Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d8k.htm |

Goldman Sachs Fourteenth Annual Agricultural Biotech Forum Larry Stranghoener, Executive Vice President and Chief Financial Officer February 10, 2010 Exhibit 99.1 |

Good morning,

everyone. I’m delighted to have the opportunity to speak with you today about

Mosaic, the outstanding long-term outlook for the crop nutrient industry, and our strong

market position in both Potash and Phosphates. We’d like to thank Bob Koort and Joe Fischer for their support and coverage of the sector. Following a year of challenging economic events and considerable uncertainty, I’m happy to say 2010 is beginning with greater clarity and direction in the markets we serve. We are

seeing encouraging signs of a return to confidence and optimism in the farm sector with farmers prepared to invest in the coming planting season. Mosaic is uniquely positioned as a leading supplier of both potash and phosphate products needed by grain and oilseed producers worldwide. This unique paring of nutrients will benefit our customers and shareholders. |

Slide 2 Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about future financial and

operating results. Such statements are based upon the current beliefs

and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to the predictability and volatility of, and customer expectations about, agriculture,

fertilizer, raw material, energy and transportation markets that are subject

to competitive and other pressures and the effects of the current

economic and financial turmoil; the level of inventories in the distribution

channels for crop nutrients; changes in foreign currency and exchange rates;

international trade risks; changes in government policy; changes in

environmental and other governmental regulation, including greenhouse gas

regulation; difficulties or delays in receiving, or increased costs of,

necessary governmental permits or approvals; the effectiveness of our

processes for managing our strategic priorities; adverse weather conditions

affecting operations in Central Florida or the Gulf Coast of the United States, including potential hurricanes or excess rainfall; actual costs of asset

retirement, environmental remediation, reclamation or other environmental

regulation differing from management’s current estimates; accidents and

other disruptions involving Mosaic’s operations, including brine

inflows at its Esterhazy, Saskatchewan potash mine and other potential mine

fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties reported from time to time in The

Mosaic Company’s reports filed with the Securities and Exchange

Commission. Actual results may differ from those set forth in the

forward-looking statements. |

Before I proceed, I need to remind you that our presentation contains

forward-looking statements. The remarks I make are based on information and understandings we believe to be

accurate as of today’s date, February 10, 2010. Actual results are likely to differ from those set forth in the forward-looking

statements. |

Slide 3 Strategic Focus Deliver value for shareholders Focus on Potash and Phosphate • Grow Potash • Strengthen Phosphate Maintain a strong balance sheet |

At Mosaic, our focus

is on shareholder value creation, driven by the unquestionable long-term demand for our

products. As a global leader in nutrients, Mosaic will benefit from the expanding

worldwide need for food, feed and fuel. At the core of our strategy is a plan to solidify our resource base and invest in the growth of both phosphate and potash. In Potash, we are pursuing brownfield expansions. In Phosphates, we are focusing on growing the value of our business and maintaining our position as one of the lowest cost phosphate producers in the world. Our expansive global distribution network, aligned with our North American production assets, provides us access to the largest global markets, often on a counter seasonal basis. Over time, the combination of two strong product lines has produced great returns for our shareholders. Compared to single nutrient focused companies, our balanced portfolio in phosphates and potash gives us steadier sales volumes and cash flow in periods, like now, where demand for one nutrient may be greater than for another. Both our Phosphates and Potash segments have generated robust results over the past few years that have resulted in our strong balance sheet today. No question, nutrient demand in calendar 2009 was disappointing. But signs suggest recovery is underway, especially in the phosphate market, and we expect shipments and applications to return to more normalized levels. Market activity in just the past couple of months reinforces this viewpoint. Supported by our strong balance sheet, we have the financial flexibility required to expand our global profile in potash and phosphates and are actively pursuing opportunities to do so. We are excited about our future. |

Slide 4 Leading Global Potash Producer Mosaic MOP production • 14% Global • 39% North America • Five mines Competitive industry position World capacity approximates 74 million tonnes (all potash products) Mil tonnes •Potash Fertilizer Capacity Source: Fertecon / Mosaic 0 5 10 15 PotashCorp Mosaic Belaruskali Kali & Salz Silvinit Uralkali |

Let’s first talk about our Potash segment. Mosaic is one of the

world’s top producers of potash with an estimated 14% of global market

share. Potash is produced in only 12 countries in the world, and

agricultural giants such as China, India and Brazil depend on imports. |

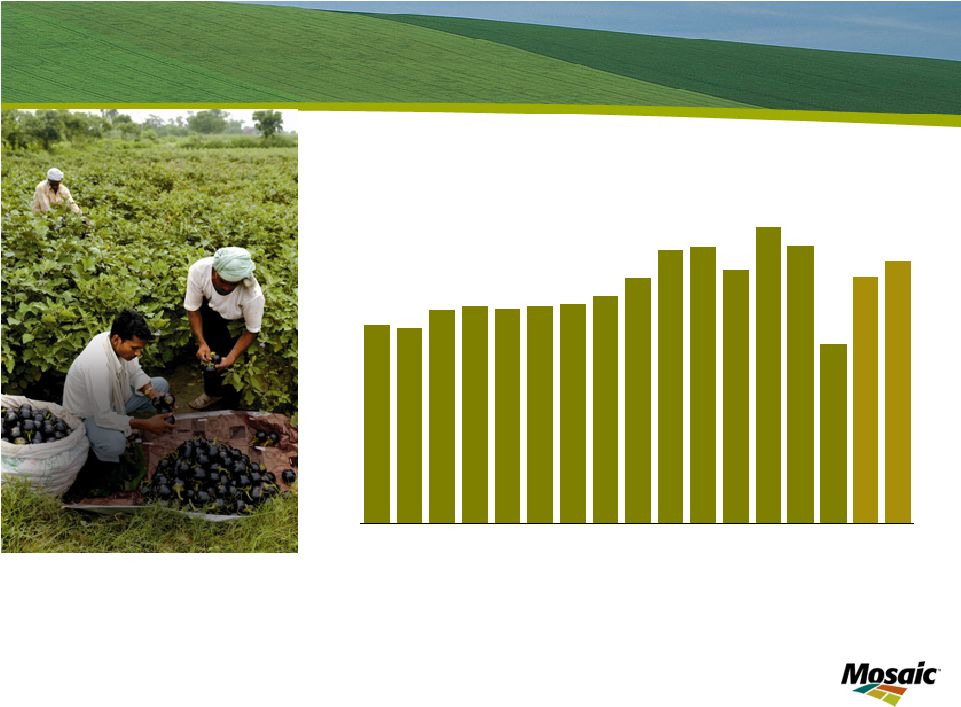

Slide 5 Rebounding Potash Demand World MOP Demand 0 10 20 30 40 50 60 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09F Mil Tonnes Source: Mosaic 10F Low & High Range |

Following the well documented drop in potash demand last year, we believe potash

demand will rebound in calendar 2010. The nutritional value of potash is

critical to optimize crop yields and increase food production and we believe the nutrient has been under-applied historically. We project the potash market to come into balance during the first half of calendar

2010 as the recent decline in potash prices unleashes large pent-up

demand from all corners of the globe. We are starting to see this

with recent pickup in sales activity in anticipation of the North

American spring planting season. We forecast that global MOP shipments will increase to 47 to 50 million tonnes in calendar 2010 compared to about 32 million tonnes in calendar 2009. As a result, North American producer stocks are projected to continue to trend downward and inventories

likely will drop to average or even below average levels by

mid-year. Longer term, we expect potash demand to grow between 3%

and 3.5% annually. |

Slide 6 Growth Opportunities - Our Potash Expansions Existing Capacity Tolling Agreement 0 2 4 6 8 10 12 14 16 18 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Estimated Mosaic Potash Capacity Belle Plaine expansions Esterhazy expansions Colonsay expansions Note: The projected annual capacity includes approximately 1.3 million tonnes that we currently

produce under a third party tolling agreement at our Esterhazy, Saskatchewan potash mine that

will revert to us when the tolling agreement expires. |

Mosaic has the

capacity to meet the increasing demands from the agricultural market. We currently own

enough mineral reserves to run our mines for over 100 years. In addition, our ongoing

expansions are expected to increase annual capacity by over five million tonnes by 2020, ensuring that we will maintain our position as one of the premier potash companies in the world. We are mindful of the threat of new entrants into this industry. Time will tell whether these threats become reality. As a well established, large player in this industry, we believe we are well positioned to bring on the new brownfield expansions more economically than greenfield capacity. Notwithstanding the weak potash market of the past year or so, we are proceeding with our expansion program, as we are confident in the long term supply/demand outlook. Our expansion program consists of nearly a dozen discrete, multi-year projects at our three Canadian mine sites, and we will adjust the pace of these projects in response to supply/demand dynamics. In addition, we produce 1.3 million tonnes annually for a competitor under a tolling agreement, which we expect to revert to Mosaic in the near future. When these tonnes revert to Mosaic, we will add 1.3 million tonnes of additional capacity at no additional cost. |

Slide 7 Expansions Improve Mosaic’s Cost Structure *Excludes Canadian resource taxes and royalties for all Canadian potash producers Source: Mosaic Industry Cost Curve - MOP 2009 Q2 * Delivered US Cornbelt First Quintile Weighted Average Second Quintile Weighted Average Third Quintile Weighted Average Fourth Quintile Weighted Average Fifth Quintile Weighted Average 0 10 20 30 40 50 60 Million Tonnes US$ Tonne Mosaic |

The global potash industry has a relatively flat cost curve. This chart shows

estimated cost per tonne for all major potash producers. Mosaic’s potash cost structure is

competitive and should improve as our expansions come on line. The expected

increase in sales and production volumes will leverage the existing assets

at our three Canadian mines – thereby driving lower cost per tonne. Our industry leadership, together with our investments to expand capacity, places us in a strong competitive position to leverage the anticipated growth of this market.

|

Slide 8 World’s Largest Integrated Phosphate Producer World’s largest capacity of finished phosphate fertilizer Mosaic phosphate production share 14% Globally 59% U.S. World scale & efficient operations World capacity approximates 76 million tonnes (DAP/MAP/TSP) •Phosphate Fertilizer Capacity Mil tonnes Source: Fertecon / Mosaic |

Now, let’s turn to our Phosphate segment. As a large, vertically integrated

producer, our Phosphate business possesses its own attractive set of

attributes. We have substantial company-owned rock reserves,

granulation capacity, and a worldwide supply chain and distribution

network. We have the largest global capacity of finished phosphate fertilizer in the world. Mosaic’s rock reserves provide a significant competitive advantage over

non-integrated producers, where rock input costs are significantly

higher than those of Mosaic. A strategic priority for our phosphates

business is to secure additional rock sources outside of North America, to

maintain this advantage. |

Slide 9 Phosphate Demand Recovery World Processed Phosphate Demand 0 10 20 30 40 50 60 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09F Mil Tonnes Source: Mosaic DAP, MAP and TSP 10F Low & High Range |

Demand and price

momentum in phosphates had been strong until demand came to an abrupt halt last year.

Raw material costs reset, lowering selling prices and causing buyers to back away from the

market. This is a story most of you know well. Now, the phosphates market is recovering nicely. This began during our fiscal second quarter, especially in Asia and the Americas, as distributors purchased crop nutrients to meet farmer demand. We continue to see good product movement for both application and distributor inventory. Producer stocks are likely to remain at low levels at least through May. Prices seem to have bottomed a few months ago, and continue on an upward trend. As of last Friday, prevailing market DAP selling prices approximate $470 per tonne FOB Tampa. This compares with $380 in early January. |

Slide 10 Industry Leading Cost Structure in Phosphate Industry Cost Curve - DAP fob Plant/Port 2009 Q2 First Quintile Weighted Average Second Quintile Weighted Average Third Quintile Weighted Average Fourth Quintile Weighted Average Fifth Quintile Weighted Average 0 5 10 15 20 25 30 Million Tonnes US$ Tonne Mosaic Average Source: Mosaic |

Unlike the potash industry, the phosphate industry cost curve is steeper – and you can see that Mosaic is one of the world’s low cost producers. We are working on

a number of operational fronts to maintain that position, as I will discuss

further. |

Slide 11 Phosphates Opportunities Operational Cost Savings Maintenance Contract services Process chemicals Energy – heat recovery and conversion Phosphate Rock and Other Strategic Opportunities |

We are increasing

investments to further enhance efficiencies across our phosphates business, and in turn, lower

costs. Already recognized as among the best operators in the business, we are

reengineering our phosphates business across the enterprise, targeting maintenance, contract

services, process chemicals and other areas for cost savings. We are also increasing

investments in waste heat recovery systems in order to minimize our net purchases of

electricity by 2015. We have specific, per tonne cost reduction targets for all of these initiatives, intended to maintain our low cost position. Over time, we look to generate better returns in an already attractive business. Finally, I have already noted our interest in accessing additional rock reserves. Phosphates is a fragmented industry and there may be niche acquisition opportunities which will allow us to enhance our asset base. |

Slide 12 Distribution Assets Aligned with Global Demand |

Mosaic also has a distribution network without peer in our industry – allowing us to move our products where and when needed, efficiently and cost-effectively.

Our industry leading North American distribution capabilities are bolstered by

strong networks in prime growth regions such as Asia and Latin America

where we combine production assets, blending and bagging facilities, ports

and other capabilities. This global network is especially valuable in balancing seasonal demand patterns. It allows us to run our North American production plants more efficiently as we can ship

products to key regions around the world as needed. We are also taking steps to further align our global distribution network with our

North American production assets. Last quarter, we realigned our

business segment reporting to more clearly reflect this strategic

change. Our strategic priorities in Phosphates focus on growing the value of

our business and maintaining our position as one of the lowest cost

phosphate producers in the world |

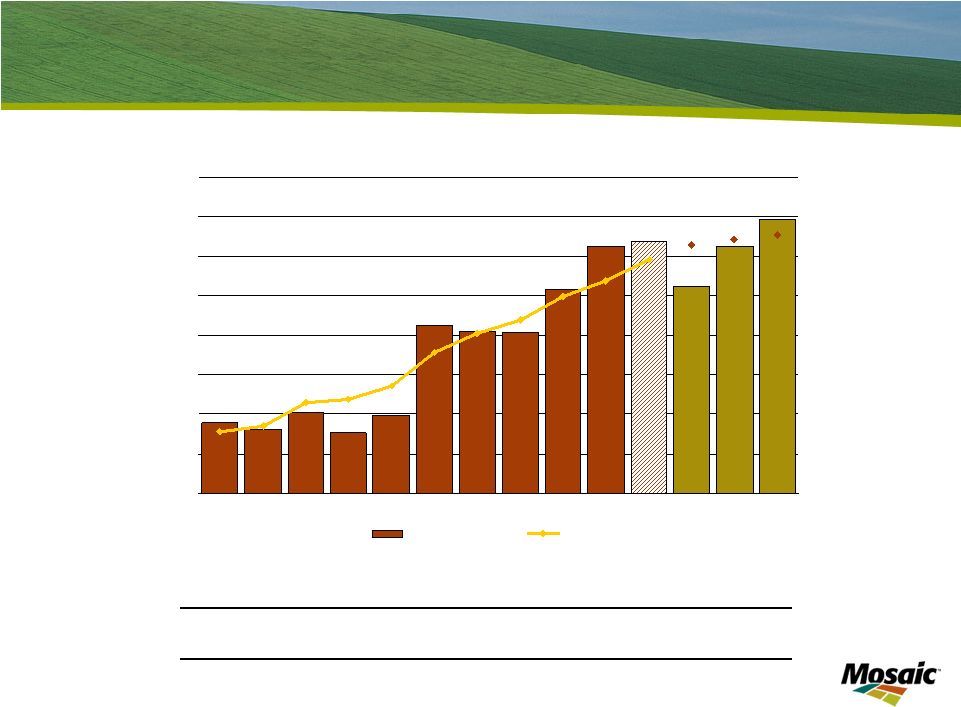

Strong Financial Position Cash and Cash Equivalent Less Debt ¹ 1 Cash and Cash Equivalent Less Debt Reconciliation: See Appendix

|

As

we have discussed, our overall strategy is to capitalize on attractive long-term agriculture fundamentals by investing in and reengineering our potash and phosphate

businesses. Through the ups and downs of the markets we serve, we have created long term value

through sound capital allocation decisions. Our strong cash flow has

allowed us to remain financially strong during the recent economic

downturn. We have demonstrated our willingness and ability to make

investments, to divest non-strategic assets and to return cash to

shareholders, as appropriate. |

3rd Qtr FY 2010

FY 2010 Phosphate Sales Volume 2.2 - 2.6 million tonnes DAP Selling Price $310 - $350 per tonne Potash Sales Volume 1.7 - 2.0 million tonnes MOP Selling Price $340 - $360 per tonne Capital Spending $1.0 billion - $1.2 billion SG&A $350 - $370 million Effective Tax Rate High 20% range Financial Guidance Slide 14 |

Now I will share some

financial guidance for fiscal 2010. We are reconfirming third quarter guidance we previously

shared for Phosphates. We expect to be at the high end of the volume range and within

the price range. As we have shared before, even though we expect the third quarter

average selling price to be higher, this will be largely offset by higher raw material

costs. We expect only a modest improvement in gross margin from our second quarter result. For our fourth quarter, we expect greater gross margin improvement. Potash activity has picked up since our last earnings call and we have confidence to share guidance again. For the third quarter, we estimate Potash sales volumes of 1.7 to 2 million metric tonnes and average MOP selling price of $340 to $360 per tonne. We are reconfirming the guidance we previously shared on capital spending, SG&A, and the effective tax rate as noted in the chart. |

Business Outlook |

Now I will give a few thoughts on the outlook for the agricultural markets.

|

Slide 16 Growing Global Affluence + Fuel World Arable Land per Person 200 210 220 230 240 250 260 270 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 Hectares per 1,000 People Source: FAO and IHS Global Insight GDP Growth Three Largest Asian Countries by Population 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 00 01 02 03 04 05 06 07 08 09F 10F 11F 12F Source: IHS Global Insight China India Indonesia |

Long term agricultural fundamentals continue to look positive. We believe several

macro trends will continue to place increasing pressure on the global food

supply. Increasing population is stretching the world’s arable

land. On a per capita basis, arable land has been steadily

declining. In addition, continued economic development means a greater

demand for higher calorie, higher protein diets. The combination of

less arable land per capita and increasing demands for better quality food

means continual pressure on the agricultural sector. Biofuels are another factor placing significant stress on the food supply. In the US, the

ethanol mandate increases from 10.5 billion gallons in 2009 to 12 billion

gallons in 2010. Recent developments in policy indicate a bias for

continued support for corn based ethanol. To meet food and fuel demands, grain production will need to increase substantially in

the future. Improved farming practices, including proper application

of crop nutrients, is vital to grow the world the food it needs.

|

Slide 17 Growing Grain & Oilseed Use World Grain and Oilseed Production and Use 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 99/00 00/01 01/02 02/03 03/04 04/05 05/06 06/07 07/08 08/09 09/10 10/11 L 10/11 M 10/11 H Bil Tonnes Production Use Source: USDA and Mosaic 2010/11 Scenario Assumptions Low Medium High Harvested Area Change -0.5% -0.5% -0.5% Yield Deviation from 11-Year Trend Largest Negative 0 Largest Positve Demand Growth 1.5% 2.0% 2.5% |

Here we show the increase in grain and oilseed production and use over the past

decade. As you can see, use has grown slowly, but consistently. History has proven that economic slowdowns don’t have a large negative impact on food consumption – people still need to eat. On the production side, we have seen significant increases over the past two

years. This growth has come from increased harvested land and above

trend yields. As you can see, we need to continue this above trend

growth just to stay even with projected use. |

Slide 18 More Cushion but Stocks Still Not at Secure Levels World Grain and Oilseed Stocks 250 300 350 400 450 500 550 600 650 99/00 00/01 01/02 02/03 03/04 04/05 05/06 06/07 07/08 08/09 09/10 10/11 L 10/11 M 10/11 H Mil Tonnes 40 50 60 70 80 90 100 110 120 Days of Use Stocks Days of Use Source: USDA and Mosaic 2010/11 Scenario Assumptions Low Medium High Harvested Area Change -0.5% -0.5% -0.5% Yield Deviation from 11-Year Trend Largest Negative 0 Largest Positve Demand Growth 1.5% 2.0% 2.5% |

Back-to-back

bumper crops have built global grain and oilseed stocks and calmed agricultural

markets. Supply has responded to higher prices and good weather. Our base forecast assumes a trend yield and a slight decrease in harvested area. We expect the stock to use ratio to remain at a relatively low level. We believe global stocks still are not at a secure level that could withstand weather or other shocks over a period of time. Note that most of the increase in stocks in the past year has come from wheat. Stocks in many other commodities remain at low levels. Therefore, we will likely continue to see spikes in some commodity prices. Farmers cannot afford to take their foot off the food production accelerator. |

Slide 19 Farm Economics ISU application rate recommendations 2009 and 2010 crops sold at CBOT closing prices on January 27, 2010 less basis Fertilizer prices for 2003 - 2009 are from USDA. 2010 fertilizer prices are based on current spot wholesale prices Crop Nutrient Costs on Corn in Iowa Bushels of Corn Per Acre 0 5 10 15 20 25 30 35 40 45 2003 2004 2005 2006 2007 2008 2009 2010 Sources: Iowa State University, USDA and Mosaic Bu Corn Return After Variable Cost for a U.S. Midwest High Yield Farm Operation $0 $100 $200 $300 $400 $500 $600 $700 2005 2006 2007 2008 2009F 2010F Source: Iowa State University and Mosaic $ Acre Soybeans Corn Following Soybeans Corn Following Corn Key assumptions |

Farmer economics remain relatively strong despite the recent downward trend in grain

markets. The graph at the left shows farmer profitability. Grain prices remain at

relatively high levels as compared to historical prices. At the same

time, input prices have reset. This has allowed farmers to maintain

profitability. The graph on the right shows the number of bushels of corn

that a farmer would have to sell in order to pay for crop nutrients.

This indicates that the cost of crop nutrients has declined to the low end

of the recent historical range. |

Slide 20 Growth Expected to Resume World Nutrient Use 110 120 130 140 150 160 170 180 190 95 96 97 98 99 00 01 02 03 04 05 06 07 08E 09F 10F Source: IFA November 2009 Mil Tonnes 2007/08 2008/09E 2009/10F 2010/11F Nitrogen 3.2% -1.5% 1.6% 2.6% Phosphate 0.1% -10.5% 3.0% 6.2% Potash 6.8% -19.8% -4.5% 13.5% Total 3.1% -6.7% 1.0% 4.9% Changes in World Fertilizer Consumption |

Despite the drop in

nutrient use in 2008 and 2009, we expect use to rebound significantly. Over the next

several years, the International Fertilizer Industry Association projects crop nutrient use to

increase 12% over the peak 2007 period. Agronomic science points to the need for the replenishment of nutrients in the soil, a fact well-understood by farmers as they plan for this year’s crop. Given favorable demand trends, lower input costs and growing confidence across the supply chain – it is not surprising that we are seeing signs of recovery. |

Slide 21 Key Takeaways Focus on value creation Global leader with vertically integrated operations Potash growth projects at attractive capital costs Phosphate growth options in rock reserves and acquisitions Encouraging recent market trends |

In

closing, I would like to emphasize four key points about Mosaic. First, we have managed well through a challenging year while keeping a focus on

creating long term value. Second, we are an established industry leader with vertically integrated operations, a

strong balance sheet and a broad international presence. Our global

scale is unmatched due to our strength in both potash and phosphates.

Next, we are making significant investments to grow our capacity in Potash at competitive costs. In addition, we are strengthening our Phosphates business by improving efficiencies at

our plants and mines and exploring opportunities to expand rock reserves

outside North America. Finally, signs suggest a recovery in demand for

nutrients is underway. We expect shipments and applications to return to more normalized levels in calendar 2010. We remain confident in Mosaic’s long-term outlook. Agricultural

fundamentals remain positive because of continued global demand for food

and fuel. We are seeing encouraging signs of a return to confidence

and optimism in the farm sector with farmers prepared to invest in the coming planting season. Mosaic is uniquely positioned as a leading supplier of

both potash and phosphate products needed by agricultural producers worldwide. |

Thank you! |

I

appreciate you listening to Mosaic’s story and our outlook for the future. Now I’d be happy to take questions. |

Slide 23 $ in billions Period Ended Cash and Cash Equivalents Short-Term Debt Current Maturities Long-Term Debt Total Debt Net (Debt) Cash 8/31/2007 $ 0.6 $ 0.2 $ 0.5 $ 1.6 $ 2.2 $ (1.6) 11/30/2007 $ 0.6 $ 0.1 $ 0.2 $ 1.4 $ 1.7 $ (1.0) 2/29/2008 $ 1.1 $ 0.2 $ 0.0 $ 1.4 $ 1.7 $ (0.5) 5/31/2008 $ 2.0 $ 0.1 $ 0.0 $ 1.4 $ 1.6 $ 0.4 8/31/2008 $ 2.2 $ 0.1 $ 0.1 $ 1.3 $ 1.5 $ 0.7 11/30/2008 $ 2.8 $ 0.1 $ 0.0 $ 1.3 $ 1.4 $ 1.4 2/28/2009 $ 2.5 $ 0.1 $ 0.0 $ 1.3 $ 1.4 $ 1.1 5/31/2009 $ 2.7 $ 0.1 $ 0.0 $ 1.3 $ 1.4 $ 1.3 8/31/2009 $ 2.6 $ 0.1 $ 0.0 $ 1.3 $ 1.4 $ 1.2 11/30/2009 $ 2.6 $ 0.1 $ 0.0 $ 1.3 $ 1.4 $ 1.2 Source: Cash and cash equivalents from 10Q/10K as filed. Total debt includes Short

term debt, Current maturities of long-term debt, Long-term debt less

current maturities, Long-term debt due to Cargill Inc and affiliates. Appendix: Cash and Cash Equivalent Less Debt Reconciliation |