Attached files

| file | filename |

|---|---|

| EX-32.2 - China Ritar Power Corp. | v172968_ex32-2.htm |

| EX-31.1 - China Ritar Power Corp. | v172968_ex31-1.htm |

| EX-31.2 - China Ritar Power Corp. | v172968_ex31-2.htm |

| EX-32.1 - China Ritar Power Corp. | v172968_ex32-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

(Amendment

1)

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended: December 31, 2008

OR

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from __________ to ____________

Commission

File Number: 000-51908

CHINA

RITAR POWER CORP.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

87-0422564

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer Identification Number)

|

|

Room

405, Tower C, Huahan Building,

16

Langshan Road, North High-Tech Industrial Park, Nanshan

District,

Shenzhen,

China, 518057

|

|

|

(Address

of principal executive office and zip code)

|

|

|

(86)

755-83475380

|

|

|

(Registrant’s

telephone number, including area code)

|

|

|

Securities

registered pursuant to Section 12(b) of the Act: None.

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par value

$0.001

|

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes x No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of “large

accelerated filer,” “accelerated filer,” and “smaller reporting company” in

Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer o

|

Smaller

reporting

company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act). Yes o No x

As of

June 30, 2008, the aggregate market value of the shares of the Registrant’s

common stock held by non-affiliates (based upon the closing price of such shares

as reported on the Over-the-Counter Bulletin Board) was approximately $49.5

million. Shares of the Registrant’s common stock held by each executive officer

and director and by each person who owns 10 percent or more of the outstanding

common stock have been excluded in that such persons may be deemed to be

affiliates of the Registrant. This determination of affiliate status is not

necessarily a conclusive determination for other purposes.

As of

March 11, 2009 there were 19,134,992 shares of the Registrant’s common stock

outstanding.

Explanatory Note

China

Ritar Power Corp. (the “Company”) is filing this Amendment No. 1 to its Annual

Report on Form 10-K for the fiscal year ended December 31, 2008, as filed with

the Securities and Exchange Commission (“SEC”) on March 31, 2009 (the “Original

Filing”). The purpose of this amendment is to correct the entity name set forth

in exhibit 32.2 to the Original Filing to correctly refer to the Company. The

remainder of the Company’s Annual Report on Form 10-K remains

unchanged.

This

report speaks as of the filing date of the Original Filing and has not been

updated to reflect events occurring subsequent to March 31, 2009. Accordingly,

in conjunction with reading this Form 10-K/A, you should also read all other

filings that the Company has made with the SEC since the date of the Original

Filing.

CHINA

RITAR POWER CORP.

FORM

10-K

For

the Fiscal Year Ended December 31, 2008

|

Page

|

|||

|

PART

I

|

|||

|

Item

1.

|

Business

|

2

|

|

|

Item

1A.

|

Risk

Factors

|

10

|

|

|

Item

2.

|

Properties

|

18

|

|

|

Item

3.

|

Legal

Proceedings

|

19

|

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

19

|

|

|

PART

II

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

19

|

|

|

Item

6.

|

Selected

Financial Data

|

20

|

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

20

|

|

|

Item

8.

|

Financial

Statements and Supplementary Financial Data

|

34

|

|

|

Item

9.

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

34

|

|

|

Item

9A(T)

|

Controls

and Procedures

|

36

|

|

|

Item

9B.

|

Other

Information.

|

36

|

|

|

PART

III

|

|||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

37

|

|

|

Item

11.

|

Executive

Compensation

|

40

|

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

41

|

|

|

Item

13.

|

Certain

Relationships and Related Party Transactions, and director

independence

|

42

|

|

|

Item

14.

|

Principal

Accountant Fees and Services

|

43

|

|

|

PART

IV

|

|||

|

Item

15.

|

Exhibits,

Financial Statements Schedules

|

44

|

Use

of Term

Except as

otherwise indicated by the context, all references in this annual report to (i)

“Ritar,” the “Company,” “we,” “us” or “our” are to China Ritar Power Corp., a

Nevada corporation, and its direct and indirect subsidiaries; (ii) “Ritar BVI”

are to our subsidiary Ritar International Group Limited, a British Virgin

Islands corporation, and/or its operating subsidiaries, as the case may be;

(iii) “Shenzhen Ritar” are to our subsidiary Shenzhen Ritar Power Co., Ltd., a

corporation incorporated in the People’s Republic of China; (iv) “Shanghai

Ritar” are to our subsidiary Shanghai Ritar Power Co., Ltd., a corporation

incorporated in the People’s Republic of China; (v)“Securities Act” are to the

Securities Act of 1933, as amended; (vi) “Exchange Act” means the Securities

Exchange Act of 1934, as amended; (vii) “RMB” are to Renminbi, the legal

currency of China; (viii) “U.S. dollar,” “$” and “US$” are to the legal currency

of the United States; (ix) “China” and “PRC” are to the People’s Republic of

China; (x) “BVI” are to the British Virgin Islands; and (xi) “SEC” are to the

United States Securities and Exchange Commission.

Forward-Looking

Statements

Statements

contained in this annual report include “forward-looking statements” within the

meaning of such term in Section 27A of the Securities Act and Section 21E of the

Exchange Act. Forward-looking statements involve known and unknown risks,

uncertainties and other factors which could cause actual financial or operating

results, performances or achievements expressed or implied by such

forward-looking statements not to occur or be realized. Forward-looking

statements made in this Report generally are based on our best estimates of

future results, performances or achievements, predicated upon current conditions

and the most recent results of the companies involved and their respective

industries. Forward-looking statements may be identified by the use of

forward-looking terminology such as “may,” “will,” “could,” “should,” “project,”

“expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,”

“potential,” “opportunity” or similar terms, variations of those terms or the

negative of those terms or other variations of those terms or comparable words

or expressions. Potential risks and uncertainties include, among other things,

such factors as:

|

·

|

our

heavy reliance on limited number of consumers;

|

|

|

·

|

strong

competition in our industry;

|

|

·

|

increases

in our raw material costs; and

|

|

|

·

|

an

inability to fund our capital

requirements.

|

Additional

disclosures regarding factors that could cause our results and performance to

differ from results or performance anticipated by this annual report are

discussed in Item 1A. “Risk Factors.” Readers are urged to carefully review and

consider the various disclosures made by us in this annual report and our other

filings with the SEC. These reports attempt to advise interested parties of the

risks and factors that may affect our business, financial condition and results

of operations and prospects. The forward-looking statements made in this annual

report speak only as of the date hereof and we disclaim any obligation to

provide updates, revisions or amendments to any forward-looking statements to

reflect changes in our expectations or future events.

1

PART

I

|

ITEM

1.

|

BUSINESS

|

Overview

We are

one of the leading manufacturers of lead-acid batteries in China. Through our

Chinese subsidiaries, we design, develop, manufacture and sell environmentally

friendly lead-acid batteries with a wide range of applications and capacities,

including telecommunications, uninterrupted powers source devices, light

electric vehicles and alternative energy production (solar and wind power). We

conduct all of our operations in China. Our access to China’s supply of low-cost

skilled labor, raw materials, machinery and facilities enables us to price our

products competitively in an increasingly price-sensitive market. We market,

sell and service our 6 series and 197 models of “Ritar” branded, cadmium-free,

valve-regulated lead-acid, or VRLA, batteries in China and

internationally.

Our

client base mainly includes alternative energy production manufacturers such as

Suntech, and Servico e Desenvolvimento S.A, Angola, international

uninterruptible power source, or UPS, manufacturers, including Delta Electronics

(Jiangsu) Ltd. and SSB Battery Service GmbH, and telecommunications operators

such as Bharti Infratel Limited, India, Smart communications Inc ., Philippines

, China Telecom Corporation Limited, China Mobile Communication Corporation,

China Network Communications Group Corporation, Siemens AG, and Lucent

Technologies. A majority of our products are sold outside of China, with

overseas sales accounting for 76.2% of our total revenue in fiscal year 2008.

Our major export markets are India, Italy, Germany, the United States, Australia

and Brazil.

Through

our manufacturing facilities located in Shenzhen and Shanghai, we currently have

19 lead acid battery production lines that are operational. Three of them are

located at Shanghai Ritar, eleven production lines are located at Shenzhen

Ritar, and five production lines are located at Hengyang Ritar. Our current

annual designed production capacity of lead acid battery is approximately 2.51

million kilowatt-hours. We have completed construction of the first phase of our

new technical and manufacturing complex in Hengyang City, Hunan Province and

Lead acid battery production at this facility began in April 2008. In addition,

in July of 2008, production of lead plates began at the Hengyang

facility.

History

and Corporate Structure

We were

originally organized under the laws of the State of Utah on May 21, 1985 under

the name Concept Capital Corporation. On July 7, 2006, in order to change the

domicile of Concept Capital Corporation from Utah to Nevada, Concept Capital

Corporation merged with and into Concept Ventures Corporation, a Nevada

corporation. From our inception in 1985 until February 16, 2007 when we

completed a reverse acquisition transaction with Ritar International Group

Limited, a BVI company, whose subsidiary companies originally commenced business

in May 2002, we were a blank check company and did not engage in active business

operations other than our search for, and evaluation of, potential business

opportunities for acquisition or participation.

On

February 16, 2007, we acquired Ritar BVI through a share exchange transaction

pursuant to which the stockholders of Ritar BVI transferred all capital stock of

Ritar BVI to us in exchange for a majority ownership of our Company. Our

acquisition of Ritar BVI is accounted for as a recapitalization effected by a

share exchange, wherein Ritar BVI is considered the acquirer for accounting and

financial reporting purposes. The assets and liabilities of the acquired entity

have been brought forward at their book value and no goodwill has been

recognized.

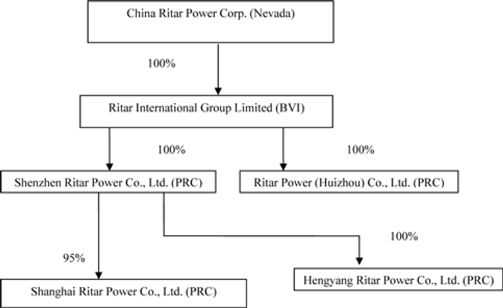

The

following chart reflects our organization structure as of the date of this

annual report.

2

Business

Strategy

Our goal

is to build on our existing strengths to become a global leader in the

development and manufacturing of lead-acid batteries. We are committed to

providing high quality products, responsive service and competitive prices in

the niche market of lead-acid batteries. We intend to profitably grow our

business by pursuing the following strategies:

|

·

|

Increase production

capacity. The construction of the first phase of our new technical

and manufacturing complex at our wholly-owned subsidiary Hengyang Ritar

Power Co., Ltd., or Hengyang Ritar, has been completed and our lead acid

battery production began in April of 2008. The new production lines

increased our production capacity for lead acid batteries by about 100% by

the end of 2008. In addition, in July of 2008, the production of lead

plates commenced at Hengyang Ritar.

|

|

·

|

Improve production

cost-efficiency through vertical integration. Hengyang Ritar is

strategically located near lead mining reserves in Shuikou Shan, Hunan,

which will allow us to more readily secure a long-term supply of lead for

our batteries. In July of 2008, Hengyang Ritar commenced production of

lead plates, which comprises approximately 70.2% of the total cost of lead

acid batteries. We expect that vertically integrating the production of

lead plates will provide an approximate 3%-5% improvement in gross margins

for the Company in the long-term.

|

|

·

|

Targeting niche applications.

We target niche applications within the lead acid battery market,

avoiding the highly competitive automotive market. Our batteries are

primarily used in UPS, telecommunications, alternative energy (solar and

wind power), and LEV applications. We expect that in these markets, where

our gel compound/photovoltaic batteries have demonstrated competitive

advantages, our revenues will grow at faster rates than the overall

economy for the next few years.

|

|

·

|

Strengthen our research and

development efforts. We intend to continue to strengthen our

research and development capacities in order to provide high-quality

products and a wide spectrum of value-added services and further build up

our brand in both Chinese and the international market. In particular, our

research and development efforts will focus on the

following:

|

|

o

|

Developing

our Nano Battery, which has a higher storage capacity, longer life cycle

and higher discharge rate than our other lead acid battery products with

the same storage capacity, yet will be smaller and lighter. We expect to

be the first company in China for commercial production of this

product.

|

3

|

o

|

Developing

United Liquid Alloy Batteries, which have longer life cycle and weigh less

than half of our other lead acid batteries with the same storage

capacity.

|

Our

Products

We

market, sell and service our six series and 197 models of “Ritar” branded valve

regulated lead-acid batteries in China and Internationally.

Our

battery series, applicable voltage, capacity and applications are as

follows:

|

Series

Name

|

Voltage

|

Capacity

(Ampere-

hour

or AH)

|

Application

|

|||

|

RT

Series

|

2V

4V

6V

8V

10V

12V

18V

24V

36V

|

Less

than or equal to

28AH

|

UPS

Emergency

lights

Automatic

control systems

Medical

equipment

Electric

toys and tools

|

|||

|

RA

Series

|

6V

12V

|

28AH

– 240AH

|

UPS

Telecommunications

and power systems

Automatic

control systems

Solar

and wind powered systems

Medical

equipment

|

|||

|

RL

Series

|

2V

|

200AH

|

Emergency

power system, or EPS

Telecommunications

and power systems

Automatic

control systems

Solar

and wind powered systems

|

|||

|

Gel

Series

|

2V

|

UPS

Telecommunications

and power systems

Automatic

control systems

Solar

and wind powered systems

|

||||

|

LEV

Series

|

12V

|

14AH

22AH

24AH

(20 hours)

|

Electric

bicycles

Electric

motorcycles

Electric

three wheelers

Golf

carts

Electric

scooters

|

|||

|

FT

Series

|

12V

|

55AH

– 180AH

|

UPS

EPS

Telecommunications

and power systems

Automatic

control systems

Solar

and wind powered systems

|

Sales of

our products can be categorized among the different applications for our

products. These applications consist of:

|

·

|

UPS

– a device which maintains a continuous supply of electric power to

connected equipment by supplying power from a separate source when utility

power is not available. While not limited to any particular type of

equipment, a UPS is typically used to protect computers, telecommunication

equipment or other computer-controlled electrical equipment where an

unexpected power disruption could cause injuries, fatalities, serious

business disruption or data loss

|

4

|

·

|

LEV

– basically electric bicycles, electric motorcycles, electric scooters,

electric three wheelers, and electric golf

carts

|

|

·

|

Telecommunications

– such as wireless, wire line and internet access systems, central and

local switching systems, satellite stations and radio transmission

stations

|

|

·

|

Power

– used in electric utilities and energy

pipelines

|

|

·

|

EPS

and alarm systems

|

|

·

|

Others

(electric toys, solar power and wind

power)

|

Manufacturing

Our

manufacturing facilities are located in Shenzhen, Shanghai and Hengyang in the

PRC. We currently have 19 lead acid battery production lines that are

operational. Three of them are located at Shanghai Ritar, eleven production

lines are located at Shenzhen Ritar, five production lines are located at

Hengyang Ritar. Our current annual designed production capacity of lead acid

battery is approximately 2.51 million kilowatt-hours. We have completed

construction of the first phase of our new technical and manufacturing complex

in Hengyang City, Hunan Province and Lead acid battery production at this

facility began in April 2008. In addition, in July of 2008, production of lead

plates began at the Hengyang facility.

Raw

Materials

We have

developed a complete supply chain utilizing a group of primarily Chinese

material and equipment suppliers.

The major

components of lead-acid batteries are the positive and negative lead plates,

which account for approximately 78% of the total cost of raw materials, and the

battery case, including the battery container, cover and top lid, accounting for

over 12% of the total cost of raw materials. The remaining portion of our raw

materials cost is comprised of the separators, electrolytes, active substances

and other miscellaneous raw materials used in the production of our products.

The prices of these raw materials are determined according to prevailing market

conditions, supply and demand.

Our

sourcing system and good business relationships with leading raw materials

manufacturers, particularly manufacturers of positive and negative lead plates

(an important factor for lead-acid battery manufacturers), ensures quality,

stability and availability of the raw materials used to produce our products. We

have maintained stable and good relationships with all of these suppliers since

the commencement of our business in 2002.

Lead is

the most important raw material used in the production of our products. The cost

of lead accounts for approximately 80.5% of the total cost of positive and

negative lead plates, and approximately 62.8% of the total cost of raw

materials.

We take

the following measures to mitigate the adverse effects of fluctuations in the

cost of lead:

|

·

|

We

enter into fixed-term (generally one year) and fixed-priced agreements

with plate suppliers.

|

|

·

|

Since

2004, we have provided in our agreements with our clients that the price

of our products will rise 0.6% every time the price of lead increases by

1%. Because lead is traded on the world’s commodity markets and its price

fluctuates daily, our lead price is based on the average price in Shanghai

Nonferrous Metals (the net web). Meanwhile, we also agree that the price

changes of our products only occur if the lead price rises or decreases

over RMB 500 (approximately $73) per

ton.

|

5

|

·

|

Our

research and development department and production department jointly

initiated a design improvement process intended to reduce the costs of raw

materials without sacrificing product

quality.

|

|

·

|

Hengyang

Ritar is strategically located near lead mining reserves in Shuikou Shan,

Hunan, which will allow us to more readily secure a long-term supply of

lead for our batteries.

|

China has

also already announced new measures to adjust the export tax rebate. This

announcement came on September 14, 2006 and was effective September 15, 2006. As

a result of this measure, the export rebate tax previously imposed on lead-acid

batteries was abolished. We expect the Chinese government to introduce other

measures which will increase the supply of lead to the Chinese lead market and

which should reduce the cost of lead in the Chinese market. Regardless of the

introduction of such governmental measures, lead prices have decreased as a

result of the downturn in the global economy.

Customers

We serve

about 800 clients in 81 countries with approximately $28.4 million, or 23.8%, of

our net sales in fiscal year 2008 attributable to China and $91.2 million, or

76.2%, attributable to other countries. Our overseas sales cover 80 countries,

such as India, Italy, Germany, the United States, Australia and Brazil. Our

overseas sales accounted for approximately 76.2%, 64.6% and 47.0% of total sales

for the years ended December 31, 2008, 2007 and 2006, respectively.

We

market, sell and service our products nationally and globally through a

combination of company-owned offices and independent manufacturers’

representatives. We believe we are well positioned to meet our clients’ delivery

and servicing requirements. We have targeted our approach to meet local market

conditions, which we believe provides the best possible service for our regional

clients and our global accounts.

We serve

a broad client base of LEV manufacturers, international UPS manufacturers, and

telecommunications operators. The following table provides information on our

top ten clients in fiscal years 2008.

|

TOP TEN CLIENTS IN

2008

|

|

No.

|

Name

|

Description of

Client

|

Sales

(in thousands

of US dollars)

|

Percentage of

Total Sales

|

||||||

|

1

|

Bharti

Infratel Limited

|

Telecommunications

operator in India

|

6,513

|

5.4

|

%

|

|||||

|

2

|

Sanat

Rayan Pars Ltd

|

UPS

battery distributor in Hongkong

|

6,266

|

5.2

|

%

|

|||||

|

3

|

OKIN

Gesellschaft fur Antriebstechnik GmbH

|

Massage

chair manufacturer in China

|

4,610

|

3.8

|

%

|

|||||

|

4

|

Smart

communications Inc.

|

Telecommunications

supplier in Philippines

|

4,186

|

3.5

|

%

|

|||||

|

5

|

SSB

Battery Service GmbH

|

UPS

battery distributor in Germany

|

3,423

|

2.9

|

%

|

|||||

|

6

|

Electrical

APAC Region Eaton

|

UPS

manufacturer in China

|

3,318

|

2.8

|

%

|

|||||

|

7

|

Shandong

Shenyang Electric Co. Ltd.

|

Telecommunications

supplier in China

|

3,296

|

2.8

|

%

|

|||||

|

8

|

Unicoba

Ind.De Comp.Eletronicos Einformatica Ltda.

|

UPS

manufacturer in Brazil

|

2,395

|

2.0

|

%

|

|||||

|

9

|

Material

In Motion

|

UPS

manufacturer in USA

|

2,286

|

1.9

|

%

|

|||||

|

10

|

Whitesand

Capital Inc.

|

Telecommunications

supplier in Russia

|

2,215

|

1.9

|

%

|

|||||

|

Total

|

38,510

|

32.2

|

%

|

|||||||

6

Sales

and Marketing

For

domestic sales, we have about 600 domestic original equipment manufacturers, or

OEM clients that we sell our products to directly. Our domestic sales accounted

for about 23.8%, 35.4% and 53.0% of total sales for the years ended December 31,

2008, 2007 and 2006, respectively.

Our

overseas (outside of China) sales cover 80 countries, such as India, Italy,

Germany, the United States, Australia and Brazil. Our overseas sales accounted

for approximately 76.2%, 64.6% and 47.0% of total sales for the years ended

December 31, 2008, 2007 and 2006, respectively. Our sales staff continually

works to explore new and better ways to provide services, as a core part of the

company’s business strategy.

Our

marketing approach focuses on the demands of our clients. We develop new

business by identifying and contacting potential new clients through referrals

or as a result of new clients contacting us because of our reputation in the

industry. Prospective clients are invited to evaluate our research and

development capabilities, tour our production facilities, review our quality

control functions, and discuss other operating aspects of our business with our

management. If a prospective client retains us, we normally initially enter into

small volume sales contracts. We undertake a series of tests on the performance

of the products that we will produce for the new client and then begin to supply

these products to the client in small batches. Typically, the purchase volume

will then grow over time. Eventually, we strive to become a major supplier to

each of our clients. The time that this process takes varies for different

product segments, different markets and different clients. For example, it

usually takes from one week to one month for Chinese LEV market clients and one

to two months for the UPS market segment. While in the overseas market, it

usually takes half a year to one year for us to become the supplier because all

of our overseas clients are high-end OEMs. Furthermore, sales in China have

relatively higher margins, a larger potential market and large number of

potential customers, but the overseas sales are relatively more stable, and are

less of a credit risk.

We work

to strengthen our market presence through various types of campaigns. We

participate in several domestic and international trade fairs such as CeBIT,

which is the world’s largest trade fair showcasing digital IT and

telecommunications solutions for home and work environments. We also participate

in SuperComm, the

world’s premier annual communications and information technology exhibition and

conference, each year to raise our recognition and promote our products

internationally. These trade fairs not only promote our company reputation, but

also our brand name.

Competition

Foreign

battery companies are seeking to take advantage of growth of the Chinese battery

market. These foreign battery manufacturers also desire to reduce production

costs. Many foreign battery manufacturers are investing in joint ventures or

investing directly in China. At present, Japanese companies like Panasonic are

setting up plants in China.

Many new

energy storage technologies, other than lead acid, which have been introduced

over the past several years, also compete with our products for customers who

may decide to use these new battery technologies instead of our products. In

addition, we now face potential competition from fuel cell manufacturers as a

result of recent developments in fuel cell technology.

7

We

compete based upon the price and quality of our products, ability to produce a

diverse range of products and customer service. In the UPS and telecommunication

product segments, which we believe are our fastest growing segments, we compete

principally with Harbin Guangyu Battery Co., Ltd., or Guangyu, and Exide

Technologies, or Exide.

We

believe that the price of our products is significantly lower than that of Exide

and approximately equivalent to the prices charged by our other competitors. We

believe that the quality of our products is superior to the quality of Guangyu’s

products, but is equivalent to the quality of Exide’s products. Our product mix

is more diverse than the product mix of all of our competitors. Finally, we

believe that our customer service is better than that of our

competitors.

Intellectual

Property

We

currently have the following patents either issued or pending

approval:

|

Patent Name

|

Patent type

|

Patent

No./Application No.

|

Expiration

Date

|

Status

|

|||||

|

Construct

of Sealed

terminal

of VRLA battery

|

Utility

Model

|

|

ZL 200420042736.7

|

|

February 17, 2014

|

Approved

|

|||

|

Nano-Silicon

Fiber Stationary

Storage

lead acid battery

|

Invention Patent

|

200610061139.2

|

N/A

|

Pending

|

|||||

|

Nano-Silicon

Fiber Stationary

Storage

lead acid battery

|

Utility

Model

|

ZL

200620014068.6

|

May

18, 2016

|

Approved

|

|||||

We have

registered the trademark for the logo  with the

Trademark Office of the State Administration for Industry and Commerce of China.

We use our trademark for the sales and marketing of our products. Our trademark

expires in August 2013 and may be continually renewed thereafter.

with the

Trademark Office of the State Administration for Industry and Commerce of China.

We use our trademark for the sales and marketing of our products. Our trademark

expires in August 2013 and may be continually renewed thereafter.

with the

Trademark Office of the State Administration for Industry and Commerce of China.

We use our trademark for the sales and marketing of our products. Our trademark

expires in August 2013 and may be continually renewed thereafter.

with the

Trademark Office of the State Administration for Industry and Commerce of China.

We use our trademark for the sales and marketing of our products. Our trademark

expires in August 2013 and may be continually renewed thereafter.In

addition, we protect our know-how technologies through confidentiality

provisions of the employment contracts we enter into with our

employees.

Research

and Development Efforts

We

currently operate one research and development center located in Shenzhen. As of

December 31, 2008, we had 79 research and development staff (26 of whom hold

Master/PhD degrees) who independently manage new product development projects.

Our research and development center’s mission is to develop advanced

technologies, advanced battery materials, new gel and photovoltaic battery

development, and training.

Unlike

other major lead-acid battery manufacturers, we do not solely depend on

joint-development programs with universities. Instead, we emphasize the

independent development of proprietary technology. Our Chief Technology Officer,

Mr. He, has led our research and development team’s efforts relating to the

development of several series of new products, including, the LEV battery

series, and gel battery series (including solar energy storage batteries), all

of which are revenue generating products for us. All of these new products

contribute and we expect that they will continue to contribute revenues to us in

the future.

8

During

the fiscal years 2008, 2007 and 2006, our research and development expenses

amounted to approximately $0.47, $0.27 million and $0.21 million, representing

approximately 0.39%, 0.36% and 0.52% of our sales, respectively. These expenses

were mainly composed of staff costs and depreciation of testing equipment used

in a variety of projects and other research and development

expenses.

Employees

As of

December 31, 2008, we had about 1700 full-time employees. The following table

illustrates the allocation of these employees among the various job functions

conducted at our company.

|

Department

|

Number of Employees

|

|||

|

Production

|

1,294

|

|||

|

Quality

Control

|

132

|

|||

|

Domestic

Sales

|

25

|

|||

|

After

Sales Service

|

15

|

|||

|

Human

Resources

|

45

|

|||

|

Planning

and Material Center

|

35

|

|||

|

Research

and Development

|

79

|

|||

|

International

Sales

|

60

|

|||

|

Finance

|

15

|

|||

|

Total

|

1,700

|

|||

We

believe that our relationship with our employees is good. The remuneration

payable to employees includes basic salaries and allowances. We have not

experienced any significant problems or disruption to our operations due to

labor disputes, nor have we experienced any difficulties in recruitment and

retention of experienced staff.

As

required by applicable Chinese laws, we have entered into employment contracts

with all of our officers, managers and employees.

Our

employees in China participate in a state pension scheme organized by Chinese

municipal and provincial governments. We are required to contribute to the

scheme at a rate of 8% of the average monthly salary. In addition, we are

required by Chinese laws to cover employees in China with various types of

social insurance. We have purchased required social insurance for all of our

employees.

Regulation

Since our

operating subsidiaries Shenzhen Ritar, Hengyang Ritar and Shanghai Ritar are

located in China, we are subject to a variety of PRC environmental laws and

regulations related to air emission, noise, water discharge and storage and

disposal of solid and hazardous wastes. The primary environmental regulations

applicable to us include the PRC Environmental Protection Law, the PRC Law on

the Prevention and Control of Water Pollution and its Implementation Rules, the

PRC Law on the Prevention and Control of Air Pollution and its Implementation

Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and

the PRC Law on the Prevention and Control of Noise Pollution. Our production

sites in the PRC are also subject to regulation and periodic monitoring by the

relevant environmental protection authorities.

9

We

believe that it is important to carry out our operations in an environmentally

friendly manner. As such, we attempt to reduce the consumption of natural

resources in our operations as much as possible. We also take steps to ensure

that waste and by-products produced as a result of our operations are properly

disposed of in accordance with applicable laws so as to minimize adverse effects

to the environment. These steps include : (1) making sure there is no waste

water drained off from our operations; (2) entering into an agreement with Waste

Disposal Station, Bao’an District, Shenzhen for wasted acid and hazardous

materials disposal; (3) collectively recycling the wasted old materials of the

productions by Qiaotou Village Committee; (4) hiring professional waste battery

recycling companies to be in charge of waste batteries within the territory of

PRC; and (5) being a member of Portable Rechargeable Battery Association, or

PRBA an international organization which endeavors to obtain consistent domestic

and international solutions to environmental and other selected issues affecting

the use, recycling and disposal of small sealed rechargeable batteries. We have

signed a recycling agreement with PRBA which authorizes PRBA to be in charge of

battery recycling outside the territory of PRC.

In

addition, we are also subject to PRC’s foreign currency regulations. The PRC

government has control over RMB reserves through, among other things, direct

regulation of the conversion or RMB into other foreign currencies. Although

foreign currencies which are required for “current account” transactions can be

bought freely at authorized Chinese banks, the proper procedural requirements

prescribed by Chinese law must be met. At the same time, Chinese companies are

also required to sell their foreign exchange earnings to authorized Chinese

banks and the purchase of foreign currencies for capital account transactions

still requires prior approval of the Chinese government.

|

ITEM

1A.

|

RISK

FACTORS

|

RISKS

RELATED TO OUR BUSINESS

We

operate in an extremely competitive industry and are subject to continual

pricing pressure that could negatively affect our financial

results.

We

compete with a number of major domestic and international manufacturers and

distributors of lead-acid batteries, as well as a large number of smaller,

regional competitors. Due to excess capacity in some sectors of our industry,

consolidation among industrial battery purchasers and the financial difficulties

experienced by several of our competitors, we have been subject to continual and

significant pricing pressures. Several of our competitors have strong technical,

marketing, sales, manufacturing, distribution and other resources, as well as

significant name recognition, established positions in the market and

long-standing relationships with original equipment manufacturers and other

customers. In addition, some of our competitors own lead smelting facilities

which, during periods of lead cost increases or price volatility, may provide a

competitive pricing advantage and reduce their exposure to volatile raw material

costs. Our ability to maintain and improve our operating margins has depended,

and continues to depend, on our ability to control and reduce our costs. We

cannot assure you that we will be able to continue to reduce our operating

expenses, to raise or maintain our prices or increase our unit volume, in order

to maintain or improve our operating results.

Cyclical

industry conditions have adversely affected, and may continue to adversely

affect, the results of our operations.

Our

operating results are affected by the general cyclical pattern of the industries

in which our major customer groups operate, and the overall economic conditions

in which we and our customers operate. All of our target client segments are

heavily dependent on the end-user markets they serve, such as LEV,

telecommunications, and uninterruptible power systems. A weak capital

expenditure environment in these markets has had, and can be expected to have, a

material adverse effect on the results of our operations.

Our

results of operations can be significantly affected by the volatility in the

prices of the raw materials that we use to produce our products.

Our raw

materials costs are volatile and expose us to significant fluctuations in our

product costs. We employ significant amounts of lead, plastics, and other

materials in our manufacturing processes. Lead is our most significant raw

material and represents approximately 63.7% of our total raw materials costs.

The costs of these raw materials, particularly lead, are volatile and beyond our

control. Volatile raw materials costs can significantly affect our operating

results and make period-to-period comparisons extremely difficult. We may not be

able to hedge our raw material requirements at a reasonable cost or to pass on

to our customers the increased costs of our raw materials.

10

Compliance

with environmental regulations can be expensive, and our failure to comply with

these regulations may result in adverse publicity and a material adverse effect

on our business.

As a

manufacturer, we are subject to various Chinese environmental laws and

regulations on air emission, waste water discharge, solid wastes and noise.

Although we believe that our operations are in substantial compliance with

current environmental laws and regulations, we may not be able to comply with

these regulations at all times as the Chinese environmental legal regime is

evolving and becoming more stringent. Therefore, if the Chinese government

imposes more stringent regulations in the future, we will have to incur

additional and potentially substantial costs and expenses in order to comply

with new regulations, which may negatively affect our results of operations. If

we fail to comply with any of the present or future environmental regulations in

any material aspects, we may suffer from negative publicity and may be required

to pay substantial fines, suspend or even cease operations. Failure to comply

with Chinese environmental laws and regulations may materially and adversely

affect our business, financial condition and results of operations.

Our

failure to introduce new products and product enhancements and broad market

acceptance of new technologies introduced by our competitors could adversely

affect our business.

Many new

energy storage technologies, other than lead-acid, have been introduced over the

past few years. In addition, recent advances in fuel cell and flywheel

technology have been introduced for use in selected applications that compete

with the end uses for lead-acid industrial batteries. For many important and

growing markets, such as aerospace and defense, lithium-based battery

technologies have large and growing market shares and lead-acid technologies

have decreasing market shares. Our ability to achieve significant and sustained

penetration of key developing markets, including aerospace and defense, will

depend upon our success in developing or acquiring these and other technologies,

either independently, through joint ventures or through acquisitions. If we fail

to develop or acquire, and to manufacture and sell, products that satisfy our

customers’ demands, or if we fail to respond effectively to new product

announcements by our competitors by quickly introducing competitive products,

market acceptance of our products could be reduced and our business could be

adversely affected.

We

may not be able to adequately protect our proprietary intellectual property and

technology, which may harm our competitive position and result in increased

expenses incurred to enforce our rights.

We rely

on a combination of copyright, trademark, patent and trade secret laws,

non-disclosure agreements and other confidentiality procedures and contractual

provisions to establish, protect and maintain our proprietary intellectual

property and technology and other confidential information. Some of these

technologies, especially in thin plate pure lead technology, are important to

our business and are not protected by patents. Despite our efforts, the steps we

have taken to protect our proprietary intellectual property and technology and

other confidential information may not be adequate to preclude misappropriation

of our proprietary information or infringement of our intellectual property

rights. Protecting against the unauthorized use of our products, trademarks and

other proprietary rights is also expensive, difficult and, in some cases,

impossible. Litigation may be necessary in the future to enforce or defend our

intellectual property rights, to protect our trade secrets or to determine the

validity and scope of the proprietary rights of others. Such litigation could

result in substantial costs and diversion of management resources, either of

which could harm our business, operating results and financial

condition.

Product

branding is important to us and if our brands are misappropriated or our

reputation otherwise harmed, our operations and financial results could be

negatively impacted.

We rely

upon a combination of trademark, licensing and contractual covenants to

establish and protect the brand names of our products. We have registered our

trademark in the Trademark Office of China. In many market segments, our

reputation is closely related to our brand names. Monitoring unauthorized use of

our brand names is difficult, and we cannot be certain that the steps we have

taken will prevent their unauthorized use, particularly in foreign countries

where the laws may not protect our proprietary rights as fully as in China. Our

brand names may be misappropriated or utilized without our consent and such

actions may have a material adverse effect on our reputation and on the results

of our operations.

11

If

we grow through acquisitions and fail to successfully integrate acquired

companies, our operations could be disrupted and management could become

distracted by integration issues.

As part

of our business strategy, we plan to grow in part by acquiring other product

lines, technologies or facilities that complement or expand our existing

business. We may be unable to implement this part of our business strategy and

may not be able to make acquisitions to continue our growth. There is

significant competition for acquisition targets in the industrial battery

industry. We may not be able to identify suitable acquisition candidates or

negotiate attractive terms. In addition, we may have difficulty obtaining the

financing necessary to complete transactions that we pursue. Future acquisitions

may involve the issuance of our equity securities as payment, in part or in

full, for the businesses or assets acquired. Any future issuances of equity

securities would dilute your ownership interests. In addition, future

acquisitions might not increase, and may even decrease, our earnings or earnings

per share and the benefits derived by us from an acquisition might not outweigh

or might not exceed the dilutive effect of the acquisition. We also may incur

additional debt or suffer adverse tax and accounting consequences in connection

with any future acquisitions, although we currently do not have any identified

future acquisition targets.

Where we

are successful in completing acquisitions, we might experience difficulties in

integrating the acquired business or assets. Acquisitions might result in

unanticipated liabilities, unforeseen expenses and distraction of management’s

time and attention. We cannot assure you that our acquisition strategy will be

successful.

A

significant portion of our sales are derived from a limited number of customers,

and results from operations could be adversely affected and stockholder value

harmed if we lose these customers.

A

significant portion of our revenues has been historically derived from a limited

number of customers. For the fiscal years ended December 31, 2008, 2007 and

2006, over 32.2 %, 41% and 45% of our revenues, respectively, were derived from

our ten largest customers. The loss of any of these significant customers that

is not accompanied by the retention of new business in similar volume would

adversely affect our revenues and stockholder value.

Our

products could be subject to product liability claims by customers and/or

consumers, which would adversely affect our profit margins, results of

operations and stockholder value.

A

significant portion of our products are used in light electric vehicles, such as

electric scooters. If our products are not properly designed or built and/or

personal injuries are sustained as a result of our equipment, we could be

subject to claims for damages based on theories of product liability and other

legal theories. The costs and resources to defend such claims could be

substantial and, if such claims are successful, we could be responsible for

paying some or all of the damages. Also, our reputation could be adversely

affected, regardless of whether such claims are successful. Any of these results

would adversely affect our profit margins, results from operations and

stockholder value.

We

may be exposed to liabilities under the Foreign Corrupt Practices Act, and any

determination that we violated the Foreign Corrupt Practices Act could have a

material adverse effect on our business.

We are

subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that

prohibit improper payments or offers of payments to foreign governments and

their officials and political parties by U.S. persons and issuers as defined by

the statute for the purpose of obtaining or retaining business. We have

operations, agreements with third parties and make sales in China, which may

experience corruption. Our activities in China create the risk of unauthorized

payments or offers of payments by one of the employees, consultants, sales

agents or distributors of our Company, even though these parties are not always

subject to our control. It is our policy to implement safeguards to discourage

these practices by our employees. However, our existing safeguards and any

future improvements may prove to be less than effective, and the employees,

consultants, sales agents or distributors of our Company may engage in conduct

for which we might be held responsible. Violations of the FCPA may result in

severe criminal or civil sanctions, and we may be subject to other liabilities,

which could negatively affect our business, operating results and financial

condition. In addition, the government may seek to hold our Company liable for

successor liability FCPA violations committed by companies in which we invest or

that we acquire.

12

Expansion

of our business may put added pressure on our management and operational

infrastructure impeding our ability to meet any increased demand for our

cadmium-free, valve-regulated lead-acid products and possibly hurting our

operating results.

Our

business plan is to significantly grow our operations to meet anticipated growth

in demand for existing products, and by the introduction of new product

offerings. Our planned growth includes the construction of new production lines

to be put into operation over the next twelve months. Growth in our business may

place a significant strain on our personnel, management, financial systems and

other resources. The evolution of our business also presents numerous risks and

challenges, including:

|

·

|

our

ability to successfully and rapidly expand sales to potential customers in

response to potentially increasing

demand;

|

|

·

|

the

costs associated with such growth, which are difficult to quantify, but

could be significant; and

|

|

·

|

rapid

technological change.

|

To

accommodate any such growth and compete effectively, we may need to obtain

additional funding to improve information systems, procedures and controls and

expand, train, motivate and manage our employees, and such funding may not be

available in sufficient quantities, if at all. If we are not able to manage

these activities and implement these strategies successfully to expand to meet

any increased demand, our operating results could suffer.

We

depend heavily on key personnel, and turnover of key employees and senior

management could harm our business.

Our

future business and results of operations depend in significant part upon the

continued contributions of our key technical and senior management personnel,

including Jiada Hu, our Chief Executive Officer, President, Secretary and

Treasurer, Jianjun Zeng, our Chief Operating Officer, Degang He, our Chief

Technology Officer, and Zhenghua Cai, our Chief Financial Officer. They also

depend in significant part upon our ability to attract and retain additional

qualified management, technical, marketing and sales and support personnel for

our operations. If we lose a key employee or if a key employee fails to perform

in his or her current position, or if we are not able to attract and retain

skilled employees as needed, our business could suffer. Significant turnover in

our senior management could significantly deplete our institutional knowledge

held by our existing senior management team. We depend on the skills and

abilities of these key employees in managing the manufacturing, technical,

marketing and sales aspects of our business, any part of which could be harmed

by further turnover.

We may be exposed

to potential risks relating to our internal controls over financial reporting

and our ability to have the operating

effectiveness of our internal controls attested to by our independent

auditors.

As

directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC

adopted rules requiring public companies to include a report of management on

the company’s internal controls over financial reporting in their annual

reports, including Form 10-K. In addition, the independent registered public

accounting firm auditing a company’s financial statements must also attest to

and report on the operating effectiveness of our internal controls. We are

subject to this requirement commencing with our fiscal year ended December 31,

2007 and a report of our management on our internal control over financial

reporting for the fiscal year ended December 31, 2008 is included under Item

9A(T) of this Annual Report on Form 10-K. Our management has concluded that our

internal controls over our financial reporting are effective for the period

covered by this Annual Report. However, in the future, our management may

conclude that our internal controls over our financial reporting are not

effective due to the identification of one or more material weaknesses, or our

independent registered public accounting firm may issue an adverse opinion on

our internal control over financial reporting if one or more material weaknesses

are identified. We can provide no assurance that we will comply with all of the

requirements imposed by SOX 404 and there can be no positive assurance that we

will receive a positive attestation from our independent auditors. In the event

we identify significant deficiencies or material weaknesses in our internal

controls that we cannot remediate in a timely manner or we are unable to receive

a positive attestation from our independent auditors with respect to our

internal controls, investors and others may lose confidence in the reliability

of our financial statements.

13

Our

holding company structure may limit the payment of dividends to our

stockholders.

China

Ritar Power Corp. has no direct business operations, other than its ownership of

our subsidiaries. While we have no current intention of paying dividends, should

we decide in the future to do so, as a holding company, our ability to pay

dividends and meet other obligations depends upon the receipt of dividends or

other payments from our operating subsidiaries and other holdings and

investments. In addition, our operating subsidiaries, from time to time, may be

subject to restrictions on their ability to make distributions to us, including

as a result of restrictive covenants in loan agreements, restrictions on the

conversion of local currency into U.S. dollars or other hard currency and other

regulatory restrictions as discussed below. If future dividends are paid in RMB,

fluctuations in the exchange rate for the conversion of RMB into U.S. dollars

may reduce the amount received by U.S. stockholders upon conversion of the

dividend payment into U.S. dollars.

PRC

regulations currently permit the payment of dividends only out of accumulated

profits as determined in accordance with PRC accounting standards and

regulations. Our subsidiaries in China are also required to set aside a portion

of their after tax profits according to PRC accounting standards and regulations

to fund certain reserve funds. Currently, our subsidiaries in China are the only

sources of revenues or investment holdings for the payment of dividends. If they

do not accumulate sufficient profits under PRC accounting standards and

regulations to first fund certain reserve funds as required by PRC accounting

standards, we will be unable to pay any dividends.

RISKS

RELATED TO DOING BUSINESS IN CHINA

Adverse

changes in China’s political or economic situation could harm us and our

operational results.

Economic

reforms adopted by the Chinese government have had a positive effect on the

economic development of the country, but the government could change these

economic reforms or any of the legal systems at any time. This could either

benefit or damage our operations and profitability. Some of the things that

could have this effect are:

|

•

|

Level

of government involvement in the

economy;

|

|

•

|

Control

of foreign exchange;

|

|

•

|

Methods

of allocating resources;

|

|

•

|

Balance

of payments position;

|

|

•

|

International

trade restrictions; and

|

|

•

|

International

conflict.

|

The

Chinese economy differs from the economies of most countries belonging to the

Organization for Economic Cooperation and Development, or OECD, in many ways. As

a result of these differences, we may not develop in the same way or at the same

rate as might be expected if the Chinese economy were similar to those of the

OECD member countries.

Our

business is largely subject to the uncertain legal environment in China and your

legal protection could be limited.

The

Chinese legal system is a civil law system based on written statutes. Unlike

common law systems, it is a system in which precedents set in earlier legal

cases are not generally used. The overall effect of legislation enacted over the

past 20 years has been to enhance the protections afforded to foreign invested

enterprises in China. However, these laws, regulations and legal requirements

are relatively recent and are evolving rapidly, and their interpretation and

enforcement involve uncertainties. These uncertainties could limit the legal

protections available to foreign investors, such as the right of foreign

invested enterprises to hold licenses and permits such as requisite business

licenses. In addition, all of our executive officers are residents of China and

not of the U.S., and substantially all the assets of these persons are located

outside the U.S. As a result, it could be difficult for investors to effect

service of process in the U.S., or to enforce a judgment obtained in the U.S.

against us or any of these persons.

14

The

Chinese government exerts substantial influence over the manner in which we must

conduct our business activities.

China

only recently has permitted provincial and local economic autonomy and private

economic activities. The Chinese government has exercised and continues to

exercise substantial control over virtually every sector of the Chinese economy

through regulation and state ownership. Our ability to operate in China may be

harmed by changes in its laws and regulations, including those relating to

taxation, import and export tariffs, environmental regulations, land use rights,

property and other matters. We believe that our operations in China are in

material compliance with all applicable legal and regulatory requirements.

However, the central or local governments of these jurisdictions may impose new,

stricter regulations or interpretations of existing regulations that would

require additional expenditures and efforts on our part to ensure our compliance

with such regulations or interpretations.

Accordingly,

government actions in the future, including any decision not to continue to

support recent economic reforms and to return to a more centrally planned

economy or regional or local variations in the implementation of economic

policies, could have a significant effect on economic conditions in China or

particular regions thereof, and could require us to divest ourselves of any

interest we then hold in Chinese properties or joint ventures.

Future

inflation in China may inhibit our ability to conduct business profitably in

China.

In recent

years, the Chinese economy has experienced periods of rapid expansion and high

rates of inflation. During the past ten years, the rate of inflation in China

has been as high as 20.7% and as low as -2.2%. These factors have led to the

adoption by the Chinese government, from time to time, of various corrective

measures designed to restrict the availability of credit or regulate growth and

contain inflation. High inflation may in the future cause the Chinese government

to impose controls on credit and/or prices, or to take other action, which could

inhibit economic activity in China, and thereby harm the market for our

products.

Any

recurrence of severe acute respiratory syndrome, or SARS, or another widespread

public health problem, could harm our operations.

A renewed

outbreak of SARS or another widespread public health problem in China, where our

operations are conducted, could have a negative effect on our

operations.

Our

operations may be impacted by a number of health-related factors, including the

following:

|

·

|

quarantines

or closures of some of our offices which would severely disrupt our

operations,

|

|

·

|

the

sickness or death of our key officers and employees,

and

|

|

·

|

a

general slowdown in the Chinese

economy.

|

Any of

the foregoing events or other unforeseen consequences of public health problems

could damage our operations.

Restrictions

on currency exchange may limit our ability to receive and use our revenues

effectively.

The

majority of our revenues will be settled in RMB and U.S. dollars, and any future

restrictions on currency exchanges may limit our ability to use revenue

generated in RMB to fund any future business activities outside China or to make

dividend or other payments in U.S. dollars. Although the Chinese government

introduced regulations in 1996 to allow greater convertibility of the RMB for

current account transactions, significant restrictions still remain, including

primarily the restriction that foreign-invested enterprises may only buy, sell

or remit foreign currencies after providing valid commercial documents, at those

banks in China authorized to conduct foreign exchange business. In addition,

conversion of RMB for capital account items, including direct investment and

loans, is subject to governmental approval in China, and companies are required

to open and maintain separate foreign exchange accounts for capital account

items. We cannot be certain that the Chinese regulatory authorities will not

impose more stringent restrictions on the convertibility of the

RMB.

15

Failure

to comply with PRC regulations relating to the establishment of offshore special

purpose companies by PRC residents may subject our PRC resident stockholders to

personal liability, limit our ability to acquire PRC companies or to inject

capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to

distribute profits to us or otherwise materially adversely affect

us.

In

October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued

the Notice on Relevant Issues in the Foreign Exchange Control over Financing and

Return Investment Through Special Purpose Companies by Residents Inside China,

generally referred to as Circular 75, which required PRC residents to register

with the competent local SAFE branch before establishing or acquiring control

over an offshore special purpose company, or SPV, for the purpose of engaging in

an equity financing outside of China on the strength of domestic PRC assets

originally held by those residents. Internal implementing guidelines issued by

SAFE, which became public in June 2007 (known as Notice 106), expanded the reach

of Circular 75 by (i) purporting to cover the establishment or acquisition of

control by PRC residents of offshore entities which merely acquire “control”

over domestic companies or assets, even in the absence of legal ownership; (ii)

adding requirements relating to the source of the PRC resident’s funds used to

establish or acquire the offshore entity; (iii) covering the use of existing

offshore entities for offshore financings; (iv) purporting to cover situations

in which an offshore SPV establishes a new subsidiary in China or acquires an

unrelated company or unrelated assets in China; and (v) making the domestic

affiliate of the SPV responsible for the accuracy of certain documents which

must be filed in connection with any such registration, notably, the business

plan which describes the overseas financing and the use of proceeds. Amendments

to registrations made under Circular 75 are required in connection with any

increase or decrease of capital, transfer of shares, mergers and acquisitions,

equity investment or creation of any security interest in any assets located in

China to guarantee offshore obligations, and Notice 106 makes the offshore SPV

jointly responsible for these filings. In the case of an SPV which was

established, and which acquired a related domestic company or assets, before the

implementation date of Circular 75, a retroactive SAFE registration was required

to have been completed before March 31, 2006; this date was subsequently

extended indefinitely by Notice 106, which also required that the registrant

establish that all foreign exchange transactions undertaken by the SPV and its

affiliates were in compliance with applicable laws and regulations. Failure to

comply with the requirements of Circular 75, as applied by SAFE in accordance

with Notice 106, may result in fines and other penalties under PRC laws for

evasion of applicable foreign exchange restrictions. Any such failure could also

result in the SPV’s affiliates being impeded or prevented from distributing

their profits and the proceeds from any reduction in capital, share transfer or

liquidation to the SPV, or from engaging in other transfers of funds into or out

of China.

We

believe our stockholders who are PRC residents as defined in Circular 75 have

registered with the relevant branch of SAFE, as currently required, in

connection with their equity interests in us and our acquisitions of equity

interests in our PRC subsidiaries. However, we cannot provide any assurances

that their existing registrations have fully complied with, and they have made

all necessary amendments to their registration to fully comply with, all

applicable registrations or approvals required by Circular 75. Moreover, because

of uncertainty over how Circular 75 will be interpreted and implemented, and how

or whether SAFE will apply it to us, we cannot predict how it will affect our

business operations or future strategies. For example, our present and

prospective PRC subsidiaries’ ability to conduct foreign exchange activities,

such as the remittance of dividends and foreign currency-denominated borrowings,

may be subject to compliance with Circular 75 by our PRC resident beneficial

holders. In addition, such PRC residents may not always be able to complete the

necessary registration procedures required by Circular 75. We also have little

control over either our present or prospective direct or indirect stockholders

or the outcome of such registration procedures. A failure by our PRC resident

beneficial holders or future PRC resident stockholders to comply with Circular

75, if SAFE requires it, could subject these PRC resident beneficial holders to

fines or legal sanctions, restrict our overseas or cross-border investment

activities, limit our subsidiaries’ ability to make distributions or pay

dividends or affect our ownership structure, which could adversely affect our

business and prospects.

16

We

may be unable to complete a business combination transaction efficiently or on

favorable terms due to complicated merger and acquisition regulations that

became effective on September 8, 2006.

On August

8, 2006, six PRC regulatory agencies promulgated the Regulation on Mergers and

Acquisitions of Domestic Companies by Foreign Investors, which became effective

on September 8, 2006. This new regulation, among other things, governs the

approval process by which a PRC company may participate in an acquisition of

assets or equity interests. Depending on the structure of the transaction, the

new regulation will require the PRC parties to make a series of applications and

supplemental applications to the government agencies. In some instances, the

application process may require the presentation of economic data concerning a

transaction, including appraisals of the target business and evaluations of the