Attached files

| file | filename |

|---|---|

| EX-3.7 - Offshore Petroleum Corp. | v171578_ex3-7.htm |

| EX-5.1 - Offshore Petroleum Corp. | v171578_ex5-1.htm |

| EX-3.2 - Offshore Petroleum Corp. | v171578_ex3-2.htm |

| EX-3.6 - Offshore Petroleum Corp. | v171578_ex3-6.htm |

| EX-3.5 - Offshore Petroleum Corp. | v171578_ex3-5.htm |

| EX-3.4 - Offshore Petroleum Corp. | v171578_ex3-4.htm |

| EX-3.3 - Offshore Petroleum Corp. | v171578_ex3-3.htm |

| EX-3.1 - Offshore Petroleum Corp. | v171578_ex3-1.htm |

| EX-10.3 - Offshore Petroleum Corp. | v171578_ex10-3.htm |

| EX-23.1 - Offshore Petroleum Corp. | v171578_ex23-1.htm |

| EX-10.4 - Offshore Petroleum Corp. | v171578_ex10-4.htm |

| EX-10.5 - Offshore Petroleum Corp. | v171578_ex10-5.htm |

| EX-10.2 - Offshore Petroleum Corp. | v171578_ex10-2.htm |

| EX-10.1 - Offshore Petroleum Corp. | v171578_ex10-1.htm |

AS

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON

January

__, 2010

REGISTRATION

NO. 33-____________

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES

ACT OF 1933

OFFSHORE

PETROLEUM CORP.

(Name of

Registrant as specified in its charter)

|

DELAWARE

|

1311

|

65-0947544

|

|

(State

or other jurisdiction

of

incorporation or

organization)

|

(Primary

Standard Industrial

Classification

Code Number)

|

(I.R.S.

Employer

Identification

No.)

|

OFFSHORE

PETROLEUM CORP.

110 East

Broward Boulevard, Suite 1700

Ft.

Lauderdale, FL 33301

Telephone:

877-655-0501

FAX:

866-786-6415

(Name,

address, including zip code, and

telephone

number, including

area

code, of registrant’s principal executive offices)

Jonathan

H. Gardner

Kavinoky

Cook LLP

726

Exchange Street; Suite 800

Buffalo,

New York 14210

(Name,

address, including zip code, and

telephone

number, including

area

code, of agent for service)

Approximate

date of proposed sale to the public: As soon as practicable after the effective

date of this Registration Statement.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. ¨

If this

Form is filed to register additional securities pursuant to Rule 462(b) under

the Securities Act, please check the following box and list the Securities Act

Registration Statement number of the earlier effective Registration Statement

for the same offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act Registration

Statement number of the earlier effective Registration Statement for the same

offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act Registration

Statement number of the earlier effective Registration Statement for the same

offering. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer”, and

“smaller reporting company” in Ruler 12B-2 of the Exchange Act.

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

|

Non-accelerated

filer ¨

|

(do

not check if a smaller

|

Smaller

reporting company x

|

|

reporting

company)

|

CALCULATION

OF REGISTRATION FEE:

|

Title Of Each Class Of

Securities To Be Registered

|

Amount to be

Registered

|

Proposed

Maximum

offering price per

Share

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

||||||||||||

|

Common

Stock, par

value $0.0001 per Share (1)

|

17,502,500

|

$ | 0.10 | $ |

1,750,250

|

$ | 124.79 | |||||||||

|

Total

|

17,502,500

|

$ |

1,750,250

|

$ | 124.79 | |||||||||||

(1) Represents

shares of common stock which may be sold by the selling shareholders listed in

this Registration Statement.

The

offering price with respect to Shares has been estimated solely for the purpose

of calculating the registration fee pursuant to Rule 457(C). This

price is not an indication of value nor has it been established by any

recognized methodology for deriving the value of the Shares.

The

Registrant hereby amends this Registration Statement on such date or dates as

may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until the Registration Statement

shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

PROSPECTUS

PRELIMINARY

PROSPECTUS SUBJECT TO COMPLETION

The

information in this prospectus is not complete and may be

changed. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where the

offer or sale is not permitted.

OFFSHORE

PETROLEUM CORP.

SHARES OF

COMMON STOCK TO BE SOLD BY THE SELLING STOCKHOLDERS

The

selling shareholders named in this prospectus (the “Selling Shareholders”) are

offering up to 17,502,500 shares of the common stock of Offshore Petroleum

Corp., a Delaware corporation (“Offshore” or the “Company”), par value $0.0001

per share (“Shares”).

No public

market exists for the Shares or any other security issued by

Offshore. Offshore will undertake to include its Shares for trading

on the Over-The-Counter Bulletin Board, however, no assurance can be given that

such market will be established. The Selling Shareholders may offer

to sell the Shares being offered in this prospectus at fixed prices, at

prevailing market prices at the time of sale, at varying prices or at negotiated

prices. We will not receive any of the proceeds of the sale of Shares

by the Selling Shareholders. We will pay all of the costs associated

with this registration statement and prospectus, but we will not pay any

commissions or expenses of the actual sale of the Shares. We have

limited working capital and will require additional capital to fund exploration

activities. We will use our working capital and any additional

financing we obtain in the future for operating and administrative expenses,

maintenance of our exploration rights and exploration for oil and gas in the

areas subject to our Licenses, when granted.

WE

ARE IN AN EXPLORATION STAGE ONLY AND HAVE NO RESERVES. READERS ARE

STRONGLY URGED TO READ THE “RISK FACTORS” SECTION OF THIS

PROSPECTUS.

BEFORE

BUYING THE SHARES OF COMMON STOCK, CAREFULLY READ THIS

PROSPECTUS. THE PURCHASE OF OUR SECURITIES INVOLVES A HIGH DEGREE OF

RISK.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS

APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY

OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

The

information in this prospectus is not complete and may be

changed. The Selling Shareholders may not sell the Shares until the

registration statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell the Shares and it

is not soliciting an offer to buy the Shares in any state where the offer or

sale is not permitted.

The date

of this prospectus is _________________, 2010.

- 2

-

TABLE OF CONTENTS

|

|

Page

|

|

Prospectus

Summary

|

4

|

|

Summary

Financial Data

|

6

|

|

Risk

Factors

|

7

|

|

Determination

of Offering Price

|

9

|

|

Dilution

|

10

|

|

Description

of Business

|

10

|

|

Properties

|

11

|

|

Fiscal

Year

|

17

|

|

Transfer

Agent

|

18

|

|

Employees

|

18

|

|

Stock

Option Plan

|

18

|

|

Competition

|

18

|

|

History

|

18

|

|

Management's

Discussion and Analysis or Plan of Operation

|

20

|

|

Disclosure

Controls and Procedures

|

27

|

|

Market

for Common Equity and Related Stockholder Matters

|

28

|

|

Directors,

Executive Officers, Promoters, Control Persons

|

29

|

|

Executive

Compensation

|

31

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

32

|

|

Certain

Relationships and Related Transactions

|

32

|

|

Organization

Within the Last Five Years

|

33

|

|

Description

of Securities

|

33

|

|

Use

of Proceeds

|

33

|

|

Determination

of Offering Price

|

33

|

|

Selling

Shareholders and Plan of Distribution

|

33

|

|

Legal

Proceedings

|

37

|

|

Legal

Matters

|

37

|

|

Experts

|

37

|

|

Disclosure

of Commission Position on Indemnification for Securities Act

Liabilities

|

37

|

|

How

To Get More Information

|

38

|

|

Glossary

|

38

|

|

Index to Financial

Statements

|

|

|

Financial

Statements for the nine month period ended September 30, 2009 (unaudited)

and December 31, 2008 (audited)

|

F-1

|

|

Financial

Statements for the years ended December 31, 2008 and

2007 (audited)

|

F-15

|

Until

______________, 2010, all dealers that effect transactions in these securities,

whether or not participating in this offering, may be required to deliver a

prospectus. This is in addition to the dealer’s obligation to deliver

a prospectus when acting as underwriters and with respect to their unsold

allotments or subscriptions.

- 3

-

PROSPECTUS

SUMMARY

History and

Business. Our name is Offshore Petroleum Corp.

and we sometimes refer to ourselves in this prospectus as “Offshore Petroleum”

or “Offshore”, the “Company” or as “we,” “our,” or “us.” We are an

oil and gas exploration company. Our objective is to explore and, if

warranted, develop the area covered by eight licenses for which we have applied

to the Government of the Commonwealth of the Bahamas (the

“Licenses”). The area is located in the offshore waters controlled by

the Commonwealth of the Bahamas; as more fully described herein. We

were incorporated in the state of New York on September 8, 1999, under the name

of Enviroclens Inc. On January 23, 2007, the Company moved its

jurisdiction and was incorporated in the State of Delaware. On May 9,

2007, the Company changed its name to Offshore Petroleum Corp.

On

November 30, 2009, the Company closed in escrow a Share Exchange Agreement to

purchase two Cayman Island companies which will become wholly owned subsidiaries

of the Company (the “Share Exchange Agreement”). Pursuant to the

Share Exchange Agreement, the Cayman companies to be acquired by Offshore are

Atlantic Petroleum Ltd. (“Atlantic”) and Bahamas Exploration Limited

(“Bahamas”). Atlantic and Bahamas together are sometimes referred to

herein as our “Subsidiaries.” Pursuant to the Share Exchange

Agreement, upon the breaking of escrow and completion of the closing, Offshore

will release to the shareholders of the corporate parent of the Subsidiaries (a)

15 million common shares of Offshore and (b) a promissory note with a face

amount of $1.5 million payable over a two-year term and bearing interest at

5%. Upon such breaking of escrow and completion of the closing the

Subsidiaries will be wholly owned by Offshore. The Share Exchange

Agreement is more fully described herein in the section entitled, “PROPERTIES –

Share Exchange Agreement.” The Subsidiaries each have applied to the

Government of the Commonwealth of the Bahamas for certain rights to explore for

oil and gas in territorial waters controlled by the Commonwealth of the

Bahamas. We refer to such exploration rights as the

“Licenses.” The Subsidiaries are seeking eight Licenses that are more

fully described herein in the section herein entitled, “PROPERTIES – Licenses

for Exploration.” The geographic location and area covered by the

Licenses (the “Licensed Areas”) and a description of the work that has been

performed on the Licensed Areas is described herein in the section entitled,

“PROPERTIES – Description of Licensed Areas”. The closing of the

Share Exchange Agreement is contingent upon certain closing conditions,

including the granting of the Licenses by the Bahamian

Government. There is no assurance that the Licenses will be granted

or that the closing will be completed. We will not list our shares on

any exchange, or further pursue the effectiveness of the registration statement

of which this prospectus forms a part, unless the closing is

completed.

If the

Licenses are granted and the closing of the Share Exchange Agreement completed,

Offshore will endeavor to secure the financing to undertake exploration of the

area covered by the Licenses. Offshore may seek a joint venture

partner with exploration experience and operational capability to undertake our

exploration activities and assist with financing. Our activities are

subject to risks and uncertainties described herein under “RISK

FACTORS.” Potential investors in the Company’s shares are strongly

urged to review carefully such RISK FACTORS.

Our head

office is at 110 East Broward Boulevard, Suite 1700, Ft. Lauderdale, FL 33301

and our administration office is at 1226 White Oaks Blvd., Oakville, Ontario

Canada L6H 2B9. Our telephone numbers are 877-655-5501 and our fax

number is 866-786-6415.

WE

HAVE NO RESERVES. WE ARE IN AN EXPLORATION STAGE

ONLY. READERS ARE STRONGLY URGED TO READ THE “RISK FACTORS” SECTION

OF THIS PROSPECTUS.

Neither

the Governor-General, the Minister or any Governmental Department of the

Government of the Bahamas, or any person or body acting on their behalf, has

formed or expressed an opinion that the Licensed Areas are, from their

geological formation or otherwise, likely to contain petroleum.

- 4

-

Securities Being

Offered. We have 45,300,000 shares of common stock, par value

$0.0001 per share (“Shares”) issued and outstanding as of December 15,

2009. The Selling Shareholders are offering up to 17,502,500

Shares. No public market exists for the Shares or any other security

issued by Offshore. Offshore will undertake to include its Shares for

trading on the Over-The-Counter Bulletin Board, however, no assurance can be

given that such market will be established. Offshore will not

undertake to list, or include for quotation, any other security of the Company

on any exchange or quotation system. The Selling Shareholders may

offer to sell the Shares being offered in this prospectus at fixed prices, at

prevailing market prices at the time of sale, at varying prices or at negotiated

prices. There is no minimum number of shares that must be sold in

this offering.

Risk Factors. You

should read the “RISK FACTORS” section as well as the other cautionary

statements throughout this prospectus so that you understand the risks

associated with an investment in our securities. Any investment in

our common stock should be considered a high-risk investment because of the

nature of mineral exploration. Only investors who can afford to lose

their entire investment should invest in these securities.

Use of

Proceeds. The Selling Shareholders are selling shares of

common stock covered by this prospectus for their own account. We

will not receive any of the proceeds from the sale of these shares by the

Selling Shareholders. Our working capital and any additional

financing we obtain in the future will be used to fund our operations and

administrative expenses, maintain our Licenses and fund exploration for oil and

gas in the areas subject to our Licenses, when granted. See

PROPERTIES – Licenses for Exploration. We are paying all of the

expenses relating to the registration of the Selling Shareholders’ Shares, but

we will not pay any commissions or expenses of the actual sale of the

Shares.

- 5

-

SUMMARY

FINANCIAL DATA

The

following summary financial data should be read in conjunction with MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, the

audited FINANCIAL STATEMENTS OF OFFSHORE from inception to December 31, 2008 and

the internally prepared unaudited FINANCIAL STATEMENTS OF OFFSHORE for the nine

month period ended September 30, 2009, including the notes thereto, contained

elsewhere in this Prospectus.

|

Balance

|

As at

|

As at

|

||||||

|

Sheet Data

|

Sept. 30, 2009

|

Dec. 31, 2008

|

||||||

|

(Unaudited)

|

(Audited)

|

|||||||

|

Cash

|

$ | 436,564 | $ | Nil | ||||

|

Total

Assets

|

$ | 436,564 | $ | Nil | ||||

|

Liabilities

|

$ | 44,687 | $ | 10,758 | ||||

|

Total

Stockholders' Equity (Deficiency)

|

$ | 391,877 | $ | (10,758 | ) | |||

|

Statement of

|

For the nine-month

|

For the nine-month

|

||||||

|

Operations Data

|

period ended

|

period ended

|

||||||

|

Sept. 30, 2009

|

Sept. 30, 2008

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Revenue

from Operations

|

$ |

Nil

|

$ | Nil | ||||

|

Other

Income-Interest

|

$ | 408 | $ | Nil | ||||

|

Net

Loss

|

$ | 102,465 | $ | Nil | ||||

- 6

-

RISK

FACTORS

|

1.

|

THE

COMPANY HAS NO SOURCE OF OPERATING REVENUE AND EXPECTS TO INCUR

SIGNIFICANT EXPENSES BEFORE ESTABLISHING AN OPERATING COMPANY, IF IT IS

ABLE TO ESTABLISH AN OPERATING COMPANY AT

ALL.

|

Currently,

the Company has no source of revenue, limited working capital and no commitments

to obtain additional financing. The Company will require significant

additional working capital to maintain its Licenses, when granted, and to carry

out its exploration programs in the Licensed Areas. Failure to raise

the necessary capital to maintain our Licenses and commence exploration could

cause the Company to go out of business.

|

2.

|

WE

HAVE NO TRACK RECORD

|

The

Company has no exploration track record or operating history upon which an

evaluation of its future success or failure can be made.

|

3.

|

OUR

DEVELOPMENT AND EXPLORATION OPERATIONS REQUIRE SUBSTANTIAL CAPITAL AND WE

MAY BE UNABLE TO OBTAIN NEEDED CAPITAL OR FINANCING ON SATISFACTORY TERMS,

WHICH COULD LEAD TO A LOSS OF OUR

LICENSES.

|

Our

Licenses with the Bahamian Government, if we are successful in obtaining them,

will require us to pay rent and meet minimum annual investment thresholds

for the exploration and, if warranted, development of the Licensed Areas, as

more fully described in the section entitled, “PROPERTIES – Licenses for

Exploration.” Rent has been prepaid for the first year. In

the second and third years of the initial term of the Licenses, our Subsidiaries

will pay an aggregate of $600,000 and $800,000 in rent respectively. In addition

to the payment of rent, with respect to each of the eight Licenses, Atlantic and

Bahamas must invest specified amounts in the exploration and development of the

Licensed Areas. Such investments must be for qualifying activities

and expenses as specified in the License. In the first year of each

License, each Subsidiary must invest an aggregate of $250,000 in its Licensed

Areas. Each Subsidiary must then invest an aggregate of $375,000 in

its Licensed Areas in the second and third years in order to maintain their

respective Licenses. Consequently, the Subsidiaries will invest in

qualifying expenditures an aggregate of $500,000 in the first year of the

Licenses and $750,000 in each of the second and third years of the

Licenses. The Company believes it has sufficient capital and

exploration credits to ensure it meets its operating requirements over the next

year. Overall, the Company believes it must raise $4 million to meet

the conditions of the initial three-year term of all eight

Licenses. If we are unable to meet such conditions, we will lose some

or all of our Licenses and cease doing business, in which case our shareholders

will lose their investment in the Company.

|

4.

|

IF

THE COMPANY DEVELOPS HYDROCARBON RESOURCES, THERE IS NO ASSURANCE THAT

PRODUCTION WILL BE PROFITABLE.

|

Even if

the Company finds hydrocarbon resources, there is no assurance that it will be

able to produce them or that a production operation would be profitable on any

of its Licenses.

- 7

-

|

5.

|

OIL

AND NATURAL GAS PRICES ARE VOLATILE AND SUBSTANTIAL DECLINES WILL

ADVERSELY AFFECT OUR FINANCIAL RESULTS AND IMPEDE OUR

GROWTH.

|

Profitability

and liquidity are substantially dependent upon prevailing prices for oil and

natural gas, which can be extremely volatile. Even relatively modest drops in

prices can significantly affect financial results. Prices for oil and natural

gas may fluctuate widely in response to relatively minor changes in the supply

of, and demand for, oil and natural gas, market uncertainty and a wide variety

of additional factors that are beyond our control, such as the domestic and

foreign supply of oil and natural gas; the price of foreign imports; the ability

of members of the Organization of Petroleum Exporting Countries to agree to and

maintain oil price and production controls; technological advances affecting

energy consumption, domestic and foreign governmental regulations, and

variations between product prices at sales points and applicable index

prices. In addition, regional oil and gas prices may vary from

national prices due to regional factors such as regional gas production being

constrained by regional gas pipeline capacity.

|

6.

|

OIL

AND GAS OPERATIONS ARE INHERENTLY

RISKY.

|

The

nature of the oil and gas business involves a variety of risks, particularly the

risk of drilling wells that are found to be unable to produce any oil and/or gas

or unable to produce and sell oil and/or gas at prices sufficient to repay the

costs of the wells. It is possible that we may in the future

recognize substantial impairment expenses when uneconomic wells and declines in

oil and gas prices result in impairments of the capitalized costs of our oil and

gas Licenses.

The oil

and gas business also includes operating hazards such as fires, explosions,

cratering, blow-outs and encountering formations with abnormal pressures. The

occurrence of any of these events could result in losses and, if not fully

insured against, could have a material adverse effect on our financial position

and results of operations.

We expect

to carry stated levels and types of casualty and liability insurance and

additional insurance against well blow-outs and other unusual risks in the

drilling, completion and operation of oil and gas wells at such time as we reach

this stage of development. However, there may still be fires, blow-outs and

other events that result in losses not fully covered by our

insurance.

|

7.

|

THE

COMPANY IS HIGHLY DEPENDENT UPON ITS OFFICERS AND

DIRECTORS. BECAUSE OF THEIR INVOLVEMENT IN OTHER SIMILAR

BUSINESSES WHICH MAY BE COMPETITORS, THEY MAY HAVE A CONFLICT OF

INTEREST.

|

None of

the Company’s officers or directors works for the Company on a full-time

basis. There are no proposals or definitive arrangements to engage

them on a full-time basis. None of the officers or directors have

employment agreements with the Company or its Subsidiaries. All of

the directors are officers or directors of other companies in similar

exploration businesses. Such business activities may be considered a

conflict of interest because these individuals must continually make decisions

on how much of their time they will allocate to the Company as against their

other business projects, which may be competitive. Also, the Company

has no key man life insurance policy on any of its senior management or

directors. The loss of one or more of these officers or directors

could adversely affect the ability of the Company to carry on

business.

|

8.

|

THE

COMPANY COULD ENCOUNTER REGULATORY AND PERMITTING

DELAYS.

|

Even if

the Company is successful in obtaining the Licenses, the Company could face

delays in obtaining production leases to proceed with production on the Licensed

Areas. Such delays could jeopardize financing, if any is available,

which could result in having to delay or abandon work on some or all of the

Licensed Areas.

|

9.

|

WE

ARE SUBJECT TO EXTENSIVE GOVERNMENT

REGULATIONS

|

Our

business is affected by Bahamian Government laws and regulations, including

energy, environmental, conservation, tax and other laws and regulations relating

to the oil and gas development and production.

- 8

-

The areas

outlined in the Bahamian Petroleum Act of 1971 and the regulations promulgated

thereunder include: (a) the prevention of waste, (b) the discharge of materials

into the environment, (c) the conservation of oil and natural gas, (d)

pollution, (e) permits for drilling operations, (f) drilling bonds and (g)

reports concerning operations, spacing of wells, and the unitization and pooling

of properties. Failure to comply with any laws and regulations may result

in the loss of one or more Licenses, and/or assessment of administrative, civil

and criminal penalties. Moreover, changes in any of the above outlined

laws or regulations could have a material adverse effect on our business.

Concerns of global warming may result in changes to laws and regulations

that increase the cost of oil and gas operations and decrease the use and demand

for crude oil and natural gas. In view of the many uncertainties with

respect to current and future laws and regulations, including their

applicability to us, we cannot predict the overall effect of such laws and

regulations on our future operations.

|

10.

|

THERE

ARE PENNY STOCK SECURITIES LAW CONSIDERATIONS THAT COULD LIMIT YOUR

ABILITY TO SELL YOUR SHARES.

|

Our

common stock is considered a "penny stock" and the sale of our stock by you will

be subject to the "penny stock rules" of the Securities and Exchange

Commission. The penny stock rules require broker-dealers to take

steps before making any penny stock trades in customer accounts. As a

result, the market for our shares could be illiquid and there could be delays in

the trading of our stock which would negatively affect your ability to sell your

shares and could negatively affect the trading price of your

shares.

|

11.

|

SHORTAGES

OF RIGS, EQUIPMENT, SUPPLIES AND PERSONNEL COULD DELAY OR OTHERWISE

ADVERSELY AFFECT OUR COST OF

EXPLORATION.

|

We, or

our joint venture operators, may experience shortages of drilling and completion

rigs, field equipment and qualified personnel which may cause delays in our

ability to continue to drill, complete, test and connect wells to processing

facilities. Shortages of drilling and completion rigs, field equipment or

qualified personnel could delay, restrict or curtail our exploration operations,

which may materially adversely affect our business.

|

12.

|

SHORTAGES

OF TRANSPORTATION SERVICES AND PROCESSING FACILITIES MAY RESULT IN OUR

RECEIVING A DISCOUNT IN THE PRICE WE RECEIVE FOR OIL AND NATURAL GAS SALES

OR MAY ADVERSELY AFFECT OUR ABILITY TO SELL OUR OIL AND NATURAL

GAS.

|

We may

experience limited access to transportation used to transport our oil and

natural gas to processing facilities. We may also experience limited access to

processing facilities. If either or both of these situations arise, we may not

be able to sell our oil and natural gas at prevailing market prices, or may be

completely unable to sell our oil and/or natural gas, which would materially

adversely affect our business.

DETERMINATION

OF OFFERING PRICE

The

offering price has been estimated solely for the purpose of calculating the

registration fee payable to the Securities and Exchange Commission in connection

with this prospectus. The offering price is not an indication of

value nor has it been established by any recognized methodology for deriving the

value of the Shares.

- 9

-

DILUTION

We will

likely be required to issue more common stock from treasury in order to raise

additional capital. If common stock is issued to raise additional

capital, it will result in the dilution of the existing

shareholders.

DESCRIPTION

OF BUSINESS

We are an

oil and gas exploration company. Our objective is to explore and, if

warranted and feasible, to develop oil and/or gas production on sites covered by

our Licenses which are located in waters off the shore of the Commonwealth of

the Bahamas.

On

November 30, 2009, the Company closed in escrow a Share Exchange Agreement with

NPT Oil Corporation Ltd, a Cayman Islands company (“NPT”) to purchase from NPT

all of the equity stock of two Cayman Island companies (the “Share Exchange

Agreement”). Pursuant to the Share Exchange Agreement, the Cayman

Islands companies to be acquired by Offshore are Atlantic Petroleum Ltd.

(“Atlantic”) and Bahamas Exploration Limited (“Bahamas”). Atlantic

and Bahamas together are sometimes referred to herein as our

“Subsidiaries.” Pursuant to the Share Exchange Agreement, upon the

breaking of escrow and completion of the closing, Offshore will pay

consideration to NPT consisting of: (a) 15 million Shares of Offshore and (b) a

promissory note with a face amount of $1.5 million payable over a two-year term

and bearing interest at 5%. Concurrent with the execution of the

Share Exchange Agreement, NPT assigned to its own shareholders all of the Shares

of Offshore to be issued upon closing of the Share Exchange Agreement. Ryan

Bateman, John Rainwater and Mickey Wiesinger, principals of NPT, are

members of Offshore’s Board of Directors. Mr. Rainwater is the

President and Chairman of the Board of Offshore.

The Share

Exchange Agreement is more fully described below in “PROPERTIES – Share Exchange

Agreement.”

The

Subsidiaries each have applied to the Government of the Commonwealth of the

Bahamas for certain rights to explore for oil and gas in territorial waters

controlled by the Commonwealth of the Bahamas. We refer to such

exploration rights as the “Licenses.” The Subsidiaries are seeking

eight Licenses that are more fully described below in “PROPERTIES – Licenses for

Exploration.” The geographic location and area covered by the

Licenses (the “Licensed Areas”) and a description of the work that has been

performed on the Licensed Areas is described below in “PROPERTIES – Description

of Licensed Areas” The closing of the Share Exchange Agreement is

contingent upon certain closing conditions, including the granting of the

Licenses by the Bahamian Government. There is no assurance that the

Licenses will be granted or that the closing will be completed. We

will not list our Shares on any exchange, or further pursue the effectiveness of

the registration statement of which this prospectus forms a part, unless the

closing is completed.

In the

event that the Licenses are granted and the closing of the Share Exchange

Agreement completed, Offshore will endeavor to secure the financing to undertake

exploration of the area covered by the Licenses. Our activities are

subject to risks and uncertainties described herein under “RISK

FACTORS.” Potential investors in the Company’s Shares are strongly

urged to review carefully such RISK FACTORS. As of the date of this

prospectus, our applications for the Licenses are pending and, we believe, close

to receiving approval from the Bahamian Government.

- 10

-

PROPERTIES

Share Exchange

Agreement

On

November 30, 2009, the Company closed in escrow a Share Exchange Agreement with

NPT Oil Corporation Ltd, a Cayman Islands company (“NPT”) to purchase from NPT

all of the equity stock of two Cayman Island companies (the “Share Exchange

Agreement”). Pursuant to the Share Exchange Agreement, the Cayman

Islands companies to be acquired by Offshore are Atlantic Petroleum Ltd.

(“Atlantic”) and Bahamas Exploration Limited (“Bahamas”). Atlantic

and Bahamas together are sometimes referred to herein as the

“Subsidiaries.” Pursuant to the Share Exchange Agreement, upon the

breaking of escrow and completion of the closing, Offshore will pay

consideration to NPT consisting of: (a) 15 million common shares of Offshore and

(b) a promissory note with a face amount of $1.5 million payable over a two-year

term and bearing interest at 5%. Concurrent with the execution of the

Share Exchange Agreement, NPT assigned to its own shareholders all of the shares

of Offshore to be issued upon closing of the Share Exchange

Agreement. In connection with the Share Exchange Agreement, Ryan

Bateman, John Rainwater and Mickey Wiesinger, principals of NPT, were appointed

to Offshore’s Board of Directors.

As

further described below under “Licenses for Exploration,” the Subsidiaries each

have applied to the Government of the Commonwealth of the Bahamas for certain

rights to explore for oil and gas in territorial waters controlled by the

Commonwealth of the Bahamas. We refer to such exploration rights and

the written agreements with the Bahamian Government that specify such rights as

the “Licenses.” The Subsidiaries are seeking eight such

Licenses. The breaking of escrow and closing of the Share Exchange

Agreement is contingent upon certain closing conditions, including the granting

of the Licenses by the Bahamian Government to the Subsidiaries. The

Licenses application process began on December 12, 2008. The Company

and the Subsidiaries believe they are in the final stages of completing this

process and obtaining the Licenses. There is no assurance, however,

that the Licenses will be granted or that the escrow will be broken and the

closing completed. Offshore will not list its shares on any exchange,

or further pursue the effectiveness of the registration statement of which this

prospectus forms a part, unless the closing is completed. The parties

have agreed that the closing shall be completed on or before February 15,

2010. Such closing date may be extended by the mutual agreement of

the parties.

The Share

Exchange Agreement provides that the equity shares of the Subsidiaries must be

conveyed to Offshore free and clear of any encumbrances

whatsoever. Further, the Subsidiaries must obtain the approval of the

Bahamian Government of the sale of the Subsidiaries by NPT to Offshore and

provide evidence that the Licenses shall remain in effect following the

completion of the closing. NPT has agreed, as a condition of the

Share Exchange Agreement, to indemnify Offshore for any breach of the Share

Exchange Agreement.

The

following assets (which were held by the Subsidiaries as of the date of the

Share Exchange Agreement) form the basis of our knowledge of the Licensed

Areas.

|

|

·

|

a

1977 2D seismic data shoot by Tenneco

Inc.

|

|

|

·

|

Geophysical

analysis of a qualified engineer performed in1977 including 2D seismic

data

|

|

|

·

|

Geophysical

analysis of a qualified engineer regarding the 1977 seismic

data

|

|

|

·

|

Gravity

and magnetic data relating to the Blake Plateau,

Bahamas

|

|

|

·

|

an

Oil migration model relating to the Licensed

Areas

|

|

|

·

|

Ocean

floor seep satellite data - Bahamas

|

|

|

·

|

Pore

pressure analysis studies relating to the Licensed

Areas

|

|

|

·

|

Source

rock study and analysis of the Licensed

Areas

|

|

|

·

|

Analog

field analysis with volumetric

calculations

|

|

|

·

|

a

Logistical and marketing study –

Bahamas

|

|

|

·

|

Misc.

geological maps of the Bahamas including the Licensed

Areas

|

The

Subsidiaries invested approximately $500,000 to obtain the above

information. This amount is eligible to be applied against work

commitments on the Licenses in the first year of the Licenses. Such

credit for work performed and the investment of one year’s rent in each of the

eight Licenses (upon application) was a component of the valuation and resulting

consideration paid by Offshore for the Subsidiaries pursuant to the Share

Exchange Agreement.

- 11

-

Licenses for

Exploration

The

Subsidiaries’ applications for the Licenses are pending and, we believe, close

to receiving approval from the Bahamian Government. Final approval of

the Licenses has not been granted by

the Bahamian Government as of the date of this prospectus. While the

terms and conditions of the Licenses cannot be stated with certainty until the

Licenses are issued, based upon drafts of the Licenses and discussions with the

Bahamian Government, the Company anticipates that the rights to be granted to

the Subsidiaries will consist of eight separate Licenses covering geographic

areas specified in each License and described below in “Description of Licensed

Areas.” They are designated as follows.

|

Subsidiary

Holding License

|

Name

Assigned to Specific Licensed Area

|

|

Atlantic

Petroleum Ltd

|

License

No. 1 Aphrodite

|

|

License

No. 2 Mercury

|

|

|

License

No. 3 Neptune

|

|

|

License

No. 4 Venus

|

|

|

Bahamas

Exploration Limited

|

License

No. 5 Apollo

|

|

License

No. 6 Poseidon

|

|

|

License

No. 7 Hermes

|

|

|

License

No. 81 Zeus

|

Term

In each

case, the License will have an initial term of three (3) years with one option

to renew for another three-year term. After the second renewal term,

the Licenses can be renewed for two more three-year terms at the discretion of

the Bahamian Government as to all or a portion of the Licensed Area. At any time

during the term of the Licenses, or any renewal terms, if we drill a well that

can be developed into a producing well, the Subsidiary holding the License has a

right to convert the License into a Lease. The terms and conditions

of such a Lease are described below in “Development and Conversion Into

Lease.”

Rent

Each

License requires annual rent of $50,000 in the first year (already paid in each

case with the application for the License) and $75,000 in the second year and

$100,000. The annual rent in the third year and any subsequent renewal years

would be $100,000.

Investment in

Development

In

addition to the payment of rent, Atlantic and Bahamas must invest specified

amounts in the exploration and development of the Licensed Areas. In

the first year of each License, each of the Subsidiaries must invest an

aggregate of $250,000 in qualifying expenditures for its four Licensed

Areas. The Subsidiaries each must then invest an aggregate of

$375,000 in qualifying expenditures for its four Licensed Areas in the second

and third years in order to maintain their respective

Licenses. Consequently, the Subsidiaries will invest an aggregate of

$500,000 in the first year of the Licenses and $750,000 for each of the second

and third years of the Licenses. Of the amount due in the first year

of the Licenses, Atlantic and Bahamas will receive credit of $500,000 for work

performed and information obtained prior to the date hereof. In the

event a Subsidiary has qualifying expenditures for a given Licensed Area greater

than the amount required by the License, the surplus can be used to offset

annual expenditure obligations in subsequent years. If, at the end of

the License term or any renewal period thereafter, a Subsidiary has not met the

aggregate expenditure obligations for such term, such Subsidiary would owe a

penalty to the Bahamian Government equal to one-half of the amount

deficient.

- 12

-

Development and Conversion

Into Lease

Each

License entitles its holder to develop and operate oil and gas rigs in the

Licensed Area, subject to certain approvals of the Bahamian Government,

including approval of any and all third party operators or joint

venturers. In the event that we drill a well that can be developed

into a producing well, the Subsidiary holding the License has a right to convert

the License into a Lease which would contain substantially identical terms and

conditions. The Lease would have an initial term of ten years with

one option to renew for an additional ten-year renewal term. We would

pay royalties to the Bahamian Government as follows.

|

Production Levels

|

Percentage Royalty based upon fair

market value of the oil produced1

|

|

First

75,000 barrels/day

|

12½%

of FMV

|

|

75,000

– 150,000 barrels/day

|

15%

of FMV

|

|

150,000

– 250,000 barrels/day

|

17½

of FMV

|

|

All

amounts in excess of 250,000 barrels

|

20%

of FMV

|

| Natural Gas |

12½%

of

FMC

|

1 All

royalty amounts are to be paid in U.S. dollars, unless an arrangement for

payment in kind has been made. The fair market value of the petroleum

shall be determined by the mutual agreement of the parties. Rent paid

by under the Lease shall be credited against royalty payments.

In the

event a producing well is drilled and commences operation during the term of a

License and such License has not been converted into a lease, the Subsidiary

would be required to pay to the Bahamian Government royalties in an amount

identical to the royalty that would be owned pursuant to a lease.

Additional

Agreements

Each

Subsidiary is required to maintain insurance issued by carriers approved by the

Bahamian Government. In addition, each of the Subsidiaries is

required to post a bond of $1 million backing funding and performance of the

investment in development to be undertaken pursuant to the Licenses, as

described above in “Investment in Development” above. Such bond must

be issued by an approved financial institution, and the amount of the bond is to

be reduced at the end of each year by an amount equal to the actual amount

expended on exploration.

The

Subsidiaries are required to have a manager that is a Bahamian resident, and a

qualified engineer must supervise any and all exploration and operation

undertaken on the Licensed Areas. The Licenses may not be assigned without the

written consent of the Bahamian Government.

We are

generally obligated to conduct our operations in a manner that prevents

contamination of the environment. The Bahamian Government is

authorized to oversee our operations and enforce these requirements pursuant to

the Bahamian Petroleum Act.

Additional Agreements under

Lease

In the

event any License is converted into a lease, as described above, the

Subsidiaries-lessee would be required to sell to refineries in the Bahamas up to

25% of the oil produced from such well. During the term of any lease

the Subsidiary-lessee would be required to indemnify the Bahamian Government

from any third party claims. In addition, the Bahamian Government

would have the right to appoint a Bahamian Governmental official to such

Subsidiary’s Board of Directors and the right to pre-empt the purchase of the

output of a producing well in the event of war.

- 13

-

Neither

the Governor-General, the Minister or any Governmental Department of the

Government of the Bahamas, or any person or body acting on their behalf, has

formed or expressed an opinion that the Licensed Areas are, from their

geological formation or otherwise, likely to contain petroleum.

Description

of Licensed Areas

The

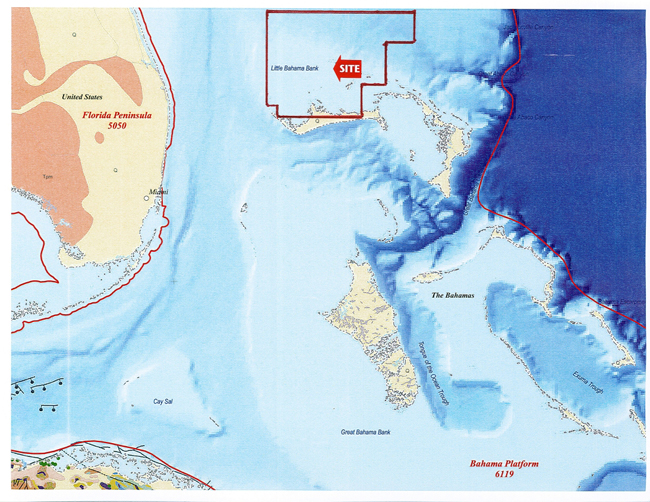

following map shows the location of the Lincensed Area.

The

following are legal descriptions of the area covered by the

Licenses.

LICENSED

AREAS HELD BY ATLANTIC PETROLEUM LTD.

Limits of

Area Aphrodite

All those

lands or submarine areas or both situate in the Commonwealth of the Bahamas and

having an approximate area of 848,630 acres.

The

following coordinates specify the Southwestern corner of each of the ten (10)

submarine blocks to be covered by License No. 1 (Area Aphrodite).

|

Block

No.

|

Longitude

|

Latitude

|

||

|

16

|

79°

|

00'

W

|

26°

|

50'

N

|

|

17

|

78°

|

50'

W

|

26°

|

50'

N

|

|

18

|

78°

|

20'

W

|

26°

|

40'

N

|

|

19

|

78°

|

30'

W

|

26°

|

50'

N

|

|

20

|

78°

|

20'

W

|

26°

|

50'

N

|

|

9

|

79°

|

00'

W

|

27°

|

00'

N

|

|

46

|

79°

|

00'

W

|

26°

|

40'

N

|

|

3

|

78°

|

50'

W

|

26°

|

40'

N

|

|

5

|

78°

|

30'

W

|

26°

|

40'

N

|

|

4

|

78°

|

40'

W

|

26°

|

40'

N

|

Limits of

Area Mercury

All those

lands or submarine areas or both situate in the Commonwealth of the Bahamas and

having an approximate area of 848,630 acres.

The

following coordinates specify the Southwestern corner of each of the ten (10)

submarine blocks to be covered by License No. 2 (Area Mercury).

|

Block

No.

|

Longitude

|

Latitude

|

||

|

47

|

78°

|

20'W

|

27°

|

20'

N

|

|

37

|

78°

|

40'W

|

27°

|

30'

N

|

|

38

|

78°

|

30'W

|

27°

|

30'

N

|

|

39

|

78°

|

20'W

|

27°

|

30'

N

|

|

29

|

78°

|

20'W

|

27°

|

40'

N

|

|

18

|

78°

|

20'W

|

27°

|

50'

N

|

|

6

|

78°

|

20'W

|

28°

|

00'

N

|

|

7

|

78°

|

10'W

|

28°

|

00'

N

|

|

8

|

78°

|

00'W

|

28°

|

00'

N

|

|

20

|

78°

|

00'W

|

27°

|

50

N

|

- 14

-

Limits of

Area Neptune

All those

lands or submarine areas or both indicated on the attached plat situate in the

Commonwealth of the Bahamas and having an approximate area of 848,630

acres.

The

following coordinates specify the Southwestern corner of each of the ten (10)

submarine blocks to be covered by License No. 3 (Area Neptune).

|

Block

No.

|

Longitude

|

Latitude

|

||

|

40

|

78°

|

10'W

|

27°

|

30'N

|

|

30

|

78°

|

10'W

|

27°

|

40'N

|

|

31

|

78°

|

00'W

|

27°

|

40'N

|

|

32

|

77°

|

50'W

|

27°

|

40'N

|

|

19

|

78°

|

10'W

|

27°

|

50'N

|

|

21

|

77°

|

50'W

|

27°

|

50'N

|

|

22

|

77°

|

40'W

|

27°

|

50'N

|

|

9

|

77°

|

50'W

|

28°

|

00'N

|

|

10

|

77°

|

40'W

|

28°

|

00'N

|

|

11

|

77°

|

30'W

|

28°

|

00'N

|

Limits of

Area Venus

All those

lands or submarine areas or both indicated on the attached plat situate in the

Commonwealth of the Bahamas and having an approximate area of 848,630

acres.

The

following coordinates specify the Southwestern corner of each of the ten (10)

submarine blocks to be covered by License No. 4 (Area Venus).

|

Block

No.

|

Longitude

|

Latitude

|

||

|

11

|

78°

|

40'W

|

27°

|

00'

N

|

|

12

|

78°

|

30'W

|

27°

|

00'

N

|

|

13

|

78°

|

20'W

|

27°

|

00'

N

|

|

45

|

78°

|

10'W

|

27°

|

00'

N

|

|

10

|

78°

|

50'W

|

27°

|

00'

N

|

|

1

|

79°

|

00'W

|

27°

|

10'

N

|

|

2

|

78°

|

50'W

|

27°

|

10'

N

|

|

6

|

78°

|

10'W

|

27°

|

10'

N

|

|

43

|

79°

|

00'W

|

27°

|

20'

N

|

|

48

|

78°

|

10'W

|

27°

|

20'

N

|

- 15

-

LICENSED

AREAS HELD BY BAHAMAS EXPLORATION LIMITED

Limits of

Area Apollo

All those

lands or submarine areas or both situate in the Commonwealth of the Bahamas and

having an approximate area of 848,630 acres.

The

following coordinates specify the Southwestern corner of each of the ten (10)

submarine blocks to be covered by License No. 5 (Area Apollo).

|

Block

No.

|

Longitude

|

Latitude

|

||

|

1

|

79°

|

10'W

|

28°

|

00'

N

|

|

2

|

79°

|

00'W

|

28°

|

00'

N

|

|

3

|

78°

|

50'W

|

28°

|

00'

N

|

|

4

|

78°

|

40'W

|

28°

|

00'

N

|

|

16

|

78°

|

40'W

|

28°

|

00'

N

|

|

41

|

79°

|

20'W

|

27°

|

20'

N

|

|

33

|

79°

|

20'W

|

27°

|

30'

N

|

|

23

|

79°

|

20'W

|

27°

|

40'

N

|

|

12

|

79°

|

20'W

|

27°

|

50'

N

|

|

13

|

79°

|

10'W

|

27°

|

50'

N

|

Limits of

Area Hermes

All those

lands or submarine areas or both situate in the Commonwealth of the Bahamas and

having an approximate area of 848,630 acres.

The

following coordinates specify the Southwestern corner of each of the ten (10)

submarine blocks to be covered by License No. 6 (Area Hermes).

|

Block

No.

|

Longitude

|

Latitude

|

||

|

14

|

79°

|

20'W

|

26°

|

50'

N

|

|

7

|

79°

|

20'W

|

27°

|

00'

N

|

|

49

|

79°

|

20'W

|

27°

|

10'

N

|

|

50

|

79°

|

10'W

|

27°

|

10'

N

|

|

8

|

79°

|

10'W

|

27°

|

00'

N

|

|

15

|

79°

|

10'W

|

26°

|

50'N

|

|

42

|

79°

|

10'W

|

27°

|

20'N

|

|

34

|

79°

|

10'W

|

27°

|

30'

N

|

|

24

|

79°

|

10'W

|

27°

|

40'N

|

|

35

|

79°

|

00'W

|

27°

|

30'N

|

Limits of

Area Poseidon

All those

lands or submarine areas or both situate in the Commonwealth of the Bahamas and

having an approximate area of 848,630 acres.

- 16

-

The

following coordinates specify the Southwestern corner of each of the ten (10)

submarine blocks to be covered by License No. 7 (Area Poseidon).

|

Block

No.

|

Longitude

|

Latitude

|

||

|

44

|

78°

|

50'W

|

27°

|

20'N

|

|

36

|

78°

|

50'W

|

27°

|

30'N

|

|

25

|

79°

|

00'W

|

27°

|

40'N

|

|

26

|

78°

|

50'W

|

27°

|

40'N

|

|

27

|

78°

|

40'W

|

27°

|

40'N

|

|

28

|

78°

|

30'W

|

27°

|

40'N

|

|

14

|

79°

|

00'W

|

27°

|

50'N

|

|

15

|

78°

|

50'W

|

27°

|

50'N

|

|

17

|

78°

|

30'W

|

27°

|

50'N

|

|

5

|

78°

|

30'W

|

28°

|

00'N

|

Limits of

Area Zeus

All those

lands or submarine areas or both situate in the Commonwealth of the Bahamas and

having an approximate area of 169,726 acres.

The

following coordinates specify the Southwestern corner of each of the two (2)

submarine blocks to be covered by License No. 8 (Area Zeus).

|

Block

No.

|

Longitude

|

Latitude

|

|

4

|

78° 20'W

|

27° 20'N

|

|

5

|

78° 30'W

|

27° 20'N

|

Further

Exploration

The

Company has sufficient capital and exploration credits to ensure it meets its

operating requirements over the next year. The results of specific

exploration activity on the Licenses will be released as they become

available.

Regulations

Governing Gas and Oil in the Commonwealth of the Bahamas

Our

exploration activities are governed by the Government of the Bahamas, Petroleum

Act which regulates all petroleum exploration in the Bahamas and their

territorial waters. The Act covers among other things, the granting

of licenses, royalties to be paid to the government, pollution control, bonding,

exemption from customs and duties and other ancillary rights. Upon

the granting of the Licenses, the Company and its Subsidiaries will be in

compliance with all currently applicable regulations of the Bahamian

Government.

FISCAL

YEAR

Our

fiscal year end is December 31st.

- 17

-

TRANSFER

AGENT

Our

Transfer Agent and Registrar for the Common Stock is Olde Monmouth Stock

Transfer Co. Inc., 200 Memorial Parkway, Atlantic Highlands, New Jersey

07716.

EMPLOYEES

We have

no full-time employees. We rely primarily upon consultants and

contractors to accomplish our administration and exploration

activities. We are not subject to a union labor contract or

collective bargaining agreement. Management services are provided by

our executive officers on an "as-needed" basis. We have no employment

agreement with any of our officers and directors and we carry no key-man life

insurance.

STOCK

OPTION PLAN

On

September 8, 2008, we adopted the 2008 Stock Option Plan (the "Plan") under

which our officers, directors, consultants, advisors and employees may receive

stock options. The aggregate number of shares of common stock that

may be issued under the plan is 5,000,000. The purpose of the Plan is

to assist us in attracting and retaining selected individuals to serve as

directors, officers, consultants, advisors, and employees of Offshore who

contribute to our success, and to achieve long-term objectives that will inure

to the benefit of all shareholders through the additional incentive inherent in

the ownership of our common stock. Options granted under the plan

will be either "incentive stock options", intended to qualify as such under the

provisions of section 422 of the Internal Revenue Code of 1986, as from time to

time amended (the "Code") or "unqualified stock options". For the

purposes of the Plan, the term "subsidiary" shall mean “Subsidiary Corporation,”

as such term is defined in section 424(f) of the Code, and "affiliate" shall

have the meaning set forth in Rule 12b-2 of the Exchange Act.

The Plan

will be administered by the Board of Directors who will set the terms under

which options are granted. No options have been granted under the

Plan as of the date of this prospectus.

COMPETITION

There is

aggressive competition within the industry to discover and acquire properties

considered to have commercial potential. We compete for the

opportunity to participate in promising exploration projects with other

entities, many of which have much greater resources than we do. In

addition, we compete with others in efforts to obtain financing to explore and

develop oil and gas properties.

HISTORY

We were

incorporated in the State of New York on September 8, 1999 under the name

"Enviroclens Inc." as a wholly owned subsidiary of another

corporation. Our then parent-corporation formed the Company in order

to pursue a proposed business opportunity that was unrelated to its core

business. On September 30, 2002, our former parent corporation issued

shares of the Company as a dividend to its shareholders. The intended

project did not proceed. On January 23, 2007, the Company moved its

jurisdiction and was re-domiciled in the State of Delaware. On May 9,

2007, we changed our name to “Offshore Petroleum Corp.”

On

September 15, 2008, John Rainwater and Mickey Wiesinger were appointed to the

Board of Directors. At that time, Todd D. Montgomery, the then President and

sole Director of the Company, resigned. On March 12, 2009, Ryan Bateman was

appointed to the Board of Directors and on December 1, 2009, Gary Adams was

appointed to the Board of Directors. On January 14, 2010, Mr.

Rainwater was made Chairman of the Board of Directors.

- 18

-

On

November 30, 2009, the Company closed in escrow a Share Exchange Agreement with

NPT Oil Corporation Ltd, a Cayman Islands company (“NPT”) to purchase from NPT

all of the equity stock of the Subsidiaries (the “Share Exchange

Agreement”). Pursuant to the Share Exchange Agreement, upon the

breaking of escrow and completion of the closing, Offshore will pay

consideration to NPT consisting of: (a) 15 million Shares of Offshore and (b) a

promissory note with a face amount of $1.5 million payable over a two-year term

and bearing interest at 5%. Concurrent with the execution of the

Share Exchange Agreement, NPT assigned to its own shareholders all of the Shares

of Offshore to be issued upon closing of the Share Exchange

Agreement. For more information regarding the Subsidiaries and our

properties, please see the section entitled “PROPERTIES – Share Exchange

Agreement”, herein.

Prior to

entering into the Share Exchange Agreement, NPT, through the Subsidiaries,

pursued with the Bahamian Government an application for the

Licenses. NPT was aware of prior exploration that had been conducted

in the Licensed Areas by another oil and gas exploration company and was aware

that the exploration rights in the Licensed Area were available. NPT

funded the costs of forming Atlantic and Bahamas and applying for the

Licenses. Principals of NPT, Ryan Bateman, John Rainwater and Mickey

Wiesinger, are also directors of Offshore.

Private

Placements

The

Company completed private placements of 9,350,000 shares of its common stock at

$0.10 per share on the following dates with the following

investors. These private placements were exempt from registration

under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to

an exemption provided by Regulation D promulgated thereunder (“Regulation

D”).

|

Name

|

Date

Issued

|

Shares

|

$

|

|||||||

|

Sirius

Intervest Ltd.

|

April

14, 2009

|

1,000,000 | 100,000 | |||||||

|

Allentown

Consulting Corp.

|

June

25, 2009

|

1,500,000 | 150,000 | |||||||

|

Catalyst

Trading Inc

|

April

28, 2009

|

750,000 | 75,000 | |||||||

|

Steven

Pearce

|

April

28, 2009

|

500,000 | 50,000 | |||||||

|

Zul

Rashid

|

May

1, 2009

|

200,000 | 20,000 | |||||||

|

Sirius

Intervest Ltd.

|

May

8, 2009

|

1,000,000 | 100,000 | |||||||

|

Zul

Rashid

|

Sept

29, 2009

|

150,000 | 15,000 | |||||||

|

Benjamin

Marler

|

Sept

30, 2009

|

50,000 | 5,000 | |||||||

|

Shane

Manning

|

October

14, 2009

|

100,000 | 10,000 | |||||||

|

Hubert

Manning

|

October

15, 2009

|

100,000 | 10,000 | |||||||

|

Wade

Alexander

|

October

27, 2009

|

250,000 | 25,000 | |||||||

|

Cottonwood

Investments, LLC

|

November

16, 2009

|

2,000,000 | 200,000 | |||||||

|

Ray

Westall

|

November

16, 2009

|

250,000 | 25,000 | |||||||

|

J.

L. Guerra, Jr.

|

November

25, 2009

|

500,000 | 50,000 | |||||||

|

Pineview

Worldwide Corp.

|

December

4, 2009

|

1,000,000 | 100,000 | |||||||

|

Total

|

9,350,000 | 935,000 | ||||||||

- 19

-

MANAGEMENT'S

DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

PLAN OF

OPERATIONS

In the

event that we are successful in Closing the Share Exchange Agreement and

obtaining the Licenses from the Bahamian Government through our then newly

acquired Subsidiaries, our main focus will be raising the additional financing

necessary to pay rent owed under the Licenses for their initial three-year term

and meet our exploration expenditure obligations. For more information regarding

the Licenses please see “PROPERTIES” – Share Exchange Agreement and PROPERTIES -

Licenses for Exploration, herein. We may seek a joint venture partner

with exploration experience and operational capability to undertake our

exploration activities and assist with financing. We will require

substantial additional capital to implement this plan and additional financing

to bring any one or more sites in the Licensed Area to production, if production

is warranted and feasible. We may raise additional capital through a

public offering, private placements of our securities, a joint venture or

through loans or some combination of the foregoing. We estimate that

we will have to raise approximately $4 million to fulfill the terms of the

initial three years of the eight Licenses. If, following exploration,

we believe that any one or more sites in the Licensed Area warrants development,

we will engage a third party to undertake a feasibility study to asses whether a

reserve exists. If a reserve is found to exist, we will consider

options for development, including a joint venture with a significant producing

company or obtaining further financing and contracting for development and

production.

Discussion

of Operations & Financial Condition from inception to December 31, 2008 and

Nine months ended September 30, 2009

Offshore

has no source of revenue and we continue to operate at a loss. We

have no oil or gas reserves of any kind. We expect our operating

losses to continue for so long as we remain in an exploration stage and perhaps

thereafter. As at December 31, 2008, we had accumulated losses of

$23,516. As at September 30, 2009, we had accumulated losses of

$125,981. Our ability to emerge from the exploration stage and

conduct production operations is dependent, in large part, upon our ability to

raise additional financing.

As

described in greater detail below, the Company’s major endeavor for the year

ended December 31, 2008 and the nine month period ended September 30, 2009 has

been its effort to complete the acquisition of Atlantic and Bahamas and to raise

additional working capital. We are continuing our efforts to raise

additional capital to pursue exploration activities.

The

contract for the acquisition of Atlantic and Bahamas has been closed in escrow

subject to the final delivery of the Licenses from the Bahamian Government and

satisfaction of other conditions.

- 20

-

SELECTED FINANCIAL

INFORMATION

|

Sept.

30, 2009

|

Dec.

31, 2008

|

|||||||

|

(Unaudited)

|

(Audited)

|

|||||||

|

Revenues

|

Nil

|

Nil

|

||||||

|

Net

Loss

|

$ | 102,465 | $ | 10,862 | ||||

|

Loss

per share-basic and diluted

|

$ | 0.01 | $ | 0.00 | ||||

|

Total

Assets

|

$ | 436,564 |

Nil

|

|||||

|

Total

Liabilities

|

$ | 44,687 | $ | 10,758 | ||||

|

Cash

dividends declared per share

|

Nil

|

Nil

|

||||||

There

were no assets for the year ended December 31, 2008. For the nine

month period ended September 30, 2009, total assets included cash and cash

equivalents of $436,564. The current assets increased to $436,564 on September

30, 2009 as a result of subscriptions received during the nine month period. For

more information regarding capital raises please see “Private

Placements”.

Revenues

No

revenue was generated by the Company’s operations during the year ended December

31, 2008 and the nine month period ended September 30, 2009.

Net

Loss

The

significant components of expense that have contributed to the total net loss

are discussed as follows:

Years ended December 31,

2008 and 2007 (Audited)

(a) General and Administrative

Expense

Included

in operating expenses for the year ended December 31, 2008 are general and

administrative expenses of $10,862, as compared with $3,285 for the year ended

December 31, 2007. General and administrative expense represented

100% of the total operating expense for the year ended December 31, 2008 and

100% of the total operating expense for the year ended December 31,

2007. General and administrative expense increased by $7,577 in the

current year, compared to the prior year. The increase in this

expense is mainly due to the professional fees and costs, consulting fees,

office expense and general and other miscellaneous costs incurred during the

year ended December 31, 2008.

Nine month periods ended

September 30, 2009 and 2008 (Unaudited)

(a) General and Administrative

Expense

Included

in operating expenses for the nine month period ended September 30, 2009 are

general and administrative expenses of $102,873 as compared with $nil for the

nine month period ended September 30, 2008. General and

administrative expense represents 100% of the total operating expense for the

nine month period ended September 30, 2009. General and administrative expense

represents professional fees, consulting fees, office expense and general and

other miscellaneous costs incurred during the nine month period ended September

30, 2009.

(b) Project

Expense

The

Company had limited operation activity prior to September 30, 2009 and as a

result there were no project expenses for the nine month periods ended September

30, 2009 and 2008.

- 21

-

Liquidity

and Capital Resources

The

following table summarizes the company’s cash flows and cash in

hand:

|

Year

ended

|

Year

ended

|

|||||||

|

Dec.

31, 2008

|

Dec.

31, 2007

|

|||||||

|

Cash

and cash equivalent

|

$ | Nil | $ | Nil | ||||

|

Working

capital deficiency

|

$ | 10,758 | $ | Nil | ||||

|

Cash

used in operating activities

|

$ | 104 | $ | 3,285 | ||||

|

Cash

used in investing activities

|

$ | Nil | $ | Nil | ||||

|

Cash

provided by financing activities

|

$ | 104 | $ | 3,285 | ||||

|

Nine

month

|

Nine

month

|

|||||||

|

period

ended

|

period

ended

|

|||||||

|

Sept.

30, 2009

(Unaudited)

|

Sept.

30, 2008

(Unaudited)

|

|||||||

|

Cash

and cash equivalent

|

$ | 436,564 | $ | Nil | ||||

|

Working

capital

|

$ | 391,877 | $ | Nil | ||||

|

Cash

used in operating activities

|

$ | 68,536 | $ | Nil | ||||

|

Cash

used in investing activities

|

$ | Nil | $ | Nil | ||||

|

Cash

provided by financing activities

|

$ | 505,100 | $ | Nil | ||||

As at

December 31, 2008, the Company had a working capital deficiency of $10,758 as

compared to $Nil as of December 31, 2007.

As at