Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWFIELD EXPLORATION CO /DE/ | nfx8k-01122010.htm |

| EX-99.2 - PRESS RELEASE - NEWFIELD EXPLORATION CO /DE/ | nfx8k-01122010ex992.htm |

Exhibit

99.1

@NFX is

periodically published to keep shareholders aware of current operating

activities at Newfield. It may include estimates of expected production volumes,

costs and expenses, recent changes to hedging positions and commodity

pricing.

January

12, 2010 – Goldman Sachs Conference

Newfield

Exploration Company will disclose the following information at the 2010 Goldman

Sachs Energy Conference in Tampa, Florida.

The Rocky

Mountains:

Uinta Basin – Newfield has

more than 200,000 gross acres (more than 150,000 net) in the Uinta Basin. The

region is the centerpiece of the Company’s domestic oil assets. Major field

areas in the Uinta Basin include Monument Butte, the adjoining Ute Tribal

acreage and Horseshoe Bend (located 15 miles northeast of Monument

Butte).

Recent

drilling successes highlight the potential on the Ute Tribal acreage -- an area

encompassing 63,000 gross acres immediately north of Monument Butte. To date,

the Company has drilled 65 wells on the Tribal acreage and current gross

production is approximately 1,500 BOPD. An operated rig will be dedicated to

drill wells on this acreage throughout 2010. Notable recent wells

include:

|

·

|

A

step-out Tribal well extended production approximately 10 miles to the

west of known field production. The well averaged 400 BOPD over the first

three days of production. (Date of first production: Dec. 10,

2009)

|

|

·

|

A

Tribal well drilled about four miles northeast of Monument Butte averaged

85 BOPD during its initial month on production. (Date of first production:

Nov. 19, 2009)

|

|

·

|

Two

wells drilled on an NFX fee lease north of Monument Butte averaged 344

BOPD and 396 BOPD, respectively, during their initial week on line. (Date

of first production: Dec. 5, 1009 and Dec.14,

2009)

|

|

·

|

Historical

average initial production rates (approximately 1,300 producing wells) are

65-80 BOPD.

|

Newfield

plans to run at least five operated rigs in its Monument Butte field area in

2010. Current gross production is approximately 16,500 BOPD. Production from the

Monument Butte field area is expected to grow more than 10-15% in

2010.

Over the

last several years, Newfield has been pursuing the formation and approval of a

“super unit” in the Monument Butte field. The super unit, approved in December

2009, consolidates all of the previously existing units and non-unitized leases

and allows for waterflood operations across common interests and 20-acre infill

drilling on previous unit or lease line boundaries. The super unit approval will

allow for additional oil reserves to be booked as proved at year-end

2009.

1

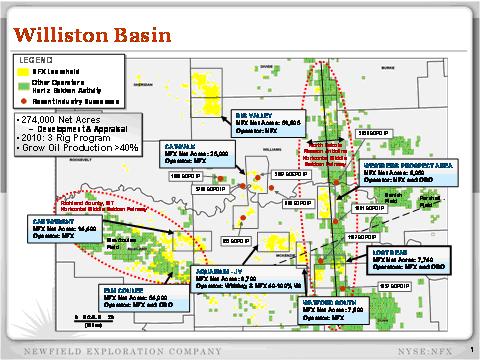

Williston

and Southern Alberta Basin - Newfield has more than

500,000 net acres, which includes more than 330,000 highly-prospective net acres

in the Williston and Southern Alberta Basins. The table below categorizes the

net acres by development, appraisal or exploration. Newfield expects to run a

three to four rig program in 2010 to expedite the evaluation of the acreage and

grow oil production by an estimated 40% over 2009 levels.

In the

Williston Basin, Newfield has ramped up drilling in its core development areas,

located primarily along the Nesson Anticline (see map on Newfield

website).

|

·

|

The

most recent well, drilled in the Westberg development area, the Clear

Creek State 1-36H, had an initial gross 24-hour production rate of 1,300

BOEPD, nearly double the offset wells previously drilled

(2008-09). The well’s first production was Dec. 9,

2009.

|

In 2010,

Newfield plans to drill 22 development wells in the Williston Basin. One rig

will be dedicated exclusively to appraising the Catwalk, Aquarium and Watford

areas where three successful wells have been drilled to date.

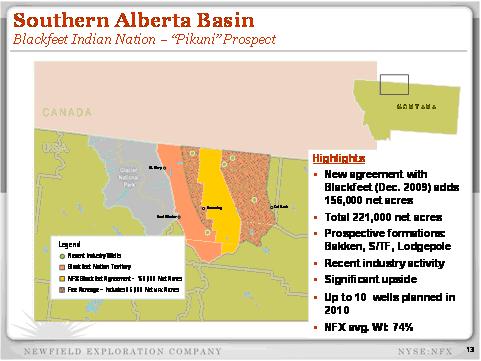

In the

Southern Alberta Basin, Newfield now has 221,000 net acres – including 156,000

net acres added through a new exploration venture with the Blackfeet Indian

Nation. The acreage is located in Glacier County, Montana. The area is

geologically similar to the Williston Basin and is prospective in the oil

bearing Bakken, Three Forks and Lodgepole formations. The Company plans to drill

up to 10 wells on the acreage in 2010.

The

following table details Newfield’s significant oil plays in the Rocky Mountain

Region:

2

Rocky

Mountain Oil Summary

|

Field

|

Acres,

Gross/Net

|

Gross

operated remaining locations

|

Gross

EUR/well (BOE)

|

Est.

Well Cost ($/MM)

|

Effective

W.I.

|

Total

Gross Unrisked Resource Reserve Potential (MMBOE)

|

Total

Net Unrisked Resource Reserve Potential (MMBOE)

|

|||||||||||||||||||||

|

UINTA

BASIN

|

||||||||||||||||||||||||||||

|

Mon.

Butte,

Ute

Tribal

H.

Bend

|

207,000 / 156,250 | 4,700 | (1) | 70,000 | $ | 0.9 | 75 | % | 400 | 246 | ||||||||||||||||||

|

WILLISTON

BASIN

|

||||||||||||||||||||||||||||

|

Development

Areas

|

||||||||||||||||||||||||||||

|

Westberg

/

Lost

Bear

|

34,882 / 17,790 | 66 | (3) | 360,000 | $ | 4.2 | 51 | % | 22 | 10 | ||||||||||||||||||

|

Appraisal

Areas

|

||||||||||||||||||||||||||||

|

Catwalk,

Aquarium,

Watford

|

78,181 / 43,000 | 338 | (2) | 354,000 | $ | 4.2 | 48 | % | 119 | 50 | ||||||||||||||||||

|

Big

Valley

|

67,222 / 48,400 | 70 | (3) | 224,000 | $ | 3.5 | 72 | % | 16 | 9 | ||||||||||||||||||

|

Other

Acreage

(expires

2010)

|

240,000 / 240,000 | |||||||||||||||||||||||||||

|

SOUTHERN

ALBERTA BASIN

|

||||||||||||||||||||||||||||

|

Exploration

Areas

|

||||||||||||||||||||||||||||

|

Blackfeet

Nation

|

156,600 / 156,600 | 488 | (3) | 225,000 | $ | 3.5 | 100 | % | 110 | 90 | ||||||||||||||||||

|

Whitegrass

Fee

|

100,000 / 65,000 | 456 | (3) | 225,000 | $ | 3.5 | 35 | % | 102 | 29 | ||||||||||||||||||

|

TOTAL

ROCKY MOUNTAINS

|

883,885 / 727,040 | 6,118 | - | - | - | 769 | 434 | |||||||||||||||||||||

Table

does not include developed property base for Uinta or Williston

Basins

(1) Predominately 20-acre spacing at

Monument Butte, 40-acre spacing elsewhere; includes approximately 70 MMBOE for

additional secondary recovery

(2) 320-acre spacing, multiple

horizons

(3) 320-acre spacing

3

4

Mid-Continent:

Newfield’s

largest division is the Mid-Continent. The region accounted for 43% of the

Company’s estimated total 2009 production. Production from the division grew

more than 20% in 2009, excluding the 2.6 Bcfe that was voluntarily curtailed in

the third quarter of 2009 due to low gas prices.

The

Woodford – Newfield’s net acreage

position in the Woodford is approximately 166,500 acres. Substantially all of

the acreage is now held by production. Current gross operated production is

approximately 300 MMcfe/d, or 170 MMcfe/d net. Production is expected to further

increase in the first quarter of 2010 as more than 20 wells (deferred

completions from the second half of 2009) are completed and placed on

production.

Six of

those 20 wells are super extended laterals – or SXLs (laterals >5000’) -- and

will have lateral lengths of more than 7,000’. Two of the recent SXL wells were

completed with initial production rates of 6 and 10 MMcfe/d (gross). The Company

expects to have results from four additional SXL completions in the first

quarter of 2010. Newfield expects that the average lateral length of its

Woodford completions in 2010 will be approximately 6,000’.

To date,

Newfield has drilled more than 300 operated horizontal wells in the play.

Newfield has significantly enhanced the economics in the Woodford through

improved efficiencies and the drilling and completion of longer lateral

wells.

Based on

drilling to date and 3-D seismic data that covers the entirety of Newfield’s

Woodford acreage, the Company estimates that approximately 25% of its Woodford

acreage will ultimately be developed with SXL completions. The Company has

applied to unitize a large portion of its acreage to facilitate drilling more

SXLs. Approval of the unit would increase this estimated percentage to

approximately 33% of the acreage, or 55,000 net acres.

Newfield

expects to run 6-8 operated rigs in the Woodford in 2010 and increase production

by approximately 20% over 2009 levels.

5

|

Typical

Woodford Well Economic Assumptions

|

|

|

Lease

Burden

|

19%

Royalty

|

|

Average

Sunk Cost per Acre

|

$800

|

|

Lease

Operating Expense (includes transportation)

|

$0.43/Mcf

|

|

Production

Tax (% of Rev.)

|

|

|

Prod Tax during credit period

|

1.09%

|

|

Prod Tax after credit period (48 months or payout)

|

7.09%

|

|

Wellhead

Pricing vs. Henry Hub ($/Mcf)

|

NYMEX

less $0.75

|

|

Total

Fuel Gas (used in compression – all resource plays have fuel

costs)

|

8%

|

|

NYMEX

gas price necessary for NPV 10 ($/MMBtu)

|

$4.50

|

6

7

Onshore

Gulf Coast:

Newfield

also issued a news release today providing an update on Newfield’s previously

disclosed offer to acquire assets from TXCO Resources Inc.

NATURAL

GAS HEDGE POSITIONS

Please

see the tables below for our complete hedging positions.

8

The

following hedge positions for the first quarter of 2010 and beyond are as of

January 8, 2010:

First Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

31,800

MMMBtus

|

$ | 6.79 | — | — | — | — | ||||||||||||||

|

5,700

MMMBtus

|

— | — | $ | 8.50 — $10.44 | $ | 8.50 | $ | 10.00 — $11.00 | ||||||||||||

Second Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

34,850

MMMBtus

|

$ | 6.41 | — | — | — | — | ||||||||||||||

Third Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

35,200

MMMBtus

|

$ | 6.41 | — | — | — | — | ||||||||||||||

Fourth Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

28,320

MMMBtus

|

$ | 6.49 | — | — | — | — | ||||||||||||||

First Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

18,900

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

|

9,900

MMMBtus*

|

— | — | $ | 6.00 — $7.91 | $ | 6.00 | $ | 7.75 — $8.03 | ||||||||||||

Second Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

19,110

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

|

10,010

MMMBtus*

|

— | — | $ | 6.00 — $7.91 | $ | 6.00 | $ | 7.75 — $8.03 | ||||||||||||

Third Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

19,320

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

|

10,120

MMMBtus*

|

— | — | $ | 6.00 — $7.91 | $ | 6.00 | $ | 7.75 — $8.03 | ||||||||||||

Fourth Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

6,510

MMMBtus

|

$ | 6.55 | — | — | — | — | ||||||||||||||

|

8,290

MMMBtus*

|

— | — | $ | 6.00 — $7.94 | $ | 6.00 | $ | 7.75 — $8.03 | ||||||||||||

*These

3-way collar contracts are standard natural gas collar contracts with respect to

the periods, volumes and prices stated above. The contracts have floor and

ceiling prices per MMMBtu as per the table above until the price drops below a

weighted average price of $4.50 per MMMBtu. Below $4.50 per MMMBtu, these

contracts effectively result in realized prices that are on average $1.50 per

MMMBtu higher than the cash price that otherwise would have been

realized.

9

The

following table details the expected impact to pre-tax income from the

settlement of our derivative contracts, outlined above, at various NYMEX gas

prices, net of premiums paid for these contracts (in millions).

|

Gas

Prices

|

||||||||||||||||||||||||

| $ | 4.00 | $ | 5.00 | $ | 6.00 | $ | 7.00 | $ | 8.00 | $ | 9.00 | |||||||||||||

|

2010

|

||||||||||||||||||||||||

|

1st

Quarter

|

$ | 114 | $ | 77 | $ | 40 | $ | 2 | $ | (35 | ) | $ | (70 | ) | ||||||||||

|

2nd

Quarter

|

$ | 84 | $ | 49 | $ | 14 | $ | (21 | ) | $ | (56 | ) | $ | (91 | ) | |||||||||

|

3rd

Quarter

|

$ | 85 | $ | 49 | $ | 14 | $ | (21 | ) | $ | (56 | ) | $ | (91 | ) | |||||||||

|

4th

Quarter

|

$ | 70 | $ | 43 | $ | 14 | $ | (14 | ) | $ | (43 | ) | $ | (71 | ) | |||||||||

|

Total

2010

|

$ | 353 | $ | 218 | $ | 82 | $ | (54 | ) | $ | (190 | ) | $ | (323 | ) | |||||||||

|

2011

|

||||||||||||||||||||||||

|

1st

Quarter

|

$ | 63 | $ | 39 | $ | 10 | $ | (8 | ) | $ | (28 | ) | $ | (57 | ) | |||||||||

|

2nd

Quarter

|

$ | 64 | $ | 40 | $ | 10 | $ | (9 | ) | $ | (29 | ) | $ | (58 | ) | |||||||||

|

3rd

Quarter

|

$ | 64 | $ | 40 | $ | 11 | $ | (9 | ) | $ | (29 | ) | $ | (58 | ) | |||||||||

|

4th

Quarter

|

$ | 29 | $ | 18 | $ | 4 | $ | (3 | ) | $ | (10 | ) | $ | (25 | ) | |||||||||

|

Total

2011

|

$ | 220 | $ | 137 | $ | 35 | $ | (29 | ) | $ | (96 | ) | $ | (198 | ) | |||||||||

In the Rocky Mountains, we

hedged basis associated with 48% of the proved producing fields from January

2010 through full-year 2012. This is in addition to the 8,000 MMBtu/d sold on a

fixed physical basis for the same term for a total basis hedged for the period

of 73% at an average of $(0.94) per MMBtu.

In the Mid-Continent, we

hedged basis associated with 22% of our anticipated Stiles/Britt priced

production from January 2010 through August 2011. This is in addition to the

30,000 MMbtu/d sold on a fixed physical basis for the same term for a total

basis hedged for the period of 55% at an average of $(0.52) per MMBtu. We hedged

basis associated with 53% of our anticipated Stiles/Britt production from

September 2011 through December 2012 at an average of $(0.55) per

MMBtu.

Approximately

10% of our natural gas production correlates to Houston Ship Channel, 13% to

Columbia Gulf, 13% to Texas Gas Zone 1, 5% to Southern Natural Gas, 10% to Tenn

100, 6% to CenterPoint/East, 24% to Panhandle Eastern Pipeline, 6% to Waha, 7%

to Colorado Interstate, and 6% to others.

CRUDE

OIL HEDGE POSITIONS

The

following hedge positions for the first quarter of 2010 and beyond are as of

January 8, 2010:

First Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000 Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

810,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

360,000

Bbls*

|

— | — | $ | 67.50 — $106.28 | $ | 60.00 — $75.00 | $ | 100.00 —$112.10 | ||||||||||||

Second Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000 Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

819,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

364,000

Bbls*

|

— | — | $ | 67.50 — $106.28 | $ | 60.00 — $75.00 | $ | 100.00 —$112.10 | ||||||||||||

Third Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000 Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

828,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

368,000

Bbls*

|

— | — | $ | 67.50 — $106.28 | $ | 60.00 — $75.00 | $ | 100.00 —$112.10 | ||||||||||||

10

Fourth Quarter

2010

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

90,000 Bbls

|

$ | 93.40 | — | — | — | — | ||||||||||||||

|

828,000

Bbls

|

— | — | $ | 127.97— $170.00 | $ | 125.50 — $130.50 | $ | 170.00 | ||||||||||||

|

368,000

Bbls*

|

— | — | $ | 67.50 — $106.28 | $ | 60.00 — $75.00 | $ | 100.00 —$112.10 | ||||||||||||

First Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

360,000

Bbls*

|

— | — | $ | 77.50 — $119.94 | $ | 75.00 — $80.00 | $ | 118.50—$121.50 | ||||||||||||

Second Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

364,000

Bbls*

|

— | — | $ | 77.50 — $119.94 | $ | 75.00 — $80.00 | $ | 118.50—$121.50 | ||||||||||||

Third Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

368,000

Bbls*

|

— | — | $ | 77.50 — $119.94 | $ | 75.00 — $80.00 | $ | 118.50—$121.50 | ||||||||||||

Fourth Quarter

2011

|

Weighted

Average

|

Range

|

|||||||||||||||||||

|

Volume

|

Fixed

|

Floors

|

Collars

|

Floor

|

Ceiling

|

|||||||||||||||

|

368,000

Bbls*

|

— | — | $ | 77.50 — $119.94 | $ | 75.00 — $80.00 | $ | 118.50—$121.50 | ||||||||||||

*These

3-way collar contracts are standard crude oil collar contracts with respect to

the periods, volumes and prices stated above. The contracts have floor and

ceiling prices per Bbl as per the table above until the price drops below a

weighted average price of $58.75 per Bbl. Below $58.75 per Bbl, these contracts

effectively result in realized prices that are on average $13.75 per Bbl higher

than the cash price that otherwise would have been realized.

The following table details the

expected impact to pre-tax income from the settlement of our derivative

contracts, outlined above, at various NYMEX oil prices, net of premiums paid for

these contracts (in millions).

|

Oil

Prices

|

||||||||||||||||||||||||||||

| $ | 40.00 | $ | 50.00 | $ | 60.00 | $ | 70.00 | $ | 80.00 | $ | 90.00 | $ | 100.00 | |||||||||||||||

|

2010

|

||||||||||||||||||||||||||||

|

1st

Quarter

|

$ | 73 | $ | 64 | $ | 53 | $ | 43 | $ | 33 | $ | 23 | $ | 14 | ||||||||||||||

|

2nd

Quarter

|

$ | 74 | $ | 65 | $ | 54 | $ | 43 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

3rd

Quarter

|

$ | 74 | $ | 65 | $ | 54 | $ | 43 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

4th

Quarter

|

$ | 75 | $ | 65 | $ | 54 | $ | 43 | $ | 33 | $ | 24 | $ | 15 | ||||||||||||||

|

Total

2010

|

$ | 296 | $ | 259 | $ | 215 | $ | 172 | $ | 132 | $ | 95 | $ | 59 | ||||||||||||||

|

2011

|

||||||||||||||||||||||||||||

|

1st

Quarter

|

$ | 5 | $ | 5 | $ | 5 | $ | 2 | $ | - | $ | - | $ | - | ||||||||||||||

|

2nd

Quarter

|

$ | 5 | $ | 5 | $ | 5 | $ | 3 | $ | - | $ | - | $ | - | ||||||||||||||

|

3rd

Quarter

|

$ | 6 | $ | 6 | $ | 6 | $ | 3 | $ | - | $ | - | $ | - | ||||||||||||||

|

4th

Quarter

|

$ | 6 | $ | 6 | $ | 6 | $ | 3 | $ | - | $ | - | $ | - | ||||||||||||||

|

Total

2011

|

$ | 22 | $ | 22 | $ | 22 | $ | 11 | $ | - | $ | - | $ | - | ||||||||||||||

11

We

provide information regarding our outstanding hedging positions in our annual

and quarterly reports filed with the SEC and in our electronic publication --

@NFX. This publication can be found on Newfield’s web page at http://www.newfield.com. Through the web page,

you may elect to receive @NFX through e-mail distribution.

Newfield

Exploration Company is an independent crude oil and natural gas exploration and

production company. The Company relies on a proven growth strategy of growing

reserves through the drilling of a balanced risk/reward portfolio and select

acquisitions. Newfield's domestic areas of operation include the U.S. onshore

Gulf Coast, the Anadarko and Arkoma Basins of the Mid-Continent, the Rocky

Mountains and the Gulf of Mexico. The Company has international operations in

Malaysia and China.

This

publication contains forward-looking information. All information other than

historical facts included in this publication, such as information regarding

estimated or anticipated results, estimated production and costs, drilling and

development plans and the timing of activities, is forward-looking information.

Although Newfield believes that these expectations are reasonable, this

information is based upon assumptions and anticipated results that are subject

to numerous uncertainties and risks. Actual results may vary significantly from

those anticipated due to many factors, including drilling results, oil and gas

prices, industry conditions, the prices of goods and services, the availability

of drilling rigs and other support services, the availability of refining

capacity for the crude oil Newfield produces from its Monument Butte field in

Utah, the availability and cost of capital resources, labor conditions and

severe weather conditions (such as hurricanes). In addition, the drilling of oil

and gas wells and the production of hydrocarbons are subject to governmental

regulations and operating risks.

12