Attached files

| file | filename |

|---|---|

| 8-K - SUN HEALTHCARE GROUP INC | form8k.htm |

| EX-99.1 - SUN HEALTHCARE GROUP INC | ex991.htm |

28th Annual

JPMorgan

Healthcare

Conference

January

11, 2010

2

Forward-Looking

Statements

Statements made in

this presentation may contain "forward-looking" information (as defined in the

Private Securities Litigation

Reform Act of 1995), such as forecasts of future financial performance. Such statements involve risks and uncertainties and are

subject to change at any time. Factors that could cause actual results to differ are identified in the public filings made by the

company with the Securities and Exchange Commission and include changes in Medicare and Medicaid reimbursements; our

ability to maintain the occupancy rates and payor mix at our long-term care centers; potential liability for losses not covered by,

or in excess of, our insurance; the effects of government regulations and investigations; the significant amount of our

indebtedness, covenants in our debt agreements that may restrict our activities, including our ability to make acquisitions, incur

more indebtedness and refinance indebtedness on favorable terms; increasing labor costs and the shortage of qualified

healthcare personnel; the impact of current economic conditions on our liquidity, results of operations and our ability to collect

our receivables; and our ability to receive increases in reimbursement rates from government payors to cover increased costs.

More information on factors that could affect our business and financial results are included in our public filings made with the

Securities and Exchange Commission, including our Annual Report on Forms 10-K and 10-KA and Quarterly Reports on Forms

10-Q and 10-QA, copies of which are available on Sun’s web site, www.sunh.com.

Reform Act of 1995), such as forecasts of future financial performance. Such statements involve risks and uncertainties and are

subject to change at any time. Factors that could cause actual results to differ are identified in the public filings made by the

company with the Securities and Exchange Commission and include changes in Medicare and Medicaid reimbursements; our

ability to maintain the occupancy rates and payor mix at our long-term care centers; potential liability for losses not covered by,

or in excess of, our insurance; the effects of government regulations and investigations; the significant amount of our

indebtedness, covenants in our debt agreements that may restrict our activities, including our ability to make acquisitions, incur

more indebtedness and refinance indebtedness on favorable terms; increasing labor costs and the shortage of qualified

healthcare personnel; the impact of current economic conditions on our liquidity, results of operations and our ability to collect

our receivables; and our ability to receive increases in reimbursement rates from government payors to cover increased costs.

More information on factors that could affect our business and financial results are included in our public filings made with the

Securities and Exchange Commission, including our Annual Report on Forms 10-K and 10-KA and Quarterly Reports on Forms

10-Q and 10-QA, copies of which are available on Sun’s web site, www.sunh.com.

The forward-looking statements involve known and unknown risks, uncertainties and other factors that are, in some cases,

beyond our control. We caution that any forward-looking statements made by us are not guarantees of future performance. We

disclaim any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-

looking statements to reflect future events or developments.

Furthermore,

references to non-GAAP financial information and pro forma, normalized data

contained herein are reconciled to

comparable GAAP financial information in our earnings release dated October 27, 2009, which is available on our website at

www.sunh.com and has been filed with the SEC on Form 8-K. Any documents filed by Sun with the SEC may be obtained free

of charge at the SEC’s web site at www.sec.gov. In addition, investors and stockholders of Sun may obtain free copies of the

documents filed with the SEC by contacting the Investor Relations Department of Sun at (505) 468-2341 (TDD users, please

call (505) 468-4458) or by sending a written request to Investor Relations, Sun Healthcare Group, Inc., 101 Sun Avenue NE,

Albuquerque, NM 87109. You may also read and copy any reports, statements, and other information filed by Sun with the SEC

at the SEC public reference room at Room 1580, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at (800)

SEC- 0330 or visit the SEC’s web site for further information.

comparable GAAP financial information in our earnings release dated October 27, 2009, which is available on our website at

www.sunh.com and has been filed with the SEC on Form 8-K. Any documents filed by Sun with the SEC may be obtained free

of charge at the SEC’s web site at www.sec.gov. In addition, investors and stockholders of Sun may obtain free copies of the

documents filed with the SEC by contacting the Investor Relations Department of Sun at (505) 468-2341 (TDD users, please

call (505) 468-4458) or by sending a written request to Investor Relations, Sun Healthcare Group, Inc., 101 Sun Avenue NE,

Albuquerque, NM 87109. You may also read and copy any reports, statements, and other information filed by Sun with the SEC

at the SEC public reference room at Room 1580, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at (800)

SEC- 0330 or visit the SEC’s web site for further information.

References

to “Sun” refer to Sun Healthcare Group, Inc. and its subsidiaries

3

Investment

Highlights

• Solid

balance sheet with leverage reducing every quarter

• The

economy does not change the need for post-acute services

• Part

of the solution to lowering healthcare costs

• Attractive

industry fundamentals and reimbursement outlook

• Nationally

diversified portfolio of facilities

• Focus

on high-acuity patients

• Strong

financial performance

• Robust

cash flow

• Proven

and experienced management team

4

Sun

Healthcare Group

• SunBridge

– 205

inpatient facilities

19,700 patients/residents

19,700 patients/residents

– Significant

facility ownership

• 93

Facilities - 45%

• SunDance

– 440+

contracts/328 non-affiliated

– Contract

services, rehab agency,

management services

management services

• CareerStaff

– More

than 50% of business is in

hospital settings (also serves SNFs,

schools, prisons)

hospital settings (also serves SNFs,

schools, prisons)

– Primary

customer needs served are

for therapists

for therapists

• SolAmor

– Targeted

growth business

– Doubled

revenues in 9/30/09 LTM

Private

Pay

and Other

and Other

Skilled

Mix

Medicaid

CareerStaff

Inpatient

SunDance

9/30/09

LTM Net Revenue

9/30/09

LTM Net Revenue

Total: $ 1.9

billion

Total: $ 1.9

billion

%

of 9/30/09 LTM Net Revenue

%

of 9/30/09 LTM Net Revenue

By

Business Unit

By

Business Unit

25.0%

35.0%

40.0%

5.6%

88.9%

5.5%

5

Growth

Story

Revenue

EBITDA

(Normalized)

(Normalized)

($

in millions)

(a) Pro Forma with

Harborside

(b) Unaudited

estimate

(c) 2010 Guidance

Midpoint

$1,883.0

2008

2007

(a)

$1,718.7

2009

(b)

$1,823.5

($

in millions)

2008

$176.0

2007

(a)

$129.6

2009

(b)

$162.9

$1,942.0

2010

(c)

$171.1

2010

(c)

7.5%

margin

8.9%

margin

9.3%

margin

8.8%

margin

6.1%

increase

3.3%

increase

3.1%

increase

6

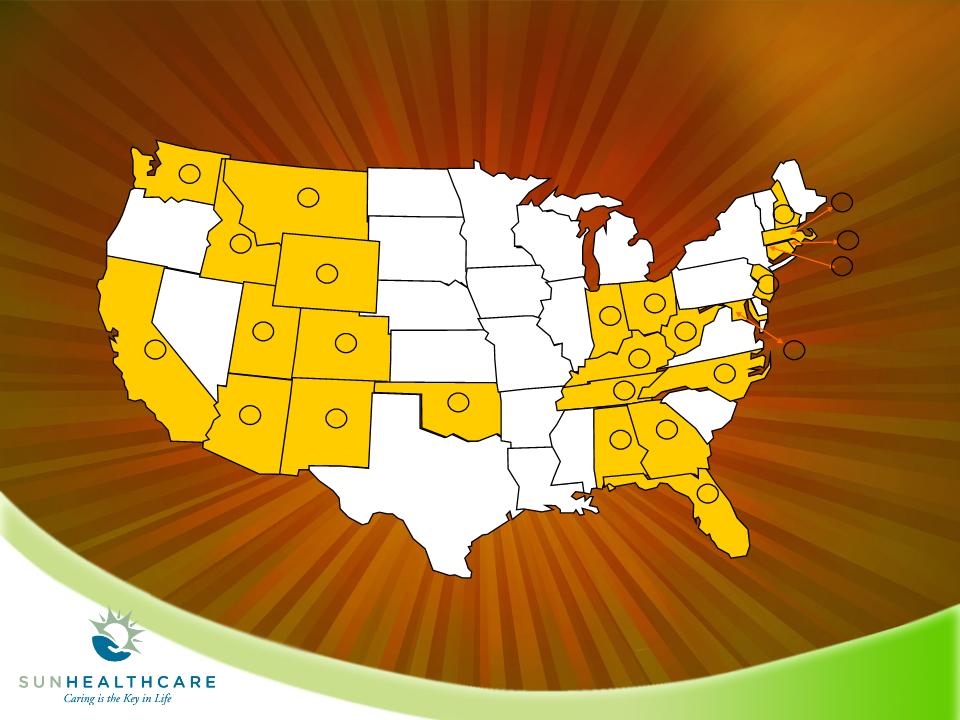

Nationally

Diversified Portfolio Of Facilities

6

5

10

15

1

1

9

1

12

9

2

20

3

18

10

1

15

2

17

7

9

8

8

9

7

23,205

Licensed Beds in 25 States

22,423

Available Beds

205

inpatient facilities - 93 owned (45%)

7

2010

Guidance

|

(Dollars

in millions, except EPS)

|

|

2010

Full-Year Guidance

|

|

|

|

|

Low

|

High

|

|

Revenue

|

|

$ 1,930.0

|

$ 1,954.0

|

|

EBITDAR

|

|

$ 244.0

|

$ 250.0

|

|

EBITDA

|

|

$ 168.2

|

$ 174.0

|

|

Pre-tax

earnings

|

|

$ 69.2

|

$ 73.8

|

|

Income

from continuing operations

|

|

$ 40.8

|

$ 43.5

|

|

Diluted

earnings per share

|

|

$ 0.92

|

$ 0.98

|

|

Diluted

weighted average shares

|

|

44.5

|

44.5

|

|

EBITDAR

margin

|

|

12.6%

|

12.8%

|

|

EBITDA

margin

|

|

8.7%

|

8.9%

|

8

2010

Guidance Assumptions:

• compensation

and benefits are expected to increase approximately 3 percent;

• center

lease costs are expected to increase approximately 3.8 percent:

– 1.5

percent for built-in increases

– 2.3

percent related to facility modernization in cooperation with certain

landlords

• non-recurring

costs in 2010 of $2.5 million associated with completing the installation of

the

first phase of our new clinical/billing platform, which will be fully

implemented and operational

in third quarter 2010; and

Non-Operating

Assumptions

• no

additional acquisitions or dispositions;

• an

average outstanding debt balance of $685 million with an average all-in interest

rate of 7.4

percent;

percent;

• annual

increase in depreciation and amortization of $5.0 million;

• capital

expenditures of between $50 million and $55 million, principally

for:

– routine

maintenance and renovations for facilities and IT systems;

– the

build-out of 570 suite beds for our Rehab Recovery Suites® in 2010, bringing

our

total suite bed count up to 2,100 by the end of 2010, an increase of almost 38

percent; and

– the

completion of our new clinical/billing platform.

• an

effective income tax rate of 41 percent and 2010 cash income taxes paid between

$8 million

and $10 million

and $10 million

Sun’s

2010 guidance is based on the continuing operations of the company and the

following

additional

assumptions:

Operating

Assumptions

9

Reimbursement

Update

Medicare

• Washington

Healthcare Reform Update

• STRIVE

(Staff Time and Resource Intensity

Verification project)

Verification project)

– Implementation

proposed for FY 2011

(October 2010)

(October 2010)

– Update

current Resource Utilization Group

(RUG) system to RUG - IV

(RUG) system to RUG - IV

Medicaid

• 20

out of 25 states have frozen or reduced rates

in CY 2009, resulting in an estimated $5.4

million loss of expected revenue

in CY 2009, resulting in an estimated $5.4

million loss of expected revenue

10

SunBridge

Key Strategies

• Enhance

our clinical product

– Focus

on specialty services -Solana/Rehab Recovery

Suites®

Suites®

– Execute

on systems/processes to ensure consistency

• Enhance

Business Development activities to define

markets and train team

markets and train team

– Obtain

strategic support data: demographics, hospital

sources

sources

– Provide

training, tools, tracking and standards to sales and

relationship management team

relationship management team

– Improve

intake and admission process

• Upgrade

physical assets and technology

– Reinvest

in the “bricks and mortar”

– Upgrade

clinical/billing and time and attendance technology

platforms

platforms

11

SunBridge

Performance Metrics

Occupancy

(1)

Occupancy excludes hospital

Q3

‘08

Q3

‘09

88.7%

87.9%

Q2

‘09

87.7%

(3)

Quality mix includes all non-Medicaid inpatient

revenues

revenues

Inpatient

Revenue Quality Mix

Q2

‘09

Q3

‘09

Q3

‘08

54.3%

54.9%

54.9%

$172

$171

$352

$458

Inpatient

Revenue Per Patient Day

$423

$371

$167

Medicaid

Private

and Other

(Percentages

represent change from prior period)

Q3

‘08

Q3

‘09

$175

Managed

Care/Comm

Medicare

Part A

3.0%

2.6%

5.4%

8.1%

(2)

SNF beds only

Managed

Care

Care

Skilled

Mix as a % of Revenue

Q2

‘09

32.2%

31.6 %

Q3

‘09

Q3

‘08

6.1%

37.4%

38.3%

Medicare

5.8%

6.5%

39.1%

32.6 %

12

Product

Diversification

Rehab

Recovery Suites®

• Separate

and distinct units within

a center

a center

• Enhanced

therapy and clinical product

• Hospitality

services - dedicated concierge

• Target

short-term

younger Medicare and

managed care patient

managed care patient

– Average

unit size: 21 beds per center

– Cost/bed

: $25,000/bed

– Development

time: 6-9 months

• 1530

beds in 63 centers at the end of 2009

– Target

570 additional beds in 2010

Solana

Alzheimer’s Care

• Separate

and distinct units within

47 centers

47 centers

• Designated

program directors

• Structured

schedule of activities

• 5.3

million U.S. citizens have

Alzheimer’s

Alzheimer’s

– 3.4

million over age 71 have

dementia

dementia

– 1

out 8 persons over age of 65

have Alzheimer’s

have Alzheimer’s

• Target

long-term

stay

residents through

community referrals

community referrals

– Average

unit size : 38 beds per

center

center

– Average

occupancy: 90.9%

13

Rehab

Recovery Suites

Skilled

Mix % Based on

Patient Days

Patient Days

Centers

w/ RRS units

Q3

‘08

Q3

‘08

Q3

‘09

Q3

‘09

5.2%

5.5%

15.9%

16.0%

2.9%

3.0%

15.5%

All

other centers

15.0%

21.1%

21.5%

18.4%

18.0%

Managed

Care

Medicare

Centers

w/ RRS units

All

other centers

89.8%

44.8%

88.4%

40.4%

Q3

‘09

Q3

‘09

REX

Rehab

3rd Quarter 2009 Rehab

%

14

SolAmor

Hospice Key Strategies

• Focus

on synergistic opportunity

– Approximately

10 percent of patients in each LTC center are

eligible for hospice services

eligible for hospice services

• Complete

rollout of new technology (Home Care Home Base)

• “A

Novel Approach”

– Individualizing

hospice care through alternative therapies and

final wishes

final wishes

• Add

Palliative Care as link from LTC to hospice

– Quality

of Life Specialist

• Grow

through acquisitions

– Focus

where we have a large concentration of SunBridge

affiliated centers

affiliated centers

– On

October 1, 2009 we acquired regional hospice company

with ADC of approximately 300, annual revenues of

$17 million, and EBITDA margins of 20%

15

SolAmor

Performance Metrics

Q3

‘08

Q3

‘09

340

546

ADC

Q3

‘09

Q3

‘08

Revenue

($

in millions)

$4.1

$7.2

EBITDA

Margin

22.2%

8.3%

Q3

‘08

Q3

‘09

16

SunDance

Key Strategies

• Enhance

recruitment and retention

• Accelerate

sales volume and new sales contribution

• Augment

customer service and contract retention

priorities

priorities

• Execute

product installation and standardization

– Customized

clinical products for growing ALF/CCRC market

segment

segment

• Improve

margin

– Exit

strategies for non-profitable business sites

– Grow

favorable payor mix

17

Q3

‘08

Q3

‘09

$44.5

$45.0

Revenue

($

in millions)

Q2

‘09

$38.3

Revenue

/ Contract

($

in thousands)

$86.9

$99.6

Q3

‘08

Q3

‘09

Q2

‘09

$100.2

Q3

‘09

Q2

‘09

7.3%

6.1%

EBITDA

Margin

Q3

‘08

5.0%

Non-Affiliated

Contracts

Q3

‘08

Q2

‘09

Q3

‘09

325

326

328

18

CareerStaff

Key Strategies

• Extend

service areas in all marketplaces

– Increased

focus on virtual markets to expand geographical

coverage

coverage

• Focus

on long term assignments

• New

service offerings

– Weekend

only therapy placements to acute care hospitals

• Strengthen

Locum Tenens

– Introduce

additional specialties: radiology, OB Gyn, and pediatrics

– Improve

growth in: general surgery, anesthesiology and primary

care

care

• Public

school system

• Home

healthcare

– Focus

on start-of-care evaluations

• Aggressive

implementation of Tax Free Advantage Program (TFAP)

– Intended

as a way to offset margin erosion

19

Q3

’09 Revenue

By Type

60.7%

25.4%

7.7%

6.2%

Pharmacy

Allied

Nursing

Physician

Services

CareerStaff

Unlimited Performance Metrics

EBITDA

Margin

8.9%

9.5%

Q3

‘08

Q3

‘09

Q2

‘09

9.3%

Q3

‘08

Q3

‘09

Revenue

($

in millions)

Q2

‘09

$30.1

$26.7

$24.4

Sun’s

Commitment to Quality

• Published

1st annual

report

on quality

on quality

– Quality

First Pledge

– Advancing

Excellence

Campaign

Campaign

• Key

metrics ahead of

national peers

national peers

p.

2 Letter

from Our CEO

p.

3 Our

Public Commitments to Quality Improvement

p.

7 About

Our Nursing Centers

p.

9 Our

Approach to Quality and its Measurement

p.

10 Quality

Information

p.

18 Enhancing

the Quality of Our Residents’ Lives

p.

20 About

Our Employees

p.

22 Employee

Spirit and Achievement

p.

24 Investing

in Our Future

(Can

be found on our website @ www.sunh.com)

21

22

|

(dollars

in thousands, except per share data)

|

2008

|

|||

|

|

2009

|

|||

|

Revenue

|

$470,893 |

$455,757

|

||

|

Depreciation

and amortization

|

11,460

|

10,165

|

||

|

Interest

expense, net

|

12,231

|

13,070

|

||

|

Income

from continuing operations

|

10,389

|

9,421

$ 57,351

|

||

|

EBITDAR

normalized

|

$ 60,366

|

|||

|

Margin

- EBITDAR normalized

|

12.8%

|

12.6%

|

||

|

|

||||

|

EBITDA

normalized

|

$ 42,172

|

$ 38,942

|

||

|

Margin

- EBITDA normalized

|

9.0%

|

8.5%

|

||

|

Income

from continuing operations -

normalized |

$ 10,903

|

$ 9,421

|

||

|

Diluted

earnings per share - normalized

|

$0.25

|

$0.21

|

||

Sun

3rd Quarter 2009 Results

3rd Quarter Ended

September 30,

Actual

Results

23

Interest

Rate

Rate

Debt

Table - September 2009

9.57%

5.21%

6.79%

11.76%

6.85%

5.76%

($

in millions)

330.0

Term

Loans

$ -

Revolving

Credit Facility - $50 million

$ 702.6

200.0

502.6

0.9

171.7

$ 117.4

Total

Debt

Subordinated

Debt

Senior

Secured Debt

Capital

Leases

Mortgage

Debt

Debt:

Cash

Debt

24

Credit

Statistics

<4.25x

2009

Credit

Statistics

174.9

172.3

EBITDA

(LTM Normalized Pro Forma)

53.5

54.2

Interest

Expense

3.59x

$618.6

June

30, 2009

Required

Bank Covenants

3.40x

Total

Net Debt/EBITDA

$595.2

Total

Net Debt (1)

Sept

30, 2009

(1) Total

Debt reduced by cash balances in excess of $10 million

Total

Net Debt/EBITDA

*All

amounts calculated as defined in Sun’s Credit Agreement

2010

<3.50x

($

in millions)

25

Average

Weighted Cost of Debt

|

Debt

Type

|

Outstanding

|

%

of

Total

|

Average

Rate (2)

|

|

Variable

|

$205.1

|

29%

|

3.40%

|

|

Fixed (1)

|

497.5

|

71%

|

8.27%

|

|

Total

|

$702.6

|

100%

|

6.85%

(3)

|

1) Includes

$150 million of term loans fixed via an interest rate swap

2) Includes

amortization of deferred financing costs

3) 17

basis points lower than June 30, 2009

Variable

vs. Fixed

As

of September 30, 2009

($

in millions)

26

Strong

Free Cash Flow

|

($

in millions)

|

|

|

|

Cash

flow from operations

|

$87.8

|

$92.0

|

|

Capital

expenditures

|

(42.5)

|

(41.5)

|

|

Free

cash flow

|

$45.3

|

$50.5

|

|

Projected

FYE 2009

|

|

$48

to $53

|

(1)

Includes $7.1 million related to converting a portion of restricted cash to a

letter of credit

Nine

Months

2009

(1)

FYE

2008