Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - US ECOLOGY, INC. | aec_8k-011210.htm |

1

Investor

Presentation

January

2010

2

Jim

Baumgardner

President

and Chief Executive Officer

Steve

Welling

Senior

Vice President of Sales and Marketing

Jeff

Feeler

Vice

President and Chief Financial Officer

3

Safe

Harbor

During

the course of this presentation I will be making forward-looking statements (as

such term

is defined in the Private Securities Litigation Reform Act of 1995) that are based on management’s

current expectations, beliefs and assumptions about the industry and markets in which we and our

subsidiaries operate. Because such statements include risks and uncertainties, actual results may

differ materially from what is expressed and no assurance can be given that the Company will

meet its 2009 earnings estimates, successfully execute its growth strategy, or declare or pay future

dividends. For information on other factors that could cause actual results to differ materially

from expectations, please refer to our December 31, 2008 Annual Report on Form 10-K and other

reports filed with the Securities and Exchange Commission. Many of the factors that will

determine our future results are beyond our ability to control or predict. Participants should not

place undue reliance on forward-looking statements, which reflect our views only as of today. We

undertake no obligation to revise or update any forward-looking statements, or to make any other

forward-looking statements, whether as a result of new information, future events or otherwise.

is defined in the Private Securities Litigation Reform Act of 1995) that are based on management’s

current expectations, beliefs and assumptions about the industry and markets in which we and our

subsidiaries operate. Because such statements include risks and uncertainties, actual results may

differ materially from what is expressed and no assurance can be given that the Company will

meet its 2009 earnings estimates, successfully execute its growth strategy, or declare or pay future

dividends. For information on other factors that could cause actual results to differ materially

from expectations, please refer to our December 31, 2008 Annual Report on Form 10-K and other

reports filed with the Securities and Exchange Commission. Many of the factors that will

determine our future results are beyond our ability to control or predict. Participants should not

place undue reliance on forward-looking statements, which reflect our views only as of today. We

undertake no obligation to revise or update any forward-looking statements, or to make any other

forward-looking statements, whether as a result of new information, future events or otherwise.

Important

assumptions and other important factors that could cause actual results to

differ

materially from those set forth in the forward-looking information include a loss of a major

customer, compliance with and changes to applicable laws and regulations, access to cost effective

transportation services, access to insurance and other financial assurances, loss of key personnel,

lawsuits, adverse economic conditions, government funding or competitive pressures, incidents

that could limit or suspend specific operations, implementation of new technologies, our ability to

perform under required contracts, our willingness or ability to pay dividends and our ability to

integrate any potential acquisitions.

materially from those set forth in the forward-looking information include a loss of a major

customer, compliance with and changes to applicable laws and regulations, access to cost effective

transportation services, access to insurance and other financial assurances, loss of key personnel,

lawsuits, adverse economic conditions, government funding or competitive pressures, incidents

that could limit or suspend specific operations, implementation of new technologies, our ability to

perform under required contracts, our willingness or ability to pay dividends and our ability to

integrate any potential acquisitions.

4

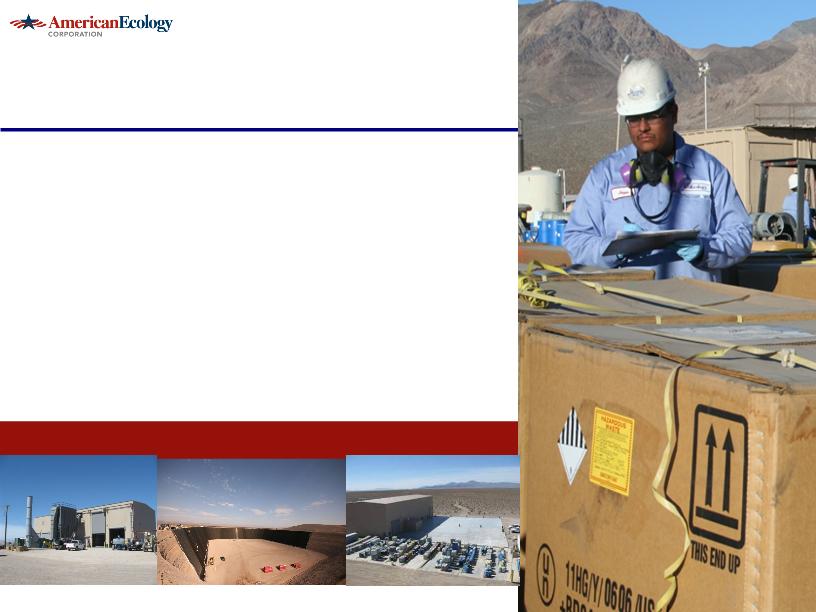

Business

Overview

Ø Operate

4 Hazardous & Radioactive Waste Disposal Facilities

Ø Headquartered

in Boise, Idaho (Nasdaq: ECOL)

- 221

Employees

- 9 Month

Revenue $109 million

Ø Services

to U.S. industry & government

- “Base”

Business: recurring waste streams

- “Event”

Business: Discrete clean-ups

Ø Transportation

logistics including 234 company owned railcars

Ø In

business since 1952

5

American

Ecology Mission

Provide

safe, secure & cost-effective hazardous and

radioactive materials management solutions to industry

& government while creating sustainable shareholder

value.

radioactive materials management solutions to industry

& government while creating sustainable shareholder

value.

6

American

Ecology Vision

Ø Cement

our position as the premier hazardous & radioactive

materials services provider in the diverse markets we serve

materials services provider in the diverse markets we serve

-

Be

the best at what we do!

Ø Build on

our strong relationships with customers & regulators

by providing cost-effective, technically superior environmental

management solutions.

by providing cost-effective, technically superior environmental

management solutions.

Ø Empower

and align employees to actively participate in our

success.

success.

Ø Generate

sustainable increases in earnings per share and cash

flow at rate faster than growth of the markets we operate in.

flow at rate faster than growth of the markets we operate in.

7

Investment

Highlights

Ø Unique

set of radioactive & hazardous services and assets

Ø Seasoned,

committed Executive management team

Ø Strong

cash flow business

- Investment

in infrastructure fueling organic growth

Ø Significant

operating leverage once fixed costs covered

Ø Strong

balance sheet with no

debt

Ø Industry-leading

return on invested capital: 15.2% ttm

8

Market

Cap: $ 312

million*

Recent

Price: $17.21*

52 Wk.

Range: $13.56

- $21.21

Shares

Out./Float: 18.2 /

15.5 million

Dividend/Yield: $0.72 /

4.2%

SG&A

% of Revenue 9.3%

**

Cash

Position: $20.1

million**

Term

Debt: -0-

Avail.

line of credit: $11

million

Solid

Financials

*at

1-5-2010 **at

9-30-2009

9

Ø Historically

~3.5M tons/year - Down in 2009 due to economy

— Base

Business: Recurring business from industrial base

• Lower

manufacturing output in 2009 producing lower

waste volumes - Must take market share to grow

waste volumes - Must take market share to grow

— Event

Business: Discrete ‘Clean-ups’

• Private/discretionary

clean-ups continue to be deferred &

delayed - Uncertain when normal conditions will return

delayed - Uncertain when normal conditions will return

• Government

clean-ups moving forward but slower than

anticipated

anticipated

U.S.

Disposal Market Overview

10

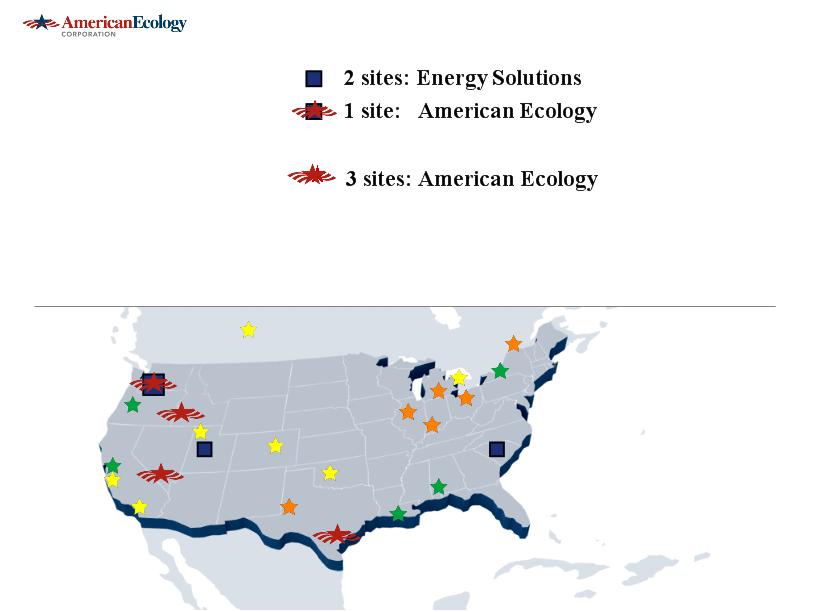

3

Commercial Nuclear Waste Sites in US

21

Hazardous Waste Sites in US & Canada

« 5

sites: Waste Management

« 7

sites: Clean Harbors

« 6

sites: Others

11

Changes

Expected to Benefit

Our Industry Long-term

Our Industry Long-term

Ø American

Recovery & Reinvestment Act of 2009 (“Stimulus”):

—

$100

million extra to Army Corps FUSRAP Program

—

$800

million extra to EPA Superfund & underground storage

tank programs

—

Main

benefit expected in 2010 & 2011 - timing and impact

difficult to predict

difficult to predict

Ø Proposals

to reinstate lapsed Superfund excise tax on industry

Ø FY 2010

EPA budget largest in agency’s history

—

Heightened

enforcement should drive more mandated clean-ups

• Timing

& impact difficult to predict

Ø Private

Sector Redevelopment of Brownfields

12

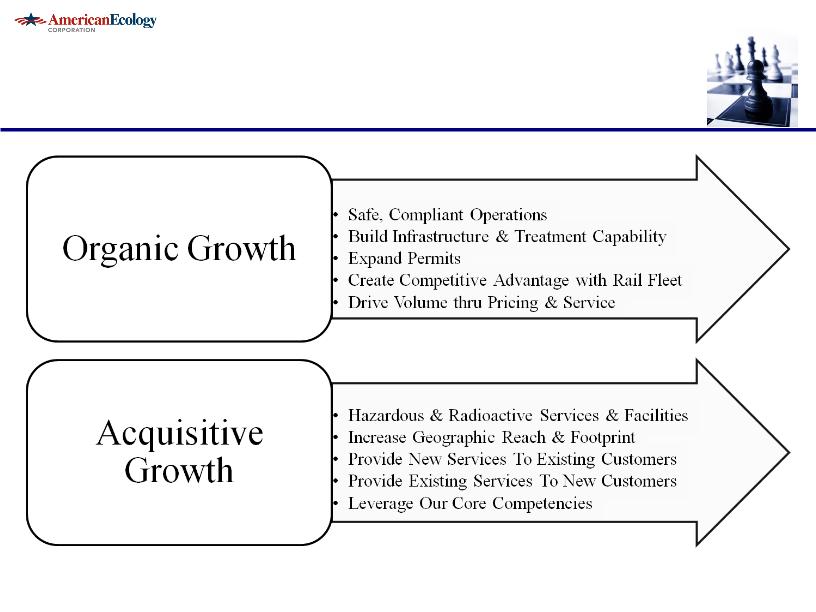

Growth

Strategy Overview

Ø Strong

safety culture & regulatory compliance

Ø Expand

waste handling infrastructure including rail

Ø Modify

facility permits to support entry into new markets, develop

new services & attract new customers

new services & attract new customers

Ø Maximize

operating leverage inherent to business

Ø Aggressively

manage cost structure

and

Ø Execute

acquisitions consistent with Vision, Mission, and Core

Competencies

Competencies

13

Disciplined

Dual Growth Strategy

14

Acquisition

Approach

Ø Deals

must be consistent with our Vision, Mission, Core

Competencies & Strategy

Competencies & Strategy

— Think

broadly, but act in a focused way

— Will the

deal help us solve customer hazardous/radioactive

waste problem or issue?

waste problem or issue?

Ø Be

disciplined. No deal is much better than a bad deal.

Ø Don’t

overpay — Can never be

‘fixed’

Ø Don’t

underestimate execution complexity. The hard part starts

after the purchase.

after the purchase.

15

Ø Remote

desert site fed by rail specializes in

high volumes

high volumes

- 5+ years

of permitted capacity, but

more unpermitted space for growth

more unpermitted space for growth

Ø “Hybrid”

site for low-activity radioactive

and hazardous waste

and hazardous waste

Ø Long-term

business from U.S. Army Corps

of Engineers through ~ 2021

of Engineers through ~ 2021

Premier

U.S. Hazardous Waste Site

Grand

View, Idaho

16

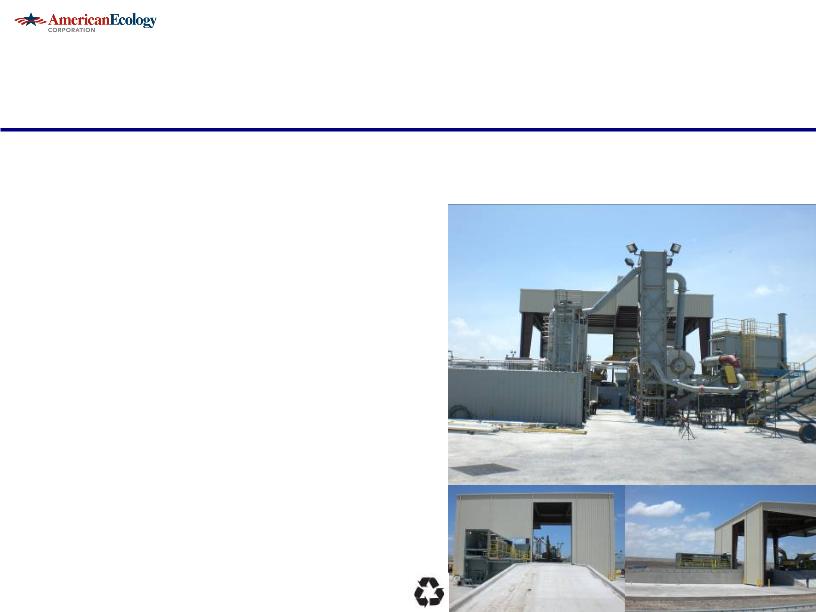

Ø Adding

New Infrastructure and Disposal

Space for Growth in 2010:

Space for Growth in 2010:

— Adding

expanded treatment and

drum

handling capacity

handling capacity

— Constructing

additional landfill cell

— 10+

years of permitted capacity

Robstown,

Texas

Serving

the Gulf Coast Oil & Gas Market

17

Texas

Thermal Recycling

Ø Recycles

refinery tank bottoms,

cracking catalyst & other oil

bearing wastes

cracking catalyst & other oil

bearing wastes

—

Industrial

reuse of catalyst

—

Used Oil

resold into market

Ø Key

advantage: Internalize cost

of by-product waste (ash &

liquids)

of by-product waste (ash &

liquids)

Ø Building

market share despite

increased competition in 2009

increased competition in 2009

— Very

Price Competitive

18

Ø New

disposal area built in 2008

- 10+

years of capacity

Ø New,

state-of-the-art treatment

building with high capacity drum

handling capability

building with high capacity drum

handling capability

Ø Superb

natural conditions for disposal

Beatty,

Nevada

Great

Desert Location Serving California Markets

19

ØRegulated

monopoly for low-level

radioactive waste in 8 western states

radioactive waste in 8 western states

ØNaturally

occurring radioactive material

at free market pricing

at free market pricing

Steady,

Rate-Regulated Earnings

Richland,

Washington

20

20

2010

Outlook

Ø We

believe general economic weakness will persist in 2010 with

slow improvement over the course of the year

slow improvement over the course of the year

— Regional

& industry pockets will improve before wide-spread recovery

Ø Continued

pressure on pricing, especially on thermal services

Ø Forecast

‘Event’ clean-up projects will be slow to return

Ø Expect

‘Base’ business to improve slightly through the year as

industrial production increases

industrial production increases

Ø Anticipate

Army Corps business to rebound due to specific

project needs and stimulus spending

project needs and stimulus spending

Ø Given

economic outlook, treatment and disposal revenue from

Honeywell will be hard to fully replace despite non-Honeywell

growth

Honeywell will be hard to fully replace despite non-Honeywell

growth

Focus

on Growth in a Sustainable Way!