Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - FIRST PLACE FINANCIAL CORP /DE/ | d8k.htm |

Sterne

Agee Financial Services Symposium February 9 & 10, 2010 Steven R. Lewis, President & CEO “The Bank that means Business” Exhibit 99.1 |

2 economic conditions in the market areas the Company conducts business, which could materially impact credit quality trends, changes in laws, regulations or policies of regulatory agencies, fluctuations in interest rates, demand for loans in the market areas the Company conducts business, and competition, that could cause actual results to differ materially from historical earnings and those presently anticipated or projected. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. When used in this presentation, or future presentations or other public or shareholder communications, in filings by First Place Financial Corp. (the Company) with the Securities and Exchange Commission, or in oral statements made with the approval of an authorized executive officer, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the Company’s actual results to be materially different from those indicated. Such statements are subject to certain risks and uncertainties including changes in Forward-Looking Statements The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

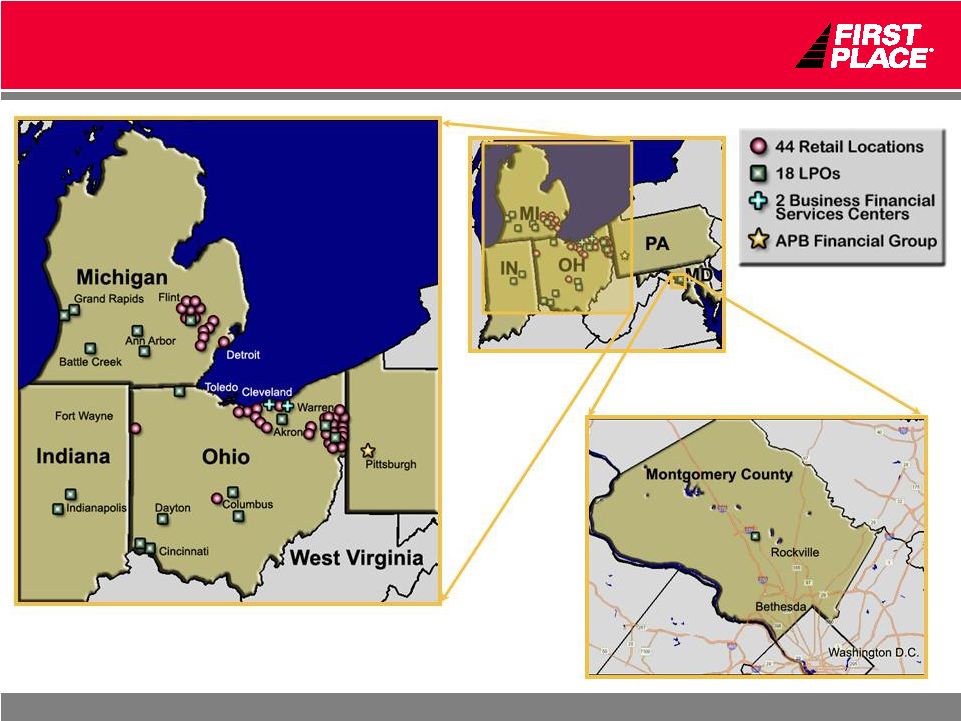

3 • Ticker Symbol: FPFC • Average Daily Trading Volume: 17,132 (10/1/09 – 12/31/09) • Primary Regulator: Office of Thrift Supervision • Institutional & Insider Ownership: 19.1% & 10.6% respectively First Place Assets $3.3 Billion Retail Locations 44 Loan Offices 18 States: Ohio, Indiana, Maryland, Michigan, Pennsylvania First Place Corporate Profile The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

4 Corporate Description • Multi-market footprint with heavy market share in core markets • Evolving balance sheet toward commercial profile • Diversified products and services delivered through a super community bank model • Superior expense management culture • Experienced M & A player • Strong performing Mortgage Banking unit with consistent results • All delivered through highly incentivized sales and service The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

5 First Place at a glance … The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

6 Timeline Significant Milestones Completion of Stock Conversion and Initial Public Offering of Stock 12/31/98 Ravenna Savings Bank Acquisition 5/12/00 FFY Financial Corp. Acquisition Franklin Bancorp. Acquisition Northern Savings & Loan Acquisition Citizens Republic Branch Purchase ($200 Million Deposits) HBLS Bank Acquisition 5/28/04 12/22/00 6/27/06 4/27/07 10/31/07 6/30/08 OC Financial Acquisition CPP: FPFC issues $73 million in preferred shares to US Treasury

3/13/09 The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

7 “Remember the Alamo” CFPA FDIC Media Admin D.C. Regulators Credit Fraud Cyber Fraud ODP Community Banks Community Banks The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

8 Experience • Commercial Banking Kenton Thompson 32 • Mortgage Banking Bruce Wenmoth 20 • Retail Dominique Stoeber 19 • Wealth Management Mark Wenick 27 Transitioning our Business Model The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

9 Job # 1 = Credit Quality Job # 2 = Partnering with Treasury Management priorities Job # 3 = Attracting A+

Credits (C & I focused) Job # 4 = Bolstering SBA activity Commercial Banking The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

10 Job # 1 = Take advantage of chaos in the competitive environment Job # 2 = Upgrade systems Job # 3 = Enhance controls Job # 4 = Introduce targeted customers to Wealth Management services Mortgage Banking The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

11 FY ’08 FY ’09 First half ‘10 Loan Originations $1.3B $1.9B $1.0B Gain on Sale $9.3 mil $14.5 mil $8.7 mil Conclusions: Keep Growing Implement new loan origination system Mortgage Banking The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

12 Mortgage Servicing Rights 0.98% 1.01% Value 2,340,400 2,520,768 Loans Serviced 22,964 25,430 Net Loan Servicing Asset (1,164) (589) Impairment Allowance 24,128 26,019 Asset December 2009 September 2009 The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

13 Job # 1 = Continue to influence deposit mix through all products Job # 2 = Devote resources to enhance Treasury products and delivery Job # 3 = Partner with Wealth Management group to maximize relationships • Job # 4 = Continue fee enhancement strategies Retail The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

14 December 2009 September 2009 Change Demand 494,597 416,484 78,113 Savings 404,353 406,434 (2,081) Money Market 342,970 335,116 7,854 Certificates 1,224,850 1,172,835 52,015 Total Deposits 2,466,770 2,330,869 135,901 Deposits: A Changing Mix The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

15 COST OF DEPOSITS Quarter Ended 6/30/09 9/30/09 12/31/09 Q4 09 Q1 10 Change Q2 10 Change Cost of Deposits

2.03% 1.74% -0.29%

1.29% -0.45% Net Interest

Margin 3.06% 3.38% +0.32%

3.65% +0.27% NET CHECKING ACCOUNT GROWTH

FY’10 6 mos. 2009 Q1’10 Q2’10 Consumer 1,792 866 920 Business Checking 1,421 241 245 Retail Banking The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

16 Job # 1 = Complete the development plan Job # 2 = Attract talented professionals Job # 3 = Leverage the bank’s Private Banking group as the team quarterback • Job # 4 = Partner with other business lines Wealth Management The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

17 17 |

18 Job # 1 = Maximize and leverage “Community Banking” message Job # 2 = Execute Cruze strategy Job # 3 = Educate consumers about

where they live • Job # 4 = Be efficient Marketing The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

19 The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

20 First Place Financial Corp. • Selected for the Treasury Capital Purchase Program for Healthy Institutions • Issued $73 Million in Preferred Stock and Warrants on 3/13/09 • Invested $41 Million in First Place Bank to Strengthen Capital Position First Place Bank • Was Considered “Well Capitalized” Before $31 Million • Has Remained “Well Capitalized” Capital The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

21 Capital – First Place Financial Corp. $45.14 8.27% 8.57% 9/30/09 8.23% 7.96% Tangible Equity to Tangible Assets 8.52% 8.27% Equity to Assets Cash on Hand $35.25 $46.79 12/31/09 6/30/09 ($ in millions) The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

22 Strengthened Capital

Position First Place Bank Required to be Well 6/30/09 9/30/09 12/31/09 Capitalized Excess Total Capital to 12.37% 12.67% 13.14%

10.00% 3.14% Risk

Weighted Assets Tier 1 Capital to 11.23%

11.42% 11.88% 6.00% 5.88% Risk Weighted Assets Tangible Capital

8.16% 8.35% 8.72%

5.00% 3.72% to

Adjusted Assets The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

23 10.61% 10.42% 11.47% 13.14% 12.37% 11.16% Jun-05 Jun-06 Jun-07 Jun-08 Jun-09 Dec-09 Minimum to be well capitalized = 10.00% 10.00% 12 Total Capital to Risk Weighted Assets Year End Bank Regulatory Capital is at a Five Year High Minimum to be well capitalized = 10.00% The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

24 Common Stock • Closed at $3.29 on February 3, 2010 • Negatively impacted by dropping out of the Russell 3000 on June 26, 2009 • Currently at 26.8% of book value • Currently at 28.2% of tangible book value The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

25 What’s the Plan? Credit Challenges … The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

26 Process Changes • Revisions to Underwriting Standards and increased staffing • Line of Business vs. Regional Alignment • ALLL Methodology and Granularity • Special Asset Credit Committee (SACC) • Delinquency Monitoring Process • Separate REO Function entirely focused on REO disposition The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

27 Asset Quality Snapshot December September 31, 2009 30, 2009 Total loans 2,420,917 2,449,937 Net charge-offs 12,170 11,437 Nonperforming loans (non-accrual and TDR) 141,801 126,740 Delinquent loans 169,728 175,100 Nonperforming assets (non-perf.loans + REO) 172,527 159,863 Classified loans 310,340 275,816 Allowance for loan losses 52,473 50,643 Nonperforming loans / loans 5.86% 5.17% Nonperforming assets / total assets 5.29% 4.93% Delinquent loans / loans 7.01% 7.15% Allowance for loan losses / loans 2.17% 2.07% Allowance for loan losses / Nonperforming loan 37.00% 39.96% The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

28 Delinquency Review - Delinquency Trends (30-89 days) . Positive trends seen in some portfolios . Declining principal balances have increased delinquency percentages in the residential portfolio The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 Dec-09 Adjusted for Delinquency as change in % of Portfolio Jun-09 Sep-09 Dec-09 Portfolio size 5+ Family 2.56% 5.74% 5.72% 5.65% Commercial 2.84% 4.41% 4.12% 4.19% Home Equity 7.91% 9.31% 9.96% 9.24% Purchase Money Seconds 6.00% 6.93% 7.09% 7.14% Revolving 3.65% 4.53% 4.53% 4.49% 1-4 Family Portfolio 5.84% 11.22% 12.43% 11.11% 1-4 Family Investment 23.76% 25.01% 27.30% 26.09% Construction 4.39% 3.13% 2.47% 2.75% 1-4 Family Interest only 10.17% 8.54% 10.78% 10.79% 1-4 Family Jumbo 5.95% 8.03% 7.78% 8.17% Consumer 4.29% 4.58% 5.11% 4.69% HBCF/LD 15.81% 14.26% 11.41% 10.53% |

29 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 12/31/08 3/31/09 6/30/09 9/30/09 12/31/09 2-Pay 3-Pay Non-Accrual TDR Total Delinquency & Non-Performing Loans (%) The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

30 Provision and Net Charge Off $19,620 $22,500 $14,000 $12,170 $11,437 $15,805 $4,609 $7,066 $9,216 $6,797 12/31/08 3/31/09 6/30/09 9/30/09 12/31/09 Net Charge Off Provision ($ in millions) The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

31 A Diversified Loan Portfolio Loan portfolio value as of 12/31/2009: $2.421 Billion Loan Portfolio Mix as of December 31, 2009 Commercial & Industrial Residential Home Equity HELOC Consumer Commerical Real Estate Facilities & Land Development Multi-family Real Estate The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

32 Corporate Accolades • Second largest publicly traded savings institution in Ohio, and 26 th largest in America • Deemed “well capitalized” by the U.S. Treasury Office of Thrift Supervision • Ranked in the Top 150 Performers two years in a row by Bank Director magazine • Named one of the country’s Top 100 Mid-Tier Banks by US Banker magazine • Number one mortgage lender in many of the markets served • Chosen by FNMA to help pilot their new Home Path Program • First Place originators included in Mortgage Originator magazine’s list of the

nation’s top 200 mortgage originators for 10 consecutive years, including six

recognized for their 2008 performance • Named Top Bank by readers of the Warren Tribune Chronicle • Named Top Bank by readers of the Flint Morning

Journal The Bank that means

Business First Place Financial Corp./Qtr End 12/31/09 |

33 Strategic Opportunities • Margin – prepare for rising rate environment • Maintain focus on NPA elimination • Continue pursuit of mortgage bank opportunities • Allow mortgage servicing to build • Maintain energy toward core account growth • Be proactive as competitive landscape shifts • Maintain disciplines as market opportunities emerge • Wealth management / Fee Income The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

34 • Transitioned corporate business model to Line of Business • Opened new LPO in Rockville, Maryland • Opened new LPO in Grand Rapids, Michigan • Integrated OC Financial into First Place Bank • Acquired the Guerra, Richards and Mulvey Insurance • Developed new comprehensive model for providing wealth management services • Transitioned the Franklin Bank name to First Place Bank • Launched a new web site • Opened our new Liberty office • Consolidated two Southfield, Michigan offices into one new facility • Implemented Remote Capture, Positive Pay features, and automated Lock Box Strategic Achievements The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

35 Fiscal 2010 Results The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

36 -5.321 -$110.43 $10.79 $25.62 2007 2008 2009 1st Half 2010 Net Income (Loss) History * * Includes write-off goodwill of $92.14 million, net of tax. ($ in millions) The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

37 Factors Contributing to the Decline in Net Income $28.21 3.53 6.29 27.94 8.74 92.14 $(110.43) 2009 $22.39 $29.67 $31.06 All Other Components of Net Income 1.79 .25 .17 Federal Deposit Insurance 2.19 2.33 .47 Real Estate Owned Expense 23.73 10.70 4.80 Provision for Loan Losses Credit Related Charges - 5.60 - Securities Impairment - - - Goodwill Impairment $(5.32) $10.79 $25.62 Net Income (Loss) 1 st Half 2010 2008 2007 All amounts are in Millions of Dollars and are Net of Income Taxes The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

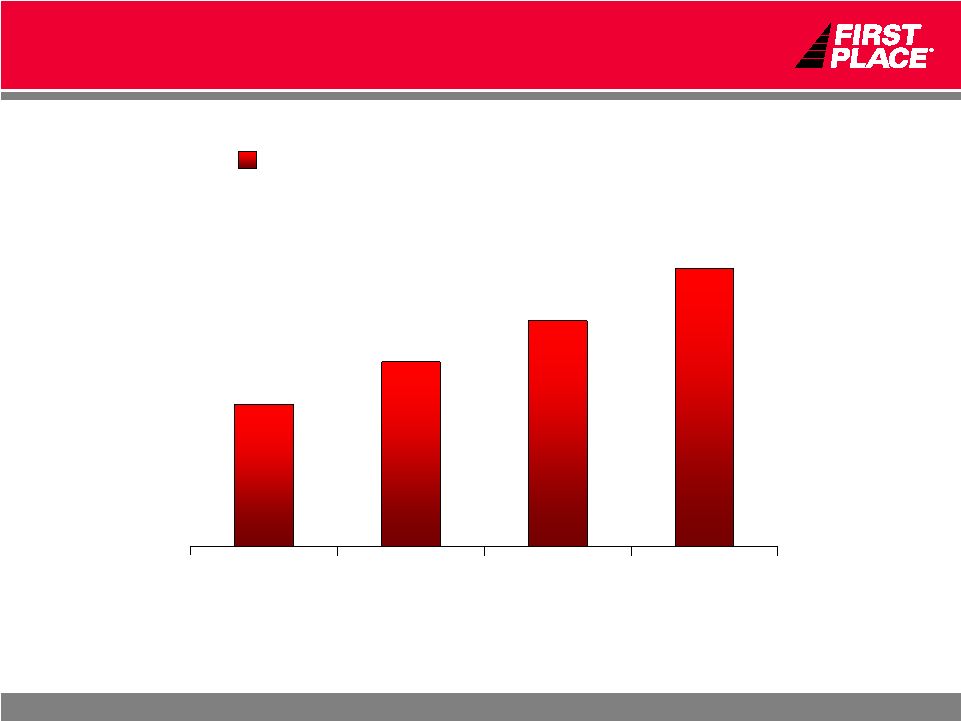

38 Positive Income Factors – Deposit Fees $12.60 $10.21 $8.35 $6.44 2007 2008 2009 1st Half 2010 Service Charges on Deposit Accounts ($ in millions) (Annualized) The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

39 Positive Income Factors – Mortgage Banking $1,163 $1,565 $874 $1,005 $5.02 $9.26 $7.24 $14.47 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 2007 2008 2009 1st Half 2010 $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 Sales Mortgage Banking Gains ($ in millions) Fiscal Year Ended: 6/30 The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

40 Balance Sheet Growth $2,467 $2,421 $3,259 12/31/09 14.3% 15.3% 11.8% Compound Annual Growth Rate Growth Rate without Acquisitions 12/31/03 4.7% $1,105 Deposits 8.5% $1,032 Loans 4.0% $1,671 Assets ($ in millions) • 4 whole company and 1 branch acquisition in the last 6 years The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

41 2 nd Quarter 2010 Results |

42 Factors Negatively Impacting Net Income Credit Related Charges 9.10 14.63 12.75 4.42 5.99 Provision for Loan Losses 1.50 .69 3.97 .72 .90 Real Estate Owned Expense 0.85 .94 1.98 .64 .84 FDIC Insurance $0.59 $(5.91) $(12.72) $2.54 $(94.10) Net Income (Loss) 92.14 Goodwill Impairment - - .71 .32 1.65 Securities Impairment $12.04 $10.35 $6.69 $8.64 $7.42 All Other Components of Net Income 12/31/08 Quarter Ended 3/31/09 12/31/09 9/30/09 6/30/09 All amounts are in Millions of Dollars and are Net of Income Taxes The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

43 Positive Income Factors Quarter Ended 28.5% $0.70 $3.16 $2.46 Service Charges on Deposit Accounts 128.9% $2.72 $4.83 $2.11 Mortgage Banking Gains 29.9% 0.84% 3.65% 2.81% Net Interest Margin 12/31/08 12/31/09 (Decrease) Increase ($ in millions) The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

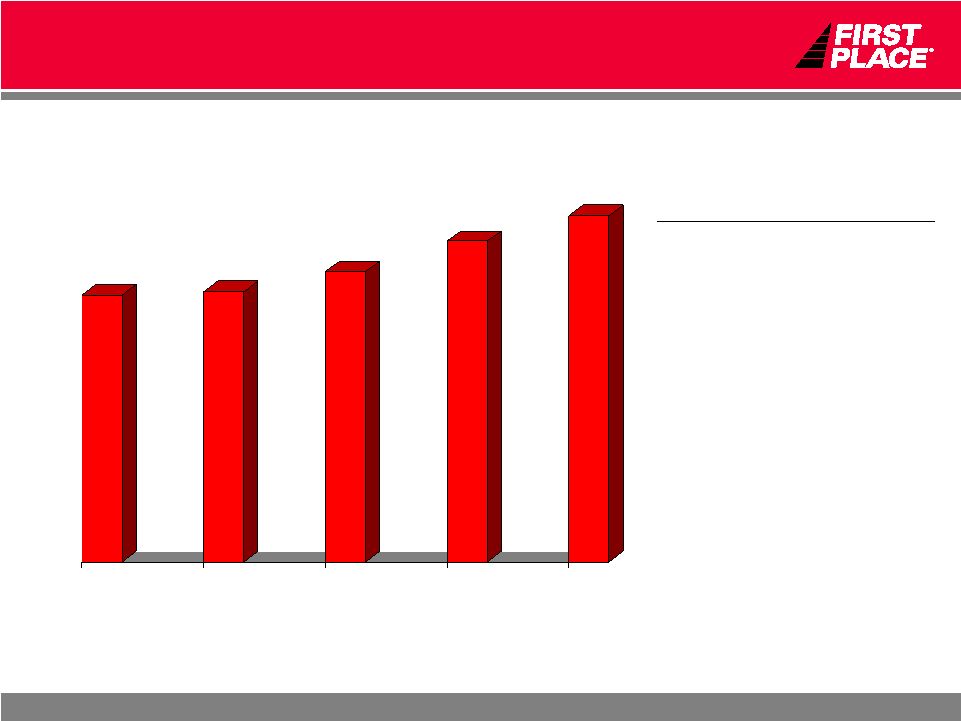

44 Service Charge on Deposit Accounts ($ in millions) $2.46 $2.46 $2.68 $2.94 $3.15 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 12/1/08 3/1/09 6/1/09 9/1/09 12/1/09 Factors Driving Growth • Checking A/C Dollars Growing Faster than Total Deposits • Continuous Growth in Number of Checking Accounts • Fee Growth from Both Consumer and Business Accounts The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

45 Mortgage Banking Gains ($ in millions) $2.11 $6.81 $3.77 $3.91 $4.83 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 12/1/08 3/1/09 6/1/09 9/1/09 12/1/09 Factors Driving Growth • Added Over 40 Loan Officers in Past 12 Months • Opened Rockville, MD Loan Production Office in August 2009 • Opened Grand Rapids, MI Loan Production Office in July 2009 The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

46 Net Interest Margin ($ in millions) 2.81% 2.85% 3.06% 3.38% 3.65% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 12/1/08 3/1/09 6/1/09 9/1/09 12/1/09 Factors Driving Growth • Improvement in Mix of Deposits Lowered Cost of Deposits • Single Service High Cost Certificates of Deposits not Renewed • Other Certificates of Deposit Renewed at Substantially Decreased Rates The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

47 • Positive Pre-Tax Pre-Provision Trend • Positive Margin Trend • Positive Noninterest Income trend • Geographic Diversity • Strong Regulatory Capital • Diversity of Earnings Stream • Strong Retail Sales Culture • Priced at Only 28.2% Tangible Book Value (2/3/10) Investment Rationale The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

48 “It’s not the load that breaks you down, it’s the way you carry it.” - Lou Holtz The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

49 QUESTION & ANSWER The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |

50 The Bank That Means The Bank That Means Business Business The Bank that means Business First Place Financial Corp./Qtr End 12/31/09 |