Attached files

| file | filename |

|---|---|

| EX-10.3 - EXHIBIT 10.3 - China Environmental Protection Inc. | tod_ex10x3.htm |

| EX-10.6 - EXHIBIT 10.6 - China Environmental Protection Inc. | tod_ex10x6.htm |

| EX-10.8 - EXHIBIT 10.8 - China Environmental Protection Inc. | tod_ex10x8.htm |

| EX-10.2 - EXHIBIT 10.2 - China Environmental Protection Inc. | tod_ex10x2.htm |

| EX-10.4 - EXHIBIT 10.4 - China Environmental Protection Inc. | tod_ex10x4.htm |

| EX-10.5 - EXHIBIT 10.5 - China Environmental Protection Inc. | tod_ex10x5.htm |

| EX-10.9 - EXHIBIT 10.9 - China Environmental Protection Inc. | tod_ex10x9.htm |

| EX-10.7 - EXHIBIT 10.7 - China Environmental Protection Inc. | tod_ex10x7.htm |

| EX-16.1 - EXHIBIT 16.1 - China Environmental Protection Inc. | tod_ex16x1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

Report: February 12, 2010

T.O.D.

TASTE ON DEMAND INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

333-148928

|

75-3255056

|

|

(State

or Other

Jurisdiction

of

Incorporation)

|

(Commission

File

Number)

|

(IRS

Employer

Identification

No.)

|

Jiangsu

Zhenyu Environmental Protection Technology Co. Ltd.

West

Garden, Gaocheng Town, Yixing City, Jiangsu Province, P.R. China

(ADDRESS

OF PRINCIPAL EXECUTIVE OFFICES)

214214

(Zip

Code)

[+86-510-87838598]

(Registrant's telephone

number, including area code)

55 Hakeshet Street,

Reuth, Israel 91708

(Former

Name or Former Address if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

|

Forward

Looking Statements

Some

of the statements contained in this Form 8-K that are not historical facts are

"forward-looking statements" which can be identified by the use of terminology

such as "estimates," "projects," "plans," "believes," "expects," "anticipates,"

"intends," or the negative or other variations, or by discussions of strategy

that involve risks and uncertainties. We urge you to be cautious of the

forward-looking statements, that such statements, which are contained in this

Form 8-K, reflect our current beliefs with respect to future events and involve

known and unknown risks, uncertainties and other factors affecting our

operations, market growth, services, products and licenses. No assurances can be

given regarding the achievement of future results, as actual results may differ

materially as a result of the risks we face, and actual events may differ from

the assumptions underlying the statements that have been made regarding

anticipated events. Factors that may cause actual results, our performance or

achievements, or industry results, to differ materially from those contemplated

by such forward-looking statements include without limitation: our ability to

attract and retain management, and to integrate and maintain technical

information and management information systems; our ability to raise capital

when needed and on acceptable terms and conditions; the intensity of

competition; and general economic conditions. Please see Risk Factors for

discussion in detail. All written and oral forward-looking statements made in

connection with this Form 8-K that are attributable to us or persons acting on

our behalf are expressly qualified in their entirety by these cautionary

statements. Given the uncertainties that surround such statements, you are

cautioned not to place undue reliance on such forward-looking

statements.

Item

1.01 Entry into a Material Definitive

Agreement

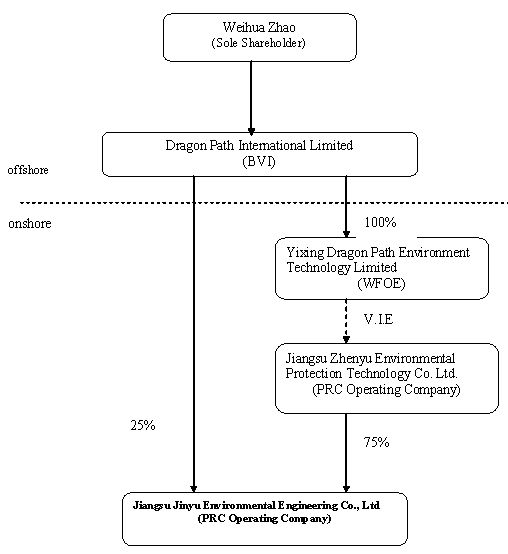

As reported on T.O.D. Taste On Demand

Inc.’s (the “Company”) Current Report on Form 8-K filed with the Securities and

Exchange Commission (the “Commission”) on February 9, 2010, the Company entered

into an agreement (the “Merger Agreement”) with Dragon Path International

Limited, a British Virgin Islands corporation (“Dragon Path”), and the sole

shareholder of Dragon Path. The merger was closed on February 12,

2010. Pursuant to the terms of the Merger Agreement, the Company acquired all of

the outstanding capital stock of Dragon Path through the merger with China

Environmental Protection Inc., a Nevada corporation (the “Merger Sub”) wholly

owned by the Company. Dragon Path is a holding company whose only asset, held

through a subsidiary, is 100% of the registered capital of Yixing Dragon Path

Environment Technology Limited (“Yixing Dragon Path”), a limited liability

company organized under the laws of the People’s Republic of China (“China” or

“PRC”). Substantially all of Dragon Path's operations are conducted in China

through Yixing Dragon Path, and through contractual arrangements with Yixing

Dragon Path’s consolidated affiliated entity in China, Jiangsu Zhenyu

Environmental Protection Technology Co. Ltd. (“Zhenyu”). Zhenyu is engaged in

design, manufacture, and installation of water and waster water treatment

equipment for environmental protection purposes, as well as providing

high-quality after-sales services.

In

connection with the acquisition, the following transactions took

place:

|

§

|

The

Merger Sub issued 100 shares of the common stock of the Merger Sub which

constituted no more than 10% ownership interest in the Merger Sub in

exchange for all the shares of the capital stock of Dragon Path (the

“Share Exchange” or “Merger”). The 100 shares of the common stock of the

Merger Sub were converted into approximately 16,150,000 shares of the

common stock of the Company (the “Merger Consideration”) so that upon

completion of the Merger, the sole shareholder of Dragon Path and his

designees own approximately 95% of the common stock of the

Company.

|

|

§

|

Before

the closing of the Merger, the Company affected a 4.61896118 for 1 reverse

split of the outstanding common stock of the Company, so that after such

split but before the issuance of the Merger Consideration there were

approximately issued and outstanding 850,000 shares of common stock of the

Company.

|

|

§

|

Before

the closing of the Merger, on February 11, 2010, the

Company contributed all of the assets of

the Company's business to T.O.D. (2010)

Inc. a Nevada corporation ("Spin-Off Sub")

which is wholly-owned by the Company, in preparation for a

distribution of the stock of such subsidiary to the shareholders of the

Company. The restricted shares of Spin-Off Sub will be distributed to the

shareholders of the Company as of February 11,

2010.

|

|

§

|

All

officers of the Company before the Merger, including David Katzir, the

Company’s Chief Executive Officer and President, resigned upon the

effectiveness of the Merger.

|

|

§

|

Boping

Li, Chairman, Chief Executive Officer and President of Zhenyu, was elected

to serve on our Board of Directors as

Chairman of the Board, and as President and Chief Executive Officer of the

Company.

|

|

§

|

Upon

the effectiveness of the Merger, Mr. Asael Karfiol resigned as a director

of the Company. Mr. Yuqiang Wu will become a director of the

Company and Mr. David Katzir will resign as a director of the Company ten

days after the notice pursuant to Rule 14f-1 is mailed to the shareholders

of record.

|

|

§

|

Ping

Ye was appointed as Chief Financial Officer of the

Company.

|

|

§

|

As

part of the Merger, the Company’s name was changed from “T.O.D. Taste on

Demand, Inc.” to the Merger Sub’s name “China Environmental Protection

Inc.” The Company is communicating with FINRA for the name change and

trading symbol change on the OTC Bulletin

Board.

|

2

As a result of these transactions,

persons affiliated with Zhenyu now own securities that in the aggregate

represent approximately 95% of the equity in the Company. In addition, persons

affiliated with Zhenyu will control the Board of Directors of the Company ten

days after the notice pursuant to Rule 14f-1 is mailed to the shareholders of

record.

New

Management

Upon the

completion of the Merger, the new executive officers and directors of the

Company will be:

|

Name

|

Age

|

Positions with the

Company

|

|

Boping

Li

|

48

|

Chairman,

President and Chief Executive Officer

|

|

Ping

Ye

|

39

|

Chief

Financial Officer

|

|

Yuqiang

Wu

|

33

|

Director

|

All

directors hold office until the next annual meeting of our shareholders and

until their successors have been elected and qualify. Officers serve

at the pleasure of the Board of Directors.

Boping Li, 48, Founder,

Chairman and Chief Executive Officer of Zhenyu. Mr. Li served as Chairman

and Chief Executive Officer of Zhenyu since September 1992. Prior to that,

he was Vice Manager of Yixing Gaocheng Fiber Glass Equipment Factory from

October 1987 to August 1992. Prior to that, he was Production Director of Yixing

Gaocheng Glass Factory from May 1981 to September 1987. Mr. Li graduated from

Nanjing University of Science and Technology with a bachelor degree in

business administration.

Ping Ye, 39, is a US Certified

Public Accountant (CPA) with over sixteen years’ experience working in public

and private sectors, including the banking industry in China and the public

accounting firm of Arthur Andersen in the US, supervising and performing audits

from March 1998 to January 2001. Ms. Ye also worked for American International

Group Inc. (AIG), the Museum of Fine Arts in Boston from September 2001

to February 2005 and MIT from May 2005 to January 2007. Most

recently, Ms. Ye served as Vice-President of Finance and Accounting for USI

Insurance Services, a Goldman Sachs private equity holding from January 2007 to

July 2009.

Ms. Ye

earned a Bachelors of Business Administration summa cum laude majoring in

Accounting from Baruch College, City University of New York. She also holds an

MBA from the Wharton School, University of Pennsylvania.

Yuqiang Wu, 33, Vice President

of Zhenyu and Director of Jiangsu Jinyu Environmental Engineering Co. Ltd. Mr.

Wu joined the Company in August 2005. Prior to that, he served as Vice President

and Finance Director of Yixing Gaojinhechuang Co. Ltd from August 2000 to July

2005. Prior to that, he served as Finance Director of Yixing Circulating Water

Equipment Company from August 1999 to July 2000. He graduated from Metallurgic

College of Jiangsu University of Science & Technology majored in financial

accounting.

Security Ownership of

Certain Beneficial Owners and Management

Upon

completion of the Merger, there were 17,000,000 shares of the Company’s common

stock issued and outstanding. The following table sets forth

information known to us with respect to the beneficial ownership of our common

stock as of February 12, 2010 by the following:

|

▪

|

each

shareholder who beneficially owns more than 5% of our

common;

|

|

▪

|

each

of our named executive officers;

|

|

▪

|

Each

of our directors; and

|

|

▪

|

Executive

officers and directors as a group.

|

Beneficial

ownership is determined in accordance with the rules of the SEC, which deem a

person to beneficially own any shares the person has or shares voting or

dispositive power over and any additional shares obtainable within 60 days

through the exercise of options, warrants or other purchase rights. Shares of

our common stock subject to options, warrants or other rights to purchase that

are currently exercisable or are exercisable within 60 days of February 12, 2010

(including shares subject to restrictions that lapse within 60 days of February

12, 2010) are deemed outstanding for purposes of computing the percentage

ownership of the person holding such shares, options, warrants or other rights,

but are not deemed outstanding for purposes of computing the percentage

ownership of any other person. Unless otherwise indicated, each person possesses

sole voting and investment power with respect to the shares identified as

beneficially owned.

3

|

Name and

Address of Beneficial Owner(1)

|

Amount

and Nature

of

Beneficial

Ownership

|

Percentage

of

Class

|

||||||

|

Boping

Li

|

0

|

(2)

|

--

|

|||||

|

Ping Ye

|

0

|

--

|

||||||

|

Yuqiang

Wu

|

0

|

--

|

||||||

|

David

Katzir(3)

|

22,924

|

Less

than one percent

|

||||||

|

All such directors

and executive officers as a group (4

persons)

|

22,924 | Less than one percent |

|

|||||

|

Five

Percent Shareholders (other than directors and named executive

officers)

|

||||||||

|

Weihua

Zhao (4)

|

11,020,000

|

64.82

|

%

|

|||||

|

(1)

|

All

shares are owned of record and beneficially except as otherwise noted.

Except as otherwise noted, each shareholder’s address is c/o Jiangsu

Zhenyu Environmental Protection Technology Co. Ltd, West Garden, Gaocheng

Town, Yixing City, Jiangsu Province, P.R. China,

214214.

|

|

(2)

|

Mr.

Boping Li, his wife Ms. Qinfen Ding and Mr. Weihua Zhao, the sole

shareholder of Crown Orient International Limited, a BVI corporation and

our principal shareholder, have entered into an agreement dated January

27, 2010, pursuant to which Mr. Li and Ms. Ding may purchase shares of the

common stock of Crown Orient International Limited from Mr. Zhao for a

nominal price if the merged company achieves certain revenue

thresholds.

|

|

(3)

|

The

address of this stockholder is c/o T.O.D. (2010) Inc., 55 Hakeshet Street,

Reuth, Israel 91708.

|

|

(4)

|

Beneficially

owns the shares indicated, which are owned of record by Crown Orient

International Limited, a BVI corporation and our principal

shareholder.

|

INFORMATION REGARDING THE ACQUIRED

COMPANIES

Dragon Path International

Limited

Dragon Path International Limited

(“Dragon Path”) was organized under the laws of the British Virgin Islands on

November 5, 2009. Mr. Weihua Zhao, a New Zealand citizen, is the sole

shareholder of Dragon Path.

Yixing Dragon Path

Environment Technology Limited

Yixing Dragon Path Environment

Technology Limited (“Yixing Dragon Path”) was incorporated as a limited

liability company on January 26, 2010 under PRC law. It is currently 100% owned

by Dragon Path, and by virtue of such ownership Yixing Dragon Path is a “wholly

foreign owned enterprise” (“WFOE”) under PRC law. Our business is currently

conducted through contractual arrangements with Zhenyu, our consolidated

affiliated entity in China. These contractual arrangements enable us

to:

|

§

|

exercise

effective control over Zhenyu;

|

|

§

|

receive

a substantial portion of the economic benefits from Zhenyu;

and

|

|

§

|

have

an exclusive option to purchase all or part of the equity interests in

Zhenyu when and to the extent permitted by PRC

law.

|

Jiangsu Zhenyu Environmental

Protection Technology Co. Ltd.

We are a

prominent China-based water treatment equipment supplier and project contractor.

Holding six national patents and through sixteen years of development, we have

relatively strong market share in waste

water treatment sector in China and are ranked among top six of Yixing City’s

best environmental protection enterprises based on Yixing Municipal Government’s

ranking of 2009 outstanding environment protection enterprises (Yizhengfa

Document No.[2010]18). Yixing is the country’s production base for environment

protection equipment. We are headquartered in Yixing, Jiangsu, with

total building areas of 7,800 square meters. We have six offices located in

different parts of China to engage in product sales and engineering project

construction activities. We have 171 employees in total.

Our major

customers include customers conducting business in petroleum and chemical

industry, electricity industry, as well as many municipal waste water treatment

plants. Our products address the key steps in the water treatment process, such

as filtration, water softening, water-sediment separation, aeration,

disinfection and reverse osmosis. Our major products include ZFP-1380 Rotating

Disc Aeration equipment, ZYXG Series of Sludge Suction Scraper, ZYSR Series of

Surface Scraper and other water treatment environmental protection

equipment.

We have

established cooperative relationship with major universities and other

industrial design institutions to conduct our R&D activities. We continually

expand our market by introducing new products that diversify our revenue base,

staying current with technological developments in the water treatment equipment

industry, and effectively maintaining our competitive advantage.

We have

experienced significant growth in our financial results. In the

fiscal year ended September 30, 2009, we have generated RMB 178.9 million (USD

26.0 million) in consolidated revenue and RMB 41.0 million (USD 6.01 million) of

net profit attributable to the Company, which represent over 199.75% and 278.63%

increase over the fiscal year 2008 results, respectively.

4

Our Industry

The water

treatment industry in China has experienced and is expected to continue to

experience rapid growth. China faces severe water shortages and natural water

resource pollution due to rapid growth in population, urbanization and

industrialization. To address those issues, the Chinese government has enacted

environmental standards and invested significantly in water treatment projects

to promote sustainable economic growth and to provide its population with

affordable, purified water.

According to

the poll conducted by Freedonia, the global market demand for waste water

treatment equipment will consistently grow at an annual rate of 6.4% for the

next few years. The global sales volume will reach $39.9 billion by the year of

2011. In the Chinese market, the same demand will increase at an annual growth

rate of 15.5% before 2012.

During the

past 5 years, the market demand trend for waste water treatment equipment in

China has been kept steadily increasing, primarily due to increased level of

industrialization, urbanization, and awareness of environment protection among

general public. According to the relevant data provided by Frost & Sullivan,

more than 3,000 waste water treatment plants have been built and put into use in

China from 2001 to 2005.

China

Environmental Protection Industry Association predicts that sales of waste water

treatment equipment will increase from $2.1 billion in 2004 to $3.8 billion in

2010, with compound annual growth rate of 10.1%. In the meantime, revenue

generated from waste water treatment related industry will increase from $3

billion in 2004 to $14.6 billion in 2010, with compound annual growth rate of

30.0%. The newly published laws and regulations relating to

environment protection in China, as well as general public’s concerns on

industrial pollution, have also educated enterprises and general public,

enabling them to become aware of the importance and benefits of waste water

treatment.

China ranks

88th in the world in terms of per capita water resource, with 2,200 cubic

meters per person in China compared to the world average of 8,800 cubic meters

per person. Meanwhile, China faces poor water management issue. The water

utilization rate, for a number of rivers in China, including the Huai River,

Liao River and Yellow River, was as high as 60% in 2007 in comparison with the

30% to 40% international standards with the intention of conserving water

resources. Moreover, 49% of China’s seven major water bodies were designated as

Type IV and V water bodies, which indicates that they are polluted and

unsuitable for humans (a designation of Type I, II or III is

required for drinking water, National Surface Water Quality Monthly

Report of February 2008 issued by the China National Environmental Monitoring

Center).

China has

enacted numerous water reforms to address the country’s water shortage and water

pollution problems. We believe stricter water quality regulations for existing

infrastructure will continue to drive incremental spending in water treatment

methods. According to the Ministry of Water Resources, the average

water tariff of waterworks increased 505% from RMB0.0280 per cubic meter in 2000

to RMB0.1442 per cubic meter in 2007.

China’s water

shortage and pollution control strategies are driving increased water treatment

investment by the Chinese government and private investors. For example,

approximately 3,000 wastewater plants were built in China between 2001 and 2005

according to Frost & Sullivan. In addition, major water supply projects

in China, such as the South-to-North Water Diversion Project providing for a

network of water transfer canals from the relatively water rich south to the

north, will cost approximately $22 billion before 2013.

The Chinese

government’s National Environmental Protection 11th Five-Year Plan

(2006-2010), or the Five-Year Plan, establishes explicit objectives for water

resource protection, drinking water quality improvement and water treatment

development. For example, the plan requires all urban municipalities to build

wastewater treatment facilities with wastewater treatment rate of no less than

70% and a nationwide urban wastewater treatment capacity of 100 million

tons per day. To accomplish those goals, planned investment of urban wastewater

infrastructure (including the cost of wastewater treatment, sewers, sludge

treatment and wastewater recycling) in China is expected to be

RMB332 billion between 2006 and 2010 according to the National Urban

Wastewater Treatment and Recycling Facilities Construction 11th Five-Year

Plan.

The Chinese

government has also implemented market reforms and encouraged private sector

participation to improve operational efficiencies at municipal wastewater

treatment facilities. As a result of such reforms, two market-based management

models—build-operate-transfer, or BOT, and transfer-operate-transfer, or

TOT—have been developed in an effort to expand available sources of capital and

improve operational efficiencies within the water sector.

Market Size and Growth

Potential

With China’s

ongoing industrialization and urbanization, we expect a strong demand for water

treatment equipment in China in the coming years. The global demand for water

treatment products is projected to grow nearly 6.4% per year to

$39.9 billion in 2011, and the demand for water treatment products in China

is estimated to increase nearly 15.5% per year through 2012 (Freedonia

Group).

5

The sources

of demand and resulting customers in the Chinese market for water treatment

equipment can be classified into the following four broad categories: the

circulating water treatment industry, the industrial water purification

industry, the wastewater treatment industry and the waste water treatment

industry. According to The China Association of Environmental Protection

Industry, or CAEPI, the market for these industries will have double digit

annual growth rate ranging from 12% to 25% until year

2010.

The size of

the circulating water treatment industry in China is estimated at

$2.2 billion in 2010. Many industrial sectors, such as food and beverages,

electronics, pharmaceuticals and chemical/petroleum processors, require treated

circulating water in their products or as part of their manufacturing processes.

The use of untreated circulating water in manufacturing processes can result in

inconsistent product quality and substantial equipment degradation, which can

lead to high maintenance or replacement costs.

The size of

the industrial water purification sector, is estimated at $14.4 billion in

2010. The pharmaceutical, chemical, food and beverage, food processing and

electronics industries all require highly purified water in their manufacturing

processes and significantly affects the business outlook of those industries in

China.

Chinese

regulations regarding the disposal of aqueous industrial waste, combined with

public concern for industrial pollution, have led to increased awareness on the

part of businesses and public utilities as to the benefits of wastewater

treatment and waste minimization. In response to higher water prices and rising

wastewater discharge fees, industrial manufacturers have also become aware of

the cost-effectiveness of recycling their wastewater. As a result of these

factors, industrial manufacturers increasingly require complex systems and

equipment to treat and recycle process water and wastewater.

According to

the Organization for Economic Co-operation and Development’s Environmental

Performance Reviews on China, the size of the municipal waste water treatment

industry in China is estimated at $15 billion in 2010. Water in nearly half

of China’s major cities fails to meet the national standards for drinking water.

Defects in chemical treatment of tap water and aging municipal water supply

systems have caused additional pollution. Traditional processes of using

chemicals for water treatment have only limited capability in removing organic

matters in water and may result in the concentration of harmful substances such

as ammonia nitrogen and bio-assimilating organic carbon and odor in the treated

water. Improving the quality of drinking water has become an urgent task in

China.

Our Strengths, Strategies, Risks and

Uncertainties

Under the

current circumstances, we believe the following strengths allow us to compete

effectively in the water treatment equipment and project construction industry

in China:

|

§

|

With

more than 16 years and rich experience in the industry, we are one of the

first few water treatment companies in China with strong customer

recognition and industry

reputation.

|

|

§

|

We

have established good cooperative relationship with major universities and

other industrial design institutions for our R& D activities.

With six national patents on our key products, we will continue to

make significant efforts on R&D development. From raw

materials to finished goods, from product design to engineering

installation, we rely on our own ability, rather than outsourcing to cut

costs.

|

|

§

|

Our

standardized and scalable business model focuses on standardized water

treatment equipment as well as engineering process designed for high asset

turnover.

|

Our

strategies are to capitalize on our competitive strengths, to expand our current

market penetration and to benefit from the anticipated rapid growth in China’s

water treatment industry. Our goal is to become the leading player in the

environmental protection industry in China focusing on water treatment by

implementing the following strategies:

|

§

|

Business

Transition –We are making business transition from traditional equipment

manufacturing to the design, manufacture, installation of both equipment

and engineering projects for waste water treatment, as well as provide

after-sales services to customers.

|

|

§

|

Market

Share Expansion – We are expanding our market share through strengthened

marketing campaign aiming at targeted markets: including more than 50 new

municipal waste water treatment plants in Hebei province, 60 new municipal

waste water treatment plants in Hubei province, and construction of

facilities of municipal waste water interception pipelines for 113

municipal waste water treatment plants in Hunan

province.

|

|

§

|

Cost

Control – We strive to increase our innovative ability in order to

maintain strict cost control.

|

6

Our ability

to realize our business objectives and execute our strategies is subject to

risks and uncertainties, including the following:

|

§

|

We

need to timely make new product enhancements and new products, otherwise

we may be unable to grow our revenue as expected and may incur expenses

relating to the development or acquisition of new products and

technologies;

|

|

§

|

Competition

from present and future competitors in China’s growing water treatment

market; and

|

|

§

|

Our

business is capital intensive and our growth strategy may require

additional capital which may not be available on favorable terms or at

all

|

These risks

and uncertainties, along with others, are also described in the Risk Factors

section of this Current Report on Form 8-K.

Risk

Factors

An investment

in our common stock or other securities involves a number of

risks. You should carefully consider each of the risks described

below before deciding to invest in our common stock. If any of the

following risks develops into actual events, our business, financial condition

or results of operations could be negatively affected, the market price of our

common stock or other securities could decline and you may lose all or part of

your investment.

The risk

factors presented below are all of the ones that we currently consider material.

However, they are not the only ones facing our Company. Additional

risks not presently known to us, or which we currently consider immaterial, may

also adversely affect us. There may be risks that a particular

investor views differently from us, and our analysis might be

wrong. If any of the risks that we face actually occur, our business,

financial condition and operating results could be materially adversely affected

and could differ materially from any possible results suggested by any

forward-looking statements that we have made or might make. In such

case, the trading price of our common stock could decline, and you could lose

part or all of your investment.

Risks

Relating to Our Business and Industry

If the market for

water treatment equipment does not grow at the rate we expect or at all, our

sales and profitability may be materially and adversely

affected.

We derive

all of our revenue from sales of our products in China. Our business’

development depends, in large part, on continued growth in the demand for

quality water treatment equipment in China. Although this market has grown

rapidly, the growth may not continue at the same rate. The Freedonia Group, a

market research firm, projects demand for water treatment products in China will

increase nearly 15.5% per year through 2012. However, developments in our

industry are, to a large extent, outside of our control and any reduced demand

for water treatment equipment, any downturn or other adverse changes in China’s

economy could materially and adversely harm our sales and

profitability.

If we fail to

meet evolving customer demands and requirements for water treatment equipment,

including through product enhancements or new product introductions, or if our

products do not compete effectively, our financial results may be materially and

adversely affected.

The

market for water treatment equipment is characterized by changing technologies,

periodic new product introductions and evolving customer and industry

requirements, including solution requirements for different contaminants or

varying volumes of water. Our competitors are continuously searching for more

cost effective and efficient water treatment methods and technologies which, if

successful, could render our products obsolete in whole or in part. Our research

and development efforts will focus on developing new processes, applications and

technologies to enhance our existing products. If we fail to timely develop new

product enhancements and new products or if our products are rendered obsolete,

we may be unable to grow our revenue as expected and may incur expenses relating

to the development or acquisition of new products and technologies that are not

fully offset by the revenue they generate, which could materially and adversely

affect our financial results.

If we fail to

maintain or improve our market position or respond successfully to changes in

the competitive landscape, our business, financial condition and results of

operations may be materially and adversely affected.

We operate in a highly competitive

industry characterized by rapid technological development and evolving industry

standards. Our competitors include a number of global and China-based companies

that produce and sell products similar to ours. Some of our international

competitors have stronger brand names, greater access to capital, longer

operating histories, longer or more established relationships with their

customers, stronger research and development capabilities and greater marketing

and other resources than we do. Some of our domestic competitors have stronger

distribution networks and end-user customer bases, better access to government

authorities and stronger industry-based backgrounds than us. Due to the evolving

markets in which we compete, additional competitors with significant market

presence and financial resources may enter those markets, and thereby intensify

competition. These competitors may be able to reduce our market share by

adopting more aggressive pricing policies than we can or by developing

technology and services that gain wider market acceptance than our products.

Existing and potential competitors may also develop relationships with our

distributors in a manner that could significantly harm our ability to sell,

market and develop our products. As a result of these competitive pressures and

expected increases in competition, we may price our products lower than our

competitors to maintain market share. Any lower pricing may negatively affect

our profit margins. If we fail to maintain or improve our market position or

fail to respond successfully to changes in the competitive landscape, our

business, financial condition and results of operations may be materially and

adversely affected.

7

Our business is

capital intensive and our growth strategy may require additional capital which

may not be available on favorable terms or at

all.

We may

require additional cash resources due to changed business conditions,

implementation of our strategy to expand our manufacturing capacity or potential

investments or acquisitions we may pursue. To meet our capital needs, we may

sell additional equity or debt securities or obtain additional credit

facilities. The sale of additional equity securities could result in dilution of

your holdings. The incurrence of indebtedness would result in increased debt

service obligations and could require us to agree to operating and financial

covenants that would restrict our operations. Financing may not be available in

amounts or on terms acceptable to us, if at all. Any failure by us to raise

additional funds on terms favorable to us, or at all, could limit our ability to

expand our business operations and could harm our overall business

prospects.

Our failure to

adequately protect, or uncertainty regarding the validity, enforceability or

scope of, our intellectual property rights may undermine our competitive

position, and litigation to protect our intellectual property rights may be

costly.

We strive to

strengthen and differentiate our product portfolio by developing new and

innovative products and product improvements. As a result, we regard our

intellectual property as critical to our success. Implementation and enforcement

of intellectual property-related laws in China has historically been lacking due

primarily to ambiguities in Chinese intellectual property law. Accordingly,

protection of intellectual property and proprietary rights in China may not be

as effective as in the United States or other countries. Currently, we

hold six Chinese patents. We will continue to rely on a combination of

patents, trade secrets, trademarks and copyrights to protect our intellectual

property, but this protection may be inadequate. For example, our pending or

future patent applications may not be approved or, if allowed, they may not be

of sufficient strength or scope to protect our intellectual property. As a

result, third parties may use the technologies and proprietary processes that we

have developed and compete with us, which may negatively affect any competitive

advantage we enjoy, dilute our brand and materially and adversely affect our

results of operations. In addition, policing the unauthorized use of our

proprietary technology can be difficult and expensive. Litigation may be

necessary to enforce our intellectual property rights and due to the relative

unpredictability of China’s legal system and potential difficulties of enforcing

a court’s judgment in China, there is no guarantee litigation would result in an

outcome favorable to us. Furthermore, any such litigation may be costly and may

divert our management’s attention away from our core business. An adverse

determination in any lawsuit involving our intellectual property is likely to

jeopardize our business prospects and reputation. We have no insurance coverage

against litigation costs so we would be forced to bear all litigation costs if

we cannot recover them from other parties. All of the foregoing factors could

harm our business, financial condition and results of

operations.

Third party use of

our trademarks and the “Zhenyu” name may dilute their value and materially and

adversely affect our reputation, goodwill and brand.

Due to

ambiguities in Chinese intellectual property law, the cost of enforcement and

our prior lack of enforcement, we may be unable to prevent third parties from

using the Zhenyu trademark and our name, Zhenyu.

We may be exposed to

infringement or misappropriation claims by third parties, which, if determined

adversely against us, could disrupt our business and subject us to significant

liability to third parties.

Our success

largely depends on our ability to use and develop our technology, know-how and

product designs without infringing upon the intellectual property rights of

third parties. We may be subject to litigation involving claims of patent

infringement or violation of other intellectual property rights of third

parties. The holders of patents and other intellectual property rights

potentially relevant to our product offerings may be unknown to us or may

otherwise make it difficult for us to acquire a license on commercially

acceptable terms.

There may

also be technologies licensed to and relied on by us that are subject to

infringement or other corresponding allegations or claims by third parties which

may damage our ability to rely on such technologies. In addition, although we

endeavor to ensure that companies that work with us possess appropriate

intellectual property rights or licenses, we cannot fully avoid the risks of

intellectual property rights infringement created by suppliers of components

used in our products or by companies we work with in cooperative research and

development activities. Our current or potential competitors, many of which have

substantial resources and have made substantial investments in competing

technologies, may have obtained or may obtain patents that will prevent, limit

or interfere with our ability to make, use or sell our products in China or

other countries. The defense of intellectual property claims, including patent

infringement suits, and related legal and administrative proceedings can be both

costly and time consuming, and may significantly divert the efforts and

resources of our technical and management personnel. Furthermore, an adverse

determination in any such litigation or proceeding to which we may become a

party could cause us to:

|

▪

|

pay damage

awards;

|

|

▪

|

seek

licenses from third parties;

|

|

▪

|

pay

additional ongoing royalties, which could decrease our profit

margins;

|

|

▪

|

redesign

our products; or

|

|

▪

|

be

restricted by injunctions.

|

8

These factors

could effectively prevent us from pursuing some or all of our business and

result in our end-user customers or potential end-user customers deferring,

canceling or limiting their purchase or use of our products, which may have a

material adverse effect on our business, financial condition and results of

operations.

We may undertake

acquisitions, which may have a material adverse effect on our ability to manage

our business, and may end up being unsuccessful.

Our growth

strategy may involve the acquisition of new technologies, businesses, products

or services or the creation of strategic alliances in areas in which we do not

currently operate. These acquisitions could require that our management develop

expertise in new areas, manage new business relationships and attract new types

of customers. Furthermore, acquisitions may require significant attention from

our management, and the diversion of our management’s attention and resources

could have a material adverse effect on our ability to manage our business. We

may also experience difficulties integrating acquisitions into our existing

business and operations. Future acquisitions may also expose us to potential

risks, including risks associated with:

|

▪

|

the

integration of new operations, services and personnel;

|

|

|

▪

|

unforeseen

or hidden liabilities;

|

|

|

▪

|

the

diversion of resources from our existing businesses and

technologies;

|

|

|

▪

|

our

inability to generate sufficient revenue to offset the costs of

acquisitions; and

|

|

|

▪

|

potential

loss of, or harm to, relationships with employees or customers, any of

which may have a material adverse effect on our ability to manage our

business.

|

Failure to manage

our growth could strain our management, operational and other resources, which

may materially and adversely affect our business, financial condition and

results of operations.

Our

growth strategy includes increasing market penetration of our existing products,

developing new products, expanding our product offerings and providing a

comprehensive integrated set of products. Pursuing these strategies has resulted

in, and will continue to result in, substantial demands on management resources.

In particular, the management of our growth will require, among other

things:

|

▪

|

continued

enhancement of our research and development

capabilities

|

|

▪

|

continued

growth of our manufacturing

capacity;

|

|

▪

|

stringent

cost controls and sufficient

liquidity;

|

|

▪

|

strengthening

of financial and management

controls;

|

|

▪

|

increased

marketing, sales and sales support activities;

and

|

|

▪

|

hiring

and training of new personnel

|

We may

not be able to effectively manage any expansion in one or more of these areas,

and any failure to do so could harm our ability to maintain or increase revenue

and operating results. In addition, our growth may require us to make

significant capital expenditures or to incur other significant expenses. If we

are not able to manage our growth successfully, our business, financial

condition and results of operations may be materially and adversely

affected.

The slowdown of

China’s economy caused in part by the recent challenging global economic

conditions may adversely affect our business, results of operations and

financial condition.

China’s

economy has experienced a slowdown after the second quarter of 2007, when the

quarterly growth rate of China’s gross domestic product reached 11.9%. A number

of factors have contributed to this slowdown, including appreciation of the

Renminbi, which has adversely affected China’s exports, and tightening

macroeconomic measures and monetary policies adopted by the Chinese government

aimed at preventing overheating of China’s economy and controlling China’s high

level of inflation. The slowdown has been further exacerbated by the challenging

global economic conditions in the financial services and credit markets, which

in recent months has resulted in extreme volatility and dislocation of the

global capital and credit markets.

On

November 5, 2008, the State Council of China announced an economic stimulus

plan in the amount of $585 billion to stimulate economic growth and bolster

domestic demand. The economic stimulus plan includes, among others, increased

spending on basic infrastructure construction projects for water, electricity,

gas and heat to improve the standard of living in China and protect the

environment. Although the economic stimulus plan could generate increased demand

for our water treatment equipment, we cannot assure you that the economic

stimulus plan or various macroeconomic measures and monetary policies adopted by

the Chinese government to guide economic growth and the allocation of resources

will be effective in sustaining the growth of the Chinese economy. The slowdown

of the Chinese economy could lead to a decrease in business and construction

activity nationwide, which could reduce demand for our products and adversely

affect our business, results of operations and financial condition.

9

If we fail to

accurately project demand for our products, we may encounter problems of

inadequate supply or oversupply, which would materially and adversely affect our

business, financial condition and results of operations, as well as damage our

reputation and brand.

We

project demand for our products based on rolling projections and our

understanding of industrial policies and government plans for future residential

developments that may affect demand for water treatment equipment. The varying

sales and purchasing cycles, however, make it difficult for us to accurately

forecast future demand for our products.

If we

overestimate demand, we may purchase more raw materials or components than

required. If we underestimate demand, our third party suppliers may have

inadequate raw material or product component inventories, which could interrupt

our manufacturing and delay shipments, and could result in lost sales. In

particular, we are seeking to reduce our procurement and inventory costs by

matching our inventories closely with our projected manufacturing needs and by

deferring our purchase of raw materials and components from time to time in

anticipation of supplier price reductions. As we seek to balance reduced

inventory costs and production flexibility, we may fail to accurately forecast

demand and coordinate our procurement and production to meet demand on a timely

basis. Our inability to accurately predict and to timely meet our demand would

materially and adversely affect our business, financial conditions and results

of operations as well as damage our reputation and brand.

If we cannot

obtain sufficient raw materials and components that meet our production

standards at a reasonable cost or at all, our ability to produce and market our

products, and thus our business, could suffer.

For the

fiscal year 2009, 54.96% of our raw materials were purchased from our top two

vendors. If any supplier is unwilling or unable to provide us with high-quality

raw materials and components in required quantities and at acceptable costs, we

may not be able to find alternative sources on satisfactory terms in a timely

manner, or at all. In addition, some of our suppliers may fail to meet

qualifications and standards required by our customers now or in the future,

which could impact our ability to source raw materials and components. Our

inability to find or develop alternative supply sources could result in delays

or reductions in manufacturing and product shipments. We may be required to

redesign our products to conform to the materials and components provided by

these alternative suppliers. Moreover, these suppliers may delay shipments or

supply us with inferior quality raw materials and components that may adversely

impact the performance of our products. The costs of raw materials could

increase and we may not be able to pass these price increases on to our

customers. If any of these events occur, our ability to produce and market our

products, and thus our business could suffer.

Any interruption

in our manufacturing operations or production and distribution processes could

impair our financial performance and negatively affect our

brand.

Our

manufacturing operations involve the coordination of raw materials and

components (some sourced from third parties), internal production processes and

external distribution processes. While these operations are modified on a

regular basis in an effort to improve manufacturing and distribution efficiency

and flexibility, we may experience difficulties in coordinating the various

aspects of our manufacturing processes, thereby causing downtime and delays. We

manufacture, assemble and store almost all of our products, as well as conduct

some of our primary research and development activities, at a principal facility

located in the Langfang Economic & Technical Development Zone near

Beijing, China. We do not maintain back-up facilities, so we depend on this

facility for the continued operation of our business. A natural disaster or

other unanticipated catastrophic event, including power interruptions, water

shortage, storms, fires, earthquakes, terrorist attacks and wars, could

significantly impair our ability to manufacture our products and operate our

business, as well as delay our research and development activities. Our facility

and certain equipment located in this facility would be difficult to replace and

could require substantial replacement lead-time. Catastrophic events may also

destroy any inventory located in our facility. The occurrence of such an event

could materially and adversely affect our business. In addition, any stoppage in

production, even if temporary, or delay in delivery to our customers could

severely affect our business or reputation. We currently do not have business

interruption insurance to offset these potential losses and any interruption in

our manufacturing operations or production and distribution processes could

impair our financial performance and negatively affect our brand.

Our insurance

coverage may be inadequate to protect us against losses.

Although

we maintain property insurance coverage for our facilities , we do not have any

business liability, loss of data or business interruption insurance coverage for

our operations in China. If any claims for injury are brought against us, or if

we experience any business disruption, litigation or natural disaster, we might

incur substantial costs and diversion of resources.

Problems with

product quality or product performance could result in a decrease in customers

and revenue, unexpected expenses and loss of market share.

Our

operating results depend, in part, on our ability to deliver quality products on

a timely and cost effective basis. As our products become more advanced, it may

become more difficult to maintain our quality standards. If we experience

deterioration in the performance or quality of any of our products, including as

a result of the expansion of our manufacturing capabilities, it could result in

delays in delivery, cancellations of orders or customer returns and complaints,

loss of goodwill and harm to our brand and reputation. Furthermore, our products

are manufactured using raw materials and components that have been produced by

third parties, and when a problem occurs, it may be difficult to identify the

source of the problem. These problems may lead to a decrease in customers and

revenue, harm to our brand, unexpected expenses, loss of market share, the

incurrence of significant repair costs, diversion of the attention of our

personnel from our product development efforts or customer relation problems,

any one of which may materially and adversely affect our business, financial

condition and results of operations.

10

Our products may

become subject to recall in the event of defects or other performance related

issues.

Our

products may become subject to recall and we may be at risk for product recall

costs which are costs incurred when, either voluntarily or involuntarily, a

product is recalled through a formal campaign to solicit the return of specific

products due to a known or suspected performance defect. Costs typically include

the cost of the product, part or component being replaced, the cost of the

recall borne by our customers and labor to remove and replace the defective part

or component. Our products have not been the subject of an open recall. If a

recall decision is made, we will need to estimate the cost of the recall and

record a charge to earnings in that period. In making this estimate, judgment is

required as to the quantity or volume to be recalled, the total cost of the

recall campaign, the ultimate negotiated sharing of the cost between us and the

customer and, in some cases, the extent to which the supplier of the part or

component will share in the recall cost. As a result, these estimates are

subject to change. Excessive recall costs or our failure to adequately estimate

these costs may negatively affect our operating results.

Environmental

claims or failure to comply with any present or future environmental regulations

may require us to spend additional funds and may harm our results of

operations.

We are

subject to environmental, health and safety laws and regulations that affect our

operations, facilities and products in China. Any failure to comply with any

present or future environmental, health and safety laws and regulations could

result in the assessment of damages or imposition of fines against us,

suspension of production, cessation of our operations or even criminal

sanctions. New laws and regulations could also require us to acquire costly

equipment or to incur other significant expenses. Our failure to control the use

of, or adequately restrict the discharge of, hazardous substances could subject

us to potentially significant monetary damages and fines or suspension of our

business operations, which may harm our results of operations.

If we are

deemed to have materially violated the regulation regarding the discharge of

pollutants, the governmental authorities may order us to rectify the situation

of noncompliance within a time limit. If more stringent regulations are adopted

in the future, the related compliance costs could be substantial. Any failure by

us to control the use of or to adequately restrict the discharge of hazardous

substances could subject us to potentially significant monetary damages and

fines or suspensions in our business operations.

We depend heavily

on key personnel, and the loss of key employees and senior management could harm

our business.

Our

future success depends in significant part upon the continued contributions of

our key technical and senior management personnel, Mr. Boping Li, our

founder and chief executive officer, for example. It also depends in significant

part upon our ability to attract and retain additional qualified management,

technical, sales and marketing and support personnel for our operations.

Competition for such personnel is intense and we may fail to retain our key

personnel or fail to attract, assimilate or retain other high-qualified

personnel in the future. If we lose a key employee, if a key employee fails to

perform in his or her current position or if we are not able to attract and

retain skilled employees as needed, our business could suffer. Turnover in our

senior management could significantly deplete institutional knowledge held by

our existing senior management team and impair our operations, which could harm

our business.

In

addition, if any of these key personnel joins a competitor or forms a competing

company, we may lose some of our end-user customers. In such cases, our

profitability and financial performance may be adversely affected. We have

entered into confidentiality and non-competition agreements with all of these

key personnel. However, if any disputes arise between these key personnel and

us, it is not clear, in light of uncertainties associated with the Chinese legal

system, what the court decisions will be and the extent to which these court

decisions could be enforced in China, where all of these key personnel reside

and hold some of their assets. See “—Risks Related to Doing Business in

China—China’s legal and judicial system may not adequately protect our business

and operations and the rights of foreign investors.”

The newly enacted

Chinese enterprise income tax law will affect tax exemptions on the dividends we

receive and increase the enterprise income tax rate applicable to

us.

We

conduct substantially all of our business through our wholly owned Chinese

subsidiaries and we derive all of our income from these subsidiaries. Prior to

January 1, 2008, dividends derived by foreign legal persons from business

operations in China were not subject to the Chinese enterprise income tax.

However, such tax exemption ceased after January 1, 2008 with the

effectiveness of the new EIT law.

We will incur

increased costs as a result of being a public company.

Upon

completion of this offering, we will become a public company and expect to incur

significant legal, accounting and other expenses that we did not incur as a

private company. Moreover, the Sarbanes-Oxley Act of 2002, as well as new rules

subsequently implemented by the Securities and Exchange Commission and the New

York Stock Exchange, have imposed additional requirements on corporate

governance practices of public companies. We expect these new rules and

regulations to increase our legal and financial compliance costs and to make

some corporate activities more time-consuming and costly. For example, as a

result of becoming a public company, we will need to add independent directors

to our board and adopt policies regarding internal controls and disclosure

controls and procedures. In addition, we will incur additional costs associated

with our public company reporting requirements. It may also be difficult for us

to attract and retain qualified persons to serve on our board of directors due

to increased risks of liability to our directors under the new rules and

regulations. We are currently evaluating and monitoring developments with

respect to these new rules and regulations, and we cannot predict or estimate

with any degree of certainty the amount or timing of additional costs we may

incur.

11

Although

our results of operations, cash flows and financial condition reflected in our

combined and consolidated financial statements include all of the expenses

allocable to our business, because of the additional administrative and

financial obligations associated with operating as a publicly traded company,

they may not be indicative of the results of operations that we would have

achieved had we operated as a public entity for all periods presented or of

future results that we may achieve as a publicly traded company with our current

holding company structure. Such variations may be material to our

business.

Risks

Relating to Doing Business in China

Our business operations are

primarily conducted in China. Because China’s economy and its laws,

regulations and policies are different from those typically found in the west

and are continually changing, we will face risks including those summarized

below.

Adverse changes

in political and economic policies of the Chinese government could impede the

overall economic growth of China, which could reduce the demand for our products

and have a material adverse effect on our business and

prospects.

We

conduct all of our operations and generate all of our sales in China.

Accordingly, our business, financial condition, results of operations and

prospects are affected significantly by economic, political and legal

developments in China. The Chinese economy differs from the economies of most

developed countries in many respects, including:

|

•

|

the

higher level of government involvement;

|

|

|

•

|

the

early stage of development of the market-oriented sector of the

economy;

|

|

|

•

|

the

rapid growth rate;

|

|

|

•

|

the

higher level of control over foreign exchange; and

|

|

|

•

|

the

allocation of resources.

|

As the

Chinese economy has been transitioning from a planned economy to a more

market-oriented economy, the Chinese government has implemented various measures

to encourage economic growth and guide the allocation of resources. While the

Chinese economy has grown significantly in the past 30 years, the growth

has been uneven geographically among various sectors of the economy, and during

different periods. We cannot assure you that the Chinese economy will continue

to grow, or that if there is growth, such growth will be steady and uniform, or

that if there is a slowdown, such slowdown will not have a negative effect on

our business. For example, the Chinese economy experienced high inflation in the

second half of 2007 and the first half of 2008. China’s consumer price index

soared 7.9% during the six months ended June 30, 2008 as compared to the

same period in 2007. To combat inflation and prevent the economy from

overheating, the Chinese government adopted a number of tightening macroeconomic

measures and monetary policies, including increasing interest rates, raising

statutory reserve rates for banks and controlling bank lending to certain

industries or economic sectors. However, due in part to the challenging global

economic conditions facing the financial services and credit markets and other

factors, the growth rate of China’s gross domestic product has decreased to 6.8%

in the fourth quarter of 2008, down from 11.9% in the second quarter of 2007. As

a result, beginning in September 2008, among other measures, the Chinese

government began to loosen macroeconomic measures and monetary policies by

reducing interest rates and decreasing the statutory reserve rates for banks. In

addition, on November 5, 2008, the State Council of China announced an

economic stimulus plan in the amount of $585 billion to stimulate economic

growth and bolster domestic demand. The economic stimulus plan includes, among

others, increased spending on basic infrastructure construction projects for

water, electricity, gas and heat to improve the standard of living in China and

protect the environment. Although the economic stimulus plan could generate

increased demand for our water treatment equipment, we cannot assure you that

the economic stimulus plan or various macroeconomic measures and monetary

policies adopted by the Chinese government to guide economic growth and the

allocation of resources will be effective in sustaining the growth of the

Chinese economy.

12

The Chinese

government will continue to exercise significant control over economic growth in

China through the allocation of resources, controlling payment of foreign

currency denominated obligations, setting monetary policy and imposing policies

that impact particular industries or companies in different ways. Any adverse

change in the economic conditions or government policies in China could have a

material adverse effect on the overall economic growth and the level of water

treatment investments and expenditures in China, which in turn could lead to a

reduction in demand for our products and consequently have a material adverse

effect on our business and prospects. Our ability to operate in China may also

be harmed by changes in its laws and regulations, including those relating to

taxation, import and export tariffs, environmental regulations, land-use-rights,

property and other matters. We believe that our operations in China are in

material compliance with all applicable legal and regulatory requirements.

However, the central or local governments of the jurisdictions in which we

operate may impose new, stricter regulations or interpretations of existing

regulations that would require additional expenditures and efforts on our part

to ensure our compliance with such regulations or interpretations. Accordingly,

government actions in the future, including any decision not to continue to

support China’s economic reforms and to return to a more centrally planned

economy or regional or local variations in the implementation of economic

policies, could have a significant effect on economic conditions in China or

particular regions thereof and could require us to divest ourselves of any

interest we then hold in Chinese properties or joint

ventures.

If the PRC

government finds that the agreements that establish the structure for operating

our China business do not comply with PRC governmental restrictions on foreign

investment, we could be subject to severe penalties.

Our

businesses are currently primarily provided through contractual arrangements

between Yixing Dragon Path, our WFOE operating subsidiary and

Zhenyu. If we, our existing or future PRC operating subsidiaries and

affiliates are found to be in violation of any existing or future PRC laws or

regulations or fail to obtain or maintain any of the required permits or

approvals, the relevant PRC regulatory authorities, including the State

Administration for Industry and Commerce, would have broad discretion in dealing

with such violations, including:

|

•

|

revoking

the business and operating licenses of our PRC subsidiaries and

affiliates;

|

||

|

•

|

discontinuing

or restricting our PRC subsidiaries’ and affiliates’

operations;

|

||

|

•

|

imposing

conditions or requirements with which we or our PRC subsidiaries and

affiliates may not be able to comply;

|

||

|

•

|

requiring

us or our PRC subsidiaries and affiliates to restructure the relevant

ownership structure or operations; or

|

||

|

•

|

restricting

or prohibiting our use of the proceeds of this offering to finance our

business and operations in China.

|

The

imposition of any of these penalties would result in a material and adverse

effect on our ability to conduct our business.

We rely on

contractual arrangements with Zhenyu and its shareholders for a substantial

portion of our China operations, which may not be as effective in providing

operational control as direct ownership.

We rely on

contractual arrangements with Zhenyu and its shareholders to operate our

business. For a description of these contractual arrangements, see “Corporate

Structure and Contractual Arrangements” and “Related Party Transactions”. These

contractual arrangements may not be as effective in providing us with control

over Zhenyu as direct ownership. If we had direct ownership of Zhenyu, we would

be able to exercise our rights as a shareholder to effect changes in the board

of directors of Zhenyu which in turn could effect changes, subject to any

applicable fiduciary obligations, at the management level. However, under the

current contractual arrangements, as a legal matter, if Zhenyu or any of its

shareholders fails to perform respective obligations under these contractual

arrangements, we may have to incur substantial costs and resources to enforce

such arrangements, and rely on legal remedies under PRC law, including seeking

specific performance or injunctive relief, and claiming damages, which we cannot

assure you to be effective. For example, if the shareholders of Zhenyu were to

refuse to transfer their equity interest in Zhenyu to us or our designee when we

exercise the purchase option pursuant to these contractual arrangements, or if

they were otherwise to act in bad faith toward us, then we may have to take

legal action to compel them to fulfill their contractual

obligations.

Many of these

contractual arrangements are governed by PRC law and provide for the resolution

of disputes through either arbitration or litigation in the PRC. Accordingly,

these contracts would be interpreted in accordance with PRC law and any disputes

would be resolved in accordance with PRC legal procedures. The legal environment

in the PRC is not as developed as in other jurisdictions, such as the United

States. As a result, uncertainties in the PRC legal system could limit our

ability to enforce these contractual arrangements. In the event we are unable to

enforce these contractual arrangements, we may not be able to exert effective

control over our operating entities, and our ability to conduct our business may

be negatively affected.

Contractual

arrangements we have entered into among our subsidiary and affiliated entity may

be subject to scrutiny by the PRC tax authorities and a finding that we owe

additional taxes or are ineligible for our tax exemption, or both, could

substantially increase our taxes owed, and reduce our net income and the value

of your investment.

Under

PRC law, arrangements and transactions among related parties may be subject

to audit or challenge by the PRC tax authorities. If any of the transactions we

have entered into among our subsidiaries and affiliated entities are found not

to be on an arm’s-length basis, or to result in an unreasonable reduction in tax

under PRC law, the PRC tax authorities have the authority to disallow our tax

savings, adjust the profits and losses of our respective PRC entities and assess

late payment interest and penalties.

As a result

of this risk, you should evaluate our results of operations and financial

condition without regard to these tax savings.

13

The PRC legal

system embodies uncertainties which could limit the legal protections available

to you and us.

The PRC legal

system is a civil law system based on written statutes. Unlike common law

systems, it is a system in which decided legal cases have little precedential

value. In 1979, the PRC government began to promulgate a comprehensive system of

laws and regulations governing economic matters in general. The overall effect

of legislation over the past 26 years has significantly enhanced the

protections afforded to various forms of foreign investment in China. Our PRC

operating subsidiary, Yixing Dragon Path, is a wholly foreign-owned enterprise

which is an enterprise incorporated in China and wholly-owned by foreign

investors. Yixing Dragon Path is subject to laws and regulations applicable to

foreign investment in China in general and laws and regulations applicable to

wholly foreign-owned enterprises in particular. However, these laws, regulations

and legal requirements change frequently, and their interpretation and