Attached files

| file | filename |

|---|---|

| EX-99.2 - CHEMICAL FINANCIAL PDF COPY OF EXHIBIT 99.2 - TCF FINANCIAL CORP | chemex992_010810.pdf |

| 8-K - CHEMICAL FINANCIAL FORM 8-K - TCF FINANCIAL CORP | chem8k_010810.htm |

| EX-2.1 - CHEMICAL FINANCIAL EXHIBIT 2.1 TO FORM 8-K - TCF FINANCIAL CORP | chemex21_010810.htm |

| EX-99.1 - CHEMICAL FINANCIAL EXHIBIT 99.1 TO FORM 8-K - TCF FINANCIAL CORP | chemex991_010810.htm |

EXHIBIT 99.2

CHEMICAL FINANCIAL CORPORATION SM & OAK Financial Corporation "Compelling Strategic and Cultural Fit Between Two of Michigan's Stronger Institutions" January 2010

FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements regarding Chemical Financial Corporation's ("Chemical") outlook or expectations with respect to the planned acquisition of O.A.K. Financial Corporation ("OAK"), the expected costs to be incurred in connection with the acquisition, OAK's future performance and consequences of its integration into Chemical, and the impact of the transaction on Chemical's future performance. Words such as "anticipates," "believes," "estimates," "expects," "forecasts," "intends," "is likely," "judgment," "plans," "predicts," "projects," "should," "will," variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation speak only as of the date of this presentation, and each of Chemical and OAK has no duty, and do not undertake, to update them. Actual results or future events could differ, possibly materially, from those that are anticipated in these forward-looking statements. Forward-looking statements are subject to the risks and uncertainties applicable to the respective businesses of Chemical and OAK generally that are disclosed in each company's Annual Report on Form 10-K for the fiscal year ended December 31, 2008 and in each company's current year Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (available on the Security and Exchange Commission's website at http://www.sec.gov/). Forward-looking statements in this presentation are subject to, among others, the following risks and uncertainties related both to the acquisition transaction itself and to the integration of the acquired business into Chemical after closing: Completion of the transaction is dependent on, among other things, receipt of regulatory and OAK shareholder approvals, the timing of which cannot be predicted with precision at this point and which may not be received at all. The impact of the completion of the transaction on Chemical's financial statements will be affected by the timing of the transaction, including in particular the ability to complete the acquisition in the second quarter of 2010. The transaction may be more expensive to complete and the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events. Chemical's ability to achieve anticipated results from the transaction is dependent on the state of the economic and financial markets going forward, which have been under significant stress recently. Specifically, Chemical may incur more credit losses from OAK's loan portfolio than expected and deposit attrition may be greater than expected. The integration of OAK's business and operations into Chemical, which will include conversion of OAK's operating systems and procedures, may take longer than anticipated or be more costly than anticipated or have unanticipated adverse results relating to OAK's or Chemical's existing businesses. Chemical will file a registration statement with the Securities and Exchange Commission to register the securities that the OAK shareholders will receive if the merger is consummated. The registration statement will contain a prospectus and proxy statement and other relevant documents concerning the merger. Investors are urged to read the registration statement, the prospectus and proxy statement, and any other relevant documents when they become available because they will contain important information about Chemical, OAK, and the merger. Investors will be able to obtain the documents free of charge at the Securities and Exchange Commission's website, http://www.sec.gov. The proposed transaction will be submitted to the shareholders of OAK. for their consideration and approval. In connection with the proposed transaction, OAK will be filing a proxy statement and other relevant documents to be distributed to the shareholders of OAK. Investors are urged to read the proxy statement regarding the proposed transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. Investors will be able to obtain a free copy of the proxy statement, as well as other filings containing information about Chemical and OAK, free of charge from the SEC's website (www.sec.gov), by contacting Chemical Financial Corporation, 333 East Main Street, P.O. Box 569, Midland, MI 48640-0569, Attention: Ms. Lori A. Gwizdala, Investor Relations, telephone 800-867-9757 or by contacting O.A.K. Financial Corporation, 2445 84th Street, SW, Byron Center, MI 49315, Attention: Mr. James A. Luyk, Investor Relations, telephone 616-588-7419. INVESTORS SHOULD READ THE PROXY STATEMENT AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TRANSACTION. OAK and its directors, executive officers, and certain other members of management and employees may be soliciting proxies from OAK shareholders in favor of the transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of OAK shareholders in connection with the proposed transaction will be set forth in the proxy statement when it is filed with the SEC. You can find information about OAK's executive officers and directors in its most recent proxy statement filed with the SEC, which is available at the SEC's website (www.sec.gov). You can also obtain free copies of these documents from Chemical or OAK, as appropriate, using the contact information above. CHEMICAL FINANCIAL CORPORATION SM 2

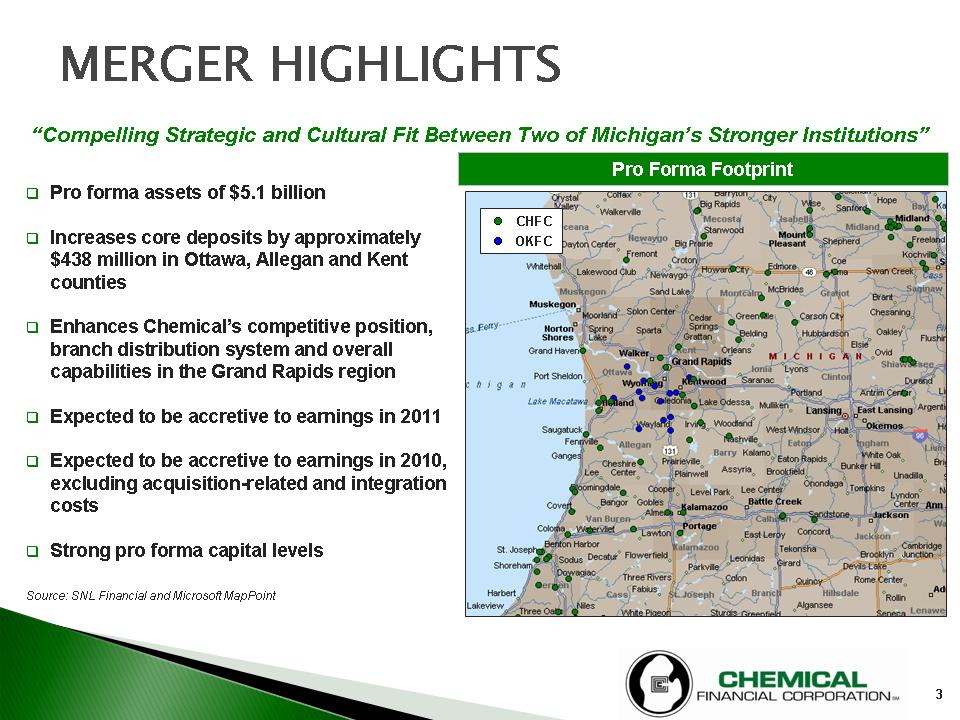

MERGER HIGHLIGHTS "Compelling Strategic and Cultural Fit Between Two of Michigan's Stronger Institutions" Pro forma assets of $5.1 billion Increases core deposits by approximately $438 million in Ottawa, Allegan and Kent counties Enhances Chemical's competitive position, branch distribution system and overall capabilities in the Grand Rapids region Expected to be accretive to earnings in 2011Expected to be accretive to earnings in 2010, excluding acquisition-related and integration costs Strong pro forma capital levels Source: SNL Financial and Microsoft MapPoint Pro Forma Footprint CHFC OKFC CHEMICAL FINANCIAL CORPORATION SM 3

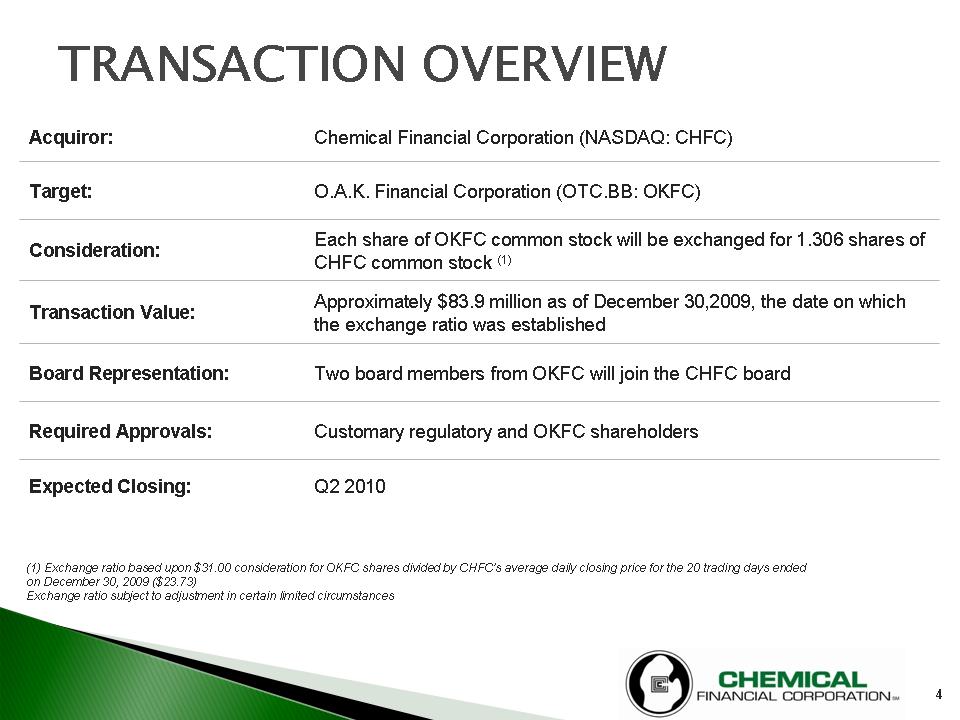

TRANSACTION OVERVIEW Acquiror: Chemical Financial Corporation (NASDAQ: CHFC) Target: O.A.K. Financial Corporation (OTC.BB: OKFC) Consideration: Each share of OKFC common stock will be exchanged for 1.306 shares of CHFC common stock (1)Transaction Value: Approximately $83.9 million as of December 30,2009, the date on which the exchange ratio was established Board Representation: Two board members from OKFC will join the CHFC board Required Approvals: Customary regulatory and OKFC shareholders Expected Closing: Q2 2010 (1) Exchange ratio based upon $31.00 consideration for OKFC shares divided by CHFC's average daily closing price for the 20 trading days ended on December 30, 2009 ($23.73) Exchange ratio subject to adjustment in certain limited circumstances CHEMICAL FINANCIAL CORPORATION SM 4

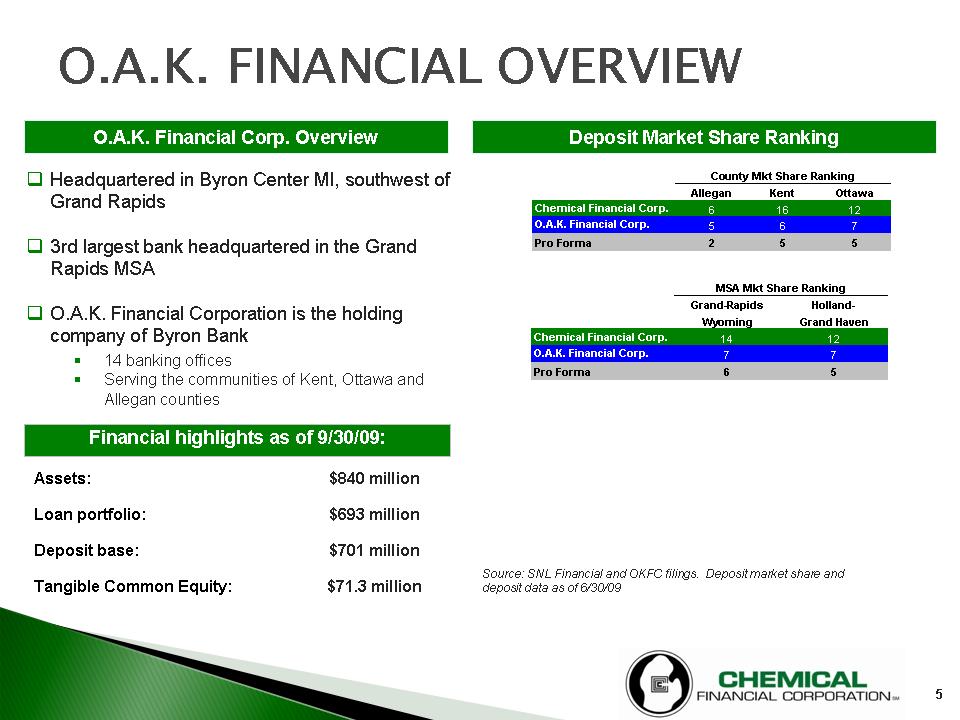

O.A.K. FINANCIAL OVERVIEW O.A.K. Financial Corp. Overview Headquartered in Byron Center MI, southwest of Grand Rapids 3rd largest bank headquartered in the Grand Rapids MSA O.A.K. Financial Corporation is the holding company of Byron Bank 14 banking offices Serving the communities of Kent, Ottawa and Allegan counties Financial highlights as of 9/30/09: Assets: $840 million Loan portfolio: $693 million Deposit base: $701 million Tangible Common Equity: $71.3 million Deposit Market Share Ranking County Mkt Share Ranking Allegan Kent Ottawa Chemical Financial Corp. 6 16 12 O.A.K. Financial Corp. 5 6 7 Pro Forma 2 5 5 MSA Mkt Share Ranking Grand-Rapids Wyoming Holland-Grand Haven Chemical Financial Corp. 14 12 O.A.K. Financial Corp. 7 7 Pro Forma 6 5 Source: SNL Financial and OKFC filings. Deposit market share and deposit data as of 6/30/09 CHEMICAL FINANCIAL CORPORATION SM 5

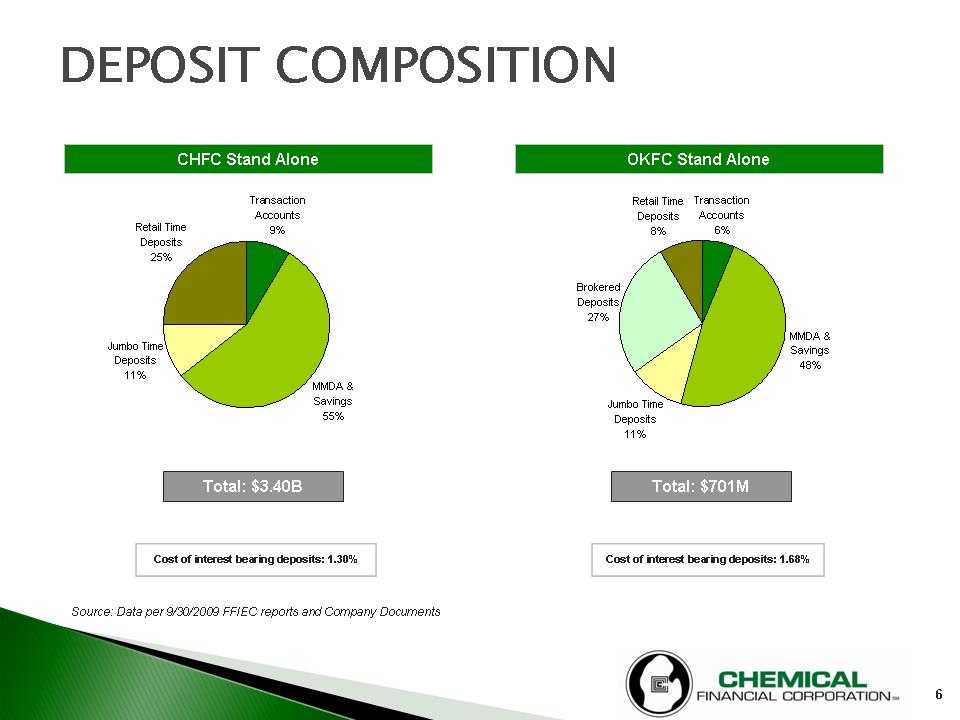

DEPOSIT COMPOSITION CHFC Stand Alone Transaction Accounts 9% MMDA & Savings 55% Jumbo Time Deposits 11% Retail Time Deposits 25% Total: $3.40B Cost of interest bearing deposits: 1.30% Source: Data per 9/30/2009 FFIEC reports and Company Documents OKFC Stand Alone Transaction Accounts 6% MMDA & Savings 48% Jumbo Time Deposits 11% Brokered Deposits 27% Retail Time Deposits 8% Total: $701M Cost of interest bearing deposits: 1.68% CHEMICAL FINANCIAL CORPORATION SM 6

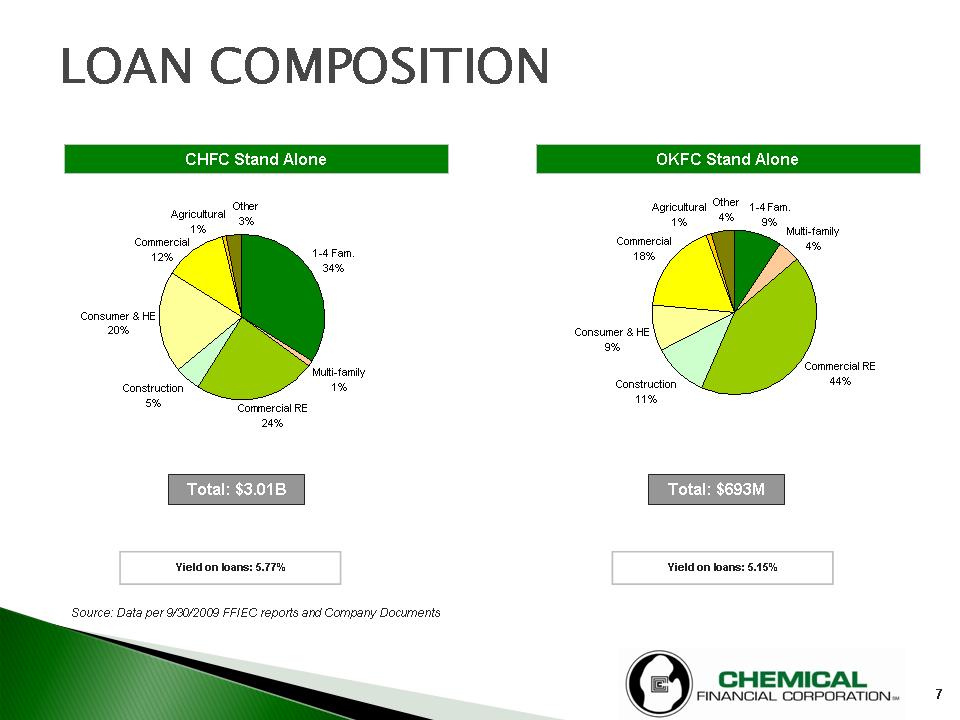

LOAN COMPOSITION CHFC Stand Alone Other 3% 1-4 Fam. 34% Multi-family 1% Commercial RE 24% Construction 5% Consumer & HE 20% Commercial 12% Agricultural 1% Total $3.01B Yield on loans: 5.77% Source: Data per 9/30/2009 FFIEC reports and Company Documents OKFC Stand Alone Other 4% 1-4 Fam. 9% Multi-family 4% Commercial RE 44% Construction 11% Consumer & HE 9% Commercial 18% Agricultural 1% Total: $693M Yield on loans: 5.15% CHEMICAL FINANCIAL CORPORATION SM 7

FINANCIAL IMPACT Expected to be accretive to earnings in 2011 Expected to be accretive to earnings in 2010, excluding acquisition-related and integration costs Expected to result in the reduction of approximately $3.8 million of OKFC's annual operating expenses CHFC conducted thorough credit due diligence which resulted in estimated fair value credit adjustments in OKFC's current loan portfolio that lower the recorded carrying amount of OKFC's net loans between 3 percent and 5 percent Pro forma capital ratios continue to remain strong CHEMICAL FINANCIAL CORPORATION SM 8

CHEMICAL FINANCIAL CORPORATION SM & OAK Financial Corporation "Compelling Strategic and Cultural Fit Between Two of Michigan's Stronger Institutions" January 2010