Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

InTake Communications, Inc.

---------------------------

(Exact name of registrant as specified in its charter)

Florida

-------

(State or other jurisdiction of incorporation or organization)

7372

----

(Primary Standard Industrial Classification Code Number)

27-1551007

----------

(I.R.S. Employer Identification Number)

Ron Warren

4655 Gran River Glen, Duluth GA 30096

678-516-5910

---------------------------------------

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

As soon as practicable after the effective date of this registration statement

------------------------------------------------------------------------------

(Approximate date of commencement of proposed sale to the public)

This is the initial public offering of the Company's common stock.

If any of the securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant

to Rule 462(b) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective

registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting Company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting Company" in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting Company [X]

CALCULATION OF REGISTRATION FEE

Title of Each Proposed Proposed

Class of Amount Maximum Maximum Amount of

Securities to to be Offering Price Aggregate Registration

be Registered Registered Per Unit(1) Offering Price Fee(2)

------------- ---------- -------------- -------------- ------------

Common Stock

by Company 3,000,000 $0.01 $30,000 $1.57

(1) The offering price has been arbitrarily determined by the Company and bears

no relationship to assets, earnings, or any other valuation criteria. No

assurance can be given that the shares offered hereby will have a market value

or that they may be sold at this, or at any price.

(2) Estimated solely for the purpose of calculating the registration fee based

on Rule 457 (o).

The registrant hereby amends this registration statement on such date or dates

as may be necessary to delay its effective date until the Registrant shall file

a further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

InTake Communications, Inc.

3,000,000 SHARES OF COMMON STOCK

This registration statement constitutes the initial public offering of InTake

Communications' common stock. InTake Communications is registering 3,000,000

shares of common stock at an offering price of $0.01 per share for a total

amount of $30,000. The Company will sell the securities in $500 increments.

There are no underwritings or broker dealers involved with the offering.

The Company's CEO, Ron Warren will be responsible to market and sell these

securities. The Company will offer the securities on a best efforts basis and

there will be no minimum amount required to close the transaction. If all the

shares are not sold, there is the possibility that the amount raised may be

minimal and might not even cover the costs of the offering which the Company

estimates at $5,000. The offering price of $0.01 per share may not reflect the

market price of the shares after the offering.

The proceeds from the sale of the securities will be placed directly into the

Company's account and there will not be an escrow account. All proceeds from the

sale of the securities are non-refundable, except as may be required by

applicable laws. The Company will pay all expenses incurred in this offering.

There has been no public trading market for the common stock of InTake

Communications.

THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY

IF YOU CAN AFFORD A COMPLETE LOSS. SEE "RISK FACTORS" BEGINNING ON PAGE 7.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of the prospectus. Any representation to the contrary is a

criminal offense.

The information in this prospectus is not complete and may be changed. We may

not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer

to sell these securities and is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

The date of this prospectus is _______________, 2010

TABLE OF CONTENTS

Page No.

--------

Part I

------

SUMMARY OF OUR OFFERING................................................. 3

SUMMARY OF FINANCIAL INFORMATION........................................ 5

DESCRIPTION OF PROPERTY................................................. 5

RISK FACTORS............................................................ 5

USE OF PROCEEDS......................................................... 23

DETERMINATION OF OFFERING PRICE......................................... 23

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES........................... 24

THE OFFERING BY THE COMPANY............................................. 24

PLAN OF DISTRIBUTION.................................................... 25

LEGAL PROCEEDINGS....................................................... 26

BUSINESS................................................................ 26

MANAGEMENT.............................................................. 36

SALES AND MARKETING..................................................... 36

COMPETITION............................................................. 36

STAFFING................................................................ 36

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION............... 37

LIMITED OPERATING HISTORY; NEED FOR ADDITIONAL CAPITAL.................. 37

CODE OF BUSINESS CONDUCT AND ETHICS..................................... 41

BACKGROUND OF OFFICERS AND DIRECTORS.................................... 42

EXECUTIVE COMPENSATION.................................................. 42

PRINCIPAL STOCKHOLDERS.................................................. 44

DESCRIPTION OF SECURITIES............................................... 45

REPORTING............................................................... 46

STOCK TRANSFER AGENT.................................................... 46

STOCK OPTION PLAN....................................................... 46

LITIGATION.............................................................. 46

LEGAL MATTERS........................................................... 46

EXPERTS................................................................. 46

FINANCIAL STATEMENTS.................................................... F-1

Part II

-------

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION ............................ II-1

RECENT SALES OF UNREGISTERED SECURITIES ................................ II-1

EXHIBITS ............................................................... II-1

UNDERTAKINGS ........................................................... II-2

SIGNATURES ............................................................. II-4

DEALER PROSPECTUS DELIVERY OBLIGATION

Until _______________, (90 days after the effective date of this prospectus) all

dealers that effect transactions in these securities, whether or not

participating in this offering, may be required to deliver a prospectus. This is

in addition to the dealers' obligation to deliver a prospectus when acting as

underwriters and with respect to their unsold allotments or subscriptions.

2

SUMMARY OF OUR OFFERING

InTake Communications, Inc. has 9,000,000 shares of common stock issued and

outstanding and is registering an additional 3,000,000 shares of common stock

for offering to the public. The company may endeavor to sell all 3,000,000

shares of common stock after this registration becomes effective. The price at

which the company offers these shares is fixed at $0.01 per share for the

duration of the offering. There is no arrangement to address the possible effect

of the offering on the price of the stock. InTake Communications will receive

all proceeds from the sale of the common stock.

3,000,000 shares of common stock are offered by the company.

Offering price per share by the The price, if and when the company sells

company the shares of common stock is set at

$0.01.

Number of shares outstanding before 9,000,000 common shares are currently

the offering of common shares issued and outstanding.

Number of shares outstanding after 12,000,000 common shares will be issued

the offering of common shares and outstanding after this offering is

completed if all shares are sold. If the

offering is not fully subscribed, less

than 12,000,000 will be outstanding

after the offering. For example, if the

Company sells 50% of the total offering,

the Company will sell 1.5 million shares

and there will be 10.5 million shares

outstanding after the offering under

these circumstances.

The minimum number of shares to be None.

sold in this offering

Market for the common shares There is no public market for the common

shares. The shares are being offered at

$0.01 per share. InTake Communications

may not be able to meet the requirement

for a public listing or quotation of its

common stock. Further, even if InTake

Communications, Inc. common stock is

quoted or granted listing, a market for

the common shares may not develop. If a

market develops, the price of the shares

in the market may not be greater than or

equal to the price in this offering.

Use of proceeds The Company intends to use the proceeds

this offering to develop and complete

the business and marketing plan, and for

other general corporate and working

capital purposes. The expenses of this

offering, including the preparation of

this prospectus and the filing of this

registration statement, estimated at

3

$5,000 are being paid for by InTake

Communications. The net proceeds will be

the gross proceeds from the offering

less the expenses of $5,000. Therefore,

if the all shares are sold in the

offering, the net proceeds will be

$25,000 ($30,000 Gross proceeds - $5,000

expenses). If all shares are not sold,

the gross proceeds will be less and may

not cover the expenses of the offering.

For example, if the Company sells 50% of

the securities, the Company will sell

1.5 million shares and there will be

10.5 million shares outstanding after

the offering under these circumstances.

Termination of the offering The offering will conclude when all

3,000,000 shares of common stock have

been sold, or 90 days after this

registration statement becomes effective

with the Securities and Exchange

Commission. InTake Communications, Inc.

may at its discretion extend the

offering at its discretion for an

additional 90 days.

Terms of the offering The Company's president and sole

director will sell the common stock upon

effectiveness of this registration

statement.

You should rely only upon the information contained in this prospectus. InTake

Communications has not authorized anyone to provide you with information

different from that which is contained in this prospectus. InTake Communications

is offering to sell shares of common stock and seeking offers to buy shares of

common stock only in jurisdictions where offers and sales are permitted. The

information contained in this prospectus is accurate only as of the date of this

prospectus, regardless of the time of delivery of this prospectus, or of any

sale of the common stock.

This summary provides an overview of selected information contained in this

prospectus. It does not contain all the information that you should consider

before making a decision to purchase the shares offered by InTake

Communications. You should very carefully and thoroughly read the more detailed

information in this prospectus and review our financial statements.

SUMMARY INFORMATION ABOUT INTAKE COMMUNICATIONS

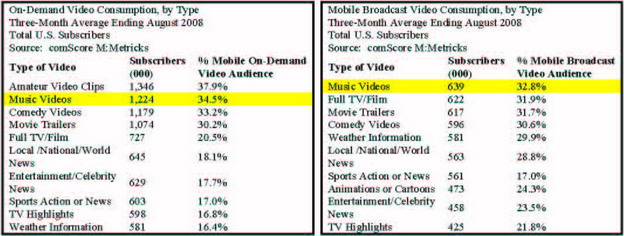

InTake Communications (the "Company") is in business to provide software to

companies to help them market and sell their music and entertainment content to

consumers. The music and entertainment content is audio and video clips of

concerts, music, videos, and artist interviews. Based on the customer request,

the software will extract the music and entertainment content from the music and

entertainment company's library and stream that content to the customer. This

content is referred to as "digital assets". The customer can request the content

from any internet device such as a computer, laptop or mobile device.

4

InTake Communications is primarily focusing the company's business model in the

music and entertainment marketplace for growth in mobile devices, PCs the

Internet, and digital storefront like Websites. The Company has identified the

product requirements; however the product development has not started. At this

time, the Company estimates a 12-15 month timeframe to complete the first

version of the software. Today, there is no prototype and until we create our

first version of the software, the Company will not be able to market the

software or generate any revenues. See BUSINESS Section on page 21 for more

details.

Our business and registered office is located at 4655 Gran River Glen., Duluth

GA 30096. Our contact number is 678-516-5910.

As of December 31, 2009, InTake Communications, had raised $6,000 through the

sale of its common stock and has a $3,000 in a subscription receivable. There is

$6,000 of cash on hand in the corporate bank account. The Company currently has

liabilities of $0. The Company anticipates incurring costs associated with this

offering totaling approximately $5,000. As of the date of this prospectus, we

have not generated any revenue from our business operations. The following

financial information summarizes the more complete historical financial

information found in the audited financial statements of the Company filed with

this prospectus.

SUMMARY OF FINANCIAL INFORMATION

The following summary financial information for the period stated summarizes

certain information from our financial statements included elsewhere in this

prospectus. You should read this information in conjunction with Management's

Plan of Operations, the financial statements and the related notes thereto

included elsewhere in this prospectus.

BALANCE SHEET AS OF DECEMBER 31, 2009

------------- --------------------

Total Assets ........................... $ 6,000

Total Liabilities ...................... $ 3,579

Shareholder's Equity ................... $ 2,421

OPERATING DATA DECEMBER 24, 2009 THROUGH DECEMBER 31, 2009

-------------- -------------------------------------------

Revenue ................................ $ 0.00

Net Loss ............................... $ 3,579

Net Loss Per Share ..................... $ 0.00

As indicated in the financial statements accompanying this prospectus, InTake

communications has had no revenue to date and has incurred only losses since its

inception. The Company has had no operations and has been issued a "going

concern" opinion from their auditors, based upon the Company's reliance upon the

sale of our common stock as the sole source of funds for our future operations.

DESCRIPTION OF PROPERTY

The company does not own any real estate or other properties. The company's

office is located at 4655 Gran River Glen, Duluth GA 30096. The business office

is located at the office of Ron Warren, the CEO, of the company at no charge.

RISK FACTORS

Please consider the following risk factors and other information in this

prospectus relating to our business and prospects before deciding to invest in

our common stock.

5

This offering and any investment in our common stock involves a high degree of

risk. You should carefully consider the risks described below and all of the

information contained in this prospectus before deciding whether to purchase our

common stock. If any of the following risks actually occur, our business,

financial condition and results of operations could be harmed.

The Company considers the following to be the material risks for an investor

regarding this offering. InTake Communications should be viewed as a high-risk

investment and speculative in nature. An investment in our common stock may

result in a complete loss of the invested amount. Please consider the following

risk factors before deciding to invest in our common stock.

AUDITOR'S GOING CONCERN

-----------------------

THERE IS SUBSTANTIAL UNCERTAINTY ABOUT THE ABILITY OF INTAKE COMMUNICATIONS,

INC. TO CONTINUE ITS OPERATIONS AS A GOING CONCERN

In their audit report for the period ending December 31, 2009 and dated January

14, 2010; our auditors have expressed an opinion that substantial doubt exists

as to whether we can continue as an ongoing business. Because our officers may

be unwilling or unable to loan or advance any additional capital to InTake

Communications, Inc. we believe that if we do not raise additional capital

within 12 months of the effective date of this registration statement, we may be

required to suspend or cease the implementation of our business plans. Due to

the fact that there is no minimum investment and no refunds on sold shares, you

may be investing in a Company that will not have the funds necessary to develop

its business strategies. As such we may have to cease operations and you could

lose your entire investment. See the December 31, 2009 Audited Financial

Statements - Audit Report". Because the Company has been issued an opinion by

its auditors that substantial doubt exists as to whether it can continue as a

going concern it may be more difficult to attract investors.

RISKS RELATED TO OUR FINANCIAL CONDITION

----------------------------------------

SINCE INTAKE COMMUNICATIONS ANTICIPATES OPERATING EXPENSES WILL INCREASE PRIOR

TO EARNING REVENUE, IT MAY NEVER ACHIEVE PROFITABILITY AND IF THE COMPANY CAN

NOT ACHIEVE PROFITABILITY OR RAISE ADDITIONAL CAPITAL, IT MAY FAIL RESULTING IN

A COMPLETE LOSS OF YOUR INVESTMENT

The Company anticipates an increase in its operating expenses, without realizing

any revenues from the sale of its products. Within the next 12 months, the

Company will have costs of at least $175,000 related to (i) the development of

products, (ii) administrative expenses and (iii) the completion of the business

plan.

There is no history upon which to base any assumption as to the likelihood that

the Company will prove successful. We cannot provide investors with any

assurance that our products will attract customers; generate any operating

revenue or ever achieve profitable operations. If we are unable to address these

risks, there is a high probability that our business can fail, which will result

in the loss of your entire investment.

OUR BUSINESS WILL FAIL IF WE DO NOT OBTAIN ADEQUATE FINANCING, RESULTING IN THE

COMPLETE LOSS OF YOUR INVESTMENT

6

If we are not successful in earning revenue once we have started our sale

activities, we may require additional financing to sustain our business

operations. Over the next 12 months, we anticipate needing at least $175,000 to

complete the business plan, development of products and other operating

expenses. Currently, we do not have any arrangements for financing and can

provide no assurances to investors that we will be able to obtain any when

required. Obtaining additional financing would be subject to a number of

factors, including the Company's sales results. These factors may have an effect

on the timing, amount, terms or conditions of additional financing and make such

additional financing unavailable to us. See "Description of Business."

No assurance can be given that the Company will obtain access to capital markets

in the future or that adequate financing to satisfy the cash requirements of

implementing our business strategies will be available on acceptable terms. The

inability of the Company to gain access to capital markets or obtain acceptable

financing could have a material adverse effect upon the results of its

operations and its financial conditions.

RISKS RELATED TO THIS OFFERING

------------------------------

BECAUSE THERE IS NO PUBLIC TRADING MARKET FOR OUR COMMON STOCK, YOU MAY NOT BE

ABLE TO RESELL YOUR STOCK AND NOT BE ABLE TO TURN YOUR INVESTMENT INTO CASH

There is currently no public trading market for our common stock. Therefore,

there is no central place, such as a stock exchange or electronic trading

system, to resell your shares. If you do want to resell your shares, you will

have to locate a buyer and negotiate your own sale. The offering price and other

terms and conditions relative to the Company's shares have been arbitrarily

determined by the Company and do not bear any relationship to assets, earnings,

book value or any other objective criteria of value. Additionally, as the

Company was formed recently and has only a limited operating history and no

earnings, the price of the offered shares is not based on its past earnings and

no investment banker, appraiser or other independent third party has been

consulted concerning the offering price for the shares or the fairness of the

offering price used for the shares.

INVESTING IN THE COMPANY IS HIGHLY SPECULATIVE AND COULD RESULT IN THE ENTIRE

LOSS OF YOUR INVESTMENT

Purchasing the offered shares is highly speculative and involves significant

risk. The offered shares should not be purchased by any person who cannot afford

to lose their entire investment. The business objectives of the Company are also

speculative, and it is possible that we would be unable to accomplish them. The

Company's shareholders may be unable to realize a substantial or any return on

their purchase of the offered shares and may lose their entire investment. For

this reason, each prospective purchaser of the offered shares should read this

prospectus and all of its exhibits carefully and consult with their attorney,

business and/or investment advisor.

INVESTING IN OUR COMPANY MAY RESULT IN AN IMMEDIATE LOSS BECAUSE BUYERS WILL PAY

MORE FOR OUR COMMON STOCK THAN THE PRO RATA PORTION OF THE ASSETS ARE WORTH

The Company has only been recently formed and has only a limited operating

history and no earnings, therefore, the price of the offered shares is not based

on any data. The offering price and other terms and conditions regarding the

Company's shares have been arbitrarily determined and do not bear any

7

relationship to assets, earnings, book value or any other objective criteria of

value. No investment banker, appraiser or other independent third party has been

consulted concerning the offering price for the shares or the fairness of the

offering price used for the shares.

The arbitrary offering price of $0.01 per common share as determined herein is

substantially higher than the net tangible book value per share of the Company's

common stock. InTake Communications' assets do not substantiate a share price of

$0.01. This premium in share price applies to the terms of this offering and

does not attempt to reflect any forward looking share price subsequent to the

Company obtaining a listing on any exchange, or becoming quoted on the OTC

Bulletin Board.

BECAUSE THE COMPANY HAS 250,000,000 AUTHORIZED SHARES, MANAGEMENT COULD ISSUE

ADDITIONAL SHARES, DILUTING THE CURRENT SHAREHOLDERS' EQUITY

The Company has 250,000,000 authorized shares, of which only 9,000,000 are

currently issued and outstanding and a maximum amount of 12,000,000 will be

issued and outstanding after this offering terminates. The Company's management

could, without the consent of the existing shareholders, issue substantially

more shares, causing a large dilution in the equity position of the Company's

current shareholders. Additionally, large share issuances would generally have a

negative impact on the Company's share price. It is possible that, due to

additional share issuance, you could lose a substantial amount, or all, of your

investment.

WE DO NOT HAVE AN ESCROW OR TRUST ACCOUNT WITH SUBSCRIPTIONS FOR INVESTORS, IF

WE FILE FOR OR ARE FORCED INTO BANKRUPTCY PROTECTION, THEY WILL LOSE THE ENTIRE

INVESTMENT

Invested funds for this offering will not be placed in an escrow or trust

account and if we file for bankruptcy protection or a petition for involuntary

bankruptcy is filed by creditors against us, your funds will become part of the

bankruptcy estate and administered according to the bankruptcy laws. As such,

your funds will be used to pay creditors, and if there are not sufficient funds

to pay all creditors, you will lose your investment.

THE COMPANY DOES NOT ANTICIPATE PAYING DIVIDENDS IN THE FORESEEABLE FUTURE, SO

THERE WILL BE FEWER WAYS IN WHICH YOU CAN MAKE A GAIN ON ANY INVESTMENT IN THIS

COMPANY

We do not anticipate paying dividends on our common stock in the foreseeable

future, but plan rather to retain earnings, if any, for the operation growth and

expansion of our business. Therefore, the only way to liquidate your investment

is to sell your stock.

AS WE MAY BE UNABLE TO CREATE OR SUSTAIN A MARKET FOR OUR SHARES, THEY MAY BE

EXTREMELY ILLIQUID AND YOU MAY NOT BE ABLE TO LIQUIDATE YOUR INVESTMENT

If no market develops, the holders of our common stock may find it difficult or

impossible to sell their shares. Further, even if a market develops, our common

stock will be subject to fluctuations and volatility and the Company cannot

apply directly to be quoted on the NASD Over-The-Counter Bulletin Board (OTC).

Additionally, the stock may be listed or traded only to the extent that there is

interest by broker-dealers in acting as a market maker in the Company's stock.

Despite the Company's efforts, it may not be able to convince any broker/dealers

to act as market-makers and make quotations on the OTC Bulletin Board. The

Company may consider pursuing a listing on the OTCBB after this registration

becomes effective and the Company has completed its offering.

8

IN THE EVENT THAT THE COMPANY'S SHARES ARE TRADED, THEY MAY TRADE UNDER $5.00

PER SHARE AND THUS WILL BE A PENNY STOCK. TRADING IN PENNY STOCKS HAS MANY

RESTRICTIONS AND THESE RESTRICTIONS COULD ADVERSELY AFFECT THE PRICE AND

LIQUIDITY OF THE COMPANY'S SHARES CREATING A POTENTIAL LOSS OF INVESTMENT

In the event that our shares are traded, and our stock trades below $5.00 per

share, our stock would be known as a "penny stock", which is subject to various

regulations involving disclosures to be given to you prior to the purchase of

any penny stock. The U.S. Securities and Exchange Commission (the "SEC") has

adopted regulations which generally define a "penny stock" to be any equity

security that has a market price of less than $5.00 per share, subject to

certain exceptions. Depending on market fluctuations, our common stock could be

considered to be a "penny stock". A penny stock is subject to rules that impose

additional sales practice requirements on broker/dealers who sell these

securities to persons other than established customers and accredited investors.

For transactions covered by these rules, the broker/dealer must make a special

suitability determination for the purchase of these securities. In addition, he

must receive the purchaser's written consent to the transaction prior to the

purchase. He must also provide certain written disclosures to the purchaser.

Consequently, the "penny stock" rules may restrict the ability of broker/dealers

to sell our securities, and may negatively affect the ability of holders of

shares of our common stock to resell them. These disclosures require you to

acknowledge that you understand the risks associated with buying penny stocks

and that you can absorb the loss of your entire investment. Penny stocks are low

priced securities that do not have a very high trading volume. Consequently, the

price of the stock is often volatile and you may not be able to buy or sell the

stock when you want to.

SINCE OUR SOLE OFFICER AND DIRECTOR CURRENTLY OWNS 100% OF THE OUTSTANDING

COMMON STOCK, INVESTORS MAY FEEL THAT HIS DECISIONS ARE CONTRARY TO THEIR

INTERESTS

The Company's sole officer, Ron Warren, and director owns 100% of the

outstanding shares and will own no less than 75% after this offering is

completed. For example, if 50% of the offering is sold, Mr. Warren will retain

87.5% of the shares outstanding. As a result, he will maintain control of the

Company and be able to choose all of our directors. His interests may differ

from those of other stockholders. Factors that could cause his interests to

differ from the other stockholders include the impact of corporate transactions

on the timing of business operations and his ability to continue to manage the

business given the amount of time he is able to devote to the Company.

All decisions regarding the management of the Company's affairs will be made

exclusively by him. Purchasers of the offered shares may not participate in the

management of the Company and, therefore, are dependent upon his management

abilities. The only assurance that the shareholders of the Company, including

purchasers of the offered shares, have that the Company's sole officer and

director will not abuse his discretion in executing the Company's business

affairs, is his fiduciary obligation and business integrity. Such discretionary

powers include, but are not limited to, decisions regarding all aspects of

business operations, corporate transactions and financing. Accordingly, no

person should purchase the offered shares unless willing to entrust all aspects

of management to the sole officer and director, or his successors. Potential

purchasers of the offered shares must carefully evaluate the personal experience

and business performance of the Company's management.

9

RISKS RELATED TO INVESTING IN OUR COMPANY

-----------------------------------------

OUR LACK OF AN OPERATING HISTORY GIVES NO ASSURANCE THAT OUR FUTURE OPERATIONS

WILL RESULT IN PROFITABLE REVENUES, WHICH COULD RESULT IN THE SUSPENSION OR

TERMINATION OF OUR OPERATIONS AND INVESTORS MAY LOOSE THEIR ENTIRE INVESTMENT

We were incorporated on December 24, 2009 and we have not realized any revenues

to date. We are an early stage company in a very competitive market. We have

very little operating history upon which an evaluation of our future success or

failure can be made. Our ability to achieve and maintain profitability and

positive cash flow is dependent upon the completion of this offering and our

ability to generate revenues through sales of our products.

Based upon current plans, we expect to incur operating losses in future periods

because we will be incurring expenses and not generating revenues. We cannot

guarantee that we will be successful in generating revenues in the future.

Failure to generate revenues will cause us to go out of business.

OUR OPERATING RESULTS MAY PROVE UNPREDICTABLE WHICH MAY IMPACT THE COMPANY AND

THE VALUE OF THE INVESTMENT

Our operating results are likely to fluctuate significantly in the future due to

a variety of factors, many of which we have no control over. Currently, we don't

have a product or prototype. Factors that may cause our operating results to

fluctuate significantly include: our inability to generate enough working

capital from future equity sales; and after we create a commercial product, the

factors include: the level of commercial acceptance by the music and

entertainment market of our products; fluctuations in the demand for our product

and capital expenditures relating to expansion of our future business,

operations and infrastructure and general economic conditions. If realized, any

of these risks could have a materially adverse effect on our business, financial

condition and operating results.

BECAUSE WE ARE SMALL AND DO NOT HAVE MUCH CAPITAL, WE MUST LIMIT OUR MARKETING

ACTIVITIES. AS A RESULT, OUR SALES MAY NOT BE ENOUGH TO OPERATE PROFITABLY. IF

WE DO NOT MAKE A PROFIT, WE MAY HAVE TO SUSPEND OR CEASE OPERATIONS.

Due to the fact we are small and do not have much capital, we must limit our

marketing activities to potential customers having the likelihood of purchasing

our products. We intend to generate revenue through the sale of our products.

Because we will be limiting the scope of our marketing activities, we may not be

able to generate enough sales to operate profitably. If we cannot operate

profitably, we may have to suspend or cease operations.

THE COMPANY'S SOLE OFFICER AND DIRECTOR MAY NOT BE IN A POSITION TO DEVOTE A

MAJORITY OF HIS TIME TO THE COMPANY, WHICH MAY RESULT IN PERIODIC INTERRUPTIONS

AND EVEN BUSINESS FAILURE.

Mr. Warren, our sole officer and director, has other business interests and

currently devotes approximately 20 to 25 hours per week to our operations. Our

operations may be sporadic and occur at times which are not convenient to Mr.

Warren, which may result in periodic interruptions or suspensions of our

business plan. If the demands of the Company's business require the full

business time of our sole officer and director, he is prepared to adjust his

timetable to devote more time to the Company. However, he may not be able to

devote sufficient time to the management of the business, which may result in

periodic interruptions in implementing the Company's plans in a timely manner.

Such delays could have a significant negative effect on the success of the

business.

10

KEY MANAGEMENT PERSONNEL MAY LEAVE THE COMPANY WHICH COULD ADVERSELY AFFECT THE

ABILITY OF THE COMPANY TO CONTINUE OPERATIONS. IF THE COMPANY CEASES OPERATIONS,

YOU WILL LOOSE YOUR INVESTMENT

Because the Company is entirely dependent on the efforts of its sole officer and

director, his departure or the loss of other key personnel in the future, could

have a materially adverse effect on the business. He has other outside business

activities and is devoting only approximately 20-25 hours per week to our

operations. His expertise in the music and entertainment industry as well as his

technical expertise are critical to the success of the business. The loss of

this resource would have a significant impact on our business. In addition, our

operations may be sporadic and occur at times which are not convenient to Ron

Warren, which may result in periodic interruptions or suspensions of our

business plan. If the demands of the company's business require the full time of

our executive officer, he is prepared to adjust his timetable in order to devote

more time to conducting our business operations. However, our executive officer

may be unable to devote sufficient time to the management of the company's

business, which may result in periodic interruptions in the implementation of

the company's business plans and operations. Such delays could have a

significant negative effect on the success of our business. The Company believes

that all commercially reasonable efforts have been made to minimize the risks

associated with the departure by key personnel from service. However, there is

no guarantee that replacement personnel with the specific industry and technical

expertise in the music and entertainment industry, if any, will help the Company

to operate profitably. The Company does not maintain key person life insurance

on its sole officer and director.

IF THE COMPANY IS DISSOLVED, IT IS UNLIKELY THAT THERE WILL BE SUFFICIENT ASSETS

REMAINING TO DISTRIBUTE TO THE SHAREHOLDERS RESULTING IN UP TO A COMPLETE LOSS

OF YOUR INVESTMENT.

In the event of the dissolution of the Company, the proceeds realized from the

liquidation of its assets, if any, will be used primarily to pay the claims of

the Company's creditors, if any, before there can be any distribution to the

shareholders. In that case, the ability of purchasers of the offered shares to

recover all or any portion of the purchase price for the offered shares will

depend on the amount of funds realized and the claims to be satisfied there

from.

RISKS RELATED TO THE COMPANY'S MARKET AND STRATEGY

--------------------------------------------------

THE MUSIC AND ENTERTAINMENT DIGITAL RIGHTS MARKET IS VERY COMPETITIVE AND

OBTAINING THOSE RIGHTS EITHER DIRECTLY OR INDIRECTLY IS NECESSARY TO BROADCAST

THE MEDIA. WITHOUT THOSE RIGHTS, THE COMPANY CAN NOT BROADCAST THE MEDIA AND

WILL FAIL. IF THE COMPANY FAILS, YOU WILL LOOSE YOUR INVESTMENT

The market to obtain the digital rights for music and entertainment content is

very competitive. There are several industry leaders that obtain these exclusive

rights over a multiple year period. The Company must partner with these rights

holders to broadcast the media or obtain those rights directly from the rights

holder. If the Company cannot obtain the rights, the Company cannot broadcast

the media and without these rights, the Company will have difficulty generating

revenues.

11

MARKET FACTORS LIKE COMPETITION AND HIRING QUALIFIED RESOURCES ARE DIFFICULT TO

MANAGE. IF WE CAN NOT MANAGE THESE MARKET FACTORS SUCCESSFULLY, WE FACE A HIGH

RISK OF BUSINESS FAILURE WHICH WOULD RESULT IN THE LOSS OF YOUR INVESTMENT.

The Company expects that its results of operations may also fluctuate

significantly in the future as a result of a variety of market factors

including, among others, the competitive nature of the music and entertainment

market, the entry of new competitors offering a similar product; the

availability of motivated and qualified personnel; the initiation, renewal or

expiration of our customer base; pricing changes by the Company or its

competitors, specific economic conditions in the financial markets. Accordingly,

our future sales and operating results are difficult to forecast.

As of the date of this prospectus, we have earned no revenue. Failure to

generate revenue will cause us to go out of business, which could result in the

complete loss of your investment.

WE MAY BE UNABLE TO GAIN ANY SIGNIFICANT MARKET ACCEPTANCE FOR OUR PRODUCTS OR

ESTABLISH A SIGNIFICANT MARKET PRESENCE. IF WE CAN NOT GAIN MARKET ACCEPTANCE,

WE WILL NOT BE ABLE TO GENERATE REVENUE AND OUR BUSINESS WILL FAIL.

The Company's growth strategy is substantially dependent upon its ability to

market its products successfully to prospective music and entertainment clients.

However, its planned services may not achieve significant acceptance. Such

acceptance, if achieved, may not be sustained for any significant period of

time. In addition, there is no guarantee that any acceptance by a client will

remain especially in the music and entertainment market. Failure of the

Company's services to achieve or sustain market acceptance could have a

materially adverse effect on our business, financial conditions and the results

of our operations.

MANAGEMENT'S ABILITY TO IMPLEMENT THE BUSINESS STRATEGY SUCCESSFULLY IS CRITICAL

TO THE BUSINESS SUCCESS. IF THE MANAGEMENT FAILS TO IMPLEMENT THE BUSINESS

STRATEGY, THE COMPANY WILL FAIL AND INVESTORS WILL LOOSE THEIR INVESTMENT

Although the Company intends to pursue a strategy of marketing its products

throughout North America, our business success depends on a number of factors.

These include: our ability to establish a significant music and entertainment

customer base and maintain favorable relationships with customers and partners

in the music and entertainment industry; obtain adequate business financing on

favorable terms in order to buy all the necessary equipment and materials;

development and maintenance of appropriate operating procedures, policies and

systems; hire, train and retain skilled employees knowledgeable in the music and

entertainment industry. The inability of the Company to manage any or all of

these factors could impair its ability to implement its business strategy

successfully, which could have a materially adverse effect on the results of its

operations and its financial condition.

INTAKE COMMUNICATIONS, INC. MAY BE UNABLE TO MANAGE ITS FUTURE GROWTH. IF THE

COMPANY CAN NOT SUCCESSFULLY MANAGE THE GROWTH, THE COMPANY MAY RUN OUT OF MONEY

AND FAIL.

Any extraordinary growth may place a significant strain on management,

financial, operating and technical resources. Failure to manage this growth

effectively could have a materially adverse effect on the Company's financial

condition or the results of its operations.

12

RISKS RELATED TO INVESTING IN OUR BUSINESS

------------------------------------------

THE COMPANY MAY BE UNABLE TO MAKE NECESSARY ARRANGEMENTS AT ACCEPTABLE COSTS

WHICH WILL IMPACT PROFITABILITY AND MAY CAUSE US TO CEASE OPERATIONS IF WE RUN

OUT OF CAPITAL

Because we are a small business, with limited assets, we are not in a position

to assume unanticipated costs and expenses. If we have to make changes in the

Company structure or are faced with circumstances that are beyond our ability to

afford, we may have to suspend operations or cease operations entirely which

could result in a total loss of your investment.

BECAUSE WE HAVEN'T BUILT A PROTOTYPE, OUR PRODUCTS MAY NOT WORK PROPERLY AND/OR

THE PRODUCTION COST CAN EXCEED EXPECTATIONS. IF OUR PROTOTYPE IS NOT SUCCESSFUL

AND WE DON'T RAISE ANY ADDITIONAL CAPITAL, WE WILL HAVE TO CEASE OPERATIONS

We have not built a prototype of our software yet; therefore, we don't know the

exact cost of production. In the case of a higher than expected cost of

production, we won't be able to offer our products at a reasonable price.

Furthermore, we may find problems in the development process and/or product

functionality. If we are unable to develop our products, we will have to cease

our operations, resulting in the complete loss of your investment.

GENERAL COMPETITION

The Company has identified a market opportunity for our products. The music and

entertainment market is very competitive and aggressive. Competitors may enter

this sector with superior products, services, financial resources, conditions

and/or benefits. This would infringe on our customer base, lengthen our sales

cycle, increase marketing costs, which in turn will have an adverse affect upon

our business and the results of our operations.

The mobile software industry is a highly competitive market. We will compete

with both large and small corporations. Most of these companies have greater

financial and personnel resources than we do.

COMPETITION MAY DECREASE OUR MARKET SHARE, REVENUES, AND GROSS MARGINS.

We face intense and increasing competition in the multimedia broadcast market.

If we do not compete effectively or if we experience reduced market share from

increased competition, our business will be harmed. In addition, the more

successful we are in the emerging market for multimedia broadcast services, the

more competitors are likely to emerge. We believe that the principal competitive

factors in our market include:

o service functionality, quality and performance;

o ease of use, reliability and security of services;

o establishing a significant base of customers and distribution partners;

o ability to introduce new services to the market in a timely manner;

o customer service and support; and

o pricing.

13

Although we do not currently compete against any one entity with respect to all

aspects of multimedia broadcast products and services, there are various

competitors that provide various products and services in the following

categories:

o collaboration, which provides for document and application sharing as well

as user interactivity,

o live video and streaming multimedia,

o hosted services,

o training, which provides e-learning applications, and

o on-premise software.

There are a number of companies, such as Verizon, Sprint and MobiTV, among

others, that provide outsourced digital media services. As the multimedia

broadcast market continues to develop, we expect to see increased competition

from traditional telecommunication service providers or resellers of those

services. We also face competition from the in-house encoding services,

streaming networks and content management systems and encoding services.

All of our competitors have substantially more capital, longer operating

histories, greater brand recognition, larger customer bases and significantly

greater financial, technical and marketing resources than we do. These

competitors may also engage in more extensive development of their technologies,

adopt more aggressive pricing policies and establish more comprehensive

marketing and advertising campaigns than we can. Our competitors may develop

products and service offerings that we do not offer or that are more

sophisticated or more cost effective than our own. For these and other reasons,

our competitors' products and services may achieve greater acceptance in the

marketplace than our own, limiting our ability to gain market share and customer

loyalty and to generate sufficient revenues to achieve a profitable level of

operations. Our failure to adequately address any of the above factors could

harm our business and operating results.

OUR INDUSTRY IS EXPERIENCING CONSOLIDATION THAT MAY INTENSIFY COMPETITION.

The multimedia broadcast services industries are undergoing substantial change

that has resulted in increasing consolidation and a proliferation of strategic

transactions. Many companies in these industries have been going out of business

or are being acquired by larger entities. As a result, we are increasingly

competing with larger competitors that have substantially greater resources than

we do. We expect this consolidation and strategic partnering to continue.

Acquisitions or strategic relationships could harm us in a number of ways. For

example:

o competitors could acquire or enter into relationships with companies with

which we have strategic relationships and discontinue our relationship,

resulting in the loss of distribution opportunities for our products and

services or the loss of certain enhancements or value-added features to

our products and services;

o competitors could obtain exclusive access to desirable multimedia content

and prevent that content from being available in certain formats, thus

decreasing the use of our products and services to distribute and

experience the content that audiences most desire, and hurting our ability

to attract customers;

14

o a competitor could be acquired by a party with significant resources and

experience that could increase the ability of the competitor to compete

with our products and services; and

o other companies with related interests could combine to form new,

formidable competition, which could preclude us from obtaining access to

certain markets or content, or which could dramatically change the market

for our products and services.

Any of these results could put us at a competitive disadvantage that could cause

us to lose customers, revenue and market share. They could also force us to

expend greater resources to meet the competitive threat, which could also harm

our operating results.

IF WE CANNOT PRODUCE SOFTWARE THAT MEETS PRICE AND/OR PERFORMANCE CRITERIA, THE

BUSINESS WILL FAIL.

The software market is very competitive, especially in the music and

entertainment market. Customers require specific functional and technical

requirements as well as competitive prices for the software. Each customer has

different functional and technical requirements and the Company cannot guarantee

that the software will meet each customer's requirements. If the Company cannot

develop software that meets the customer requirements and/or the software is not

competitively priced, the business will fail.

IF, AFTER DEMONSTRATING PROOF-OF-CONCEPT, WE ARE UNABLE TO ESTABLISH

RELATIONSHIPS WITH DEVELOPMENT PARTNERS AND/OR CUSTOMERS, THE BUSINESS WILL

FAIL.

Because there may be a substantial delay between the completion of this offering

and the execution of the business plan, our expenses may be increased and it may

take us longer to generate revenues. We have no way to predict when we will

begin our service. In addition, it takes time, money, and resources to build

relationships with customers and partners. If these efforts are unsuccessful or

take longer than anticipated, the Company may run out of capital and the

business will fail.

THERE IS NO MINIMUM AMOUNT REQUIRED TO BE RAISED IN THIS OFFERING, AND IF WE

CANNOT GENERATE SUFFICIENT FUNDS FROM THIS OFFERING, THE BUSINESS WILL FAIL.

There is not a minimum amount of shares that need to be sold in this Offering

for the Company to access the funds. Therefore, this Offering will be

immediately available for use by us and we don't have to wait until a minimum

number of Shares have been sold to keep the proceeds from any sales. We can't

assure you that subscriptions for the entire Offering will be obtained. We have

the right to terminate the offering of the Shares at any time, regardless of the

number of Shares we have sold since there is no minimum subscription

requirement. Our ability to meet our financial obligations, cash needs, and to

achieve our objectives, could be adversely affected if the entire offering of

Shares is not fully subscribed for.

BLUE SKY LAWS MAY LIMIT YOUR ABILITY TO SELL YOUR SHARES. IF THE STATE LAWS ARE

NOT FOLLOWED, YOU WILL NOT BE ABLE TO SELL YOUR SHARES AND YOU MAY LOOSE YOUR

INVESTMENT

State Blue Sky laws may limit resale of the Shares. The holders of our shares of

common stock and persons who desire to purchase them in any trading market that

might develop in the future should be aware that there may be significant state

law restrictions upon the ability of investors to resell our shares.

15

Accordingly, even if we are successful in having the Shares available for

trading on the OTCBB, investors should consider any secondary market for the

Company's securities to be a limited one. We intend to seek coverage and

publication of information regarding the Company in an accepted publication

which permits a "manual exemption". This manual exemption permits a security to

be distributed in a particular state without being registered if the company

issuing the security has a listing for that security in a securities manual

recognized by the state. However, it is not enough for the security to be listed

in a recognized manual. The listing entry must contain (1) the names of issuers,

officers, and directors, (2) an issuer's balance sheet, and (3) a profit and

loss statement for either the fiscal year preceding the balance sheet or for the

most recent fiscal year of operations. Furthermore, the manual exemption is a

non issuer exemption restricted to secondary trading transactions, making it

unavailable for issuers selling newly issued securities. Most of the accepted

manuals are those published in Standard and Poor's, Moody's Investor Service,

Fitch's Investment Service, and Best's Insurance Reports, and many states

expressly recognize these manuals. A smaller number of states declare that they

recognize securities manuals' but do not specify the recognized manuals. The

following states do not have any provisions and therefore do not expressly

recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana,

Montana, South Dakota, Tennessee, Vermont and Wisconsin. If we do not execute

our business plan on schedule or within budget, our ability to generate revenue

may be diminished or delayed. Our ability to adhere to our schedule and budget

face many uncertainties.

WE DO NOT MAINTAIN PRODUCT LIABILITY COVERAGE. WE COULD BECOME LIABLE FOR

UNINSURED PRODUCT LIABILITY CLAIMS WHICH WOULD ADVERSELY AFFECT OUR ABILITY TO

CONTINUE AS A GOING CONCERN, AND COULD CAUSE OUR BUSINESS TO FAIL.

The company does not maintain any product liability insurance at this time. Once

the product is released, the Company will evaluate the need for product

liability insurance. If no product liability insurance is obtained, product

claims against the company could have a material effect and potentially cause

the business to fail.

THE COMPANY'S SOLE OFFICER AND DIRECTOR HAVE COMPLETE CONTROL OF ALL COMPANY

DECISIONS AND INVESTORS DON'T HAVE THE ABILITY TO PARTICIPATE IN THE BUSINESS.

IF MANAGEMENT MAKES POOR DECISIONS, WE MAY BE UNABLE TO CONTINUE OUR OPERATIONS

AND OUR BUSINESS MAY FAIL

All decisions regarding the management of the company's affairs will be made

exclusively by its sole officer and director. Purchasers of the offered shares

may not participate in the management of the company and, therefore, are

dependent upon the management abilities of the company's sole officer and

director. The only assurance that the shareholders of the company (including

purchasers of the offered shares) have that the company's sole officer and

director will not abuse his discretion in making decisions, with respect to its

affairs and other business decisions, is his fiduciary obligations and business

integrity. Accordingly, no person should purchase offered shares unless that

person is willing to entrust all aspects of management to the company's sole

officer and director, or his successors. Potential purchasers of the offered

shares must carefully evaluate the personal experience and business performance

of the company's management.

THE COMPANY MAY RETAIN INDEPENDENT RESOURCES OR CONSULTANTS TO HELP GROW THE

BUSINESS. IF THESE RESOURCES DO NOT PERFORM, THE COMPANY MAY HAVE TO CEASE

OPERATIONS AND YOU MAY LOOSE YOUR INVESTMENT

16

The company's management may retain independent contractors to provide services

to the company. Those independent individuals and organizations have no

fiduciary duty to the shareholders of the company and may not perform as

expected.

RISKS RELATING TO OUR BUSINESS

OUR FAILURE TO RESPOND TO RAPID CHANGES IN TECHNOLOGY AND ITS APPLICATION, AND

INTENSE COMPETITION IN THE MOBILE ENTERTAINMENT SERVICES INDUSTRY COULD MAKE OUR

SERVICES OBSOLETE

The mobile entertainment services industry is subject to rapid and substantial

technological development and product innovations. To be successful, we must

respond to new developments in technology, new applications of existing

technology and new treatment methods. Our response may be stymied if we require,

but cannot secure, rights to essential third-party intellectual property. We

compete against numerous companies offering alternative systems to ours, some of

which have greater financial, marketing and technical resources to utilize in

pursuing technological development. Our financial condition and operating

results could be adversely affected if our mobile entertainment services fail to

compete favorably with these technological developments, or if we fail to be

responsive in a timely and effective manner to competitors' new services or

price strategies.

OUR MOBILE ENTERTAINMENT SERVICES AND ANY OF OUR FUTURE SERVICES MAY FAIL TO

GAIN MARKET ACCEPTANCE, WHICH WOULD ADVERSELY AFFECT OUR COMPETITIVE POSITION.

We have not conducted any independent studies with regard to the feasibility of

our proposed business plan, present and future business prospects and capital

requirements. We have generated limited commercial distribution for our mobile

entertainment services. Our services may fail to gain market acceptance and our

infrastructure to enable such expansion is still limited. Even if adequate

financing is available and our services are ready for market, we cannot be

certain that our services will find sufficient acceptance in the marketplace to

fulfill our long and short-term goals. Failure of our services to achieve market

acceptance would have a material adverse effect on our business, financial

condition and results of operations.

AVERAGE SELLING PRICES OF OUR PRODUCTS AND SERVICES MAY DECREASE, WHICH MAY HARM

OUR GROSS MARGINS.

The average selling prices of our products and services may be lower than

expected as a result of competitive pricing pressures and promotional programs.

We expect to experience pricing pressure and anticipate that the average selling

prices and gross margins for our products may decrease over product life cycles.

We may not be successful in developing and introducing on a timely basis new

products with enhanced features and services that can be sold at higher gross

margins.

AVERAGE SELLING PRICES OF OUR PRODUCTS AND SERVICES MAY DECREASE, WHICH MAY HARM

OUR GROSS MARGINS.

The average selling prices of our products and services may be lower than

expected as a result of competitive pricing pressures and promotional programs.

We expect to experience pricing pressure and anticipate that the average selling

prices and gross margins for our products may decrease over product life cycles.

We may not be successful in developing and introducing on a timely basis new

products with enhanced features and services that can be sold at higher gross

margins.

17

WE MAY FACE THIRD-PARTY INTELLECTUAL PROPERTY INFRINGEMENT CLAIMS AND OTHER

RELATED CLAIMS THAT COULD SEVERELY IMPACT OUR BUSINESS.

It may be alleged that we are liable to third-parties for certain legal matters

relating to video, music, software, and other content that we encode,

distribute, or make available to our customers if, among other things:

o the content or the performance of our services violates third-party

copyright, trademark, or other intellectual property rights;

o our customers violate the intellectual property rights of others by

providing content to us or by having us perform digital media services; or

o content that we encode or otherwise handle for our customers is deemed

obscene, indecent, or defamatory.

Any alleged liability could damage our business by damaging our reputation,

requiring us to incur legal costs in defense, exposing us to awards of damages

and costs and diverting management's attention, all which could have an adverse

effect on our business, results of operations and financial condition. Our

customers generally agree to hold us harmless from claims arising from their

failure to have the right to encode or distribute multimedia software and other

content given to us for that purpose. However, in some cases we may not be able

to obtain such agreements or customers may contest this responsibility or not

have sufficient resources to defend claims. In addition, we have limited

insurance coverage for claims of this nature and may not be able to cover losses

above our insurance coverage limits.

Because we host, stream and deploy audio and video content on or from our

websites for customers and provide services related to digital media content, we

face potential liability or alleged liability for negligence, infringement of

copyright, patent, or trademark rights, defamation, indecency and other claims

based on the nature and content of the materials. Claims of this nature have

been brought and sometimes successfully made against content distributors. In

addition, we could be exposed to liability with respect to the unauthorized

duplication of content or unauthorized use of other parties' proprietary

technology. Any imposition of liability that is not covered by insurance or is

in excess of insurance coverage or any alleged liability could harm our

business.

We cannot be certain that third-parties will not claim infringement by us with

respect to past, current, or future technologies. We expect that participants in

our markets will be increasingly subject to infringement claims as the number of

services and competitors in our industry segment grows. In addition, these risks

are difficult to quantify in light of the continuously evolving nature of laws

and regulations governing the Internet. Any claim relating to proprietary

rights, whether meritorious or not, could be time-consuming, result in costly

litigation, cause service upgrade delays or require us to enter into royalty or

licensing agreements, and we cannot be sure that we will have adequate insurance

coverage or that royalty or licensing agreements will be made available on terms

acceptable to us or at all.

WE CANNOT BE CERTAIN THAT WE WILL BE ABLE TO PROTECT OUR INTELLECTUAL PROPERTY,

WHICH COULD HARM OUR BUSINESS.

18

Our intellectual property is critical to our business, and we seek to protect

our intellectual property through copyrights, trademarks, patents, trade

secrets, confidentiality provisions in our customer, supplier, potential

investors, and strategic relationship agreements, nondisclosure agreements with

third-parties, and invention assignment agreements with our employees and

contractors. We cannot be certain that measures we take to protect our

intellectual property will be successful or that third-parties will not develop

alternative solutions that do not infringe upon our intellectual property.

Further, we plan to offer our mobile entertainment services and applications to

customers worldwide including customers in foreign countries that may offer less

protection for our intellectual property than the United States. Our failure to

protect against misappropriation of our intellectual property, or claims that we

are infringing the intellectual property of third-parties could have a negative

effect on our business, results of operations and financial condition.

WE WILL RELY ON STRATEGIC RELATIONSHIPS TO PROMOTE OUR SERVICES AND FOR ACCESS

TO LICENSED TECHNOLOGY; IF WE FAIL TO DEVELOP, MAINTAIN OR ENHANCE THESE

RELATIONSHIPS, OUR ABILITY TO SERVE OUR CUSTOMERS AND DEVELOP NEW SERVICES AND

APPLICATIONS COULD BE HARMED.

Our ability to provide our services to users of multiple technologies and

platforms depends significantly on our ability to develop, maintain or enhance

our strategic relationships with wireless carriers, handset distributors, key

streaming media technology companies and content providers. We will rely on

these relationships for licensed technology and content. Obtaining comprehensive

multimedia content licenses is challenging, as doing so may require us to obtain

copyright licenses with various third-parties in the fragmented multimedia

recording and publishing industries. These copyrights often address differing

activities related to the delivery of digital media, including reproduction and

performance, some of which may require separate licensing arrangements from

various rights holders such as publishers, content providers, artists and record

labels. The effort to obtain the necessary rights by such third-parties is often

significant, and could disrupt, delay, or prevent us from executing our business

plans. Because of the large number of potential parties from which we must

obtain licenses, we may never be able to obtain a sufficient number of licenses

to allow us to provide services that will meet our customers' expectations.

Due to the evolving nature of our industry, we will need to develop additional

relationships to adapt to changing technologies and standards and to work with

newly emerging companies with whom we do not have pre-existing relationships. We

cannot be certain that we will be successful in developing new relationships or

that our partners will view these relationships as significant to their own

business, or that our partners will continue their commitment to us in the

future. If we are unable to maintain or enhance these relationships, we may have

difficulty strengthening our technology development and increasing the adoption

of our brand and services.

IF WE CANNOT EFFECTIVELY PROMOTE OUR PRODUCTS, WE WILL NOT ATTRACT CUSTOMERS AND

AS A RESULT, OUR BUSINESS MAY FAIL.

We must partner with established players in the industry to generate enough

revenues to succeed. If we cannot partner with a distribution business partner

(ex. a carrier like AT&T) of mobile software products, we will not have the

ability to attract customers. A failure to achieve partners would have a

material and adverse effect on our business, operating results and financial

condition.

19

IF WE CANNOT ESTABLISH AND MAINTAIN QUALIFICATIONS AS A QUALITY SUPPLIER TO

MUSIC AND ENTERTAINMENT CUSTOMERS AND PARTNERS, THE BUSINESS WILL BE ADVERSELY

AFFECTED AND OUR BUSINESS MAY FAIL.

If we cannot achieve and maintain the necessary qualifications for our business,

our customers and partners may elect to seek solutions from other companies.

These qualifications traditionally include music and entertainment oriented

content, attractive look and feel of the product offering, customer service and

technical support requirements (ex. 7x24x365 support). If the Company is

successful in raising additional capital and able to hire and retain qualified

resources for the qualifications noted above, the Company believes it will be

successful in achieving and maintaining the necessary qualifications for the

customers. If the Company cannot achieve or maintain these types of customer

qualifications for customers, our business will be impacted in an adverse way.

THE TECHNOLOGY UNDERLYING OUR SERVICES AND APPLICATIONS IS COMPLEX AND MAY

CONTAIN UNKNOWN DEFECTS THAT COULD HARM OUR REPUTATION, RESULT IN PRODUCT

LIABILITY OR DECREASE MARKET ACCEPTANCE OF OUR SERVICES AND APPLICATIONS.

The technology underlying our multimedia broadcast services and applications is

complex and includes software that is internally developed and software licensed

from third-parties. These software products may contain errors or defects,

particularly when first introduced or when new versions or enhancements are

released. We may not discover software defects that affect our current or new

services and applications or enhancements until after they are sold.

Furthermore, because our digital media services are designed to work in

conjunction with various platforms and applications, we are susceptible to

errors or defects in third-party applications that can result in a lower quality

product for our customers. Because our customers depend on us for digital media

management, any interruptions could:

o damage our reputation;

o cause our customers to initiate product liability suits against us;

o decrease our product development resources;

o cause us to lose revenues; and

o delay market acceptance of our digital media services and applications.

OUR BUSINESS WILL SUFFER IF OUR SYSTEMS FAIL OR OUR THIRD-PARTY FACILITIES

BECOME UNAVAILABLE.

A reduction in the performance, reliability and availability of our systems and

network infrastructure may harm our ability to distribute our products and

services to our customers and other users, as well as harm our reputation and

ability to attract and retain customers and content providers. Our systems and

operations are susceptible to, and could be damaged or interrupted by, outages

caused by fire, flood, power loss, telecommunications failure, Internet

breakdown, earthquake and similar events. We may not have any redundancy in our

Internet multimedia broadcasting facilities and therefore any damage or

destruction to these would significantly harm our multimedia broadcasting

business. Our systems are also subject to human error, security breaches, power

losses, computer viruses, break-ins, "denial of service" attacks, sabotage,

intentional acts of vandalism and tampering designed to disrupt our computer

systems, Websites and network communications. This could lead to slower response

times or system failures.

20

Our operations also depend on receipt of timely feeds from our content

providers, and any failure or delay in the transmission or receipt of such feeds

could disrupt our operations. We also depend on Web browsers, ISPs and online

service providers to provide access over the Internet to our product and service

offerings. Many of these providers have experienced significant outages or

interruptions in the past, and could experience outages, delays and other

difficulties due to system failures unrelated to our systems. These types of

interruptions could continue or increase in the future.

Our digital distribution activities are managed by sophisticated software and

computer systems. We must continually develop and update these systems over time

as our business and business needs grow and change, these systems may not

adequately reflect the current needs of our business. We may encounter delays in

developing these systems, and the systems may contain undetected errors that

could cause system failures. Any system error or failure that causes

interruption in availability of products or content or an increase in response

time could result in a loss of potential or existing business services,

customers, users, advertisers or content providers. If we suffer sustained or

repeated interruptions, our products, services and Websites could be less

attractive to such entities or individuals and our business could be harmed.

Significant portions of our business are dependent on providing customers with

efficient and reliable services to enable customers to broadcast content to

large audiences on a live or on-demand basis. Our operations are dependent in

part upon transmission capacity provided by third-party telecommunications

network providers. Any failure of such network providers to provide the capacity

we require may result in a reduction in, or interruption of, service to our

customers. If we do not have access to third-party transmission capacity, we

could lose customers and, if we are unable to obtain such capacity on terms

commercially acceptable to us our business and operating results could suffer.

Our computer and communications infrastructure is located at a single leased

facility in Atlanta, Georgia. We do not have fully redundant systems, and we may

not have adequate business interruption insurance to compensate us for losses

that may occur from a system outage. Despite our efforts, our network

infrastructure and systems could be subject to service interruptions or damage

and any resulting interruption of services could harm our business, operating

results and reputation.

GOVERNMENT REGULATION COULD ADVERSELY AFFECT OUR BUSINESS PROSPECTS.

We do not know with certainty how existing laws governing issues such as

property ownership, copyright and other intellectual property issues, taxation,

illegal or obscene content, and retransmission of media, personal privacy and

data protection will apply to the Internet or to the distribution of multimedia

and other proprietary content over the Internet. Most of these laws were adopted

before the advent of the Internet and related technologies and therefore do not

address the unique issues associated with the Internet and related technologies.

Depending on how these laws are developed and are interpreted by the judicial

system, they could have the effect of:

o increasing our costs due to new or changes in tax legislation;

o limiting the growth of the Internet;

o creating uncertainty in the marketplace that could reduce demand for our

products and services;

o limiting our access to new markets which may include countries and

technology platforms;

21

o increasing our cost of doing business;

o exposing us to significant liabilities associated with content distributed

or accessed through our products or services; or

o leading to increased product and applications development costs, or

otherwise harming our business.

Specifically with respect to one aspect of copyright law, on October 28, 1998,

the Digital Millennium Copyright Act (or "DMCA") was enacted. The DMCA includes

statutory licenses for the performance of sound recordings and for the making of

recordings to facilitate transmissions. Under these statutory licenses,

depending on our future business activities, we and our customers may be

required to pay licensing fees in connection with digital sound recordings we

deliver or our customers provide on their Website and through retransmissions of

radio broadcasts and/or other audio content.

Because of this rapidly evolving and uncertain regulatory environment, both

domestically and internationally, we cannot predict how existing or proposed

laws and regulations might affect our business. In addition, these uncertainties

make it difficult to ensure compliance with the laws and regulations governing

digital music. These laws and regulations could harm us by subjecting us to

liability or forcing us to change our business.

FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements regarding

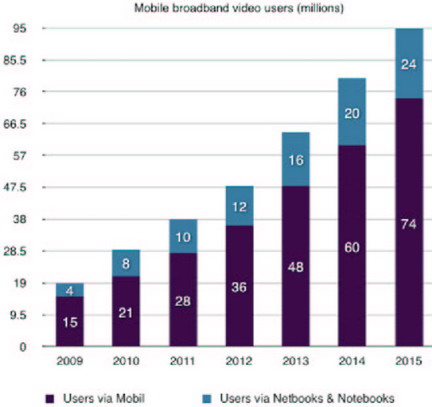

management's plans and objectives for future operations, including plans and