Attached files

As

filed with the Securities and Exchange Commission on January 29,

2010

Registration

No. 333-________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

CLAVIS

TECHNOLOGIES INTERNATIONAL CO., LTD.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

7379

|

27-1505309

|

|

(State

or other jurisdiction of

|

(Primary

SIC Number)

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

No.)

|

#1564-1,

Seojin Bldg., 3rd

Floor

Seocho3-Dong

Seocho-Gu,

Seoul, Korea 137-874

(011)

82-2-3471-9340

(Address,

including zip code, and telephone number, including area code, of principal

executive offices)

Resident

Agency Incorporated

377

S. Nevada Street

Carson

City, Nevada 89703

(775)

882-7549

(Name,

address, including zip code, and telephone number, including area code, of agent

for service)

With

a copy to:

Richard

C. Fox, Esq.

Fox

Law Offices, P.A.

c/o

131 Court Street, # 11

Exeter,

NH 03833

(603)

778-9910

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Title of Class of Securities to be Registered

|

Amount to be

Registered (1)

|

Proposed

Maximum

Aggregate

Price Per Share

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

||||||||||||

|

Common

Stock, $.001 per share (2)

|

17,375,200 | $ | $0.00533 | (3) | $ | 92,609.92 | $ | 6.77 | ||||||||

|

Total

|

17,375,200 | $ | 92,609.92 | $ | 6.77 | |||||||||||

(1) In the event of a stock

split, stock dividend or similar transaction involving our common stock, the

number of shares registered shall automatically be increased to cover the

additional shares of common stock issuable pursuant to Rule 416 under the

Securities Act of 1933, as amended.

(2) Represents shares of

common stock currently outstanding to be sold by the selling security

holders.

(3) The offering price has

been estimated solely for the purpose of computing the amount of the

registration fee in accordance with Rule 457(o). Our common stock is not

currently trading on any national exchange. Therefore, in

accordance with Rule 457, the offering price of $0.00533 was determined by the

price shares of common stock that we sold in a Regulation S offering that was

entered into between September 2009 and January 2010. The price of $0.00533

is a fixed price at which the selling security holders may sell their shares

until our common stock is quoted on the OTC Bulletin Board at which time the

shares may be sold at prevailing market prices or privately negotiated

prices.

The

registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with section 8(a) of the

securities act of 1933 or until the registration statement shall become

effective on such date as the commission, acting pursuant to said section 8(a),

may determine.

The information in this prospectus is not complete and may be

changed. The selling stockholders named in this prospectus may not

sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer

to sell these securities and the selling stockholders are not soliciting offers

to buy these securities in any state where the offer or sale is not

permitted.

|

Subject To Completion, Dated January 29, 2010

|

|

|

PROSPECTUS

|

Clavis

Technologies International Co., Ltd.

17,375,200

shares of Common Stock

This

prospectus covers the offer and sale of up to 17,375,200 shares of our common

stock from time to time by the selling security holders named in this

prospectus. The shares of common stock covered by this prospectus are

shares that are held, beneficially and of record, by the selling security

holders. We are not offering any shares of common

stock. The selling

security holders

will receive all of the net proceeds from sales of the common stock covered by

this prospectus.

Our

common stock is presently not traded on any national market or securities

exchange or in the over-the-counter market. The sales price to the

public of the shares of our common stock offered by the selling security holders

under this prospectus is fixed at $0.00533 per share until such time as our

common stock is quoted on the Over-The-Counter (OTC) Bulletin Board. Although we

intend to request a registered broker-dealer to apply with the Financial

Industry Regulatory Authority to have our common stock eligible for quotation on

the OTC Bulletin Board, public trading of our common stock may never materialize

or, even if materialized, trading may not be sustained. If our common stock is

quoted on the OTC Bulletin Board, then the sale price to the public will vary

according to prevailing market prices or privately negotiated prices by the

selling security holders. To the best of our knowledge, none of the

selling security holders are broker-dealers, underwriters or affiliates

thereof.

As of

January 28, 2010, we had 62,375,200 shares of common stock issued and

outstanding.

INVESTING

IN OUR SECURITIES IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK AND SHOULD

BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE

INVESTMENT. PLEASE REFER TO “RISK FACTORS” BEGINNING ON PAGE

5.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS

APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR

ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

Our

offices are located at #1564-1, Seojin Bldg., 3rd Fl., Seocho3-Dong, Seocho-Gu,

Seoul, Korea 137-874. Our telephone number is (011)

82-2-3471-9340. Our website can be found at

www.clavistech.com.

The date

of the prospectus is , 2010.

TABLE

OF CONTENTS

|

About

This Prospectus

|

3

|

|

Prospectus

Summary

|

4

|

|

Special

Note Regarding Forward-Looking Statements

|

4

|

|

Risk

Factors

|

5

|

|

Use

of Proceeds

|

10

|

|

Selling

Security Holders

|

10

|

|

Plan

of Distribution

|

14

|

|

Description

of Securities

|

16

|

|

Interest

of Named Experts and Counsel

|

16

|

|

Description

of Business

|

17

|

|

Description

of Property

|

39

|

|

Legal

Proceedings

|

39

|

|

Market

for Common Equity and Related Stockholder Matters

|

39

|

|

Where

You Can Find More Information

|

40

|

|

Index

Financial Statements

|

41

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

42

|

|

Quantitative

and Qualitative Disclosure About Market Risk

|

60

|

|

Changes

In and Disagreements with Accountants on Accounting and Financial

Disclosure

|

60

|

|

Directors,

Executive Officers, Promoters and Control Persons

|

60

|

|

Executive

Compensation

|

62

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

64

|

|

Certain

Relationships and Related Transactions

|

65

|

|

Experts

|

65

|

|

Disclosure

of Commission Position of Indemnification for Securities Act

Liabilities

|

65

|

2

ABOUT

THIS PROSPECTUS

Unless

the context otherwise requires, all references to “Clavis Technologies

International,” “Clavis Nevada,” “we,” “us,” “our,” “our company,” or “the

Company” in this prospectus refer to Clavis Technologies International Co.,

Ltd., a Nevada corporation, and its sole subsidiary, Clavis Technologies Co.,

Ltd., a corporation organized under the laws of the Republic of Korea, for the

applicable periods, considered as a single enterprise.

All

references to “Clavis Korea”, “Clavis Technologies” or “our subsidiary,” refer

to Clavis Technologies Co., Ltd., a corporation organized under the laws of the

Republic of Korea.

You

should rely only on the information contained in this prospectus. We

have not authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent

information, you should not rely on it. For further information,

please see the section of this prospectus entitled “Where You Can Find More

Information.” The selling security holders are not making an offer to

sell these securities in any jurisdiction where the offer or sale is not

permitted.

You

should not assume that the information appearing in this prospectus is accurate

as of any date other than the date on the front cover of this prospectus,

regardless of the time of delivery of this prospectus or any sale of a

security. Our business, financial condition, results of operations

and prospects may have changed since those dates.

3

PROSPECTUS

SUMMARY

This

summary highlights important features of this offering and the information

included in this prospectus. This summary does not contain all of the

information that you should consider before investing in our

securities. You should read this prospectus carefully as it contains

important information you should consider when making your investment

decision. See “Risk Factors” on page 6.

About

Clavis Technologies International Co., Ltd.

On

December 1, 2009, we acquired all of the outstanding shares of common stock of

entered into a with Clavis Technologies Co., Ltd., a corporation organized under

the laws of the Republic of Korea, in an exchange of shares of the Registrant’s

common stock for all of the issued and outstanding shares of Clavis Korea under

Section 368(a)(1)(B) of the Internal Revenue Code (the “Share

Exchange”). We are a Nevada corporation with headquarters at 377 S

Nevada Street, Carson City, Nevada 89703.

Clavis

Technologies, Co. Ltd. was incorporated under the laws of Republic of Korea on

January 28, 2003. Clavis is located in Seoul, Korea, and has been engaged in the

development of EPCglobal Network software. Clavis provides ubiquitous computing

solutions using its proprietary Radio Frequency Identification (“RFID”)

middleware which is based on the Electronic Product Code Network and mobile

financial solutions.

Principal

Executive Offices

Our

principal executive offices are located at #1564-1, Seojin Bldg., 3rd Fl.,

Seocho3-Dong, Seocho-Gu, Seoul, Korea 137-874. Our telephone number

is (011) 82-2-3471-9340 and our fax number is

(011) 82-2-3471-9337. Our website address is www.clavistech.com. The

information on our website is not incorporated by reference into this prospectus

and should not be relied upon with respect to this offering.

The

Offering

|

Shares

of common stock being registered

|

17,375,200

shares of our common stock offered by selling security

holders

|

|

Total

shares of common stock outstanding as of the date of this

prospectus

|

62,375,200

|

|

Total

proceeds raised by us from the disposition of the common stock by the

selling security holders or their transferees

|

We

will not receive any proceeds from the sale of shares by the selling

security holders

|

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes forward-looking statements. All statements other than

statements of historical facts contained in this prospectus, including

statements regarding our future results of operations and financial position,

business strategy and plans and objectives of management for future operations,

the development of the market for our products and the acceptance of our

products in these markets, are forward-looking statements. The words “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and

similar expressions are intended to identify forward-looking statements. We have

based these forward-looking statements largely on our current expectations and

projections about future events and financial trends that we believe may affect

our financial condition, results of operations, business strategy, short-term

and long-term business operations and objectives, and financial needs. These

forward-looking statements are subject to a number of risks, uncertainties and

assumptions, including those described in “Risk Factors.” In light of these

risks, uncertainties and assumptions, the forward-looking events and

circumstances discussed in this prospectus may not occur, and actual results

could differ materially and adversely from those anticipated or implied in the

forward-looking statements.

This

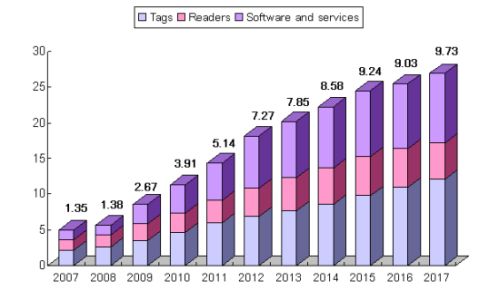

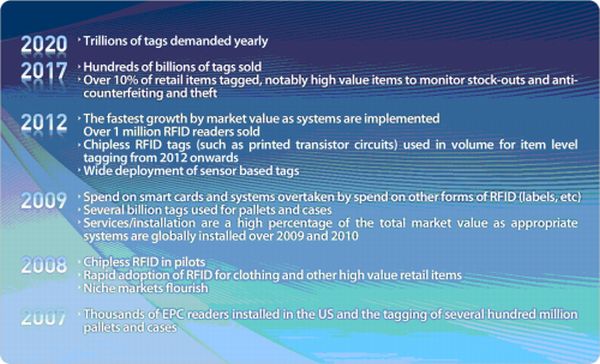

prospectus contains industry data and other statistical information regarding

the RFID industry that we obtained from independent publications, government

publications, press releases, reports by market research firms or other

published independent sources. Although we believe these sources are reliable,

we have not independently verified their data.

4

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should

carefully consider the risks described below and the other information before

deciding to invest in our common stock. The risks described below are not the

only ones facing our company. Additional risks not presently known to us or that

we currently consider immaterial may also adversely affect our business. We have

attempted to identify below the major factors that could cause differences

between actual and planned or expected results, but we cannot assure you that we

have identified all of those factors.

If any of

the following risks actually happen, our business, financial condition and

operating results could be materially adversely affected. In this case, the

trading price of our common stock could decline, and you could lose all or part

of your investment.

Risks

Related to Our Company

We

have a history of losses, and we expect to incur additional losses in the

future. We cannot be certain that we will achieve or sustain

profitability.

We have

never been profitable. We have experienced operating losses in the past, and we

expect to continue to incur additional operating losses in the future. We

incurred a net loss of $181,893 for the nine months ended September 30, 2009

(not including any loss or gain from currency translation) and a net loss of

$367,830 and $554,814 for the years ended December 31, 2008 and 2007,

respectively. As of September 30, 2009, we had an accumulated deficit

of $2,620,016. Our ability to achieve or sustain profitability is based on a

number of factors, many of which are out of our control, including the increase

in the use of RFID products by companies generally, and the demand for our RFID

products, in particular. We may never be able to generate sufficient

revenues or sell a sufficient volume of our software or middleware products to

achieve or sustain profitability on a quarterly or annual basis. We

continue to have significant operating expenses, and we expect to continue to

incur considerable product development and administrative expenses as we attempt

to grow our business. We also expect to continue to incur significant

expenditures in our sales and marketing efforts. This continued

spending will have an adverse impact on our operating results if our revenues do

not grow sufficiently to cover the expenditures. If we fail to manage

our cost structure, we may not achieve or sustain profitability. If

our business does not grow because the use of RFID by companies generally, and

our RFID products in particular, do not materialize, we may not achieve or

sustain profitability.

We

rely on a few customers for a significant portion of our sales. If we were to

lose any one of our major customers, our sales and our operating results would

be adversely affected and our stock price would be negatively

affected.

In 2008,

Asiana IDT and KTNetworks accounted for approximately 76% of our annual sales

and in 2009, Korea Pallet Pool Co and KTNetworks accounted for approximately 70%

of our annual sales. KTNetworks accounted for approximately 30% and

21% of our sales in 2008 and 2009, respectively. In 2010 we expect a

substantial portion of our sales to be from two different

customers. While we do not rely on any one repeat customer for a

substantial portion of our sales (not withstanding KTNetworks), we are dependent

on a few big customers for most of our sales. With the global

recession affecting capital spending by businesses, if we are unable to continue

to get additional or repeat business from a few big customers, our sales would

be significantly lower, which would have a negative effect on our stock

price.

Fluctuations

in the valuation of the Korean won could impact costs and/or revenues we

disclose in U.S. dollars, and could result in foreign currency

losses.

We are

exposed to a variety of market risks, including the effects of changes in

currency exchange rates and interest rates. See Part 7A. Quantitative and

Qualitative Disclosures About Market Risk.

Our

operating subsidiary, Clavis Korea, conducts its business in the Koran Won, its

functional currency. For SEC reporting purposes, Clavis Korea’s

financial information must be

translated into U.S. Dollars. Any major changes in the currency

exchange rate between the Korean Won and the U.S. Dollar may have a significant

impact on the results of our operations. In addition, the

valuation of current assets and liabilities that are denominated in a currency

other than U.S. Dollars (such as the assets and liabilities of Clavis Korea,

which are in the Korean Won) can result in currency exchange gains and losses.

We cannot predict the effect of exchange rate fluctuations upon future quarterly

and annual operating results. The effect of currency exchange rate changes may

increase or decrease our costs and/or revenues in any given quarter, and it may

experience currency losses in the future. To date, we have not adopted a hedging

program to protect us from risks associated with foreign currency

fluctuations.

5

The markets we serve are highly

competitive and we may be unable to compete effectively if we are unable to

provide and market innovative and cost-effective products at competitive

prices.

We face

competition from large, multinational companies and other regional companies.

Some of these companies may have substantially greater financial and other

resources than we do. We compete primarily on the basis of efficient

installation capability and the effectiveness of our products to help our

customers manage RFID data. It is possible that our competitors will

be able to offer additional products, services, lower prices, or other

incentives that we cannot offer or that will make our products less

profitable. It is also possible that our competitors will offer

incentive programs or will market and advertise their products in a way that

will impact customers’ preferences, and we may not be able to compete

effectively.

We may be

unable to anticipate the timing and scale of our competitors’ activities and

initiatives, or we may be unable to successfully counteract them, which could

harm our business. In addition, the cost of responding to our competitors’

activities may affect our financial performance for any given reporting

period. Our ability to compete also depends on our ability to attract

and retain key talent, and develop innovative and cost-effective products. A

failure to compete effectively could adversely affect our growth and

profitability.

We

will incur increased costs as a result of being a publicly listed company, which

may negative affect our results of operations because of the added expense and

additional demands on our management.

The

Sarbanes-Oxley Act of 2002, as well as rules promulgated by the SEC requires us

to adopt corporate governance practices applicable to U.S. public companies.

These rules and regulations will increase our legal and financial compliance

costs and make certain compliance and reporting activities more time-consuming.

We also expect it to be more difficult and more expensive for us to obtain and

maintain director and officer liability insurance, which may cause us to accept

reduced policy limits and reduced coverage or to incur substantially higher

costs to obtain the same or similar coverage. As a result, it may be more

difficult for us to attract and retain qualified persons to serve on our board

of directors or as executive officers. We cannot predict or estimate the amount

of additional costs we may incur, but these additional costs and demands on

management time and attention may harm our business and results of

operations.

Our

officers have no experience in managing a public company, which increases the

risk that we will be unable to establish and maintain all disclosure controls

and procedures and internal controls over financial reporting and meet the

public reporting and the financial requirements for our business.

We are

highly dependent on our officers to develop and operate and manage our business.

Although our officers have substantial business experience, they have no

experience in managing a public company. They have no experience in establishing

and maintaining disclosure controls and procedures in compliance with the

securities laws, including the requirements mandated by the Sarbanes-Oxley Act

of 2002. This lack of experience with regard to public company

disclosure controls and procedures may result in our Securities Act filings or

our periodic reports not containing all of the information required to be

contained therein. We would be required to disclose in our periodic

reports any deficiencies in our disclosure controls and procedures, such as the

lack of experience in management in establishing and maintaining disclosure

controls and procedures. Such assessments by our management may cause

negative perception by investors of our common stock and result in a decrease in

the price and/or liquidity of our stock. Additionally, to remedy such

a deficiency, such as hiring and training of personnel and implementation of

multiple-party-review of our filings, would result in significant increase in

our operating expenses and could result in lower earnings. The

standards that must be met for management to assess the internal control over

financial reporting as effective require significant documentation, testing and

possible remediation to meet the detailed standards. We may encounter

problems or delays in completing activities necessary to make an assessment of

our internal control over financial reporting. In addition, the attestation

process by our independent registered public accounting firm is new to us and we

may encounter problems or delays in completing the implementation of any

requested improvements and receiving an attestation of our assessment by our

independent registered public accounting firm. If we cannot assess

our internal control over financial reporting as effective, or our independent

registered public accounting firm is unable to provide an unqualified

attestation report on such assessment, investor confidence and share value may

be negatively impacted.

Increased tensions with North Korea

could adversely affect our operations and the price of our common

stock.

Our

operating subsidiary is based in Seoul, Korea. Relations between

Korea and North Korea have been tense over most of Korea’s history and the

Demilitarized Zone between the two countries is the most fortified border in the

world. Currently, the U.S. maintains approximately 28,500 troops in

the Republic of Korea. The level of tension between Korea and North

Korea has fluctuated and may increase or change abruptly over the years, as a

result of military skirmishes, North Korea’s military build and nuclear facility

program, sanctions imposed by the United States, military exercises by each

Korea and North Korea and missile tests and nuclear tests by North

Korea. We cannot assure you that recent events will not lead to an

escalation of tension with North Korea. Any further increase in geopolitical

tensions, resulting from testing of long-range nuclear missiles, continuing

nuclear programs by North Korea, transition of power in leadership in North

Korea, a break-down in existing contacts or an outbreak in military hostilities

could adversely affect our business, prospects, financial condition and results

of operations and could lead to a decline in the market value of our common

stock.

6

We

may need to raise additional capital, which may not be available on favorable

terms, if at all, which would adversely affect our ability to operate our

business.

The

recent financial and credit crisis has reduced credit availability and liquidity

for many companies. We believe, however, that the strength of our core business,

cash position, access to credit markets, and our ability to generate positive

cash flow will sustain us through the next 12 months. We are working

to reduce our liquidity risk by accelerating efforts to improve working capital

while reducing expenses in areas that will not adversely impact the future

potential of our business. As of September 30, 2009, our cash and cash

equivalents were $579,628 as compared to $865,902 as of December 31,

2008. Cash and cash equivalents decreased in 2009

primarily due to the expenditures of advance payments on

contracts. If we need to raise additional funds due to unforeseen

circumstances or material expenditures or if our operating losses are greater

than expected, we cannot be certain that we will be able to obtain additional

financing on favorable terms, if at all, and any additional financings could

result in additional dilution to our existing stockholders. If we

need additional capital and cannot raise it on acceptable terms, we may not be

able to meet our business objectives, our stock price may fall and you may lose

some or all of your investment.

We

depend on key personnel to manage our business effectively, and if we are unable

to hire, retain or motivate qualified personnel, our ability to design,

manufacture and sell our products could be harmed.

Our

future success depends, in part, on certain key employees, including key

technical personnel, and on our ability to attract and retain highly skilled

personnel. The loss of the services of any of our key personnel, the

inability to attract or retain qualified personnel, or delays in hiring required

personnel, particularly finance, engineering, sales or marketing personnel, may

seriously harm our business, financial condition and results of

operations. Our officers and key employees may terminate their

employment at any time. We do not have key person life insurance policies

covering any of our employees. Our ability to continue to attract and retain

highly skilled personnel will be a critical factor in determining whether we

will be successful in the future. Competition for highly skilled personnel is

frequently intense, especially in Korea. We may not be successful in attracting,

assimilating or retaining qualified personnel to fulfill our current or future

needs.

Adverse

developments in Korea may adversely affect our financial condition and our

results of operations.

Our

financial condition and results of operations are subject to political,

economic, legal and regulatory risks specific to Korea, where most of our assets

are located and where we generate most of our income.

Developments

that could hurt Korea’s economy in the future include:

|

●

|

financial

and other problems of chaebols (Korean

conglomerates) or their suppliers and their potential adverse impact on

the Korean economy;

|

|

●

|

a

slowdown in consumer spending, a rising level of household debt and the

resulting slowdown in the Korean overall

economy;

|

|

●

|

adverse

changes or volatility in foreign currency reserve levels, exchange rates

(including depreciation of U.S. dollar or Yen or revaluation of Renminbi),

interest rates and stock markets;

|

|

●

|

adverse

developments in the economies in other markets, including countries that

are important export markets for Korea, such as the United States, Japan

and China, or in emerging economies in Asia or elsewhere that could result

in a loss of confidence in the Korean

economy;

|

|

●

|

social

and labor unrest;

|

|

●

|

a

decrease in tax revenues and a substantial increase in the Government’s

expenditures for unemployment compensation and other social programs that,

together, would lead to an increased government budget

deficit;

|

|

●

|

deterioration

in economic or diplomatic relations between Korea and its trading partners

or allies, including deterioration resulting from trade disputes or

disagreements in foreign policy;

and/or

|

|

●

|

political

uncertainty or increasing strife among or within political parties in

Korea.

|

Additionally,

events related to terrorist attacks, developments in the Middle East, higher oil

and other commodity prices and the outbreak of endemics such as SARS or the H5N1

avian flu in Asia or the H1N1 swine flu in Mexico and other parts of the world

have increased and may continue to increase the uncertainty of global economic

prospects in general and the Korean economy in particular. Any further

deterioration of the Korean economy could further lower demand for by companies

in Korea for our RFID software products, which would in turn negatively impact

our financial condition and results of operations.

7

Risks

Related to Our Industry

Changes

in industry standards and government regulation could adversely affect our

ability to sell our products and impair our operating results.

In order

to encourage widespread market adoption of RFID technology, industry standards

have been developed, and we have designed our products to comply with these

standards. Changes in industry standards, or the development of new industry

standards, may make our products obsolete or negate the improvements we have

made in our products. For example, we are currently focusing a

majority of our product development and our sales and marketing efforts on

products that comply with the EPCglobal Gen 2 standard. If the

EPCglobal Gen 2 standard is not widely accepted by the market, we may not

be able to sell our products and our revenue would decline. Our

ability to compete effectively may depend on our ability to adapt our products

to support relevant industry standards. We may be required to invest

significant effort and to incur significant expense to re-engineer our products

and services to address relevant standards. If our products and/or services do

not meet relevant industry standards, including compliance with any

qualification or certification processes, or if we are delayed in obtaining such

certification, we could miss sales opportunities and our revenue would decline,

adversely affecting our operating results, financial conditions, business and

prospects.

Widespread

market acceptance of RFID products in the application areas that we target has

been slow to develop. If the market for RFID products does not continue to

develop, or develops more slowly than we expect, our business may be

harmed.

The

market for radio frequency identification, or RFID, products in the application

areas that we target is relatively new and, to a large extent, unproven, and it

is uncertain whether RFID products for these applications will achieve and

sustain high levels of demand and market acceptance. To date, the adoption rate

for RFID technology has been slower than anticipated or forecasted by industry

sources. Although RFID holds great potential for companies, such as

making manufacturer’s supply chain management more efficient, the hefty cost of

implementing the technology -- software, customized RFID tags and RFID

readers/scanners -- has slowed its rate of adoption by manufacturers and

retailers, particularly in the current shaky economic climate. The

development of the markets for our RFID products and services will be dependent

upon other businesses and governmental agencies, both in Korea and else where in

Asia, implementing programs and initiatives to deploy RFID systems in their

supply chains and other settings. Any delay, slowdown or failure by

organizations to implement RFID systems throughout their supply chains, or to

adopt them more slowly than we currently anticipate, could materially and

adversely affect our business, operating results, financial condition and

prospects.

If

unauthorized access is obtained to customer RFID systems or data, including

through breach of security measures or unauthorized encoding of RFID tags,

customers may curtail or stop their use of RFID products and, as a result, would

not need our products, which would harm our business, operating results and

financial condition.

RFID tags

may be scanned and read by readers within a certain range. Unauthorized readers

may access a company’s proprietary information, even if security measures such

as shielding devices and encryption are used. For example, criminals seeking to

divert or steal certain pharmaceutical products could seek to identify them as

they pass through the supply chain by looking for cases with EPCs corresponding

to those products. In addition, it has been shown that it is possible to encode

RFID tags so that they may provide unauthorized access to or cause improper

changes in the systems or databases that scan those tags. Security breaches

could expose us to litigation and possible liability. If our customers’ security

measures are breached as a result of third-party action, employee error,

criminal acts by an employee, malfeasance or otherwise, and, as a result,

someone obtains unauthorized access to customer data, our reputation could be

damaged, our business and prospects may suffer and we could incur significant

liability.

Risks

Related to Our Stock

We

could issue additional common stock, which might dilute the book value of our

common stock.

Our board

of directors has authority, without action or vote of our stockholders, to issue

all or a part of our authorized but unissued shares. Such stock issuances could

be made at a price that reflects a discount or a premium from the then-current

trading price of our common stock. In addition, in order to raise capital, we

may need to issue securities that are convertible into or exchangeable for a

significant amount of our common stock. These issuances would dilute

your percentage ownership interest, which would have the effect of reducing your

influence on matters on which our stockholders vote, and might dilute the book

value of our common stock. You may incur additional dilution if holders of stock

options, whether currently outstanding or subsequently granted, exercise their

options, or if warrant holders exercise their warrants to purchase shares of our

common stock.

8

Our

board of directors has the power to designate a series of preferred stock

without shareholder approval that could contain conversion or voting rights that

adversely affect the voting power of holders of our common stock and may have an

adverse effect on our stock price.

Our

Certificate of Incorporation provide for the authorization of 10,000,000 shares

of “blank check” preferred stock. Pursuant to our Certificate of

Incorporation, our Board of Directors is authorized to issue such “blank check”

preferred stock with rights that are superior to the rights of stockholders of

our common stock, at a purchase price then approved by our Board of Directors,

which purchase price may be substantially lower than the market price of shares

of our common stock, without stockholder approval. Though we currently do

not have any plans to issue any such preferred stock, such issuance could give

the holders of such preferred stock voting control of the Company which would

have a negative effect on the voting power of the holders of our common stock

and may cause our stock price to decline.

Our

common stock is considered “a penny stock” and, as a result, it may be difficult

to trade a significant number of shares of our common stock.

The

Securities and Exchange Commission (“SEC”) has adopted regulations that

generally define “penny stock” to be an equity security that has a market price

of less than $5.00 per share, subject to specific

exemptions. Our common stock is presently not traded on any

national market or securities exchange or in the over-the-counter

market. The sales price to the public of the shares of our common

stock offered by the selling security holders under this prospectus is fixed at

$0.00533 per share until such time as our common stock is quoted on the

Over-The-Counter (OTC) Bulletin Board. Once our common stock becomes

eligible for quotation in the OTC bulletin board, we expect that the market

price for shares of our common stock to be less than $5.00 per

share. Consequently, it is likely that the market price for our

common stock will remain less than $5.00 per share for the foreseeable future

and therefore may be a “penny stock” according to SEC rules. This designation

requires any broker or dealer selling these securities to disclose certain

information concerning the transaction, obtain a written agreement from the

purchaser and determine that the purchaser is reasonably suitable to purchase

the securities. These rules may restrict the ability of brokers or dealers

to sell our common stock and may affect the ability of investors hereunder to

sell their shares. In addition, when, as we expect, our common stock is traded

on the OTC Bulletin Board, investors may find it difficult to obtain accurate

quotations of the stock and may experience a lack of buyers to purchase such

stock or a lack of market makers to support the stock price.

There

is currently no public market for our shares and if such a market materializes,

our stockholders may still not be able to resell their shares at or above the

price at which they purchased their shares.

There is

currently no established public trading market for our securities and an active

trading market in our securities may not develop or, if developed, may not be

sustained. We intend to apply for admission to quotation of our securities on

the OTC Bulletin Board after this prospectus is declared effective by the

SEC. If for any reason our common stock is not quoted on the OTC

Bulletin Board or a public trading market does not otherwise develop, purchasers

of the shares may have difficulty selling their common stock should they desire

to do so. No market makers have committed to becoming market makers

for our common stock and none may do so.

State

securities laws may limit secondary trading, which may restrict the states in

which and conditions under which you can sell the shares offered by this

prospectus.

Secondary

trading in common stock sold in this offering will not be possible in any state

until the common stock is qualified for sale under the applicable securities

laws of the state or there is confirmation that an exemption, such as listing in

certain recognized securities manuals, is available for secondary trading in the

state. If we fail to register or qualify, or to obtain or verify an

exemption for the secondary trading of, the common stock in any particular

state, the common stock could not be offered or sold to, or purchased by, a

resident of that state. In the event that a significant number of states refuse

to permit secondary trading in our common stock, the liquidity for the common

stock could be significantly impacted thus causing you to realize a loss on your

investment.

We

do not intend to pay dividends for the foreseeable future.

We have

never declared or paid any cash dividends on our common stock and do not intend

to pay any cash dividends in the foreseeable future. We anticipate

that we will retain all of our future earnings for use in the development of our

business and for general corporate purposes. Any determination to pay dividends

in the future will be at the discretion of our board of directors. Accordingly,

investors must rely on sales of their common stock after price appreciation,

which may never occur, as the only way to realize any future gains on their

investments.

9

USE OF PROCEEDS

We will

not receive any proceeds from the sale of the shares by the selling

stockholders.

SELLING

SECURITY HOLDERS

In

September 2009, we sold 15,000,000 shares of our common stock to five purchasers

in a transaction exempt from registration pursuant to Regulation S promulgated

by the SEC pursuant to the Securities Act of 1933, as amended (the “Securities

Act”). The purchase price per share in this Regulation S offering was

$0.00533 and all of the purchasers were non-U.S. persons as defined in

Regulation S.

In

December 2009 and January 2010, we sold an aggregate of 2,375,200 shares of our

common stock to 27 purchasers in a transaction exempt from registration pursuant

to Regulation S promulgated by the SEC pursuant to the Securities

Act. The purchase price per share in this Regulation S offering was

$0.00533 and all of the purchasers were non-U.S. persons as defined in

Regulation S.

This

prospectus covers the sale by the selling stockholders from time to time of

17,375,200 shares of our common stock sold by us in these Regulation S

offerings.

The term

" selling security holder" includes (i) each person and entity that is

identified in the table below (as such table may be amended from time to time by

means of an amendment to the registration statement of which this prospectus

forms a part) and (ii) any transferee, donee, pledgee or other successor of any

person or entity named in the table that acquires any of the shares of common

stock covered by this prospectus in a transaction exempt from the registration

requirements of the Securities Act of 1933 and that is identified in a

supplement or amendment to this prospectus.

We have

listed below:

|

●

|

the

name of each selling security

holder;

|

|

●

|

the

number of shares of common stock beneficially owned by each selling

security holder as of the date of this

prospectus;

|

|

●

|

the

maximum number of shares of common stock being offered by each of the

selling security holders in this offering;

and

|

|

●

|

the

number of shares of common stock to be owned by each selling security

holder after this offering (assuming sale of such maximum number of

shares) and the percentage of the class which such number constitutes (if

one percent or more).

|

None of

the selling security holders are a registered broker-dealer or an affiliate of a

registered broker-dealer.

During

the last three years, no selling security holder has been an officer, director

or affiliate of our company, nor has any selling security holder had any

material relationship with our company or any of our affiliates during that

period. Each selling security holder represented at the closing of

the private placement that it was acquiring the shares of our common stock for

its own account and not on behalf of any U.S. person, and the resale of such

shares has not been pre-arranged with a purchaser in the United

States.

The

shares of common stock being offered hereby are being registered to permit

public secondary trading, and the selling security holders are under no

obligation to sell all or any portion of their shares included in this

prospectus. The information contained in the following table is

derived from information provided to us by the selling security holders, our

books and records, as well as from our transfer agent.

Unless

otherwise indicated, each person has sole investment and voting power with

respect to the shares indicated. For purposes of this table, a selling security

holder is deemed to have “beneficial ownership” of any shares as of a given date

which such person has the right to acquire within 60 days after such

date.

10

For

purposes of this table, we have assumed that, after completion of the offering,

none of the shares covered by this prospectus will be held by the selling

security holders.

|

Name

and Address

of

Selling Stockholder

|

Common

Stock Beneficially

Owned

Prior

to the

Offering

|

Common Stock

Offered

Pursuant to

this Prospectus 1

|

Common Stock

Owned

Upon

Completion

of

this Offering

|

Percentage of

Common

Stock

Owned

Upon

Completion

of

this

Offering

|

||

|

Mandarin

Global Equity (1)

Kings

Court, 3rd Floor

Bay

Street

Nassau

New

Providence, Bahamas

|

3,000,000

|

3,000,000

|

0

|

*

|

||

|

Blue

Shade Inc. (2)

P.O.

Box 14

Clarkes

Estate

Cades

Bay

Nevis,

West Indies

|

3,000,000

|

3,000,000

|

0

|

*

|

||

|

Stoneland

Limited (3)

P.O.

Box 14

Clarkes

Estate

Cades

Bay

Nevis,

West Indies

|

3,000,000

|

3,000,000

|

0

|

*

|

||

|

Hampton

Bay Holdings Inc. (4)

Kings

Court, 3rd Floor

Bay

Street

Nassau

New

Providence, Bahamas

|

3,000,000

|

3,000,000

|

0

|

*

|

||

|

Belvedere

Holdings Corp. (5)

Kings

Court, 3rd Floor

Bay

Street

Nassau

New

Providence, Bahamas

|

3,000,000

|

3,000,000

|

0

|

*

|

||

|

Kashim

Ltd. (6)

31

Don House

Gibraltar

|

100,000

|

100,000

|

0

|

*

|

||

|

Glenstar

Enterprises Ltd. (7)

Clarkes

Estate

Charlestown

Nevis,

West Indies

|

100,000

|

100,000

|

0

|

*

|

||

|

Cyrus

Capital Corp. (8)

3rd

Floor

Kings

Court

Nassau,

Bahamas

|

100,000

|

100,000

|

0

|

*

|

||

|

Shires

Ltd. (9)

15

Leeward Highway

Providenciales,

Turks and Caicos

|

100,000

|

100,000

|

0

|

*

|

||

|

Irwin

Rapoport

7415

Sherbrooke Street West

Montreal,

Quebec H4B 152

Canada

|

100,000

|

100,000

|

0

|

*

|

||

|

Mary

Ciappara

Fl.

4, 38 Salina Court

T.

Ashby Street

Marsacala,

Malta

|

100,000

|

100,000

|

0

|

*

|

11

|

Name

and Address

of

Selling Stockholder

|

Common

Stock Beneficially

Owned

Prior

to the

Offering

|

Common Stock

Offered

Pursuant to

this Prospectus 1

|

Common Stock

Owned

Upon

Completion

of

this Offering

|

Percentage of

Common

Stock

Owned

Upon

Completion

of

this

Offering

|

||

|

Peggy

Zammit

130

Bloor St. W

Suite

601

Toronto,

Ontario M55 1N5

|

100,000

|

100,000

|

0

|

*

|

||

|

Paul

Zammit

130

Bloor St. W

Suite

601

Toronto,

Ontario M55 1N5

|

100,000

|

100,000

|

0

|

*

|

||

|

Shari

McMaster

130

Bloor St. W

Suite

601

Toronto,

Ontario M55 1N5

|

18,800

|

18,800

|

0

|

*

|

||

|

Elisa

Maguolo

15

Weisman Street

Kefar

Saba, Israel

|

100,000

|

100,000

|

0

|

*

|

||

|

Avraham

Einhoren

c/o

Electro Tech Ltd.

2

Bloor Street West, Suite 735

Toronto,

Ontario M4W 3R1

Canada

|

100,000

|

100,000

|

0

|

*

|

||

|

Nama

Einhoren

34

Bavli Street

Tel

Aviv, Israel

|

100,000

|

100,000

|

0

|

*

|

||

|

Brian

Rapoport

5009

Clanranald, #30

Montreal,

Quebec H3X 253

Canada

|

18,800

|

18,800

|

0

|

*

|

||

|

Felicia

Cohen5009

Clanranald,

#30

Montreal,

Quebec H3X 253

Canada

|

18,800

|

18,800

|

0

|

*

|

||

|

Nahid

Shaygan

85

Skymark Drive, #2203

Toronto,

Ontario M24 3P2

Canada

|

100,000

|

100,000

|

0

|

*

|

||

|

Mohammad

Shaygan

21

– Camino Real

Calle

Winston Churchill

Patilla

Panama

City, Panama

|

100,000

|

100,000

|

0

|

*

|

||

|

Reza

Shaygan

85

Skymark Drive, #2203

Toronto,

Ontario M24 3P2

Canada

|

100,000

|

100,000

|

0

|

*

|

||

|

Felisa

Londono Esguerra

Edificio

Monaco, # 9-B

Calle

56

Ave.

Abel Bravo

Panama

City, Panama

|

100,000

|

100,000

|

0

|

*

|

||

|

Ludovina

C. De Dominguez

Calle

Emilio Castro, #14

Las

Tablas, Panama

|

100,000

|

100,000

|

0

|

*

|

12

|

Name

and Address

of

Selling Stockholder

|

Common

Stock Beneficially

Owned

Prior

to the

Offering

|

Common Stock

Offered

Pursuant to

this Prospectus 1

|

Common Stock

Owned

Upon

Completion

of

this Offering

|

Percentage of

Common

Stock

Owned

Upon

Completion

of

this

Offering

|

||

|

Gary

Dominguez

Calle

Emilio Castro, #14

Las

Tablas, Panama

|

100,000

|

100,000

|

0

|

*

|

||

|

Jacob

Dominguez

Edificio

Monaco, # 9-B

Calle

56

Ave.

Abel Bravo

Panama

City, Panama

|

100,000

|

100,000

|

0

|

*

|

||

|

Farhad

Amirkhani

1762

Seven Oaks Drive

Mississauga,

Ontario L5K 2N3

Canada

|

100,000

|

100,000

|

0

|

*

|

||

|

Irwin

Rapoport

5009

Clanranald, #30

Montreal,

Quebec H3X 253

Canada

|

18,800

|

18,800

|

0

|

*

|

||

|

Ji

Hye Lee

Kkachi

Maeul 1-danji Sunkyoung

Apt

109-2103

Gumi-dong

Bundang-gu

Seongnam-si

Gyeonggi-do 463-743 Korea

|

100,000

|

100,000

|

0

|

*

|

||

|

Hyun

Ki Kim

Kkachi

Maeul 1-danji Sunkyoung

Apt

109-2103

Gumi-dong

Bundang-gu

Seongnam-si

Gyeonggi-do 463-743 Korea

|

100,000

|

100,000

|

0

|

*

|

||

|

Jung

Suk Lee

101-110

Woosung Apt. 108-2203

Haengun-dong

Gwankak-gu

Seoul 151-775

Korea

|

100,000

|

100,000

|

0

|

*

|

||

|

Han

Sang Seo

Sosajukong

Apt 107-1001

Sosa-gu

Bucheo-si

Gyeonggi-do 422-230

Korea

|

100,000

|

100,000

|

0

|

*

|

||

|

Jae

Tack Han

401

ho

155-15,

Seokchon-dong

Songpa-gu

Seoul

138-843

Korea

|

100,000

|

100,000

|

0

|

*

|

||

|

TOTAL

|

17,375,200

|

* Amount

less than one percent.

Percentage

calculations are based on 62,375,200 shares of our common stock issued and

outstanding as of January 28, 2010.

______________________

(1)

Mehmet Birol Ensari, the owner of Mandarin Global Equity, has the power to vote

and dispose of the Company’s securities held by Mandarin Global

Equity.

(2)

Wilfred Gatambia Kamau, the owner of Blue Shade Inc., has the power to vote and

dispose of the Company’s securities held by Blue Shade.

(3)

Yaroslava Gryshyna, the owner of Stoneland Limited, has the power to vote and

dispose of the Company’s securities held by Stoneland Limited.

(4) Aysan

Celik, the owner of Hampton Bay Holdings Inc., has the power to vote and dispose

of the Company’s securities held by Hampton Bay Holdings.

(5)

Nadiya Shcherbyna, the owner of Belvedere Holdings Corp., has the power to vote

and dispose of the Company’s securities held by Belvedere Holdings.

(6) Mae

Robins, an officer of Kashim Ltd., has the power to vote and dispose

of the Company’s securities held by Kashim.

(7)

Michael Dwen, an officer of Glenstar Enterprises Ltd., has the power to vote and

dispose of the Company’s securities held by Glenstar Enterprises.

(8)

Abbygail Gibson, an officer of Cyrus Capital Corp., has the power to

vote and dispose of the Company’s securities held by Cyrus Capital.

(9) Ms.

Kofi Bain, an officer of Shires Ltd., has the power to vote and

dispose of the Company’s securities held by Shires.

13

PLAN

OF DISTRIBUTION

As of the

date of this prospectus, there is no market for our securities. After

the date of this prospectus, we expect to have an application filed with the

Financial Industry Regulatory Authority for our common stock to be eligible for

trading on the OTC Bulletin Board. Until our common stock becomes

eligible for trading on the OTC Bulletin Board, the selling security holders

will be offering our shares of common stock at a fixed price of $0.00533 per

share of common stock. After our common stock becomes eligible for

trading on the OTC Bulletin Board, the selling security holders may, from time

to time, sell all or a portion of the shares of common stock on OTC Bulletin

Board or any market upon which the shares of common stock may be listed or

quoted currently the National Association of Securities Dealers OTC Bulletin

Board in the United States, in privately negotiated transactions or otherwise.

After our common stock becomes eligible for trading on the OTC Bulletin Board,

such sales may be at fixed prices prevailing at the time of sale, at prices

related to the market prices or at negotiated prices.

After our

common stock becomes eligible for trading on the OTC Bulletin Board, the shares

of common stock being offered for resale by this prospectus may be sold by the

selling security holders by one or more of the following methods, without

limitation:

|

●

|

ordinary

brokerage transactions and transactions in which the broker-dealer

solicits purchasers;

|

|

●

|

block

trades in which the broker-dealer will attempt to sell the shares as agent

but may position and resell a portion of the block as principal to

facilitate the transaction;

|

|

●

|

purchases

by a broker-dealer as principal and resale by the broker-dealer for its

account;

|

|

●

|

an

exchange distribution in accordance with the rules of the applicable

exchange;

|

|

●

|

privately

negotiated transactions;

|

|

●

|

settlement

of short sales entered into after the effective date of the registration

statement of which this prospectus is a

part;

|

|

●

|

broker-dealers

may agree with the selling security holders to sell a specified number of

shares at a stipulated price per

share;

|

|

●

|

through

the writing or settlement of options or other hedging transactions,

whether through an options exchange or

otherwise;

|

|

●

|

a

combination of any of these methods of sale;

or

|

|

●

|

any

other method permitted pursuant to applicable

law.

|

The

selling security holders may also sell shares under Rule 144 under the

Securities Act, if available, rather than under this prospectus.

Broker-dealers

engaged by the selling security holders may arrange for other brokers-dealers to

participate in sales. Broker-dealers may receive commissions or discounts from

the selling security holders (or, if any broker-dealer acts as agent for the

purchaser of shares, from the purchaser) in amounts to be negotiated, but,

except as set forth in a supplement to this prospectus, in the case of an agency

transaction not in excess of a customary brokerage commission in compliance with

FINRA/NASD Rule 2440 in the FINRA Manual; and in the case of a principal

transaction a markup or markdown in compliance with FINRA/NASD

IM-2440. Before our common stock becomes eligible for trading

on the OTC Bulletin Board, broker-dealers may agree with a selling security

holder to sell a specified number of the shares of common stock at a price per

share of $0.00533. After our common stock becomes eligible for

trading on the OTC Bulletin Board, broker-dealers may agree with a selling

security holder to sell a specified number of the shares of common stock at a

stipulated price per share.

In

connection with the sale of shares, the selling security holders may enter into

hedging transactions with broker-dealers or other financial institutions, which

may in turn engage in short sales of the shares in the course of hedging the

positions they assume. The selling security holders may also sell shares short

and deliver these shares to close out their short positions, or loan or pledge

shares to broker-dealers that in turn may sell these shares. The selling

security holders may also enter into option or other transactions with

broker-dealers or other financial institutions or the creation of one or more

derivative securities which require the delivery to that broker-dealer or other

financial institution of shares offered by this prospectus, which shares that

broker-dealer or other financial institution may resell pursuant to this

prospectus (as supplemented or amended to reflect that

transaction).

14

We will

be paying certain fees and expenses incurred by us incident to the registration

of the shares.

We will

keep this prospectus effective until the earlier of (i) the date on which

the shares may be resold by the selling security holders without registration

and without regard to any volume limitations by reason of Rule 144 under the

Securities Act or any other rule of similar effect or (ii) all of the

shares have been sold pursuant to this prospectus or Rule 144 under the

Securities Act or any other rule of similar effect. The shares will be sold only

through registered or licensed brokers or dealers if required under applicable

state securities laws. In addition, in certain states, the shares may not be

sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is

available and is complied with.

Under

applicable rules and regulations under the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), any person engaged in the distribution of the

shares may not simultaneously engage in market making activities with respect to

the common stock for the applicable restricted period, as defined in Regulation

M, prior to the commencement of the distribution. In addition, the selling

security holders will be subject to applicable provisions of the Exchange Act

and the rules and regulations there under, including Regulation M, which may

limit the timing of purchases and sales of the shares by the selling security

holders or any other person. We will make copies of this prospectus available to

the selling security holders and have informed them of the need to deliver a

copy of this prospectus to each purchaser at or prior to the time of the sale

(including by compliance with Rule 172 under the Securities Act).

Blue

Sky Restrictions on Resale

When a

selling security holder wants to sell shares of common stock under this

registration statement, the selling security holders will also need to comply

with state securities laws, also known as "Blue Sky laws," with regard to

secondary sales. All states offer a variety of exemption from

registration for secondary sales. Many states, for example, have an exemption

for secondary trading of securities registered under Section 12(g) of the

Securities Exchange Act of 1934 or for securities of issuers that publish

continuous disclosure of financial and non-financial information in a recognized

securities manual, such as Standard & Poor's. The broker for a selling

security holder will be able to advise a selling security holder which states

our shares of common stock is exempt from registration with that state for

secondary sales.

Any

person who purchases shares of common stock from a selling security holder under

this registration statement who then wants to sell such shares will also have to

comply with Blue Sky laws regarding secondary sales. When the

registration statement becomes effective, and a selling security holder

indicates in which state(s) he desires to sell his shares, we will be able to

identify whether it will need to register or will rely on an exemption there

from.

Penny

Stock Regulations

The

Securities and Exchange Commission has adopted Rule 15g-9 which establishes the

definition of a "penny stock," for the purposes relevant to us, as any equity

security that has a market price of less than $5.00 per share or with an

exercise price of less than $5.00 per share, subject to certain exceptions. For

any transaction involving a penny stock, unless exempt, the rules

require:

|

●

|

That

a broker or dealer approve a person’s account for transactions in penny

stocks; and

|

|

●

|

That

the broker or dealer receives from the investor a written agreement to the

transaction, setting forth the identity and quantity of the penny stock to

be purchased.

|

In order

to approve a person's account for transactions in penny stocks, the broker or

dealer must:

|

●

|

Obtain

financial information and investment experience objectives of the person;

and

|

|

●

|

Make

a reasonable determination that the transactions in penny stocks are

suitable for that person and the person has sufficient knowledge and

experience in financial matters to be capable of evaluating the risks of

transactions in penny stocks.

|

15

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a

disclosure schedule prescribed by the Securities and Exchange Commission

relating to the penny stock market, which, in highlight form:

|

●

|

Sets

forth the basis on which the broker or dealer made the suitability

determination; and

|

|

●

|

Specifies

that the broker or dealer received a signed, written

agreement.

|

Disclosure

also has to be made about the risks of investing in penny stocks in both public

offerings and in secondary trading and about the commissions payable to both the

broker-dealer and the registered representative, current quotations for the

securities and the rights and remedies available to an investor in cases of

fraud in penny stock transactions. Finally, monthly statements have to be sent

disclosing recent price information for the penny stock held in the account and

information on the limited market in penny stocks.

DESCRIPTION

OF SECURITIES

We are

currently authorized to issue 10,000,000 shares of preferred stock having a par

value of $.001 per share and 100,000,000 shares of common stock, having a par

value of $0.001 per share. As of the date of this prospectus, we had

62,375,200 shares of common stock issued and outstanding and no shares of

preferred stock issued and outstanding.

Common

Stock

We are

authorized to issue 100,000,000 shares of common stock, $0.001 par value per

share, of which 62,375,200 shares were issued and outstanding as of January 28,

2010. The holders of outstanding common stock are entitled to receive

dividends out of assets legally available therefore at such times and in such

amounts as our Board may from time to time determine. We have no

present intention of paying dividends on our common stock. Upon liquidation,

dissolution or winding up of the Company, and subject to the priority of any

outstanding preferred stock, the assets legally available for distribution to

stockholders are distributable ratably among the holders of the common stock at

the time outstanding. No holder of shares of common stock has a

preemptive right to subscribe to future issuances of securities by the

Company. There are no conversion rights or redemption or sinking fund

provisions with respect to the common stock. Holders of common stock

are entitled to cast one vote for each share held of record on all matters

presented to stockholders.

INTEREST

OF NAMED EXPERTS AND COUNSEL

No expert

or counsel named in this prospectus as having prepared or certified any part of

this prospectus or having given an opinion upon the validity of the securities

being registered or upon other legal matters in connection with the registration

or offering of the common stock was employed on a contingency basis, or had, or

is to receive, in connection with the offering, a substantial interest, direct

or indirect, in the registrant or any of its parents or subsidiaries. Nor was

any such person connected with the registrant or any of its parents or

subsidiaries as a promoter, managing or principal underwriter, voting trustee,

director, officer, or employee.

The

consolidated financial statements of Clavis Technologies International Co., Ltd.

and subsidiaries as of December 31, 2008 and 2007 and for each of the years then

ended has been included herein and in the Registration Statement in reliance

upon the report of Kim & Lee Corporation, CPAs, an independent registered

public accounting firm, appearing elsewhere herein, and upon the authority of

said firm as experts in accounting and auditing.

Certain

legal matters in connection with this offering and Registration Statement are

being passed upon by Fox Law Offices, P.A., Exeter, New Hampshire.

16

DESCRIPTION OF BUSINESS

Overview

Clavis

Technologies International Co., Ltd., a Nevada corporation ("the Company"), was

incorporated in Nevada on September 10, 2009. On December 1, 2009,

the Company entered into a definitive Share Exchange Agreement with Clavis

Technologies Co., Ltd., a Korean corporation (“Clavis Technologies” or “Clavis

Korea”), and the shareholders of Clavis Korea. Pursuant to the

agreement, the Company acquired 100% of the issued and outstanding capital stock

of Clavis Korea in exchange for 45,000,000 shares of the Company’s common stock,

representing approximately 75% of the issued and outstanding stock of the

Company. Clavis Korea was incorporated under the laws of Republic of

Korea on January 28, 2003. Clavis Korea is located in Seoul, Korea, and has been

engaged in the development of global Electronic Product Code (EPC) network

software. The Company’s goal is to be a global player in ubiquitous computing

solutions using its proprietary Radio Frequency Identification (“RFID”)

middleware which is based on the Electronic Product Code Network and mobile

financial solutions.

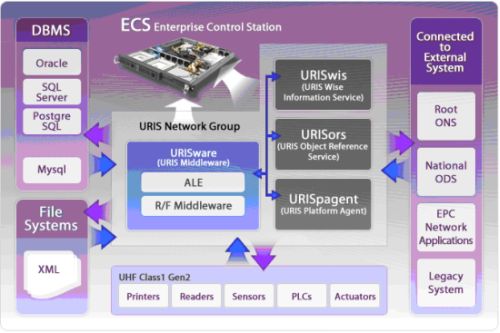

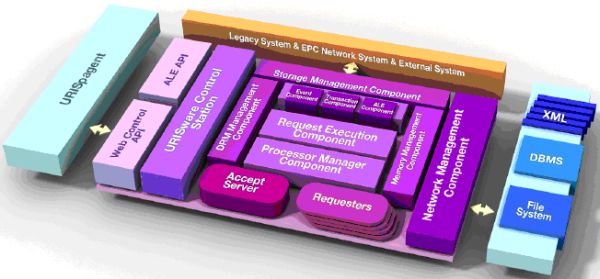

Clavis

Technologies has been providing RFID-enabled solutions, including business

processes, based on the world standard to various industrial markets as a vendor

of RFID technology since 2003. As Clavis Technologies combines its products,

expertise, partnerships and integration capability into solutions for a wide

range of device computing applications, Clavis Technologies enables its clients

to tap into the wealth of data captured by networked devices such as RFID

readers or handheld devices to extend the quality of valuable information to any

device where companies or their customers need.

Historically,

Clavis Technologies has concentrated on the RFID business as a provider that

sold only RFID middleware. As the RFID market has experienced significant growth

recently, Clavis Technologies has launched its framework-based product packages,

which has been developed since 2003, including added-value RFID applications

that can be customized for a broad range of industries.

Currently,

our results are heavily dependent upon sales to the retail and business to