Attached files

| file | filename |

|---|---|

| EX-10.15 - Asia Cork Inc. | akrk_ex1015.htm |

| EX-10.14 - Asia Cork Inc. | akrk_ex1014.htm |

| EX-10.10 - Asia Cork Inc. | akrk_ex1010.htm |

| EX-10.6(A) - Asia Cork Inc. | akrk_ex106a.htm |

| EX-10.9 - Asia Cork Inc. | akrk_ex109.htm |

| EX-23.1 - Asia Cork Inc. | akrk_ex231.htm |

| EX-10.12 - Asia Cork Inc. | akrk_ex1012.htm |

| EX-10.6(B) - Asia Cork Inc. | akrk_ex106b.htm |

| EX-14.4 - Asia Cork Inc. | akrk_ex144.htm |

| EX-10.11 - Asia Cork Inc. | akrk_ex1011.htm |

| EX-10.13 - Asia Cork Inc. | akrk_ex1013.htm |

| EX-10.16 - Asia Cork Inc. | akrk_ex1016.htm |

| EX-10.17 - Asia Cork Inc. | akrk_ex1017.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ASIA

CORK INC.

(Name of

Registrant as Specified in Its Charter)

|

Delaware

|

2435 |

13-3912047

|

||

|

(State

or Other Jurisdiction of

|

(Primary

Standard Industrial

|

(I.R.S.

Employer

|

||

|

Incorporation

or Organization)

|

Classification

Code Number)

|

Identification

No.)

|

3rd

Floor, A Tower of Chuang Xin

Information

Building

No. 72

Second Keji Road, Hi Tech Zone

Xi’An

China

(011)

86 - 13301996766

(Address

and Telephone Number of Principal Executive Offices)

(Name,

Address and Telephone Number of Agent for Service)

COPIES

TO:

|

Steve

Schuster, Esq

McLaughlin

& Stern, llp

|

SUNNY

J. BARKATS, ESQ

JSBarkats, PLLC

|

|

|

260

Madison Avenue

New

York, New York 10016

(212) 448 1100

Fax (212)

448 0066

|

100

Church Street, 8th

Fl.

New

York, NY 10007

(646)

502-7001

Fax

(646) 607-5544

|

Approximate Date of Proposed Sale to

the Public: As soon as practicable after the effective date of this

Registration Statement.

If any of

the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. þ

If this

form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration

statement for the same offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement the same

offering. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

¨

|

Accelerated

filer

¨

|

Non-accelerated

filer

¨

|

Smaller

reporting company þ

|

|||

|

|

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to Be Registered

|

Amount to Be

Registered (1)

|

Proposed

Maximum

Offering Price

per Share

|

Proposed Maximum

Aggregate

Offering Price

|

Amount of

RegistrationFee

|

||||||||||||

|

Units,

each consisting of one share of Common Stock and one

Warrant

|

(2)(4) | $ | $ | 9,315,000 | $ | 664.16 | ||||||||||

|

Common

Stock, $0.0001 par value per share (3)

(4)

|

— | $ | — | $ | 9,315,000 | $ | 664.16 | |||||||||

|

Units,

each consisting of one share of Common Stock and one Warrant

(5)

|

$ | $ | 931,500 | $ | 66.42 | |||||||||||

|

Common

Stock, $0.0001 par value per share (5)(6)

|

$ | $ | 931,500 | $ | 66.42 | |||||||||||

|

Common

Stock, $0.0001 par value per share (7)

|

$ | $ | 350,000 | $ | 24.96 | |||||||||||

|

Common

Stock, $0.0001 par value per share (8)

|

$ | $ | 1,136,000 | $ | 72.98 | |||||||||||

|

Total

Registration Fee

|

$ | $ | 21,979,000 | $ | 1567.10 | |||||||||||

|

(1)

|

In

accordance with Rule 416(a), the Registrant is also registering hereunder

an indeterminate number of additional shares of common stock that shall be

issuable pursuant to Rule 416 pursuant to the anti-dilution provisions of

the underwriter’s warrants, the Warrants and warrants

previously issued selling

shareholders.

|

|

(2)

|

Includes

___________ Units issuable upon exercise of the Underwriter’s

over-allotment option. This Registration Statement covers the

public offering of up

to Units, each Unit

consisting of one share of common stock and one Warrant under a Public

Offering Prospectus through the underwriter. The registration fee for

securities to be offered by the Registrant is based on an estimate of the

Proposed Maximum Aggregate Offering Price of the securities, and such

estimate is solely for the purpose of calculating the registration fee

pursuant to Rule 457(o).

|

|

(3)

|

Issuable

upon exercise of the Warrants

|

|

(4)

|

Assumes

the Underwriter’s over-allotment option is exercised in full.

|

|

(5)

|

Issuable

upon exercise of the Underwriter’s Warrants

|

|

(6)

|

Issuable

upon exercise of the Warrants issuable upon exercise of the Underwriter’s

Warrants

|

|

(7)

|

Represents

shares of the Registrant’s common stock being registered for resale that

have been or may be acquired upon the exercise of warrants that have been

previously issued to selling stockholders named in the Resale

Prospectus.

|

|

(8)

|

Represents

shares of the Registrant’s common stock being registered for resale that

have been or may be acquired upon the conversion of Promissory Notes that

have been previously issued to selling stockholders named in the Resale

Prospectus.

|

|

(9)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457. In accordance with Rule 457(g) under the Securities

Act, because the shares of the Registrant’s common stock underlying the

underwriter’s warrants are registered hereby, no separate registration fee

is required with respect to the warrants registered

hereby.

|

THE REGISTRANT HEREBY AMENDS THIS

REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS

EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH

SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME

EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS

AMENDED OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE

AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a) MAY

DETERMINE.

EXPLANATORY

NOTE

This

Registration Statement contains two prospectuses, as set forth

below.

Public Offering

Prospectus. A prospectus to be used for the public offering by the

Registrant of up to Units of the Registrant, each consisting of one share

of common stock and one Warrant to purchase one share of

common stock (in addition to Units that may be sold upon exercise of the

underwriter’s over-allotment option) through the underwriter named on the cover

page of the Public Offering Prospectus.We are also registering the

Units (including the shares of common stock underlying the warrants to be

received by the underwriter in this offering (the “Public Offering

Prospectus”).

Resale

Prospectus. A prospectus to be used for the resale by selling

stockholders (the “Selling Stockholders”) of up to___________ shares of the

Registrant’s common stock (including shares that have been or may be

acquired upon the exercise of warrants, and shares that have been or may be

acquired upon the conversion of Promissory Notes that have been previously

issued to selling stockholders named in the Resale Prospectus) (the “Resale

Prospectus”).

The

Resale Prospectus is substantively identical to the Public Offering Prospectus,

except for the following principal points:

|

•

|

they

contain different outside and inside front covers;

|

|

•

|

they

contain different Offering sections in the Prospectus Summary section on

page __;

|

|

•

|

they

contain different Use of Proceeds sections on page __;

|

|

•

|

The

Capitalization and Dilution sections are deleted from the Resale

Prospectus on page __;

|

|

•

|

A

Selling Stockholder section is included in the Resale Prospectus beginning

on page __;

|

|

•

|

references

in the Public Offering Prospectus to the Resale Prospectus will be deleted

from the Resale Prospectus;

|

|

•

|

the

Underwriting section from the Public Offering Prospectus on page __

is deleted from the Resale Prospectus and a Plan of Distribution is

inserted in its place;

|

|

•

|

The

Legal Matters section in the Resale Prospectus on page __ deletes the

reference to counsel for the underwriter; and

|

|

•

|

the

outside back cover of the Public Offering Prospectus is deleted from the

Resale Prospectus.

|

The

Registrant has included in this Registration Statement, after the financial

statements, a set of alternate pages to reflect the foregoing differences of the

Resale Prospectus as compared to the Public Offering Prospectus.

The

Selling Stockholders named in the Resale Prospectus holding an aggregate

of shares of common stock, including, shares of common stock issuable upon

the exercise of warrants and shares of common stock underlying Promissory Notes,

have agreed that they will not sell any of such shares of common stock for a

period of ________months [STILL SUBJECT TO NEGOTIATION] after the Offering is

completed, when all of their shares will be released from the lock-up

restrictions.

|

The information in this prospectus is not complete and may be

changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission becomes effective. This

prospectus is not an offer to sell these securities and we are not

soliciting offers to buy these securities in any state where the offer or

sale is not permitted.

|

Subject to Completion

Preliminary Prospectus Dated February 12, 2009

PROSPECTUS

___________Units

ASIA

CORK, INC.

Each

Unit Consisting of

One

Share of Common Stock and One Warrant to Purchase One Share of Common

Stock

This is a

public offering of ________________ units (the “Units”) of Asia Cork, Inc.,

a Delaware corporation (the “Company”), (the “Offering”).

Each of the _______ Units offered hereby consists of one share of our

common stock, $.0001 par value per share, and one warrant entitled

the registered holder thereof to purchase one share of common

stock (the “Warrants”). The Warrants are exercisable to

purchase one share of common stock at $______ per share at any time from the

date of issuance through _______, 2015 (five years after the date of this

Prospectus). Each share of Common Stock and Warrant will not separately

transferable for a period of one year, unless sooner as may be approved by the

underwriter, in its sole discretion. The Warrants are subject to

redemption commencing one year after the date hereof at $.05 per

Warrant on 20 days prior written notice provided the closing price

of the Common Stock for 20 consecutive trading days ending within 15

days of the date of notice of redemption averages in excess

of $______ per share. (___% of the initial offering

price) See “Description of Securities.”

We are a

reporting company under the Securities Exchange Act of 1934, as

amended. Our common stock is quoted on the OTC Bulletin Board

maintained by the Financial Industry Regulatory Authority (“FINRA”) under the

symbol “AKRK.” The closing bid price for our common stock on

December , 2009 was $ .00

per share, as reported on the OTC Bulletin Board. We intend to apply

to have the units listed on the American Stock Exchange (“AMEX”) under the

symbol “_____” on or promptly after the date of this prospectus. Each of the

underlying common stock and warrants shall trade separately on the nearest

trading date which is 180 days after the date of this prospectus, provided,

however , the representative of the underwriters may determine that an earlier

date is acceptable. Prior to their separate trading we will apply to have the

common stock and warrants comprising the units listed on AMEX under the symbols

“___” and “___” or if eligible directly apply for the listing of our common

stock on the NASDAQ Stock Market LLC (“NASDAQ”) {and anticipate having our

common stock approved for listing as of the date of this

prospectus]. We expect that the public offering price of our Units

will be between $ .00 and $ .00 per

unit.

Concurrently

with this Offering, there are being offered, pursuant to a Resale Prospectus, by

certain security holders (collectively, the “Selling

Stockholders”), _______shares of Common Stock (collectively, the “Selling

Stockholders’ Securities”). Each of the Selling Stockholders have agreed not to

sell any of the Selling Stockholders’ Securities for a period

of [_____} months after the date of this prospectus

without the prior consent of the underwriter of the offering by the Company...

Sales of the Selling Stockholders’ Securities in such offering (the “Concurrent

Offering”) will be subject to the prospectus delivery requirements and other

requirements of the Securities Act.

The

purchase of the securities involves a high degree of risk. See section entitled

“Risk Factors” beginning on page 5.

|

Price

to the Public

|

Underwriting

Discounts

And

Commissions (1)

|

Proceeds

to the Company (2)

|

||||||||||

|

Per

Unit(3)

|

$ | $ | $ | |||||||||

|

Total

(4)

|

$ | 8,100,000 | $ | 729,000 | $ | 7,371,000 | ||||||

(1) Does

not include additional compensation to the Underwriters in the form of (i) a

non-accountable expense allowance equal to 2.0% of the gross proceeds of this

Offering (of which $20,000 has been paid), (ii) a Warrant (the "Underwriters

Warrants") to purchase up to Units (each Unit consisting of one share of

Common Stock and one Warrant at an exercise price equal to $_____ per Unit), and

(iii) a $60,000 consulting agreement. In addition, the Company has

agreed to indemnify the Underwriters against certain civil liabilities,

including liabilities under the Securities Act of 1933, as

amended. See "Underwriting."

(2) Before

deducting expenses payable by the Company (including the Underwriter’s

non-accountable expense allowance and consulting

agreement) estimated at $_____, ($_______, if the Underwriter’s over-allotment

option is exercised in full.)

(3) Includes

only the Units being offered hereby by the Company.

(4) The

Company has granted the Underwriter a 60-day option to purchase up to _______

additional Units on the same terms and conditions as set forth above, solely to

cover over-allotments, if any. If such option is exercised in full,

the total price to Public will be $9,315,000, the total Underwriting Discounts

and Commissions will be $838,350 and the total Proceeds to Company will be

$8,476,650. See "Underwriting."

The Units are being offered by the

Underwriter, subject to prior sale, when, as and if delivered to and accepted by

it, and subject to approval of certain legal matters by its counsel and to

certain other conditions. The Underwriters reserves the right to

withdraw, cancel or modify this Offering and to reject any order in whole or in

part. The underwriter expects to deliver the Units to

purchasers on or about [ ], 2010.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission

has approved or disapproved of anyone’s investment in these securities or

determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

The

Date of this Prospectus is: February 12, 2010

Asia

Cork, Inc.

TABLE

OF CONTENTS

|

Page

|

|

|

Prospectus

Summary

|

1 |

|

Risk

Factors

|

5 |

|

Risks

Related To Our Business

|

5 |

|

Risks

Related To Doing Business in China

|

8 |

|

Risks

Related to the Market of Our Stock

|

12 |

|

Use

of Proceeds

|

14 |

|

Dividend

Policy

|

15 |

|

Capitalization

|

16 |

|

Market

for Common Equity and Related Stockholder Matters

|

16 |

|

Dilution

|

17 |

|

Accounting

for the Share and Exchange

|

18 |

|

Description

of Business

|

19 |

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operation

|

34 |

|

Management

|

43 |

|

Certain

Relationships and Related Transactions

|

49 |

|

Security

Ownership of Certain Beneficial Owners and Management

|

50 |

|

Description

of Securities

|

51 |

|

Shares

Eligible for Future Sale

|

54 |

|

Underwriting

|

55 |

|

Legal

Matters

|

57 |

|

Experts

|

57 |

|

Additional

Information

|

57 |

|

Financial

Statements

|

F-1 |

Please

read this prospectus carefully. It describes our business, our financial

condition and results of operations. We have prepared this prospectus so that

you will have the information necessary to make an informed investment

decision.

You

should rely only on information contained in this prospectus. We have not, and

the underwriter has not, authorized any other person to provide you with

different information. This prospectus is not an offer to sell, nor is it

seeking an offer to buy, these securities in any state where the offer or sale

is not permitted. The information in this prospectus is complete and accurate as

of the date on the front cover, but the information may have changed since that

date.

PROSPECTUS

SUMMARY

Because

this is only a summary, it does not contain all of the information that may be

important to you. You should carefully read the more detailed information

contained in this prospectus, including our financial statements and related

notes. Our business involves significant risks. You should carefully consider

the information under the heading “Risk Factors” beginning on

page . Unless otherwise indicated, all share and per share

information gives effect to the conversion of all of our outstanding Selling

Stockholder’s Promissory Notes into shares of our common stock (the “Promissory

Note Conversion”).

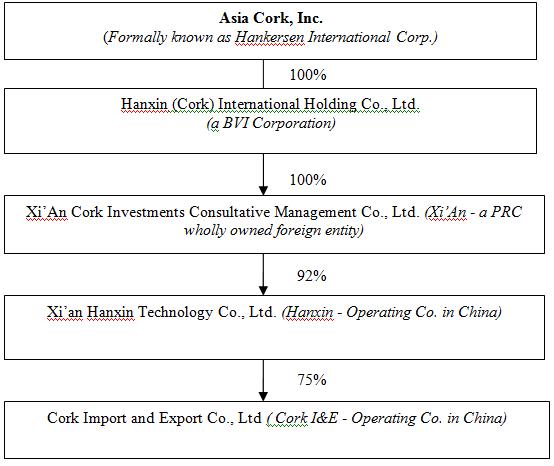

As used

in this prospectus, unless otherwise indicated, the terms “we”, “our”, “us”,

“Company” and “Hanxin” refer to ASIA CORK, INC., a Delaware corporation,

formerly known as Hankersen International Corp . (“Hankersen”); its wholly-owned

subsidiary, Hanxin (Cork) International Holding Co., Ltd., a company organized

in the British Virgin Islands (“Hanxin International”); its wholly-owned

subsidiary, Xi’An Cork Investments Consultative Management co., Ltd., a company

organized in the People’s Republic of China (“Xi’An”); Xian Hanxin Technology

co., Ltd. (“Hanxin”), the subsidiary which it owns 92% equity interest and was

organized in the People’s Republic of China,

and Hanxin owns 75% equity interestof Cork Import and

Export Co., Ltd., a company organized in the People’s Republic of China (“Cork

I&E”). “China” or “PRC” refers to the People’s Republic of China. “RMB” or

“Renminbi” refers to the legal currency of China and “$” or “U.S. Dollars”

refers to the legal currency of the United States.

THE

COMPANY

Asia

Cork, Inc.

We are a

holding company whose primary business operations are conducted through our

wholly-owned subsidiary Hanxin International, and its subsidiaries, Hanxin and

Cork I&E. We are engaged in the development, manufacture and distribution of

cork wood floor, wall, sheets, rolls and other cork decorating materials in

China and other countries.

Our

Background History

Asia Cork

Inc. (f/k/a Hankersen International Corp.), was incorporated under the laws of

the State of Delaware on August 1, 1996. We were formed in connection with

the merger acquisition of Kushi Macrobiotics Corp. (“KMC”) with American Phoenix

Group, Inc. (“APGI”) in 1996. Prior to such acquisition, KMC had operated a

business of marketing a line of natural foods (the “Kushi Cuisine”). This

business was not successful and management determined that it would be in the

shareholder’s interest for KMC to operate a different business.

In

August 2005, we, through Kushi Sub, Inc., a newly formed Delaware

corporation and wholly-owned subsidiary of us ("Acquisition Sub") acquired all

the ownership interest in Hanxin (Cork) International Holding Co., Ltd. ("Hanxin

International"), a British Virgin Islands limited liability corporation,

organized in September 2004. We acquired Hanxin International in exchange

for 24,000,000 shares of common stock and 1,000 shares of the Series A

Preferred Stock, which such shares converted into 29,530,937 shares of common

stock. Subsequent to the merger and upon the conversion of the Series A

Preferred Stock, the former shareholders of Hanxin International own 95% of the

outstanding shares of our common stock.

Hanxin

International has no other business activities other than owning 100% of Xi'An

Cork Investments Consultative Management Co., Ltd. ("Xi'An"), which owns 92% of

Xian Hanxin Technology Co., Ltd. ("Hanxin"), incorporated in July 2002,

both Xi'An and Hanxin are People's Republic of China (PRC) corporations. Most of

our operating and business activities are conducted through Hanxin. Hanxin

is our principal operating subsidiary.

During

the year ended December 31, 2005, Hanxin acquired a 75% equity interest of

Cork Import and Export Co. Ltd. (“Cork I&E”), a PRC corporation that engages

in cork trading businesses.

We are a

reporting company under Section 13 of the Securities Exchange Act of 1934, as

amended. Our shares of common stock are not currently listed or quoted for

trading on any national securities exchange or national quotation system. We

intend to apply for the listing of our common stock on the NASDAQ or the

American Stock Exchange.

1

Recent

Events

Merger

and Change of Name

On

July 11, 2008, the Company's wholly owned subsidiary, Asia Cork Inc., was

merged into its parent, the Company, in order to change the name of the Company,

after approval by the Board of Directors of the Company pursuant to the Delaware

General Corporation Law. The Company is the surviving company of the merger and,

except for the adoption of the new name its Certificate of Incorporation is

otherwise unchanged. The wholly-owned subsidiary was formed in July 2008

and had no material assets.

As

permitted by Delaware General Corporation Law, the Company assumed the name of

its wholly owned subsidiary following the merger and now operates under the name

Asia Cork Inc. The Company’s common stock is quoted on the Over the Counter

Bulletin Board under the trading symbol “AKRK.OB”

Reverse

Stock Split

Concurrently

with the date of this prospectus, the Company will effectuate a ___ to one

reverse stock split (the “Reverse Split”). The Reverse Split

will be subject to approval by our stockholders, which approval is a condition

to the Offering. All references to the outstanding shares of our

common stock in this prospectus give effect to the Reverse

Split. [THE TERMS OF THE REVERSE SPLIT HAVE NOT YET BEEN

DETERMINED]

Selling

Stockholder Promissory Notes and Warrants

On

June 4 and June 12, 2008, the Company consummated an offering to the

Selling Stockholders of convertible promissory notes and warrants for aggregate

gross proceeds of $700,000. The notes matured in June 2009 and remain

outstanding. The interest rate on the Selling Stockholders’

promissory notes through the maturity dates was 18% per annum and the interest

rate since the maturity dates is 24% per annum. Each investor has the option to

(i) be paid the principal and interest due under the promissory note or (ii)

convert the note into shares of common stock at a conversion price of $0.228 per

share (without giving effect to the Reverse Split) or (iii) convert the note

into shares of common stock at a conversion price equal to 50% of the offering

price per share of common stock in this Offering. . Each investor

also received warrants exercisable for 4 years to purchase shares of our common

stock at an exercise price $.228 per share. Under the warrants, investors can

purchase an amount of shares for an aggregate consideration up to 50 per cent of

the amount of their investment. Our obligations under the promissory

notes are secured by 7,630,814 shares of common stock pledged by

Mr. Pengcheng Chen, our Chief Executive Officer, and by Mr. Fangshe

Zhang, our Chairman. We have not repaid the Selling Stockholders’ Promissory

Notes to date and the Selling Stockholders have not sought the shares being held

in escrow

The

shares of common stock issuable upon conversion of the Selling Stockholders’

Promissory Notes and exercise of the Selling Stockholders Warrants are the

Selling Stockholders Securities being offered for resale pursuant to the Resale

Prospectus.

2

THE

OFFERING

|

Securities

we are Offering

|

___________Units,

each consisting of one share of common stock and one warrant to

purchase one share of common stock(1)

|

|

|

|

|

Common

stock outstanding after the offering

|

|

| Outstanding Prior to Offering |

_____________

shares (2)

|

|

|

|

|

Outstanding

After Offering

|

______________shares

(2)

|

|

|

|

|

Offering

price

|

$ ____to

$_______per Unit; $.____ to $_____ per share and $___ per

Warrant

|

|

Use

of proceeds

|

We

intend to use the net proceeds of this offering for general corporate

purposes. See “Use of Proceeds” on page _____ for more

information on the use of proceeds.

|

|

Risk

Factors

|

Investing

in these securities involves a high degree of risk. As an investor you

should be able to bear a complete loss of your investment. You should

carefully consider the information set forth in the “Risk Factors” section

beginning on page 4 .

|

|

(1)

|

Excludes

(i) up to shares that may be sold upon the underwriter’s over-allotment

option and (ii) up to shares of common stock underlying warrants to be

received by the underwriter in this offering.

|

|

(2)

|

Based

on 35,663,850 shares of common stock issued and outstanding as

of January 20, 2010, without giving effect to the Reverse

Split, _____________ shares of common stock after giving effect

to the conversion of the Selling Stockholders’ Promissory Notes)

and shares of common stock issued in the public offering (excluding

the shares issuable upon exercise of the Warrants, the underwriter’s

over-allotment option of up to Units and

theunderwriter’s warrants to purchase up to shares of

common stock).

|

3

SUMMARY

OF CONSOLIDATED FINANCIAL INFORMATION

The

following tables summarize our consolidated financial data for the periods

presented. You should read the following financial information together with the

information under “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” and our consolidated financial statements and the

related notes to these consolidated financial statements appearing elsewhere in

this Prospectus. The selected consolidated statements of operations data for the

nine months financial period ended September 30, 2009 and 2008, and the

consolidated balance sheet data as of September 30, 2009 are derived from our unaudited

consolidated financial statements, which are included elsewhere herein. The

unaudited consolidated financial statements have been prepared on the same basis

as our audited financial statements and include, in the opinion of management,

all adjustments that management considers necessary for a fair presentation of

the financial information set forth in those statements. The selected

consolidated statements of operations data for the financial years ended

December 31, 2008 and 2007; and the selected consolidated balance sheet data as

of December 31, 2008 are derived from our consolidated financial statements,

which are included elsewhere herein, and have been audited by MS Group CPA, LLC,

an independent registered public accounting firm, as indicated in their report.

Whereas the selected consolidated statements of operations data for the

financial years ended December 31, 2006 and 2005, and the selected consolidated

balance sheet data as of December 31, 2006 and 2005 are derived from our

consolidated financial statements, which are not included in this prospectus,

and have been audited by MS Group CPA LLC and the selected

consolidated statements of operations data for the financial year ended December

31, 2004; and the selected consolidated balance sheet data as of December 31,

2004 have been audited by Most & Company LLC, an independent

registered public accounting firm, as indicated in their report. Historical

results are not necessarily indicative of the results to be expected in future

periods.

|

Year

Ended December 31,

|

Nine

Months Ended

September

30,

|

|||||||||||||||||||||||||||

|

2004

|

2005

|

2006

|

2007 |

2008

|

2009

|

2008

|

||||||||||||||||||||||

|

(in

thousands)

|

(unaudited)

|

|||||||||||||||||||||||||||

|

Revenue

|

$ | 10,473 | $ | 12,156 | $ | 12,042 | $ | 16,051 | 21,378 | $ | 17,057 | $ | 17,841 | |||||||||||||||

|

Cost

of sales

|

5,523 | 7,045 | 9,333 | 10,990 | 13,937 | 11,033 | 11,666 | |||||||||||||||||||||

|

Gross

profit

|

4.950 | 5,111 | 2,709 | 5,061 | 7,441 | 6,024 | 6,175 | |||||||||||||||||||||

|

Depreciation

and amortization

|

179 | 232 | 238 | 249 | 286 | 223 | 198 | |||||||||||||||||||||

|

Selling

and distribution expenses

|

1,144 | 1,312 | 1,363 | 1,954 | 2,712 | 2,723 | 2,265 | |||||||||||||||||||||

|

General

and administrative expenses

|

673 | 796 | 563 | 513 | 759 | 501 | 661 | |||||||||||||||||||||

|

Other

income (expense)

|

72 | (51 | ) | 68 | 24 | 74 | 79 | 31 | ||||||||||||||||||||

|

Interest

income (expense)

|

32 | 47 | 51 | (6 | ) | (275 | ) | (259 | ) | (160 | ) | |||||||||||||||||

|

Loss

on fix assets disposal

|

0 | (23 | ) | (72 | ) | (342 | ) | (159 | ) | 0 | 0 | |||||||||||||||||

|

Income

before income tax

|

3,237 | $ | 2,976 | $ | 830 | 2,269 | 3,610 | 2,620 | 3,120 | |||||||||||||||||||

|

Income

tax expense

|

0 | $ | 482 | $ | 134 | 349 | 597 | 477 | 501 | |||||||||||||||||||

|

Net

income attributable to the Shareholders

of

the Company

|

$ | 2,978 | $ | 2,274 | $ | 633 | 1,762 | 2,732 | 1,964 | 2,404 | ||||||||||||||||||

|

Earnings

per Share — basic (US$) (1)

|

$ | 0.52 | $ | 0.39 | $ | 0.04 | 0.05 | 0.08 | 0.06 | 0.07 | ||||||||||||||||||

|

Earnings

per Share — diluted (US$) (2)

|

$ | 0.52 | $ | 0.32 | $ | 0.02 | 0.05 | 0.08 | 0.06 | 0.07 | ||||||||||||||||||

Note:

|

(1)

|

Actual

figures (not in thousands), and assume there are shares of basic

common stock outstanding after this offering was applied

retrospectively.

|

|

(2)

|

Actual

figures (not in thousands), and assume there are shares of diluted

common stock outstanding after this offering was applied

retrospectively.

|

4

|

As

at December 31,

|

As

at

|

|||||||||||||||||||||||

|

2004

|

2005

|

2006

|

2007

|

2008

|

September 30, 2009 | |||||||||||||||||||

|

(unaudited)

|

||||||||||||||||||||||||

| Balance Sheet Data: |

(in

thousands)

|

|||||||||||||||||||||||

|

Cash

and cash equivalents

|

$ | 16 | $ | 575 | $ | 565 | $ | 367 | $ | 24 | $ | 544 | ||||||||||||

|

Total

current assets

|

16 | 7,850 | 6,695 | 6,109 | 11,806 | 14,296 | ||||||||||||||||||

|

Total

assets

|

16 | 12,104 | 14,029 | 17,399 | 22,348 | 26,780 | ||||||||||||||||||

|

Short-term

borrowings

|

0 | 372 | 897 | 535 | 1,014 | 915 | ||||||||||||||||||

|

Total

current liabilities

|

18 | 1,082 | 1,920 | 2,440 | 2,905 | 5,203 | ||||||||||||||||||

|

Total

stockholders’ equity

|

(2)

|

9,721 | 10,745 | 13,437 | 17,641 | 19,595 | ||||||||||||||||||

RISK

FACTORS

Any

investment in our common stock involves a high degree of

risk. Investors should carefully consider the risks described below

and all of the information contained in this prospectus before deciding whether

to purchase our common stock. Our business, financial condition or

results of operations could be materially adversely affected by these risks if

any of them actually occur. The trading price could decline due to

any of these risks, and an investor may lose all or part of his

investment. Some of these factors have affected our financial

condition and operating results in the past or are currently affecting our

company. This prospectus also contains forward-looking statements

that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in these forward-looking statements as a

result of certain factors, including the risks we face as described below and

elsewhere in this prospectus.

RISKS

RELATED TO OUR BUSINESS

During

The Fourth Quarter of 2008 And The First Quarter Of 2009, Adverse

Market Conditions Caused A Decline In Revenue And Increase In Outstanding

Accounts Receivable That Adversely Affected Our Liquidity.

Our

business was adversely affected by a decline in revenues and an increase in

outstanding accounts receivable, particularly during the fourth quarter of 2008

and the first quarter of 2009. Revenues and the collection of

outstanding receivables improved significantly during the nine months ended

September 30, 2009, with nearly no accounts receivable outstanding over six

months, which improved our liquidity. However, our business may still

be subject to fluctuation, particularly if general economic conditions

deteriorate again. Such a decline would adversely affect our

liquidity and operations.

Hanxin

Must Be Able To Effectively Improve Its Products And If It Is Unable To Improve

Its Products, Its Business May Be Adversely Affected.

Hanxin is

seeking to improve its profitability by producing more finished cork products,

which generally have higher profit margins, as a percentage of its total sale.

Management believes that Hanxin’s cork products enjoy technical advantages over

its competitors in China. If Hanxin is unable to improve and develop its

products, Hanxin may not be able to improve its profit margins or improve its

ability to compete effectively.

Hanxin

Is Dependent On Its Raw Materials. Any Shortages Of The Necessary Materials

Would Have A Materially Adverse Effect On Its Business.

The

supply of cork raw material is the base of production. The shortfall of raw

material will impair the development and production of Hanxin’s products. The

supply of these raw materials can also be adversely affected by any material

change in the climate or other environmental conditions, which may have a

material adverse impact on the costs of raw materials. Our financial

performance may be affected by changes in production costs brought about by

fluctuations in the prices of our raw materials. The prices of our major raw

materials may fluctuate due to changes in supply and demand conditions. Any

shortage in supply or upsurge in demand of our major raw materials may lead to

an increase in prices, which may adversely affect our profitability due to

increased production costs and lower profit margins.

5

Hanxin

Is Dependent On Key Personnel, And The Loss Of Any Key Employees, Officers

And/Or Directors May Have A Materially Adverse Effect On Hanxin’s

Operations.

Hanxin’s

success is substantially dependent on the continued services of its executive

officers, particularly Fangshe Zhang, our Chairman, and Pengcheng Chen, our

Chief Executive Officer and other key personnel who generally have extensive

experience in the cork industry and have been employed by Hanxin for substantial

periods of time. The loss of the services of any key employees, or Hanxin’s

failure to attract and retain other qualified and experienced personnel on

acceptable terms, could have a material adverse effect on its business and

results of operations.

We

Do Not Own All Of The Cork Processing Technology Related Patents We Are Using

And Are Subject To The Terms And Conditions Of A Licensing

Agreement.

We are

dependent on the patents licensed to us from Fangshe Zhang, our Chairman and

principal shareholder. He owns 14 cork processing technology related

patents in China. Hanxin has an exclusive license to three patents in

consideration for annual payments and Hanxin has an exclusive right to use

another 11 patents for free. Hanxin also owns three patents

transferred from Mr. Zhang. As a result, our business activities related to

exploiting these patents are dependent on the license granted to us from him. In

the event that the license is terminated, such a result would have a material

adverse affect on the company as it would prevent us from using them in our

business and deriving revenue associated therewith.

Hanxin’s

Overseas Growth Is Dependent On The Strategic Plan On Expanding Foreign

Markets.

Hanxin

plans to expand the foreign markets, especially the U.S. market, for the next

few years. We have established cooperation relationships with several large

building and decoration material dealers in the U.S. and Taiwan. Should there be

any economic turndown that significantly weakens the sales ability of these

dealers and other foreign wholesalers and retailers, we may not achieve our goal

of revenues and our strategic growth would be significantly and adversely

affected.

Due

To Fluctuations Any Quarter-To-Quarter Comparisons In Our Consolidated Financial

Statements May Not Be Meaningful

Hanxin’s

business is subject to fluctuations, which may cause its operating results to

fluctuate from quarter-to-quarter. This fluctuation may result in volatility or

have an adverse effect on the market price of our common stock.

Changes

In The Extensive Regulations To Which Hanxin Is Subject Could Increase Its Cost

Of Doing Business Or Affect Its Ability To Grow.

The

governments of countries where Hanxin’s exports products, including, but not

limited to India, the United States, Germany and Japan, may, from time to time,

consider regulatory proposals relating to raw materials, market, and

environmental regulation, which, if adopted, could lead to disruptions in supply

and/or increases in operational costs, and hence indirectly affect Hanxin’s

profitability. To the extent that Hanxin increases its product prices as a

result of such changes, its sales volume and revenues may be adversely affected.

Furthermore, these governments may change certain regulations or impose

additional taxes or duties on certain Chinese imports from time to time. Such

regulations, if effected, may have a material adverse impact on Hanxin’s

operations revenue and/or profitability.

Our

Business Activities Are Subject To Certain Laws And Regulations And Our

Operation May Be Affected If We Fail To Have In Force The Requisite Licenses And

Permits.

We are

required to obtain various licenses and permits in order to conduct our business

of production and export of cork products. The business is also subject to

applicable laws and regulations. Any failure to comply with the

conditions stipulated in our licenses and permits may lead to their revocation

or non-renewal. Any failure to observe the applicable laws and regulations may

lead to the termination or suspension of some or all of our business activities

or penalties being imposed on us. The occurrence of any of these events may

adversely affect our business, financial condition and results of

operations.

6

We

Are Dependent On Our Customers’ Ability To Maintain And Expand Their Sales And

Distribution Channels. Should These Distributors Be Unsuccessful In maintaining

And Expanding Their Distribution Channels, Our Results Of Operation Will Be

Adversely Affected.

Demand

for our products from end-consumers and our prospects depend on the retail

growth and penetration rate of our products to end-consumers. Sales of our

products are conducted mainly through distributors, over whom we have limited

control. These distributors sub-distribute our products. We are thus dependent

on the sales and distribution channels of our distributors for broadening the

geographic reach of our products. Should these distributors be unable to

maintain and expand their distribution channels, our results of operations and

financial position will be adversely affected.

Hanxin

May Not Be Entitled To Certain Benefits That It Receives From The Chinese

Government, Which May Have An Adverse Affect On Its Business.

Hanxin

takes advantage of favorable tax rates and other beneficial governmental

policies afforded to it as a result of the nature of its business. In the event

that the program offered to Hanxin is amended or rescinded or Hanxin’s business

no longer meets the eligibility requirements of the program, it may not be able

to enjoy the benefits of these programs and as a result may have to pay higher

income taxes, which may have a material adverse affect on Hanxin.

The

Chinese government might adjust the current industrial policies and tax rates

with the growth of political and economic environment in China, which may

negatively impact Hanxin’s business.

Control

By Principal Shareholders, Officers And Directors.

Messrs.

Fangshe Zhang, our Chairman, and Pengcheng Chen, our Chief Executive Officer own

in the aggregate approximately 37.33 percent (37.33%) of our common stock.

As a result, such persons may have the ability to control us and direct our

affairs and business. Such concentration of ownership may also have the effect

of delaying, deferring or preventing change in control of us. See “Security

Ownership Of Certain Beneficial Owners And Management.” After giving effect to

the offering and the conversion of the Selling Stockholder’s Promissory Notes,

Messrs. Zhang and Chen will own, in the aggregate,

approximately ______% of our common stock.

We

Are Dependent On Certain Major Suppliers For Our Raw Materials. In The Event

That We Are No Longer Able To Secure Raw Materials From These Suppliers And Are

Unable To Find Alternative Sources of Supply At Similar Or More Competitive

Rates, Our Operations And Profitability Will Be Adversely Affected.

For the

production of our products, we rely on our major suppliers for a significant

portion of the supply of raw cork material. Although we purchase supplies from

approximately 24 suppliers, three suppliers accounted for about 40% of our

supply of raw material in 2008. In the event that we are unable to secure our

raw materials from these suppliers and we are unable to find alternative sources

of supply at similar or more competitive rates, our business and operations will

be adversely affected.

Indemnification

Of Officers And Directors.

Our

Articles of Incorporation and applicable Delaware Law provide for the

indemnification of our directors, officers, employees, and agents, under certain

circumstances, against attorney’s fees and other expenses incurred by them in

any litigation to which they become a party arising from their association with

or activities on behalf of us. We will also bear the expenses of such litigation

for any of its directors, officers, employees, or agents, upon such person’s

promise to repay us therefore if it is ultimately determined that any such

person shall not have been entitled to indemnification. This indemnification

policy could result in substantial expenditures by us which it will be unable to

recoup.

Director’s

Liability Limited.

Our

Articles of Incorporation exclude personal liability of our directors to us and

our stockholders for monetary damages for breach of fiduciary duty except in

certain specified circumstances. Accordingly, we will have a much more limited

right of action against our directors than otherwise would be the case. This

provision does not affect the liability of any director under federal or

applicable state securities laws.

No

Foreseeable Dividends.

We have

not paid dividends on its Common Stock and do not anticipate paying such

dividends in the foreseeable future.

7

RISKS

RELATED TO DOING BUSINESS IN CHINA

Substantially

all of our assets are located in the PRC and substantially all of our revenues

are derived from our operations in China, and changes in the political and

economic policies of the PRC government could have a significant impact upon the

business we may be able to conduct in the PRC and accordingly on the results of

our operations and financial condition.

Our

business operations may be adversely affected by the current and future

political environment in the PRC. The Chinese government exerts substantial

influence and control over the manner in which we must conduct our business

activities. Our ability to operate in China may be adversely affected by changes

in Chinese laws and regulations, including those relating to taxation, import

and export tariffs, raw materials, environmental regulations, land use rights,

property and other matters. Under the current government leadership, the

government of the PRC has been pursuing economic reform policies that encourage

private economic activity and greater economic decentralization. There is no

assurance, however, that the government of the PRC will continue to pursue these

policies, or that it will not significantly alter these policies from time to

time without notice.

Our

operations are subject to PRC laws and regulations that are sometimes vague and

uncertain. Any changes in such PRC laws and regulations, or the interpretations

thereof, may have a material and adverse effect on our business.

The PRC’s

legal system is a civil law system based on written statutes. Unlike the common

law system prevalent in the United States, decided legal cases have little value

as precedent in China. There are substantial uncertainties regarding the

interpretation and application of PRC laws and regulations, including but not

limited to, the laws and regulations governing our business, or the enforcement

and performance of our arrangements with customers in the event of the

imposition of statutory liens, death, bankruptcy or criminal proceedings. The

Chinese government has been developing a comprehensive system of commercial

laws, and considerable progress has been made in introducing laws and

regulations dealing with economic matters such as foreign investment, corporate

organization and governance, commerce, taxation and trade. However, because

these laws and regulations are relatively new, and because of the limited volume

of published cases and judicial interpretation and their lack of force as

precedents, interpretation and enforcement of these laws and regulations involve

significant uncertainties. New laws and regulations that affect existing and

proposed future businesses may also be applied retroactively.

Our

principal operating subsidiary, Hanxin, is considered a foreign invested

enterprise under PRC laws, and as a result is required to comply with PRC laws

and regulations, including laws and regulations specifically governing the

activities and conduct of foreign invested enterprises. We cannot predict what

effect the interpretation of existing or new PRC laws or regulations may have on

our businesses. If the relevant authorities find us in violation of PRC laws or

regulations, they would have broad discretion in dealing with such a violation,

including, without limitation:

|

•

|

levying

fines;

|

|

•

|

revoking

our business license, other licenses or authorities;

|

|

•

|

requiring

that we restructure our ownership or operations; and

|

|

•

|

requiring

that we discontinue any portion or all of our

business.

|

Investors

may experience difficulties in effecting service of legal process, enforcing

foreign judgments or bringing original actions in China based upon U.S. laws,

including the federal securities laws or other foreign laws against us or our

management.

Most of

our current operations, including the manufacturing and distribution of our

products, are conducted in China. Moreover, all of our directors and officers

are nationals and residents of China. All or substantially all of the assets of

these persons are located outside the United States and in the PRC. As a result,

it may not be possible to effect service of process within the United States or

elsewhere outside China upon these persons. In addition, uncertainty exists as

to whether the courts of China would recognize or enforce judgments of U.S.

courts obtained against us or such officers and/or directors predicated upon the

civil liability provisions of the securities laws of the United States or any

state thereof, or be competent to hear original actions brought in China against

us or such persons predicated upon the securities laws of the United States or

any state thereof.

8

We

are subject to a variety of environmental laws and regulations related to our

manufacturing operations. Our failure to comply with environmental laws and

regulations may have a material adverse effect on our business and results of

operations.

We cannot

assure you that at all times we will be in compliance with environmental laws

and regulations or that we will not be required to expend significant funds to

comply with, or discharge liabilities arising under, environmental laws,

regulations and permits.

Our

labor costs are likely to increase as a result of changes in Chinese labor

laws.

We expect

to experience an increase in our cost of labor due to recent changes in Chinese

labor laws which are likely to increase costs further and impose restrictions on

our relationship with our employees. In June 2007, the National People’s

Congress of the PRC enacted new labor law legislation called the Labor Contract

Law and more strictly enforced existing labor laws. The new law, which became

effective on January 1, 2008, amended and formalized workers’ rights concerning

overtime hours, pensions, layoffs, employment contracts and the role of trade

unions. As a result of the new law, the Company has had to reduce the number of

hours of overtime its employees can work, substantially increase the salaries of

its employees, provide additional benefits to its employees, and revise certain

other of its labor practices. The increase in labor costs has increased the

Company’s operating costs, which the Company has not always been able to pass

through to its customers. As a result, the Company has incurred certain

operating losses as its cost of manufacturing increased. In addition, under the

new law, employees who either have worked for the Company for 10 years or more

or who have had two consecutive fixed-term contracts must be given an

“open-ended employment contract” that, in effect, constitutes a lifetime,

permanent contract, which is terminable only in the event the employee

materially breaches the Company’s rules and regulations or is in serious

dereliction of his duty. Such non-cancelable employment contracts will

substantially increase its employment related risks and limit the Company’s

ability to downsize its workforce in the event of an economic downturn. No

assurance can be given that the Company will not in the future be subject to

labor strikes or that it will not have to make other payments to resolve future

labor issues caused by the new laws. Furthermore, there can be no assurance that

the labor laws will not change further or that their interpretation and

implementation will vary, which may have a negative effect upon our business and

results of operations.

The

ability of our Chinese operating subsidiaries to pay dividends may be restricted

due to foreign exchange control and other regulations of China.

Under

applicable PRC regulations, foreign-invested enterprises in China may pay

dividends only out of their accumulated profits, if any, determined in

accordance with PRC accounting standards and regulations. In addition, a

foreign-invested enterprise in China is required to set aside at least 10.0% of

its after-tax profit based on PRC accounting standards each year to its general

reserves until the accumulative amount of such reserves reach 50.0% of its

registered capital. These reserves are not distributable as cash dividends. The

board of directors of a foreign-invested enterprise has the discretion to

allocate a portion of its after-tax profits to staff welfare and bonus funds,

which may not be distributed to equity owners except in the event of

liquidation.

Furthermore,

the ability of our Chinese operating subsidiaries to pay dividends may be

restricted due to the foreign exchange control policies and availability of cash

balance of the Chinese operating subsidiaries. Because substantially all of our

operations are conducted in China and a substantial majority of our revenues are

generated in China, a majority of our revenue being earned and currency received

are denominated in Renminbi (RMB). RMB is subject to the exchange control

regulation in China, and, as a result, we may unable to distribute any dividends

outside of China due to PRC exchange control regulations that restrict our

ability to convert RMB into U.S. Dollars.

Our

inability to receive dividends or other payments from our Chinese operating

subsidiary could adversely limit our ability to grow, make investments or

acquisitions that could be beneficial to our business, pay dividends, or

otherwise fund and conduct our business. Hanxin’s funds may not be readily

available to us to satisfy obligations which have been incurred outside the PRC,

which could adversely affect our business and prospects or our ability to meet

our cash obligations. Accordingly, if we do not receive dividends from our

Chinese operating subsidiary, our liquidity, financial condition and ability to

make dividend distributions to our stockholders will be materially and adversely

affected.

9

The

foreign currency exchange rate between U.S. Dollars and Renminbi could adversely

affect our financial condition.

To the

extent that we need to convert U.S. Dollars into Renminbi for our operational

needs, our financial position and the price of our common stock may be adversely

affected should the Renminbi appreciate against the U.S. Dollar at that time.

Conversely, if we decide to convert our Renminbi into U.S. Dollars for the

operational needs or paying dividends on our common stock, the dollar equivalent

of our earnings from our subsidiaries in China would be reduced should the U.S.

Dollar appreciate against the Renminbi.

Until

1994, the Renminbi experienced a gradual but significant devaluation against

most major currencies, including U.S. Dollars, and there was a significant

devaluation of the Renminbi on January 1, 1994 in connection with the

replacement of the dual exchange rate system with a unified managed floating

rate foreign exchange system. Since 1994, the value of the Renminbi relative to

the U.S. Dollar has remained stable and has appreciated slightly against the

U.S. Dollar. Countries, including the United States, have argued that the

Renminbi is artificially undervalued due to China’s current monetary policies

and have pressured China to allow the Renminbi to float freely in world markets.

In July 2005, the PRC government changed its policy of pegging the value of the

Renminbi to the U.S. Dollar. Under the new policy the Renminbi is permitted to

fluctuate within a narrow and managed band against a basket of designated

foreign currencies. While the international reaction to the Renminbi revaluation

has generally been positive, there remains significant international pressure on

the PRC government to adopt an even more flexible currency policy, which could

result in further and more significant appreciation of the Renminbi against the

U.S. Dollar.

According

to our development plan, we will expand the foreign market in the next few

years, which may increase our revenue designated in U.S. Dollar. Thus an

appreciation of U.S. Dollar against RMB may increase our revenue while

depreciation may decrease it.

Inflation

in the PRC could negatively affect our profitability and growth.

While the

PRC economy has experienced rapid growth, such growth has been uneven among

various sectors of the economy and in different geographical areas of the

country. Rapid economic growth can lead to growth in the money supply and rising

inflation. During the past decade, the rate of inflation in China has been as

high as approximately 20% and China has experienced deflation as low as

approximately minus 2%. If prices for our products and services rise at a rate

that is insufficient to compensate for the rise in the costs of supplies such as

raw materials, it may have an adverse effect on our profitability. In order to

control inflation in the past, the PRC government has imposed controls on bank

credits, limits on loans for fixed assets and restrictions on state bank

lending. The implementation of such policies may impede economic growth. In

October 2004, the People’s Bank of China, the PRC’s central bank, raised

interest rates for the first time in nearly a decade and indicated in a

statement that the measure was prompted by inflationary concerns in the Chinese

economy. In April 2006, the People’s Bank of China raised the interest rate

again. Repeated rises in interest rates by the central bank would likely slow

economic activity in China which could, in turn, materially increase our costs

and also reduce demand for our products and services.

Failure

to comply with the United States Foreign Corrupt Practices Act could subject us

to penalties and other adverse consequences.

As our

ultimate holding company is a Delaware corporation, we are subject to the United

States Foreign Corrupt Practices Act, which generally prohibits United States

companies from engaging in bribery or other prohibited payments to foreign

officials for the purpose of obtaining or retaining business. Foreign companies,

including some that may compete with us, are not subject to these prohibitions.

Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices

may occur from time-to-time in the PRC. We can make no assurance, however, that

our employees or other agents will not engage in such conduct for which we might

be held responsible. If our employees or other agents are found to have engaged

in such practices, we could suffer severe penalties and other consequences that

may have a material adverse effect on our business, financial condition and

results of operations.

10

If

we make equity compensation grants to persons who are PRC citizens, they may be

required to register with the State Administration of Foreign Exchange of the

PRC, or SAFE. We may also face regulatory uncertainties that could restrict our

ability to adopt an equity compensation plan for our directors and employees and

other parties under PRC law.

On April

6, 2007, SAFE issued the “Operating Procedures for Administration of Domestic

Individuals Participating in the Employee Stock Ownership Plan or Stock Option

Plan of An Overseas Listed Company, also known as “Circular 78.” It is not clear

whether Circular 78 covers all forms of equity compensation plans or only those

which provide for the granting of stock options. For any plans which are so

covered and are adopted by a non-PRC listed company after April 6, 2007,

Circular 78 requires all participants who are PRC citizens to register with and

obtain approvals from SAFE prior to their participation in the plan. In

addition, Circular 78 also requires PRC citizens to register with SAFE and make

the necessary applications and filings if they participated in an overseas

listed company’s covered equity compensation plan prior to April 6, 2007. We

intend to adopt an equity compensation plan in the future and make substantial

option grants to our officers and directors, most of who are PRC citizens.

Circular 78 may require our officers and directors who receive option grants and

are PRC citizens to register with SAFE. We believe that the registration and

approval requirements contemplated in Circular 78 will be burdensome and time

consuming. If it is determined that any of our equity compensation plans are

subject to Circular 78, failure to comply with such provisions may subject us

and participants of our equity incentive plan who are PRC citizens, including or

Chief Executive Officer, to fines and legal sanctions and prevent us from being

able to grant equity compensation to our PRC employees. In that case, our

ability to compensate our employees and directors through equity compensation

would be hindered and our business operations may be adversely

affected.

A

downturn in the economy of the PRC may slow our growth and

profitability.

The

growth of the Chinese economy has been uneven across geographic regions and

economic sectors. There can be no assurance that growth of the Chinese economy

will be steady or that any downturn will not have a negative effect on our

business, especially if it results in either a decreased use of our products or

in pressure on us to lower our prices.

Our operations in the PRC are subject

to the laws and regulations of the PRC.

As our

products are exported from the PRC, we are subject to and have to operate within

the framework of the PRC legal system. Any changes in the laws or policies of

the PRC or the implementation thereof, for example in areas such as foreign

exchange controls, tariffs, trade barriers, taxes, export license requirements

and environmental protection, may have a material impact on our operations and

financial performance. The corporate affairs of our companies in the

PRC are governed by their articles of association and the corporate and foreign

investment laws and regulations of the PRC. The principles of the PRC laws

relating to matters such as the fiduciary duties of directors and other

corporate governance matters and foreign investment laws in the PRC are

relatively new. Hence, the enforcement of investors or shareholders' rights

under the articles of association of a PRC company and the interpretation of the

relevant laws relating to corporate governance matters remain largely untested

in the PRC.

Our

subsidiaries, operations and significant assets are located outside the U.S.

Shareholders may not be accorded the same rights and protection that would be

accorded under the Securities Act. In addition, it could be difficult to enforce

a U.S. judgment against our Directors and officers.

Our

subsidiaries, operations and assets are located in the PRC. Our subsidiaries are

therefore subject to the relevant laws in the PRC. U.S. law may provide

shareholders with certain rights and protection which may not have corresponding

or similar provisions under the laws of the PRC. As such, investors in our

common stock may or may not be accorded the same level of shareholder rights and

protection that would be accorded under the Securities Act. In addition, all our

current executive directors are non-residents of the U.S. and the assets of

these persons are mainly located outside the U.S. As such, there may be

difficult for our shareholders to effect service of process in the U.S., or to

enforce a judgment obtained in the U.S. against any of these

persons.

11

The

Chinese government exerts substantial influence over the manner in which we must

conduct our business activities.

China

only recently has permitted provincial and local economic autonomy and private

economic activities. The Chinese government has exercised and continues to

exercise substantial control over virtually every sector of the Chinese economy

through regulation and state ownership. Our ability to continue to operate in

China may be affected by changes in its laws and regulations, including those

relating to taxation, import and export tariffs, environmental regulations, land

use rights, property and other matters. We believe that our operations in China

are in material compliance with all applicable legal and regulatory

requirements. However, the central or local governments of the jurisdictions in

which we operate may impose new, stricter regulations or interpretations of

existing regulations that would require additional expenditures and efforts on

our part to ensure our compliance with such regulations or

interpretations.

Accordingly,

government actions in the future including any decision not to continue to

support recent economic reforms and to return to a more centrally planned

economy or regional or local variations in the implementation of economic

policies, could have a significant effect on economic conditions in China or

particular regions thereof, and could require us to divest ourselves of any

interest we then hold in Chinese properties or joint ventures.

RISKS RELATED TO THE MARKET FOR OUR

STOCK

Sales

of our common stock by the selling stockholders in a concurrent offering may

depress our stock price.

Commencing

__ months after our initial public offering, our Selling Stockholders may offer

for sale, from time to time, _______shares of our common stock. If we sell

all ___shares we are offering, we would have _____shares outstanding

(after giving effect to the conversion of the Selling Stockholder Promissory

Notes but without giving effect to the exercise of the Selling Stockholder

warrants), _______of which would be freely tradable in the public . Sales

of a substantial number of shares of our common stock by the Selling

Stockholders within a relatively short period of time could have the effect of

depressing the market price of our common stock and could impair our ability to

raise capital through the sale of additional equity securities.

We

will sell broker-dealer warrants to our underwriter in connection with the

public offering.

We will

sell to _________________, the underwriter for the initial public offering, as

additional compensation, warrants to purchase one Unit for each ten Units sold

in the offering, which is up to a maximum of _____warrants, (the

“Underwriter’s Warrants”). The Underwriter’s Warrants may be exercised at any

time commencing one year from the date of this prospectus and continuing for

five years thereafter to purchase Units at an exercise price equal

to_______% of the offering price of the Units in this offering.

During

the term of the Underwriter’s Warrants, their holders will have the opportunity

to profit from an increase in the price of the shares. The existence of the

Underwriter’s Warrants may adversely affect the market price of the shares if

they become publicly traded and the terms on which we can obtain additional

financing. The holders of the Underwriter’s Warrants can be expected to be

exercising them at a time when we would, in all likelihood, be able to obtain

additional capital on terms more favorable than those contained in the

Underwriter’s Warrants. Please see “Underwriting” and “Description of

Securities” for additional information regarding the Underwriter’s Warrants and

our common stock.

Compliance

with changing regulation of corporate governance and public disclosure will

result in additional expenses.

Changing

laws, regulations and standards relating to corporate governance and public

disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC

regulations, have created uncertainty for public companies and significantly

increased the costs and risks associated with accessing the public markets and

public reporting. Our management team will need to invest significant management

time and financial resources to comply with both existing and evolving standards

for public companies, which will lead to increased general and administrative

expenses and a diversion of management time and attention from revenue

generating activities to compliance activities.

12

If

we fail to maintain effective internal controls over financial reporting, the

price of our common stock may be adversely affected.

We are

required to establish and maintain appropriate internal controls over financial

reporting. Failure to establish those controls, or any failure of those controls

once established, could adversely impact our public disclosures regarding our

business, financial condition or results of operations. Any failure of these

controls could also prevent us from maintaining accurate accounting records and

discovering accounting errors and financial frauds. Rules adopted by the SEC

pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual

assessment of our internal control over financial reporting, and attestation of

this assessment by our independent registered public accountants. The SEC

extended the compliance dates for non-accelerated filers, as defined by the SEC.

Accordingly, the annual assessment of our internal controls requirement first

applied to our annual report for the 2007 fiscal year and the attestation

requirement of management’s assessment by our independent registered public

accountants will first apply to our annual report for the 2010 fiscal year. The

standards that must be met for management to assess the internal control over

financial reporting as effective are new and complex, and require significant

documentation, testing and possible remediation to meet the detailed standards.

We may encounter problems or delays in completing activities necessary to make

an assessment of our internal control over financial reporting. In addition, the

attestation process by our independent registered public accountants is new and

we may encounter problems or delays in completing the implementation of any

requested improvements and receiving an attestation of our assessment by our

independent registered public accountants. If we cannot assess our internal

control over financial reporting as effective, or our independent registered

public accountants are unable to provide an unqualified attestation report on