Attached files

Exhibit 10.5

AMENDED AND RESTATED SECURITY AGREEMENT

THIS AMENDED AND RESTATED SECURITY AGREEMENT (this “Agreement”), dated as of June 19, 2009, is entered into by and among each of the parties signatory hereto as Grantors (including any permitted successors and assigns, collectively, the “Grantors” and each a “Grantor”), and Bank of America, N.A., as Administrative Agent (“Administrative Agent”), for the ratable benefit of each Secured Party (as hereinafter defined).

BACKGROUND.

A. Bank of America, N.A., as Administrative Agent, Swing Line Lender and L/C Issuer, the Lenders party thereto, and Texas Industries, Inc., a Delaware corporation (the “Borrower”), entered into the First Amended and Restated Credit Agreement dated as of August 15, 2007 (as amended by a First Amendment dated January 28, 2008, a Second Amendment dated March 20, 2008 and a Third Amendment dated November 21, 2008, the “Existing Credit Agreement”).

B. In connection with the Existing Credit Agreement, the Grantors entered into that certain Security Agreement dated November 21, 2008 (the “Existing Security Agreement”), pursuant to which the Grantors granted a first priority security interest in personal property of the Grantors to Administrative Agent.

C. Concurrently herewith, the Borrower, Administrative Agent and the Required Lenders are entering into a Second Amended and Restated Credit Agreement (the “Credit Agreement”), pursuant to which the Existing Credit Agreement will be amended and restated in its entirety.

D. It is a condition precedent to effectiveness of the Credit Agreement that the Grantors shall have executed and delivered to Administrative Agent this Agreement which amends and restates the Existing Security Agreement.

AGREEMENT.

NOW, THEREFORE, in consideration of the premises set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and in order to induce the Secured Parties to enter into the Credit Agreement and continue to make Loans and the L/C Issuer to continue to issue Letters of Credit under the Credit Agreement and to extend other credit accommodations under the Loan Documents, each Grantor hereby agrees with Administrative Agent, for the ratable benefit of the Secured Parties, to amend and restate the Existing Security Agreement as follows, and hereby further agrees as follows:

ARTICLE I

DEFINITIONS

1.1. Definitions. For purposes of this Agreement:

1

“Accession” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to an accession (as defined in the UCC), and (whether or not included in that definition), a good that is physically united with another good in such a manner that the identity of the original good is not lost.

“Account” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to an account (as defined in the UCC), and (whether or not included in such definition), a right to payment of a monetary obligation, whether or not earned by performance, for property that has been or is to be sold, leased, licensed, assigned, or otherwise disposed of, and for service rendered or to be rendered, and all right, title, and interest in any such returned property, together with all rights, titles, securities, and guarantees with respect thereto, including any rights to stoppage in transit, replevin, reclamation, and resales, and all related Liens whether voluntary or involuntary.

“Account Debtor” means any Person who is or who may become obligated to each Grantor under, with respect to or on account of an Account.

“Aggregates” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to all stone, sand, gravel, limestone and similar minerals, including, but not limited to, all such materials that constitute As-Extracted Collateral (excluding oil and gas).

“As-Extracted Collateral” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to as-extracted collateral (as defined in the UCC), and (whether or not included in such definition) all oil, gas and other minerals extracted by any Grantor from real estate and all accounts arising out of the sale at the wellhead or minehead of oil, gas and other minerals.

“Chattel Paper” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to chattel paper (as defined in the UCC), and (whether or not included in such definition) a Record or Records that evidence both a monetary obligation and a security interest in specific Goods, a security interest in specific Goods and Software used in the Goods, or a lease of specific Goods.

“Collateral” means all (a) Accounts, (b) Accessions, (c) Chattel Paper, (d) Commercial Tort Claims, including but not limited to the specific Commercial Tort Claims described on Schedule 7, (e) Commodity Accounts, (f) Commodity Contracts, (g) Deposit Accounts, (h) Documents, (i) Equipment, (j) Financial Assets, (k) General Intangibles, (l) Goods, (m) Intellectual Property, (n) Instruments, (o) Inventory, (p) Investment Property, (q) Letters of Credit, (r) Letter-of-Credit Rights, (s) Payment Intangibles, (t) Permits, (u) Securities, (v) Securities Accounts, (w) Security Entitlements, (x) Software, (y) supporting obligations, (z) cash and cash accounts, (aa) Proceeds, (ab) products of Collateral, (ac) Collateral Records, (ad) Insurance, (ae) Money, and (af) Pledged Equity Interests, provided that “Collateral” does not include any fixtures or real property or any property or assets subject to a Lien permitted by clause (f) of the definition of “Permitted Liens” in the Credit Agreement.

2

“Collateral Records” shall mean books, records, ledger cards, files, correspondence, customer lists, blueprints, technical specifications, manuals, computer software, computer printouts, tapes, disks and related data processing software and similar items that at any time evidence or contain information relating to any of the Collateral or are otherwise necessary or helpful in the collection thereof or realization thereupon.

“Commercial Tort Claim” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a commercial tort claim (as defined in the UCC), and (whether or not included in such definition), all claims arising in tort with respect to which the claimant (a) is an organization, or (b) an individual and the claim (i) arose in the course of the claimant’s business or profession, and (ii) does not include damages arising out of personal injury to or the death of an individual.

“Commodity Account” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a commodity account (as defined in the UCC), and (whether or not included in such definition), an account maintained by a Commodity Intermediary in which a Commodity Contract is carried for a Commodity Customer.

“Commodity Contract” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a commodity futures contract, an option on a commodity futures contract, a commodity option, or any other contract if the contract or option is (a) traded on or subject to the rules of a board of trade that has been designated as a contract market for such a contract pursuant to the federal commodities Laws, or (b) traded on a foreign commodity board of trade, exchange, or market, and is carried on the books of a Commodity Intermediary for a Commodity Customer.

“Commodity Customer” means a Person for whom a Commodity Intermediary carries a Commodity Contract on its books.

“Commodity Intermediary” means (a) a Person that is registered as a futures commission merchant under the federal commodities Laws or (b) a Person that in the ordinary course of its business provides clearance or settlement services for a board of trade that has been designated as a contract market pursuant to federal commodities Laws.

“Copyright License” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to any written agreement, now or hereafter in effect, granting any right to any third party under any Copyright now or hereafter owned by each such Grantor or which each such Grantor otherwise has the right to license, or granting any right to each such Grantor under any Copyright now or hereafter owned by any third party, and all rights of each such Grantor under any such agreement.

“Copyrights” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to (a) all copyright rights in any work subject to the copyright Laws of any Governmental Authority, whether as author, assignee, transferee, or otherwise set forth on Schedule 5(d), (b) all registrations and applications for registration of any such copyright in any Governmental Authority, including registrations,

3

recordings, supplemental registrations, and pending applications for registration in any jurisdiction, and (c) all rights to use and/or sell any of the foregoing.

“Deposit Account” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a deposit account (as defined in the UCC), and (whether or not included in such definition), a demand, time, savings, passbook, or similar account maintained at a bank (as defined in the UCC).

“Document” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a document (as defined in the UCC), and (whether or not included in such definition), a document of title, bill of lading, dock warrant, dock receipt, warehouse receipt, or order for the delivery of Goods.

“Electronic Chattel Paper” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to electronic chattel paper (as defined in the UCC), and (whether or not included in such definition), chattel paper evidenced by a Record or Records consisting of information stored in electronic medium.

“Entitlement Holder” means a Person identified in the records of a Securities Intermediary as the Person having a Security Entitlement against the Securities Intermediary. If a Person acquires a Security Entitlement by virtue of Section 8.501(b)(2) or (3) of the UCC, such Person is the Entitlement Holder.

“Equipment” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to equipment (as defined in the UCC), and (whether or not included in such definition), all Rolling Stock and Goods other than Inventory, farm products or consumer goods, and all improvements, accessions, or appurtenances thereto.

“Financial Asset” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a financial asset (as defined in the UCC), and (whether or not included in such definition), (a) a Security, (b) an obligation of a Person or a share, participation or other interest in a Person or in property or an enterprise of a Person, that is, or is of a type, dealt in or traded on financial markets or that is recognized in any area in which it is issued or dealt in as a medium for investment, or (c) any property that is held by a Securities Intermediary for another Person in a Securities Account if the Securities Intermediary has expressly agreed with the other Person that the property is to be treated as a financial asset under Chapter 8 of the UCC. As the context requires, “Financial Asset” means either the interest itself or the means by which a Person’s claim to it is evidenced, including a certificated or uncertificated Security, a certificate representing a Security, or a Security Entitlement.

“General Intangible” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a general intangible (as defined in the UCC), and (whether or not included in such definition) all other personal property, including things in action, other than Accounts, Chattel Paper, Commercial Tort Claims, Deposit

4

Accounts, Documents, Goods, Instruments, Investment Property, Letter-of-Credit Rights, Letters of Credit, Money, and oil, gas or other minerals before extraction.

“Goods” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to goods (as defined in the UCC).

“Governmental Authority” means any nation or government, any state or other political subdivision thereof, any agency, authority, instrumentality, regulatory body, court, administrative tribunal, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government, and any corporation or other entity owned or controlled, through stock or capital ownership or otherwise, by any of the foregoing.

“Instrument” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to an instrument (as defined in the UCC), and (whether or not included in such definition), a negotiable instrument or any other writing that evidences a right to the payment of a monetary obligation, is not itself a security agreement or lease, and is of a type that in ordinary course of business is transferred by delivery with any necessary indorsement or assignment.

“Insurance” shall mean all right, title and interest to insurance policies covering any or all of the Collateral (regardless of whether Administrative Agent is the loss payee thereof).

“Intellectual Property” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to all Patents, Copyrights, Licenses, Trademarks, Trade Secrets, confidential or proprietary technical and business information, know-how, show-how or other data or information, Software and databases and all embodiments or fixations thereof and related documentation, registrations and franchises, and all additions, improvements and accessions to, and books and records describing or used in connection with, any of the foregoing.

“Inventory” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to inventory (as defined in the UCC), and (whether or not included in such definition), Goods (other than farm products) that (a) are leased by such Grantor as lessor, (b) are held by such Grantor for sale or lease or to be furnished under a contract of service, (c) are furnished by such Grantor under a contract of service, or (d) consist of raw materials (including Aggregates), work in process, or materials used or consumed in a business, including packaging materials, scrap material, manufacturing supplies and spare parts, and all such Goods that have been returned to or repossessed by or on behalf of such Grantor.

“Investment Property” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to investment property (as defined in the UCC), and (whether or not included in such definition), a Security (whether certificated or uncertificated), a Security Entitlement and a Securities Account.

5

“Letter of Credit” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a letter of credit (as defined in the UCC).

“Letter-of-Credit Right” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a letter-of-credit right (as defined in the UCC), and (whether or not included in such definition), a right to payment or performance under a letter of credit, whether or not the beneficiary has demanded or is at the time entitled to demand payment or performance.

“License” means any Patent License, Trademark License, Copyright License, or other similar license or sublicense.

“Money” shall mean “money” as defined in the UCC.

“Patent License” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to any written agreement, now or hereafter in effect, granting to any third party any right to make, use or sell any invention on which a Patent, now or hereafter owned by each such Grantor or which each such Grantor otherwise has the right to license, is in existence, or granting to each such Grantor any right to make, use or sell any invention on which a Patent, now or hereafter owned by any third party, is in existence, and all rights of each such Grantor under any such agreement.

“Patents” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to (a) all letters patent of any Governmental Authority set forth on Schedule 5(b), all registrations and recordings thereof, and all applications for letters patent of any Governmental Authority set forth on Schedule 5(c), and (b) all reissues, continuations, divisions, continuations-in-part, renewals, or extensions thereof, and the inventions disclosed or claimed therein, including the right to make, use and/or sell the inventions disclosed or claimed therein.

“Payment Intangible” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to a payment intangible (as defined in the UCC), and (whether or not included in such definition), a General Intangible under which the Account Debtor’s principal obligation is a monetary obligation.

“Permit” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to any authorization, consent, approval, permit, license or exemption of or from a Governmental Authority, together with any registration or filing with, or report or notice to, any such Governmental Authority as part of such authorization, consent, approval, permit, license or exemption.

“Pledged Equity Interests” shall mean all Pledged Stock, Pledged LLC Interests, Pledged Partnership Interests and Pledged Trust Interests, provided, however, notwithstanding anything herein to the contrary, the amount of pledged equity interests of any Foreign Subsidiary pledged by any Grantor shall be limited to 66% of the issued and outstanding equity interests of such Foreign Subsidiary owned directly by such Grantor.

6

“Pledged LLC Interests” shall mean, with respect to each Grantor, all interests of such Grantor in any limited liability company and the certificates, if any, representing such limited liability company interests and any interest of such Grantor on the books and records of such limited liability company or on the books and records of any Securities Intermediary pertaining to such interest and all dividends, distributions, cash, warrants, rights, options, instruments, securities and other property or proceeds from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of such limited liability company interests, provided, however, notwithstanding anything herein to the contrary, the amount of pledged limited liability company interests of any Foreign Subsidiary pledged by any Grantor shall be limited to 66% of the issued and outstanding limited liability company interests of such Foreign Subsidiary owned directly by such Grantor.

“Pledged Partnership Interests” shall mean, with respect to each Grantor, all interests of such Grantor in any general partnership, limited partnership, limited liability partnership or other partnership and the certificates, if any, representing such partnership interests and any interest of such Grantor on the books and records of such partnership or on the books and records of any Securities Intermediary pertaining to such interest and all dividends, distributions, cash, warrants, rights, options, instruments, securities and other property or proceeds from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of such partnership interests, provided, however, notwithstanding anything herein to the contrary, the amount of pledged general partnership, limited partnership, limited liability partnership or other partnership interests of any Foreign Subsidiary pledged by any Grantor shall be limited to 66% of the issued and outstanding general partnership, limited partnership, limited liability partnership or other partnership interests of such Foreign Subsidiary owned directly by such Grantor.

“Pledged Stock” shall mean, with respect to each Grantor, all shares of capital stock owned by such Grantor and the certificates, if any, representing such shares and any interest of such Grantor on the books of the issuer of such shares or on the books of any Securities Intermediary pertaining to such shares, and all dividends, distributions, cash, warrants, rights, options, instruments, securities and other property or proceeds from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of such shares, provided, however, notwithstanding anything herein to the contrary, the amount of pledged capital stock of any Foreign Subsidiary pledged by any Grantor shall be limited to 66% of the issued and outstanding capital stock of such Foreign Subsidiary owned directly by such Grantor.

“Pledged Trust Interests” shall mean, with respect to each Grantor, all interests of such Grantor in a business trust or other trust and the certificates, if any, representing such trust interests and any interest of such Grantor on the books and records of such trust or on the books and records of any Securities Intermediary pertaining to such interest and all dividends, distributions, cash, warrants, rights, options, instruments, securities and other property or proceeds from time to time received, receivable or otherwise distributed in respect of or in exchange for any or all of such trust interests.

“Proceeds” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to proceeds (as defined in the UCC) of Collateral, and (whether or not included in such definition), (a) whatever is acquired upon the

7

sale, lease, license, exchange, or other disposition of the Collateral, (b) whatever is collected on, or distributed on account of, the Collateral, (c) rights arising out of the Collateral, (d) claims arising out of the loss, nonconformity, or interference with the use of, defects or infringement of rights in, or damage to the Collateral, (e) insurance payable by reason of the loss or nonconformity of, defects or infringement of rights in, or damage to the Collateral, and (f) any and all other amounts from time to time paid or payable under or in connection with any of the Collateral.

“Record” means information that is inscribed on a tangible medium or that is stored in an electronic or other medium and is retrievable in perceivable form.

“Release Date” means the date on which all of the conditions set forth in Section 9.10(a)(i) of the Credit Agreement have been satisfied.

“Responsible Senior Officer” means the chief financial officer, general counsel or treasurer of the Borrower.

“Rolling Stock” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to all locomotives, railcars, automobiles, trucks, trailers, tractors, bulldozers, scrapers, loaders, forklifts and other motor vehicles and mobile equipment.

“Secured Party” has the meaning given to such term in the Credit Agreement.

“Secured Obligations” has the meaning given to such term in the Credit Agreement.

“Securities Account” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to an account to which a Financial Asset is or may be credited in accordance with an agreement under which the Person maintaining the account undertakes to treat the Person for whom the account is maintained as entitled to exercise rights that comprise the Financial Asset.

“Securities Collateral” has the meaning specified in Section 4.5.

“Securities Intermediary” means (a) a clearing corporation, or (b) a Person, including a bank or broker, that in the ordinary course of its business maintains securities accounts for others and is acting in that capacity.

“Security” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to any obligation of an issuer or any share, participation or other interest in an issuer or in property or an enterprise of an issuer which (a) is represented by a certificate representing a security in bearer or registered form, or the transfer of which may be registered upon books maintained for that purpose by or on behalf of the issuer, (b) is one of a class or series or by its terms is divisible into a class or series of shares, participations, interests or obligations, and (c)(i) is, or is of a type, dealt with or traded on securities exchanges or securities markets or (ii) is a medium for investment and by its terms expressly provides that it is a security governed by Chapter 8 of the UCC.

8

“Security Entitlements” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to the rights and property interests as and of an Entitlement Holder with respect to a Financial Asset.

“Software” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to software (as defined in the UCC), and (whether or not included in such definition), a computer program (including both source and object code) and any supporting information provided in connection with a transaction relating to the program.

“Tangible Chattel Paper” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to tangible chattel paper (as defined in the UCC), and (whether or not included in such definition), chattel paper evidenced by a Record or Records consisting of information that is inscribed on a tangible medium.

“Trade Secrets” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to all trade secrets, know-how, inventions, processes, methods, information, data, plans, blueprints, specifications, designs, drawings, engineering reports, test reports, materials standards, processing standards and performance standards, and all Software directly related thereto, and all Licenses or other agreements to which such Grantor is a party with respect to any of the foregoing.

“Trademark License” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to any written agreement, now or hereafter in effect, granting to any third party any right to use any Trademark now or hereafter owned by such Grantor or which such Grantor otherwise has the right to license, or granting to such Grantor any right to use any Trademark now or hereafter owned by any third party, and all rights of such Grantor under any such agreement.

“Trademarks” means all right, title, and interest of each Grantor (in each case whether now or hereafter existing, owned, arising, or acquired) in and to (a) all trademarks, service marks, trade names, corporate names, company names, business names, fictitious business names, trade styles, trade dress, logos, other source or business identifiers, designs and general intangibles of like nature, all registrations and recordings thereof set forth on Schedule 5(a), and all registration and recording applications filed with any Governmental Authority in connection therewith, and all extensions or renewals thereof, (b) all goodwill associated therewith or symbolized thereby, (c) all other assets, rights and interests that uniquely reflect or embody such goodwill, (d) all rights to use and/or sell any of the foregoing, and (e) the portion of the business to which each trademark pertains.

“UCC” means Chapters 8 and 9 of the Uniform Commercial Code as in effect from time to time in the State of Texas.

1.2. Other Definitional Provisions. Capitalized terms not otherwise defined herein have the meaning specified in the Credit Agreement, and, to the extent of any conflict, terms as

9

defined in the Credit Agreement shall control (provided, that a more expansive or explanatory definition shall not be deemed a conflict).

1.3. Construction. Unless otherwise expressly provided in this Agreement or the context requires otherwise, (a) the singular shall include the plural, and vice versa, (b) words of a gender include the other genders, (c) monetary references are to Dollars, (d) time references are to Dallas time, (e) references to “Articles,” “Sections,” “Exhibits,” and “Schedules” are to the Articles, Sections, Exhibits, and Schedules of and to this Agreement, (f) headings used in this Agreement are for convenience only and shall not be used in connection with the interpretation of any provision hereof, (g) references to any Person include that Person’s heirs, personal representatives, successors, trustees, receivers, and permitted assigns, that Person as a debtor-in possession, and any receiver, trustee, liquidator, conservator, custodian, or similar party appointed for such Person or all or substantially all of its assets, (h) references to any Law include every amendment or restatement to it, rule and regulation adopted under it, and successor or replacement for it, (i) references to a particular Loan Document include each amendment or restatement to it made in accordance with the Credit Agreement and such Loan Document, and (j) the inclusion of Proceeds in the definition of “Collateral” shall not be deemed a consent by the Secured Parties to any sale or other disposition of any Collateral not otherwise specifically permitted by the terms of the Credit Agreement or this Agreement. This Agreement is a Loan Document.

ARTICLE II

GRANT OF SECURITY INTEREST

2.1. Assignment and Grant of Security Interest. As security for the payment and performance, as the case may be, in full of the Secured Obligations, each Grantor hereby ratifies and confirms its assignment, pledge and grant to Administrative Agent (pursuant to the Existing Security Agreement), for its benefit and the ratable benefit of the other Secured Parties, of:

(a) a security interest in the entire right, title, and interest of Grantor in and to all Collateral of each such Grantor, whether now or hereafter existing, owned, arising or acquired (provided, the amount of Equity Interests of any Foreign Subsidiary pledged by such Grantor hereunder shall be limited to 66% of the issued and outstanding Equity Interests of such Foreign Subsidiary directly owned by such Grantor); and

(b) an irrevocable royalty-free right and license to use, upon the occurrence and during continuance of an Event of Default, the Intellectual Property of such Grantor worldwide in order to enable Administrative Agent to exercise its rights and remedies with respect to the Collateral as Administrative Agent reasonably deems necessary or appropriate.

To the extent (if any) necessary to make such security interest, right and license effective as to any Collateral, each Grantor also assigns, pledges and grants the same to Administrative Agent for its benefit and the ratable benefit of the other Secured Parties. The Collateral shall not include any agreement, license or permit which by Law or its terms validly prohibits the granting of a security interest therein unless a consent to the security interest and pledge hereunder has

10

been obtained; provided that the foregoing limitation shall not affect, limit, restrict, or impair the grant by each Grantor of a security interest pursuant to this Agreement in any such Collateral to the extent that an otherwise applicable prohibition on such grant is rendered ineffective by the UCC or other applicable Law. Collateral shall not include any general intangibles to the extent the grant by such Grantor of a security interest pursuant to this Agreement in such general intangibles is expressly prohibited or restricted, unless such prohibition or restriction is rendered ineffective pursuant to Section 9.408 of the UCC, provided that the foregoing limitation shall not affect, limit, restrict or impair the grant by such Grantor of a security interest pursuant to this Agreement in any money or other amounts due or sums due in respect of such general intangible under Section 9.408 of the UCC.

2.2. Grantor Remains Liable. Anything herein to the contrary notwithstanding, (a) each Grantor shall remain liable under the contracts and agreements included in such Grantor’s Collateral to the extent set forth therein to perform all of its duties and obligations thereunder to the same extent as if this Agreement had not been executed, (b) the exercise by any Secured Party of any of the rights hereunder shall not release any Grantor from any of its duties or obligations under the contracts and agreements included in such Grantor’s Collateral, and (c) no Secured Party shall have any obligation or liability under the contracts and agreements included in such Grantor’s Collateral by reason of this Agreement, nor shall any Secured Party be obligated to perform any of the obligations or duties of any Grantor thereunder or to take any action to collect or enforce any claim for payment assigned hereunder.

2.3. Delivery of Pledged Equity Interests. All certificates or instruments constituting or evidencing the Pledged Equity Interests shall be delivered to and held by or on behalf of Administrative Agent pursuant hereto and shall be in suitable form for transfer by delivery, or shall be accompanied by undated and duly executed instruments of transfer or assignment in blank, all in form and substance reasonably satisfactory to Administrative Agent. If an Event of Default exists, Administrative Agent has the right, without notice to any Grantor, to register in the name of Administrative Agent or any of its nominees any or all of such Collateral. In addition, Administrative Agent has the right at any time, with the consent of the Borrower prior to an Event of Default, to exchange certificates or instruments representing or evidencing Pledged Equity Interests for certificates or instruments of smaller or larger denominations.

ARTICLE III

REPRESENTATIONS AND WARRANTIES

3.1. Representations and Warranties. Each Grantor represents and warrants to each Secured Party with respect to itself and the Collateral owned by it that:

(a) This Agreement and the grant of the security interest pursuant to this Agreement in the Collateral create a valid first priority security interest in favor of Administrative Agent for the ratable benefit of the Secured Parties in the Collateral (subject to Permitted Liens), securing the payment and performance of the Secured Obligations, and all filings and other actions necessary to perfect and protect such security interest and such priority (other than with respect to Collateral consisting of (i) Rolling Stock that is not Eligible Rolling Stock, (ii) Aggregates constituting As-Extracted

11

Collateral, (iii) certain Deposit Accounts over which Administrative Agent is not required to have control pursuant to Section 6.15 of the Credit Agreement, (iv) Instruments and Chattel Paper that remain in a Grantor’s possession, and (v) Letters of Credit over which Administrative Agent does not have control) have been duly taken (or will be taken upon any Grantor obtaining rights in Collateral after the date hereof), subject, however, with respect to Proceeds, to the provisions of Section 9.315 of the UCC.

(b) Each Grantor has good and indefeasible title to, or a valid leasehold interest in, all of the Collateral free and clear of any Lien, except for Permitted Liens. No Grantor has granted a currently effective security interest or other Lien in or made a currently effective assignment of any of the Collateral (except for Permitted Liens). No Grantor has entered into nor is it or any of its property subject to any agreement limiting the ability of such Grantor to grant a Lien in any Collateral of such Grantor, or the ability of such Grantor to agree to grant or not grant a Lien in any property of such Grantor (in each case, except as permitted by the Credit Agreement). None of the Collateral is consigned Goods or subject to any agreement of repurchase except in the ordinary course of business, nor is any Collateral subject to any dispute, defense, or counterclaim. No effective financing statement or other similar document used to perfect and preserve a security interest or other Lien under the Laws of any jurisdiction covering all or any part of the Collateral is on file in any recording office, except such as may have been filed (i) pursuant to this Agreement or other Loan Document, or (ii) relating to Permitted Liens. Except as permitted under the Credit Agreement, no Grantor has made any presently effective sale of any interest in any of its Accounts (other than past due or doubtful Accounts assigned to third parties for collection), Chattel Paper, promissory notes, or Payment Intangibles. Except for consignments of immaterial amounts Inventory that do not constitute Eligible Inventory, no Grantor has consigned any of its Inventory.

(c) All of the Pledged Equity Interests have been duly and validly issued, and the Pledged Stock is fully paid and nonassessable. All of the Pledged Equity Interests consisting of certificated securities have been delivered to Administrative Agent. Other than Pledged Partnership Interests, Pledged LLC Interests and Pledged Trust Interests (which constitute General Intangibles and not Securities), there are no Pledged Equity Interests other than those represented by certificated securities in the possession of Administrative Agent. There are no restrictions in any Organization Document governing any Pledged Equity Interest or any other document related thereto which would limit or restrict (i) the grant of a Lien in the Pledged Equity Interests, (ii) the perfection of such Lien or (iii) the exercise of remedies in respect of such perfected Lien in the Pledged Equity Interests as contemplated by this Agreement that have not been waived. Upon the exercise of remedies in respect of Pledged Partnership Interests, Pledged LLC Interests and Pledged Trust Interests, a transferee or assignee of a partnership interest, a membership interest, or a trust interest, as the case may be, of such partnership, limited liability company or trust, as the case may be, shall become a partner, member, trustee, beneficiary or settlor, as the case may be, of such partnership, limited liability company or trust, as the case may be, entitled to participate in the management thereof to the extent such partnership, membership or trust interest would otherwise permit such transferee or assignee to participate in management, and, upon the transfer of

12

the entire interest of such Grantor, such Grantor ceases to be a partner, member, trustee, beneficiary or settlor, as the case may be.

(d) Schedule 1 states the exact name of each Grantor, as such name appears in its currently effective organizational documents as filed with the appropriate authority of the jurisdiction of each Grantor’s organization. Schedule 1, Section (a) states the jurisdiction of organization of each Guarantor. Schedule 1, Section (b) sets forth the type of entity and each other name each Grantor has had in the past two years, together with the date of the relevant change. Except as set forth in Schedule 1, Section (c), each Grantor has not changed its identity or type of entity in any way within the past two years. Changes in identity or type of entity include mergers, consolidations, conversions, and any change in the form, nature, or jurisdiction of organization. Schedules 1 and 2 contain the information required by this Section as to each acquiree or constituent party to a merger, consolidation, or conversion within the preceding two years. Schedule 1, Section (d) states all other names (including trade, assumed, and similar names) used by each Grantor or any of its divisions or other business units at any time during the past two years. Schedule 1, Section (e) states the Federal Taxpayer Identification Number of each Grantor. Schedule 1, Section (f) states the corporate or other organizational number of each Grantor.

(e) As of the Closing Date, the chief executive office of each Grantor is located at the address stated on Schedule 2, Section (a) and Schedule 2, Section (b) states all locations where each Grantor maintains any books or records relating to all Accounts (with each location at which Chattel Paper, if any, is kept being indicated by an “*”). As of the Closing Date, Schedule 2, Section (c) states all locations where each Grantor maintains any Equipment or Inventory. As of the Closing Date, Schedule 2, Section (d) states all the places of business of each Grantor or other locations of material Collateral not identified in Schedule 2, Sections 2(a), (b), or (c). As of the Closing Date, Schedule 2, Section (e) states the names and addresses of all Persons other than each Grantor who have possession of any of the Collateral of each such Grantor, other than (i) Equipment temporarily out of service or out of repair, (ii) Inventory in the hands of transporters, and (iii) immaterial amounts of Inventory that is not, and is not claimed to be, Eligible Inventory but is instead in the hands of third party processors, storage providers and consignees.

(f) No Grantor owns any aircraft, ships or other vessels.

(g) Each Grantor has exclusive possession and control of the Equipment and Inventory pledged by it hereunder, other than Equipment temporarily out of service or out for repair and Inventory in the hands of third party processors, transporters or storage providers.

(h) As of the Closing Date, Schedule 3 is a complete and correct list of all the issued and outstanding stock, partnership interests, limited liability company membership interests, or other equity interest of each Grantor and the record and beneficial owners of such stock, partnership interests, membership interests or other equity interests. Also set

13

forth on Schedule 3 is each equity investment of each Grantor that represents 50% or less of the equity of the entity in which such investment was made as of the Closing Date.

(i) As of the Closing Date, Schedule 4 is a complete and correct list of each promissory note and other Instrument evidencing indebtedness owed to and held by each Grantor (excluding all intercompany notes and other instruments between each Grantor and each Subsidiary, and each Subsidiary and each other Subsidiary).

(j) As of the Closing Date, Schedule 5(a) is a complete and correct list of each United States Trademark registration and Trademark application in which each Grantor has any interest as owner, including the name of the registered owner, the registered or applied for Trademark, and the Trademark application serial and/or registration number. As of the Closing Date, no Grantor owns or is the licensee of any non-United States Trademark, or is the licensee of any United States Trademark, that in each case is material to its business.

(k) As of the Closing Date, Schedule 5(b) is a complete and correct list of each United States Patent in which each Grantor has any interest as owner, including the name of the registered owner and the Patent number. As of the Closing Date, no Grantor owns or is the licensee of any non-United States Patent, or is the licensee of any United States Patent, that in each case is material to its business.

(l) As of the Closing Date, Schedule 5(c) is a complete and correct list of each United States Patent application in which each Grantor has any interest as owner, including the name of the Person applying to be the registered owner and the Patent application number. As of the Closing Date, no Grantor owns or is the licensee of any non-United States Patent application, or is the licensee of any United States Patent application, that in each case is material to its business.

(m) As of the Closing Date, Schedule 5(d) is a complete and correct list of each United States Copyright (including the related registration and Copyright application, if any) in which each Grantor has any interest as owner, including the name of the registered owner, the title of the work which is the subject of the registered or applied for Copyright, and the registration number (if applicable). As of the Closing Date, no Grantor (i) owns or is the licensee of any non-United States Copyright, (ii) has pending any non-United States Copyright application or (iii) is the licensee of any United States Copyright that, in each case, is material to its business.

(n) As of the Closing Date, Schedule 5(e) is a complete and correct list of all allegations of use under Section 1(c) or 1(d) of the Trademark Act (15 U.S.C. §1051, et seq.) filed under the Trademark Act by each Grantor.

(o) As of the Closing Date, Schedule 6 is a complete and correct list of all material Software (other than non-custom generally available Software) in which each Grantor has any interest (either as owner or licensee), including the name of the licensor and the escrow agent under the applicable Software escrow agreement (if any).

14

(p) As of the Closing Date, Schedule 7 is a complete and correct list of all pending Commercial Tort Claims known to a Responsible Senior Officer in which any Grantor has any interest, including the complete case name or style, the case number, and the court or other tribunal in which the case is pending.

(q) As of the Closing Date, except as set forth on Schedule 8, no consent of any other Person and no authorization, approval or other action by, and no notice to or filing with, any Governmental Authority is required (i) for the pledge by each Grantor of the Collateral pledged by it hereunder, for the grant by each Grantor of the security interest granted hereby, or for the execution, delivery, or performance of this Agreement by each Grantor, (ii) for the perfection or maintenance of the pledge, assignment, and security interest created hereby (including the first priority nature of such pledge, assignment, and security interest) as contemplated herein or (iii) for the enforcement of remedies by Administrative Agent or any other Secured Parties.

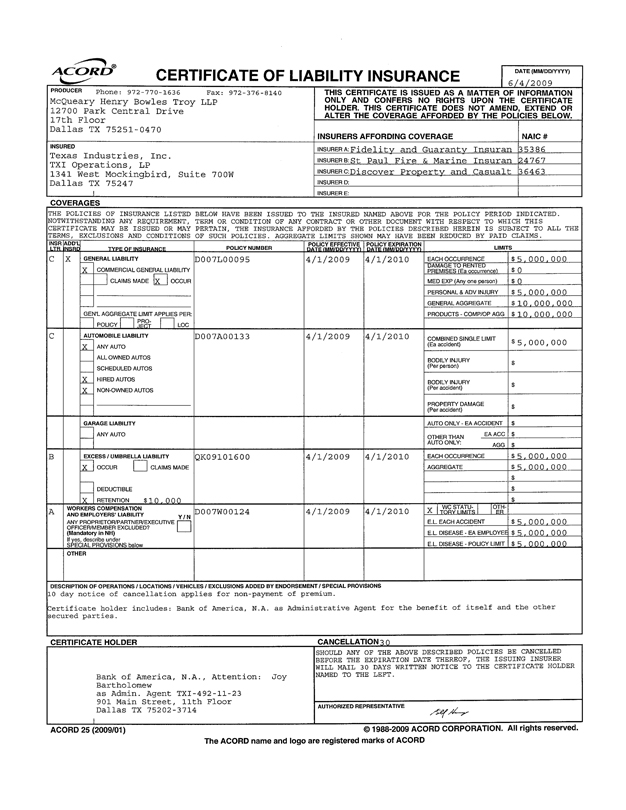

(r) As of the Closing Date, Schedule 9 is a complete and correct list of all insurance policies covering losses with respect to Collateral for which each Grantor is a named insured.

(s) With respect to each Account of such Grantor at the time it is shown as an Eligible Account in a Borrowing Base Certificate:

(i) it is, at such time, an Eligible Account, meeting all requirements for Eligible Accounts set out in the Credit Agreement;

(ii) it is for a sum certain, maturing as stated in the invoice covering such sale or rendition of services, a copy of which has been furnished or is available to Administrative Agent on request;

(iii) no purchase order, agreement, document or Applicable Law restricts assignment of the Account to Administrative Agent (regardless of whether, under the UCC, the restriction is ineffective), and such Grantor is the sole payee or remittance party shown on the invoice; and

(iv) to the knowledge of the Responsible Senior Officers, (i) there are no facts or circumstances that are reasonably likely to impair the enforceability or collectability of such Account; (ii) the Account Debtor had the capacity to contract when the Account arose, continues to meet such Grantor’s customary credit standards, is Solvent, is not contemplating or subject to any proceeding under Debtor Relief Laws, and has not failed, or suspended or ceased doing business; and (iii) there are no proceedings or actions threatened or pending against any Account Debtor that could reasonably be expected to have a material adverse effect on the Account Debtor’s financial condition.

(t) As of the Closing Date, Schedule 10 is a complete list of all the Securities Accounts in which each Grantor has any interest.

15

(u) As of the Closing Date, Schedule 11 is a complete list of all Letter-of-Credit Rights in which any Grantor has an interest.

ARTICLE IV

COVENANTS

4.1. Further Assurances.

(a) Each Grantor will, from time to time and at each Grantor’s expense, promptly execute and deliver such financing or continuation statements, or amendments thereto, such control agreements and such patent or trademark filings and promptly deliver such certificated securities, as may be necessary, or as Administrative Agent may request, in order to perfect and preserve the pledge, assignment, and security interest granted or purported to be granted hereby, and take all further action in connection with the filing of such financing or continuation statements or amendments thereto, such control agreements and such patent or trademark office filings that Administrative Agent may reasonably request, in order to perfect and protect any pledge, assignment, or security interest granted or purported to be granted hereby, and the priority thereof, or to enable Administrative Agent to exercise and enforce Administrative Agent’s and other Secured Parties’ rights and remedies hereunder with respect to any Collateral. Without limitation to the foregoing, within 30 days following the Closing Date each Grantor shall take all actions necessary to establish Administrative Agent’s control, for the purposes of 9-106 of the UCC, of each Securities Account owned by it, provided, that Administrative Agent agrees not to exercise such control unless an Event of Default has occurred and is continuing.

(b) In addition to such other information as shall be specifically provided for herein, each Grantor shall promptly furnish to Administrative Agent such other information with respect to the Collateral as Administrative Agent may reasonably request.

(c) Each Grantor will not, and will not permit any Person to, revise, modify, amend, or restate the Organization Documents of any Person the Equity Interests in which is Pledged Equity Interests in a manner that adversely affects the security interest of Administrative Agent therein, except as permitted by the Credit Agreement, or terminate, cancel, or dissolve any such Person except as permitted by the Credit Agreement.

(d) Each Grantor shall promptly, and in any event within five Business Days after any Responsible Senior Officer obtains knowledge thereof, notify Administrative Agent in writing if, after the Closing Date, it obtains any interest in any Collateral consisting of Deposit Accounts, Securities Accounts, Documents or Letter-of-Credit Rights and, upon Administrative Agent’s request (except with respect to Petty Cash Accounts and as set forth in Section 4.2(c)), shall promptly take such actions as Administrative Agent deems appropriate to effect Administrative Agent’s duly perfected,

16

first priority Lien upon such Collateral, including obtaining any appropriate possession, control agreement or Lien Waiver.

(e) Within ten Business Days after a Grantor’s general counsel learns of the existence of any Commercial Tort Claim and concludes that it is a valid and material claim that such Grantor intends to prosecute, each Grantor will notify Administrative Agent of such Commercial Tort Claim and, if Administrative Agent requests, such Grantor shall enter into an amendment to this Agreement granting to Administrative Agent a first priority security interest in such Commercial Tort Claim.

(f) Each Grantor authorizes Administrative Agent to file one or more financing or continuation statements and amendments thereto and any patent and trademark filings, relating to all or any part of the Collateral without the authentication of any Grantor where permitted by Law. Such financing statements may describe the Collateral as “all personal property other than fixtures” of such Grantor. Administrative Agent hereby agrees, upon request by any Grantor, to amend or partially release all financing statements and similar filings covering Collateral to exclude from the coverage thereof any properties or assets that now or hereafter are fixtures or are subject to a Lien permitted by clause (f) of the definition of “Permitted Liens” in the Credit Agreement. A photocopy or other reproduction of this Agreement or any financing statement covering the Collateral or any part thereof shall be sufficient as a financing statement where permitted by Law. Each Grantor ratifies its execution and delivery of, and the filing of, any financing statement describing any of the Collateral which was filed prior to the date of this Agreement.

(g) Notwithstanding anything to the contrary herein, each Grantor shall take such actions with respect to perfection of Administrative Agent’s Lien on Rolling Stock as are required under the Credit Agreement, and no Grantor shall be obligated hereunder to take any action not required under the Credit Agreement to perfect Administrative Agent’s Lien on any Rolling Stock.

4.2. Place of Perfection; Records; Collection of Accounts, Chattel Paper and Instruments; Letters of Credit

(a) No Grantor shall change the jurisdiction of its organization from the jurisdiction specified in Schedule 1, Section (a), its type of entity from the type of entity specified in Schedule 1, Section (b), or its name from the name specified in Schedule 1, unless the appropriate Grantor has delivered to Administrative Agent 30 days prior written notice and taken such actions as Administrative Agent may reasonably require with respect to such change. Each Grantor shall keep its chief executive office at the address specified in Schedule 2, Section (a), and the offices where it keeps its books and records concerning the Accounts, and the originals of all Chattel Paper and Instruments not otherwise delivered to Administrative Agent, at the addresses specified in Schedule 2, Section (b), unless the appropriate Grantor has delivered to Administrative Agent 30 days prior written notice and taken such actions as Administrative Agent may reasonably require with respect to such change. Each Grantor will hold and preserve such records and Chattel Paper and Instruments and will permit representatives of Administrative

17

Agent at any time during normal business hours to inspect and make abstracts from and copies of such records and Chattel Paper and Instruments.

(b) Except as otherwise provided in this Section 4.2(b), each Grantor shall continue to collect, at its own expense, all amounts due or to become due each Grantor under the Accounts, Chattel Paper, and Instruments. In connection with such collections, each Grantor may take (and, at Administrative Agent’s direction, shall take) such action as each such Grantor or Administrative Agent may deem necessary or advisable to enforce collection of the Accounts, Chattel Paper, and Instruments; provided, however, that Administrative Agent shall have the right, if an Event of Default exists and is continuing, without notice to any Grantor, to notify the Account Debtors or obligors under any Accounts, Chattel Paper, and Instruments of the assignment of such Accounts, Chattel Paper, and Instruments to Administrative Agent and to direct such Account Debtors or obligors to make payment of all amounts due or to become due to each Grantor thereunder directly to Administrative Agent and, at the expense of each Grantor, to enforce collection of any such Accounts, Chattel Paper, and Instruments, and to adjust, settle or compromise the amount or payment thereof, in the same manner and to the same extent as each Grantor might have done or as Administrative Agent deems appropriate. Each Grantor shall not adjust, settle, or compromise the amount or payment of any Account, Chattel Paper, or Instrument, release wholly or partly any Account Debtor or obligor thereof, or allow any credit or discount thereon, except in the ordinary course of business. If any Collateral shall be or be evidenced by a promissory note or other Instrument or be Tangible Chattel Paper, and is, in each case, in the original amount of $1,500,000 or greater, the applicable Grantor shall deliver to Administrative Agent such note, Instrument or Tangible Chattel Paper duly endorsed (whether by allonge or otherwise) and accompanied by duly executed instruments of transfer or assignment, all in form and substance satisfactory to Administrative Agent; provided, however, upon the occurrence of a Trigger Period, Grantors shall deliver, promptly upon request by the Administrative Agent therefor, to Administrative Agent all Collateral evidenced by a promissory note, Instrument or Chattel Paper, duly endorsed and accompanied by duly executed instruments of transfer or assignment, all in form and substance satisfactory to Administrative Agent.

(c) If any Grantor is or becomes the beneficiary of a Letter of Credit with a face amount of $1,500,000 or greater, then within five Business Days after any Responsible Senior Officer obtains knowledge thereof, such Grantor will notify Administrative Agent of such Letter of Credit and such Grantor shall, promptly upon request by Administrative Agent therefor, use commercially reasonable efforts to cause the issuer and/or confirming bank to (i) consent to the assignment of any Letter-of-Credit Rights with respect thereto to Administrative Agent and (ii) agree to direct all payments thereunder to a Dominion Account, all in form and substance reasonably satisfactory to Administrative Agent; provided, however, upon the occurrence of a Trigger Period, Grantors shall, promptly upon request by Administrative Agent therefor, use commercially reasonable efforts to cause each issuer and/or confirming bank for each Letter of Credit (regardless of the face amount thereof) to consent and agree to the foregoing actions.

18

(d) If an Account includes a charge for any Taxes then, during the continuation of any Trigger Period, Administrative Agent is authorized, in its discretion, to pay the amount thereof to the proper taxing authority for the account of the applicable Grantor and to charge the Grantors therefor; provided, however, that neither Administrative Agent nor any other Secured Party shall be liable for any Taxes that may be due from the Grantors or with respect to any Collateral.

(e) Whether or not a Default or Event of Default exists, Administrative Agent shall have the right at any time, in the name of Administrative Agent, any designee of Administrative Agent or any Grantor, to verify the validity, amount or any other matter relating to any Accounts by mail, telephone or otherwise. Each Grantor shall cooperate fully with Administrative Agent in an effort to facilitate and promptly conclude any such verification process. Administrative Agent shall use commercially reasonable efforts to conduct any such verification process in a manner that does not adversely impact Grantors’ relationships with their customers.

4.3. Patents, Trademarks, and Copyrights.

(a) [Reserved].

(b) No Grantor (either itself or through licensees or sublicensees) will do any act, or omit to do any act, whereby any material Patent may become invalidated or dedicated to the public, and shall continue to mark any products covered by a material Patent with the relevant patent number as necessary and sufficient to establish and preserve its maximum rights under Applicable Laws.

(c) Each Grantor (either itself or through licensees or sublicensees) will, for each material registered Trademark, (i) maintain such Trademark in full force free from any claim of abandonment or invalidity for non-use; (ii) maintain the quality of products and services offered under such Trademark, (iii) display such Trademark with notice of United States federal or foreign registration to the extent necessary and sufficient to establish and preserve its maximum rights under Applicable Law, and (iv) not use or permit the use of such Trademark in violation of any third party rights.

(d) Each Grantor (either itself or through licensees or sublicensees) will, for each work covered by a material Copyright, continue to publish, reproduce, display, adopt, and distribute the work with appropriate copyright notice as necessary and sufficient to establish and preserve its maximum rights under Applicable Laws.

(e) Each Grantor shall notify Administrative Agent immediately if any Responsible Senior Officer obtains knowledge that any material Patent, Trademark, or Copyright may become abandoned, lost, or dedicated to the public, or of any adverse determination or development (including the institution of, or any such determination or development in, any proceeding in the United States Patent and Trademark Office, United States Copyright Office, or any Governmental Authority in any jurisdiction) regarding Grantor’s ownership of any material Patent, Trademark, or Copyright, its right to register the same, or to keep and maintain the same.

19

(f) In no event shall any Grantor, either itself or through any agent, employee, licensee, or designee, file an application for any material Patent, Trademark, or Copyright (or for the registration of any Trademark or Copyright) with the United States Patent and Trademark Office, United States Copyright Office, or any Governmental Authority in any jurisdiction, unless it informs Administrative Agent within 15 Business Days of such filing, and, upon request of Administrative Agent, executes and delivers any and all agreements, instruments, documents, and papers as Administrative Agent may request to evidence Administrative Agent’s and Secured Parties’ security interest in such Patent, Trademark, or Copyright, and each Grantor hereby appoints Administrative Agent as its attorney-in-fact to execute and file such writings for the foregoing purposes.

(g) Each Grantor will take all necessary steps that are consistent with the practice in any proceeding before the United States Patent and Trademark Office, United States Copyright Office, or any Governmental Authority in any other jurisdiction as may be required by Administrative Agent, to maintain and pursue each application relating to the material Patents, Trademarks, and/or Copyrights (and to obtain the relevant grant or registration), and to maintain each such issued Patent and each registration of such Trademarks and Copyrights, including timely filings of applications for renewal, affidavits of use, affidavits of incontestability and payment of maintenance fees, and, if consistent with good business judgment, to initiate opposition, interference, and cancellation proceedings against third parties.

(h) If any Grantor has reason to believe that any Collateral consisting of a material Patent, Trademark, or Copyright has been or is about to be infringed, misappropriated, or diluted by a third party, each such Grantor promptly shall notify Administrative Agent and shall, if consistent with good business judgment, unless such Grantor shall reasonably determine that such Patent, Trademark or Copyright is in no way material to the conduct of its business or operations, promptly sue for infringement, misappropriation, or dilution and to recover any and all damages for such infringement, misappropriation, or dilution, and take such other actions as are appropriate under the circumstances to protect such Collateral.

(i) If an Event of Default exists, each Grantor shall use commercially reasonable efforts to obtain all requisite consents or approvals by the licensor of each Copyright License, Patent License, or Trademark License to effect the collateral assignment of all of each Grantor’s right, title, and interest thereunder to Administrative Agent or its designee.

(j) In no event shall any Grantor acquire or purchase any patent, registered trademark, or registered copyright which any Grantor, in its reasonable discretion, determines is material to the business operations of such Grantor unless it informs Administrative Agent within 15 Business Days of such purchase or acquisition, and, upon request of Administrative Agent, executes and delivers any and all agreements, instruments, documents, and papers as Administrative Agent may reasonably request to evidence Administrative Agent’s and Secured Parties’ security interest in such purchased or acquired patent, registered trademark, or registered copyright. Each Grantor hereby appoints Administrative Agent as its attorney-in-fact to execute and file any evidence of

20

Administrative Agent’s security interest and Lien in any such patent, registered trademark, or registered copyright (or for the application for any patent or registration of any copyright) with the United States Patent and Trademark Office, United States Copyright Office, or any Governmental Authority in any other jurisdiction as may be reasonably required by Administrative Agent, in connection with such purchase or acquisition of any such patent, registered trademark, or registered copyright.

(k) The parties acknowledge and agree that the Intellectual Property is the sole and exclusive property of each applicable Grantor, subject to the terms and conditions stated in this Agreement. Other than in connection with any security interest in the Intellectual Property that any Grantor has granted to Administrative Agent, or any rights and remedies of Secured Parties under Applicable Law, neither Administrative Agent nor any other Secured Party shall challenge any Grantor’s ownership of the Intellectual Property. Each Grantor expressly retains all rights, prior to the occurrence of an Event of Default, to license third parties to use the Intellectual Property for any purpose whatsoever not in violation of the Loan Documents and which are not exclusive as to prevent Administrative Agent from using any of the Intellectual Property in connection with the Grantors’ operations.

(l) The license granted to Administrative Agent hereunder shall include the right of Administrative Agent to grant sublicenses to others to use the Intellectual Property if an Event of Default exists, and to enable such sublicensees to exercise any rights and remedies of Secured Parties with respect to the Collateral, as Administrative Agent reasonably deems necessary or appropriate in the exercise of the rights and remedies of Secured Parties. In any country where sublicenses are incapable of registration or where registration of a sublicense will not satisfactorily protect the rights of Grantor and Administrative Agent, Administrative Agent shall also have the right to designate other parties as direct licensees of Grantor to use the Intellectual Property if an Event of Default exists and to enable such direct licensees to exercise any rights and remedies of Secured Parties as such licensees reasonably deem necessary or appropriate and Grantor agrees to enter into direct written licenses with the parties as designated on the same terms as would be applicable to a sublicense, and any such direct license may, depending on the relevant local requirements, be either (a) in lieu of a sublicense or (b) supplemental to a sublicense. In either case, the parties hereto shall cooperate to determine what shall be necessary or appropriate in the circumstances. For each sublicense to a sublicensee and direct license to a licensee, Grantor appoints Administrative Agent its agent for the purpose of exercising quality control over the sublicensee. Grantor shall execute this Agreement in any form, content and language suitable for recordation, notice and/or registration in all available and appropriate agencies of foreign countries as Administrative Agent may require.

(m) In connection with the assignment or other transfer (in whole or in part) of its obligations to any other Person, Administrative Agent may assign the license granted herein without Grantor’s consent and upon such assignment or transfer such other Person shall thereupon become vested with all rights and benefits in respect thereof granted to Administrative Agent under this Agreement (to the extent of such assignment or transfer).

21

(n) The parties hereto shall take reasonable action to preserve the confidentiality of the Intellectual Property; provided, that Administrative Agent shall not have any liability to any Person for any disclosure of the Intellectual Property upon and after any realization upon Collateral.

(o) Notwithstanding any other provisions of this Agreement, nothing herein obligates any Grantor to pursue registration or other protection of, and any Grantor may abandon, relinquish, withdraw or release, any Intellectual Property determined by such Grantor as not in any way material to the conduct of its business or operations.

4.4. Rights to Dividends and Distributions. With respect to any certificates, bonds, or other Instruments or Securities constituting a part of the Collateral, Administrative Agent shall have authority if an Event of Default exists and is continuing, either to have the same registered in Administrative Agent’s name or in the name of a nominee, and, with or without such registration, to demand of the issuer thereof, and to receive and receipt for, any and all dividends (including any stock or similar dividend or distribution) payable in respect thereof, whether they be ordinary or extraordinary. Administrative Agent shall send to the respective Grantor notice of Administrative Agent’s election to take any action described in the preceding sentence; provided any failure of any Grantor to receive any such notice shall not invalidate any action taken by Administrative Agent or impair any of its rights. If any Grantor shall become entitled to receive or shall receive any interest in or certificate (including, without limitation, any interest in or certificate representing a dividend or a distribution in connection with any reclassification, increase, or reduction of capital, or issued in connection with any reorganization), or any option or rights arising from or relating to any of the Collateral, whether as an addition to, in substitution of, as a conversion of, or in exchange for any of the Collateral, or otherwise, each Grantor agrees to accept the same as Administrative Agent’s agent and to hold the same in trust on behalf of and for the benefit of Administrative Agent, and to deliver the same immediately to Administrative Agent in the exact form received, with appropriate undated stock or similar powers, duly executed in blank, to be held by Administrative Agent, subject to the terms hereof, as Collateral. Unless an Event of Default exists, each Grantor shall be entitled to receive all cash dividends and distributions paid in respect of any of the Collateral (subject to the restrictions of any other Loan Document). Administrative Agent shall be entitled to all dividends and distributions, and to any sums paid upon or in respect of any Collateral, upon the liquidation, dissolution, or reorganization of the issuer thereof (except those constituting Dispositions permitted under the Credit Agreement) which shall be paid to Administrative Agent to be held by it as additional collateral security for and application to the Secured Obligations at the discretion of Administrative Agent. All dividends paid or distributed in respect of the Collateral which are received by any Grantor in violation of this Agreement shall, until paid or delivered to Administrative Agent, be held by each Grantor in trust as additional Collateral for the Secured Obligations.

4.5. Right of Administrative Agent to Notify Issuers. If an Event of Default exists and is continuing and at such other times as Administrative Agent is entitled to receive dividends and other property in respect of or consisting of any Collateral which is or represents an equity or ownership interest in any Person (“Securities Collateral”), Administrative Agent may notify issuers of the Securities Collateral to make payments of all dividends and distributions directly to Administrative Agent and Administrative Agent may take control of all Proceeds of any

22

Securities Collateral. Until Administrative Agent elects to exercise such rights, if an Event of Default exists, each Grantor, as agent of Administrative Agent, shall collect and segregate all dividends and other amounts paid or distributed with respect to the Securities Collateral.

4.6. Insurance. All policies of insurance required to be maintained pursuant to Section 6.07 of the Credit Agreement insuring the Equipment and Inventory shall be written for the benefit of Administrative Agent for itself and the other Secured Parties and each Grantor, as their interests may appear, and shall provide for at least thirty days’ prior written notice of cancellation to Administrative Agent. Upon reasonable request by Administrative Agent, each Grantor shall promptly furnish to Administrative Agent evidence of such insurance in form and content satisfactory to Administrative Agent. If any Grantor fails to perform or observe any applicable covenants as to insurance, Administrative Agent may at its option obtain insurance on only Secured Parties’ interest in the Equipment and Inventory, any premium thereby paid by Administrative Agent to become part of the Secured Obligations, bear interest prior to the existence of an Event of Default, at the then applicable Base Rate, and during the existence of an Event of Default, at the lesser of (i) the Highest Lawful Rate and (ii) the Default Rate. If Administrative Agent maintains such substitute insurance, the premium for such insurance shall be due on demand and payable by the applicable Grantor to Administrative Agent. Each Grantor grants and appoints Administrative Agent its attorney-in-fact to, if an Event of Default exists, endorse any check or draft that may be payable to each such Grantor in order to collect any payments in respect of insurance, including any refunds of unearned premiums in connection with any cancellation, adjustment, or termination of any policy of insurance. Any such sums collected by Administrative Agent shall be credited, except to the extent applied to the purchase by Administrative Agent of similar insurance, to any amounts then owing on the Secured Obligations in accordance with the Credit Agreement.

4.7. Transfers and Other Liens. No Grantor shall (a) Dispose of any of the Collateral, except as permitted under the Credit Agreement and the other Loan Documents, or (b) create or permit to exist any Lien upon or with respect to any of the Collateral, except for Permitted Liens.

4.8. Administrative Agent Appointed Attorney-in-Fact. Each Grantor hereby irrevocably appoints Administrative Agent Grantor’s attorney-in-fact, with full authority in the place and stead of each Grantor and in the name of each Grantor or otherwise to take any action and to execute any instrument which Administrative Agent may deem reasonably necessary or advisable to accomplish the purposes of this Agreement, including, without limitation (provided that, except as otherwise authorized in any lockbox servicing or deposit account agreement with respect to clause (c) below, the actions listed in clauses (b), (c) and (d) below may only be taken or exercised if an Event of Default exists):

(a) to obtain and adjust insurance as and when authorized pursuant to Section 4.6;

(b) to ask, demand, collect, sue for, recover, compromise, receive, and give acquittance and receipts for moneys due and to become due under or in connection with the Collateral;

23

(c) to receive, indorse, and collect any drafts or other Instruments, Documents, and Chattel Paper, in connection therewith; and

(d) to file any claims or take any action or institute any proceedings which Administrative Agent may deem necessary or desirable for the collection of any of the Collateral or otherwise to enforce compliance with the terms and conditions of any Collateral or the rights of Administrative Agent with respect to any of the Collateral. EACH GRANTOR HEREBY IRREVOCABLY GRANTS TO ADMINISTRATIVE AGENT EACH SUCH GRANTOR’S PROXY (EXERCISABLE ONLY IF AN EVENT OF DEFAULT EXISTS) TO VOTE ANY SECURITIES COLLATERAL AND APPOINTS ADMINISTRATIVE AGENT EACH SUCH GRANTOR’S ATTORNEY-IN-FACT TO PERFORM ALL OBLIGATIONS OF GRANTOR UNDER THIS AGREEMENT AND TO EXERCISE ALL OF ADMINISTRATIVE AGENT’S AND EACH OTHER SECURED PARTY’S RIGHTS HEREUNDER. THE PROXY AND EACH POWER OF ATTORNEY HEREIN GRANTED, AND EACH STOCK POWER AND SIMILAR POWER NOW OR HEREAFTER GRANTED (INCLUDING ANY EVIDENCED BY A SEPARATE WRITING), ARE COUPLED WITH AN INTEREST AND ARE IRREVOCABLE PRIOR TO FINAL PAYMENT IN FULL OF THE SECURED OBLIGATIONS.