Attached files

| file | filename |

|---|---|

| 8-K - United Financial Bancorp, Inc. | form8k-105267_ubnk.htm |

Holding Company for

NASDAQ: UBNK

Forward Looking Statements

Certain comments made in the course of this presentation by UBNK are forward-looking in nature. These include all statements about UBNK’s operating results or financial position for periods ending or

on dates occurring

after December 31, 2009 and usually use words such as “expect”, “anticipate”, “believe”, and similar expressions. These comments represent management’s current beliefs, based upon information

available to it at the time

the statements are made with regard to the matters addressed.

All forward looking statements are subject to risks and uncertainties that could cause UBNK’s actual results or financial condition to differ

materially from those expressed in or implied by such statements. Factors of particular

importance to UBNK include, but are not limited to: (1) changes in general economic conditions, including interest rates; (2) competition among providers

of financial services; (3) changes in the interest rate environment that

reduce our margins or reduce the fair value of financial instruments; (4) adverse changes in the securities markets; and (5) our ability to enter new markets successfully and capitalize

on growth opportunities. UBNK does not

undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Why invest in United Financial Bancorp, Inc.?

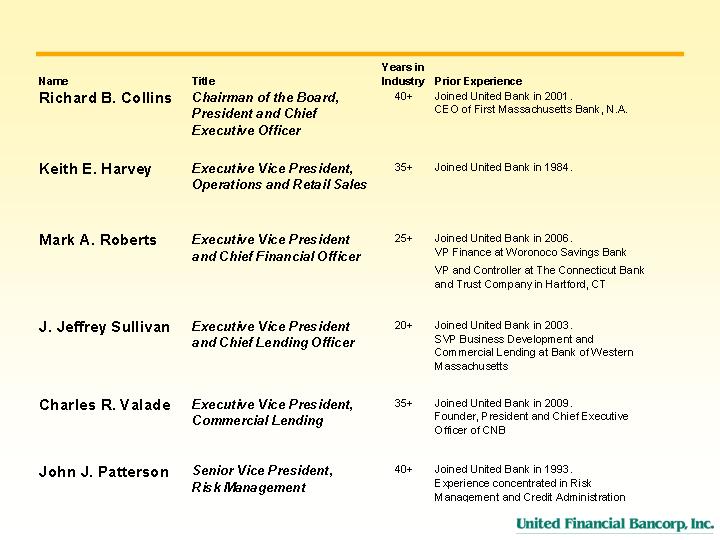

Experienced Management Team focused on creating shareholder value

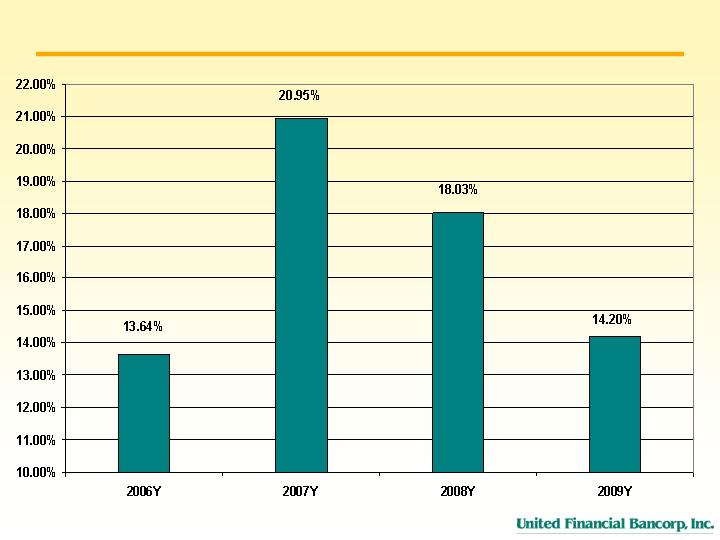

Well capitalized (14% Tangible Equity/ Tangible Assets)

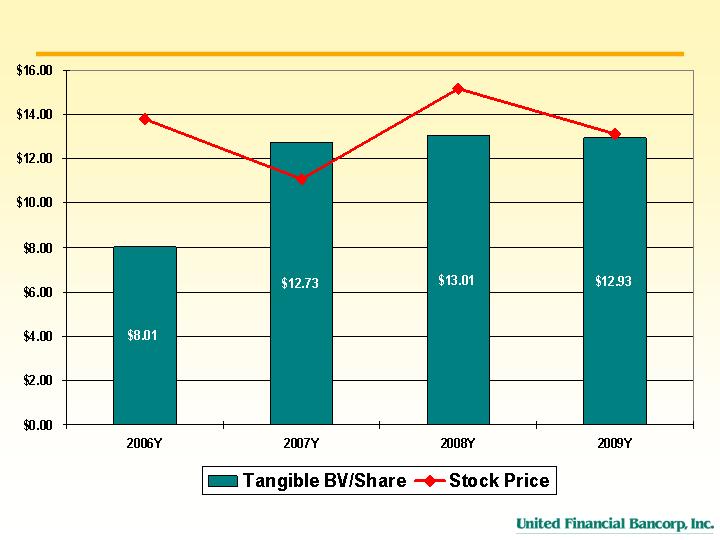

Effective Capital Management Strategy with successful stock repurchase program and competitive dividend yield

Continuous growth through an expanding franchise

Organic growth

De Novo branching

Acquisition

Balanced Loan & Deposit Mix and Growth

Strong market position in both loans & deposits

More bank-like mix in loans

54% of deposits in core

Excellent asset quality

63% of NPLs driven by 5 loans with workout strategies

95% of Investment portfolio is agency backed

Deploying our Strong Capital Position

CAPITAL

Consistent Brand and Product Marketing:

Continue emphasis on core deposit growth

Leverage Customer Relationship Management

Franchise Expansion:

Organic growth

De Novo branching

Strategic acquisitions

Commercial Lending Focus:

Added 4 experienced Springfield Commercial

Lenders

Added 6 experienced Worcester Commercial

Lenders

Maintain focus on experience/ conservative

underwriting and credit administration

Expand/diversify sources of non-interest income:

$121.6mm AUM at United Wealth Management Group

Consistent growth in consumer/commercial checking accounts

Effective Capital Management Strategy:

Competitive dividend yield

Successful common stock repurchase program:

Completed: three buy back programs repurchasing

1,726,517 at average price of $13.44.

In progress: 5% program commenced on 12/1/09 to

repurchase 798,055 shares of which 215,368 have been

purchased to date at an avg price of $12.89.

To date: 2,018,173 shares at an average price of $13.34.

9

0

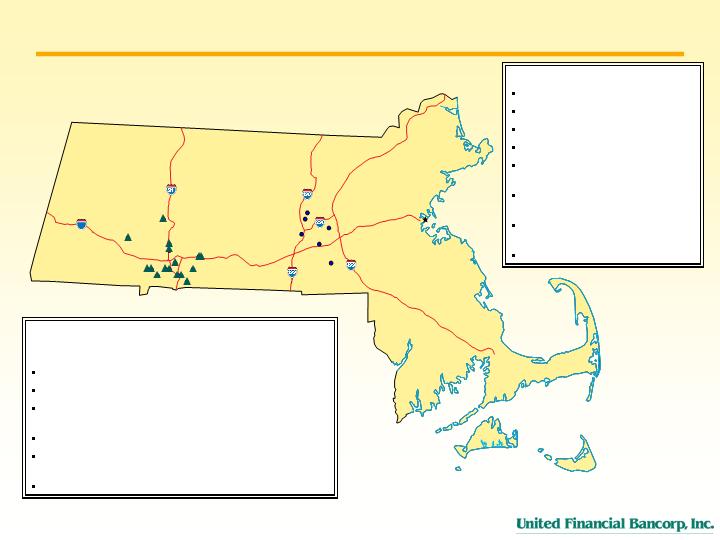

Worcester

Springfield

Boston

United Bank- founded in 1881

$1.3 billion in assets

16 Full-Service Branches

Two Express (Drive-Up) Branches

19 ATM locations

Located at the crossroads of New

England

Intersection of Interstate 91 and Mass

Turnpike

90 minutes from Albany, NY and

Boston, MA

30 minutes North of Hartford, CT

Commonwealth National Bank

Acquisition completed 11/30/09

$300 million in assets

6 Branches

Headquartered in Worcester, MA – 2nd largest population in

New

England

7 ATM locations

Market is adjacent to I-495 Technology Corridor & 30 minutes

to Boston’s Metro/West area

One hour to corporate headquarters in West Springfield

Expanding Franchise

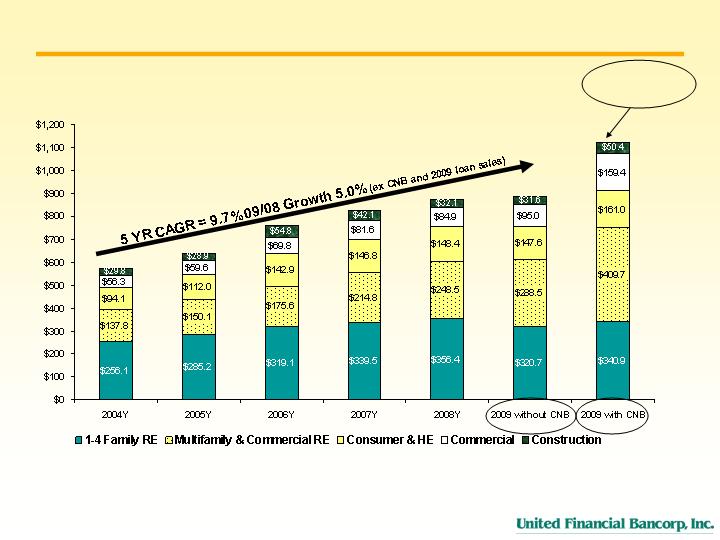

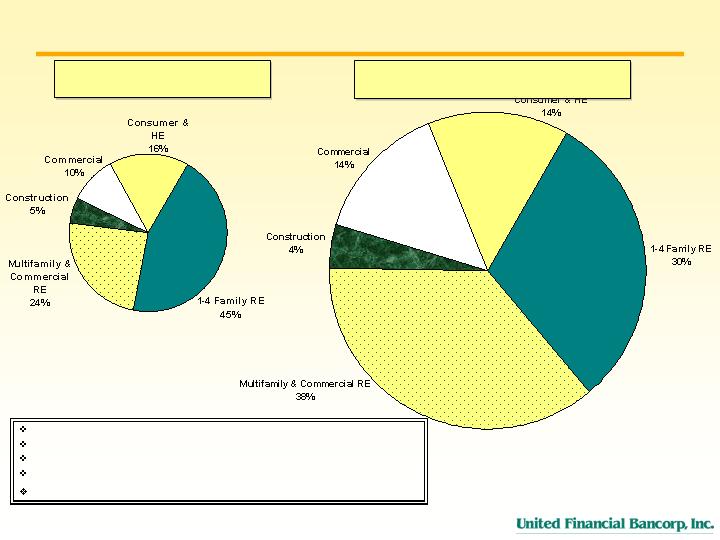

Shift toward Bank-Like Mix for Loans

Mortgage Market Share – Hampden County #1 in 2009, up from #5 in 2008.

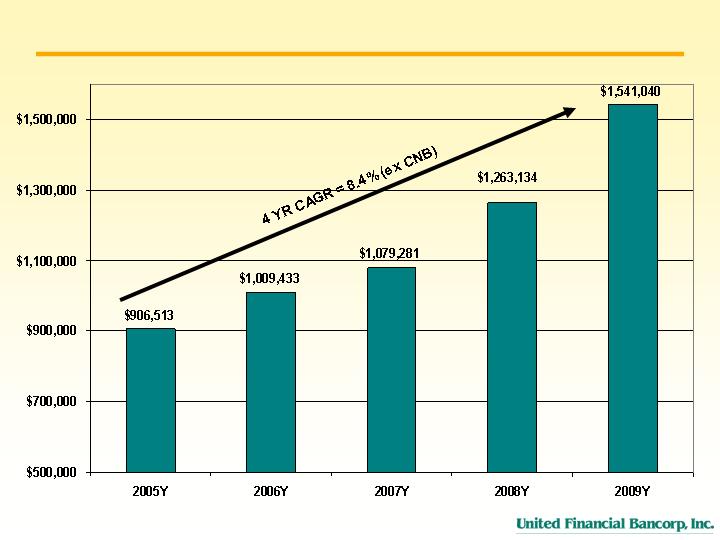

5 yr CAGR 9.7%: 09/08 growth is 5.0% (ex CNB & 2009 loan sales).

Includes $243 million in CNB gross acquired loans as of 11/30/09.

Continued conservative Underwriting Standards.

Higher percentage of CRE loans with high degree of diversification.

Loan Mix as of December 31, 2009

(in millions)

$341.8

$159.4

$50.4

$409.7

Total Loans $1,122.2

Yield 5.51%

$256.1

$94.1

$56.3

$137.8

$29.8

Loan Mix as of December 31, 2004

(in millions)

Total Loans $574.1

Yield 5.51%

$29.8

$161.0

$50.4

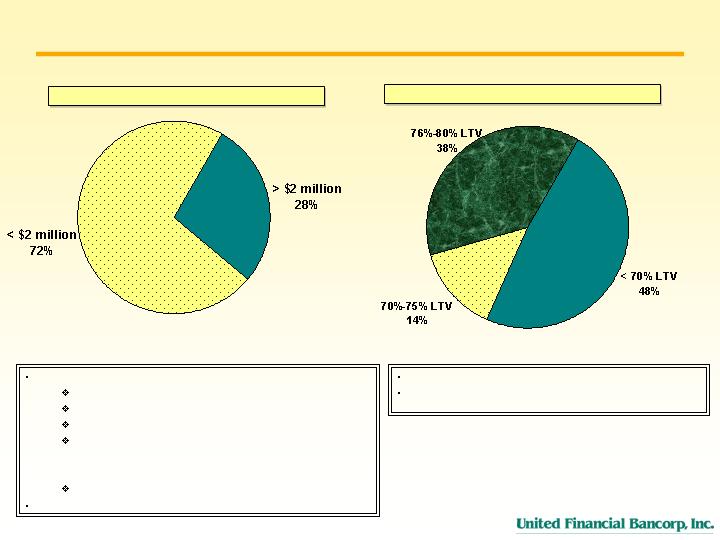

Commercial Loan Portfolio

$256.1

$233.1

No out of market loans above 70% LTV

LTV ratios estimated based on current appraised values

$29.8

Commercial Loans (in millions)

Total Commercial, CRE &

Construction Loans - $619 million

$29.8

$448

$171

$60

$77

$22

CRE’s over $2 million (in millions)

Total CRE loans > $2 million - $159 million

$171 million = 47 loans > $2 million:

$159 million CRE

$7 million C&I

$5 million Construction

Loan grade: $84 million - Strong or Good

$65 million - Acceptable

$22 million - Special Mention or Classified

$448 million = 940 loans < $2 million

Average size $294k; Median size $195k

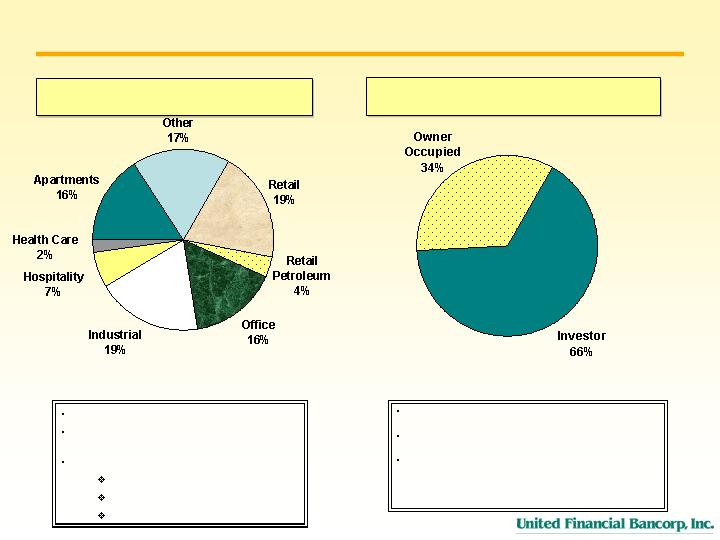

CRE Property Types & Owner Occupied %

$256.1

$29.8

CRE Mix as of December 31, 2009

(in millions)

Total CRE Loans $409.7

$233.1

Average Loan size $207,000

Two largest CRE loans are $14.1 million office

building and $10 million supermarket

Retail includes:

$27 million neighborhood retail

$19 million credit rated pharmacies

$10 million anchored supermarket

$256.1

$29.8

Owner Occupied % as of December 31, 2009

(in millions)

80% of non-owner occupied loans originated in primary market

area

65% of non-owner occupied portfolio originated by Springfield; 35%

originated

by Worcester

5 largest developer relationships are between $14-$16 million

$139.7

$270.0

Total CRE Loans $409.7

$81.2

$71.4

$65.5

$27.0

$77.6

$64.0

$14.7

$8.3

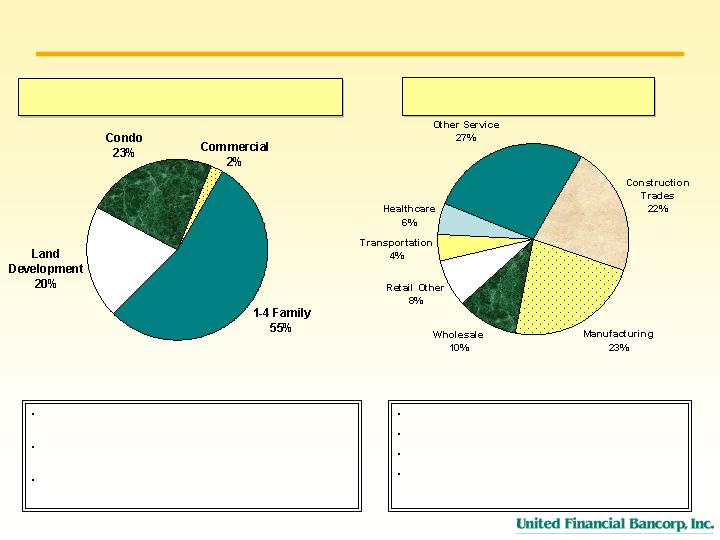

Reduced Construction and Diversified C&I Mix

$256.1

$29.8

$233.1

Portfolio is half of the balance at real estate construction

peak in 2006 ($94 million at 12/31/06 –including CNB)

Condo loans centered in 5 projects with strong local

sponsors

1-4 family loans are highly diversified across 61 projects

with average size under $500,000

$256.1

$29.8

C&I Mix as of December 31, 2009

(in millions)

Diversified

Average Loan size under $100k

Largest C&I Loan is $4.4 million

Regional Mix: $97 million Springfield and $64 million

Worcester

Commercial Construction Mix as of December 31, 2009

(in millions)

Total Commercial Construction Loans $48.8

4% of Overall Loan Portfolio

Total C&I Loans $159.4

$9.9

$11.4

$26.4

$35.0

$36.5

$16.3

$12.6

$7.0

$8.8

$43.2

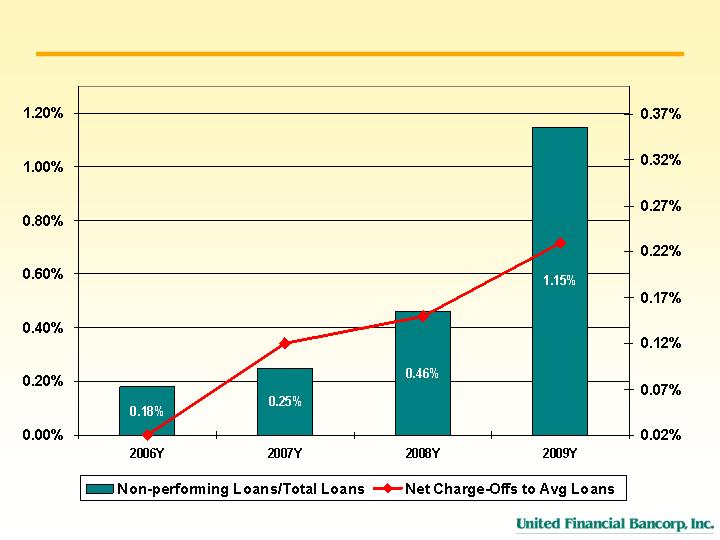

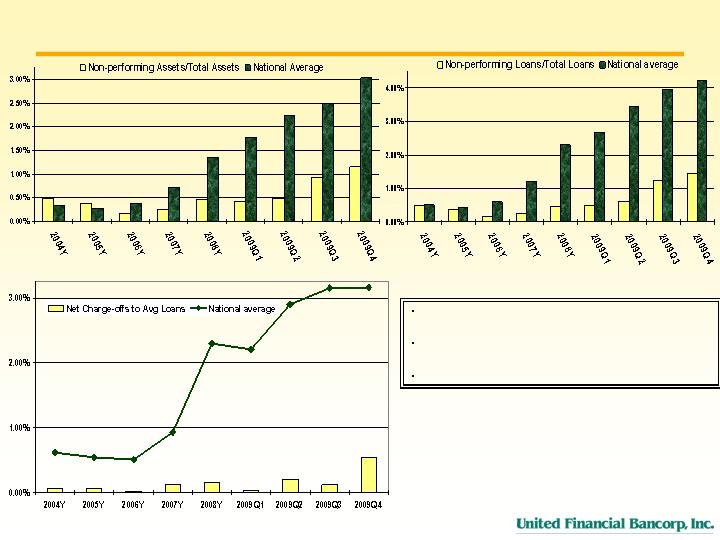

Excellent Asset Quality

5 commercial credits drive charge-offs and 63% of NPL’s. All with specific

workout strategies.

Reserves to Total Loans at 1.07%, excluding purchased loans (CNB $243

million and other purchased loans of $22.7 million).

Conservative investment portfolio – 95% gov’t owned or sponsored.

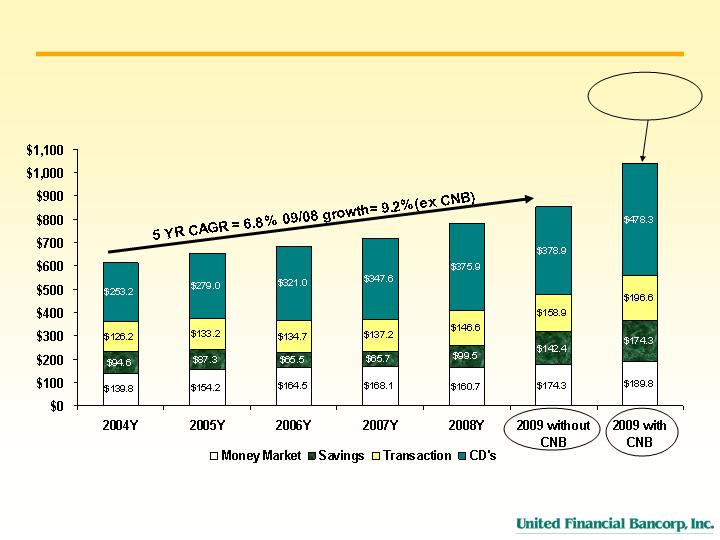

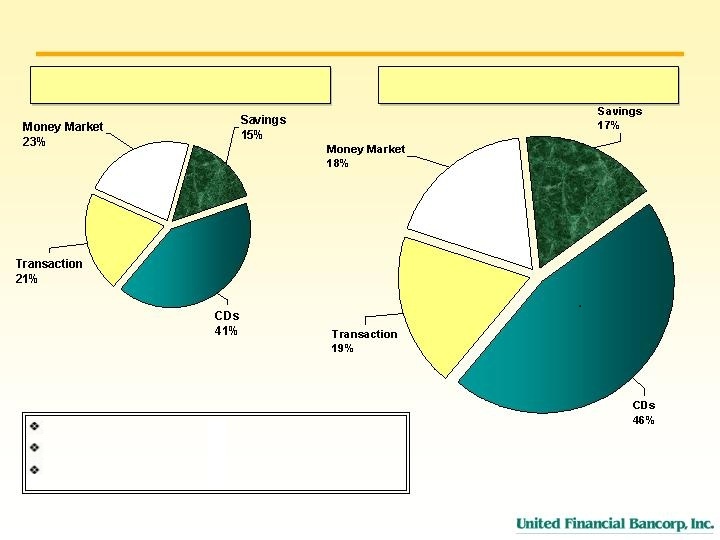

Includes $195 million in CNB acquired deposits as of 11/30/09.

Excluding CNB: 5 Yr Deposit CAGR: 6.8%, ‘09/’08 growth 9.2%

Core deposits >50% of total; 5 Yr Core Deposit CAGR 5.7%

Deposit Mix as of December 31, 2004

(in millions)

Deposit Mix and Growth

Total Deposits $613.7

QTD Cost of Deposits 1.54%

Total Deposits $1,038.9

QTD Cost of Deposits 1.47%

$196.6

$189.8

$478.3

$174.3

Deposit Mix as of December 31, 2009

(in millions)

$94.6

$139.8

$126.1

$253.2

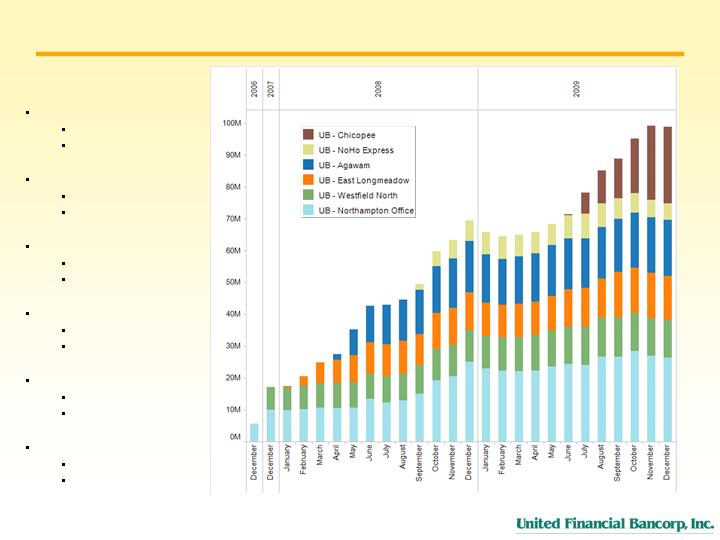

$98.8 Million in Deposits at De Novo Branches

As of 12/31/09:

Northampton

Opened 06/05/06

$26,292,402

Westfield North

Opened 12/29/06

$11,960,610

East Longmeadow

Opened 01/28/08

$13,798,445

Agawam

Opened 04/21/08

$17,612,607

Northampton Express

Opened 09/15/08

$5,070,841

Chicopee

Opened 06/29/09

$24,202,175

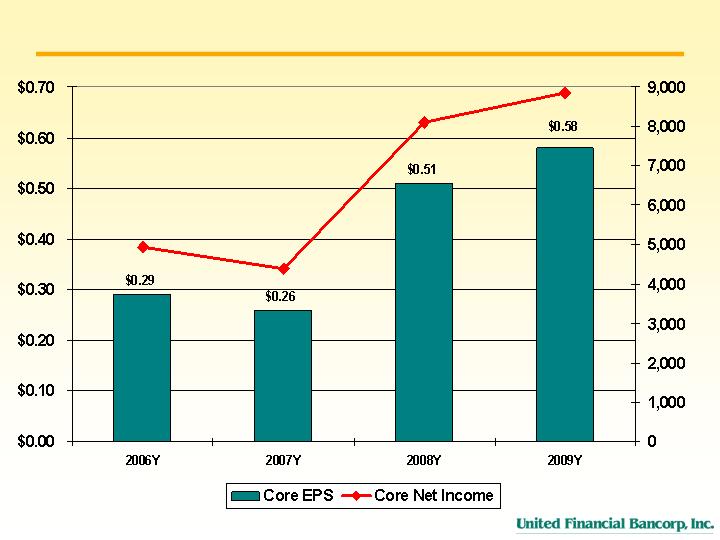

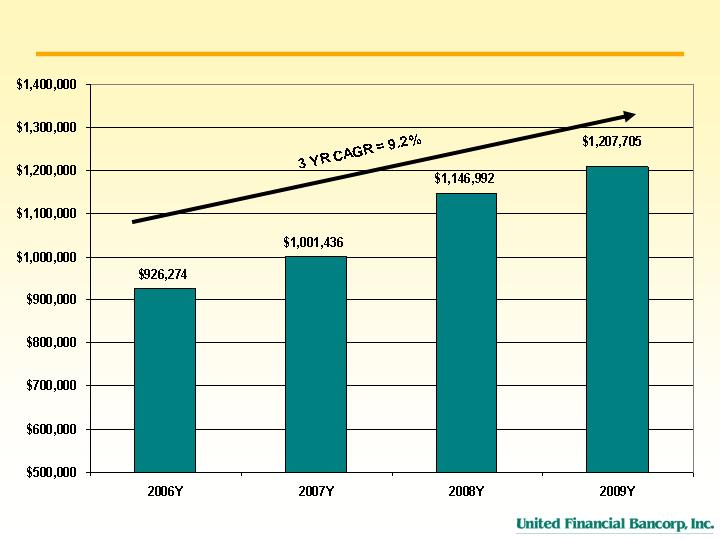

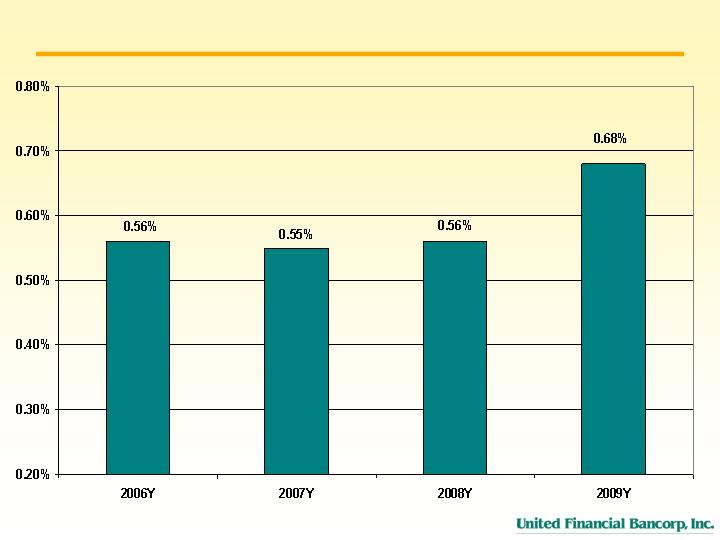

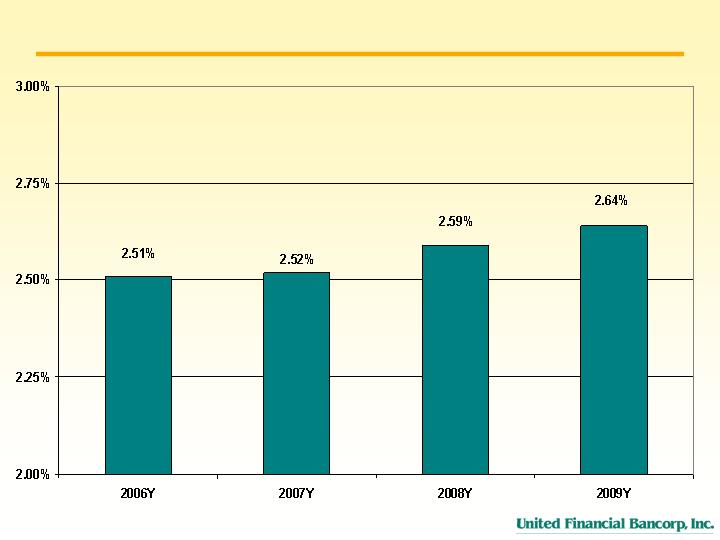

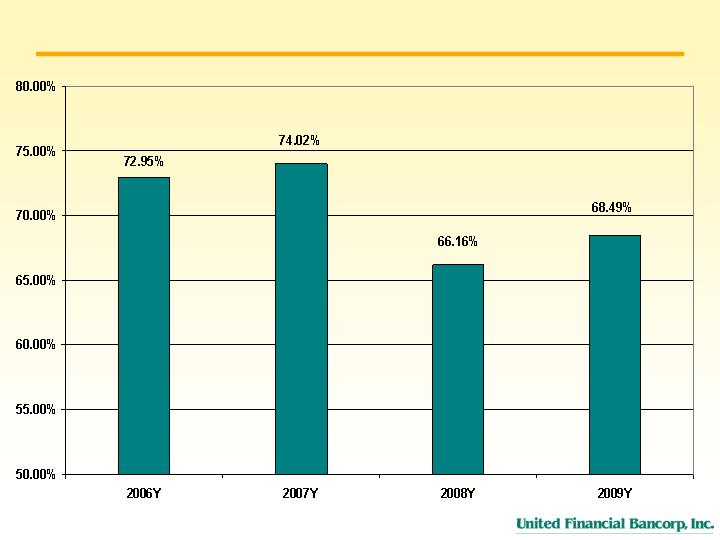

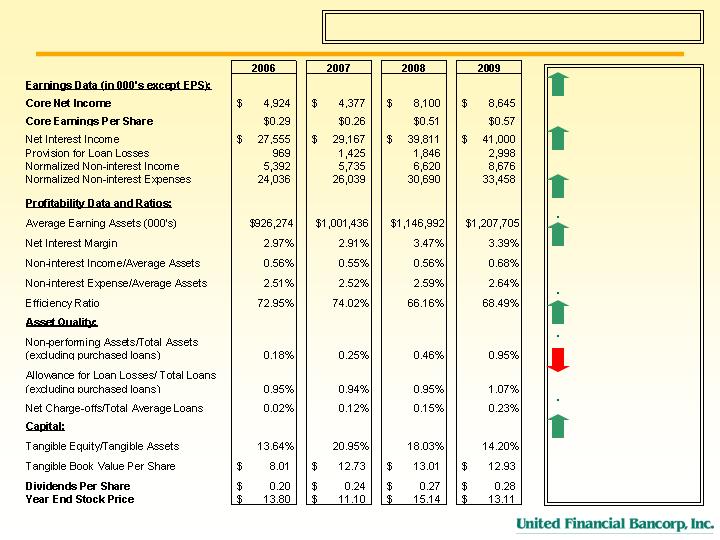

3 Yr CAGR: Core Net

Income 22% Core EPS

26%

Loan growth drove 9% 3

Yr CAGR on average

earning assets

NIM improvement 42 bps

Non-interest income grew

in deposit service charges

(increase in accounts &

transactions) and Wealth

Mgmt (increase in AUM)

Efficiency ratio improving

as we grow

NPA and charge-offs

increased due to 5

commercial credits with

workout strategies

Well capitalized at 14%.

Decrease in tangible equity

to tangible assets driven by

buybacks, balance sheet

growth and CNB

acquisition

Financial Performance

CNB Earnings Impact: 2010 Earnings Accretion projected > initial projection of 9%.

Minimal dilution to tangible book value.

Why invest in United Financial Bancorp, Inc.?

Experienced Management Team focused on creating shareholder value

Well capitalized (14% Tangible Equity/ Tangible Assets)

Effective Capital Management Strategy with successful stock repurchase program and competitive dividend yield

Continuous growth through an expanding franchise

Organic growth

De Novo branching

Acquisition

Balanced Loan & Deposit Mix and Growth

Strong market position in both loans & deposits

More bank-like mix in loans

54% of deposits in core

Excellent asset quality

63% of NPLs driven by 5 loans with workout strategies

95% of Investment portfolio is agency backed

Holding Company for

FOR QUESTIONS, PLEASE CONTACT:

Dena M. Hall, SVP, Marketing and Investor Relations

(413) 787- 1292

dhall@bankatunited.com

Mark A. Roberts, Executive Vice President and Chief Financial Officer

(413) 787-1201

mroberts@bankatunited.com

Holding Company for

APPENDIX