Attached files

Exhibit 99.1: Revised Management’s Discussion and Analysis

Management’s Discussion and Analysis

The purpose of this discussion is to provide an understanding of P&G’s financial results and condition by focusing on changes in certain key measures from year to year. Management’s Discussion and Analysis (MD&A) is organized in the following sections:

| • | Overview |

| • | Summary of 2009 Results |

| • | Forward-Looking Statements |

| • | Results of Operations |

| • | Segment Results |

| • | Financial Condition |

| • | Significant Accounting Policies and Estimates |

| • | Other Information |

Throughout MD&A, we refer to measures used by management to evaluate performance, including unit volume growth, net outside sales and net earnings. We also refer to a number of financial measures that are not defined under accounting principles generally accepted in the United States of America (U.S. GAAP), including organic sales growth, free cash flow and free cash flow productivity. We believe these measures provide investors with important information that is useful in understanding our business results and trends. The explanation at the end of MD&A provides more details on the use and the derivation of these measures. Management also uses certain market share and market consumption estimates to evaluate performance relative to competition despite some limitations on the availability and comparability of share information. References to market share and market consumption in MD&A are based on a combination of vendor-reported consumption and market size data, as well as internal estimates.

In October 2009, we sold our global pharmaceuticals business to Warner Chilcott plc (Warner Chilcott) for $2.8 billion. Under the terms of the agreement, Warner Chilcott acquired our portfolio of branded pharmaceuticals products, our prescription drug product pipeline and manufacturing facilities in Puerto Rico and Germany. The pharmaceuticals business had historically been part of the Health Care reportable segment. In accordance with the applicable accounting guidance for the impairment or disposal of long-lived assets, the results of our pharmaceuticals business are presented as discontinued operations and, as such, have been excluded from continuing operations and from segment results for all periods presented.

Effective July 1, 2009, we implemented a number of changes to our organization structure for the Beauty Global Business Unit (GBU), which resulted in changes to the components of its segment structure. As a result, the Beauty GBU became the Beauty and Grooming GBU and reportable segments under the GBU moved to a new consumer-oriented alignment. The two reportable segments within the Beauty and Grooming GBU continue to be Beauty and Grooming. However, female blades and razors transitioned from Grooming to Beauty. In addition, certain male-focused brands and businesses, such as Old Spice and Gillette personal care, moved from Beauty to Grooming. These changes have been reflected in our segment reporting beginning in fiscal year 2010. Our historical segment reporting for the years ended June 30, 2007, 2008 and 2009 has been restated to reflect the new structure. The GBU and segment discussions in the MD&A and accompanying Consolidated Financial Statements have been revised to reflect the new organizational structure implemented on July 1, 2009.

In November 2008, we completed the divestiture of our coffee business through the merger of our Folgers coffee subsidiary into The J.M. Smucker Company (Smucker) in an all-stock reverse Morris Trust transaction. In connection with the merger, 38.7 million shares of P&G common stock were tendered by our shareholders and exchanged for all shares of Folgers common stock. Pursuant to the merger, a Smucker subsidiary merged with and into Folgers and Folgers became a wholly owned subsidiary of Smucker. The Company recognized an after-tax gain on the disposition of $2.0 billion, which is included as part of net earnings from discontinued operations.

- 1 -

The coffee business had historically been part of the Company’s Snacks, Coffee and Pet Care reportable segment, as well as the coffee portion of the away-from-home business which was included in the Fabric Care and Home Care reportable segment. In accordance with the applicable accounting guidance for the impairment or disposal of long-lived assets, the results of our coffee business are presented as discontinued operations and, as such, have been excluded from continuing operations and from segment results for all periods presented. The Snacks, Coffee and Pet Care reportable segment was renamed Snacks and Pet Care to reflect this change.

OVERVIEW

P&G’s business is focused on providing branded consumer packaged goods. Our goal is to provide products of superior quality and value to improve the lives of the world’s consumers. We believe this will result in leadership sales, earnings and value creation, allowing employees, shareholders and the communities in which we operate to prosper.

Our products are sold in more than 180 countries primarily through mass merchandisers, grocery stores, membership club stores, drug stores and “high frequency stores,” the neighborhood stores which serve many consumers in developing markets. We continue to expand our presence in other channels including department stores, perfumeries, pharmacies, salons and e-commerce. We have on-the-ground operations in approximately 80 countries.

Our market environment is highly competitive, with global, regional and local competitors. In many of the markets and industry segments in which we sell our products, we compete against other branded products as well as retailers’ private-label brands. Additionally, many of the product segments in which we compete are differentiated by price (referred to as super-premium, premium, mid-tier value and low-tier economy products). Generally speaking, we compete with super-premium, premium and mid-tier value products and are well positioned in the industry segments and markets in which we operate – often holding a leadership or significant market share position.

Organizational Structure

Our organizational structure is comprised of three Global Business Units (GBUs), Global Operations, Global Business Services (GBS) and Corporate Functions (CF).

Global Business Units

Our three GBUs are Beauty and Grooming, Health and Well-Being and Household Care. The primary responsibility of the GBUs is to develop the overall strategy for our brands. They identify common consumer needs, develop new product innovations and upgrades and build our brands through effective commercial innovations and marketing plans.

Under U.S. GAAP, the business units comprising the GBUs were aggregated into six reportable segments: Beauty; Grooming; Health Care; Snacks and Pet Care; Fabric Care and Home Care; and Baby Care and Family Care. The following provides additional detail on our GBUs and reportable segments and the key product and brand composition within each.

| GBU |

Reportable Segment |

% of Net Sales* |

% of Net Earnings* |

Key Products |

Billion Dollar Brands | |||||||

| Beauty and Grooming |

Beauty | 24 | % | 24 | % | Female Beauty Products (Cosmetics, Deodorants, Female Blades and Razors, Personal Cleansing, Skin Care), Hair Care (Retail & Salon Professional), Prestige Fragrances | Head & Shoulders, Olay, Pantene, Wella | |||||

| Grooming | 10 | % | 13 | % | Electric Hair Removal Devices, Home Appliances, Male Blades and Razors, Male Personal Care Products (Deodorants, Face and Shave Products, Hair Care, Personal Cleansing) | Braun, Fusion, Gillette, Mach3 | ||||||

| Health and Well-Being |

Health Care | 14 | % | 17 | % | Feminine Care, Oral Care, Personal Health Care | Always, Crest, Oral-B | |||||

| Snacks and Pet Care |

4 | % | 2 | % | Pet Food, Snacks | Iams, Pringles | ||||||

| Household Care |

Fabric Care and Home Care |

30 | % | 28 | % | Air Care, Batteries, Dish Care, Fabric Care, Surface Care | Ariel, Dawn, Downy, Duracell, Gain, Tide | |||||

| Baby Care and Family Care |

18 | % | 16 | % | Baby Wipes, Bath Tissue, Diapers, Facial Tissue, Paper Towels | Bounty, Charmin, Pampers |

| * | Percent of net sales and net earnings from continuing operations for the year ended June 30, 2009 (excluding results held in Corporate). |

- 2 -

Beauty and Grooming

Beauty: We are a global market leader in the beauty category. Most of the beauty markets in which we compete are highly fragmented with a large number of global and local competitors. In female beauty, we compete with a wide variety of products, ranging from cosmetics to female blades and razors to skin care. Our largest female beauty brand is Olay, which is the top facial skin care retail brand in the world. In hair care, we compete in both the retail and salon professional channels. We are the global market leader in the retail hair care market with over 20% of the global market share. In the prestige channel, we compete primarily with prestige fragrances and the SK-II brand. We are one of the global market leaders in prestige fragrances, primarily behind the Gucci, Hugo Boss and Dolce & Gabbana fragrance brands.

Grooming: We hold leadership market share in the male blades and razors market on a global basis and in almost all of the geographies in which we compete. Our global male blades and razors market share is over 70%, primarily behind the Gillette franchise including Mach3 and Fusion. We also compete in male personal care with deodorants, face and shave preparation, hair care and personal cleansing products. Our electric hair removal devices and small home appliances are sold under the Braun brand in a number of markets around the world, where we compete against both global and regional competitors. Our primary focus in this area is electric hair removal devices, such as electric razors and epilators, where we hold approximately 30% and 50% of the male and female markets, respectively.

Health and Well-Being

Health Care: We compete in oral care, feminine care and personal health. In oral care, there are several global competitors in the market, and we have the number two market share position with approximately 20% of the global market. We are the global market leader in the feminine care category with over 35% of the global market share. In personal health, we are the market leader in nonprescription heartburn medications and in respiratory treatments with Prilosec OTC and Vicks, respectively.

Snacks and Pet Care: In snacks, we compete against both global and local competitors and have a global market share of approximately 10% in the potato chips market behind our Pringles brand. In pet care, we compete in several markets around the globe in the premium pet care segment, with the Iams and Eukanuba brands. The vast majority of our pet care business is in North America, where we have approximately a 10% share of the market.

Household Care

Fabric Care and Home Care: This segment is comprised of a variety of fabric care products, including laundry cleaning products and fabric conditioners; home care products, including dishwashing liquids and detergents, surface cleaners and air fresheners; and batteries. In fabric care, we generally have the number one or number two share position in the markets in which we compete and are the global market leader, with over 30% of the global market share. Our global home care market share is over 15% across the categories in which we compete. In batteries, we compete primarily behind the Duracell brand and have over 25% of the global general purpose battery market share.

Baby Care and Family Care: In baby care, we compete primarily in diapers, training pants and baby wipes, with approximately 35% of the global market share. We are the number one or number two baby care competitor in most of the key markets in which we compete, primarily behind Pampers, the Company’s largest brand, with annual net sales of approximately $8 billion. Our family care business is predominantly a North American business comprised primarily of the Bounty paper towel and Charmin toilet tissue brands, with U.S. market shares of over 45% and 25%, respectively.

Global Operations

Global Operations is comprised of our Market Development Organization (MDO), which is responsible for developing go-to-market plans at the local level. The MDO includes dedicated retail customer, trade channel and country-specific teams. It is organized along five geographic units: North America, Western Europe, Central &

- 3 -

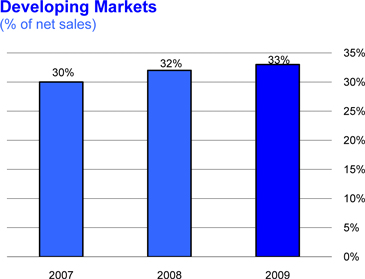

Eastern Europe/Middle East/Africa (CEEMEA), Latin America and Asia, which is comprised of Japan, Greater China and ASEAN/Australia/India/Korea (AAIK). Throughout MD&A, we reference business results in developing markets, which we define as the aggregate of CEEMEA, Latin America, AAIK and Greater China, and developed markets, which are comprised of North America, Western Europe and Japan.

Global Business Services

GBS provides technology, processes and standard data tools to enable the GBUs and the MDO to better understand the business and better serve consumers and customers. The GBS organization is responsible for providing world-class solutions at a low cost and with minimal capital investment.

Corporate Functions

CF provides Company-level strategy and portfolio analysis, corporate accounting, treasury, external relations, governance, human resources and legal, as well as other centralized functional support.

Strategic Focus

P&G is focused on strategies that we believe are right for the long-term health of the Company and will increase returns for our shareholders. The Company’s long-term financial targets are:

| • | Organic sales growth of 4% to 6%. This is comprised of: |

| • | 3% to 4% of market growth, plus |

| • | 1% to 2% of share growth |

| • | 0% to 1% of mix enhancement and whitespace expansion, plus |

| • | 1% of growth acceleration behind revenue synergies associated with the Gillette acquisition. |

| • | Operating margin expansion of 50 to 75 basis points. |

| • | Diluted net earnings per share (EPS) growth of 10%. |

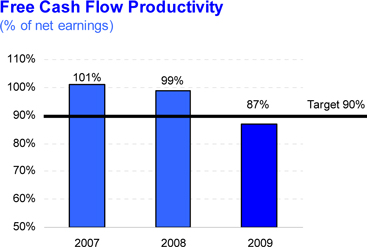

| • | Free cash flow productivity of 90% or greater (defined as the ratio of operating cash flow less capital expenditures to net earnings). |

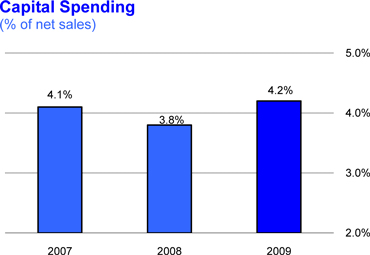

| • | Capital spending at or below 4% of net sales annually. |

As a result of the recent global economic downturn, market growth rates have slowed and for 2010 are expected to be below the range that underpins our long-term financial growth targets. We are continuing to monitor market growth and may reassess our long-term targets in the future.

In order to achieve these targets, we will focus on three primary areas:

| • | Grow our leading, global brands and core categories. Our portfolio includes 22 brands that generate over $1 billion in annual sales and 20 brands that generate approximately $500 million or more in annual sales. Combined, these 42 brands account for 85% or more of our sales and profits. These brands are platforms for future innovations that will drive sales growth, expand categories for retail customers and differentiate brands in the minds of consumers. Our core categories, Baby Care, Blades and Razors, Fabric Care, Family Care, Feminine Care, Home Care, Oral Care, Prestige Fragrances, Retail Hair Care and Skin Care, have opportunities for continued growth. We will focus on profitable share growth across all of our businesses by leveraging our core strengths in innovation and brand-building. |

| • | Build business with underserved and unserved consumers. We are increasing our presence in developing markets, where 86% of the world’s population lives. We will increase the amount of sales from these markets by focusing on affordability, accessibility and awareness of our brands. We are extending our distribution systems to reach more consumers through underserved retail channels such as e-commerce and high frequency stores. And, we are creating a broader and deeper product portfolio. Our initiative pipeline has new and improved products that extend and strengthen our category and brand portfolios vertically and horizontally. |

- 4 -

| • | Continue to grow and develop faster-growing, structurally attractive businesses with global leadership potential. We are continually optimizing our portfolio of brands and businesses with an emphasis on opportunities in Beauty, Health Care and selective portfolio and geographic acquisitions in Household Care. We will also identify growth opportunities in services, particularly businesses that can be franchised and expanded rapidly. |

To achieve our targets, we will also leverage core strengths that create competitive advantages and are critical to winning in the consumer products industry: consumer knowledge, innovation, brand-building, go-to-market capabilities and scale. We are placing particular emphasis on execution, simplification and scale as key improvement areas that will enable P&G to create the greatest value and competitive advantage. Finally, we are strengthening the depth, breadth and quality of leadership at all levels of the Company to make P&G a more demand-driven, real-time, future-focused organization.

SUMMARY OF 2009 RESULTS

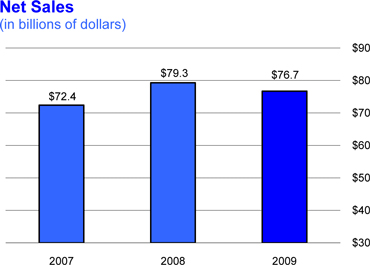

| • | Net sales decreased 3% to $76.7 billion. |

| • | Organic sales, which exclude the impacts of acquisitions, divestitures and foreign exchange, increased 2%, which is below our organic sales growth target range. |

| • | Net earnings increased 11% to $13.4 billion. |

| • | Net earnings from continuing operations decreased 5% to $10.7 billion primarily due to lower net sales and a higher effective tax rate. |

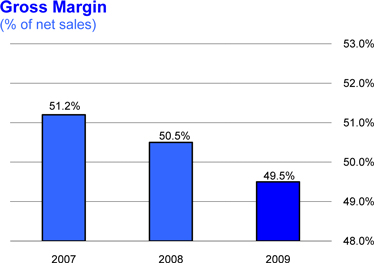

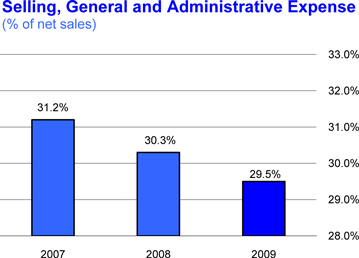

| • | Operating margin declined 20 basis points versus the prior year behind a commodity-driven reduction in gross margins, partially offset by reduced selling, general and administrative expenses (SG&A). |

| • | Net earnings from discontinued operations increased $2.0 billion to $2.8 billion mainly due to the impact of the Folgers coffee divestiture. |

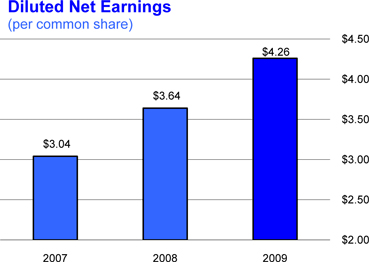

| • | Diluted net earnings per share increased 17% to $4.26. |

| • | Earnings per share included $0.87 from discontinued operations, an increase of $0.63 primarily due to the gain on the sale of the Folgers coffee business. |

| • | Earnings per share from continuing operations were $3.39, down $0.01 versus the prior fiscal year. |

| • | Earnings per share grew ahead of net earnings due to the impact of share repurchases and the shares tendered in the Folgers coffee transaction. |

| • | Cash flow from operating activities was $14.9 billion. |

| • | Free cash flow, which is operating cash flow less capital spending, was $11.7 billion. |

| • | Free cash flow productivity, which is the ratio of free cash flow to net earnings, was 87% and included a negative 15% impact resulting from the non-cash gain on the Folgers coffee transaction. |

FORWARD-LOOKING STATEMENTS

We discuss expectations regarding future performance, events and outcomes, such as our business outlook and objectives, in annual and quarterly reports, press releases and other written and oral communications. All such statements, except for historical and present factual information, are “forward-looking statements,” and are based on financial data and our business plans available only as of the time the statements are made, which may become out-of-date or incomplete. We assume no obligation to update any forward-looking statements as a result of new information, future events or other factors. Forward-looking statements are inherently uncertain and investors must recognize that events could be significantly different from our expectations. For more information on risks that could impact our results, refer to Item 1A Risk Factors in our most recent 10-Q, 10-K and 8-K filings.

Ability to Achieve Business Plans. We are a consumer products company and rely on continued demand for our brands and products. To achieve business goals, we must develop and sell products that appeal to consumers and retail trade customers. Our continued success is dependent on leading-edge innovation with respect to both products and operations and on the continued positive reputations of our brands. This means we must be able to

- 5 -

obtain patents and respond to technological advances and patents granted to competition. Our success is also dependent on effective sales, advertising and marketing programs in an increasingly fragmented media environment. Our ability to innovate and execute in these areas will determine the extent to which we are able to grow existing sales and volume profitably, especially with respect to the product categories and geographic markets (including developing markets) in which we have chosen to focus. There are high levels of competitive activity in the environments in which we operate. To address these challenges, we must respond to competitive factors, including pricing, promotional incentives, trade terms and product initiatives. We must manage each of these factors, as well as maintain mutually beneficial relationships with our key customers, in order to effectively compete and achieve our business plans. As a company that manages a portfolio of consumer brands, our ongoing business model involves a certain level of ongoing acquisition and divestiture activities. We must be able to successfully manage the impacts of these activities, while at the same time delivering against base business objectives. Our success will also depend on our ability to maintain key information technology systems.

Cost Pressures. Our costs are subject to fluctuations, particularly due to changes in commodity prices, raw materials, cost of labor, foreign exchange and interest rates. Therefore, our success is dependent, in part, on our continued ability to manage these fluctuations through pricing actions, cost savings projects, sourcing decisions and certain hedging transactions. We also must manage our debt and currency exposure, especially in certain countries, such as Venezuela, China and India. We need to maintain key manufacturing and supply arrangements, including sole supplier and sole manufacturing plant arrangements. We must implement, achieve and sustain cost improvement plans, including our outsourcing projects and those related to general overhead and workforce optimization. Successfully managing these changes, including identifying, developing and retaining key employees, is critical to our success.

Global Economic Conditions. Economic changes, terrorist activity and political unrest may result in business interruption, inflation, deflation or decreased demand for our products. Our success will depend, in part, on our ability to manage continued global political and/or economic uncertainty, especially in our significant geographic markets, as well as any political or economic disruption due to terrorist and other hostile activities.

Regulatory Environment. Changes in laws, regulations and the related interpretations may alter the environment in which we do business. This includes changes in environmental, competitive and product-related laws, as well as changes in accounting standards and taxation requirements. Our ability to manage regulatory, tax and legal matters (including product liability, patent, intellectual property, competition law matters and tax policy) and to resolve pending legal matters within current estimates may impact our results.

RESULTS OF OPERATIONS

Net Sales

Net sales decreased 3% in 2009 to $76.7 billion behind a 3% decline in unit volume. Unfavorable foreign exchange reduced net sales by 4% as many foreign currencies weakened versus the U.S. dollar. Price increases, taken across all segments, primarily to offset higher commodity costs and foreign exchange impacts, added 5% to net sales. Negative product mix reduced net sales by 1% mainly due to disproportionate volume declines in our more discretionary categories and channels (primarily Prestige, Salon Professional and Braun appliances), along with Personal Health Care, all of which have higher than Company average selling prices. Every reportable segment except Baby Care and Family Care reported volume declines led by mid-single-digit declines in Grooming and Snacks and Pet Care. Volume in both developed and developing regions was below previous year levels. Organic volume, which excludes the impact of acquisitions and divestitures, declined 2%. Organic sales increased 2% behind the net benefit of pricing and mix. The global economic downturn, credit crisis and price increases have contributed to market contractions, trade inventory reductions and share declines in certain businesses, resulting in organic sales below the Company’s long-term financial target range. These impacts were more pronounced in our more discretionary categories and may continue to negatively impact results of operations into fiscal 2010.

- 6 -

Net sales increased 9% in 2008 to $79.3 billion behind 4% unit volume growth, a favorable 5% foreign exchange impact and a positive 1% pricing impact. Favorable foreign exchange resulted primarily from the strengthening of European and other currencies relative to the U.S. dollar. Price increases were taken across a number of our businesses primarily to offset higher commodity costs. Mix had a negative 1% impact on net sales primarily due to disproportionate growth in developing regions, where selling prices are below the Company average. Each reportable segment posted year-on-year volume growth, with mid-single-digit growth in Fabric Care and Home Care, Baby Care and Family Care, Grooming and Health Care and low single-digit growth in Beauty and Snacks and Pet Care. Each geographic region posted year-on-year volume growth except Western Europe, which was down low single digits due to the impact of divestitures. Volume grew primarily behind initiative activity on key brands and continued double-digit growth in developing regions. Organic sales increased 5% behind organic volume growth of 5%. Each reportable segment posted year-on-year organic sales and organic volume growth.

Operating Costs

| YEARS ENDED JUNE 30 | |||||||||||||||

| Comparisons as a percentage of net sales |

2009 | Basis Point Change |

2008 | Basis Point Change |

2007 | ||||||||||

| Gross margin |

49.5 | % | (100 | ) | 50.5 | % | (70 | ) | 51.2 | % | |||||

| Selling, general and administrative |

29.5 | % | (80 | ) | 30.3 | % | (90 | ) | 31.2 | % | |||||

| Operating margin |

20.0 | % | (20 | ) | 20.2 | % | 20 | 20.0 | % | ||||||

| Earnings from continuing operations before income taxes |

18.8 | % | 0 | 18.8 | % | (10 | ) | 18.9 | % | ||||||

| Net earnings from continuing operations |

13.9 | % | (30 | ) | 14.2 | % | 90 | 13.3 | % | ||||||

- 7 -

Gross margin declined 100 basis points to 49.5% of net sales in 2009. Higher commodity and energy costs, partially offset by savings projects on raw and packing materials, negatively impacted gross margin by about 250 basis points. Unfavorable foreign exchange and incremental restructuring charges also negatively impacted gross margin. These impacts were partially offset by price increases and manufacturing and logistics cost savings.

Gross margin was down 70 basis points in 2008 to 50.5% of net sales. Commodity and energy cost increases had a negative impact on gross margin of about 200 basis points. These were largely offset by the benefits of scale leverage from volume growth and cost savings projects resulting from manufacturing efficiency improvements and product reformulations.

Total selling, general and administrative expenses (SG&A) decreased 6% to $22.6 billion in 2009 driven primarily by foreign currency impacts and cost reduction efforts. SG&A as a percentage of net sales was down 80 basis points due to lower marketing expenses and the impact of foreign currency transaction gains on working capital balances caused by strengthening of the U.S. dollar. Marketing expenses were down as a percentage of net sales for the total Company and for most reportable segments mainly due to media rate reductions, foreign exchange and reductions in the amount of media purchased primarily in the fourth fiscal quarter. Overhead spending as a percentage of net sales was up 30 basis points versus the prior year as productivity improvements were mostly offset by the negative impacts of sales deleverage and incremental restructuring charges.

SG&A increased 6% to $24.0 billion in 2008 driven by higher overhead and marketing spending to support business growth. SG&A as a percentage of net sales was down 90 basis points. Overhead spending was down as a percentage of net sales for the total Company and for each reportable segment primarily due to volume scale leverage, a focus on overhead productivity and incremental synergy savings from the Gillette acquisition. Marketing spending as a percentage of net sales was in line with previous year levels.

- 8 -

We fund a number of restructuring-type activities primarily related to manufacturing and workforce optimization efforts to maintain a competitive cost structure. We have incurred annual charges of approximately $400 million after tax in recent years. In 2009, we implemented additional restructuring-type activities in order to offset the dilution caused by the disposition of our coffee business. These incremental charges, which impacted both gross margin and SG&A as a percentage of net sales, reduced operating margin by about 40 basis points in 2009.

Non-Operating Items

Non-operating items primarily include interest expense, divestiture gains and interest and investment income. Interest expense decreased 7% in 2009 to $1.4 billion primarily driven by a reduction in U.S. dollar interest rates partially offset by a higher debt level primarily to fund the Company’s previously announced share repurchase program. In July 2007, the Company announced plans to repurchase $24 - 30 billion of P&G stock over a three-year period. In 2008, interest expense increased 13% to $1.5 billion driven by a higher interest rate on our long-term borrowings and a higher debt level to fund the Company’s previously announced share repurchase program.

Other non-operating income increased $24 million in 2009 mainly due to higher divestiture gains from the current year sales of Thermacare, Noxzema, Infusium and other minor brands. In 2008, other non-operating income decreased $108 million versus the prior year primarily due to lower interest income resulting from lower interest rates and cash balances. Divestiture gains in 2008 were in line with previous year levels and included the sale of the Western European tissue and Japanese adult incontinence businesses as well as other minor brands.

The effective tax rate from continuing operations in 2009 was up 180 basis points to 25.9% primarily due to a lower level of net favorable adjustments to reserves for previously existing uncertain tax positions and the utilization of tax credits, partially offset by unfavorable geographic mix of earnings across all reporting segments resulting from a weakening of key foreign currencies versus the U.S. dollar. During the current year, net adjustments to reserves for uncertain tax positions benefitted the effective tax rate by 130 basis points, versus a benefit of 340 basis points in 2008. The effective tax rate from continuing operations declined from 29.3% in 2007 to 24.1% in 2008. Approximately 300 basis points of the decline was due to the tax reserve adjustments for previously existing uncertain tax positions. The balance of the decline in 2008 was primarily driven by a more favorable geographic mix of earnings and a reduction in the German statutory tax rate, which reduced our deferred tax liabilities related to acquired intangible assets.

Net Earnings

Net earnings from continuing operations decreased 5% to $10.7 billion in 2009 mainly due to lower net sales and a higher effective tax rate. Operating margin was down 20 basis points behind a commodity-driven decline in gross margin, partially offset by lower SG&A as a percentage of net sales. Net earnings from continuing operations in 2008 increased 17% to $11.3 billion behind sales growth, a 20-basis point improvement in operating margin and a lower tax rate. Operating margin increased in 2008 due to lower SG&A as a percentage of net sales, which more than offset lower gross margin.

- 9 -

Net earnings from discontinued operations, which includes the results of the coffee and pharmaceuticals businesses, increased $2.0 billion in 2009 primarily due to a $2.0 billion after-tax gain on the sale of the coffee business in November 2008. The loss of earnings contribution from the coffee business in 2009 was mostly offset by an increase in earnings of the pharmaceuticals business. In 2008, net earnings from discontinued operations were $784 million, an increase of $106 million over 2007 driven by higher net earnings of the pharmaceuticals business.

Diluted net earnings per share in 2009 increased 17% to $4.26. The increase was due mainly to the gain on the sale of our coffee business, partially offset by lower net earnings from continuing operations. Diluted net earnings per share from continuing operations in 2009 decreased $0.01 to $3.39. Diluted net earnings per share from discontinued operations was $0.87, comprised primarily of the gain on the sale of the coffee business and current year earnings of the pharmaceuticals business. Diluted net earnings per share was positively impacted by fewer shares outstanding as a result of share repurchase activity and shares tendered in the Folgers coffee transaction. Treasury shares in the amount of $6.4 billion were repurchased in 2009, nearly all of which were made under our publicly announced share repurchase program.

Diluted net earnings per share in 2008 were up 20% versus the prior year to $3.64 per share, comprised of $3.40 per share from continuing operations and $0.24 per share from discontinued operations. Diluted net earnings per share growth exceeded net earnings growth due to share repurchase activity. Treasury shares in the amount of $10.0 billion were repurchased in 2008, nearly all of which were made under our publicly announced share repurchase program. Gillette was modestly accretive to earnings per share results in 2008, compared to dilution of approximately $0.10 - $0.12 per share in 2007. The elimination of Gillette dilution on earnings per share drove approximately 4 percentage points of earnings per share growth in 2008.

SEGMENT RESULTS

Results for the segments reflect information on the same basis we use for internal management reporting and performance evaluation. Within the Beauty and Grooming GBU, we provide data for the Beauty and the Grooming reportable segments. In the Health and Well-Being GBU, we provide data for the Health Care and the Snacks and Pet Care reportable segments. In the Household Care GBU, we provide data for the Fabric Care and Home Care and the Baby Care and Family Care reportable segments. All references to net earnings throughout the discussion of segment results refer to net earnings from continuing operations.

The results of these reportable business segments do not include certain non-business unit specific costs such as interest expense, investing activities and certain restructuring costs. These costs are reported in our Corporate segment and are included as part of our Corporate segment discussion. Additionally, as described in Note 11 to

- 10 -

the Consolidated Financial Statements, we have investments in certain companies over which we exert significant influence, but do not control the financial and operating decisions and, therefore, do not consolidate them for U.S. GAAP purposes (“unconsolidated entities”). Given that certain of these investments are managed as integral parts of the Company’s business units, they are accounted for as if they were consolidated subsidiaries for management and segment reporting purposes. This means pretax earnings in the business units include 100% of each pretax income statement component. In determining after-tax earnings in the business units, we eliminate the share of earnings applicable to other ownership interests, in a manner similar to minority interest, and apply the statutory tax rates. Eliminations to adjust each line item to U.S. GAAP are included in our Corporate segment.

| Net Sales Change Drivers vs. Year Ago (2009 vs. 2008) | ||||||||||||

| Volume with Acquisitions & Divestitures |

Volume Excluding Acquisitions & Divestitures |

Foreign Exchange |

Price | Mix/Other | Net Sales Growth | |||||||

| Beauty and Grooming |

||||||||||||

| Beauty |

-2% | -2% | -4% | 2% | 0% | -4% | ||||||

| Grooming |

-5% | -5% | -6% | 4% | -2% | -9% | ||||||

| Health and Well-Being |

||||||||||||

| Health Care |

-3% | -3% | -5% | 3% | -2% | -7% | ||||||

| Snacks and Pet Care |

-6% | -6% | -4% | 9% | -2% | -3% | ||||||

| Household Care |

||||||||||||

| Fabric Care and Home Care |

-3% | -3% | -5% | 6% | 0% | -2% | ||||||

| Baby Care and Family Care |

1% | 2% | -4% | 5% | -1% | 1% | ||||||

| Total Company |

-3% | -2% | -4% | 5% | -1% | -3% | ||||||

Sales percentage changes are approximations based on quantitative formulas that are consistently applied.

Beauty and Grooming

Beauty

| 2009 | Change vs. Prior Year |

2008 | Change vs. Prior Year | |||||||

| Volume |

n/a | -2% | n/a | +3% | ||||||

| Net sales ($ millions) |

$ | 18,924 | -4% | $ | 19,666 | +9% | ||||

| Net earnings ($ millions) |

$ | 2,664 | -6% | $ | 2,827 | +5% | ||||

Beauty net sales decreased 4% in 2009 to $18.9 billion on a 2% decline in unit volume. Price increases to offset higher commodity costs added 2% to net sales. Unfavorable foreign exchange reduced net sales by 4%. Organic sales increased 1% versus the prior year behind price increases. Volume in developed regions declined mid-single digits, while volume in developing regions grew low single digits. Hair Care volume in the retail channel grew low single digits behind growth of Pantene, Head & Shoulders and Rejoice. Salon Professional volume declined mid-single digits mainly due to market contractions and trade inventory reductions. Volume in Female Beauty declined mid-single digits primarily due to competitive activity affecting shipments of Olay and lower shipments of personal cleansing products driven by trade inventory reductions, market contractions and the divestiture of Noxzema. Prestige volume declined high single digits primarily due to market contractions and trade inventory reductions of prestige fragrances. Our market shares in key categories within Beauty were generally consistent with the prior year.

Net earnings decreased 6% in 2009 to $2.7 billion mainly due to lower net sales and reduced net earnings margin. Net earnings margin contracted 30 basis points due to reduced gross margin and a higher effective tax rate, partially offset by reduced SG&A as a percentage of net sales. Gross margin declined due to higher commodity costs, which were only partially offset by price increases and manufacturing cost savings. SG&A was down primarily due to lower marketing spending as a percentage of net sales.

- 11 -

Beauty net sales increased 9% in 2008 to $19.7 billion behind 3% volume growth and 6% of favorable foreign exchange. Volume in developing regions grew high single digits, while volume in developed regions was consistent with the prior year. Hair Care volume in retail channels was up mid-single digits, led by high single-digit growth in developing regions. Hair Care volume in developed regions was flat as a double-digit volume increase of Head & Shoulders was offset by a double-digit volume decline of Pantene in North America. Global market share of retail hair care was in line with the prior year level. Salon Professional volume declined mid-single digits as growth from color was more than offset by declines in care and styling. Female Beauty volume was up low single digits as initiative-driven growth of female blades and razors, skin care and cosmetic products behind Venus Embrace and Breeze, Olay Definity and Regenerist and Cover Girl Lash Blast Mascara was partially offset by lower shipments of deodorants due to trade inventory reductions and lower promotional activity. Our global skin care market share was up slightly, driven primarily by about a 1 point increase in our U.S. market share. Prestige volume was up low single digits and organic volume was up high single digits behind new product launches on Dolce & Gabbana and Hugo Boss. Net earnings in Beauty increased 5% to $2.8 billion in 2008 as the impact of higher net sales was partially offset by a lower net earnings margin. Net earnings margin was down 60 basis points as lower gross margin and the impact of base period divestiture gains on minor brands more than offset the benefit of a lower tax rate due to geographic mix. Gross margin was down due to higher commodity costs, which more than offset the benefit of increased volume scale leverage and manufacturing cost savings projects. SG&A decreased slightly as lower overhead spending as a percentage of net sales was partially offset by higher marketing spending as a percentage of net sales.

Grooming

| 2009 | Change vs. Prior Year |

2008 | Change vs. Prior Year | |||||||

| Volume |

n/a | -5% | n/a | +5% | ||||||

| Net sales ($ millions) |

$ | 7,408 | -9% | $ | 8,103 | +11% | ||||

| Net earnings ($ millions) |

$ | 1,359 | -14% | $ | 1,582 | +22% | ||||

Grooming net sales declined 9% in 2009 to $7.4 billion on a 5% decline in unit volume. Unfavorable foreign exchange reduced net sales by 6%. Product mix had a negative 2% impact on net sales as favorable product mix from growth of the premium-priced Gillette Fusion brand was more than offset by a disproportionate decline of Braun, both of which have higher than segment average selling prices. Price increases, taken across most product lines and in part to offset foreign exchange impacts in developing regions, added 4% to net sales. Organic sales were down 2% versus the prior year on a 5% decline in organic volume, mainly due to the sharp decline of the Braun business. Volume in both developed and developing regions declined mid-single digits. Male Blades and Razors volume declined low single digits primarily driven by market contractions in developed regions and trade inventory reductions. Growth of Gillette Fusion was more than offset by declines in legacy shaving systems. Global value share of male blades and razors was up less than half a point versus the prior year. Male Personal Care volume was in line with the prior year as the full-year impact of the Gillette hair care and personal cleansing initiatives launched late in fiscal 2008 was offset by lower shipments of body sprays and shave products. Volume in Braun was down double digits due to market contractions, trade inventory reductions and the exits of the U.S. home appliance and Tassimo coffee appliance businesses. Global value share of the male dry shaving market was down less than half a point.

Net earnings were down 14% in 2009 to $1.4 billion primarily on the decline in net sales and a 120-basis point reduction in net earnings margin. Net earnings margin was down due to a higher effective tax rate and reduced gross margin, partially offset by lower SG&A as a percentage of net sales. Gross margin declined due to unfavorable product mix resulting from disproportionate growth of disposable razors, higher commodity costs and volume scale deleverage which were partially offset by price increases and manufacturing cost savings. The economic downturn in fiscal 2009 has resulted in a disproportionate decline in the Braun business, particularly in developing geographies, given the more discretionary nature of home and personal grooming appliance purchases. We believe the Braun business will return to sales and earnings growth rates consistent with our long-term business plans. Failure to achieve these business plans or a further deterioration of the macroeconomic conditions could result in an impairment of the Braun business goodwill and intangibles recorded in 2005 as part of the Gillette acquisition.

- 12 -

Grooming net sales increased 11% to $8.1 billion in 2008. Net sales were up behind 5% volume growth, a 7% favorable foreign exchange impact and a 1% positive pricing impact driven by price increases on premium shaving systems. Product mix had a negative 2% impact on net sales as positive product mix from growth on the premium-priced Gillette Fusion brand was more than offset by the impact of disproportionate growth in developing regions, where selling prices are below the segment average. Male Blades and Razors volume increased mid-single digits behind double-digit growth in developing regions driven primarily by Gillette Fusion expansion and the Prestobarba3 launch. In developed regions, Male Blades and Razors volume was down mid-single digits as double-digit growth on Fusion was more than offset by lower shipments of legacy shaving systems. Gillette Fusion delivered more than $1 billion in net sales for 2008. Male Personal Care volume grew high single digits behind improved retailer support of shave products, the launch of the Gillette hair care and personal cleansing initiatives and strong growth in developing regions. Braun volume was down mid-single digits primarily due to supply constraints at a contract manufacturer, the announced exits of certain appliance businesses and the divestiture of the thermometer and blood pressure devices business. Net earnings in Grooming were up 22% in 2008 to $1.6 billion behind net sales growth and a 180-basis point earnings margin expansion. Earnings margin improved behind lower SG&A as a percentage of net sales, partially offset by a reduction in gross margin. Gross margin declined due to higher costs incurred at a contract manufacturer on the Braun home appliance business, which more than offset benefits from higher pricing and volume scale leverage. SG&A as a percentage of net sales was down primarily due to lower overhead spending driven largely by synergies from the integration of Gillette into P&G’s infrastructure.

Health and Well-Being

Health Care

| 2009 | Change vs. Prior Year |

2008 | Change vs. Prior Year | |||||||

| Volume |

n/a | -3% | n/a | +6% | ||||||

| Net sales ($ millions) |

$ | 11,288 | -7% | $ | 12,087 | +10% | ||||

| Net earnings ($ millions) |

$ | 1,835 | -9% | $ | 2,021 | +10% | ||||

Health Care net sales were down 7% to $11.3 billion in 2009 on a 3% decline in unit volume. Unfavorable foreign exchange reduced net sales by 5%. Negative product mix from disproportionately higher volume declines of Personal Health Care, which have higher than segment average selling prices, reduced net sales by 2%. These negative impacts were partially offset by positive pricing impacts of 3%. Organic sales were down 1% versus fiscal 2008. Volume declined mid-single digits in developed regions and low single digits in developing regions. Personal Health Care volume was down double digits due to the loss of marketplace exclusivity of Prilosec in North America, the impact of a mild cold and flu season on Vicks and the divestiture of Thermacare. All-outlet value share of the U.S. personal health care market has declined over 2 points, including a double-digit share decline of Prilosec OTC. The impact from the loss of Prilosec exclusivity is expected to continue. Oral Care volume declined low single digits behind trade inventory reductions and market contractions in North America and CEEMEA. Our global market share of oral care was in line with the prior year. Feminine Care volume was down low single digits mainly due to trade inventory reductions and market contractions in North America and CEEMEA. Our global feminine care market share was down half a point versus the prior year.

Net earnings declined 9% to $1.8 billion in 2009 mainly due to lower net sales. Net earnings margin was down 50 basis points due primarily to lower gross margin and higher overhead spending as a percentage of net sales, partially offset by a reduction in marketing spending as a percentage of net sales. The decline in gross margin was driven by higher commodity costs, which were partially offset by price increases and manufacturing cost savings.

- 13 -

Health Care net sales increased 10% in 2008 to $12.1 billion behind a 6% increase in unit volume. Foreign exchange had a positive 6% impact on net sales. Disproportionate growth in developing regions, which have selling prices below the segment average, resulted in a negative 2% mix impact. Feminine Care volume increased mid-single digits and organic volume was up high single digits behind double-digit growth on Naturella and high single-digit growth on Always, which more than offset a low single-digit decline on Tampax. Our global feminine care market share increased slightly in 2008. Oral Care volume was up mid-single digits behind initiative-driven growth on Oral-B toothbrushes and Crest. Volume in Personal Health was up double digits behind growth in diagnostics product and the impact of adding the Swiss Precision Diagnostics business, partially offset by lower shipments of Prilosec OTC and PuR. The PuR decline was from adjustments to a Whirlpool® water filters licensing agreement. Prilosec OTC volume began to decline in the third fiscal quarter of 2008 due to the loss of marketplace exclusivity and the entry of competing products into the market. This is expected to continue and to have an adverse effect on the results of the Health Care segment in future periods. Net earnings in Health Care were up 10% in 2008 to $2.0 billion mainly due to higher net sales. Net earnings margin was consistent with the prior year as reduced SG&A as a percentage of net sales and a lower tax rate were offset by lower gross margin. Gross margin was down due to higher commodity costs and a less profitable mix driven primarily by disproportionate growth in developing regions and lower shipments of Prilosec OTC, which more than offset the benefit of increased volume scale leverage and manufacturing cost savings. SG&A improved behind lower overhead spending as a percentage of net sales due to a focus on productivity improvement and Gillette synergy benefits and lower marketing spending as a percentage of net sales behind marketing spending efficiencies.

Snacks and Pet Care

| 2009 | Change vs. Prior Year |

2008 | Change vs. Prior Year | |||||||

| Volume |

n/a | -6% | n/a | +3% | ||||||

| Net sales ($ millions) |

$ | 3,114 | -3% | $ | 3,204 | +7% | ||||

| Net earnings ($ millions) |

$ | 234 | -10% | $ | 261 | +7% | ||||

Snacks and Pet Care net sales decreased 3% to $3.1 billion in 2009 on a 6% decline in unit volume. Price increases to offset higher commodity costs added 9% to net sales. Product mix reduced net sales by 2% due to lower shipments of Eukanuba and premium snack products, which have higher than segment average selling prices. Unfavorable foreign exchange reduced net sales by 4%. Organic sales increased 1%. Snacks volume decreased high single digits due to lower merchandising support and trade inventory levels, a high base period, which included the Rice Infusion, Extreme Flavors and Stix product launches and market share declines following price increases. Our global snacks market share declined about 1 point versus the prior year. Volume in Pet Care declined mid-single digits mainly due to declines in the premium nutrition business following multiple price increases.

Net earnings in 2009 were down 10% to $234 million on lower net sales and a 60-basis point reduction in net earnings margin. A reduction in gross margin and a higher effective tax rate each reduced net earnings margin. These impacts were partially offset by lower SG&A as a percentage of net sales. Gross margin declined due to higher commodity costs, partially offset by higher selling prices and manufacturing cost savings. SG&A as a percentage of net sales declined due to reductions in both marketing and overhead spending.

Snacks and Pet Care net sales increased 7% to $3.2 billion in 2008. Net sales grew behind a 3% volume increase, a positive 1% price impact resulting from price increases in Pet Care and a 4% favorable foreign exchange impact. Product mix had a negative 1% impact on net sales from an increase in Snacks volume, which has lower selling prices than the segment average. Snacks volume was up high single digits behind the launch of Rice Infusion in Western Europe and Extreme Flavors and Pringles Stix in North America. In Pet Care, volume was down low single digits due to negative impacts from the voluntary wet pet food recall in the U.S. in March 2007 that contributed to approximately a 1% decline in our U.S. market share. Net earnings in Snacks and Pet Care were up 7% to $261 million in 2008 due to sales growth. Operating margin was consistent with the prior year as

- 14 -

lower gross margin was offset by improved SG&A as a percentage of net sales. Gross margin was down as higher commodity costs across the segment more than offset price increases, base period pet food recall impacts and manufacturing cost savings. SG&A decreased as a percentage of net sales due to reductions in both overhead and marketing spending as a percentage of net sales.

Household Care

Fabric Care and Home Care

| 2009 | Change vs. Prior Year |

2008 | Change vs. Prior Year | |||||||

| Volume |

n/a | -3% | n/a | +6% | ||||||

| Net sales ($ millions) |

$ | 23,186 | -2% | $ | 23,714 | +11% | ||||

| Net earnings ($ millions) |

$ | 3,032 | -11% | $ | 3,411 | +9% | ||||

Fabric Care and Home Care net sales were down 2% in 2009 to $23.2 billion on a 3% decline in unit volume. Price increases, taken primarily to offset higher commodity costs, added 6% to net sales, while unfavorable foreign exchange reduced net sales by 5%. Organic sales increased 3%. Fabric Care, Home Care and Batteries unit volume were each down in both developed and developing regions. Volume in Fabric Care declined low single digits due to trade inventory reductions and net market share declines following price increases. Lower shipments of premium-priced Tide and Ariel were only partially offset by growth of Gain and Downy. Global value share of the fabric care market was down less than half a point behind declines in U.S. all-outlet shares of Tide and Downy, partially offset by share growth of Gain. Home Care volume was down low single digits due to market contractions and trade inventory reductions. Batteries volume declined high single digits due to market contractions, trade inventory reductions and competitive activity, which drove a 1-point market share decline of general purpose batteries.

Net earnings declined 11% to $3.0 billion primarily due to reduced net earnings margin and lower net sales. Net earnings margin contracted 130 basis points behind lower operating margin. Operating margin was down primarily due to a commodity-driven decline in gross margin, which was partially offset by price increases and manufacturing cost savings. Lower marketing spending as a percentage of net sales was largely offset by higher overhead spending as a percentage of net sales.

Fabric Care and Home Care net sales in 2008 increased 11% to $23.7 billion. Volume was up 6%, price increases added 1% and favorable foreign exchange added 5% to net sales growth. This was partially offset by a negative 1% mix impact primarily from disproportionate growth in developing regions and a shift toward larger sizes in fabric care, both of which have selling prices below the segment average. Fabric Care volume increased mid-single digits behind high single-digit growth in developing regions and mid-single-digit growth in developed regions. Growth was driven by the liquid laundry detergent compaction launch in North America and initiative activity on Tide, Gain, Ariel and Downy. Home Care volume was up mid-single digits due to double-digit growth in developing regions and high-teens growth on Febreze from the launch of Febreze Candles. Batteries volume was up mid-single digits behind double-digit growth in developing regions and mid-single-digit growth in developed regions. Net earnings in Fabric Care and Home Care increased 9% to $3.4 billion in 2008 primarily behind higher net sales. Net earnings margin was down 20 basis points primarily due to lower gross margin, partially offset by a reduction in SG&A as a percentage of net sales. Gross margin was down due to higher commodity costs, which more than offset benefits from pricing, increased volume scale leverage and manufacturing cost savings projects. SG&A improved as a percentage of net sales due to lower overhead spending as a percentage of net sales resulting from a focus on overhead productivity improvements.

Baby Care and Family Care

| 2009 |

Change vs. Prior Year |

2008 | Change vs. Prior Year | |||||||

| Volume |

n/a | +1% | n/a | +4% | ||||||

| Net sales ($ millions) |

$ | 14,103 | +1% | $ | 13,898 | +9% | ||||

| Net earnings ($ millions) |

$ | 1,770 | +2% | $ | 1,728 | +20% | ||||

- 15 -

Baby Care and Family Care net sales increased 1% to $14.1 billion in 2009 on 1% volume growth. Pricing to help recover higher commodity and energy costs contributed 5% to net sales growth. Unfavorable foreign exchange reduced net sales by 4%. Negative product mix from higher shipments of mid-tier brands, which have lower than segment average selling prices, reduced net sales by 1%. Organic sales were up 7% on a 2% increase in organic volume. Volume growth was driven by low single-digit growth in developing regions, while volume in developed regions was in line with the prior year. Baby Care volume increased low single digits due to growth of Pampers primarily in developing regions and double-digit growth of Luvs in North America. Our global market share of baby care was up nearly half a point. Family Care volume was down low single digits due to the Western European family care divestiture. Organic volume for Family Care was up low single digits behind double-digit growth of Charmin Basic and Bounty Basic. U.S. market share on Bounty was up nearly 1 point, while Charmin market share remained consistent with the prior year.

Net earnings were up 2% versus the prior year to $1.8 billion due to net sales growth and higher net earnings margin. Net earnings margin increased 10 basis points as higher gross margin was partially offset by an increase in SG&A as a percentage of net sales and a higher effective tax rate. Gross margin improved due to the impact of price increases, manufacturing cost savings and more positive product mix following the Western European family care divestiture, which more than offset higher commodity and energy costs. SG&A as a percentage of net sales increased due to the higher current period overhead spending and base period reimbursements for services related to the Western European family care divestiture, partially offset by lower marketing spending.

Baby Care and Family Care net sales increased 9% in 2008 to $13.9 billion. Volume was up 4%, including the impact of the Western European family care divestiture. Price increases contributed 1% to net sales and foreign exchange had a positive 4% impact on net sales. Organic volume and organic sales, which exclude the impacts of the Western European family care divestiture and foreign exchange, both grew 8%. Organic volume growth was balanced across the segment with high single-digit growth in both Baby Care and Family Care. Baby Care volume in developed regions was up mid-single digits behind growth on the Pampers Baby Stages of Development and on the Baby Dry Caterpillar Flex initiative. In developing regions, Baby Care volume was up double digits behind continued growth on Pampers. Family Care volume was down low single digits due to the divestiture of the Western European family care business but was up high single digits on an organic basis behind the Bounty and Charmin product restages. U.S. market share on both Bounty and Charmin was up over 1 point. Net earnings in Baby Care and Family Care were up 20% to $1.7 billion in 2008 behind higher net sales and earnings margin expansion. Net earnings margin improved 110 basis points primarily behind higher gross margin and lower SG&A as a percentage of net sales. Gross margin was up due to a more profitable product mix following the Western Europe family care divestiture, the benefit of increased volume scale leverage, pricing and manufacturing cost savings projects, which more than offset higher commodity and energy costs. SG&A improved as a percentage of net sales due to lower overhead spending as a percentage of net sales, partially offset by higher marketing expenses as a percentage of net sales.

Corporate

Corporate includes certain operating and non-operating activities not allocated to specific business units. These include: the incidental businesses managed at the corporate level; financing and investing activities; other general corporate items; the historical results of certain divested brands and categories; and certain restructuring-type activities to maintain a competitive cost structure, including manufacturing and workforce optimization. Corporate also includes reconciling items to adjust the accounting policies used in the segments to U.S. GAAP. The most significant reconciling items include income taxes (to adjust from statutory rates that are reflected in the segments to the overall Company effective tax rate), adjustments for unconsolidated entities (to eliminate sales, cost of products sold and SG&A for entities that are consolidated in the segments but accounted for using the equity method for U.S. GAAP) and minority interest adjustments for subsidiaries where we do not have 100%

- 16 -

ownership. Since certain unconsolidated entities and less than 100%-owned subsidiaries are managed as integral parts of the Company, they are accounted for similar to a wholly owned subsidiary for management and segment purposes. This means our segment results recognize 100% of each income statement component through before-tax earnings in the segments, with eliminations for unconsolidated entities in Corporate. In determining segment after-tax net earnings, we apply the statutory tax rates (with adjustments to arrive at the Company’s effective tax rate in Corporate) and eliminate the share of earnings applicable to other ownership interests, in a manner similar to minority interest.

Corporate net sales primarily reflect the adjustment to eliminate the sales of unconsolidated entities included in business segment results. Accordingly, Corporate net sales is generally a negative balance. Negative net sales in Corporate declined $86 million in 2009 primarily driven by lower adjustments to eliminate these sales. These adjustments decreased due to lower net sales of existing unconsolidated entities. Net expenses from continuing operations decreased $325 million to $214 million. The decrease was primarily due to corporate hedging impacts, lower interest expense and higher current period divestiture gains, partially offset by higher restructuring spending. These items are discussed in more detail in the Results of Operations section.

In 2008, negative net sales increased $474 million in Corporate primarily driven by higher adjustments to eliminate the impact of joint venture net sales for unconsolidated entities. These adjustments increased due to sales growth of existing unconsolidated entities and the addition of the Swiss Precision Diagnostics business. Net expenses in Corporate decreased $434 million in 2008. The decrease was driven primarily by a lower tax rate resulting from the net benefits of adjustments to reserves for uncertain tax positions.

FINANCIAL CONDITION

We believe our financial condition continues to be of high quality, as evidenced by our ability to generate substantial cash from operations and ready access to capital markets at competitive rates.

Operating cash flow provides the primary source of funds to finance operating needs and capital expenditures. Excess operating cash is used first to fund shareholder dividends. Other discretionary uses include share repurchases and “tack-on” acquisitions to complement our portfolio of brands and geographies. As necessary, we may supplement operating cash flow with debt to fund these activities. The overall cash position of the Company reflects our strong business results and a global cash management strategy that takes into account liquidity management, economic factors and tax considerations.

Operating Activities

Operating cash flow was $14.9 billion in 2009, a decrease of 1% versus the prior year total of $15.0 billion. Operating cash flow resulted primarily from net earnings adjusted for non-cash items (depreciation and amortization, stock-based compensation, deferred income taxes and gain on the sale of businesses). The combination of net earnings and non-cash items provided $15.3 billion of operating cash as compared to $16.7 billion in the prior year. The decrease in operating cash flow versus 2008 was primarily due to a decline in net earnings from continuing operations. A net decrease in working capital also added to cash flow in the current year as lower accounts receivable and inventory balances were partially offset by a decline in accounts payable. The decrease in working capital was primarily due to the impact of lower net sales and our ability to adequately adjust production to better meet unit volume requirements. Accounts receivable days declined primarily due to improved collection efforts. Inventory and accounts payable days declined due in part to the optimization of our manufacturing process and inventory levels and a moderation of commodity costs late in the year. Other operating assets and liabilities reduced cash flow primarily due to changes in postretirement benefit plans. Cash flow from discontinued operations contributed $662 million to operating cash flow.

In 2008, operating cash flow increased 12% over the prior year to $15.0 billion. Both operating cash flow and the increase in operating cash flow over the prior year resulted primarily from higher net earnings and non-cash charges (depreciation and amortization, stock-based compensation, deferred income taxes and gain on the sale of businesses). Working capital balances increased primarily to support business growth resulting in a net use of cash. Cash flow from discontinued operations contributed $762 million to operating cash flow.

- 17 -

Free Cash Flow. We view free cash flow as an important measure because it is one factor impacting the amount of cash available for dividends and discretionary investment. It is defined as operating cash flow less capital expenditures and is one of the measures used to evaluate senior management and determine their at-risk compensation. Free cash flow was $11.7 billion in 2009, compared to $12.0 billion in 2008. Free cash flow decreased as a result of higher capital spending and lower operating cash flow. Free cash flow productivity, defined as the ratio of free cash flow to net earnings, was 87% in 2009. This is below our 90% target primarily due to the gain on the Folgers coffee transaction which lowered productivity by approximately 15% because the gain is included in net earnings but had no impact on operating cash flow.

In 2008, free cash flow was $12.0 billion, compared to $10.5 billion in 2007. Free cash flow increased primarily as a result of higher operating cash flow. Capital expenditures were $3.0 billion and 3.8% of net sales. Free cash flow productivity was 99% in 2008, ahead of our 90% target.

Investing Activities

Net investing activities used $2.4 billion of cash in 2009 and $2.5 billion in 2008 mainly due to capital spending. Discontinued operations contributed $69 million to cash from investing activities in 2009 and consumed $8 million in 2008.

Capital Spending. We view capital spending efficiency as a critical component of our overall cash management strategy. Capital expenditures in 2009 were $3.2 billion, compared to $3.0 billion in 2008. Capital spending as a percentage of net sales was 4.2% in 2009, compared to 3.8% in 2008, as we continued to make investments to support capacity, innovation and cost savings. Capital spending for our discontinued coffee and pharmaceuticals businesses was $11 million and $42 million in 2009 and 2008, respectively.

- 18 -

Acquisitions. Acquisitions used $368 million of cash in 2009 primarily for the acquisition of Nioxin, a leader in the scalp care professional hair care market, which was incorporated into Beauty. In 2008, acquisitions used $381 million of cash primarily for the acquisition of Frederic Fekkai, a premium hair care brand, in Beauty.

Proceeds from Asset Sales. Proceeds from asset sales were $1.1 billion in 2009 mainly due to the sale of our coffee business and the Thermacare brand. Of these proceeds, $350 million related to debt issued in connection with the Folgers coffee transaction. The underlying debt obligation was transferred to The J.M. Smucker Company pursuant to the transaction. No cash was received from Smucker in the exchange transaction. During 2009, we also divested our Thermacare brand and a number of other minor brands. In 2008, proceeds from asset sales were $928 million primarily behind the sale of our Western Europe family care business as well as several minor Beauty and Health Care divestitures. Proceeds from asset sales of discontinued operations contributed $81 million and $34 million in 2009 and 2008, respectively.

Financing Activities

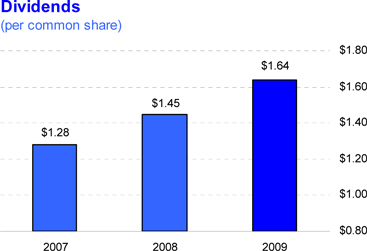

Dividend Payments. Our first discretionary use of cash is dividend payments. Dividends per common share increased 13% to $1.64 per share in 2009. Total dividend payments to both common and preferred shareholders were $5.0 billion, $4.7 billion and $4.2 billion in 2009, 2008 and 2007, respectively. In April 2009, the Board of Directors declared an increase in our quarterly dividend from $0.40 to $0.44 per share on Common Stock and Series A and B ESOP Convertible Class A Preferred Stock.

- 19 -

Long-Term and Short-Term Debt. We maintain debt levels we consider appropriate after evaluating a number of factors, including cash flow expectations, cash requirements for ongoing operations, investment and financing plans (including acquisitions and share repurchase activities) and the overall cost of capital. Total debt was $37.0 billion in 2009, $36.7 billion in 2008 and $35.4 billion in 2007. Debt increased in 2009 and 2008 primarily to fund our share repurchase plan discussed below.

Treasury Purchases. In 2007, we began to acquire $24 - 30 billion of our outstanding shares under a publicly announced three-year share repurchase plan. To date, we have acquired $16.3 billion of shares under this repurchase plan. Total share repurchases were $6.4 billion in 2009 and $10.0 billion in 2008, nearly all of which were made under our publicly announced share repurchase plan. Total share repurchases under the publicly announced plan may be below the announced range due to lower earnings growth in fiscal 2009 and 2010 versus expectations at the time the plan was publicly announced.

In November 2008, we completed the divestiture of our Folgers coffee subsidiary. In connection with this divestiture, 38.7 million shares of P&G common stock were tendered by shareholders and exchanged for all shares of Folgers common stock, resulting in an increase of treasury stock of $2.5 billion.

Liquidity

Our current liabilities exceeded current assets by $9.0 billion, driven by our short-term debt position. We utilize short- and long-term debt to fund discretionary items such as acquisitions and share repurchases. We anticipate being able to support our short-term liquidity and operating needs largely through cash generated from operations. We have strong short- and long-term debt ratings which despite the current credit crisis have enabled and should continue to enable us to refinance our debt as it becomes due at favorable rates in commercial paper and bond markets. In addition, we have agreements with a diverse group of financial institutions that, if needed, should provide sufficient credit funding to meet short-term financing requirements.

On June 30, 2009, our short-term credit ratings from Moody’s and Standard & Poor’s (S&P) are P-1 and A-1+, respectively. Our Moody’s and S&P long-term credit ratings are Aa3 with a negative outlook and AA- with a stable outlook, respectively.

We maintain three bank credit facilities: a $6 billion 5-year facility expiring in August 2012, a $3 billion 5-year facility expiring in August 2012 and a $1.8 billion 364-day facility expiring in June 2010. The credit facilities are in place to support our ongoing commercial paper program. The two 5-year facilities can be extended for certain periods of time as specified in, and in accordance with, the terms of each of these credit agreements. We anticipate that these facilities will remain largely undrawn for the foreseeable future. These credit facilities do not have cross-default or ratings triggers, nor do they have material adverse events clauses, except at the time of signing. In addition to these credit facilities, we have an automatically effective registration statement on Form S-3 filed with the SEC that is available for registered offerings of short- or long-term debt securities.

Guarantees and Other Off-Balance Sheet Arrangements

We do not have guarantees or other off-balance sheet financing arrangements, including variable interest entities, which we believe could have a material impact on financial condition or liquidity.

Contractual Commitments

The following table provides information on the amount and payable date of our contractual commitments as of June 30, 2009.

| ($ millions) |

Total | Less Than 1 Year |

1-3 Years | 3-5 Years | After 5 Years | ||||||||||

| Recorded liabilities |

|||||||||||||||

| Total debt |

$ | 36,631 | $ | 16,270 | $ | 1,438 | $ | 6,091 | $ | 12,832 | |||||

| Capital leases |

392 | 46 | 84 | 76 | 186 | ||||||||||

| Unrecognized tax benefit(1) |

— | — | — | — | — | ||||||||||

| Other |

|||||||||||||||

| Interest payments relating to long-term debt |

12,616 | 1,183 | 2,469 | 1,788 | 7,176 | ||||||||||

| Operating leases(2) |

1,620 | 305 | 495 | 378 | 442 | ||||||||||

| Minimum pension funding(3) |

1,499 | 616 | 883 | — | — | ||||||||||

| Purchase obligations(4) |

3,897 | 1,258 | 1,659 | 681 | 299 | ||||||||||

| Total Contractual Commitments |

56,655 | 19,678 | 7,028 | 9,014 | 20,935 | ||||||||||

- 20 -

| (1) | As of June 30, 2009, the Company’s Consolidated Balance Sheet reflects a liability for unrecognized tax benefits of $2.7 billion, including $736 of interest and penalties. Due to the high degree of uncertainty regarding the timing of future cash outflows of liabilities for unrecognized tax benefits, a reasonable estimate of the period of cash settlement beyond the balance sheet date of June 30, 2009, can not be made. |

| (2) | Operating lease obligations are shown net of guaranteed sublease income. |

| (3) | Represents future pension payments to comply with local funding requirements. The projected payments beyond fiscal year 2012 are not currently determinable. |

| (4) | Primarily reflects future contractual payments under various take-or-pay arrangements entered into as part of the normal course of business. Commitments made under take-or-pay obligations represent future purchases in line with expected usage to obtain favorable pricing. Approximately 43% relates to service contracts for information technology, human resources management and facilities management activities that have been outsourced. While the amounts listed represent contractual obligations, we do not believe it is likely that the full contractual amount would be paid if the underlying contracts were canceled prior to maturity. In such cases, we generally are able to negotiate new contracts or cancellation penalties, resulting in a reduced payment. The amounts do not include obligations related to other contractual purchase obligations that are not take-or-pay arrangements. Such contractual purchase obligations are primarily purchase orders at fair value that are part of normal operations and are reflected in historical operating cash flow trends. We do not believe such purchase obligations will adversely affect our liquidity position. |

SIGNIFICANT ACCOUNTING POLICIES AND ESTIMATES

In preparing our financial statements in accordance with U.S. GAAP, there are certain accounting policies that are particularly important. These include revenue recognition, income taxes, certain employee benefits, acquisitions and goodwill and intangible assets. We believe these accounting policies, and others set forth in Note 1 to the Consolidated Financial Statements, should be reviewed as they are integral to understanding the results of operations and financial condition of the Company. In the case of revenue recognition, these policies simply represent required accounting and there is minimal judgment or estimation involved. In other areas, they may represent a choice between acceptable accounting methods or may require substantial judgment or estimation in their application.

Due to the nature of our business, these estimates generally are not considered highly uncertain at the time of estimation. Accordingly, they are not expected to result in changes that would materially affect our financial condition, results of operations or cash flows in any given year. However, for ongoing impairment testing of goodwill and intangible valuations, significant changes in the underlying assumptions used in the valuation models, including discount and tax rates or future cash flow projections, versus those anticipated at the time of the initial valuations, could result in impairment charges that could materially affect the financial statements in any given year.

The Company has discussed the selection of significant accounting policies and the effect of estimates with the Audit Committee of the Company’s Board of Directors.