Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

x ANNUAL REPORT PURSUANT TO SECTION 13

OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

fiscal year ended October 31, 2009

or

p TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

transition period from _________________to__________________.

Commission

File Number: 0-20842

PLATO

LEARNING, INC.

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

36-3660532

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

10801

Nesbitt Avenue South, Bloomington, MN 55437

(Address

of principal executive offices)

(952)

832-1000

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which

registered

|

|

Common

Stock, $0.01 Par Value

|

NASDAQ

Global Market

|

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes p No x

Indicate

by check mark if the Registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes p No x

Indicate

by check mark whether the Registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No p

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes p No p

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definition of “large accelerated filer,” “accelerated

filer” and smaller reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large

Accelerated Filer p

|

Accelerated

Filer x

|

|

Non-Accelerated

Filer p (Do

not check if smaller reporting company)

|

Smaller

Reporting Company p

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act.)

Yes p No x

The

aggregate market value of common stock held by non-affiliates of the registrant,

as of April 30, 2009 (the last business day of the Registrant’s most recently

completed second fiscal quarter) was approximately $60,000,000.

The

number of shares outstanding of the registrant’s common stock as of December 31,

2009 was 24,379,414.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the Company’s definitive Proxy Statement for the Company’s Annual Meeting of

Stockholders to be held on March 25, 2010 (the “2010 Proxy Statement”) are

incorporated by reference in Part III.

Form

10-K

Fiscal

Year Ended October 31, 2009

TABLE

OF CONTENTS

|

|

Page

|

|

|

Business

|

1

|

|

|

Risk

Factors

|

8

|

|

|

Unresolved

Staff Comments:

|

13

|

|

|

Properties

|

13

|

|

|

Legal

Proceedings

|

14

|

|

|

Submission

of Matters to a Vote of Security Holders

|

14

|

|

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

15

|

|

|

Selected

Financial Data

|

17

|

|

|

Management’s

Discussion and Analysis of Financial Conditions and Results of

Operations

|

18

|

|

|

Quantitative

and Qualitative Disclosures About Market Risk

|

33

|

|

|

Financial

Statements and Supplementary Data

|

34

|

|

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

64

|

|

|

Controls

and Procedures

|

64

|

|

|

Other

Information

|

65

|

|

|

|

||

|

Directors

and Executive Officers of the Registrant

|

66

|

|

|

Executive

Compensation

|

66

|

|

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

67

|

|

|

Certain

Relationships and Related Transactions

|

67

|

|

|

Principal

Accountant Fees and Services

|

67

|

|

|

Exhibits,

Financial Statement Schedules

|

68

|

|

|

69

|

||

|

70

|

Forward-Looking

Statements

In addition to historical information,

this Form 10-K contains forward-looking statements. These forward-looking

statements are made in reliance upon the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995 (“the Act”). The words

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,”

“should” and similar expressions are intended to identify “forward-looking

statements” within the meaning of the Act. Forward-looking statements include,

among others, statements about our future performance, future releases of our

products, new courses we intend to make available to our customers, the

sufficiency of our sources of capital for future needs, and the expected impact

of recently issued accounting pronouncements. These forward-looking

statements are subject to certain risks and uncertainties that could cause

actual results to differ materially from those reflected in the forward-looking

statements. Factors that might cause such a difference include, but are not

limited to, those discussed in Part I Item 1A of this Form 10-K. Readers are

cautioned not to place undue reliance on these forward-looking statements, which

reflect management’s opinions only as of the date hereof. We undertake no

obligation to revise or publicly release any revision to these forward-looking

statements based on circumstances or events, which occur in the future. Readers

should carefully review the risk factors described in Part I Item 1A of this

report on Form 10-K and in other documents we file from time to time with the

Securities and Exchange Commission.

Trademark

and Copyright References

PLATO®,

Straight Curve® and Academic Systems® are registered trademarks of PLATO

Learning, Inc. PLATO Learning, PLATO Learning Environment™ and

PLE™ are trademarks of PLATO Learning, Inc. Solely for convenience,

we refer to our trademarks in this Form 10-K without the ™ and ® symbols, but

such references are not intended to indicate, in any way, that we will not

assert, to the fullest extent under applicable law, our rights to these

trademarks.

Business

Description

PLATO

Learning, Inc. is a Delaware corporation that was incorporated in 1989 and is

headquartered in Bloomington, Minnesota. We are a leading provider of

on-line instruction, curriculum management, assessment, and related professional

development services to K–12 schools, community colleges and other educational

institutions across the country. Our products are used by customers principally

to provide alternative instruction to students performing below their grade

level in order to help those students return to the classroom, recover course

credits, pass high school exit exams or prepare for college and other

post-secondary studies. In addition to the value provided to

students, our solutions allow school districts to retain state and federal

funding tied to student enrollment, and help educators meet the demands of state

and federal student achievement initiatives for intervention, dropout prevention

and college readiness. We also offer online and onsite staff professional

development services to ensure optimal use of our products and to help schools

meet their accountability requirements and school improvement

plans.

Our

research-based courseware library includes thousands of hours of mastery-based

instruction covering discrete learning objectives in the subject areas of

reading, writing, language arts, mathematics, science, and social studies. Our

web-based assessment and alignment tools allow instruction to be personalized to

each student’s unique needs with curriculum that is aligned to local, state, and

national standards. Using our web-based products, educators are able to identify

each student’s instructional needs and prescribe an individual learning program

of PLATO Learning courseware, educational web sites, the school’s textbooks and

other core and supplemental instructional materials. A variety of reports are

available to help educators identify gaps in student understanding, monitor

student progress and ensure that standard learning objectives are being

addressed.

Beginning

in late fiscal year 2005, we implemented a strategy to deliver our products and

solutions on a subscription basis using a new internet-based learning management

platform we market as the PLATO Learning Environment, or PLE. As of October 31,

2009, approximately 1,360 school districts, community colleges and other

educational institutions across 50 states subscribed to our instructional

solutions delivered on PLE, and over 1.7 million students, teachers and

administrators at these institutions were registered to use PLE.

Our

principal business is the development and marketing of online curriculum

solutions and related services.

Market

Based on

recent market data from Simba Information (“Simba”), approximately $9.3 billion

is spent annually on print and electronic instructional materials in the U.S.

K-12 education market. Of that spending, approximately $1.75 billion is spent on

K-12 digital content.

Our

instructional products are delivered on a subscription basis over the internet,

via our learning management system, the PLATO Learning Environment, or PLE.

Today, 99% of the nation’s K-12 public schools have Internet access, and as a

result, schools are increasingly turning to web-based methods of instruction as

a supplement to their instructor-led programs due to their flexibility,

cost-efficiency, and effectiveness.

Our

instructional solutions are primarily used as alternative programs for students

that have not been successful in the traditional classroom environment, as well

as for online programs that offer first time credit for students at, below,

and/or above grade level. Additionally, many of our customers have

integrated our products into their core classroom

instruction. Earning a high-school diploma represents a key milestone

in an individual's schooling and social and economic advancement, but according

to the National Center for Education Statistics, more than 25% of incoming

freshman do not finish high school. Statistics like these raise the awareness of

the effectiveness of U.S. public schools and have led to legislative

requirements and public demand for increased accountability and improvements in

U.S. K-12 schools. These trends have led to increasing demand for solutions like

ours and others that address the need to improve school effectiveness and

graduation rates. As a result, we believe that technology-based instructional

materials have the ability to cost effectively create an individualized and

flexible instructional environment, and are generally preferred over print-based

materials by today’s students. We believe that these ongoing market

dynamics will cause technology-based instructional materials to continue to grow

faster than the total instructional materials market.

Strategy

Our

strategy is focused on the following strategic initiatives:

|

|

·

|

Deliver our

instructional solutions on a single, Internet-based delivery

platform. Emerging trends over the last several years are driving

acknowledgement of the benefits of delivering curriculum into the K–12

market over the Internet. These trends include improving Internet

technology, significant investments by school districts in technology

infrastructure, the high cost of ownership of multi-vendor, on-site

applications, growing use and acceptance of Internet-based resources in

the K–12 market, ubiquitous Internet accessibility outside the classroom,

and student and teacher demographics with respect to technology

expectations and adoption. Targeting these trends, we developed and

launched PLE in July 2006, an intuitive, web-based Learning Management

System that is available to students, teachers and administrators anywhere

an Internet connection and browser are available. In 2009 we

completed work to enhance the PLE platform to offer more flexibility,

reporting and usability. PLE 2.0 is set to release in the first

quarter of fiscal year 2010.

|

|

|

·

|

Leverage our strong

brand and extensive library of curriculum to grow market share in the

individualized instruction and online courses

markets.

|

|

|

o

|

Our

traditional strength has been the intervention market - solutions that

help students who are one or more grade levels behind and at risk of not

being promoted to the next grade or not graduating. Instruction delivered

using technology provides an ideal solution for this market as

instructional intervention generally occurs outside the traditional

classroom and requires self-paced learning which is personalized for each

student’s unique learning needs. The technology solutions currently sold

to this market are characterized by a large number of smaller competitors.

We believe that providing new and differentiated solutions on an

Internet-based and constantly evolving platform such as PLE, combined with

our strong brand in this market, uniquely positions us to be a dominant

provider of technology-based solutions in the fragmented intervention

market.

|

|

|

o

|

In

addition to designing our courseware to effectively help struggling

learners, we expect to continue to invest in courseware to meet the

growing demand from school districts for solutions that allow them to

offer a full online learning experience for students at and above grade

level.

|

|

|

·

|

Subscription-based,

on-demand, software-as-a-service (“SaaS”)

application. Historically, we operated a traditional

software business model in which software products were licensed to

customers on a perpetual basis for installation and use on their own

technology. This business model has many undesirable

characteristics including high product maintenance and support costs, high

volatility

and low visibility of financial results, and a dependence on large sales

at or near quarter-end to achieve financial targets, often resulting in

significant price discounting and a short-term business focus. We believe

the subscription-based business model provides significant advantages in

that it produces significant operating leverage, a predictable recurring

revenue stream through subscription renewals, and greater visibility and

stability to future operating results. In fiscal year 2009,

approximately 93% of our product orders were for subscription-based

products, up from approximately 85% in fiscal year

2008.

|

|

|

|

|

|

·

|

Best in class

competencies in software product development. Our

software development organization is centered on an on- and off-shore

development model and structured software development processes that have

greatly lowered development costs and improved product quality and time to

market.

|

Products

Our

products consist of a comprehensive portfolio of technology-based instructional

content, classroom assessment, and related professional development that we

market to K–12 schools, community colleges and other educational institutions.

Our products are used by these customers principally to provide individualized

instruction to students performing at or below their grade level. Our

programs are most frequently leveraged for students returning to the classroom,

course credits recovery, high school exit exam preparation and/or preparation

for college and other post-secondary studies.

Instructional

Content

Our

content library consists of rich, interactive, multimedia instructional content

that is highly engaging for both students and teachers. This research-based

courseware library includes more than 6,000 hours of mastery-based instruction

material covering the primary K-12 subject areas of mathematics, science,

reading/language arts, and social studies.

Our

content can be applied to multiple student learning profiles (e.g. general

education, special education, at-risk) and tailored for students across multiple

grade-levels. Content offerings are classified as intervention solutions when

applied to students performing below grade-level, as core or supplemental

instructional solutions for mainstream students performing at grade level, and

as advanced placement offerings for students performing above grade level. We

believe our content provides the following differentiating factors:

|

|

·

|

Interactive,

engaging multimedia instruction that is highly differentiated from static

text-based or video content provided by many other

companies;

|

|

|

·

|

Content

that is cross-referenced to academic standards set by states, the federal

government, and other standard-setting

bodies;

|

|

|

·

|

Assessments

that are tied to these standards and generate personalized lesson plans

based on an individual student’s test

results;

|

|

|

·

|

Content

that is arranged into a series of semester-long pre-configured online

courses for grades 7–12 that can be employed both inside and outside of

the classroom, and is fully customizable by schools to fit their unique

instructional needs;

|

|

|

·

|

Correlated

to primary textbooks used in K–12

schools.

|

Learning

Management System

The PLATO

Learning Environment (PLE), a web-based platform to deliver all of our

instructional solutions, provides a unified curriculum management and delivery

system that requires only an Internet connection and a browser. In addition to

anytime-anywhere delivery of our products, PLE provides the following

differentiating factors:

|

|

·

|

Automated

alignments of instructional content to learning standards in all states

and the major national standards such as SAT, ACT, GED, and

NAEP;

|

|

|

·

|

Access

to pre-set teacher materials used to supplement the online

curriculum;

|

|

|

·

|

Built-in

links to many popular websites containing other K–12

curriculum;

|

|

|

·

|

Functionality

allowing school districts to create customized courses tailored to their

specific instructional scope and sequence, including the ability for

teachers to upload documents they have created for access by

students;

|

|

|

·

|

Search

functionality that allows users to find resources and content based on

standards applicable to their instructional

requirements;

|

|

|

·

|

Preparation

of assessment tests and generation of recommendations for relevant

follow-up content based on results;

|

|

|

·

|

Automated

grading and reporting for whole course or supplemental

programs.

|

Classroom Formative

Assessment

Formative

assessment involves collecting feedback from learning activities to adapt

instruction to a learner’s needs. Our assessment database consists of

more than 180,000 test items linked to state, district, and national learning

objectives across all subject areas of reading, math, science and social

studies. In conjunction with powerful data management tools, our assessment

solutions can provide assessment results by student demographic category and

facilitate data-driven decision making for school curriculum development,

textbook choices and providing personalized learning. PLATO Test Packs with

Prescriptions prescribe individual learning paths to PLATO content based on

student performance, which can then be completed at the student’s own learning

pace. As a result, PLATO Test Packs give teachers the flexibility to allow PLE

to automatically prescribe assignments or to make manual adjustments before

assigning lessons.

Instructional

Solutions

We

combine our large library of interactive content and assessments with the unique

features of PLE to deliver a variety of instructional solutions to educational

institutions. In K-12 schools, these solutions primarily address

at-risk students who have fallen behind in the classroom, allowing these

students to recover credits, move to the next grade level, avoid dropping out of

school or prepare for their high school exit exam. In the post-secondary market,

our developmental algebra products, sold under the Academic Systems brand, are

primarily intended for students who have completed high school but are not yet

ready for college level math courses. We also provide instructional

solutions to adult education markets for GED preparation, workforce readiness

and life and career skills.

Services

and Product Support

Our

professional services offerings ensure that customers receive the consultation,

training and services needed to successfully implement our solutions and integrate

educational technology into their day-to-day teaching and learning environment.

Services are delivered in face-to-face sessions as well as synchronous and

asynchronous online delivery methods.

We

provide telephone and online product support to our customers. Subscription

customers are entitled to support as part of their subscription fees to our

online products. Customers who purchased perpetual license products

can choose to obtain telephone support by paying an annual software maintenance

fee.

Sales

and Marketing

Our sales

channel consists of direct sales representatives located throughout the U.S. and

inside sales representatives operating out of our corporate headquarters in

Bloomington, Minnesota. We also utilize distributors and resellers in certain

geographic markets.

In the

K–12 market we sell to school districts of all sizes, but generally target

larger school districts. In the post-secondary market, we target community

colleges, four-year universities, adult education centers, and correctional

institutions.

Competition

The

market for electronic instructional materials is served by hundreds of companies

that offer a range of instructional products and services. At one end of the

market are companies offering modular software applications or videos that

consist of a single element of instructional content or an individual course or

application. At the other end are companies like PLATO Learning that provide

full course offerings that span multiple grade levels and/or subject areas.

These companies are “comprehensive” in terms of being able to package a solution

that covers multiple grade levels, subjects, and associated reports and

assessments. Between the comprehensive and non-comprehensive categories there

are as many variations as there are companies.

In the

individualized instruction market we compete nationally with comprehensive

providers, such as Pearson Education, however we most frequently compete against

a number of smaller competitors, including Compass Learning, OdysseyWare,

Class.com, Apex Learning, American Education Corporation (A+), E2020, and

others. Many of these smaller companies focus on a geographic segment or

district size, rather than the national market. The needs, size, and location of

school districts often influence the opportunities for which companies choose to

compete.

When

competing with any company, we differentiate our solutions by emphasizing the

depth of our multimedia rich courseware aligned to standards, the benefits of a

single learning management system that delivers all content over the Internet

for all grades and core subject areas, the completeness of alignments to state

and national standards, and the unique diagnostic and prescriptive capabilities

of our products to improve performance on state exams and

standards. We also believe that our record of student improvement and

product development capabilities differentiate us from the competition. Based on

our experience, we believe that these are key factors that buyers use in

evaluating competitive offerings.

Product Development

Our

product development group develops, enhances, and maintains our courseware,

assessment, instructional management software, and delivery system platforms. We

utilize both domestic and offshore resources. In fiscal year 2009, approximately

40% of our total software development spending was incurred

offshore.

Proprietary

Rights

Our

courseware is proprietary and we attempt to protect it primarily under a

combination of the laws of copyrights, trademarks, and trade secrets. We also

utilize license agreements, employment agreements, employment termination

agreements, third-party non-disclosure agreements, and other methods to protect

our proprietary rights. We regard certain of our intellectual property rights as

essential to our business and enforce our intellectual property rights when we

become aware of any infringements or potential infringements and believe they

warrant such action.

Revenue Backlog

We define

revenue backlog as the total of deferred revenue reported on our balance sheet

plus unbilled amounts due under non-cancelable subscription agreements which is

not included in the balance sheet. Following is a reconciliation of

deferred revenue to revenue backlog, and the components of revenue backlog, as

of the end of fiscal years 2009 and 2008:

|

As

of October 31,

|

||||||||||||

|

2009

|

2008

|

%

Change

|

||||||||||

|

Reconciliation:

|

||||||||||||

|

Total

Deferred revenue

|

$ | 53,698 | $ | 44,921 | 20 | % | ||||||

|

Add:

Unbilled amounts due under

|

||||||||||||

|

non-cancelable

subscription agreements

|

14,641 | 8,945 | 64 | % | ||||||||

|

Revenue

Backlog

|

$ | 68,339 | $ | 53,866 | 27 | % | ||||||

|

Components

of Revenue Backlog:

|

||||||||||||

|

Subscriptions

and related services:

|

||||||||||||

|

Subscriptions

|

$ | 56,410 | $ | 41,694 | 35 | % | ||||||

|

Professional

services

|

7,294 | 5,070 | 44 | % | ||||||||

|

Subtotal

|

63,704 | 46,764 | 36 | % | ||||||||

|

Legacy

products and services:

|

||||||||||||

|

License

fees

|

386 | 467 | (17 | %) | ||||||||

|

Software

maintenance

|

4,249 | 6,635 | (36 | %) | ||||||||

|

Subtotal

|

4,635 | 7,102 | (35 | %) | ||||||||

|

Total

Revenue Backlog

|

$ | 68,339 | $ | 53,866 | 27 | % | ||||||

At

October 31, 2009, we expect approximately $24.1 million of our deferred revenue

to be recognized subsequent to fiscal year 2010.

Seasonality

Our quarterly financial results

fluctuate as a result of a number of factors including public education budget

cycles and the mix of perpetual license fee and subscription product

sales. Historically we have experienced our lowest order levels, cash

balances and revenues in the first and second quarters of our fiscal year and

higher levels of orders, cash and revenues in our third and fourth quarters.

More recently, our increasing emphasis on sales of subscription products has

moderated the seasonality of our revenues. Because of these factors, the results

for interim periods are not necessarily indicative of the results to be expected

for the full fiscal year.

Employees

As of

October 31, 2009, we had approximately 300 employees. We also

contract with offshore resources in the development of new

products. We have never experienced a work stoppage as a result of a

labor dispute, and none of our employees are represented by a labor

organization.

Non-Audit

Services Performed by Independent Registered Public Accounting Firm

Pursuant

to Section 10A(i)(2) of the Securities Exchange Act of 1934, as added by Section

202 of the Sarbanes-Oxley Act of 2002, we are responsible for disclosing to

investors the non-audit services approved by our Audit Committee to be performed

by, our independent registered public accounting firm. Non-audit

services are defined as services other than those provided in connection with an

audit or a review of our financial statements. During the period

covered by this Annual Report on Form 10-K, our Audit Committee pre-approved

non-audit services, consisting of fees paid for online research

materials.

Web

Site Access to Reports

Our

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Definitive Proxy

Statements on Schedule 14A, Current Reports on Form 8-K, and any amendments to

those reports, are made available free of charge on our web site (www.plato.com)

as soon as reasonably practical after such reports are filed with the Securities

and Exchange Commission (“SEC”). Statements of changes in beneficial

ownership of our securities on Form 4 by our executive officers and directors

are made available on our web site by the end of the business day following the

submission of such filings to the SEC. All reports mentioned above

are also available from the SEC’s web site (www.sec.gov).

We

operate in a market environment that involves significant risks, many of which

are beyond our control. The following risk factors may adversely

impact our results of operations, financial position, cash flow and the market

price of our common stock. Although we believe that we have

identified and discussed below the key risk factors affecting our business, they

are not the only ones facing us. There may be additional risks and

uncertainties that are not presently known or that are not currently believed to

be significant that also may affect our results of operations and financial

condition.

Risks Relating to Our

Industry

We

derive a substantial portion of our revenues from public school funding, which

is dependent on support from federal, state, and local

governments. Changes or reductions in funding for public school

systems could reduce our revenues and cash flows and negatively impact our

margins and impede the growth of our business.

The

availability of funding to purchase our products is subject to many factors that

affect government spending. These factors include downturns in

general economic conditions, like those which we are currently experiencing,

that can reduce government tax revenues and may affect education funding,

emergence of other priorities that can divert government funding from

educational objectives, periodic changes in government leadership that can

change spending priorities, and the government appropriations process, which is

often slow and unpredictable. In many instances, customers rely on

specific funding appropriations to purchase our

products. Curtailments, delays, or reductions in this funding can

delay or reduce revenues and cash flow we had otherwise forecasted to

receive.

The

growth of our business depends on continued investment by public school systems

in interactive educational technology and products. Changes to funding of public

school systems can slow this type of investment and adversely affect our

revenues and market opportunities.

If

national educational standards and assessments are adopted, or if existing

metrics for applying state standards are revised, new competitors could more

easily enter our markets or the demands in the markets we currently serve may

change.

With the

reauthorization of the Elementary and Secondary Education Act, known as No Child

Left Behind, or NCLB, in 2001, Congress conditioned the receipt of federal

funding for education on the establishment of educational standards, annual

assessments and the achievement of adequate yearly progress milestones. These

standards are established at the state level, and there are currently no

national educational standards that are required to be assessed pursuant to

NCLB. As part of NCLB, each state is required to establish clear performance

standards for each grade level in reading, math and science in grades 3 through

8, and for high school exit or end-of-course exams. Our products are

specifically built to align to the educational and assessment standards in all

50 states, which we believe differentiates them from the products offered by our

competitors. If a uniform set of national standards and assessments were to

replace individual state level standards, it would be easier for competitors to

develop similar products. If such an increase in competition occurred, our

ability to compete effectively could be negatively impacted and our revenue and

profitability could materially decline.

Competition

in our industry is intense and growing, which could adversely affect our

performance.

Our

industry is intensely competitive, rapidly evolving, and subject to

technological change. We compete primarily against organizations

offering educational and training software and services, including comprehensive

curriculum software publishers, companies providing single-title retail

products, and Internet content and service providers. Some of our

competitors have substantially greater financial, technical and marketing

resources than us. The demand for e-learning products and services

has grown significantly with the advent of on-line educational institutions,

improvements

in Internet access and reductions in the cost of technology. While

this growing demand presents opportunities for us, it also results in the

addition or consolidation of competitors. Increased competition in

our industry could result in price reductions, reduced operating margins, or

loss of market share, which could seriously harm our business, cash flows, and

operating results.

Risks

Relating to Our Company

The

success of our business model is dependent on growth in market acceptance of

online subscription products delivered over the Internet. If this acceptance

does not grow or is otherwise diminished, our revenues will continue to decline

and may affect our ability to maintain profitability.

Our

ability to generate revenue growth and to continue to be profitable is dependent

on significant growth of subscription fees to our Internet-based

products. Market acceptance of software solutions delivered over the

Internet can be negatively affected by factors such as customers’

confidentiality concerns with regard to student information that is stored

outside of their controlled computing environments, existing investments in

owned courseware, technology infrastructure and related personnel, customer

preferences with regard to perpetual licenses vs. annual subscription decisions,

and availability, reliability and security of access to the Internet within a

school district.

Adverse

changes in these factors could result in a decline in the acceptance of

web-based courseware solutions making it difficult for us to execute our current

business model. As a result, we may need to reevaluate that business

model, which may affect our ability to continue to achieve

profitability.

The

success of our product investment strategy and our ability to remain competitive

against companies with access to larger amounts of capital is dependent on our

ability to maintain our cost-effective off-shore development resources. If we

are unable to do so, we would experience significant product delays and

increases in product development costs which would adversely affect our

strategy, competitive position, revenues and profitability.

More than

40% of our total software development and maintenance spending in fiscal year

2009 was incurred on off-shore development resources. We believe the

use of these resources provides us greater flexibility, cost savings, and a

greater return on our development investments. These resources are also critical

to our ability to respond quickly to market changes and to compete against

companies with access to larger amounts of capital than we

have. However, this dependence introduces risks common to many

outsourcing relationships. These risks include the supplier’s ability

to maintain sufficient capacity, control costs, and hire, train, and retain

qualified resources, as well as risks associated with our limited direct control

and physical access to these resources including the ability to protect and

enforce our intellectual property rights. In our supplier agreements

we strive to include provisions intended to limit some of these risks; however,

that is not always possible and there can be no assurance that they will be

effective at doing so. If our supplier relationships are suddenly and

adversely affected, it would cause significant product delays, increased

development costs and could impact product usability, which would have a

material negative effect on our competitive position, revenues and

profitability.

Our

future success may be dependent on our ability to compete in the broader

instructional materials market against larger competitors with significantly

greater resources than we have.

The

instructional materials market has been dominated for many years by a small

number of large publishers that provide textbooks and other printed materials to

the school market. These companies have well-established distribution

channels and significantly greater marketing, curriculum and financial resources

than us. As electronic instructional materials continue to grow and

take market share from print materials, competition from these companies will

increase and we may not be able to compete effectively.

If

we are unable to adapt our products and services to technological changes, to

the emergence of new computing devices and to more sophisticated online

services, we may lose market share and service revenue, and our business could

suffer.

We need to anticipate, develop and introduce new products, services and applications on a timely and cost effective basis that keeps pace with technological developments and changing customer needs. We may encounter difficulties responding to these changes that could delay our introduction of products and services or require us to make larger than anticipated investments to maintain existing products. Software industries are characterized by rapid technological change and obsolescence, frequent product introductions, and evolving industry standards. For example, the number of individuals who access the internet through devices other than a personal computer, such as personal digital assistants, mobile telephones, televisions and set-top box devices, has increased dramatically, and this trend is likely to continue. Our subscription services were designed for internet use on desktop and laptop computers. The lower resolution, functionality and memory associated with alternative devices currently available may make the use of our products through such devices difficult. We have no experience to date in operating versions of our products and services developed or optimized for users of alternative devices. Accordingly, it is difficult to predict the problems we may encounter in developing versions of our products and services for use on these alternative devices, and we may need to devote significant resources to the creation, support and maintenance of such versions. If we fail to develop or sell products and services cost effectively that respond to these or other technological developments and changing customer needs, we may lose market share and revenue and our business could materially suffer.

Since

fiscal 2005 we have transitioned our business from products that are licensed on

a perpetual basis to those that are licensed on a subscription basis. The

different revenue recognition characteristics of these products affect the

comparability of our financial results. As a result, our business will be

difficult to compare from period to period. Our business is also seasonal. As a

result of these factors, we may continue to experience unexpected fluctuations

in our quarterly cash flows, revenues and results from operations, which may

adversely affect our stock price and the implementation of our

strategy.

We expect

sales of perpetual license products and related software maintenance to continue

to decline because we completed the transition of our business model to

subscription-based products. As a result, our operating results may be difficult

to compare

to historical periods, and may fluctuate from quarter-to-quarter due to factors

such as the size, timing, and product mix of license vs. subscription

orders. In addition, public school budget cycles result in

purchases that have historically been concentrated in the last two quarters of

our fiscal year. Accordingly, our annual operating performance can be materially

and adversely affected if factors such as school budget constraints,

availability of federal and state funding, sales productivity and new product

introductions do not align with these purchasing patterns. If such

annual results are not achieved we may have to delay or adjust components of our

strategy implementation which may affect our ability to maintain

profitability.

Our

transition from perpetual to subscription-based products has resulted in an

increasing trend whereby cash receipts from the sale of our products has shifted

from payment shortly after the time of sale, to payment over the subscription

period. This trend, together with the seasonality of our business previously

discussed, may adversely affect our short-term liquidity.

We

generally require that one-year subscriptions and sales of perpetual licenses be

paid in full within a short time after completion of the

sale. Multi-year subscription customers may be given an option to pay

for these subscriptions annually in advance, and these customers are

increasingly electing, or negotiating, to make multi-year payments. This

increasing delay in the receipt of payment for the sales of our products,

together with the seasonality of our business discussed above, has adversely

affected our cash flows and may increase our short-term liquidity

needs.

Misuse

or misappropriation of our proprietary rights or inadvertent infringement by us

on the rights of others could adversely affect our results of

operations.

We regard

certain of our intellectual property rights as essential to our

business. We rely on a combination of the laws of copyrights,

trademarks, and trade secrets, as well as license agreements, employment and

employment termination agreements, third-party non-disclosure agreements, and

other methods to protect our proprietary rights. We enforce our

intellectual property rights when we become aware of any infringements or

potential infringements and believe they warrant such action. If we

were unsuccessful in our ability to protect these rights, our operating results

could be adversely affected.

Although

we believe our products and services have been independently developed and that

none of our products or services infringes on the rights of others, third

parties may assert infringement claims against us in the future. We

may be required to modify our products, services or technologies or obtain a

license to permit our continued use of those rights. We may not be

able to do so in a timely manner or upon reasonable terms and

conditions. Failure to do so could harm our business and operating

results. In addition, we leverage certain third party generated

products through license and/or royalty agreements and we have the risk that

certain of these relationships will not continue or that the underlying products

will not be properly supported or updated by the third parties.

We have a

number of technological mechanisms to prevent or inhibit unauthorized copying of

our software products and generally require the execution of a written license

agreement, which restricts use and copying of our software products.

However,

if such copying or misuse were to occur to any substantial degree, our operating

results could be adversely affected.

If

our security measures are breached and unauthorized access is obtained to our

web-based products, they may be perceived as not being secure, customers may

curtail or stop using these products and we may incur significant legal and

financial exposure and liabilities.

The use

of our web-based subscription products involves the storage of certain personal

information with regard to the teachers and students using these products. If

our security measures are breached and unauthorized access to this information

occurs, our reputation will be damaged, our business may suffer and we could

incur significant liability. Because the techniques used to attempt unauthorized

access to systems such as ours change frequently and generally are not

recognized until attempted on a target, we may be unable to anticipate these

techniques or to implement adequate preventative measures. If an actual or

perceived breach of our security occurs, the market perception of the security

of our system could be harmed and we could lose sales and

customers.

Claims relating to content available

on or accessible from, our web sites may subject us to liabilities and

additional expense.

Our

web-based subscription products incorporate content not under our direct control

including content from, and links to, third-party web sites, and content

uploaded by our customers. As a result, we could be subject to claims

relating to this content. In addition to exposing us to potential

liability, claims of this type could require us to change our web sites in a

manner that could be less attractive to our customers and divert our financial

and development resources.

Interruptions

or delays in service from our third-party Web hosting facilities could impair

the delivery of our service and harm our business.

Our

subscription products are delivered using standard computer hardware located in

two, third-party Web hosting facilities, with the primary facility located on

the west coast of the United States. We do not control the operation of these

facilities, and they are vulnerable to damage or interruption from earthquakes,

floods, fires, power loss, telecommunications failures and similar events.

Despite precautions taken at these facilities, the occurrence of a natural

disaster or other unanticipated problems at these facilities could result in

lengthy interruptions in our service. Even with disaster recovery arrangements

in place, our service could be interrupted. Interruptions in our service may

reduce our revenue, cause us to issue credits, cause customers to terminate

their subscriptions and adversely affect our renewal rates and our ability to

attract new customers. Our business will also be harmed if our customers and

potential customers believe our service is unreliable.

None.

We lease

all of our facilities, including our corporate headquarters in Bloomington,

Minnesota, which expires in June 2010. We currently anticipate that in 2010 we

will likely execute a new lease for a different facility in or near Bloomington,

although we may renew our current lease for less square footage. We also

continue to be a party to two leases for unoccupied office space in the United

Kingdom. Other than our plans to address the expiration of our

headquarters facility lease discussed above, our leased facilities are adequate

to meet our current and expected business requirements.

From time

to time, we may become involved in litigation arising out of operations in the

normal course of business. As of October 31, 2009, we were not party

to any pending legal proceedings the outcome of which could reasonably be

expected to have a material unfavorable or favorable effect on our operating

results, financial position or cash flows.

None.

Market

Information

Our

common stock has traded publicly on the NASDAQ Global Market under the symbol

“TUTR” since December 23, 1992. The quarterly ranges of high and low

prices per share of our common stock were as follows:

| 2009 | 2008 | |||||||||||||||

| Fiscal Quarter | High | Low | High | Low | ||||||||||||

| First | $ | 1.80 | $ | 0.81 | $ | 4.70 | $ | 2.90 | ||||||||

| Second | 3.17 | 1.13 | 3.88 | 2.44 | ||||||||||||

| Third | 4.34 | 2.50 | 3.04 | 1.84 | ||||||||||||

| Fourth | 4.98 | 3.87 | 3.22 | 1.30 | ||||||||||||

Holders

As of

December 31, 2009, there were approximately 480 record holders of our common

stock, excluding stockholders whose stock is held either in nominee name and/or

street name brokerage accounts. Based on information available to us,

there were approximately 1,727 holders of our common stock whose stock is held

either in nominee name and/or street name brokerage accounts.

Stock

Performance Graph

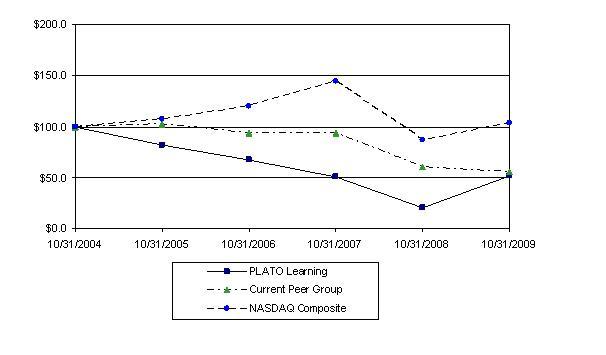

The

following stock performance graph does not constitute soliciting material, and

should not be deemed filed or incorporated by reference into any other Company

filing under the Securities Act of 1933 or the Securities Exchange Act of 1934,

except to the extent the Company specifically incorporates this stock

performance graph by reference therein.

In

accordance with Securities and Exchange Commission regulations, the following

performance graph compares the cumulative total stockholder return on our common

stock to the cumulative total return on the NASDAQ Composite Index and the

weighted average return of our peer group (described below) for the five years

ended October 31, 2009, assuming an initial investment of $100 and the

reinvestment of all dividends.

Our

current peer group consists of the following: LeapFrog Enterprises, Inc., Nobel

Learning Communities, Princeton Review, Inc., Renaissance Learning, Inc.,

Scholastic Corp., School Specialty, Inc. and Scientific Learning,

Inc.

| 10/31/2004 | 10/31/2005 | 10/31/2006 | 10/31/2007 | 10/31/2008 | 10/31/2009 | |||||||||||||||||||

| PLATO Learning, Inc. | $ | 100.00 | 81.49 | $ | 67.51 | $ | 50.32 | $ | 20.08 | $ | 51.96 | |||||||||||||

| Current Peer Group | 100.00 | 102.30 | 94.07 | 93.78 | 60.31 | 55.76 | ||||||||||||||||||

| NASDAQ | 100.00 | 107.36 | 119.83 | 144.77 | 87.14 | 103.55 | ||||||||||||||||||

Dividends

We did

not declare or pay cash dividends on our common stock in fiscal years 2009, 2008

or 2007. While future cash dividend payments are at the discretion of

our Board of Directors, our current intentions are to reinvest all earnings in

the development and growth of our business.

Securities

Authorized for Issuance Under Equity Compensation Plans

The

information required by Item 201(d) of Regulation S-K is set forth under Item 12

of this Annual Report on Form 10-K.

Repurchases

We

repurchased 1,471 shares of our common stock for an aggregate cost of

approximately $4,000 during the second quarter of fiscal 2009. The

shares were repurchased in accordance with employee elections to withhold shares

to fund tax withholdings due upon vesting of restricted stock. Shares

repurchased but not reissued are presented as treasury stock in the Consolidated

Balance Sheet.

|

(In

thousands, except per share amounts)

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||||

|

For

the year ended October 31:

|

|||||||||||||||||||||||

|

Revenues(1)

|

$ | 65,183 | $ | 68,401 | $ | 69,632 | $ | 90,719 | $ | 121,804 | |||||||||||||

|

Gross

profit (2)

|

37,317 | 26,933 | 32,113 | 49,936 | 56,996 | ||||||||||||||||||

|

Operating

expenses:

|

|||||||||||||||||||||||

|

Sales

and marketing

|

23,762 | 27,632 | 29,849 | 38,598 | 49,996 | ||||||||||||||||||

|

General

and administrative

|

8,984 | 10,366 | 12,095 | 16,619 | 18,420 | ||||||||||||||||||

|

Software

maintenance and development

|

2,637 | 4,060 | 4,334 | 5,496 | 5,646 | ||||||||||||||||||

|

Amortization

of intangibles

|

853 | 1,550 | 1,740 | 3,711 | 4,322 | ||||||||||||||||||

|

Goodwill

impairment (3)

|

- | 71,865 | - | - | - | ||||||||||||||||||

|

Restructuring,

impairment and other charges

|

- | 6,748 | (478 | ) | 9,093 | 6,025 | |||||||||||||||||

|

Operating

income (loss)

|

1,081 | (95,288 | ) | (15,427 | ) | (23,581 | ) | (27,413 | ) | ||||||||||||||

|

Other

(expense) income, net

|

(124 | ) | 254 | 1,159 | 1,701 | 586 | |||||||||||||||||

|

Income

tax (benefit) expense

|

- | (3,137 | ) | 608 | 600 | 860 | |||||||||||||||||

|

Net

income (loss)

|

957 | (91,897 | ) | (14,876 | ) | (22,480 | ) | (27,687 | ) | ||||||||||||||

|

Basic

income (loss) per share

|

$ | 0.04 | $ | (3.85 | ) | $ | (0.63 | ) | $ | (0.95 | ) | $ | (1.18 | ) | |||||||||

|

Diluted

income (loss) per share

|

$ | 0.04 | $ | (3.85 | ) | $ | (0.63 | ) | $ | (0.95 | ) | $ | (1.18 | ) | |||||||||

|

At

October 31:

|

|||||||||||||||||||||||

|

Cash

and cash equivalents

|

$ | 28,164 | $ | 20,018 | $ | 24,297 | $ | 33,094 | $ | 46,901 | |||||||||||||

|

Marketable

securities

|

- | - | - | - | 213 | ||||||||||||||||||

|

Accounts

receivable, net

|

10,710 | 6,834 | 11,752 | 17,522 | 22,768 | ||||||||||||||||||

|

Total

assets

|

45,413 | 68,967 | 162,780 | 175,198 | 197,328 | ||||||||||||||||||

|

Long-term

debt, excluding current portion

|

- | - | - | 18 | 57 | ||||||||||||||||||

|

Deferred

revenue

|

53,698 | 44,921 | 44,600 | 40,814 | 40,431 | ||||||||||||||||||

|

Total

liabilities

|

61,030 | 58,911 | 62,045 | 60,748 | 62,501 | ||||||||||||||||||

|

Stockholders'

equity

|

$ | 12,422 | $ | 10,056 | $ | 100,735 | $ | 114,450 | $ | 134,827 | |||||||||||||

| (1 | ) |

In

2006, we began transitioning our business model from one that sells

one-time perpetual

|

|||||||||||||||||||||

|

licenses

to our software, for which revenue is generally recognized up-front upon

delivery, to one that

|

|||||||||||||||||||||||

|

sells

subscription-based products, for which revenue is recognized over the

subscription

|

|||||||||||||||||||||||

|

period. As

a result, this transition will affect the comparability of our revenues

and profitability from

|

|||||||||||||||||||||||

|

period

to period until it is complete.

|

|||||||||||||||||||||||

| (2 | ) |

Gross

profit was reduced by asset impairment charges related to:

|

|||||||||||||||||||||

| 2008 | 2007 | 2006 | 2005 | ||||||||||||||||||||

|

Capitalized

product development

|

$ | 5,085 | $ | 531 | $ | - | $ | 4,412 | |||||||||||||||

|

Purchased

technology intangible assets

|

- | - | 1,089 | 8,782 | |||||||||||||||||||

| $ | 5,085 | $ | 531 | $ | 1,089 | $ | 13,194 | ||||||||||||||||

|

There

were no asset impairment charges in fiscal year 2009. See Notes 7 and

8 to the Consolidated

|

|||||||||||||||||||||||

|

Financial

Statements.

|

|||||||||||||||||||||||

|

(3)

For additional detailed information see Note 14 to the Consolidated

Financial Statements.

|

|||||||||||||||||||||||

Fiscal

Year

Our

fiscal year is from November 1 to October 31. Unless otherwise stated,

references to the years 2009, 2008, and 2007 relate to the fiscal years ended

October 31, 2009, 2008, and 2007, respectively. References to future years also

relate to our fiscal year ending October 31.

Critical

Accounting Policies and Estimates

Our

discussion and analysis of financial condition and results of operations is

based upon our consolidated financial statements, which have been prepared in

accordance with accounting principles generally accepted in the United States of

America. The preparation of these financial statements requires us to

make estimates and judgments that affect the reported amounts of assets,

liabilities, revenues, and expenses. We continually evaluate our

critical accounting policies and estimates, and have identified the policies

relating to the following areas as those that are significant to our financial

statement presentation, and require difficult, subjective, or complex

judgments:

|

|

·

|

Revenue

recognition

|

|

|

·

|

Capitalized

software development costs

|

|

|

·

|

Valuation

of deferred income taxes

|

|

|

·

|

Impairment

analysis of goodwill and identified intangible

assets

|

Our

discussion of these policies is intended to supplement, but not replace, the

more detailed discussion of these and other accounting policies and disclosures

contained in the Notes to Consolidated Financial Statements.

Revenue Recognition. We

derive our revenues from three sources: (1) subscription revenues, which are

comprised of subscription fees from customers accessing our online, web-based

products; (2) license revenues from non-cancelable perpetual license agreements;

and (3) related professional and support services and other

revenue.

We

recognize revenue when all of the following conditions are met:

|

|

·

|

There

is persuasive evidence of an

arrangement;

|

|

|

·

|

Access

to our online subscription products has been provided to the customer or

the perpetual courseware has been

delivered;

|

|

|

·

|

The

amount of fees to be paid by the customer is fixed and determinable;

and

|

|

|

·

|

The

collectability of the fee is

probable.

|

Revenue

from the licensing of software under subscription arrangements is recognized on

a ratable basis over the subscription period starting the later of the first day

of the subscription period or when all revenue recognition criteria identified

above have been met. Amounts that have been invoiced are recorded in

accounts receivable and in deferred revenue or revenue, depending on whether the

revenue recognition criteria have been met. Amounts due under

non-cancelable subscription agreements are not

recognized in accounts receivable or deferred revenue until such amounts are

invoiced to the customer.

We also

provide professional services, which consist of training and implementation

services, as well as ongoing customer support and

maintenance. Training and implementation services are not essential

to the functionality of our software products. Revenues from these

services are recognized separately upon delivery where there is objective and

reliable evidence of fair value of each deliverable. Software support

revenue is deferred and recognized ratably over the support period.

For

revenue arrangements with multiple deliverables, we allocate the total amount

the customer will pay to the separate units of accounting based on their

relative fair values, as determined by the price of the undelivered items when

sold separately.

If

collectability of the fee is not probable, revenue is recognized as payments are

received from the customer provided all other revenue recognition criteria have

been met. If the fee due from the customer is not fixed or

determinable, revenue is recognized as the payments become due provided all

other revenue recognition criteria have been met.

Capitalized Software Development

Costs. Our investments in software development are significant, and the

rules that govern how these costs are accounted for in our financial statements

can have a significant impact on our operating results from period to

period.

At the

end of fiscal year 2008, we completed our transition to a software-as-a-service

business model in which substantially all of our products are now delivered on a

hosted, subscription service basis. Effective for fiscal year 2009,

we have applied authoritative guidance that accounts for the costs of computer

software developed for internal use. The guidance provides that

hosting arrangements in which customers do not have a contractual right to take

possession of the software are service arrangements, and such software, subject

to certain exceptions, is considered internal use software.

Our

software development costs relate to the research, development, enhancement, and

maintenance of our software products. Costs related to the initial

design and development of new products and the routine enhancement and

maintenance of existing products are expensed as incurred. When projects reach

the application development stage we begin capitalization of the related project

costs. Capitalization ends when a product is available for general release to

our customers, at which time amortization of the capitalized costs begins. The

amortization of these costs is included in cost of revenues.

Prior to

fiscal year 2009, we accounted for our software development costs as computer

software to be sold, leased or otherwise marketed. Capitalization

began when technological feasibility was achieved and an allocation of indirect

costs was included in the amounts capitalized. Capitalization ended when a

product was available for general release to our customers, at which time

amortization of the capitalized costs began.

We

evaluate our capitalized costs whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be

recoverable. Prior to 2009, we evaluated

our capitalized costs on a quarterly basis to determine if the unamortized cost

related to any product, or group of products, exceeded its estimated net

realizable value. Estimating net realizable value requires us to use judgment in

projecting future revenues and cash flows to be generated by the product and

thereby quantifying the amount, if any, to be written off. Actual cash flows

realized could differ materially from those estimated. In addition, any future

changes to our software product offerings could result in write-offs of

previously capitalized costs and have a significant impact on our consolidated

results of operations. Our analysis as of October 31, 2008 resulted

in impairment charges on these assets of $4.6 million. There were no

impairment charges on capitalized software development costs

2009.

Valuation of Deferred Income

Taxes. Our accounting policy for the valuation of deferred income taxes

is considered critical for several reasons. Significant judgment is required in

the assessment of the need for a valuation allowance. In addition, income tax

accounting rules, in combination with purchase accounting rules applied in the

acquisition of Lightspan in 2004, resulted in a complex tax accounting situation

in which, until 2008, we had not recognized tax benefits on operating losses or

on the realization of deferred tax assets, but regardless of our operating

results, had been recognizing tax expense on future tax liabilities related to

tax deductible goodwill.

The

majority of our deferred tax assets represent net operating loss carryforwards

which are available to offset future taxable income. These loss carryforwards

include those acquired in the acquisition of Lightspan in 2004, as well as

carryforward losses that existed prior to, or were incurred after, the

acquisition. Our ability to realize the benefit of these loss carryforwards is

dependent upon our ability to generate future taxable income., Our history of

cumulative operating losses over the past several years has led to our current

assessment that it is more likely than not that our net deferred taxes will not

be realized. As a result, our deferred tax assets are fully reserved

and will remain fully reserved until the related tax benefits are realized

through the generation of taxable income in a particular year, or until we can

demonstrate a history of generating taxable income.

Until

2008, our calculation of net deferred tax assets excluded a deferred tax

liability related to tax deductible goodwill. The timing of the reversal of this

difference was considered indefinite because it would not reverse until the

underlying assets that created the goodwill were disposed of or

sold. In 2008, the goodwill was determined to by fully impaired, and

as a result, the deferred tax liability associated with tax deductible goodwill

was reversed.

Goodwill and Identified Intangible

Assets. Goodwill and identified intangible assets are recorded when the

purchase price paid for an acquisition exceeds the fair value of the tangible

assets acquired. Most of the companies we have acquired have not had

significant tangible assets. As a result, a significant portion of

the purchase price paid in acquisitions has been allocated to identified

intangible assets and/or goodwill.

Identified

intangible assets are amortized to expense over their expected useful lives and

goodwill was not amortized. Once established, these assets are

subject to periodic impairment assessments to determine if their current

carrying values are recoverable based on information available at the time these

assessments are made. Significant assumptions and estimates are

required in making these assessments.

Accordingly,

the assumptions and estimates we use in implementing this policy affect the

amount of identified intangible asset amortization and impairment charges, if

any, reflected in our operating results. Our impairment assessments at October

31, 2008 resulted in the elimination of goodwill and a related impairment charge

of $71.9 million, and impairment charges of $1.9 million on identified

intangible technology, trademark and customer assets acquired in previous

acquisitions. There were no impairment charges in 2009.

General

Factors Affecting our Financial Results

There are

a number of general factors that affect our results from period to period. These

factors are discussed below.

Revenue. In 2008, we

completed a transition of our business model from one that sells one-time

perpetual licenses to software, for which revenue is generally recognized

up-front upon delivery, to one that sells subscription-based products, for which

revenue is recognized over the subscription period. The transition began in late

fiscal 2005 when we introduced many of our new subscription-based products and

affects the comparability of our revenues over this period. In 2009,

a meaningful, but declining portion of our revenues continued to be derived from

sales of perpetual licenses of our software products and related maintenance.

These revenues are reported as license fees and software maintenance (included

in services revenue) in our consolidated statement of operations. As

subscription revenues grow as a percentage of total revenues, we expect our

period to period revenues to become more comparable and

predictable.

Cost of Revenues and Gross

Profit. Our cost of revenues and gross profit during a period is

dependent on a number of factors. License fee and software maintenance revenues

historically have had high gross profit due to the low direct cost of delivering

these products and services. As a result, the mix of license fee revenues to

total revenues in a given period significantly influences reported total gross

profit. In addition, a large portion of our costs of revenue are fixed in

nature. These costs include amortization of capitalized software development and

purchased technology, depreciation and other infrastructure costs to support our

hosted subscription services, customer support operations, and full-time

professional services personnel who deliver our training services. Accordingly,

increases in revenues allow us to leverage these costs resulting in higher gross

profit, while decreases in revenues have the opposite effect.

Operating Expenses. General

and administrative expenses are substantially fixed in nature. However, certain

components such as our provision for bad debts, professional fees, and other

expenses can vary based on business results, individual events, or initiatives

we may be pursuing at various times throughout the year.

Incentive

compensation is a significant variable component of our sales and marketing

expenses, approximating 8% to 9% of total revenues in any given period. Sales

and marketing expenses also include costs such as travel, tradeshows, and

conferences that can vary with revenue activity or individual events that occur

during the period.

Software maintenance and development expense in our consolidated statement of

operations does not reflect our total level of software product spending. Costs

to enhance or maintain existing products, or to develop products prior to the

application development stage, are charged to software maintenance and

development expense as incurred. Costs incurred to develop new products after

the preliminary project stage is completed, which represent the majority of our

total development spending, are capitalized and amortized to cost of revenues.

Accordingly, software maintenance and development expense in our consolidated

statement of operations can fluctuate from period to period, in terms of both

total dollars and as a percentage of revenue, based on the nature and timing of

activities occurring during the period.

Amortization

of intangibles represents the amortization of certain identified intangible

assets acquired through various acquisitions. While these expenses are generally

predictable from period to period because they are fixed over the course of

their individual useful lives, they can be affected by events and other factors

that result in impairment of these assets and a corresponding reduction in

future amortization.

Non-GAAP

Financial Measures

The

following discussion and analysis of our financial condition and results of

operations includes non-GAAP financial measures, identified in the

reconciliations below, that is not prepared in accordance with generally

accepted accounting principles and may be different from non-GAAP financial

measures used by other companies. Non-GAAP financial measures should

not be considered as a substitute for, or superior to, measures of financial

performance prepared in accordance with GAAP. Investors are encouraged to review

the following reconciliations of the non-GAAP financial measures used herein to

their most directly comparable GAAP financial measures as provided in our

consolidated financial statements.

Our

management has used these non-GAAP financial measures to gauge the success of

our transition to a software-as-a-service business model. This