Attached files

| file | filename |

|---|---|

| EX-5.1 - ZST Digital Networks, Inc. | v170889_ex5-1.htm |

| EX-23.1 - ZST Digital Networks, Inc. | v170889_ex23-1.htm |

| EX-23.3 - ZST Digital Networks, Inc. | v170889_ex23-3.htm |

As

filed with the Securities and Exchange Commission on January 14,

2010 Registration No. 333-164107

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Pre-Effective

Amendment No. 1 on

FORM

S-1/A

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

ZST

DIGITAL NETWORKS, INC.

(Name of

Registrant as Specified in Its Charter)

|

Delaware

|

3663

|

20-8057756

|

|

(State

or Other Jurisdiction of

|

(Primary

Standard Industrial

|

(I.R.S.

Employer

|

|

Incorporation

or Organization)

|

Classification

Code Number)

|

Identification

No.)

|

206

Tongbo Street, Boyaxicheng Second Floor

Zhengzhou

City, Henan Province

People’s

Republic of China 450007

(86)

371-6771-6850

(Address

and Telephone Number of Principal Executive Offices)

Corporation

Service Company

2711

Centerville Road

Suite

400

Wilmington,

DE 19808

(800)

222-2122

(Name,

Address and Telephone Number of Agent for Service)

Copies

to:

|

Thomas

J. Poletti, Esq.

|

|

Ayla

A. Nazli, Esq.

|

|

K&L

Gates LLP

|

|

10100

Santa Monica Blvd., 7 th

Floor

|

|

Los

Angeles, CA 90067

|

|

Telephone

(310) 552-5000

|

|

Facsimile

(310) 552-5001

|

Approximate Date of Proposed Sale to

the Public: From time to time after the effective date of this

Registration Statement.

If any of

the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this

form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration

statement for the same offering. o

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

If this

form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement the same

offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer o

|

Smaller

reporting

company

x

|

CALCULATION

OF REGISTRATION FEE

|

Proposed

|

Proposed

|

|||||||||||||||

|

Maximum

|

Maximum

|

Amount of

|

||||||||||||||

|

Title of Each Class of

|

Amount to Be

|

Offering Price

|

Aggregate

|

Registration

|

||||||||||||

|

Securities to Be Registered

|

Registered

(1)

|

Per Share

(2)

|

Offering Price

(2)

|

Fee

|

||||||||||||

|

Common

Stock, $0.0001 par value per share

|

1,086,400 | (3) | $ | 7.78 | $ | 8,452,192 | $ | 602.64 | ||||||||

|

Total

Registration Fee

|

$ | 602.64 | (4) | |||||||||||||

|

(1)

|

In

accordance with Rule 416(a), the Registrant is also registering hereunder

an indeterminate number of additional shares of common stock that shall be

issuable pursuant to Rule 416 to prevent dilution resulting from stock

splits, stock dividends or similar

transactions.

|

|

(2)

|

Estimated

pursuant to Rule 457(c) of the Securities Act of 1933, as amended, solely

for the purpose of computing the amount of the registration fee based on

the average of the high and low sales prices reported on the NASDAQ Global

Market on December 29, 2009.

|

|

(3)

|

Represents

shares of the Registrant’s common stock being registered for resale that

have been issued to the selling stockholders named in the prospectus or

prospectus supplement.

|

|

(4)

|

This

amount has been previously

paid.

|

The

Registrant amends this registration statement on such date or dates as may be

necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall

hereafter become effective in accordance with Section 8(a) of the Securities Act

of 1933, or until the registration statement shall become effective on such date

as the Commission, acting pursuant to Section 8(a), may

determine.

The

information in this prospectus is not complete and may be changed. We may not

sell these securities until the registration statement filed with the Securities

and Exchange Commission becomes effective. This prospectus is not an offer to

sell these securities and we are not soliciting offers to buy these securities

in any state where the offer or sale is not permitted.

|

PRELIMINARY

PROSPECTUS

|

Subject

to Completion

|

January

14, 2010

|

1,086,400

Shares

ZST

DIGITAL NETWORKS, INC.

Common

Stock

This

prospectus relates to the resale by the selling stockholders of up to 1,086,400

shares of our common stock. The selling stockholders may sell common stock from

time to time in the principal market on which the stock is traded at the

prevailing market price or in negotiated transactions. We will not receive any

proceeds from the sales by the selling stockholders. The selling stockholders

named herein may be deemed underwriters of the shares of common stock which they

are offering.

Our

shares of common stock are traded on the NASDAQ Global Market under the ticker

symbol “ZSTN.” On January 7, 2010, the closing sales price for our

common stock on the NASDAQ Global Market was $10.09 per share.

The

selling stockholders holding an aggregate of 1,086,400 shares of common stock

offered through this prospectus have agreed not sell any of the shares until six

(6) months after our common stock began to be listed on the NASDAQ Global

Market.

Investing

in our common stock involves a high degree of risk. Before buying any

shares, you should carefully read the discussion of material risks of investing

in our common stock in “Risk Factors” beginning on page 7 of this

prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission

has approved or disapproved of anyone’s investment in these securities or

determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

The

date of this prospectus is __________________, 2010

TABLE

OF CONTENTS

|

Page

|

||

|

Prospectus

Summary

|

1

|

|

|

Summary

Financial Data

|

5

|

|

|

Risk

Factors

|

7

|

|

|

Cautionary

Statement Regarding Forward-Looking Statements

|

26

|

|

|

Use

of Proceeds

|

27

|

|

|

Dividend

Policy

|

27

|

|

|

Market

for Common Equity and Related Stockholder Matters

|

27

|

|

|

Accounting

for the Share Exchange

|

27

|

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

28

|

|

|

Description

of Business

|

39

|

|

|

Management

|

50

|

|

|

Certain

Relationships and Related Transactions

|

55

|

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

57

|

|

|

Description

of Securities

|

58

|

|

|

Shares

Eligible for Future Sale

|

62

|

|

|

Selling

Stockholders

|

65

|

|

|

Plan

of Distribution

|

68

|

|

|

Legal

Matters

|

70

|

|

|

Experts

|

70

|

|

|

Additional

Information

|

70

|

|

|

Financial

Statements

|

F-1

|

|

|

Part

II Information Not Required in the Prospectus

|

II-1

|

|

|

Signatures

|

|

II-8

|

Please

read this prospectus carefully. It describes our business, our financial

condition and results of operations. We have prepared this prospectus so that

you will have the information necessary to make an informed investment

decision.

You

should rely only on information contained in this prospectus. We have not

authorized any other person to provide you with different information. This

prospectus is not an offer to sell, nor is it seeking an offer to buy, these

securities in any state where the offer or sale is not permitted. The

information in this prospectus is complete and accurate as of the date on the

front cover, but the information may have changed since that

date.

PROSPECTUS

SUMMARY

Because

this is only a summary, it does not contain all of the information that may be

important to you. You should carefully read the more detailed information

contained in this prospectus, including our financial statements and related

notes. Our business involves significant risks. You should carefully consider

the information under the heading “Risk Factors” beginning on page 7. Unless

otherwise indicated, all share and per share information gives effect to the

conversion of all of our outstanding shares of Series A Convertible Preferred

Stock into shares of our common stock (the “Series A Conversion”).

As used

in this prospectus, unless otherwise indicated, the terms “we”, “our”, “us”,

“Company” and “ZST” refer to ZST Digital Networks, Inc., a Delaware corporation,

formerly known as SRKP 18, Inc. (“SRKP 18”), its wholly-owned subsidiary, World

Orient Universal Limited, a company organized in the British Virgin Islands

(“World Orient”), its wholly-owned subsidiary, Global Asia Universal Limited, a

company organized in the British Virgin Islands (“Global Asia”), its

wholly-owned subsidiary, Everfair Technologies, Ltd., a company organized in

Hong Kong (“Everfair”), and its wholly-owned subsidiary, Zhengzhou Shenyang

Technology Company Limited, a company organized in the People’s Republic of

China (“Zhengzhou ZST”). “China” or “PRC” refers to the People’s Republic of

China. “RMB” or “Renminbi” refers to the legal currency of China and “$” or

“U.S. Dollars” refers to the legal currency of the United States.

ZST

Digital Networks, Inc.

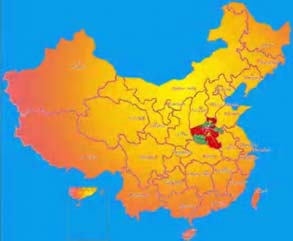

We are

principally engaged in supplying digital and optical network equipment to cable

system operators in the Henan Province of China. We have developed a line of

internet protocol television (“IPTV”) set-top boxes that are used to provide

bundled cable television, Internet and telephone services to residential and

commercial customers. We have assisted in the installation and construction of

over 400 local cable networks covering more than 90 municipal districts,

counties, townships, and enterprises. Our services and products have been

recognized with various certifications, including “integrated computer

information system qualification class III” issued by the Ministry of Industry

Information, “communication user cable construction enterprise qualification”

issued by the Henan Province Administration of Communication, “Henan Province

Security Technology Prevention Engineering Qualification Class III”, a

certificate of “ISO9001: 2000 Quality System Authentication”, and “Double High”

certification, high-tech product and high-tech enterprise issued by the Henan

Province government.

At

present, our main clients are broadcasting TV bureaus and cable network

operators serving various cities and counties. We have over 30 main customers,

including the broadcasting TV bureaus and cable network operators of the cities

of Nanyang, Mengzhou, Xuchang, Pingdingshan, Kaifeng, Zhoukou and Gongyi, and

the counties of Yuanyang, Luoning, Neihuang, Yinyang, Xixia, Kaifeng, Nanzhao,

and Gushi.

In the

near future, we plan to joint venture with cable network operators to provide

bundled television programming, Internet and telephone services to residential

customers in cities and counties located in the Henan Province of China. In

addition, we are currently in the process of establishing a partnership with

China Unicom, a wireless network provider, in connection with the Company’s

development and sale of its GPS tracking units. In March 2009, the Company

entered into a network access right agreement with the Henan Subsidiary of China

Unicom that allows the Company to use the China Unicom wireless network for

providing GPS location and tracking services to third parties. In the near

future, the Company intends to negotiate a reseller agreement with the Henan

Subsidiary of China Unicom whereby GPS tracking units supplied by the Company

would be sold in the Henan Subsidiary of China Unicom retail stores, with the

Company receiving a share of subscriber revenue collected by the Henan

Subsidiary of China Unicom.

Corporate

Information

We were

incorporated in the State of Delaware on December 7, 2006. We were originally

organized as a “blank check” shell company to investigate and acquire a target

company or business seeking the perceived advantages of being a publicly held

corporation.

On

January 9, 2009, we closed a share exchange transaction pursuant to which we (i)

issued 806,408 shares of our common stock to acquire 100% equity ownership of

World Orient, (ii) assumed the operations of World Orient and its subsidiaries,

including Zhengzhou ZST, and (iii) changed our name from SRKP 18, Inc. to ZST

Digital Networks, Inc.

Our

corporate offices are located at 206 Tongbo Street, Boyaxicheng Second Floor,

Zhengzhou City, Henan Province, People’s Republic of China 450007. Our telephone

number is (86) 371-6771-6850.

We are a

reporting company under Section 13 of the Securities Exchange Act of 1934, as

amended. Our shares of common stock are traded on the NASDAQ Global Market under

the ticker symbol “ZSTN.” On January 7, 2010, the closing sales price

for our common stock on the NASDAQ Global Market was $10.09 per

share.

1

Recent

Events

Reverse Stock

Split

On

October 6, 2009, we effected a 1-for-2.461538462 reverse stock split of all of

our issued and outstanding shares of common stock and Series A Convertible

Preferred Stock (the “Reverse Stock Split”) by filing an amendment to our

Certificate of Incorporation with the Secretary of State of Delaware. The par

value and number of authorized shares of our common stock and Series A

Convertible Preferred Stock remained unchanged. The number of shares and per

share amounts included in the consolidated financial statements and the

accompanying notes included in the F- section have been adjusted to reflect the

Reverse Stock Split retroactively. Unless otherwise indicated, all references to

number of shares, per share amounts and earnings per share information contained

in this prospectus give effect to the Reverse Stock Split.

Share

Exchange

On

December 11, 2008, we entered into a share exchange agreement, as amended on

January 9, 2009 (the “Exchange Agreement”), with World Orient and its

stockholders, pursuant to which the stockholders would transfer all of the

issued and outstanding shares of World Orient to the Company in exchange for

806,408 shares of our common stock (the “Share Exchange”). On January 9, 2009,

the Share Exchange closed and World Orient became our wholly-owned subsidiary

and we immediately changed our name from “SRKP 18, Inc.” to “ZST Digital

Networks, Inc.” A total of 806,408 shares were issued to the former stockholders

of World Orient.

Purchase

Right

On

January 14, 2009, Zhong Bo, our Chief Executive Officer and Chairman of the

Board, Wu Dexiu, Huang Jiankang, Sun Hui and Li Yuting (the “ZST Management”)

each entered into a Common Stock Purchase Agreement pursuant to which the

Company issued and the ZST Management agreed to purchase an aggregate of

5,090,315 shares of our common stock at a per share purchase price of $0.6907

(the “Purchase Right”). The purchase price for the shares was paid in full on

May 25, 2009. Each of the stockholders and warrantholders of the Company prior

to the Share Exchange agreed to cancel 0.3317 shares of common stock and

warrants to purchase 0.5328 shares of common stock held by each of them for each

one (1) share of common stock purchased by the ZST Management pursuant to the

Purchase Right (the “Share and Warrant Cancellation”). Pursuant to the Share and

Warrant Cancellation, an aggregate of 1,688,532 shares of common stock and

warrants to purchase 2,712,283 shares of common stock held by certain of our

stockholders and warrantholders prior to the Share Exchange were

cancelled.

Private

Placement

On May 5,

2009, we completed the final closing in a series of five closings beginning

January 9, 2009 of a private placement transaction (the “Private Placement”).

Pursuant to subscription agreements entered into with the investors, we sold an

aggregate of 1,263,723 shares of Series A Convertible Preferred Stock at $3.94

per share. As a result, we received gross proceeds in the amount of

approximately $4.98 million. As of the date of this prospectus, the conversion

price of the Series A Convertible Preferred Stock is equal to

$3.94. See “Description of Securities — Preferred Stock” on

page 58 for a more complete description of our Series A Convertible

Preferred Stock.

Restructuring

Our BVI

subsidiary, World Orient, its wholly-owned BVI subsidiary, Global Asia, and

Global Asia’s wholly-owned Hong Kong subsidiary, Everfair, were owned by non-PRC

individuals. Everfair obtained all the equity interests of Zhengzhou ZST further

to an Equity Purchase Agreement dated October 10, 2008 (the “Equity Purchase

Agreement”) by and among Everfair, Zhong Bo, our Chief Executive Officer and

Chairman of the Board, Wu Dexiu, Huang Jiankang, Sun Hui and Li Yuting (the “ZST

Management”).

2

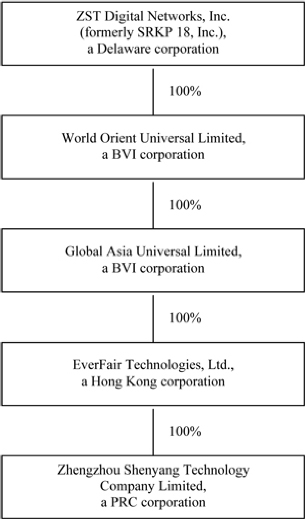

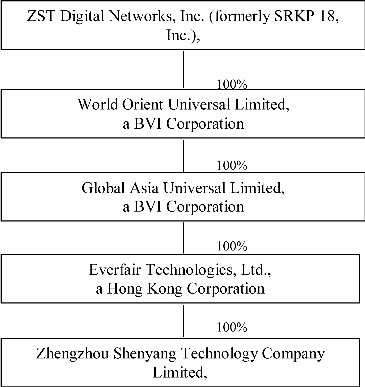

The

corporate structure of the Company is illustrated as follows:

Following

the full exercise of the Purchase Right and Share and Warrant Cancellation, Mr.

Zhong beneficially owned approximately 59.87% of our outstanding common stock

(after giving effect to the Series A Conversion). See “Risk Factors” beginning

on page 7 for a more complete description of the aforementioned

restructuring and risks associated therewith.

Public

Offering

In

October 2009, we completed a public offering consisting of 3,125,000 shares of

our common stock. Rodman & Renshaw, LLC (“Rodman”) and WestPark

Capital, Inc. (“WestPark” and together with Rodman, the “Underwriters”) acted as

co-underwriters in the public offering. Our shares of common stock

were sold to the public at a price of $8.00 per share, for gross proceeds of $25

million. Compensation for the Underwriters’ services included

discounts and commissions of $1,875,000, a $250,000 non-accountable expense

allowance, roadshow expenses of approximately $10,000, and legal counsel fees

(excluding blue sky fees) of $40,000. The Underwriters also received

warrants to purchase an aggregate of 156,250 shares of our common stock at an

exercise price of $10.00 per share. The warrants, which have a term

of five years, are not exercisable until at least one year from the date of

issuance. The warrants also carry registration

rights.

3

THE

OFFERING

|

Common

stock offered by selling stockholders

|

1,086,400

shares

|

|

|

Common

stock outstanding

|

11,650,442

shares (1)

|

|

|

Use

of proceeds

|

We

will not receive any proceeds from the sale of the common stock by the

selling stockholders.

|

|

|

Risk

factors

|

Investing

in these securities involves a high degree of risk. As an investor you

should be able to bear a complete loss of your investment. You should

carefully consider the information set forth in the “Risk Factors” section

beginning on page 7.

|

|

(1)

|

Based on 11,650,442 shares of

common stock issued and outstanding as of the date of this

prospectus. Excludes 156,250 shares of common stock that are

issuable upon the exercise of outstanding

warrants.

|

The

selling stockholders holding an aggregate of 1,086,400 shares of common stock

have agreed not to sell any of these shares until six (6) months after our

common stock began to be listed on the NASDAQ Global

Market.

4

SUMMARY

FINANCIAL DATA

The

following summary financial information contains consolidated statement of

operations data for the nine months ended September 30, 2009 and 2008

(unaudited) and for each of the years in the five-year period ended December 31,

2008 and the consolidated balance sheet data as of September 30, 2009 and

year-end for each of the years in the five-year period ended December 31, 2008.

The consolidated statement of operations data and balance sheet data were

derived from the audited consolidated financial statements, except for data for

the nine months ended and as of September 30, 2009 and 2008 and the years ended

and as of December 31, 2005 and 2004. Such financial data should be read in

conjunction with the consolidated financial statements and the notes to the

consolidated financial statements starting on page F-1 and with “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.”

Consolidated

Statements of Operations (U.S. Dollars in

Thousands)

|

For

the Year

|

||||||||||||||||||||||||||||

|

For

the Nine Months Ended

|

Ended

|

|||||||||||||||||||||||||||

|

September

30,

|

December

31,

|

|||||||||||||||||||||||||||

|

2009

|

2008

|

2008

|

2007

|

2006

|

2005

|

2004

|

||||||||||||||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

|||||||||||||||||||||||||

|

Revenue

|

$

|

70,067

|

40,987

|

$

|

55,431

|

$

|

28,717

|

$

|

5,650

|

$

|

2,129

|

$

|

1,585

|

|||||||||||||||

|

Cost

of goods sold

|

58,774

|

33,563

|

45,594

|

23,221

|

4,478

|

1,501

|

1,325

|

|||||||||||||||||||||

|

Gross

Profit

|

11,293

|

7,424

|

9,837

|

5,496

|

1,172

|

628

|

260

|

|||||||||||||||||||||

|

Operating

Costs and Expenses

|

||||||||||||||||||||||||||||

|

Selling

expenses

|

35

|

107

|

146

|

3

|

19

|

57

|

144

|

|||||||||||||||||||||

|

Depreciation

|

28

|

34

|

21

|

44

|

42

|

26

|

42

|

|||||||||||||||||||||

|

General

and administrative

|

725

|

614

|

1,006

|

715

|

230

|

-

|

374

|

|||||||||||||||||||||

|

Merger

cost

|

567

|

—

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||

|

Research

and development

|

109

|

—

|

-

|

89

|

-

|

304

|

-

|

|||||||||||||||||||||

|

Total

operating costs and expenses

|

1,464

|

755

|

1,173

|

851

|

291

|

387

|

560

|

|||||||||||||||||||||

|

Income

from operations

|

9,829

|

6,669

|

8,664

|

4,645

|

881

|

241

|

(300

|

)

|

||||||||||||||||||||

|

Other

income (expenses)

|

||||||||||||||||||||||||||||

|

Gain

on disposal of assets

|

—

|

—

|

(11

|

)

|

-

|

48

|

-

|

-

|

||||||||||||||||||||

|

Interest

income

|

44

|

15

|

10

|

3

|

-

|

44

|

-

|

|||||||||||||||||||||

|

Interest

expense

|

(141

|

) |

(261

|

) |

(339

|

)

|

(196

|

)

|

(12

|

)

|

(7

|

)

|

-

|

|||||||||||||||

|

Imputed

interest

|

(31

|

) |

(49

|

) |

(71

|

)

|

(70

|

)

|

(20

|

)

|

-

|

-

|

||||||||||||||||

|

Sundry

income (expense), net

|

(7

|

) |

(1

|

) |

(11

|

)

|

-

|

55

|

-

|

(2

|

)

|

|||||||||||||||||

|

Total

other income (expenses)

|

(135

|

) |

(296

|

) |

(422

|

)

|

(263

|

)

|

71

|

37

|

(2

|

)

|

||||||||||||||||

|

Income

before income taxes

|

9,694

|

6,373

|

8,242

|

4,382

|

952

|

278

|

(302

|

)

|

||||||||||||||||||||

|

Income

taxes

|

(2,594

|

) |

(1,566

|

) |

(2,133

|

)

|

(1,515

|

)

|

(314

|

)

|

(92

|

)

|

-

|

|||||||||||||||

|

Net

income

|

$

|

7,100

|

4,807

|

$

|

6,109

|

$

|

2,867

|

$

|

638

|

$

|

186

|

$

|

(302

|

)

|

||||||||||||||

|

Basic

earnings per share

|

$

|

1.01

|

0.82

|

$

|

1.04

|

$

|

0.49

|

$

|

0.11

|

$

|

0.03

|

$

|

(0.05

|

)

|

||||||||||||||

|

Weighted

average shares outstanding, basic

|

7,056,103

|

5,896,723

|

5,896,723

|

5,896,723

|

5,896,723

|

5,896,723

|

5,896,723

|

|||||||||||||||||||||

|

Diluted

earnings per share

|

$

|

0.86

|

0.82

|

$

|

1.04

|

$

|

0.49

|

$

|

0.11

|

$

|

0.03

|

$

|

(0.05

|

)

|

||||||||||||||

|

Weighted

average shares outstanding, diluted

|

8,265,403

|

5,896,723

|

5,896,723

|

5,896,723

|

5,896,723

|

5,896,723

|

5,896,723

|

|||||||||||||||||||||

5

Consolidated Balance Sheets

(U.S. Dollars in Thousands)

|

September

30,

|

September

30,

|

December

31,

|

December

31,

|

December

31,

|

December

31,

|

December

31,

|

||||||||||||||||||||||

|

2009

|

2008

|

2008

|

2007

|

2006

|

2005

|

2004

|

||||||||||||||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

|||||||||||||||||||||||||

|

Total

current assets

|

$

|

32,028

|

19,722

|

$

|

17,270

|

$

|

16,918

|

$

|

8,069

|

$

|

3,103

|

$

|

3,055

|

|||||||||||||||

|

Total

assets

|

32,980

|

19,743

|

17,304

|

16,980

|

8,150

|

4,189

|

3,788

|

|||||||||||||||||||||

|

Total

current liabilities

|

10,666

|

12,108

|

8,321

|

14,413

|

6,381

|

1,786

|

1,884

|

|||||||||||||||||||||

|

Total

liabilities

|

10,666

|

12,108

|

8,321

|

14,413

|

6,381

|

2,042

|

1,885

|

|||||||||||||||||||||

|

Total

stockholders' equity

|

22,314

|

7,635

|

8,983

|

2,567

|

1,769

|

2,147

|

1,903

|

|||||||||||||||||||||

6

RISK

FACTORS

Any

investment in our common stock involves a high degree of

risk. Investors should carefully consider the risks described below

and all of the information contained in this prospectus before deciding whether

to purchase our common stock. Our business, financial condition or

results of operations could be materially adversely affected by these risks if

any of them actually occur. The trading price could decline due to

any of these risks, and an investor may lose all or part of his

investment. Some of these factors have affected our financial

condition and operating results in the past or are currently affecting our

company. This prospectus also contains forward-looking statements

that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in these forward-looking statements as a

result of certain factors, including the risks we face as described below and

elsewhere in this prospectus.

Risks

Related to Our Operations

We

derive substantially all of our revenues from sales in the PRC and any downturn

in the Chinese economy could have a material adverse effect on our business and

financial condition.

Substantially

all of our revenues are generated from sales in the PRC. We anticipate that

revenues from sales of our products in the PRC will continue to represent the

substantial portion of our total revenues in the near future. Our sales and

earnings can also be affected by changes in the general economy since purchases

of cable television services are generally discretionary for consumers. Our

success is influenced by a number of economic factors which affect disposable

consumer income, such as employment levels, business conditions, interest rates,

oil and gas prices and taxation rates. Adverse changes in these economic

factors, among others, may restrict consumer spending, thereby negatively

affecting our sales and profitability.

We

are and will continue to be subject to rapidly declining average selling prices,

which may harm our results of operations.

Set-top

boxes and networking products such as those we offer are often subject to

declines in average selling prices due to rapidly evolving technologies,

industry standards and consumer preferences. These products are also subject to

rapid technological changes which often cause product obsolescence. Companies

within our industry are continuously developing new products with heightened

performance and functionality. This puts pricing pressure on existing products

and constantly threatens to make them, or causes them to be, obsolete. Our

typical product’s life cycle is short, typically generating lower average

selling prices as the cycle matures. If we fail to accurately anticipate the

introduction of new technologies, we may possess significant amounts of obsolete

inventory that can only be sold at substantially lower prices and profit margins

than we anticipated. In addition, if we fail to accurately anticipate the

introduction of new technologies, we may be unable to compete effectively due to

our failure to offer products most demanded by the marketplace. If any of these

failures occur, our sales, profit margins and profitability will be adversely

affected.

In

addition, network systems operators expect suppliers, such as our Company, to

cut their costs and lower the price of their products to lessen the negative

impact on their own profit margins. As a result, we have previously reduced the

price of some of our products and expect to continue to face market-driven

downward pricing pressures in the future. Our results of operations will suffer

if we are unable to offset any declines in the average selling prices of our

products by developing new or enhanced products with higher selling prices or

gross profit margins, increasing our sales volumes or reducing our production

costs.

If

we do not correctly forecast demand for our products, we could have costly

excess production or inventories and we may not be able to secure sufficient or

cost effective quantities of our products or production materials and our

revenues, cost of revenues and financial condition could be adversely

affected.

The

demand for our products depends on many factors, including pricing and inventory

levels, and is difficult to forecast due in part to variations in economic

conditions, changes in consumer and business preferences, relatively short

product life cycles, changes in competition, seasonality and reliance on key

third party carriers. It is particularly difficult to forecast demand by

individual product. Significant unanticipated fluctuations in demand, the timing

and disclosure of new product releases or the timing of key sales orders could

result in costly excess production or inventories or the inability to secure

sufficient, cost-effective quantities of our products or production materials.

These inventory risks are particularly acute during end product transitions in

which a new generation of set-top boxes is being deployed and inventory of older

generation set-top boxes is at a higher risk of obsolescence. Furthermore,

because of the competitive nature of the set-top box business and the short-term

nature of our purchase orders, we could in the future be required to reduce the

average selling-prices of our set-top boxes, which in turn would adversely

affect our gross margins and profitability. This could adversely impact our

revenues, cost of revenues and financial condition.

7

We

depend on sales of set-top boxes for a substantial portion of our revenue, and

if sales of our set-top boxes decline or we are not able to penetrate new

markets for set-up boxes, our business and financial position will

suffer.

The

substantial portion of our revenues consists primarily of sales of our set-top

boxes. In addition, we currently derive, and expect to continue to derive in the

near term, revenue from sales of our set-top boxes to a limited number of

customers. Continued market acceptance of our set-top boxes is critical to our

future success. If we are not able to expand sales of our set-top boxes to other

providers of digital television, our growth prospects will be limited, and our

revenues will be substantially impacted.

Our

set-up boxes were initially designed for, and have been deployed mostly by,

providers of cable-delivered digital television. To date, we have not made any

sales of our set-top boxes to direct-to-home satellite providers. In addition,

the set-top box market is highly competitive and we expect competition to

intensify in the future. In particular, we believe that most set-top boxes are

sold by a small number of well entrenched competitors who have long-standing

relationships with direct-to-home satellite providers. This competition may make

it more difficult for us to sell home satellite set-top boxes, and may result in

pricing pressure, small profit margins, high sales and marketing expenses and

failure to obtain market share, any of which could likely seriously harm our

business, operating results and financial condition.

Our

business may suffer if cable television operators, who currently comprise our

customer base, do not compete successfully with existing and emerging

alternative platforms for delivering digital television, including terrestrial

networks, internet protocol television and direct-to-home satellite service

providers.

Our

existing customers are cable television operators, which compete with

direct-to-home satellite video providers and terrestrial broadcasters for the

same pool of viewers. As technologies develop, other means of delivering

information and entertainment to television viewers are evolving. For example,

some telecommunications companies are seeking to compete with terrestrial

broadcasters, cable television network operators and direct-to-home satellite

services by offering internet protocol television, which allows

telecommunications companies to stream television programs through telephone

lines or fiber optic lines. To the extent that the terrestrial television

networks, telecommunications companies and direct-to-home satellite providers

compete successfully against cable television networks services for viewers, the

ability of our existing customer base to attract and retain subscribers may be

adversely affected. As a result, demand for our set-top boxes could decline and

we may not be able to sustain our current revenue levels.

Our

products may contain errors or defects, which could result in the rejection of

our products, damage to our reputation, lost revenues, diverted development

resources and increased service costs, warranty claims and

litigation.

Our

products are complex and must meet stringent user requirements. In addition, we

must develop our products to keep pace with the rapidly changing markets.

Sophisticated products like ours are likely to contain undetected errors or

defects, especially when first introduced or when new models or versions are

released. Our products may not be free from errors or defects after commercial

shipments have begun, which could result in the rejection of our products and

jeopardize our relationship with carriers. End users may also reject or find

issues with our products and have a right to return them even if the products

are free from errors or defects. In either case, returns or quality issues could

result in damage to our reputation, lost revenues, diverted development

resources, increased customer service and support costs, and warranty claims and

litigation which could harm our business, results of operations and financial

condition.

We

do not carry any business interruption insurance, products liability insurance

or any other insurance policy. As a result, we may incur uninsured losses,

increasing the possibility that you would lose your entire investment in our

company.

We could

be exposed to liabilities or other claims for which we would have no insurance

protection. We do not currently maintain any business interruption insurance,

products liability insurance, or any other comprehensive insurance policy. As a

result, we may incur uninsured liabilities and losses as a result of the conduct

of our business. There can be no guarantee that we will be able to obtain

additional insurance coverage in the future, and even if we are able to obtain

additional coverage, we may not carry sufficient insurance coverage to satisfy

potential claims. Should uninsured losses occur, any purchasers of our common

stock could lose their entire investment.

Because

we do not carry products liability insurance, a failure of any of the products

marketed by us may subject us to the risk of product liability claims and

litigation arising from injuries allegedly caused by the improper functioning or

design of our products. We cannot assure that we will have enough funds to

defend or pay for liabilities arising out of a products liability claim. To the

extent we incur any product liability or other litigation losses, our expenses

could materially increase substantially. There can be no assurance that we will

have sufficient funds to pay for such expenses, which could end our operations

and you would lose your entire investment.

8

We

intend to make significant investments in new products and services that may not

be profitable.

Companies

in our industry are under pressure to develop new designs and product

innovations to support changing consumer tastes and regulatory requirements. To

date, we have engaged in modest research and development activities and much of

our expenditures on research and development have been reimbursed by the local

government. However, we believe that substantial additional research and

development activities are necessary to allow us to offer

technologically-advanced products to serve a broader array of customers. We

expect that our research and development budget will substantially increase as

the scope of our operations expands and as we have access to additional working

capital to fund these activities. However, research and development and

investments in new technology are inherently speculative and commercial success

depends on many factors including technological innovation, novelty, service and

support, and effective sales and marketing. We may not achieve significant

revenue from new product and service investments for a number of years, if at

all. Moreover, new products and services may not be profitable, and even if they

are profitable, operating margins for new products and businesses may be

minimal.

We

are subject to intense competition in the industry in which we operate, which

could cause material reductions in the selling price of our products or losses

of our market share.

The

market for set-top boxes and networking products is highly competitive,

especially with respect to pricing and the introduction of new products and

features. Our products compete primarily on the basis of:

|

|

•

|

reliability;

|

|

|

•

|

brand

recognition;

|

|

|

•

|

quality;

|

|

|

•

|

price;

|

|

|

|

|

|

•

|

design;

and

|

|

|

•

|

quality

service and support to retailers and our

customers.

|

Currently,

there are many significant competitors in the set-top box business including

several established companies who have sold set-top boxes to major cable

operators for many years. These competitors include companies such as Motorola,

Cisco Systems, and Pace. In addition, a number of rapidly growing companies have

recently entered the market, many of them with set-top box offerings similar to

our existing set-top box products. We also expect additional competition in the

future from new and existing companies who do not currently compete in the

market for set-top boxes. As the set-top box business evolves, our current and

potential competitors may establish cooperative relationships among themselves

or with third parties, including software and hardware companies that could

acquire significant market share, which could adversely affect our business. We

also face competition from set-top boxes that have been internally developed by

digital video providers.

In recent

years, we and many of our competitors, have regularly lowered prices, and we

expect these pricing pressures to continue. If these pricing pressures are not

mitigated by increases in volume, cost reductions from our supplier or changes

in product mix, our revenues and profits could be substantially reduced. As

compared to us, many of our competitors have:

|

|

•

|

significantly

longer operating histories;

|

|

|

•

|

significantly

greater managerial, financial, marketing, technical and other competitive

resources; and

|

|

|

•

|

greater

brand recognition.

|

As a

result, our competitors may be able to:

|

|

•

|

adapt

more quickly to new or emerging technologies and changes in customer

requirements;

|

|

|

•

|

devote

greater resources to the promotion and sale of their products and

services; and

|

|

|

•

|

respond

more effectively to pricing

pressures.

|

9

These

factors could materially adversely affect our operations and financial

condition. In addition, competition could increase if:

|

|

•

|

new

companies enter the market;

|

|

|

•

|

existing

competitors expand their product mix;

or

|

|

|

•

|

we

expand into new markets.

|

An

increase in competition could result in material price reductions or loss of our

market share.

Changes

in existing technologies or the emergence of new products or technologies could

significantly harm our business.

Our

businesses change rapidly as new technologies are developed. These new

technologies may cause our services and products to become obsolete. Changes in

existing technologies could also cause demand for our products and services to

decline. For example, if changes in technology allow digital television

subscribers to use devices such as personal computers, cable ready televisions

and network based digital video recording services in place of set-top boxes,

our customers may not need to purchase our set-top boxes to provide their

digital television subscribers with digital video recording and other set-top

box features. One or more new technologies also could be introduced that compete

favorably with our set-top boxes or that cause our set-top boxes to no longer be

of significant benefit to our customers.

We and

our suppliers also may not be able to keep pace with technological developments.

Alternatively, if the new technologies on which we intend to focus our research

and development investments fail to achieve acceptance in the marketplace, we

could suffer a material adverse effect on our future competitive position that

could cause a reduction in our revenues and earnings. Our competitors could also

obtain or develop proprietary technologies that are perceived by the market as

being superior to ours. Further, after we have incurred substantial research and

development costs, one or more of the technologies under development could

become obsolete prior to its introduction. Finally, delays in the delivery of

components or other unforeseen problems may occur that could materially and

adversely affect our ability to generate revenue, offer new products and

services and remain competitive.

Technological

innovation is important to our success and depends, to a significant degree, on

the work of technically skilled employees. Competition for the services of these

types of employees is intense. We may not be able to attract and retain these

employees. If we are unable to attract and maintain technically skilled

employees, our competitive position could be materially and adversely

affected.

The

loss or significant reduction in business of any of our key customers could

materially and adversely affect our revenues and earnings.

We are

highly dependent upon sales of our products to certain of our customers. During

our fiscal year ended December 31, 2008, Neihuang Radio & Television Bureau

and Kaifeng Radio & Television Bureau each accounted for approximately 10%

of our net revenues. During the fiscal year ended December 31, 2007, Nanyang

Radio & Television Bureau, Mengzhou Radio & Television Bureau and

Xuchang Radio & Television Bureau accounted for approximately 16%, 14% and

13%, respectively, of our net revenues. During the fiscal year December 31,

2006, Kaifeng Radio & Television Bureau, Xinye Radio & Television

Bureau, Xuchang Radio & Television Bureau, Huaxian Radio & Television

Bureau and Nanyang Radio & Television Bureau accounted for approximately

24%, 24%, 19%, 13% and 10%, respectively, of our net revenues. No other customer

accounted for greater than 5% of our net revenues during these periods. All

purchases of our products by customers are made through purchase orders and we

do not have long-term contracts with any of our customers. The loss of Neihuang

County Broadcasting Television Information Network Center and Henan Cable TV

Network Group Co., Ltd. Kaifeng Branch, or any of our other customers to which

we sell a significant amount of our products or any significant portion of

orders from Cable TV Station of Pingdingshan and Cable TV Station of Nanyang, or

such other customers or any material adverse change in the financial condition

of such customers could negatively affect our revenues and decrease our

earnings.

We cannot

rely on long-term purchase orders or commitments to protect us from the negative

financial effects of a decline in demand for our products. The limited certainty

of product orders can make it difficult for us to forecast our sales and

allocate our resources in a manner consistent with our actual sales. Moreover,

our expense levels are based in part on our expectations of future sales and, if

our expectations regarding future sales are inaccurate, we may be unable to

reduce costs in a timely manner to adjust for sales shortfalls. Cancellations or

reductions of customer orders could result in the loss of anticipated sales

without allowing us sufficient time to reduce our inventory and operating

expenses. Furthermore, because we depend on a small number of customers for the

vast majority of our sales, the magnitude of the ramifications of these risks is

greater than if our sales were less concentrated with a small number of

customers. As a result of our lack of long-term purchase orders and purchase

commitments we may experience a rapid decline in our sales and

profitability.

In

addition, there is a relatively small number of potential new customers for our

set-top boxes and we expect this customer concentration to continue for the

foreseeable future. Therefore, our operating results will likely continue to

depend on sales to a relatively small number of customers, as well as the

continued success of these customers. If we do not develop relationships with

new customers, we may not be able to expand our customer base or maintain or

increase our revenue.

10

We

depend on a limited number of suppliers for components for our products. The

inability to secure components for our products could reduce our revenues and

adversely affect our relationship with our customers.

We rely

on a limited number of suppliers for our component parts and raw materials.

Although there are many suppliers for each of our component parts and raw

materials, we are dependent on a limited number of suppliers for many of the

significant components and raw materials. This reliance involves a number of

significant potential risks, including:

|

|

•

|

lack

of availability of materials and interruptions in delivery of components

and raw materials from our

suppliers;

|

|

|

•

|

manufacturing

delays caused by such lack of availability or interruptions in

delivery;

|

|

|

•

|

fluctuations

in the quality and the price of components and raw materials, in

particular due to the petroleum price impact on such materials;

and

|

|

|

•

|

risks

related to foreign operations.

|

We

generally do not have any long-term or exclusive purchase commitments with any

of our suppliers. Hangzhou Jingbao Electronic Ltd., Farway Electronics Factory

and Henan Hui-ke Electronics Co., Ltd. are our largest suppliers of components

for our products, each of which accounted for more than 10% of our purchases of

components for our products for the fiscal year ended December 31, 2008 and the

fiscal year ended December 31, 2007. In addition, Henan Hui-ke Electronics Co.,

Ltd., Shenzhen Jiuzhou Technology, Co. Ltd. and Hangzhou Jingbao Co., Ltd. each

accounted for more than 10% of our purchases of components for our products for

the nine months ended September 30, 2009. Our failure to maintain

existing relationships with our suppliers or to establish new relationships in

the future could also negatively affect our ability to obtain our components and

raw materials used in our products in a timely manner. If we are unable to

obtain ample supply of products from our existing suppliers or alternative

sources of supply, we may be unable to satisfy our customers’ orders which could

materially and adversely affect our revenues and our relationship with our

customers.

Certain

disruptions in supply of and changes in the competitive environment for

components and raw materials integral to our products may adversely affect our

profitability.

We use a

broad range of materials and supplies, including LCD components, ICs, flash

memories, WiFi modules, GPS modules, capacitors, resistors, switches,

connectors, batteries and other electronic components in our products. A

significant disruption in the supply of these materials could decrease

production and shipping levels, materially increase our operating costs and

materially adversely affect our profit margins. Shortages of materials or

interruptions in transportation systems, labor strikes, work stoppages, war,

acts of terrorism or other interruptions to or difficulties in the employment of

labor or transportation in the markets in which we purchase materials,

components and supplies for the production of our products, in each case may

adversely affect our ability to maintain production of our products and sustain

profitability. If we were to experience a significant or prolonged shortage of

critical components and raw materials from any of our suppliers and could not

procure the components from other sources, we would be unable to meet our

production schedules for some of our key products and to ship such products to

our customers in a timely fashion, which would adversely affect our sales,

margins and customer relations.

Substantial

defaults by our customers on accounts receivable or the loss of significant

customers could have a material adverse effect on our business.

A

substantial portion of our working capital consists of accounts receivable from

customers. If customers responsible for a significant amount of accounts

receivable were to become insolvent or otherwise unable to pay for products and

services, or to make payments in a timely manner, our business, results of

operations or financial condition could be materially adversely affected. An

economic or industry downturn could materially adversely affect the servicing of

these accounts receivable, which could result in longer payment cycles,

increased collection costs and defaults in excess of management’s expectations.

A significant deterioration in our ability to collect on accounts receivable

could also impact the cost or availability of financing available to

us.

In

addition, our business is characterized by long periods for collection from our

customers and short periods for payment to our suppliers, the combination of

which may cause us to have liquidity problems. We experience an average accounts

settlement period ranging from one month to as high as four months from the time

we sell our products to the time we receive payment from our customers. In

contrast, we typically need to place certain deposits and advances with our

suppliers on a portion of the purchase price in advance and for some suppliers

we must maintain a deposit for future orders. Because our payment cycle is

considerably shorter than our receivable cycle, we may experience working

capital shortages. Working capital management, including prompt and diligent

billing and collection, is an important factor in our results of operations and

liquidity. We cannot assure you that system problems, industry trends or other

issues will not extend our collection period, adversely impact our working

capital.

11

Our

operations would be materially adversely affected if third-party carriers were

unable to transport our products on a timely basis.

All of

our products are shipped through third party carriers. If a strike or other

event prevented or disrupted these carriers from transporting our products,

other carriers may be unavailable or may not have the capacity to deliver our

products to our customers. If adequate third party sources to ship our products

were unavailable at any time, our business would be materially adversely

affected.

Our

quarterly results may fluctuate because of many factors and, as a result,

investors should not rely on quarterly operating results as indicative of future

results.

Fluctuations

in operating results or the failure of operating results to meet the

expectations of public market analysts and investors may negatively impact the

value of our securities. Quarterly operating results may fluctuate in the future

due to a variety of factors that could affect revenues or expenses in any

particular quarter. Fluctuations in quarterly operating results could cause the

value of our securities to decline. Investors should not rely on

quarter-to-quarter comparisons of results of operations as an indication of

future performance. As a result of the factors listed below, it is possible that

in future periods results of operations may be below the expectations of public

market analysts and investors. This could cause the market price of our

securities to decline. Factors that may affect our quarterly results

include:

|

|

•

|

seasonal variations in operating

results;

|

|

|

•

|

variations in the sales of our

products to our significant

customers;

|

|

|

•

|

the discretionary nature of our

customers’ demands and spending

patterns;

|

|

|

•

|

variations in manufacturing and

supplier relationships;

|

|

|

•

|

fluctuation and unpredictability

of costs related to the components and raw materials used to manufacture

our products;

|

|

|

•

|

if we are unable to correctly

anticipate and provide for inventory requirements from quarter to quarter,

we may not have sufficient inventory to deliver our products to our

customers in a timely fashion or we may have excess inventory that we are

unable to sell;

|

|

|

•

|

competition from our

competitors;

|

|

|

•

|

changes in market and economic

conditions;

|

|

|

•

|

vulnerability of our business to

a general economic downturn in

China;

|

|

|

•

|

changes in the laws of the PRC

that affect our operations;

and

|

|

|

•

|

our ability to obtain necessary

government certifications and/or licenses to conduct our

business.

|

In

addition, our quarterly operating results could be materially adversely affected

by political instability, war, acts of terrorism or other

disasters.

As a

result of these and other factors, revenues for any quarter are subject to

significant variation, which may adversely affect our results of operations and

the market price for our common stock.

We

depend upon a patent we license from a third party, Zhong Bo, our Chief

Executive Officer and Chairman of the Board. The loss of this license, an

increase in the costs of this license or Mr. Zhong’s failure to properly

maintain or enforce the patent underlying such license may require us to suspend

our operations until we obtain replacements and/or redesign our

products.

We rely

upon certain patents licensed from our Chief Executive Officer and Chairman of

the Board, Zhong Bo, which gives us rights to third party intellectual property

that is necessary or useful for our business. On January 9, 2009, we

entered into a patent license agreement with Mr. Zhong for the right to use such

patent in the operation of our business. In addition, we also applied

to SIPO for the transfer of the patent to Zhengzhou ZST and SIPO accepted the

application regarding the patent transfer to Zhengzhou ZST on December 31, 2008.

The patent transfer to Zhengzhou ZST was approved on January 9,

2009. Mr. Zhong did not receive any additional consideration for the

transfer of the intellectual property rights to the Company, other than the

execution of the patent license agreement being a condition to the closing of

the Share Exchange.

12

We may

also enter into additional licenses to third party intellectual property in the

future. In addition, because we do not own any patents relating to our

technologies, we do not have the right to defend perceived infringements of

patents relating to such technologies. Thus, our success will depend in part on

the ability and willingness of our licensors to obtain, maintain and enforce

patent protection for our licensed intellectual property, in particular, those

patents to which we have secured exclusive rights. Our licensors may not

successfully prosecute the patent applications for the intellectual property we

have licensed. Even if patents issue in respect of these patent applications,

our licensors may fail to maintain these patents, may determine not to pursue

litigation against other companies that are infringing these patents, or may

pursue such litigation less aggressively than we would. Without protection for

the intellectual property we license, other companies might be able to offer

substantially identical products for sale, which could adversely affect our

competitive business position and harm our business prospects.

Our

ability to compete partly depends on the superiority, uniqueness and value of

our technologies, including both internally developed technology and technology

licensed from third parties. To protect our proprietary rights, we rely on a

combination of trademark, patent, copyright and trade secret laws,

confidentiality agreements with our employees and third parties, and protective

contractual provisions. Despite our efforts to protect our intellectual

property, any of the following occurrences may reduce the value of our

intellectual property:

|

|

•

|

our applications for trademarks

or patents may not be granted and, if granted, may be challenged or

invalidated;

|

|

|

•

|

issued patents, copyrights and

trademarks may not provide us with any competitive

advantages;

|

|

|

•

|

our efforts to protect our

intellectual property rights may not be effective in preventing

misappropriation of our technology or dilution of our

trademarks;

|

|

|

•

|

our efforts may not prevent the

development and design by others of products or technologies similar to or

competitive with, or superior to those that we develop;

or

|

|

|

•

|

another party may obtain a

blocking patent that would force us to either obtain a license or design

around the patent to continue to offer the contested feature or service in

our technologies.

|

We

rely on trade secret protections through confidentiality agreements with our

employees, customers and other parties; the breach of such agreements could

adversely affect our business and results of operations.

We also

rely on trade secrets, which we seek to protect, in part, through

confidentiality and non-disclosure agreements with our employees, customers and

other parties. There can be no assurance that these agreements will not be

breached, that we would have adequate remedies for any such breach or that our

trade secrets will not otherwise become known to or independently developed by

competitors. To the extent that consultants, key employees or other third

parties apply technological information independently developed by them or by

others to our proposed projects, disputes may arise as to the proprietary rights

to such information that may not be resolved in our favor. We may be involved

from time to time in litigation to determine the enforceability, scope and

validity of our proprietary rights. Any such litigation could result in

substantial cost and diversion of effort by our management and technical

personnel.

We

intend to pursue future acquisitions. Our business may be adversely affected if

we cannot consummate acquisitions on satisfactory terms, or if we cannot

effectively integrate acquired operations.

Part of

our growth strategy involves the acquisition of other companies. Any future

growth through acquisitions will be partially dependent upon the availability of

suitable acquisition candidates at favorable prices and upon advantageous terms

and conditions. We intend to pursue acquisitions that we believe will present

opportunities consistent with our overall business strategy. However, we may not

be able to find suitable acquisition candidates to purchase or may be unable to

acquire desired businesses or assets on economically acceptable terms. In

addition, we may not be able to raise the capital necessary to fund future

acquisitions. In addition, acquisitions involve risks that the businesses

acquired will not perform in accordance with expectations and that business

judgments concerning the value, strengths and weaknesses of businesses acquired

will prove incorrect.

We

regularly engage in discussions with respect to potential acquisition and

investment opportunities. If we consummate an acquisition, our capitalization

and results of operations may change significantly. Future acquisitions could

likely result in the incurrence of additional debt and contingent liabilities

and an increase in interest and amortization expenses or periodic impairment

charges related to goodwill and other intangible assets as well as significant

charges relating to integration costs.

In

addition, we may not be able to successfully integrate any business we acquire

into our existing business. The successful integration of new businesses depends

on our ability to manage these new businesses and cut excess costs. The

successful integration of future acquisitions may also require substantial

attention from our senior management and the management of the acquired

business, which could decrease the time that they have to service and attract

customers and develop new products and services. In addition, because we may

actively pursue a number of opportunities simultaneously, we may encounter

unforeseen expenses, complications and delays, including difficulties in

employing sufficient staff and maintaining operational and management

oversight.

13

We

may need additional capital to implement our current business strategy, which

may not be available to us, and if we raise additional capital, it may dilute

your ownership in us.

We

currently depend on bank loans and net revenues to meet our short-term cash

requirements. In order to grow revenues and sustain profitability, we will need

additional capital. We recently completed a public offering of shares of common

stock, and we may conduct additional financing transactions in the

future. Obtaining additional financing will be subject to a number of

factors, including market conditions, our operating performance and investor

sentiment. These factors may make the timing, amount, terms and conditions of

additional financing unattractive to us. We cannot assure you that we will be

able to obtain any additional financing. If we are unable to obtain the

financing needed to implement our business strategy, our ability to increase

revenues will be impaired and we may not be able to sustain

profitability.

The

capital and credit markets have been experiencing extreme volatility and

disruption for more than twelve months. In recent months, the volatility and

disruption have reached unprecedented levels. In some cases, the markets have

exerted downward pressure on availability of liquidity and credit capacity for

certain issuers. We have historically relied on credit to fund our business and

we need liquidity to pay our operating expenses. Without sufficient liquidity,

we will be forced to curtail our operations, and our business will suffer.

Disruptions, uncertainty or volatility in the capital and credit markets may

also limit our access to capital required to operate our business. Such market

conditions may limit our ability to replace, in a timely manner, maturing

liabilities and access the capital necessary to operate and grow our business.

As such, we may be forced to delay raising capital or bear an unattractive cost

of capital which could decrease our profitability and significantly reduce our

financial flexibility. Our results of operations, financial condition, cash

flows and capital position could be materially adversely affected by disruptions

in the financial markets.

Our

failure to effectively manage growth could harm our business.

We have

rapidly and significantly expanded the number and types of products we sell, and

we will endeavor to further expand our product portfolio. We must continually

introduce new products and technologies, enhance existing products in order to

remain competitive, and effectively stimulate customer demand for new products

and upgraded versions of our existing products.

This

expansion of our products places a significant strain on our management,

operations and engineering resources. Specifically, the areas that are strained

most by our growth include the following:

|

|

•

|

New Product

Launch.

With the growth of our product portfolio, we experience

increased complexity in coordinating product development, manufacturing,

and shipping. As this complexity increases, it places a strain on our

ability to accurately coordinate the commercial launch of our products

with adequate supply to meet anticipated customer demand and effective

marketing to stimulate demand and market acceptance. If we are unable to

scale and improve our product launch coordination, we could frustrate our

customers and lose retail shelf space and product

sales;

|

|

|

•

|

Forecasting,

Planning and Supply Chain Logistics. With the growth of

our product portfolio, we also experience increased complexity in

forecasting customer demand and in planning for production, and