Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - IRELAND INC. | form8k.htm |

| EX-99.2 - NEWS RELEASE DATED FEBRUARY 1, 2010 - IRELAND INC. | exhibit99-2.htm |

Forward Looking Statements

This Presentation may contain, in addition to historical information, forward-looking statements. Statements in this Presentation that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed under the heading "Risk Factors” and elsewhere in the Company's periodic filings with the U.S. Securities and Exchange Commission. When used in this Presentation, the words such as "could," "plan," "estimate," "expect," "intend," "may," "potential,“ "should," and similar expressions, are forward-looking statements. The risk factors that could cause actual results to differ from these forward-looking statements include, but are not restricted to the Company‘s limited operating history, uncertainties about the availability of additional financing, geological or mechanical difficulties affecting the Company's planned geological work programs, uncertainty of estimates of mineralized material, operational risk, environmental risk, financial risk, currency risk, and other statements that are not historical facts as disclosed under the heading" Risk Factors" in the Company's Annual Report on Form 10-K filing with the SEC and elsewhere in the Company's periodic filings with securities regulators in the United States. Copies of the Company's periodic reports are available on the SEC's website at http://www. sec.gov.

2

Company Vision

|

Build Ireland (IRLD) into a significant mid-tier mining company through the development to monetization of two precious metal projects. • Columbus Project – In active development Owns 100% of Gold / Silver mining rights Option to Expand • Red Mountain Project – Not in active development Option to acquire 100%Gold / Tungsten / Silver mining rights |

3

Management Team

Douglas

Birnie – Chief Executive Officer, President and Director

Mr. Birnie was a founder of Columbus

Group Communications Inc., a privately -owned company that was acquired by TELUS

Corp., one of Canada’s leading telecommunications companies

Robert

McDougal – Chief Financial Officer and Director

Mr. McDougal, a Certified Public

Accountant, was a director and officer of GEXA Gold Corporation and was one

of the founders of Millennium Mining Corporation, which has been merged into

Gold Summit Corporation

Mark

Brennan - Director

Mr. Brennan is the President of his

own consulting firm, the Brennan Consulting Group. In addition to his ongoing

management consulting practice, Mr. Brennan has also founded and operated a

number of private companies in a variety of industries

Michael

Steele – Director

Mr. Steele is a Principal in Avonlea

Investments and Steele Consulting, which provide business, financial, technology

and strategic consulting services to private and publicly traded natural resource

companies

Nanominerals

Corp. / Dr. Charles Ager

Nanominerals is a private company

focused on the development and application of new technology in the exploration

of refractory gold deposits. Dr. Ager, the CEO of Nanominerals, is a geophysical

engineer with almost 40 years of international experience in mine discovery,

production and finance.

4

Overview – Columbus Project

|

• Gold and Silver Project • A “dry salt marsh” with drill indicated zones of surface mineable material • Located between Las Vegas and Reno in the Columbus Basin, in Esmeralda County, Nevada – a region with a proven history of major discoveries of gold and silver • Mine site production permit has been granted • Short horizon to production |

| Columbus Project Mill-Site Facility |

5

Columbus Project - Opportunity

With permits already granted,

the Columbus Project is

expected to be in production in 2010.

Prefeasibility

work and drilling programs are ongoing.

As a result of the 2008 Drilling

Program, we have:

-

Identified an area containing approx. 200 million tons of mineable material with an average sample head grade of 0.041 oz/per ton Au Equivalent

-

Identified a simple low-cost direct leach extraction process

-

Pilot scale tests indicate extraction rates of precious metals of 70% to 83%

Expect results from 2009 Drilling Program and new resource calculations in Q1 2010

Ireland is an unrecognized

investment opportunity and could achieve

substantially higher valuations based on the progress of its technical

program and the value of its resources.

6

Columbus Project- Regional History

|

• Round Mountain (Gold)* |

| • Owned by Barrick and Kinross | |

| • 20 M oz gold deposit/16 M oz mined | |

| • ~ 75% extraction rate | |

| • 97% “invisible” gold | |

| • Head Grade 0.018 opt Au | |

| • ~ 60 miles from Columbus Project | |

| • Candelaria (Silver)* | |

| • 151 M oz of silver identified | |

| • 68 M oz of silver mined | |

| • ~ 5 miles from Columbus Project | |

| * - data from published reports |

7

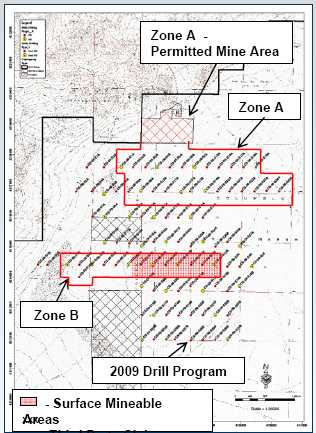

Columbus Project Assets

|

• 19,680 acres of mineral claims on federal land administered by the BLM (Bureau of Land Management), with an option for an additional ~22,640 acres. • 380 acres permitted to 40 feet for extraction of gold and silver (Zone A – Permitted Area) - 320 acre mine site, 60 acre mill site - 15,000 sq ft mill building • Water usage rights of aquifers in basin • 80 acres of private land - Future development flexibility |

8

Exploratory Drill Program’08/09

|

97-hole drill program conducted in “Area of Interest” (~5,000acres / 8 sq. miles) New Gold/Silver Discovery– Large Tonnage Potential • Three

surface mineable areas: ~1,590

acres •

~200MM tons potentially mineable material 2009 Drill Program data and new Resource Calculations expected in Q1 2010 All reported results are by Caustic Fusion assay and analysis of extracted metal-in-hand for gold and silver. The causticfusion protocol was selected because research has proven it to be a more effective pyrometallurgical method than conventional fire assay to extract gold and silver from the organic carbon rich clays at Columbus. |

| - Third Party

Claims * Cost estimates and recent test results have led the Company to believe that the dredge mining method could mine to 200 foot depth |

9

Project Prefeasibility

Direct Solution Leach Extraction Test Results

| Parameter |

Test

Size (lbs) |

Au

Equivalent Head Grade (opt) |

%

Recovered into Solution |

%

Recovered as Metal-in-Hand |

| Zone A – Permitted Mine Area | 1,738 | 0.062 | 86.6% | 69.4% |

| Zone B – Hole (S7B) | 2,000 | 0.070 | 94.4% | 84.1% |

| Zone B – Drill Composite (S1B) | 5.5 | 0.041 | 91.0% | n/a |

| Zone B – Drill Composite (S9B) | 5.5 | 0.074 | 90.0% | n/a |

| Zone B – Drill Composite (S12B) | 5.5 | 0.057 | 80.6% | n/a |

-

Goal: 75% Extraction of gold and silver

-

Bench Scale Tests (5.5 pounds) are not large enough to recover on resins or activated carbon, instead, precious metals were extracted by precipitation from leach solution

-

Zone B is located 3 miles south of the Zone A – Permitted Mine Area

10

Project Pre-Feasibility

Process Flow Diagram

Estimated Operating Costs (similar to typical Tank Leach Operations) ~ $10/ton

Current Production Permits:

mine up to 792,000tpy in Zone A – Permitted Mine

Area, a

320-acre area, to a depth of 40 ft. (estimated mine life 17+

years)

11

Independent Confirmation

All reported work to date has

been completed and performed by

third party engineers/geologists under Chain of Custody(COC)

Technical Team– Independent firms:

Permitting

- Lumos & Associates – based in Reno, NV

Project Resources

- McEwen Geological – Drill program management / Modeling

- Arrakis Inc. – Mining and production process design/ Metallurgy

- AuRIC Metallurgical Labs – Drill sample analysis / Metallurgy

Project Feasibility

- Arrakis – Pilot Plant Operations/Project Construction

- AuRIC – Leach Testing / Extraction Process Development

12

2009 Accomplishments

| •Discovered mineralized areas; ~1,590 acres potential |

| •200 MM tons of mineable material with an average sample grade of 0.041 opt Au equivalent |

| •Completed two ~2,000-lbs pilot scale leach tests |

| •Recovered ~70% to 83% of Au and Ag as metal-in-hand |

|

|

| •Defined simple direct leach extraction process |

| •Showed consistency in extraction |

| •Defined and refined extraction process |

|

|

| •Operated mine (dredge) and pilot plant to test mining and concentrating methods |

13

Project Development 2010

Determine Increased Project Resources/Reserves

| •Expanded drilled area with completed 2009 drill program |

| •Calculate increased project resources and reserves |

| •Complete resources/reserves technical report |

Complete Project Feasibility

| •Operate on-site pilot plant to optimize/finalize production process |

| •Determine operating/capital costs for full production |

| •Complete site plan for full production facility |

| •Complete application for permit modifications (if necessary) |

14

Columbus Project Summary

|

A solid exploration and production opportunity with: •Full permit for the extraction of Gold and Silver •High volume and low cost mining operation •Surface mining with environmentally neutral process •Near term production expected |

15

Red Mountain Project

|

• Option to acquire 100% by Dec 31, 2011 • Longer term exploration project for Gold, Tungsten and Silver • Over 25 years of sampling and testing • Drilling and Sampling planned for 2010 |

| Red Mountain, CA

137 miles northeast of Los Angeles |

16

Financial Information

17

Capitalization and Finances

| Capitalization (1/8/2010) | |

| Issued and Outstanding | 121,934,442 |

| Free Float | ~54,000,000 |

| Total Fully Diluted | 154,274,930 |

| Market Capitalization (1/22/2010) | ~$97 M |

| Finances | |

| Cash (09/30/09) | ~$592,000 |

| Recent Financing | ~$9,765,750 |

| Budget (Jan ‘10 to Dec 31 ‘10) | $7,487,000 |

18

Expenses

| Cash Expenses | |

| Budget (01/01/10 – 12/31/10) | |

| Columbus Project | |

| Property Payments | $ 80,000 |

| Drilling Program and Resource Estimates | 1,962,000 |

| Pilot Plant / Project Feasibility | 1,985,000 |

| Columbus Project Sub-Total | 4,027,000 |

| Red Mountain Project | 1,905,000 |

| General and Admin. | 1,555,000 |

| Cash Expenditure | $7,487,000 |

19

Investment Summary

-

Exploration company with production expected by mid-2010

-

Anticipate increase in total mineable material with 2009 and 2010 Drilling Program results

-

Simple, environmentally neutral leaching extraction process indicates ~75% extraction

-

Assembled Talented Technical Team

20

Ireland Inc.

Corporate Office:

2441 West Horizon Ridge Parkway,

Suite 100

Henderson, NV, 89052

(702) 932-0353

info@irelandminerals.com

http://www.irelandminerals.com

Investor Relations:

| Terri MacInnis | R. Jerry Falkner, CFA |

| Bibicoff + MacInnis, Inc. | RJ Falkner & Company, Inc. |

| Tel: 818-379-8500 | Tel: 800-377-9893 |

| Email: terri@bibimac.com | Email: info@rjfalkner.com |

21