Attached files

Table of Contents

As filed with the Securities and Exchange Commission on February 16, 2010

Registration No. 333-163041

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 4 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Dehaier Medical Systems Limited

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands | 3841 | Not applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Dehaier Medical Systems Limited 1223 Epoch Center No. 31 Zi Zhu Yuan Road Haidian District Beijing 100089 People’s Republic of China (8610) 5166-0080 |

CT Corporation System 111 Eighth Avenue New York, New York 10011 (800) 624-0909 | |

| (Address, including zip code, and telephone number, including area code, of principal executive offices) |

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Bradley A. Haneberg, Esq.

Anthony W. Basch, Esq.

Kaufman & Canoles, P.C.

Three James Center, 1051 East Cary Street, 12th Floor

Richmond, Virginia 23219

(804) 771-5700 – telephone

(804) 771-5777 – facsimile

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Table of Contents

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common Shares(2) |

$13,500,000 | $753.30 | ||

| Placement Agent’s Warrants(3) |

$150 | $0.01 | ||

| Common Shares Underlying Placement Agent’s Warrants(3) |

$1,687,500 | $94.81 | ||

| Total |

$15,187,650 | $848.52(4) | ||

| (1) | The registration fee for securities is based on an estimate of the Proposed Maximum Aggregate Offering Price of the securities, assuming the sale of the maximum number of shares at the highest expected offering price, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(o). Please note that the remainder of the registration statement assumes an offering price at the midpoint of the offering range. |

| (2) | In accordance with Rule 416(a), the Registrant is also registering an indeterminate number of additional common shares that shall be issuable pursuant to Rule 416 to prevent dilution resulting from share splits, share dividends or similar transactions. |

| (3) | We have agreed to issue, on the closing date of this offering, warrants to our placement agent, Anderson & Strudwick, Incorporated (the “Placement Agent”), to purchase up to 10% of the aggregate number of common shares sold by the Registrant (the “Placement Agent’s Warrants”). The price to be paid by the Placement Agent for the Placement Agent’s Warrants is $0.001 per warrant. The closing date will be a date mutually acceptable to the Placement Agent and the Registrant after the minimum offering has been sold; provided, however, that the closing date will be on or before May 31, 2010. Assuming a maximum placement and a maximum offering price of $9.00 per share, on the closing date the Placement Agent would receive 150,000 Placement Agent’s Warrants at an aggregate purchase price of $150. The exercise price of the Placement Agent’s Warrants is equal to 125% of the price of the common shares offered hereby. Assuming a maximum placement and an exercise price of $11.25 per share, we would receive, in the aggregate, $1,687,500 upon exercise of the Placement Agent’s Warrants. The common shares underlying the Placement Agent’s Warrants are exercisable within one year of the date of this registration statement and are deemed to commence simultaneously with the Placement Agent’s Warrants. |

| (4) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED February 16, 2010

Registration Statement No. 333-163041

Dehaier Medical Systems Limited

Minimum Offering: 1,250,000 Common Shares

Maximum Offering: 1,500,000 Common Shares

This is the initial public offering of Dehaier Medical Systems Limited, a British Virgin Islands limited company. We are offering a minimum of 1,250,000 and a maximum of 1,500,000 of our common shares. None of our officers, directors or affiliates may purchase shares in this offering.

We expect that the offering price will be between $7.00 and $9.00 per common share. No public market currently exists for our common shares. We have applied for approval for quotation on the NASDAQ Capital Market under the symbol “DHRM” for the common shares we are offering.

Investing in these common shares involves significant risks. See “Risk Factors” beginning on page 12 of this prospectus.

| Per Common Share | Minimum Offering | Maximum Offering | |||||||

| Assumed public offering price |

$ | 8.00 | $ | 10,000,000 | $ | 12,000,000 | |||

| Placement discount |

$ | 0.56 | $ | 700,000 | $ | 840,000 | |||

| Proceeds to us, before expenses |

$ | 7.44 | $ | 9,300,000 | $ | 11,160,000 | |||

We expect our total cash expenses for this offering to be approximately $500,000, exclusive of the above commissions. In addition, we will pay our placement agent a non-accountable expense allowance of 1% of the amount of the offering, or up to $120,000 (maximum offering, exclusive of any shares registered under Rule 462(b)) or $100,000 (minimum offering). The placement agent must sell the minimum number of securities offered (1,250,000 common shares) if any are sold. The placement agent is only required to use its best efforts to sell the maximum number of securities offered (1,500,000 common shares). The offering will terminate upon the earlier of: (i) a date mutually acceptable to us and our placement agent after which the minimum offering is sold or (ii) May 31, 2010. Until we sell at least 1,250,000 shares, all investor funds will be held in an escrow account at SunTrust Bank, Richmond, Virginia. If we do not sell at least 1,250,000 shares by May 31, 2010, all funds will be promptly returned to investors (within one business day) without interest or deduction. If we complete this offering, net proceeds will be delivered to our company on the closing date. We will not be able to use such proceeds in China, however, until we complete certain remittance procedures in China. If we complete this offering, then on the closing date, we will issue common shares to investors in the offering and placement agent warrants to our placement agent exercisable at a rate of one warrant per share to purchase up to 10% of the aggregate number of Common Shares sold in this offering.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Anderson & Strudwick,

Incorporated

Prospectus dated , 2010

Table of Contents

Table of Contents

Except where the context otherwise requires and for purposes of this prospectus only:

| • | the terms “we,” “us,” “our company” and “our” refer to (i) Dehaier Medical Systems Limited, a British Virgin Islands company, (ii) Beijing Dehaier Medical Technology Company Limited, a PRC company, (iii) De-haier Medical Systems (Hong Kong) Limited, a Hong Kong company and (iv) Beijing Dehaier Technology Company Limited, a PRC company. |

| • | “shares” and “common shares” refer to our common shares, $0.002731 par value per share; |

| • | “our branded products” refers to those products developed by our company; |

| • | “our distributed products” refers to those products developed by third parties and distributed by our company; |

| • | “our products” refers both to our branded products and our distributed products. |

| • | “China” and “PRC” refer to the People’s Republic of China, and for the purpose of this prospectus only, excluding Taiwan, Hong Kong and Macau; and |

| • | all references to “RMB,” “Renminbi” and “¥” are to the legal currency of China, and all references to “$” and “U.S. dollars” are to the legal currency of the United States. |

For purposes of clarity, where the context requires us to differentiate between the entities generally referred to collectively as “our company”, and for purposes of this prospectus only:

| • | “Dehaier” refers to Dehaier Medical Systems Limited, a British Virgin Islands business company with limited liability. |

| • | “DHK” refers to De-haier Medical Systems (Hong Kong) Limited, our wholly-owned subsidiary in Hong Kong. |

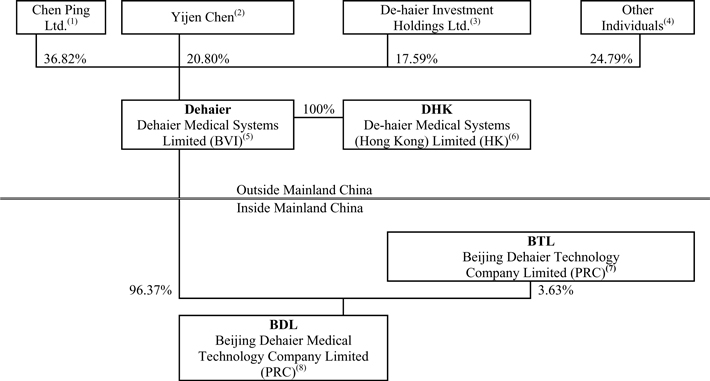

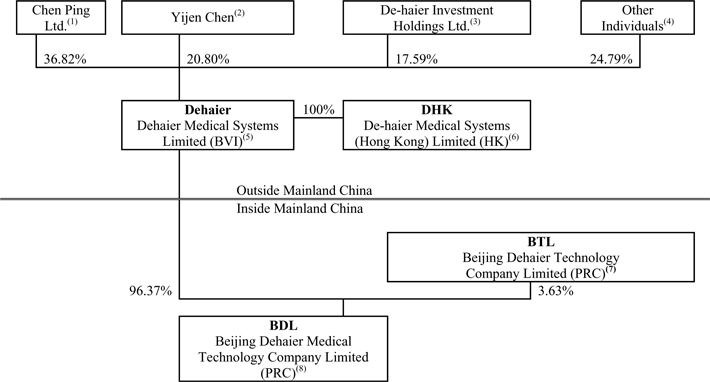

| • | “BDL” refers to Beijing Dehaier Medical Technology Company Limited, our PRC operating subsidiary, of which Dehaier owns 96.37% and BTL owns the remaining 3.63% of equity. |

| • | “BTL” refers to Beijing Dehaier Technology Company Limited, a PRC company controlled by our chief executive officer, Mr. Ping Chen. BTL owns approximately 3.63% of BDL’s equity. |

This prospectus contains translations of certain Renminbi amounts into U.S. dollars amounts at a specified rate solely for the convenience of the reader. Except as provided below or otherwise noted, all translations made in this prospectus are based upon a rate of ¥6.8262 to $1.00, which was the exchange rate on September 30, 2009. Unless otherwise stated, we have translated balance sheet amounts with the exception of equity at December 31, 2008 at ¥6.8225 to $1.00 as compared to ¥7.2946 to $1.00 at December 31, 2007. We have stated equity accounts at their historical rate. The average translation rates applied to income statement accounts for the year ended December 31, 2008 and the year ended December 31, 2007 were ¥6.9483 and ¥7.6040, respectively. The translation rates of DHK were not significant for the years ended December 31, 2008 and 2007.

We make no representation that the RMB or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all. See “Risk Factors – Fluctuation of the Renminbi could materially affect our financial condition and results of operations” for discussions of the effects of fluctuating exchange rates on the value of our common shares. Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This prospectus follows the English naming convention of first name followed by last name, whether an individual’s name is Chinese or English. For example, the name of the chief executive officer of Dehaier is presented as “Ping Chen,” even though, in Chinese, his name is presented as “Chen Ping.”

Unless otherwise indicated, all information in this prospectus assumes:

| • | no person will exercise any outstanding options; |

| • | the sale of 1,500,000 common shares, the maximum shares offered in this offering; and |

| • | an assumed initial public offering price of $8.00 per common share, the midpoint of the range set forth on the cover page of this prospectus. |

We have relied on statistics provided by a variety publicly-available sources regarding China’s expectations of growth and market potential in our industry, increased government spending on infrastructure and economic development. We did not, directly or indirectly, sponsor or participate in the publication of such materials.

i

Table of Contents

This summary highlights information that we present more fully in the rest of this prospectus. This summary does not contain all of the information you should consider before buying common shares in this offering. This summary contains forward-looking statements that involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “should,” “could,” and similar expressions. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. You should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements and the notes to those statements.

Our Company

Our business consists of the marketing and sale of home respiratory and oxygen homecare products and other medical devices in China. We develop and assemble some of our branded products ourselves from components manufactured by third parties according to our specifications. We do not manufacture these components ourselves. In addition to our branded products, we also sell a variety of products developed, manufactured and assembled by third parties, which we refer to in this prospectus as our distributed products.

Prior to 2009, our branded products have accounted for approximately one-third of our revenues, and our distributed products have accounted for approximately two-thirds of our revenues. In the nine months ended September 30, 2009, our branded products and distributed products have each accounted for approximately half of our revenues.

We sell the majority of our branded and distributed products to distributors, and a very small amount to other end users. Distributors, however, sell their products to the same end users. We estimate that approximately 90% of our sales are to distributors, 7% are to hospitals, 1% are to clinics, and 2% are to individuals. Based on the expected use of products sold to distributors, we estimate that they sell approximately 60% of our products to hospitals, 20% to clinics and 10% to individuals. As a result, we estimate that approximately 67% of our products (on a revenue basis, rather than unit basis) are sold to hospitals, approximately 21% to clinics and approximately 12% to individuals. We have contractual distribution relationships with over 2,000 independent distributors, and we employ 70 direct sales and sales support personnel.

Our Branded Products

We develop, assemble and market home respiratory and oxygen homecare products and other medical devices in China. We offer a broad range of approximately 30 products that can be used in the surgery room, patient room and at home, and we also provide technical service products to manufacturers and distributors. In recent years, we have placed a significant emphasis on our respiratory and oxygen homecare products. Through the integration of technology, customer input, and employee creativity, we seek to provide innovative, high quality and affordable products that improve the lives of people with sleep and respiratory disorders.

Our branded products include medical devices, technical service products and respiratory and oxygen homecare products:

Medical Devices

| • | Mobile Medical X-Ray Image Devices. We provide four types of DHR Explorer Series mobile and C-armed X-ray machines. X-ray is used for visualizing bone structures and other dense tissues such as tumors. These mobile and C-armed X-ray machines provide added convenience for use in hospitals and clinics. |

| • | Anesthesia Machines. We provide two types of DHR ORSA Series anesthesia machines. These machines are used by anesthesiologists to support the administration of anesthesia. These machines administer a precise and continuous supply of anesthetic gases and vapors to the patient at accurate and safe levels of pressure and flow. These machines maintain a continuous, closed-loop control over the pressure of gas within a patient’s mouth or respiratory according to the selected pressure input. |

| • | Patient Monitoring Devices. We provide two types of DHR 930 patient monitoring devices which monitor patients’ physiological parameters, such as heart rate, blood pressure, respiration and temperature. We also provide polysomnograph devices, which are used to monitor and record patients’ sleep data through multiple parameters. These machines are suitable for adult, pediatric and neonatal care and principally used by hospitals in intensive care units, operating rooms and emergency rooms. |

1

Table of Contents

Technical Service Products

| • | Ventilator Air Compressor. We provide two types of air compressors to support medical ventilators in surgery by supplying continuous airflow for the ventilator. Where a facility lacks a central pressured air supply system, our C250 and C280 air compressors provide a portable source of such pressured air. |

| • | Trolleys for Ventilators. We provide three types of trolleys to hold ventilators and their accessories for mobility. These trolleys can be fit with a monitor to further enhance the portability and utility. |

| • | Sterilizers for Ventilators. We provide one type of sterilizer to treat the air from patients in order to control cross-contamination and infection in a facility in general and for subsequent ventilator patients in particular. |

Respiratory and Oxygen Homecare Products

| • | Oxygen Concentrating Products. We provide two types of oxygen concentrator products, including, the DHR-3L/5L Oxi-Fairy and the DHR-3L/5L Oxi-Pioneer. These products use our patented advanced Pressure Swing Absorbing (“PSA”) technology to produce highly-concentrated, therapeutic-level oxygen (approximately 90% oxygen concentration) from air at normal temperatures. These products are used by patients with cardiovascular disease, respiratory diseases, such as chronic obstructive pulmonary disease, and geriatric patients. |

| • | Sleep Apnea Treatment Products. We have designed and expect to provide several products designed for obstructive sleep apnea (“OSA”) therapy. These products include our DHR CPAP C5, DHR Auto CPAP A8, and DHR Auto S-CPAP A9. Our DHR CPAP C5, Auto CPAP A8 and DHR S-CPAP A9 are in the process of obtaining PRC State Food and Drug Administration (SFDA) approval and will not be available for sale until we receive such approval. The SFDA is the competent authority on regulating the safety of medical devices in the PRC. While we expect to receive this approval within the first half of 2010, we cannot guarantee that we will obtain such SFDA approval in this timeframe or all. These products are all non-invasive therapy products that treat symptoms of sleep apnea. Our CPAP devices do not cure apnea but instead use air pressure to open customers’ airways to reduce snoring and apnea disturbances during sleep. Our automatic CPAP products provide air pressure at a customized, adjustable level, while our traditional CPAP products provide a constant level of air pressure. |

| • | Diagnostic Products. We have designed and expect to provide two types of screening and diagnosis products are portable sleep respiratory recording devices that can be used in a healthcare facility or in a patient’s home to assist physicians in determining whether the patient has obstructive sleep apnea requiring use of a CPAP device. We have applied to SFDA for approval of our DHR 998 and DHR 999 diagnostic products, and they will not be available for sale until we receive such approval. While we expect to receive this approval within the first half of 2010, we cannot guarantee that we will obtain such SFDA approval in this timeframe or all. |

| • | Thermotherapy Products. We have designed and expect to provide our thermotherapy device for patients with rhinitis and delivers atomized clean water at a therapeutic temperature to the affected site. We have not yet begun to market this device and cannot project when we will begin to market this device. |

Our Distributed Products

We serve as a significant distributor in China for several foreign producers of medical devices and respiratory and oxygen homecare products, including IMD, Timesco, JMS and ResMed. We believe this extensive platform allows us to be responsive to local market demand. We distribute medical devices and respiratory and oxygen homecare products for these companies.

Medical Devices

| • | Mobile Medical X-Ray Image Devices. We provide two types of X-ray machines developed by other companies: the IMD Radius Series mobile and C-armed X-ray machine and the IMD Compact Series mobile-X-ray machine. |

| • | Medical Ventilator. We provide three types of ventilators developed by other companies: the ResMed VS Serena, Ultra and Integra Ventilators. The VS Series of medical ventilators mechanically move breathable air to and from the lungs to support breathing support for patients who are physically unable to breathe or who are breathing insufficiently. |

| • | Laryngoscopes. We provide four types of laryngoscopes developed by other companies: the Optima, Optima XL and Eclipse lines of laryngoscopes from Timesco. Laryngoscopes are flexible lighted tubes that are used to look at the inside of the larynx. Anesthesiologists make use of laryngoscopes to assist with intubation in surgery. |

2

Table of Contents

Respiratory and Oxygen Homecare Products

| • | Sleep Apnea Treatment Products. We provide two types of products developed by other companies designed for obstructive sleep apnea (“OSA”) therapy. These products include the ResMed S6 and MAP MiniPAP. |

Our Distribution Network

To date, we have sold medical devices developed by our company and other producers to approximately 3,000 hospitals, clinics and other healthcare facilities and have sold respiratory and oxygen homecare products to over 35,000 families. We leverage our network of relationships with healthcare facilities and with distributors to drive sales of both our branded products and our distributed products. By growing our distribution network and product offerings, we are able to offer both branded and distributed products for sale, depending on the needs and budget of the customer.

Assembly

We assemble some of our branded product components and final branded products at our assembly facility in Beijing. We employ 40 full-time employees at this facility. Every year we assemble under ten thousand of our branded products at this assembly facility. In some cases, we assemble final branded products from components manufactured for us by our suppliers. No other companies distribute those branded products except for Friend of Health (Chuzhou) Medical Technology Co. Ltd. (“Friend of Health”), which assembles some of our branded products and is then allowed to sell them only in Chuzhou. For example, we assemble between approximately 40 and 50 C-arm X-ray machines each year from components supplied by our suppliers. In other cases, we assemble components that must be incorporated into final branded products. For example, we assemble the core component of our oxygen concentrators, the oxi-chip, in our assembly facility and then provide that oxi-chip to another company for inclusion in the oxygen concentrator assembled by that company. Depending on the component or branded product, we assemble between approximately 40 (C-arm X-ray machines) and more than 5,000 (oxi-chip) products or components annually.

Marketing

We focus our marketing efforts on two annual exhibitions of medical devices in China and on our Customer Experience Centers (“CECs”). We use the annual exhibitions to introduce our branded and distributed product offerings to distributors and end users. We have focused on meeting potential new distributors at these meetings and on showing our solutions to potential purchasers of those branded and distributed products.

We have used our CEC model as another method to introduce our branded and distributed products to potential purchasers. The CEC allows distributors, hospital and clinic representatives, individual purchasers and other interested parties to see how the products work in practice.

To date, we have not provided any market support to any distributors and have no current plans to do so. Distributors are responsible for meeting their sales goals, and we understand that some distributors may purchase advertising. Nevertheless, Dehaier does not currently reimburse any such costs for growing such distributors’ client bases.

Our Industry

In April 2009, the Chinese government implemented large-scale healthcare reform. The State Council allocated $123 billion as part of its New Medical Reform Plan. The plan, which is part of China’s stimulus package aimed at correcting the recent global economic down-turn, contemplates the development of a universal healthcare system that will cover 90% of China’s population by 2010. In addition, the plan includes significant improvements to health care facilities and expansion of China’s health related infrastructure.

Specifically, within three years, the Chinese government aims to improve the urban healthcare system by rebuilding and restructuring approximately 3,700 existing urban community health centers and 11,000 community health clinics. The plan will also accommodate the development of approximately 2,400 new urban health centers. In effect, the plan de-emphasizes the prevalence of large, magnet facilities in favor of smaller, more accessible clinics.

In addition, the plan is designed to dramatically improve medical services available for the 800 million rural poor in China. Through the plan, the Chinese government contemplates the development of clinics in every village and a hospital in every county in China by the end of 2011. If successfully implemented, the plan would result in at least 2,000 new county-level hospitals and 29,000 township hospitals and the upgrading of another 5,000 more.

Our Opportunity

We believe that we are well positioned to benefit from the rapid growth of expenditures on medical devices in China and the growing demand for domestic medical devices in China. A recent article published by the Wharton School of the University of Pennsylvania suggests that the expected value of China’s medical device market will reach $28 billion by 2014. As this market was valued at $12.14 billion in 2008, or roughly one-eighth of China’s overall healthcare market, there may still be significant potential for growth. China’s medical device market is projected to grow faster than the global medical device market. China is already the third largest medical device market in the world behind the United States and Japan, and within the next five to seven years China is expected to surpass Japan and become the second largest medical device market in the world. The respiratory and oxygen homecare market in China is also experiencing rapid growth. Market growth rates for 2009 are projected at 11.2%. Reasons for the rapid growth of China’s medical device market include:

| • | fast growing economy; |

| • | increasing percentage of gross domestic product, or GDP, expected to be spent on healthcare by the Chinese government; |

| • | increasing desire for and utilization of more advanced technologies in Chinese hospitals and clinics; |

| • | increasing availability of healthcare insurance; |

| • | higher degree of operating autonomy at hospitals and clinics; and |

| • | growing desire for better quality of care. |

Hospitals and clinics in China purchase almost all of their medical devices and supplies through distributors. These distributors tend to operate in small territories in China, and many focus on eastern coastal cities. As a result,

3

Table of Contents

medical device companies need to develop relationships with several distributors in different regions to be able to reach a broad end user base. We believe the ability to leverage local contacts and knowledge is vital in establishing an effective distribution network, constituting a significant barrier to entry for both smaller local companies and international competitors that lack a meaningful local presence in China.

Our Competitive Strengths

We believe we have the following principal competitive strengths, enabling us to attain a leading position in China’s medical device and respiratory and oxygen homecare industries:

| • | our established brand and market position in China’s medical device and respiratory and oxygen homecare industries; |

| • | our established distribution, sales and service network throughout China; |

| • | our research and development capabilities; |

| • | our established relationships with foreign medical device manufacturers; |

| • | our established relationships with approximately 3,000 hospital customers; and |

| • | dedicated customer support and service. |

Our Strategies

Our objective is to strengthen our position as one of China’s leaders in developing, assembling and marketing respiratory and oxygen homecare products and to develop a presence in certain select foreign markets, including, Europe and America. We intend to achieve our objective by implementing the following strategies:

| • | increasing our market share in China’s respiratory and oxygen homecare market; |

| • | increasing our focus on research and development in order to develop more advanced products and new product lines; |

| • | enhancing our market position and brand recognition in China as well as other certain select foreign markets; |

| • | maintaining our disciplined cost focus; |

| • | pursuing favorable opportunities to acquire complementary businesses; and |

| • | maintaining our distribution network through active management and regular reviews of distributor performance. |

Our Challenges and Risks

The successful execution of our strategies is subject to certain risks and uncertainties, including those related to:

| • | uncertainties in our development, introduction and marketing of new solution and services; |

| • | recruitment, training and retention of skilled engineers and other personnel; |

| • | our ability to respond to competitive pressures; |

| • | our ability to build our brand recognition in our existing and any future markets; |

| • | our ability to increase the market penetration of our products; |

| • | our ability to export our branded products to new markets in the future; |

| • | uncertainties in the fluctuation of the RMB; |

| • | uncertainties in the world economy, including potential continuance and recurrence of the current global economic slowdown; |

| • | our ability to purchase products from our international suppliers at competitive prices; |

| • | protection of our trade secrets and other valuable intellectual property; |

| • | our ability to identify and negotiate favorable opportunities to acquire complementary businesses; and |

| • | complexities of the regulatory environment in China. |

In addition, we face risks and uncertainties that may materially affect our business, financial condition, results of operations and prospects. Thus, you should consider the risks discussed in “Risk Factors” and elsewhere in this prospectus before investing in our common shares.

4

Table of Contents

Our Corporate Structure

Historical Overview

Our founder, Mr. Ping Chen, founded BTL on July 5, 2001 to develop and distribute medical devices. He currently owns approximately 86% of BTL, and his wife and employees of Dehaier own the remaining 14% of BTL. BTL leases some of our property to us and provides certain transportation and repair services to medical devices for which we are not obligated to perform warranty services, either because the warranty is expired or because the product was sold by another company. We do not receive any payment for such services from BTL. BTL served as the domestic partner to our joint venture pursuant to which we, a British Virgin Islands company, own the majority BDL, a PRC company in the medical device business. At the time of the formation of the joint venture, foreign enterprises were not permitted to own such companies without PRC partners.

In 2003, in order to continue to grow our business, BTL engaged in a corporate restructuring and Series A venture capital financing. As a result of those actions, Dehaier, BDL and DHK were established and a venture capital investor, De-haier Investment Holdings, Ltd., a British Virgin Islands company, became a shareholder in Dehaier. At the same time, Mr. Chen’s wholly-owned company, Chen Ping Ltd., became a shareholder in Dehaier, and we created the holding company structure that is currently in place.

Dehaier was incorporated as an international business company under the International Business Companies Act, 1984, in the British Virgin Islands on July 22, 2003 under the name “De-Haier Medical Systems Limited.” We changed this name to “Dehaier Medical Systems Limited” on June 3, 2005. Dehaier is a holding company. Dehaier does not conduct business in China and instead relies on BDL to conduct business in China.

On September 24, 2003, we established BDL. BDL conducts substantially all of our operations in China and is responsible for generating substantially all of our revenues. BDL was formed as a joint venture between a Chinese entity, BTL, and a foreign invested enterprise, Dehaier, in order to allow foreign investments to be used to grow our business. Because BDL is engaged in an encouraged industry under the Foreign Investment Industrial Guidance Catalogue, it was allowed to have foreign investments and to be established as a Chinese-foreign equity joint-venture. This structure allowed BDL access to foreign capital that would not have been available outside this structure. In addition to its engagement in an encouraged industry, the use of this joint venture structure allowed BDL to take advantage of favorable tax rates available prior to January 1, 2008. Before January 1, 2008, equity joint-ventures such as BDL could enjoy a preferential enterprise income tax rate of 24%. In addition to the lower standard rate, such equity joint-ventures were also allowed a two-year income tax exemption from the date they first became profitable and a 50% income tax reduction for the following three years after that time. After January 1, 2008, the income tax rates were unified at 25% under the PRC Enterprise Income Tax Law; however, BDL’s ability to pay lower income taxes prior to this date left it with more net income with which to grow its business. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Tax Matters Applicable to Our Company — PRC Enterprise Income Taxes.”

On October 15, 2003, we founded DHK and created a holding company structure by which we are the parent company of BDL and DHK. DHK was formed in anticipation of opportunities to make use of its status as a Hong Kong company to grow our business; we have not yet made significant use of DHK for such purposes and have no present plans to do so. BDL has been focused on the development and distribution of medical devices since its inception and began developing its respiratory and oxygen homecare business in 2006.

Effective as of January 5, 2007, we completed a Series B venture capital financing with Crystal East Group Limited, a British Virgin Islands company. Crystal East Group Limited subsequently completed the transfer of its shares to its individual shareholder, Yijen Chen.

Relationship among Dehaier, BTL and BDL

BTL is a PRC company established on July 5, 2001. Dehaier is a BVI company established on July 22, 2003. Dehaier and BTL jointly established BDL on September 24, 2003 as a Chinese-foreign equity joint-venture under the PRC laws. Dehaier has been and is BDL’s foreign shareholder, and BTL has been and is BDL’s domestic shareholder since BDL was established. Currently, Dehaier owns 96.37% of the contributions of BDL, and BTL owns 3.63% of the contributions of BDL. Under PRC laws, the shareholders of the equity joint-venture share the profits, risks and losses in proportion to their respective contributions of the equity joint-venture.

5

Table of Contents

As described above, the business of Dehaier was historically performed by BTL before we completed our Series A venture capital financing in 2003. At the time of the Series A venture capital financing, BTL’s founder, Mr. Ping Chen, sought capital to grow the business, and a foreign (non-Chinese) investor wanted to invest in BTL. Chinese law at the time required such foreign investments in companies like BTL to be in the form of a joint venture between a foreign company and a Chinese company. For this reason, our company was restructured to create a joint venture, with BTL as the Chinese party to the joint venture and Dehaier as the foreign party to the joint venture. Dehaier was considered the foreign party to the joint venture both because it is a British Virgin Islands company and because its shareholders at the time were also British Virgin Islands companies. In connection with the joint venture, BDL was formed as the operating entity. As a result of this restructuring, BDL conducted the business previously conducted by BTL.

Dehaier presently operates as a holding company, of which DHK is its wholly owned subsidiary and BDL is its 96.37%-owned subsidiary. BTL exists primarily as the Chinese joint venture party for the reasons described above. In addition, BTL performs certain limited functions, including leasing some of our property to us and providing certain transportation and repair services to medical devices for which we are not obligated to perform warranty services, either because the warranty is expired or because the product was sold by another company. BDL is our operating entity through which we sell all of our medical products and provide all of our warranty services. We develop, assemble and market our branded products through BDL and market our distributed products through BDL.

Financings and Restructurings

2003 Series A Financing

On October 23, 2003, Dehaier agreed to issue up to $2,400,000 in Series A Preferred Shares to De-haier Investment Holdings Ltd., a British Virgin Islands company. The investor received one-half of these shares in 2003 for $1,200,000 and had an option to acquire the other half of the shares for the remainder of the purchase price. The investor ultimately elected in 2006 not to purchase the other one-half of the Series A Preferred Shares. In connection with the transaction, BDL was formed as a Sino-foreign joint venture with Dehaier holding a majority of the registered capital and BTL holding a minority of the registered capital. In connection with closing, BTL’s assets were transferred to BDL. In connection with the Series A Financing, the parties entered into a Shareholder Agreement that granted certain rights to the Series A Preferred shareholders that terminated upon conversion of the Series A Preferred Shares to common shares.

The Series A financing was exempt from registration under U.S. Securities laws by virtue of exemptions provided by Regulation S and Section 4(2) of the Securities Act of 1933 and by falling outside the an offering covered by Section 5 of the Securities Act of 1933.

2007 Series B Financing

Effective January 5, 2007, Dehaier agreed to issue up to $2,000,000 in Series B Preferred Shares to Crystal East Group Limited, a British Virgin Islands company. In connection with the Series B Financing, the parties entered into a Shareholder Agreement that granted certain rights to the Series B Preferred shareholders that terminated upon conversion of the Series B Preferred Shares to common shares.

The Series B financing was exempt from registration under U.S. Securities laws by virtue of exemptions provided by Regulation S and Section 4(2) of the Securities Act of 1933 and by falling outside the an offering covered by Section 5 of the Securities Act of 1933.

2009 Restructuring

In preparation for the commencement of this initial public offering, our company completed a restructuring to accomplish two goals. First, we sought to convert all Series A and Series B Preferred Shares into common shares. Second, we completed a shares split so that we would have, in the aggregate, 3,000,000 common shares outstanding prior to commencement of the offering. As to the first goal, our Series A and Series B Preferred shareholders agreed to convert their respective Series A and Series B Preferred Shares into an equal number of our common shares. This 1:1 conversion was completed without consideration. As to the second goal, we completed a 3.66140766-for-1 share split of common shares completed of October 31, 2009. As a result of the conversions and share split, we have 3,000,000 common shares issued and outstanding prior to commencement of this offering and no issued and outstanding preferred shares.

6

Table of Contents

Our Structure

As a result of the above 2003 restructuring, rounds of financing completed in 2003 and 2007 and the 2009 conversion of outstanding preferred shares, the following diagram illustrates our current corporate structure as of the date of this prospectus.

| (1) | Chen Ping Ltd. is a British Virgin Islands company beneficially owned by our Chief Executive Officer, Mr. Ping Chen. |

| (2) | These shares were initially acquired by Crystal East Group Limited, a British Virgin Islands company, in our second round of venture capital financing. Crystal East Group Limited transferred the Series B preferred shares to its shareholder, Ms. Chen, and such shares were converted into our common shares as of October 31, 2009. Ms. Chen is not related to our chief executive officer, Mr. Ping Chen. |

| (3) | De-haier Investment Holdings Ltd, a British Virgin Islands company, obtained these shares in our first round of venture capital financing. These Series A preferred shares were converted into our common shares as of October 31, 2009. |

| (4) | Such shareholders consist of employees and consultants to our company. |

| (5) | Dehaier is our British Virgin Islands holding company that seeks to register its common shares in this initial public offering. |

| (6) | DHK is a Hong Kong company owned by Dehaier, through which we may in the future conduct operations. We do not, however, have any present plans to do so. We do not currently receive any significant revenues through DHK. |

| (7) | BTL is a variable interest entity, and BDL is the primary beneficiary. BTL owns a building which is pledged as collateral for BDL’s bank loans. In exchange, BDL loans money to BTL to finance its operations. Dehaier, BDL and BTL are under common control, and BDL provides substantial financial support to BTL. This substantial financial support is primarily for working capital loans to finance BTL’s operations. At December 31, 2006, 2007, 2008 and September 30, 2009, BDL had advanced to BTL funds in the amount of $823,405, $786,816, $292,011 and $164,248, which represented 87%, 74%, 24% and 13% of BTL’s equity, respectively. Because BTL has insufficient equity to finance its operations, BTL then is required to obtain additional financial support to fund its operations. Accordingly, BTL’s sales are included in Dehaier’s consolidated income from operations. Mr. Chen owns 86% of BTL and his wife and employees of Dehaier own the remaining 14%. BTL performs certain out-of-warranty repair work for products we sell and provides transportation services related to such services. |

7

Table of Contents

| (8) | BDL is our Chinese operating entity. We develop, assemble, market and distribute our branded products through BDL, and we market and distribute our distributed products developed by other companies through BDL. |

The Offering

| Shares Offered: |

Minimum: 1,250,000 common shares | |

| Maximum: 1,500,000 common shares | ||

| Shares Outstanding Prior to Completion of Offering: |

3,000,000 common shares | |

| Shares to be Outstanding after Offering: |

Minimum: 4,250,000 common shares | |

| Maximum: 4,500,000 common shares | ||

| Assumed Offering Price per Share: |

$8.00 | |

| Gross Proceeds: |

Minimum: $10,000,000 | |

| Maximum: $12,000,000 | ||

| Proposed NASDAQ Capital Market Symbol: |

“DHRM” (CUSIP No. G27010 100) | |

| Transfer Agent: |

Computershare Trust Company, N.A. 250 Royall Street, Canton, Massachusetts 02021 | |

| Risk Factors: |

Investing in these securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this prospectus before deciding to invest in our common shares. | |

| Closing of Offering: |

The offering contemplated by this prospectus will terminate upon the earlier of: (i) a date mutually acceptable to us and our placement agent after the minimum offering is sold or (ii) May 31, 2010. If we complete this offering, net proceeds will be delivered to our company on the closing date (such closing date being the above mutually acceptable date on or before May 31, 2010, provided the minimum offering has been sold). We will not complete this offering unless our application to list on the NASDAQ Capital Market is approved. We will not be able to use such proceeds in China, however, until we complete certain remittance procedures in China. If we complete this offering, then on the closing date, we will issue shares to investors and placement agent warrants to our placement agent exercisable at a rate of one warrant per share to purchase up to 10% of the aggregate number of common shares sold in this offering. | |

8

Table of Contents

Placement

We have engaged Anderson & Strudwick, Incorporated to conduct this offering on a “best efforts, minimum/maximum” basis. The offering is being made without a firm commitment by the placement agent, which has no obligation or commitment to purchase any of our common shares. Our placement agent is required to use only its best efforts to sell the securities offered. The offering will terminate upon the earlier of: (i) a date mutually acceptable to us and our placement agent after which at least 1,250,000 common shares are sold or (ii) May 31, 2010. Until we sell at least 1,250,000 common shares, all investor funds will be held in an escrow account at SunTrust Bank, Richmond, Virginia. If we do not sell at least 1,250,000 common shares by May 31, 2010, all funds will be promptly returned to investors (within one business day) without interest or deduction. If we complete this offering, net proceeds will be delivered to our company on the closing date. We will not be able to use such proceeds in China, however, until we complete certain remittance procedures in China. None of our officers, directors or affiliates may purchase shares in this offering. If we complete this offering, then on the closing date, we will issue shares to investors and placement agent warrants to our placement agent exercisable at a rate of one warrant per share to purchase up to 10% of the aggregate number of Common Shares Sold in this offering.

Make-Good Escrow

We have agreed with our placement agent to value our company based on a multiple of approximately 6.6 times our targeted after-tax earnings for the year ending December 31, 2010, subject to the terms of a Make-Good Escrow Agreement to be executed before effectiveness of this registration statement and our ability to redeem a sufficient number of Make-Good Shares to meet our target audited after-tax earnings per share for the year ending December 31, 2010, as more fully discussed below. If we are unable to achieve these targeted after-tax earnings, then there is a risk that our company would be considered overvalued based on this multiple. In order to mitigate some of this risk, each of Ping Chen, Zheng (Rita) Liu, Weibing Yang, Jian Sun and Yong Wang has agreed to place, on a prorated basis, that number of beneficially owned common shares into escrow that is equal to 40% of the maximum number of shares to be sold in this offering. These shares will be placed into escrow prior to the time we request effectiveness of the registration statement. Upon closing of this offering, the escrow agent will return any shares in excess of 40% of the actual number of shares sold in the offering. Such escrowed shares are referred to as the “Make-Good Shares.” The Make-Good Shares will remain in escrow with SunTrust Bank or another bank acceptable to our placement agent pending the filing of our company’s Form 10-K for the year ending December 31, 2010.

To the extent our audited after-tax earnings per share for the year ending December 31, 2010 are less than the target of $0.80, excluding any expenses associated with releasing the Make-Good Shares back to the original owners, our company will redeem and cancel, pro rata, the Make-Good Shares without any consideration to the extent necessary to cause our audited after-tax earnings per share to be equal to the target of $0.80. We cannot guarantee that we will be able to redeem a sufficient number of Make-Good Shares to increase audited after-tax earnings per share to the target of $0.80 if our company either has low net income or any net losses in 2010.

Any remaining Make-Good Shares will be released from escrow to our initial shareholders upon the earlier of (i) one (1) business day after the termination of this offering without closing or (ii) thirty (30) calendar days after the filing of the Form 10-K for the year ending December 31, 2010 after redeeming any Make-Good Shares. Additionally, notwithstanding any other terms of the Make-Good Escrow, if our shares trade at or above 2.5 times the price of this offering for a period of five trading days within a ten day trading period, the Make-Good Escrow will terminate and the Make-Good Shares will be released to the initial shareholders. Any delay in redeeming the Make-Good Shares will delay the release of such remaining Make-Good Shares from escrow.

We believe the Make-Good Escrow arrangement benefits the shareholders of our company (other than those who may forfeit shares without consideration) because it is designed to increase the likelihood that our company will achieve the after-tax earnings per share upon which our valuation is based. To the extent Make-Good Shares are redeemed without cost, the after-tax per-share earnings will increase for all remaining outstanding shares. While we believe the Make-Good Escrow arrangement is a benefit to our shareholders, we may be unable to redeem enough Make-Good Shares to reach our targeted 2010 after-tax earnings per share. This could occur if we either have net losses or substantially lower than anticipated earnings. If this were to happen, our audited after-tax earnings after redemption of the Make-Good Shares could be less than the target of $0.80 per share. See “Risk Factors – A redemption of Make-Good Shares may be insufficient to cause our company to achieve targeted earnings and may reduce our management’s involvement and stake in our company.”

Placement Agent’s Warrants

In connection with this offering, we will, for a nominal amount, sell our placement agent warrants exercisable at a rate of one warrant per share to purchase up to ten percent of the shares sold in the offering. These warrants are exercisable for a period of five years from the date of issuance at a price equal to 125% of the price of the shares in this offering. If we complete the maximum offering, then on the closing date we will issue 150,000 warrants to the placement agent to purchase one common share each. During the term of the warrants, the holders thereof will be given the opportunity to profit from a rise in the market

9

Table of Contents

price of our common shares, with a resulting dilution in the interest of our other shareholders. The terms on which we could obtain additional capital during the life of these warrants may be adversely affected because the holders of these warrants might be expected to exercise them when we are able to obtain any needed additional capital in a new offering of securities at a price greater than the exercise price of the warrants. If the placement agent exercises all of its warrants, we would have between 2.94% (minimum offering) and 3.33% (maximum offering) more shares outstanding after the placement agent’s warrant exercise than at the conclusion of the offering, assuming no other issuances (including any issuances under the share incentive plan). See “Placement.”

Corporate Information

Our principal executive offices are located at 1223 Epoch Center, No. 31 Zi Zhu Yuan Road, Haidian District, Beijing, People’s Republic of China (100089). Our website address is http://www.chinadhr.com. Information contained on our website or any other website is not a part of this prospectus.

10

Table of Contents

Summary Financial Information

In the table below, we provide you with summary financial data of our company. This information is derived from our consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected for any future period. When you read this historical selected financial data, it is important that you read it along with the historical statements and notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

| For the nine months ended |

For the fiscal year ended December 31, |

|||||||||||

| September 30, 2009 | 2008 | 2007 | ||||||||||

| (Unaudited) | ||||||||||||

| Revenue |

$ | 9,422,460 | $ | 9,414,430 | $ | 6,599,512 | ||||||

| Operating income |

2,586,824 | 1,496,086 | 970,622 | |||||||||

| Net income |

2,110,278 | 980,351 | 848,421 | |||||||||

| Non-controlling interest in income |

(38,502 | ) | (62,331 | ) | (53,214 | ) | ||||||

| Net income attributable to Dehaier |

2,071,776 | 918,020 | 795,207 | |||||||||

| Basic earnings per share (based on 1,891,930 shares outstanding on each of September 30, 2009, December 31, 2008 and 2007)(1) |

1.10 | 0.48 | 0.42 | |||||||||

| Diluted earnings per share (based on 3,000,000, 3,000,000 and 2,451,624 shares outstanding on September 30, 2009, December 31, 2008 and 2007, respectively)(1) |

0.69 | 0.31 | 0.32 | |||||||||

| Pro forma basic earnings per share (based on 1,291,930 shares outstanding on each of September 30, 2009 and December 31, 2008)(2) |

1.60 | 0.71 | N/A | |||||||||

| Pro forma diluted earnings per share (based on 2,400,000 shares outstanding on each of September 30, 2009 and December 31, 2008, respectively)(2) |

0.86 | 0.38 | N/A | |||||||||

| December 31, | ||||||||||||

| September 30, 2009 | 2008 | 2007 | ||||||||||

| (Unaudited) | ||||||||||||

| Total assets |

$ | 16,485,711 | $ | 13,046,400 | $ | 9,928,863 | ||||||

| Total current liabilities |

6,566,373 | 5,232,464 | 3,550,505 | |||||||||

| Total Dehaier shareholders’ equity |

8,676,245 | 6,608,704 | 5,310,499 | |||||||||

| Non-controlling interest |

1,243,093 | 1,205,232 | 1,067,859 | |||||||||

| Total liabilities and shareholders’ equity |

16,485,711 | 13,046,400 | 9,928,863 | |||||||||

| (1) | We have presented these basic and diluted earnings per share in Dehaier after giving retroactive effect to the 3.66140766-for-1 share split of common shares completed as of October 31, 2009. |

| (2) | We have presented these pro forma earnings per share after (a) giving retroactive effect to the 3.66140766-for-1 share split of our common shares completed as of October 31, 2009 and (b) assuming the redemption of all shares placed into escrow as described in the section entitled “Related Party Transactions – Make-Good Shares Subject to Redemption.” The number of escrowed shares is based on 600,000 common shares (40% of an assumed maximum of 1,500,000 common shares). Pro forma basic EPS for the nine months ended September 30, 2008 calculated on the foregoing assumptions and based on 1,291,930 Dehaier shares, is $0.40. Pro forma diluted EPS for the nine months ended September 30, 2008 calculated on the foregoing assumptions and based on 2,400,000 Dehaier shares, is $0.22. No pro forma numbers have been provided for the year ended December 31, 2007. |

11

Table of Contents

Investment in our securities involves a high degree of risk. You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision. The risks and uncertainties described below represent our known material risks to our business. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, you may lose all or part of your investment. You should not invest in this offering unless you can afford to lose your entire investment.

Risks Related to Our Business and Industry

Our quarterly revenues and operating results are difficult to predict and could fall below investor expectations, which could cause the trading price of our common shares to decline.

Our quarterly revenues and operating results have fluctuated in the past and may continue to fluctuate significantly depending upon numerous factors. In particular, during the period from April to May, we generally experience an increase in revenues associated with our attendance at the China International Medical Equipment Fair, the largest exhibition of medical equipment, related products and services in Asia-Pacific region. This fair occurs in the spring each year. In addition, we generally experience an increase in revenues in the period from September through November. This increase is associated with hospital purchasing designed to extinguish governmental budgets prior to the fiscal year end. We believe that our first quarter performance will generally decline as a result of the lack of business conducted during the Chinese Lunar New Year Holiday. To the extent our financial performance fluctuates significantly, investors may lose confidence in our business and the price of our common shares could decrease.

We may fail to effectively develop and commercialize new products, which could materially and adversely affect our business, financial condition, results of operations and prospects.

The respiratory and oxygen homecare market is developing rapidly and related technology trends are constantly evolving. This results in the frequent introduction of new products, short product life cycles and significant price competition. Consequently, our future success depends on our ability to anticipate technology development trends and identify, develop and commercialize in a timely and cost-effective manner the new and advanced products that our customers demand. New products contribute significantly to our revenues. In 2008, we developed three new products in the respiratory and oxygen homecare market. We expect the respiratory and oxygen homecare market to continue to evolve toward newer and more advanced products. Moreover, it may take an extended period of time for our new products to gain market acceptance, if at all. Furthermore, as the life cycle for a product matures, the average selling price generally decreases. In the future, we may be unable to offset the effect of declining average sales prices through increased sales volume and controlling product costs. Lastly, during a product’s life cycle, problems may arise regarding regulatory, intellectual property, product liability or other issues which may affect the product’s continued commercial viability. Whether we are successful in developing and commercializing new products will depend on our ability to:

| • | accurately assess technology trends and customer needs and meet market demands; |

| • | optimize our assembly and procurement processes to predict and control costs; |

| • | assemble and deliver products in a timely manner; |

| • | increase customer awareness and acceptance of our products; |

| • | minimize the time and costs required to obtain required regulatory clearances or approvals; |

| • | anticipate and compete effectively with other medical device developers, manufacturers and marketers; |

| • | price our products competitively; and |

| • | effectively integrate customer feedback into our research and development planning. |

Our revenues are highly dependent on a limited number of customers involved in China’s healthcare device industry.

For the years ended December 31, 2008 and 2007, and for the nine months ended September 2009 and 2008, approximately 11%, 17%, 8% and 7%, respectively, of our sales were from one customer, Poverty Aid Office.

We anticipate that our dependence on a limited number of customers will continue for the foreseeable future. Consequently, any one of the following events may cause material fluctuations or declines in our revenues:

| • | reduction, delay or cancellation of orders from one or more of our significant customers; |

12

Table of Contents

| • | loss of one or more of our significant customers and our failure to identify additional or replacement customers; and |

| • | failure of any of our significant customers to make timely payment for our products. |

To anticipate our client’s future needs, we must maintain a close relationship with our key customers. Any failure to maintain this close relationship, due to unsuccessful sales and marketing efforts, lack of suitable products, unsatisfactory performance or other reasons, could result in our losing a client and its business. If we lose a key customer or a portion of work we currently receive from it, a key customer significantly reduces its purchasing levels or delays a major purchase or we fail to attract additional major customers, our revenues could decline, and our operating results could be materially and adversely affected.

We sell our products primarily to distributors and our ability to add distributors will impact our revenue growth. Failure to maintain or expand our distribution network would materially and adversely affect our business.

With contractual relationships with over 2,000 independent distributors throughout China, we depend on sales to distributors for a significant majority of our revenues. Our distributors purchase all products ordered regardless of whether the products are ultimately sold. Products are not purchased by distributors on consignment, and distributors have no right to return unsold products. As our existing distributor agreements expire, we may be unable to renew such agreements on favorable terms or at all, and we do not own, employ or control these independent distributors. Furthermore, we actively manage our distribution network and regularly review the performance of each distributor. We may terminate agreements with distributors if we are not satisfied with their performance for any reason. We periodically terminate relationships with underperforming exclusive distributors. When an exclusive distributor in a particular geographic area fails to meet our expectations, then we are economically incentivized to replace that distributor with a new distributor so that area can be served as well as possible. We occasionally terminate a relationship with a non-exclusive distributor and are more likely to simply appoint another one; however, we have found that in some instances we are better served to replace an underperforming non-exclusive distributor with an exclusive distributor. Additionally, we have found that even in cases where there may not be an economic incentive to terminate a non-exclusive distributor, having the ability to replace a distributor often motivates distributors to increase their efforts to meet our expectations. This policy may make us less attractive to some distributors. In addition, we compete for distributors with other leading medical device companies who may enter into long-term distribution agreements, effectively preventing many distributors from selling our products. As a result, a significant amount of time and resources must be devoted to maintaining and growing our distribution network. Any disruption in our distribution network could have negative effects on our ability to sell our products, which would in turn materially and adversely affect our business, financial condition and results of operations.

We sell products for some of our competitors, some of which compete with our branded products.

We are the exclusive distributor in China for IMD, Timesco and JMS in the PRC. We are a non-exclusive regional distributor for ResMed. Our agreement with IMD does not prohibit us from selling X-ray units from other companies, and we provide four types of branded mobile and C-armed X-ray machines. Our agreements with Timesco, JMS, and ResMed contain provisions that limit our ability to sell products that compete with the products we sell for them. We do not currently sell any branded laryngoscopes, including any that would compete with those from Timesco. We also do not sell any infusion pumps or syringe pumps, including any that would compete with those from JMS. We do not currently sell any products to treat obstructive sleep apnea that would compete with those from ResMed; however, we have developed and are currently seeking SFDA approval for our DHR CPAP C5, DHR Auto CPAP A8 and DHR Auto S-CPAP A9. ResMed may claim that these products compete with the ResMed S6 and MAP MiniPAP and may seek to terminate our distribution agreement with them on that basis. The percentage of our total revenues attributable to the distribution agreement for the ResMed S6 and MAP MiniPAP was 1.86% and 0.58% for the years ended December 31, 2008 and 2007, respectively and 1.91% and 2.18% for the nine months ended September 30, 2009 and 2008, respectively.

In addition, our sales of X-ray machines that may compete with those from IMD and sleep apnea devices that may compete with those from ResMed could result in claims from our suppliers that we have favored our branded products over distributed products in marketing. Further, where our agreements with suppliers limit our ability to sell competing branded products, we may have to forego developing potentially profitable products. Any of these results could materially harm our business.

We rely on some of our competitors to supply component parts for our branded products.

We obtain some components from companies that are competitors in our market, including IMD and Spacelabs Medical Trading (Shanghai) Co., Ltd. None of these competitors supplies more than 4% of our components, and we are not reliant on them for such components. We do, however, provide detailed technical specifications to these competitors for use in producing components for our branded products. If these companies were to reverse-engineer or otherwise misappropriate such information, our business could be materially harmed.

13

Table of Contents

Although we do not own or control our distributors, the actions of these distributors may affect our business operations or our reputation in the marketplace.

Our distributors are independent from us, and as such, our ability to effectively manage their activities is limited. Distributors could take any number of actions that could have material adverse effects on our business. If we fail to adequately manage our distribution network or if distributors do not comply with our distribution agreements, our corporate image could be tarnished among end users, disrupting our sales. Furthermore, we could be liable for actions taken by our distributors, including any violations of applicable law in connection with the marketing or sale of our products, including China’s anti-corruption laws. Recently, the PRC government has increased its anti-bribery efforts in the healthcare sector to reduce improper payments received by hospital administrators and doctors in connection with the purchase of pharmaceutical products and medical devices. Our distributors may violate these laws or otherwise engage in illegal practices with respect to their sales or marketing of our products. If our distributors violate these laws, we could be required to pay damages or fines, which could materially and adversely affect our financial condition and results of operations. In addition, our brand and reputation, our sales activities or the price of our shares could be adversely affected if our company becomes the target of any negative publicity as a result of actions taken by our distributors.

We plan to expand our homecare and technical service products internationally and become a leader in selected international markets. Such expansion can be difficult and time consuming, and if unsuccessful our future profits would be materially and adversely affected.

While we currently operate exclusively in China, we envision competing in selected international markets with our homecare and technical service products. We intend to enter into markets in which we have limited or no experience and in which our brand may be less recognized. To the extent we are able to obtain approval to sell our branded products in the European Union, we currently plan to expand initially into Europe. We have not yet qualified or applied to do so, and we have no guarantee that we will be successful with any such application for approval. We plan to devote significant resources to marketing and promoting our brand internationally and attracting distributors in foreign markets. Success in international markets will depend on our ability to attract a sufficient number of distributors suitable for selling our branded products. Furthermore, in new markets we may fail to anticipate competitive conditions that are different from those in our existing markets. These competitive conditions may make it difficult or impossible for us to operate effectively in these markets.

Operation in international markets will also expose us to many other risks, including but not limited to:

| • | political instability; |

| • | economic instability and recessions; |

| • | changes in tariffs; |

| • | difficulties of administering foreign operations generally; |

| • | limited protection for intellectual property rights; |

| • | obligations to comply with a wide variety of foreign laws and other regulatory requirements; |

| • | financial condition, expertise and performance of international distributors; |

| • | export license requirements; |

| • | unauthorized re-export of our branded products; |

| • | inability to purchase our distributed products from international suppliers at competitive prices; |

| • | potentially adverse tax consequences; and |

| • | inability to effectively enforce contractual or legal rights. |

We are highly dependent on our key personnel such as key executives and research and development personnel.

We are highly dependent on the continued service of our key executives and other key personnel. In particular, we substantially rely on our chairman and chief executive officer Mr. Ping Chen to manage our business and operations. We also rely on key research and development personnel for the development of new products. In addition, we rely on customer service personnel for the installation and support of our products and on marketing and sales personnel, engineers and other personnel with technical and industry knowledge to market, sell, install and service our products. We have entered into standard one-year employment contracts with all of our officers and managers and other key personnel and one-year employment contracts with our other employees. These contracts prohibit our employees from engaging in any conduct or activity that would be competitive with our business during the course

14

Table of Contents

of their employment. Loss of any of our key personnel could severely disrupt our business. We may not be able to find suitable or qualified replacements, and will likely incur additional expenses in order to recruit and train any new personnel.

Competition for qualified management and key personnel in the medical technology field is intense and the pool of qualified candidates is limited. We not only compete with other medical device companies but also universities and other research institutions to attract and retain qualified personnel. This intense competition may force us to offer higher compensation and benefit packages in order to attract and retain the most qualified personnel. Our future success depends on our ability to attract and retain these individuals and failure to do so could result in severe disruptions to our business and growth.

Our business is subject to intense competition, which may reduce demand for our products and materially and adversely affect our business, financial condition, results of operations and prospects.

The medical device market is highly competitive, and we expect competition to intensify. Given the $585 billion stimulus initiative in China and its impact on healthcare, we expect the availability of healthcare to increase, as more hospitals and clinics are developed rurally.

We face direct competition from both domestic and international competitors across all product lines and price points. Our competitors also vary by product. Currently, our competitors include publicly traded and privately held multinational companies, such as Respironics, Inc., ResMed Inc., and Covidien, as well as domestic Chinese companies such as Beijing Aoji, Beijing Ya’ao, Jiangsu Yuyue and Zhejiang Longfei. As we expand into international sales, we expect our competitors will primarily be publicly traded and privately held multinational companies. We also expect to face competition in international sales from companies that have local operations in the markets in which we sell our products. Some of our larger competitors may have:

| • | greater financial and other resources; |

| • | larger variety of products; |

| • | more products that have received regulatory approvals; |

| • | greater pricing flexibility; |

| • | more extensive research and development and technical capabilities; |

| • | patent portfolios that may present an obstacle to our conduct of business; |

| • | greater knowledge of local market conditions where we seek to increase our international sales; |

| • | stronger brand recognition; and |

| • | larger sales and distribution networks. |

As a result, we may be unable to offer products similar to, or more desirable than, those offered by our competitors, market our products as effectively as our competitors or otherwise respond successfully to competitive pressures. In addition, our competitors may be able to offer discounts on competing products as part of a “bundle” of non-competing products, systems and services that they sell to our customers, and we may not be able to profitably match those discounts. Our competitors may develop technologies and products that are more effective than those we currently offer or that render our products obsolete or uncompetitive. The timing of the introduction of competing products into the market could affect the market acceptance and market share of our products. As we expect demand for our products to increase along with the availability of healthcare, we must continue to focus on competitive pricing and innovation by being at the forefront of market trends and improving our product and service offerings. Our failure to compete successfully could materially and adversely affect our business, financial condition, results of operation and prospects.