Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K ASHLAND INC. - ASHLAND LLC | form8k.htm |

| 8-K - PDF VERSION OF 8-K - ASHLAND LLC | form8k.pdf |

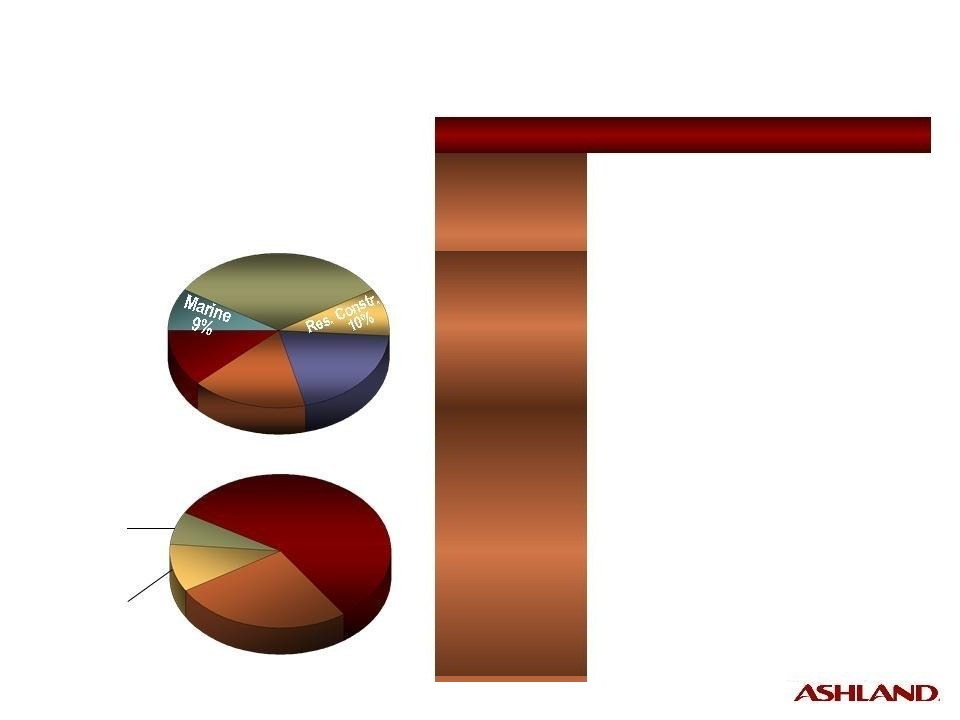

1 For the fiscal year

ended Sept. 30, 2009. Includes pro forma results from the acquired operations of

Hercules.

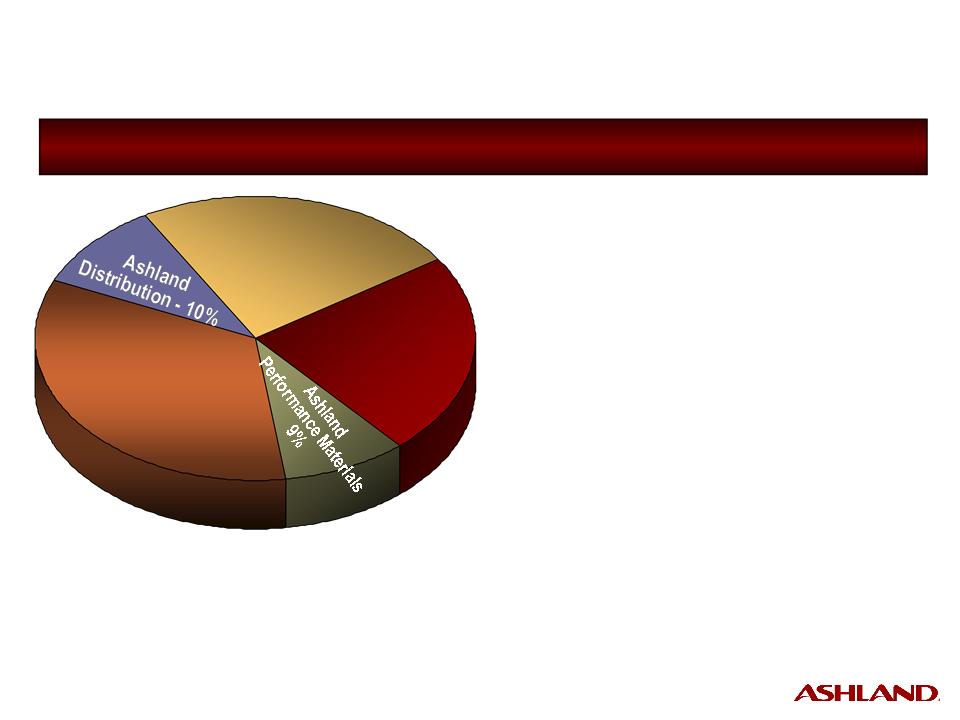

Ashland

Consumer

Markets

34%

Markets

34%

Ashland

Hercules

Water Technologies

Water Technologies

Ashland

Hercules

Water Technologies

Water Technologies

23%

23%

Ashland

Ashland

Aqualon

Functional

Aqualon

Functional

Ingredients

Ingredients

24%

24%

• 56

percent of EBITDA comes from specialty chemicals

• Nearly

25 percent from renewable materials

|

NYSE

Ticker Symbol:

|

ASH

|

|

Total

Employees:

|

~14,700

|

|

Outside

North America

|

33%

|

|

Number

of Countries

in Which Ashland Has Sales: |

More

than 100 |

Adjusted

EBITDA1: $854

million

Fiscal

2009

Corporate Profile

Corporate Profile

Exhibit

99.1

Ashland

Distribution

36%

Distribution

36%

Ashland

Distribution

36%

Distribution

36%

Ashland

Consumer

Markets

19%

Consumer

Markets

19%

By

commercial unit

21%

21%

Ashland

Aqualon

Functional

Ingredients

Aqualon

Functional

Ingredients

Ashland

Aqualon

Functional

Ingredients

Aqualon

Functional

Ingredients

11%

11%

2 For the fiscal year

ended Sept. 30, 2009. Includes intersegment sales and pro forma results from the

acquired

operations of Hercules.

operations of Hercules.

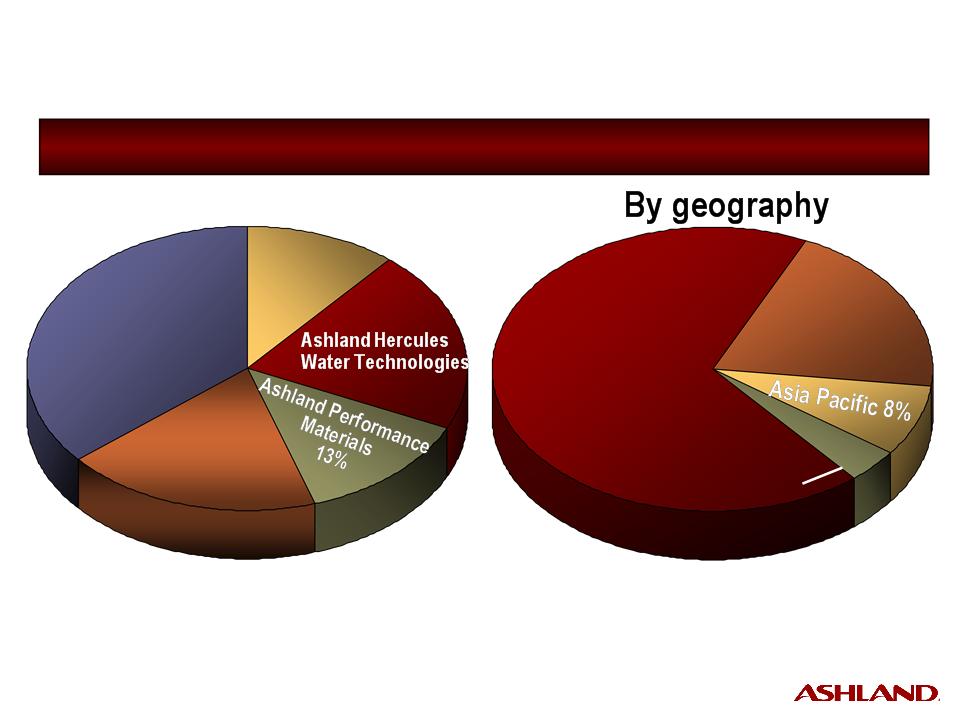

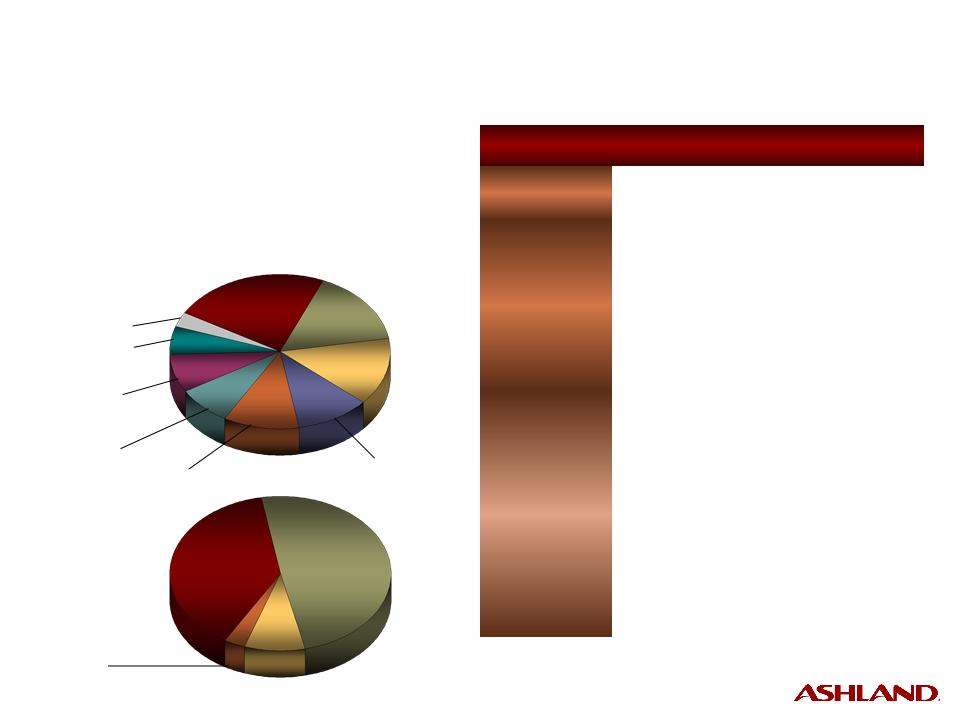

North

America

68%

America

68%

North

America

68%

America

68%

Latin

America/

Other - 4%

Other - 4%

Europe

Europe

20%

20%

~32

percent of total sales come

from outside North America

from outside North America

Adjusted

Sales2: $8.4

billion

Fiscal

2009

Corporate Profile

Corporate Profile

7%

7%

North

America

America

North

America

America

40%

40%

Asia

Pacific

Pacific

Asia

Pacific

Pacific

17%

17%

Europe

36%

Latin

America/

Other

- 7%

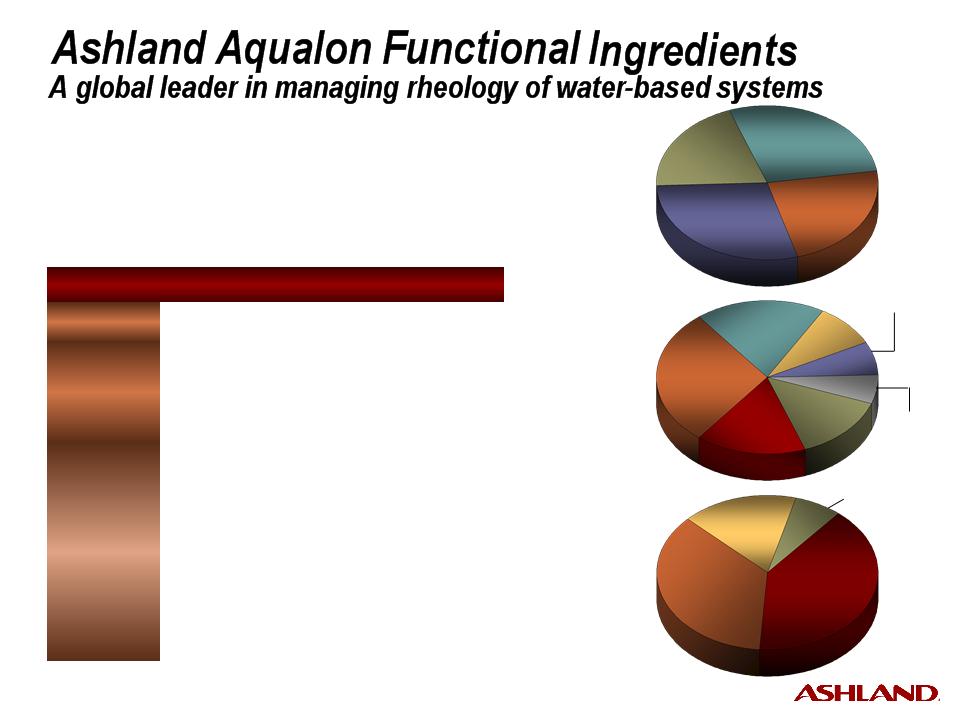

Coatings

Additives

28%

Additives

28%

Coatings

Additives

28%

Additives

28%

Energy

&

Specialties

Solutions

23%

Specialties

Solutions

23%

Regulated

Industries

29%

Industries

29%

Regulated

Industries

29%

Industries

29%

Sales

by Geography

by Geography

Sales

by Market

by Market

For

the Fiscal Year Ended Sept. 30, 2009

Adjusted

Sales: $0.9 billion

Adjusted

EBITDA: $203 million

Adjusted

EBITDA Margin: 22.0%

|

Business

Overview

|

|

|

Customers

|

• Diversified,

global customer base

|

|

Products

|

• Broad

product line based

on renewable resources - Water-soluble

polymers

(cellulose ethers and guar derivatives) |

|

Markets

|

• Water-based

paints

• Paper

coatings

• Construction

• Oilfield

(chemicals

and drilling muds)

• Regulated

markets

- Personal

care

- Food

- Pharmaceuticals

|

Sales

by Product

by Product

CMC

16%

16%

CMC

16%

16%

HEC

29%

29%

HEC

29%

29%

MC

19%

19%

MC

19%

19%

Guar

9%

9%

Guar

9%

9%

Other

14%

14%

Other

14%

14%

Stumpwood

Derivatives

Derivatives

Construction

20%

20%

Construction

20%

20%

Klucel®

6%

6%

North

America

America

North

America

America

46%

46%

Asia

Pacific

Pacific

Asia

Pacific

Pacific

12%

12%

Europe

35%

Latin

America/

Other

- 7%

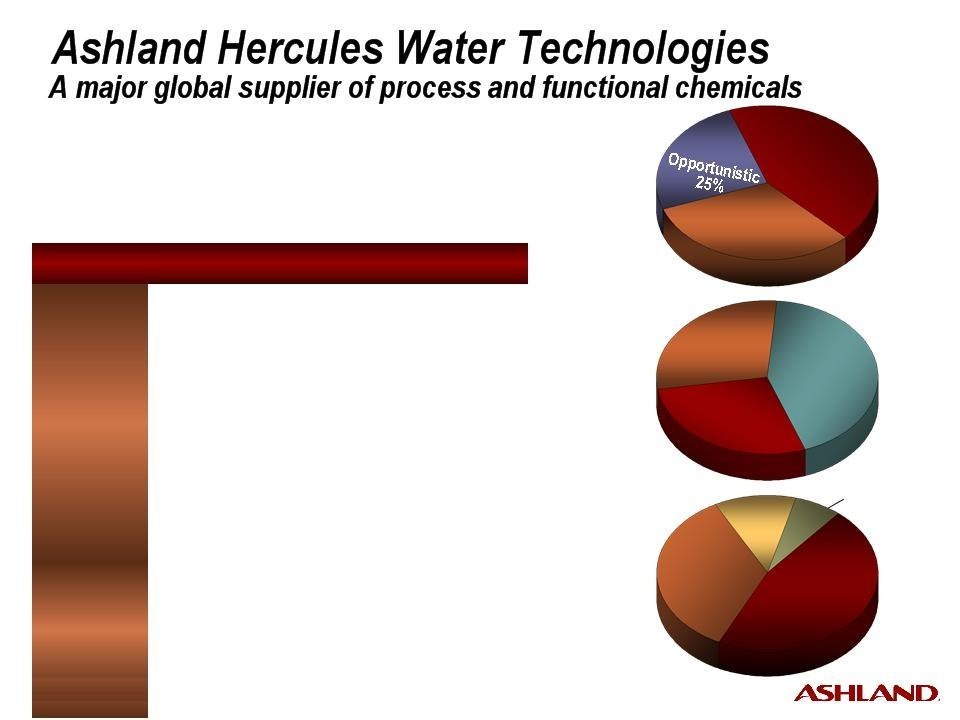

Growth

43%

43%

Growth

43%

43%

Base

32%

32%

Sales

by Geography

by Geography

Sales

by Market

by Market

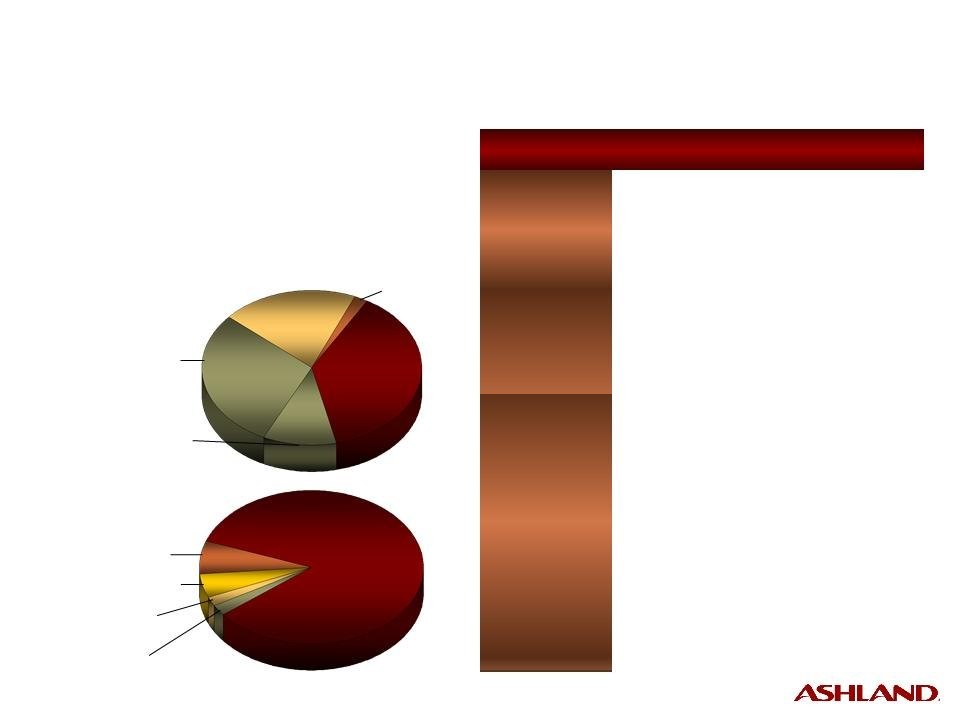

For

the Fiscal Year Ended Sept. 30, 2009

Adjusted

Sales: $1.8 billion

Adjusted

EBITDA: $198 million

Adjusted

EBITDA Margin: 11.0%

Sales

by Product

by Product

Process

28%

28%

Process

28%

28%

Utility

29%

29%

Utility

29%

29%

Functional

43%

43%

Functional

43%

43%

|

Business

Overview

|

|

|

Customers/

Markets |

• Growth

- Commercial

and

-

Packaging

institutional

-

Pulp

- Food

and beverage

-

Tissue/towel

- Mining

• Base

- Chemicals

- General

manufacturing

- Printing

and writing

• Opportunistic

- Lubricants

-

Marine*/Other

- Municipal * Divested 08/31/09

|

|

Products/

Services |

• Process

chemicals: microbial and

contaminant control, pulping aids, retention aids and defoamers • Utility

water treatments

• Functional

chemicals: sizing/wet

strength

|

Pkg.

&

Converting

20%

20%

North

America

America

North

America

America

57%

57%

Europe

26%

Latin

America/

Other - 7%

America/

Other - 7%

Trans-

portation

portation

Trans-

portation

portation

17%

17%

Ind.

Constr.

Constr.

32%

|

Business

Overview

|

|

|

Customers

|

• Auto

manufacturers; foundries; pipe

and tank fabricators; packaging and converting; bathware, countertop and window lineal manufacturers; pipe relining contractors; boat builders; wide and narrow web printers |

|

Products/

Services |

• Composites

and Adhesives

- Unsaturated

polyester resins

- Vinyl

ester resins

- Gelcoats

- Pressure-sensitive

adhesives

- Structural

adhesives

- Specialty

resins

• Casting

Solutions

- Foundry

binder resins

- Chemicals

- Sleeves

and filters

- Design

services

|

|

Markets

|

• Construction,

packaging and con-

verting, transportation, and marine |

Sales

by Geography

by Geography

Sales

by Market

by Market

For

the Fiscal Year Ended Sept. 30, 2009

Sales:

$1.1 billion

Adjusted

EBITDA: $76 million

Adjusted

EBITDA Margin: 6.9%

Infrastructure

12%

12%

Asia

Pacific - 10%

Ashland

Performance Materials

A global leader in specialty chemicals

A global leader in specialty chemicals

Lubricants

84%

Filters

- 2%

Valvoline

Int'l

20%

Int'l

20%

Valvoline

Int'l

20%

Int'l

20%

Do-It-

Yourself

Yourself

38%

|

Business

Overview

|

|

|

Customers

|

• Retail auto parts stores and

mass merchandisers who sell to consumers; installers, such as car dealers and quick lubes; distributors |

|

Products/

Services |

• Valvoline® lubricants and

automotive chemicals • MaxLife® lubricants

for high-mileage vehicles • SynPower® synthetic motor oil

• Eagle One® and Car Brite®

appearance products • Zerex® antifreeze

• Valvoline Instant Oil Change®

service |

|

Market

Channels |

• Do-It-Yourself

(DIY)

• Do-It-For-Me

(DIFM)

• Valvoline

International

|

Sales

by Product Line

by Product Line

Sales

by Market Channel

by Market Channel

Do-It-

For-Me

40%

For-Me

40%

DIFM:

Installer channel

29%

Installer channel

29%

Specialty/

Other - 2%

Other - 2%

DIFM:

Valvoline Instant

Oil Change - 11%

Valvoline Instant

Oil Change - 11%

Antifreeze

- 5%

Appearance

products - 2%

products - 2%

Chemicals

- 7%

For

the Fiscal Year Ended Sept. 30, 2009

Sales:

$1.7

billion

Adjusted

EBITDA: $288 million

Adjusted

EBITDA Margin: 17.5%

Ashland

Consumer Markets: A

leading worldwide

marketer of premium-branded automotive lubricants and chemicals

marketer of premium-branded automotive lubricants and chemicals

Chemicals

Chemicals

49%

49%

Plastics

39%

Environmental

Services/Other

- 3%

Services/Other

- 3%

Construction

Construction

23%

23%

Other

16%

|

Business

Overview

|

|

|

Customers

|

• Diversified

customer base

in North America and Europe |

|

Products/

Services |

• More

than 28,000 packaged and

bulk chemicals, solvents, plastics and additives • Comprehensive,

hazardous

and nonhazardous waste- management solutions in North America |

|

Markets

|

• Construction

• Transportation

• Chemical

manufacturing

• Paint

and coatings

• Retail

consumer

• Personal

care

• Medical

• Marine

|

Sales

by Product

Line

by Product

Line

Sales

by Market

by Market

Trans-

portation

portation

14%

Paint

& Coatings - 11%

Medical

- 6%

Marine

- 3%

Com-

posites

posites

9%

Chemical

Mfg.

- 11%

- 11%

Retail

Consumer - 8%

Consumer - 8%

Personal

Care - 8%

Care - 8%

For

the Fiscal Year Ended Sept. 30, 2009

Sales:

$3.0 billion

Adjusted

EBITDA: $84 million

Adjusted

EBITDA Margin: 2.8%

Ashland

Distribution

A leading North American chemicals and plastics distributor

A leading North American chemicals and plastics distributor

Regulation

G: Adjusted EBITDA

The

information presented herein regarding adjusted pro forma results does not

conform to generally

accepted accounting principles (GAAP) and should not be construed as an alternative to the reported

results determined in accordance with GAAP. Management has included this non-GAAP information

to assist in understanding the operating performance of the company and its segments. The non-

GAAP information provided may not be consistent with the methodologies used by other companies.

All non-GAAP information related to previous Ashland filings has been reconciled with reported

GAAP results. Certain prior period adjusted pro forma results could not be reconciled to previous

GAAP statements filed by Ashland since it relied upon pro forma information from Hercules

Incorporated ("Hercules").

accepted accounting principles (GAAP) and should not be construed as an alternative to the reported

results determined in accordance with GAAP. Management has included this non-GAAP information

to assist in understanding the operating performance of the company and its segments. The non-

GAAP information provided may not be consistent with the methodologies used by other companies.

All non-GAAP information related to previous Ashland filings has been reconciled with reported

GAAP results. Certain prior period adjusted pro forma results could not be reconciled to previous

GAAP statements filed by Ashland since it relied upon pro forma information from Hercules

Incorporated ("Hercules").

The

unaudited adjusted pro forma results are presented for informational purposes

only and do not

reflect future events that may occur or any operating efficiencies or inefficiencies that may result

from the acquisition of Hercules. Certain significant and identifiable cost allocation, reporting and

accounting policy differences have been reflected in these adjusted pro forma results. However,

these adjusted pro forma results do not purport to identify all these differences. Therefore, the

unaudited adjusted pro forma results are not necessarily indicative of results that would have been

achieved had the businesses been combined during the period presented or the results that Ashland

will experience in the future. In addition, the preparation of financial statements in conformity with

GAAP requires management to make certain estimates and assumptions. These estimates and

assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and the reported amounts of sales and expenses

during the reporting period. These estimates and assumptions can be significantly different

depending on changes to conform to Ashland policy.

reflect future events that may occur or any operating efficiencies or inefficiencies that may result

from the acquisition of Hercules. Certain significant and identifiable cost allocation, reporting and

accounting policy differences have been reflected in these adjusted pro forma results. However,

these adjusted pro forma results do not purport to identify all these differences. Therefore, the

unaudited adjusted pro forma results are not necessarily indicative of results that would have been

achieved had the businesses been combined during the period presented or the results that Ashland

will experience in the future. In addition, the preparation of financial statements in conformity with

GAAP requires management to make certain estimates and assumptions. These estimates and

assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and the reported amounts of sales and expenses

during the reporting period. These estimates and assumptions can be significantly different

depending on changes to conform to Ashland policy.

Ashland

Inc. and Consolidated Subsidiaries

Reconciliation

of Fiscal Year 2009 Non-GAAP Data

($ millions, except percentages)

|

Ashland

Aqualon Functional Ingredients

|

Ashland

FY 2009

GAAP

Results

|

Pre-Acquisition

Period:

Hercules

Oct.

1 - Nov. 13, 2008

|

Key

Items

|

Adjusted

|

||||||||||||

|

Sales

|

812 | 112 | 924 | |||||||||||||

|

Cost

of sales

|

595 | 77 | (30 | ) | 642 | |||||||||||

|

Selling,

general and administrative expenses (includes R&D)

|

181 | 20 | (15 | ) | 186 | |||||||||||

|

Equity

and other income

|

- | - | - | - | ||||||||||||

|

Operating

income

|

36 | 15 | 45 | 96 | ||||||||||||

|

Operating

income as a percent of sales

|

4.4 | % | 13.4 | % | 10.4 | % | ||||||||||

|

Gross

profit as a percent of sales

|

26.7 | % | 31.3 | % | 30.5 | % | ||||||||||

|

D&A

|

106 | 6 | (5 | ) | 107 | |||||||||||

|

EBITDA

|

142 | 21 | 40 | 203 | ||||||||||||

|

EBITDA

as a percent of sales

|

17.5 | % | 18.8 | % | 22.0 | % | ||||||||||

|

Ashland

Hercules Water Technologies

|

Ashland

FY 2009

GAAP

Results

|

Pre-Acquisition

Period:

Hercules

Oct.

1 - Nov. 13, 2008

|

Key

Items

|

Adjusted

|

||||||||||||

|

Sales

|

1,652 | 155 | 1,807 | |||||||||||||

|

Cost

of sales

|

1,092 | 116 | (7 | ) | 1,201 | |||||||||||

|

Selling,

general and administrative expenses (includes R&D)

|

484 | 34 | (9 | ) | 509 | |||||||||||

|

Equity

and other income

|

2 | - | - | 2 | ||||||||||||

|

Operating

income

|

78 | 5 | 16 | 99 | ||||||||||||

|

Operating

income as a percent of sales

|

4.7 | % | 3.2 | % | 5.5 | % | ||||||||||

|

Gross

profit as a percent of sales

|

33.9 | % | 25.2 | % | 33.5 | % | ||||||||||

|

D&A

|

99 | 5 | (5 | ) | 99 | |||||||||||

|

EBITDA

|

177 | 10 | 11 | 198 | ||||||||||||

|

EBITDA

as a percent of sales

|

10.7 | % | 6.5 | % | 11.0 | % | ||||||||||

(continued

next page)

Ashland

Inc. and Consolidated Subsidiaries

Reconciliation of Fiscal Year

2009 Non-GAAP Data (cont. from prior

page)

($ millions, except percentages)

|

Ashland

Performance Materials

|

Ashland

FY 2009

GAAP

Results

|

Pre-Acquisition

Period:

Hercules

Oct.

1 - Nov. 13, 2008

|

Key

Items

|

Adjusted

|

||||||||||||

|

Sales

|

1,106 | 1,106 | ||||||||||||||

|

Cost

of sales

|

918 | (17 | ) | 901 | ||||||||||||

|

Selling,

general and administrative expenses (includes R&D)

|

199 | (6 | ) | 193 | ||||||||||||

|

Equity

and other income

|

12 | 3 | 15 | |||||||||||||

|

Operating

income

|

1 | 26 | 27 | |||||||||||||

|

Operating

income as a percent of sales

|

0.1 | % | 2.4 | % | ||||||||||||

|

Gross

profit as a percent of sales

|

17.0 | % | 18.5 | % | ||||||||||||

|

D&A

|

63 | (14 | ) | 49 | ||||||||||||

|

EBITDA

|

64 | 12 | 76 | |||||||||||||

|

EBITDA

as a percent of sales

|

5.8 | % | 6.9 | % | ||||||||||||

|

Ashland

Consumer Markets

|

Ashland

FY 2009

GAAP

Results

|

Pre-Acquisition

Period:

Hercules

Oct.

1 - Nov. 13, 2008

|

Key

Items

|

Adjusted

|

||||||||||||

|

Sales

|

1,650 | 1,650 | ||||||||||||||

|

Cost

of sales

|

1,122 | - | 1,122 | |||||||||||||

|

Selling,

general and administrative expenses (includes R&D)

|

292 | - | 292 | |||||||||||||

|

Equity

and other income

|

16 | - | 16 | |||||||||||||

|

Operating

income

|

252 | - | 252 | |||||||||||||

|

Operating

income as a percent of sales

|

15.3 | % | 15.3 | % | ||||||||||||

|

Gross

profit as a percent of sales

|

32.0 | % | 32.0 | % | ||||||||||||

|

D&A

|

36 | - | 36 | |||||||||||||

|

EBITDA

|

288 | - | 288 | |||||||||||||

|

EBITDA

as a percent of sales

|

17.5 | % | 17.5 | % | ||||||||||||

(continued

next page)

Ashland

Inc. and Consolidated Subsidiaries

Reconciliation of Fiscal Year

2009 Non-GAAP Data (cont. from prior

page)

($ millions, except percentages)

|

Ashland

Distribution

|

Ashland

FY 2009

GAAP

Results

|

Pre-Acquisition

Period:

Hercules

Oct.

1 - Nov. 13, 2008

|

Key

Items

|

Adjusted

|

||||||||||||

|

Sales

|

3,020 | 3,020 | ||||||||||||||

|

Cost

of sales

|

2,719 | - | 2,719 | |||||||||||||

|

Selling,

general and administrative expenses (includes R&D)

|

253 | (4 | ) | 249 | ||||||||||||

|

Equity

and other income

|

4 | - | 4 | |||||||||||||

|

Operating

income

|

52 | 4 | 56 | |||||||||||||

|

Operating

income as a percent of sales

|

1.7 | % | 1.9 | % | ||||||||||||

|

Gross

profit as a percent of sales

|

10.0 | % | 10.0 | % | ||||||||||||

|

D&A

|

28 | - | 28 | |||||||||||||

|

EBITDA

|

80 | 4 | 84 | |||||||||||||

|

EBITDA

as a percent of sales

|

2.6 | % | 2.8 | % | ||||||||||||

|

Intersegment

Sales/Unallocated and Other

|

Ashland

FY 2009

GAAP

Results

|

Pre-Acquisition

Period:

Hercules

Oct.

1 - Nov. 13, 2008

|

Key

Items

|

Adjusted

|

||||||||||||

|

Sales

|

(134 | ) | (134 | ) | ||||||||||||

|

Cost

of sales

|

(129 | ) | (2 | ) | (131 | ) | ||||||||||

|

Selling,

general and administrative expenses (includes R&D)

|

28 | (25 | ) | 3 | ||||||||||||

|

Equity

and other income

|

4 | 4 | - | 8 | ||||||||||||

|

Operating

income

|

(29 | ) | 4 | 27 | 2 | |||||||||||

|

D&A

|

7 | (4 | ) | 3 | ||||||||||||

|

EBITDA

|

(22 | ) | 4 | 23 | 5 | |||||||||||

|

Ashland

Consolidated

|

Ashland

FY 2009

GAAP

Results

|

Pre-Acquisition

Period:

Hercules

Oct.

1 - Nov. 13, 2008

|

Key

Items

|

Adjusted

|

||||||||||||

|

Sales

|

8,106

|

|

267 | - |

8,373

|

|

||||||||||

|

Cost

of sales

|

6,317

|

|

193 |

(56

|

)

|

6,454

|

|

|||||||||

|

Selling,

general and administrative expenses (includes R&D)

|

1,437

|

54 |

(59

|

)

|

1,432

|

|||||||||||

|

Equity

and other income

|

38

|

4

|

3

|

45

|

||||||||||||

|

Operating

income

|

390

|

|

24

|

118

|

532

|

|||||||||||

|

Operating

income as a percent of sales

|

4.8 | % | 9.0 | % | 6.4 | % | ||||||||||

|

Gross

profit as a percent of sales

|

22.1 | % | 27.7 | % | 22.9 | % | ||||||||||

|

D&A

|

339

|

11 |

(28

|

)

|

322

|

|||||||||||

|

EBITDA

|

729

|

|

35

|

90

|

854

|

|||||||||||

|

EBITDA as a percent of

sales

|

9.0 | % | 13.1 | % | 10.2 | % | ||||||||||