Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDO HEALTH SOLUTIONS INC. | d8k.htm |

Endo

Pharmaceuticals JPMorgan 28th Annual Healthcare Conference January 2010 grow. collaborate. innovate. thrive. Exhibit 99.1 |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. FORWARD LOOKING STATEMENT 2 This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 regarding, among other things, the

company’s financial position, results of operations, market position, product development and business strategy, as well as estimates of future total revenues, future expenses, future net

income and future earnings per share. Statements including words such as

“believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may” “intend,” “guidance” or similar expressions are forward-looking statements. Because these statements reflect

our current views, expectations and beliefs concerning future events, these

forward-looking statements involve risks and uncertainties. Investors should note that many factors could affect our future financial results and could cause our actual results to differ materially from

those expressed in forward-looking statements contained in this presentation. These

factors include, but are not limited to: the possibility that the acquisition of Indevus is not complementary to Endo; the inherent uncertainty of the timing and success of, and expense

associated with, research, development, regulatory approval and commercialization of

our products and pipeline products; competition in our industry, including for branded and generic products, and in connection with our acquisition of rights to assets, including

intellectual property; government regulation of the pharmaceutical industry; our

dependence on a small number of products and on outside manufacturers for the manufacture of our products; our dependence on third parties to supply raw materials and to provide services for

certain core aspects of our business; new regulatory action or lawsuits relating to our

use of controlled substances in many of our core products; our exposure to product liability claims and product recalls and the possibility that we may not be able to adequately insure

ourselves; our ability to protect our proprietary technology; our ability to

successfully implement our in-licensing and acquisition strategy; the availability of third-party reimbursement for our products; the outcome of any pending or future litigation or claims by the government; our

dependence on sales to a limited number of large pharmacy chains and wholesale drug

distributors for a large portion of our total net sales; a determination by a regulatory agency that we are engaging in inappropriate sales or marketing activities, including promoting the

“off-label” use of our products; the loss of branded product exclusivity

periods and related intellectual property; and exposure to securities that are subject to market risk including auction-rate securities the market for which is currently illiquid; and other risks and

uncertainties, including those detailed from time to time in our periodic reports filed

with the Securities and Exchange Commission, including our current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K, particularly the discussion under the

caption "Item 1A, RISK FACTORS" in our annual report on Form 10-K for the

year ended December 31, 2008, which was filed with the Securities and Exchange Commission on March 2, 2009. The forward-looking statements in this presentation are qualified by these risk

factors. These are factors that, individually or in the aggregate, we think could cause

our actual results to differ materially from expected and historical results. We assume no obligation to publicly update any forward-looking statements, whether as a result of new

information, future developments or otherwise. |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. ENDO PHARMACEUTICALS I. Our Business II. Executing Strategy for Growth III. Financial Outlook |

grow.

collaborate. innovate. thrive. 4 STRONG OPERATING PERFORMANCE 17% 3-YEAR CAGR FOR REVENUE* $mm $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2001 2002 2003 2004 2005 2006 2007 2008 2009E $252 $399 $596 $615 $820 $910 $1,086 $1,261 $1.44B - $1.465B $80 $110 $217 $171 $285 $345 $366 $357 * Revenue CAGR includes 2009 Guidance midpoint. Revenue Cash Flow from Operations Sustaining our Growth grow. collaborate. innovate. thrive. |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. STRONG CORE BUSINESS SUPPORTING GROWTH 5 |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. STRONG CORE BUSINESS SUPPORTING GROWTH 6 LIDODERM® key component of our core business Strong source of operating cash flow Stable TRx trends 10-year Commercial launch anniversary in September 2009 Differentiated product profile provides unique offering for HCPs and patients suffering from PHN Improved PHN physician targeting for more efficient utilization of resources Solid managed care contract positioning for 2010 |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. STRONG CORE BUSINESS SUPPORTING GROWTH 7 Opioid Franchise Opana® ER Effective physician targeting and managed care strategy Continuing strong share growth: 43% TRx growth YOY in Q3 2009 LAO market being down 2% for the same period Surpassed two key competitors in TRx market share (Kadian and Avinza) Opana® IR Continued branded sales producing strong cash flow Potential to support future generic sales Percocet®/Endocet® Solid cash flow supported by appropriate brand investments |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. STRONG CORE BUSINESS SUPPORTING GROWTH 8 SUPPRELIN® LA Highlights Central Precocious Puberty Incidence: 1 in every 5,000 – 10,000 children Utilizes Hydron Implant Technology Consistent quarter over quarter growth since 2007 launch ~80% unit growth YOY SUPPRELIN LA Market Share ~35% Growing base of product adoption High level of patient, parent and physician satisfaction Re-implantation rate of ~75% Long-term efficacy / safety data (3yr.) supports first line therapy Increasing marketing support to further grow share |

Harvard

University Percocet 9 EXECUTING THE STRATEGY Defined parameters for expansion into adjacent therapeutic and device markets that leverage our commercial infrastructure Vantas Axomadol FORTESTA Urocidin Jubilant Aurigene Harvard University Supprelin LA Valstar LIDODERM OPANA ER/IR Voltaren Gel Specialty Generics Percocet FROVA AVEED grow. collaborate. innovate. thrive. |

grow.

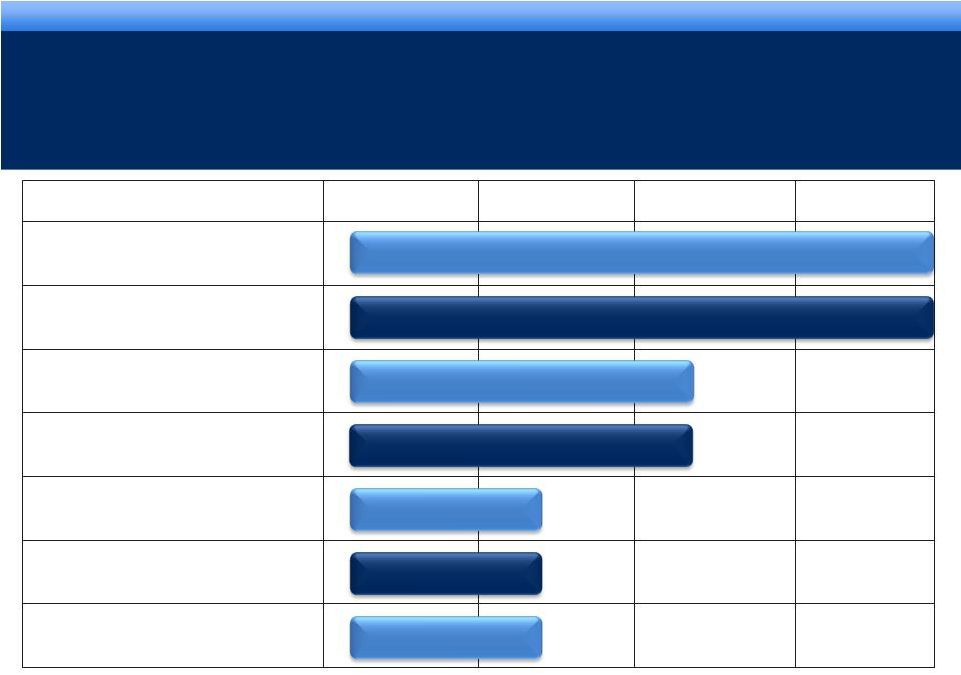

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. DEVELOPMENT PIPELINE grow. collaborate. innovate. thrive. ** Licensed to Teva Pharmaceuticals Inc. * Granted orphan drug status 10 Pending Pending Phase I Phase II Phase III NDA AVEED Long Acting Injectable Testosterone FORTESTA 2% Testosterone Gel Bladder Cancer Urocidin Octreotide Implant Acromegaly* Axomadol Moderate to moderately severe chronic pain Pagoclone** Stuttering Octreotide Implant Carcinoid Syndrome TM |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. REGULATORY DEVELOPMENTS AVEED (Long Acting Testosterone Injection) Complete Response received December 2009 FDA Comments: Very rare but serious adverse events, including post-injection anaphylactic reaction and pulmonary oil microembolism Insufficiency of proposed Risk Evaluation and Mitigation Strategy (REMS) Evaluation ongoing FORTESTA (2% Testosterone Gel) Complete Response received October 2009 FDA Requests: Additional analysis of the existing clinical data Conduct a clinical study to address the effects of washing after applying the product to reduce transference Expect to file Complete Response mid-2010 11 TM TM |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. 12 SPECIALTY GENERICS |

13

SPECIALTY GENERICS DEVELOPMENT ~40 Projects ~40 Projects 25 Near-term* 25 Near-term* 13 Current 13 Current ANDA ANDA reviews reviews *Near-term revenue 2010-2012 Approximately 40 projects under development Mycophenolate capsules approved December 2009 15 Current ANDA submissions 13 with near-term launch targets 2 with long-term launch targets Managing development for sustainable growth Potential efficiencies with branded Rx business grow. collaborate. innovate. thrive. |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. FINANCIAL OUTLOOK Current business Expect a strong finish to 2009, at the upper end of previously stated ranges for revenue and adjusted diluted EPS Revenue range of $1.44B - $1.465B Adjusted diluted EPS range of $2.67 - $2.73 Reported (GAAP) diluted EPS range of $1.41- $1.47 Flexible cost infrastructure Expect to generate $300 - $350M in annual Operating Cash Flow, going forward 14 |

15

Value creation opportunities ENDO POSITIONING FOR GROWTH grow. collaborate. innovate. thrive. |

grow.

collaborate. innovate. thrive. grow. collaborate. innovate. thrive. GROWING OUR BUSINESS Our objective is to position Endo for solid, sustainable revenue and earnings growth Healthcare industry is evolving Results-driven medicine will drive collaboration among Providers, Payers and Patients Endo is transforming to deliver the right treatment solutions Focused on consumer-driven medical decisions 16 |

Endo

Pharmaceuticals JPMorgan 28th Annual Healthcare Conference January 2010 grow. collaborate. innovate. thrive. |