Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

Report: February 12, 2010

China

Executive Education Corp.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

333-153574

|

75-3268300

|

||

|

(State

or Other Jurisdiction

of

Incorporation)

|

(Commission

File Number)

|

(IRS

Employer

Identification

No.)

|

Hangzhou

MYL Business Administration Consulting Co. Ltd.

Room

307, Hualong Business Building,

110 Moganshan Road,

Hangzhou, P.R.China

(ADDRESS

OF PRINCIPAL EXECUTIVE OFFICES)

310005

(Zip

Code)

(86)

0571-8880-8109

(Registrant's

telephone number, including area code)

N/A

(Former

Name or Former Address if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

|

Forward

Looking Statements Some of the statements contained in this Form 8-K that are

not historical facts are "forward-looking statements" which can be identified by

the use of terminology such as "estimates," "projects," "plans," "believes,"

"expects," "anticipates," "intends," or the negative or other variations, or by

discussions of strategy that involve risks and uncertainties. We urge you to be

cautious of the forward-looking statements, that such statements, which are

contained in this Form 8-K, reflect our current beliefs with respect to future

events and involve known and unknown risks, uncertainties and other factors

affecting our operations, market growth, services, products and licenses. No

assurances can be given regarding the achievement of future results, as actual

results may differ materially as a result of the risks we face, and actual

events may differ from the assumptions underlying the statements that have been

made regarding anticipated events. Factors that may cause actual results, our

performance or achievements, or industry results, to differ materially from

those contemplated by such forward-looking statements include without

limitation: our ability to attract and retain management, and to integrate and

maintain technical information and management information systems; our ability

to raise capital when needed and on acceptable terms and conditions; o The

intensity of competition; and General economic conditions. Please see Risk

Factors for discussion in detail. All written and oral forward-looking

statements made in connection with this Form 8-K that are attributable to us or

persons acting on our behalf are expressly qualified in their entirety by these

cautionary statements. Given the uncertainties that surround such statements,

you are cautioned not to place undue reliance on such forward-looking

statements.

Item

1.01 Entry into a Material Definitive Agreement

The

disclosure set forth below under Item 2.01(Completion of Acquisition or

Disposition of Assets) is hereby incorporated by reference to this Item

1.01.

Item

2.01 Completion of Acquisition or Disposition of

Assets

On February

12, 2010, On Demand Heavy Duty Corp., a Nevada Corporation (the “Company”)

acquired all of the outstanding capital stock of Surmounting Limit Marketing

Adviser Limited, a Hong Kong corporation (“SLM”), through China Executive

Education Corp., a Nevada corporation (the “Merger Sub”) wholly owned by the

Company. SLM is a holding company whose asset, held through a

subsidiary, is 100% of the registered capital of Hangzhou MYL Business

Administration Consulting Co., Ltd. (“MYL Business”), a limited liability

company organized under the laws of the People’s Republic of China (“China” or

“PRC”). Substantially all of SLM's operations are conducted in China through MYL

Business, and through contractual arrangements with several of MYL Business’s

consolidated affiliated entities in China, including Hangzhou MYL Commercial

Services Co., Ltd. (“MYL Commercial”) and its subsidiaries.MYL Commercial is a

fast-growing executive education company with dominant operation in Shanghai,

the commercial center of China.

In connection

with the acquisition, the following transactions took place:

|

▪

|

The

Merger Sub issued 20 shares of the common stock of the Merger Sub which

constituted no more than 10% ownership interest in the Merger Sub to the

shareholders of SLM, in exchange for all the shares of the capital stock

of SLM (the “Share Exchange” or “Merger”). The 10 shares of the common

stock of the Merger Sub were converted into approximately 21,560,000

shares of the common stock of the Company so that upon completion of the

Merger, the shareholders of SLM own approximately 98% of the common stock

of the Company.

|

|

▪

|

Post

the transaction contemplated in the Merger Agreement, there were

22,000,000 shares of common stock issued and

outstanding.

|

|

▪

|

Cody

Love resigned as the Company’s Chief Executive Officer, Secretary and

Treasurer on Feb 12, 2010.

|

|

▪

|

Kaien

Liang, Chairman of SLM and MYL Business, was elected to serve on our

Board of Directors as Chairman of, and was appointed as Chief Executive

Officer of the Company.

|

|

▪

|

Pokai

Hsu, Chief Executive Officer of SLM and MYL Business, was appointed

as Chief Operating Officer of the

Company.

|

|

▪

|

Tingyuan

Chen, Chief Strategy Officer of SLM and MYL Business, was appointed as

Chief Strategy Officer of the

Company.

|

2

|

▪

|

Zhiwei

Huang, Chief Financial Officer of SLM and MYL Business, was appointed as

Chief Financial Officer of the

Company.

|

|

▪

|

As

part of the Merger, pursuant to a stock purchase agreement (the “Stock

Purchase Agreement”), the Company transferred all of the outstanding

capital of its subsidiary, On Demand Heavy Duty Holdings,

Inc. (“Holdings”) to certain of its shareholders in exchange

for the cancellation of 3,000,000 shares of the Company’s common stock

(the “Split Off Transaction”). Holdings was engaged in the

business of internet travel planning. To date, Holdings’

activities were limited to capital formation, organization, set-up of a

website and development of its business plan and target customer

market. Following the Merger and the Split-Off Transaction, the

Company discontinued its former business and is now engaged in the

executive education business.

|

|

▪

|

As

part of the Merger, the Company’s name was changed from “On Demand Heavy

Duty Corp.” to the Merger Sub’s name “China Executive Education Corp.” The

Company is communicating with FINRA for the name change and trading symbol

change on the OTC Bulletin Board.

|

As a result

of these transactions, persons affiliated with Surmounting Limit Marketing

Adviser Limited now own securities that in the aggregate represent

approximately 98% of the equity in the Company.

New

Management

Upon the

completion of the Merger, the new executive officers and directors of the

Company will be:

|

Name

|

Age

|

Positions with the

Company

|

|

Kaien

Liang

|

37

|

Director,

Chairman & Chief Executive Officer

|

|

Pokai

Hsu

|

38

|

Chief

Operation Officer

|

|

Tingyuan

Chen

|

44

|

Chief

Strategy Officer

|

|

Zhiwei

Huang

|

42

|

Chief

Financial Officer

|

All directors

hold office until the next annual meeting of our shareholders and until their

successors have been elected and qualify. Officers serve at the

pleasure of the Board of Directors.

Kaien Liang,

37, Chairman of the Company. Born in Taiwan, in 1973. Before establishing the

company, he has served as president of Singapore Magic of Success Training Co.,

Ltd from 2004 to 2006. Prior to that, Mr. Liang worked as Marketing Director at

Asia Magic Your Life Group between 2000 and 2003, and Marketing Director of

Success Magazine in

Taiwan from 1997 to 2000. During that period, he had participated in and made

huge investment in learning from several professional training programs by

directly learning from 38 world-class masters in different management fields.

Mr. Liang holds 14 internationally accredited certificates in respect of

negotiation, marketing, sale, public speaking, customer service, etc. His total

audience exceeds 500,000. His books, Never Say

Impossible, Who is the Next

Magic have been published and sold well.

Pokai Hsu, 38,

Chief Executive Officer. Born in Taiwan in 1972. He joined Asia Magic Your Life

Group in 2003. He has served as the General Manager at Beijing Hongyuan Yingtong

Cultural Press Co., Ltd. Between 2002 and 2003. Prior to that, he worked in Du

Yunsheng Consulting Co., Ltd. as the Chief Consultant for 2 years.

Mr. Hsu is a master for potential motivating. By integrating his learning and

achievements in motivational training in UK, USA, and Japan, Mr. HSU has created

an efficient training system in unleashing employee potential. He has given

lectures for over 2,300 times in the last 8 years, with the audience of over

200,000. In 2006, his bestseller, How to Be No.1 in

China,

broke the Guinness record on sale of book signing event.

Tingyuan Chen,

44, Chief Strategy Officer. Born in Taiwan in

1966. Prior to joining Asia Magic Your Life Group in 2003, he worked

for Steve Chen Training Entity as a lecturer for 4 years. As a

student of Mr. Abraham, the world “marketing wizard”, Mr. Chen specialized in

teaching and coaching people in time management and strategic decision. Mr. Chen

was graduated from National United University in Taiwan in 1986.

Zhiwei Huang,

42, Chief Financial Officer of the Company. Mr. Huang joined the company in

April, 2009. Prior to that, he has served as Financial Manager in Hangzhou

Tai-Yang-Shen Marketing Co., Ltd. for 16 years. Before that, he

served as Accountant in Zhejiang Hangzhou Shipping Corp between 1989 and 1993.

Mr. Huang was graduated from Wuhan River Transport College in 1989 and graduated

from Zhejiang University of Finance & Economics in 2004.

3

Please note

that the information provided below relates to the combined Company after the

Share Exchange, unless otherwise specifically indicated.

OVERVIEW

The Company,

Surmounting Limit Marketing Adviser Limited (“SLM”) was incorporated in Hong

Kong under the Chapter 32 Companies Ordinance on October 17, 2007 as limited

company. The Company has had no operation until it established 100% stake of MYL

Business, a People’s Republic of China (“PRC”) company, on April 23,

2009.

To comply

with the PRC laws and regulations while providing our education services in

China, SLM, through its WOFE subsidiary, MYL Business, entered into contractual

agreements (known as “variable interest entity” (VIE) arrangement) with Hangzhou

MYL Commercial Service Co. Ltd., (“MYL Commercial”), in May 2009, under which

SLM provides exclusive management and technical services (the “Service

Agreements”) to MYL Commercial and its related entities in exchange for

substantially all of the net income of MYL Commercial. As collateral to ensure

MYL Commercial and its subsidiaries’ payments under the Service Agreements, the

shareholders of MYL Commercial and its subsidiaries, through an equity pledge

agreement, pledged all of their rights and interests in MYL Commercial and its

subsidiaries, including voting rights and dividend rights, to SLM. In addition,

the shareholders of MYL Commercial, through an exclusive option agreement,

granted to SLM an exclusive, irrevocable and unconditional right to purchase

part or all of the equity interests in MYL Commercial and its subsidiaries when

the purchase becomes permissible under the relevant PRC Law.

We are a

fast-growing executive education company in China. We operate comprehensive

business training programs through our controlled affiliates and subsidiaries in

Hangzhou and Shanghai, which are two prosperous and commercial cities of China.

Our executive training programs are designed to fit the needs of Chinese

entrepreneurs, and to improve their leadership skill, management skills and

marketing skills, as well as bottom-line results. Our comprehensive business

training initiatives integrate research-based, proprietary content with

processes that are specifically and explicitly connected to the critical

business issues that most private Chinese companies are facing. This allows the

trainees to better utilize achieve their potentials and better align individual

goals and competencies with organizational objectives of their employers or

business. We have developed 22 training courses which include a core course,

named “Seven Essential Classes for Business Executives”.

We derive our

sales revenue from selling our proprietary training courses. We also generate

sales revenue from our “Featured Lectures” events which are organized by us

periodically with the presence of world masters or well-known keynote speakers.

In 2009, we have organized four (4) such Featured Lectures in Shanghai. The

featured speakers are Mr. Mark Hansen, Writer of Chicken Soup for the Soul,

Roger Dawson, the top US negotiator, Joe Girard, top sales executive and the

keeper of Guinness Record, and Mr. John C. Maxwell, the World Master of

Leadership.

We sell our

training programs through our own sales team which consists of 220

self-motivated sales staff. We also promote our services through the internet.

Our websites are www.magicyourlife101.com

and www.myl101.com . The

domain name of www.magicyourlife101.com

was registered by Mr. Kaien LIANG in the name of Surmounting Limit Marketing

Adviser Limited (Shanghai). The registered operator of this website is Shanghai

Kaiye Investment Consulting Co., Ltd.. The domain name of www.myl101.com is

registered by Dreamer Marketing Adviser (Shanghai) Co., Ltd.. The registered

operator of this website is MYL Commercial.

Since our

business inception in April 2009, we have experienced rapid and steady business

growth. During the nine (9) months in operation in 2009, we have enrolled

approximately 2,874 trainees to our program, and generated approximately

US$12.76 million of fee payment, of which US $9.14 million has been

recognized as sales revenue and US$ 3.31 million as the net profit in Year 2009.

The operation results are set forth as follows:

|

In

USD Million

|

3

Months ended June 30, 2009

|

3

months ended September 30, 2009

|

3

months ended December 31, 2009

|

|||

|

Fee

Payment*

|

2.70

|

4.22

|

5.84

|

|||

|

Enrollments

|

392

|

889

|

1593

|

Note: *

Fee Payment is different from Sales Revenue, because of revenue recognition

method and contractual arrangement.

4

Hangzhou

MYL Business Administration Consulting Co., Ltd.

MYL Business

was incorporated as a limited liability company in April 23, 2009 under PRC law.

It is currently 100% owned by SLM

which is further 100% owned by Magic Dream Enterprises Ltd. Our

business is currently conducted through contractual arrangements among us, our

subsidiary and our consolidated affiliated entities in China, principally MYL

Commercial and its subsidiaries. MYL Commercial and several of its

subsidiaries hold the requisite licenses to provide executive education services

in China. These contractual arrangements enable us to:

|

▪

|

exercise

effective control over MYL Commercial and its

subsidiaries;

|

|

▪

|

receive

a substantial portion of the economic benefits from MYL

Commercial and its subsidiaries;

and

|

|

▪

|

have

an exclusive option to purchase all or part of the equity interests in MYL

Commercial and all or part of the equity interests in MYL Commercial’s

subsidiaries that are owned by MYL Commercial or its nominee holders, as

well as all or part of the assets of MYL Commercial , in each case when

and to the extent permitted by PRC

law.

|

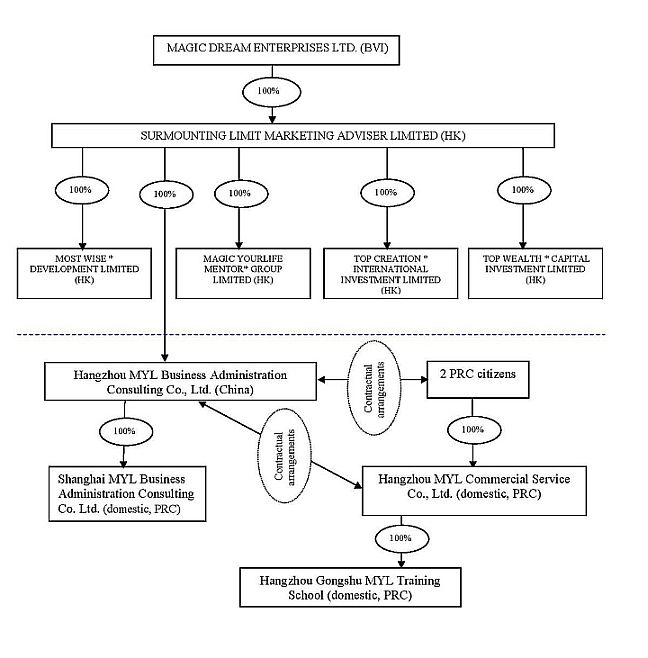

OUR

STRUCTURE

*non-active subsidiaries with

no operations.

5

CONTRACTUAL

ARRANGEMENTS

We need

to use the following contractual arrangement to exercise effective

control.

Agreements

that Transfer Economic Benefits to Us

Pursuant to

our contractual arrangements with MYL Commercial and its subsidiaries, MYL

Business provides management and consulting services to MYL Commercial and its

subsidiaries in exchange for service fees. The service fees shall equal to 95%

of the total income of MYL Commercial and its subsidiaries which can be waived

by MYL Business from time to time in its sole discretion.

Agreements

that Provide Effective Control over MYL Commercial and Its

Subsidiaries

We have

entered into the following agreements with MYL Commercial and its subsidiaries

that provide us with effective control over MYL Commercial and its

subsidiaries:

|

▪

|

an

exclusive service agreement, pursuant to which MYL

Commercial and its Subsidiaries irrevocably entrust to MYL

Business the right of management and operation of MYL

Commercial and its subsidiaries and the responsibilities and

authorities of their shareholders and directors of MYL Commercial and its

subsidiaries;

|

|

▪

|

a

voting rights proxy agreement, pursuant to which the shareholder of MYL

Commercial and its subsidiaries have granted the personnel

designated by MYL Business the right to appoint directors and senior

management of MYL Commercial and its subsidiaries and to

exercise all of their other voting rights as shareholders of MYL

Commercial and its subsidiaries, as the case may be, as

provided under the articles of association of each such

entity;

|

|

▪

|

a

call option agreement, pursuant to

which:

|

|

▪

|

neither

MYL Commercial nor any of its subsidiaries may enter into any

transaction that could materially affect its assets, liabilities, equity

or operations without the prior written consent of MYL

Business;

|

|

▪

|

neither

MYL Commercial nor any of its subsidiaries will distribute any

dividends without the prior written consent of MYL Business

and

|

|

▪

|

MYL

Business or its designee has an exclusive option to purchase all or part

of the equity interests in MYL Commercial, all or part of the equity

interests in MYL Commercial ’s subsidiaries owned by MYL

Commercial or its nominee holders, or all or part of the assets

of MYL Commercial , in each case when and to the extent permitted by PRC

law. In case of MYL Business exercising the call option in its sole

discretion upon the occurrence of the situation in which such call option

exercise become feasible under the relevant laws in PRC, any additional

consideration paid other than the $1.00 which may be required under

the laws of China to effect such purchase to comply with such legal

formalities shall be either cancelled or returned to the company

immediately with no additional compensation to the owners;

and

|

|

▪

|

an

equity pledge agreement pursuant to which each of shareholders of MYL

Commercial has pledged his or its equity interest in MYL

Commercial and its subsidiaries, as the case may be, to MYL

Business to secure their obligations under the relevant contractual

control agreements, including but not limited to, the obligations of MYL

Commercial and its subsidiaries under the exclusive services

agreement, the call option agreement, the voting rights proxy agreement

described above, and each of them has agreed not to transfer, sell,

pledge, dispose of or create any encumbrance on their equity interest in

MYL Commercial or its subsidiaries without the prior written consent of

MYL Business.

|

See

“Related Party Transactions” for further information on our contractual

arrangements with these parties.

In the

opinion of AllBright Law Offices, our PRC legal counsel:

|

▪

|

the

ownership structures of MYL Business, MYL Commercial and its

subsidiaries, both currently and after giving effect to this merger, are

in compliance with existing PRC laws and

regulations;

|

6

|

▪

|

the

contractual arrangements among MYL Business, MYL Commercial and

its subsidiaries governed by PRC law are valid, binding and enforceable,

and will not result in any violation of PRC laws or regulations currently

in effect; and

|

|

▪

|

the

business operations of MYL Business and MYL Commercial and their

respective subsidiaries, as described in this Form 8-K, are in compliance

with existing PRC laws and regulations in all material

respects.

|

However,

in spite of the above, there are substantial uncertainties regarding the

interpretation and application of current and future PRC laws and regulations.

Accordingly, there can be no assurance that the PRC regulatory authorities, in

particular the SAIC which regulates executive education companies, will not in

the future take a view that is contrary to the above opinion of our PRC legal

counsel. If the PRC government finds that the agreements that establish the

structure for operating our PRC executive education business do not comply with

PRC government restrictions on foreign investment in executive education

businesses, we could be subject to severe penalties. See “Risk Factors — If

the PRC government finds that the agreements that establish the structure for

operating our China business do not comply with PRC governmental restrictions on

foreign investment in the executive education industry, we could be subject to

severe penalties”, “— Our business operations may be affected by

legislative or regulatory changes” and “— The PRC legal system embodies

uncertainties which could limit the legal protections available to you and

us”.

COMPETITION

We face

the competition on two different fronts. One is from those major Chinese

university and business schools. They provide EMBA program targeting on

corporation executives and entrepreneurs. The most popular EMBA programs

available in China are from Euro-China International Business College in

Shanghai, Cheung Kong Graduate School of Business, Tsinghua University and

Shanghai Jiaotong University, etc. Those universities’ EMBA programs provide

their students with around 300 hours of formal in-class training programs in the

curriculum, and issue degree certificates to students at graduation. The tuition

ranges from RMB 60,000 (approximately USD 9,000) to RMB 568,000 (approximately

USD 85,000) for the whole program. Each year, each of the top business school

enrolls 400 to 600 students. Their strict admission requirements have kept many

young and less qualified candidates away from the program. Besides, the long

study periods also inconvenience many business owners and

executives.

Open-enrollment

program provided by private education institution, like us, has emerged and

constituted serious competition to those top business schools which provide

formal executive training program. On the other hand, those peer companies also

constitute direct competition with us. Among them, Jucheng Group (founded in

2003 in Shenzhen), Action Success International Education Group (founded in 2001

in Shanghai), and Sparta Group (founded in 2002 in Beijing) are most prominent

companies in our business sector. We compete with them primarily on the basis of

training courses, lecturers, prices, effectiveness of training execution and our

brand name. Since those three companies have been in business longer than us and

they have cross-region presence, they possess their strength in market coverage

and pricing. However, we believe that we also have our competitive advantage in

our international network and broad offering.

OUR

STRATEGIES, RISKS AND UNCERTAINTIES

In order

to enhance our position as one of the top executive education providers in

China, we intend to expand our network, promote our brand name, create

increasingly channels and explore new opportunities. Our ability to realize our

business objectives and execute our strategies is subject to risks and

uncertainties, including the following:

|

▪

|

our

limited operating history for our current operations and the short history

of executive education sector that make it difficult for you to evaluate

the viability and prospects of our

business;

|

|

▪

|

competition

from present and future competitors in China’s growing executive education

market; and

|

|

▪

|

the

possibility that the PRC government could determine that the agreements

that establish our operating structure do not comply with PRC government

restrictions on foreign investment in the executive education industry,

which could potentially subject us to severe

penalties.

|

These

risks and uncertainties, along with others, are also described in the Risk

Factors section of this Current Report on Form 8-K.

7

RISK

FACTORS

An

investment in our common stock or other securities involves a number of

risks. You should carefully consider each of the risks described

below before deciding to invest in our common stock. If any of the

following risks develops into actual events, our business, financial condition

or results of operations could be negatively affected, the market price of our

common stock or other securities could decline and you may lose all or part of

your investment.

The

risk factors presented below are all of the ones that we currently consider

material. However, they are not the only ones facing our

Company. Additional risks not presently known to us, or which we

currently consider immaterial, may also adversely affect us. There

may be risks that a particular investor views differently from us, and our

analysis might be wrong. If any of the risks that we face actually

occur, our business, financial condition and operating results could be

materially adversely affected and could differ materially from any possible

results suggested by any forward-looking statements that we have made or might

make. In such case, the trading price of our common stock could

decline, and you could lose part or all of your investment.

We have a limited operating

history, which may make it difficult for you to evaluate our business and

prospects.

We began

our current business operations in April 2009. Accordingly, we have a limited

operating history for our current operations upon which you can evaluate the

viability and sustainability of our business and its acceptance by private

business owners and executives. It is also difficult to evaluate the viability

of our business model because we do not have sufficient experience to address

the risks frequently encountered by early stage companies using new means to

deliver education programs and entering new and rapidly evolving markets. These

circumstances may make it difficult for you to evaluate our business and

prospects.

Our senior management and

employees have worked together for a short period of time, which may make it

difficult for you to evaluate their effectiveness and ability to address

challenges.

Due to

our limited operating history and recent additions to our management team,

certain of our senior management and employees have worked together at our

company for only a relatively short period of time. As a result, it may be

difficult for you to evaluate the effectiveness of our senior management and

other key employees and their ability to address future challenges to our

business.

Failure to manage our growth

could strain our management, operational and other resources, which could

materially and adversely affect our business and growth

potential.

We have

been rapidly expanding, and plan to continue to rapidly expand, our operations

in China. We must continue to expand our operations to meet the demands of

customers for executive training for larger and more diverse market coverage.

This expansion has resulted, and will continue to result, in substantial demands

on our management resources. To manage our growth, we must develop and improve

our existing administrative and operational systems and, our financial and

management controls and further expand, train and manage our work force. We have

already begun selling our executive education training program through our sales

agents who operate in the inland provinces and may in the future expand our

presence to some major cities in China. As we continue this effort, we may incur

substantial costs and expend substantial resources in connection with any such

expansion. We may encounter difficulties when we expand into other cities or if

we begin operations in other inland provinces in China due to different business

practice, local government regulations and cultural factors. We may not be able

to manage our current or future cross-region operations effectively and

efficiently or compete effectively in such markets. We cannot assure you that we

will be able to efficiently or effectively manage the growth of our operations,

recruit top talent and train our personnel. Any failure to efficiently manage

our expansion may materially and adversely affect our business and future

growth.

We may need additional

capital and we may not be able to obtain it, which could adversely affect our

liquidity and financial position.

To

further expand our executive education business, we may require additional cash

resources. If these sources are insufficient to satisfy our cash requirements,

we may seek to sell additional equity or debt securities or obtain a credit

facility. The sale of convertible debt securities or additional equity

securities could result in additional dilution to our shareholders. The

incurrence of indebtedness would result in increased debt service obligations

and could result in operating and financing covenants that would restrict our

operations and liquidity.

8

Our

ability to obtain additional capital on acceptable terms is subject to a variety

of uncertainties, including:

|

·

|

investors’

perception of, and demand for, securities of alternative executive

education companies;

|

|

·

|

conditions

of the U.S. and other capital markets in which we may seek to raise

funds;

|

|

·

|

our

future results of operations, financial condition and cash

flows;

|

|

·

|

PRC

governmental regulation of foreign investment in executive education

companies in China;

|

|

·

|

economic,

political and other conditions in China;

and

|

|

·

|

PRC

governmental policies relating to foreign currency

borrowings.

|

We cannot

assure you that financing will be available in amounts or on terms acceptable to

us, if at all. Any failure by us to raise additional funds on terms favorable to

us could have a material adverse effect on our liquidity and financial

condition.

We may be subject to

intellectual property infringement claims, which may force us to incur

substantial legal expenses and, if determined adversely against us, may

materially disrupt our business.

We cannot

be certain that our lectures or other aspects of our business do not or will not

infringe upon patents, copyrights or other intellectual property rights held by

third parties. Although we are not aware of any such claims, we may become

subject to legal proceedings and claims from time to time relating to the

intellectual property of others in the ordinary course of our business. If we

are found to have violated the intellectual property rights of others, we may be

enjoined from using such intellectual property, and we may incur licensing fees

or be forced to develop alternatives. In addition, we may incur substantial

expenses in defending against these third party infringement claims, regardless

of their merit. Successful infringement or licensing claims against us may

result in substantial monetary liabilities, which may materially and adversely

disrupt our business.

If the PRC government finds

that the agreements that establish the structure for operating our China

business do not comply with PRC governmental restrictions on foreign investment

in the executive education industry, we could be subject to severe

penalties.

Substantially

all of our operations are or will be conducted through our indirectly

wholly-owned operating subsidiaries in China, which we collectively refer to as

our PRC operating subsidiaries, and through our contractual arrangements with

our consolidated affiliated entities in China. PRC regulations still have strict

restriction on foreign entities operating in the executive education industry in

China. Accordingly, our PRC operating subsidiaries which are directly owned by

non-PRC subsidiaries of ours, which we collectively refer to as wholly-foreign

owned, or WOFE, operating subsidiaries, are currently ineligible to apply for

the required licenses for providing executive education services in China. Our

non-PRC subsidiaries are ineligible to apply for such required licenses too. As

such, our executive education businesses are currently primarily provided

through contractual arrangements between our WOFE operating subsidiaries and our

consolidated affiliated entities in China, which we collectively refer to as our

PRC operating affiliates. These PRC operating affiliates include MYL Commercial,

MYL Business, Hangzhou Gongshu MYL Training School and Shanghai MYL Business

Administration Consulting Co. Ltd.. Accordingly, our executive education

businesses are currently conducted by (i) our indirect PRC operating

subsidiaries and (ii) our PRC operating affiliates. Our PRC operating

affiliates, which we control through contractual relationship are owned by

either (i) one or more PRC citizens designated by us, (ii) one or more

PRC entities owned by our subsidiaries or by our designated appointees or

(iii) a combination of PRC citizens and PRC entities owned by our

subsidiaries designated by us or our designated appointees. Our PRC operating

affiliates, certain of their respective subsidiaries and certain of our indirect

PRC operating subsidiaries hold the requisite licenses to provide executive

education services in China. Our PRC operating affiliates and their respective

subsidiaries directly operate our executive education business. While our

indirect PRC operating subsidiaries are eligible for the required licenses for

providing executive education services in China and some of our indirect PRC

operating subsidiaries have obtained such licenses, we have been using and are

expected to continue to use PRC operating affiliates and their subsidiaries to

operate a significant portion of our executive education business for the

foreseeable future. We have entered into contractual arrangements with PRC

operating affiliates and their respective subsidiaries, pursuant to which we,

through our PRC operating subsidiaries or non-PRC subsidiaries, provide

technical support and consulting services to our PRC operating affiliates and

their subsidiaries. In addition, we have entered into agreements with our PRC

operating affiliates and each of their shareholders which provide us with the

substantial ability to control these affiliates and their existing and future

subsidiaries.

9

revoking

the business and operating licenses of our PRC subsidiaries and

affiliates;

discontinuing

or restricting our PRC subsidiaries’ and affiliates’ operations;

imposing

conditions or requirements with which we or our PRC subsidiaries and affiliates

may not be able to comply;

requiring

us or our PRC subsidiaries and affiliates to restructure the relevant ownership

structure or operations; or

restricting

or prohibiting our use of the proceeds of this offering to finance our business

and operations in China.

The

imposition of any of these penalties would result in a material and adverse

effect on our ability to conduct our business.

We rely on contractual

arrangements with MYL Commercial and its subsidiaries and shareholders for

a substantial portion of our China operations, which may not be as effective in

providing operational control as direct ownership.

We rely

on contractual arrangements with MYL Commercial and its subsidiaries and

shareholders to operate our executive education business. For a description of

these contractual arrangements, see “Corporate Structure” and “Related Party

Transactions”. These contractual arrangements may not be as effective in

providing us with control over MYL Commercial as direct ownership. If we had

direct ownership of MYL Commercial, we would be able to exercise our rights as a

shareholder to effect changes in the board of directors of MYL Commercial which

in turn could effect changes, subject to any applicable fiduciary obligations,

at the management level. However, under the current contractual arrangements, as

a legal matter, if MYL Commercial or any of its subsidiaries and shareholders

fails to perform its or his respective obligations under these contractual

arrangements, we may have to incur substantial costs and resources to enforce

such arrangements, and rely on legal remedies under PRC law, including seeking

specific performance or injunctive relief, and claiming damages, which we cannot

assure you to be effective. For example, if the shareholders of MYL Commercial

were to refuse to transfer his equity interest in MYL Commercial to us or our

designee when we exercise the purchase option pursuant to these contractual

arrangements, or if the shareholders of MYL Commercial were otherwise to act in

bad faith toward us, then we may have to take legal action to compel them to

fulfill their contractual obligations.

Many of

these contractual arrangements are governed by PRC law and provide for the

resolution of disputes through either arbitration or litigation in the PRC.

Accordingly, these contracts would be interpreted in accordance with PRC law and

any disputes would be resolved in accordance with PRC legal procedures. The

legal environment in the PRC is not as developed as in other jurisdictions, such

as the United States. As a result, uncertainties in the PRC legal system could

limit our ability to enforce these contractual arrangements. In the event we are

unable to enforce these contractual arrangements, we may not be able to exert

effective control over our operating entities, and our ability to conduct our

business may be negatively affected.

Contractual

arrangements we have entered into among our subsidiaries and affiliated entities

may be subject to scrutiny by the PRC tax authorities and a finding that we owe

additional taxes or are ineligible for our tax exemption, or both, could

substantially increase our taxes owed, and reduce our net income and the value

of your investment.

Under

PRC law, arrangements and transactions among related parties may be subject

to audit or challenge by the PRC tax authorities. If any of the transactions we

have entered into among our subsidiaries and affiliated entities are found not

to be on an arm’s-length basis, or to result in an unreasonable reduction in tax

under PRC law, the PRC tax authorities have the authority to disallow our tax

savings, adjust the profits and losses of our respective PRC entities and assess

late payment interest and penalties.

As a

result of this risk, you should evaluate our results of operations and financial

condition without regard to these tax savings.

Our business is dependent

upon the PRC government’s educational policies and programs.

As a

provider of educational services, we are dependent upon governmental educational

policies. Almost all of our revenue to date has been generated from the sale of

lectures and materials relating to executive training. To the extent that the

government adopts policies changes that significantly alter what is allowed in

China, our products could become obsolete, which would affect our ability to

generate revenue and operate profitably. We cannot assure you that the PRC

government agencies would not adopt such changes.

10

We are subject to numerous

PRC rules and regulations which restrict the scope of our business and could

have a material adverse impact on us.

We are

subject to numerous rules and regulations in the PRC, including, without

limitation, restrictions on foreign ownership of internet and education

companies and regulation of Internet content. Many of the rules and regulations

that we face are not explicitly communicated, but arise from the fact that

education and the internet are politically sensitive areas of the

economy. We are not aware that any of our agreements or our current

organizational structure is in violation of any governmental requirements or

restrictions, explicit or implicit. However, there can be no

assurance that we are in compliance now, or will be in the

future. Moreover, operating in the PRC involves a high risk that

restrictive rules and regulations could change. Indeed, even changes

of personnel at certain ministries of the government could have a negative

impact on us. The determination that our structure or agreements are

in violation of governmental rules or regulations in the PRC would have a

material adverse impact on us, our business and on our financial

results.

Our business may be subject

to seasonal and cyclical fluctuations in sales.

We may

experience seasonal fluctuations in our revenue in some regions in the PRC,

based on economic situation and the tendency of executives to make commitment

relating to their education during the year. Any seasonality may

cause significant pressure on us to monitor the development of materials

accurately and to anticipate and satisfy these requirements.

Our business is subject to

the health of the PRC economy.

The

purchase of educational lectures and materials not provided by the state

educational system is discretionary and dependent upon the ability and

willingness of executives and businesses to spend available funds on extra

educational products. A general economic downturn either in our market or a

general economic downturn in the PRC could have a material adverse effect on our

revenue, earnings, cash flow and working capital.

We depend on our senior

officers to manage and develop our business.

Our

success depends on the management skills of Mr. Kaien Liang, Chairman and Chief

Executive Officer, and his relationships with educators, administrators and

other business contacts. We also depend on successfully recruiting

and retaining highly skilled and experienced authors, teachers, managers, sales

persons and other personnel who can function effectively in the

PRC. In some cases, the market for these skilled employees is highly

competitive. We may not be able to retain or recruit such personnel,

which could materially and adversely affect our business, prospects and

financial condition. We do not maintain key person insurance on these

individuals. The loss of Mr. Hsu would delay our ability to implement

our business plan and would adversely affect our business.

We may not be successful in

protecting our intellectual property and proprietary rights.

Our

intellectual property consists of lectures and formats, which are contained in

our library, and courseware which we developed by engaging authors and educators

to develop these materials. Our proprietary products are primarily

protected by trade secret laws. Although we require our authors and

employees to sign confidentiality and non-disclosure agreements, we cannot

assure you that we will be able to enforce those agreements or that our authors

and software development employees will not be able to develop competitive

products that do not infringe upon our proprietary rights. We do not know the

extent that PRC courts will enforce our proprietary rights.

Others may bring defamation

and infringement actions against us, which could be time-consuming, difficult

and expensive to defend.

As a

distributor of educational materials, we face potential liability for

negligence, copyright, patent or trademark infringement and other claims based

on the nature and content of the materials that we publish or

distribute. Any claims could result in us incurring significant costs

to investigate and defend regardless of the final outcome. We do not

carry general liability insurance that would cover any potential or actual

claims. The commencement of any legal action against us or any of our

affiliates, whether or not we are successful in defending the action, could both

require us to suspend or discontinue the distribution of some or a significant

portion of our educational materials and require us to allocate resources to

investigating or defending claims.

11

We depend upon the

acquisition and maintenance of licenses to conduct our business in the

PRC.

In order

to conduct business in the PRC, we need licenses from the appropriate government

authorities, including general business licenses and an education service

provider license. The loss or failure to obtain or maintain these

licenses in full force and effect will have a material adverse impact on our

ability to conduct our business and on our financial condition.

Our growth may be inhibited

by the inability of potential customers to fund purchases of our products and

services.

Many

businesses in the PRC, do not have sufficient funds to purchase textbooks,

educational materials or lectures and course materials. In addition,

provincial and local governments may not have the funds to support the

implementation of a curriculum using our educational products or may allocate

funds to programs which are different from our products. Our failure to be able

to sell our products and services to students in certain areas of the PRC may

inhibit our growth and our ability to operate profitably.

Changes in the policies of

the government in the PRC could significant impact our ability to operate

profitably.

The

economy of the PRC is a planned economy subject to five-year and annual plans

adopted by the government that set down national economic development

goals. Government policies can have significant effect on the

economic conditions of the PRC generally and the educational system in

particular. Although the government in the PRC has confirmed that

economic development will follow a model of market economy under socialism, a

change in the direction of government planning may materially affect our

business, prospects and financial condition.

Inflation in the PRC could

negatively affect our profitability and growth.

While the

economy in the PRC has experienced rapid growth, such growth has been uneven

among various sectors of the economy and in different geographical areas of the

country. Rapid economic growth can lead to growth in the money supply and rising

inflation. If prices for our services rise at a rate that is insufficient to

compensate for the rise in our costs, it may have an adverse effect on

profitability. In order to control inflation in the past, the government has

imposed controls in bank credits, limits on loans for fixed assets purchase, and

restrictions on state bank lending. Such an austerity policy can lead to a

slowing economic growth which could impair our ability to operate

profitably.

If we make any acquisitions,

they may disrupt or have a negative impact on our business.

If we

make acquisitions, we could have difficulty integrating personnel and operations

of the acquired companies with our own. In addition, the key personnel of the

acquired business may not be willing to work for us. We cannot predict the

affect expansion which may have on our core business. Regardless of whether we

are successful in making an acquisition, the negotiations could disrupt our

ongoing business, distract our management and employees and increase our

expenses. In addition to the risks described above, acquisitions are accompanied

by a number of inherent risks, including, without limitation, the

following:

|

·

|

the

difficulty of integrating acquired products, services or

operations;

|

|

·

|

the

potential disruption of the ongoing businesses and distraction of our

management and the management of acquired

companies;

|

|

·

|

the

difficulty of incorporating acquired rights or products into our existing

business;

|

|

·

|

difficulties

in disposing of the excess or idle facilities of an acquired company or

business and expenses in maintaining such

facilities;

|

|

·

|

difficulties

in maintaining uniform standards, controls, procedures and

policies;

|

|

·

|

the

potential impairment of relationships with employees and customers as a

result of any integration of new management

personnel;

|

12

|

·

|

the

potential inability or failure to achieve additional sales and enhance our

customer base through cross-marketing of the products to new and existing

customers;

|

|

·

|

the

effect of any government regulations which relate to the business

acquired;

|

|

·

|

potential

unknown liabilities associated with acquired businesses or product lines,

or the need to spend significant amounts to retool, reposition or modify

the marketing and sales of acquired products or the defense of any

litigation, whether of not successful, resulting from actions of the

acquired company prior to our

acquisition.

|

Our

business could be severely impaired to the extent that we are unable to succeed

in addressing any of these risks or other problems encountered in connection

with these acquisitions, many of which cannot be presently identified, these

risks and problems could disrupt our ongoing business, distract our management

and employees, increase our expenses and adversely affect our results of

operations.

Our operations and assets in

the PRC are subject to significant political and economic

uncertainties.

Government

policies are subject to rapid change, and the government of the PRC may adopt

policies which have the effect of hindering private economic activity and

greater economic decentralization. There is no assurance that the government of

the PRC will not significantly alter its policies from time to time without

notice in a manner which reduces or eliminates any benefits from its present

policies of economic reform. In addition, a substantial portion of productive

assets in the PRC remains government-owned. For instance, all lands are state

owned and leased to business entities or individuals through governmental

granting of state-owned land use rights. The granting process is typically based

on government policies at the time of granting, which could be lengthy and

complex. The government of the PRC also exercises significant control over its

economic growth through the allocation of resources, controlling payment of

foreign currency and providing preferential treatment to particular industries

or companies. Uncertainties may arise with changing of governmental policies and

measures. In addition, changes in laws and regulations, or their interpretation,

or the imposition of confiscatory taxation, restrictions on currency conversion,

imports and sources of supply, devaluations of currency, the nationalization or

other expropriation of private enterprises, as well as adverse changes in the

political, economic or social conditions in the PRC, could have a material

adverse effect on our business, results of operations and financial

condition.

Recent regulations relating

to offshore investment activities by PRC residents may increase the

administrative burden we face and create regulatory uncertainties that could

restrict our overseas and cross-border investment activity, and a failure by our

shareholders who are PRC residents to make any required applications and filings

pursuant to such regulations may prevent us from being able to distribute

profits and could expose us and our PRC resident shareholders to liability under

PRC law.

The PRC

National Development and Reform Commission, or NDRC, and SAFE recently

promulgated regulations that require PRC residents and PRC corporate entities to

register with and obtain approvals from relevant PRC government authorities in

connection with their direct or indirect offshore investment activities. These

regulations apply to our shareholders who are PRC residents and may apply to any

offshore acquisitions that we make in the future.

Under the

SAFE regulations, PRC residents who make, or have previously made, direct or

indirect investments in offshore companies will be required to register those

investments. In addition, any PRC resident who is a direct or indirect

shareholder of an offshore company is required to file with the local branch of

SAFE, with respect to that offshore company, any material change involving

capital variation, such as an increase or decrease in capital, transfer or swap

of shares, merger, division, long term equity or debt investment or creation of

any security interest over the assets located in China. If any PRC shareholder

fails to make the required SAFE registration, the PRC subsidiaries of that

offshore parent company may be prohibited from distributing their profits and

the proceeds from any reduction in capital, share transfer or liquidation, to

their offshore parent company, and the offshore parent company may also be

prohibited from injecting additional capital into their PRC subsidiaries.

Moreover, failure to comply with the various SAFE registration requirements

described above could result in liability under PRC laws for evasion of

applicable foreign exchange restrictions.

13

The PRC tax authorities may

require us to pay additional taxes in connection with our acquisitions of

offshore entities that conducted their PRC operations through their affiliates

in China.

Our

operations and transactions are subject to review by the PRC tax authorities

pursuant to relevant PRC laws and regulations. However, these laws, regulations

and legal requirements change frequently, and their interpretation and

enforcement involve uncertainties. For example, in the case of some of our

acquisitions of offshore entities that conducted their PRC operations through

their affiliates in China, we cannot assure you that the PRC tax authorities

will not require us to pay additional taxes in relation to such acquisitions. In

the event that the sellers failed to pay any taxes required under PRC law in

connection with these transactions, the PRC tax authorities might require us to

pay the tax, together with late-payment interest and penalties.

If any of our PRC affiliates

becomes the subject of a bankruptcy or liquidation proceeding, we may lose the

ability to use and enjoy those assets, which could reduce the size of our

executive education distribution network and materially and adversely affect our

business, ability to generate revenue and the market price of our

stock.

To comply

with PRC laws and regulations relating to foreign ownership restrictions in the

executive education business, we currently conduct our operations in China

through contractual arrangements with MYL Commercial, its shareholders and

subsidiaries. As part of these arrangements, MYL Commercial and its subsidiaries

hold certain of the assets that are important to the operation of our business.

If any of these entities goes bankrupt and all or part of their assets become

subject to liens or rights of third-party creditors, we may be unable to

continue some or all of our business activities, which could materially and

adversely affect our business, financial condition and results of operations. If

any of MYL Commercial and its subsidiaries undergoes a voluntary or involuntary

liquidation proceeding, its shareholders or unrelated third-party creditors may

claim rights to some or all of these assets, thereby hindering our ability to

operate our business, which could materially and adversely affect our business,

our ability to generate revenue and the market price of our stock.

Restrictions on currency

exchange may limit our ability to utilize our revenues

effectively.

Substantially

all of our revenues and operating expenses are denominated in Renminbi. The

Renminbi is currently convertible under the “current account”, which includes

dividends, trade and service-related foreign exchange transactions, but not

under the “capital account”, which includes foreign direct investment and loans.

Currently, MYL Business may purchase foreign exchange for settlement of “current

account transactions”, including payment of dividends to us, without the

approval of the State Administration of Foreign Exchange. However, we cannot

assure you that the relevant PRC governmental authorities will not limit or

eliminate our ability to purchase foreign currencies in the future. Since a

significant amount of our future revenues will be denominated in Renminbi, any

existing and future restrictions on currency exchange may limit our ability to

utilize revenues generated in Renminbi to fund our business activities outside

China, if any, or expenditures denominated in foreign currencies. Foreign

exchange transactions under the capital account are still subject to limitations

and require approvals from, or registration with, the State Administration of

Foreign Exchange and other relevant PRC governmental authorities. This could

affect MYL Business’s ability to obtain foreign exchange through debt or equity

financing, including by means of loans or capital contributions from

us.

Because

our earnings and cash and cash equivalent assets are denominated in Renminbi and

the net proceeds from this offering will be denominated in U.S. dollars,

fluctuations in exchange rates between U.S. dollars and Renminbi will affect the

relative purchasing power of these proceeds and our balance sheet and earnings

per share in U.S. dollars following this offering. In addition, appreciation or

depreciation in the value of the Renminbi relative to the U.S. dollar would

affect our financial results reported in U.S. dollar terms without giving effect

to any underlying change in our business or results of operations. Since

July 2005 the Renminbi is no longer pegged solely to the U.S. dollar.

Instead, it is reported to be pegged against a basket of currencies, determined

by the People’s Bank of China, against which it can rise or fall by as much as

0.3% each day. This change in policy has resulted in the gradual increase in the

value of the Renminbi against the U.S. dollar over time. As of March 31,

2009, the Renminbi had appreciated approximately 17.4% against the U.S. dollar

since July 21, 2005. On March 31, 2008, the Renminbi was valued

against the U.S. dollar at approximately RMB6.8240 to the U.S. dollar. The

Renminbi may appreciate or depreciate significantly in value against the U.S.

dollar in the long term, depending on the fluctuation of the basket of

currencies against which it is currently valued or it may be permitted to enter

into a full float, which may also result in a significant appreciation or

depreciation of the Renminbi against the U.S. dollar. Fluctuations in the

exchange rate will also affect the relative value of any dividend we issue in

the future which will be exchanged into U.S. dollars and earnings from and the

value of any U.S. dollar-denominated investments we make in the

future.

Very

limited hedging transactions are available in China to reduce our exposure to

exchange rate fluctuations. To date, we have not entered into any hedging

transactions in an effort to reduce our exposure to foreign currency exchange

risk. We do not intend to enter into any hedging transactions. Even if we may

decide to enter into hedging transactions in the future, the availability and

effectiveness of these hedges may be limited and we may not be able to

successfully hedge our exposure at all. In addition, our currency exchange

losses may be magnified by PRC exchange control regulations that restrict our

ability to convert Renminbi into foreign currency.

14

Price controls may affect

both our revenues and net income.

The laws

of the PRC provide the government broad power to fix and adjust prices. We need

to obtain government approval in setting our prices for classroom coursework and

tutorials. Although the sale of educational materials over the Internet is not

presently subject to price controls, we cannot give you any assurance that they

will not be subject to controls in the future. To the extent that we are subject

to price control, our revenue, gross profit, gross margin and net income will be

affected since the revenue we derive from our services will be limited and we

may face no limitation on our costs. As a result, we may not be able to pass on

to our students any increases in costs we incur, or any increases in the costs

of our faculty. Further, if price controls affect both our revenue and our

costs, our ability to be profitable and the extent of our profitability will be

effectively subject to determination by the applicable PRC regulatory

authorities.

Our operations may not

develop in the same way or at the same rate as might be expected if the PRC

economy were similar to the market-oriented economies of most developed

countries.

The

economy of the PRC has historically been a nationalistic, “planned economy,”

meaning it functions and produces according to governmental plans and pre-set

targets or quotas. In certain aspects, the PRC’s economy has been making a

transition to a more market-oriented economy, although the government imposes

price controls on certain products and in certain industries. However, we cannot

predict the future direction of these economic reforms or the effects these

measures may have. The economy of the PRC also differs from the economies of

most developed countries including with respect to the amount of government

involvement, level of development, growth rate, control of foreign exchange and

allocation of resources. As a result of these differences, our business may not

develop in the same way or at the same rate as might be expected if the economy

of the PRC were similar to those of other developed countries.

Because our officers and

directors reside outside of the United States, it may be difficult for you to

enforce your rights against them or enforce United States court judgments

against them in the PRC.

Our

directors and our executive officers reside in the PRC and all of our assets are

located in the PRC. It may therefore be difficult for United States investors to

enforce their legal rights, to effect service of process upon our directors or

officers or to enforce judgments of United States courts predicated upon civil

liabilities and criminal penalties of our directors and officers under federal

securities laws. Further, it is unclear if extradition treaties now in effect

between the United States and the PRC would permit effective enforcement of

criminal penalties of the federal securities laws.

We may have limited legal

recourse under PRC law if disputes arise under contracts with third

parties.

All of

our agreements, which are made by our PRC subsidiaries, are governed by the laws

of the PRC. The PRC legal system is a civil law system based on written

statutes. Accordingly decided legal cases have little precedential value. The

government of the PRC has enacted some laws and regulations dealing with matters

such as corporate organization and governance, foreign investment, commerce,

taxation and trade. However, these laws are relatively new and their experience

in implementing, interpreting and enforcing these laws and regulations is

limited. Therefore, our ability to enforce commercial claims or to resolve

commercial disputes may be uncertain. The resolution of these matters may be

subject to the exercise of considerable discretion by the parties charged with

enforcement of the applicable laws. Any rights we may have to specific

performance or to seek an injunction under PRC law may be limited, and without a

means of recourse, we may be unable to prevent these situations from occurring.

The occurrence of any such events could have a material adverse effect on our

business, financial condition and results of operations.

Because we may not be able

to obtain business insurance in the PRC, we may not be protected from risks that

are customarily covered by insurance in the United States.

Business

insurance is not readily available in the PRC. To the extent that we suffer a

loss of a type which would normally be covered by insurance in the United

States, such as product liability and general liability insurance, we would

incur significant expenses in both defending any action and in paying any claims

that result from a settlement or judgment.

15

Because our funds are held

in banks which do not provide insurance, the failure of any bank in which we

deposit our funds could affect our ability to continue in

business.

Banks and

other financial institutions in the PRC do not provide insurance for funds held

on deposit. As a result, in the event of a bank failure, we may not have access

to funds on deposit. Depending upon the amount of money we maintain in a bank

that fails, our inability to have access to our cash could impair our

operations, and, if we are not able to access funds to pay our suppliers,

employees and other creditors, we may be unable to continue in

business.

Failure to comply with the

United States Foreign Corrupt Practices Act could subject us to penalties and

other adverse consequences.

We are

subject to the United States Foreign Corrupt Practices Act, which generally

prohibits United States companies from engaging in bribery or other prohibited

payments to foreign officials for the purpose of obtaining or retaining

business. Foreign companies, including some that may compete with us, are not

subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft

and other fraudulent practices occur from time-to-time in the PRC. We can make

no assurance, however, that our employees or other agents will not engage in

such conduct for which we might be held responsible. If our employees or other

agents are found to have engaged in such practices, we could suffer severe

penalties and other consequences that may have a material adverse effect on our

business, financial condition and results of operations.

Fluctuations in the exchange

rate could have a material adverse effect upon our business.

We

conduct our business in the Renminbi. The value of the Renminbi against the U.S.

dollar and other currencies may fluctuate and is affected by, among other

things, changes in political and economic conditions. On July 21, 2005, the PRC

government changed its decade old policy of pegging its currency to the U.S.

currency. Under the current policy, the Renminbi is permitted to fluctuate

within a narrow and managed band against a basket of certain foreign currencies.

This change in policy has resulted in an approximately 17% appreciation of the

Renminbi against the U.S. dollar between July 21, 2005 and March 23, 2009.

However, there remains significant international pressure on the PRC government

to adopt an even more flexible currency policy, which could result in a further

and more significant appreciation of the RMB against the U.S. dollar. To the

extent our future revenues are denominated in currencies other the United States

dollars, we would be subject to increased risks relating to foreign currency

exchange rate fluctuations which could have a material adverse affect on our

financial condition and operating results since our operating results are

reported in United States dollars and significant changes in the exchange rate

could materially impact our reported earnings.

Recent recalls of PRC

products may affect the market for our stock.

Although

we do not sell consumer products in the international market, the recent recalls

of PRC products in the United States and elsewhere could affect the market for

our stock by causing investors to invest in companies that are not based on the

PRC.

Certain of our stockholders

control a significant amount of our common stock.

Approximately

80% of our outstanding common stock is owned by our chairman, Mr. Kaien

Liang. Mr. Liang presently has the voting power to elect all of the

directors and approve any transaction requiring stockholder

approval.

The terms on which we may

raise additional capital may result in significant dilution and may impair our

stock price.

We cannot

assure you that we will be able to get additional financing on any terms, and,

if we are able to raise funds, it may be necessary for us to sell our securities

at a price which is at a significant discount from the market price and on other

terms which may be disadvantageous to us. In connection with any such financing,

we may be required to provide registration rights to the investors and pay

damages to the investor in the event that the registration statement is not

filed or declared effective by specified dates. The price and terms of any

financing which would be available to us could result in both the issuance of a

significant number of shares and significant downward pressure on our stock

price.

16

Risks

Associated with Investing in our Common Stock

The rights of the holders of

common stock may be impaired by the potential issuance of preferred

stock.

Although

we do not have any authorized preferred stock at the moment, we cannot assure

you that there will not be preferred stock in the future, which may have

superior liquidation rights, voting rights and other rights.

Failure to achieve and

maintain effective internal controls in accordance with Section 404 of the

Sarbanes-Oxley Act could have a material adverse effect on our business and

operating results and stockholders could lose confidence in our financial

reporting.

Internal

controls are necessary for us to provide reliable financial reports and

effectively prevent fraud. If we cannot provide reliable financial reports or

prevent fraud, our operating results could be harmed. Under the current SEC

regulations, we will be required to include a management report on internal

controls over financial reporting in our Form 10-K annual report for the year

ended December 31, 2009, and we will be required to include an auditor’s report

on internal controls over financial reporting for the year ended December 31,

2010. Failure to achieve and maintain an effective internal control environment,

regardless of whether we are required to maintain such controls, could also

cause investors to lose confidence in our reported financial information, which

could have a material adverse effect on our stock price. Although we are not

aware of anything that would impact our ability to maintain effective internal

controls, we have not obtained an independent audit of our internal controls,

and, as a result, we are not aware of any deficiencies which would result from

such an audit. Further, at such time as we are required to comply with the

internal controls requirements of Sarbanes Oxley, we may incur significant