Attached files

OMB APPROVAL UNITED STATES FORM 10K [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 or For the fiscal year ended October 31, 2009 [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001 34107 SPENCE - LINGO & COMPANY LTD. (Exact name of Registrant as specified in its charter) |

|||

Georgia State or other jurisdiction of incorporation or organization |

02

0808637 (I.R.S. Employer Identification No.) |

||

656

Bellemeade Avenue Suite A Atlanta, GA (Address of principal executive offices) |

30318 (Zip Code) |

||

| Registrant’s telephone number, including area code | 770

369 1889 |

||

| Securities registered pursuant to Section 12(b) of the Act : | |||

Title

of each class Common Share Class A |

Name

of each exchange on which registered Over the counter Bulletin Board (OTCBB) |

||

| Securities registered

pursuant to section 12(g) of the Act None This registration statement does not include exemptions |

|||

(Title

of class) (Title of class) |

|||

| Indicate

by check mark if the Registrant is a well known seasoned issuer, as defined

in Rule 405 of the Securities Act. Yes No X Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X Note Checking the box above will not relieve any Registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections. Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation ST (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes No X Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation SK (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10K or any amendment to this Form 10K N/A |

|||

| Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non accelerated filer, or a smaller reporting Company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting Company” in Rule 12b2 of the Exchange Act | |||

| Larger accelerated

filer No Non accelerated filer No |

Accelerated

filer No Smaller reporting Company X |

| Indicate by check mark whether the Registrant is a shell Company (as defined in Rule 12b2 of the Act). Yes No X | |

| State

the aggregate market value of the voting and nonvoting common equity

held by non affiliates computed by reference to the price at which the

common equity was last sold, or the average bid and asked price of such

common equity, as of the last business day of the Registrant’s

most recently completed second fiscal quarter. This Registrant is majority owned by affiliate FreedomTree Mutual Funds and Asset Management, LLC and therefore, pursuant to this Form 10-K item, disclosure of market value of outstanding voting stock is superfluous. |

|||

| Title of Share Common Share Class A |

Total Authorized 1,000,000,000 billion |

Amount to be Registered

and Issued 18,000,000 million |

Total Shares

Issued & Outstanding 16,800,000 million |

Note.—If

a determination as to whether a particular person or entity is an

affiliate cannot be made without involving unreasonable effort and

expense, the aggregate market value of the common stock held by non

affiliates may be calculated on the basis of assumptions reasonable

under the circumstances, provided that the assumptions are set forth

in this Form. |

|||

APPLICABLE

ONLY TO REGISTRANT INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS |

|||

| Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes No X | |||

(APPLICABLE

ONLY TO CORPORATE REGISTRANT) |

|||

| Indicate the number

of shares outstanding of each of the Registrant’s classes of common

stock, as of the latest practicable date. October 31, 2009 Common Share Class A: 16, 800,000 million outstanding $0.000001 par value |

|||

DOCUMENTS

INCORPORATED BY REFERENCE |

|||

| List hereunder the following documents if incorporated by reference and the Part of the Form 10K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). | |||

| 1. Georgia Life/Health Concepts (9th ed.). (2001).Indianapolis, IN:Bisys Education Services. | Part I |

| 2. Swiss Re, sigma. (2009). World insurance in 2008 life premiums fall in the industrialized countries | Part I |

strong growth in the emerging markets Statistical appendix (No 3/2009). [Brochure data update]. Zurich, Switzerland: Schweizerische RuckversicherungsGesellschaft AG |

|

| 3. Miller, J., Prosser, K., & Burak, M. (Eds.). (2000). Passtrak Series 7 General Securities | Part I |

Representatives (11th ed.). United States of America. |

|

| 4. Overview and History of the OTCBB. (n.d.) Retrieved November 21, 2009. | Part

II |

from http://www.otcbb.com/aboutOTCBB/overview.stm#2a bouthistory |

|

| 5. Kimmel, P.D., Weygandt, J.J., & Kieso, D. (2007). Financial Accounting: Tools for business | Part

II |

Decision Marking (4th ed.) . New Jersey: John Wiley & Sons, Inc. |

|

| 6. BigChart.com. (2009). Nasdaq OTC Index Other Financial OFIN, December 1, 2009 [Chart]. | Part

II |

Available from MarketWatch.com Web site, http://www.marketwatch.com |

|

| 7. BigChart.com. (2009). Nasdaq OTC Index Insurance INSR, December 1, 2009 | Part

II |

[Chart]. Available from MarketWatch.com Web site, http://www.marketwatch.com |

|

| 8. BigChart.com. (2009). eHealth Inc NASDAQ GM: EHTH, December 1, 2009 | Part

II |

[Chart]. Available from MarketWatch.com Web site, http://www.marketwatch.com |

|

| 9. BigChart.com. (2009). Donegal Group Inc NASDAQ GM: DGIC.A, December 1, 2009 | Part

II |

[Chart]. Available from MarketWatch.com Web site, http://www.marketwatch.com |

|

| 10. Financial crisis of 20072009. (n.d.) . Retrieved December 4, 2009, from | Part

II |

http://en.wikipedia.org/wiki/crash_of_2008 |

|

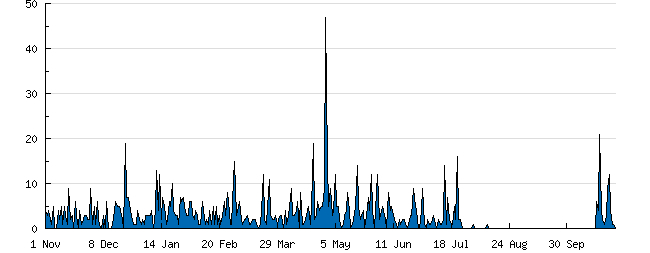

| 11. Graph Summary, 2009. [Area Chart]. Retrieved from Statcounter Web site, | Part

II |

http://www.statcounter.com |

|

| 12. Berkshire Hathaway, Inc. (2009, March 2). Form 10K Annual Report Pursuant to | Part

II |

Section 13 or 15(d) of the Securities Exchange Act of 1934. Retrieved December 7, 2009, from http://sec.gov/Archives/edgar/data/106 |

|

| 14. (2006). Peachtree Complete Accounting (2007) [Computer Software].Irvine, California: | Part

II |

Sage Software SB, Inc. |

|

| 15. (2001). Microsoft Excel (10.6850.6845) [Computer Software]. | Part

II |

Redmond California: Microsoft Corporation. |

|

| 16. (2009). Bluebeam PDF Revu (Version 7.2.1) [ Computer Software]. Pasadena, California: | See

embedded graphics |

Bluebeam Software, Inc. |

Part

I |

|||

| Table of Contents | |||

| Item 1. 229.101 (Item 101) Description of business. | |||

An overview of the general development of business is provided pursuant to Title 17 229.101(a)(1): Spence-Lingo & Company, Ltd ("The Firm", "Spence-Lingo", "the Company", "this Registrant") was incorporated on June 1, 2007 under the laws of the State of Georgia. The Firm regularly conducts business as "The FreedomTree Financial Group", "FreedomTree Financial, The Agency", "FreedomTree Stock Transfer & Clearing" and "FreedomTree Lending". Since the initial filing, The Firm's fiscal year start and end dates were shifted. The fiscal year will close annually October 31. This offering is a certificated issue, and stockholders are encouraged to apply their signature to each stock certificate upon receipt. Members of the public are able to read and copy any materials filed at the Securities and Exchange Commission's "the Commission" Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. Members of the public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with Commission located at http://www.sec.gov. |

|||

| Quarter 1 (Q1) November 1 January 31 | |||

| Quarter 2 (Q2) February 1 April 30 | |||

| Quarter 3 (Q3) May 1 - July 31 | |||

| Quarter 4 (Q4) August 1 October 31 | |||

(2) This Registrant - (i) is not filing a registration statement on Form S1 or on Form 10 FreedomTree Financial, The Agency The primary business of the Firm acts as an independent insurance agency, offering annuities, life insurance, long term care insurance, disability income insurance and health insurance to individuals, small businesses and institutions. As a member of the American Agency system1, Spence-Lingo offers insurance products to more than 7 major insurance companies. The American Agency system is composed of independent and exclusive agencies who contract and employ agents to distribute products offered by a multitude of carriers. The worldwide insurance industry reported 2008 premiums of 4.218 Trillion USD2, and we are excited to about the prospects for the new fiscal year. FreedomTree Stock Transfer & Clearing Since the Firm's initial Form 10 12B registration in the Summer of 2008, FreedomTree Tree Stock Transfer, an in house segment of The Firm, was granted registration by the the Commission. Spence-Lingo & Company, Ltd doing business as FreedomTree Stock Transfer completed FORM TA1 submission in July of 2008. As the sole stock transfer agent, FreedomTree Stock Transfer is charged with maintaining shareholder records for the the Firm's entire 18 Million Common Share issue as well as administrating cash dividends, stock dividends and stock splits. Stockholders' name, broker dealer, address and other pertinent details are cataloged on site at Company headquarters in Atlanta, Georgia. FreedomTree Stock Transfer, a recognized State of Georgia Third Party Administrator, operates in accordance to written internal risk management procedures which work to ensure client data is not corrupted, and shareholder information remains intact. FreedomTree Clearing, the internal securities reconciliation agent, directs the post trade functions of affiliate and control entity FreedomTree Mutual Funds and Asset Management, LLC, a Registered Investment Advisor ("FreedomTree Asset Management" "FAM") (SEE Item 5). Freedom Tree Asset Management is lead underwriter for The Firm's Common Share Class A issue and is seeking registration effectiveness status for its broker /dealer transactions. In addition to this common share issue, FAM will underwrite and distribute FreedomTree Mutual Fund's family of funds to individual investors beginning January 1, 2011, and we encourage industry professionals and institutions to contact us toll free at 877 369 1889 to arrange partnership FreedomTree Lending is the newest segment of the FreedomTree Financial Group. Spence-Lingo has engaged the services of several ancillary loan brokers to offer debt infusions which are collateralized by the debtor's debit and/or credit card receipts or equipment. |

|||

____________________________________________________________________________________ |

|||

| Table of Contents | |||

| Item 1A. 229.503(c) (Item 503) Prospectus summary, risk factors, and ratio of earnings to fixed charges. | |||

As is required pursuant to Title 17 229.503(c) , provided here are the risk factors involved in this issue, Spence-Lingo & Company, Ltd, Common Share Class A Capital Risk Purchasers of this offering should be mindful of the rewards of long term investment attitudes3. Traders in the over the counter arena should be prepared to trade in thin markets where 1) buyers are limited and/or 2) where buyers may seek to purchase and sell at prices lower than your purchase price or the last quoted market price. Please know that Spence-Lingo and the specialized apparatus that supports the supply and delivery of its common share is committed to enduring market performance. Timing Risk Investors seeking a marked return should study their positions before selling. The alternative is selling at an unfortunate moment and realizing less returns than other investors on the street. Reinvestment Risk Considering the prospect of future dividends, selling shares in order to reinvest proceeds in another company's issue may possibly net lower returns than what were previously realized while holding shares of this Registrant. Market Risk The peaks and troughs of share prices are sometimes unrelated to a corporation's internal operational performance. Prospective shareholders of this issue should understand the immense powers that large institutional dealers and brokers have on blocks of securities which they may possibly sale at prices lower than even their own acquisition costs or in clearer terms, selling losses to reduce income tax liabilities. Liquidity risk This equity offering is generally marketable, although certain aspects of other securities such as dividend and interest history may make this offering less attractive to your potential buyers. Presented here pursuant to Title 17

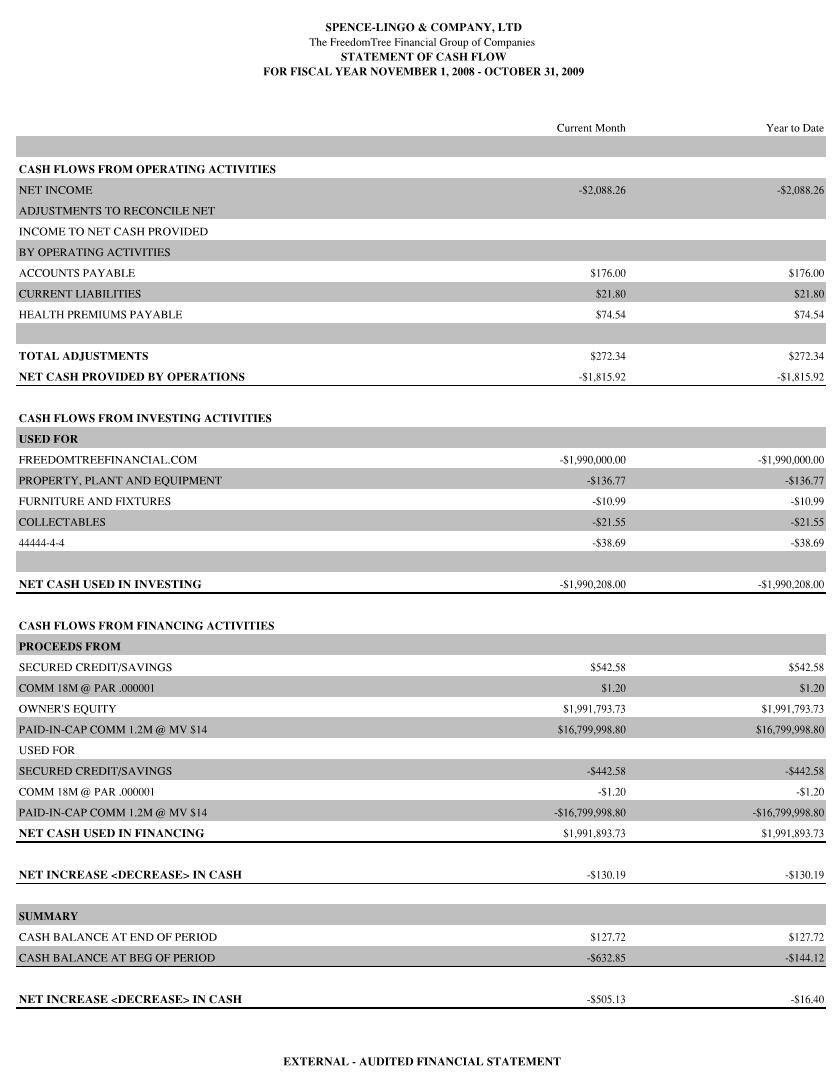

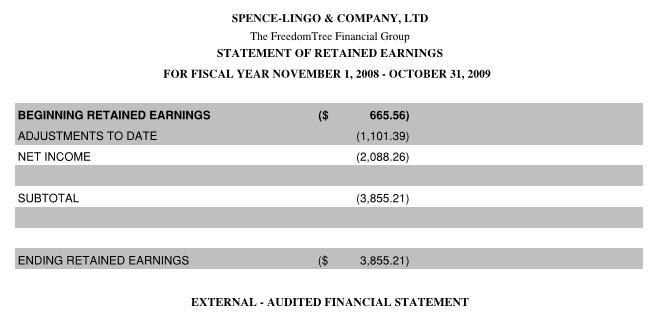

229.503(c)(3) A statement of Financial Position |

|||

|

|||

Graphic

2. Statement of Retained Earnings for Fiscal Year Ending October 31, 2009 |

|||

|

|||

____________________________________________________________________________________ |

|||

| Table of Content | |||

| Item 1B. Unresolved Staff Comments. | |||

On June 27, 2008 the Commission made mention of several deficiencies of the original June 23, 2008 filing (TEXT). The Commission noted in item 1) of that letter that the 10 12B filling was unnecessary because the Over the Counter Bulletin Board ("OTC BB") is not a national exchange and does not carry Form 10 filing requirements. Item 1) of the letter also pointed out that the June 23, 2008 filing indicated 12(g) exempt issues. In Item 2) the Commission indicated that the June 23 filing did not contain audited financial statements as is required by Item 13 of Form 10 General form for registration of securities pursuant to Section 12(b) or (g). Item 3) asked that a revision be made in order to disclose more detailed information regarding the Firm's business segments, products, revenue and anticipated development. Item 4) requested that the signature page conform to Form 10. The Commission asked that a substantive amendment be submitted to correct the registration statement. On August 4, 2008 the Commission made another series of responses to the June 23, 2008 filling. This letter, once again, stated that the Firm should seek 12G registration status instead of 12B The Firm transmitted another filing on July 22, 2008 (HTML). In response to the Commission's June 27, 2008 letter's item 3) and 4), the July 22, 2008 filing included more substantive descriptions of Company products and also included a correctly formatted signature clause. Also, Company chief executive Jermaine E. Spence prepared a letter dated September 4, 2008 which responded to the Commission's June 27, 2008 letter item 1) and 2). In that letter Mr. Spence asserted that, in response to item 1), OTCBB issues require Commission registration and periodic federal oversight however the Pink Sheets do not. In response to item 2) Mr. Spence called to attention the Firm's book value which is below the book value requirement for a 12G filing, illustrating that the Firm does not seek 12G registration status. In regards to the Commission's June 27 letter item 2), the financial statement presented in the June 23 filing's Item 13 229.302 (Item 302) (c) was entered although it is not required that this Registrant at the time of the June 23 or July 22 filing present financial information for Form 10 ITEM 13 nor is it required for that financial information to be audited because Spence-Lingo is defined as a smaller reporting company as is defined by Title 17 229.10(f)(1). Furthermore, as is laid forth, in Title 17 229.10(f)(2) Determination: Spence-Lingo remained a smaller reporting Company for the period immediately following June 23, 2008 and for fiscal year starting November 1, 2008 and ending October 31, 2009. |

|||

____________________________________________________________________________________ |

|||

| Table of Contents | |||

| Item 2. 229.102 (Item 102) Description of property. | |||

| The

Firm's principal physical address is a rented unit located at 656 Bellemeade

Avenue Suite A Atlanta, GA 30318. The grounds are secured, and there are

no incidents of theft involving the Firm's unit since occupancy began in

August 2004. All segments of the Firm are housed at this Atlanta location.

All written correspondence should be directed to POST OFFICE BOX 4421 Atlanta, Georgia 30302-4421 |

|||

____________________________________________________________________________________ |

|||

| Table of Contents | |||

| Item 3. 229.103 (Item 10) Legal Proceedings. | |||

(a) There are no pending proceedings involving the Firm, including ordinary routine litigation incidental to the business, to which this Registrant or any of its subsidiaries are a part or of which any of their property is the subject. |

|||

____________________________________________________________________________________ |

|||

| Table of Contents | |||

Item 4. Submission of Matters to a Vote of Security Holders. |

|||

There

are no reportable disclosures relating to: (a) meetings, either annual or special purpose |

|||

____________________________________________________________________________________ |

|||

Part

II |

|||

| Table of Contents | |||

| Item 5. 229.201 (Item 201) Market price of and dividends on the Registrant's common equity and related stockholder matters. | |||

(a) Market Information

Price history below includes pricing during the Regulation D and Red Herring periods. |

Fiscal

Year 2008, ending October 2008 |

Fiscal

Year, ending October 2009 |

|||

High |

Low |

High |

Low |

|

| Q3 | $0.00000617284 |

$0.00000617284 |

||

| Q4 | $0.00000617284 |

$0.00000617284 |

||

| Q1 | $0.00000617284 |

$0.00000617284 |

||

| Q2 | $0.00000617284 |

$0.00000617284 |

||

| Q3 | $0.00000617284 |

$0.00000617284 |

||

| Q4 | $0.00000617284 |

$0.00000617284 |

Pursuant to Title 17 Section 229.201(a) (2) information contained in this section and the preceding section (a)(1) relating to this Class A Common Share offering

|

(b) Holders (1) Below is listed the approximate number of holders of each class of common equity of the Registrant |

||||

| Title

of Class of Common |

Number of Holders |

|||

A |

3 |

|||

| (2) The information presented in 229.201 section (b)(1) is not presented being presented due to proxy statements, an acquisition, business combination, merger, or other reorganization. | ||||

| However, with respect to the Securities and Exchange Act Section 13(d)(3) information is reported below concerning the beneficial ownership of more than 5 percent of Class A. Information below includes (i) any person or group that is termed as a beneficial owner and their proportionate change in ownership not due to the acquisitions, business combination or other reorganization. | ||||

| (1) Title of class | (2) Name and address of beneficial owner | (3) Amount and nature of beneficial ownership | (4) Percent of class |

| Common Share Class A |

FreedomTree

Mutual Funds and Asset Management LLC P.O. Box 4421 Atlanta,GA 30302 |

16,200,000 |

90% pending secondary issue of 5.4 million shares resulting in 60-70% ownership |

| Common Share Class A | 人81

Black Men of America & The Missionaries |

600,000 (3.333%) | ___ (3.333% <5%) Trading securities 5 therefore not beneficially owned. |

| There is no relevant disclose of information related to ownership by (ii) any director or nominee or (iii) a group of directors and officers in partnership. There are no present commitments to such person with respect to Common Share Class A. |

(c) Dividends.

(1) There were no dividends declared on any class of Common Share |

|||

| Quarter End Date | Dividend Payment | ||

| Q1 | January 31 | February 15 | |

| Q2 | April 30 | May 15 | |

| Q3 | July 31 | August 15 | |

| Q4 | October 31 | November 15 | |

| (d) 1 There are no equity compensation plans in use for this Registrant. | |||

Equity

Compensation Plan Information |

|||

| Plan

category |

(2)(i)

Number of securities to be issued upon exercise of outstanding options,

warrants and rights |

(2)(ii)

Weighted-average exercise price of outstanding options, warrants and

rights |

(2)(iii)

Number of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in column (a)) |

| (a) |

(b) |

(c) |

|

| (1)(i) Equity compensation plans approved by security holders | 0 |

0 |

0 |

| (1)(ii) Equity compensation plans not approved by security holders | 0 |

0 |

0 |

| (3) There is no reportable disclosure for equity compensation plans which were executed without the approval of security holders for this Registrant in use at the close of the most recent fiscal year. | |||

| (e) Performance graph (1) relating to the yearly percentage change in this Registrant's cumulative total shareholder return is not available as there were no change in share price nor were their cash or stock dividends paid. | |||

| Information provided below is provided pursuant to Title 17 229.201(e)(i-ii[A-C]) except that the illustrations does not contain calculations involving reinvestment of dividends. | |||

(i) SEE displayed below: The cumulative total return of a broad equity market index assuming reinvestment of dividends, that includes companies whose equity securities are traded on the same exchange or are of comparable market capitalization; |

|

The

adjacent graph is of the Nasdaq OTC Index - Other Financial OFIN6 |

| (ii) SEE

displayed below: The cumulative total returns, assuming reinvestment of

dividends, of: (A) A published industry or line-of-business index |

|

|

The

adjacent graph is of the Nasdaq OTC Index - Insurance INSR7

|

| (B) SEE displayed below: Peer issuer(s) selected in good faith. | |

|

The

adjacent graph is of the Nasdaq OTC eHealth EHTH8 |

| (C) SEE displayed below: Issuer(s) with similar market capitalization(s), but only if the Registrant does not use a published industry or line-of-business index and does not believe it can reasonably identify a peer group. If the Registrant uses this alternative, the graph shall be accompanied by a statement of the reasons for this selection. Graph is presented although a preceding chart industry representations was made. | |

|

The adjacent graph

is of the Nasdaq OTC Donegal Group Inc DGIC9 Closing Price - 12/01/2009 14.63 Prior year Closing Price - 12/01/2008 12.42 $ +/- +2.21 % + 17.7948 % |

| 229.701 (Item 701) Recent sales of unregistered securities; use of proceeds from registered securities. | |||

| Furnished below is a table displaying pertinent information regarding sales of unregistered securities of this Registrant during Fiscal year from November 1, 2008 to October 31, 2009. For purposes of this section 'unregistered' shall mean Red Herring transactions | |||

| (a) | Date |

Title | Amount of Securities |

| Securities sold | October 16, 2009 | Common Share Class A | 16,200,000 |

| (b) | Name of Underwriter | Buyer | |

| Underwriters and other Purchasers | FreedomTree Asset Management | FreedomTree Asset Management | |

| (c) | Aggregate Offering Price | Discounts or commissions | Aggregate |

| Consideration | $0.00000617284 | $0 | $100.00 |

| (d) | |||

| Basis for exemption | The preceding disclosures involve securities purchased under Securities Act of 1933 Section 4(3)(C) whereby the transactions qualifies for exemption because it involved the subscription of underwriter/dealer to the issuer | ||

| (e) | |||

| Terms of conversion or exercise | There are no transactions involving conversions or other purchases or sale of warrants or options. | ||

| (f) | |||

| Use of Proceeds | Disclosures relating to the use of proceeds from this unregistered transaction is superfluous because "proceeds" defined pursuant to Title 17 230.463 does not include consideration received from a member of the selling consortium or underwriter. | ||

| 229.703 Purchases of equity securities by the issuer and affiliated purchasers furnished in Tabular format (a) and (b)(1) through (b)(4) | ||||

Period |

(b)(1) (a) Total number of shares (or units) purchased |

(b)(2) (b) Average price paid per share (or unit) |

(b)(3) (c) Total number of shares purchased as part of a publicly announced plan or programs |

(b)(4) (d) Maximum number (or approximate dollar value) of shares (or units) that may yet be purchased under the plans or programs |

| Month #1 February 1 April 30, 2009 | 0 |

Not

Applicable |

Not

Applicable |

Not

Applicable |

| Month #2 May 1 July 31, 2009 | 0 |

Not Applicable |

Not Applicable |

Not Applicable |

| Month #3 August 1 October 31, 2009 | 16,200,000 |

$0.00000617284 |

16,200,000 |

16,200,000 |

Spence-Lingo

Expense Profile for fiscal year ending Nov 1 Oct 31, 2009 |

||||

| Rank | Expense | Amount | ||

| 1 | Bank Charges | $ 363.50 | ||

| 2 | Stationary, printing, document services | $ 234.49 | ||

| 3 | Toll Free telephone | $ 223.69 | ||

| 4 | Interest Expense for secured card | $ 188.89 | ||

| 5 | State of Georgia Insurance License Fee | $ 150.00 | ||

| 6 | World Wide Web site registration, design and hosting | $ 137.76 | ||

| 7 | Travel Expense | $ 130.91 | ||

| 8 | State of Georgia corporation tax | $ 130.00 | ||

| 9 | Meals and Entertainment | $ 119.76 | ||

| 10 | Depreciation Expense | $ 113.79 | ||

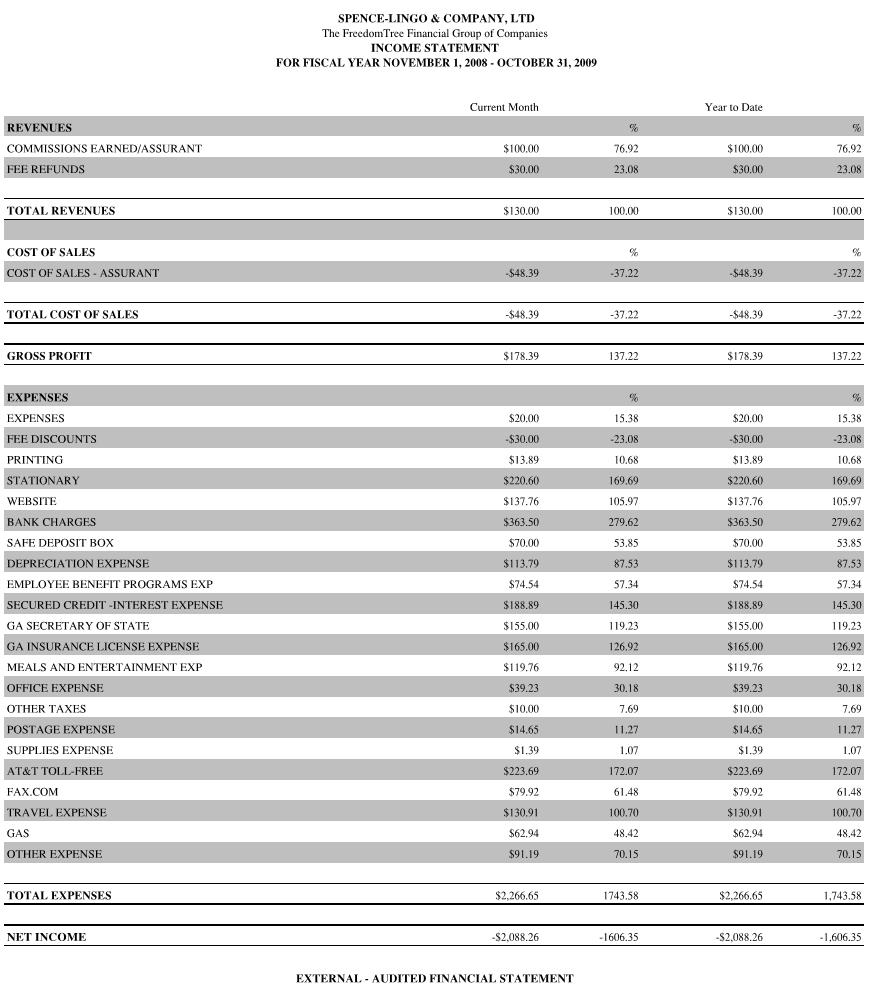

| Graphic 9.Income Statement | |||

|

|||

(4) Off balance

sheet arrangements.(i) In October of 2008 just prior to the start

of the 2008-2009 Fiscal Year, the Firm's management explored secured

credit line solutions in order to establish credit ratings for the corporation.

Secured credit accounts require a cash deposit made to the creditor

which remain in custody with the creditor as collateral in the event

of default. The credit limit or maximum is determined by the initial

cash deposit and any other prepayments.

(A) As was put forth in the preceding section (a)(4)(i) off balance sheet activities were limited by type and magnitude and pertained to this secured credit card account. The balance due was less than five hundred ($500.00); (5) Tabular disclosure of contractual obligations. |

| Contractual obligations |

Payments due by period |

35 years |

More than 5 years |

||

| Total |

Less than 1 year |

13 years |

|||

| [Long Term Debt Obligations] |

0 |

||||

| [Capital Lease Obligations] |

0 |

||||

| [Operating Lease Obligations] |

0 |

||||

| [Purchase Obligations] |

0 |

||||

| [Other Long Term Liabilities Reflected on the Registrant's Balance Sheet under GAAP] |

0 |

||||

| Total |

0 |

||||

| Title of Share | Coefficient Alpha | Coefficient B | ||

| Common Share Class A | 1.02 | .99 | ||

| Purchasing

securities of various maturities, investment rating, geography, instrument

type and industry all work to mitigate risk. Optimally the Company hopes

that the mechanisms that supports the distribution of its equity provides

for a fluid trading atmosphere where there is a buyer for every willing

seller.

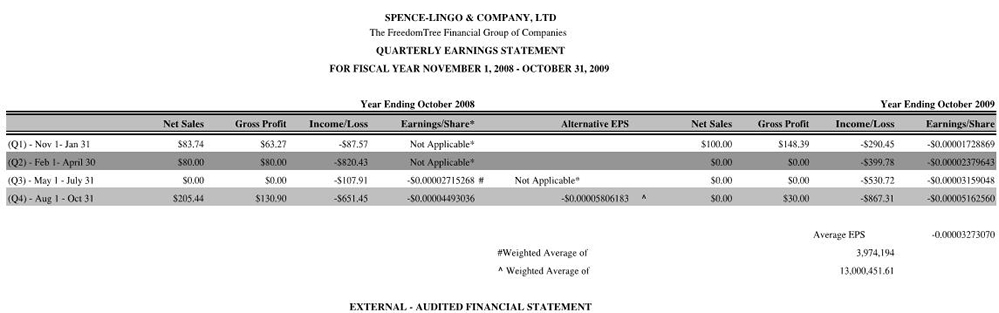

____________________________________________________________________________________ Item 8. 229.302 (Item 302) Financial Statements and Supplementary Data (a) Selected quarterly financial data. (1) Disclosure in this section is made for net sales, gross profit, income and Earnings per share data for all quarters in the two most recent fiscal years beginning November 1, 2007October 2008 and November 1, 2008 October 2009. Graphic 10 Quarterly Earnings Statement for Fiscal Year Ending October 31, 2009 |

|||

|

|||

^ For values stated 'Not Applicable' this registrant had no outstanding shares On August 22, 2008, payment was received for 16,800,000 million shares. The weighted average of shares outstanding for May 1 July 31 was 3,974,194, due to the impeding August 22, 2008 payment. The August 1- October 31 2008 entry includes the entire 16,800,000 outstanding lot. However the alternative weighted average calculation for August 1 October 31 2008 included a denominator of 13,000,451.61 for the weighted average shares outstanding. (2) This Registrant has not previously disclosed quarterly financial data or has it reported data which developed from a combination or merger. (3) In November 2007 this Registrant experienced an extraordinary item involving the theft and destruction of several for business use vehicles. Estimates of losses to property and equipment, income and capitalization range from $80,000 to $120,000. Substratal discovery hearings point to the State of Georgia's National Guard, United States' Army, Marine and Atlanta City Police officers being the perpetrators; litigation is pending. Due to this incident of vandalism, financial data for periods before November 1, 2007 are not included in calculations of per share data, retained earnings and other ratios presented in this Form 10-K filing. Moreover, as was stated in Item 1, the company was incorporated June 1, 2007, thusly revenue was not legally assigned to the corporation until October of 2008. Additionally, special attention should be taken for Quarter 3 and 4 of 2008. The Earnings per Share figures include the shares purchased for beneficial ownership by lead underwriter FreedomTree Asset Management. There were no extraordinary items to report for Q3 or Q4 of 2008 or 2009. (5) Information required of registrants filing pursuant to section 12(b) of the Securities and Exchange Act of 1934

|

|||

| Table of Contents | |||

| Item 9. 229.304 (Item 304(b)) Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | |||

(a)(1) For this Registrant's most recent fiscal years there is no reportable disclosure regarding (i) the resignation, abdication or dismissal of any independent accountant. (2) There are no disclosures concerning new engagements with an independent accountant and this Registrant, new engagements with an accountant to audit a subsidiary of the registrant, disclosures relating to said accountant's reliance on principal accountant to audit this Registrant's financial statements or the date of such engagement.

|

|||

____________________________________________________________________________________ |

|||

| Table of Contents | |||

| Item 9A. 229.307 (Item 307) Controls and Procedures | |||

| In accordance to Title 17 Item 229.307 and 240.13a15(e), this Registrant's principal executive and principal financial officers conclude that the disclosure controls regarding this report were sufficient in providing for a timely submission of the Company's financial statements and germane disclosures. | |||

| Item 9A. 229.308T (Item 308T) Controls and Procedures | |||

(a) Management's

annual report on internal control over financial reporting: The following

entries are made under Section 18 of the Securities and Exchange Act and

Title 17 240.12a15(f)

(b) Changes in internal control over financial reporting. There are no reportable changes in the registrant's internal control over financial reporting instigated as is required in connection with the internal evaluation criteria required by paragraph (d) of Title 17 Item 240.13a.015. ____________________________________________________________________________________ |

|||

| Table of Contents | |||

| Item 9B. Other Information. | |||

| Reported here in

accordance to Item 9B and Form 8K is information which is required to be

disclosed in a report on Form 8K during the fourth quarter of the year covered

by this Form 10K. Information may be repeated in other items of this form. Item 1.01 There are no reportable disclosures for material definitive agreements in which this Registrant has entered. |

|||

| Item 1.02 There

are no reportable disclosures for the termination of a material definitive

agreement. Item 1.03 There are no reportable disclosures involving the appointment of a receiver due to this Registrant's bankruptcy. Item 2.01 There are no reportable disclosures relating to the acquisition or disposition of a significant amount of this Registrant's assets or those of an affiliate. Item 2.02 There are no reportable disclosures relating to the public announcement or release of information concerning material nonpublic information regarding the Registrant's results of operations. Item 2.03There are no reportable disclosures relating to direct financial obligations or an obligation under an off balance sheet arrangement. Item 2.04 There are no reportable disclosures relating to triggering events which have accelerated or increased a direct financial obligation or an obligation under an off balance sheet arrangement. Item 2.05 There are no reportable disclosures relating to costs associated with exit or disposal activities of long live assets. Item 2.06 There are no reportable disclosures relating to material impairments in goodwill or any other acquired business segment. Item 3.01 There are no reportable disclosures relating to this Registrant's receipt of a notice from the national securities exchange concerning that national securities exchange or national securities association stating that any class of this Registrant's securities does not satisfy a rule or standard for continued listing on the exchange or association or initiated procedures to delist or has delisted any class of this Registrant's securities. Item 3.02 Disclosure relevant to this section concerning the unregistered sales of equity securities was disclosed in this document in Item 5 229.701 (Item 701). The October 2009 sales of unregistered securities occurred between the lead underwriter FreedomTree Asset Management and Company management, and therefore does not fit within the scope of "sale" to outside unaffiliated, unqualified parities. Item 3.03 There are no reportable disclosures relating to modification of rights of security holders. Item 4.01 There are no reportable disclosures relating to changes in this Registrant's certifying accountant. Item 4.02 There are no reportable disclosures relating to previously issued financial statements being determined to be erroneous . Item 5.01 There are no reportable disclosures relating to changes in control of this Registrant resulting from alterations in this Registrant's Board of Directors, a committee of the Board of Directors or authorized officer or officers of the registrant. Item 5.02 There are no reportable disclosures relating to the departure of directors or certain officers or election of directors or appoint of certain officers or compensation thereto. Item 5.03 Information supplied in this section is in regards to Amendments to Articles of Incorporation or Bylaws; change in fiscal year.

|

|||

| Item 5.04 There

are no reportable disclosures relating to the temporary suspension of trading

under registrant's employee benefit plans. Item 5.05 There are no reportable disclosures relating to amendments to this Registrant's code of ethics, or waiver of a provision of the Code of Ethics. Section 5.06 There are no reportable disclosures relating to a status change concerning this Registrant reporting itself to be a shell company or revisions thereto. Section 6. There are no reportable disclosures concerning asset backed securities. Item 6.01 There are no reportable disclosures concerning ABS informational and computational material. Item 6.02 There are no reportable disclosures concerning change of service or trustee concerning Asset-backed Securities. Item 6.03 There are no reportable disclosures concerning changes in credit enhancement or other external support types, including termination of contract. Item 6.04 There are no reportable disclosures concerning this Registrant's failure to make a required distribution to holders of asset backed securities. Item 6.05 There are no reportable disclosures concerning this Registrant reporting of material changes in pool characteristics which differ at issue from their statements made in the prospectus. Item 7.01 Regulation FD Disclosure. In accordance to Title 17 243.100 243.103 this Registrant is reporting that there is no information which was not supplied [243.100] due to exclusionary provisions which would [243.102] indeed if not reported not violate anti fraud liability stipulations put forth in Rule 10b5 under the Securities Exchange Act or [243.103] indeed if not reported would render this non reported information has having no effect upon requirements put form in the Exchange Act regarding reporting status. Item 8.01 There are no reportable disclosures concerning information not otherwise called for by this form. Item 9.01 There are no reportable disclosures relating to financial statements which would display information concerning businesses acquired or pro forma financial information. ____________________________________________________________________________________

|

|||

Part III |

|||

| Table of Contents | |||

| Item 10. 229.401 (Item 401) Directors, Executive Officers and Corporate Governance. | |||

| (a) Identification of Directors. As is required by Title 17 Item 229.401 listed immediately below are the names and ages of all directors of the registrant and all persons nominated or chosen to become directors. including positions and offices held and term in office | |||

Presently the Board of Directors posts are vacant. As was put forth in this Registrant's June 23, 2008 and July 22, 2008 Form 10 12b filings, prospective Board of Director members' recruitment and retention will depend on:

Candidates for Board of Director membership and prospective shareholders should have a measurable understanding of State of Georgia code O.C.G.A. Title 14 concerning shareholder rights, voting rights of common stock and stipulations which govern stock ownership for corporations having their situs in the State of Georgia, United States of America. |

|||

| (b) Identification of executive officers . As is required by Title 17 Item 229.401, listed immediately below are the names and ages of all executive officers of the registrant and all persons nominated or chosen to become executive officers. |

Name |

Service Start Date |

Term

Length & Retention Stipulations |

Age |

|

| Jermaine E. Spence |

8/29/2006 |

Indefinite No special employment stipulations beyond sales performance and executive duties |

28 |

|

| Shonna C. Lingo |

06/1/2007 |

Indefinite

No Special employment stipulations beyond data entry |

37 |

|

| Delphine S. Lingo |

06/1/2007 |

Indefinite No Special

employment stipulations beyond administrative and sales support duties |

56 |

|

(c) Identification

of certain significant employees.

This Registrant does not currently employ persons who make or who are expected to make significant contributions to the business of this Registrant such as production managers, sales managers, or research scientists who are not executive officers. |

||

| (d) Family relationships. | ||

| Name | Relationship | |

| Jermaine E. Spence | Shonna Lingo | Sibling |

| Delphine Lingo | Mother | |

| Shonna Lingo | Delphine Lingo | Mother |

(e) Business Experience

(1) Background Although this item requested that employment information

be disclosed for each executive for a period of the prior five years

along with executive's employment experience with this Registrant for

a period of the prior five years, this Registrant has existed for three

years

Mr. Spence is founder of Spence-Lingo Company, Ltd and affiliate and control entity FreedomTree Financial Mutual Funds and Asset Management, LLC. He has maintained employment with the Firm since August of 2006 when operations were conducted as a sole proprietorship. Mr. Spence earned a Bachelor of Arts degree from Georgia State University (2005) and is pursing a Master of Business Administration (2011). Financial industry licensure include:

Mr. Spence has maintained licensure in the financial services industry since 2005. Prior to his service with the Firm, Mr. Spence was employed at the companies listed below in order of recentcy:

Shonna Lingo is completing a Bachelor's degree in Business from Troy University, Alabama. (2011). For the previous 14 years she has maintained employment in allied health industries, starting at a regional hospital in South Georgia. Her duties here at the Firm include supervision of the data collection processors that image agent applications, entering all relevant information into the Company's customer relationship management software systems before initiating customer invoices. Ms. S. Lingo maintains con concurrent employment with this Firm along with her duties in the health professions. Delephine Lingo assisted Lingo Exterminators with marketing of their line of pest extermination chemicals and services. Lingo Exterminators has operated for more than 35 years and is privately owned by the Lingo family. Duties include client contact entry and records recollections, postal mail retrieval functions and clerical support. Ms. D. Lingo is responsible for similar duties here at Spence-Lingo. (2) Directorships. There are no other reportable disclosures relating to any director or executive of Spence-Lingo holding any other position with this Company having a class of securities registered pursuant to section 12 of the Exchange Act or subject to the requirements of Section 15(D) of such Act or this Company registered as an investment company under the Investment Company Act of 1940. (f) Involvement in certain legal proceedings There are no reportable disclosures arising from events occurring in the last five years regarding this Registrant and

(g) Promoters and control persons.

229.405 (Item 405) Compliance With section 16(a) of the Exchange Act. (a) As is required by this item, Title 17 229.405 (a) this Registrant received notification via form Form 3 that 10 percent or more of its stock was beneficially owned by the parties below. The parties named below ARE NOT directors or officers of this Registrant, and the disclosure made below does not fit within Section 16(a) of the Securities Exchange Act of 1934 because the purchase of the stock in question was made in a dealer issuer transaction, which under Section 16(d) of the Securities Exchange Act of 1934, is exempt from Form 3, Form 4 and Form 5 registration requirements because the beneficially owned stock was acquired by a dealer in the ordinary course of business and done so in order to establish and maintain a secondary market.

|

| Title of Stock | Name of Owner | Number of Shares Owned | Percent of Outstanding Stock Owned | Percent of Registered Stocked Owned |

| Common Share Class A | FreedomTree Asset Management | 16, 200,000 Million | 96.4286 percent | 90 percent |

Summary

Compensation Table# |

|||||||||

| Name

and principal position |

Year |

Salary **

($) |

Bonus

s*** ($) |

Stock awards

**** ($) |

Option awards

***** ($) |

Non

equity incentive plan compensation ## ($) |

Non

qualified deferred compensation earnings ### ($) |

All other

compensation #### ($) |

Total ($)

|

| (a) | (b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

(i) |

(j) |

| (m)(2)(i) PEO | |||||||||

| Jermaine Spence | 2009* |

81,000 |

0 |

0 |

0 |

0 |

0 |

0 |

81,000 |

| (m)(2)(ii) MNG | |||||||||

| Shonna C. Lingo | 2010 |

72,000 |

0 |

0 |

0 |

0 |

0 |

0 |

72,000 |

| (1) Title of class | (2) Name and address of beneficial owner | (3) Amount and nature of

beneficial ownership |

(4) Percent of class |

| Common Share Class A | FreedomTree

Mutual Funds and Asset Management LLC P.O. Box 4421 Atlanta,GA 30302 |

16,200,000 | 90 percent of registered and 96.4286 percent of outstanding |

| SIGNATURES Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this registration report be signed on its behalf by the undersigned, thereunto duly authorized. |

| Date: December 31, 2009 By: /s/ Jermaine E. Spence _________________________ Name: Jermaine E. Spence Title: Chief Executive Officer Spence-Lingo & Company, Ltd |

|

Visit www.FreedomTreeFinancial.com ! |

STATEMENT OF INDEPENDENT ACCOUNTING FIRM To the Shareholders of Spence-Lingo

& Company, Ltd. In our assessment of the books and records of this Registrant Spence-Lingo & Company and subsidiaries as of October 31, 2009 and including fiscal year ending October 31, 2008 our findings are that Spence-Lingo & Control presented in a comprehensive and accurate manner all material aspects of the financial standing of this Registrant as is reflected in the incorporated financial statements in this document in entirety elsewhere and listed by reference in Item 15 as: Balance Sheet - Year ended October 2009, Statement of Retained Earnings - Year ended October 2009, Statement of Cash Flow - Year ended October 2009, Income Statement - Year ended October 2009, Quarterly Earnings Statement - Year ended October 2009. Our audit found that these statements did not reflect accurate book keeping for periods before November 1, 2007. BERKELY PARK ACCOUNTING & LEGAL AIDJanuary 8, 2010 |

| Exhibit

Table |

Securities Act forms | Exchange Act forms | |||||||||||

| S1 |

S3 |

S4

|

S8 |

S11 |

F

1 |

F

3 |

F

4 |

10

D |

10

Q |

10

K |

|||

| (1) Underwriting agreement | |||||||||||||

| (2) Plan of acquisition, reorganization, arrangement, liquidation or succession | |||||||||||||

| (3)(i) Articles of incorporation | |||||||||||||

| (ii) Bylaws | |||||||||||||

| (4) Instruments defining the rights of security holders, including indentures | |||||||||||||

| (5) Opinion re legality | |||||||||||||

| (6) [Reserved] | |||||||||||||

| (7) Correspondence from an independent accountant regarding non reliance on a previously issued audit report or completed interim review | |||||||||||||

| (8) Opinion re tax matters | |||||||||||||

| (9) Voting trust agreement | |||||||||||||

| (10) Material contracts | |||||||||||||

| (11) Statement re computation of per share earnings | |||||||||||||

| (12) Statements re computation of ratios | |||||||||||||

| (13) Annual report to security holders, Form 10 Q or quarterly report to security holders | |||||||||||||

| (14) Code of Ethics | |||||||||||||

| (15) Letter re unaudited interim financial information | |||||||||||||

| (16) Letter re change in certifying accountant | |||||||||||||

| (17) Correspondence on departure of director | |||||||||||||

| (18) Letter re change in accounting principles | |||||||||||||

| (19) Report furnished to security holders | |||||||||||||

| (20) Other documents or statements to security holders | |||||||||||||

| (21) Subsidiaries of the registrant | |||||||||||||

| (22) Published report regarding matters submitted to vote of security holders | |||||||||||||

| (23) Consents of experts and counsel | |||||||||||||

| (24) Power of attorney | |||||||||||||

| (25) Statement of eligibility of trustee | |||||||||||||

| (26) Invitation for competitive bids | |||||||||||||

| (27) The FreedomTree Financial Group of Companies Master Plan | |||||||||||||

| (28) -(30) Reserved | |||||||||||||

| (31)(i) Rule 13a 14(a)/15d 14(a) Certifications | |||||||||||||

| (ii) Rule 13a 14/15d 14 Certifications | |||||||||||||

| (32) Section 1350 Certifications | |||||||||||||

| (33) Report on assessment of compliance with servicing criteria for asset backed issuers | |||||||||||||

| (34) Attestation report on assessment of compliance with servicing criteria for asset backed securities | |||||||||||||

| (35) Service compliance statement | |||||||||||||

| (36) (98) [Reserved] | |||||||||||||

| (99) Additional exhibits | |||||||||||||

| (100) XBRL Related Documents | |||||||||||||

| (101) Interactive Data File | |||||||||||||