Attached files

| file | filename |

|---|---|

| 8-K - BEST ENERGY SERVICES 8-K 1-6-2010 - BEST ENERGY SERVICES, INC. | form8k.htm |

BEST

Practices:

Back-to-Basics

Back-to-Basics

Corporate

Presentation:

January 2010

January 2010

Certain statements

contained in this presentation, which are not based on historical facts, are

forward-

looking statements as the term is defined in the Private Securities Litigation Reform Act of 1995 and, as

such, are subject to substantial uncertainties and risks that may cause actual results to materially differ

from projections. Although the Company believes that the expectations expressed herein are based on

reasonable assumptions within the bounds of the Company’s knowledge of its businesses, operations,

business plans, budgets and internal financial projections, there can be no assurance that actual results

will not differ materially from the expectations expressed herein. Important factors currently known to

management that could cause actual results to differ materially from those in forward-looking statements

include the Company's ability to (i) properly execute its business model, (ii) raise additional capital to

sustain its business model, (iii) attract and retain personnel, including highly qualified executives,

management and operational personnel, (iv) negotiate favorable current debt and future capital raises,

(v) manage the inherent risks associated with operating a diversified business to achieve and maintain

positive cash flow and net profitability, and (vi) get back into compliance, and remain in compliance, with

its current senior secured credit facility with PNC Bank, N.A. as well as the other risks detailed from time

to time in the SEC reports of Best Energy Services, Inc., including its annual report on Form 10-K/A for the

transition period from February 1, 2008 to December 31, 2008 and its quarterly reports on Form 10-Q for

the three months ended March 31, 2009, June 30, 2009 and September 30, 2009. In light of these risks

and uncertainties, there can be no assurance that the forward-looking information contained in this

presentation will, in fact, occur. The forward-looking statements made herein speak only as of the date

hereof and Best Energy disclaims any obligation to update these forward-looking statements.

looking statements as the term is defined in the Private Securities Litigation Reform Act of 1995 and, as

such, are subject to substantial uncertainties and risks that may cause actual results to materially differ

from projections. Although the Company believes that the expectations expressed herein are based on

reasonable assumptions within the bounds of the Company’s knowledge of its businesses, operations,

business plans, budgets and internal financial projections, there can be no assurance that actual results

will not differ materially from the expectations expressed herein. Important factors currently known to

management that could cause actual results to differ materially from those in forward-looking statements

include the Company's ability to (i) properly execute its business model, (ii) raise additional capital to

sustain its business model, (iii) attract and retain personnel, including highly qualified executives,

management and operational personnel, (iv) negotiate favorable current debt and future capital raises,

(v) manage the inherent risks associated with operating a diversified business to achieve and maintain

positive cash flow and net profitability, and (vi) get back into compliance, and remain in compliance, with

its current senior secured credit facility with PNC Bank, N.A. as well as the other risks detailed from time

to time in the SEC reports of Best Energy Services, Inc., including its annual report on Form 10-K/A for the

transition period from February 1, 2008 to December 31, 2008 and its quarterly reports on Form 10-Q for

the three months ended March 31, 2009, June 30, 2009 and September 30, 2009. In light of these risks

and uncertainties, there can be no assurance that the forward-looking information contained in this

presentation will, in fact, occur. The forward-looking statements made herein speak only as of the date

hereof and Best Energy disclaims any obligation to update these forward-looking statements.

OUR

REASON TO EXIST

Best believes

every company must earn a right to exist. Over the past

year, and in the face of the most severe contraction in two decades,

Best has:

year, and in the face of the most severe contraction in two decades,

Best has:

Ø Successfully

refocused on its core growth market in workover

services

services

— Grown Hugoton

Basin market share from 35% to

80%+

— Secured coveted

customers and new contracts

Ø Further reduced

annual corporate G&A from $5.4MM to

$960K

Ø Discontinued

3

of

4 business lines

with assets to be sold and

deleverage balance sheet

deleverage balance sheet

Ø Maintained a

strong working relationship with PNC Credit- our

senior lender

senior lender

Ø Developed

“outside the box” revenue generation initiatives for

implementation in the first half of 2010.

implementation in the first half of 2010.

OUR

REASON TO EXIST

In

short, Best has now earned its right to exist by developing a

highly functional, high margin model with organic growth

capability all developed around a highly capable team of its

people. Best’s performance in the execution of this model is

solely pointed to delivering fundamental performance for its

shareholders and lenders and enhancing their returns on

invested capital.

highly functional, high margin model with organic growth

capability all developed around a highly capable team of its

people. Best’s performance in the execution of this model is

solely pointed to delivering fundamental performance for its

shareholders and lenders and enhancing their returns on

invested capital.

Ø Established in

February 2008

Ø

Acquisitions

• Best Well

Services

•Bob Beeman

Drilling

•Certain Housing

Accommodation assets

ØFailure of

prior management to execute

Ø Management

swap in 10/08

•Correctly

anticipated significant commodity price

and activity decline

and activity decline

•Immediately

discontinued failed rig redeployment

model

model

•Immediately cut

annual G&A to $1.8MM

from

$ 5.4MM (now $960K)

$ 5.4MM (now $960K)

•Immediately

implemented deep digging profit

models for all business units to gauge

fundamental viability

models for all business units to gauge

fundamental viability

•Subsequently

discontinued 3 of

4 business

units

Leadership:

Accomplished & Respected

Mark

Harrington, Chairman and CEO

•Aided in

formation of Best Energy Services

•Founding board

member; Appointed CEO December 2008

•30-years

experience -Oil and Gas; Financial Services; Business Development

•Chairman,

President, CEO and COO -Eight Energy and Private Equity Cos.

•Featured on

CNBC, Canada AM, Dow Jones News & Bloomberg

Eugene

Allen, General Manager, Best Well Services, Inc.

• A second

generation oilman with 4o-years hand-on experience in the

oil and gas industry.

oil and gas industry.

• Oversees

day-to-day operations, managing and coordinating all rigs,

equipment and personnel.

equipment and personnel.

Tony

Bruce, Director, President and COO

• Founder of

Best Well Services, largest subsidiary of Best Energy Services

•Founding board

member; Appointed President and COO February 2009

•30- year

veteran of U.S. oil and gas industry.

•Original family

drilling business founded in 1940’s

Strategic

Strengths of Our Core Workover Services Business

Ø

Longevity- BWS

established in 1991

Ø

Sustainability- Grew steadily

from 1 rig to 25 rigs

Ø

Reputation- A coveted

book of business

Ø

Customer Centric- A history of

value and service to our customers

Ø

Management- Significant

depth of management and continuity of

key employees

key employees

Why

Our Customers Choose Best

ØExceptional

Safety Record- Over one year

with not an hour lost due to a

safety incident

safety incident

ØAlways

Fair and Competitively Priced

•Market Peak: BWS

$240/hour Competitors

$360/hour

•Today’s

Pricing: BWS

$220/hour Competitors

$240/hour

ØContinuity

in our Crews- Historical

turnover<5%, industry norm >40%

ØSuperior

Depth of Knowledge and Experience- Faster execution

times for

our customers

our customers

Best’s

Customers Represent

a Substantial Portion of Active Operators:

Ø

80%+

Market Share in Hugoton Basin

Ø

Customers

Include:

-Cleary

Petroleum -Anadarko

Petroleum

-Arena

Resources -Bengalia

Land and Cattle

-Ellora

Energy -EnerVest

Operating

-EOG -Kaiser-Francis

Oil

-Marlin

Oil -Merit

Energy

-Midwestern

Exploration -Noble

Energy

-OXY USA -Pioneer

Exploration

-Samson -XTO

-Dominion -Devon

-Pride

Energy -Linn

Energy

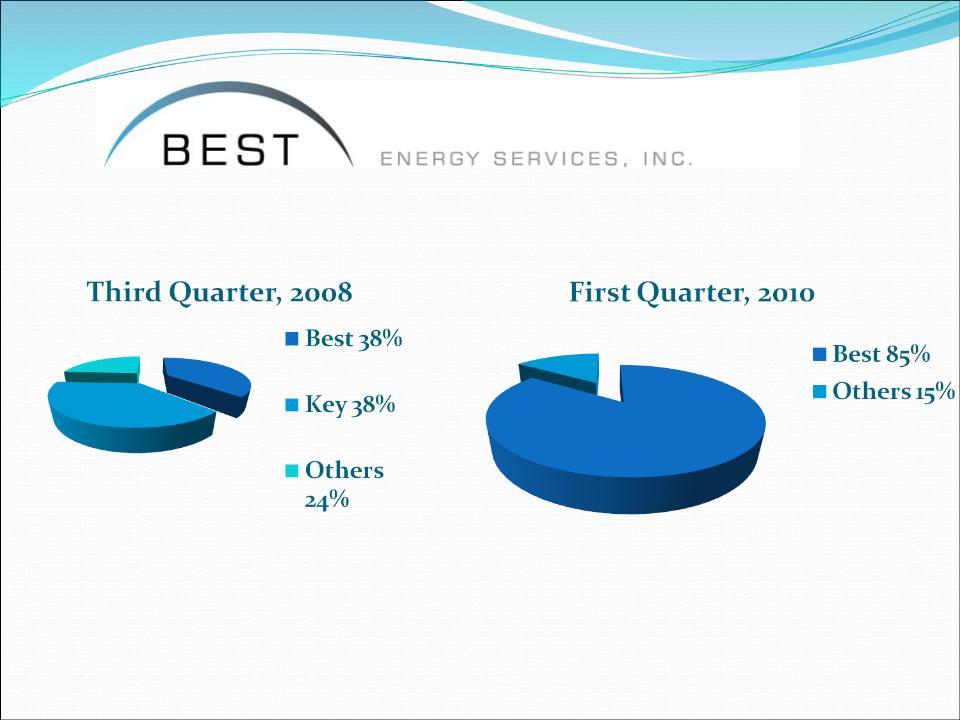

Our

First Focus: Scale

the Revenue Model

Ø STEP

ONE:

Capture Market Share

•Accomplished

•Now at 80%+ vs35%

in 2008

Ø STEP

TWO:

Capture New

Contracts

•Accomplished

•Awarded new

coveted 6 rig contract from major oil company

•Credited to safety

record and historical performance for customer

Ø STEP

THREE: Design and

Implement “outside the box” revenue

creation

model

model

•Hugoton Basin

Financing Partners

•Market Potential--

$20MM+

•Marries

proprietary financial product to asset base

•Highly

scalable

Our

Second Focus: Deleverage the Balance Sheet

Ø Sale

of Equipment from Discontinued Operations—Target

$4MM

Ø

Execute

on Best Energy Ventures

•Leverages use

of BWS equipment/expertise to secure niche

positions in promising E&P plays

positions in promising E&P plays

•No cash

exposure to Best

•Validate and

Flip Model

Financial

Performance: Key Considerations

Ø Operating and

Overhead Expense Containment Completed

ØKey Financial

Driver is Revenue Line

ØKey Drivers to

Revenue Generation are:

•Maintaining

Integrity of the Business Unit

o 19 Years in

business

o Continuity of key

management

o Exceptional

safety record

•Market Conditions

in Hugoton

o Natural Gas

Prices at Wellhead

o Capital

Allocations by customers

o Potential impact

from HBFP Product

Key

Drivers to Natural Gas Market

ØA contracting

supply side

•Decreased

supply lags a decreasing rig count

•Underperforming

shale economics

•Significant

deferred maintenance in bread and butter basins, e.g.

Hugoton

Hugoton

•LNG moving to

more price advantaged European markets

ØAn increasing

demand side

•Precipitous

drop in industrial demand now reversing

•Natural gas

favored to oil on BTU equivalency by wide margin, thus fuel

switching likely

switching likely

•Unexpected

weather events

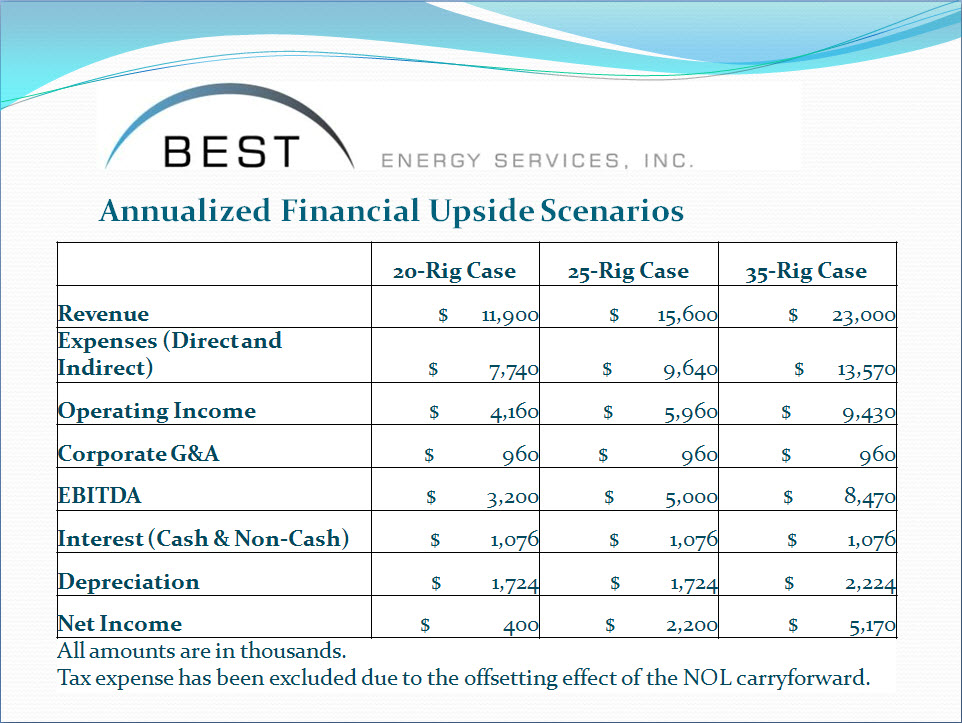

Key

Thresholds in Best Rig Count

•10

Rigs-

Positive EBITDA

•15

Rigs-

1:1 coverage on debt service

•20

Rigs-Annual EBITDA

$3.2MM +

•25Rigs-Annual EBITDA

$5.0MM+

•35

Rigs-

Annual EBITDA $8.5MM+

20-Rig

Case 25-Rig Case 35-Rig Case Annualized Financial Upside Scenarios Revenue

Expenses (Direct and Indirect) Operating Income Corporate G&A EBITDA

Interest (Cash & Non-Cash) Depreciation Net Income 11,900 15,600 23,000

7,740 9,640 13,570 4,160 5,960 9,430 960 3,200 5,000 8,470 1,076 1,724 2,224 400

2,200 5,170 All amounts are in thousands. Tax expense has been

excluded due to the offsetting effect of the NOL

carryforward.

Corporate

Headquarters

5433 Westheimer

Avenue, Suite 825

Houston, Texas

77056

Phone:

713-933-2600