Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_3-20100128.htm |

| EX-99.1 - EXHIBIT 99.1 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_1-20100128.htm |

| EX-99.2 - EXHIBIT 99.2 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_2-20100128.htm |

| EX-99.5 - EXHIBIT 99.5 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_5-20100128.htm |

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20100128.htm |

Fourth

Quarter 2009

Fourth

Quarter 2009

Earnings Conference

Call

Earnings Conference

Call

January

28, 2010

January

28, 2010

1

2

Fourth

Quarter 2009 Earnings - Highlights

• Core

Results - $1.1 Billion vs. $957 Million in 4Q08

– Core

EPS $1.30 (diluted) vs. $1.18 in 4Q08.

• Net Income - $938

Million vs. $443 Million in 4Q08

– EPS $1.15 (diluted)

vs. $0.55 in 4Q08.

– 4Q09 net income

includes after-tax non-core charges

mostly consisting of a $115 mm impairment of certain

Argentine producing properties.

mostly consisting of a $115 mm impairment of certain

Argentine producing properties.

2

3

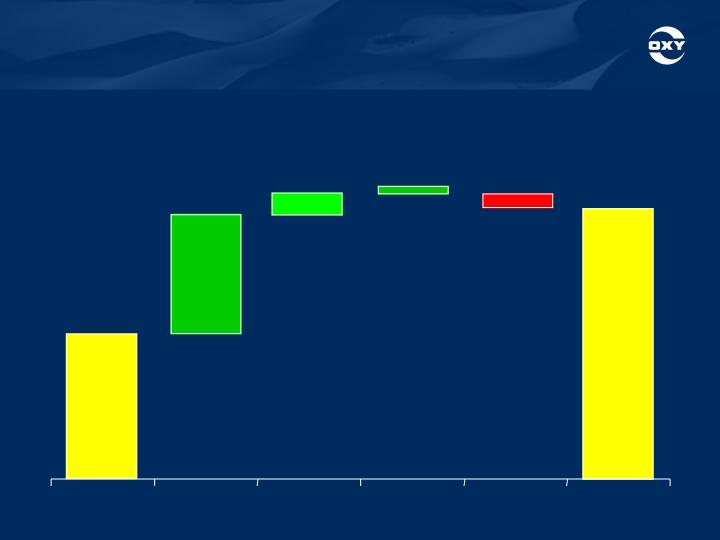

($

in millions)

($

in millions)

4Q

08

Sales

Price

Sales

Volume

Exploration

Expense

All

Others*

4Q

09

$996

$1,813

$746

$83

$35

$47

*All

Others include: Lower FX gains and higher DD&A rate partially offset by

lower operating costs.

Fourth

Quarter 2009 Earnings - Oil & Gas

Segment Variance Analysis - 4Q09 vs. 4Q08

Segment Variance Analysis - 4Q09 vs. 4Q08

• Core

Results for 4Q09 of $1.8 B vs. $1.0 B in 4Q08

– The increase was due

to higher crude oil prices and sales volumes and lower

operating expenses.

operating expenses.

3

4

4Q09 4Q08

4Q09 4Q08

Reported Segment

Earnings ($ mm) $1,643 $339

Reported Segment

Earnings ($ mm) $1,643 $339

WTI Oil

Price ($/bbl) $76.19 $58.73

WTI Oil

Price ($/bbl) $76.19 $58.73

NYMEX

Gas Price ($/mcf) $4.29 $6.97

NYMEX

Gas Price ($/mcf)

$4.29 $6.97

Oxy’s

Realized Prices

Oxy’s

Realized Prices

Worldwide

Oil ($/bbl) $69.39 $53.52

Worldwide

Oil ($/bbl) $69.39 $53.52

US

Natural Gas ($/mcf) $4.37 $4.67

US

Natural Gas ($/mcf) $4.37 $4.67

Fourth

Quarter 2009 Earnings -

Oil & Gas Segment

Oil & Gas Segment

4

5

Fourth

Quarter 2009 Earnings -

Oil & Gas Segment - Production

Oil & Gas Segment - Production

Fourth

Quarter 2009 Earnings -

Oil & Gas Segment - Production

Oil & Gas Segment - Production

4Q09 4Q08

• Oil and Gas Sales

Volumes (mboe/d) 650 620

– +

4.8% year-over-year or 30 mboe/d.

• Year-over-year sales

volume increase includes:

– + 23 mboe/d from

Oman and Bahrain;

– + 6 mboe/d from

Argentina, and;

– + 13 mboe/d from

California operations, excluding Long Beach;

– partially offset by

- 7 mboe/d of volumes in the Middle East caused

by higher oil prices affecting our PSCs.

by higher oil prices affecting our PSCs.

5

6

Fourth

Quarter 2009 Earnings -

Oil & Gas Segment - Production

Oil & Gas Segment - Production

Fourth

Quarter 2009 Earnings -

Oil & Gas Segment - Production

Oil & Gas Segment - Production

4Q09 3Q09

• Oil and Gas Sales

Volumes (mboe/d) 650 628

– +

3.5% quarter-over-quarter or 22 mboe/d.

• Sequential sales

volume increase includes:

– Bahrain production

and development activities began on 12/1/09;

– Argentina volumes

increased by 8 mboe/d. 3Q09

included a 9

mboe/d loss due to the Santa Cruz strike;

mboe/d loss due to the Santa Cruz strike;

– California volumes,

excluding Long Beach, increased by 3 mboe/d;

– Oman volumes

increased by 4 mboe/d from the Mukhaizna field.

• Exploration expense

was $99 million in 4Q09.

6

7

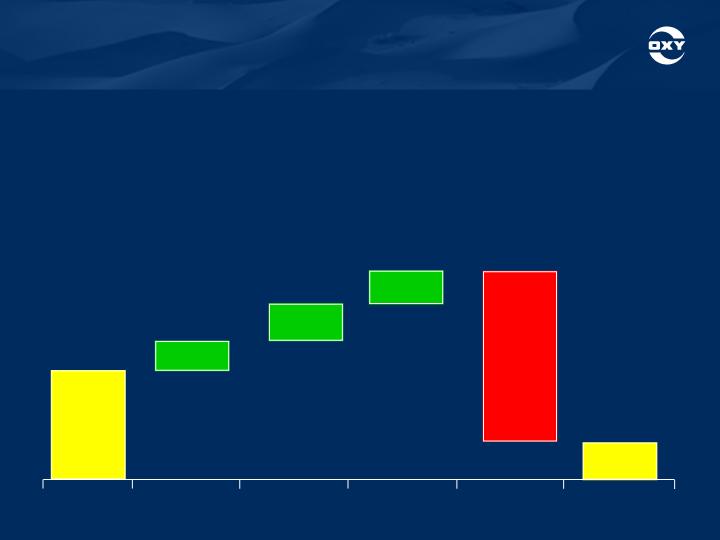

4Q

08

Sales

Volume

/ Mix

All

Others

Operations/

Manufacturing*

Sales

Price

4Q

09

$217

$33

$27

$42

$35

$288

($

in millions)

*Lower

energy costs.

Fourth

Quarter 2009 Earnings - Chemical

Segment Variance Analysis - 4Q09 vs. 4Q08

Segment Variance Analysis - 4Q09 vs. 4Q08

Fourth

Quarter 2009 Earnings - Chemical

Segment Variance Analysis - 4Q09 vs. 4Q08

Segment Variance Analysis - 4Q09 vs. 4Q08

• Core

Results for 4Q09 of $33 mm vs. $217 mm in 4Q08

• Core

Results for 4Q09 of $33 mm vs. $217 mm in 4Q08

– Reflects the

continued weakness in most domestic markets, but in particular U.S.

housing, durable goods and agricultural sectors.

housing, durable goods and agricultural sectors.

– Reflects the

continued weakness in most domestic markets, but in particular U.S.

housing, durable goods and agricultural sectors.

housing, durable goods and agricultural sectors.

7

8

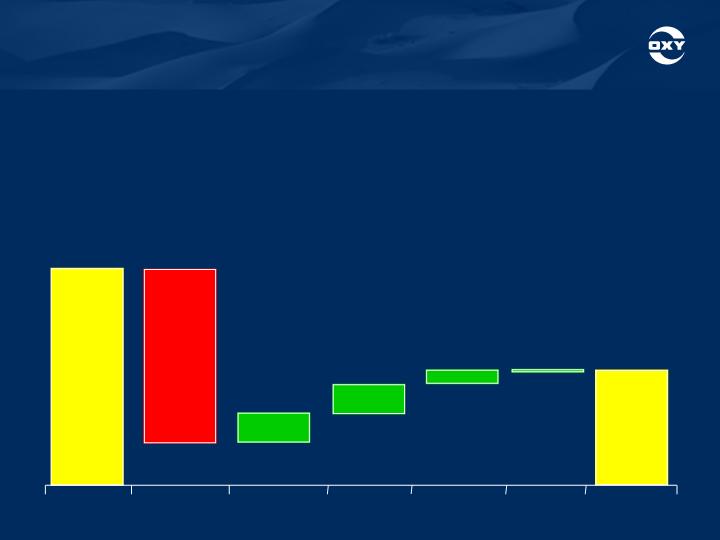

4Q

08

Marketing

Gas

Processing

Power

Generation

All

Others

4Q

09

$170

$81

$132

$18

$6

$1

($

in millions)

$18

Dolphin

Pipeline

Fourth

Quarter 2009 Earnings - Midstream

Segment Variance Analysis - 4Q09 vs. 4Q08

Segment Variance Analysis - 4Q09 vs. 4Q08

Fourth

Quarter 2009 Earnings - Midstream

Segment Variance Analysis - 4Q09 vs. 4Q08

Segment Variance Analysis - 4Q09 vs. 4Q08

• Core

Results for 4Q09 of $81 mm vs. $170 mm in 4Q08

• Core

Results for 4Q09 of $81 mm vs. $170 mm in 4Q08

– The decrease was due

to lower year-over-year margins in the marketing

business, partially offset by improved NGL margins resulting from lower

maintenance expenses, energy costs and property taxes in the gas processing

business and higher income from the Dolphin Pipeline.

business, partially offset by improved NGL margins resulting from lower

maintenance expenses, energy costs and property taxes in the gas processing

business and higher income from the Dolphin Pipeline.

– The decrease was due

to lower year-over-year margins in the marketing

business, partially offset by improved NGL margins resulting from lower

maintenance expenses, energy costs and property taxes in the gas processing

business and higher income from the Dolphin Pipeline.

business, partially offset by improved NGL margins resulting from lower

maintenance expenses, energy costs and property taxes in the gas processing

business and higher income from the Dolphin Pipeline.

8

9

Fourth

Quarter 2009 Earnings -

Full Year 2009 Results

Full Year 2009 Results

YTD2009 YTD2008

• Net Income ($

mm)

$2,915 $6,857

EPS (diluted) $3.58 $8.34

• Core Results ($

mm) $3,083 $7,348

EPS

(diluted) $3.78 $8.94

• Oil and Gas Sales

Volumes (mboe/d)

645 601

– +7.3%

year-over-year

• Oil and gas cash

production costs, excluding production and property taxes, were

$10.37 p/boe for 2009, a 15% decline from 2008 full year costs of $12.13 p/boe.

$10.37 p/boe for 2009, a 15% decline from 2008 full year costs of $12.13 p/boe.

• Taxes - other than

on income were $1.77 p/boe for 2009 compared to $2.62 p/boe

for all of 2008. These costs, which are sensitive to product prices, reflect lower

crude oil and gas prices in 2009.

for all of 2008. These costs, which are sensitive to product prices, reflect lower

crude oil and gas prices in 2009.

• Capex for 2009 was

$3.6 billion.

– Capital expenditures

by segment were 79% in Oil and Gas, 6% in Chemical and 15% in

Midstream.

Midstream.

– The Oil and Gas

expenditures were 56% in foreign operations and 44%

domestically.

9

10

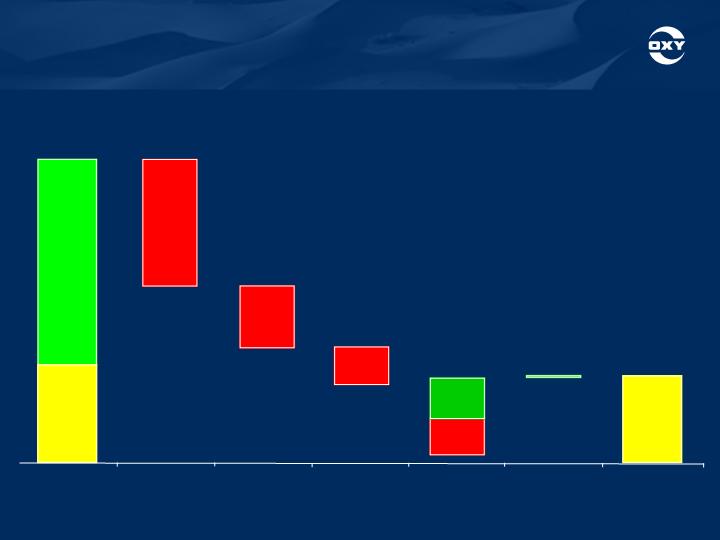

$7,600

$40

$1,065

$1,750

$1,230

Available

Cash

Capex

Net

Debt

Issuance

Dividends

Acquisitions

&

Foreign

Bonuses

Ending

Cash

Balance

12/31/09

Cash

Flow

From

Operations

$5,800

($

in millions)

Beginning

Cash

$1,800

12/31/08

$3,600

Other

$5

Debt

Issuance

$740

Debt

Reduction

$700

Fourth

Quarter 2009 Earnings -

Full Year 2009 Cash Flow

Full Year 2009 Cash Flow

10

11

Fourth

Quarter 2009 Earnings -

Shares Outstanding, Debt and Returns

Shares Outstanding, Debt and Returns

Shares Outstanding

(mm) 2009 12/31/09

Weighted

Average Basic

811.3

Weighted

Average Diluted

813.8

Basic

Shares Outstanding 812.0

Diluted

Shares Outstanding

814.4

2009

Debt/Capital

9%

ROE 10.3%

ROCE 9.6%

11

12

Fourth

Quarter 2009 Earnings -

2010 Reporting Changes

2010 Reporting Changes

Fourth

Quarter 2009 Earnings -

2010 Reporting Changes

2010 Reporting Changes

• Beginning

in 2010, we are making three reporting changes

which will impact comparability between years.

which will impact comparability between years.

• Beginning

in 2010, we are making three reporting changes

which will impact comparability between years.

which will impact comparability between years.

• #1

—

Historically,

our production volumes have been reported

as a mix of pre-tax and after tax volumes while our revenues

have reflected only pre-tax sales.

as a mix of pre-tax and after tax volumes while our revenues

have reflected only pre-tax sales.

• #1

—

Historically,

our production volumes have been reported

as a mix of pre-tax and after tax volumes while our revenues

have reflected only pre-tax sales.

as a mix of pre-tax and after tax volumes while our revenues

have reflected only pre-tax sales.

– Difference is caused

by our PSCs in the Middle East and North Africa

where production is immediately taken and sold to pay the local income

tax.

where production is immediately taken and sold to pay the local income

tax.

– Difference is caused

by our PSCs in the Middle East and North Africa

where production is immediately taken and sold to pay the local income

tax.

where production is immediately taken and sold to pay the local income

tax.

– We have treated this

as additional revenues but not additional

production.

production.

– We have treated this

as additional revenues but not additional

production.

production.

– To simplify our

reporting and to conform with industry practice, our

production and our revenues will now be tied.

production and our revenues will now be tied.

– To simplify our

reporting and to conform with industry practice, our

production and our revenues will now be tied.

production and our revenues will now be tied.

– Beginning this year

we will refer to production on this more accurate and

consistent basis.

consistent basis.

– Beginning this year

we will refer to production on this more accurate and

consistent basis.

consistent basis.

– All references to

growth and volume comparisons will be against these

reformatted production volumes.

reformatted production volumes.

– All references to

growth and volume comparisons will be against these

reformatted production volumes.

reformatted production volumes.

– For example, the

production from last year will be referred to as 714

mboe/d rather than 645 mboe/d for the year.

mboe/d rather than 645 mboe/d for the year.

– For example, the

production from last year will be referred to as 714

mboe/d rather than 645 mboe/d for the year.

mboe/d rather than 645 mboe/d for the year.

– This change will

have no effect on the company's financial statements.

– This change will

have no effect on the company's financial statements.

12

13

Fourth

Quarter 2009 Earnings -

2010 Reporting Changes

2010 Reporting Changes

Fourth

Quarter 2009 Earnings -

2010 Reporting Changes

2010 Reporting Changes

• #2

— We have combined most of our gas production in the mid

-continental regions of the US into a single business unit called

Midcontinent Gas.

-continental regions of the US into a single business unit called

Midcontinent Gas.

• #2

— We have combined most of our gas production in the mid

-continental regions of the US into a single business unit called

Midcontinent Gas.

-continental regions of the US into a single business unit called

Midcontinent Gas.

– This was done in

order to take advantage of common development

methods and production optimization opportunities.

methods and production optimization opportunities.

– This was done in

order to take advantage of common development

methods and production optimization opportunities.

methods and production optimization opportunities.

– This business unit

will include:

– This business unit

will include:

• the Hugoton

field;

• the Hugoton

field;

• the Piceance

basin;

• the Piceance

basin;

• and the bulk of

the Permian basin non-associated gas assets, which had

been reported as part of the Permian business unit through the end of 2009.

been reported as part of the Permian business unit through the end of 2009.

• and the bulk of

the Permian basin non-associated gas assets, which had

been reported as part of the Permian business unit through the end of 2009.

been reported as part of the Permian business unit through the end of 2009.

– Starting in 2010,

these assets will be reported in Midcontinent Gas.

– Starting in 2010,

these assets will be reported in Midcontinent Gas.

– As a result,

Midcontinent Gas unit's production will be approximately

75% gas and 25% liquids.

75% gas and 25% liquids.

– As a result,

Midcontinent Gas unit's production will be approximately

75% gas and 25% liquids.

75% gas and 25% liquids.

– Permian's production

will go from 84% liquids and 16% gas, to 89%

liquids and 11%, mostly associated, gas.

liquids and 11%, mostly associated, gas.

– Permian's production

will go from 84% liquids and 16% gas, to 89%

liquids and 11%, mostly associated, gas.

liquids and 11%, mostly associated, gas.

13

14

Fourth

Quarter 2009 Earnings -

2010 Reporting Changes

2010 Reporting Changes

Fourth

Quarter 2009 Earnings -

2010 Reporting Changes

2010 Reporting Changes

• #3

— Capitalized CO2

• #3

— Capitalized CO2

– Oxy's policy

regarding tertiary recovery is to capitalize costs, such as

CO2, when they support development of proved reserves and generally

expense these costs when they support current production.

CO2, when they support development of proved reserves and generally

expense these costs when they support current production.

– Oxy's policy

regarding tertiary recovery is to capitalize costs, such as

CO2, when they support development of proved reserves and generally

expense these costs when they support current production.

CO2, when they support development of proved reserves and generally

expense these costs when they support current production.

– In 2009, we

capitalized approximately 50% of the CO2 injected in the

Permian basin.

Permian basin.

– In 2009, we

capitalized approximately 50% of the CO2 injected in the

Permian basin.

Permian basin.

– As the CO2 program matures, a larger

portion of the injected gas

supports current production.

supports current production.

– As the CO2 program matures, a larger

portion of the injected gas

supports current production.

supports current production.

– Beginning in 2010,

we will be expensing 100% of the CO2 injected, in

order to simplify the process of determining the portion that should be

capitalized versus expensed.

order to simplify the process of determining the portion that should be

capitalized versus expensed.

– Beginning in 2010,

we will be expensing 100% of the CO2 injected, in

order to simplify the process of determining the portion that should be

capitalized versus expensed.

order to simplify the process of determining the portion that should be

capitalized versus expensed.

– In 2009, $69 million

of CO2 costs were

capitalized.

– In 2009, $69 million

of CO2 costs were

capitalized.

14

15

Fourth

Quarter 2009 Earnings - 1Q10 Outlook

• We expect oil and

gas sales volumes to increase from the

reformatted 4Q09 amount of 722 mboe/d to about 730 to 740

mboe/d in 1Q10 at about current oil prices.

reformatted 4Q09 amount of 722 mboe/d to about 730 to 740

mboe/d in 1Q10 at about current oil prices.

– Production

increases will come from California, Bahrain and Oman.

• Commodity Price

Sensitivity - Earnings

– At current market

prices, a $1.00 per barrel change in oil prices impacts oil

and gas quarterly earnings before income taxes by about $36 mm;

and gas quarterly earnings before income taxes by about $36 mm;

– A swing of $0.50

per mm BTU in domestic gas prices has a $24 mm impact

on quarterly earnings before income taxes;

on quarterly earnings before income taxes;

• We expect 1Q10

exploration expense to be about $75 mm

for seismic and drilling for our exploration programs.

for seismic and drilling for our exploration programs.

15

16

Fourth

Quarter 2009 Earnings - 1Q10 Outlook

Fourth

Quarter 2009 Earnings - 1Q10 Outlook

• For the Chemical

segment:

– The international

markets remain solid;

– In the U.S., we have

a competitive advantage against foreign

products; however, the housing and construction markets remain

weak, which will limit improvement in sales volumes and margins.

products; however, the housing and construction markets remain

weak, which will limit improvement in sales volumes and margins.

– Chemical earnings

for 1Q10 are expected to be in the range of $30

mm to $50 mm.

mm to $50 mm.

• We expect our

combined worldwide tax rate in 1Q10 to be in

the range of 42 to 43 percent depending on the split between

domestic and foreign sourced income.

the range of 42 to 43 percent depending on the split between

domestic and foreign sourced income.

16

17

Fourth

Quarter 2009 Earnings -

2010 Capital Spending and DD&A

2010 Capital Spending and DD&A

Fourth

Quarter 2009 Earnings -

2010 Capital Spending and DD&A

2010 Capital Spending and DD&A

• We expect capital

spending for the total year of 2010 to be

about $4.3 billion.

about $4.3 billion.

• We expect capital

spending for the total year of 2010 to be

about $4.3 billion.

about $4.3 billion.

– Our capital program

will continue to focus on ensuring that our returns

remain well above our cost of capital.

remain well above our cost of capital.

– Our capital program

will continue to focus on ensuring that our returns

remain well above our cost of capital.

remain well above our cost of capital.

– The additional

capital from 2009's $3.6 billion level will be allocated to

the Oil and Gas segment.

the Oil and Gas segment.

– The additional

capital from 2009's $3.6 billion level will be allocated to

the Oil and Gas segment.

the Oil and Gas segment.

– Of this

increase:

– Of this

increase:

• about a quarter

each will go to California and Iraq;

• about a quarter

each will go to California and Iraq;

• about 15% to

Bahrain and 10% to Midcontinent Gas.

• about 15% to

Bahrain and 10% to Midcontinent Gas.

– As a result, the

capital allocation will be approximately 82% in Oil and

Gas with the remainder being spent in Midstream and Chemical.

Gas with the remainder being spent in Midstream and Chemical.

– As a result, the

capital allocation will be approximately 82% in Oil and

Gas with the remainder being spent in Midstream and Chemical.

Gas with the remainder being spent in Midstream and Chemical.

• Our Oil and Gas

DD&A expense for 2010 should be

approximately $10.75 p/boe.

approximately $10.75 p/boe.

• Our Oil and Gas

DD&A expense for 2010 should be

approximately $10.75 p/boe.

approximately $10.75 p/boe.

• Depreciation for the

other two segments should be

approximately $450 million.

approximately $450 million.

• Depreciation for the

other two segments should be

approximately $450 million.

approximately $450 million.

17

18

Fourth

Quarter 2009 Earnings -

California Exploration

California Exploration

Fourth

Quarter 2009 Earnings -

California Exploration

California Exploration

• Excluding

the Kern County

discovery:

discovery:

• Excluding

the Kern County

discovery:

discovery:

– Over the course of

a couple of

years, we have drilled 39 exploration

wells seeking non-traditional

hydrocarbon bearing zones in

California.

years, we have drilled 39 exploration

wells seeking non-traditional

hydrocarbon bearing zones in

California.

– Over the course of

a couple of

years, we have drilled 39 exploration

wells seeking non-traditional

hydrocarbon bearing zones in

California.

years, we have drilled 39 exploration

wells seeking non-traditional

hydrocarbon bearing zones in

California.

– Of these wells, 12

are commercial

and 10 are currently being

evaluated;

and 10 are currently being

evaluated;

– Of these wells, 12

are commercial

and 10 are currently being

evaluated;

and 10 are currently being

evaluated;

– Oxy holds 1.3 mm

acres of net fee

minerals and leasehold in CA, which

have been acquired in the last few

years to exploit these opportunities.

Discoveries similar to the Kern

County discovery are possible in this

net acre position.

minerals and leasehold in CA, which

have been acquired in the last few

years to exploit these opportunities.

Discoveries similar to the Kern

County discovery are possible in this

net acre position.

– Oxy holds 1.3 mm

acres of net fee

minerals and leasehold in CA, which

have been acquired in the last few

years to exploit these opportunities.

Discoveries similar to the Kern

County discovery are possible in this

net acre position.

minerals and leasehold in CA, which

have been acquired in the last few

years to exploit these opportunities.

Discoveries similar to the Kern

County discovery are possible in this

net acre position.

– Additionally, we

continue to pursue

shale production which is expected

to produce oil on this acreage.

shale production which is expected

to produce oil on this acreage.

– Additionally, we

continue to pursue

shale production which is expected

to produce oil on this acreage.

shale production which is expected

to produce oil on this acreage.

18

19

*Production and

producing wells as of each of the quarterly earnings disclosure

dates.

Fourth

Quarter 2009 Earnings -

California Exploration - Kern County Discovery

California Exploration - Kern County Discovery

Fourth

Quarter 2009 Earnings -

California Exploration - Kern County Discovery

California Exploration - Kern County Discovery

KERN

COUNTY DISCOVERY AREA

KERN

COUNTY DISCOVERY AREA

The

discovery, which is near Elk Hills, is not below any

producing zones.

producing zones.

The

discovery, which is near Elk Hills, is not below any

producing zones.

producing zones.

4Q09 3Q09 2Q09 1Q09

4Q09 3Q09 2Q09 1Q09

Gross

Production*

Gross

Production*

– Natural Gas

(mmcf/d) 145 105 74 28

– Natural Gas

(mmcf/d) 145 105 74 28

– Liquids (mb/d) 7.5 8.5 5 3

– Liquids (mb/d) 7.5 8.5 5 3

– Total mboe/d 31.7 26.0 17.3 7.7

– Total mboe/d 31.7 26.0 17.3 7.7

Number

of producing wells* 15 10 6 4

Number

of producing wells* 15 10 6 4

19

20

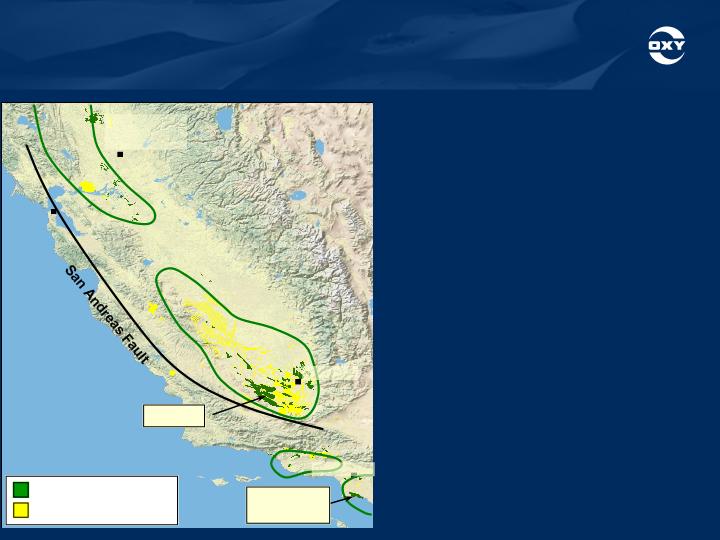

San

Joaquin

Valley

OXY

Producing Properties

Exploration

Acreage

Elk

Hills

Long

Beach

&

Tidelands

San

Francisco

Sacramento

Bakersfield

Los

Angeles

Sacramento

Valley

Fourth

Quarter 2009 Earnings -

California Exploration - Kern County Discovery

California Exploration - Kern County Discovery

Fourth

Quarter 2009 Earnings -

California Exploration - Kern County Discovery

California Exploration - Kern County Discovery

• Cumulative gross

production

since the start of production

through 12/31/09 has been 19.4

bcf of gas and 1.5 mm barrels of

liquids;

since the start of production

through 12/31/09 has been 19.4

bcf of gas and 1.5 mm barrels of

liquids;

• Cumulative gross

production

since the start of production

through 12/31/09 has been 19.4

bcf of gas and 1.5 mm barrels of

liquids;

since the start of production

through 12/31/09 has been 19.4

bcf of gas and 1.5 mm barrels of

liquids;

• We expect to drill 8

wells in the

first half of 2010 focusing on oil

drilling and exploring the limits of

the field;

first half of 2010 focusing on oil

drilling and exploring the limits of

the field;

• We expect to drill 8

wells in the

first half of 2010 focusing on oil

drilling and exploring the limits of

the field;

first half of 2010 focusing on oil

drilling and exploring the limits of

the field;

• We also expect to

add skid

mounted gas processing facilities

by 2Q10;

mounted gas processing facilities

by 2Q10;

• We also expect to

add skid

mounted gas processing facilities

by 2Q10;

mounted gas processing facilities

by 2Q10;

• We expect to add to

our gas

production once these facilities

are installed.

production once these facilities

are installed.

• We expect to add to

our gas

production once these facilities

are installed.

production once these facilities

are installed.

20

21

21