained consistent levels of exploration and production capital expenditures

Despite the industry downturn beginning in late 2008, many large and well capitalized oil and gas companies have maintained consistent levels of capital spending. Because large oil and gas development projects can take several years before a field is productive, many large companies take a longer term view of commodity prices in setting capital budgets.

Our Strengths

We believe that the following strengths provide us with significant competitive advantages:

Our high resolution RG3D seismic solutions

As a result of our extensive experience designing and implementing seismic data acquisition programs in a variety of environments, and our use of the latest technologies available in the industry, we provide our clients with high resolution seismic data. We have a common technology platform and configured its design in order to perform high channel count seismic data acquisition projects which increase the resolution, or "trace density," and other advanced attributes of the data. We believe our high resolution RG3D seismic solutions can help our clients more effectively identify and develop oil and gas reserves.

International footprint with extensive experience operating in challenging environments

We operate globally in many challenging environments including marsh, forest, jungle, arctic, mountain and desert. Our recent experience includes executing on projects in Mexico, Colombia, Argentina, Chile, Peru, Georgia, Uganda, Algeria, Iraq, Oman and India. In addition, our operations management team has experience operating in over 60 countries. To further extend our footprint and complement our skills, we selectively engage in strategic alliances with foreign partners that enhance our relationships with regional clients, offer commercial and regulatory guidance and provide access to local facilities, equipment and personnel.

Operational efficiency and flexibility

We manage our crews and projects with a focus on efficiency so that our projects may be completed in less time and at a lower cost, thereby improving our margins. The equipment we employ is an important factor in our success, as our common platform allows us to easily and efficiently allocate components and people to meet specific project objectives while also maximizing utilization. Our operational flexibility also allows us to quickly reallocate our equipment and crews across our global operations in response to our business or client needs. This can be particularly important to our clients who face lease exploration deadlines. In addition, our integrated product offering provides us with flexibility to be responsive to our clients' specific needs. For example, on a recent project in Algeria for BP, we successfully deployed our advanced processing services directly in the field thereby reducing the time required to deliver processed seismic data.

3

Blue chip client base

Members of our management have long-standing relationships with blue chip clients including NOCs such as ONGC and Pemex and major IOCs such as BP, ConocoPhillips and ExxonMobil. Although the terms of our master service agreements with our clients do not guarantee future business, we believe that our status as an approved service provider with numerous industry participants and our past performance with these clients enhances our ability to win new business. Historically, our NOC and IOC clients have represented a significant percentage of our revenues.

Strong operations management team with extensive industry experience and relationships

Our operations management team averages more than 25 years of industry experience, having served in a variety of roles and senior positions at other seismic companies, including PGS, CGGVeritas, Western Geophysical and its successor, WesternGeco. We believe that the knowledge base, experience and relationships that our management team has extends our operating capabilities, improves the quality of our services, facilitates access to clients and underlies our strong reputation in the industry.

Our Strategies

We intend to continue to use our competitive strengths to advance our corporate strategy. The following are key elements of that strategy:

Continue to advance our high resolution RG3D seismic solutions

We intend to continue providing our clients with high resolution seismic technology and processing in order to help our clients make more informed decisions regarding their exploration and development programs. We are committed to providing our clients the most advanced technologies in the market and have made recent investments in the design and development of advanced seismic technology such as land nodal recording systems and tethered seafloor nodal systems. Our land nodal recording systems, if successfully developed, are intended to operate autonomously and record continuously. Our tethered seafloor nodal systems, if successfully developed, are intended to operate in deep water with the goal of providing higher quality and more cost effective data than that provided by towed streamers. In addition, we have invested in multi-component recording equipment which provides additional information compared to standard, single component recording channels. To complement our investment in equipment technology, we will continue to develop and expand our processing and interpretation capabilities, which we believe benefits both our data acquisition and multi-client seismic services businesses.

Enhance and expand client relationships

We intend to continue enhancing our relationships with our existing clients by seeking to perform services for them in new geographic regions, as well as by continuing to provide the latest technologies and an integrated suite of services. For example, BP awarded us a high resolution seismic project in Algeria after we successfully completed a project for them in Oman. Additionally, we intend to build relationships with new clients through our reputation for high quality services, operational flexibility and our ability to provide higher-end integrated service offerings throughout the world.

Expand our multi-client seismic data library

We intend to continue investing in seismic data surveys for our multi-client seismic data library. Our focus is on oil and gas basins that our clients believe have the highest potential for development. For example, we recently completed a multi-client seismic shoot in the southwestern U.S. that was sponsored by Anadarko, Chesapeake, Marathon Oil Corporation and others. We also recently launched multi-client programs in the Bakken, Eagle Ford, Haynesville and Marcellus shale plays. We target pre-committed funding from our clients of approximately 80% of our expected investment in our multi-client program. To date, we have exceeded our 80% target of pre-commitments on all of our completed multi-client programs.

4

Expand our marine services operations

We plan to increase our use of ocean bottom cable and other seafloor recording technologies to extend the application of our high resolution RG3D seismic solutions further into the deep water environment. We are currently investing in the design and development of equipment, including seafloor nodal technology, that, if successfully developed will combine seismic sensors and data recording technology in a manner that does not require cabling or an external power source.

Attract and retain talented, experienced employees

Our senior management and employees have an established track record of successfully executing seismic data projects. As we have done since inception, we intend to continue hiring industry experts with a broad experience base and extensive client relationships. We believe this valuable mix of skills and relationships will continue to improve our service offerings and facilitate our continued growth.

Proposed Refinancing Transactions

Concurrently with this offering we intend to privately offer and sell $175.0 million in aggregate principal amount of our senior unsecured notes due 2017 (our "Senior Notes") to qualified institutional buyers in reliance on Rule 144A under the Securities Act and to certain non-U.S. persons in transactions outside the United States in reliance on Regulation S under the Securities Act (our "Proposed Senior Notes Offering") and to enter into a new senior secured revolving credit facility (our "New Revolving Credit Facility"). The proceeds of our Senior Notes, together with proceeds from this offering, will be used to repay all of the existing indebtedness outstanding under our first lien and second lien credit agreements (our "Existing Credit Facilities"), a construction loan and our capital leases. We refer to our Proposed Senior Notes Offering and the execution of our New Revolving Credit Facility as our "Proposed Refinancing Transactions." See "Description of our Proposed Financing Transactions" for a more detailed description of our Senior Notes and our New Revolving Credit Facility.

However, the completion of this offering is not contingent upon our consummation of the Proposed Refinancing Transactions. We cannot assure you that we will complete our Proposed Senior Notes Offering or enter into our New Revolving Credit Facility or that borrowings under that facility will become available to us in a timely manner or at all. See "Risk Factors—In connection with the closing of our Proposed Senior Notes Offering, we expect to enter into a New Revolving Credit Facility. Until such time as we enter into our New Revolving Credit Facility, our ability to finance our working capital needs may be limited."

This prospectus shall not be deemed to be an offer to sell or a solicitation of an offer to buy the Senior Notes. The offer and sale of our Senior Notes will not be registered under the Securities Act and the Senior Notes may not be offered or sold in the U.S. absent registration or in reliance on an applicable exemption from registration requirements.

Our Challenges

We face a number of challenges in implementing our strategies. For example:

- •

- If the current economic downturn continues for an extended period of time or commodity prices become depressed or decline,

our results of operations could be adversely affected.

- •

- Spending on services such as ours is subject to rapid and material change. Increases in oil and natural gas prices may not

increase demand for our services or otherwise have a positive effect on our financial condition or results of operations.

- •

- Our revenues are subject to fluctuations beyond our control, which could adversely affect our results of operations in any financial period.

5

- •

- Our working capital needs are difficult to forecast and may vary significantly, which could require us to seek additional

financing that we may not be able to obtain on satisfactory terms, or at all.

- •

- We face intense competition in our business that could result in downward pricing pressure and the loss of market share.

- •

- We have had losses in the past and there is no assurance of our profitability for the future.

- •

- We are dependent upon a small number of significant clients and projects at any given time.

- •

- Technological change in our business creates risks of technological obsolescence and requirements for future capital

expenditures. If we are unable to continue investing in the latest technology, we may not be able to compete effectively.

- •

- We have invested, and expect to continue to invest, significant amounts of money in acquiring and processing seismic data for our seismic data library without knowing precisely how much of this seismic data we will be able to sell or when and at what price we will be able to sell such data.

For further discussion of these and other challenges we face, see "Risk Factors" beginning on page 10.

Corporate Information

Our principal executive offices are located in the greater Houston, Texas metropolitan area at 13927 South Gessner Road, Missouri City, Texas 77489, and our telephone number is (713) 972-9200. Our website address is www.globalgeophysical.com. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

6

The Offering

| Issuer | Global Geophysical Services, Inc. | |

| Selling stockholders | Richard Degner, our Chief Executive Officer, and certain other stockholders. See "Principal and Selling Stockholders." | |

| Common stock offered by us | shares | |

| Common stock offered by the selling stockholders | shares | |

| Underwriters' option to purchase additional shares | We have granted the underwriters a 30-day option to purchase up to an additional shares of common stock. | |

| Common stock to be outstanding after this offering | shares | |

| Use of proceeds | We estimate that our net proceeds from this offering will be approximately $ million after deducting underwriting discounts and commissions and estimated offering expenses, assuming an offering price of $ per share, which is the midpoint of the range set forth on the cover page of this prospectus. We estimate that our net proceeds from our Proposed Senior Notes Offering will be approximately $ million after deducting the initial purchasers' discounts and estimated offering expenses. | |

| In the event that we do not complete the Proposed Senior Notes Offering, we expect to use the net proceeds of this offering to repay approximately $25.0 million in aggregate principal amount of indebtedness outstanding under our First Lien Term Loan Facility and to use the remainder for anticipated capital expenditures and general corporate purposes, including for working capital. In the event that we do complete the Proposed Senior Notes offering, we intend to use the net proceeds from this offering and the proceeds from our Proposed Senior Notes Offering to repay indebtedness outstanding under our Existing Credit Facilities, a construction loan and our capital leases equal, in an aggregate principal amount equal to approximately $ million (collectively, our "Existing Indebtedness") and to use the remainder for anticipated capital expenditures and general corporate purposes, including for working capital. | ||

| Completion of this offering is not contingent upon completion of our Proposed Senior Notes Offering. | ||

| We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders. | ||

| Dividend policy | We have not declared or paid any cash dividends on our common stock, and we do not currently anticipate paying any cash dividends on our common stock in the foreseeable future. | |

| Proposed NYSE symbol | GGS. | |

| Risk factors | An investment in our common stock involves a high degree of risk. See "Risk Factors" and other information included elsewhere in this prospectus for a discussion of factors you should consider before investing in our common stock. |

The number of shares of common stock to be outstanding after this offering is based on 28,868,356 shares outstanding as of February 12, 2010. This number (i) gives effect to the conversion of each share of our outstanding Class A and Class B common stock and our Series A convertible preferred stock into one share of our common stock, which we refer to as the "Stock Conversions", and (ii) excludes an aggregate of 4,661,373 shares of common stock reserved and available for future issuance under our 2006 Incentive Compensation Plan, 390,000 shares issuable upon exercise of outstanding warrants and shares issuable pursuant to the underwriters' option to purchase additional shares.

7

Summary Historical Financial Information

The following table presents summary historical financial information for the periods indicated. The summary historical consolidated statement of operations information for each of the years in the three-year period ended December 31, 2009 has been derived from our audited financial statements included herein. For further information that will help you better understand the summary data, you should read this financial data in conjunction with the "Selected Financial Information" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of this prospectus and the financial statements and related notes and other financial information included elsewhere in this prospectus. Our historical results of operations are not necessarily indicative of results to be expected for any future periods.

| |

Year Ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2007 | 2008 | 2009 | ||||||||

| |

(in thousands) |

||||||||||

Statement of Operations Information: |

|||||||||||

Revenues(1) |

$ | 225,742 | $ | 376,256 | $ | $312,796 | |||||

Operating expenses |

188,702 | 319,451 | 262,168 | ||||||||

Gross profit |

37,040 | 56,805 | 50,628 | ||||||||

Selling, general and administrative expenses |

18,684 | 30,190 | 32,300 | ||||||||

Income from operations |

18,356 | 26,615 | 18,328 | ||||||||

Interest expense, net |

(10,745 | ) | (22,384 | ) | (18,613 | ) | |||||

Other income (expense), net(2) |

(233 | ) | (6,250 | ) | 1,023 | ||||||

Income (loss) before income taxes |

7,378 | (2,019 | ) | 738 | |||||||

Income tax expense |

4,941 | 6,027 | 293 | ||||||||

Net income (loss) |

$ | 2,437 | $ | (8,046 | ) | $ | 445 | ||||

Other Data (unaudited): |

|||||||||||

EBITDA(3) |

$ | 51,454 | $ | 94,279 | $ | 99,441 | |||||

EBITDA margin |

23% | 25% | 32% | ||||||||

| |

At December 31, 2009 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Historical |

As Adjusted(6) |

As Further Adjusted(7) |

||||||||

| |

|

(unaudited) |

(unaudited) |

||||||||

Balance Sheet Data: |

|||||||||||

Cash and cash equivalents(4) |

$ | 17,027 | $ | $ | |||||||

Total assets |

316,620 | ||||||||||

Total debt, including current portion(5) |

169,890 | ||||||||||

Total liabilities |

252,691 | ||||||||||

Total stockholders' equity |

63,928 | ||||||||||

- (1)

- Includes

$25.0 million and $24.5 million in recognized revenues generated from multi-client services in the years ended December 31,

2008 and 2009, respectively.

- (2)

- Includes

unrealized gain (loss) on derivative instruments, foreign exchange gain (loss), other income (loss) and gains and losses on sales of assets.

- (3)

- We

define EBITDA as net income (loss) before interest expense, net, taxes, depreciation and amortization. Our management believes EBITDA is useful to an

investor in evaluating our operating performance because this measure is widely used by investors in the energy industry to measure a company's operating performance without regard to items excluded

from the calculation of such term, which can vary substantially from company to company depending upon, among other factors, accounting methods, book value of assets, capital structure and the method

by which assets were acquired. We believe EBITDA helps investors more meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our capital

structure and asset base from our operating structure. EBITDA is also used as a supplemental financial measure by our management in presentations to our board of directors, as a basis for strategic

planning and forecasting, and as a component for setting incentive compensation.

EBITDA has limitations as an analytical tool and should not be considered an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. EBITDA excludes some, but not all, items that affect net income and operating income and these measures may vary among other companies. Limitations to using EBITDA as an analytical tool include:

- •

- EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or capital commitments;

8

- •

- EBITDA

does not reflect changes in, or cash requirements necessary to service interest or principal payments on, our debt;

- •

- although

depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced

in the future, and EBITDA does not reflect any cash requirements for such replacements; and

- •

- other

companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure.

The following table presents a reconciliation of the non-GAAP financial measure of EBITDA to the most directly comparable GAAP financial measures on a historical basis for each of the indicated periods.

| |

Year Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2007 | 2008 | 2009 | |||||||||

| |

(in thousands) |

|||||||||||

Reconciliation of EBITDA to Net Income (Loss): |

||||||||||||

Net income (loss) |

$ | 2,437 | $ | (8,046 | ) | $ | 445 | |||||

Interest expense, net |

10,745 | 22,384 | 18,613 | |||||||||

Income tax expense |

4,941 | 6,027 | 293 | |||||||||

Depreciation and amortization |

33,331 | 73,914 | 80,090 | |||||||||

EBITDA |

$ | 51,454 | $ | 94,279 | $ | 99,441 | ||||||

- (4)

- Cash

and cash equivalents do not include approximately $5.3 million of restricted cash investments securing certain letters of credit.

- (5)

- Excludes

unamortized original issue discount of approximately $2.1 million and capital lease obligations of approximately $2.1 million at

December 31, 2009.

- (6)

- As

adjusted to reflect the issuance of shares of common stock in this offering at an assumed offering

price of $ ,

which is the midpoint of the range set forth on the cover page of this prospectus, and the application of the net proceeds of this offering as described in "Use of Proceeds."

- (7)

- As further adjusted to reflect the consummation of the Proposed Senior Notes Offering and the application of the net proceeds of this offering and of the Proposed Senior Notes Offering as described in "Use of Proceeds."

9

An investment in our common stock offered by this prospectus involves a substantial risk of loss. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before you decide to purchase shares of our common stock. The occurrence of any of the following risks could materially harm our business, financial condition or results of operations. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

If the current economic downturn continues for an extended period of time or commodity prices become depressed or decline, our results of operations could be adversely affected.

Commencing in late 2008, prices for oil and natural gas declined significantly and did not recover until relatively recently. During that period of depressed commodity prices, many oil and gas exploration and production companies significantly reduced their levels of capital spending, including amounts dedicated to the purchase of seismic data services. Historically, demand for our services has been sensitive to the level of exploration spending by oil and gas companies. A return of depressed commodity prices, or a decline in existing commodity prices, could adversely affect demand for the services we provide, and therefore affect our business, financial condition, results of operations and cash flows.

Spending on services such as ours is subject to rapid and material change. Increases in oil and natural gas prices may not increase demand for our services or otherwise have a positive effect on our financial condition or results of operations.

Our clients' willingness to explore, develop and produce depends largely upon prevailing industry conditions that are influenced by numerous factors over which our management has no control, such as:

- •

- demand for oil and natural gas, especially in the United States, China and India;

- •

- the ability of oil and gas exploration and production companies to generate funds or otherwise obtain external capital for

exploration, development, construction and production operations;

- •

- the sale and expiration dates of leases in the United States and overseas;

- •

- domestic and foreign tax policies;

- •

- the cost of exploring for, developing, producing and delivering oil and natural gas;

- •

- the expected rates of declining current production;

- •

- the availability and discovery rates of new oil and gas reserves;

- •

- technical advances affecting energy exploration, production, transportation and consumption;

- •

- weather conditions, including hurricanes and monsoons that can affect oil and gas operations over a wide area as well as

less severe inclement weather that can preclude or delay seismic data acquisition;

- •

- political instability in oil and gas producing countries;

- •

- government and other organizational policies, including those of the Organization of the Petroleum Exporting Countries,

regarding the exploration, production and development of oil and gas reserves;

- •

- the ability of oil and gas producers to raise equity capital and debt financing; and

- •

- merger and divestiture activity among oil and gas producers.

10

Increases in oil and natural gas prices may not increase demand for our services or otherwise have a positive effect on our financial condition or results of operations. Previously forecasted trends in oil and gas exploration and development activities may not continue and demand for our products may not reflect the level of activity in the industry.

Our revenues are subject to fluctuations that are beyond our control, which could adversely affect our results of operations in any financial period.

Our operating results may vary in material respects from quarter to quarter and may continue to do so in the future. Factors that cause variations include the timing of the receipt and commencement of contracts for seismic data acquisition, processing or interpretation and clients' budgetary cycles, both of which are beyond our control. Furthermore, in any given period, we could have idle crews which result in a significant portion of our revenues, cash flows and earnings coming from a relatively small number of crews. Additionally, due to location, service line or particular project, some of our individual crews may achieve results that are a significant percentage of our consolidated operating results. Should one or more of these crews experience significant changes in timing, our financial results could be subject to significant variations from period to period. Combined with our high fixed costs, these revenue fluctuations could have a material adverse effect on our results of operations in any fiscal period.

Our working capital needs are difficult to forecast and may vary significantly, which could require us to seek additional financing that we may not be able to obtain on satisfactory terms, or at all.

Our working capital needs are difficult to predict with certainty. This difficulty is due primarily to working capital requirements related to our seismic data services where our revenues vary in material respects as a result of, among other things, the timing of our projects, our clients' budgetary cycles and our receipt of payment. We may therefore be subject to significant and rapid increases in our working capital needs that could require us to seek additional financing sources. Restrictions in our debt agreements may impair our ability to obtain other sources of financing, and access to additional sources of financing may not be available on terms acceptable to us, or at all.

We face intense competition in our business that could result in downward pricing pressure and the loss of market share.

Competition among seismic contractors historically has been, and likely will continue to be, intense. Competitive factors have in recent years included price, crew experience, equipment availability, technological expertise and reputation for quality and dependability. We also face increasing competition from nationally owned companies in various international jurisdictions that operate under less significant financial constraints than those we experience. Many of our competitors have greater financial and other resources, more clients, greater market recognition and more established relationships and alliances in the industry than we do. They and other competitors may be better positioned to withstand and adjust more quickly to volatile market conditions, such as fluctuations in oil and natural gas prices and production levels, as well as changes in government regulations. Additionally, the seismic data acquisition business is extremely price competitive and has a history of protracted periods of months or years where seismic contractors under financial duress bid jobs at unattractive pricing levels and therefore adversely affect industry pricing. Competition from these and other competitors could result in downward pricing pressure, which could adversely affect our EBITDA margins, and the loss of market share.

We have had losses in the past and there is no assurance of our profitability for the future.

Following the precipitous decline in oil and natural gas prices beginning in 2008, we recorded a net loss in 2008 of $8.0 million. Additionally, we expect to record a net loss for the quarter ending March 31, 2010. We cannot assure you that we will be profitable in future periods.

11

We have supply arrangements with a limited number of key suppliers, the loss of any one of which could have a material adverse effect on our financial condition and results of operations. Additionally, our supply agreement with Sercel, Inc., under which we purchase the majority of our recording equipment on "most favored client" terms, expires in 2011.

We purchase substantially all of our seismic data acquisition equipment from two key suppliers, Sercel, Inc. ("Sercel") and ION Geophysical Corporation ("ION"). If either of our key suppliers discontinues operations or otherwise refuses to honor its supply arrangements with us, we may be required to enter into agreements with alternative suppliers on terms less favorable to us, which could result in increased product costs and longer delivery lead times.

Under its supply agreement with us, Sercel is obligated to sell to us recording equipment at prices and on terms at least as favorable as those made available to its other customers who purchase similar volumes of like equipment. This agreement expires in 2011. If Sercel declined to extend this agreement beyond 2011, or otherwise did not offer to sell such equipment to us on "most favored client" terms, the cost to us of additional or replacement recording equipment could increase significantly. The loss of any of our key suppliers, or our failure to renew or extend our existing supply agreement with Sercel, could have a material adverse effect on our financial condition and results of operations.

Key suppliers or their affiliates may compete with us.

A number of seismic equipment manufacturers are affiliated with or are otherwise controlled by our competitors. We currently purchase a majority of our recording equipment from Sercel, a subsidiary of one of our competitors, CCGVeritas. In addition, we purchase seismic vibrator equipment manufactured by ION, an entity which is partially owned by BGP, Inc., a subsidiary of the Chinese National Petroleum Corporation, which is a competitor of ours. There are a limited number of companies which manufacture this equipment in addition to Sercel and ION. If either of Sercel or ION choose to no longer sell this equipment to us, or to no longer sell such equipment to us on commercially reasonable terms, whether as a result of competitive pressures or otherwise, we may be required to use less suitable replacement equipment which could impair our ability to execute our business solutions for customers.

We are dependent upon a small number of significant clients. Additionally, from time to time a significant portion of our revenues are generated by a single project.

We derive a significant amount of our revenues from a small number of oil and gas exploration and development companies. During the year ended December 31, 2009, our three largest clients, ExxonMobil, ONGC and BP, accounted for approximately 37%, 16% and 11% of our revenues, respectively. While our revenues are derived from a concentrated client base, our significant clients may vary between years. If we lose one or more major clients in the future, or if one or more clients encounter financial difficulties, our business, financial condition and results of operations could be materially and adversely affected.

Additionally, from time to time, a significant portion of our revenues are generated by a single project. For example, a single seismic data services project generated approximately 30% of our revenues for 2009. Our dependence from time to time on a single project for a significant percentage of our revenues may result in significant variability of our earnings from period to period as these projects are completed.

12

We cannot assure you that NOC and IOC clients will continue to generate the majority, or even a significant percentage, of our revenue. Smaller or less well capitalized oil and gas exploration and production companies may be forced to reduce their budgets for seismic data acquisition services in periods of depressed or declining commodity prices. Our dependence on customers other than NOCs and IOCs for the majority of our revenue could expose us to greater earnings volatility.

Historically, our NOC and IOC clients have represented a significant percentage of our revenues. For example, for the year ended December 31, 2009, our NOC and IOC clients represented approximately 76% of our revenues, which is higher than our historic average. Smaller or less well capitalized oil and gas exploration and production companies may be required to sharply reduce their expenditures for seismic data acquisition services in periods of depressed or declining commodity prices. Our dependence on customers other than NOCs and IOCs for the majority of our revenue could expose us to greater earnings volatility.

Revenues derived from our projects may not be sufficient to cover our costs of completing those projects. As a result, our results of operations may be adversely affected.

Our revenues are determined, in part, by the price we receive for our services, the productivity of our crew and the accuracy of our cost estimates. Our crew's productivity is partly a function of external factors, such as seasonal variations in the length of days, weather, including the onset of monsoons, difficult terrain and marine environments, and third party delays, over which we have no control. In addition, cost estimates for our projects may be inadequate due to unknown factors associated with the work to be performed and market conditions, resulting in cost over-runs. If our crew encounters operational difficulties or delays, or if we have not correctly priced our services, our results of operation may vary, and in some cases, may be adversely affected. We have in the past experienced cost over-runs that caused the cost from a particular project to exceed the revenues from that project and cannot assure you that this will not happen again.

Many of our projects are performed on a turnkey basis where a defined amount and scope of work is provided by us for a fixed price and extra work, which is subject to client approval, is billed separately. The revenue, cost and gross profit realized on a turnkey contract can vary from our estimated amount because of changes in job conditions, variations in labor and equipment productivity from the original estimates, and the performance of subcontractors. Turnkey contracts may also cause us to bear substantially all of the risks of business interruption caused by weather delays and other hazards. These variations, delays and risks inherent in billing clients at a fixed price may result in us experiencing reduced profitability or losses on projects.

From time to time we experience disputes with our clients relating to the amounts we invoice for our services, particularly with respect to billings relating to standby time. The exercise of remedies against clients in connection with our collection efforts could negatively affect our ability to secure future business from those clients.

Our contracts for seismic data acquisition services typically include provisions that require payment to us at a reduced rate for a limited amount of time if we are unable to record seismic data as a result of weather conditions or certain other factors outside our control, including delays caused by our clients. From time to time we experience disputes with our clients relating to the amounts we invoice for this period of delay, or "standby time". For example, as of December 31, 2009, we had disputes with three customers, British Gas, BP and Repsol YPF, involving invoices totaling approximately $13.8 million, $3.8 million and $1.7 million, respectively, and a portion of each of such invoices related to our charges for standby time. We have initiated arbitration proceedings with British Gas, and expect to initiate similar proceedings against BP, our third largest client in 2009, with respect to a project in our Europe, Africa and Middle East Region that was completed in 2008. The exercise of these remedies against these or other clients in connection with our collection efforts could negatively affect

13

our relationship with these clients, and could result in the loss of future business which in turn could negatively affect our earnings in future periods.

Technological change in our business creates risks of technological obsolescence and requirements for future capital expenditures. If we are unable to continue investing in, or otherwise acquire, the latest technology, we may not be able to compete effectively.

The development of seismic data acquisition, processing and interpretation equipment has been characterized by rapid technological advancements in recent years and we expect this trend to continue. Manufacturers of seismic equipment may develop new systems that have competitive advantages relative to systems now in use that either render the equipment we currently use obsolete or require us to make substantial capital expenditures to maintain our competitive position. Additionally, a number of seismic equipment manufacturers are affiliated with or are otherwise controlled by our competitors. If any such equipment manufacturer developed new equipment or systems and, for competitive reasons or otherwise, declined to sell such equipment or systems to us, we could be placed at a competitive disadvantage. In order to remain competitive, we must continue to invest additional capital to maintain, upgrade and expand our seismic data acquisition capabilities. In addition to our continuing investment in seismic data acquisition equipment from third party suppliers, we are also currently investing in the design and development of our own land and sea floor nodal technology. However, we may not be successful in developing and deploying this technology in a manner that is technologically or commercially viable. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Capital Expenditures."

Seismic data acquisition equipment is expensive and our ability to operate and expand our business operations is dependent upon the availability of internally generated cash flow and financing alternatives. Such financing may consist of bank or commercial debt, equity or debt securities or any combination thereof. There can be no assurance that we will be successful in obtaining sufficient capital to upgrade and expand our current operations through cash from operations or additional financing or other transactions if and when required on terms acceptable to us.

If we do not effectively manage our transitions into new products and services, our revenues may suffer.

Products and services for the seismic industry are characterized by rapid technological advances in hardware performance, software functionality and features, frequent introduction of new products and services, and improvement in price characteristics relative to product and service performance. Among the risks associated with the introduction of new products and services are delays in development or manufacturing, variations in costs, delays in customer purchases or reductions in price of existing products in anticipation of new introductions, write-offs or write-downs of the carrying costs of assets associated with prior generation products, difficulty in predicting customer demand for new product and service offerings and effectively managing inventory levels so that they are in line with anticipated demand, risks associated with customer qualification, evaluation of new products, and the risk that new products may have quality or other defects or may not be supported adequately by application software. The introduction of new products and services by our competitors also may result in delays in customer purchases and difficulty in predicting customer demand. If we do not make an effective transition from existing products and services to future offerings, our revenues and margins may decline.

Furthermore, sales of our new products and services may replace sales, or result in discounting, of some of our current offerings, offsetting the benefit of a successful new product introduction. In addition, it may be difficult to ensure performance of new products and services in accordance with our revenue, margin, and cost estimates and to achieve operational efficiencies embedded in our estimates. Given the competitive nature of the seismic industry, if any of these risks materializes, future demand for our products and services, and our future results of operations, may suffer.

14

We are exposed to risks related to complex, highly technical products.

Our customers often require demanding specifications for product performance and reliability. Because many of our products are complex and often use unique advanced components, processes, technologies, and techniques, undetected errors and design and manufacturing flaws may occur. Even though we attempt to assure that our systems perform reliably in the field, the many technical variables related to their operations can cause a combination of factors that may, and from time to time have, caused performance and service issues with certain of our products. Product defects result in higher product service, warranty, and replacement costs and may affect our customer relationships and industry reputation, all of which may adversely impact our results of operations. Despite our testing and quality assurance programs, undetected errors may not be discovered until the product is purchased and used by a customer in a variety of field conditions. If our customers deploy our new products and they do not work correctly, our relationship with our customers may be materially and adversely affected.

Our backlog is subject to unexpected adjustments and cancellations and thus may not be timely converted to revenues in any particular fiscal period or be indicative of our actual operating results for any future period.

Our backlog represents those seismic data acquisition projects for which a client has executed a contract and has a scheduled start date for the project as well as unrecognized pre-committed funding from our multi-client services business. Backlog levels vary during the year depending on the timing of the completion of certain projects and when new projects are awarded and contracts are signed. Because of potential changes in the scope or schedule of our clients' projects, we cannot predict with certainty when or if our backlog will be realized. Even where a project proceeds as scheduled, it is possible that the client may default and fail to pay amounts owed to us. In addition, the contracts in our backlog are cancelable by the client. Material delays, payment defaults or cancellations could reduce the amount of backlog currently reported, and consequently, could inhibit the conversion of that backlog into revenues.

We have invested, and expect to continue to invest, significant amounts of money in acquiring and processing seismic data for multi-client surveys and for our seismic data library without knowing precisely how much of this seismic data we will be able to sell or when and at what price we will be able to sell such data.

Multi-client surveys and the resulting seismic data library are an increasingly important part of our business and our future investments. We invest significant amounts of money in acquiring and processing seismic data that we own. By making such investments, we are exposed to the following risks:

- •

- We may not fully recover our costs of acquiring, processing and interpreting seismic data through future sales. The

amounts of these data sales are uncertain and depend on a variety of factors, many of which are beyond our control.

- •

- The timing of these sales is unpredictable and can vary greatly from period to period. The costs of each survey are

capitalized and then amortized over the expected useful life of the data. This amortization will affect our earnings and when combined with the sporadic nature of sales, will result in increased

earnings volatility.

- •

- Regulatory changes that affect companies' ability to drill, either generally or in a specific location where we have acquired seismic data, could materially adversely affect the value of the seismic data contained in our library. Technology changes could also make existing data sets obsolete. Additionally, each of our individual surveys has a limited book life based on its location and oil and gas companies' interest in prospecting for reserves in such location, so a particular survey may be subject to a significant decline in value beyond our initial estimates.

15

- •

- The value of our multi-client data could be significantly adversely affected if any material adverse change occurs in the

general prospects for oil and gas exploration, development and production activities.

- •

- The cost estimates upon which we base our pre-commitments of funding could be wrong, which could result in

losses that have a material adverse effect on our financial condition and results or operations.

- •

- Pre-commitments of funding are subject to the creditworthiness of our clients. In the event that a client

refuses or is unable to pay its commitment, we could lose a material amount of money.

- •

- If our clients significantly increase their preference toward licensing seismic data from multi-client data libraries, we may not have the appropriate existing data library assets, be able to obtain permits and access rights to geographic areas of interest from which to record such data, or make appropriate levels of investment in the creation of new data library assets to support our business strategy.

Any reduction in the market value of such data will require us to write down its recorded value, which could have a significant material adverse effect on our results of operations.

Our operations are subject to delays related to obtaining land access rights from third parties which could affect our results of operations.

Our seismic data acquisition operations could be adversely affected by our inability to timely obtain access to both public and private land included within a seismic survey. We cannot begin surveys on property without obtaining permits from certain governmental entities as well as the permission of the parties who have rights to the land being surveyed. In recent years, it has become more difficult, costly and time-consuming to obtain access rights as drilling activities have expanded into more populated areas. Additionally, while land owners generally are cooperative in granting access rights, some have become more resistant to seismic and drilling activities occurring on their property and stall or refuse to grant these rights for various reasons. In our multi-client services business, we acquire data sets pertaining to large areas of land. Consequently, if we do not obtain land access rights from a specific land owner, we may not be able to provide a complete survey for that area. The failure to redact or remove the seismic information relating to mineral interests held by non-consenting third parties could result in claims against us for seismic trespass. In addition, governmental entities do not always grant permits within the time periods expected. Delays associated with obtaining such permits and significant omissions from a survey as a result of the failure to obtain consents could have a material adverse effect on our financial condition and results of operations.

We operate under hazardous conditions that subject us and our employees to risk of damage to property or personal injury and limitations on our insurance coverage may expose us to potentially significant liability costs.

Our activities are often conducted in dangerous environments and include hazardous conditions, including the detonation of dynamite. Operating in such environments and under such conditions carries with it inherent risks, such as loss of human life or equipment, as well as the risk of downtime or reduced productivity resulting from equipment failures caused by an adverse operating environment. These risks could cause us to experience equipment losses, injuries to our personnel and interruptions in our business. We cannot assure you that our insurance will be sufficient or adequate to cover all losses or liabilities or that insurance will continue to be available to us or available to us on acceptable terms. A successful claim for which we are not fully insured, or which exceeds the policy limits of our applicable insurance could have a material adverse effect on our financial condition. Moreover, we do not carry business interruption insurance with respect to our operations.

16

Our agreements with our clients may not adequately protect us from unforeseen events or address all issues that could arise with our clients. The occurrence of unforeseen events not adequately addressed in the contracts could result in increased liability, costs and expenses associated with any given project.

With many of our clients we enter into master service agreements which allocate certain operational risks. Despite the inclusion of risk allocation provisions in our agreements, our operations may be affected by a number of events that are unforeseen or not within our control. We cannot assure you that our agreements will adequately protect us from each possible event. If an event occurs which we have not contemplated or otherwise addressed in our agreement, we, and not our client, will likely bear the increased cost or liability. To the extent our agreements do not adequately address these and other issues, or we are not able to successfully resolve resulting disputes, we may incur increased liability, costs and expenses.

Weather may adversely affect our ability to conduct business.

Our seismic data acquisition operations could be adversely affected by inclement weather conditions. Delays associated with weather conditions could have a material adverse effect on our financial condition and results of operations. For example, weather delays focused on a particular project or region could lengthen the time to complete the project, resulting in decreased margins to us. Our operations in or near the Gulf of Mexico may be subject to stoppages for hurricanes. In addition, our operations in the Arabian Sea and the Bay of Bengal are subject to stoppages for monsoons. Accordingly, the results of any one quarter are not necessarily indicative of annual results or continuing trends.

We may be held liable for the actions of our subcontractors.

We often work as the general contractor on seismic data acquisition surveys and consequently engage a number of subcontractors to perform services and provide products. There can be no assurance we will not be held liable for the actions of these subcontractors. In addition, subcontractors may cause damage or injury to our personnel and property that is not fully covered by insurance.

Current or future distressed financial conditions of clients could have an adverse effect on us in the event these clients are unable to pay us for our services.

Some of our clients are experiencing, or may experience in the future, severe financial problems that have had or may have a significant effect on their creditworthiness. We generally do not require that our clients make advance payments or otherwise collateralize their payment obligations. We cannot provide assurance that one or more of our financially distressed clients will not default on their payment obligations to us or that such a default or defaults will not have a material adverse effect on our business, financial position, results of operations or cash flows. Furthermore, the bankruptcy of one or more of our clients, or other similar proceeding or liquidity constraint, will reduce the amounts we can expect to recover, if any, with respect to amounts owed to us by such party. In addition, such events might force those clients to reduce or curtail their future use of our products and services, which could have a material adverse effect on our results of operations and financial condition.

The high fixed costs of our operations could result in operating losses.

We are subject to high fixed costs which primarily consist of depreciation, maintenance expenses associated with our seismic data acquisition, processing and interpretation equipment and certain crew costs. Because substantially all of our equipment is new or nearly new, we believe that our depreciation expense relative to our revenues is higher than that of many of our competitors. Extended periods of significant downtime or low productivity caused by reduced demand, weather interruptions, equipment failures, permit delays or other causes could reduce our profitability and have a material adverse effect

17

on our financial condition and results of operations because we will not be able to reduce our fixed costs as fast as revenues decline.

Our results of operations could be adversely affected by asset impairments.

We periodically review our portfolio of equipment for impairment. If we expect significant sustained decreases in oil and natural gas prices in the future, we may be required to write down the value of our equipment if the future cash flows anticipated to be generated from the related equipment falls below net book value. A decline in oil and natural gas prices, if sustained, can result in future impairments. In addition, changes in industry conditions, such as changes in applicable laws and regulations, could affect the usefulness of our multi-client seismic data library to oil and gas companies, thereby requiring us to write down the value of our seismic data library. If we are forced to write down the value of our assets, these non-cash asset impairments could negatively affect our results of operations in the period in which they are recorded. See discussion of "Impairment of Long-lived Assets" included in "Critical Accounting Policies and Estimates."

We are subject to compliance with stringent environmental laws and regulations that may expose us to significant costs and liabilities.

Our operations are subject to stringent federal, provincial, state and local environmental laws and regulations in the United States and foreign jurisdictions relating to environmental protection. In our business, we use explosives and certain other regulated hazardous materials that are subject to such regulation. These laws and regulations may impose numerous obligations that are applicable to our operations including:

- •

- the acquisition of permits before commencing regulated activities;

- •

- the limitation or prohibition of seismic activities in environmentally sensitive or protected areas such as wetlands or

wilderness areas; and

- •

- restrictions pertaining to the management and operation of our vehicles and equipment.

Numerous governmental authorities, such as the Federal Environmental Protection Agency, the Bureau of Alcohol, Tobacco and Firearms, the Bureau of Land Management and analogous state agencies in the United States and governmental bodies with control over environmental matters in foreign jurisdictions, have the power to enforce compliance with these laws and regulations and any permits issued under them, oftentimes requiring difficult and costly actions. Failure to comply with these laws, regulations and permits may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations and the issuance of injunctions limiting or preventing some or all of our operations.

We believe that the regulatory environment for the oil and natural gas industry and related service providers is likely to become more burdensome and time consuming than it ever has been before. Over the last year, permitting authorities have begun requiring us to comply with standards that have never before applied to seismic companies. Some proposed regulations would inhibit the use of hydraulic fracturing in connection with the drilling of wells, which is a crucial part in recovering economic amounts of hydrocarbons from shale plays, which represent a significant opportunity for us. If oil and natural gas companies face regulation that makes drilling for resources uneconomic, the demand for our services may be adversely affected.

There is inherent risk of incurring significant environmental costs and liabilities in our operations due to our controlled storage, use and disposal of explosives. In the event of an accident, we could be held liable for any damages that result or we could be penalized with fines, and any liability could exceed the limits of or fall outside our insurance coverage.

18

Historically our operational expenses incurred in connection with international seismic data projects have been higher, as a percentage of revenues, than the operational expenses incurred in connection with seismic data projects undertaken in the United States. The profitability of our future international operations will depend significantly on our ability to control these expenses.

The expense of mobilizing personnel and equipment to various foreign locations, as well as the cost of obtaining and complying with local regulatory requirements historically have been significantly higher than the expenses incurred in connection with seismic data projects undertaken in the United States. If we are unable to reduce the expenses incurred in connection with an international seismic data project, or to obtain better pricing for such services, our results of operations could be materially and adversely affected.

Operating internationally subjects us to significant risks and regulation inherent in operating in foreign countries.

We conduct operations on a global scale. As of December 31, 2009, approximately 41% of our property, plant and equipment and approximately 18% of our employees were located outside of the U.S. and, for the year ended December 31, 2009, approximately 42% of our revenues were attributable to operations in foreign countries.

Our international operations are subject to a number of risks inherent to any business operating in foreign countries, and especially those with emerging markets. As we continue to increase our presence in such countries, our operations will encounter the following risks, among others:

- •

- government instability, which can cause investment in capital projects by our potential clients to be withdrawn or

delayed, reducing or eliminating the viability of some markets for our services;

- •

- potential expropriation, seizure, nationalization or detention of assets;

- •

- difficulty in repatriating foreign currency received in excess of local currency requirements;

- •

- import/export quotas;

- •

- civil uprisings, riots and war, which can make it unsafe to continue operations, adversely affect both budgets and

schedules and expose us to losses;

- •

- availability of suitable personnel and equipment, which can be affected by government policy, or changes in policy, which

limit the importation of qualified crewmembers or specialized equipment in areas where local resources are insufficient;

- •

- decrees, laws, regulations, interpretation and court decisions under legal systems, which are not always fully developed

and which may be retroactively applied and cause us to incur unanticipated and/or unrecoverable costs as well as delays which may result in real or opportunity costs; and

- •

- terrorist attacks, including kidnappings of our personnel.

We cannot predict the nature and the likelihood of any such events. However, if any of these or other similar events should occur, it could have a material adverse effect on our financial condition and results of operation.

Certain of the seismic equipment that we use in certain foreign countries may require prior U.S. government approval in the form of an export license and may otherwise be subject to tariffs and import/export restrictions. The delay in obtaining required governmental approvals could affect our ability to timely commence a project, and the failure to comply with all such controls could result in fines and other penalties.