Attached files

| file | filename |

|---|---|

| EX-10 - INTEGRATED BIOPHARMA INC | exhibit10_1.htm |

| EX-32 - INTEGRATED BIOPHARMA INC | exhibit32_2.htm |

| EX-31 - INTEGRATED BIOPHARMA INC | exhibit31_1.htm |

| EX-32 - INTEGRATED BIOPHARMA INC | exhibit32_1.htm |

| EX-31 - INTEGRATED BIOPHARMA INC | exhibit31_2.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington

D.C. 20549

____________

FORM

10-Q

x Quarterly Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

For the

quarterly period ended December 31, 2009

OR

o

Transition Report Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

For the

transition period

from to

Commission

File Number 001-31668

INTEGRATED BIOPHARMA,

INC.

(Exact

name of registrant, as specified in its charter)

| Delaware | 22-2407475 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporaton or organization | Identification No.) |

|

|

|

225 Long Ave.,

Hillside, New Jersey

|

07205

|

| (Address of principal executive offices) |

(Zip

Code)

|

(888)

319-6962

(Registrant's telephone number,

including Area Code)

Not

Applicable

(Former

name, former address and former fiscal year, if changed since last

report)

Indicate

by check mark whether the Registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the Registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes x No o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer

|

Accelerated

filer

|

Non-accelerated

filer

|

Smaller

reporting company þ

|

Indicate by check whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act).

Yes o No x

Applicable

only to Corporate Issuers:

The

number of shares outstanding of each of the issuer’s class of common stock, as

of the latest practicable date:

| Class |

Outstanding at February 12,

2010

|

| Common Stock, $0.002 par value | 20,469,342 Shares |

|

|

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

FORM

10-Q QUARTERLY REPORT

For

the Six Months Ended December 31, 2009

INDEX

|

Page

|

||

|

Part

I. Financial Information

|

||

|

Item

1.

|

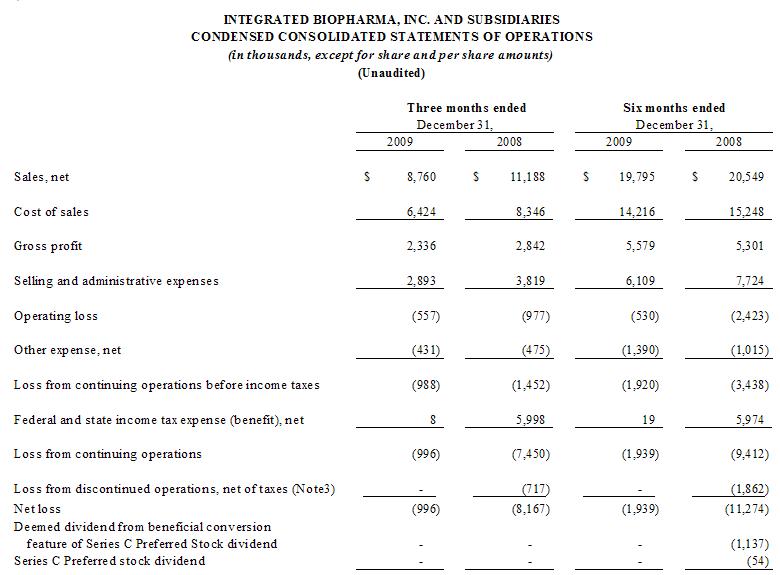

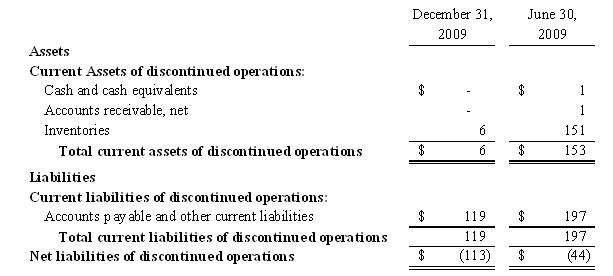

Condensed

Consolidated Statements of Operations for the Three and Six Months Ended

December 31, 2009 and 2008 (unaudited)

|

2

|

|

Condensed

Consolidated Balance Sheets as of December 31, 2009 (unaudited) and June

30, 2009

|

3

|

|

|

Condensed

Consolidated Statements of Changes in Stockholders’ Equity for the Six

Months Ended December 31, 2009 (unaudited)

|

4

|

|

|

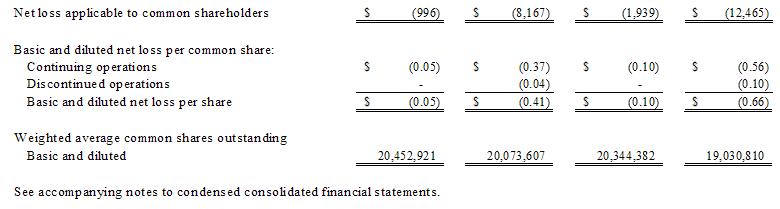

Condensed

Consolidated Statements of Cash Flows for the Six Months Ended December

31, 2009 and 2008 (unaudited)

|

5

|

|

|

Notes

to Condensed Consolidated Statements

|

6

|

|

|

Item

2.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

22

|

|

Item

3.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

30

|

|

Item

4T.

|

Controls

and Procedures

|

30

|

|

Part

II. Other Information

|

||

|

Item

1.

|

Legal

Proceedings

|

31

|

|

Item

1A.

|

Risk

Factors

|

31

|

|

Item

2.

|

Unregistered

Sales of Equity Securities and Use of Proceeds

|

32

|

|

Item

3.

|

Defaults

Upon Senior Securities

|

32

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

32

|

|

Item

5.

|

Other

Information

|

32

|

|

Item

6.

|

Exhibits

|

33

|

|

Other

|

||

|

Signatures

|

34

|

|

Disclosure Regarding Forward-Looking

Statements Disclosure Regarding Forward-Looking Statements Certain

statements in the Quarterly Report on Form 10-Q may constitute “forward-looking”

statements as defined in Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), Section 21E of the Securities Act of 1934, as amended

(the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the

“PSLRA”) or in releases made by the Securities and Exchange Commission, all as

may be amended from time to time. Such forward-looking statements involve known

and unknown risks, uncertainties and other factors which may cause the actual

results, performance or achievements of Integrated BioPharma, Inc. (the

“Company”) or industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. Statements that are not historical fact are

forward-looking statements. Forward-looking statements can be identified by,

among other things, the use of forward-looking language, such as the words,

“plan”, “believe”, “expect”, “anticipate”, “intend”, “estimate”, “project”,

“may”, “will”, “would”, “could”, “should”, “seeks”, or “scheduled to”, or other

similar words, or the negative of these terms or other variations of these terms

or comparable language, or by discussion of strategy or intentions. These

cautionary statements are being made pursuant to the Securities Act, the

Exchange Act and the PSLRA with the intention of obtaining the benefits of the

“safe harbor” provisions of such laws. The Company cautions investors that any

forward-looking statements made by the Company are not guarantees or indicative

of future performance. Important assumptions and other important factors that

could cause actual results to differ materially from those forward-looking

statements with respect to the Company, include, but are not limited to, the

risks and uncertainties affecting its businesses described in Items 1 and 1A of

the Company’s Annual Report filed on Form 10-K for the year ended June 30, 2009

and in registration statements and other securities filings by the Company.

Although the Company believes that its plans, intentions and expectations

reflected in or suggested by such forward-looking statements are reasonable,

actual results could differ materially from a projection or assumption in any of

the forward-looking statements and are subject to change due inherent risks and

uncertainties. The forward-looking statements contained in this Quarterly Report

on Form 10-Q are made only as of the date hereof and the Company does not have

or undertake any obligation to update or revise any forward-looking statements

whether as a result of new information, subsequent events or otherwise, unless

otherwise required by law.

1

ITEM 1. FINANCIAL

STATEMENTS

2

3

4

5

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

Note

1. Principles of Consolidation and Basis of Presentation

The

accompanying condensed financial statements for the interim periods are

unaudited and include the accounts of the Company. The interim condensed

consolidated financial statements have been prepared in conformity with Rule

10-01 of Regulation S-X of the Securities and Exchange Commission (“SEC”) and

therefore do not include information or footnotes necessary for a complete

presentation of financial position, results of operations and cash flows in

conformity with accounting principles generally accepted in the United States of

America. However, all adjustments (consisting only of normal recurring

adjustments) which are, in the opinion of management, necessary for a fair

presentation of the financial position and operating results for the periods

presented have been included. These condensed financial statements should be

read in conjunction with the financial statements and notes thereto, together

with Management’s Discussion and Analysis of Financial Condition and Results of

Operations, contained in the Company’s Annual Report on Form 10-K for the fiscal

year ended June 30, 2009 (“10-K”), as filed with the SEC. The June 30, 2009

balance sheet was derived from audited financial statements, but does not

include all disclosures required by accounting principles generally accepted in

the United States of America. The results of operations for the three and six

months ended December 31, 2009, are not necessarily indicative of the results

for the full fiscal year ending June 30, 2010 or for any other

period.

Integrated

BioPharma, Inc., a Delaware corporation (together with its subsidiaries, the

“Company”), is engaged primarily in manufacturing, distributing, marketing and

sales of vitamins, nutritional supplements and herbal products. The

Company’s customers are located primarily in the United States. The Company was

previously known as Integrated Health Technologies, Inc. and, prior to that, as

Chem International, Inc. The Company was reincorporated in its current form in

Delaware in 1995. As of September 22, 2009, the Company’s common stock trades on

the OTC Bulletin Board under the symbol INBP.OB. From February 27,

2009 through September 22, 2009, the Company’s common stock traded on the Pink

Sheets under the symbol INBP.PK. Immediately prior to February 27,

2009, the Company’s common stock traded on the NASDAQ Global Market under the

symbol “INBP.” The Company continues to do business with certain of

its customers and vendors as Chem International, Inc.

The

Company, subsequent to the spin-off of its Biotechnologies segment and the sale

of the Pharmaceutical segment, which occurred in Fiscal 2009, see Note 3. –

Discontinued Operations, has one remaining reportable segment for its operation,

the Nutraceutical segment.

The

Nutraceutical segment, our one remaining business operation, includes:

InB:Manhattan Drug Company, Inc. (“Manhattan Drug”), which manufactures vitamins

and nutritional supplements for sale to distributors, multilevel marketers and

specialized health-care providers; AgroLabs, Inc. (“AgroLabs”), which

distributes for sale through major mass market, grocery, drug and vitamin

retailers, healthful nutritional products under the following brands: Naturally

Noni, Naturally Pomegranate, Naturally Aloe, Aloe Pure, Naturally Thai

Mangosteen, Peaceful Sleep, Green Envy, 1st

Choice Multi-Vitamin, ACAI Extra, ACAI Immune, ACAI Cleanse, and other products

which are being introduced into the market, these are referred to as our branded

proprietary Nutraceutical business and/or products; and The Vitamin Factory,

which sells private label Manhattan Drug products, as well as our AgroLabs

products, through mail order catalogs and the Internet.

The

Company also distributes fine natural chemicals through its wholly-owned

subsidiary IHT Health Products, Inc. and is a distributor of certain raw

materials for DSM Nutritional Products, Inc.

These

condensed consolidated financial statements, reflect the spin-off of iBio, Inc.

("iBio"), the sale of InB: Hauser Pharmaceuticals, Inc. (“Hauser”), the

discontinued operations of The Organic Beverage Company (“TOBC”), and related

transactions (see Note 3. – Discontinued Operations).

6

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

Reclassifications.

Certain reclassifications have

been made to the prior year data to conform with the current year

presentation.

Principles of

Consolidation. The accompanying condensed consolidated financial

statements include the accounts of the Company and its wholly-owned

subsidiaries. Intercompany transactions and accounts are eliminated in

consolidation.

Estimates.

The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting period.

Management bases its estimates on historical experience and on various other

assumptions that are believed to be reasonable under the circumstances, the

results of which form the basis for making judgments about the carrying values

of assets and liabilities that are not readily apparent from other sources. The

most significant estimates include:

|

·

|

sales

returns and allowances;

|

|

·

|

trade

marketing and merchandising;

|

|

·

|

allowance

for doubtful accounts;

|

|

·

|

inventory

valuation;

|

|

·

|

valuation

and recoverability of long-lived and intangible assets, including the

values assigned to acquired intangible

assets;

|

|

·

|

income

taxes and valuation allowance on deferred income taxes;

and,

|

|

·

|

accruals

for, and the probability of, the outcome of current

litigation.

|

On a

continual basis, management reviews its estimates utilizing currently available

information, changes in facts and circumstances, historical experience and

reasonable assumptions. After such reviews, and if deemed appropriate, those

estimates are adjusted accordingly. Actual results could differ from those

estimates. Nothing has come to our attention which would cause a change in these

estimates.

Subsequent

Events. For purposes of preparing the accompanying condensed

consolidated financial statements and the following notes to these condensed

financial statements, the Company evaluated subsequent events through the date

the condensed financial statements were issued.

Investment in

iBio, Inc. The Company accounts for its investment in iBio on the cost

basis as it retained approximately 6% of its interest in iBio at the time of the

spin-off of this subsidiary (see Note 3. Discontinued

Operations). The Company reviews its investment in iBio for

impairment and records a loss when there is deemed to be an impairment of the

investment.

Revenue

Recognition. For product sales, the Company recognizes revenue when the

product’s title and risk of loss transfers to the customer. The Company believes

this revenue recognition practice is appropriate because the Company’s sales

policies meet the four criteria of Staff Accounting Bulletin 104 which are: (i)

persuasive evidence that an arrangement exists, (ii) delivery has occurred,

(iii) the seller’s price to the buyer is fixed and determinable and (iv)

collectability is reasonably assured. The Company’s sales policy is to require

customers to provide purchase orders establishing selling prices and shipping

terms. The Company evaluates the credit risk of each customer and establishes an

allowance of doubtful accounts for any credit risk. Sales returns and allowances

are estimated upon shipment.

7

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

Shipping and

Handling Costs. Shipping and handling costs are included in cost of

sales.

Trade Marketing

and Merchandising. In order to support the Company’s proprietary

Nutraceutical product lines, various promotional activities are conducted

through the retail trade, distributors or directly with consumers, including

in-store display and product placement programs, feature price discounts,

coupons, and other similar activities. The Company regularly reviews and

revises, when it deems necessary, estimates of costs to the Company for these

promotional programs based on estimates of what will be redeemed by the retail

trade, distributors, or consumers. These estimates are made using various

techniques, including historical data on performance of similar promotional

programs. Differences between estimated expense and actual performance are

generally not material and are recognized as a change in management’s estimate

in a subsequent period.

Supplemental

Statement of Cash Flows

Earnings Per

Share. Basic earnings per common share amounts are based on weighted

average number of common shares outstanding. Diluted earnings per share amounts

are based on the weighted average number of common shares outstanding, plus the

incremental shares that would have been outstanding upon the assumed exercise of

all potentially dilutive stock options, warrants and convertible preferred

stock, subject to anti-dilution limitations using the treasury stock

method.

For both

the three and six months periods ended December 31, 2009 and 2008, total options

and warrants of 3,007,888 and 3,073,017, respectively, to purchase shares of

common stock, were outstanding but were not included in the computation of

diluted earnings per share as they were anti-dilutive as a result of net losses

applicable to common shareholders during the periods.

8

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

For both

the three and six month periods ended December 31, 2009 and 2008, options to

purchase shares of common stock with exercise prices below the market price,

respectively, were outstanding but were not included in the computation of

diluted earnings per share as they are anti-dilutive as a result of net losses

during the period.

For both

the three and six month periods ended December 31, 2009 and 2008, common share

equivalents of 2,250,000 and 1,779,755, respectively, related to the Convertible

Note Payable were not included in the computation of diluted earnings per share

as they were anti-dilutive as a result of net losses applicable to common

shareholders.

Recent Accounting

Pronouncements.

The

Financial Accounting Standards Board released an update to guidance for fair

value measurements and disclosures. This update requires new disclosures for

significant transfers in and out of Level 1 and Level 2 fair value measurements

and separate presentation of certain information in the reconciliation for fair

value measurements using significant unobservable inputs. In addition, the

updated guidance clarifies the requirements of existing disclosures. The update

is effective for interim and annual reporting periods beginning after December

15, 2009, which is the third quarter of fiscal 2010 for the Company. The Company

does not expect this update to have a material impact on its financial

statements.

Note 2.

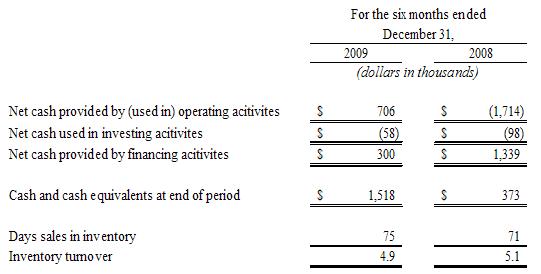

Liquidity. The Company’s condensed consolidated financial statements have

been prepared assuming that it will continue as a going concern. The Company has

incurred recurring operating losses and negative operating cash flows for the

three consecutive fiscal years ended in June 30, 2009, including a net loss

attributable to common stockholders of $19,367 and negative operating cash flows

of $2,752 for the year ended June 30, 2009. For the six months ended December

31, 2009, the Company had a net operating loss of $530 and a net loss of

$1,939. At December 31, 2009, the Company had cash and cash

equivalents of $1,518, a working capital deficit of $3,693, primarily

attributable to the amended Notes Payable (See Note 7. (c)) in the amount of

$7,805, which were due on November 15, 2009, and an accumulated deficit of

$46,304.

As of

February 12, 2010, the Company has not repaid its amended Notes Payable in the

amount of $7,805, nor has it completed the negotiations of modified terms,

including an extension or refinancing thereof. The Company also has

not received any demand of payment from the amended Notes Payable holders nor

have they exercised their rights to foreclose on substantially all of the assets

of the Company, which were pledged as collateral for the Company’s obligation

under the amended Notes Payable.

Assuming

the Company is able to raise additional capital and/or refinance its Notes

Payable, and it is not adversely affected by the current economic conditions,

the Company believes that its available capital as of December 31, 2009 will

enable it to continue as a going concern through the third quarter of the fiscal

year ending June 30, 2011. There can be no assurance that the Company will be

able to raise additional capital or successfully refinance the amended Notes

Payable of at least $7,805, upon acceptable terms, nor that the current economic

conditions will not negatively impact it. If the Company is unable to raise

additional capital or successfully refinance its amended Notes Payable of at

least $7,805 upon acceptable terms, it would have a material adverse effect on

the Company. The accompanying condensed consolidated financial statements do not

include any adjustments that might result from this uncertainty.

9

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

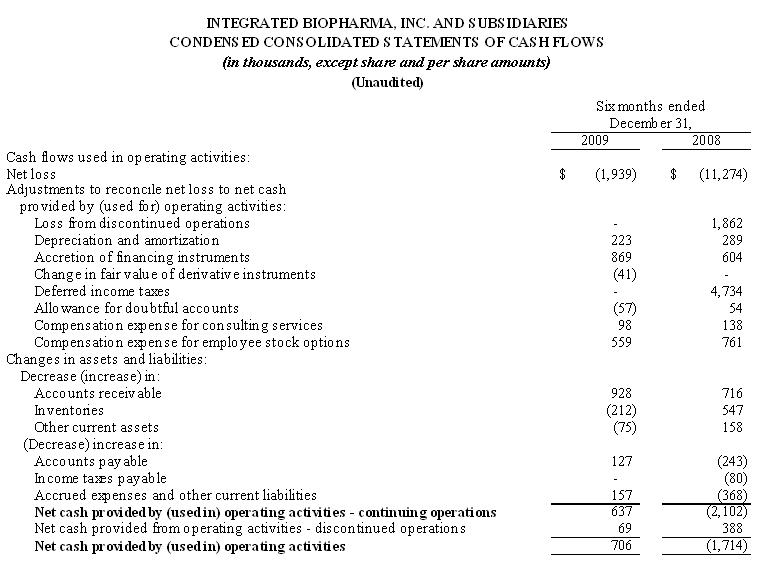

Note

3. Discontinued Operations

In the

fiscal year ended June 30, 2009, the Company classified the spin-off of iBio in

August 2008, the sale of Hauser in March 2009 and the discontinued operations of

TOBC in June 2009 as discontinued operations for the current and prior periods

and the associated results of operations, financial position and cash flows are

separately reported for all periods presented. The remaining net assets of TOBC

are classified as assets and liabilities related to discontinued operations in

the Company’s condensed consolidated balance sheet as of December 31, 2009 and

June 30, 2009.

The net

assets from discontinued operations were comprised of the

following:

|

(a)

|

Spin-off of

iBio – In August 2008, the Company completed the spin-off of iBio.

As a result, the Company recognized an after-tax loss of $105 during the

first quarter of the fiscal year ended June 30, 2009. iBio revenues from

discontinued operations were $169 for the three and six months ended

December 31, 2008. The Company’s loss from the discontinued

operations of iBio, net of taxes, was $105 for the three and six months

ended December 31, 2008.

|

|

(b)

|

Sale of

Hauser – In March 2009, the Company entered into a stock purchase

agreement and consummated the sale of all of the issued and outstanding

shares of common stock of its wholly owned subsidiary Hauser to Cedarburg

Pharmaceuticals, Inc. (“Cedarburg”). Prior to the sale of Hauser, the

Company sold substantially all the assets of INB: Paxis Pharmaceuticals,

Inc. (“Paxis”) and transferred outstanding payables owed by Paxis (the

“Net Assets of Paxis”) to Hauser in consideration for the outstanding

intercompany debt between these two subsidiaries of the

Company. The Net Assets of Paxis transferred under this

transaction were owned by Hauser at the time of the sale of Hauser’s

common stock to Cedarburg and are no longer assets and liabilities of the

Company. The Company continues to own certain assets of Paxis through its

ownership of common stock of Paxis. The purchase price received by the

Company in connection with the sale of Hauser consisted of $1,160 in cash

and a promissory note in favor of the Company in the principal amount of

$340. The promissory note matures on March 17, 2010 and bears interest at

a rate of 12% per annum, payable quarterly. On April 7, 2009, this

promissory note was sold to CD Financial, LLC, a related party and the

holder of the Company’s Convertible Note Payable (see Note 7(a)), for the

full principal amount of $340 and accrued interest of

$2.

|

As a

result of the sale of Hauser, the Company recognized a loss of $629 during the

fiscal year ended June 30, 2009. The Hauser revenues from discontinued

operations were $1,043 and $2,183 for the three and six months ended December

31, 2008, respectively. The Company’s net loss from the Hauser discontinued

operations, net of taxes were $598 and $1,385 for the three and six months ended

December 31, 2008, respectively.

10

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

|

(c)

|

Discontinued

operations of TOBC – During the six months ended September 30,

2008, the Company curtailed its operations of TOBC and combined the sales

efforts for the Syzmo™ product line with the AgroLabs

products. In June 2009, the Company determined that the Syzmo™

product line was to be discontinued as the Company does not have the

financial resources to pursue the further development of the Syzmo™

product in the very competitive energy drink market

place.

|

Revenues

from TOBC’s discontinued operations were $(5) and $151 for the three and six

months ended December 31, 2008. The Company’s net losses from TOBC’s

discontinued operations were $119 and $372 for the three and six months ended

December 31, 2008.

The

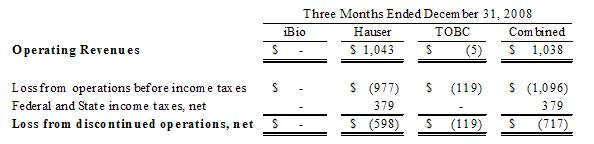

Company’s revenue and loss from discontinued operations, net of taxes, from

these events were $1,038 and $717 for the three months ended December 31, 2008,

respectively, as follows:

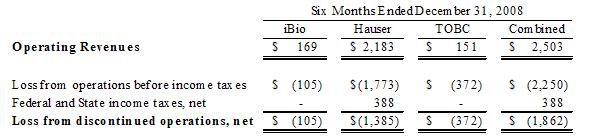

The

Company’s revenue and loss from discontinued operations, net of taxes, from

these events were $2,503 and $1,862 for the six months ended December 31, 2008,

respectively, as follows:

11

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

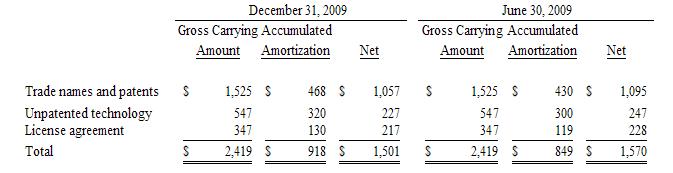

Note 4.

Intangible Assets, net

Intangible

assets consist of trade names, license fees, and unpatented technology. The

carrying amount of other intangible assets, net is as follows as

of:

Amortization

expense from continuing operations recorded on the intangible assets for each of

the three and six months ended December 31, 2009 and 2008 was $34 and $69,

respectively. Amortization expense is recorded on the straight-line method over

periods ranging from 2 years to 20 years based on contractual or estimated lives

and is included in selling and administrative expenses. Included in the

Company’s loss from discontinued operations is amortization expense of $25 and

$83 for the three and six months ended December 31, 2008,

respectively.

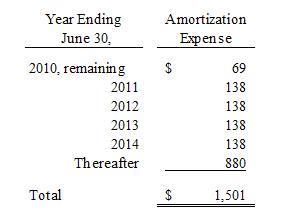

The

estimated annual amortization expense for intangible assets for the five

succeeding fiscal years is as follows:

Note

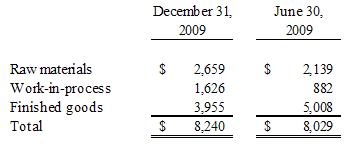

5. Inventories

Inventories

are stated at the lower of cost or market using the first-in, first-out method

and consist of the following as of:

12

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

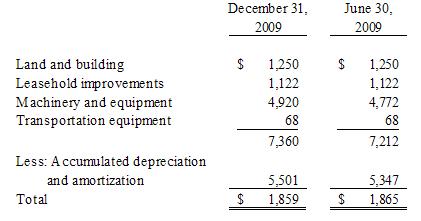

Note

6. Property and Equipment, net

Property

and equipment consists of the following as of:

Depreciation

and amortization expense was $79 and $104 for the three months ended December

31, 2009 and 2008, respectively and $154 and $220 for the six months ended

December 31, 2009 and 2008, respectively.

Note

7. Notes Payable, Convertible Note Payable – CD Financial, LLC and Series C

Redeemable Convertible Preferred Stock

On

February 21, 2008, the Company entered into two Securities Purchase Agreements

(the "SPAs") relating to a private placement of securities with two investors,

one of whom is an affiliate of Carl DeSantis, a director of the Company, which

resulted in gross proceeds, in the aggregate, of $17,337 to the Company. The

private placement involved the sale of (i) 6,000 shares of newly designated

Series C Redeemable Convertible Preferred Stock (the “Series C Preferred Stock”)

with a stated value of $1,000 per share (see Note 11(d) Series C Redeemable

Convertible Preferred Stock), (ii) $4,500 in principal amount of 9.5%

Convertible Note Payable (the “Convertible Note Payable”), (iii) $7,000 in

principal amount of 8.0% Notes Payable (the “Notes Payable”) and (iv) 200,000

shares of the Company’s common stock. The Company also has recorded $218 of

deferred financing costs associated with the SPAs and $130 of such deferred

financing costs were netted against the gross proceeds received. These costs

were allocated to each of the components of the transaction, based on the

relative fair values and are amortized based on the terms of the component of

the transaction to which the costs were allocated. As of December 31 and June

30, 2009, the Company had $29 and $41 of deferred financing costs remaining,

respectively, of which is to be amortized to interest expense over two to

eighteen months. The Notes Payable and the Convertible Note Payable are secured

by a pledge of substantially all of the Company’s assets. Concurrently with

entry into the SPAs, the Company terminated its outstanding credit facilities

with Amalgamated Bank in the amount of $16,333 with the repayment of

$16,006.

(a) CD

Financial, LLC (“CD Financial”), a related party, provided gross proceeds of

$7,500, exclusive of a $163 discount to be repaid by the Company at a future

date, in exchange for 3,000 shares of Series C Preferred Stock, with a stated

value of $1,000 per share, and $4,500 in principal amount of Convertible Note

Payable. The Company allocated the proceeds and the discount based on the

relative fair value of the Convertible Note Payable and the Series C Preferred

Stock. The Company is amortizing to interest expense the discount applied to the

Convertible Note Payable over the term of the note, and charged to Additional

Paid in Capital the discount applied to the Series C Preferred Stock. The

Company recorded a beneficial conversion feature of $715 on the Convertible Note

Payable that was being accreted over the three-year period until maturity or the

redemption of the Convertible Note Payable. The Company also recorded a

beneficial conversion feature on the Series C Preferred Stock of $608 which was

accreted over the five-year maturity period until the redemption of the Series C

Preferred Stock in August 2008. As of December 31 and June 30, 2009, the unpaid

discount on the Series C Preferred Stock and Convertible Note Payable in the

amount of $163 is included in accrued expenses in the accompanying Condensed

Consolidated Balance Sheet.

13

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

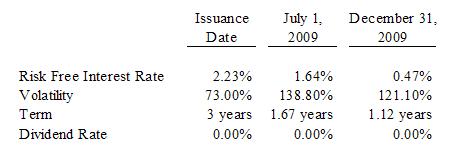

The

beneficial conversion features were accreted using the effective interest rate

method until July 1, 2009 when the Company adopted “Accounting For Derivative

Financial Instruments Indexed to, and Potentially Settled in, a Company's Own

Stock”. As of July 1, 2009, the Company recorded an accumulated

adjustment to account for the embedded derivative liability of the conversion

feature of the Convertible Note Payable, resulting in a decrease to additional

paid in capital of $715, a decrease in accumulated deficit of $2,097, a decrease

in the carry value of the Convertible Note Payable of $1,426 and the recognition

of a derivative liability of $44. As of December 31, 2009, the

related derivative liability to the Convertible Note Payable decreased to $7 and

is included in accrued expenses and other current liabilities in the

accompanying condensed balance sheets. The embedded derivative

liability created in connection with the Convertible Note Payable was valued at

a fair value using the Black-Scholes option pricing model as of the issuance

date and subsequently as of July 1, 2009 and December 31, 2009.

The

Company used the following assumptions to calculate the fair value of the

derivative liability:

The

Convertible Note Payable bears interest at an annual rate of 9.5% and matures on

or before February 21, 2011. It may be converted, at any time and at the

holder’s option, into shares of our common stock based on a conversion price as

set out in the Convertible Note Payable. The conversion price is a formula that

bases the conversion price on the greater of (i) 90% of the average Volume

Weighted Average Price (the "VWAP") market price of our common stock for 20

trading days immediately preceding the conversion date and (ii) $2.00, subject

to adjustment in the event of a stock dividend, stock split or combination,

reclassification or similar event and upon certain issuances below the

conversion price. We have the option to prepay the Convertible Note

Payable.

Included

in Other Expense, net in the accompanying Condensed Consolidated Statement of

Operations, is $8 and $16 related to the accretion of the discount and $240 and

$461 related to the accretion of the embedded derivative liability related to

the Convertible Note Payable, for the three and six months ended December 31,

2009, respectively, and $8 and $16 related to the accretion of the discount and

$57 and $114 accretion of the beneficial conversion feature on the Convertible

Note Payable, respectively, for the three and six months ended December 31,

2008. As of December 31, 2009, the Company had interest in arrears of

$182 on the Convertible Note Payable. In March 2009, the Company and

CD Financial entered into an oral agreement to suspend the cash interest

payments on the Convertible Note Payable until the Company returned to positive

cash flows in its operations. In this oral agreement, CD Financial

agreed not to give any default notices or increase interest rates due to such

default (the default interest rate as defined in the Convertible Note Payable is

18%).

Also, in

accordance with the Convertible Note Payable, the Company will issue and deliver

to CD Financial, for no additional consideration, 50,000 shares of common stock,

on a quarterly basis in arrears, commencing with the three-month anniversary of

the issuance date, until the Convertible Note Payable has been repaid in full,

after which the Company's obligations to issue shares of common stock will no

longer be applicable.

14

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

(b) On

November 24, 2009, MDC, a wholly owned subsidiary of the Company, entered into a

$300 promissory note (the “CD Note”) with CD Financial (see Note

7(a)). The CD Note matures on November 24, 2010 and bears interest at

the rate of 5%. Interest is accrued monthly and is payable upon

maturity.

(c)

Imperium, provided gross proceeds of $9,837, including a discount of $163, in

exchange for 3,000 shares of Series C Preferred Stock, with a stated value of

$1,000 per share, $7,000 in principal amount of 8.0% Notes Payable and 200,000

shares of the Company’s common stock. The Notes Payable originally matured on

February 21, 2009. The Company allocated the proceeds and the discount based on

the relative fair value of the Notes Payable, the Series C Preferred Stock and

the Company’s common stock. The Company amortized, to interest expense, the

discount applied to the Notes Payable over the term of the notes and charged to

Additional Paid in Capital the discounts applied to the Series C Preferred Stock

and the common stock. The Company recorded a beneficial conversion feature on

the Series C Preferred Stock of $608. The beneficial conversion feature was

accreted over the five-year maturity period until the redemption of the Series C

Preferred Stock in August 2008. The beneficial conversion features were accreted

using the effective interest rate method. For the three and six months ended

December 31, 2008, included in Other Expense, net in the accompanying Condensed

Consolidated Statement of Operations, is $198 and $322, respectively, related to

the accretion of the discount on the Notes Payable.

On

October 14, 2008, the Company and the Notes Payable holders amended their SPA to

extend the maturity from February 21, 2009 to November 15, 2009 (See Note 2.

Liquidity). In consideration for extending the maturity of the Notes Payable,

the Notes Payable holders will forgo the 200,000 shares of common stock as

additional interest and the Company (i) granted a 11.5% premium on

the principal, thus aggregating a principal balance due of $7,805 and certain

other amounts payable under the Notes Payable, if any, (ii) certain new

covenants are applicable to the Company effective October 14, 2008, (iii) the

Company issued warrants to purchase 500,000 shares of the Company’s Common

Stock, with a five year term at an exercise price of $0.80 per share, and (iv)

the registration of the resale of the shares of the Company’s Common Stock for

which the warrants are exercisable. Since the October 14, 2008 amendment

significantly modified the terms of the original Notes Payable, the Company

accounted for the amendment as an extinguishment of the original Notes Payable

and issuance of new Notes Payable in accordance with “Debtor’s Accounting for a

Modification or Exchange of Debt Instruments”. As a result of the extinguishment

of the original Notes Payable, the Company accelerated the amortization of the

then remaining discount of $178 and prepaid financing costs of $32 applied to

the original Notes Payable to interest expense. Furthermore, the Company

reversed the accrual of additional consideration of $208 related to the 200,000

shares of the Company’s common stock.

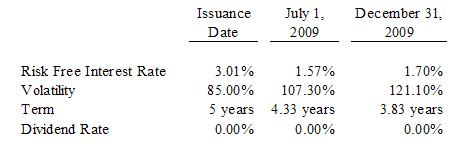

The

amended Notes Payable in the amount of $7,000 bear an interest rate of 8.0% and

matured on November 15, 2009. The Company accreted the premium of $805 over the

term of the amendment, using the effective interest method, which resulted in

additional interest expense for the three and six months ended December 31, 2009

of $96 and $288. As of July 1, 2009, the warrants issued were deemed to have a

derivative liability resulting in an accumulated adjustment to account for the

embedded derivative liability of the strike price resulting in a decrease to

additional paid in capital of $169, a decrease in accumulated deficit of $140, a

decrease in the carry value of the amended Notes Payable of $6 and the

recognition of a derivative liability of $34. As of December 31,

2009, the related derivative liability to the amended Notes Payable decreased to

$30 and is included in accrued expenses and other current liabilities in the

accompanying condensed balance sheets. The embedded derivative liability created

in connection with the warrants issued was valued at a fair value using the

Black-Scholes option pricing model as of the issuance date and subsequently as

of July 1, 2009 and December 31, 2009.

15

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

The

Company used the following assumptions to calculate the fair value of the

derivative liability:

The

discount to the amended Notes Payable for the warrants which is being accreted

using the effective interest method resulted in interest expense for the three

and six months ended December 31, 2009 of $22 and $65, respectively and $33 of

interest expense for each of the three and six months ended December 31, 2008.

The Company also recorded an additional $10 of deferred financing costs as a

result of the issuance of the amended Notes Payable. The Company is

amortizing to interest expense the deferred financing costs using the effective

interest method. The amount amortized to interest expense relating to the

amended Notes Payable for the three and six months ended December 31, 2009 was

less than $1 and $3, respectively and $2 for each of the three and six months

ended December 31, 2008.

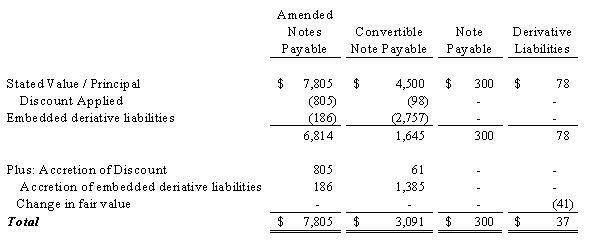

The

following table presents the stated value/principal of each of the securities

issued in connection with the debt outstanding as of December 31,

2009:

The

Company accreted $54 and $1,137, in the three and six months ended December 31,

2008, for the Series C Preferred Stock dividend and for the acceleration of the

deemed dividend from the beneficial conversion feature of the Series C Preferred

Stock, respectively (See Note 11(d) Series C Redeemable Convertible Preferred

Stock). Such amounts are included in the accompanying Condensed

Consolidated Statement of Operations.

The

weighted average interest rate paid was 8.59% in each of the three and six

months ended December 31, 2009 and 2008. As of December 31, 2009 and

June 30, 2009, the Company had accrued and unpaid interest of approximately $267

and $192, respectively, for the Notes Payable and Convertible Note

Payable. (See Note 7(a) above).

As of

December 31, 2009, the Company is in technical default of the financial

covenants of the amended Notes Payable relating to the Company's tangible net

worth requirements and minimum net capital requirements and has not repaid the

amended Notes Payable in the amount of $7,805. As of February 12,

2010, the Company continues to work with the note holders to work out the

refinancing of the amounts due under the amended Notes Payable, however at this

time the Company and the note holders have not yet come to an agreement and the

note holders have not exercised their rights, with respect to the amended Notes

Payable, based on the Company's non payment of the amended Notes

Payable. Upon the occurrence of an event of default, the note holders

have the right, to give the Company an Acceleration Notice, which would (i)

accelerate the payment of all unpaid principal and accrued and unpaid interest

(including default interest (if any)) on the Notes Payable, and (ii) require the

Company to pay an amount equal to the sum of all of the amounts described in the

preceding clause (i) in same day funds on the payment date specified in the

notice, provided such date must be at least two (2) business days following the

date on which the notice is delivered to the

Company.

16

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

Note

8. Significant Risks and Uncertainties

(a)

Concentrations of Credit Risk-Cash. The Company maintains balances at

several financial institutions. Deposits at each institution are insured by the

Federal Deposit Insurance Corporation up to $250 through December 31, 2013. The

FDIC is temporarily insuring deposits up to $250 at financial institutions

through December 31, 2013. As of January 1, 2010, the Company had $870 of

uninsured deposits at these financial institutions.

(b)

Concentrations of Credit Risk-Receivables. The Company routinely assesses

the financial strength of its customers and, based upon factors surrounding the

credit risk of its customers, establishes an allowance for uncollectible

accounts and, as a consequence, believes that its accounts receivable credit

risk exposure beyond such allowances is limited. The Company does not require

collateral in relation to its trade accounts receivable credit risk. The amount

of the allowance for uncollectible accounts and other allowances was $241 and

$298 at December 31, 2009 and June 30, 2009, respectively.

(c) Major

Customers. For the three and six months ended December 31, 2009,

approximately 76.6 % of revenues was derived from two customers. For

the three and six months ended December 31, 2008 approximately 79.2% and 79.0%

of revenues were derived from three customers. Accounts receivable as

of December 31, 2009 from the two major customers represented approximately 37%

of total accounts receivable. The loss of these customers would have an adverse

affect on the Company’s operations. Major customers are those customers who

account for more than 10% of net sales.

(d) Other

Business Risks. The Company insures it business and assets against

insurable risks, to the extent that it deems appropriate, based upon an analysis

of the relative risks and costs. The Company believes that the risk of loss from

non-insurable events would not have a material adverse effect on the Company’s

operations as a whole.

The raw

materials used by the Company are primarily commodities and agricultural-based

products. Raw materials used by the Company in the manufacture of its

Nutraceutical products are purchased from independent suppliers. Raw materials

are available from numerous sources and the Company believes that it will

continue to obtain adequate supplies.

Approximately

50% the Company’s employees, located in its New Jersey facility, are covered by

a union contract. The contract was renewed in August 2006 and will expire in

August 2010.

Note

9. Commitments and Contingencies

(a)

Leases

Related Party

Leases. Warehouse and office facilities are leased from Vitamin Realty

Associates, L.L.C., a limited liability company, which is 90% owned by the

Chairman of the Company’s Board of Directors, a director and majority

shareholder and certain of his family members and 10% owned by an employee of

the Company. The lease provides for minimum annual rental payment of $324

through May 31, 2015 plus increases in real estate taxes and building operating

expenses. On July 1, 2004, the Company leased an additional 24,810 square feet

of warehouse space on a month-to month basis. Rent expense for the three and six

months ended December 31, 2009 and 2008 on these leases were $177 and $183 and

$405 and $393, respectively, and are included in both cost of sales and selling

and administrative expenses in the accompanying Condensed Consolidated

Statements of Operations. At December 31, 2009 and June 30, 2009, the Company

had an outstanding obligation of $544 and $443, respectively, included in

accounts payable in the accompanying Condensed Consolidated Balance

Sheet.

17

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

Other Lease

Commitments. The Company has entered into certain non-cancelable

operating lease agreements expiring up through May 31, 2015, related to office

and warehouse space, equipment and vehicles. Total rent expense, including real

estate taxes and maintenance charges, was approximately $240 and $265 for the

three months ended December 31, 2009 and 2008 and $532 and $536 for the six

months ended December 31, 2009 and 2008, respectively. Rent expense is stated

net of sublease income of approximately $9 for each of the three months ended

December 31, 2009 and 2008 and $18 for each of the six month periods ended

December 31, 2009 and 2008. This is included in both cost of sales

and selling and administrative expenses in the accompanying Condensed

Consolidated Statements of Operations.

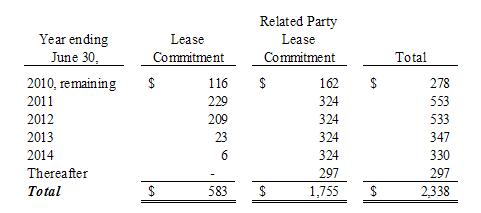

The

minimum rental commitment for long-term non-cancelable leases is as

follows:

(b)

Consulting Agreements.

Effective

July 1, 2008, the Company entered into a three year consulting agreement with

Jeffrey Leach (an employee of the Company as of the date of the agreement and

its former President and Chief Executive Officer). Pursuant to the consulting

agreement, Mr. Leach is to provide consulting and specialized services to the

Company in the area of finance, acquisition of product lines, refinancing of

existing debt and capital raising under the direction of the Company, including

for any company in which the Company has an ownership interest. In connection

with the consulting agreement, the Company issued 250,000 shares of the

Company’s common stock to Mr. Leach.

(c)

Legal Proceedings.

On June

16, 2008, the State of Texas filed an Original Petition for injunctive relief

and civil penalties in the 101st Judicial District, Dallas, Texas (the "Court"),

against AgroLabs Inc., the Company, Kurt Cahill and Gerald Kay (collectively the

"Defendants"). The State alleged that the Defendants sold or

distributed juices and dietary supplements marketed with inappropriate disease

and nutritional claims. AgroLabs has appeared in the lawsuit and

filed an answer denying all claims. Additionally, AgroLabs filed a

counterclaim against the State for declaratory relief, in which AgroLabs sought

a declaratory judgment from the Court that the State's causes of action were

preempted under federal law because the product benefit claims at issue are

fully compliant with applicable federal law.

18

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

The

Company and Mr. Kay filed motions to dismiss the lawsuit for lack of personal

jurisdiction. In November 2009, the State of Texas agreed to dismiss

the Company and Mr. Kay from the lawsuit. The parties have now

resolved all of the remaining issues in this lawsuit. Neither party

has admitted any liability. Under the settlement agreement, the

Company will make a payment to the State of Texas in the amount of $130,000 to

be allocated to the State of Texas' judicial fund for programs approved by the

Texas Supreme Court that provide basic civil legal services to the indigent;

attorneys' fees and investigation costs incurred by the Office of the Attorney

General; and investigative costs incurred by the Texas Department of State

Health Services. The Company recognized this payment obligation in

its results of operations for the three and six months ended December 31,

2009.

On April

23, 2009, Braker Five & Eight Investors, L.P., (the “Landlord”) filed an

Original Petition relief and damages pursuant to a Lease Agreement for the

premises located in Austin, Texas in the 126th Judicial District, Travis County,

Texas, against BevSpec, Inc., Bioscience Technologies, Inc. dba The Organic

Beverage Company, and Integrated BioPharma, Inc., as Guarantor (collectively,

the “Defendants”). The Landlord has sued for sums due under the Lease

under breach of contract and guaranty theories. The Company believes

it has several meritorious defenses which would relieve it of all liability to

the Landlord and has filed an answer in which it generally denies liability to

the Landlord and asserts several affirmative defenses. The parties

are presently engaged in the discovery process; no trial date has been

set. The Company is unable, at this time, to make a determination as

to the likelihood of an unfavorable outcome or to estimate the amount or range

or possible loss or gain and the impact, if any, this claim will have on the

Company and its operations.

On or

about August 10, 2009, AgroLabs, Inc. commenced an action in the Superior Court

of New Jersey, Law Division, against defendants Kurt E. Cahill, Cheryl A.

Cahill, Joseph E. Cahill, Jr. and Monty C. Lloyd (all of whom were previously

employed by AgroLabs, Inc.) for, among other things, breach of contract, breach

of fiduciary duty, negligent performance of duties and other and related

relief. On or about September 1, 2009, the defendants removed the action

to the United States District Court for the District of New Jersey. On or

about September 15, 2009, the defendants filed an answer and affirmative

defenses. The defendants, however, asserted no counterclaims. The

parties have exchanged initial disclosures and other information, and

the parties have also engaged in settlement discussions. In the absence of

a settlement, the Company is unable to make a determination as to the likelihood

of a favorable outcome or to estimate the amount or range or possible loss or

gain and the impact, if any, of this claim will have on the Company and its

operations.

Note

10. Related Party Transactions

The

Company has a verbal consulting agreement with Eugene Kay, a former employee of

the Company and a brother of E. Gerald Kay, the Chairman of the Company’s Board

of Directors, a director and majority shareholder. This agreement is on a

month-to-month basis for $1 per month. The total consulting expense recorded per

this agreement for each of the three and six months ended December 31, 2009 and

2008 was $3 and $6 in each period. The Company had another consulting agreement

with EVJ, LLC, a limited liability company controlled by Robert Kay, a director

of the Company, the Chairman of its subsidiary, Paxis, and a brother of E.

Gerald Kay and Eugene Kay. This agreement was assumed by and became a liability

of the Company as a part of the Company's acquisition of Paxis in the fiscal

year ended June 30, 2004. The total consulting expense under this agreement was

$15 for the six month period ended December 31, 2008 and is included in

discontinued operations in the accompanying condensed consolidated statement of

operations. The agreement was terminated in August 2008.

Carl

DeSantis, a director of the Company and a member of CD Financial (see Note 7(a))

and CD Financial have guaranteed certain liabilities of the

Company. On April 7, 2009, CD Financial entered into a Guaranty

Agreement with Creative Flavors, Inc. (“CFC”), a major supplier of the Company,

guaranteeing up to $500 of the Company’s outstanding obligation with

CFC. The guaranty is continuing and remains in effect until

terminated by written notice to CFC. As of December 31, 2009, the

Company had an outstanding obligation to CFC in the amount of $907, which amount

is included in accounts payable in the Company’s Condensed Consolidated Balance

Sheet.

19

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

On July

1, 2009, the Company entered into a credit and payment agreement (the “Payment

Agreement”) with a major supplier, Triarco, Inc. (“Triarco”). Under

the terms of the Payment Agreement, the Company is obligated to pay its past due

balance in eight equal installments of $50 beginning August 1, 2009 and Mr.

DeSantis agreed to separately guaranty (the “Personal Guaranty”) the Company’s

obligations to Triarco. In exchange, Triarco agreed to extend additional credit

of $400 (the “Additional Amount Outstanding”) on net thirty day terms beginning

with trade payables dated June 24, 2009. The Personal Guaranty is

limited to the lesser of the aggregate amount owed to Triarco, or

$800. As of December 31, 2009, the Company owes Triarco $135, $32

under the Additional Amount Outstanding and $104 was past due, these amounts are

included in accounts payable in the Company’s Condensed Consolidated Balance

Sheet.

CD

Financial and Mr. DeSantis did not receive any compensation from the Company in

connection with these guarantees.

In August

2008, the Company ceased allocating corporate overhead to iBio and entered into

a Transitional Services Agreement (the “TS Agreement”) with iBio. The

transitional services agreement permitted the Company to continue to provide

certain corporate services to iBio in exchange for a management charge. The

scope of these services was limited to legal, strategic financial planning, SEC

reporting, and tax services by certain corporate employees of the Company. The

TS Agreement provided for a per annum fee of $100. In the six months

ended December 31, 2009 and 2008, the Company billed iBio approximately $8 and

$37, respectively under the TS Agreement. The TS Agreement was

terminated in August 2009.

See Note

7(a) and (b) – Notes Payable and Convertible Note Payable – CD Financial, LLC

for related party securities transactions.

See Note

9(a) - Leases for related party lease transactions.

Note

11. Equity Transactions

(a) Stock Option

Plan and Warrants. There were no stock options or warrants issued in the

three and six months ended December 31, 2009. During the three and

six months ended December 31, 2008, there were stock options authorized by the

Board of Directors and issued in January 2009 to Company employees and Directors

to purchase 1,000,000 shares of common stock and warrants to purchase 500,000

shares of common stock at $0.80 in connection with the amended Notes Payable

agreement (See Note 7(b) Notes Payable). During the three and six months ended

December 31, 2009 and 2008, the Company has incurred stock compensation expense

of $281 and $462 and $559 and $761, respectively. Included in

discontinued operations is stock compensation of $5 and $21 for the three and

six months ended December 31, 2008. In the six month period ended

December 31, 2008, certain key executives and a significant shareholder of the

Company exercised stock options for shares of common stock of 2,095,852 which

provided cash proceeds to the Company of approximately $1,341.

(b) Restricted

Stock Award. There were no

restricted stock awards issued in the three and six months ended December 31,

2009 and 2008, respectively.

(c) Consulting

Agreements. Effective July 1, 2008, the Company entered into two

three-year consulting agreements which resulted in the issuance of 350,000

shares of the Company’s common stock. On the effective date of these

consulting agreements, the Company recognized prepaid consulting expenses of

$830 with a corresponding increase in common stock and additional paid in

capital. During the three and six months ended December 31, 2009 and 2008, the

Company amortized $49 and $69, and $98 and $138, respectively, to selling and

administrative expenses in the Company’s Condensed Consolidated Statement of

Operations. The consulting expenses will continue to be amortized into selling

and administrative expenses over the three year terms, of the consulting

agreements.

20

INTEGRATED

BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO

THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2009 AND JUNE 30, 2009 AND FOR THE

THREE AND

SIX MONTHS ENDED DECEMBER 31, 2009 AND 2008

(in

thousands, except share and per share amounts)

Of the

common stock issued in connection with the consulting agreements, 100,000 shares

of common stock have not been registered under the Securities Act of 1933, as

amended (the "Securities Act"), and were issued and sold in reliance upon the

exemption from registration contained in Section 4(2) of the Securities Act and

Regulation D promulgated thereunder. These shares of common stock may not be

offered or sold in the United States in the absence of an effective registration

statement or exemption from the registration requirements under the Securities

Act. In March 2009, these 100,000 shares were cancelled as the

related consulting agreement was rescinded by both parties.

(d) Series C

Preferred Stock. On February 21, 2008, the Company raised

$5,788 in net proceeds from the sale of 6,000 shares of the Company’s Series C

Preferred Stock, par value $1,000 per share, at a purchase price of $1,000 per

share. Upon issuance of the Series C Preferred Stock, the Company recorded the

beneficial conversion feature of $1,216 and such amounts were being accreted

over the five year period until the mandatory redemption date of the Series C

Preferred Stock, the fifth anniversary of closing.

During

July and August 2008, all 6,269 Series C Preferred Stock (inclusive of

cumulative dividends of 269 shares of Series C Preferred Stock) were converted

into 2,639,204 shares of the Company’s common stock. The conversion resulted in

an increase to common stock of $5 and additional paid in capital of $6,264. Also

during the six months ended December 31, 2008, the Company incurred a deemed

dividend from beneficial conversion feature of the Series C Preferred Stock of

$1,137 as a result of accelerating the accretion of the beneficial conversion

feature and the discount, respectively.

Dividends

of the Series C Preferred Stock were 10% per annum, payable on an annual basis,

by the Company in shares of the Company's Series C Preferred Stock. Accordingly,

the Company had accrued approximately $216 at June 30, 2008, and incurred $54

during the six months ended December 31, 2008, which were paid in Series C

Preferred Stock and cash for the fractional shares during the period ended

December 31, 2008. The redemption of the shares of Series C Preferred Stock

accelerated a payment of a dividend on the Series C Preferred

Stock.

Note

12. Income Taxes

The

Company recognizes deferred tax assets, net of applicable valuation allowances,

related to net operating loss carry-forwards and certain temporary differences

and deferred tax liabilities related to certain temporary differences. The

Company recognizes a future tax benefit to the extent that realization of such

benefit is considered to be more likely than not. This determination is based on

projected taxable income and tax planning strategies. Otherwise, a valuation

allowance is applied.

In the

fiscal year ended June 30, 2009, the Company’s deferred tax asset as well as

projected taxable income was reviewed for expected utilization using the “more

likely than not” approach by assessing the available positive and negative

evidence surrounding its recoverability. A full valuation allowance of $5,955

was recorded in the fiscal year ended June 30, 2009, against the Company’s

deferred tax asset, as it was determined based upon past losses, the Company’s

liquidity concerns and the current economic environment, that it was “more

likely than not” that the Company’s deferred tax assets may not be realized. In

future years, if the deferred tax assets are determined by management to be more

likely than not to be realized, the recognized tax benefits relating to the

reversal of the valuation allowance will be recorded.

21

Item

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANICAL CONDITION AND RESULTS OF

OPERATION

|

|

Certain

statements set forth under this caption constitute “forward-looking statements.”

See “Disclosure Regarding Forward-Looking Statements” on page 1 of this Report

for additional factors relating to such statements. The following discussion

should also be read in conjunction with the condensed consolidated financial

statements of the Company and Notes thereto included elsewhere herein and the

Company’s Annual Report on Form 10-K.

The

Company is engaged primarily in the manufacturing, distributing, marketing and

sales of vitamins, nutritional supplements and herbal products. The Company’s

customers are located primarily throughout North America.

Business

Outlook

Our

future results of operations and the other forward-looking statements contained

in this Form 10-Q, including this MD&A, involve a number of risks and

uncertainties—in particular, the statements regarding our goals and strategies,

new product introductions, plans to cultivate new businesses, pending

divestitures, future economic conditions, revenue, pricing, gross margin and

costs, the tax rate, and pending legal proceedings. We are focusing on efforts

to improve operational efficiency and reduce spending that may have an impact on

expense levels and gross margin. In addition to the various important factors

discussed above, a number of other important factors could cause actual results

to differ significantly from our expectations. See the risks described in “Risk

Factors” in Part II, Item 1A of this Form 10-Q.

Our

financial results are substantially dependent on net sales of our Nutraceutical

product lines. Net sales is partly a function of the mix of branded

proprietary Nutraceutical products, contract manufactured products and other

Nutraceutical, all of which are difficult to forecast. The varied

sales pricing among our products and promotional support in the form of consumer

coupons or other sales price allowances, along with the mix of products sold

affects the average selling price that we will realize and has a large impact on

our revenue and gross margins. Net sales is affected by the timing of new

product introductions and the demand for and market acceptance of our products;

actions taken by our competitors, including new product offerings and

introductions, marketing programs and pricing pressures, and our response to

such actions; our ability to respond quickly to consumer tastes and needs; and

the availability of sufficient raw materials and production lead-time from

suppliers to meet demand. Factors that could cause demand to be different from

our expectations include customer acceptance of our products and our competitors

products; changes in customer order patterns, including order returns; changes

in the level of inventory at customers; and changes in business and economic

conditions, including conditions in the credit market that could affect consumer

confidence and result in lower than expected demand for our

products.

We

believe that we have the product offerings and introductions, facilities,

personnel, and competitive and financial resources in place for business

success; however, future revenue, costs, gross margins, and profits are all

influenced by a number of factors, including those discussed above, all of which

are inherently difficult to forecast.

Critical

Accounting Policies and Estimates

There

have been no changes to our critical accounting policies in the six months ended

December 31, 2009. Critical accounting policies and the significant estimates

made in accordance with them are regularly discussed with our Audit Committee.

Those policies are discussed under “Critical Accounting Policies” in our

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” included in Item 7 of our Annual Report on Form 10-K for the year

ended June 30, 2009.

22

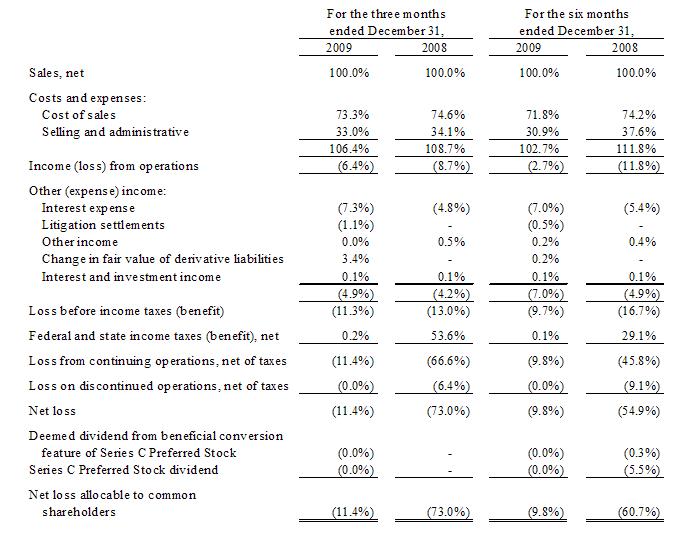

Results

of Operations

Our

results from operations in the following table, which for the three and six

months ended December 31, 2008, have been reclassified as a result of

discontinued operations, sets forth the income statement data of our results as

a percentage of net sales for the periods indicated:

For

the six months ended December 31, 2009 compared to the six months ended December

31, 2008

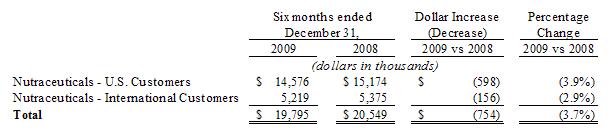

Sales, net. Sales, net, for the six months ended

December 31, 2009 and 2008 were $19.8 million and $20.5 million, respectively, a

decrease of $754 or 3.7%. The decrease is comprised of the

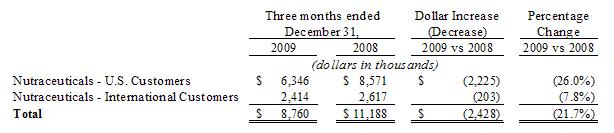

following:

For the

six months ended December 31, 2009, approximately 77% of total net sales were

derived from two customers as compared to 79% of total net sales from three

customers for the six months ended December 31, 2008. The loss of any

of these customers would have an adverse affect on our operations. We

continue to expand our customer base by expanding from selling our proprietary

branded Nutraceutical products primarily to “club” stores to the retail sales

segment and expanding our sales in the international market and e-commerce

markets.

23

The

decrease in our net sales is the result of a decrease our branded proprietary

Nutraceutical product line of approximately $1.3 million due to declining sales

of our original three products introduced to the market four years

ago. Management believes that these products may have reached their

marketing life cycle and has focused its efforts on introducing new products

into the market place, including packaging, product size and new

formulations. Our contract manufacturing product sales increased by

approximately $0.7 million primarily from increased sales from its major

customer, Herbalife. The remaining Nutraceutical product lines had

net sales decreases of approximately $0.2 million compared to the prior

period.

Cost of

sales. Cost of sales decreased by $1.0 million to $14.2

million for the six months ended December 31, 2009 as compared to $15.2 million

for the six months ended December 31, 2008. Cost of sales decreased as a

percentage of sales to 71.8% for the six months ended December 31, 2009 as

compared to 74.2% for the six months ended December 31, 2008. The decrease in

cost of goods sold amount was primarily the result of decreased

sales. The lower cost of goods sold as a percentage of sales is the

result of increased sales in the contract manufacturing business which has fixed

manufacturing costs regardless of the dollars sold and better cost controls in

our branded nutraceutical business line.

Selling and

Administrative Expenses. Selling and administrative expenses

were $6.1 million for the six months ended December 31, 2009, as compared to

$7.7 million for the six months ended December 31, 2008, a decrease of $1.6

million or 20.9%. As a percentage of sales, net, selling and administrative

expenses were 30.9% for the six months ended December 31, 2009 and 37.6% for the

prior comparable period.

The net

decrease in selling and administrative expenses of $1.6 million is mainly due to

decreases aggregating approximately $1.6 million in:

|

·

|

advertising

and marketing ($0.6 million)

|

|

·

|

compensation

and employee benefits ($0.3

million)

|

|

·

|

stock

compensation expenses ($0.2

million),

|

|

·

|

travel

and entertainment ($0.2 million)

|

|

·

|

professional

fess ($0.1 million) and

|

|

·

|

other

expenses ($0.2 million);

|

Our

advertising and marketing costs decreased by approximately $0.6 million in the

six months ended December 31, 2009 compared to the six months ended December 31,

2008 primarily as a result of a decrease in in-store demonstrations (“demos”) of

our products at one of our customers store locations. Our management

has temporally suspended demos as a form of advertising with this customer as it

was determined that it was not producing a significant enough increase in the

number of units being sold through to the consumer.

Our

compensation and employee benefits decreased by $0.3 million as a result of

decreasing our corporate staff by two employees, the suspension of the company

match of employee’s retirement savings deferrals in the profit sharing plan and

the decreased cost resulting from switching professional employment

organizations (reduced administrative costs with outsourcing our human resources