Attached files

China Pediatric Pharmaceuticals, Inc.

As filed with the United States Securities and Exchange Commission on January 28, 2010

Registration No. 000-52007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA PEDIATRIC PHARMACEUTICALS, INC.

Formerly Lid Hair Studios International, Inc.

(Name of small business issuer in its charter)

|

Nevada |

2834 |

20-271 8075 |

|

(State or other jurisdiction of

incorporation or organization) |

(primary standard industrial

classification code number) |

(I.R.S. Employer

Identification No.) |

9th Floor, No. 29 Nanxin Street,

Xi’an, Shaanxi Province

P.R.C., 710004

86 29 8727 1818

(Address and telephone number of principal executive offices and principal place of business)

__________

Copies to:

William Macdonald

MACDONALD TUSKEY

CORPORATE AND SECURITIES LAWYERS

(W.L. Macdonald Law Corporation)

1210 - 777 Hornby Street

Vancouver BC V6Z 1S4

Tel: 604.689.1022 Fax: 604.681.4760

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

¨ |

|

Accelerated Filer |

¨ |

|

Non-Accelerated Filer |

¨ |

Smaller Reporting Company |

þ |

If the delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

|

Title Of Each

Class of Securities

To be Registered |

Amount To

Be Registered |

Proposed

Maximum

Offering Price

Per Share(1) |

Proposed

Maximum

Aggregate

Offering Price |

Amount of

Registration Fee(3) |

||||||||||||

|

Common stock, par value $0.001 per share (2)(3) |

1,250,000 | $ | 3.00 | $ | 3,750,000 | $ | 267.38 | |||||||||

|

Common stock, par value $0.001 per share (2)(3) |

1,250,000 | $ | 5.00 | $ | 6,250,000 | $ | 445.63 | |||||||||

|

Total |

2,500,000 | $ | 10,000,000 | $ | 713.00 | |||||||||||

———————

(1) The price is estimated in accordance with Rule 457(h)(1) under the Securities Act of 1933, as amended, solely for the purpose of calculating the registration fee. Our estimate is based on the average of the high and low prices for our common stock as reported on the National Association of Securities Dealers Inc.'s

OTC Bulletin Board on January 28, 2010

(2) An indeterminate number of additional shares of common stock shall be issuable pursuant to Rule 416 to prevent dilution resulting from stock splits, stock dividends or similar transactions and in such an event the number of shares registered shall automatically be increased to cover the additional shares in accordance

with Rule 416 under the Securities Act.

(3) We are registering up to 2,500,000 shares of our common stock that we may issue upon the exercise of share purchase warrants.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities

Act of 1933, as amended, or until the registration statement shall become effective on such date as the United States Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the United States Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state

where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED January 28, 2010

PRELIMINARY PROSPECTUS

CHINA PEDIATRIC PHARMACEUTICALS, INC.

2,500,000 shares of common stock

This prospectus relates to the resale of up to 2,500,000 shares of our common stock, $0.001 par value per share, by certain of our stockholders. These persons, together with their transferees, are referred to throughout this prospectus as “selling stockholders.”

We issued all of the shares described above in private placement transactions completed prior to the filing of this registration statement.

The selling stockholders may offer to sell the shares of common stock being offered in this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices. Our common stock is quoted on the OTC Bulletin Board under the symbol "CPDU". On January 28, 2010, the closing

bid price for one share of our common stock on the OTC Bulletin Board was $2.38.

You should consider carefully the risk factors beginning on page 4 of this prospectus.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved of these securities or determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is:

You should rely only on the information contained in the prospectus. We have not authorized anyone to provide you with information or to make any representations about us, the selling stockholders, the securities or any matter discussed in this prospectus, other than that contained in the prospectus. If any other information

or representation is given or made, such information or representations may not be relied upon as having been authorized by us or any selling stockholder. The selling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful. The information contained

in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities

laws.

When used in this prospectus, the terms:

|

|

● |

“Asia Pharm,” refers to Asia Pharm Holdings, Inc., a British Virgin Islands Company |

|

|

● |

“China Pediatric,” “China Pediatric Pharmaceuticals,” “Lid Hair Studios International, Inc.,” “CPDU,” “LHSI,” the “Company,” “we,” “our” and “us” refers to China Pediatric Pharmaceuticals, Inc., formerly Lid Hair Studios International, Inc. a Nevada corporation. |

|

|

● |

“Coova Children Pharmaceuticals Co. Ltd.” refers to our wholly owned subsidiary China Children Pharmaceuticals Co., Ltd., a limited liability company organized under the laws of the Hong Kong. |

|

|

● |

“China Children Pharmaceuticals” refers to our variable interest entity (“VIE”), Shaanxi Jial Pharmaceutical Co., Ltd. a company organized under the laws of the PRC that has entered into a series of agreements with Coova Children Pharmaceuticals Co. Ltd. that (i) give Coova Children Pharmaceuticals Co. Ltd. control over the board of directors, officers, operations and finances of China

Children Pharmaceuticals; (ii) permit China Children Pharmaceuticals to be treated as a subsidiary of Coova Children Pharmaceuticals Co. Ltd. under the laws of the People’s Republic of China; and (iii) allow us to consolidate its financial statements under GAAP. |

|

|

● |

“WOFE” refers to Coova Children Pharmaceuticals Co. Ltd. which is a “wholly owned foreign enterprise” under the laws of the People’s Republic of China. |

|

|

● |

“China Children Shareholders” refers to the shareholders of China Children Pharmaceuticals who are also some of the shareholders of China Pediatric Pharmaceuticals. |

|

|

● |

“Yuan” or “RMB” refer to the Chinese yuan (also known as the Renminbi). According to the currency website xe.com, as of December 16, 2009, $1 = 6.82990 yuan. |

|

|

● |

“PRC” or “China” refers to the People’s Republic of China. |

|

|

● |

“SFDA” refers to the PRC State Food and Drug Administration |

|

|

● |

“OTC Bulletin Board” or the “OTCBB” refers to the Over-the-Counter Bulletin Board, an electronic quotation system for equity securities overseen by the Financial Industry Regulatory Authority (formerly the National Association of Securities Dealers), which is accessible through its website at WWW.OTCBB.COM |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION CONTAINED IN THIS PROSPECTUS

This prospectus contains some forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties. Forward-looking statements

include statements regarding, among other things, (a) projected sales, profitability, and cash flows, (b) growth strategies, (c) anticipated trends, (d) future financing plans and (e) anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipates,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,”

“management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Plan of Operation” and “Business,” as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products or product approvals, future performance

or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Any or all of the forward-looking statements in this report may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including,

without limitation, the risks outlined under “Risk Factors” and matters described in the prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

This summary highlights selected information contained elsewhere in this prospectus. It is not complete and does not contain all of the information that you should consider before investing in our common stock. To understand this offering fully, you should read the entire prospectus carefully, including “Risk Factors”

and the Consolidated Financial Statements and the Related Notes.

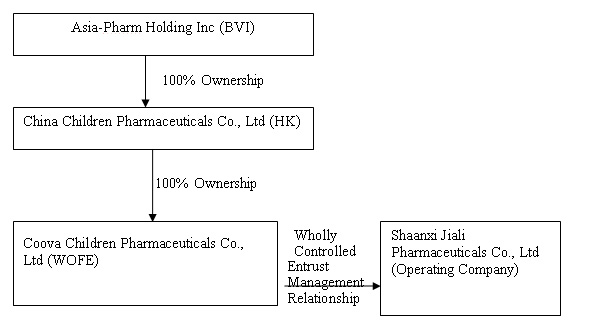

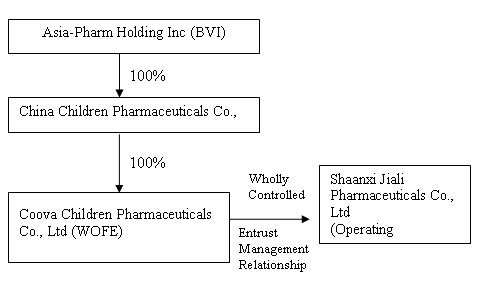

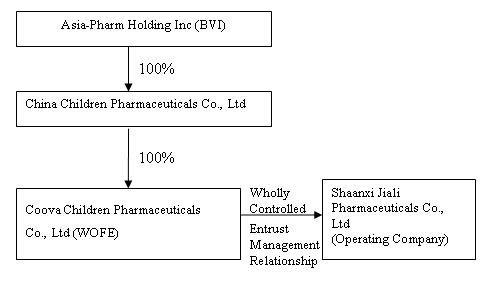

Shaanxi Jiali was incorporated in the PRC under the name Shaanxi Jiali Technologies Co, Ltd. on July 1, 1998. In October 2000, Shaanxi Jiali Technologies changed its name to Shaanxi Jiali Pharmaceutical Co. Ltd. Asia-Pharm was incorporated in British Virgin Islands on June 20, 2008. As described below, on August

4, 2008, Asia-Pharm through its wholly owned subsidiary China Children Pharmaceutical, Inc. (“China Children”), became the indirect holding company for Shaanxi Jiali Pharmaceutical Co. Ltd. ("Shaanxi Jiali"), a medical and pharmaceutical developer, manufacturer and marketer in the PRC. China Children was incorporated in Hong Kong on June 27, 2008. China Children is a wholly owned subsidiary of Asia-Pharm. Xi-an Coova Children Pharmaceuticals Co., Ltd, (“Xi-an Coova”) is a “wholly

owned foreign enterprise” incorporated in the PRC on July 25, 2008. Xi’an Coova is a wholly owned subsidiary of China Children. On August 4, 2008, an Entrustment Management Agreement was entered into between Xi-an Coova and Shaanxi Jiali, to which China Children exercises control over the operations and business of Shaanxi Jiali through Xi’an Coova. Pursuant to the Entrustment Management Agreement, China Children shall receive all net profits and assume all operational

losses of Shaanxi Jiali through Xi’an Coova.

As more fully described in Item 2.01 below, we acquired China Children Pharmaceutical, Inc. (“China Children”), a Hong Kong based pharmaceutical manufacturer and distributor company in accordance with a Share Exchange Agreement dated September 30, 2009 (“Exchange Agreement”) made by and among Lid Hair Studios International,

Inc., (“Company”) a Nevada corporation, Eric Anderson the (“Principal Company Shareholder”), and Asia-Pharm Holding (“Asia-Pharm”), Inc. a company incorporated in the British Virgin Islands, the sole shareholder of China Children.

The close of the Share Exchange transaction (the "Closing") took place on September 30, 2009 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding capital stock and ownership interests of China Children Pharmaceuticals Inc.(the “Interests”)

from Asia-Pharm and they transferred and contributed all of their Interests to us. In exchange, we issued to Asia-Pharm 7,000,000 shares of our common stock.

Asia-Pharm was incorporated in British Virgin Islands on June 20, 2008. As described below, on August 4, 2008, Asia-Pharm through its wholly owned subsidiary China Children became the indirect holding company for Shaanxi Jiali Pharmaceutical Co. Ltd. ("Shaanxi Jiali"), a medical and pharmaceutical developer, manufacturer and marketer

in the PRC.

China Children was incorporated in Hong Kong on June 27, 2008. China Children is a wholly owned subsidiary of Asia-Pharm.

Xi-an Coova Children Pharmaceuticals Co., Ltd, (“Xi-an Coova”) was a “wholly owned foreign enterprise” incorporated in the PRC on July 25, 2008. Xi’an Coova is a wholly owned subsidiary of China Children.

Shaanxi Jiali was incorporated in the PRC under the name Shaanxi Jiali Technologies Co, Ltd. on July 1, 1998. In October 2000, Shaanxi Jiali Technologies changed its name to Shaanxi Jiali Pharmaceutical Co. Ltd. Shaanxi Jiali is our operating company and is in the business of manufacturing, marketing and sales of

pharmaceuticals in China with pediatric medicine as its focus.

As described below, on August 4, 2008, an Entrustment Management Agreement (described in detail on page X) was entered into between Xi-an Coova and Shaanxi Jiali, to which China Children exercises control over the operations and business of Shaanxi Jiali through Xi’an Coova. Pursuant to the Entrustment Management Agreement, China

Children shall receive all net profits and assume all operational losses of Shaanxi Jiali through Xi’an Coova.

Xi’an Coova acquired management control over Shaanxi Jiali, in the same manner as if it were a wholly owned subsidiary under PRC law.

China Children, Xi’an Coova, and Shaanxi Jiali shall be referred to herein collectively as “Shaanxi Jiali." Shaanxi Jiali is principally engaged in the development and distribution of medicines, active pharmaceutical ingredients and pharmaceutical intermediaries.

This transaction is discussed more fully in Section 2.01 of this Report. The information therein is hereby incorporated in this Section 1.01 by reference.

Pursuant to the share exchange agreement of September 30, 2009, Eric Anderson transferred 5,000,000 shares of common stock of Lid Hair Studios to Lid Hair Studios for cancellation and forgives the outstanding shareholder’s loan to the company in the amount of $86,173in exchange for 100% of the issued and outstanding shares of Lid Hair

Studios’ wholly-owned subsidiary, Belford Enterprises B.C. Ltd., d/b/a Lid Hair Studio. Lid Hair Studios cancelled the shares of common stock received from Eric Anderson prior to affecting the reverse stock split which reduce the amount of common stock then issued and outstanding. Eric Anderson and Lid Hair Studios entered into a binding agreement with respect to such transaction on September 30, 2009.

Our operations are headquartered in Xi’an, Shaanxi Province, China. We are a profitable, mid-sized Chinese pharmaceutical company that identifies, discovers, develops manufactures and distributes both prescription and over-the counter, including both conventional and Traditional Chinese Medicines (“TCMs”),

for the treatment of some of the most common ailments and diseases, with pediatric medicine as its focus.

We currently have one operating company: Shaanxi Jiali identifies, discovers, develops manufactures and distributes both prescription and over-the counter, including both conventional and Traditional Chinese Medicines (“TCMs”), for the treatment of some of the most common ailments and diseases, with pediatric medicine

as its focus.

Our operating company has its own manufacturing facility located in Baoji, Shaanxi Province. Our manufacturing facility was issued a Good Manufacturing Practices1 (“GMP”) certification by the SFDA2 in

2004. We were awarded the National High-tech Enterprise Award by the Shaanxi Technology Administration in 2006. As a result of receiving the National High-tech Award Shaanxi Jiali is entitled to the “Two exemption Three half” tax holiday based on the local government’s policy to encourage outside investment into the locality. According to PRC tax laws, “Two exemption Three half” policy means foreign investment enterprises including Shaanxi Jiali may enjoy an

exemption from corporate income tax for 2 years starting from its first profitable year, followed by 3 years at a rate that is one half of the regular rate for corporate income tax.

We distribute our high value, branded medicines, both prescription and OTC, through exclusive territory agents who sell our products directly to local pharmacies who in turn sell them to their retail customers.

Lid Hair Studios International, Inc. was established on April 20, 2005 in the state of Nevada. The company was originally incorporated under the name Belford Enterprises, Inc. and changed its name to Lid Hair Studios International Inc. on August 15, 2005. Our operating subsidiary Belford Enterprises B.C. Ltd., doing business

as Lid Hair Studio was established June 7, 2005, in the City of Vancouver, British Columbia Canada. There are no bankruptcies, receivership, or similar proceedings against the parent or operating subsidiary.

On June 18, 2005, the company purchased hair salon equipment and the rights to an office lease from Farideh Jafari in the amount of approximately $39,150US ($45,000CDN).

___________________________

1 Good Manufacturing Practices (“GMP”) is an internationally-recognized standard for pharmaceutical plant design and construction. GMP has been defined as “that part of quality assurance which ensures that products are

consistently produced and controlled to the quality standards appropriate for their intended use and as required by the marketing authorization” (World Health Organization). GMP covers all aspects of the manufacturing process: defined manufacturing process; validated critical manufacturing steps; suitable premises, storage, transport; qualified and trained production and quality control personnel; adequate laboratory facilities; approved written procedures and instructions; records to show all steps of

defined procedures taken; full traceability of a product through batch processing records and distribution records; and systems for recall and investigation of complaints.

2 The Chinese government agency, SFDA, is analogous to the Food and Drug Administration (“FDA”) in the United States. Unlike the FDA, however, the SFDA provides intellectual property and competitive protection to certain classes

of approved drugs.

On July 4, 2005 we entered into a lease agreement by way of Assignment of Lease by Tenant with Landlord’s Consent. The lease commenced July 1, 2005 and terminates June 30, 2015.

Effective on October 9, 2009, the Company changed its name from Lid Hair Studios International Inc. to China Pediatric Pharmaceuticals, Inc. The name change was effected through a parent/subsidiary merger of our wholly-owned subsidiary, China Pediatric Pharmaceuticals, Inc., with and into the Company, with the Company as the surviving

corporation. To effectuate the merger, the Company filed its Articles of Merger with the Nevada Secretary of State and the merger became effective on October 9, 2009. A copy of the filed Articles of Merger is being filed under Exhibit 3.3. The Company’s board of directors approved the merger which resulted in the name change on October 9, 2009. In accordance with Section 92A.180 of the Nevada Revised Statutes,

shareholder approval of the merger was not required. On the effective date of the merger, the Company’s name was changed to “China Pediatric Pharmaceuticals, Inc.” and the Company’s Articles of Incorporation were amended to reflect this name change. Following the Combination, the combined Company will continue to be traded on the OTCBB, under the symbol “LHSI”, however we will request a new symbol closer in form to China Pediatric Pharmaceuticals, Inc.

Shaanxi Jiali was incorporated in the PRC under the name Shaanxi Jiali Technologies Co, Ltd. on July 1, 1998. In October 2000, Shaanxi Jiali Technologies changed its name to Shaanxi Jiali Pharmaceutical Co. Ltd. Shaanxi Jiali is our operating company and is in the business of manufacturing, marketing and sales of

pharmaceuticals in China with pediatric medicine as its focus.

Asia-Pharm was incorporated in British Virgin Islands on June 20, 2008. As described below, on August 4, 2008, Asia-Pharm through its wholly owned subsidiary China Children Pharmaceutical, Inc. (“China Children”), became the indirect holding company for Shaanxi Jiali Pharmaceutical Co. Ltd. ("Shaanxi Jiali"), a medical and

pharmaceutical developer, manufacturer and marketer in the PRC.

China Children was incorporated in Hong Kong on June 27, 2008. China Children is a wholly owned subsidiary of Asia-Pharm.

Xi-an Coova Children Pharmaceuticals Co., Ltd, (“Xi-an Coova”) is a “wholly owned foreign enterprise” incorporated in the PRC on July 25, 2008. Xi’an Coova is a wholly owned subsidiary of China Children.

As described below, on August 4, 2008, an Entrustment Management Agreement (described in detail on page X) was entered into between Xi-an Coova and Shaanxi Jiali, to which China Children exercises control over the operations and business of Shaanxi Jiali through Xi’an Coova. Pursuant to the Entrustment Management Agreement, China

Children shall receive all net profits and assume all operational losses of Shaanxi Jiali through Xi’an Coova.

Xi’an Coova entered into a Management Entrustment Agreement with Shaanxi Jiali and the shareholders of Shaanxi Jiali (the “Management Entrustment Agreement”), in which Shaanxi Jiali and its shareholders agreed to transfer control, or entrust, the operations and management of its business to Xi’an Coova. Under

the agreement, Xi’an Coova manages the operations and assets of Shaanxi Jiali , controls all of the cash flows of Shaanxi Jiali through a bank account controlled by Xi’an Coova, is entitled to 100% of earnings before tax of Shaanxi Jiali, a management fee, and is obligated to pay all payables and loan payments of Shaanxi Jiali. In addition, under the terms of the Management Entrustment Agreement, Xi’an Coova has been granted certain rights which include, in part, the right to appoint and terminate

members of Shaanxi Jiali’s Board of Directors, hire management and administrative personnel and control decisions relating to entering and performing customer contracts and other instruments. We anticipate that Shaanxi Jiali will continue to be the contracting party under its customer contracts, bank loans and certain other instruments unless Xi’an Coova exercises its option. The agreement does not terminate unless the business of Shaanxi Jiali is terminated or Xi’an Coova exercises its option

to acquire all of the assets or equity of Shaanxi Jiali under the terms of the Exclusive Option Agreement as more fully described below and completes the acquisition of Shaanxi Jiali.

In exchange for causing Shaanxi Jiali to enter into the Management Entrustment Agreement, Xi’an Coova, through its parent company Asia-Pharm, issued an aggregate of 12,000,000 shares of Asia-Pharm’s common stock to the shareholders of Shaanxi Jiali which was allocated based on their respective pro rata ownership of Shaanxi Jiali.

In order to give Xi’an Coova further control over Shaanxi Jiali, the Shaanxi Jiali shareholders and Xi’an Coova, a wholly owned subsidiary of China Children in the PRC, entered into a shareholders’ Voting Proxy Agreement (the “Voting Proxy

Agreement”) whereby the Shaanxi Jiali shareholders irrevocably and exclusively appointed the members of Xi’an Coova’s board of directors, as their proxies to vote on all matters that require Shaanxi Jiali shareholder approval, including, without limitation, the right to appoint members of the board of directors of Shaanxi

Jiali. The agreement further provides that Shaanxi Jiali will appoint all of the board of directors of Xi’an Coova as its board of directors. Xi’an Coova’s board of directors changes, Shaanxi Jiali must remove and appoint new members to its board. The agreement terminates upon the exercise of the option by Xi’an Coova to purchase the shares of Shaanxi Jiali as described below and is governed by the laws of the PRC.

In order to permit Shaanxi Jiali to become an indirectly wholly owned subsidiary of China Children when permitted under PRC law, Xi’an Coova, Shaanxi Jiali and the Shaanxi Jiali shareholders entered into an exclusive option agreement (the “Exclusive Option Agreement”) whereby the Shaanxi Jiali shareholders granted Xi’an

Coova an irrevocable and exclusive purchase option (the “Option”) to acquire Shaanxi Jiali’s equity and/or remaining assets, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. Current PRC law does not specifically provide for the equity of a non-PRC entity to be used as consideration for the purchase of a PRC entity’s assets or equity unless the value of the shares are equal to or greater than the value of the enterprise acquired.

In addition, there is a lengthy appraisal process which must be approved by the provincial PRC government entities. The consideration for the exercise of the Option is to be determined by the parties and memorialized in future definitive agreements setting forth the kind and value of such consideration. Accordingly, we will consider exercising the Option under such circumstances we believe will be in our best interests and our shareholders and the Exclusive Option Agreement has been drafted to give us such flexibility.

In considering whether or not we will exercise the Option we may consider such factors as (1) if the exercise price can be lower than the appraised value under current PRC law (2) availability of funds, (3) any relevant tax considerations at the time, (4) any other relevant PRC laws that may exist at the time, (5) the value of our shares that were previously paid to shareholders of Shaanxi Jiali, and (6) whether or not the exercise of the Option will provide any other additional benefits to us or our shareholders. Upon

exercise of the Option, the parties will prepare transfer documents to be submitted for governmental approval and work together to obtain all approvals and permits. The agreement may be terminated by agreement of all parties or by with 30 days notice and is governed by the laws of the PRC.

In order to further solidify China Children’s rights, benefits and control of Shaanxi Jiali through its ownership of Xi’an Coova under the Entrusted Management Agreement, Voting Proxy Agreement and Exclusive Option Agreement, Xi’an Coova and the Shaanxi Jiali shareholders entered into a share pledge agreement (the

“Share Pledge Agreement”) whereby the Shaanxi Jiali shareholders pledged all of their equity interests in Shaanxi Jiali, including the proceeds thereof, to guarantee the performance by the shareholders of all of the agreements they entered into with Xi’an Coova. Upon breach by any of the shareholders of any of the Management Entrustment Agreement, Voting Proxy Agreement, the Exclusive Option Agreement or the Share Pledge Agreement, Xi’an Coova is entitled by operation of law to become

the beneficial owner of the shares of Shaanxi Jiali. Prior to termination of the Share Pledge Agreement, the pledged equity interests of Shaanxi Jiali cannot be transferred without Xi’an Coova’s prior written consent. The provisions of the Share Pledge Agreement and the Voting Proxy Agreement work together to give the board of directors of Xi’an Coova control over transfers by the shareholders of Shaanxi Jiali . The agreement will not terminate until agreed to by all of the parties

in writing and is governed by the laws of the PRC.

On September 30, 2009, we acquired a Hong Kong based pharmaceutical manufacturer and distributor company in accordance with a Share Exchange Agreement dated September 30, 2009 (“Exchange Agreement”) made by and among Lid Hair Studios International, Inc., (“Company”) a Nevada corporation, Eric Anderson

the (“Principal Company Shareholder”), and Asia-Pharm Holding (“Asia-Pharm”), Inc. a company incorporated in the British Virgin Islands.

The close of the Share Exchange transaction (the "Closing") took place on September 30, 2009 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding capital stock and ownership interests of China Children Pharmaceuticals Inc.(the “Interests”)

from Asia-Pharm, and they transferred and contributed all of their Interests to us. In exchange, we issued to Asia-Pharm 7,000,000 shares of our common stock.

Shaanxi Jiali was incorporated in the PRC under the name Shaanxi Jiali Technologies Co, Ltd. on July 1, 1998. In October 2000, Shaanxi Jiali Technologies changed its name to Shaanxi Jiali Pharmaceutical Co. Ltd. Shaanxi Jiali is our operating company and is in the business of research and development, manufacturing,

marketing and sales, and distribution of pharmaceuticals in China, with pediatric medicine as its focus.

Asia-Pharm was incorporated in British Virgin Islands on June 20, 2008. As described below, on August 4, 2008, Asia-Pharm through its wholly owned subsidiary China Children Pharmaceutical, Inc. (“China Children”), became the indirect holding company for Shaanxi Jiali Pharmaceutical Co. Ltd. ("Shaanxi Jiali"), a medical and pharmaceutical

developer, manufacturer and marketer in the PRC.

China Children was incorporated in Hong Kong on June 27, 2008. China Children is a wholly owned subsidiary of Asia-Pharm. Xi-an Coova Children Pharmaceuticals Co., Ltd, (“Xi-an Coova”) is a “wholly owned foreign enterprise” incorporated in the PRC on July 25, 2008. Xi’an Coova is a wholly

owned subsidiary of China Children. On August 4, 2008, an Entrustment Management Agreement (described in detail on page 7) was entered into between Xi-an Coova and Shaanxi Jiali, to which China Children exercises control over the operations and business of Shaanxi Jiali through Xi’an Coova. Pursuant to the Entrustment Management Agreement, China Children shall receive all net profits and assume all operational losses of Shaanxi Jiali through Xi’an Coova.

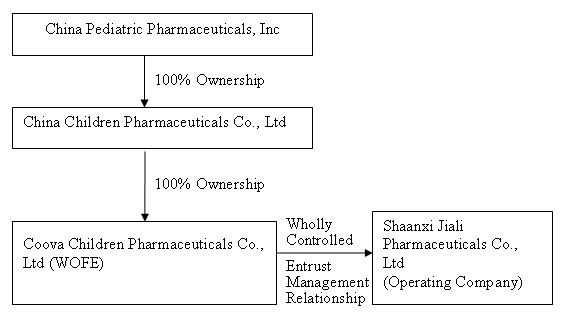

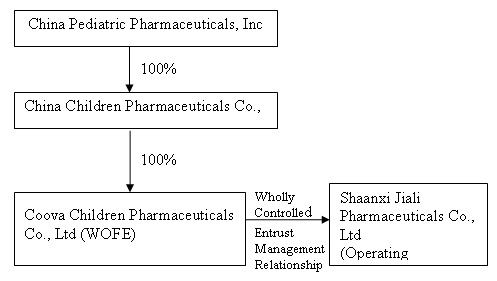

The organization and ownership structure of the Company subsequent to the consummation of the reorganization as summarized in the paragraphs above is as follows:

On September 30, 2009, Asia-Pharm, Eric Anderson and Lid Hair Studios, entered into a definitive Share Exchange Agreement (“Exchange Agreement”) for the combination of us and China Children Pharmaceuticals (the “Combination”). The Combination was accomplished by means of a share exchange in which Asia-Pharm exchanged

all of their stock in China Children Pharma for the new issuance of our common stock. Under the terms of the Exchange Agreement and as a result of the Combination:

|

● |

China Children became our wholly owned subsidiary; |

|

● |

In exchange for all of their shares of China Children stock, Asia-Pharm received 7,000,000 newly issued shares of our common stock. |

|

● |

Immediately following the closing of the Combination, such shares of CPPI common stock represent approximately 65.25% of our issued and outstanding shares on a fully diluted basis. |

The organization and ownership structure of the Company subsequent to the consummation of the combination as summarized in the paragraphs above is as follows:

This transaction closed on September 30, 2009.

|

Common stock outstanding |

|

8,305,288 shares as of December 31, 2009. |

|

Common stock that may be offered by selling stockholders |

Up to 2,500,000 shares. | |

|

Total proceeds raised by offering |

Total Proceeds will be $10,000,000 covered from the shares of the prospectus. | |

|

Common Stock Outstanding after the offering |

10,805,288 | |

|

Risk factors |

There are significant risks involved in investing in our company. For a discussion of risk factors you should consider before buying our common stock, see “Risk Factors” beginning on page 4. These risk factors include:

·

Various risks of doing business in China since all of our revenues are derived from operations of China Children Pharmaceuticals in China including changes in political and economics in China, changes in the laws of the People’s Republic of China, exchange rate issues, difficulty in establishing management, legal and financial

controls;

·

The risk of the loss of China Children Pharmaceuticals as our operating business;

|

| Risks associated with Shaanxi Jiali’s business, which include among other, competition, ability to manage growth, discovery and development of new products, need for additional capital to fund operations, dependence on key personnel, need for regulatory approval of products, need to obtain renewal of licenses to

operate business, governmental price controls, products being replaced by newer products

·

Risk related to our common stock, which include but are not limited to the illiquidity of our stock price, need for internal controls, additional expenses due to regulatory requirements, penny stock regulations that will be applicable to our common stock. | ||

|

Use of Proceeds |

The shares of common stock offered hereby are being registered for the account of the selling stockholders named in this prospectus. As a result, all proceeds from the sales of the common stock will go to the selling

stockholders and we will not receive any proceeds from the resale of the common stock by the selling stockholders, although we could receive proceeds

of up to $10,000,000 if all of the share purchase warrants are exercised. We will, however, incur all costs associated with this registration statement and prospectus. |

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking

statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

|

● |

WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE. |

In order to maximize potential growth in our current and potential markets, we believe that we must expand our manufacturing and marketing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls,

operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

|

● |

WE CANNOT ASSURE YOU THAT OUR ORGANIC GROWTH STRATEGY WILL BE SUCCESSFUL WHICH MAY RESULT IN A NEGATIVE IMPACT ON OUR GROWTH, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND CASH FLOW. |

One of our strategies is to grow organically through increasing the distribution and sales of our products by penetrating existing markets in PRC and entering new geographic markets in PRC. However, many obstacles to entering such new markets exist, including, but not limited to, trade and tariff barriers, shipping and delivery costs, costs

associated with marketing efforts. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to implement this organic growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

|

● |

WE CANNOT ASSURE YOU THAT OUR ACQUISITION GROWTH STRATEGY WILL BE SUCCESSFUL RESULTING IN OUR FAILURE TO MEET GROWTH AND REVENUE EXPECTATIONS. |

In addition to our organic growth strategy, we also expect to grow through strategic acquisitions. We intend to pursue opportunities to acquire businesses in PRC that are complementary or related in product lines and business structure to us. We may not be able to locate suitable acquisition candidates at prices that we consider appropriate

or to finance acquisitions on terms that are satisfactory to us. If we do identify an appropriate acquisition candidate, we may not be able to negotiate successfully the terms of an acquisition, or, if the acquisition occurs, integrate the acquired business into our existing business. Acquisitions of businesses or other material operations may require debt financing or additional equity financing, resulting in leverage or dilution of ownership. Integration of acquired business operations could disrupt our business

by diverting management away from day-to-day operations. The difficulties of integration may be increased by the necessity of coordinating geographically dispersed organizations, integrating personnel with disparate business backgrounds and combining different corporate cultures. We also may not be able to maintain key employees or customers of an acquired business or realize cost efficiencies or synergies or other benefits we anticipated when selecting our acquisition candidates. In addition, we may need to

record write-downs from future impairments of intangible assets, which could reduce our future reported earnings. At times, acquisition candidates may have liabilities or adverse operating issues that we fail to discover through due diligence prior to the acquisition. In addition to the above, acquisitions in PRC, including of state owned businesses, will be required to comply with laws of the People's Republic of China ("PRC"), to the extent applicable. There can be no assurance that any given proposed acquisition

will be able to comply with PRC requirements, rules and/or regulations, or that we will successfully obtain governmental approvals which are necessary to consummate such acquisitions, to the extent required. If our acquisition strategy is unsuccessful, we will not grow our operations and revenues at the rate that we anticipate.

|

● |

IF WE ARE NOT ABLE TO IMPLEMENT OUR STRATEGIES IN ACHIEVING OUR BUSINESS OBJECTIVES, OUR BUSINESS OPERATIONS AND FINANCIAL PERFORMANCE MAY BE ADVERSELY AFFECTED. |

Our business plan is based on circumstances currently prevailing and the bases and assumptions that certain circumstances will or will not occur, as well as the inherent risks and uncertainties involved in various stages of development. However, there is no assurance that we will be successful in implementing our strategies or that our strategies,

even if implemented, will lead to the successful achievement of our objectives. If we are not able to successfully implement our strategies, our business operations and financial performance may be adversely affected.

|

● |

IF WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS. |

If adequate additional financing is not available on reasonable terms, we may not be able to undertake plant expansion, purchase additional machinery and purchase equipment for our operations and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us after this Offering.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition;

(iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we cannot obtain additional funding, we may be required to: (i) limit our investments in research and development; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures.

Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible

debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

|

●

|

SHAANXI JIAL IS CURRENTLY ENTITLED TO A BENEFICIAL TAX EXEMPTION FOR A FIVE YEAR PERIOD; HOWEVER, SUCH TAX EXEMPTION MAY BE INTERPRETED TO BE NOT IN COMPLIANCE WITH PRC TAX LAWS IN THE FUTURE CAUSING US TO SET ASIDE CERTAIN CONTINGENCY FUNDS FOR DEALING WITH POTENTIAL RETROSPECTIVE TAX LIABILITIES. |

Shaanxi Jiali is entitled to enjoy the “Two exemption Three half” tax holiday based on the local government’s policy to encourage outside investment into the locality. According to PRC tax laws, “Two exemption Three half” policy means foreign investment enterprises including Shaanxi Jiali may enjoy

an exemption from corporate income tax for 2 years starting from its first profitable year, followed by 3 years at a rate that is one half of the regular rate for corporate income tax.

As to the tax treatment promised by local governments to purely domestic enterprises, i.e., Shaanxi Jiali, invested by non-local (but not foreign) investors under the so called preferential policy announced by local governments, our consultation with PRC certified public accountants and lawyers, is that the above policy is not compliant with

the PRC laws. Even though such practice exists in many areas across the country, the policy faces the risk of being ruled illegal at any time for non-compliance with relevant laws. In this event, there is a risk that we might be assessed retrospective tax liabilities.

|

● |

WE MAY HAVE DIFFICULTY DEFENDING OUR INTELLECTUAL PROPERTY RIGHTS FROM INFRINGEMENT RESULTING IN LAWSUITS REQUIRING US TO DEVOTE FINANCIAL AND MANAGEMENT RESOURCES THAT WOULD HAVE A NEGATIVE IMPACT ON OUR OPERATING RESULTS. |

We regard our service marks, trademarks, trade secrets, patents and similar intellectual property as critical to our success. We rely on trademark, patent and trade secret law, as well as confidentiality and license agreements with certain of our employees, customers and others to protect our proprietary rights. We have received trademark

and patent protection for certain of our products in the People's Republic of China. No assurance can be given that our patents and licenses will not be challenged, invalidated, infringed or circumvented, or that our intellectual property rights will provide competitive advantages to us. There can be no assurance that we will be able to obtain a license from a third-party technology that we may need to conduct our business or that such technology can be licensed at a reasonable cost.

Presently, we sell our products mainly in PRC. To date, no trademark or patent filings have been made other than in PRC. To the extent that we market our products in other countries, we may have to take additional action to protect our intellectual property. The measures we take to protect our proprietary rights may be inadequate and we cannot

give you any assurance that our competitors will not independently develop formulations and processes that are substantially equivalent or superior to our own or copy our products.

Currently, the SFDA does not automatically stay drug registration approval upon initiation of an infringement lawsuit by a third party. At present, we must wait until a copycat manufacturer has received marketing approval from SFDA before we can bring an infringement lawsuit. Furthermore, Chinese courts have been hesitant to issue preliminary

injunctions to suspend sales until a final judgment is issued in the lawsuit. Our sales could be lowered were a competitor to infringe our intellectual property rights by marketing one or more versions of SFDA-approved drugs proprietary to us, such as the Qiweiben capsule, until we can curtail such infringement through legal action. Pursuing infringement lawsuits would require us to devote financial and management resources that could impact the results of our operations.

|

● |

WE DEPEND ON THE SUPPLY OF RAW MATERIALS, AND ANY ADVERSE CHANGES IN SUCH INTENSE COMPETITION FROM EXISTING AND NEW ENTITIES MAY ADVERSELY AFFECT OUR REVENUES AND PROFITABILITY. |

We compete with other companies, many of whom are developing or can be expected to develop products similar to ours. Our markets are large with many competitors. The market for pharmaceutical raw materials manufacturing is particularly competitive. In this market, our competitors include a number of contract manufacturers and, from time to

time, demand for particular products may be greatly exceeded by production capacity. Many of our competitors are more established than we are, and have significantly greater financial, technical, marketing and other resources than us. Some of our competitors may have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive

terms to customers, and adopt more aggressive pricing policies. We intend to create greater brand awareness for our brand name so that we can successfully compete with our competitors. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

|

● |

OUR PRODUCTS AND THE PROCESSES COULD EXPOSE US TO SUBSTANTIAL PRODUCT LIABILITY CLAIMS WHICH WILL NEGATIVELY IMPACT OUR PROFITABILITY. |

We face an inherent business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in adverse side effects. Side effects or marketing or manufacturing problems pertaining to any of our products could result in product liability claims or adverse publicity. These risks will exist

for those products in clinical development and with respect to those products that have received regulatory approval for commercial sale. To date, we have not experienced any product liability claims. However, that does not mean that we will not have any such claims with respect to our products in the future which will negatively impact our profitability.

|

● |

WE DEPEND ON OUR KEY MANAGEMENT PERSONNEL AND THE LOSS OF THEIR SERVICES COULD ADVERSELY AFFECT OUR BUSINESS. |

We place substantial reliance upon the efforts and abilities of our executive officers, Jun Xia, our Chairman and Chief Executive Officer and Minggang Xiao, our Chief Financial Officer. The loss of the services of any of our executive officers could have a material adverse effect on our business, operations, revenues or prospects. We do not

maintain key man life insurance on the lives of these individuals.

|

● |

WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS. |

We did not declare any dividends for the year ended December 31, 2008 and have not declared any dividends to date in 2009. Our board of directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon,

among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

|

● |

MANAGEMENT EXERCISES SIGNIFICANT CONTROL OVER MATTERS REQUIRING SHAREHOLDER APPROVAL WHICH MAY RESULT IN THE DELAY OR PREVENTION OF A CHANGE IN OUR CONTROL. |

Mr. Xia, our Chief Executive Officer, through his common stock ownership, currently has voting power equal to approximately 22.8% of our voting securities. As a result, management through such stock ownership exercises significant control over all matters requiring shareholder approval, including the election of directors and approval of significant

corporate transactions. This concentration of ownership in management may also have the effect of delaying or preventing a change in control of us that may be otherwise viewed as beneficial by shareholders other than management.

|

● |

WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS. |

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations

to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals

to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

|

● |

WE MAY NOT BE ABLE TO MEET THE ACCELERATED FILING AND INTERNAL CONTROL REPORTING REQUIREMENTS IMPOSED BY THE SECURITIES AND EXCHANGE COMMISSION RESULTING IN A POSSIBLE DECLINE IN THE PRICE OF OUR COMMON STOCK AND OUR INABILITY TO OBTAIN FUTURE FINANCING. |

As directed by Section 404 of the Sarbanes-Oxley Act, the Securities and Exchange Commission adopted rules requiring each public company to include a report of management on the company's internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm auditing a company's financial

statements must

also attest to and report on management's assessment of the effectiveness of the company's internal controls over financial reporting as well as the operating effectiveness of the company's internal controls.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from

our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements

and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the Securities and Exchange Commission, which could also adversely affect the market price of our common stock and our ability to secure additional financing as needed.

|

● |

WE MAY HAVE DIFFICULTY RAISING NECESSARY CAPITAL TO FUND OPERATIONS AS A RESULT OF MARKET PRICE VOLATILITY FOR OUR SHARES OF COMMON STOCK. |

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For

these reasons, our shares of common stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If our business development plans are successful, we may require additional financing to continue to develop and exploit existing and new technologies and to expand into new markets. The exploitation of our technologies may, therefore, be dependent upon our ability to obtain financing through debt and equity or other means.

Risks Relating to the People's Republic of China

|

● |

THE SALES PRICES OF SOME MEDICINES ARE CURRENTLY CONTROLLED BY THE CHINESE GOVERNMENT AND THAT MAY ADVERSELY AFFECT OUR BUSINESS. |

Prices paid by end consumers for many of our medicines are regulated by PRC's State Development and Reform Commission. PRC justifies its need to control the drug prices on the basis that, at present, only workers at state or private companies have health insurance. About 900 million rural Chinese people and 35 million urban unemployed Chinese

people lack insurance coverage and cannot afford expensive drugs. Our future profitability might suffer if a significant portion of our revenues were to be derived from products whose final selling prices were state-controlled and if those prices were held at levels close to or below our cost of sales.

|

● |

SALES OF OUR PRODUCTS COULD BE HARMED BY THE WIDESPREAD PRESENCE OF COUNTERFEIT MEDICATION IN PRC NEGATIVELY IMPACTING OUR PROFITABILITY. |

Chinese counterfeiting of pharmaceuticals and other products affecting public health has grown in tandem with counterfeiting and piracy of goods such as brand-name clothing, compact discs and computer software. Exact data are impossible to collect, but the FBI believes that more than half of the pharmaceuticals sold in PRC are counterfeit.

Examples of the seriousness of the problem include: six months after Viagra was introduced in 2002, state media reported that some 90 percent of little blue pills sold in Shanghai were counterfeit; and 192,000 Chinese patients were reported to have died in 2001 from fake drugs. Counterfeit products shrink markets for legitimate goods. This situation affects Shaanxi, Jiali and other major domestic and foreign drug manufacturers in PRC, especially for products marketed through the OTC rather than hospital channel.

However, we believe the Chinese authorities are becoming increasingly vigilant against counterfeiting. .

|

● |

THERE COULD BE CHANGES IN GOVERNMENT REGULATIONS TOWARDS THE PHARMACEUTICAL AND HEALTH SUPPLEMENT INDUSTRIES THAT MAY ADVERSELY AFFECT OUR GROWTH AND PROFITABILITY. |

The manufacture and sale of APIs in the PRC is heavily regulated by many state, provincial and local authorities. These regulations have significantly increased the difficulty and costs involved in obtaining and maintaining regulatory approvals for marketing new and existing products. Our future growth and profitability depend to a large extent

on our ability to obtain regulatory approvals.

The SFDA of PRC recently implemented new guidelines for licensing of APIs. All existing manufacturers with licenses were required to apply for GMP certifications and to receive approvals. However, should we fail to receive or maintain the GMP certifications under the new guidelines in the future; our businesses would be materially and adversely affected.

Moreover, the laws and regulations regarding acquisitions of the pharmaceutical industry in the PRC may also change and may significantly impact our ability to grow through acquisitions.

|

● |

CERTAIN POLITICAL AND ECONOMIC CONSIDERATIONS RELATING TO THE PRC COULD ADVERSELY AFFECT OUR COMPANY. |

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on

foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive

effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC's economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

|

● |

THE RECENT NATURE AND UNCERTAIN APPLICATION OF MANY PRC LAWS APPLICABLE TO US CREATE AN UNCERTAIN ENVIRONMENT FOR BUSINESS OPERATIONS AND THEY COULD HAVE A NEGATIVE EFFECT ON US. |

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic

and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects. In addition, as these laws, regulations and legal requirements are relatively

recent, their interpretation and enforcement involve significant uncertainty.

|

● |

RECENT PRC REGULATIONS RELATING TO THE ESTABLISHMENT OF OFFSHORE SPECIAL PURPOSE COMPANIES BY PRC RESIDENTS MAY SUBJECT OUR PRC RESIDENT SHAREHOLDERS TO PERSONAL LIABILITY AND LIMIT OUR ABILITY TO INJECT CAPITAL INTO OUR PRC SUBSIDIARIES, LIMIT OUR PRC SUBSIDIARIES’ ABILITY TO DISTRIBUTE PROFITS TO US, OR OTHERWISE ADVERSELY AFFECT US. |

SAFE issued a public notice in October 2005, or the SAFE notice, requiring PRC residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.”

PRC residents that are shareholders of offshore special purpose companies established before November 1, 2005 were required to register with the local SAFE branch before March 31, 2006. Our current beneficial owners who are PRC residents have registered with the local SAFE branch as required under the SAFE notice. The failure of these beneficial owners to timely amend their SAFE registrations pursuant to the SAFE notice or the failure of future beneficial owners of our company who are PRC residents

to comply with the registration procedures set forth in the SAFE notice may subject such beneficial owners to fines and legal sanctions and may also limit our ability to contribute additional capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute dividends to our company or otherwise adversely affect our business.

Other Risks

|

● |

CURRENCY CONVERSION AND EXCHANGE RATE VOLATILITY COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION. |

The PRC government imposes control over the conversion of Renminbi (“RMB”) into foreign currencies. Under the current unified floating exchange rate system, the People's Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day's dealings in the inter-bank foreign exchange

market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign

exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions.

On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts

and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Since 1994, the exchange rate for Renminbi against the United States dollar has remained relatively stable, most of the time in the region of approximately RMB8.28 to $1.00. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just

the U.S. dollar and, the exchange rate for the Renminbi against the U.S. dollar became RMB8.02 to $1.00. As our operations are primarily in PRC, any significant revaluation or devaluation of the Chinese Renminbi may materially and adversely affect our cash flows, revenues and financial condition. We may not be able to hedge effectively against in any such case. For example, to the extent that we need to convert United States dollars into Chinese Renminbi for our operations, appreciation of this currency against

the United States dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. There can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse

effect on our financial condition. China Pediatric’s operating companies are FIEs to which the Foreign Exchange Control Regulations are applicable. There can be no assurance that we will be able to obtain sufficient foreign exchange to pay dividends or satisfy other foreign exchange requirements in the future.

|

● |

IT MAY BE DIFFICULT TO AFFECT SERVICE OF PROCESS AND ENFORCEMENT OF LEGAL JUDGMENTS UPON OUR COMPANY AND OUR OFFICERS AND DIRECTORS BECAUSE THEY RESIDE OUTSIDE THE UNITED STATES. |

As our operations are presently based in PRC and a majority of our directors and all of our officers reside in PRC, service of process on our company and such directors and officers may be difficult to effect within the United States. Also, our main assets are located in PRC and any judgment obtained in the United States against us may not

be enforceable outside the United States.

|

● |

ANY FUTURE OUTBREAK OF AVIAN INFLUENZA, OR THE ASIAN BIRD FLU, OR ANY OTHER EPIDEMIC IN PRC COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS OPERATIONS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

Since mid-December 2003, a number of Asian countries have reported outbreaks of highly pathogenic avian influenza in chickens and ducks. Since all of our operations are in PRC, an outbreak of the Asian Bird Flu in PRC in the future may disrupt our business operations and have a material adverse effect on our financial condition and results

of operations. For example, a new outbreak of Asian Bird Flu, or any other epidemic, may reduce the level of economic activity in affected areas, which may lead to a reduction in our revenue if our clients cancel existing contracts or defer future expenditures. In addition, health or other government regulations may require temporary closure

of our offices, or the offices of our customers or partners, which will severely disrupt our business operations and have a material adverse effect on our financial condition and results of operations.

|

● |

OUR BUSINESS MAY BE AFFECTED BY UNEXPECTED CHANGES IN REGULATORY REQUIREMENTS IN THE JURISDICTIONS IN WHICH WE OPERATE. |

We are subject to many general regulations governing business entities and their behavior in PRC and in other jurisdictions in which we have, or plan to have, operations and market our products. In particular, we are subject to laws and regulations covering food, dietary supplements and APIs. Such regulations typically deal with licensing,

approvals and permits. Any change in product licensing may make our products more or less available on the market. Such changes may have a positive or negative impact on the sale of our products and may directly impact the associated costs in compliance and our operational and financial viability. Such regulatory environment also covers any existing or potential trade barriers in the form of import tariff and taxes that may make it difficult for us to import our products to certain countries and regions, such

as Hong Kong, which would limit our international expansion.

|

● |

SINCE MOST OF OUR ASSETS ARE LOCATED IN PRC, ANY DIVIDENDS OF PROCEEDS FROM LIQUIDATION IS SUBJECT TO THE APPROVAL OF THE RELEVANT CHINESE GOVERNMENT AGENCIES. |

Our assets are predominantly located inside PRC. Under the laws governing foreign invested enterprises in PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange

rules governing such repatriation. Any liquidation is subject to the relevant government agency's approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

Risks Associated with Our Shares of Common Stock

|

● |

OUR SHARES OF COMMON STOCK ARE VERY THINLY TRADED, AND THE PRICE MAY NOT REFLECT OUR VALUE AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE. |

Our shares of common stock are very thinly traded, and the price if traded may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management

might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds

a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for any loans.

|

● |

WE MAY BE SUBJECT TO THE PENNY STOCK RULES WHICH WILL MAKE THE SHARES OF OUR COMMON STOCK MORE DIFFICULT TO SELL. |

We may be subject now and in the future to the SEC’s “penny stock” rules if our shares of common stock sell below $5.00 per share. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker-dealers to deliver a standardized risk disclosure document prepared by the SEC

which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally

or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer's confirmation.

In addition, the penny stock rules require that prior to a transaction, the broker dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. The penny stock rules are burdensome and may reduce purchases of any offerings

and reduce the trading activity for shares of our common stock. As long as our shares of common stock are subject to the penny stock rules, the holders of such shares of common stock may find it more difficult to sell their securities.

|

● |

SALES OF OUR CURRENTLY ISSUED AND OUTSTANDING STOCK MAY BECOME FREELY TRADABLE PURSUANT TO RULE 144 AND MAY DILUTE THE MARKET FOR YOUR SHARES AND HAVE A DEPRESSIVE EFFECT ON THE PRICE OF THE SHARES OF OUR COMMON STOCK. |

A substantial majority of our outstanding shares of common stock are "restricted securities" within the meaning of Rule 144 under the Securities Act. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under

the Act and as required under applicable state securities laws. Rule 144 provides in essence that a person who has held restricted securities for a period of at least one year may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1% of a company's outstanding shares of common stock or the average weekly trading volume during the four calendar weeks prior to the sale (the four calendar week rule does not apply to companies quoted

on the OTC Bulletin Board). There is no limit on the amount of restricted securities that may be sold by a non-affiliate after the restricted securities have been held by the owner for a period of two years or more and such owner has not been an affiliate for the 90 day period prior to sale. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock

in any active market that may develop.

|

● |

THERE CAN BE NO ASSURANCE THAT THE PRICE OF OUR SHARES OF COMMON STOCK WILL MEET OR EXCEED THE EXERCISE PRICE OF THE WARRANTS DURING THE EXERCISE PERIOD OR AT ANY TIME THEREAFTER. |

Unless the price of our shares of Common Stock equals or exceeds the exercise price of the Warrants at the time of such exercise, an Investor may not be able to exercise his Warrants profitably. There can be no assurance that the price of our shares of Common Stock will meet or exceed the exercise price of the Warrants during the exercise

period or at any time thereafter. Accordingly, should an Investor choose to exercise the Warrants, the value of our shares of Common Stock purchased upon such exercise may be less than the Warrant exercise price the Investor pays. The Warrant may be worthless and expire unexercised if the price of our shares of Common Stock does not exceed the Warrant exercise price. Please see “Description of Securities - Warrants” for additional information as to the terms of the Warrants.

|

● |

MANAGEMENT EXERCISES SIGNIFICANT CONTROL OVER MATTERS REQUIRING SHAREHOLDER APPROVAL AND INVESTORS WILL HAVE CONTROL OVER COMPANY ACTIONS. |

As a practical matter, our officers and directors will have control of us and will be able to assert significant influence over the election of directors and other matters presented for a vote of stockholders. Even after the Offering is complete, a majority of our shares of Common Stock will be owned by Mr. Xia. Through his concentration of