Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Tennessee Commerce Bancorp, Inc. | a10-3371_18k.htm |

Exhibit 99.1

|

|

Tennessee Commerce Bancorp, Inc. Investor Presentation February 2010 NASDAQ:TNCC www.tncommercebank.com [LOGO] |

|

|

|

|

|

Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements, which are based on assumptions and estimates and describe our future plans, strategies, and expectations, are generally identifiable by the use of the words “anticipate,” “will,” “believe,” “may,” “could,” “would,” “should,” “estimate,” “expect,” “intend,” “seek,” or similar expressions. These forward-looking statements may address, among other things, our business plans, objectives or goals for future operations or expansion, the anticipated effects of the offering of the securities hereunder, our forecasted revenues, earnings, assets, or other measures of performance, or estimates of risks and future costs and benefits. Although these statements reflect our good faith belief based on current expectations, estimates and projections, they are subject to risks, uncertainties and assumptions, and are not guarantees of future performance. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this presentation are described in the RISK FACTORS section of the prospectus filed with the SEC and those factors include, but are not limited to: Our potential growth, including our entrance or expansion into new markets, and the need for sufficient capital to support that growth; Changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers or issuers; An insufficient allowance for loan losses as a result of inaccurate assumptions; The strength of the economies in our target market area, as well as general economic market or business conditions; Changes in demand for loan products and financial services; Increased competition or market concentration; Concentration of credit exposure; Changes in interest rates, yield curves and interest rate spread relationships; Changes in regulatory environments; New state or federal registration, regulations, or the initiation or outcome of litigation; and Other circumstances, many of which may be beyond our control. If one or more of these risks or uncertainties materialize, or if any of our underlying assumptions prove incorrect, our actual results, performance, or achievements may vary materially for future results, performance, or achievements expressed or implied by these forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements in this section. We do not intend to and assume no responsibility for updating or revising any forward-looking statements contained in this presentation, whether as a result of new information, future events, or otherwise. 1 |

|

|

Experienced Management Team EXECUTIVE TITLE AGE BANKING EXPERIENCE Michael R. Sapp Chairman & Chief Executive Officer and President 57 32 H. Lamar Cox Chief Operations Officer 66 37 Frank Perez Chief Financial Officer 41 12 Martin M. Zorn Chief Administrative Officer 53 32 Tommy Crocker Chief Risk Officer 59 30 Doug Rogers National Lending Executive 59 35 John Burton Regional Lending Executive 60 35 Combined years experience - 213 Average years experience - 30 2 February 2010 |

|

|

Ownership Management ownership of 5.88% Total insider ownership of 11.10% Institutional ownership of 17.50% 3 February 2010 |

|

|

Business Banking Focus Focused on serving owner managed businesses, entrepreneurs and professionals One branch with four lending offices Efficient operating model Scalable business platform “Seasoned” bankers – multiple cycle experience Not dependent on real estate 4 February 2010 |

|

|

Representative Lending Transactions Construction & Road Builder Revenue: $100 million Credit Facility: $15 million Revolver: 1 year Term: 5 year amortized Cash management and other depository Remote capture Revenue: $15 - $20 million Credit Facility: $20 million Revolver: 18 months Term: 5-7 years, with balloon Cash management and other depository DIRECT LENDING / OWNER MANAGED BUSINESS – NASHVILLE AREA ASSISTED LIVING FACILITIES / USDA CREDIT ENHANCEMENT 5 February 2010 |

|

|

Representative Lending Transactions LARGE INDIRECT LENDING Southeast Major Regional Bank – Item Processing Equipment Asset cost: $2.7 million Term: 5 years SMALL INDIRECT LENDING Small independent business – local delivery trucks Asset cost: $45,000 Term: 36 months Nationally recognized producer of self-moving rental trucks and trailers Asset Cost: $10 million Term: 7 years Cash management and remote capture INDIRECT LENDING OTHER 6 February 2010 |

|

|

2009 Highlights Turned the corner on earnings during 2nd half of ’09 FOUR consecutive quarters of net interest margin expansion NPAs and NPLs have declined significantly Pre-Provision revenue continues to expand 7 February 2010 |

|

|

Deposit Funding Reducing reliance on wholesale deposits while increasing core deposits... 8 February 2010 |

|

|

Cost of Interest Bearing Liabilities 9 February 2010 34% decline since 2008 Q4... Source: SNL |

|

|

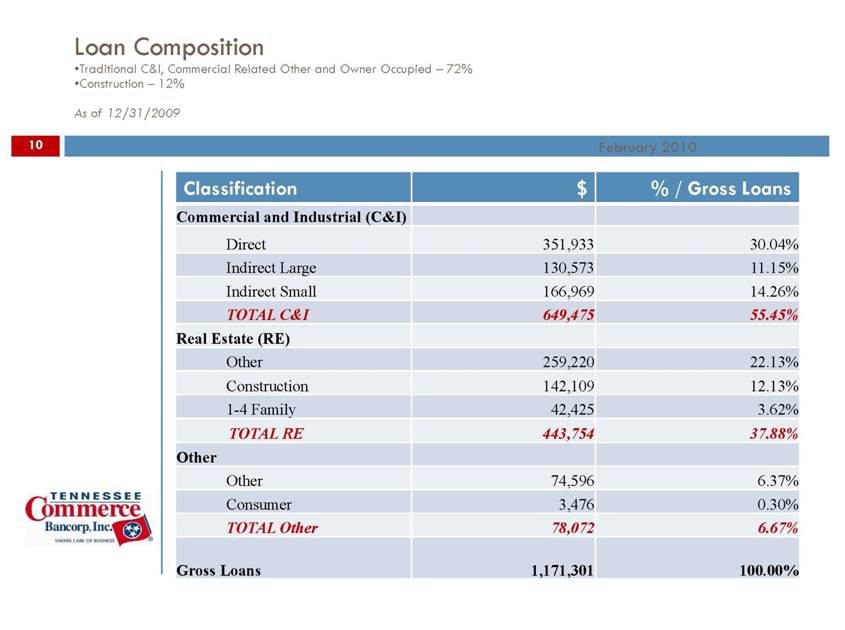

Loan Composition Traditional C&I, Commercial Related Other and Owner Occupied – 72% Construction – 12% As of 12/31/2009 Classification $ % / Gross Loans Commercial and Industrial (C&I) Direct 351,933 30.04% Indirect Large 130,573 11.15% Indirect Small 166,969 14.26% TOTAL C&I 649,475 55.45% Real Estate (RE) Other 259,220 22.13% Construction 142,109 12.13% 1-4 Family 42,425 3.62% TOTAL RE 443,754 37.88% Other Other 74,596 6.37% Consumer 3,476 0.30% TOTAL Other 78,072 6.67% Gross Loans 1,171,301 100.00% 10 February 2010 |

|

|

Non-Performing Assets / Assets Lowest NPA level in 5 quarters. 11 February 2010 Source: SNL |

|

|

Non-Performing Loans / Loans 12 February 2010 Lowest NPL level in 4 quarters... Source: SNL |

|

|

Loan Loss Reserve / Non-Performing Loans 13 February 2010 Over 100% coverage of NPLs... Source: SNL |

|

|

Net Interest Margin 4 consecutive quarters of net interest margin expansion. 14 February 2010 Source: SNL |

|

|

Efficiency Ratio One of the best efficiency ratios in the industry! *Publicly traded bank average (71.10%) median (67.14%) as of 4Q09. 15 February 2010 * Averages from SNL Source: SNL |

|

|

Pre-Provision Revenue Power 16 February 2010 Source: SNL |

|

|

Assets / Revenue per Employee Ratio $ Comments Assets per Employee $15.4 million 3x greater than industry average Revenue per Employee $476,000 Top 1% in the industry 17 February 2010 |

|

|

Capital Position Ratio Current (Consolidated) Management Goal Tier 1 Leverage 8.93% 8.00% Tier 1 Risk Based 9.55% 9.00% Total Risk Based 10.81% 12.00% Tangible Common Equity 4.81% 7.00% 18 February 2010 The bank exceeds all regulatory ratios to be considered well capitalized. |

|

|

Proforma Impact of Equity Raise Assumed Offering Price Total New Capital (Based on 5 million newly issued shares) Common Equity Tangible Book Value Tangible Book Value Dilution Offering Price to Book Value Tangible Common Equity Total Risk Based Capital $7.00 35,000 101,500 $9.53 19.05% 73.42% 6.79% 13.59% $8.00 40,000 106,500 $10.00 15.07% 79.97% 7.13% 13.99% $9.00 45,000 111,500 $10.47 11.08% 85.93% 7.46% 14.39% 19 February 2010 As of 12/31/2009 Common Equity - $66,500 Shares O/S – 5,646 Tangible Book Value - $11.78 |

|

|

Conclusion: Opportunity for Multiple Expansion Price/Tangible Book Value Performance 20 February 2010 |

|

|

Investor Relations Contact Frank Perez, Chief Financial Officer Tennessee Commerce Bancorp, Inc. 381 Mallory Station Rd. Franklin, TN 37067 Tel: (615) 599-2274 Fax: (615) 807-3206 Email: IR@tncommercebank.com 21 February 2010 |