Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - Good Hemp, Inc. | ex51.htm |

| EX-23.1 - EXHIBIT 23.1 - Good Hemp, Inc. | ex231.htm |

| EX-23.2 - EXHIBIT 23.2 - Good Hemp, Inc. | ex232.htm |

As

filed with the Securities and Exchange Commission on January 19, 2010

Registration

Statement No. 333-159561

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1/A

(Amendment

No. 3)

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

KEYSER RESOURCES

INC.

(Name of

registrant specified in its Charter)

|

Nevada

|

1000

|

N/A

|

|

(State

or Other Jurisdiction of

|

(Primary

Standard Industrial

|

(IRS

Employer

|

|

Incorporation

or Organization)

|

Classification

Code Number)

|

Identification

Number)

|

61

Sherwood Circle NW

Calgary

Alberta T3R 1R3

Telephone:

(403) 455-7185 Facsimile: (403) 455-7185

(Address

and telephone number of principal executive offices and principal place of

business)

|

EastBiz.com,

Inc.

|

|

5348

Vegas Drive

|

|

Las

Vegas, Nevada 89108

|

|

Telephone:

(702) 871-8678

|

|

(Name,

address and telephone number of agent for service)

|

|

Copies

to:

|

|

Darrin

Ocasio

|

|

Peter

DiChiara

|

|

Sichenzia

Ross Friedman Ference LLP

|

|

61

Broadway

|

|

New

York, New York 10006

|

|

Telephone:

(212) 930-9700

|

|

Facsimile:

(212) 930-9725

|

Approximate

date of proposed sale to the public: From time to time after this Registration

Statement becomes effective.

If any

securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box: x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

Indicate

by a check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer o

|

Accelerated Filer o

|

|

Non-accelerated Filer o

|

Smaller Reporting Company x

|

(Do not

check if a smaller reporting company)

CALCULATION

OF REGISTRATION FEE

|

Title

of Each Class of

Securities

To Be

Registered

|

Amount

to be

registered

|

Proposed

Maximum

Offering

Price per Unit (1)

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount

of

Registration

Fee (2)

|

|

Shares

of Common

Stock,

Par Value $0.001

|

2,765,000

|

$0.05

|

$138,250

|

$8.08

|

|

(1)

|

Estimated

in accordance with Rule 457 of the Securities Act of 1933 solely for

the purpose of computing the amount of the registration

fee. Our common stock is not traded on any national exchange

and the offering price is based on the price at which shares of the

registrant's common stock were sold to investors in a private placement

completed in December 2008. The price at which the shares were

sold in the December 2008 private placement was arbitrarily determined and

bears no relationship to the registrant's book value, assets, past

operating results, financial condition or any other established criteria

of value. The price of $0.05 is a fixed price at which the

selling security holders may sell their shares until our common stock is

quoted on the OTC Bulletin Board, at which time the shares may be sold at

prevailing market prices or at privately negotiated prices. There can be

no assurance that a market maker will agree to file the necessary

documents with the Financial Industry Regulatory Authority, which operates

the OTC Bulletin Board, that such an application for quotation will be

approved or that our common stock ever will trade. The

registrant makes no representation as to the price at which its common

stock may trade.

|

|

(2)

|

This

fee was calculated in accordance with Rule 457(o) under the Securities

Act of

1933, as amended, and paid with our initial

filing.

|

The

registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until this registration statement shall become

effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling

stockholders may not sell these securities until the registration statement is

filed with the Securities and Exchange Commission and becomes effective. This

prospectus is not an offer to sell these securities and is not soliciting an

offer to buy these securities in any state where the sale is not

permitted.

SUBJECT

TO COMPLETION, DATED JANUARY 19,

2010

Prospectus

KEYSER

RESOURES INCORPORATED

2,765,000

Shares of Common Stock

This

prospectus relates to the resale of up to 2,765,000 shares of common stock,

$0.001 par value per share, of Keyser Resources Incorporated that may be

sold from time to time by the selling stockholders identified in this

prospectus. These persons, together with their transferees, are

referred to throughout this prospectus as “selling stockholders.”

We are

not selling any shares of our common stock in this offering and therefore will

not receive any proceeds from this offering.

Our

common stock does not presently trade on any exchange or electronic

medium. The selling stockholders and/or their registered

representatives have agreed to sell their shares of common stock at a fixed

price of $0.05 until such time as our common stock is admitted to quotation, if

ever, on the Over-the-Counter Bulletin Board, or OTC Bulletin Board, an

electronic quotation system for equity securities overseen by the Financial

Industry Regulatory Authority or another exchange or electronic medium and

thereafter at prevailing market prices or privately negotiated

prices. As a result of such activities, the selling stockholders may

be deemed to be underwriters as that term is defined in the federal securities

laws.

We have

not applied for listing to trade on any public market nor has a market maker

applied to have our common stock admitted to quotation on the OTC Bulletin

Board. We will seek to identify a market maker to file an application

to have our common stock admitted to quotation on the OTC Bulletin

Board. We can not, however, assure you that our common stock ever

will be quoted on the OTC Bulletin Board or trade on any other public market or

electronic medium.

We will

pay all of the expenses incident to the registration of the shares offered under

this prospectus, except for sales commissions and other expenses of selling

stockholders applicable to the sales of their shares.

Selling

stockholders may sell their shares directly or through agents or broker-dealers

acting as agents on behalf of the selling stockholders. The selling

stockholders may engage brokers, dealers, or agents who may receive commissions,

or discounts from the selling stockholders. See “Selling

Stockholders” and “Plan of Distribution” in this prospectus.

An

investment in our common stock is speculative and involves a high degree of

risk. Investors should carefully consider the risk factors and

other uncertainties described in this prospectus before purchasing our common

stock. See “Risk Factors” beginning on page

4.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of the prospectus. Any representation to the contrary is a criminal

offense.

The

date of this prospectus is January [*], 2010

Table

of Contents

|

Special

Note Regarding Forward-Looking Statements

|

1

|

|

Prospectus

Summary

|

2

|

|

Risk

Factors

|

4

|

|

Use

of Proceeds

|

8

|

|

Determination

of Offering Price

|

8

|

|

Dilution

|

8

|

|

Selling

Shareholders

|

9

|

|

Plan

of Distribution

|

10

|

|

Description

of Securities

|

12

|

|

Legal

Matters

|

13

|

|

Experts

|

13

|

|

Description

of Business

|

14

|

|

Legal

Proceedings

|

19

|

|

Description

of Property

|

19

|

|

Market

For Our Common Stock and Other Related Stockholder

Matters

|

23

|

|

Management's

Discussion and Analysis

|

23

|

|

Quantitative

and Qualitative Disclosures About Market Risk

|

25

|

|

Management

|

26

|

|

Security

Ownership of Certain Beneficial Owners and

Management

|

27

|

|

Executive

Compensation

|

27

|

|

Changes

In and Disagreements with Accountants

|

28

|

|

Financial

Statements

|

F-1

|

AVAILABLE

INFORMATION

This

prospectus constitutes a part of a registration statement on Form S-1 (together

with all amendments and exhibits thereto, the “Registration Statement”) filed by

us with the SEC under the Securities Act of 1933, as amended (the “Securities

Act”). As permitted by the rules and regulations of the SEC, this

prospectus omits certain information contained in the Registration Statement,

and reference is made to the Registration Statement and related exhibits for

further information with respect to Keyser Resources Incorporated and the

securities offered hereby. Any statements contained herein concerning

the provisions of any document filed as an exhibit to the Registration Statement

or otherwise filed with the SEC are not necessarily complete, and in each

instance reference is made to the copy of such document so filed. Each such

statement is qualified in its entirety by such reference.

You

should rely only on the information contained in this prospectus. We have not

authorized anyone to provide you with information different from that which is

contained in this prospectus. This prospectus may be used only where it is legal

to sell these securities. The information in this prospectus may only be

accurate on the date of this prospectus, regardless of the time of delivery of

this prospectus or of any sale of securities.

REPORTS

TO SECURITY HOLDERS

Upon

effectiveness of this Prospectus, we will be subject to the reporting and other

requirements of the Exchange Act and we intend to furnish our shareholders

annual reports containing financial statements audited by our independent

auditors and to make available quarterly reports containing unaudited financial

statements for each of the first three quarters of each year.

The

public may read and copy any materials that we file with the SEC at the SEC’s

Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public

may obtain information on the operation of the Public Reference Room by calling

the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains

reports, proxy and information statements, and other information regarding

issuers that file electronically with the SEC. The address of that site is

www.sec.gov.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains “forward-looking statements.” Such forward-looking

statements concern the Company's anticipated results and developments in the

Company's operations in future periods, planned exploration and development of

its properties, plans related to its business and other matters that may occur

in the future. These statements relate to analyses and other information that

are based on forecasts of future results, estimates of amounts not yet

determinable and assumptions of management.

Any

statements that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions or future

events or performance (often, but not always, using words or phrases such as

“believes” or “does not believe”, "expects" or "does not expect", "is expected",

"anticipates" or "does not anticipate", "plans", "estimates" or "intends", or

stating that certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved) are not statements of historical fact

and may be forward-looking statements. Forward-looking statements are subject to

a variety of known and unknown risks, uncertainties and other factors which

could cause actual events or results to differ from those expressed or implied

by the forward-looking statements, including, without limitation, risks related

to:

|

·

|

risks

and uncertainties relating to the interpretation of sampling results, the

geology, grade and continuity of mineral

deposits;

|

|

·

|

risks

and uncertainties that results of initial sampling and mapping will not be

consistent with our expectations;

|

|

·

|

the

potential for delays in exploration

activities;

|

|

·

|

the

substantial risk that no commercially viable gold or copper deposits will

be found as a result of the speculative nature of mineral property

exploration

|

|

·

|

risks

related to the inherent uncertainty of cost estimates and the potential

for unexpected costs and expenses;

|

|

·

|

failure

to make required payments or expenditures that could lead to the loss

of title to the mineral

claim

|

|

·

|

risks

related to failure to obtain adequate financing on a timely basis and on

acceptable terms for our planned exploration

program;

|

|

·

|

other

risks and uncertainties related to our mineral property, mining business

and business strategy.

|

This list

is not exhaustive of the factors that may affect our forward-looking statements.

Some of the important risks and uncertainties that could affect forward-looking

statements are described further under the sections titled "Risk Factors",

"Description of the Business" and "Management's Discussion and Analysis" of this

prospectus. Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may vary

materially from those anticipated, believed, estimated or expected.

Forward-looking statements speak only as of the date made. Except as required by

law, we disclaim any obligation subsequently to revise any forward-looking

statements to reflect events or circumstances after the date of such statements

or to reflect the occurrence of anticipated or unanticipated

events.

1

PROSPECTUS

SUMMARY

The

following is a summary of some of the information contained in this

prospectus. In addition to this summary, we urge you to read the more

detailed information, including the financial statements and related notes

thereto and the “Risk Factors” section, included elsewhere in this

prospectus. Unless the context otherwise requires, any reference to

“our company,” “we,” “us,” or, “our” refers to Keyser Resources Incorporated, a

Nevada corporation.

Corporate

History

We are a

start-up exploration stage company without significant operations and we are in

the business of gold and copper exploration. Keyser Resources Incorporated was

incorporated in the State of Nevada on November 26, 2007. On the

date of our incorporation, we appointed Maurice Bidaux as our

Director. Mr. Bidaux was then appointed President, Principal

Financial Officer, Principal Accounting Officer and Secretary of our

company. Our principal office is located at 61 Sherwood Circle NW,

Calgary Alberta T3R 1R3. Our telephone number is (403) 455-7185.

Our

Business

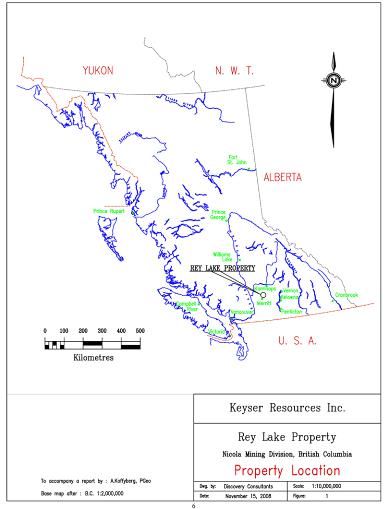

On June

11, 2008 we signed an option agreement with Bearclaw Capital Corporation

(“Bearclaw”) to acquire 90% interest in the Rey Lake Property, which is located

in the Nicola Mining Division of British Columbia, 45 kilometers north-west of

Merrit, British Columbia, Canada. There is no assurance that a

commercially viable deposit exists on this mineral claim. Exploration will be

required before a final evaluation as to the economic and legal feasibility of

the mineral claim is determined.

The

agreement with Bearclaw allows Keyser to acquire the 90% interest in the Rey

Lake Property by making exploration expenditures totaling CDN$150,000

(approximately US$156,000 using current translation rates) through September 30,

2010 and paying CDN $12,500 (approximately US$ 13,000) cash (of which CDN $5,000

(approximately US$ 5,200) has been paid) to Bearclaw by September 30,

2010. The agreement with Bearclaw was amended on September 28, 2009

to extend a requirement for an interim exploration milestone from September 30,

2009 to July 31, 2010. The option agreement required that Bearclaw

transfer title to us within 30 days of signing the agreement. On our

request, Bearclaw transferred title to our President, Mr. Maurice Bidaux, who

has executed a trust agreement and has agreed to hold the claim in trust for us

(since British Columbia laws prevent a Nevada corporation from holding title

directly). If we do not make the exploration expenditures, we will forfeit our

right to exercise the option.

Plan

of Operation

Our plan

of operations is to carry out exploration of the Rey Lake Property. Our specific

exploration plan for the Rey Lake Property, together with information regarding

the location and access, history of operations, present condition and geology,

is presented in this prospectus under the heading “Description of Properties.”

Our exploration program is preliminary in nature in that its completion will not

result in a determination that the property contains commercially exploitable

quantities of mineralization.

We

anticipate that we will require additional financing in order to pursue full

exploration of the Rey Lake Property. We do not have sufficient financing to

undertake full exploration of the Rey Lake Property at present and there is no

assurance that we will be able to obtain the necessary financing.

Further

exploration beyond the scope of our planned exploration activities will be

required before a final evaluation as to the economic and legal feasibility of

mining of the Rey Lake Property is determined. There is no assurance that

further exploration will result in a final evaluation that a commercially viable

mineral deposit exists on any of our mineral properties. It is too early for us

to estimate how long it will take us and how much it will cost us to determine

whether there is a commercially viable mineral deposit on the Rey Lake

Property.

We have

no revenues, have achieved losses since inception, have been issued a going

concern opinion by our auditors and rely upon the sale of our securities to fund

operations. We will not generate revenues even if our exploration program

indicates that a mineral deposit may exist on the Rey Lake Property.

Accordingly, we will be dependent on future additional financing in order to

maintain our operations and continue our exploration activities.

We have

not commenced any work on the Rey Lake Property. Maurice Bidaux is our sole

director and officer and had no previous experience in mineral exploration or

operating a mining company before November 2007. Our business plan may fail due

to our management’s lack of experience in this industry.

2

Private

Placement

To date,

in addition to an issuance to Mr. Maurice Bidaux of 3,000,000 shares of common

stock at $0.001 per share for cash proceeds of $3,000, we have raised $81,025

through two private placements completed in April 2008 and December

2008. The following table summarizes the date of offering, the price

per share paid, the number of shares sold and the amount raised for these

private placements. All of these issuances were made to non-US investors

pursuant to exemptions contained in Regulation S of the Securities Act of

1933.

|

Closing

Date of Offering

|

Price

Per Share Paid

|

Number

of Shares Sold

|

Amount

Raised

|

|

April

28, 2008

|

$0.015

|

1,635,000

|

$24,525

|

|

December

24, 2008

|

$0.05

|

1,130,000

|

$56,500

|

Mr.

Bidaux owns 52.0% of our issued and outstanding common stock as at January 15, 2010 . Since Mr. Bidaux owns a majority of our

outstanding shares and he is the sole director and officer of our company he has

the ability to elect directors and control the future course of our company.

Investors may find the corporate decisions made by Mr. Bidaux are inconsistent

with the interests of other stockholders. There are many other factors,

described in detail under the section of Risk Factors, which may adversely

affect our ability to begin and sustain profitable operations.

The

Offering

|

Common

Stock Offered by

the

Selling Stockholders

|

2,765,000

shares of common stock

|

|

|

Common

Stock Outstanding

as

of January 15, 2010

|

5,765,000

shares of common stock

|

|

|

Offering

Price

|

The

shares may be offered and sold from time to time by the selling

stockholders and/or their registered representatives at a fixed price of

$0.05 until such shares are admitted to quotation, if ever, on the OTC

Bulletin Board or another exchange or electronic medium and

thereafter at prevailing market prices or privately negotiated

prices.

|

|

|

Use

of Proceeds

|

We

will not receive any of the proceeds from sales of the shares offered by

the selling stockholders.

|

|

|

Dividend

Policy

|

We

intend to retain all available funds and any future earnings, if any, for

use in our business operations. Accordingly, we do not

anticipate paying any cash dividends on our common stock in the

foreseeable future.

|

|

|

Fees

and Expenses

|

We

will pay all of the expenses incident to the registration of such shares,

except for sales commissions and other expenses of selling

stockholders.

|

|

|

Market

Information

|

Our

common stock is not currently listed on any national securities exchange

and is not quoted on any over-the-counter market. We will seek to identify

a market maker to file an application with the Financial Industry

Regulatory Authority, Inc. for our common stock to be admitted for

quotation on the OTC Bulletin Board after the effective date of this

registration statement. We have not yet identified a market

maker that has agreed to file such application. We can not

assure you that a public market for our common stock will develop in the

future.

|

|

|

Risk

Factors

|

An

investment in our common stock is highly speculative and involves a high

degree of risk. Investors should carefully consider the risk

factors and other uncertainties described in this prospectus before

purchasing our common stock. See “Risk Factors” beginning on

page 4.

|

3

RISK

FACTORS

You

should carefully consider the risks described below together with all of the

other information included in this prospectus before making an investment

decision with regard to our securities. The statements contained in or

incorporated into this offering that are not historic facts are forward-looking

statements that are subject to risks and uncertainties that could cause actual

results to differ materially from those set forth in or implied by

forward-looking statements. If any of the following risks actually occurs, our

business, financial condition or results of operations could be harmed. In that

case, the trading price of our common stock could decline, and you may lose all

or part of your investment.

RISKS

RELATED TO OUR BUSINESS

Because

of the speculative nature of mineral property exploration, there is substantial

risk that no commercially viable gold, copper or mineral deposits will be found

and our business will fail.

Exploration

for gold, copper and minerals is a speculative venture involving substantial

risk. Rey Lake mineral property may not contain commercially viable deposits.

The exploration program that we will conduct on our claim may not result in the

discovery of commercial viable deposits. Problems such as unusual and unexpected

rock formations and other conditions commonly occur in exploration which often

results in unsuccessful exploration efforts. In such a case, we may be unable to

complete our business plan and you could lose your entire investment in this

offering.

Because

market factors in the mining business are out of our control, we may not be able

to market any minerals that may be found.

The

mining industry, in general, is intensely competitive and, even if gold is

discovered, a ready market will exist for the sale of any gold found. Numerous

factors beyond our control may affect the marketability of gold. These factors

include market fluctuations, the proximity and capacity of natural resource

markets and processing equipment, government regulations, including regulations

relating to prices, taxes, royalties, land tenure, land use, importing and

exporting of minerals and environmental protection. The exact effect of these

factors cannot be accurately predicted, but the combination of these factors may

result in our not receiving an adequate return on invested capital and you may

lose your entire investment in this offering.

Because

of the inherent dangers involved in gold exploration, there is a risk that we

may incur liability or damages as we conduct our business.

The

search for gold involves numerous hazards. As a result, we may become subject to

liability for such hazards, including pollution, cave-ins and other hazards

against which we cannot insure or against which we may elect not to insure. We

currently have no such insurance nor do we expect to get such insurance for the

foreseeable future. If a hazard were to occur, the costs of rectifying the

hazard may exceed our asset value and cause us to liquidate all our assets

resulting in the loss of your entire investment in this offering.

Because

access to our mineral claim is often restricted by inclement weather, we will be

delayed in our exploration and any future mining efforts.

Surface

exploration and drilling access, according to the Rey Lake Geologist Report (as

defined under "Experts") was, to our Rey Lake mineral property is most favorable

between April 1 and October 31 of each year due to snow in the area at other

times of the year. As a result, any attempts to visit, test, or explore the

property are largely limited to these few months of the year when weather

permits such activities. These limitations can result in significant delays in

exploration efforts, as well as mining and production in the event that

commercial amounts of minerals are found. Such delays can result in our

inability to meet deadlines for exploration expenditures as defined by the

Province of British Columbia. This could cause our business venture to fail and

the loss of your entire investment in this offering unless we can meet

deadlines.

4

As

we undertake exploration of our mineral claim, we will be subject to government

regulations that may increase the anticipated time and cost of our exploration

program.

There are

several governmental regulations that materially restrict the exploration of

minerals. We will be subject to the mining laws and regulations as contained in

the Mineral Tenure Act of the Province of British Columbia as we carry out our

exploration program. We may be required to obtain work permits, post bonds and

perform remediation work for any physical disturbance to the land in order to

comply with these regulations. There is a risk that new regulations could

increase our time and costs of doing business and prevent us from carrying out

our exploration program.

If

we do not find a joint venture partner for the continued development of our

mineral claim, we may not be able to advance exploration work, which could cause

our business to fail.

If the

results of our Phase Two exploration program are successful, we may try to enter

into a joint venture agreement with a partner for the further exploration and

possible production of our Rey Lake Property. We would face competition in

finding a joint venture partner, from other junior mineral resource exploration

companies who have properties that the joint venture partner may deem to be more

attractive in terms of potential return and investment cost. In addition, if we

entered into a joint venture agreement, we would likely assign a percentage of

our interest in the Rey Lake claim to the joint venture partner. If we are

unable to enter into a joint venture agreement with a partner, our operations

may fail and you may lose your entire investment in this offering.

If

we do not obtain additional financing, our business plan will fail.

Our

current operating funds are estimated to be sufficient to complete the first

phase of our exploration program on the Rey Lake mineral property. However, we

will need to obtain additional financing in order to complete our business plan.

Our business plan calls for significant expenses in connection with the

exploration of our mineral claim. We have not made arrangements to secure any

additional financing.

If

we do not obtain clear title to the mineral claim, our business may

fail.

Under

British Columbia law, title to a British Columbia mineral claim can only be held

by individuals or British Columbia corporations. Since we are a Nevada

corporation we are not legally allowed to hold claims in British Columbia. Our

mineral claim is being held in trust for us by our President, a Canadian

resident. If we confirm economically viable deposits of gold on our mineral

claim we will incorporate a British Columbia subsidiary to hold title to the

mineral claim and our President will transfer the claim to the subsidiary. Until

we can confirm viable gold deposits, our President is holding the claim in trust

for us by means of a trust agreement. However, there could be situations such as

the death of our President that could prevent us from obtaining clear title to

the mineral claim. If we are unable to obtain clear title to the mineral claim

our business will likely fail and you will lose your entire investment in this

offering.

Our

failure to make required payments or expenditures could cause us to lose title

to the mineral claim.

The Rey

Lake mineral property has an expiry date of September 30, 2010 and in order to

maintain the tenure in good standing it will be necessary for us to either

perform and record valid exploration work with value of approximately $150,000

for the 100 hectares of the claim) through September 30, 2010 or pay the

equivalent sum to the Province of British Columbia in lieu of work. Failure to

perform and record valid exploration work or pay the equivalent sum to the

Province of British Columbia on the anniversary dates will result in forfeiture

of title to the claim.

5

Because

we have only recently commenced business operations, we face a high risk of

business failure and this could result in a total loss of your

investment.

We have

not yet begun the initial stages of exploration of our mineral claim, and thus

have no way to evaluate the likelihood of whether we will be able to operate our

business successfully. We were incorporated on November 26, 2007 and to date

have been involved primarily in organizational activities, obtaining financing

and staking our mineral claim. We have not earned any revenues and as of January 15, 2010 , we have never

achieved profitability. We expect to incur operating losses for the foreseeable

future.

Potential

investors should be aware of the difficulties normally encountered by new

mineral exploration companies and the high rate of failure of such enterprises.

The likelihood of success must be considered in the light of problems, expenses,

difficulties, complications and delays encountered in connection with the

exploration of the mineral properties that we plan to undertake. These potential

problems include, but are not limited to, unanticipated problems relating to

exploration and additional costs and expenses that may exceed current estimates.

We have no history upon which to base any assumption as to the likelihood that

our business will prove successful, will generate any operating revenues or ever

achieve profitable operations. If we are unsuccessful in addressing these risks

our business will likely fail and you will lose your entire investment in this

offering.

Because

our management has no experience in the mineral exploration business we may make

business decisions that are not advantageous to us, and this could cause our

business to fail.

Our

President has no previous experience operating an exploration or a mining

company and because of this lack of experience he may make mistakes. Our

management lacks the technical training and experience with exploring for,

starting, or operating a mine. With no direct training or experience in these

areas our management may not be fully aware of the many specific requirements

related to working in this industry. Our management's decisions and choices may

not take into account standard engineering or managerial approaches that mineral

exploration companies commonly use. Consequently, our operations, earnings, and

ultimate financial success could suffer irreparable harm due to our management's

lack of experience in this industry.

Because

our sole director and officer owns the majority of our common stock, he has the

ability to override the interests of the other stockholders, which could prevent

us from becoming profitable.

Our

President, Maurice Bidaux, owns 52.0% of our outstanding common stock and serves

as our sole director and officer. Because Mr. Bidaux owns more than 50% of our

issued common stock, he will be able to elect all of our directors and control

our operations. He may have an interest in pursuing acquisitions, divestitures

and other transactions that involve risks. For example, he could cause us to

make acquisitions that increase our indebtedness or to sell revenue generating

assets. He may from time to time acquire and hold interests in businesses that

compete directly or indirectly with us. If he fails to act in our best interests

or fails to perform adequately to manage us, you may have difficulty in removing

him as director, which could prevent us from becoming profitable.

There

is substantial doubt as to whether we will continue operations. If we

discontinue operations, you could lose your investment.

The

following factors raise substantial doubt regarding the ability of our business

to continue as a going concern: (i) the losses we incurred since our inception;

(ii) our lack of operating revenues as at January 15, 2010 ; and (iii) our dependence on the

sale of equity securities and receipt of capital from outside sources to

continue in operation. We anticipate that we will incur increased expenses

without realizing enough revenues. We therefore expect to incur significant

losses in the foreseeable future. The financial statements do not include any

adjustments that might result from the uncertainty about our ability to continue

our business. If we are unable to obtain additional financing from outside

sources and eventually produce enough revenues, we may be forced to sell our

assets, curtail or cease our operations. If this happens, you could lose all or

part of your investment.

6

RISKS

RELATED TO OUR COMMON STOCK

There

is no liquidity and no established public market for our common stock and it may

prove impossible to sell your shares.

There is

presently no public market in our shares. We intend to contact an authorized OTC

Bulletin Board market maker for sponsorship of our securities. Such

sponsorship, however, may not be approved and our stock may not be quoted on the

OTC Bulletin Board for sale. Even if our shares are quoted for sale, buyers may

be insufficient in numbers to allow for a robust market, and it may prove

impossible to sell your shares.

If

the selling shareholders sell a large number of shares all at once or in blocks,

the value of our shares would most likely decline.

The

selling shareholders are offering 2,765,000 shares of our common stock through

this prospectus. They must sell these shares at a fixed price of $0.05 until

such time as they are quoted on the OTC Bulletin Board or other quotation system

or stock exchange. Our common stock is presently not traded on any market or

securities exchange, but should a market develop, shares sold at a price below

the current market price at which the common stock is trading will cause that

market price to decline. Moreover, the offer or sale of large numbers of shares

at any price may cause the market price to fall. The number of shares being

registered by this prospectus represent approximately 48% of the common shares

currently outstanding.

Because

the SEC imposes additional sales practice requirements on brokers who deal in

our shares which are penny stocks, some brokers may be unwilling to trade them.

This means that you may have difficulty reselling your shares and this may cause

the price of the shares to decline.

A penny

stock is generally a stock that is not listed on a national securities exchange

or NASDAQ, is listed in the "pink sheets" or on the OTC Bulletin Board, has a

price per share of less than $5.00, and is issued by a company with net tangible

assets less than $5 million.

The penny

stock trading rules impose additional duties and responsibilities upon

broker-dealers and salespersons effecting purchase and sale transactions in

Common Stock and other equity securities, including determination of the

purchaser's investment suitability, delivery of certain information and

disclosures to the purchaser, and receipt of a specific purchase agreement

before effecting the purchase transaction.

Many

broker-dealers will not effect transactions in penny stocks, except on an

unsolicited basis, in order to avoid compliance with the penny stock trading

rules. In the event our Common Stock becomes subject to the penny stock trading

rules:

|

·

|

such

rules may materially limit or restrict the ability to resell our Common

Stock, and

|

|

·

|

the

liquidity typically associated with other publicly traded equity

securities may not exist.

|

Because

of the significant restrictions on trading penny stocks, a public market may

never emerge for our securities. If this happens, you may never be able to

publicly sell your shares.

7

As

our sole director and officer and our assets are located in Canada, investors

may be limited in their ability to enforce US civil actions against our director

or our assets. You may not be able to receive compensation for damages to the

value of your investment caused by wrongful actions by our

director.

Our

assets are located in Canada and our director is a resident of Canada.

Consequently, it may be difficult for United States investors to affect service

of process within the United States on our director. A judgment of a

US court predicated solely upon such civil liabilities may not be enforceable in

Canada by a Canadian court if the US court in which the judgment was obtained

did not have jurisdiction, as determined by the Canadian court, in the matter.

There is substantial doubt whether an original action could be brought

successfully in Canada against any of our future assets or our director

predicated solely upon such civil liabilities. You may not be able to recover

damages as compensation for a decline in your investment.

We

do not intend to pay dividends and there will be less ways in which you can make

a gain on any investment in us.

We have

never paid any cash dividends and currently do not intend to pay any dividends

for the foreseeable future. To the extent that we require additional funding

currently not provided for in our financing plan, our funding sources may likely

prohibit the payment of a dividend. Because we do not intend to declare

dividends, any gain on an investment in us will need to come through

appreciation of the stock’s price.

USE OF

PROCEEDS

The

shares of common stock offered by this prospectus are being registered for the

account of the selling stockholders named in this prospectus. We will

not receive any proceeds from the sale of the common stock offered through this

prospectus by the selling stockholders. We will pay all of the

expenses incident to the registration of the shares except for sales commissions

and other expenses of selling stockholders.

DETERMINATION OF

OFFERING PRICE

The

selling shareholders will sell at an initial price of $0.05 per share until our

shares are quoted on the OTC Bulletin Board and thereafter at prevailing market

prices or privately negotiated prices. The $0.05 per share initial price of our

common stock was determined by our Board of Directors.

Since our

shares are not listed or quoted on any exchange or quotation system, the

offering price of the shares of common stock was arbitrarily

determined. The offering price was determined by the price at which

shares were sold to our shareholders in our private placement which was

completed in November 2008 and does not necessarily bear any relationship to our

book value, assets, past operating results, financial condition or any other

established criteria of value. The price of our shares of common

stock is not based on past earnings, nor is the price of the shares of our

common stock indicative of current market value for the assets owned by us. No

valuation or appraisal has been prepared for our business. You cannot be sure

that a public market for any of our securities will develop.

We intend

to apply to the OTC Bulletin Board for the trading of our common stock. If our

common stock becomes listed on the OTC Bulletin Board and a market for the stock

develops, the actual price of the shares sold herein by the selling shareholders

will be determined by prevailing market prices at the time of sale or by private

transactions negotiated by the selling shareholders named in this

Prospectus.

The

number of shares that may be actually sold by a selling shareholder will be

determined by each selling shareholder. The selling shareholders are under no

obligation to sell all or any portion of the shares offered, nor are the selling

shareholders obligated to sell such shares immediately under this Prospectus. A

shareholder may sell shares at a price different than $0.05 per share depending

on privately negotiated factors such as a shareholder's own cash requirements,

or objective criteria of value such as the market value of our

assets.

DILUTION

All

2,765,000 shares of the common stock to be sold by the selling shareholders are

currently issued and outstanding. Accordingly, they will not cause dilution to

our existing shareholders.

8

SELLING

SHAREHOLDERS

The

following table sets forth certain information regarding the selling

stockholders and the shares offered by them in this prospectus. Beneficial

ownership is determined in accordance with the rules of the SEC. Each

selling stockholder’s percentage of ownership in the following table is based

upon 5,765,000 shares of common stock outstanding as of January 15, 2010 .

|

Name

of Selling

Shareholder

|

Shares

Owned

Before

the

Offering

(1)

|

Percent

(%)

|

Maximum

Number

of

Shares

Being

Offered

|

Beneficial

Ownership

After

Offering

|

Percentage

of

Shares

Owned

After

the

Offering

is

Complete

|

|||||||||||||||

|

Tim

Hayward

|

133,333

|

2.3

|

133,333

|

0

|

0

|

|||||||||||||||

|

Joseph

Babiar

|

166,666

|

2.9

|

166,666

|

0

|

0

|

|||||||||||||||

|

Caroline

Peacock

|

80,000

|

1.4

|

80,000

|

0

|

0

|

|||||||||||||||

|

Martin

Kilo

|

146,666

|

2.5

|

146,666

|

0

|

0

|

|||||||||||||||

|

Michelle

Duncan

|

125,000

|

2.2

|

125,000

|

0

|

0

|

|||||||||||||||

|

Debra

McDiarmid

|

83,333

|

1.4

|

83,333

|

0

|

0

|

|||||||||||||||

|

Christian

Wirth

|

166,666

|

2.9

|

166,666

|

0

|

0

|

|||||||||||||||

|

Howard

Tolley

|

125,000

|

2.2

|

125,000

|

0

|

0

|

|||||||||||||||

|

Douglas

Klumpp

|

125,000

|

2.2

|

125,000

|

0

|

0

|

|||||||||||||||

|

Helen

Klassen

|

100,000

|

1.7

|

100,000

|

0

|

0

|

|||||||||||||||

|

Daryl

Domes

|

83,333

|

1.4

|

83,333

|

0

|

0

|

|||||||||||||||

|

Gregory

Corcoran

|

166,666

|

2.9

|

166,666

|

0

|

0

|

|||||||||||||||

|

Todd

Scott

|

133,333

|

2.3

|

133,333

|

0

|

0

|

|||||||||||||||

|

Terry

Thorpe

|

70,000

|

1.2

|

70,000

|

0

|

0

|

|||||||||||||||

|

Kelly

Mote

|

50,000

|

+

|

50,000

|

0

|

0

|

|||||||||||||||

|

Tiffany

Carroll

|

100,000

|

1.7

|

100,000

|

0

|

0

|

|||||||||||||||

|

Yuvraj

Dhesi

|

70,000

|

1.2

|

70,000

|

0

|

0

|

|||||||||||||||

|

Kelty

Christensen

|

50,000

|

+

|

50,000

|

0

|

0

|

|||||||||||||||

|

Frank

Garvin

|

25,000

|

+

|

25,000

|

0

|

0

|

|||||||||||||||

|

Parveshindera

Sidhu

|

25,000

|

+

|

25,000

|

0

|

0

|

|||||||||||||||

|

Sarah

Guardado

|

60,000

|

1.0

|

60,000

|

0

|

0

|

|||||||||||||||

|

Evan

Schindel

|

100,000

|

1.7

|

100,000

|

0

|

0

|

|||||||||||||||

|

Chad

Verpy

|

60,000

|

1.0

|

60,000

|

0

|

0

|

|||||||||||||||

|

Roland

Requier

|

60,000

|

1.0

|

60,000

|

0

|

0

|

|||||||||||||||

|

Tricia

Franks

|

20,000

|

+

|

20,000

|

0

|

0

|

|||||||||||||||

|

Monika

Maksymik

|

70,000

|

1.2

|

70,000

|

0

|

0

|

|||||||||||||||

|

Maria

Hluchanova

|

70,000

|

1.2

|

70,000

|

0

|

0

|

|||||||||||||||

|

Jennifer

Olson

|

30,000

|

+

|

30,000

|

0

|

0

|

|||||||||||||||

|

Robert

Samuel Grier

|

25,000

|

+

|

25,000

|

0

|

0

|

|||||||||||||||

|

Ed

Frijters

|

25,000

|

+

|

25,000

|

0

|

0

|

|||||||||||||||

|

Marnie

Bryks

|

25,000

|

+

|

25,000

|

0

|

0

|

|||||||||||||||

|

Tri

Lam

|

50,000

|

+

|

50,000

|

0

|

0

|

|||||||||||||||

|

Hoang

Tran

|

25,000

|

+

|

25,000

|

0

|

0

|

|||||||||||||||

|

Linda

Tran

|

50,000

|

+

|

50,000

|

0

|

0

|

|||||||||||||||

|

Kathleen

Noval

|

70,000

|

1.2

|

70,000

|

0

|

0

|

|||||||||||||||

|

Total

|

2,764,996

|

2,764,996

|

0

|

0

|

||||||||||||||||

+Less

than 1%

9

We are

not aware of any family relationships among selling

shareholders. Except as indicated above, the named shareholders

beneficially own and have sole voting and investment power over all shares or

rights to these shares. The numbers in this table assume that none of the

selling shareholders sells shares of common stock not being offered in this

prospectus or purchases additional shares of common stock, and assumes that all

shares offered are sold. The percentages are based on 5,765,000 shares of common

stock outstanding on January 15,

2010 . The selling shareholders named in this prospectus are

offering a total of 2,765,000 shares of common stock which represents 48%

of our outstanding common stock on January 15, 2010 . Except as indicated above, none of

the selling shareholders or their beneficial owners (1) has had a material

relationship with us other than as a shareholder at any time within the past

three years; (2) has ever been one of our officers or directors; or

(3) is a registered broker-dealer or an affiliate of a registered

broker-dealer

We will

receive no proceeds from the sale of the registered shares; however, we will

receive proceeds from the exercise of options by the selling

stockholders. We have agreed to bear the expenses of registration of

the shares, other than commissions and discounts of agents or broker-dealers and

transfer taxes, if any.

PLAN

OF DISTRIBUTION

The

selling stockholders and any of their respective pledgees, donees, assignees,

and other successors-in-interest may, from time to time, sell any or all of

their shares of common stock on any stock exchange, market or trading facility

on which the shares are traded or in private transactions. These

sales will be at the fixed price of $0.05 until the shares are quoted on the OTC

Bulletin Board.

We have

agreed to bear all costs, expenses, and fees of registration of the shares of

our common stock offered by the selling stockholders for

resale. However, any brokerage commissions, discounts, concessions,

or other fees, if any, payable to broker-dealers in connection with any sale of

shares of common stock will be borne by the selling stockholders selling those

shares or by the purchasers of those shares.

On our

being notified by a selling stockholder that any material arrangement has been

entered into with a broker-dealer for the sale of shares through a block trade,

special offering, exchange distribution, or secondary distribution, or a

purchase by a broker or dealer, a supplement to this prospectus will be filed,

if required, pursuant to Rule 424(b) under the Securities Act, disclosing

the following:

|

·

|

the

name of each such selling stockholder and of any participating

broker-dealer;

|

|

|

·

|

the

number of securities involved;

|

|

|

·

|

the

price at which such securities were sold;

|

|

|

·

|

the

commissions paid or discounts or concessions allowed to any broker-dealer,

where applicable;

|

|

|

·

|

that

any broker-dealer did not conduct any investigation to verify the

information set out or incorporated by reference in this

prospectus;

|

|

|

·

|

other

facts material to the transaction.

|

The

selling stockholders may use any one or more of the following methods when

selling shares:

|

|

·

|

directly

as principals;

|

|

·

|

ordinary

brokerage transactions and transactions in which the broker-dealer

solicits purchasers;

|

|

|

·

|

block

trades in which the broker-dealer will attempt to sell the shares as agent

but may position and resell a portion of the block as principal to

facilitate the transaction;

|

|

|

·

|

purchases

by a broker-dealer as principal and resale by the broker-dealer for its

account;

|

|

|

·

|

an

exchange distribution in accordance with the rules of the applicable

exchange

|

|

|

·

|

privately

negotiated transactions

|

|

|

·

|

short

sales that are in compliance with the applicable laws and regulations of

any state and the United States and not made prior to the

effective date of this registration statement

|

|

|

·

|

broker-dealers

may agree with the selling stockholders to sell a specified number of such

shares at a stipulated price per share

|

|

|

·

|

a

combination of any such methods of sale

|

|

|

·

|

any

other method permitted pursuant to applicable

law

|

10

We are

required to pay expenses incident to the registration, offering, and sale of the

shares under this offering. The selling stockholders may also sell

shares under Rule 144 under the Securities Act, if available, rather than

under this prospectus.

Any sales

of the shares may be effected through the OTC Bulletin Board if our common stock

is admitted to quotation on the OTC Bulletin Board, in private transactions or

otherwise, and the shares may be sold at market prices prevailing at the time of

sale, at prices related to prevailing market prices.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to

participate in sales. If the selling stockholders effect sales

through underwriters, brokers, dealers or agents, such firms may receive

compensation in the form of discounts, concessions or commissions from the

selling stockholders or the purchasers of the shares for whom they may act as

agent, principal or both in amounts to be negotiated. Those persons

who act as broker-dealers or underwriters in connection with the sale of the

shares may be selected by the selling stockholders and may have other business

relationships with, and perform services for, us. The selling

stockholders do not expect these commissions and discounts to exceed what is

customary in the types of transactions involved.

In the

event that any of the selling stockholders are deemed an affiliated purchaser or

distribution participant within the meaning of Regulation M, then the selling

stockholders will not be permitted to engage in short sales of common stock.

Furthermore, under Regulation M, persons engaged in a distribution of securities

are prohibited from simultaneously engaging in market making and certain other

activities with respect to such securities for a specified period of time prior

to the commencement of such distributions, subject to specified exceptions or

exemptions. In addition, if a short sale is deemed to be a stabilizing activity,

then the selling stockholders will not be permitted to engage in a short sale of

our common stock.

Under the

securities laws of certain states, the shares may be sold in those states only

through registered or licensed brokers or dealers. In addition, in certain

states the shares may not be able to be sold unless our common stock has been

registered or qualified for sale in that state or an exemption from registration

or qualification is available and is complied with.

11

DESCRIPTION OF

SECURITIES

General

Our

authorized capital stock consists of 75,000,000 shares of common stock at a par

value of $0.001 per share.

Common

Stock

As of

January 15, 2010 ,

5,765,000 shares of common stock are issued and outstanding and held by 36

shareholders of record.

Holders

of our common stock are entitled to one vote for each share on all matters

submitted to a stockholder vote. Holders of common stock do not have cumulative

voting rights. Therefore, holders of a majority of the shares of common stock

voting for the election of directors can elect all of the directors. Holders of

a majority of shares of common stock issued and outstanding, represented in

person or by proxy, are necessary to constitute a quorum at any meeting of our

stockholders. A vote by the holders of a majority of our outstanding shares is

required to effectuate certain fundamental corporate changes such as

liquidation, merger or an amendment to our Articles of

Incorporation.

Holders

of common stock are entitled to share in all dividends that the board of

directors, in its discretion, declares from legally available funds. In the

event of a liquidation, dissolution or winding up, each outstanding share

entitles its holder to participate prorata in all assets that remain after

payment of liabilities and after providing for each class of stock, if any,

having preference over the common stock. Holders of our common stock have no

preemptive rights, no conversion rights and there are no redemption provisions

applicable to our common stock.

Preferred

Stock

As of

January 15, 2010 , there

is no preferred stock issued or authorized.

Dividend

Policy

We have

never declared or paid any cash dividends on our common stock. We currently

intend to retain future earnings, if any, to finance the expansion of our

business. As a result, we do not anticipate paying any cash dividends in the

foreseeable future.

Options,

Warrants and Convertible Securities

As of

January 15, 2010, there

are no outstanding options or warrants to purchase our securities or securities

convertible into shares of our common stock or any rights convertible or

exchangeable into shares of our common stock. We may, however, issue options,

warrants or convertible securities in the future.

Stock

Transfer Agent

As of

January 15, 2010 we had

not yet appointed a stock transfer agent.

Shares

Eligible for Future Sale

The

2,765,000 shares of common stock being registered in this offering will be

freely tradable without restrictions under the Securities Act. The

3,000,000 shares of our issued common stock that are not being registered in

this prospectus are held by Maurice Bidaux, our President, Chief Executive

Officer and Chief Financial Officer.

In

general, under Rule 144 as currently in effect, a person who has beneficially

owned restricted shares of our common stock for at least six months would be

entitled to sell their securities provided that (1) such person is not deemed to

have been one of our affiliates at the time of, or at any time during the three

months preceding, a sale, (2) we are subject to the reporting requirements of

the Securities Exchange Act of 1934, as amended, for at least 90 days before the

sale and (3) if the sale occurs prior to satisfaction of a one-year holding

period, we provide current information at the time of sale.

12

Persons

who have beneficially owned restricted shares of our common stock for at least

six months but who are our affiliates at the time of, or at any time during the

three months preceding, a sale, would be subject to additional restrictions, by

which such person would be entitled to sell within any three-month period only a

number of securities that does not exceed the greater of:

|

|

•

|

1%

of the total number of securities of the same class then outstanding,

which will equal approximately 228,632 shares immediately after this

offering; or

|

|

•

|

the

average weekly trading volume of such securities during the four calendar

weeks preceding the filing of a notice on Form 144 with respect to

such sale.

|

provided, in each case, that

we are subject to the periodic reporting requirements of the Securities Exchange

Act of 1934 for at least three months before the sale.

However,

since we will seek to initiate quotation of our common stock on the OTC Bulletin

Board, which is not an “automated quotation system,” our stockholders will not

be able to rely on the market-based volume limitation described in the second

bullet above. If, in the future, our securities are listed on an exchange or

quoted on NASDAQ, then our stockholders would be able to rely on the

market-based volume limitation. Unless and until our stock is so

listed or quoted, our stockholders can only rely on the percentage based volume

limitation described in the first bullet above. Such sales by

affiliates must also comply with the manner of sale, current public information

and notice provisions of Rule 144. The selling stockholders will not be governed

by the foregoing restrictions when selling their shares pursuant to this

prospectus.

The

3,000,000 outstanding restricted securities held by our sole director and

officer that are not registered in this prospectus are subject to the sale

limitations imposed by Rule 144. The availability for sale of substantial

amounts of common stock under Rule 144 could adversely affect prevailing market

prices for our securities.

LEGAL

MATTERS

No expert

or counsel named in this prospectus as having prepared or certified any part of

this prospectus or having given an opinion upon the validity of the securities

being registered or upon other legal matters in connection with the registration

or offering of the common stock was employed on a contingency basis, or had, or

is to receive, in connection with the offering, a substantial interest exceeding

$50,000, directly or indirectly, in Keyser Resources Incorporated. Nor was any

such person connected with Keyser Resources Incorporated as a promoter, managing

or principal underwriter, voting trustee, director, officer, or

employee.

The

validity of the issuance of the common stock offered by the selling stockholders

under this prospectus will be passed upon for us by Sichenzia Ross Freidman

Ference LLP, New York, New York.

EXPERTS

Our

audited and unaudited financial statements are included in this Prospectus in

reliance upon Seale and Beers, CPA , as experts in

auditing and accounting.

The

geological report for the Rey Lake mineral property (“Rey Lake Geologist

Report”) was prepared by Agnes Koffyberg P. Geo., and the summary information of

the geological report disclosed in this prospectus is in reliance upon the

authority and capability of Agnes Koffyberg as a Professional

Geoscientist.

13

DESCRIPTION OF THE

BUSINESS

Our

Business

Corporate

History

We are a

start-up exploration stage company without significant operations and we are in

the business of gold and copper exploration. Keyser Resources Incorporated was

incorporated in the State of Nevada on November 26, 2007. On the

date of our incorporation, we appointed Maurice Bidaux as our

Director. Mr. Bidaux was then appointed President, Principal

Financial Officer, Principal Accounting Officer and Secretary of our

company. Our principal office is located at 61 Sherwood Circle NW,

Calgary Alberta T3R 1R3.

Business

Development

Our

President, Mr. Bidaux, has had an interest in British Columbia mineral

exploration for over 12 years having invested in B.C. and other Western Canada

publicly listed mineral exploration companies over that period. Mr.

Bidaux decided to start a mineral exploration company on November 26, 2007 after

years of experience in investing in publicly listed mineral exploration

companies and observing that the commodity prices for gold, zinc, copper and

other minerals appeared to be at a sustained attractive level.

Mr.

Bidaux believed he had located claims of merit in the Omineca Mining District

using the Province of British Columbia’s on-line staking system and staked 4

claims on our behalf in April 2008. These claims proved to be not

viable after consulting a geologist at Discovery Consultants Inc. Mr.

Bidaux then approached Discovery Consultants Inc., about attractive unencumbered

properties that Discovery might be able to identify for us to acquire and

develop.

On June

11, 2008 we signed an option agreement with Bearclaw Capital Corporation

(“Bearclaw”) to acquire 90% interest in the Rey Lake Property, which is located

in the Nicola Mining Division of British Columbia, 45 kilometers north-west of

Merrit, British Columbia, Canada. There is no assurance that a

commercially viable deposit exists on this mineral claim. Exploration will be

required before a final evaluation as to the economic and legal feasibility of

the mineral claim is determined.

The

agreement with Bearclaw allows Keyser to acquire the 90% interest in the Rey

Lake Property by making exploration expenditures totaling CDN$150,000

(approximately US$156,000 using current translation rates) through September 30,

2010 and paying CDN $12,500 (approximately US$ 13,000) cash (of which CDN $5,000

(approximately US$ 5,200) has been paid) to Bearclaw by September 30,

2010. The agreement with Bearclaw was amended on September 28, 2009

to extend a requirement for an interim exploration milestone from September 30,

2009 to July 31, 2010. The option agreement required that Bearclaw

transfer title to us within 30 days of signing the agreement. On our

request, Bearclaw transferred title to our President, Mr. Maurice Bidaux, who

has executed a trust agreement and has agreed to hold the claim in trust for us

(since British Columbia laws prevent a Nevada corporation from holding title

directly). If we do not make the exploration expenditures, we will forfeit our

right to exercise the option.

The

tenure number of the Rey Lake mineral claim is 510210. Under the

British Columbia Mineral Tenure Act, title to British Columbia mineral claims

can only be held by individuals or British Columbia

corporations. Because of this regulation, our President is holding

the mineral claim in trust for us until we can determine whether there is a

commercially viable copper/gold/molybdenum deposit on our claim. If

we determine that there is a commercially viable gold and/or copper deposit on

our claim we will incorporate a British Columbia subsidiary to hold title to the

claim and our President will transfer the mineral claim to the

subsidiary. The transfer will be at no cost to us other than the

costs associated with the incorporation of the British Columbia

subsidiary.

In

November 2008, we engaged a professional geoscientist named Agnes Koffyberg, who

is familiar with the Nicola Mining District area to develop a report about the

Rey Lake property that we optioned from Bearclaw. Agnes Koffyberg was

introduced to us through Bill Gilmour, P. Eng. of Discovery

Consultants. Discovery Consultants was contracted to assess the

properties staked in the Nicola Mining District. The report entitled

“Report on the Rey Lake Property” dated November 28, 2008 describes the mineral

claim, the regional geology, the mineral potential of the claim and

recommendations how we should explore the claim.

14

Plan

of Operation

The

agreement with Bearclaw allows Keyser to acquire the 90% interest in the Rey

Lake Property by making exploration expenditures totaling CDN$150,000

(approximately US$156,000 using current translation rates) through September 30,

2010 and paying CDN $12,500 (approximately US$ 13,000) cash (of which CDN $5,000

(approximately US$ 5,200) has been paid) to Bearclaw by September 30,

2010. The agreement with Bearclaw was amended on September 28, 2009

to extend a requirement for an interim exploration milestone from September 30,

2009 to July 31, 2010. The option agreement required that Bearclaw

transfer title to us within 30 days of signing the agreement. On our

request, Bearclaw transferred title to our President, Mr. Maurice Bidaux, who

has executed a trust agreement and has agreed to hold the claim in trust for us

(since British Columbia laws prevent a Nevada corporation from holding title

directly). If we do not make the exploration expenditures, we will forfeit our

right to exercise the option.

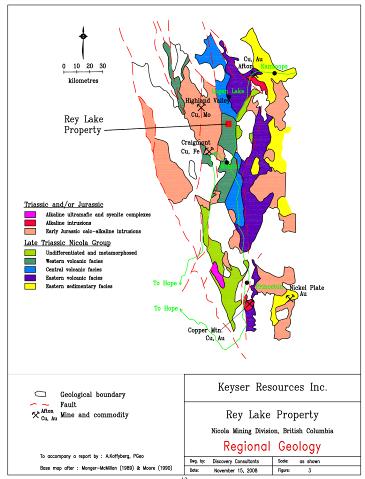

Our

consulting geologist Agnes Koffyberg has written the Rey Lake Geologist

Report providing us with recommendations of how we should explore our

claim. The potential economic significance of the mineral claim is that

according to the Rey Lake Geologist Report, the known mineralization has been

classified as a porphyry-copper-molybdenum type deposit and contains zones of

skarn alteration within the meta-sedimentary layers. Further,

according to the Rey Lake Geologist Report, our property has the potential to

host a deposit containing copper-molybdenum and gold

mineralization.

Regionally,

the Property is situated in a geologically prospective area that has proven

historic copper-molybdenum mineralization. On the property,

copper-molybdenum mineralization has been shown to occur for a distance of about

325m from DDH 75-24 (81m of 0.21% Cu, 0.023% Mo) to 72-6 (“skarn zone”) to

DDH72-1 and 2 (“breccia zone), in a north-northwest to south-southeast

direction. It remains open to the north and south. Best