Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - Yayi International Inc | exhibit21.htm |

| EX-32.2 - EXHIBIT 32.2 - Yayi International Inc | exhiit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Yayi International Inc | exhibit32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Yayi International Inc | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Yayi International Inc | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: October 31, 2009

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ____________

Commission File Number: 000-23806

YAYI INTERNATIONAL INC.

(Exact name of registrant as specified in its charter)

| Delaware | 87-0046720 |

| (State or other jurisdiction of | (I.R.S. Employer Identification Number) |

| incorporation or organization) |

No. 9 Xingguang Road,

Northern Industrial Park of Zhongbei Town,

Xiqing District, Tianjin 300384, China

(Address of principal executive office and zip code)

(86)22-2798-4033

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act.

Yes [ ]

No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ]

No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ]

No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [ X ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ]

No [ X ]

As of April 30, 2009, the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported on the Over-the-Counter Bulletin Board) was approximately $7.18 million. Shares of the Registrant’s common stock held by each executive officer and director and each by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 16, 2010, there were 26,303,113 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

YAYI INTERNATIONAL INC.

FORM 10-K

For the Fiscal Year Ended October 31, 2009

| Number | Page | |

| PART I | ||

| Item 1. | Business | 2 |

| Item 1A. | Risk Factors | 9 |

| Item 2. | Properties | 19 |

| Item 3. | Legal Proceedings | 21 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 21 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

22 |

| Item 6. | Selected Financial Data | 22 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 23 |

| Item 8. | Financial Statements and Supplementary Financial Data | 33 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | 34 |

| Item 9A(T) | Controls and Procedures. | 34 |

| Item 9B. | Other Information. | 35 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 36 |

| Item 11. | Executive Compensation | 38 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 39 |

| Item 13. | Certain Relationships and Related Party Transactions. | 41 |

| Item 14. | Principal Accountant Fees and Services. | 41 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statements Schedules. | 43 |

i

Use of Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

-

“we,” “us,” “our company,” “our” and “Yayi” refer to the combined business of Yayi International Inc. and/or its consolidated subsidiaries, as the case may be;

-

“Charleston” refers to Charleston Industrial Co. Limited, our direct, wholly-owned subsidiary, a BVI corporation;

-

“Tianjin Yayi” refers to Tianjin Yayi Industrial Co. Ltd., our indirect, wholly-owned subsidiary, a Chinese company;

-

“BVI” refers to the British Virgin Islands;

-

“China,” “Chinese” and “PRC,” refer to the People’s Republic of China;

-

“Renminbi” and “RMB” refer to the legal currency of China;

-

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States;

-

“SEC” refers to the United States Securities and Exchange Commission;

-

“Securities Act” refers to the Securities Act of 1933, as amended; and

-

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended

Forward-Looking Statements

Statements contained in this annual report include “forward-looking statements” within the meaning of such term in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements involve known and unknown risks, uncertainties and other factors which could cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements not to occur or be realized. Forward-looking statements made in this Report generally are based on our best estimates of future results, performances or achievements, predicated upon current conditions and the most recent results of the companies involved and their respective industries. Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “should,” “project,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” “potential,” “opportunity” or similar terms, variations of those terms or the negative of those terms or other variations of those terms or comparable words or expressions. Potential risks and uncertainties include, among other things, such factors as:

-

the recent credit crisis and turmoil in the global financial system;

-

our reliance on small goat farms and individual goat farmers for our supply of raw goat milk and third parties in the processing of raw goat milk; and

-

adverse changes in political and economic policies of the PRC government.

Additional disclosures regarding factors that could cause our results and performance to differ from results or performance anticipated by this annual report are discussed in Item 1A “Risk Factors.” Readers are urged to carefully review and consider the various disclosures made by us in this annual report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this annual report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

1

PART I

ITEM 1. BUSINESS

Overview

We are the first mover and a leading producer and distributor of premium goat milk formula products for infants, toddlers, young children, and adults in China. Our current formula product lines are targeted at the premium segment of the diary market and health-conscious consumers. Headquartered in Tianjin, we sell and distribute our products through a network of approximately 3,600 retail points including infant-maternity chain stores, supermarkets (including multinational chains) and drug stores, as well as catalogue sales across China. We are vertically integrated and source raw goat milk from our proprietary dairy farms as well as neighboring goat dairy farmers on a long-term contract basis in collection centers, which helps us maintain quality control.

History and Corporate Structure

We were originally incorporated in Delaware in 1986 under the name of Commercial Ventures Ltd. The name was changed to FIN U.S.A., Inc. in 1987, and in 1993 to I/NET, INC. I/NET, developed and marketed computer software for mid range computers. In 2006, Tryant, LLC acquired a significant part of ownership of I/NET. In connection therewith, the business operations related to I/NET’s prior activities ended and the company commenced seeking other business opportunities. On April 15, 2007, our name was changed to Ardmore Holding Corporation and in September 2008, following the reverse merger described below, our name was changed to Yayi International Inc.

In June 2008, we entered into and completed a series of transactions pursuant to which we, among other things, (i) raised gross proceeds of $1.3 million from the sales of our convertible notes and warrants to certain investors, or the 2008 Investors, and (ii) acquired, through a reverse subsidiary merger, Charleston. Charleston owns 100% equity interest in Tianjin, an entity organized under the laws of PRC. Tianjin Yayi is a leading manufacturer and distributor of goat milk powder products in China. As a result of this reverse merger, we became the owner of Tianjin Yayi. On November 24, 2009, we and the 2008 Investors entered into a Settlement Agreement pursuant to which, each of the 2008 Investors converted its own entire principal amount of and accrued interest on all of the notes it holds into an aggregate 1,296,275 shares of the Company’s common stock at a conversion price of $1.08 per share.

In August 2008, we acquired Fuping Milkgoat Dairy Co., Ltd., or Fuping Milkgoat for approximately $620,000. Fuping Milkgoat purchases raw goat milk and processes it into powder.

On June 18, 2009, we entered into a series A preferred stock purchase agreement, or the Stock Purchase Agreement with Global Rock Stone Industrial Ltd, a BVI company, or Global Rock, Charleston, Tianjin Yayi, the individuals named thereto and an accredited investor, SAIF Partners III L.P. (“SAIF”). Pursuant to the Stock Purchase Agreement, we issued and sold to SAIF 1,530,612 shares of the Company’s Series A Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), at a price per share of $9.80 for an aggregate purchase price of $15.0 million. The Series A Preferred Stock is convertible into the Company’s common stock at an initial conversion price at $0.98 per share, which conversion price is subject to stock split, recapitalization and other anti-dilution protection, as well as adjustments based on the Company’s financial performance.

In connection with the above private placement transaction, on June 16, 2009, we filed a Certificate of Designation of Series A Preferred Stock with the Secretary of State of the State of Delaware, or the Certificate, which became effective upon filing. Pursuant to the Certificate, there are 1,530,612 shares of Series A Preferred Stock authorized. The holders of the Series A Preferred Stock are entitled to receive non-cumulative dividends, when, as and if declared by the Board. The shares of Series A Preferred Stock may be converted into the Company’s common stock at the option of the holders of the Series A Preferred Stock in whole or in part at any time at an initial conversion price of $0.98, subject to future adjustments set forth in the Certificate. Specifically, the Certificate established a minimum after-tax net income threshold of $10.45 million for the 12-month period ending June 30, 2010 and $14.3 million for the 12-month period ending June 30, 2011, or the 2011 Net Income Threshold. If we fail to achieve these net income thresholds, then the conversion price of the Series A Preferred Stock is reduced in accordance with a formula specified in the Certificate. The adjustment applicable to the 12-month period ending June 30, 2011, however, contains a grace period that provides us with additional time if it has not achieved the 2011 Net Income Threshold by June 30, 2011. If the Company has not achieved the 2011 Net Income Threshold, the conversion price will be instead adjusted based on the Company’s after-tax net income on an annualized basis for an 18-month period ending December 31, 2011.

2

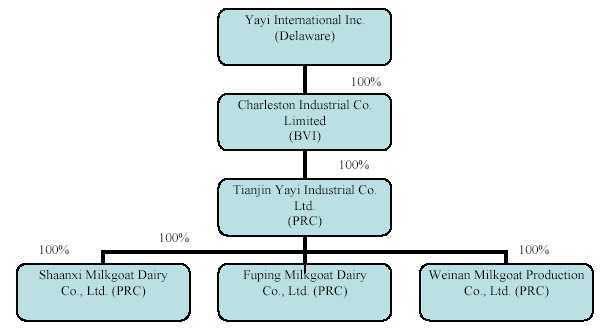

The following chart reflects our organizational structure as of the date of this report.

Dairy Industry in China

Industry Growth Drivers

China’s large population, growing disposable income and rapidly changing consumer habits create a favorable market for premium dairy products. According to a report by Bank of America Merrill Lynch, China’s per capita dairy consumption remains one of the lowest globally, merely 18.3kg in 2008 which is 1/7 of the consumption in US. Industry professionals forecast that the per capita dairy consumption in China could reach 27kg by 2015 and 36kg by 2020 driven by increasing population and higher per capita consumption.

The prospects for China’s infant formula market look particularly promising with on average 17 million newborns each year. The country may be experiencing a small baby boom due to an exception to China’s one-child policy; parents who are both single children of their respective families are allowed to have a second child. According to Euromonitor, the infant formula market is expected to grow at a compound annual growth rate of 23.1% between 2008 and 2013. In general, the one-child policy makes Chinese parents inclined to prioritize their children’s health over other consumption, which supports the market for premium infant formula products.

The Case of Goat Milk

According to China Dairy Association, goat milk can potentially account for 3% of China’s RMB200 billion (approximately $29 billion) dairy market. We , with our broad product portfolio and first mover position in goat milk production and distribution, are well positioned to take advantage of this increased demand.

China’s government has been promoting milk consumption since the mid 1990s because of its beneficial nutritional properties. The Eleventh Five-Year Plan (2006-2011) encourages every Chinese citizen to consume 0.5 kg of dairy products per day. The favorable government policies coupled with the prevalence of sensitivity towards cow milk products in China further support the demand for goat milk. Independent studies (for example Prosser et al (2003) and Bevilacqua et al (2001)) demonstrate that goat milk has a beneficial protein structure compared with cow milk, facilitating absorption of nutrients in goat milk by the human digestive system, which may make goat milk a more suitable alternative for Chinese consumers who have experienced problems with digesting cow milk.

3

Compared with cow milk, the molecules of lactose and fat globules are smaller in goat milk, making goat milk more easily absorbed by individuals who are sensitive to milk products. Moreover, lower acidity, the concentration of medium-chain triglyceride fatty acids, and the absence of r-casein, the main allergen found in cow milk, improve the digestibility of goat milk, making it an appealing substitute for cow milk.

Post Melamine Scandal Era

In 2008, the reputation of China’s dairy industry was severely damaged as melamine, a toxic chemical used to manufacture plastics, was discovered in products from 22 domestic dairy producers. In response, the Chinese government issued the Regulation on the Supervision and Administration of the Quality and Safety of Dairy Products, which encourages stricter national standards for the quality and safety of dairy products, heightens sanitary requirements, and imposes more responsibility on dairy processors to control the sources of raw milk. In addition, a Food Safety Act has been implemented in June 2009 to revise problems related to the scandal. Dairy processors are strongly encouraged to implement HACCP or GMP quality certification systems. Further efforts to align the interests of different parties including farmers, processors, dairies and consumers are underway.

Following the scandal, the Ministry of Agriculture stipulated that only one milk processing plant be allowed on a ranch within the radius of 60 kilometers. New projects must reach processing capacity of 200 tons of raw milk per day based on raw milk sources proprietary to or controlled by the dairy processor, and raw milk must contribute to no less than 30% of total processing capacity. The added capacity in expansion projects must reach at least 100 tons of raw milk per day, and 75% of the existing processing capacity must be based on raw milk sources proprietary to or controlled by the dairy processor.

With the growing awareness and lingering safety concerns about cow milk, we are well positioned to take advantage of the unprecedented opportunity to cement our presence in the goat milk and premium infant formula sectors.

Our Competitive Strengths

We believe that our success to date and potential for future growth can be attributed to a combination of our strengths, including the following:

-

First Mover Advantage. Goat milk is emerging as an ideal substitute to cow milk as consumers are increasingly aware of its benefits particularly for infants, who prefer a dairy product with a nutritional and molecular composition closer to human milk. We are the first Chinese company to produce, sell and distribute goat milk formula products throughout China since 2001.

-

Dedication to Quality Control. We source raw milk from our proprietary dairy farms and other goat dairy farmers on long-term contract basis in the Shaanxi Province in northwestern China, where dairy goats are abundant and of optimal breed for milk production. Vertically integrated production and the ability to control raw goat milk sources enable us to secure raw material supply, and thus maintain our leading position in the market. Proprietary dairy farm and goat milk collection centers have also benefited us following the 2008 cow milk scandal, when melamine was found in various cow milk-based infant formula products in China. In the wake of the scandal, Chinese food safety authorities imposed stricter industry regulation regarding supply chain quality control and expansion plans for dairy processors, which has benefited established players like us . Our facilities are ISO 9001, ISO 14001 and HACCP certified.

-

High-end Products. We have been a leading producer and distributor of goat milk formula products for infants, toddlers, young children, and adults in China. Our current formula product lines are targeted at the premium segment of the diary market and health-conscious consumers. Given goat milk’s nutritional and molecular composition closer to human milk as well as the scarcity of goat milk for dairy goats have limited production capacity when compared to dairy cows, our goat milk products are positioned as a much more highly valued dairy product in the market.

4

- Experienced Management. Our senior management team has extensive operating experience and industry knowledge. Ms. Li Liu, who is our founder, Chairwoman, CEO and President, started the Company’s goat milk business since 2001. She has been a pioneer in the industry. Mr. Feng Shek, who has served as our Executive Director, Vice President and Deputy General Manager, was deeply involved in the goat milk business while at P&G Taiwan. He was formerly Director of Sales for P&G Taiwan.

Our Growth Strategy

As a leading goat milk producer and distributor in China, we believe we are well positioned to capitalize on future industry growth in China. We are dedicated to providing healthy and high quality products to our consumers. We will implement the following strategic plans to take advantage of industry opportunities and our competitive strengths:

-

Focus on brand development. In order to manifest its position as China’s leader in goat milk products and to educate consumers about the benefits of goat milk, we plan to invest in strengthening our brand equity. In November 2009, we engaged US-based branding and strategic positioning agency, Trout & Partners to enhance our brand position and build “Milk Goat” into a household brand in China. As part of the strategy, we intend to target more supermarkets with our products.

-

Increase production capacity. We are in the process of increasing our production capacity for goat milk products by more than 400%. We broke ground on a new facility in Shaanxi Province in November 2009, which is expected to commence production by the end of 2010 and become the largest raw goat milk processing base in China. We have also invested in a new processing plant in Tianjin, which is expected to go into trial production in the second quarter of calendar year 2010. While increasing production, we also develop our product portfolio in order to penetrate additional consumer segments.

-

Expand distribution network. We sell and distribute our products through a network of approximately 3,600 retail points including infant-maternity chain stores, supermarkets (including multinational chains) and drug stores, as well as catalogue sales across China. The infant-maternity chain stores currently contribute to the bulk of our sales efforts. Beginning in 2010, we expect to expand aggressively into the supermarkets segment as well as online sales through our online store on Taobao.com.

-

Focus on quality control. We continue to improve our product inspection procedures and monitor our raw milk suppliers in order to ensure the high quality of our products.

Our Goat Milk Products – Powder and Liquid

We currently manufacture and distribute powder and liquid goat milk products. For our fiscal years ended October 31, 2009 and 2008, powder products accounted for approximately 99% and 90% of net sales, respectively, and liquid products accounted for approximately 1% and 8% of net sales, respectively. Our powder products are sold throughout most of China. Sales of powdered products began in Tianjin and Beijing during 2001 to 2003, in Southern China during 2004 to 2006 and Northern China during 2006 through the present. Sales of liquid products began in Tianjin in January 2007 and in Beijing, Zhejiang and Fujian in March 2008. We anticipate gradually expanding the areas in which liquid products are sold. Powder products generally generate higher gross margins than liquid products though we believe that over the long term, the sales volume of our liquid products will be greater than powder products.

We sell approximately 58 different goat milk powder products. Our principal goat milk powder product lines may generally be categorized as follows:

-

Powders targeted to or formulated for infants aged 0 - 6 months old, babies 6 - 12 months old, toddlers from 1 - 3 years old, pre-schoolers from 3-7 years old and children, teens and adolescents. Generally, powders targeted to age groups ranging from 0 to 7 years old represent between 60-70% of our net sales.

5

-

Powders targeted to or formulated for pre-and post-natal women.

-

Powders targeted to or formulated for those interested in maintaining general health and well being, enhancing beauty, inducing restfulness and reducing eye fatigue.

-

Sugar-free goat milk powder targeted to or formulated for those who desire to regulate their sugar intake.

-

Powders targeted to or formulated for health conscious adults.

Most of our goat milk products are formulated through the inclusion of supplements such as vitamins, calcium, iron, selenium, chromium and omega-3 fatty acids, as needed to address the nutritional or health needs of the consumer.

Raw Materials and Suppliers

Our supply of goat milk comes from Saanen dairy goats raised on individual and small-scale farms in Weinan City in China’s Shaanxi Province. This province is one of the three largest goat milk producing areas in China; an area especially conducive to the production of goat milk, with a reputation as one of the most fertile and agriculturally rich regions in China in which to raise dairy goats. Saanen dairy goats are known for the quantity and quality of milk they produce and usually yield the industry’s ideal of 3-4 percent milk fat. In fiscal 2009, approximately 41% of our goat milk requirements were supplied by five small-scale cooperative farms (i.e., farms that generally support flocks of between 100-200 goats), ,and approximately 59% of these requirements were supplied by 18 small-scale farm (i.e., farms that generally support flocks of between 100-200 goats) In fiscal 2009, we acquired an aggregate of approximately 9,418 tons of raw goat milk, of which approximately 3,868 tons was purchased from the five small scale cooperative farms and the balance was acquired from the individual farms. We have short-term supply arrangements with local governmental and quasi-governmental authorities pursuant to which we purchase all the milk produced by the small-scale farms subject to that local authority at a price negotiated from time to time by us and the individual farm.

We are not dependent on any single supplier or group of suppliers for our raw milk supply. No supplier of raw goat milk accounted for more than ten percent of our goat milk requirements for the fiscal years ended October 31, 2009 and 2008. We believe that our relationships with our raw goat milk suppliers are satisfactory and that alternative sources of supply are available to us on no less favorable terms than are currently available.

Other materials used to produce powdered include desalting whey powder, lactose, plant fat powder, lactalbumin, whey protein concentrate, soybean lecithin, various vitamin and mineral supplements and packaging materials. During fiscal 2009, LinTong Honxing Dairy Co., Ltd. accounted for approximately 7.6% of our purchasing volume and during fiscal 2008, it accounted for 13% of our purchasing volume. We have not experienced any significant difficulty in purchasing these or any other materials. We believe that alternative sources of supply are available to us on no less favorable terms than are currently available.

Processing

The raw goat milk is collected by hand or machine and brought to a collection station. There are approximately 500 collection stations (fifty of which are engaged with us through cooperation) distributed throughout Weinan County that are used to collect the goat milk into refrigerated storage tanks, which are then delivered by refrigerated vans to our processing plants.

The raw milk to be converted into a powder is passed through a high pressure gauge, converting the milk into a fine spray which, through the use of a high temperature fan, quickly dries the spray into a powder. The powder is then shipped to another processing facility at which it is supplemented with various nutritional components and is then packaged into various types of containers for distribution to our wholesale distributors.

We have one spray tower in our Fuping Milkgoat Goat Milk Co. Ltd., which is used to make raw liquid goat milk into raw goat milk powder.

6

We have engaged two independent processors to assist us in the processing of our raw goat milk into powder products. They provide, among other things, production facilities, offices, dormitories, equipment and personnel to assist in the processing of raw liquid goat milk into raw goat milk powder products.

Sales and Marketing

Currently, we have 428 experienced marketing personnel who are responsible for market research, promotion and advertisement. We strengthen our market presence by employing various types of marketing strategies. We participate in annual trade shows such as National Baby and Young Children Fair and National Sugar and Spirit Fair, offer seminars and lectures to local communities regarding the health benefits of our goat milk products, television advertisements at national and local levels, and other promotional activities. These activities help to promote our reputation and brand name recognition in the industry.

We use more than 400 distributors to sell our products. The distributors are located in 26 provinces in China. We sell and distribute our products through a network of approximately 3,600 retail points including infant-maternity chain stores, supermarkets (including multinational chains) and drug stores, as well as catalogue sales across China.

We use three independent trucking contractors to distribute our products throughout China. We selected these trucking companies based on cost and efficiency. We believe that alternative shipping arrangements are available if required, on no less favorable terms than are currently available.

We do not significantly depend on any single customer for the sales of our products. We did not have any customer constituting greater than 10% of net sales for the year ended October 31, 2009.

Competition

The dairy industry in China is highly competitive and we face substantial competition from both cow and goat milk producers.

Cow milk accounts for more than 90% of the milk consumed in China. The principal producers and distributors of cow milk are Inner Mongolia Yili Industrial Group Co., Ltd. and Inner Mongolia Meng Niu Dairy (Group) Co., Ltd. We compete with cow milk based on the nutritional advantages of goat milk. Those advantages include higher nutritional levels of proteins and vitamins (in particular, vitamins B1, B2 and C) and ease of digestibility. These factors make goat milk particularly attractive for those interested in maintaining a healthy lifestyle and for use by infants and other consumers sensitive to dairy products or allergic to cow milk. However, cow milk’s competitive advantages over goat milk include more favorable pricing, easy availability, and greater market acceptance. This greater market acceptance is attributable to, among other things, the historic association of goat milk with unfavorable smells, a much larger supply of available cow milk, and the fact that goat milk has only recently developed as an alternative available to consumers in China on a mass-market basis. We are working to improve acceptance of goat milk through marketing efforts geared towards emphasizing its nutritional advantages and its favorable taste and smell.

We also compete directly with China and foreign-based goat milk manufacturers. Our China based competitors include Dalian Jiuyang, Shaanxi Red Star Dairy Ltd. and Shaanxi Guanshan Dairy Ltd. We believe that the principal competitive advantages in competing with our China-based competitors are product recognition (including recognition based on quality flavor and price), strong distribution relationships, established supply sources, and quality. Our foreign competitors include Karihome (Dairy Goat Co-operative (NZ) Ltd ("DGC")) and Mead Johnson. We compete with our foreign competitors, and in particular, the products sold by Mead Johnson principally through more favorable pricing though we believe that the quality of our products is comparable to, if not superior to, the quality of our competitors’ products.

Research and Development

Our research and development activities focus on upgrading and enhancing our unique, traditional recipes for our products and improvement in packaging. We currently have five employees dedicated to research and development.

7

For the years ended October 31, 2009 and 2008, we expended $150,101 and $113,309, respectively, with respect to research and development activities. We are in the process of developing new goat milk based products but do not anticipate that such products will have a material impact in the near term on our results of operations.

Intellectual Property

In 2002, we registered in China the trademark, “Mei Ke Gao Te” (a transliteration of “Milk Goat” in Chinese) for use with our liquid and powder products and the trademark, “Yi Mei Shi” for use with our powder products. The “Mei Ke Gao Te” mark is generally used for all our products other than those formulated to provide a particular nutritional or health benefit and the “Yi Mei Shi” mark is used for those products emphasizing a specific health or nutritional benefit. Each of such trademarks has a term of ten years and may be renewed thereafter.

On June 12, 2009, we entered into a purchase agreement to buy the goat odor elimination technologies out right from Taiwan Richlink Enterprise Company Ltd., pursuant to which we are permitted to use these technologies with respect to all of our products. All payments required to be made by us under this arrangement have been made. We are prohibited, with certain exceptions, from disclosing or transferring the technology.

Regulatory Matters

We are regulated under national, provincial and local laws in China. These regulations govern, among other things, the manufacture and composition of products and ingredients, product labeling and packaging (including the format and content of product labels nutritional information), product safety and specified manufacturing practices (including mandating quality assurance programs). Our facilities are subject to inspection and licensing requirements and our trade practices (including claims made with respect to product effectiveness of our products) are regulated.

The national, provincial and local governments have increased their oversight of the production and distribution of dairy products in response to melamine contamination of certain dairy products produced in China. In September 2008, our goat milk products were inspected by China's Administration of Quality Supervision, Inspection and Quarantine (“AQSIQ”). AQSIQ determined that our products are safe. We anticipate that we will incur additional expense in complying with additional governmental regulation and oversight. We anticipate that we will generate additional net sales as consumers migrate to dairy products processed by companies, such as Tianjin Yayi, with reputations for producing quality products, though no assurance can be given in this regard.

We believe that we comply in all material respects with applicable rules and regulations.

Seasonality

While the consumption of goat milk is not seasonal, goat milk production is seasonal because goats generally do not produce milk from November through February. During such period, we generate sales of goat milk powder from our inventory that builds during the period preceding such hiatus.

Our Employees

As of October 31, 2009, we employed 604 full-time employees. The following table sets forth the number of our employees by function as of October 31, 2009.

| FUNCTION | NUMBER OF EMPLOYEES | |

| Sales Department | 428 | |

| Production Department | 96 | |

| Financial Department | 12 | |

| Administrative Office | 68 | |

| TOTAL | 604 |

8

Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any work stoppages and we believe our relationship with our employees is satisfactory.

We are required by the PRC law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

Insurance

We do not have any business liability, interruption or litigation insurance coverage for our operations in China. Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Therefore, we are subject to business and product liability exposure. See “Risk Factors – We do not carry any business interruption insurance, third-party liability insurance for our production facilities or insurance that covers the risk of loss of our products in shipment.”

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below, together with all of the other information included in this report. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline. You should also refer to the other information about us contained in this report, including our financial statements and related notes.

RISKS RELATED TO OUR BUSINESS

Our products may not achieve or maintain market acceptance

We may have difficulty gaining market acceptance for goat milk generally and our products in particular because cow milk dominates the milk market in China, (constituting more than 90% of the milk sold), the favorable pricing of cow milk compared to goat milk, and the historic and long-term association of goat milk with unpleasant smells and tastes. As a result, achieving and maintaining market acceptance for our products will require substantial marketing efforts and the expenditure of significant funds to encourage consumption of goat milk in general, and the purchase of our products in particular. There is substantial risk that the market may not accept or be receptive to our products. Market acceptance of our products will depend, in large part upon our ability to inform potential customers that the distinctive characteristics of our products make them superior to competitive products and justify their pricing. Our products may not be accepted by consumers or be able to compete effectively.

The global economic crisis could further impair the dairy industry thereby limiting demand for our products and affecting the overall availability and cost of external financing for our operations.

The continuation or intensification of the global economic crisis and turmoil in the global financial markets may adversely impact our business and our potential sources of capital financing. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise capital, which could have an impact on our flexibility to react to changing economic and business conditions. In addition, these economic conditions also impact levels of consumer spending, which have recently deteriorated significantly and may remain depressed for the foreseeable future. Consumer purchases of discretionary items, including our goat milk powder, generally decline during recessionary periods and other periods where disposable income is adversely affected. If demand for our products fluctuates as a result of economic conditions or otherwise, our revenue and gross margin could be harmed. Presently, it is unclear whether and to what extent the economic stimulus measures and other actions taken or contemplated by the Chinese government and other governments throughout the world will mitigate the effects of the crisis on the dairy industry and other industries that affect our business. Although these conditions have not presently impaired our ability to access credit markets and finance our operations, the impact of the current crisis on our ability to obtain capital financing in the future, and the cost and terms of same, is unclear.

9

We depend on the national and local governments to support our industry and us.

The government plays a significant role in the economy in general and, the dairy industry in particular. Governmental authorities provide support for the development of the goat milk industry by, among other things, providing land, space and equipment for goat farms, financing goat farms, waiving compliance with otherwise applicable regulations, and reducing or eliminating tax obligations. Changes in governmental policies supportive of the development of this industry or failure to maintain good relations with governmental authorities may require us to incur expenses we are otherwise not required to incur. We may not have sufficient funds to pay such additional expenses and even if we do, our profitability may be reduced.

Recently discovered contamination of milk powder products produced in China could result in negative publicity and have a material adverse effect on our business.

Recently, a number of milk powder products produced within China were found to contain unsafe levels of tripolycyanamide, also known as melamine, sickening thousands of infants. This prompted the Chinese government to conduct a nationwide investigation into how the milk powder was contaminated, and caused a worldwide recall of certain milk powder products produced within China. Although we believe that the inevitable contraction in the Chinese milk powder industry caused by this crisis will lead to increased demand for our products, it is possible that the illnesses caused by contamination in the milk powder industry may lead to a sustained decrease in demand for milk powder products produced within China, thereby having a material adverse effect on our business. See “Item 1. Business-Regulatory Matters.”

We depend on supplies of raw milk and other raw materials, a shortage of which could result in reduced production and sales revenues and/or increased production costs.

Raw goat milk is the primary raw material we use to produce our products. We do not own our goats and depend on small goat farms and individual goat farmers for our supply of raw goat milk. We expect that we will need to continue to increase the number of farms and farmers from which we source raw milk. If we are not able to maintain our relationships with current suppliers and develop new sources of supply, we will not be able to meet our production goals and our sales will fall. If we are forced to expand our sources for raw milk, it may be more and more difficult for us to maintain our quality control over the handling of the product in our supply and manufacturing chain. A decrease in the quality of our raw materials would cause a decrease in the quality of our product and could damage our reputation and cause sales to decrease.

Raw goat milk production is, in turn, influenced by a number of factors that are beyond our control including, but not limited to, the following:

-

seasonal factors: goats generally do not produce milk from November through February; further goats produce more milk in temperate weather than in cold or hot weather and extended unseasonably cold or hot weather could lead to lower than expected production; and

-

governmental agricultural and environmental policy: declines in government grants, subsidies, provision of land, technical assistance and other changes in agricultural and environmental policies may have a negative effect on the viability of individual and small farms, and the numbers of dairy cows and quantities of milk they are able to produce.

Even if we are able to source sufficient quantities of raw milk or our other raw materials to meet our needs, downturns in the supply of such raw materials caused by one or more of these factors could lead to increased raw material costs which we may not be able to pass on to the consumers of our products, causing our profit margins to decrease.

10

The milk business is highly competitive and, therefore, we face substantial competition in connection with the marketing and sale of our products.

We face competition from cow milk and goat milk producers. Most of our competitors producing cow milk are well established, have greater financial, marketing, personnel and other resources than we have been in business for longer periods of time than we have, and have products that have gained wide customer acceptance in the marketplace. The greater financial resources of such competitors will permit them to procure retail store shelf space and to implement extensive marketing and promotional programs, both generally and in direct response to our advertising claims. The milk industry is also characterized by the frequent introduction of new products, accompanied by substantial promotional campaigns. We may be unable to compete successfully or our competitors may develop products that have superior qualities or gain wider market acceptance than ours.

Possible volatility of raw milk costs makes our operating results difficult to predict, and a steep cost increase could cause our profits to diminish significantly.

The policy of China since the mid-1990s has focused on moving the industry in a more market-oriented direction. These reforms have resulted in the potential for greater price volatility relative to past periods, as prices are more responsive to the fundamental supply and demand aspects of the market. These changes in China’s dairy policy could increase the risk of price volatility in the dairy industry, making our net income difficult to predict. Also, if prices are allowed to escalate sharply, our costs will rise which will lead to a decrease in profits.

Our sales and reputation may be affected by product liability claims, litigation, product recalls, or adverse publicity in relation to our products.

The sale of products for human consumption involves an inherent risk of injury to consumers. We face risks associated with product liability claims, litigation, or product recalls, if our products cause injury, or become adulterated or misbranded. Our products are subject to product tampering, and to contamination risks, such as mold, bacteria, insects, and other pests, and off-flavor contamination during the various stages of the procurement, production, transportation and storage processes. If any of our products were to be tampered with, or become tainted in any of these respects and we were unable to detect this, our products could be subject to product liability claims or product recalls. We cannot predict what impact such product liability claims or resulting negative publicity would have on our business or on our brand image. The successful assertion of product liability claims against us could result in potentially significant monetary damages, diversion of management resources and require us to make significant payments and incur substantial legal expenses. We do not have product liability insurance and have not made provisions for potential product liability claims. Therefore, we may not have adequate resources to satisfy a judgment if a successful claim is brought against us. Even if a product liability claim is not successfully pursued to judgment by a claimant, we may still incur substantial legal expenses defending against such a claim. Finally, serious product quality concerns could result in governmental action against us, which, among other things, could result in the suspension of production or distribution of our products, loss of certain licenses, or other governmental penalties. A widespread product recall could result in significant loss due to the cost of conducting a product recall including destruction of inventory and the loss of sales resulting from the unavailability of the product for a period of time. In addition, product liability claims and product recalls could have a material adverse effect on the demand for our products and on our business goodwill and reputation. Adverse publicity could result in a loss of consumer confidence in our products.

We compete in an industry that is brand-conscious, and unless we are able to establish and maintain brand name recognition, our sales may be negatively impacted.

Our business is substantially dependent upon awareness and market acceptance of our products and brand by our targeted consumers. In addition, our business depends on acceptance by our suppliers and consumers of our brand. Although we believe that we have made progress towards establishing market recognition for our brands “Mei Ke Gao Te” and “Yi Mei Shi” in the dairy products industry in China, it is too early in the product life cycle of the brand to determine whether our products and brand will achieve and maintain satisfactory levels of acceptance by our customers.

11

Expansion of our business may put added pressure on our management and operational infrastructure impeding our ability to meet any potential increased demand for the products that we sell and possibly hurting our future operating results.

Our business plan is to grow our operations significantly to meet anticipated growth in demand for the products that we sell, and by the introduction of new product offerings. Growth in our business may place a significant strain on our personnel, management, financial systems and other resources. The evolution of our business also presents numerous risks and challenges, including:

-

our ability to successfully and rapidly expand sales to potential new distributors in response to potentially increasing demand;

-

the costs associated with such growth, which are difficult to quantify, but could be significant; and

-

rapid technological change.

To accommodate any such growth and compete effectively, we may need to obtain additional funding to improve information systems, procedures and controls and expand, train, motivate and manage our employees, and such funding may not be available in sufficient quantities, if at all. If we are not able to manage these activities and implement these strategies successfully to expand to meet any increased demand, our operating results could suffer.

Due to our rapid growth in recent years, our past results may not be indicative of our future performance and evaluating our business and prospects may be difficult.

Our business has grown and evolved rapidly in recent years as demonstrated by our growth in net income for the fiscal year ended October 31, 2009 to $5.4 million, from $1.8 million for the prior fiscal year. We may not be able to achieve similar growth in future periods, and our historical operating results may not provide a meaningful basis for evaluating our business, financial performance and prospects. Moreover, our ability to achieve satisfactory production results at higher volumes is unproven. Therefore, you should not rely on our past results or our historical rate of growth as an indication of our future performance.

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Li Liu, our chief executive officer and chairperson, and Feng Shek, our Vice President. If we lose any of these key employees and are unable to find a qualified replacement in a timely manner, our business will be negative impacted. In addition, if a key employee fails to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete the institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the reclamation, technical, and marketing aspects of our business, any part of which could be harmed by turnover in the future.

Our inability to protect our intellectual property may prevent us from successfully marketing our products and competing effectively.

Failure to protect our intellectual property could harm our brands and our reputation, and adversely affect our ability to compete effectively. Further, enforcing or defending our intellectual property rights, including our trademarks, patents, copyrights, know how and trade secrets, could result in the expenditure of significant financial and managerial resources. We produce, market and sell our products using trademarks of “Mei Ke Gao Te” and “Yi Mei Shi.” We regard our intellectual property, particularly our trademark, know how and trade secrets to be of considerable value and importance to our business and our success. We rely on a combination of patent, trademark, trade secrecy laws, and contractual provisions to protect our intellectual property rights. There can be no assurance that the steps taken by us to protect these proprietary rights will be adequate or that third parties will not infringe or misappropriate our patent, trademark, trade secrets or similar proprietary rights. In addition, there can be no assurance that other parties will not assert infringement claims against us, and we may have to pursue litigation against other parties to assert our rights. Any such claim or litigation could be costly and we may lack the resources required to defend against such claims. In addition, any event that would jeopardize our proprietary rights or any claims of infringement by third parties could have a material adverse affect on our ability to market or sell our brands, and profitably exploit our products.

12

We do not carry any business interruption insurance, third-party liability insurance for our production facilities or insurance that covers the risk of loss of our products in shipment.

Operation of our facilities involves many risks, including equipment failures, natural disasters, industrial accidents, power outages, labor disturbances and other business interruptions. Furthermore, if any of our products are faulty, then we may become subject to product liability claims or we may have to engage in a product recall. We do not carry any business interruption insurance, product recall or third-party liability insurance for our production facilities or with respect to our products to cover claims pertaining to personal injury or property or environmental damage arising from defects in our products, product recalls, accidents on our property or damage relating to our operations. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or the FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We have operations, agreements with third parties and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our company, because these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. Also, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

Our management has identified deficiencies in our internal control over financial reporting, which if not properly remediated could result in material misstatements in our future interim and annual financial statements and have a material adverse effect on our business, financial condition and results of operations and the price of our common stock.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with U.S. generally accepted accounting principles.

See “Item 9A(T). Controls and Procedures” for a discussion of matters pertaining to our internal controls over financial reporting.

Although we are in the process of implementing initiatives aimed at addressing these deficiencies, these initiatives may not remediate the inadequacy. Failure to achieve and maintain an effective internal control environment could result in us not being able to accurately report our financial results, prevent or detect fraud or provide timely and reliable financial and other information pursuant to the reporting obligations we have as a public company, which could have a material adverse effect on our business, financial condition and results of operations. Further, it could cause our investors to lose confidence in the information we report, which could adversely affect the price of our common stock.

13

We do not have any independent directors and may be unable to appoint any qualified independent directors.

We currently do not have any independent directors. We plan to appoint a number of independent directors that will constitute a majority of our board of directors before our common stock is listed on a national securities exchange or NASDAQ, but we may not be able to identify independent directors qualified to be on our board.

RISKS RELATED TO DOING BUSINESS IN CHINA

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct substantially all of our operations and generate most of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

-

a higher level of government involvement;

-

a early stage of development of the market-oriented sector of the economy;

-

a rapid growth rate;

-

a higher level of control over foreign exchange; and

-

the allocation of resources.

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in economic conditions or government policies in China could have a material adverse effect on the overall economic growth in China, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our business and prospects.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiaries in the PRC. Our operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and all of our directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

14

If we are found to have failed to comply with applicable laws, we may incur additional expenditures or be subject to significant fines and penalties.

Our operations are subject to PRC laws and regulations applicable to us. However, many PRC laws and regulations are uncertain in their scope, and the implementation of such laws and regulations in different localities could have significant differences. In certain instances, local implementation rules and/or the actual implementation are not necessarily consistent with the regulations at the national level. Although we strive to comply with all the applicable PRC laws and regulations, we cannot assure you that the relevant PRC government authorities will not later determine that we have not been in compliance with certain laws or regulations. Our failure to comply with applicable PRC laws and regulations could subject us to administrative penalties and injunctive relief, as well as civil remedies, including fines, injunctions and recalls of our products. It is possible that changes to such laws or more rigorous enforcement of such laws or with respect to our current or past practices could have a material adverse effect on our business, operating results and financial condition.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Extensive regulation of the food processing and distribution industry in China could increase our expenses resulting in reduced profits.

We are subject to extensive regulation by China's Agricultural Ministry, and by other county and local authorities in jurisdictions in which our products are processed or sold, regarding the processing, packaging, storage, distribution and labeling of our products. Applicable laws and regulations governing our products may include nutritional labeling and serving size requirements. Our processing facilities and products are subject to periodic inspection by national, county and local authorities. To the extent that new regulations are adopted, we will be required to conform our activities in order to comply with such regulations. Our failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on our business, operations and finances.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

All our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in RMB, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in RMB to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by our PRC operating subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiaries borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local counterparts. These limitations could affect their ability to obtain foreign exchange through debt or equity financing.

15

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue in the future as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to hedge our exposure successfully at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiaries’ ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by our PRC subsidiaries. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividend by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Under the New EIT Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to our non-PRC stockholders and us.

China passed a new Enterprise Income Tax Law, or the New EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. Because the New EIT Law and its implementing rules are new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that Yayi International Inc. is a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. We are actively monitoring the possibility of “resident enterprise” treatment for the 2008 tax year and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible.

16

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

If the China Securities Regulatory Commission, or CSRC, or another PRC regulatory agency determines that CSRC approval is required in connection with the reverse acquisition of Charleston, the reverse acquisition may be unwound, or we may become subject to penalties.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule, which became effective on September 8, 2006. The M&A Rule, among other things, requires that an offshore company controlled by PRC companies or individuals that have acquired a PRC domestic company for the purpose of listing the PRC domestic company’s equity interest on an overseas stock exchange must obtain the approval of the CSRC prior to the listing and trading of such offshore company’s securities on an overseas stock exchange. On September 21, 2006, the CSRC, pursuant to the M&A Rule, published on its official web site procedures specifying documents and materials required to be submitted to it by offshore companies seeking CSRC approval of their overseas listings.

We do not believe that the M&A Rule concerning the CSRC approval for acquisition of a PRC domestic company by an offshore company controlled by PRC companies or individuals applies to our reverse acquisition of Charleston because neither Yayi International Inc. nor Charleston is a “Special Purpose Vehicle” or an “offshore company controlled by PRC companies or individuals” as defined in the M&A Rule. If the CSRC or another PRC governmental agency subsequently determines that we must obtain CSRC approval prior to the completion of the reverse acquisition, the reverse acquisition may be unwound and we may face regulatory actions or other sanctions from the CSRC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China and limit our operating privileges in China, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our shares.

The M&A Rule establishes more complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China.

The M&A Rule establishes additional procedures and requirements that could make some acquisitions of Chinese companies by foreign investors more time-consuming and complex, including requirements in some instances that the PRC Ministry of Commerce be notified in advance of any change-of-control transaction and in some situations, require approval of the PRC Ministry of Commerce when a foreign investor takes control of a Chinese domestic enterprise. In the future, we may grow our business in part by acquiring complementary businesses, although we do not have any plans to do so at this time. The M&A Rule also requires PRC Ministry of Commerce anti-trust review of any change-of-control transactions involving certain types of foreign acquirers. Complying with the requirements of the M&A Rule to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the PRC Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

17

You may have difficulty enforcing judgments against us.