Attached files

| file | filename |

|---|---|

| 8-K - DYNEGY INC. | presentation8k.htm |

2010

Credit Suisse Energy Summit

February

2, 2010

Investor

Relations | Norelle Lundy,

Vice

President | Laura

Hrehor,

Senior Director | 713-507-6466 | ir@dynegy.com

• This presentation

contains statements reflecting assumptions, expectations, projections,

intentions or beliefs

about future events that are intended as “forward-looking statements.” You can identify these statements,

including those relating to Dynegy’s 2009 and 2010 financial estimates, by the fact that they do not relate

strictly to historical or current facts. Management cautions that any or all of Dynegy’s forward-looking

statements may turn out to be wrong. Please read Dynegy’s annual, quarterly and current reports under the

Securities Exchange Act of 1934, including its 2008 Form 10-K, as supplemented, and first, second and third

quarter 2009 Forms 10-Q for additional information about the risks, uncertainties and other factors affecting

these forward-looking statements and Dynegy generally. Dynegy’s actual future results may vary materially

from those expressed or implied in any forward-looking statements. All of Dynegy’s forward-looking

statements, whether written or oral, are expressly qualified by these cautionary statements and any other

cautionary statements that may accompany such forward-looking statements. In addition, Dynegy disclaims

any obligation to update any forward-looking statements to reflect events or circumstances after the date

hereof.

about future events that are intended as “forward-looking statements.” You can identify these statements,

including those relating to Dynegy’s 2009 and 2010 financial estimates, by the fact that they do not relate

strictly to historical or current facts. Management cautions that any or all of Dynegy’s forward-looking

statements may turn out to be wrong. Please read Dynegy’s annual, quarterly and current reports under the

Securities Exchange Act of 1934, including its 2008 Form 10-K, as supplemented, and first, second and third

quarter 2009 Forms 10-Q for additional information about the risks, uncertainties and other factors affecting

these forward-looking statements and Dynegy generally. Dynegy’s actual future results may vary materially

from those expressed or implied in any forward-looking statements. All of Dynegy’s forward-looking

statements, whether written or oral, are expressly qualified by these cautionary statements and any other

cautionary statements that may accompany such forward-looking statements. In addition, Dynegy disclaims

any obligation to update any forward-looking statements to reflect events or circumstances after the date

hereof.

• Non-GAAP Financial

Measures: This

presentation contains non-GAAP financial measures including EBITDA,

Adjusted EBITDA, Adjusted Cash Flow from Operations, Adjusted Free Cash Flow, Net Debt and Adjusted

Gross Margin. Reconciliations of these measures to the most directly comparable GAAP measures to the

extent available without unreasonable effort are contained herein. To the extent required, statements

disclosing the utility and purposes of these measures are set forth in Item 2.02 to our Current Report on

Form 8-K filed with the SEC on November 5, 2009, which is available on our website free of charge,

www.dynegy.com.

Adjusted EBITDA, Adjusted Cash Flow from Operations, Adjusted Free Cash Flow, Net Debt and Adjusted

Gross Margin. Reconciliations of these measures to the most directly comparable GAAP measures to the

extent available without unreasonable effort are contained herein. To the extent required, statements

disclosing the utility and purposes of these measures are set forth in Item 2.02 to our Current Report on

Form 8-K filed with the SEC on November 5, 2009, which is available on our website free of charge,

www.dynegy.com.

Forward-looking

Statements

2

3

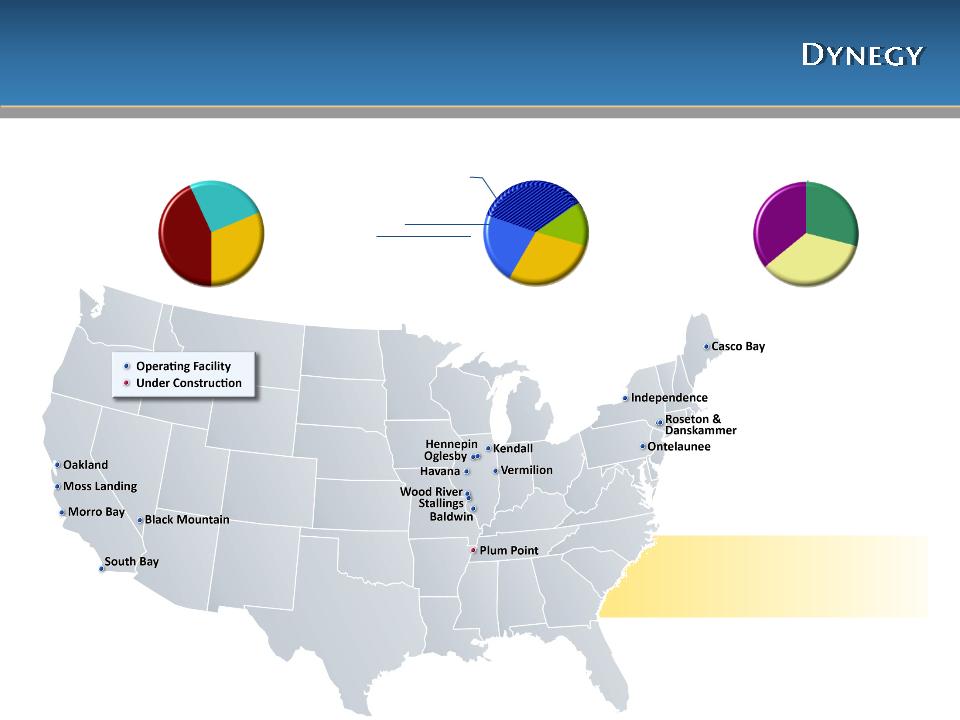

Dynegy

at a Glance

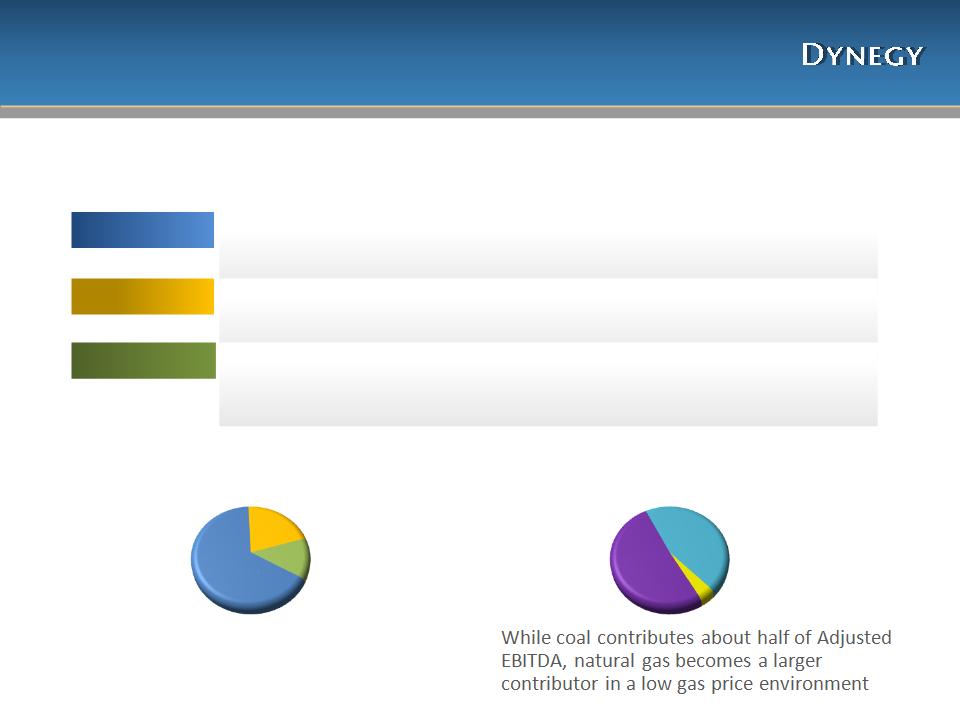

|

Generation

Capacity

|

~12,500

MW

|

|

2010

Adjusted EBITDA (2)

|

$ 425 - 550

MM

|

|

2010

Adjusted Cash Flow from Ops (2)

|

$ (15) - 110

MM

|

|

2010

Adjusted Free Cash Flow (2)

|

$ (360) -

(235) MM

|

|

Market Cap

(1)

|

$ 1.07

B

|

|

Share price

(1)

|

$

1.81

|

|

Shares

outstanding

|

~595

MM

|

|

(1)

As of December 31, 2009. (2) Forecasted estimates provided on November 5,

2009.

|

|

Dynegy

provides wholesale power, capacity and ancillary

services to utilities,

cooperatives, municipalities and other energy companies in key U.S. regions

cooperatives, municipalities and other energy companies in key U.S. regions

Midwest

5,575

MW

10

facilities

Regional

Overview

4

Dynegy’s

~12,500 MW portfolio is focused in 3 regions

Primarily

low-cost baseload coal and efficient CCGTs

well-positioned in generation dispatch order

well-positioned in generation dispatch order

Dynegy’s Midwest

region represents

~40% of generation capacity, but

contributes ~65% of Adjusted EBITDA

~40% of generation capacity, but

contributes ~65% of Adjusted EBITDA

West

Diverse

fuels and dispatch type

Primarily

natural gas-fired facilities

Adjusted

EBITDA by Region

Northeast

~15%

West

~20%

Midwest

~65%

Adjusted

EBITDA by Fuel Type

Other

~5%

Gas

~45%

Coal

~50%

3,696

MW

5

facilities

3,282

MW

4

facilities

Northeast

5

We

Believe Long Term Industry

Fundamentals Remain Strong

Fundamentals Remain Strong

§ Power markets

should tighten

§ Natural gas prices

should rise,

increasing power prices

increasing power prices

§ Newer, more

efficient units could push

older generation into retirement

older generation into retirement

§ Development trends

point to emphasis

on renewables - however, cost is high

and grid infrastructure remains an issue

on renewables - however, cost is high

and grid infrastructure remains an issue

§ Industry

consolidation could provide

synergies leading to shareholder value

synergies leading to shareholder value

§ Power prices

remain weak

§ Natural gas prices

remain volatile

§ New power

generation will come online

at a slower rate due to barriers to entry

such as:

at a slower rate due to barriers to entry

such as:

– Depressed capital

markets

– Uncertainty around

Cap & Trade and other

environmental regulation & legislation

environmental regulation & legislation

– Low power prices,

making it difficult to

justify returns

justify returns

Near

Term Expectations

Long

Term Expectations

Power

generation remains cyclical - the recent downward trend is

expected to reverse over time as supply/demand tightens

expected to reverse over time as supply/demand tightens

•Near

term,

Dynegy will continue to focus on operating and commercializing well

and on maintaining ample liquidity

and on maintaining ample liquidity

•Longer

term,

Dynegy’s ability to harvest value will center around capitalizing on

expected stronger power prices and demand

expected stronger power prices and demand

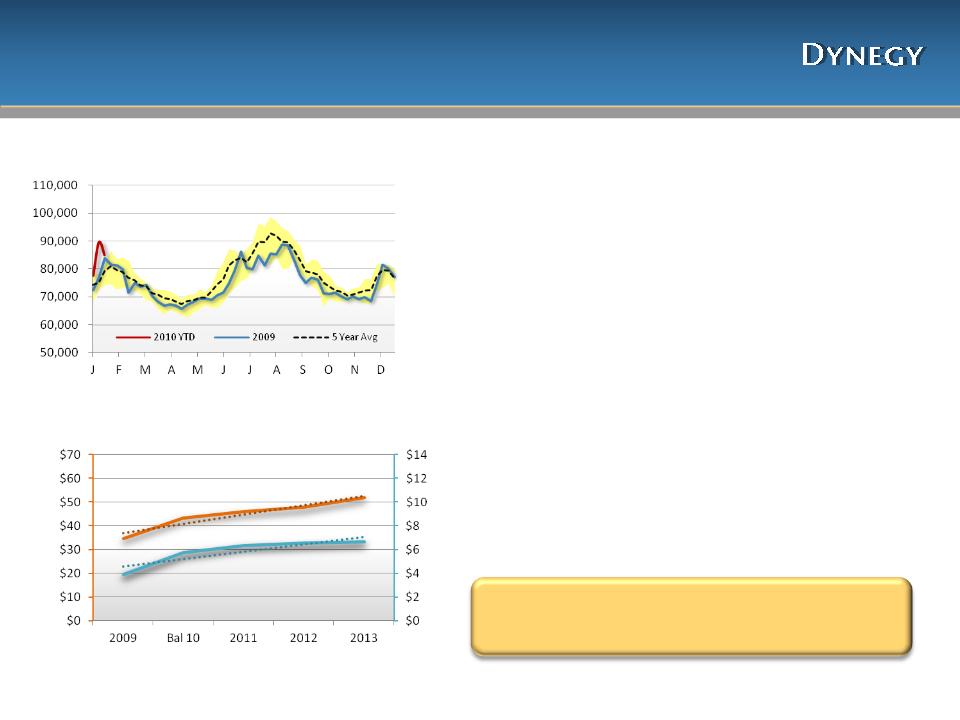

• 2009 U.S. electric

demand was down ~4%, but

remained within the 5 year average range

remained within the 5 year average range

• 2010 may continue

to be a challenging business

environment with commodity prices

remaining volatile as markets begin to recover

environment with commodity prices

remaining volatile as markets begin to recover

• Weather spikes, as

seen in January 2010,

represent opportunities to capture

incremental value

represent opportunities to capture

incremental value

• U.S. electricity

demand is projected to increase

over the next two years

over the next two years

• Despite ongoing

volatility, commodity prices

are beginning to trend upward

are beginning to trend upward

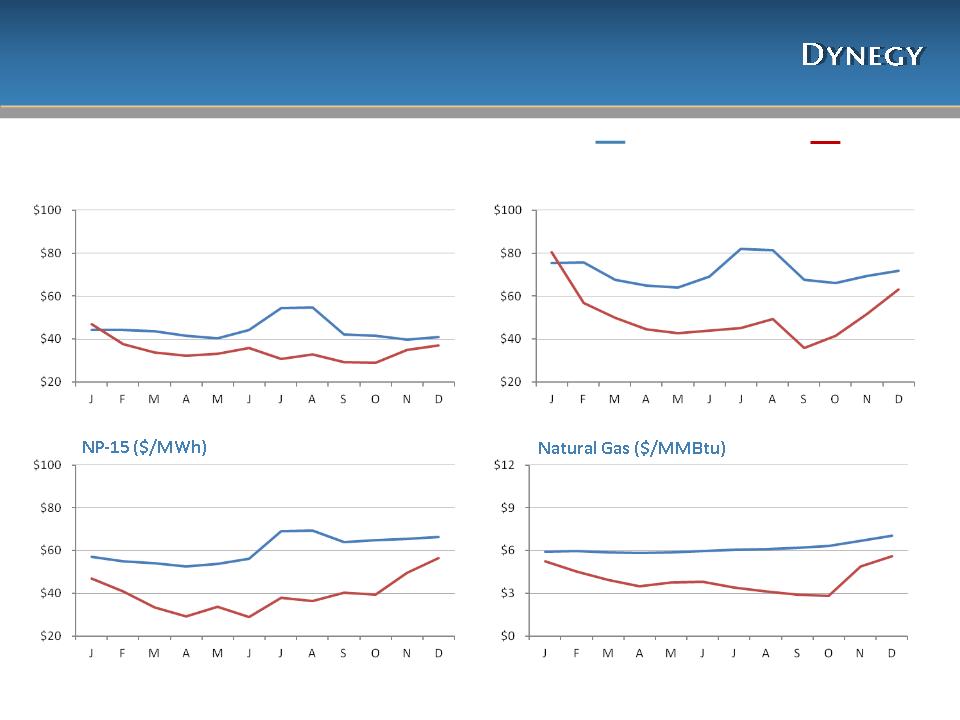

Dynegy

Expects Commodity Prices

to Rise Long Term

to Rise Long Term

6

Natural

Gas & Power Prices

CIN

Hub On-Peak ($/MWh)

Natural

Gas ($/MMBtu)

Note:

Generation

as of 1/16/10 from EEI.

Pricing

as of 1/11/10, reflect actual day ahead on-peak settlement prices and quoted

forward on-peak monthly prices.

Source:

Brokered market indicators

U.S.

Electric Generation (GWh)

We

believe long term power industry

fundamentals remain strong

fundamentals remain strong

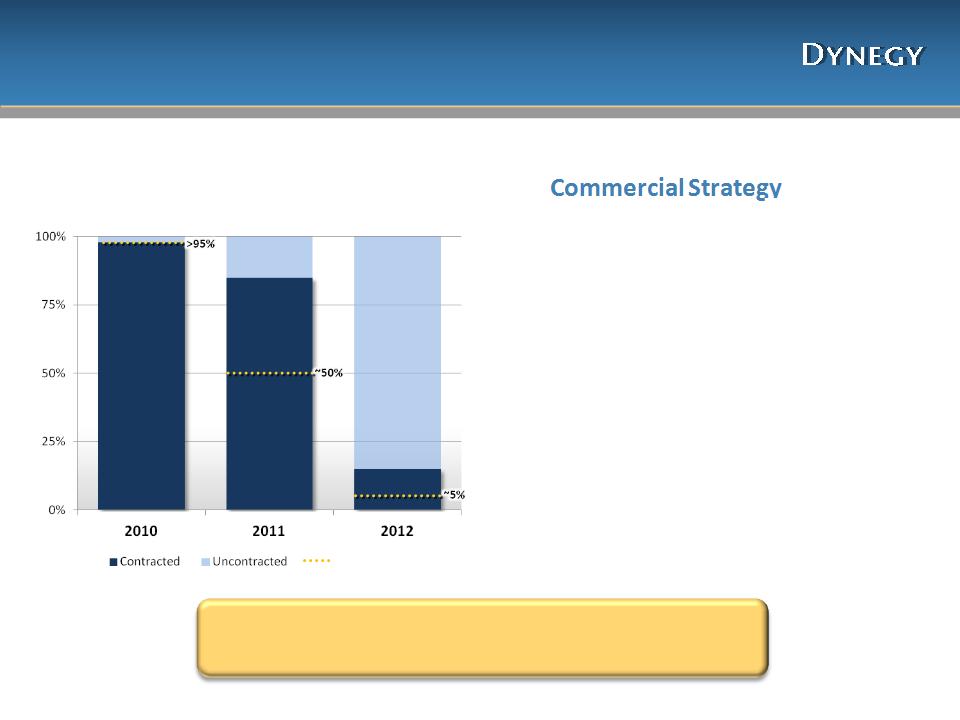

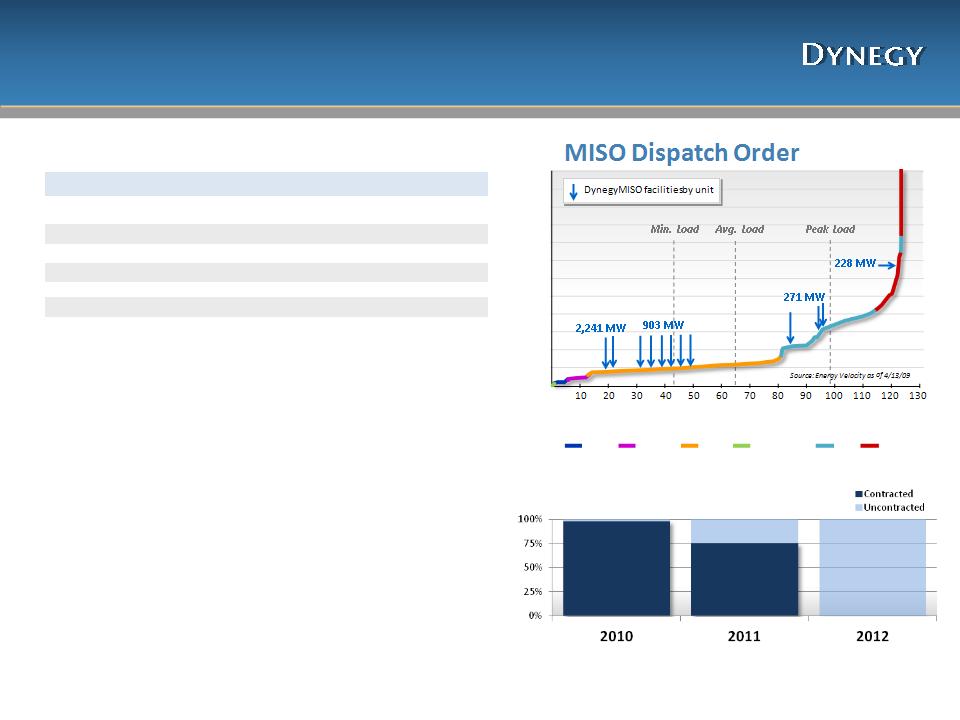

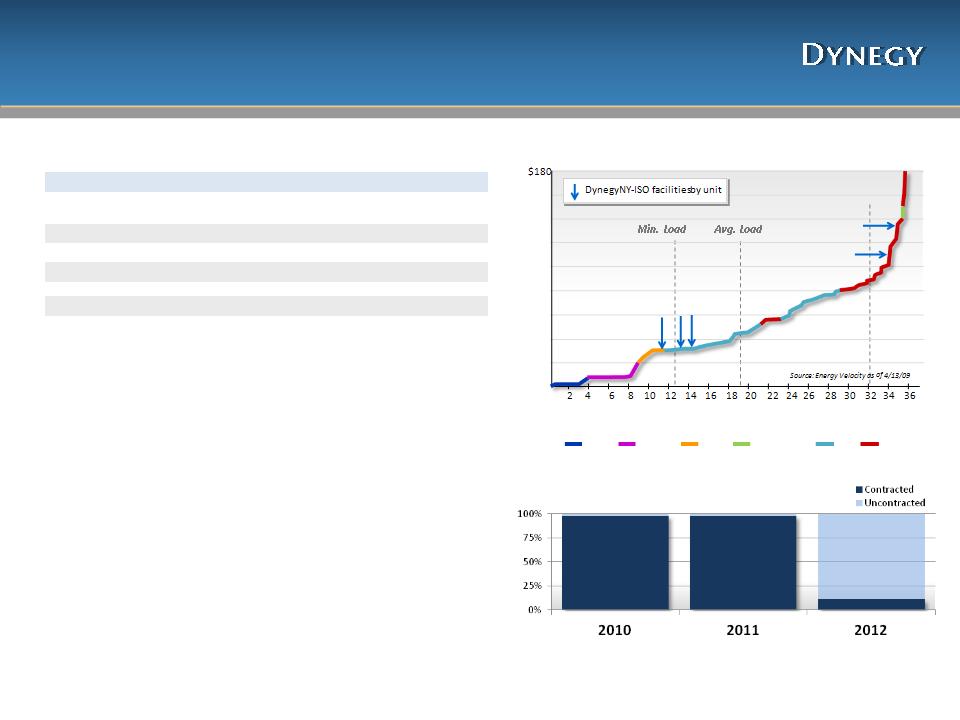

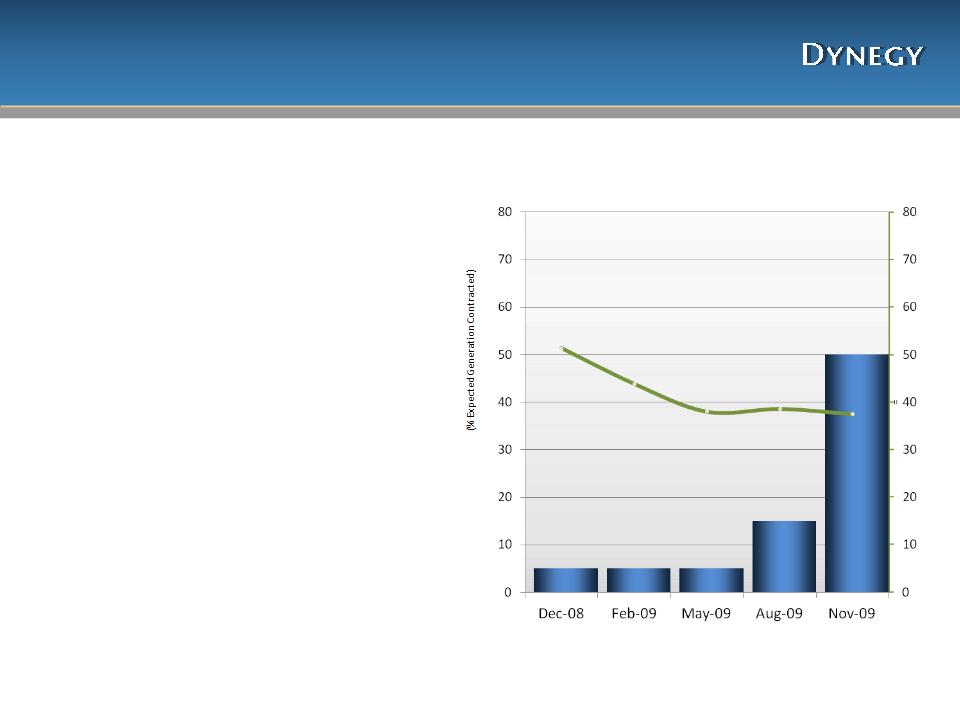

Contracted

Percentage of Expected

Generation Volumes (% of MWh)

Generation Volumes (% of MWh)

~85%

>95%

7

Near

to intermediate term view:

• Dynegy is focused

on increased

predictability of earnings and cash

flow while also protecting against

downside risk

predictability of earnings and cash

flow while also protecting against

downside risk

Long

term view:

• Staying relatively

uncontracted in

outer years should provide

opportunities to capture value in a

fundamentally rising price

environment as supply/demand

tightens

outer years should provide

opportunities to capture value in a

fundamentally rising price

environment as supply/demand

tightens

Dynegy’s Commercial Strategy

Reflects Long Term Industry Fundamentals

Maintaining

long term market upside potential

while protecting against downside risks

while protecting against downside risks

Note:

As

of 1/11/10 and reflects the impact of assets sold to LS Power.

~15%

Level

as of 11/5/09

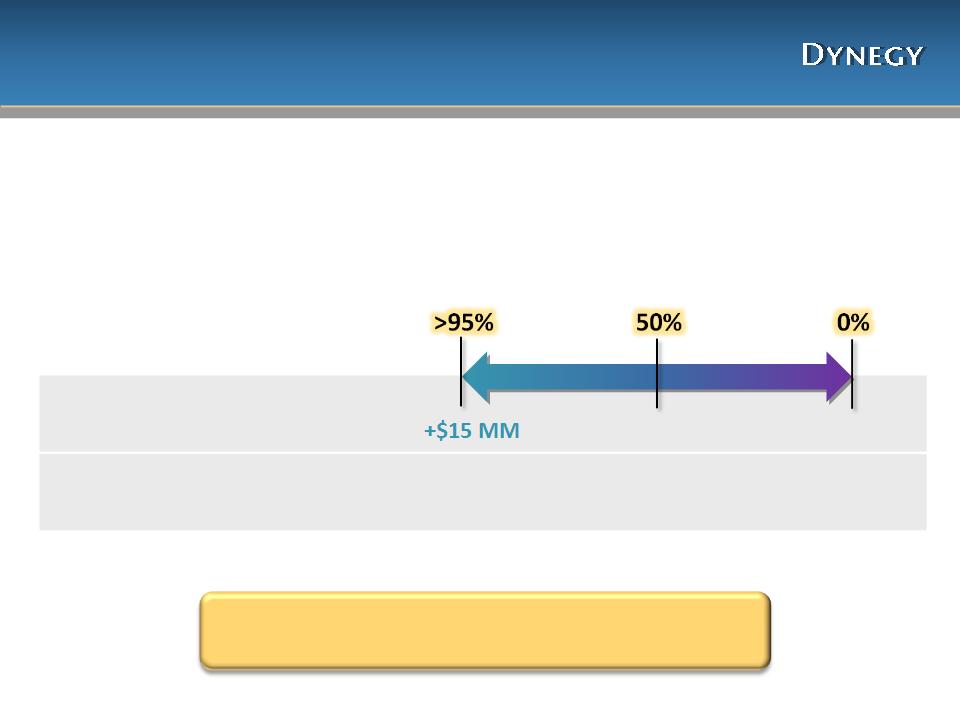

Beyond

“Current +1/+2”, results will be more sensitive to commodity price

movements as these years are less hedged

movements as these years are less hedged

Commercial

Strategy Works

to Capture Value around Assets

to Capture Value around Assets

8

%

Expected Generation Contracted:

+$70

MM

+$165

MM

Impact

to Adjusted EBITDA of

+$1.00/MMBtu Natural Gas:

+$1.00/MMBtu Natural Gas:

$(15)

MM

$(70)

MM

$(165)

MM

Impact

to Adjusted EBITDA of

-$1.00/MMBtu

Natural Gas:

Note:

Other

events and variables can impact results materially. See

Appendix for other sensitivities.

Baseload

and intermediate assets positioned

to capture the most value as markets recover

to capture the most value as markets recover

Dynegy’s

Capital Structure

Complements Our Commercial Strategy

Complements Our Commercial Strategy

9

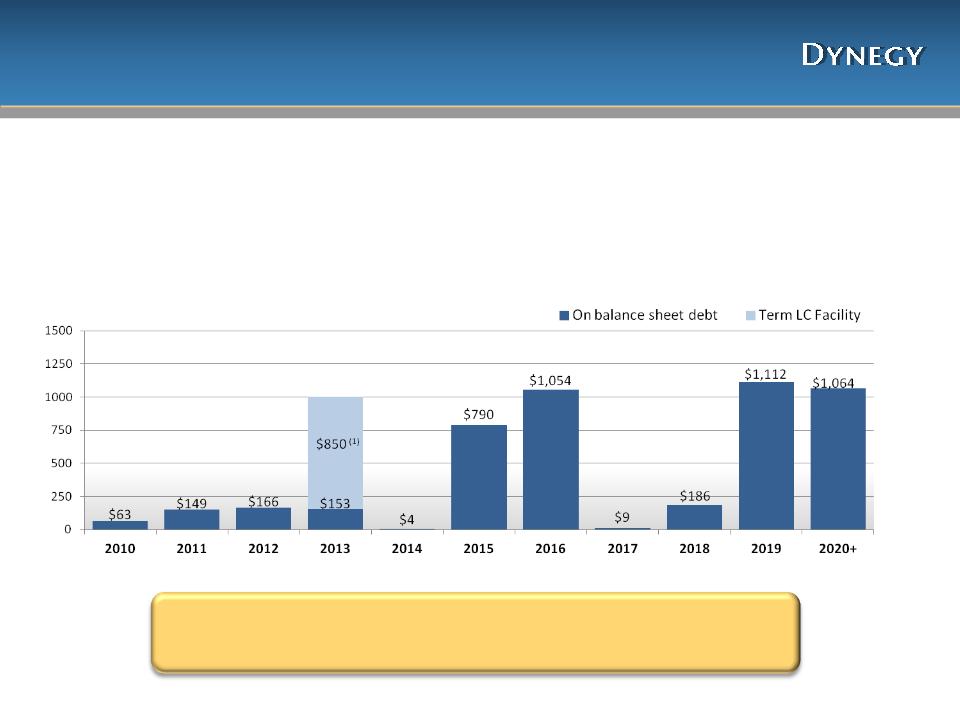

Debt

Maturity Profile (As of 12/31/09,

$MM)

Total

balance sheet debt = ~$5.6 B

$1,003

(1)

Synthetic

Letter of Credit facility is supported by $850 million of restricted

cash.

Dynegy

has minimal near-term debt maturities and

sufficient liquidity to commercialize positions

sufficient liquidity to commercialize positions

In

2009, Dynegy successfully executed our Liability Management Plan

•Reducing debt by

$830 million with no significant maturities until 2015

•Maintaining

liquidity of ~$2.0 billion to support our commercial

strategy

10

What

Makes a Long-Term Value Play?

|

Ability

to

manage risk |

|

|

|

Prudent

financial management |

|

|

|

Investor

confidence |

|

By

operating and commercializing well today, Dynegy believes it will

be

positioned to capture value as markets improve over the longer term

positioned to capture value as markets improve over the longer term

Appendix

12,553

MW

Dynegy’s

Diversified Asset Portfolio

Note:

Plum Point is currently under construction.

Dispatch

Diversity

Peaking

36%

Intermediate

35%

Baseload

29%

Geographic

Diversity

Midwest

44%

Northeast

26%

West

30%

Fuel

Diversity

Combined

Cycle

35%

Peaking

22%

Total

Gas-fired

57%

Coal

29%

Fuel

Oil

14%

12

2010

Commodity Pricing Assumptions

13

*

Represents annual average based on 10/6/09 pricing.

|

|

2010E*

|

|

|

Natural

Gas - Henry Hub

($/MMBtu)

|

$

6.15

|

|

|

|

|

|

|

On-Peak

Power

($/MWh)

|

|

Facilities

|

|

NI Hub /

ComEd

|

$42.95

|

Kendall

|

|

PJM

West

|

$59.25

|

Ontelaunee

|

|

Cinergy

|

$44.32

|

Midwest

Coal

|

|

NY - Zone

C

|

$53.62

|

Independence

|

|

NY - Zone

G

|

$71.24

|

Roseton,

Danskammer

|

|

NE - Mass

Hub

|

$66.11

|

Casco

Bay

|

|

NP-15 -

California

|

$60.65

|

Moss

Landing, Morro Bay, Oakland

|

|

SP-15 -

California

|

$58.90

|

South

Bay

|

|

|

|

|

|

Coal

($/MMBtu)

|

|

|

|

Powder River

Basin (PRB) delivered

|

$1.49

|

Baldwin

|

|

South

American delivered to Northeast

|

$3.55

|

Danskammer

|

|

|

|

|

|

Fuel

Oil #6 delivered to Northeast

($/MMBtu)

|

$10.97

|

Roseton

|

As

presented November 5, 2009

14

Tax

and Other Assumptions

Tax

Assumptions

–Tax expense

accrues at ~40%; expect to pay

state cash tax payments of ~$2 million

state cash tax payments of ~$2 million

–Dynegy not

expected to become a

significant cash tax payer until well into the

future

significant cash tax payer until well into the

future

Other

Assumptions

– Commodity pricing

assumes

$6.15/MMBtu natural gas

$6.15/MMBtu natural gas

– ~$50 million

annual amortization

expense included in Northeast Adjusted

EBITDA through 2014 related to ConEd

contract; annual capacity payment

received of ~$100 million

expense included in Northeast Adjusted

EBITDA through 2014 related to ConEd

contract; annual capacity payment

received of ~$100 million

– Shares outstanding

~595 MM

As

presented November 5, 2009

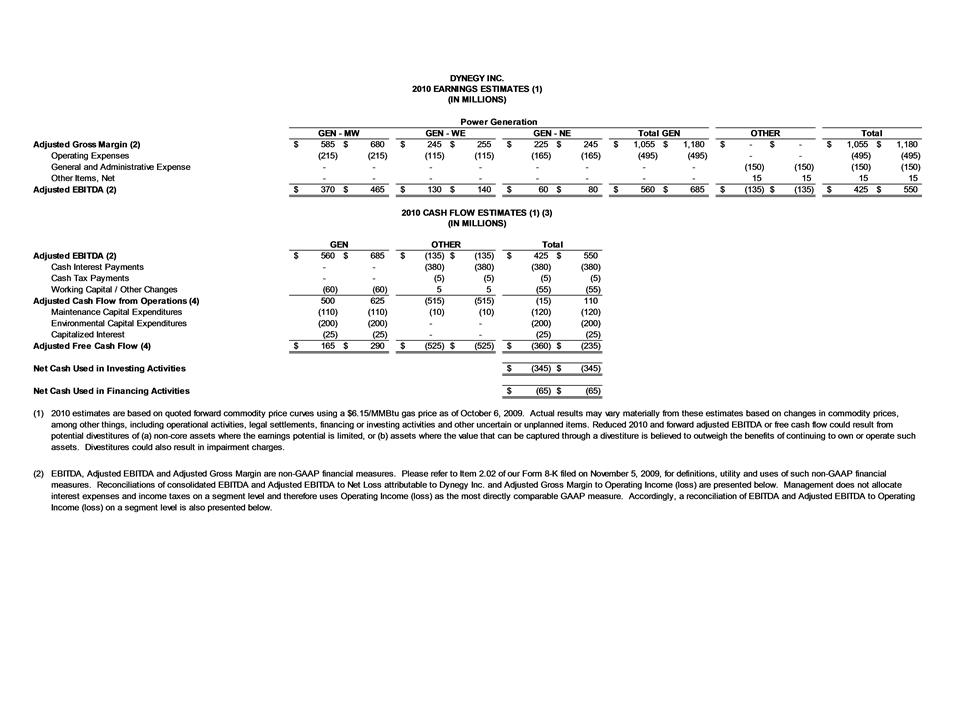

2010

Guidance Estimates

15

Note:

Guidance estimates are forward-looking in nature; actual results may vary

materially from these estimates. (1)

Based on 2010 forward natural gas prices of $6.15/MMBtu as of 10/6/09.

(2)

Interest

payments could change based on outcome of ultimate Liability Management Program.

payments could change based on outcome of ultimate Liability Management Program.

|

($MM)

|

|

11/5/2009

Guidance(1)

|

|

Adjusted

Gross Margin

|

|

$

1,055 - 1,180

|

|

Operating

Expenses

|

|

(495)

|

|

G&A /

Interest income / Other

|

|

(135)

|

|

Adjusted

EBITDA

|

|

$ 425

- 550

|

|

Interest

payments (2)

|

|

(380)

|

|

Working

capital / Non-cash adjustments / Cash taxes / Other

|

|

(60)

|

|

Adjusted

cash flow from operations

|

|

$ (15)

- 110

|

|

Maintenance

capital expenditures

|

|

(120)

|

|

Environmental

capital expenditures

|

|

(200)

|

|

Capitalized

Interest

|

|

(25)

|

|

Adjusted

free cash flow

|

|

$ (360)

- (235)

|

|

Table

above is not intended as a GAAP reconciliation; reconciliation located in

the Appendix.

|

|

|

|

2010

Guidance - GAAP Measures

|

($MM)

|

||

|

Net

loss

|

|

$

|

(250) -

(175)

|

|

Net cash

used and provided by operating activities

|

|

$

|

(15) -

110

|

|

Net cash

used by investing activities

|

|

$

|

(345)

|

|

Net cash

used by financing activities

|

|

$

|

(65)

|

As

presented November 5, 2009

($/MMBtu)

Adjusted

2010 EBITDA Sensitivities

16

Note:

Sensitivities reflect >95% of expected generation contracted on a

consolidated basis. 11/5/09

guidance ranges based on 2010 forward natural gas prices of $6.15/MMBtu as of

10/6/09.

$550

MM

$425

MM

• Expected range of

Adjusted EBITDA

for 2010 continues to be sensitive to

several factors

for 2010 continues to be sensitive to

several factors

• The horizontal

X-axis represents possible

changes in natural gas prices

changes in natural gas prices

– As percentage of

expected generation

contracted goes up, sensitivity decreases

contracted goes up, sensitivity decreases

• The vertical

Y-axis represents the possible

impacts of various other factors:

impacts of various other factors:

– Volatility of

commodity prices

– Basis

differentials

– Capacity

prices

– Unplanned

outages

• Often events and

variables are

interrelated and individual sensitivities

are not always additive

interrelated and individual sensitivities

are not always additive

$35.00

$42.00

$49.00

CIN

Hub On-Peak

($/MWh)

$600

$550

$500

$450

$400

Anticipated

Range for

2010

Adjusted EBITDA ($MM)

$6.15 Gas

As

presented November 5, 2009

Natural

Gas Sensitivity

Primarily Impacts Baseload Coal

Primarily Impacts Baseload Coal

17

• Sensitivities

based on full-year estimates and assume natural gas price change

occurs for the entire year and entire portfolio

occurs for the entire year and entire portfolio

– On-peak power

prices are adjusted by holding the spark spread constant to a

7,000 Btu/KWh heat rate

7,000 Btu/KWh heat rate

– Off-peak prices

are adjusted holding the market implied heat rate constant

Note:

Uncontracted

portfolio for longer term assumed for illustrative purposes only.

|

|

Adjusted

EBITDA Sensitivity ($MM)

|

|

|

Change in

Cost of Natural Gas

($/MMBtu) |

2010 >95%

Contracted

|

Longer Term

Uncontracted

|

|

+

$2.00

|

$

30

|

$

340

|

|

+

$1.00

|

$

15

|

$

165

|

|

-

$1.00

|

$

(15)

|

$

(165)

|

As

presented November 5, 2009

18

|

2010

with >95% Contracted

|

|||

|

Market

Implied

Heat Rate Movement (Btu/KWh) |

Generation

Adjusted EBITDA Sensitivity

($MM) |

||

|

Coal/Fuel

Oil

|

Natural

Gas

|

TOTAL

|

|

|

+

1,000

|

$-

|

$20

|

$20

|

|

+

500

|

$-

|

$10

|

$10

|

|

-

500

|

$-

|

$(5)

|

$(5)

|

• Sensitivities

based on “on-peak” power price changes and full-year estimates

• Assumes constant

natural gas price of ~$6.15/MMBtu and heat rate changes are for a full

year

• Increased run-time

will result in increased maintenance costs, which are not included in

sensitivities

sensitivities

Market

Implied Heat Rate

Sensitivities Impact Entire Fleet

Sensitivities Impact Entire Fleet

Note:

Spark

spread value changes depend on natural gas price assumptions. Uncontracted

portfolio for longer term assumed for illustrative purposes only.

|

Longer-Term:

Uncontracted

|

|||

|

Market

Implied

Heat Rate Movement (Btu/KWh) |

Generation

Adjusted EBITDA Sensitivity

($MM) |

||

|

Coal/Fuel

Oil

|

Natural

Gas

|

TOTAL

|

|

|

+

1,000

|

$15

|

$120

|

$135

|

|

+

500

|

$5

|

$60

|

$65

|

|

-

500

|

$(5)

|

$(55)

|

$(60)

|

As

presented November 5, 2009

• Midwest

– 2010 Plan assumes

average generation to CIN Hub basis of

$(5.50)/MWh

$(5.50)/MWh

– 2010 Plan assumes

Midwest volumes of ~25 MM MWh

– +/- $1.00/MWh

change in basis = +/- $25 million impact to Adjusted

EBITDA on a full year basis

EBITDA on a full year basis

• Northeast

– 2010 Plan assumes

average Casco Bay generation to Mass Hub basis of

$(4.50)/MWh on peak and $(2.75)/MWh off peak

$(4.50)/MWh on peak and $(2.75)/MWh off peak

– 2010 Plan assumes

Casco Bay volumes of ~2 MM MWh

– +/- $1.00/MWh

change in basis = +/- $2 million impact to Adjusted

EBITDA on a full year basis

EBITDA on a full year basis

Basis Sensitivities

19

As

presented November 5, 2009

• 2010 Guidance

assumes:

– As of 10/6/09, the

weighted average unsold MISO capacity of 2,066 MW

– Average capacity

price of $0.58/KW-Mo (using 10/6/09 pricing)

– Current value of

unsold MISO capacity in 2010 Plan = ~$14 million

– Change in price

and volumes can alter capacity revenue

Midwest

Capacity Price Sensitivities

20

As

presented November 5, 2009

21

Midwest

- Well-Positioned

Baseload Coal & Efficient CCGTs

Baseload Coal & Efficient CCGTs

|

Generation

Volumes

|

~25 MM

MWh

|

|

($MM)

|

|

|

Adjusted

Gross Margin (1)

|

$

585 - 680

|

|

Operating

Expenses (2)

|

(215)

|

|

Adjusted

EBITDA(1)

|

$

370 - 465

|

|

|

|

|

Operating

Income

|

$

30 - 125

|

|

Price:

|

• CIN Hub

power price for MISO fleet

• Spark

spreads for Kendall and Ontelaunee

• Coal

generally has been setting the marginal price of

power in MISO ~80-85% of the time in a low natural gas environment and reduced demand • Natural gas

sets the marginal price of power in PJM

|

|

Cost:

|

• Low cost PRB

coal and rail contracts 100% contracted/

priced for 2010 • 2010 Average

Delivered PRB to Baldwin is

$1.49/MMBtu • Operating

expense incorporates impact of investing in

pollution control equipment |

|

Watch:

|

• Track CIN

Hub to IL Hub basis differentials

• Capacity

markets in MISO

• Potential

carbon and other new environmental

regulation |

>95%

~75%

~0%

Note:

Additional

regional data provided in the Appendix. (1)

Adjusted Gross Margin and

Adjusted EBITDA are non-GAAP financial measures. Reconciliations of these measures to

the most directly comparable GAAP measure are included in the Appendix. (2) Operating

Expenses exclude depreciation and amortization.

Adjusted EBITDA are non-GAAP financial measures. Reconciliations of these measures to

the most directly comparable GAAP measure are included in the Appendix. (2) Operating

Expenses exclude depreciation and amortization.

Hedging

Profile as of

1/11/10

Hydro

Nuclear

Coal

Renewables

Gas

Oil

$240

220

200

180

160

140

120

100

80

60

40

20

0

Cumulative

Capacity GW

Regional

Performance Drivers

Regional

Estimates as of

11/5/09 2010E

$/MWh

22

Midwest

Generation - Primarily Baseload Coal

Midwest

Forecast ($MM)

2010

Coal

$ 250

- 325

Combined

Cycle

105 -

120

Peaking/Other

(1)

15 -

20

Adjusted

EBITDA

$ 370

- 465

Operating

Income

$ 30

- 125

Forecasted

Fundamentals 2010

Volumes

(MM

MWh)

24.9

Fleet

Heat

Rate (2)

Rate (2)

(Nameplate

Btu/KWh)

Btu/KWh)

Baseload

10,000 -

11,000

CC

7,000

- 8,000

Peaking

10,000 -

12,000

Delivered PRB Coal

(Baldwin)

$1.49/MMBtu

Delivered Natural

Gas

(TET M-3 + $0.05)

(TET M-3 + $0.05)

$6.96/MMBtu

Delivered Natural

Gas

(CHI CG + $0.10)

(CHI CG + $0.10)

$6.31/MMBtu

Power

Prices

(Average on

peak

prices $/MWh)

prices $/MWh)

CIN

Hub

$44.32

PJM

West

$59.25

NI

Hub

$42.95

Avg.

Spark Spread (PJM West vs TET

M-3 @ 7HR)

$10.90

Avg.

Spark Spread (NI Hub vs CHI CG @

7HR) ($.54)

Annual

Average

Capacity

Factors

Baseload

70% -

90%

CC

10% -

20%

Peaking

0% -

10%

Average

Capacity

Price

(KW-Mo)

(KW-Mo)

MISO

$0.58

PJM

RTO/MAAC

$4.38/$5.52

Avg

Gen to

CIN Hub Basis

($/MWh)

CIN Hub Basis

($/MWh)

On-Peak

$(5.70)

Off-Peak

$(5.30)

Note:

Pricing

as of 10/6/09.

(1) Other

comprised of ancillary services, emission credit sales and

amortization of intangibles and trading. (2) Nameplate Heat Rate is after adjustment for

generating starts & stops, weather, fuel types, efficiencies and other operational components.

amortization of intangibles and trading. (2) Nameplate Heat Rate is after adjustment for

generating starts & stops, weather, fuel types, efficiencies and other operational components.

Other

noteworthy items:

•Unlike PJM, the

MISO capacity market is

not liquid in the outer years

not liquid in the outer years

As

presented November 5, 2009

|

Revenue

Contracts: |

• Contracting

activity primarily centers on the Midwest coal fleet

– ~600 MW CIN

Hub On-Peak at an average price of ~$45/MWh, ~2,000MW CIN Hub

Off-Peak

at an average price of $32/MWh; – ~600 MW IL

Hub On-Peak at an average price of ~$42/MWh; ~600MW IL Hub Off-Peak at

an

average price of ~$28/MWh • ~ 280 MW

under tolling agreement to 2017 for ~$20 million in 2010

• Term

capacity sales in place

– PJM capacity

auctions:

– MISO

capacity sales:

§ ~900 MW

bilateral capacity sales in place for 2010

|

|

|

|

|

Fuel

Contracts:

|

• 100% of PRB

coal supply is contracted and priced through 2010

• Ten year

transportation agreement with Burlington Northern through 2013 at

attractive rates – 2010 Average

delivered coal cost at Baldwin is forecasted to be

$1.49/MMBtu

|

|

|

Midwest

- Key Contracts

23

|

Auction

Year

|

DYN

MW cleared

|

Auction

Price

(~$/MW-day) |

|

2009/2010

|

~800

|

$

102

|

|

|

~515

|

$

191

|

|

2010/2011

|

~1,300

|

$

174

|

|

2011/2012

|

~1,300

|

$

110

|

|

2012/2013

|

~820

|

$16

|

|

|

~490

|

$133

|

As

presented November 5, 2009

Significant

Environmental Progress

24

On

target to further reduce emissions in the Midwest

Major

Assumptions

• Estimate of

remaining spend is ~$470 million for a total

investment of $960 million

investment of $960 million

• Approximately 25%

of remaining costs are firm

• Labor and material

prices are assumed to escalate at 4%

annually

annually

• All projects

include installing baghouses and scrubbers

with the exception of Hennepin and Vermilion, which

have baghouses only

with the exception of Hennepin and Vermilion, which

have baghouses only

Labor

56%

Rental

Equipment

& Other 8%

& Other 8%

Cost

Composition

Materials

36%

2008

2010

2009

2011

2012

2007

Vermilion

Hennepin

Baldwin

3

Baldwin

1

Baldwin

2

Havana

As

presented November 5, 2009

25

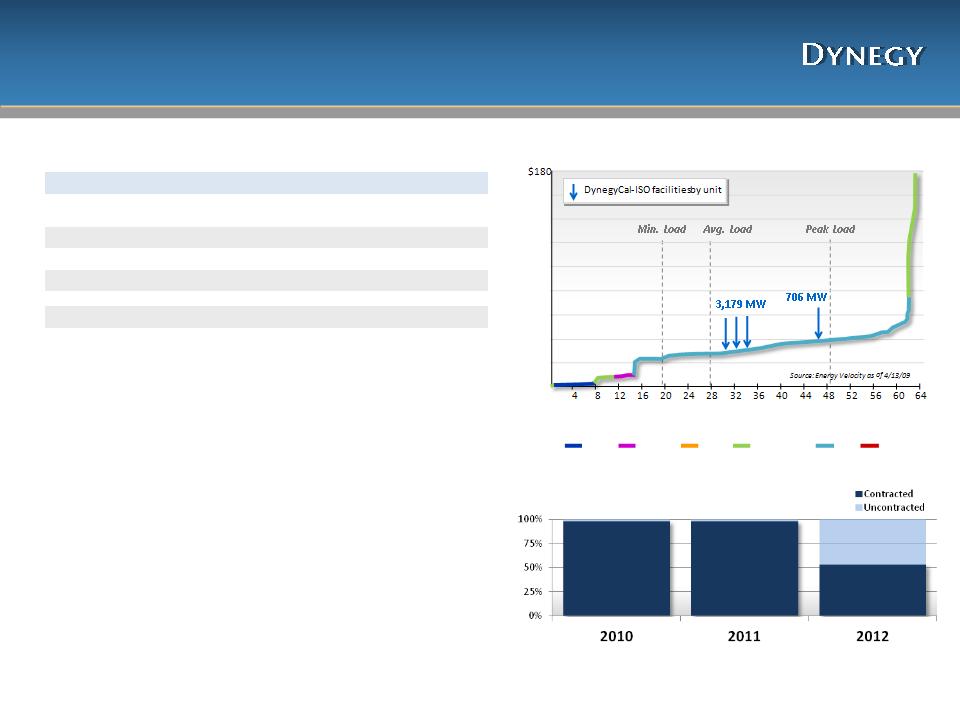

West

- Primarily Natural Gas

|

Generation

Volumes

|

~7 MM

MWh

|

|

($MM)

|

|

|

Adjusted

Gross Margin (1)

|

$

245 - 255

|

|

Operating

Expenses (2)

|

(115)

|

|

Adjusted

EBITDA (1)

|

$

130 - 140

|

|

|

|

|

Operating

Income

|

$

70 - 80

|

Regional

Performance Drivers

>95%

>95%

>95%

>95%

~50%

~50%

Cal-ISO

Dispatch Order

Hedging

Profile as of

1/11/10

|

Price:

|

• ~70% of

Adjusted Gross Margin is derived through

tolling agreements in the near-term • Regional

spark spreads

• Natural gas

sets the marginal price of power

|

|

Cost:

|

• Tolling

counterparties take financial and delivery risk

for fuel during tolled periods • Fuel is

purchased as needed at index related prices

|

|

Watch:

|

• Operational

performance since the majority of the

plants operate under tolling contracts • Weather can

affect volumes of uncontracted CCGT

fleet • Spread

variability mitigated by toll contracts

• Potential

once-through cooling regulations

|

Note:

Additional

regional data provided in the Appendix. (1)

Adjusted Gross Margin and

Adjusted EBITDA are non-GAAP financial measures. Reconciliations of these measures to

the most directly comparable GAAP measure are included in the Appendix. (2) Operating

Expenses exclude depreciation and amortization.

Adjusted EBITDA are non-GAAP financial measures. Reconciliations of these measures to

the most directly comparable GAAP measure are included in the Appendix. (2) Operating

Expenses exclude depreciation and amortization.

Cumulative

Capacity GW

Hydro

Nuclear

Coal

Renewables

Gas

Oil

160

140

120

100

80

60

40

20

0

Regional

Estimates as of

11/5/09 2010E

$/MWh

26

West

Generation - Primarily Natural Gas

Forecasted

Fundamentals 2010

Volumes

(MM

MWh)

6.8

Fleet

Heat Rate (2)

(Nameplate, Btu/KWh)

(Nameplate, Btu/KWh)

Baseload

n/a

CC

7,000

- 7,200

Peaking

9,500

- 10,500

Delivered Natural

Gas (PG&E +

$0.30)

$6.67/MMBtu

Power

Prices (Average

on

-peak prices $/MWh)

-peak prices $/MWh)

NP-15

$60.65

Avg.

Spark Spread (NP15 vs PG&E @

7HR)

$16.04

Annual

Average

Capacity

Factors

Baseload

n/a

CC

30% -

60%

Peaking

0% -

20%

Avg.

Capacity Price

(KW-Mo)

(KW-Mo)

System RA $0.40 -

$1.25

|

West

Forecast ($MM) 2010

|

|

|

Combined

Cycle

|

$ 110

- 115

|

|

Peaker/RMR/Other

(1)

|

20

- 25

|

|

Adjusted

EBITDA

|

$ 130

- 140

|

|

Operating

Income

|

$ 70 -

80

|

NOTE: Pricing

as of 10/6/09.

(1) Other

comprised of ancillary services, emission credit sales, equity earnings/losses

and amortization of intangibles and trading. (2)

Nameplate

Heat Rate is after adjustment

for generating starts & stops, weather, fuel types, efficiencies and other operational components.

for generating starts & stops, weather, fuel types, efficiencies and other operational components.

Other

noteworthy items:

•~70% toll/RMR

contracts

As

presented November 5, 2009

|

Revenue

Contracts:

|

• Tolling,

RMR, Heat Rate Call Options

– Morro Bay:

650

MW Toll

thru Sep 2013

– Moss Landing

1 & 2: 750

MW Heat

rate call option thru Sept 2010

– Moss Landing

6 & 7: 1,500

MW Year

round toll through 2010; 2011 - 2013

– Oakland:

RMR

year-to-year

– South Bay 1

& 2: RMR

year-to-year

|

|

|

|

|

Fuel

Contracts:

|

• Gas is

transported to Moss Landing via firm and interruptible

transportation agreements with PG&E , pass-through costs on units 6 & 7 to tolling counterparty • Tolling

counterparty assumes fuel delivery risk associated with gas

requirements during tolled periods for tolled capacity |

|

|

West

- Key Contracts

27

As

presented November 5, 2009, except Moss Landing 6 & 7 toll

update

28

Northeast

- Diverse Fuel and Dispatch Type

|

Generation

Volumes

|

~6 MM

MWh

|

|

($MM)

|

|

|

Adjusted

Gross Margin (1)

(2)

|

$

225 - 245

|

|

Operating

Expenses (3)

|

(165)

|

|

Adjusted

EBITDA (2)

|

$

60 - 80

|

|

|

|

|

Operating

Income

|

$

20 - 40

|

Regional

Performance Drivers

>95%

>95%

>95%

>95%

~10%

NY-ISO

Dispatch Order

Hedging

Profile as of

1/11/10

Note:

Additional

regional data provided in the Appendix. (

1) Adjusted

Gross Margin includes

contract amortization from the Independence ConEd contract. See Appendix for more detail.

(2) Adjusted Gross Margin and Adjusted EBITDA are non-GAAP financial measures.

Reconciliations of these measures to the most directly comparable GAAP measure are included

in the Appendix. (3) Operating Expenses include effects of Central Hudson lease expense and

exclude depreciation and amortization.

contract amortization from the Independence ConEd contract. See Appendix for more detail.

(2) Adjusted Gross Margin and Adjusted EBITDA are non-GAAP financial measures.

Reconciliations of these measures to the most directly comparable GAAP measure are included

in the Appendix. (3) Operating Expenses include effects of Central Hudson lease expense and

exclude depreciation and amortization.

|

Price:

|

• New York

Zone G power price for Danskammer and

New York Zone G spark spread for Roseton • Spark

spreads for New York Zone C for Independence

and Mass Hub for Casco Bay • Natural gas

sets the marginal price of power

|

|

Cost:

|

• 2010

delivered South American coal 80% contracted/

priced at $3.55/MMBtu • Natural gas

purchased as needed

• RGGI

allowance cost at market rates

|

|

Watch:

|

• Weather can

affect volumes of uncontracted CCGT

fleet and Roseton facility • Coal

delivery

• New

environmental regulations/enforcement

|

Cumulative

Capacity GW

Hydro

Nuclear

Coal

Renewables

Gas

Oil

160

140

120

100

80

60

40

20

0

1,185

MW

1,974

MW

123

MW

Peak

Load

Regional

Estimates as of

11/5/09 2010E

$/MWh

Northeast

Generation -

Coal, Fuel Oil & Natural Gas

Coal, Fuel Oil & Natural Gas

29

Other

noteworthy items:

• Operating expense

includes $50 million of

Central Hudson lease expense, and Operating

Cash Flow includes cash lease payments of $95

million in 2010

Central Hudson lease expense, and Operating

Cash Flow includes cash lease payments of $95

million in 2010

• Independence under

capacity agreement with

ConEd expiring 11/2014

ConEd expiring 11/2014

– Adjusted EBITDA

includes approximately $50 million

net earnings, however Adjusted Cash Flow from

Operations will include cash receipt of approximately

$100 million in 2010

net earnings, however Adjusted Cash Flow from

Operations will include cash receipt of approximately

$100 million in 2010

• Carbon emissions

include a cost assumption of

~$2.33/MT for CO2 allowances associated with

RGGI

~$2.33/MT for CO2 allowances associated with

RGGI

Forecasted

Fundamentals 2010

Volumes

(MM

MWh)

6.2

Fleet

Heat Rate (2)

(Nameplate,

Btu/KWh)

Baseload

10,000 -

11,000

CC

7,000

- 8,000

Peaking

9,500

- 10,500

Delivered

Fuel

Fuel

Oil #6

$10.97/MMBtu

SA

Coal

$3.55/MMBtu

Power

Prices

(Average on

peak

prices $/MWh)

prices $/MWh)

NY

Zone G

$71.24

NY

Zone C

$53.62

Mass

Hub

$66.11

Delivered Natural

Gas (Dawn +

$0.25)

$6.72/MMBtu

Delivered Natural

Gas (Tran Z6 -

NY)

$7.29/MMBtu

Avg.

Spark

Spread

Spread

Fuel

Oil (NY-G vs #6 Oil

@11HR)

($49.42)

Gas

(NY

Zone C vs Dawn @ 7HR)

$6.59

Gas

(Mass

Hub vs TRAN Z6-NY @ 7HR)

$15.11

Annual

Average

Capacity

Factors

Baseload

75% -

85%

CC

20% -

50%

Peaking

0% -

10%

Average

Capacity

Price

(KW-Mo)

(KW-Mo)

NYISO

$2.42

New

England

$4.33

Average Casco

to

Mass Hub Basis

($/MWh)

Mass Hub Basis

($/MWh)

On-Peak

$(4.50)

Off-Peak

$(2.75)

Northeast

Forecast ($MM)

2010

Coal

$ 25

- 30

Combined

Cycle

50 -

60

Peaking/Other

(1)

(15) -

(10)

Adjusted

EBITDA

$ 60

- 80

Operating

Income

$ 20

- 40

NOTE:

Pricing

as of 10/6/09. (1)

Other

comprised of ancillary services, emission credit sales and amortization of

intangibles and trading. (2)

Nameplate Heat Rate is after adjustment for generating starts &

stops, weather, fuel types, efficiencies and other operational components.

stops, weather, fuel types, efficiencies and other operational components.

As

presented November 5, 2009

|

Revenue

Contracts:

|

• Independence

has a 740 MW capacity contract with ConEd (‘A-’ Rated) through

2014; receive ~$100 million, net in cash but offset by $50 million contract amortization in Adjusted Gross Margin • Danskammer

has ~100 MW on-peak and ~300 MW off-peak in power swaps at

an average price of ~$80/MWh on-peak and ~$52/MWh off-peak • NYISO has

~850 MW capacity sales in place for 2010

• Casco Bay

receives Forward

Capacity Market (FCM) payments from New New England ISO – 2010

Guidance includes ~445 MW of

capacity sold • Heat Rate

Call Options - Casco

Bay, 100 MW for ~$3/KW-Mo

|

|

|

|

|

Fuel

Contracts:

|

• Coal

(Danskammer):

– One- to

two-year contracts primarily sourced from South America

– 80% of coal

supply priced for 2010, including delivery

• Natural gas:

Purchased on an as-needed basis

• Fuel Oil

(Roseton): Due to on-site storage availability of 1 MMBbls, fuel oil

is

purchased on an opportunistic basis |

|

|

Northeast

- Key Contracts

30

|

ISO

New England Capacity Auction

|

||

|

Auction

Year

|

DYN

MW

cleared |

Auction

Price

(~$/KW-mo)

|

|

2009/2010

|

~440

|

$

3.75

|

|

2010/2011

|

~450

|

$

4.50

|

|

2011/2012

|

~425

|

$

3.60

|

As

presented November 5, 2009

|

($MM)

|

2009

|

2010

|

2011

|

2012

|

2013

|

|

Maintenance

- Coal facilities

|

$

85

|

$

85

|

$

70

|

$

70

|

$

65

|

|

Maintenance

- Gas facilities

|

100

|

25

|

55

|

20

|

70

|

|

Environmental

|

280

|

200

|

140

|

95

|

50

|

|

Corporate

|

10

|

10

|

10

|

10

|

10

|

|

Capitalized

Interest

|

25

|

25

|

20

|

10

|

5

|

|

Discretionary

|

30

|

-

|

-

|

-

|

-

|

|

TOTAL

Cap Ex

|

$

530

|

$

345

|

$

295

|

$

205

|

$

200

|

Anticipated

Capital Expenditures (2009

- 2013)

31

• “Environmental”

primarily consists of Consent Decree and mercury reduction

expenditures

• Coal facility

maintenance is relatively stable over time

• Maintenance for

“Gas facilities” is largely a function of run-time and also includes

expenditures for Roseton

expenditures for Roseton

As

presented November 5, 2009

2010

Commodity Pricing

32

Cin

Hub/Cinergy ($/MWh)

New

York Zone G ($/MWh)

2010

Forward : $44.32

2009A/F(Oct): $34.43

(1)

Pricing as of 10/6/09, which was the basis for estimates as presented 11/5/09.

Prices reflect quoted forward on-peak monthly prices for 1/1/2010 -

12/31/10.

2009A/F(Oct)

2010

Forward as of 10/6/09(1)

2010

Forward : $60.65

2009A/F(Oct): $39.44

2010

Forward : $71.24

2009A/F(Oct): $50.46

2010

Forward : $6.15

2009A/F(Oct): $3.97

As

presented November 5, 2009

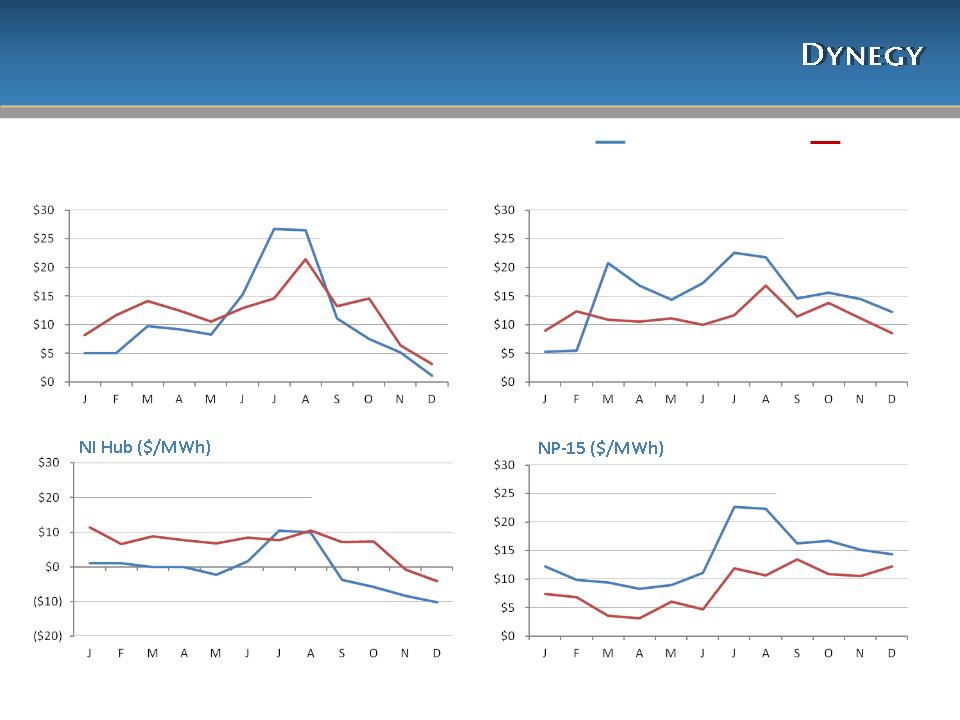

2010

Spark Spreads

33

PJM

West ($/MWh)

Mass

Hub ($/MWh)

2010

Forward : $10.90

2009A/F(Oct): $11.94

2009A/F(Oct)

2010

Forward as of 10/6/09(1)

2010

Forward : $(0.54)

2009A/F(Oct): $6.46

2010

Forward : $15.11

2009A/F(Oct): $11.43

2010

Forward : $13.94

2009A/F(Oct): $8.44

(1)

Pricing as of 10/6/09, which was the basis for estimates as presented 11/5/09.

Prices reflect quoted forward on-peak monthly prices for 1/1/10 -

12/31/10.

As

presented November 5, 2009

Understanding DYN’s 2011 Hedge Profile

34

Approximating

Hedge Value

• As the contracted

percentage of

expected generation is provided at

various periods, an average price can

be applied to the incremental

percentage contracted

expected generation is provided at

various periods, an average price can

be applied to the incremental

percentage contracted

• For

example:

─ Between May and

August in the

Midwest, Dynegy contracted an

additional ~10% of expected generation

Midwest, Dynegy contracted an

additional ~10% of expected generation

─ The average CIN

Around-the-Clock (ATC)

price for that time period was

~$39/MWh

price for that time period was

~$39/MWh

─ If Dynegy’s annual

expected generation

in the Midwest is ~25MM MWh, you can

estimate ~2.5MM MWh was contracted

at $39/MWh

in the Midwest is ~25MM MWh, you can

estimate ~2.5MM MWh was contracted

at $39/MWh

• In addition to

contracting expected

generation, Dynegy uses options to

mitigate some of the risk of potentially

low commodity prices

generation, Dynegy uses options to

mitigate some of the risk of potentially

low commodity prices

CIN

ATC Power Price (Cal 2011)

~5%

~5%

~5%

~15%

Midwest

Region Example

($/MWh)

~50%

As

presented November 5, 2009

Collar

Option Example

35

Call

Option:

Dynegy sells a 100

MW on-peak call option for the 2011

calendar year at a $65 strike price at a premium of $0.85/MWh

calendar year at a $65 strike price at a premium of $0.85/MWh

•Dynegy receives

and realizes a premium payment in current period

from buyer for the call option (See Calculation 1)

from buyer for the call option (See Calculation 1)

•Option gives buyer

right to buy 100 MW on-peak from Dynegy for

2011 calendar year at $65 if buyer strikes the option on the option

expiration date

2011 calendar year at $65 if buyer strikes the option on the option

expiration date

•Buyer will strike

option if 2011 calendar prices exceed $65 in order to

sell the 100 MW at a higher price

sell the 100 MW at a higher price

•Commitment sets a

potential price on the sale of the 100 MW for

Dynegy at $65 which is realized during option period if buyer strikes

option

Dynegy at $65 which is realized during option period if buyer strikes

option

•If prices are

below $65 on the option expiration date, option expires

Put

Option:

Dynegy buys a 100

MW on-peak put option for the 2011

calendar year at a $35 strike price at a premium of $0.45/MWh

calendar year at a $35 strike price at a premium of $0.45/MWh

•Dynegy pays and

realizes a premium expense in current period to

seller for the put option (See Calculation 2)

seller for the put option (See Calculation 2)

•Option gives

Dynegy right to sell 100 MW to seller for 2011 calendar

year at $35 if Dynegy strikes the option on the option expiration date

year at $35 if Dynegy strikes the option on the option expiration date

•Dynegy will strike

option if 2011 calendar prices go below $35 in

order to sell the 100 MW at a higher price

order to sell the 100 MW at a higher price

•Commitment sets a

potential price on the sale of the 100 MW for

Dynegy at $35 which is realized during option period if Dynegy strikes

option

Dynegy at $35 which is realized during option period if Dynegy strikes

option

•If prices are

above $35 on the option expiration date, option expires

Combining

Put & Call Options creates a

“Collar” Option

“Collar” Option

•Collars provide

earnings certainty and reduce exposure to power

price volatility

price volatility

- If market price

clears at $70, buyer will strike call option. Maximum

revenue on 100 MW will be $27MM versus $29MM had power been

sold at market price (See Calculations 3 & 4)

revenue on 100 MW will be $27MM versus $29MM had power been

sold at market price (See Calculations 3 & 4)

- If market price

clears at $30, Dynegy will strike put option. Maximum

gross margin on 100 MW will be $14MM versus $12MM had power

been sold at market price (See Calculations 5 & 6)

gross margin on 100 MW will be $14MM versus $12MM had power

been sold at market price (See Calculations 5 & 6)

•Option impact on

Revenue:

- Premium revenue

and expenses are realized in period options were

sold/purchased

sold/purchased

- Exercised option

value realized during the option period

Calculations

Premium

Calculations:

1) 4,080 on-peak

hours/year x $0.85/MWh x 100 MW

=

$346,800

2) 4,080 on-peak

hours/year x $0.45/MWh x 100 MW

=

$183,600

Sales

Calculations:

3) 4,080 on-peak

hours/year x $65/MWh x 100 MW

=

~$27

MM

4) 4,080

on-peak hours/year x $70/MWh x 100 MW

=

~$29

MM

5) 4,080 on-peak

hours/year x $35/MWh x 100 MW

=

~$14

MM

6) 4,080 on-peak

hours/year x $30/MWh x 100 MW

=

~$12

MM

As

presented November 5, 2009

Capital Structure

36

(1)

Represents drawn amounts under the revolver; actual amount of revolver was $1.08

Billion as of 9/30/09 .

(2)

Represents PV (10%) of future lease payments. Central Hudson lease payments are

unsecured obligations of

Dynegy Inc., but are a secured obligation of an unrelated third party (“lessor”) under the lease. DHI has

guaranteed the lease payments on a senior unsecured basis.

Dynegy Inc., but are a secured obligation of an unrelated third party (“lessor”) under the lease. DHI has

guaranteed the lease payments on a senior unsecured basis.

|

TOTALS ($

Million)

|

12/31/09

|

|

Secured

|

$918

|

|

Secured

Non-Recourse

|

$1,032

|

|

Unsecured

|

$4,276

|

Debt

& Other Obligations as of 12/31/09

Dynegy

Power Corp.

Central Hudson(2) $626

Dynegy

Holdings Inc.

$1,080

Million Revolver(1) $0

Term

L/C Facility $850

Tranche B Term $68

Sr.

Unsec. Notes/Debentures

$3,450

Sub.Cap.Inc.Sec

(“SKIS”) $200

Dynegy

Inc.

Senior

Debentures $287

PP

1st Lien $645

Tax

Exempt 100

Gross

Debt $745

Less:

Restricted Cash (19)

Total,

Net Debt $726

Sithe

Energies

Plum

Point Energy Assoc.

Central

Hudson Lease - Northeast Segment

37

Accrual

Lease Expense

Central

Hudson treated as Debt

(would require the following adjustments to GAAP financials):

(would require the following adjustments to GAAP financials):

•Income Statement -

Add back $50 million lease expense to Adjusted EBITDA; add $16 million

imputed interest expense to Interest Expense; add $23 million estimated depreciation &

amortization expense; adjust tax expense for net difference

imputed interest expense to Interest Expense; add $23 million estimated depreciation &

amortization expense; adjust tax expense for net difference

• Depreciation &

Amortization calculated using purchase price of $920 million divided by 40

years

•Cash Flow

Statement - Add back $100 million of imputed principal to Operating Cash

Flows

• $116 million cash

payment split between $16 million imputed interest payment (Operating

Cash

Flows) and $100 million imputed principal payment (Financing Cash Flows)

Flows) and $100 million imputed principal payment (Financing Cash Flows)

•Balance Sheet -

Include $725 million total PV (10%) of future lease payments

Central

Hudson treated as Lease

(as currently shown in GAAP financials):

(as currently shown in GAAP financials):

• Income Statement -

$50 million lease expense included in

Adjusted EBITDA; no interest expense or depreciation &

amortization expense

Adjusted EBITDA; no interest expense or depreciation &

amortization expense

• Cash Flow

Statement - $116 million cash payment included in

Operating Cash Flows

Operating Cash Flows

• Balance Sheet -

lease obligation not included in debt balance

Central

Hudson Cash Payments (remaining

as of 9/30/09, $MM)

$95

$112

$179

$142

$143

$105

Imputed Debt

Equivalent at PV (10%) of

future lease payments = $725MM(1)

future lease payments = $725MM(1)

(1)

PV of payments calculated as of 9/30/09

• Chart represents

total cash lease payments, which are included in Operating Cash

Flows

• Lease expense is

approximately $50 million per year and included in Operating

Expense

$143

$116

As

presented November 5, 2009

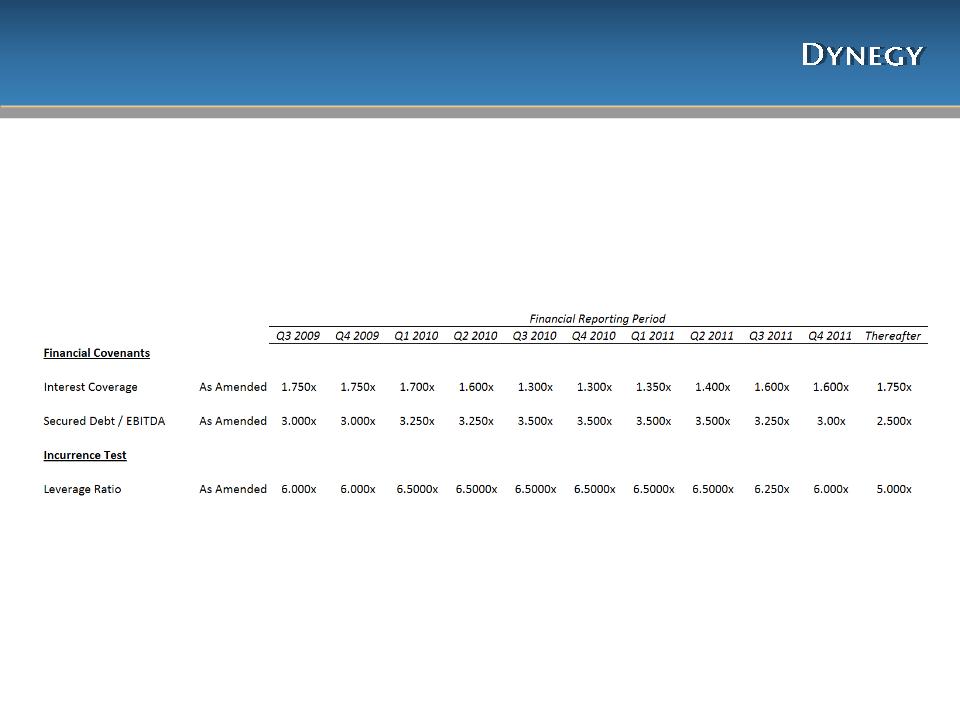

Financial

Covenant Ratios

38

Covenant ratios

are requirements of the DHI Credit Agreement covenants and are calculated

based

on trailing four quarters

on trailing four quarters

As

presented November 5, 2009

39

|

Dynegy

Generation Facilities (as of

12/31/09)

|

|||||

|

Region/Facility(1)

|

Location

|

Net

Capacity(2)

|

Primary

Fuel

|

Dispatch

Type

|

NERC

Region

|

|

MIDWEST

|

|

|

|

|

|

|

Baldwin

|

Baldwin,

IL

|

1,800

|

Coal

|

Baseload

|

MISO

|

|

Havana

|

Havana,

IL

|

|

|

|

|

|

Units

1-5

|

|

228

|

Oil

|

Peaking

|

MISO

|

|

Unit

6

|

|

441

|

Coal

|

Baseload

|

MISO

|

|

Hennepin

|

Hennepin,

IL

|

293

|

Coal

|

Baseload

|

MISO

|

|

Oglesby

|

Oglesby,

IL

|

63

|

Gas

|

Peaking

|

MISO

|

|

Stallings

|

Stallings,

IL

|

89

|

Gas

|

Peaking

|

MISO

|

|

Vermilion

|

Oakwood,

IL

|

|

|

|

|

|

Units

1-2

|

|

164

|

Coal/Gas

|

Baseload

|

MISO

|

|

Unit

3

|

|

12

|

Oil

|

Peaking

|

MISO

|

|

Wood

River

|

Alton,

IL

|

|

|

|

|

|

Units

1-3

|

|

119

|

Gas

|

Peaking

|

MISO

|

|

Units

4-5

|

|

446

|

Coal

|

Baseload

|

MISO

|

|

Kendall

|

Minooka,

IL

|

1,200

|

Gas -

CCGT

|

Intermediate

|

PJM

|

|

Ontelaunee

|

Ontelaunee

Township, PA

|

580

|

Gas -

CCGT

|

Intermediate

|

PJM

|

|

Plum

Point (3)

|

Osceola,

AR

|

140

|

Coal

|

Baseload

|

SERC

|

|

Midwest

TOTAL

|

|

5,575

|

|

|

|

|

NORTHEAST

|

|

|

|

|

|

|

Independence

|

Scriba,

NY

|

1,064

|

Gas -

CCGT

|

Intermediate

|

NYISO

|

|

Roseton (4)

|

Newburgh,

NY

|

1,185

|

Gas/Oil

|

Intermediate

|

NYISO

|

|

Casco

Bay

|

Veazie,

ME

|

540

|

Gas -

CCGT

|

Intermediate

|

ISO-NE

|

|

Danskammer

|

Newburgh,

NY

|

|

|

|

|

|

Units

1-2

|

|

123

|

Gas/Oil

|

Peaking

|

NYISO

|

|

Units 3-4

(4)

|

|

370

|

Coal/Gas

|

Baseload

|

NYISO

|

|

Northeast

TOTAL

|

|

3,282

|

|

|

|

|

WEST

|

|

|

|

|

|

|

Moss

Landing

|

Monterey

County, CA

|

|

|

|

|

|

Units

1-2

|

|

1,020

|

Gas -

CCGT

|

Intermediate

|

CAISO

|

|

Units

6-7

|

|

1,509

|

Gas

|

Peaking

|

CAISO

|

|

Morro

Bay (5)

|

Morro Bay,

CA

|

650

|

Gas

|

Peaking

|

CAISO

|

|

South

Bay (6)

|

Chula Vista,

CA

|

309

|

Gas

|

Peaking

|

CAISO

|

|

Oakland

|

Oakland,

CA

|

165

|

Oil

|

Peaking

|

CAISO

|

|

Black

Mountain

(7) |

Las Vegas,

NV

|

43

|

Gas

|

Baseload

|

WECC

|

|

West

TOTAL

|

|

3,696

|

|

|

|

|

TOTAL

GENERATION

|

12,553

|

|

|||

NOTES:

1)Dynegy owns 100% of

each unit

listed except as otherwise indicated.

For each unit in which Dynegy owns

less than a 100% interest, the Total

Net Capacity set forth in this table

includes only Dynegy’s proportionate

share of such unit’s gross generating

capacity.

listed except as otherwise indicated.

For each unit in which Dynegy owns

less than a 100% interest, the Total

Net Capacity set forth in this table

includes only Dynegy’s proportionate

share of such unit’s gross generating

capacity.

2)Unit capabilities

are based on winter

capacity.

capacity.

3)Under construction.

Represents net

ownership of 21%.

ownership of 21%.

4)Dynegy entered into

a $920 MM sale

-leaseback transaction for the Roseton

facility and units 3 and 4 of the

Danskammer facility in 2001. Cash

lease payments extend until 2029 and

include $108 MM in 2007, $144 MM in

2008, $141 MM in 2009, $95 MM in

2010 and $112 MM in 2011. GAAP

lease payments are $50.5 MM through

2030 and decrease until last GAAP

lease payment in 2035.

-leaseback transaction for the Roseton

facility and units 3 and 4 of the

Danskammer facility in 2001. Cash

lease payments extend until 2029 and

include $108 MM in 2007, $144 MM in

2008, $141 MM in 2009, $95 MM in

2010 and $112 MM in 2011. GAAP

lease payments are $50.5 MM through

2030 and decrease until last GAAP

lease payment in 2035.

5)Represents

operating capacity of

Units 3 & 4. Units 1 & 2, with a

combined net generating capacity of

352 MW, are currently in layup status

and out of operation.

Units 3 & 4. Units 1 & 2, with a

combined net generating capacity of

352 MW, are currently in layup status

and out of operation.

6)Represents

operating capacity of

Units 1 & 2. Units 3 & 4, with a

combined net generating capacity of

397 MW, did not receive RMR status

from CAISO for 2010 and are currently

out of operation and in the process of

being decommissioned.

Units 1 & 2. Units 3 & 4, with a

combined net generating capacity of

397 MW, did not receive RMR status

from CAISO for 2010 and are currently

out of operation and in the process of

being decommissioned.

7)Dynegy owns a 50%

interest in this

facility and the remaining 50% interest

is held by Chevron.

facility and the remaining 50% interest

is held by Chevron.

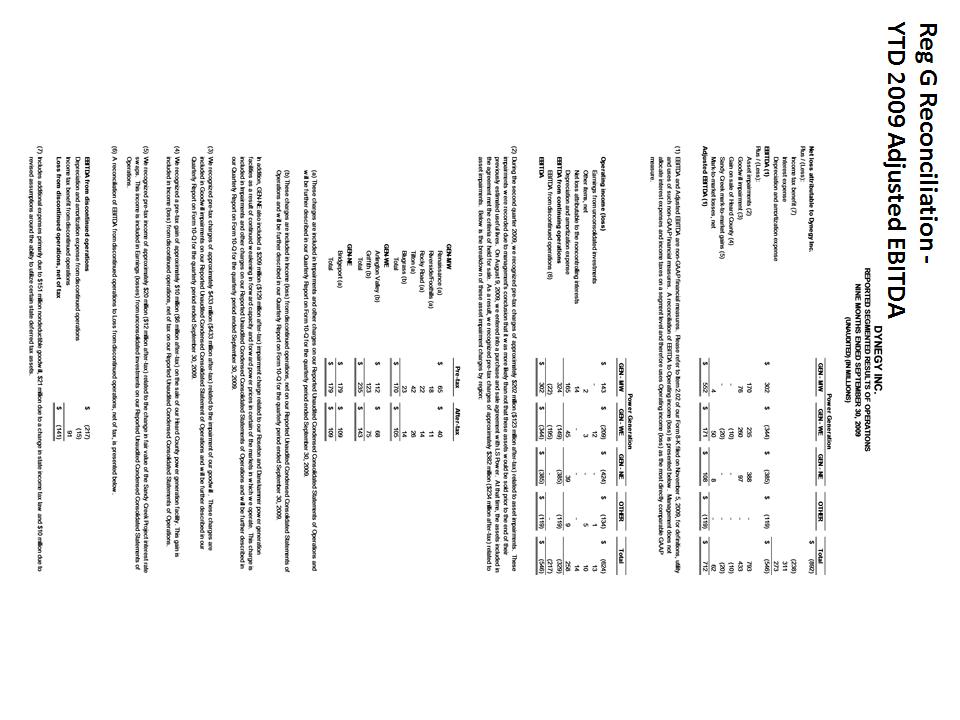

Appendix

- Reg G Reconciliations

Debt

Measures: We believe that

our debt measures are useful because we consider these

measures as a way to re-evaluate our progress toward our strategic corporate objective of

reducing our overall indebtedness. In addition, many analysts and investors use these measures

for valuation analysis purposes. The most directly comparable GAAP financial measure to the

below measures is GAAP debt.

measures as a way to re-evaluate our progress toward our strategic corporate objective of

reducing our overall indebtedness. In addition, many analysts and investors use these measures

for valuation analysis purposes. The most directly comparable GAAP financial measure to the

below measures is GAAP debt.

– “Net Debt” - We

define “Net Debt” as total GAAP debt less cash and cash equivalents and

restricted cash.

Restricted cash in this case consists only of collateral posted for the credit facility at the end of each

period, and cash associated with the Sandy Creek letter of credit, the Sithe debt reserve and Plum Point

debt, at the end of each period where applicable.

Restricted cash in this case consists only of collateral posted for the credit facility at the end of each

period, and cash associated with the Sandy Creek letter of credit, the Sithe debt reserve and Plum Point

debt, at the end of each period where applicable.

– “Net Debt and

Other Obligations” - We define “Net Debt and Other Obligations” as total GAAP

debt plus

certain operating lease commitments less cash and cash equivalents and restricted cash. Restricted cash in

this case consists only of collateral posted for the credit facility at the end of each period, and cash

associated with the Sandy Creek letter of credit and Plum Point debt, at the end of each period where

applicable.

certain operating lease commitments less cash and cash equivalents and restricted cash. Restricted cash in

this case consists only of collateral posted for the credit facility at the end of each period, and cash

associated with the Sandy Creek letter of credit and Plum Point debt, at the end of each period where

applicable.

– “Net Debt and

Other Obligations Associated with Operating Assets” - We believe that this

measure is

useful for of the purpose of evaluating our operating assets. We define “Net Debt and Other Obligations

Associated with Operating Assets” as “Net Debt and Other Obligations” less GAAP debt associated with

assets under construction.

useful for of the purpose of evaluating our operating assets. We define “Net Debt and Other Obligations

Associated with Operating Assets” as “Net Debt and Other Obligations” less GAAP debt associated with

assets under construction.

Debt

Definitions

41

42

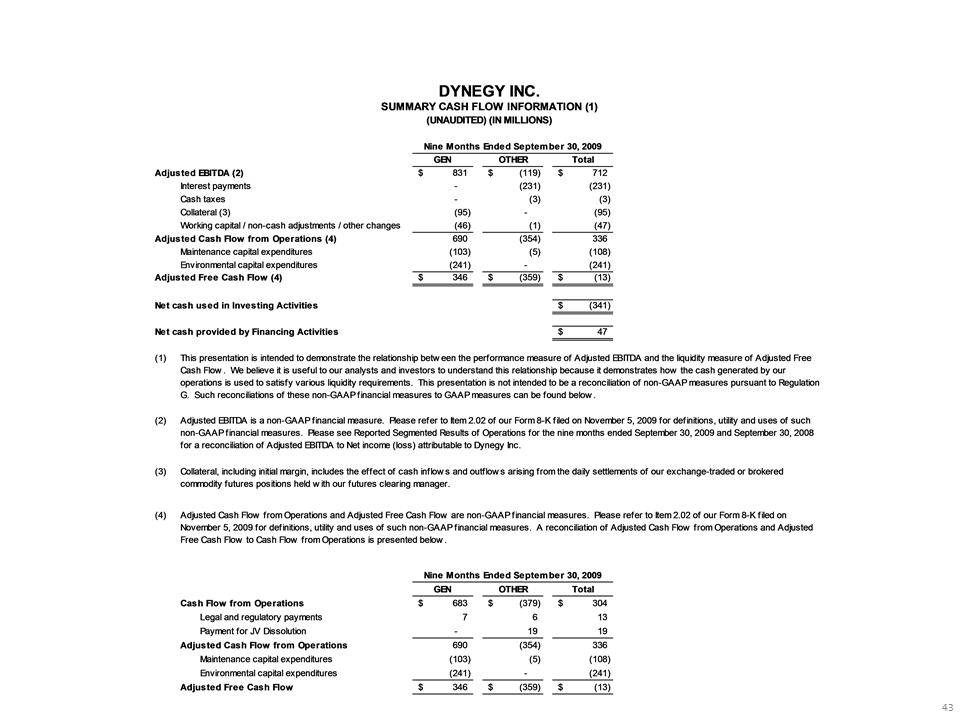

Reg

G Reconciliation - YTD Cash Flow 2009

44

Reg

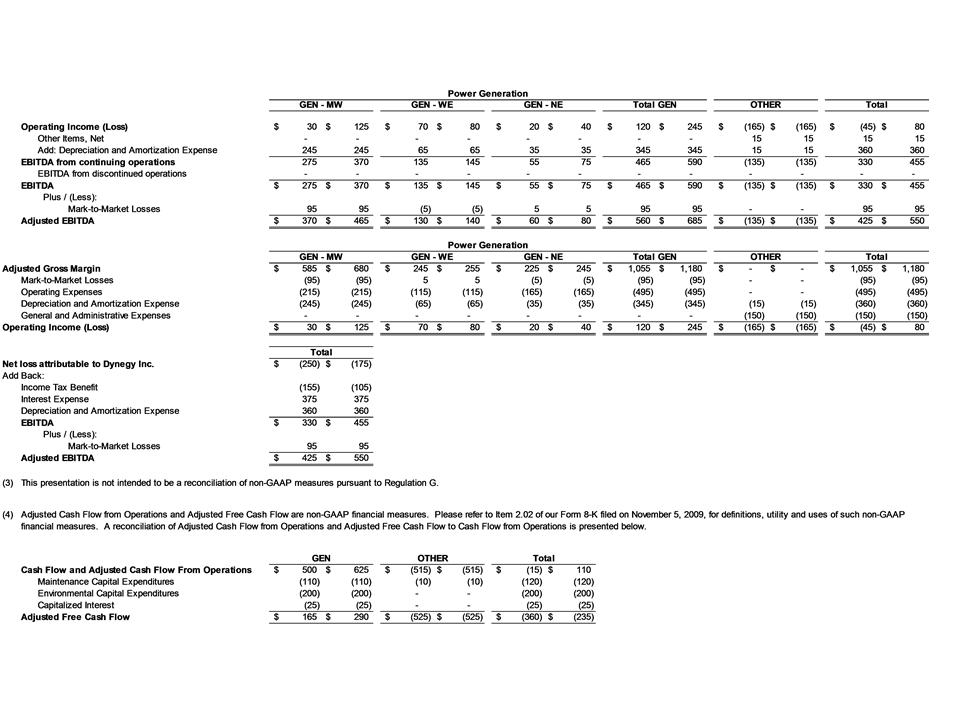

G Reconciliation - 2010 Guidance

45

Reg

G Reconciliation - 2010 Guidance, continued