Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DOT HILL SYSTEMS CORP | d8k.htm |

Investor

Overview: Cloverleaf Communications Acquisition January 7, 2010 Exhibit 99.1 |

Safe

Harbor With the exception of historical information, the matters disclosed in this presentation are forward-looking statements. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties are described in the Company’s filings with the Securities and Exchange Commission, including its Forms 10-K, 8-K and 10-Q. These forward-looking statements represent the Company’s judgment as of the date of this presentation. The Company disclaims, however, any intent or obligation to update these forward-looking statements. 2 |

Executive

Summary • HILL has substantially completed Step 1 Transformation Non-GAAP* EBITDA positive Q309 Addressed revenue concentration problem Launched new product lines based on owned IP Dramatically retooled our supply chain & lowered cost basis • Now Begun Step 2 Transformation – margin/valuation growth Board approved initiatives that include investments in SW Could take us to peer group comparable valuations • HILL Products/Vision + CL Products/Vision a Natural Fit In line with our strategic vision Accelerates time to market (ttm) by 2 years versus in-house development Expands total available market (tam) with adjacent high margin markets • HILL has done it before - successfully Acquisitions and monetization of Chaparral and Ciprico in similar situations 3 * Non-GAAP: Excludes the effects of impairment to goodwill or long lived assets, issuing warrants to a

customer, stock-based compensation expense, restructuring and severance costs,

one-time legal settlement benefits and foreign currency adjustments and are not in accordance with U.S. generally accepted accounting principles (GAAP). |

Cloverleaf

Background • Corporate Storage virtualization provider, with existing products installed at 25 customers 2009 revenues of about $1M Founded in 2001, backed by VC firms in U.S. and Israel – over $43M invested over 9 years 28 full-time staff, primarily located in Israel – 24 in development and test engineering • Products Core technology from Elta Systems & Israeli Aerospace Industries Inherited IP of hundreds of development man-years I S Network ( ), a storage software virtualization engine Enabling heterogeneous storage infrastructure managed from single pane of glass Scalability up to 12 Petabytes of virtualized storage New iSN Lite product will extend access to SME and remote offices All IP belongs to Cloverleaf – soon Dot Hill • Customers Prestigious list of customers in finance, government, legal, education markets Deployed in large, complex military/defense installations Sold via OEMs and channel partners in US and EMEA Solutions capable of scaling non-disruptively to meet enterprise level needs 4 ntelligent torage iSN |

Integrator

HILL’s Step 1 Transformation 2006-2009 In transition from: Innovator Single Customer Diversified Customer Base Onshore Operations Offshore Asian Manufacturing Rebuild the Foundation 5 |

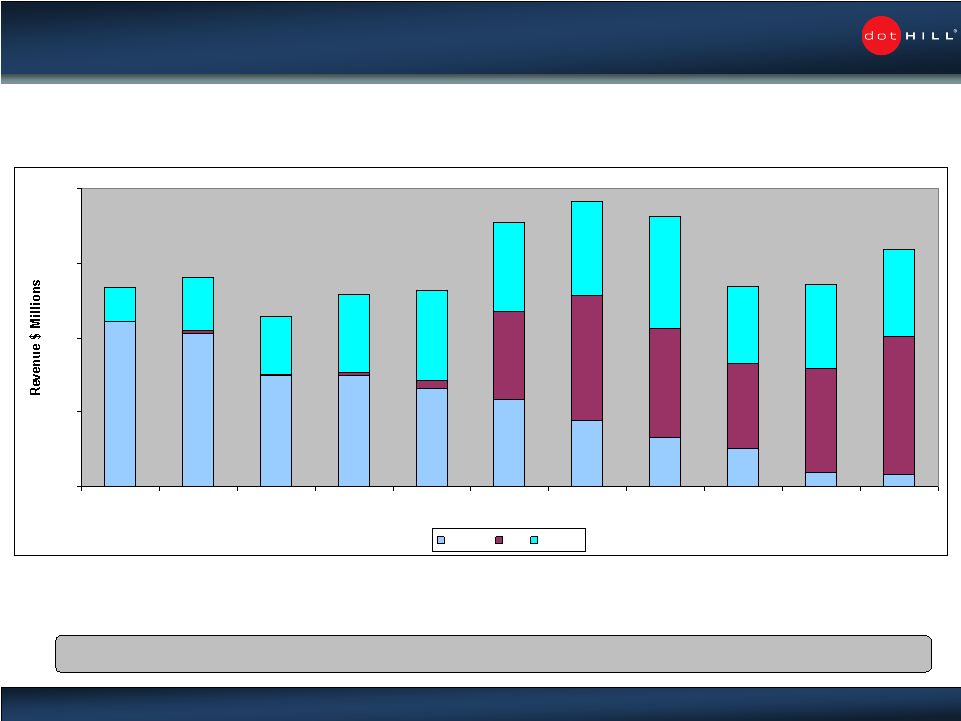

Revenue

Diversification Opportunity for revenue growth as legacy product sales have been

replaced $63.6 $54.3 $53.9 $72.4 $76.6 $71.0 $52.8 $51.8 $45.7 $56.2 $53.4 $0 $20 $40 $60 $80 Q107 Q207 Q307 Q407 Q108 Q208 Q308 Q408 Q109 Q209 Q309 Legacy HP Others 6 |

HW Centric

HILL’s Step 2 Transformation 2010-2012

In transition from: OEM Customers Channels Storage Arrays Adjacent Markets SW Centric Remodel/Upgrade the House 7 |

• Launch Formal Channel Program GOAL: Diversify Revenues at higher margins Provide smoothing function to OEM revenues Add potential Professional Services revenues • Move up the Software (SW) Value Chain GOAL: Make SW a material portion of revenue and margin in 3 years More Firmware and Embedded Data Management Services (DMS) Server based DMS ‘on top of’ RAIDCore Standalone Storage related SW • Move into Adjacent Higher Margin Markets GOAL: Diversify Revenues at higher margins Standalone Storage appliance market Unified Storage Market HILL Step 2 Strategy 2010-2012

8 Cloverleaf Addresses All Three Strategic Initiatives |

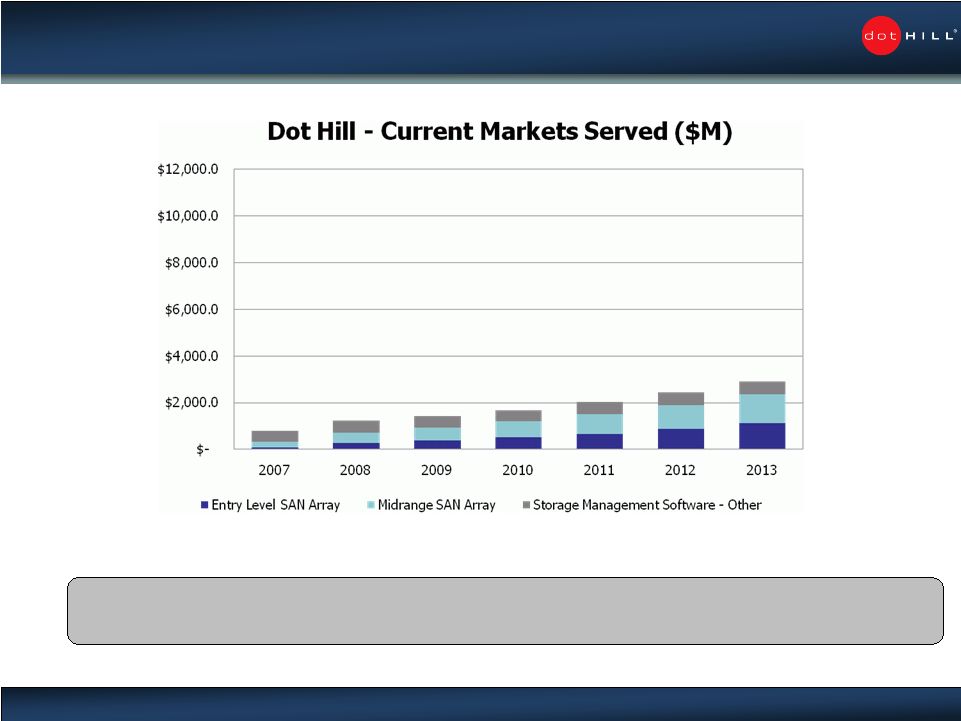

Current Markets

Served Source: IDC, Gartner Dataquest and Dot Hill estimates 9 • Dot Hill presently serves the entry level and lower mid range SAN disk array markets • Continued growth expected in our core business |

Target

Markets Source: IDC, Gartner Dataquest and Dot Hill estimates 10 • Cloverleaf’s products address a multi-billion dollar storage software market • Most significant growth comes from replication markets, driven by compliance and data retention

policies – 24.5% GAGR 2008-2013 • Heterogeneous and unified virtualized storage are key enablers for growth

|

• Mitigates Risk and Cost of In-House Development Projected internal development of 3 years for similar product Allows us to immediately start to compare against CML & FALC offerings • Beyond our Internal 3 Year Software Development Plan All the basics - Snaps, VolCopy, Mirror, Synch/Asynch Rep, Thin & Tiered provisioning But done across any storage vendor – i.e. mix and match And NAS and SAN blend - Supports Unified Storage Solution emerging as new trend • Accelerates TTM for comparable product by ~2 years Accelerates margin growth and Step 2 Transformation • Acquisition of Technology and Technologists Identical philosophy to Chaparral and Ciprico acquisitions • Solid Data Management/Data Recovery Software DHS monitoring Cloverleaf for 3+ years • Allows for Penetration of the Incremental, Standalone Storage Resource Management market Adjacent high margin market served by FALC, DataCore and LSI (StoreAge) Cloverleaf Rationale 11 |

12 • Very Robust suite of product features Appliance based – or SW only using OEM commercial servers Based on standard off-the-shelf Intel architecture All features support NAS/SAN and any storage array No server based agent SW required Single Pane, common user interface across all storage and services HA/DR support with a pair of nodes Heterogeneous Snaps, VolCopy, Split Mirror, fCDP Heterogeneous Thin provisioning, Automated Tiered Provisioning Heterogeneous Asynchronous and synchronous replication Data migration from any storage array to any storage array Heterogeneous Virtualized storage pooling across physical arrays FC, CIFS/NFS support (iSCSI Q2 2010, FCOE Q4 2010) Support for clustering up to 12 nodes for near linear performance improvements Existing Cloverleaf Products 12 |

Potential New

Products • Near term – 6 to 12 months Standalone storage management appliance based on iSN lite Bundled appliance + Dot Hill storage solutions Data migration appliance • Next 12-24 months Unified NAS/SAN appliance + storage OEM software or bundled channel product • Future Unified and fully integrated modular storage platforms 13 Standalone SAN Bundle Fully Integrated Integrated Software 13 |

14 Own RAID IP/Bundles Host Interfaces (FC, iSCSI, LAN) Ease of Use/Automation Remote Data Replication/DR Snapshots Data De-duplication CDP/near CDP Data Migration Tiered Storage Thin Provisioning Unified NAS/SAN Storage Storage Virtualization Heterogeneous Feature Dot Hill iSN DotHill 2/5000 LSI Falcon- stor Datacore Compel- lent iSN Competitive Comparison |

Merger

Consideration • Total deal value $12 million, 7.5% employee carve out • $2.5m in cash • Approx $8.78 million in unregistered common stock valued at 30 day average closing stock price of $1.851 • Approx $0.72 million be settled in restricted shares that will vest over two years and issued from Dot Hill ESOP • Merger consideration to be adjusted up or down to reflect 12/31/2009 Net Book value Note: Merger consideration subject to adjustments based on the amount of outstanding liabilities of

Cloverleaf as of the closing of the Merger, transaction expenses incurred by Cloverleaf

related to the Merger, a net book value balance sheet adjustment based upon the

unaudited consolidated balance sheet of Cloverleaf as of December 31, 2009 and escrow

provisions. In addition, there may be a post-closing net book value balance sheet adjustment to the consideration, payable in cash and stock, based upon the audited consolidated balance sheet of

Cloverleaf as of December 31, 2009. 15 |

Valuation

Considerations • Technology Purchase not for customers and revenue • Internal development of product with similar feature set – estimated 2 to 3x merger consideration with 3-4 year development schedule • Recent comparables of Israeli companies sold with similar products StoreAge – sold for $50 million to LSI Kaysha – sold for $153 million to EMC Cloverleaf acquisition enables technology purchase today at a fraction of the cost of an organic development effort with new products ready for launch in 6-12 months, thus accelerating time to market by two years and significantly reducing development schedule and scope risk. 16 |

Public Company

Comparables* Compellent [CML] 3PAR [PAR] Isilon [ISLN] Falconstor [FALC] Double Take [DBTK] Dot Hill [HILL] Current Market Cap $701M $752 $446M $185M $222M $95M Annualized Revenues $124M $186M $120M $94M $84M $235M Last Q Revenue $32M $46M $31M $22M $21M $64M Price to Sales (TTM) 6.05 3.92 3.77 2.02 2.58 0.38 Enterprise Value/Revenue (TTM) 5.53 3.37 3.12 1.51 1.54 0.14 17 *Table as of Dec 31 st , 2009 and graphs as of Sep 30 th , 2009. Price to Sales Trends (TTM) Enterprise Value/Revenue (TTM) 17 |

18 Financial Model Implications Financial Model Implications *Industry consists of the peer set we previously defined: CPL, FALC, PAR, LSI • More comprehensive model at next earnings call • Core Business + Strategic Investments (Channel Program + RAIDCore + Cloverleaf) Core business (Storage Arrays to OEM’s): significant improvement over last 12 months.

Expect a break-even to positive non-GAAP EBITDA in 2010 Channel Program: Should have positive non-GAAP EBITDA in 2010 depending on revenue ramp RAIDCore: Unlikely to be non-GAAP EBITDA positive in 2010 Cloverleaf: Unlikely to be non-GAAP EBITDA positive in 2010 • Expect 2010 overall to be non-GAAP EBITDA negative but with improvement over 2009 Expect to fund as much of the strategic investment as possible with core operating results Non-GAAP: Excludes the effects of impairment to goodwill or long lived assets, issuing warrants to a

customer, stock-based compensation expense, restructuring and severance costs,

one-time legal settlement benefits and foreign currency adjustments and are not in accordance with U.S. generally accepted accounting principles (GAAP). 18 |

Executive

Summary • HILL has substantially completed Step 1 Transformation Non-GAAP* EBITDA positive Q309 Addressed revenue concentration problem Launched new product lines based on owned IP Dramatically retooled our supply chain & lowered cost basis • Now Begun Step 2 Transformation – margin/valuation growth Board approved initiatives that include investments in SW Could take us to peer group comparable valuations • HILL Products/Vision + CL Products/Vision a Natural Fit In line with our strategic vision Accelerates time to market (ttm) by 2 years versus in-house development Expands total available market (tam) with adjacent high margin markets • HILL has done it before - successfully Acquisitions of monetization of Chaparral and Ciprico in similar situations 19 * Non-GAAP: Excludes the effects of impairment to goodwill or long lived assets, issuing warrants to a

customer, stock-based compensation expense, restructuring and severance costs,

one-time legal settlement benefits and foreign currency adjustments and are not in accordance with U.S. generally accepted accounting principles (GAAP). |