Attached files

ICS

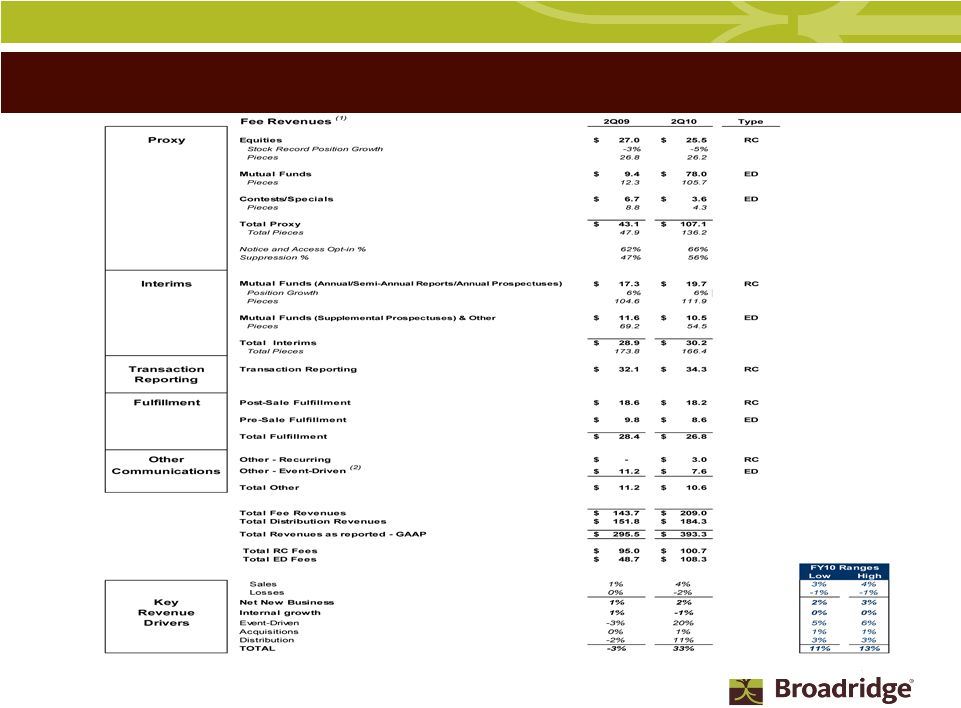

Key Segment Revenue Stats RC= Recurring ED= Event-Driven Exhibit 99.3 (1) As of 1Q09, these items represent fee revenues only and exclude

distribution revenues which are set out separately. The historical numbers have been adjusted to exclude distribution revenues. (2) Other includes 3.7M pieces for 2Q09 and 3.1M pieces for 2Q10 primarily

related to corporate actions. |

SPS

and Outsourcing Key Segment Revenue Stats RC= Recurring ED= Event-Driven (1) 2Q09 Internal Trade Volume previously was reported as 1,693 and 267 for Equities and

Fixed Income, respectively. YTD 09 Internal Trade Volume previously

was reported as 1,597 and 269 for Equities and Fixed Income, respectively. These numbers were adjusted to reflect Losses and Sales in order to present consistent business for the purpose of calculating internal trade

growth. (2) Equity Trade volume adjusted to excludes trades processed under

fixed priced contracts. Management believes excluding this trade volume presents a stronger correlation between trade volume and Equity Trade revenue. (3) Prior Year's trade volume re-stated for comparability. (4) 2Q09 Equity Transaction-Based and Non-Transaction revenue, previously

reported as $70.0M and $48.2M respectively, has been restated to reclassify

certain revenues between categories. |