Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 001-33844

Entropic Communications, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 33-0947630 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

6290 Sequence Drive

San Diego, CA 92121

(Address of Principal Executive Offices, Including Zip Code)

Registrant’s telephone number, including area code: (858) 768-3600

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.001 per share | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer x | |||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $110.6 million based on the closing price of the registrant’s common stock on The NASDAQ Global Market of $2.25 per share on June 30, 2009.

There were 71,501,575 shares of the registrant’s common stock issued and outstanding as of February 1, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference certain information from the registrant’s definitive proxy statement for the registrant’s 2010 Annual Meeting of Stockholders to be filed within 120 days after the end of the registrant’s fiscal year ended December 31, 2009.

Table of Contents

ENTROPIC COMMUNICATIONS, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

| Page | ||||

| PART I | ||||

| Item 1. |

2 | |||

| 18 | ||||

| Item 1A. |

24 | |||

| Item 1B. |

52 | |||

| Item 2. |

52 | |||

| Item 3. |

52 | |||

| Item 4. |

52 | |||

| PART II | ||||

| Item 5. |

53 | |||

| Item 6. |

57 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

59 | ||

| Item 7A. |

79 | |||

| Item 8. |

81 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

81 | ||

| Item 9A. |

81 | |||

| Item 9B. |

84 | |||

| PART III | ||||

| Item 10. |

85 | |||

| Item 11. |

85 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

85 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

85 | ||

| Item 14. |

86 | |||

| PART IV | ||||

| Item 15. |

87 | |||

Entropic, Entropic Communications, c.LINK®, RF Magic and our logo are among the trademarks of Entropic Communications, Inc. and/or its affiliates in the United States and certain foreign countries. Any other trademarks or trade names mentioned are the property of their respective owners.

i

Table of Contents

FORWARD-LOOKING STATEMENTS

All statements included or incorporated by reference in this Annual Report on Form 10-K, or Annual Report, other than statements or characterizations of historical fact, are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements concerning our ability to achieve or sustain profitability; the competitive nature of the markets in which we compete and the effect of competing products and technologies; the demand for our products; the adoption of our technologies and the Multimedia over Coax Alliance standard; the competitive nature of service providers; our dependence on manufacturers, sales representatives, distributors and other third parties; our ability to create and introduce new products and technologies; our ability to effectively manage growth; our ability to successfully acquire companies or technologies that would complement our business and successfully integrate those companies or technologies with ours; the ability of our contract manufacturers to produce and deliver products in a timely manner and at satisfactory prices; the transitioning of our silicon products to improved manufacturing process technologies; our ability to protect our intellectual property and avoid infringement of the intellectual property of others; our reliance on our key personnel; the effects of government regulation; our ability to obtain sufficient capital to expand our business; our ability to manage our business in the midst of a downturn in the economy; the cyclical nature of our industry; our ability to effectively transact business in foreign countries; and our ability to achieve and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002.

The following discussion contains forward-looking statements, which involve risks and uncertainties. These forward-looking statements are based on our current expectations, estimates, approximations and projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing” and similar expressions, and variations or negatives of these words. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors, some of which are listed under Part I, Item 1A, Risk Factors of this Annual Report and in our other filings with the Securities and Exchange Commission, or SEC. These forward-looking statements reflect our management’s belief and views with respect to future events and are based on estimates and assumptions as of the date of this Annual Report and are subject to risks and uncertainties. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements in this Annual Report or in our other filings with the SEC.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in these forward-looking statements.

In this Annual Report, “Entropic Communications, Inc.”, “Entropic Communications”, “Entropic”, the “Company”, “we”, “us” and “our” refer to Entropic Communications, Inc. and its subsidiaries, taken as a whole, unless otherwise noted.

1

Table of Contents

PART I

| Item 1. | Business |

Overview

Entropic Communications is a leading fabless semiconductor company that designs, develops and markets systems solutions to enable connected home entertainment. Our technologies significantly change the way high-definition and standard-definition television-quality video, or HD video and SD video, respectively, and other multimedia content such as movies, music, games and photos are brought into and delivered throughout the home.

We are a pioneer of key technologies that enable connected home networking of digital entertainment over existing coaxial cable. We are a founding member of the Multimedia over Coax Alliance, or MoCA, a global home networking consortium that sets standards for the distribution of video and other multimedia entertainment over coaxial cable. Our products include:

| • | home networking chipsets based on the MoCA standard; |

| • | high-speed broadband access chipsets; |

| • | integrated circuits that simplify and enhance digital broadcast satellite, or DBS services; and |

| • | silicon tuner integrated circuits. |

Our products allow telecommunications carriers, cable multiple service operators, or MSOs, and DBS service providers, which we collectively refer to as service providers, to enhance and expand their service offerings and reduce deployment costs in an increasingly competitive environment.

Our home networking solutions capitalize on the worldwide conversion of multimedia content, including video, from analog to digital. Multimedia content is now easy to store on digital video recorders, or DVRs, gaming consoles, digital versatile disk, or DVD, recorders and personal computers. The ability to store this content on various devices has created “islands” of digital entertainment within the home. Our products bridge these islands and allow consumers to access their multimedia content throughout the home. Today, we are the only high-volume supplier of MoCA-compliant chipsets, which can be embedded in a wide variety of consumer electronic devices. Service providers can employ our solutions to offer consumer applications such as multi-room DVR, multi-room and online gaming, personal computer-to-television content sharing and streaming of downloaded movies stored on a personal computer to a television. Our products also enable a new generation of consumer devices, including gaming consoles, high-definition televisions, or HDTVs, Blu-ray players and over-the-top, or OTT, set-top boxes to stream high-quality content directly and reliably from the internet.

We have extensive core competencies in video communications, networking algorithms and protocols, system-on-a-chip design, embedded software, mixed signal and radio frequency integrated circuit design, and communications and radio frequency systems. We use our considerable experience with service provider-based deployments to create solutions that address the complex requirements associated with delivering multiple streams of HD video into and throughout the home while seamlessly coexisting with video, voice and data services that are using the same coaxial cable infrastructure.

We were incorporated in Delaware in January 2001. Our principal executive offices are located at 6290 Sequence Drive, San Diego, California 92121, and our telephone number is (858) 768-3600. Our corporate website address is www.entropic.com. Our current and future annual reports on Form 10-K, future quarterly reports on Form 10-Q, current reports on Form 8-K and other filings with

2

Table of Contents

the SEC are available, free of charge, through the investor relations section of our website as soon as reasonably practicable after we electronically file such material with, or furnish them to, the SEC. The information contained on, or accessible through, our website is not intended to be part of this or any other report we file with, or furnish to, the SEC. Our common stock trades on The NASDAQ Global Market under the symbol ENTR.

Industry Background

Intense competition among service providers seeking to maximize revenues is driving a revolution in the delivery of video and other multimedia content into and throughout the home. These service providers are making significant infrastructure investments to differentiate their offerings by adding new video services such as HDTV, DVR and video on demand as well as bundled video, voice and broadband data, also referred to as “triple-play”, services. In fact, consumers typically pay a higher price for video services than for traditional voice and broadband services. A successful video offering is critical for service providers to increase average revenue per user, drive subscriber growth and reduce subscriber turnover.

Several favorable consumer entertainment trends are contributing to the increasing video and multimedia revenue opportunity for service providers. These trends include:

| • | Increasing availability of digital multimedia content. The conversion of multimedia content from an analog to a digital format, the increasing number of broadcast content providers who make their video content available for online video streaming, and the introduction of three dimensional, or 3D, video content, are significantly increasing the amount and variety of video, music, photos and other multimedia content that consumers buy, receive and store. |

| • | Proliferation of connected digital multimedia devices within the home. As a result of the increasing availability of multimedia content from sources inside the home and from the internet, connected digital multimedia devices such as HDTVs, desktop and laptop personal computers, DVD players, Blu-ray players, CD players, MP3 players, gaming consoles, DVRs and OTT set-top boxes can now be found in U.S. households in increasing numbers. |

| • | Introduction of new multimedia applications. An increasing number of multimedia applications utilize digital video and other multimedia content for consumer home entertainment. Some examples of these applications include video “time shifting”, or the ability to pause, fast forward and rewind live or stored video, the ability to watch and record multiple television shows at once, video or movie on demand, personal computer-to-television content sharing, multi-room and online gaming, streaming of downloaded movies stored on a personal computer to a television, and OTT services that directly deliver internet video content into the home. |

These trends have resulted in a growing number of “islands” of stored multimedia content within the home, including SD and HD video, movies and broadcast television programs. Service providers and original equipment manufacturers, or OEMs, have identified a tremendous opportunity to seamlessly bridge these “islands” and enable the sharing of such content across devices and between rooms throughout the home. At the same time, as the popularity of online video streaming continues to grow, broadcast service providers recognize the growing need to provide combined broadband and broadcast services to retain their existing subscribers. To address this opportunity and meet evolving customer expectations, service providers are introducing new customer premises equipment and service offerings such as multi-room DVR, which allows for video “placeshifting”, or the ability to access content from multiple locations and devices, and a new class of devices that connect the coaxial network in the home to online services. By providing improved customer premises equipment, service providers are able to easily introduce new services, simplify and

3

Table of Contents

enhance the user experience, and provide content security and service reliability. We believe service providers are competitively positioned to provide these services because they already have licensed access and distribution rights for premium video content and have established the infrastructure that enables carrier class quality of service, or QoS.

The stringent communications requirements associated with high-quality HD video, 3D video and other multimedia content present a significant obstacle for service providers today. In response, service providers require technology solutions that enable the distribution of such content into and throughout the home while maintaining the requisite high-quality standards demanded by subscribers. For any such technology solution to succeed, we believe it must satisfy the following requirements:

| • | High bandwidth, reliability and full QoS for HD video. Due to the fact that video is a streaming, real-time, visual experience, video quality rapidly degrades with any errors or delays in packet delivery. A high-quality video experience requires reliable first-pass transmission, very low packet error rate, low latency and low jitter. Moreover, video consumes up to 10 times more bandwidth than typical voice and data services and has higher QoS requirements. A connected home with capacity to support multiple high-quality HD video streams requires a high bandwidth network with net throughput in excess of 100 megabits per second. |

| • | Cost-effective deployment. It is important for service providers to leverage the existing installed network infrastructure inside and outside the home to minimize incremental cost and expedite new service deployments. Service providers prefer plug-and-play installation of new services as opposed to having to dispatch a service vehicle to customer premises, often referred to as a “truck roll.” Service providers are focused on saving installation time and minimizing customer service calls, thereby reducing total costs to deliver video services. |

| • | Customer ease of use. Most consumers have little tolerance for complicated consumer devices or service disruptions. Therefore, mainstream consumer adoption requires an easy to use and compelling service offering and plug-and-play service installation with minimal ongoing maintenance. |

| • | Co-existence with other services and devices. Consumers currently subscribe to a broad array of communications services, including traditional voice, cable, satellite or telecommunications carriers television, broadband access and cellular wireless, that are delivered using a number of different technologies. In addition, consumers may use a multitude of computing, communications and consumer electronics devices, such as personal computers, video players, gaming consoles, set-top boxes and televisions. Any successful home networking or access solution must seamlessly co-exist with existing services and devices without any interference or degradation in performance. |

| • | Security. The ability to protect content and consumer privacy is a key element of any successful bundled service offering. Therefore, home networking and access solutions require data encryption and other security mechanisms. |

To address these requirements, service providers are exploring home networking and access technology platforms that enable delivery of new services into and throughout the home. There are a variety of other technologies for delivering video into and throughout the home. Broadband access technology solutions include Data over Cable Service Interface Specifications, or DOCSIS, versions of Digital Subscriber Line, or xDSL, Ethernet and Worldwide Interoperability for Microwave Access, or WiMAX. Home networking technology solutions include Ethernet, HomePNA, HomePlug AV and Wi-Fi. In addition, the International Telecommunication Union, or ITU, is currently developing a new home networking technology known as g.HN. We believe each of these other technologies currently

4

Table of Contents

have limitations in meeting all the requirements necessary to effectively deliver multiple streams of SD, HD and 3D video and other multimedia content into and throughout the home.

Our Solutions

Entropic Communications provides systems solutions comprised of silicon integrated circuits with embedded software as a platform to enable delivery of multiple streams of HD video and other multimedia content into and throughout the home. Our solutions are based upon our ability to combine the following core competencies:

| • | Video communications, networking algorithms and protocols. We have extensive experience in defining and developing physical layer and media access controller protocols as well as networking, routing and security protocols. This includes expertise in advanced equalization, modulation and coding techniques, and contention-free media access controller protocols required for high quality of service video delivery. |

| • | System-on-a-chip design, mixed signal and embedded software capabilities. Our ability to integrate multiple complex functions into a single silicon solution is a result of our significant experience in many disciplines, including embedded system architecture, high-speed very large-scale integration design, microcontrollers, embedded software, packet processing and high-performance mixed signal design. Our mixed signal design expertise includes designing high-performance analog-to-digital and digital-to-analog converters. We also have in-depth experience in packaging design and automated high-volume test development, which allows us to develop cost-effective solutions. |

| • | Radio frequency integrated circuit design expertise. We have extensive experience developing highly-integrated radio frequency integrated circuits. Our broad radio frequency systems and design capability allow us to provide solutions that seamlessly integrate radio frequency functionality within a digital communications platform. Our team has extensive experience with the complex task of integrating digital, high-speed mixed signal and radio frequency integrated circuit designs into complementary metal-oxide semiconductor, or CMOS, systems-on-a-chip. |

| • | Comprehensive communications and radio frequency systems-level capabilities. Our system-level knowledge is the result of significant experience supplying solutions for service provider networks and includes an understanding of the critical elements in coaxial cable and satellite networks, such as service provider equipment and other devices both inside and outside the home. |

| • | Domain expertise in operator-based deployments. We have close working relationships with service providers, their original design manufacturer, or ODM, and OEM partners, and the consumer electronics markets that they serve. Our extensive experience with service provider deployments allows us to deliver rapid time-to-market solutions over multiple generations of customer premises equipment and access equipment. These close working relationships allow us to serve as a “trusted advisor” and contribute to and gain insight into future service provider, ODM and OEM roadmaps. |

Our products include home networking, broadband access, DBS outdoor unit solutions and silicon tuners. Our solutions target applications in all HD video and other multimedia content distribution networks through cable, satellite, telecommunications and terrestrial mediums. Our solutions are currently used in consumer electronic and networking devices, including set-top boxes, broadband routers with embedded wireless home networking (utilizing in-home coaxial cables as a wireless “backbone” to increase the coverage of the wireless home network), optical network terminals, low-noise block converters, multi-room DVRs, residential gateways and Ethernet-to-coax-bridges, and can potentially be used in other devices, such as digital televisions, gaming consoles, OTT set-top-boxes, media servers and network attached storage devices.

5

Table of Contents

Home Networking

Our home networking solutions target a large and rapidly growing market. Our home networking solutions are based on the MoCA standard. We are a founding member of MoCA, which was established in 2004 and includes as its members many major service providers, communications equipment companies, semiconductor manufacturers and consumer electronics companies. MoCA-based products use existing coaxial cable to create a robust internet protocol-based network for easy sharing of HD video and other multimedia content throughout the home. We expect that MoCA-based products will be widely accepted by service providers for digital home entertainment networking.

The implementation of home networking chipsets based on the MoCA specification requires expertise in multiple technical disciplines as well as extensive integration and testing. Any home network technology using the existing coaxial cable must overcome the inherent constraints of such infrastructure. The in-home coaxial cable network was designed to isolate individual cable outlets from each other in order to eliminate potential video signal interference between television sets that reside at different coaxial cable outlets in the home. The successful implementation of MoCA requires integrated circuits that support high wire speed signal transmission and enable low-level signal detection, real-time error correction and recovery. The broad range of expertise required for such implementation includes physical layer and media access controller system engineering, radio frequency integrated circuit and high-speed mixed signal design, complex baseband system-on-a-chip experience and embedded software expertise. In addition, MoCA designs must undergo a formal certification process in order to ensure interoperability and full compliance with the MoCA specification.

We have been working on home networking technologies on which the MoCA specification is based since 2001 and began shipping production quantities of MoCA-compliant chipsets in December 2004. We have started shipping our third generation of MoCA-compliant products. Our MoCA-compliant chipsets are incorporated in the equipment being deployed by Verizon Communications Inc., or Verizon, as part of its FiOS offering. We are currently the exclusive provider of chipsets that enable home networking applications such as multi-room DVR for Verizon’s FiOS offering. Our MoCA-compliant products can be used to support on demand video services, online video streaming services, personal computer-to-television content sharing and multi-room and online gaming. We see a growing need for a highly reliable wired home networking solution to support these new multimedia applications.

We believe that our pioneering role in developing the MoCA standard and our success to date in providing these solutions position us well to continue to be the leading provider of MoCA-compliant connected home entertainment solutions. Our MoCA-compliant home networking solutions provide the following key benefits:

| • | High data rates. In field trials defined and conducted by MoCA, our first generation solutions consistently delivered net throughput in excess of 110 megabits per second in real world conditions with no loss in performance when multiple devices were connected to the network. This performance enables sharing of multiple simultaneous streams of HD video. Our second and third generation solutions continue to have a physical layer rate of up to 270 megabits per second and we have increased net throughput to up to 175 megabits per second. The physical layer rate refers to the maximum speeds of the physical layer of our integrated circuits, while net throughput refers to the rate at which data is actually made available to applications and experienced by users. |

| • | High-quality video experience. Our solutions provide a reliable and high-quality video experience for the consumer that meets service provider requirements. Our solutions operate at frequencies on the coaxial cable that do not interfere with other services or devices. Our physical layer and media access controller provide a very low native packet error rate, |

6

Table of Contents

| without retransmissions, that is essential for service provider-quality HD video. Our media access controller is time coordinated and eliminates collisions in the network. Our solution also provides prioritized QoS and a reserved bandwidth, or parameterized QoS. |

| • | Ease of installation and use. Our solutions leverage the existing coaxial cable infrastructure and do not require expensive new wiring in the home. The plug-and-play installation of our solutions makes it easy for consumers to install and use and allows service providers to rapidly deploy new services. Both of these features enable service providers to minimize costly truck rolls. |

| • | Security and reliability. Our solutions operate on coaxial cable, which is a shielded, wired medium that can be simply isolated from neighboring home networks through both logical and physical means. We support service provider-based conditional access systems and related digital rights management and provide basic encryption for consumer privacy of personal multimedia content. In addition, our solutions create a self-healing network that provides high levels of fault tolerance and reliability. |

| • | Remote upgrade and diagnostics. Our solutions allow service providers to remotely upgrade firmware which gives them the ability to continuously enhance the features of their service offerings without truck rolls. Our solutions’ remote diagnostics tools also allow service providers to remotely diagnose and potentially remediate the home coaxial cable environment. |

Broadband Access

Our broadband access solutions are designed to meet broadband access requirements in areas characterized by fiber optic networks that terminate within one kilometer of a customer premises. In particular, our solutions allow cable service operators with fiber optic deployments to offer broadband triple play services that are competitive with very high-speed digital subscriber line, or VDSL, services offered by telecommunications carriers. We believe that this is a large potential target market for our broadband access products, and we are at an early stage in penetrating these markets.

Our broadband access solutions use coaxial cable infrastructure to deliver “last kilometer” connectivity for high-speed broadband access to single-family homes and multiple dwelling units. They incorporate the same physical layer used in our home networking products and a different network-optimized media access controller technology. Our broadband access solutions offer high performance with net throughput in excess of 100 megabits per second. The point-to-multi-point architecture of our solutions currently supports up to 61 subscribers on a single radio frequency channel. Our solutions can simultaneously support up to four channels over a single coaxial cable. As a result, our solutions are scalable up to 252 subscribers over a single distribution cable, supporting an effective net throughput in excess of 500 megabits per second. Our high-speed broadband access solutions enable service providers to offer bundled triple-play services over their existing services and cable infrastructure.

DBS Outdoor Unit

Our DBS outdoor unit solutions target the large and growing digital broadcast satellite market. In a traditional satellite installation, the ability to select multiple channels simultaneously may require multiple cables from the satellite dish to the set-top box. For example, in order to simultaneously view and record separate programs from the full channel lineup with DVRs in three rooms in a house, a user would need six separate cables from outside the home. Our DBS outdoor unit products can significantly reduce the deployment costs for digital broadcast satellite providers by allowing them to send multiple video streams from individual or multiple satellites into the home over a single cable. This simplified cabling architecture enables digital broadcast satellite providers to deploy set-top

7

Table of Contents

boxes, with multiple tuner capabilities, in multiple rooms and roll out new services without expensive installation and retrofitting while improving aesthetics. We believe that our solutions can improve the competitiveness of digital broadcast satellite services by reducing subscriber acquisition costs, decreasing additional services deployment costs and enabling a more attractive product offering. We are increasing our penetration within this target market.

Our DBS outdoor unit products include band translation switch and channel stacking switch integrated circuits, which are highly complex single-chip radio frequency integrated circuits that integrate multiple independent signal receivers and multiple discrete analog functions onto a single silicon die. Moreover, as many as four channel stacking switch integrated circuits can be linked to provide up to 12 digital broadcast satellite signals on a single cable. Our band translation switch products, which were specifically designed to operate with the DISH Network’s service offerings, are sold only to customers who incorporate them into products deployed by DISH Network. We sell our channel stacking switch products to customers who incorporate them into products deployed by other DBS service providers. We are the pioneers in developing band translation switch and channel stacking switch radio frequency integrated circuits and we have helped to define the standard for satellite signal distribution over a single cable in conjunction with members of the European Committee for Electrotechnical Standardization, or CENELEC. We believe that single cable standardization will lead to more rapid adoption and further expand the market for our products. Our band translation switch products are currently used in outdoor equipment deployed by DISH Network and our channel stacking switch products are currently used in outdoor equipment deployed by DIRECTV and other service providers.

Silicon Tuner

We provide silicon tuner integrated circuits for cable and terrestrial applications that conform to most major digital and analog video broadcast standards, including the U.S. and international broadcasting standards. Many set-top boxes and integrated digital televisions will have multiple tuners to enable advanced features such as DVR, watch-and-record functionality and picture-in-picture viewing, further expanding the market for tuner integrated circuits. Our tuner integrated circuits integrate radio frequency functions, including those performed by a surface acoustic wave, or SAW, filter, with other major discrete components onto a single die while maintaining the performance of traditional non-silicon can tuners. Our highly integrated solutions significantly reduce our customers’ design costs and shrink the tuner footprint in consumer electronics devices. We believe that the performance and small footprint of our tuners will lead to greater adoption of multiple-tuner applications across a broad range of consumer electronics.

8

Table of Contents

Our Products

We offer products that provide solutions for the delivery of HD video and other multimedia content into and throughout the connected home. Our products include home networking, broadband access, DBS outdoor unit and silicon tuner solutions. The chart below lists, for each of our products, its description, target markets and representative target devices or applications:

| Product |

Description |

Target Markets |

Representative Target Devices or Applications | |||

| Home Networking |

||||||

| EN101x |

Coaxial network interface radio frequency |

Networked home entertainment devices |

Multi-room DVR, set-top box, digital television, gaming console, home media server, residential gateway, personal computer and optical network terminal | |||

| EN2xxx |

Coaxial network controller integrated circuit |

Networked home entertainment devices |

Multi-room DVR, set-top box, digital television, gaming console, home media server, residential gateway, personal computer and optical network terminal | |||

| Broadband Access |

||||||

| EN101x |

Coaxial network interface radio frequency |

Broadband access, internet protocol television, and voice over internet protocol |

Optical network terminal, point-of-entry network controller, and access customer premises equipment for single family homes and multiple dwelling units | |||

| EN3011 |

Access network controller integrated circuit |

Broadband access, internet protocol television and voice over internet protocol |

Optical network terminal and point-of-entry network controller for single family homes and multiple dwelling units | |||

| EN3230 |

Access client integrated circuit | Broadband access, internet protocol television and voice over internet protocol |

Access customer premises equipment for single family homes and multiple dwelling units | |||

| DBS Outdoor Unit |

||||||

| RF5000 |

Band translation switch—Dual 2-channel integrated circuit |

U.S. digital broadcast satellite |

Low-noise block converter and multi-switch digital broadcast satellite products for single family homes and multiple dwelling units | |||

| RF510x |

Band translation switch—Triple 2-channel integrated circuit |

U.S. digital broadcast satellite |

Low-noise block converter and multi-switch digital broadcast satellite products for single family homes and multiple dwelling units | |||

| RF520x |

Channel stacking switch— 3-channel integrated circuit |

U.S. digital broadcast satellite |

Low-noise block converter and multi-switch digital broadcast satellite products for single family homes and multiple dwelling units | |||

| RF521x |

Channel stacking switch— 3-channel integrated circuit |

Global digital broadcast satellite |

Low-noise block converter and multi-switch digital broadcast satellite products for single family homes and multiple dwelling units | |||

| Silicon Tuners |

||||||

| RF4000/4400 |

Silicon tuner integrated circuit— Digital terrestrial |

Digital television and recorders |

HDTV, DVR, personal computer and converter boxes | |||

| RF4800 |

Silicon tuner integrated circuit— Digital cable |

Cable set-top boxes and cable-ready television |

DVR, set-top box and cable modem | |||

| EN4020 |

Universal silicon tuner integrated circuit |

Global terrestrial and cable television |

Digital TV, digital set-top box, DVR, DVD recorder, PCTV and cable modem products | |||

9

Table of Contents

Our Technology

We believe that we possess the expertise and experience, breadth and depth of technologies and the skills required to address and compete effectively in our target markets. These capabilities result from our in-depth understanding of the environments in which we operate, knowledge and experience with customer and operator requirements, and extensive communications system understanding.

Home Networking

Our home networking products are based on an innovative platform technology that allows very high-speed and reliable communications between coaxial cable home outlets without the need to modify the home coaxial cable system and without interfering with existing cable television services. This technology has been designed to address the very difficult communications environment of the coaxial cable home network architecture. We have developed an in-depth understanding of the home coaxial cable environment as a result of extensive testing and characterization of both the coaxial cable home network and its components, such as splitters, cables, taps and home entertainment devices including television sets and set-top boxes. These tests provided us with a large database of home coaxial cable network characteristics from which we have developed a set of tools and models that we use to optimize our solutions for this environment.

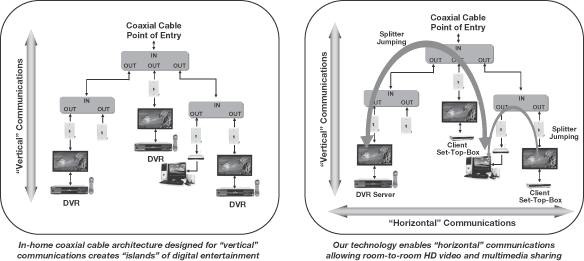

Coaxial home cabling is designed for “vertical” communications to and from the cable system head-end to the devices connected to coaxial cable outlets in the home, such as television sets and set-top boxes, and has in the past primarily been used for the delivery of cable television, data (cable modem) and, more recently, VoIP, also known as voice over internet protocol services. The in-home coaxial cable architecture has been specifically designed to prevent inter-outlet communications through the use of splitters with high port-to-port isolation. This leads to a highly dispersive physical layer channel, over which it is difficult for typical digital communication systems to operate. The historical inability to address these issues associated with in-home coaxial cable architecture has contributed to the creation of “islands” of digital entertainment within the home.

Our home networking technology is a full-mesh, peer-to-peer network. It overcomes the inherent limitations of home coaxial cable cabling and enables high-speed “horizontal” communications between the outlets in cable homes. This is accomplished through a combination of an adaptive physical layer that optimizes the signal modulation in order to maximize the channel capacity of the in-home coaxial cable network and a unique media access controller protocol that maintains very low latency independent of network load by allocating channel resources without contention or retransmission. The system simplifies installation and maintenance requirements through the use of an ad-hoc network controller functionality, which makes the network self-healing and provides redundancy. Our home networking solution is implemented using an efficient and flexible architecture through an optimized combination of hardware, firmware, software and cost effective radio frequency integrated circuit and system-on-a-chip implementations.

10

Table of Contents

The following graphic demonstrates how our home networking technology enables horizontal communications between home coaxial cable outlets, providing room-to-room connectivity, in addition to the vertical communications path traditionally used in the home coaxial cable system:

Our home networking technology was selected as the basis for the first generation MoCA standard for home networking over coaxial cable after a selection process that involved an extensive and successful field trial conducted by MoCA. Actual deployment of our product demonstrated that our home networking technology repeatedly achieved a very reliable net throughput in excess of 110 megabits per second at acceptable packet error rate levels to support in-home video distribution at quality levels appropriate for service provider-based pay-television developments. This net throughput allows for the simultaneous delivery of more than four full-rate HDTV channels and other services, such as voice and data.

MoCA has adopted and approved its second generation of specifications, known as MoCA 1.1, which addresses the evolving needs of service providers, for more bandwidth, increased device support and guaranteed QoS. Our EN2210 product, which is the first MoCA 1.1 compliant product commercially available on the market, has been selected as the standard against which other devices will be tested for compliance with the MoCA 1.1 specifications. Our EN2210 and EN2510 solutions deliver a net throughput of up to 175 megabits per second, support up to 16 nodes, provide parameterized QoS and offer security through the use of a shielded, wired connection in combination with state of the art packet-level encryption technology. The components of our EN2210 and EN2510 products are designed to easily and cost-effectively distribute multiple streams of HD quality video entertainment via a highly reliable home network.

Broadband Access

Our broadband access solutions use coaxial cable infrastructure to deliver “last kilometer” connectivity for high-speed broadband access to single-family homes and multiple dwelling units. Our solutions are designed to work on passive coaxial cable networks. This means that a fiber node in the hybrid fiber coaxial, or HFC, network, or the passive optical network, or PON, terminates at the last active device in a coaxial cable wide area network. This termination point is typically within 600 meters of a customer’s premises. For active or passive coaxial cable distribution plants extending up to 1.2 kilometers, cable operators can use a c.LINK-compliant distribution amplifier which increases coverage while delivering the same throughput performance. Our solutions are based on our c.LINK

11

Table of Contents

Access technology and provide efficient communications between an access node, such as a fiber termination in the basement of an apartment building, and the cable outlets in each apartment throughout the building.

The c.LINK Access technology utilizes a single radio frequency channel for communicating in both the “upstream” and “downstream” directions. This allows flexibility in the allocations of bandwidth transmitted in either direction. For example, if a user has a significant amount of information to send from a computer, such as video files or photos loading to a server on the Internet, the c.LINK Access technology can allocate the available bandwidth for the requisite time duration to this “upstream” direction. Also, since the access node device and the client do not transmit and receive simultaneously, the device can share much of the front-end circuitry for both transmit and receive functions, resulting in additional cost savings. Since communications to different nodes in the network and to or from each device are accomplished through the time division of the radio frequency channel, a single device using our c.LINK Access technology at the access node can communicate with as many as 31 clients, resulting in a cost-effective solution for high-speed broadband access. The time division protocol also provides each client a deterministic time slot to access the network. It guarantees true quality of service under any traffic conditions. Our solution is also able to simultaneously support up to four channels over a single coaxial cable. As a result, our solution is scalable up to 252 subscribers over a single distribution cable supporting an effective physical layer rate of over 1 gigabit per second. In addition to scalability, our c.LINK Access technology can operate in a wide range of operating frequencies between 800MHz and 1500MHz.

DBS Outdoor Unit

Our DBS outdoor unit solutions simplify the installation required to support simultaneous reception of multiple channels from multiple satellites over a single cable. This capability is critical to allow a satellite receiver to enable picture-in-picture viewing or to record and watch two or more programs simultaneously, using a single cable. In cable television systems, all the channels are available over the coaxial cable connected to the television set or the cable set-top box. In satellite systems, the number of channels available from multiple satellites typically exceeds the channel carrying capabilities of the connecting cable. The channel stacking switch and band translation switch technologies are designed to select desired satellite channels and re-arrange them for delivery to the indoor set-top box over a single connecting cable. This single cable connects the outdoor unit to either many set-top boxes in and around the home or a media center inside the home, and delivers all the programs being viewed on the various devices inside the home. In a legacy system that does not use the channel stacking switch and band translation switch technologies, additional cables may be required as the numbers of simultaneously viewed satellite channels or the number of simultaneously viewed programs increases.

The implementation of such complex radio frequency processing in an integrated radio frequency integrated circuit requires our unique radio frequency system architecture and design capabilities, including the design of multiple, independently operable, low noise oscillators on a single die, cross-point switching and high isolation techniques realized in both circuit design and advanced floor planning methodologies.

Silicon Tuners

Our radio frequency technology is well suited for the design of low-cost, high-performance, low-power and small footprint, terrestrial and cable single and multiple tuner integrated circuits. Our silicon tuner integrated circuits integrate radio frequency functions, including those performed by a SAW filter, with other major discrete components into a single die while maintaining the performance of traditional non-silicon can tuners. Our system architecture is capable of addressing today’s legacy

12

Table of Contents

standard interfaces to digital demodulation integrated circuits, and at the same time is optimized for future interfaces. This architecture is also ideal for an integrated, multiple tuner, single integrated circuit implementation. Our low noise, high dynamic range front-end and low phase noise design combined with the integrated, tunable, high selectivity radio frequency filters ensures that we can meet the stringent requirements of both digital and analog terrestrial and cable applications. Our fully-integrated, auto-calibrated, analog signal processing and high isolation techniques, including advanced floor-planning methodologies, enable us to design multi-standard, multiple tuners on a single silicon die.

Our new generation of silicon integrated circuit tuners is designed to provide a single hardware platform that is software localized for different markets. This new generation silicon tuner significantly increases the manufacturing and test efficiency for our customers by allowing them to produce a single hardware platform, thus streamlining the procurement and manufacturing process to enable net cost savings.

Customers

We work closely with ODMs, OEMs and leading service providers around the world to increase the adoption of connected home entertainment solutions that incorporate our technology. Service providers that utilize our products are mainly served by leading consumer electronic ODMs and OEMs of connected home entertainment solutions. We have been selected by leading equipment manufacturers such as Actiontec Electronics, Inc., or Actiontec, Motorola, Inc., or Motorola, Wistron NeWeb Corporation, or Wistron, and Jabil Circuit (WUXI) Co., Ltd., or Jabil Circuit, for deployments by leading service providers such as DIRECTV, DISH Network, Time Warner Cable, Cox and Verizon.

We currently rely, and expect to continue to rely, on a limited number of customers for a significant portion of our net revenues. For the year ended December 31, 2009, four customers accounted for 58% of our net revenues, and Motorola and Actiontec accounted for 27% and 16%, respectively, of our net revenues. In addition, we depend on a limited number of service providers that purchase products from our customers that incorporate our products. During the year ended December 31, 2009, products sold to our customers that were incorporated into products purchased by Verizon, DISH Network and DIRECTV accounted for substantially all of our net revenues.

For the year ended December 31, 2009, 92.1% of our net revenues were derived from Asia, 6.0% were derived from North America and 1.9% were derived from Europe. For the year ended December 31, 2008, 95.3% of our net revenues were derived from Asia, 2.6% were derived from Europe and 2.1% were derived from North America. For the year ended December 31, 2007, 93.5% of our net revenues were derived from Asia, 3.7% were derived from Europe and 2.8% were derived from North America. Many of our ODM and OEM customers in Asia incorporate our chipsets into products that they sell to U.S.-based service providers.

Research and Development

We believe our future success depends in part on our ability to introduce enhancements to our existing products and to develop new products for existing and emerging markets. We work closely with service providers and their ODM and OEM partners to understand their requirements and align our research and development efforts to meet their system requirements. We are also actively engaged in advancing the MoCA standard through our research and development efforts. We have assembled a team of highly skilled design engineers with core competencies in complex communications chipsets, radio frequency integrated circuits and embedded application software expertise. Our engineers are responsible for new product development efforts while continuing to enhance existing products and provide critical technical support to our customers.

13

Table of Contents

As of December 31, 2009, we had 178 full-time employees engaged in research and development, including 32 employees in operations. Our research and development expense was $45.2 million, $55.8 million and $35.2 million for the years ended December 31, 2009, 2008 and 2007, respectively.

Manufacturing

We use third-party foundries and assembly and test contractors to manufacture, assemble and test our products. This outsourced manufacturing approach allows us to focus our resources on the design, sales and marketing of our products and avoid the cost associated with owning and operating our own manufacturing facility. Our engineers work closely with foundries and other contractors to increase yields, lower manufacturing costs and improve quality.

We currently outsource the manufacturing of our home networking and our broadband access products principally to Taiwan Semiconductor Manufacturing Company, or TSMC, and the manufacturing of our DBS outdoor unit and silicon tuner products to TowerJazz, the name under which Tower Semiconductor Ltd. and its fully owned U.S. subsidiary Jazz Semiconductor operate. Our products are shipped from such third-party foundries to third-party assembly and testing facilities. Our home networking and our broadband access chipsets are primarily assembled and tested by Amkor Technology, Inc., or Amkor, while our DBS outdoor unit and silicon tuner products are primarily assembled by Amkor and tested by Giga Solution Tech Co., Ltd., or Giga Solution. We do not have a guaranteed level of production capacity from any of our subcontractors’ facilities to produce our products. We have implemented a robust quality management system, designed to assure high levels of product quality for our customers. We have completed and have been awarded ISO 9001:2000 certification. In addition, the independent foundries, assembly and test subcontractors identified above have been awarded ISO 9001:2000 certifications, among others.

Sales and Marketing

We sell our products worldwide through multiple channels, including our direct sales force and our network of domestic and international sales representatives and distributors. We have strategically located our direct sales personnel in the United States, Europe, China, Taiwan, Japan and Korea, where each salesperson has specific end-user market expertise. Our sales directors focus their efforts on leading ODMs and OEMs. We also have field application engineers who provide technical support and assistance to existing and potential customers in designing, testing, qualifying and certifying systems that incorporate our products.

Our sales cycles typically take a significant amount of time to complete, requiring a substantial expenditure of resources before realization of revenue from product sales, if at all. Such long sales cycles mean that service providers’ and ODM and OEM customers’ product selections, once made, are normally difficult to change. As a result, a design loss to one of our competitors may negatively impact our financial results for several years. Similarly, design wins may result in an extended period of revenue opportunities.

Our sales and marketing strategy is to achieve design wins with leading ODMs and OEMs and mass deployment of our solutions with service providers worldwide. This requires us to work extensively and collaboratively with our ODM and OEM customers as well as the service providers who purchase products from them. As a result, we believe that our established relationships allow us faster time to market and will lead to greater proliferation of our solutions.

Our marketing group focuses on our product strategy and management, product development roadmaps, product positioning, new product launch and transition, demand assessment and competitive analysis. The group also ensures that product development activities, product launch,

14

Table of Contents

channel marketing program activities, and ongoing demand and supply planning occur in a well-managed and timely manner in coordination with our development, operations and sales groups as well as our service provider representatives, ODMs and OEMs. Our marketing group also has programs in place to work closely with service providers in the role of a “trusted advisor” for MoCA deployments and initiatives designed to heighten industry awareness of our company, products and technologies, including participating in technical conferences, support of industry initiatives such as MoCA, publication of technical whitepapers and exhibition at trade shows.

Backlog

Our sales are made primarily pursuant to standard purchase orders for delivery of products. Quantities of our products to be delivered and delivery schedules are frequently revised to reflect changes in customers’ needs; customer orders generally can be canceled or rescheduled without significant penalty to the customer. For these reasons, our backlog as of any particular date is not representative of actual sales for any succeeding period, and therefore, we believe that backlog is not necessarily a reliable indicator of future net revenue levels.

Competition

The markets for our products are extremely competitive and are characterized by rapid technological change, evolving industry standards and new demands for features and performance of multimedia content delivery solutions. We believe the principal competitive factors in our markets include the following:

| • | the adoption of our products and technologies by service providers, ODMs and OEMs; |

| • | the performance and cost effectiveness of our products relative to our competitors’ products; |

| • | our ability to deliver high quality and reliable products in large volumes and on a timely basis; |

| • | our ability to build close relationships with service providers, ODMs and OEMs; |

| • | our success in developing and utilizing new technologies to offer products and features previously not available in the marketplace that are technologically superior to those offered by our competitors; |

| • | our ability to identify new and emerging markets and market trends; |

| • | our ability to recruit design and application engineers and other technical personnel; and |

| • | our ability to protect our intellectual property and obtain licenses to the intellectual property of others on commercially reasonable terms. |

We believe that we compete favorably with respect to each of these criteria. However, conditions in our markets could change rapidly and significantly as a result of technological advancements or the adoption of new standards for the delivery of HD video and other multimedia content. In addition, many of our current and potential competitors have longer operating histories, significantly greater resources, stronger name recognition and a larger base of customers than we. This may allow them to respond more quickly than we are able to respond to new or emerging technologies or changes in customer requirements or it may allow them to deliver products that are priced lower than our products or which include features and functions that are not included in our products.

In the market for home networking solutions, we are currently the only high-volume supplier of MoCA-compliant chipsets. In the near-term, therefore, we believe our primary competition in this market will be from companies that offer products based on non-MoCA home networking solutions,

15

Table of Contents

such as Ethernet, HomePNA, Home Plug AV and Wi-Fi, and potentially g.HN if and when the standard for that technology is set by the ITU. However, Broadcom Corporation, or Broadcom, has announced the availability of several multi-format video decoder system-on-a-chip solutions, or SoC, with integrated MoCA functionality and Broadcom’s home networking reference design has achieved MoCA 1.0 and MoCA 1.1 certification from the MoCA certification board. As a result, we expect products from Broadcom will begin to compete with our MoCA home networking chips in the next six months, and we expect other semiconductor manufacturers to compete with us in the manufacture and sale of MoCA-compliant chipsets in the future. In the broadband access market, our broadband access products compete with other, more well-established high-speed wide area networking technologies such as DOCSIS, xDSL and WiMAX. While we believe that our products compete favorably against alternative technologies in these markets, the ultimate competitiveness of our products is highly dependent on, and sensitive to, the particular facts and circumstances of each service provider and its end user customers such as the type of media content being distributed, the environment in which the distribution is taking place, the available network bandwidth and distribution mediums, and the number of devices connected to a network. In the DBS market, our band translation switch and channel stacking switch products face competition from discrete solution providers and other semiconductor manufacturers. In the market for tuners, our silicon tuners face competition from silicon and non-silicon tuners that offer similar functionality. In the transition to and adoption of CMOS technology to deliver silicon tuners, we believe that we currently lead the market in compliance with existing standards and quality of performance. As the integrated silicon tuner market is maturing, the number of competitive players in the market is being reduced and other competitive offerings will become available.

Intellectual Property

Our success and future revenue growth depend, in part, on our ability to develop and protect our intellectual property. We rely primarily on patent, copyright, trademark and trade secret laws, as well as nondisclosure agreements and other methods, to protect our proprietary technologies and processes. However, these measures may not provide meaningful protection for our intellectual property. We review our technological developments to identify features that provide us with a technological or commercial advantage, and we file patent applications when we deem it to be appropriate to protect these features in the United States and internationally in select countries. In addition to developing patented technology internally, we evaluate the acquisition and licensing of intellectual property from third parties that complements our business. As of February 1, 2010, we held 38 issued U.S. patents, one of which was reexamined by the U.S. Patent and Trademark Office and for which a reexamination certificate was issued. In addition, as of February 1, 2010 we had 18 foreign patents granted. Another 179 patent applications were pending in the United States and selected foreign countries as of February 1, 2010, of which nine applications have been allowed, each of which is expected to issue/grant shortly. The term of an issued patent in the United States is at least 20 years from its filing date. The U.S. Patent and Trademark Office provides term extensions for those applications that have been pending for more than three years and for which the duration of the pendency is not the fault of the applicant. Accordingly, many of our patents receive a longer term due to the benefit of such patent term extensions. Taking such patent term extensions into account, the remaining terms of our issued U.S. patents range from 12 to 17 years and the remaining terms for counter-part patents in most foreign jurisdictions are similar, provided we pay the applicable maintenance fees throughout the terms of our issued U.S. and granted foreign patents.

We are the owner of several registered trademarks in the United States and in certain foreign countries, including “Entropic,” “Entropic Communications,” “c.LINK” and “RF Magic.”

In connection with our membership in MoCA, we are required to license any of our patent claims that are essential to implement the MoCA specification to other MoCA members under reasonable

16

Table of Contents

and non-discriminatory terms. Because our core home networking technology is a primary component of the MoCA specification, we are required to license portions of this technology to other MoCA members, including other semiconductor manufacturers that may compete with us in the sale of MoCA-compliant chipsets. However, only essential patent claims necessary to implement the MoCA specification are subject to this requirement. We are not required to license patent claims that are not essential to implement the MoCA specification, nor are we required to license patent claims that are unrelated to the MoCA specification. To date we have not entered into a license of our MoCA-related patent claims, so the terms of any required license have not been established.

In addition to the licensing requirements of standards bodies to which we belong, such as MoCA, in connection with our sales or product development activities we are also sometimes required by our customers or service providers to license to unrelated third parties, on reasonable and non-discriminatory terms, patents and patent applications associated with technologies purchased or used by, or developed with or for, such customers or service providers. We expect that in the future we may be required to agree to such licensing arrangements in order to secure sales, receive development funds or settle disputes.

In addition to our patent rights, we hold significant intellectual property in the form of proprietary trade secrets which we rely on to compete. Designing integrated circuits that comply with the MoCA specification or implement our DBS outdoor unit solutions is technically difficult and requires the application of a wide range of complex engineering disciplines. During the course of creating the technology on which the MoCA standard is based, we developed significant proprietary know-how and techniques for overcoming the engineering challenges involved in designing MoCA-compliant products. We retain such know-how and techniques as proprietary trade secrets that we are not required to license to others as a result of our membership in MoCA. Similarly, we have developed significant proprietary know-how and techniques for implementing our DBS outdoor unit solutions in satellite installations. Consequently, even though we are required to license patent claims that are essential to implement the MoCA standard to other MoCA members and have agreed to license patents and patent applications related to other technologies, such as our DBS outdoor unit solutions, to third parties on reasonable and non-discriminatory terms, we believe that such licensees would need to overcome significant engineering challenges and develop or obtain comparable proprietary know-how and techniques in order to design products that compete successfully against ours.

We generally enter into confidentiality agreements with our employees, consultants and strategic partners, and typically control access to and distribution of our proprietary information. Our employees are generally required to assign their intellectual property rights to us and to treat all technology as our confidential information.

Government Regulation

As a company that provides systems solutions comprised of silicon integrated circuits with embedded software, we are subject to certain government regulations, including U.S. export controls and foreign countries’ import regulations, as well as customs duties and export quotas; regulations relating to the materials that comprise our products (such as the European Union’s Restriction on the Use of Certain Hazardous Substances in Electrical and Electronic Equipment and equivalent regulations adopted by China); and regulations placing constraints on our customers and service providers’ services (such as the Federal Communications Commission’s regulations relating to radio frequency signals emitted in the United States and laws and regulations regarding local cable franchising).

17

Table of Contents

Employees

As of December 31, 2009, we employed a total of 262 people on a full-time basis, including 146 in research and development, 84 in sales, marketing, general and administrative, and 32 in operations. We also engage temporary employees and consultants. Our ability to attract and retain qualified personnel is essential to our continued success. None of our employees is subject to a collective bargaining agreement. We have never experienced a work stoppage, and we consider our relations with our employees to be good.

EXECUTIVE OFFICERS OF THE COMPANY

The following table sets forth information regarding our executive officers as of January 30, 2010.

| Name |

Age | Position | ||

| Patrick Henry |

47 | Chief executive officer and member of our board of directors since September 2003 and president since February 2008. Mr. Henry also served as chairman of our board of directors from July 2007 to January 2009 and as our president from September 2003 to July 2007. From February 2003 to September 2003, Mr. Henry was president and chief executive officer of Pictos Technologies Inc., a developer of digital imaging products which was acquired by ESS Technology. Prior to 2003, Mr. Henry served as chief executive officer of Lincom Wireless, Inc., a chip manufacturing company focused on 802.11 wireless LAN products, vice president and general manager at LSI Logic Corporation, a provider of silicon, systems and software technologies, and senior vice president at C-Cube Microsystems Inc., a developer of digital video integrated circuits. Mr. Henry holds a B.S. in engineering science and mechanics from the Georgia Institute of Technology and an M.B.A. from the University of Southern California. |

18

Table of Contents

| Name |

Age | Position | ||

| David Lyle |

45 | Chief financial officer since June 2007. From August 2005 to June 2007, Mr. Lyle was the chief financial officer at RF Magic, Inc., or RF Magic, our wholly-owned subsidiary which we acquired in June 2007. Prior to working at RF Magic, Mr. Lyle was finance director and controller for the mobile communications business unit at Broadcom, a provider of highly-integrated semiconductor solutions. He joined Broadcom in July 2004 through its acquisition of Zyray Wireless Inc., a WCDMA baseband co-processor company, where he served as chief financial officer beginning in January 2004. Prior to 2004, Mr. Lyle served as chief financial officer at Mobilian Corporation, a wireless data communications semiconductor company, and in various finance roles at Intel Corporation, a semiconductor company, in the microprocessor and networking groups. Mr. Lyle was also previously employed at Intel Capital, the strategic investment arm of Intel Corporation, focusing on mergers and acquisitions primarily for the wireless communications and computing group. Mr. Lyle holds a B.S. in business from the University of Southern California, an M.B.A. from Arizona State University and an M.I.M. from The Thunderbird School of Global Management. |

19

Table of Contents

| Name |

Age | Position | ||

| Tom Lookabaugh |

48 | Chief technology officer since July 2009. Prior to joining Entropic, from March 2006 to June 2009, Dr. Lookabaugh was the chief executive officer of NGNA, LLC, d/b/a PolyCipher, a cable industry joint venture owned by Comcast Corporation, Time Warner Cable, Inc. and Cox Communications, Inc. focused on developing and operating a new technology for authenticating and authorizing cable services known as the Downloadable Conditional Access System for the U.S. cable industry. Prior to PolyCipher, from September 2001 through February 2006, Dr. Lookabaugh was on the faculty at the University of Colorado at Boulder where he was an assistant professor and a faculty director of the Interdisciplinary Telecommunications Program and an assistant professor in the Computer Science Department. Dr. Lookabaugh holds a B.S. in engineering physics from the Colorado School of Mines, three M.S. degrees – in electrical engineering, engineering management and statistics – from Stanford University and a Ph.D. in electrical engineering from Stanford University. |

20

Table of Contents

| Name |

Age | Position | ||

| Vinay Gokhale |

46 | Senior vice president, marketing and business development since January 2009. Prior to joining Entropic, from September 2006 until January 2009, Mr. Gokhale served as vice president, wireless segment at SiRF Technology, Inc., a supplier of products related to Global Positioning Systems. As vice president, wireless segment at SiRF Technology, Mr. Gokhale focused on developing strategic alliances and identifying early-stage technology initiatives. From September 2002 until September 2006, Mr. Gokhale served at Impinj Inc., a developer of ultra high frequency, or UHF, radio frequency identification, or RFID, solutions for both item-level and supply-chain tagging. Initially, Mr. Gokhale served as vice president, marketing, and later as executive vice president, RFID products, during which time Mr. Gokhale was responsible for driving Impinj’s entry into the RFID market and running the operations of Impinj’s RFID business unit. From July 1995 until September 2008, Mr. Gokhale served in various positions of increasing responsibility at Conexant Systems, Inc., or Conexant, a provider of solutions for imaging, video, audio and internet connectivity applications, and held the position of vice president and business unit director for Conexant’s wireless data business unit. Mr. Gokhale holds B.S. and M.S. degrees in electrical engineering from University of California, Irvine and an M.B.A. from Stanford University. |

21

Table of Contents

| Name |

Age | Position | ||

| Bill Bradford |

46 | Senior vice president of worldwide sales since October 2009. Prior to joining Entropic, from May 2009 to October 2009, Mr. Bradford was vice president of marketing and sales at Arkayne Inc., a developer of technology for internet relevancy-based search, automated link exchange and search engine optimization. From May 2008 to July 2009, Mr. Bradford also served as president and chief executive officer of IAD Industries, LLC, a company focused on the acquisition, consolidation and operation of distribution and light manufacturing operations in the infrastructure, aerospace and defense markets. From May 2006 to August 2007, Mr. Bradford was employed at Freescale Semiconductor, Inc., or Freescale, a semiconductor company. Mr. Bradford initially joined Freescale as senior vice president, global sales from May 2006 to January 2007 and later served as Freescale’s senior vice president, Americas sales and marketing and global distribution from January 2007 to August 2007. Prior to Freescale, Mr. Bradford was senior vice president, sales and marketing at ON Semiconductor Corporation, a semiconductor company, from March 2002 to May 2006. Mr. Bradford holds a B.S. in electrical engineering from Rose-Hulman Institute of Technology and a M.S. in management from the University of Alabama. | ||

| Lance Bridges |

48 | Vice president and general counsel since January 2009. Mr. Bridges joined Entropic in May 2007 as vice president of corporate development, general counsel and secretary. Prior to joining Entropic, Mr. Bridges was a partner at Cooley Godward Kronish LLP, where he practiced law since 1991. Mr. Bridges holds a B.A. in economics from the University of California, San Diego, a J.D. from the University of California, Berkeley School of Law (Boalt Hall) and an M.B.A. from the Walter A. Haas School of Business Administration, University of California, Berkeley. | ||

22

Table of Contents

| Name |

Age | Position | ||

| Kurt Noyes |