Attached files

| file | filename |

|---|---|

| EX-31.1 - Ruby Creek Resources, Inc. | exh_311rcr10q30nov09.htm |

| EX-32.1 - Ruby Creek Resources, Inc. | exh_321rcr10q30nov09.htm |

| EX-10.19 - Ruby Creek Resources, Inc. | exh_1019rcrdlmmkuviaagmtpymn.htm |

| EX-10.20 - Ruby Creek Resources, Inc. | ruby_creek-boohabridgenoten0.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[ X ] QUARTERLY REPORT UNDER SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended November 30, 2009

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934 F

for the transition period from _____ to _____

Commission File Number: 000-52354

RUBY CREEK RESOURCES, INC.

(Name of Registrant)

| NEVADA | 000-52354 | 26-4329046 |

| (State or other jurisdiction of | (Commission File No.) | (IRS Employee Identification No.) |

| incorporation or organization) |

767 3rd Avenue 36th Floor, New York, NY 10017

(Address of Principal Executive Offices)

(212) 671-0404)

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer [ ] Accelerated Filer [ ]

Non-Accelerated Filer Smaller (do not check is smaller reporting company [ ] Smaller Reporting Company [ X ]

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes [ ] No [ X ]

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

8,737,000 shares of common stock as of January 13, 2010.

RUBY CREEK RESOURCES INC.

Quarterly Report On Form 10-Q For The Quarterly Period Ended November 30, 2009

FORWARD-LOOKING STATEMENTS

This Form 10-Q for the quarterly period ended November 30, 2009 contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this document include, among others, statements regarding our capital needs, business plans and expectations. Such forward-looking statements involve assumptions, risks and uncertainties regarding, among others, the success of our business plan, availability of funds, government regulations, operating costs, our ability to achieve significant revenues, our business model and products and other factors. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. In evaluating these statements, you should consider various factors, including the assumptions, risks and uncertainties set forth in reports and other documents we have filed with or furnished to the SEC. These factors or any of them may cause our actual results to differ materially from any forward-looking statement made in this document. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events, our actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. The forward-looking statements in this document are made as of the date of this document and we do not intend or undertake to update any of the forward-looking statements to conform these statements to actual results, except as required by applicable law, including the securities laws of the United States.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

The following unaudited interim financial statements of Ruby Creek Resources Inc. are included in this Quarterly Report on Form 10-Q:

2

3

4

5

Ruby Creek Resources Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

November 30, 2009

(Unaudited)

1. Basis of Presentation

These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in US dollars. The Company’s fiscal year-end is August 31.

Unaudited Interim Financial Statements

The accompanying unaudited interim financial statements have been prepared in accordance with United States generally accepted accounting principles ("US GAAP") for interim financial information and with the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with US GAAP have been condensed or omitted pursuant to such rules and regulations. However, except as disclosed herein, there has been no material change in the information disclosed in the notes to the financial statements for the year ended August 31, 2009 included in the Company's annual report filed with the Securities and Exchange Commission. The interim unaudited financial statements should be read in conjunction with those financial statements included in the Form 10-K. In the opinion of Management, all adjustments considered necessary for a fair presentation, consisting solely of normal recurring adjustments, have been made. Operating results for the three months ended November 30, 2010 are not necessarily indicative of the results that may be expected for the year ending August 31, 2010.

2. Mineral Properties

Pursuant to an agreement dated July 15, 2006, as amended on July 9, 2008, the Company acquired an option to earn a 100% interest in the Moore Creek Property (the “Property”) located in the Iskut River region, British Columbia, Canada in exchange for cash payments totalling CDN$100,000 over 4 years, payable as follows:

(a) $2,500 on October 15, 2006 (paid); (b) $2,000 on April 15, 2008 (paid); (c) $1,500 on September 30, 2008 (paid); (d) $3,500 on May 31, 2009; (paid) (e) $3,000 on September 30, 2009; (not paid) (f) $15,000 on October 31, 2009; (not paid) (g) $20,000 on March 31, 2010; and (h) $52,500 on November 30, 2010.

The Property is subject to a 2% net smelter return royalty (“NSR”) of which 1% can be repurchased at any time by the vendor for $1,000,000. The Property is comprised of 8 mineral claims covering a total of 2,919 hectares and as of the date of these financial statements title is held in the name of the vendor. Title will be transferred to the Company upon receipt of all of the cash payments, as described above.

In November 2009, the option agreement was terminated as the Company changed its focus to another property. As a result, the Company has written off costs of $9,771 at August 31, 2009. The Company is in negotiations with the property vendor on a final termination payment, expected to be approximately $5,000.

F-5

6

Ruby Creek Resources Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

November 30, 2009

(Unaudited)

2. Mineral Properties (Continued)

On November 7, 2009, the Company entered into a Joint Venture Agreement (the “Agreement”) with Douglas Lake Minerals Inc. (“Douglas Lake”), for the right to acquire and develop a portion of Douglas Lake’s Mkuvia Gold Project. Pursuant to the terms of the Agreement, the Company will earn a seventy percent (70%) interest in 125 square kilometers of the 380 square kilometer Mkuvia Gold Project by making payments totalling $3,000,000 over three years. The Agreement provides that the Company will make payments to Douglas Lake of $250,000 of which $175,000 is due and payable at November 30, 2009 and has been paid subsequently and $75,000 is payable on or before January 31, 2010. Refer to Note 5. The Company will then conduct a due diligence on the property, which should take approximately 90 days, subject to current rainy season conditions. It has yet to be determined when the Company can begin this process. On confirmation of satisfactory due diligence, the Company will make an additional $100,000 payment and both parties will move to closing. Closing is expected to occur shortly after the 90 day due diligence period by the Company.

On the day of the closing and receipt of the first mining license, the Company is required to make another payment of $400,000 to Douglas Lake for a total of $750,000 in payments from the signing of the agreement to the closing. The Company must also pay an additional $750,000 for a total of $1,500,000 within 12 months of closing. Additionally, the Agreement provides that within 12 months of closing, the Company has the option to increase its interest to 75 percent of the 125 square kilometers by making an additional $1,000,000 payment to Douglas Lake. The Company must make additional payments of $750,000 each within 24 and 36 months of the closing. In all cases, the original owner of the prospecting licenses retains a 3 percent Net Smelter Royalty as per the Joint Venture Agreement between the owner and Douglas Lake.

3. Related Party Transactions

At November 30, 2009, the Company owed a director $59,456 (2009 - $29,293). This amount is unsecured, does not bear interest and has no fixed terms of repayment.

On September 1, 2009, the Company granted 1,100,000 compensation warrants to the President at an exercise price of $0.05 per share for a term of 5 years. These options vest 25% every three months over a period of one year. The Company estimated the fair value of these warrants to be $72,500 at the date of grant, using the Black Scholes pricing model which used an expected life of three year, a risk-free interest rate of 2.57% and an expected volatility of 100%. Stock-based compensation of $18,125 was recorded at November 30, 2009 as management fees (2009 - Nil). During the three months ended November 30, 2009 the Company recorded $20,000 (2008 - Nil) in management fees for services provided by the President. All related party transactions are in the normal course of business and are measured at the exchange amount, which is the amount of consideration established and agreed to by the related parties.

4. Common Stock

a) Effective January 29, 2009, the Company changed its jurisdiction from the Province of British Columbia, Canada to the State of Nevada. Effective the same date, the Company's authorized capital was changed from an unlimited number of common shares without par value to 500,000,000 common shares with a par value of $0.001 per share.

F-6

7

Ruby Creek Resources Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

November 30, 2009

(Unaudited)

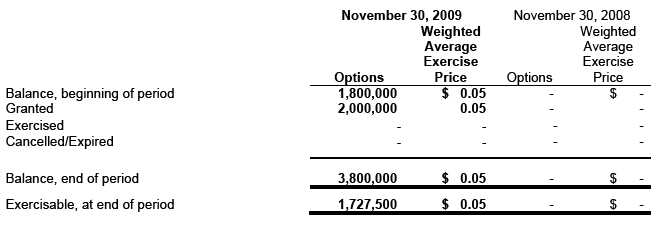

4. Common Stock (Continued) Stock Options

On July 15, 2009, the Company granted 50,000 compensation warrants to a former director at an exercise price of $0.05 per share for a term of 5 years. These options vest on November 1, 2009. The Company estimated the fair value of these warrants to be $5,107 at the date of grant, using the Black Scholes pricing model which used an expected life of three year, a risk-free interest rate of 2.57% and an expected volatility of 99%. Stock-based compensation of $2,905 was recorded as management fees in the quarter ending November 30, 2009.

On July 15, 2009, the Company granted 1,750,000 stock options to consultants at an exercise price of $0.05 per share for a term of 5 years. These options vest 25% every three months over a period of one year. The Company estimated the fair value of these options to be $178,760 at the date of grant, using the Black Scholes pricing model which used an expected life of three year, a risk-free interest rate of 2.57% and an expected volatility of 99%. Stock-based compensation of $44,690 was recorded as consulting fees during the quarter ended November 30, 2009 and the remainder will be recorded over the term of vesting.

On September 1, 2009, the Company granted 1,100,000 compensation warrants to the President at an exercise price of $0.05 per share for a term of 5 years. These options vest 25% every three months over a period of one year. The Company estimated the fair value of these warrants to be $72,500 at the date of grant, using the Black Scholes pricing model which used an expected life of three year, a risk-free interest rate of 2.57% and an expected volatility of 100%. Stock-based compensation of $18,125 was recorded at November 30, 2009 as management fees and the remainder will be recorded over the term of vesting.

On October 1, 2009, the Company granted 350,000 stock options to a consultant at an exercise price of $0.05 per share for a term of 5 years. Of these options, 80,000 vest at the grant date and 270,000 vest 33% on every three month anniversary date. The Company estimated the fair value of these options to be $22,921 at the date of grant, using the Black Scholes pricing model which used an expected life of three year, a risk-free interest rate of 2.57% and an expected volatility of 99%. Stock-based compensation of $9,169 was recorded as consulting fees during the quarter ended November 30, 2009 and the remainder will be recorded over the term of vesting.

On October 15, 2009, the Company granted 150,000 stock options to a consultant at an exercise price of $0.05 per share for a term of 5 years. These options vest 25% every three months over a period of one year. The Company estimated the fair value of these options to be $4,847 at the date of grant, using the Black Scholes pricing model which used an expected life of three year, a risk-free interest rate of 2.57% and an expected volatility of 104%. Stock-based compensation of $606 was recorded as consulting fees during the quarter ended November 30, 2009 and the remainder will be recorded over the term of vesting.

On November 1, 2009, the Company granted 250,000 stock options to a consultant at an exercise price of $0.05 per share for a term of 5 years. Of these options, 60,000 vest at the grant date, 60,000 vest on February 1, 2010, 60,000 vest on May 1, 2010 and 70,000 vest on August 1, 2010. The Company estimated the fair value of these options to be $8,271 at the date of grant, using the Black Scholes pricing model which used an expected life of three year, a risk-free interest rate of 2.57% and an expected volatility of 108%. Stock-based compensation of $2,647 was recorded as consulting fees during the quarter ended November 30, 2009 and the remainder will be recorded over the term of vesting.

8

Ruby Creek Resources Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

November 30, 2009

(Unaudited)

Stock Options (Continued)

On November 1, 2009, the Company granted 150,000 stock options to a consultant at an exercise price of $0.05 per share for a term of 5 years. These options vest 25% every three months over a period of one year. The Company estimated the fair value of these options to be $4,823 at the date of grant, using the Black Scholes pricing model which used an expected life of three year, a risk-free interest rate of 2.57% and an expected volatility of 103%. Stock-based compensation of $402 was recorded as consulting fees during the quarter ended November 30, 2009 and the remainder will be recorded over the term of vesting.

As of November 30, 2009, 1,727,500 stock options have vested and 2,072,500 stock options remain unvested. The weighted average remaining life of the vested and unvested stock options is 4.73 years and 5.08 years, respectively.

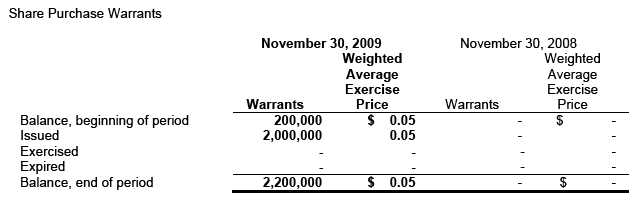

The weighted average remaining life of all outstanding share purchase warrants is 2.78 years.

9

Ruby Creek Resources Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

November 30, 2009

(Unaudited)

5. Subsequent Events

On November 27, 2009, the Company agreed to issued two 1 year, $50,000, 11% convertible notes for total proceeds of $100,000. Each note is convertible, in part or in full, into the Company’s common stock at an exercise price of $0.05 per common share, and interest is to be paid quarterly. In addition, each holder of the note received warrants to purchase 1,000,000 shares of the Company’s common stock at an exercise price of $0.05 for a term of three years. The Company closed and received the funds on December 3 and December 4 and used these funds to make the first payment on the Mkuvia Alluvial Gold Project.

On December 18, 2009, the Company, and its partner in the Mkuvia Alluvial Gold Project agreed to a change of the second payment of $150,000 to $75,000 to be paid immediately (paid), and $75,000 to be paid by January 31, 2010 or the commencement of the on-site due diligence, whichever event occurs first.

On December 22, 2009, the Company arranged for a $75,000 bridge loan at an interest rate of 11% per annum. The loan agreement grants the lender the right to convert any portion of their interest payment into shares of the Company at a price of $0.125 per share. In addition, the lender receives a bonus of $5,000 in $0.125 units. Each unit consists of one share and one warrant to purchase one share at a price of $0.25 per share for a period of two years. The bonus also included an additional 300,000 warrants to purchase 300,000 shares of the Company’s common stock at an exercise price of $0.25 for a term of 24 months. Default shall occur if the loan is not repaid by January 14, 2010. Default will grant the lender the right to convert the full amount of the loan to shares of the Company’s common stock at a price of $0.125 per share with 100% warrant coverage. Proceeds of the loan were used for the next payment required in the Mkuvia Alluvial Gold Project.

The Company evaluated subsequent events through the financial statement filing date of January 13, 2010.

10

Item 2. Management's Discussion and Analysis

As used in this quarterly report: (i) the terms "we", "us", "our" and the "Company" mean Ruby Creek Resources Inc.; (ii) "SEC" refers to the Securities and Exchange Commission; (iii) "Exchange Act" refers to the Securities Exchange Act of 1934, as amended; and (iv) all dollar amounts refer to United States dollars unless otherwise indicated.

The following discussion of our plan of operations, results of operations and financial condition for the comparative three-month period ended November 30, 2009 should be read in conjunction with our unaudited interim financial statements and related notes for the comparative three month periods ended November 30, 2008 included in this quarterly report.

Overview

The Company was originally incorporated in the Province of British Columbia, Canada on May 3, 2006. On January 29, 2009, we changed our corporate jurisdiction to the State of Nevada and established our authorized capital at 500,000,000 common shares with a par value or $0.001. We are currently considered an exploration or exploratory stage company, as we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of commercially viable reserves of ore. On November 7, 2009 we entered into a Joint Venture development agreement with Douglas Lake Minerals Inc., covering 125 sq km of the 380 sq km Mkuvia Gold Project located in the south of Tanzania. Ruby Creek has agreed to purchase a 70% interest for $3,000,000 in a series of payments over 3 years.

We are considered an exploration or exploratory stage company, as we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral deposit exists on any of our optioned mining properties, and a great deal of further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined. We have no known reserves of any type of mineral and there is no assurance that we will discover any economically viable minerals.

Our office is located at 767 3rd Avenue 36th Floor, New York, NY USA 10017; our telephone number is (212) 671-0404.

We have no revenues, have experienced losses since inception and rely upon the sale of our securities to fund our operations. Our auditors have expressed substantial doubt about our ability to continue as a going concern. We will not generate revenues even if our exploration program indicates that a mineral deposit may exist on our optioned mineral claims. Accordingly, we will be dependent on future additional financing in order to maintain our operations and continue our exploration activities.

On November 7, 2009 we entered into a Joint Venture development agreement with Douglas Lake Minerals Inc., covering 125 square kilometers of the 380 square kilometer Mkuvia Alluvial Gold Project located in the south of Tanzania. Ruby Creek has agreed to purchase a 70% interest for $3,000,000 in a series of payments over 3 years. Prior to the Joint Venture development agreement with Douglas Lake Minerals Inc., we had acquired an option to purchase a group of eight mining exploration claims, known as the More Creek property, located in northwestern British Columbia, Canada. As part of its redirection to Tanzania, Ruby Creek has fully relinquished its option on the interest in the More Creek property.

The Mkuvia Alluvial Gold Project

The Mkuvia Alluvial Gold Project is located in the Liwale and Nachingwea Districts, Lindi Region of the United Republic of Tanzania. The project is the subject of a report titled the “Technical & Resource Report on the Mkuvia Gold Project”, prepared for our joint venture partner, Douglas Lake Minerals, by Mr. Laurence Stephenson, P.Eng. of British Columbia, Canada and Ross McMaster, MAusIMM of Queensland, Australia. Mr. Stephenson and Mr. McMaster are independent and Qualified Persons in accordance with JORC and NI 43-101. Douglas Lake has spent more than $2,100,000 in the past 16

11

months in exploration, developing an understanding of the mineralization on a portion of the property while focusing on a relatively small area for mechanized production (about 10 sq km).

Our joint venture partner, Douglas Lake, has completed its technical report, reserve estimate, feasibility study and mining plan and just recently its environmental impact assessment report. Douglas Lake is filing its first Mining License application with approval expected in the first quarter of 2010. It is anticipated that the second Mining License application could be approved in early third quarter of 2010.

Ruby Creek will earn a 70 percent interest in 125 square kilometers of the Mkuvia Gold Project by making payments totaling $3,000,000 over three years. Additionally, the Agreement provides that within 12 months of closing, Ruby Creek has the option to increase its interest to 75 percent of the 125 square kilometers by making an additional $1,000,000 payment to Douglas Lake. In all cases, the original owner of the prospecting licenses, the original owner of the property, Mr. Mkuvia Maita retains a 3 percent Net Smelter Royalty as per the Joint Venture Agreement between Mr. Maita and Douglas Lake.

Nature of the Prospecting Licenses

According to the Technical & Resource Report on the Mkuvia Alluvial Gold Project prepared for our joint venture partner, by Laurence Stephenson, P.Eng. and Ross McMaster, MAusIMM, to date, the known gold mineralization in Mkuvia Property occurs as alluvial placer deposits comprising of a significant, but unquantified accumulation of gold in alluvium hosted by: 1) reworked palaeo-placer by the Mbwemkuru River and its tributaries, and 2) an over 10 meter thick zone of palaeo-placer sand and pebble beds nonconformably overlying biotite schist, gneiss, quartzite, garnet-amphibolite and granitoids. The latter comprises a poorly sorted palaeo-beach placer plateau extending over 29 km along a NW-SE direction and ~5 km wide along a NE-SW direction (Figures 5 & 6). In addition there are extensive troughs with similar continental alluvium further west in the Karroo Basin. It is however notable that at the highest point on the property, pebble conglomerates were noted on the surface that have been worked sporadically by the artisanal miners suggesting that gold is present. This is consistent with the proposition that the mineralization is associated with a wide spread beach placer environment. Gold-bearing alluvium along the Mbwemkuru River occurs within a 0.35 to 2.0 m thick zone between the bedrock and sandy-gravelly material related to present drainage active channels and terraces. This zone contains an estimated 1.0 grams per cubic meter that the small-scale miners are currently reportedly recovering.

The gold is very fine-grained in general, suggesting a distal source, although some coarser-grained flakes are present. The gold is associated with the black sands that comprise fine-grained ilmenite and pink garnet and minor magnetite. These may be represented by distinct ferruginous layers in the conglomerate sequence. The minerals in the black sand are consistent with the beach placer model.

Ownership Interest in the Prospecting Licenses

Ruby Creek will pay a 3% net smelter royalty return to Mr. Mkuvia Miata, the original property prospecting license owner.

Additionally, in order to earn the full 70% interest in the Mkuvia Gold Project, we have payment commitments to Douglas Lake as follows:

1.$100,000 within 5 business days of signing. (paid)

2.$75,000 within 15 business days of signing. (paid)

3.$75,000 upon start of on-site due diligence or January 31, 2010, whichever occurs first.

4.$100,000 upon Notice of Satisfactory Due Diligence.

5.$400,000 upon Closing with Ruby Creek receiving the first Mkuvia Mining License.

6.$750,000 payable within 12 months of Closing.

7.$750,000 payable within 24 months of Closing.

8.$750,000 payable within 36 months of Closing. Ruby Creek at its sole discretion may elect to

make this final payment in common shares of Ruby Creek. The Ruby Creek shares would be

valued at the 10 day average trading price immediately prior to the 36 month due date.

12

Prior Exploration of Our Joint Venture Prospecting Licenses

There has been little or no exploration of the Mkuvia Gold project prior to Douglas Lake’s involvement in April of 2008.

Present Condition and Current State of Exploration

As our specific joint venture prospecting licenses are not assigned to date, presently we do not have any mineral reserves. The property sections that are the subject of our prospecting licenses are currently being worked by local artisan miners. The property is considered undeveloped and does not contain any open-pit or underground mines other than artisanal operations. There is no plant or equipment located on the property.

Plan of Operations

Based on the nature of our business, we anticipate incurring operating losses in the foreseeable future. We base this expectation, in part, on the fact that very few prospecting licenses in the exploration stage ultimately develop into producing, profitable mines. Our future financial results are also uncertain due to a number of factors, some of which are outside our control.

Due to our lack of operating history and present inability to generate revenues, our auditors have stated in their report for our most recent fiscal year end that there exists substantial doubt about our ability to continue as a going concern. Even if we complete our current exploration program and it is successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit or reserve.

Our plan of operations for the next twelve months is to complete the following objectives within the time periods specified, subject to our obtaining the funding necessary for the continued exploration of our optioned mineral claims.

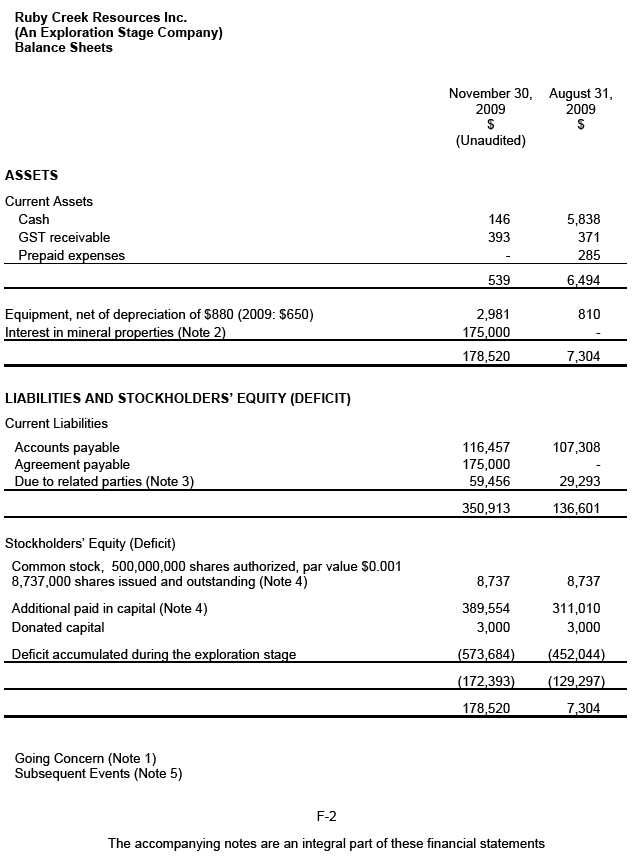

Financial Condition

At November 30, 2009, we had cash of $539 and a working capital deficit of $350,374.

Accordingly, we have insufficient funds to enable us to satisfy our on-going joint venture commitments and general and administrative expenses over the next twelve months. During the twelve-month period following the date of this report, we anticipate that we will not generate any revenues from mining. As such, we will be required to obtain additional financing in order to complete our planned operations and any additional exploration of our joint venture claims to determine whether any mineral deposit exists on these claims.

We believe that debt financing will be an alternative for funding additional phases of exploration. We also anticipate that additional funding will be in the form of equity financing from the sale of our common stock. We are in the process of raising funds through a private placement offering of our shares of common stock. However, there can be no assurance that we will complete the private placement or that the funds raised will be sufficient for us to pay our expenses beyond the next twelve months. In the absence of such financing, we will not be able to finalize the acquisition or continue exploration of our joint venture prospecting licenses and our business plan will fail. Even if we are successful in obtaining debt or equity financing to fund our acquisition and exploration program, there is no assurance that we will obtain the funding necessary to pursue any advanced exploration of any prospecting licenses we presently have or that we may acquire. If we do not continue to obtain additional financing, we will be forced to abandon our plan of operations.

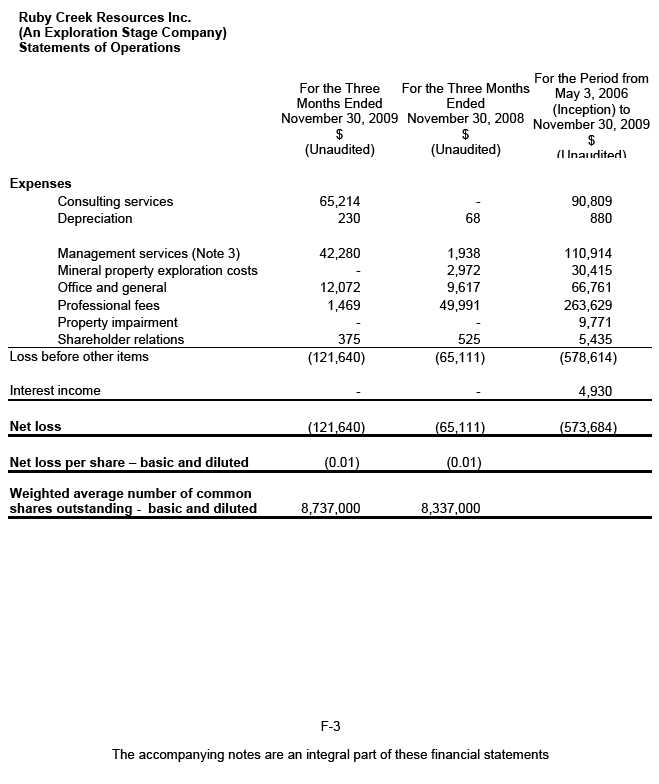

Results of Operations for the Three Month period ended November 30, 2009 Compared to the Three-Month Period ended November 30, 2008.

Revenues

13

We have had no operating revenues since our inception on May 3, 2006 to November 30, 2009. We anticipate that we will not generate any revenues for so long as we are an exploration stage company.

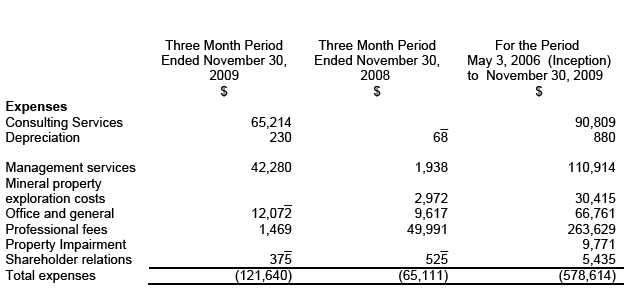

General and Administrative Expenses

Our general and administrative expenses for the three-month period ended November 30, 2009 and 2008, as well as the total of these expenses since our inception on May 3, 2006, are summarized in the table below:

Expenses for the three-month period ended November 30, 2009 totaled $121,640 and were primarily comprised of consulting services $65,214 and management services which totaled $42,280. Consulting services increased primarily from $57,514 in stock based compensation recorded for stock options granted to consultants, for the comparable period in 2008 Consulting services were Nil. Management services costs were $1,938 in the 2008 three-month period compared to $76,655 in the current three-month period, an increase of $40,342 primarily from $21,030 in stock based compensation recorded from stock options granted to the President and a former Director. Office and general expenses (consisting primarily of office rent and telecommunication costs) were $12,072 during the current three month period as compared to $9,617 in the 2008 three month period.

Net Loss

We had a net loss of $121,640 in the three months ended November 30, 2009 as compared to a net loss of $65,111 in the 2008 three month period.

Liquidity and Capital Resources

We had cash of $539 and a working capital deficit of $350,374 at November 30, 2009.

We estimate that our total expenditures over the next twelve months will be approximately $5,000,000 to $7,000,000. This estimate takes into account estimated expenditures with respect to our joint venture acquisition. At the present time, we have insufficient cash to proceed and we will be required to obtain additional financing to proceed as these expenditures will exceed our current cash reserves.

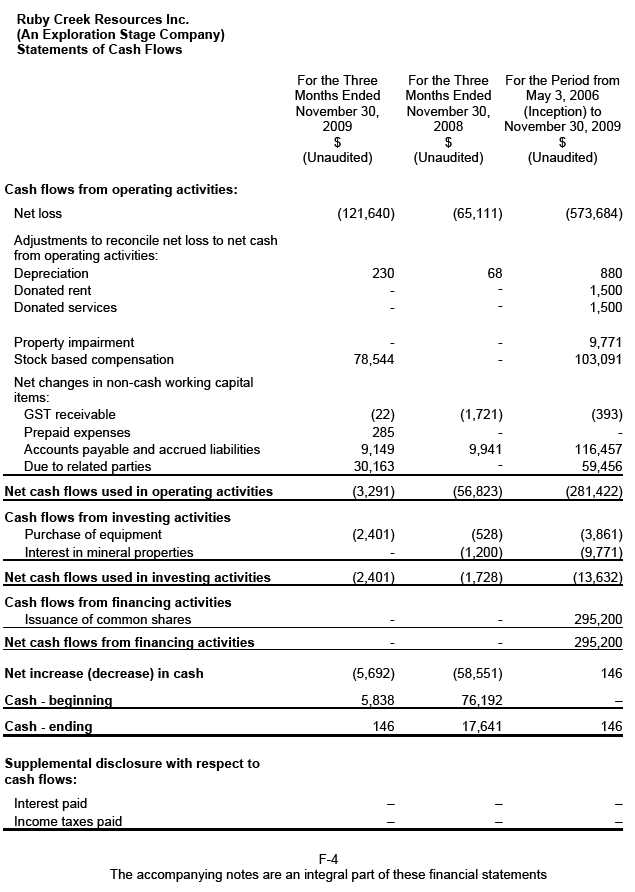

Cash from Operating Activities

14

Cash used in operating activities was $3,291 during the three-month period ended November 30, 2009, as compared to $56,823 during the three-month period ended November 30, 2008. Cash used in operating activities from our inception on May 3, 2006 to November 30, 2009 was $281,422.

Cash from Investing Activities

Cash used in investing activities (purchase of equipment, interest in mineral properties) was $2,401 during the three month period ended November 30, 2009, as compared to $1,728 during the three month period ended November 30, 2008. Cash used in investing activities from our inception on May 3, 2006 to November 30, 2009 was $13,632.

Cash from Financing Activities

We have funded our business to date primarily from sales of our common stock. From our inception on May 3, 2006 to November 30, 2009, we raised a total of approximately $295,200 from private offerings of our securities.

There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing. If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue our joint venture acquisitions or exploration and development of the claims associated with the joint venture and our undertaking will fail.

Going Concern

We are in the exploration stage and have not generated revenues since inception. We have incurred significant losses to date and further losses are anticipated raising substantial doubt about the ability of our Company to continue operating as a going concern. The continuation of our Company as a going concern is dependent upon our ability to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploitation of economically recoverable reserves on our resource properties and ultimately on the attainment of future profitable operations. Since inception to November 30, 2009, we had accumulated losses of $578,614 or $573,684 taking into account interest income of $4,930. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern.

Future Financings

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned exploration activities.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure

15

of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. In general, management's estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Mineral Property Costs

The Company has been in the exploration stage since its formation on May 3, 2006 and has not realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mineral resources.

Pursuant to EITF 04-2, the Company classifies its mineral rights as tangible assets and accordingly acquisition costs are capitalized as mineral property costs. Generally accepted accounting principles require that long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. In performing the review for recoverability, the Company is to estimate the future cash flows expected to result from the use of the asset and its eventual disposition. If the sum of the undiscounted expected future cash flows is less than the carrying amount of the asset, an impairment loss is recognized. Mineral exploration costs are expensed as incurred until commercially mineable deposits are determined to exist within a particular property. To date the Company has not established any proven or probable reserves.

The Company has adopted the provisions of SFAS No. 143 "Accounting for Asset Retirement Obligations" which establishes standards for the initial measurement and subsequent accounting for obligations associated with the sale, abandonment, or other disposal of long-term tangible assets arising from the acquisition, construction or development and for normal operations of such assets. As of August 31, 2008, any potential costs related to the retirement of the Company's mineral property interests have not yet been determined.

Foreign Currency Translation

The Company's financial statements are presented in United States dollars. In accordance with Statement of Financial Accounting Standards ("SFAS") No. 52, "Foreign Currency Translation", foreign denominated monetary assets and liabilities are translated to their United States dollar equivalents using foreign exchange rates, which prevailed at the balance sheet date. Non-monetary assets and liabilities are translated at the transaction date. Revenue and expenses are translated at average rates of exchange during the year. Related translation adjustments are reported as a separate component of stockholders' equity, whereas gains or losses resulting from foreign currency transactions are included in results of operations.

Recent Accounting Pronouncements

In April 2009, the FASB issued FSP SFAS 157-4 which, provides additional guidance for estimating fair value in accordance with SFAS 157, “Fair Value Measurements”, when the volume and level of activity for the asset or liability have significantly decreased. FSP SFAS 157-4 also includes guidance on identifying circumstances that indicate a transaction is not orderly. FSP SFAS 157-4 requires the disclosure of the inputs and valuation technique(s) used to measure fair value and a discussion of changes in valuation

16

techniques and related inputs, if any, during the period. The adoption of this statement did not have a material impact on the Company’s results of operations and financial position.

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 165, “Subsequent Events,” (“SFAS No. 165”). SFAS 165 establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. SFAS 165 applies to both interim financial statements and annual financial statements. SFAS 165 is effective for interim or annual financial periods ending after June 15, 2009. SFAS 165 does not have a material impact on our financial statements.

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 166, “Accounting for Transfers of Financial Assets, an amendment to SFAS No. 140,” (“SFAS 166”). SFAS 166 eliminates the concept of a “qualifying special-purpose entity,” changes the requirements for derecognizing financial assets, and requires additional disclosures in order to enhance information reported to users of financial statements by providing greater transparency about transfers of financial assets, including securitization transactions, and an entity’s continuing involvement in and exposure to the risks related to transferred financial assets. SFAS 166 is effective for fiscal years beginning after November 15, 2009. The Company will adopt SFAS 166 in fiscal 2010. The Company does not expect that the adoption of SFAS 166 will have a material impact on the financial statements.

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 167, “Amendments to FASB Interpretation No. 46(R),” (“SFAS 167”). The amendments include: (1) the elimination of the exemption for qualifying special purpose entities, (2) a new approach for determining who should consolidate a variable-interest entity, and (3) changes to when it is necessary to reassess who should consolidate a variable-interest entity. SFAS 167 is effective for the first annual reporting period beginning after November 15, 2009 and for interim periods within that first annual reporting period. The Company will adopt SFAS 167 in fiscal 2010. The Company does not expect that the adoption of SFAS 167 will have a material impact on the financial statements.

In June 2009, the FASB issued SFAS No. 168, The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles—a replacement of FASB Statement No. 162, which is codified in FASB ASC 105, Generally Accepted Accounting Principles (“ASC 105”). ASC 105 establishes the Codification as the source of authoritative GAAP in the United States (the “GAAP hierarchy”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. Once the Codification is in effect, all of its content will carry the same level of authority and the GAAP hierarchy will be modified to include only two levels of GAAP, authoritative and non-authoritative. ASC 105 is effective for financial statements issued for interim and annual periods ending after September 15, 2009. The Company has not yet adopted the requirements of ASC 105 but expect the impact of ASC 105 to have no material effect on the Company’s financial condition or results of operation.

On August 28, 2009, ASU 2009-05 was issued by the FASB. ASU 2009-05 will amend ASC 820-10, “Fair Value Measurements and Disclosures-Overall,” by providing additional guidance clarifying the measurement of liabilities at fair value. When a quoted price in an active market for the identical liability is not available, the amendments in ASU 2009-05 will require that the fair value of a liability be measured using one or more of the listed valuation techniques that should maximize the use of relevant observable inputs and minimize the use of unobservable inputs. In addition, the amendments in ASU 2009-05 clarify that when estimating the fair value of a liability, an entity is not required to include a separate input or adjustment to other inputs to the existence of a restriction that prevents the transfer of the liability. The Company adopted the provisions of ASU 2009-05 on October 1, 2009. Its adoption did not have a material impact on the Company’s financial condition, results of operations, or cash flows.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

We are currently not subject to any material market risks.

17

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our principal executive officer and principal financial officer has concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) were not effective as of the end of the period covered by this report, based on their evaluation of these controls and procedures required by paragraph (b) of Rules 13a-15 and 15d-15, due to certain material weaknesses in our internal control over financial reporting as of August 31, 2009, as described in our management’s report on internal control over financial reporting included in our annual report on Form 10-K for our fiscal year ended August 31, 2009, which deficiencies have not been remedied as of November 30, 2009.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal controls over financial reporting that occurred during the three months ended November 30, 2009 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

We are not a party to any material legal proceedings nor are we aware of any legal proceedings pending or threatened against us or our properties other than as follows.

The Company’s former securities law firm, based in Vancouver, Canada, has made certain representations to various parties that they are planning to commence proceedings against us in order to collect their outstanding bill of approximately $105,000.

Item 2. Unregistered Sales of Equity Securities

On July 20, 2009, the Company issued 400,000 restricted shares of common stock at a price of $0.05 per share for proceeds of $20,000. As part of this private placement, the Company issued 200,000 share purchase warrants to purchase one share of common stock exercisable at $0.05 for a period of one year. The fair value of these share purchase warrants using a risk-free rate of 2.57% and a volatility of 99% was 17,492 or $0.09 per warrant. The shares were issued to David Bukzin and Double Trouble Productions, LLC.

The shares issued to David Bukzin and Double Trouble Productions were not registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state, and were offered and sold in reliance on the exemption from registration afforded by Section 4(2) and Regulation D (Rule 506) under the Securities Act, and corresponding provisions of state securities laws, which exempt transactions involving offers or sales by an issuer solely to one or more accredited investors. Double Trouble Productions, LLC and Mr. Buzkin are “accredited investors” as such term is defined in Regulation D under the Securities Act.

On November 27, 2009, the Company entered into two convertible note agreements to issue two 1 year, $50,000, 11% convertible notes for total proceeds of $100,000. Each note is convertible, in part or in full, into the Company’s common stock at an exercise price of $0.05 per common share, and interest is to be paid quarterly. In addition, each holder of the note received warrants to purchase 1,000,000 shares of the Company’s common stock at an exercise price of $0.05 for a term of three years. The proceeds of these notes were received December 3, 2009 and used to make the first $100,000 installment in the Mkuvia Gold Project Joint Venture Agreement described above.

18

Item 3. Defaults Upon Senior Securities

None.

Item 4. Submission of Matters to a Vote of Securities Holders

None.

Item 5. Other Information

None.

19

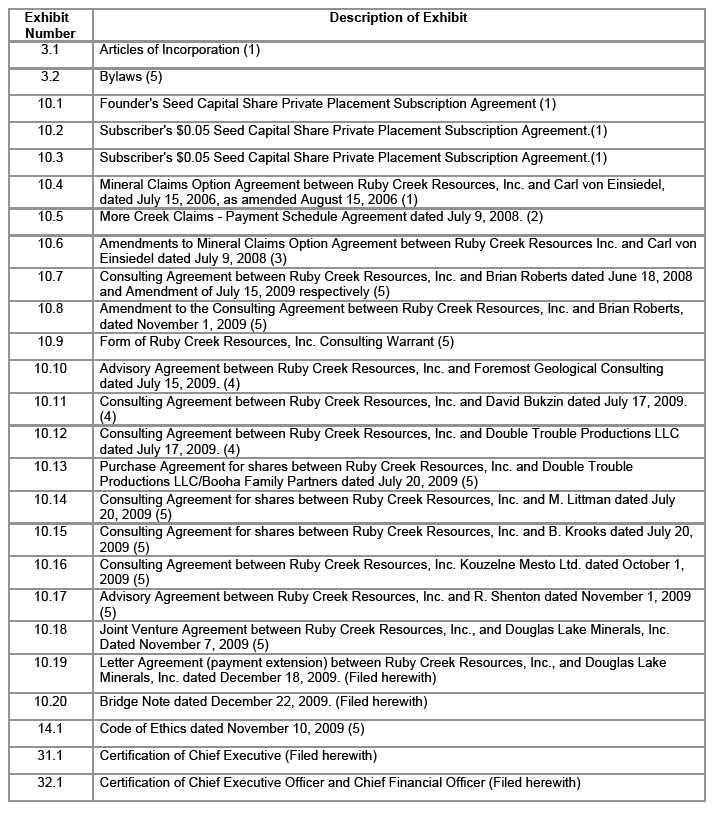

Item 6. Exhibits

The following exhibits are filed with this Annual Report on Form 10-Q unless filed previously as noted below.

20

| (1) | Incorporated by reference. Filed as an exhibit to the Company's Registration Statement on Form SB-2, as filed with the SEC on November 7, 2006, and incorporated herein by this reference. |

| (2) | Incorporated by reference. Filed as an exhibit to the Company's Form 10-K for the year ended August 31, 2008. |

| (3) | Incorporated by reference. Filed as an exhibit to the Company's Form 10-Q for the period ended February 28, 2009. |

| (4) | Incorporated by reference. Filed as an exhibit to the Company's Form 10-Q for the period ended May 31, 2009. |

| (5) | Incorporated by reference from our annual report on Form 10-K, filed with the SEC on December 10, 2009. |

SIGNATURES

Pursuant to the requirements of Section 13 and 15 (d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

RUBY CREEK RESOURCES, INC.

Rob Slavik

President, Chief Executive Officer, Chief Financial Officer, Director.

Date: January 13, 2010

21