Attached files

| file | filename |

|---|---|

| 8-K - UIL FORM 8-K DATED JANUARY 7, 2010 - UIL HOLDINGS CORP | uil_form8kdated010710.htm |

| EX-99.1 - UIL EXHIBIT 99.1 - UIL HOLDINGS CORP | exh99-1.htm |

EXHIBIT

99

December

14, 2009

Ms.

Kimberley J. Santopietro

Executive

Secretary

Department

of Public Utility Control

10

Franklin Square

New

Britain, CT 06051

|

Re:

|

Docket

No. 10-01-02– Administrative Proceeding to Incorporate DPUC Approved Power

Supply Procurement Results into The United Illuminating Company's Standard

Service and Last Resort Service Rates and Charges Effective January 1,

2010 - REVISED

|

|

|

Dear

Ms. Santopietro,

|

On December 8, 2009, The United

Illuminating Company (“UI” or the “Company”) filed its proposal in the

above-referenced docket to enable the Department of Public Utility Control

(“DPUC” or “Department”) to establish total new Standard Service and Last Resort

Service Rates that will take effect on January 1, 2010. Subsequent to

that filing, the December 2009 Transmission Adjustment Clause (“TAC”) filing was

finalized. The results of that filing, which was filed in Docket No.

09-12-01 on December 14, 2009, have now been incorporated in this revised

proposal. In addition, the proposed GSC rates have been further

reduced to reflect a lower working capital balance ($5 million vs. the

originally proposed $9.1 million). Finally, the amount of the 2010

estimated pension expense that is proposed to be incorporated into rates

effective January 1, 2010 has been reduced ($11.4 million vs. the original

amount of $12.153 million included in the December 8, 2009

filing). These two additional adjustments were incorporated into the

Company’s proposal in order to not increase Residential Rate R on January 1,

2010 as a result of this complete proposal.

The

Company proposes the following for each rate component:

1. Generation Services

Charge (GSC) – On November 25, 2009, the Company filed revised exhibits

in this docket incorporating the results of the Company’s power procurements for

2010, and updating its November 16, 2009 filing. These GSC rates also

incorporate (1) the adder to recover the GSC-allocated costs, which were

included in the GSC per the final decision dated February 4, 2009 in Docket No.

08-07-04 (“Rate Case Decision”), and (2) the estimated

adder

pertaining to the Company’s “Type B” procurements. In this revised

proposal, as noted above, the proposed GSC rates have been further reduced. The

adder necessary to recover the GSC-allocated costs has been reduced from 0.2477

cents per kWh to 0.0792 cents per kWh (to reflect a lower working capital

balance as noted above), a reduction of 0.1685 cents per kWh for all Standard

Service and Last Resort Service GSC rates from the rates that were included in

the December 8, 2009 proposal. Additionally, the Company identified

an overstatement in the previously submitted base GSC rates of 0.0594 cents per

kWh contained in Second Revised Exhibit 4. Incorporating all of these

changes results in the proposed GSC rates shown on Third Revised Exhibit 4, page

2 of 4.

2. Nonbypassable Federally

Mandated Congestion Charge (NBFMCC) – In its November 16, 2009 filing in

this docket, the Company included proposed NBFMCC rates as determined in its

response to Interrogatory EL-31 in Docket No. 09-08-01. In that

response, the Company proposed an NBFMCC rate of $0.00 per kWh, which would

preserve a working capital balance of approximately $5 million. The

Department’s Draft Decision in Docket No. 09-08-01, dated December 2, 2009,

determined that the appropriate NBFMCC rate to be effective as of January 1,

2010 should be based on the latest projections available for 2010. As

of the date of this filing, the projections that were filed in response to

Interrogatory EL-31 in Docket No. 09-08-01 are the latest

available. However, upon further review, the Company’s proposal is to

set the NBFMCC rate so that the projected December 31, 2010 NBFMCC working

capital balance will be $0. This will result in the NBFMCC rate being

a credit on customers’ bills. The proposed NBFMCC rates are shown on

Exhibit 6 submitted on December 8, 2009.

3. Systems Benefits Charge

(SBC) – In Docket No. 99-03-35RE15, the Department approved a change in

UI’s SBC rate effective as of January 1, 2010. This rate change was

incorporated in UI’s previous filings in this docket and is also shown in the

attached Third Revised Exhibit 4.

4. Transmission –

On December 14, 2009, the Company filed its request to adjust the TAC

rate in Docket No. 09-12-01, DPUC Semi-Annual Review of The

Connecticut Light and Power Company and The United Illuminating Company's

Transmission Adjustment Clause. The administrative proceeding

in that docket has already been scheduled for December 22, 2009. The

filed TAC rate is now incorporated into the Company’s revised proposal in this

docket. The Company requests that the Department take administrative notice of

the final TAC rate from Docket No. 09-12-01 and incorporate the results into

total rates effective as of January 1, 2010.

5. Competitive Transition

Assessment (CTA) – Per the Department’s Decision in Docket No.

99-03-35RE15, there is no proposed change in the CTA rate.

6. Conservation and Load Management

(CLM) Charge and Renewable Energy Investment (REI) Charge – There is no

proposed change in the CLM or REI rates.

7. Distribution -- The

proposed distribution rate effective as of January 1, 2010, factoring in all of

the items listed below, is shown on the attached Third Revised Exhibit

4.

2

(a) Implementation of Step

Increase – The Rate Case Decision in Docket No. 08-07-04 approved an

increase in distribution revenue for 2010 of $19.14 million. As

stated on page 139 of that decision, “The Department has closed the

proceeding and has determined all adjustments for 2010 except the pension

expense”. In order to minimize the number and frequency of rate

changes that will be experienced by UI’s customers, the Company proposes to make

this increase effective as of January 1, 2010 instead of February 4, 2010, with

an offset (described below) to the decoupling adjustment. The

incremental distribution revenue attributable to the January 1, 2010

implementation date (34 days of incremental revenue, January 1 – February 3) is

estimated to be $1.8 million. The derivation of this incremental

revenue, coupled with the additional incremental revenue from the adjustments

described in sections 7(b) through 7(e) below, is shown on the attached Revised

Exhibit 5. This incremental revenue will be used to benefit customers

by offsetting the accumulated charge in the decoupling adjustment (item 7(f)

below).

(b) Pension & OPEB

Regulatory Asset (for 2009 Pension Expense) – In Docket No. 08-07-04, the

Department established a regulatory asset of $10.232 million (see Rate Case

Decision, at 57). As stated on page 52 of the Rate Case

Decision,

The

Department approves the expense but in order to mitigate the impact on

ratepayers’ bills, and as suggested by the Company, the Department will

establish a regulatory asset for the increase in the pension and OPEB expenses

as a result to the change in the year end discount rates for 2008, not reflected

in approved rates for 2009 of $10.2 million, without earning a return on this

deferral.

The

Company proposes to incorporate this regulatory asset into distribution rates

effective January 1, 2010. While the Rate Case Decision is silent on

the timing of the resolution of the regulatory asset for the 2009 pension

expense, it is reasonable to assume that recovery would have been anticipated to

occur during the February 4, 2010 – February 3, 2011 rate

year. Implementing the recovery beginning January 1, 2010 yields

incremental revenue of approximately $1.0 million, similar to the implementation

of the distribution step increase discussed above. The Company would

propose the same treatment as discussed in item No. 7(a) above

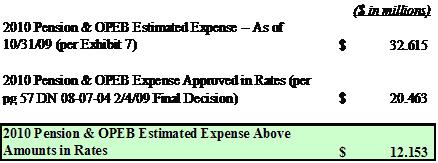

(c) Pension & OPEB

Expense - 2010 – On December 2, 2009, the Department reopened Docket No.

08-07-04 for the limited purpose of “examining UI’s pension and OPEB

expenses and to consider modifications to the approved distribution rates for

2010 so that rates can begin January 1, 2010”. In this

filing, the Company is providing a calculation of the estimated 2010 pension and

OPEB expense based on plan asset values and the applicable discount rate as of

October 31, 2009. Details of the assumptions used in this calculation

are on Exhibit 7 which was filed on December 8, 2009. The resulting

estimated incremental 2010 pension and OPEB expense that is above the amount

already included in rates is $12.153 million.

3

The Company proposes that a portion of this estimated incremental pension expense be incorporated into rates on January 1, 2010. In order to avoid an increase to Residential Rate R on January 1, 2010 as a result of this complete proposal, the Company has included $11.4 million of the 2010 estimated pension expense into rates, effective January 1, 2010. Similarly to the 2009 pension and OPEB expense discussed in item No. 7(b) above, incremental revenue of approximately $1.2 million generated by including the 2010 pension and OPEB expense in rates as of January 1, 2010 as opposed to February 4, 2010 is proposed to be netted against the decoupling adjustment.

In

January 2010, the Company will file the final 2010 pension and OPEB expense

values, based on plan asset values and the applicable discount rate as of

December 31, 2009, as contemplated in the Rate Case Decision. Any

difference between the final 2010 pension and OPEB expense and the portion of

the estimated pension and OPEB expense which has been included in rates ($11.4

million) will be established as a regulatory asset or liability for future

recovery or credit.

(d) Reconsideration 2009

Regulatory Asset (for 2009 Reconsideration Revenues) – The June 2, 2009

decision on reconsideration in Docket No. 08-07-04 approved an increase in

distribution revenue of $0.655 million for the 2009 rate year. In

accordance with pages 58, 78 and 111 of that decision, this amount has been

added to the $10.232 million 2009 pension expense regulatory asset described in

item 7(b) above. Similar to the 2009 pension expense regulatory

asset, recovery of the 2009 reconsideration amount is necessary to recoup the

one-time revenue requirement shortfall from 2009. Implementing the

recovery beginning January 1, 2010 yields incremental revenue of approximately

$0.1 million, similar to the implementation of the distribution step increase

discussed above. Again, this incremental revenue is proposed to be

netted against the decoupling adjustment.

(e) Reconsideration 2010

Revenue – The June 2, 2009 decision on reconsideration in Docket No.

08-07-04 also approved an increase in distribution revenue of $0.939 million for

the 2010 rate year. Similar to the 2010 pension expense in item 7(c)

above, recovery of

the full 2010 $0.939 million revenue requirement shortfall is necessary to

recoup in rates the ongoing revenue requirement adjustment approved by the

Department. Implementing the recovery beginning January 1, 2010

yields incremental revenue of approximately $0.1 million, similar to the

implementation of the distribution step increase discussed

above. Again, this incremental revenue is proposed to be netted

against the decoupling adjustment.

4

(f) Decoupling

Adjustment – In Docket No. 08-07-04, the Department approved a decoupling

mechanism as a two-year pilot (see Rate Case Decision, at

126). According to the Department-approved Decoupling Rider, the

Company will file the results of the decoupling mechanism within 60 days of the

close of the rate year on February 3, 2010 (i.e., by April 4,

2010). Subsequent to that filing, the appropriate charge or credit to

customers will be determined. Based on the latest information available as of

September 30, 2009, the decoupling mechanism has accumulated a $6.5 million

charge, and the Company anticipates that the April 2010 filing will necessitate

a charge to customers. The estimated incremental revenue resulting

from the proposed recoveries above in items 7(a) – (e) above to be netted

against the decoupling adjustment is projected to be $4.1m (see Revised Exhibit

5). The Company does not propose any change to the operation of the

previously approved Decoupling Rider.

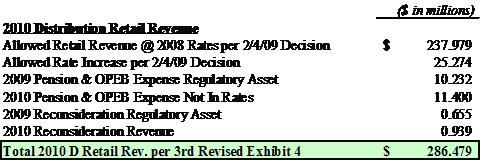

(g) 2010 Retail Revenue

Requirement Summary – The final 2010 distribution retail revenue

requirement incorporating all of the proposed adjustments above for rates

effective as of January 1, 2010 is $286.5 million (see Third Revised Exhibit 4,

page 4 of 4). The table below provides a detailed reconciliation from

the Rate Case Decision to the amount shown on Third Revised Exhibit

4.

Final Resulting Retail

Rates

Third Revised Exhibit 4 shows the total

Standard Service and Last Resort Service rates incorporating the Company’s

proposal. The total system average Standard Service retail rate will

decrease from 21.8283 to 21.5934, a decrease of 0.2349 cents per kWh, or

1.08%. Residential Rate R will remain at 23.9180 cents per kWh. In

order to incorporate these changes into rates on January 1, 2010, the Company

respectfully requests approval not later than December 23, 2009.

Please contact me if there are any

questions with respect to this filing.

Respectfully

submitted,

By

_______________________

Michael

A. Coretto

Associate

Vice President – Regulatory & Legislative Affairs

cc: Service List

5